$5.67 $5.67 $5.72 $5.59

$5.67 $5.67 $5.72 $5.59

RESORTS are enjoying room rates that are 10-15 percent higher than preCOVID levels because “the perfect storm of demand is working for The Bahamas”, a senior hotelier said yesterday.

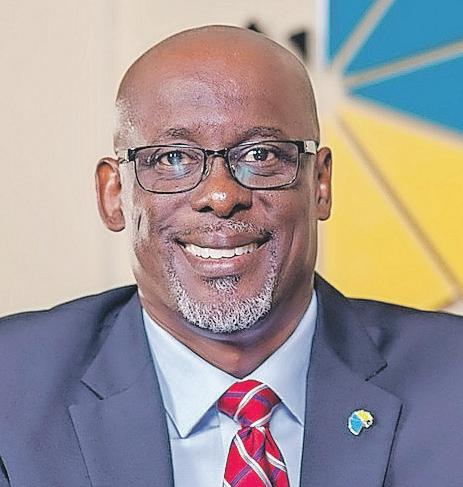

Robert Sands, the Bahamas Hotel and Tourism Association’s (BHTA) president, told Tribune Business that an increase in how long stopover visitors spend in this nation - anywhere from one to two days more - is also making “a significant difference” to the industry’s performance as it enters the peak Easter holiday period.

With many hotels either matching or exceeding their performance projections through the 2023 first quarter, he added that

the stresses imposed by COVID-19 had “opened our eyes” by highlighting how the industry can operate more efficiently and control costs.

Suggesting that the tourism and resort industries are “moving just beyond recovery”, Mr Sands nevertheless told this newspaper that a full COVID rebound will not be achieved until shuttered properties such as the British Colonial and Melia

Nassau Beach bring their room inventories back online.

And he suggested that “an analysis” must be done to determine whether Lynden Pindling International Airport (LPIA), its runways, terminal buildings and other amenities should be expanded “to sustain the level of growth” in tourism without causing any negative impact on its ability to service passenger flows.

NASSAU Cruise Port’s top executive says he is “absolutely” confident that its $300m transformation will increase visitor spending yields and lure more hotel guests downtown, adding: “We’re not creating a tourism Wal-Mart.”

The Easter holiday weekend typically marks the end, as well as the peak, of the high winter tourism season, and Mr Sands said: “I think Easter will be very strong for the islands of The Bahamas, and certainly very strong for New Providence and certainly very strong for us here at Baha Mar. Understand that the Easter break

SEE PAGE B4

THE BAHAMAS is “barely scratching the surface” of the Sand Dollar’s potential, payment providers asserted yesterday, with the digital currency needing more “high traffic” merchants to accept it to drive adoption.

Jeffrey Beckles, Island Pay’s managing director, speaking as the Central Bank issued a progress update on the Sand Dollar’s roll-out, told Tribune Business that increasing the number of businesses willing to accept the Bahamian

dollar as a means of payment will help to drive consumer confidence and increased usage.

“At present, just over 100,000 mobile phonebased wallet accounts

SEE PAGE B7

By NEIL HARTNELL Tribune Business Editor nhartnell@tribunemedia.net

By NEIL HARTNELL Tribune Business Editor nhartnell@tribunemedia.net

ROYAL Caribbean yesterday broke its silence on the controversy surrounding its $100m Paradise Island project by asserting the “first-in-kind” proposal will “ensure the economic benefit stays in The Bahamas for generations to come”.

The cruise giant, in a three-paragraph statement that provided few specifics on its Royal Beach Club ambitions, largely echoed the Davis administration by pointing to the benefits of a revised deal that both have now described as providing greater ownership,

entrepreneurial opportunities and jobs for Bahamians. It did, though, promise to provide details on the project’s projected economic and environmental impact “in the coming weeks”.

Responding to Atlantis and Bahamian environmental activists, who have voiced a mixture of concerns and criticisms of its plans, Royal Caribbean said: “For more than 50 years, Royal Caribbean International has partnered with The Bahamas to bring millions of visitors to see and experience the beloved culture and beauty of the islands. We’ve since continued to collaborate and

SEE PAGE B8

Michael Maura, in a recent interview with Tribune Business, acknowledged that “the work ahead of us is very much to” raise per capita cruise passenger spending from $80 - a sum that is among the lowest in the Caribbean - to a level closer to the near-$200 per head in St Maarten and the US Virgin Islands.

While much focus is often placed on passenger headcount, with Nassau Cruise Port receiving 13 percent more visitors during the 2023 first quarter when compared to pre-COVID figures from the same period in 2019, he said Prince George Wharf’s overhaul is designed to create “a high-end boutique

tourism experience” that will persuade tourists to part with more money.

Arguing that it “is quite possible” for Nassau to match the spending yields generated by its major Caribbean rivals, Mr Maura told this newspaper that the Bahamian capital can only achieve this with “the right product offering”. The cruise port’s nine-figure upgrade is designed to be the catalyst that sparks the revival of downtown’s waterfront, with Bahamian entrepreneurs gaining the confidence to invest in their own retail, restaurant,

• Average visitor stay increases up to two days

• LPIA ability to ‘sustain growth’ needs analysis

• Closed hotel return to ‘move beyond recovery’

THE BAHAMAS’ trade deficit for the 2022 fourth quarter expanded by almost 22 percent or $164m yearover-year compared to the

prior year as goods imports surged while exports contracted. The latest trade report unveiled by the Bahamas National Statistical Institute, which only measures this nation’s trade in physical goods, revealed that total imports for the three

months to end-December 2022 rose by 16 percent or some $148m year-overyear to hit $1.074bn. This compared to $924.897m for the 2021 fourth quarter, when the economy was still recovering from COVID-19 and associated restrictions.

Meanwhile, The Bahamas’ good exports fell by 9.3 percent or just over $15.7m year-over-year, dropping to $155.201m from $171.02m in 2021. This reduction, combined with the increase in imports, produced a deterioration in The Bahamas’ balance

of trade. The deficit, measuring by how much goods imports exceeded exports, increased to $918.448m for the final quarter of 2022 compared to $753.877m a year earlier.

This means that The Bahamas is having to use an ever-increasing amount of its foreign currency earnings, principally earned by services exports such as tourism and financial services, to acquire the imports that its citizens need for daily consumption.

“Data on merchandise trade for the 2022 fourth quarter shows that the value of commodities imported into The Bahamas totaled $1.074bn, resulting in an increase of 16 percent when compared with the same period last year,” the Institute’s quarterly trade report said.

“The major groups of merchandise were ‘machinery and transport equipment’, which totalled $203m; ‘mineral fuels, lubricants and related materials’ at $190m, and ‘food and live animals’, which totalled $183m. The combined value of these categories represented 54 percent of total imports.”

The report added: “Other categories that contributed to total imports were ‘miscellaneous manufactured articles’, which accounted for $173m; ‘manufactured goods classified chiefly by materials’ valued at $143m; and ‘chemicals’ at $82m. These groups together represented 37 percent of total imports.

“Categories that showed significant increases when compared to the same quarter last year were ‘machinery and transport equipment’, ‘miscellaneous manufactured articles’ and ‘beverages and tobacco’, which increased by 46 percent, 43 percent and 25 percent, respectively.”

As for exports, the Institute’s report said: “As it relates to total exports for the 2022 fourth quarter, data shows that the value of commodities exported (domestic and re-exported) from The Bahamas totaled $155m, resulting in an decrease of 9 percent when compared with the same period last year.

“The categories that contributed the largest proportion to the exports were ‘mineral fuels, lubricants and related materials’, which totalled $45m; ‘food and live animals’ at $34m; and ‘miscellaneous manufactured articles’ at $28m representing 69 percent of total exports.

“Categories that showed significant increases were ‘crude minerals, inedible except fuels’, and ‘beverages and tobacco’, which increased by 190 percent and 51 percent, respectively, when compared to the same quarter last year,” the report added.

“The groups that decreased in value when compared to the same period last year were ‘machinery and transport equipment, and ‘food and live animals’. which declined by 62 percent and 45 percent, respectively.”

BAHAMIAN fishermen suffered a 45 percent price drop during the now-closed crawfish season, it was disclosed yesterday, although strong catch volumes offset some of the fall caused by market “overcorrection” and higher global supply.

