THE Government is eyeing a safety crackdown on jet ski operators that could result in the industry having to sign up to and abide by a ‘code of conduct’, it was revealed yesterday.

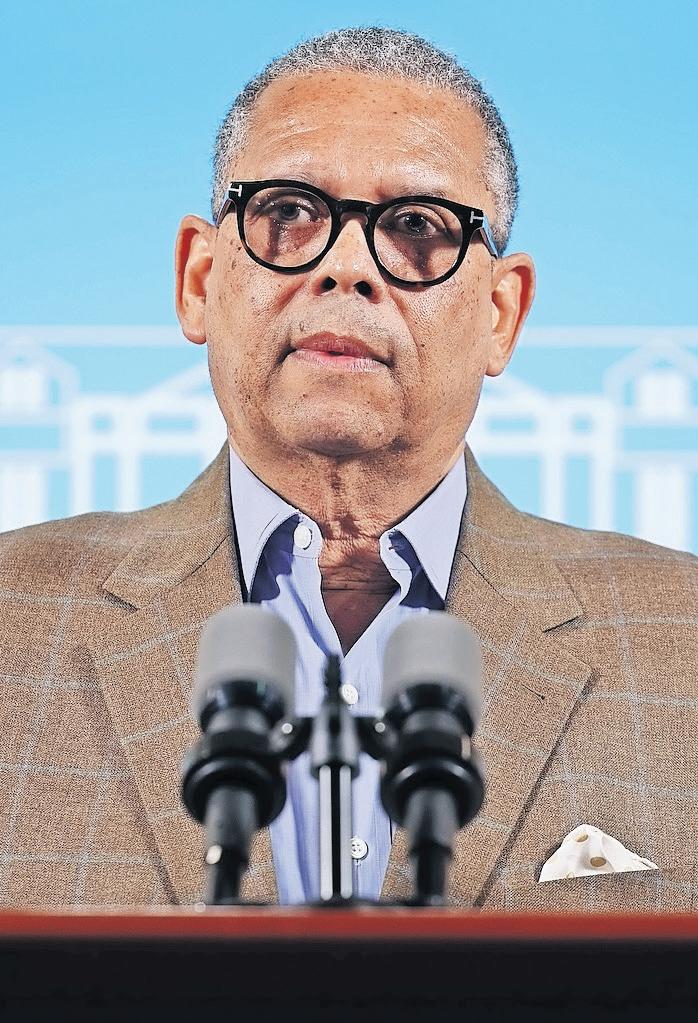

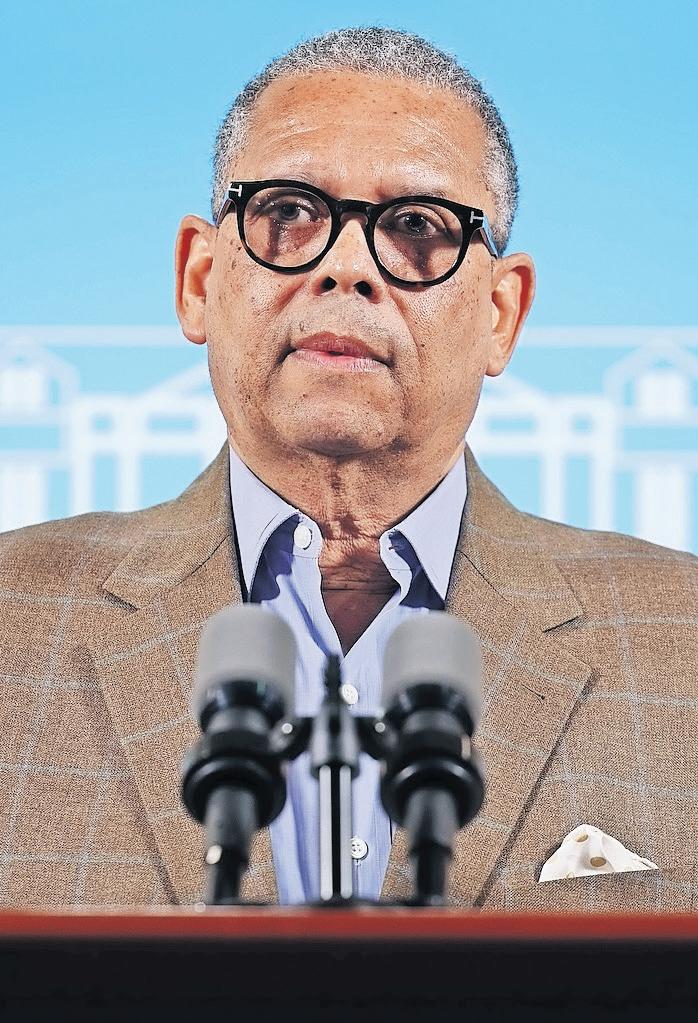

Robert Sands, the Bahamas Hotel and Tourism Association’s (BHTA) president, confirmed to Tribune Business that the sector was among “stakeholders” present at meetings organised by the Ministry of Transport and Port Department that are seeking to “strike a balance” between visitor safety and allowing jet ski/watercraft operators to earn a living.