Paul Maillis, the National Fisheries Association’s secretary, told Tribune Business that increased competition from Latin American and African fisheries industries was largely responsible for depressed crawfish prices during a season that closed on April 1.

“In terms of production it was a really good season. I’ve seen a lot of fishermen have done very, very well. The only difference between this year and last is the price of the lobster, and so it was challenging for a lot of fishermen, especially the beginning of the year with all of the uncertainty,” Mr Maillis said.

Higher fuel prices also exacted a toll on Bahamian fishermen, raising their costs at the same time as crawfish prices dropped. “That put a lot of pressure on fishermen who had planned for a continuation of good prices and made investments accordingly,” Mr Maillis added.

“The unfortunate realisation that came at the time of the opening of lobster season was the price was going to be substantially lower - critically lowerthan it was before in the past two years.” Crawfish sold at an average $20 per pound in 2021-2022, but fell to $11 during the past season.

Mr Maillis said “it was much worse on the Family Islands”, which were at the mercy of exporters who dictated prices because “they

have greater leverage on the fishermen” there. He added: “Because of the great prices that have been in existence over the last two years, a lot of new parties have entered the fishing industry, especially in other jurisdictions like in South America and other places in the Caribbean.

“So there was a general glut in the market, which drives prices down. Another theory is that there is a bit of overcorrection from the buyers for the hit they took last year for the high prices. We also have the possibility that some of our original competitors came back into line, like the South African lobster producers and the California coast lobster producers, the Australian lobster producers.

“Those places were under strict lockdowns during COVID-19 and that impacted their ability to produce. We were open for business throughout almost the entirety of COVID-19. So it could be a correction of the overall price, just based on the supply coming back to normalcy.”

Mr Maillis said it was a “tough pill to swallow” when fishermen are getting lower prices per pound for lobster, and exporters and processors are selling it at often-times triple the price they bought it - sometimes $50 per pound in parts of the US and Europe. “That’s the problem with when you have a free market. The market determines the price, and there’s no there’s no controls about a minimum or maximum price that can be offered to fishermen,” he added.

“On one hand, that’s a good thing that there’s no maximum price. Because if the price explodes and we’re able to get $30 a pile, then we will take it you take it.”

By YOURI KEMP Tribune Business Reporter ykemp@tribunemedia.netTHE hotel union’s president yesterday urged Atlantis executives to “go put their own placards on” as he asserted that workers will not fight the mega resort’s battle with Royal Caribbean for it.

Darrin Woods, the Bahamas Hotel, Catering and Allied Workers Union’s (BHCAWU) head, told Tribune Business that management first needed to explain to Atlantis staff why it was so important that the workers personally speak out against the cruise giant’s proposed Royal Beach Club project.

In the absence of concrete details as to what Royal Caribbean is proposing, he said he refuses to take a stand just because Audrey Oswell, Atlantis president and managing director, has called on the resort’s roughly 6,000 employees to do so.

“The problem is you find people try to get other people to fight their battles for them. You have to first tell me what it is, and how is it advantageous for us as Bahamians or how is it disadvantageous for us as Bahamians, and not because it affects you as an individual,” Mr Woods warned.

“I believe our people are smart enough to know that if people are calling them to do some stuff they first have to explain some stuff, because even when we call our members we have to explain to them some stuff and explain to them how is it going to impact them.”

Mr Woods spoke out after Ms Oswell, in a letter to all Atlantis staff, explained why the mega resort has significant concerns over Royal Caribbean’s plans for western Paradise Island as well

as setting out the major environmental issues it believes need to be addressed. She thus did what the hotel union president urged by explaining why the $110m Royal Beach Club investment could have a negative impact for Atlantis and its staff.

“Many of you have expressed your support for our speaking out and asked what Atlantis team members can do to make their voices heard. The local economy is driven by tourism and, for the most part, tourism is driven by the beautiful waters and beaches of The Bahamas and its people,” Ms Oswell said.

“As part of the hospitality industry, we need to stand up and protect our livelihood. I encourage you to share your thoughts with your family and friends. Follow the review process as it unfolds and, if you feel strongly, contribute to the public dialogue.”

Mr Woods responded that the hotel industry is “based on occupancy”, and if resorts are operating at full capacity they will need workers.

“Every day you go on a job, you know what could happen if you don’t own the place? This is not saying we must be flagrant with it, but we have to at least be cautious about it because we are just

hearing this now, so passionate and loud, and we didn’t hear this before because this (Royal Caribbean project) is not something that just came about; this is something that has been in the pipeline,” he added

“We just don’t know what we are standing up for… We have to be careful when we talk about taking a stand because it’s easier to just rabble rouse people and gather up people. It’s easy to do that. But we have to know what the substance of it is.

“You have to be careful when people call you out to do something. If they’re so passionate about it then why won’t they go out and do something about it? They should lead by example. What have they done, aside from getting in the newspaper to talk? Tell them to put on placards and walk down the street, instead of telling us to go and do it. I bet they

wouldn’t do it. Go and put your placards, on and go and do what you’re telling us to do, and we will follow you, maybe.”

Mr Woods said negotiations on a new industrial agreement between the union and the Bahamas Hotel and Restaurant Employers Association, whose main member is Atlantis, are “progressing well.” He said: “Unlike anything else, when you’re talking about money there are differences of opinion, but we are finding ways to get to the end.”

The union president added that there are no fears Atlantis will be forced to lay-off staff members as a result of the Bahamas Power & Light (BPL) rate hike because the hotel depends on occupancy, and once the hotels are filled to capacity they will need employees to work.

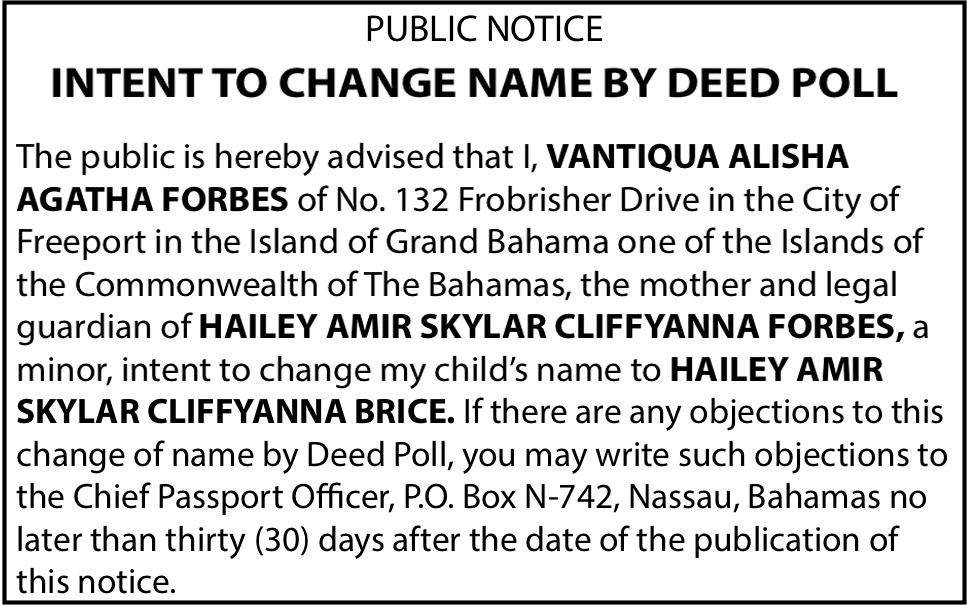

The private road of St. Augustine’s College and Monastery from St. Augustine’s Cemetery Road to Prince Charles Drive and all other premises (grounds) belonging to the school and monastery WILL BE CLOSED TO THE PUBLIC from Monday, April 10th, 2023 at 11:59 p.m. until Tuesday, April 11th, 2023 at 11:59 p.m.

is traditionally always one of the strongest periods.

“We are seeing a difference in the average length of stay and the [room] rates that are being achieved. The occupancies are traditionally high during this period. We’re certainly looking at another day, dayand-a-half, two days on the length of stay, which makes a significant difference, and we’ve gained on the average room rate anywhere

between 10-15 percent, depending on the property, compared to pre-COVID levels.

“We don’t have a real handle on the impact of Airbnbs, but we are told those are also yielding much higher rates as well.

I think it may be fair to say for many hotels that their expectations have been met, and for others their expectations have been exceeded. There still continues to be very strong

demand for the islands of The Bahamas.”

Data unveiled by the Central Bank of the Bahamas earlier this week showed that air arrivals for February 2023 were just 2.5 percent below prepandemic levels from the same month in 2019, and it forecast that gross domestic product (GDP) growth rates will “moderate as the recovery from COVID-19 becomes more complete”.

“Initial data suggested that the tourism sector continued to register robust growth during the month of February, surpassing pre-pandemic levels. The performance continued to benefit from relaxed pandemic-related conditions and heightened demand for travel in key source markets,” the Central Bank said.

of tourism.” Mr Sands, though, acknowledged that some of The Bahamas’ pricing power and yields on room rates was being driven by a reduced supply of room inventory as well as demand.

passed that point simply because a lot of those rooms that we lost offline, as a result of some of the impacts and conditions that forced their closure, have returned.

Jarol Investments Limited is seeking to fill the following position: Assistant Security

“Official data provided by the Ministry of Tourism showed that total passenger arrivals rose to 0.8m in February from 0.4m in the corresponding period of 2022. In particular, the dominant sea segment more than doubled to 0.7m from 0.3m visitors in the prior year. In addition, air traffic stabilised at 0.1m, exceeding pre-pandemic levels and representing 97.5 percent of the air arrivals recorded in 2019.”

Our company has been around gaming for over 30 years and pride ourselves on quality service and customer relationships. We are moving forward in the market and such are looking for hardworking, reliable, people friendly customer services representatives.

• Reinforces company goals and vision to all direct reports and continually implements this strategy into overall communications.

Jarol Investments Limited is seeking to fill the following position:

• Supervises, directly and/or indirectly, all Security/Surveillance team members including: selection, training, work direction, safety, communication, counseling, disciplining, performance evaluations and records.

• Oversight and training for emergency response procedures such matters as fires, bomb threats, power outages, and other serious matters or emergencies.

• Directs and monitors the security and safety of customers, employees, facilities, and grounds.

• Reviews security/surveillance investigations concerning all incidents and issues taking place on property and makes necessary reports and notifies the Assistant COO.

• Checks all security/surveillance reports for accuracy and completeness and ensure timeliness.

Cleaning and maintaining property inclusive of cleaning windows, mopping entrance, light weeding & painting, clearing fences, throwing out garbage daily from offices, keeping yard swept and clean & washing all company’s vehicle on Saturdays.

• Ensure compliance with department and Company policies and procedures.

• Create and update weekly department schedule.

• Continually evaluate Team Members for alertness, appearance, and proper performance of duties.

• Observes, supervises and instructs shift officers in the performance of their duties.

• Determines personnel requirements and makes assignments at the beginning of each shift.

Mr Sands backed this assessment, telling Tribune Business: “We continue to see a strong demand for business, and when we compare things month over month in terms of the previous years, we’re fairly strong. That’s against the backdrop of having no group business for the past three years. Therefore, with the re-emergence of group business and the robustness of transient business, the perfect storm of demand is working for the islands of The Bahamas.

With the closure of properties such as the British Colonial, the Melia and Atlantis’ Beach Towers impacting New Providence’s ability to accommodate visitor demand, the BHTA president said returning the hundreds of rooms represented by those properties to full service will mark the last steps in post-COVID recovery. “There’s no question that will make a significant difference to the supply chain, and it will also have a multiplier positive impact on revenues in the country,” Mr Sands added of that inventory. “Understand that even though we’re running very high occupancies and rates, that’s against the backdrop of the available amount of rooms.

“As we bring those additional rooms back into place we will be able to generate even more business and get ourselves into an even more favourable position for growth in the years beyond.” Once that occurs, he said the Bahamian hotel and resort industry will have completed its recovery from the COVID pandemic.

“It’s always a work in progress, but I think that collectively everything is working in the right direction. I think we’re looking beyond Easter. We’re looking to the rest of the second quarter and looking to the third quarter now. The unknown that picks up the slack is Airbnb and the higher than normal occupancies at some hotels.

“I think the industry has responded quite well to the issues that COVID has certainly introduced to us. It’s opened our eyes to operate more efficiently, and I think all those things will begin to pay dividends.”

The BHTA chief described hotel employment levels as “a mixed bag”, with some properties having returned to pre-COVID staffing levels, others exceeding those numbers and a few still “getting there”.

• Ensure effective onboarding and training for Security/Surveillance

Officers.

• Provide security and protection for customers, team members, property and assets.

Cleaning office daily, mopping, sweeping, wipping doornobs, cleaning bathrooms, dusting desks & keeping kitchen area clean.

• Reacts promptly to disturbances where Security/Surveillance is required.

• Maintain a high level of confidentiality

• Be familiar with all Chances web shops throughout the Bahamas.

Performs related duties as assigned by Management.

• Takes appropriate action, when required, of individuals suspected of illegal activities.

• Perform related duties as assigned by management.

Interested persons should email their resume to careers@chancesgames.com. or visit our Head Office on Prince Charles Drive (across from Restview Funeral Home) between the hours of 9 a.m. to 5 p.m.

Interested persons must require surveillance experience, certification, training, communication skills, attention to detail, ability to work independently and should apply at Jarol Investments Limited Head Office, Prince Charles Drive (Across from Restview) between the hours of 9am to 5pm. Or send your CV to careers@chancesgames.com Subject: Assistant Security Manager – Your Name

“We’re hopeful it will carry through the rest of the year, and we see no indication why it should not. I think we need to be looking forward, and forward thinking, in terms of the growth potential

“I think we are moving just beyond recovery,” Mr Sands added. “I think we’ll be able to say that once we get back to the volume of rooms we had pre-COVID. Then I think we’ll be in a much better to say we’ve

Mr Sands, though, said there needed to be an assessment of LPIA’s capacity to handle the surge in stopover visitors over a sustained period of time. “We must do an analysis of our airport capacity, its ability to expand and I think we have to be judicious in looking at what investment may be necessary to sustain the level of growth without having a negative impact on the airport’s infrastructure to deal with increasing demand,” he told Tribune Business.

A MINISTRY of Finance workshop was designed to help Bahamian bidders become more successful in winning contracts for planned renewable energy projects across the country. The ministry’s project execution unit (PEU) for the ‘Reconstruction with resilience in the energy sector of The Bahamas’ initiative held the event at the University of The Bahamas (UoB) Choices Restaurant on Tuesday, April 4. It also doubled as a pre-bid meeting for documents for national and international competitive bidding.

Simon Wilson, the Ministry of Finance’s financial secretary, said the workshop was being held to help Bahamian vendors become more successful in securing contracts for future renewable energy projects. He added that there are Bahamians who

are talented enough to perform the work, but they sometimes lack the knowledge to properly complete the bidding documents, thus hampering their chances of submitting a successful bid.

Mr Wilson said the Government’s focus on increased renewable energy penetration could help transform Bahamas Power & Light (BPL) and electricity supply in the country, and several projects have already been successfully completed.

Marco Rolle, the renewable energy programme co-ordinator, said this was the second workshop held in the push to expand solar energy’s roll-out in The Bahamas. “We will continue to have these workshops so that you (the vendors) can become better informed and better engaged in dealing with the various documents you

will be called upon to complete,” he said.

“We want to make sure that when you receive these documents, you are not baffled and frustrated by them; that you can work with them very smoothly and answer the questions in such a fashion that when you submit those to us they just fly through the system.”

The renewable energy projects are being funded by the Inter-American Development Bank’s (IDB) loan initiative to advance deployment of renewable energy in The Bahamas. This comprises an $80m IDB loan that has been supplemented with a $9m grant provided by the European Union (EU).

One of the projects this will finance is the Battery Energy Storage System (BESS) for BPL’s Blue Hills power station. This will provide a spinning reserve and inject a new level

of resilience and smartness into Nassau’s existing energy grid. The initiative’s focus is now turning to the islands of MICAL (Mayaguana, Inagua, Crooked Island,

Acklins and Long Island)

and the Abacos. Contracts have already been issued in preparation for the installation of microgrids in the constituency. These are part of the Government’s

policies to tackle the challenges of climate change and renewable energy. The identified sites for the microgrids are on or near existing BPL power plants.

tours, excursions and other attractions.

“The $300m that we have invested, 50 percent of it was focused on the marine works and 50 percent on the upland works,” the Nassau Cruise Port chief said, describing Prince George

Wharf’s six cruise ship berths as being equivalent to Lynden Pindling International Airport’s (LPIA) runways where guests first land in The Bahamas.

“We’re running 13 percent ahead of record 2019 levels with over 1.205m passengers for the first

three months of 2023, and are working very hard to see 4.2m visitors for the calendar year of 2023,” Mr Maura added. “We have these 4.2m opportunities, and historically Nassau has only enjoyed approximately $80 per passenger on the spend, while

other jurisdictions like the US Virgin Islands and St Maarten have been operating at close to $200 per passenger.

“The way we have looked at is that the investment we have made, the other 50 percent, which represents all the retail, the food and beverage, all the entertainment, this new restored and reimagined waterfront for downtown Nassau, is very much focused on getting visitors to spend more money.”

Mr Maura said Bahamian businesses, entrepreneurs and all sectors that rely on the cruise industry for their livelihoods need to look at Nassau’s projected 4.2m cruise passenger arrivals for 2023, and the 4.5m forecast for 2023, as “opportunities” to extract an extra $100m per head from by providing value-added experiences, products and services that justify higher spend.

With Nassau Cruise Port’s $300m transformation set for its grand opening at end-May 2023, he argued that even increasing per passenger spending by $100 during 2023’s second half would yield an extra $210m economic impact that hits both local businesses and their employees. And, were such an increase to be seen for the 2024 full year, the potential extra economic injection could be as high as $450m.

Giving an insight into what Nassau has to compete for, Mr Maura said: “That $210m increase goes into the pockets of tour operators, retailers, food and beverage providers, the Straw Market, the hair braiders. That’s not money going into the Public Treasury. That’s money actually being spent with Bahamian businesses and entrepreneurs....

“We’re talking about competing at the same level as St Maarten and St Thomas. This is quite possible when you have the right product and right offering.

It goes back to comments that I made previously; we’re going to have 4.2m opportunities this year and 4.5m opportunities next year. That’s a lot of opportunities for small businesses to develop themselves.

“I encourage people to start. If they do it well, and are a high achiever, they could be putting money in their pocket. We need that entrepreneurial spirit in New Providence. We need things for people to do.”

Mr Maura also added that the revamped cruise port, with its Junkanoo Museum and amphitheatre to host events, are focusing on a wider audience beyond the cruise industry.

“It’s not focused exclusively on the cruise market,” he told Tribune Business. “It’s also hotels.

People staying in the hotels come to Nassau to experience the culture and people, not just to experience - with all due respect to them - the best of Baha Mar or Atlantis. They’re looking for more than that. We expect downtown Nassau, as a result of the $300m we have spent, to see a pick up in the number of resort guests coming downtown to experience the waterfront.

“I can tell you this. Everything about our space is about feeding, promoting and elevating the quality of the product and the quality of the experience. We’re doing that, one, because we want to make sure we’re putting our best foot forward as a country but we’re also looking to materially benefit and massively optimise the economic potential.

“We’re not looking to create a tourism Wal-Mart. We’re looking to feature a high-end boutique tourism experience that provides a wonderful story for guests to take home, where they sit and share their experience with their family and friends in their living room, and say there was so much to do and so much to see.”

Global Ports Holding, Nassau Cruise Port’s 49 percent controlling shareholder, recently hailed Prince George Wharf’s $300m transformation “as a global blueprint for future cruise port investment”. In recently unveiling its financial results for the nine months to end-December 2022, it said Nassau Cruise Port had received close to four times’ as many passengers as it handled during the COVID-hit prior year comparative when cruising only resumed in June 2021.

“Nassau Cruise Port benefited from its proximity to the key home ports in Florida and the cruise lines’ continued desire to operate a higher volume than normal of short cruises in this area at the expense of longer itineraries to other parts of the Caribbean,” Global Ports Holding said of the nine months. “As a result, Nassau Cruise Port welcomed 2.6m passengers in 2022, up from just 687,000 passengers in the comparable period last year.

“Nassau Cruise Port, on some days, is now hosting six cruise ships simultaneously, utilising the new berthing that was created as part of our significant investment into the port. On February 27, 2023, the port welcomed record of 28,554 passengers in a single day.

“During the nine-month period, we continued to invest in the transformation of Nassau Cruise Port, and as Global Ports Holding’s investment into the port nears completion, the vision for this port is becoming a reality. Global Ports Holding’s management believes this port will stand as a testament to Global Ports Holding’s cruise port and destination development capabilities, and as a global blueprint for future cruise port investment.”

FROM PAGE B1

exist in The Bahamas, and collectively over 1,500 businesses have access to merchant services through Central Bank licensed payment services providers,” the regulator said on the state of digital payments adoption to-date.

“Along with further initialised presence in the Family Islands, this is the ecosystem in which outreach, specific to Sand Dollar, is intensifying over the remainder of 2023.

Within this ecosystem, spending, in both Sand Dollars and other tokens, remains low when compared to the overall size of the domestic payments system.”

Mr Beckles told this newspaper that it was critical to increase the number of merchants embracing Sand Dollars as a means to settle transactions beyond the present 1,500 given that there were some 50,000 Business Licence applications submitted this year.

The Sand Dollar is the Central Bank-backed digital currency (CBDC), and is the equivalent of its fiat or hard currency counterpart.

It is not a crypto currency such as Bitcoin.

Describing the Central Bank’s report as “a positive move”, the Island Pay chief said: “Some of the highlights are with regard to merchant on-boarding, which is critical if we’re going to have a real expansion and adoption of the Sand Dollar. Merchants are a large part of that. We’ve got 22,000 businesses. We’re barely scratching the

surface with 1,500 but it’s a start.

“We have 100,000-plus wallets that are active in The Bahamas, which is equivalent to close to half the working population.

That’s good. Because there are not a lot of merchants accepting Sand Dollar, using Sand Dollar is at a very low pace. The more we get merchants on board gives the consumer a lot more flexibility and utility.

At the end of the day, the Sand Dollar is as much for the common man as it is for the middle class and the rich. It’s a one-size fits all solution.”

Data released by the Central Bank showed that some $1.025m worth of Sand Dollars are currently in circulation. While some 101,636 Bahamians possess electronic wallets, there are just 1,512 of the merchant variety while the number of businesses actively accepting Sand Dollars was pegged at just 455.

“In my view the top priority has to be the collaborative effort with regard to education,” Mr Beckles said, calling for a combined push by the Central Bank, payment providers/banks operating as authorised Sand Dollar financial institutions (AFI), and the Government. “There has to be a concerted, collaborative effort to educate the merchant population, the consumer population and finding ways to incentivise adoption.

“What we need to be able to do is get more of the high traffic merchants.... the fast food operators, even the

Associated Press

THE burning of coal for electricity, cement, steel and other uses went up in 2022 despite global promises to phase down the fuel that’s the biggest source of planet-warming gases in the atmosphere, a report

Wednesday found.

The coal fleet grew by 19.5 gigawatts last year, enough to light up around 15 million homes, with nearly all newly commissioned coal projects in China, according to a report by Global Energy Monitor, an organization that tracks a variety of energy projects around the globe.

That 1% increase comes at a time when the world needs to retire its coal fleet four and a half times faster to meet climate goals, the report said. In 2021, countries around the world promised to phase down the use of coal to help achieve the goal to limit warming to 1.5 degrees Celsius (2.7 Fahrenheit).

“The more new coal projects come online, the steeper the cuts and commitments need to be in the future,” said Flora Champenois, the report’s lead author and the project manager for GEM’s Global Coal Plant Tracker.

New coal plants were added in 14 countries and eight countries announced new coal projects. China, India, Indonesia, Turkey and Zimbabwe were the only countries that both added new coal plants and announced new projects. China accounted for 92% of all new coal project announcements.

Government, the airport, the hardware stores to give serious consideration to the adoption of the Sand Dollar.” Among those companies that already accept it are Super Value, Solomon’s Fresh Market, Bamboo Shack, CBS Bahamas and the Bahamas Telecommunications Company (BTC).

The Central Bank’s update said it plans to give away some $1m throughout the course of 2023 and 2024 to incentivise Sand Dollar adoption. “As to the existing merchant ecosystem, as at January 2023, the Central Bank estimates that at least 80 percent of all domestic mobile payment transactions were denominated in Sand Dollars,” it said.

“This was due to increasing merchant and mobile wallet activations, as marketing efforts increased among the licensed payment services providers.

In this regard, January’s volume of peer-to-peer or person-to-person (P2P)

transactions was more than doubled compared to January 2022. The volume of person-to-business (P2B) transactions was more than three-fold higher than in the same period in 2022.

“In this regard, the average amount spent in P2B transactions was $68. Over 1,500 merchant relationships have been established by AFIs. The Central Bank has verified that more than 450 of these businesses are proficiently processing payments from all branded wallets.”

Acknowledging the need to step up training initiatives, the Central Bank said: “During the second quarter of 2023, the Central Bank’s promotional efforts and outreach will focus on increasing Sand Dollar usage within the existing merchant ecosystem. The particular emphasis will be on merchant training and awareness for more efficient processing of payments from all branded

wallets in use within The Bahamas.

“The Central Bank is working with AFIs to improve the point of sales signage at merchants, which broadcast the acceptance of Sand Dollars, and to ensure more seamless use of QR Code displays to process payments. In the meantime, promotional giveaways of Sand Dollars will target increased spending, particularly at merchants that are considered systemically important to early-stage adoption efforts....

“In March 2023, the Central Bank began to recruit persons of all ages to serve as Sand Dollar Ambassadors within New Providence, Grand Bahama and the Family Islands. These individuals will support more sustained adoption outreach targeting their communities during 2023 and 2024. They will be trained to provide firstline support to wallet users and merchants around all

of the Sand Dollar-enabled mobile payments applications in use within The Bahamas.”

Recruitment of the first ambassadors is to be completed this month, and the Central Bank added: “In March 2023, the Central Bank focused its Family Island outreach on central and southern Eleuthera. Events included virtual meetings with the Eleuthera Chamber of Commerce, local merchants and other stakeholders.

“The engagement culminated with an on-island visit from March 21-24, 2023. Digital wallet providers OMNI, which has a presence on the island, SunCash and Kanoo accompanied the Central Bank. The exercise resulted in the onboarding of six new Sand Dollar merchants. The Central Bank plans to visit northern Eleuthera and the surrounding cays during its next scheduled engagement.”

China added 26.8 gigawatts and India added about 3.5 gigawatts of new coal power capacity to their electricity grids. China also gave clearance for nearly 100 gigawatts of new coal power projects with construction likely to begin this year.

But “the long term trajectory is still towards clean energy,” said Shantanu Srivastava, an energy analyst with the Institute for Energy Economics and Financial Analysis who is based in New Delhi. Srivastava said the pandemic and the war in Ukraine temporarily drove some nations toward fossil fuels.

In Europe, where the Russian invasion of Ukraine meant a scramble for alternative energy sources and droughts stifled hydropower, the continent only saw a very minor increase in coal use.

Others went the other way. There were significant shutdowns in the U.S. where 13.5 gigawatts of coal power was retired. It’s one of 17 countries that closed up plants in the past year. With nearly 2,500 plants around the world, coal accounts for about a third of the total amount of energy installation globally. Other fossil fuels, nuclear energy and renewable energy make up the rest.

To meet climate goals set in the 2015 Paris Agreement, coal plants in rich countries need to be retired by 2030 and coal plants in developing countries need to be shut down by 2040, according to the International Energy Agency. That means around 117 gigawatts of coal needs to be retired every year, but only 26 gigawatts was retired in 2022.

Notice is hereby given that all persons having any claim or demand against the above Estate are required to send their names, addresses and the particulars of their debts or claims duly certified in writing to the undersigned on or before the 6th May, A. D. 2023, after which date the Attorney appointed by Deed of Power of Attorney will proceed to distribute the assets having regard only to the proved debts or claims of which notice have been given.

And Notice is hereby given that all persons indebted to the said Estate are requested to make full settlement on or before the date herein before mentioned.

FROM PAGE B1

grow with one another to increase tourism and do so responsibly.

“In the coming weeks, we will share details about the economic benefit and environmental impact of the Royal Beach Club at Paradise Island. This first-in-kind public-private partnership (PPP) is designed to ensure that the economic benefit stays in The Bahamas for generations to come though equity opportunities, new business development, jobs, tourism growth and a new tourism levy to improve other products around The Bahamas.

“We are progressing through the Government’s stringent environmental

processes, and in the upcoming review Bahamians will have the opportunity to see our innovative, industry-leading plans.” However, Royal Caribbean’s opponents, critics and competitors were not convinced and made their views clear yesterday.

Toby Smith, the Bahamian entrepreneur seeking to restore Paradise Island’s lighthouse to former glories, and who has been competing with Royal Caribbean to lease the same two-acre Crown Land parcel that the former Minnis administration sought to grant both parties, said the cruise line was “just regurgitating the same narrative” it has used previously. Referring to Royal Caribbean’s chief executive, he said: “Michael Bayley, we’ve heard it all before. They’re just using the same words, bragging about the millions coming as tourists, but they won’t publish to the Bahamian people what Royal Caribbean exports out of the country in revenue so Bahamians can quantify the crumbs left to circulate in our economy. “Bahamians are fed up. My personal belief is that Royal Caribbean thought this would be a walk in the park simply by cosying up to the Minnis administration, and it’s backfired in a big way.” Royal Caribbean has also this week started advertising for a “president” who will head the Royal Beach Club, described as “the first public-private hospitality partnership in The Bahamas”, even though all environmental approvals remain outstanding.

The cruise line, in its advertisement, says the Royal Beach Club’s creation will enable them to increase the number of passengers they bring to Nassau by 150 percent or 1.5m compared to pre-pandemic levels - going from one million in 2019 to 2.5m in 2027. However, the revised Environmental Impact Assessment (EIA) and Environmental Management Plan (EMP) have yet to be presented to the regulatory agencies or undergo public consultation.

The Royal Beach Club’s initial EIA, prepared by Islands by Design, suggested that the western Paradise Island project would be designed to cater to a maximum of 3,500 passengers and 250 staff daily. This would give it a maximum occupancy of 3,750 persons, even though the site in the Colonial Beach area could

accommodate up to 8,719 persons.

Chester Cooper, deputy prime minister, and minister of tourism, investments and aviation, in unveiling the revised Royal Beach Club deal with the Davis administration indicated that the plans had been scaled down from 3,500 passengers as the property will receive less than 5 percent of the cruise line’s visitors.

It remains to be seen, though, how this squares with the increased 2.5m annual visitors that Royal Caribbean plans to bring to Nassau by 2027. And, with the cruise line taking a reduced stake in the project compared to previous 100 percent full ownership, it will still need to ensure the Royal Beach Club remains economically viable and produces a profit.

Meanwhile Joe Darville, head of Save the Bays and Waterkeepers Bahamas, told Tribune Business it seemed “ridiculous” and “premature” for Royal Caribbean to be advertising for a project “president” when it had yet to obtain all the necessary environmental approvals from the Government.

“I am absolutely surprised that that step has been made,” he said. “It seems to be totally premature in light of the fact there are environmental matters that should be approved and taken care of, and assessed publicly before any appointment is made. It’s ridiculous. I can’t believe it.

“It’s a very surprising item to be digested when we are still not assured that the project is a go.... How does it benefit the Bahamian people? By the supply of labour at a minimum wage? There are many concerns we have with that whole situation. As far as I can tell it has not been reviewed at the environmental level and executive level of government. It’s really, really disturbing and surprising.”

And Casuarina McKinney-Lambert, executive director of the Bahamas Reef Environmental Educational Foundation (BREEF), told Tribune Business: “I am particularly concerned about the waste production and disposal. I do not feel that this has been adequately addressed for this proposed project. Cruise ships generate massive amounts of waste, both visible in the form of plastic pollution etc, and less visible but equally damaging water pollution.”

YOU may have already seen them in restaurants: waist-high machines that can greet guests, lead them to their tables, deliver food and drinks and ferry dirty dishes to the kitchen. Some have cat-like faces and even purr when you scratch their heads.

But are robot waiters the future? It's a question the restaurant industry is increasingly trying to answer. Many think robot waiters are the solution to the industry's labor shortages. Sales of them have been growing rapidly in recent years, with tens of thousands now gliding through dining rooms worldwide.

"There's no doubt in my mind that this is where the world is going," said Dennis Reynolds, dean of the Hilton College of Global Hospitality Leadership at the University of Houston. The school's restaurant began using a robot in December, and Reynolds says it has eased the workload for human staff and made service more efficient.

But others say robot waiters aren't much more than a gimmick that have a long way to go before they can replace humans. They can't take orders, and many restaurants have steps, outdoor patios and other physical challenges they can't adapt to.

"Restaurants are pretty chaotic places, so it's very hard to insert automation in a way that is really productive," said Craig Le Clair, a vice president with the consulting company Forrester who studies automation.

Still, the robots are proliferating. Redwood City, California-based Bear Robotics introduced its Servi robot in 2021 and expects to have 10,000 deployed by the end of this year in 44 U.S. states and overseas. Shenzen, Chinabased Pudu Robotics, which was founded in 2016, has deployed more than 56,000 robots worldwide.

"Every restaurant chain is looking toward as much automation as possible," said Phil Zheng of Richtech Robotics, an Austin-based maker of robot servers. "People are going to see these everywhere in the next year or two."

Li Zhai was having trouble finding staff for Noodle Topia, his Madison Heights, Michigan, restaurant, in the summer of 2021, so he bought a BellaBot from Pudu Robotics. The robot was so successful he added two more; now, one robot leads diners to their seats while another delivers bowls of steaming noodles to tables. Employees pile dirty dishes onto a third robot to shuttle back to the kitchen.

Now, Zhai only needs three people to do the same volume of business that five or six people used to handle. And they save him money. A robot costs around $15,000, he said, but a person costs $5,000 to $6,000 per month.

Zhai said the robots give human servers more time to mingle with customers, which increases tips. And customers often post videos

of the robots on social media that entice others to visit.

"Besides saving labor, the robots generate business," he said. Interactions with human servers can vary. Betzy Giron Reynosa, who works with a BellaBot at The Sushi Factory in West Melbourne, Florida, said the robot can be a pain.

"You can't really tell it to move or anything," she said. She has also had customers who don't want to interact with it.

But overall the robot is a plus, she said. It saves her trips back and forth to the kitchen and gives her more time with customers.

Labor shortages accelerated the adoption of robots globally, Le Clair said. In the U.S., the restaurant industry employed 15 million people at the end of last year, but that was still 400,000 fewer than before the pandemic, according to the National Restaurant Association. In a recent survey, 62% of restaurant operators told the association they don't have enough employees to meet customer demand.

Pandemic-era concerns about hygiene and adoption of new technology like QR code menus also laid the ground for robots, said Karthik Namasivayam, director of hospitality business at Michigan State University's Broad College of Business.

"Once an operator begins to understand and work with one technology, other technologies become less daunting and will be much more readily accepted as we go forward," he said.

Namasivayam notes that public acceptance of robot servers is already high in Asia. Pizza Hut has robot servers in 1,000 restaurants in China, for example.

The U.S. was slower to adopt robots, but some chains are now testing them. Chick-fil-A is trying them at multiple U.S. locations, and says it's found that the robots give human employees more time to refresh drinks, clear tables and greet guests.

Marcus Merritt was surprised to see a robot server at a Chick-fil-A in Atlanta recently. The robot didn't seem to be replacing staff, he said; he counted 13 employees in the store, and workers told him the robot helps service move a little faster. He was delighted that the robot told him to have a great day, and expects he'll see more robots when he goes out to eat.

"I think technology is part of our normal everyday now. Everybody has a cell phone, everybody uses some form of computer," said Merritt, who owns a marketing business. "It's a natural progression."

But not all chains have had success with robots.

Chili's introduced a robot server named Rita in 2020 and expanded the test to 61 U.S. restaurants before abruptly halting it last August. The chain found that Rita moved too slowly and got in the way of human servers. And 58% of guests surveyed said Rita didn't improve their overall experience.

Behavior Therapist to Teach Individuals with special needs how to talk, play, make friends and function independently while helping reduce any inappropriate behaviors.

Currently enrolled in college/university with 2 years of collage coursework completed in psychology related field.

FRENCH President Emmanuel Macron said Wednesday he wants to "engage China toward a shared responsibility for peace" in Ukraine when he meets Chinese leader Xi Jinping this week.

French officials said earlier that Macron planned to urge Xi in talks Thursday to use Beijing's influence with Russian President Vladimir Putin, but didn't expect a big shift in the Chinese position.

Macron is to be accompanied by European Commission President Ursula von der Leyen in a show of European unity in dealings with Beijing.

Xi and Putin declared their governments had a "no limits friendship" before Moscow's February 2022 attack on Ukraine. Beijing has refused to criticize the Kremlin but has tried to appear neutral and has called for a cease-fire and peace talks.

In a speech to French residents of China, Macron said he would "try to build, and somehow engage China toward a shared responsibility for peace and stability on international issues" including Ukraine, Iran and North Korea.

Macron expressed hope China will "participate in initiatives that are useful to the Ukrainian people."

"Dialogue with China is indispensable," Macron said during the event at the French Embassy.

Xi's government sees Russia as a source of energy and as a partner in opposing what both say is U.S. domination of global affairs.

China is the biggest buyer of Russian oil and gas, which helps to prop up the

Kremlin's revenue in the face of Western sanctions. That increases Chinese influence, but Xi appears reluctant to jeopardize that partnership by pressuring Putin.

Macron noted Putin's announcement that Moscow plans to deploy tactical nuclear weapons in Belarus, which China opposes.

"Territorial integrity, the sovereignty of nations is part" of the Charter of the United Nations, which China affirmed, Macron said.

Defending those principles "means moving forward together and trying to find a path for peace," Macron said. He noted China proposed a peace plan in February and that while France doesn't fully agree with it, the plan "shows a will to commit toward the resolution of the conflict."

Meanwhile, NATO's 31 member countries warned Wednesday of "severe consequences" should China start sending weapons and ammunition to Russia.

"Allies have been clear that any provision of lethal aid by China to Russia would be a historic mistake, with profound implications," NATO Secretary-General Jens Stoltenberg told reporters after chairing a meeting of the organization's foreign ministers in Brussels.

Stoltenberg declined to say what the implications of such a move might be, but warned only that it would involve "severe consequences."

"At a time when Beijing and Moscow are pushing back against the rules-based international order, it is even more important that we continue to stand together," he said.

AS FOSSIL fuel emissions continue warming Earth’s atmosphere, the Biden administration is turning to hydrogen as an energy source for vehicles, manufacturing and generating electricity.

It’s offering $8 billion to entice the nation’s industries, engineers and planners to figure out how to produce and deliver clean hydrogen. States and businesses are making final pitches Friday as they compete for a new program that will create regional networks, or “hubs,” of hydrogen producers, consumers and infrastructure. The aim is to accelerate the availability and use of the colorless, odorless gas that already powers some vehicles and trains.

How can enough hydrogen be produced to meet demand — in ways that don’t worsen global warming? And how can it be moved efficiently to where users can get it? Such questions will be tackled by the hubs.

Nearly every state has joined at least one proposed hub and many are working together, hoping to reap the economic development and jobs they would bring.

The governors of Arkansas, Louisiana and Oklahoma came up with the “HALO Hydrogen Hub” to compete for funding, for example.

Big fossil fuel companies like Chevron and EQT Corporation, renewable energy developers such as Obsidian, and researchers in university and government labs are involved, too.

But only a select few will receive billions in federal funding.

The bipartisan infrastructure law signed by President Joe Biden last year included $8 billion for a program to establish six to 10 regional “hydrogen hubs” around the nation. A hub is meant to be a network of companies that produce clean hydrogen and of the industries that use it — heavy transportation, for example — and infrastructure such as pipelines and refueling stations. States and companies have teamed up to create hub proposals. Their final applications are due Friday at the U.S. Department of Energy, which is expected to start awarding money later this year.

Hydrogen can be made in ways that yield little if any planet-warming greenhouse gases. The Energy Department says hydrogen, once produced, can generate power in a fuel cell, emitting only water vapor and warm air. The department says the hubs will produce “clean” hydrogen, although its definition includes hydrogen produced with natural gas. Gas companies have talked about mixing hydrogen at low concentrations with methane for delivery to homes and businesses.

Some consider hydrogen “clean” only if made through electrolysis — splitting water molecules using renewable energy sources such as wind and solar power, which also is carbon free, as well as nuclear power. But some oil and gas companies say they can use fossil fuels as feedstocks if they capture the carbon dioxide and keep it out of the atmosphere.

Environmental groups say hydrogen presents its own pollution and climate

risks. When emitted into the atmosphere, it boosts volumes of methane and other greenhouse gases, underscoring the need to avoid leaks from hydrogen systems – an issue the hubs should consider, said Nichole Saunders, staff attorney with the Environmental Defense Fund.

The Energy Department asked for detailed plans and received 79. In December, the department encouraged 33 of those with hub proposals to submit a final application, although ones that were discouraged can still apply. The department hasn’t identified the applicants because of sensitive negotiations over where to put the hubs.

The environmental nonprofit Clean Air Task Force has monitored the process and identified 23 finalists on an online map. The Associated Press contacted those groups and received responses from most, confirming that they were encouraged by the DOE to apply by Friday and sharing details of their plans. Among them are energy producers — fossil fuels as well as renewable developers — plus states, universities, national laboratories, utilities and companies that plan to use the hydrogen.

More than 60 public and private entities in the Midwest want a hub in their region, for example. The Midwest Alliance for Clean Hydrogen says it would be an “ideal fit,” partly because many large industrial sectors there, including steel, ammonia and refining, rely on “dirty hydrogen consumption” to fuel their operations.

At least eight plan to source their hydrogen from fossil fuels and produce it using natural gas, in keeping with a provision in the law that at least two hubs should be in areas with the nation’s most abundant gas supplies.

The Appalachian Regional Clean Hydrogen Hub is a partnership involving the state of West Virginia and EQT, the nation’s largest natural gas producer, among others. They say their region has enormous gas resources and could produce hydrogen from methane using heat, steam and pressure while capturing the carbon dioxide it would generate.

At least eight other proposals would generate hydrogen from water through electrolysis, primarily using renewable sources such as wind and solar, although some would power the process with nuclear energy. They are concentrated in coastal and Upper Midwestern states. California has a renewables-only plan to use hydrogen to decarbonize transportation, ports and power plants, with its Alliance for Renewable Clean Hydrogen Energy Systems. Washington and Oregon also want to use renewables to produce hydrogen to use for heavy-duty transportation, aviation, maritime and agriculture. The Pacific Northwest Hydrogen Association says it’s planning projects in those two states, plus Montana. The Great Lakes Clean Hydrogen Coalition would produce hydrogen at the Davis-Besse Nuclear Power Station in Oak Harbor, Ohio, through electrolysis and transport it by pipeline and truck for the region’s steelmaking, aviation and glass manufacturing industries.

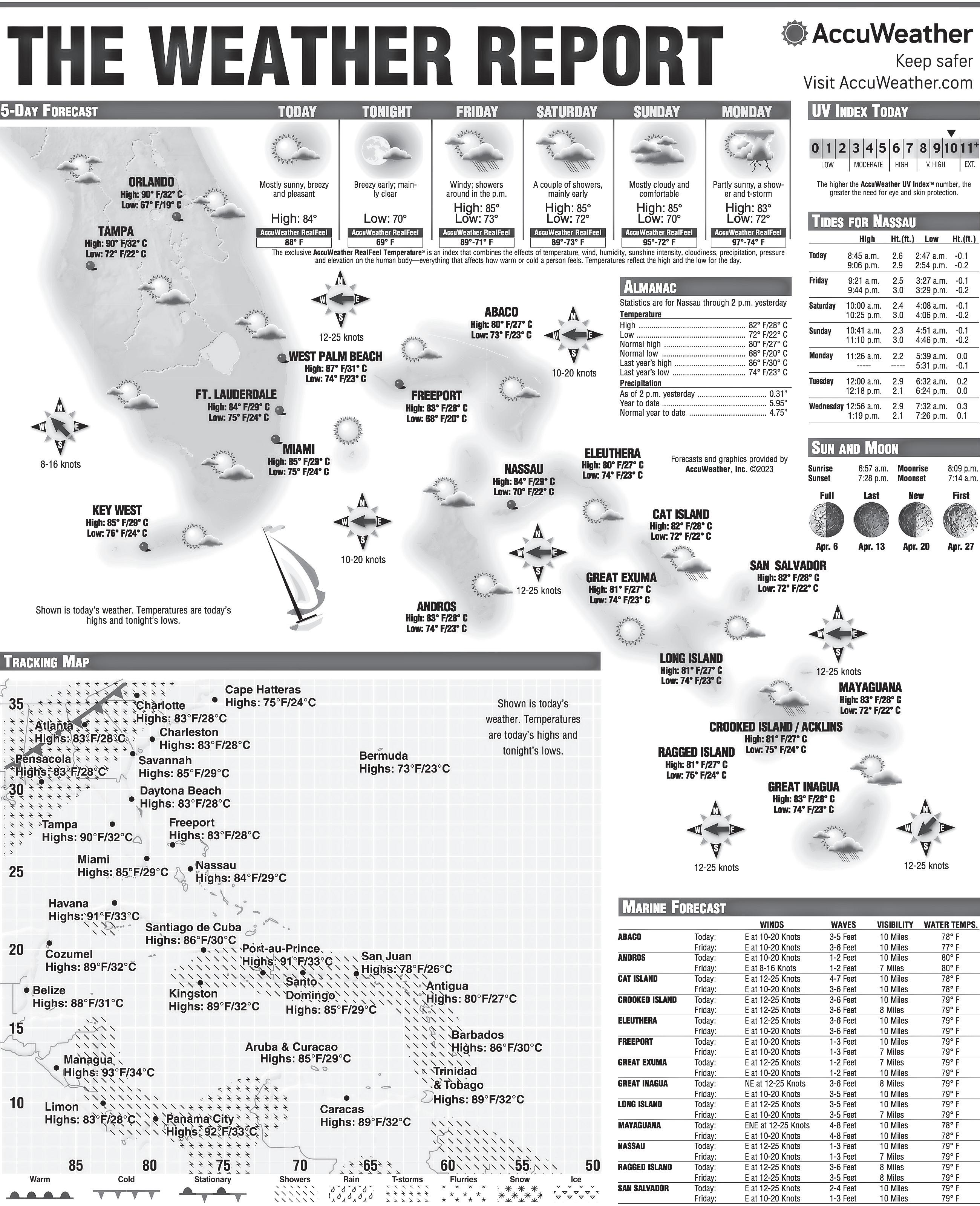

A 2021 Toyota Prius that runs on a hydrogen fuel cell sits on display at the Denver auto show Sept. 17, 2021, at Elitch’s Gardens in downtown Denver. As fossil fuel emissions continue warming Earth’s atmosphere, the Biden administration is turning to hydrogen as an energy source for vehicles, manufacturing and generating electricity.

The Tribune wants to hear from people who are making news in their neighbourhoods. Perhaps you are raising funds for a good cause, campaigning for improvements in the area or have won an award. If so, call us on 322-1986 and share your story.

IN THE ESTATE OF AMBROSE HANNA late of Narcissus Avenue, Garden Hills #1, in the Southern District of the Island of New Providence, one of the Islands of the Commonwealth of The Bahamas, deceased.

Notice is hereby given that all persons having any claim or demand against the above Estate are required to send their names, addresses and the particulars of their debts or claims duly certified in writing to the undersigned on or before the 6th May, A. D. 2023, after which date the Executor will proceed to distribute the assets having regard only to the proved debts or claims of which notice have been given. And Notice is hereby given that all persons indebted to the said Estate are requested to make full settlement on or before the date herein before mentioned.

EDWARD B. TURNER & CO. #24 Leonie Place

Flax Terrace off Malcolm Road Nassau, Bahamas

Attorneys for the Executor of the Estate of the late Ambrose Hanna

ENVIRONMENTAL Protection Agency administrator Michael Regan testifies before the Senate Environment and Public Works Committee hearing to examine President Joe Biden’s proposed budget request for fiscal year 2024 for the Environmental Protection Agency, on Capitol Hill, March 22, 2023, in Washington. The Environmental Protection Agency is tightening rules that limit emissions of mercury and other harmful pollutants from coal-fired power plants, updating standards imposed more than a decade ago.

THE Environmental Protection Agency is tightening rules that limit emissions of mercury and other harmful pollutants from coal-fired power plants, updating standards imposed more than a decade ago.

The rules proposed Wednesday would lower emissions of mercury and other toxic pollutants that can harm brain development of young children and contribute to heart attacks and other health problems in adults.

The move follows a legal finding by EPA in February that regulating toxic emissions under the Clean Air Act is “appropriate and necessary” to protect the public health. The Feb. 17 finding reversed a move by former President Donald Trump’s administration to weaken the legal basis for limiting mercury emissions.

The proposed rule will support and strengthen EPA’s Mercury and Air Toxics Standards, which have delivered a 90% reduction in mercury emissions from power plants since they were adopted in 2012 under former President Barack Obama, EPA Administrator Michael Regan said.

“By leveraging proven, emissions-reduction measures available at reasonable costs and encouraging new, advanced control technologies, we can reduce hazardous pollution from coal-fired power plants — protecting our planet and improving public health for all,” Regan said in a statement.

The proposed rule is expected to become final next year, “ensuring historic protections for communities across the nation, especially for our children and our vulnerable populations,” Regan said.

The new rule aims to eliminate up to 70% of mercury emissions and other toxic pollutants such as lead, nickel and arsenic, while also reducing fine dust from coal plant emissions.

The mercury rule is among several EPA regulations aimed at coal plants, including proposals to restrict smokestack emissions that burden downwindareas with smog, tighten limits on wastewater pollution and toughen standards for fine particle pollution, more commonly known as soot.

Biden has pledged to make the U.S. electricity sector carbon neutral by 2035, and stricter pollution standards have pushed electric plants to replace coal and oil with natural gas, wind and solar power.

The EPA said the mercury rule would result in the likely retirement of 500 megawatts of power by 2028 — an amount produced by a single large plant — but a spokesman for the National Mining Association called that number “grossly underestimated.’’

The mercury rule “is one piece of a larger agenda to force retirements of welloperating coal plants,’’ said Conor Bernstein, a spokesman for the mining group.

“The cumulative effect of EPA’s agenda is a less reliable and increasingly expensive supply of electricity as the nation continues to struggle with energy-driven inflation.’’ Regan did not attend a news briefing Wednesday, but he said last year that industry should “take a look at this suite of rules all at once and say, ‘Is it worth doubling down on investments in this current facility? Or should we look at the cost and say no, it’s time to pivot and invest in a clean energy future?’ “

If some plants decide that investments in new technologies are not worth the cost “ and you get an expedited retirement, that’s the best tool for reducing greenhouse gas emissions,” Regan said at a March 2022 energy industry conference.

Coal-fired power plants are the largest single manmade source of mercury pollutants, which enter the food chain through fish and other items that people consume. Mercury can affect the nervous system and kidneys; the World Health Organization says fetuses are especially vulnerable to birth defects via exposure in a mother’s womb.

Environmental and public health groups praised the EPA proposal, saying it protects Americans, especially children, from some of the most dangerous forms of air pollution.

“There is no safe level of mercury exposure, and while we have made significant progress advancing clean energy, coal-fired power plants remain one of the largest sources of mercury pollution,’’ said Holly Bender, senior director of energy campaigns for the Sierra Club.

“It’s alarming to think that toxic pollutants from coal plants can build up in places like Lake Michigan,’’ where many Americans camp and swim during the summer, “and where people fish to feed their families,’’ Bender said. “Our kids deserve to live and play in a healthy, safe environment.’’

The Edison Electric Institute, which represents investor-owned electric companies, said it was reviewing details of the EPA proposal, but added that its members “have fully and successfully implemented the Mercury and Air Toxics Standards” for 11 years, “resulting in dramatically reduced mercury and related emissions” from U.S. power plants.

“We look forward to continuing to work with” EPA to ensure the final standard “is consistent with our industry’s ongoing clean energy transformation,” said Emily Fisher, the group’s executive vice president of clean energy,

Sen. Shelley Moore Capito, R-W.Va., took a more combative approach, saying Biden’s administration “continues to wage war on coal and affordable, reliable energy by issuing unnecessary regulations intended to drive down electricity production from our nation’s baseload power resources.’’

STOCKS on Wall Street mostly slipped Wednesday following the latest signals that the U.S. economy is slowing under the weight of much higher interest rates.

The S&P 500 dipped 10.22 points, or 0.2%, to 4,090.38, a day after it broke a four-day winning streak. The Dow Jones Industrial Average rose 80.34, or 0.2%, to 33,482.72, and the Nasdaq composite dropped 129.47, or 1.1%, to 11,996.86.

Yields also fell in the bond market following weaker-than-expected reports on the health of U.S. services industries and the job market. They’re the latest signs that the economy is losing momentum following a feverish set of hikes to interest rates by the Federal Reserve meant to get inflation under control.

One report from the Institute for Supply Management said that growth in the U.S. services sector slowed last month by more than economists expected, as the pace of new orders cooled. A separate report suggested private employers added 145,000 jobs in March, down sharply from February’s 261,000. Perhaps more importantly for markets, pay raises also weakened for workers, according to the ADP Research Institute.

“Our March payroll data is one of several signals that the economy is slowing,” said Nela Richardson, chief economist at ADP. “Employers are pulling back from a year of strong hiring and pay growth, after a three-month plateau, is inching down.”

Higher interest rates can undercut inflation, but only by slowing the entire economy with a blunt hammer. The hope is that the Fed can pull off the tricky balancing act of slowing the economy and job market just enough to stamp out high inflation, but not so much that it causes a recession. The Fed has hiked rates over the last year at the fastest pace in decades.

ADP’s private payroll report could offer a preview of what Friday’s more comprehensive jobs report from the U.S. government will show. Economists expect it to say employers added 240,000 jobs last month, down from 311,000 in February.

If the job market really is slowing from the strong growth that’s helped to prop up the larger economy recently, it could offer the

Fed reason to pause on its hikes to interest rates.

That’s a big deal for markets not only because it could lessen the odds of an upcoming recession, which some economists already see as a high probability. Higher rates also drag on prices for stocks, bonds and other investments.

Other reports on the economy this week also came in weaker than expected, including readings on the number of job openings across the country and the health of the manufacturing sector.

The reports have traders increasing bets for the Fed to hold rates steady at its next meeting in May, which would be the first time that’s happened in more than a year. Many traders are also betting the Fed will have to cut rates later this year, something that can act like steroids for markets.

The Fed, though, has consistently said it doesn’t expect to cut rates this year. Inflation is still high, and the Fed has talked often about the risk of letting up on the battle too soon. Other central banks around the world are staying aggressive to fight it.

New Zealand’s central bank raised its key rate by half a percentage point to 5.25%, double the size of what many economists were expecting. It was the Reserve Bank of New Zealand’s 11th straight rate hike as it tries to cool inflation.

On Wall Street, the majority of stocks fell within the S&P 500, but many of the moves were modest.

On the winning side was Johnson & Johnson, which rose 4.5% after it proposed to pay nearly $9 billion to cover allegations that its baby powder containing talc caused cancer. It was one of the biggest drivers of the Dow Jones Industrial Average’s gain for Wednesday.

In the bond market, the yield on the 10-year Treasury dipped to 3.30% from 3.34% late Tuesday. It helps set rates for mortgages and other loans. The two-year yield, which tends to move more on expectations for the Fed, slipped to 3.80% from 3.82%.

Gold held relatively steady and dipped $2.60 to settle at $2,035.60 per ounce. It’s up more than 11% so far this year after jumping last month amid worries about the strength of the global banking system.