Confirming that the hotel and tourism industry has been “pressing” for improved watersports industry regulation and behaviour “for a long time”, he disclosed that the discussions have focused on implementing a “code of discipline” for operators

and identifying specific locations where activities can be conducted in a bid to ensure “the country’s reputation” remains intact. The talks were revealed at last week’s BHTA quarterly meeting, where Mr Sands said: “On March 22, there was another collaborative meeting between the

Bahamas Hotel and Tourism Association, representatives of the Port Department, the Royal Bahamas Police Force and other law enforcement agencies and the Ministry of Tourism to address and discuss matters relating to the watercraft sector, in particular, jet ski operators.”

Pressed for more details yesterday, Mr Sands said the meeting was called by the Ministry of Transport and Port Department. He added that all relevant “stakeholders” were present, with the regulatory agencies also meeting with jet ski operators “to try and work out a methodology by which they can co-exist in the tourism

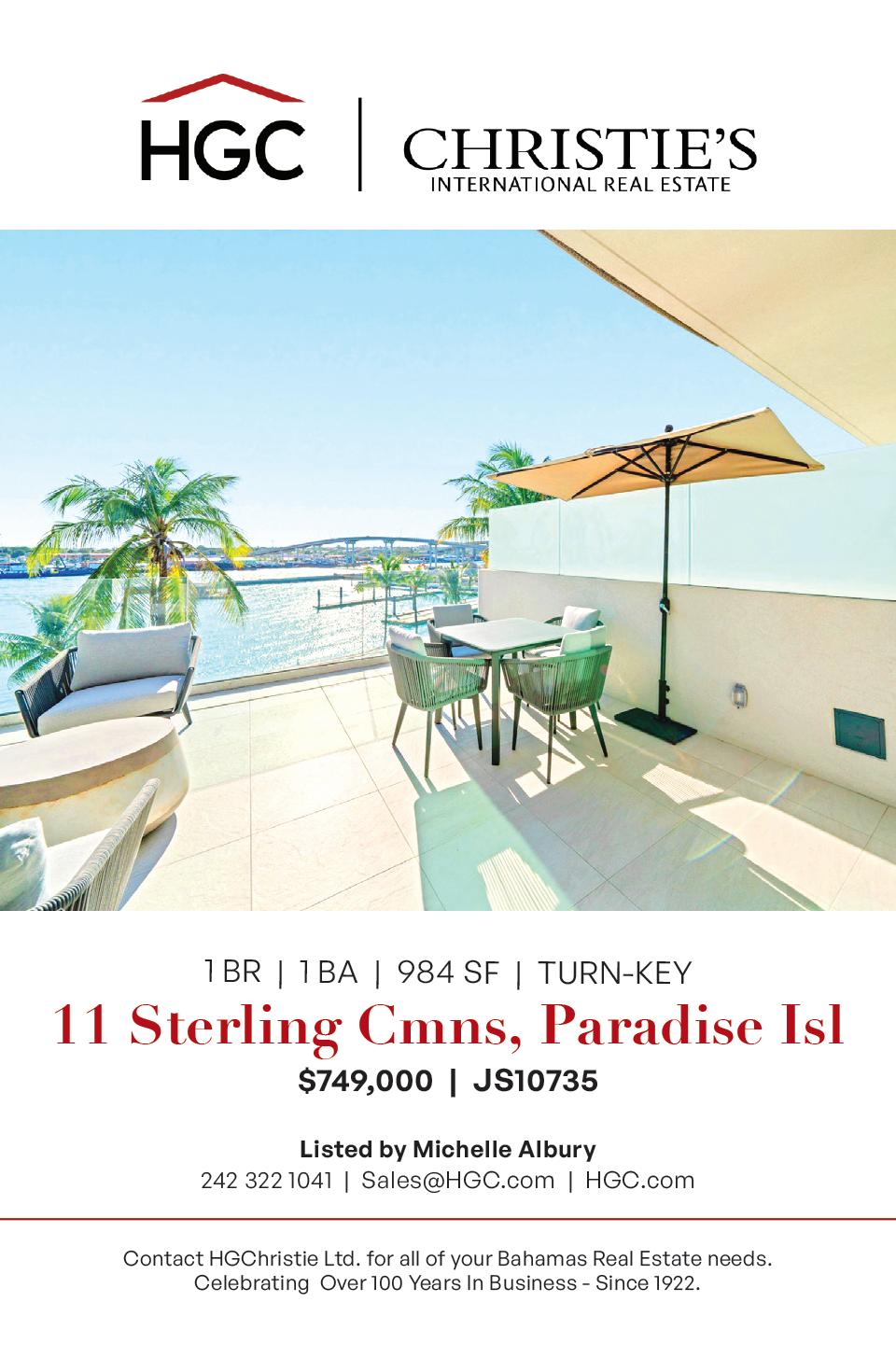

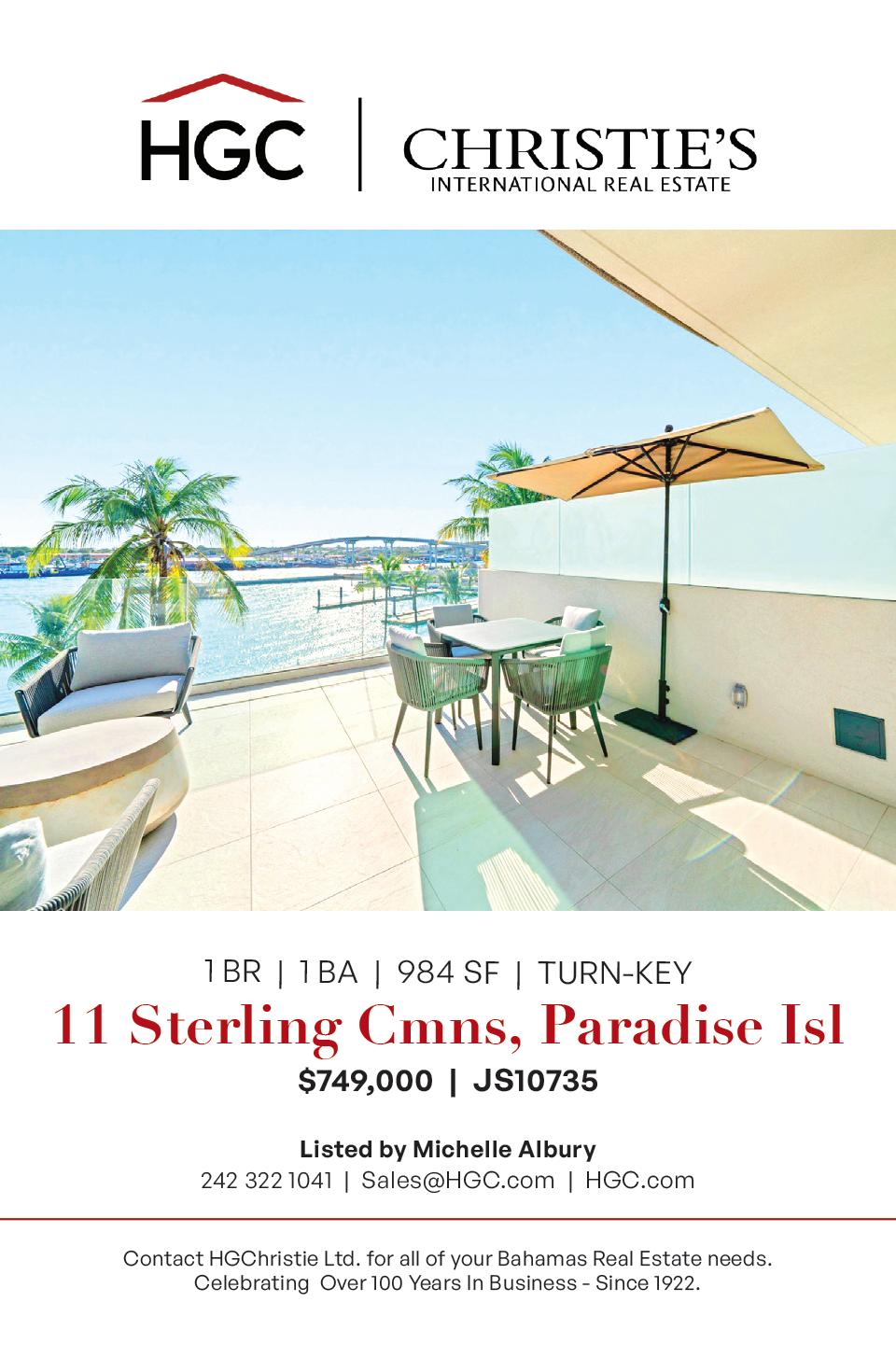

Freeport real estate sees 25% surge before market ‘explodes’

By NEIL HARTNELL Tribune Business

property sales and rentals were yesterday said to have increased by 25 percent in recent months as buyers seek to enter the market before it “explodes” from $2bn worth of investment projects.

Multiple realtors told Tribune Business that real estate activity in The Bahamas’ second city has surged sharply amid growing recognition that developments such as Carnival’s $600m cruise port, the Grand Bahama Shipyard’s $600m expansion and multiple other investments appear to be for real with many already underway and into their construction phases.

Donna Laing-Jones, a broker with Keys Bahamas Realty, estimated that 2024 first quarter business

volumes had grown by 10-15 percent year-overyear with the buyer mix split 50/50 between Nassau residents and foreigners. She added that inquiries have picked up by some 20 percent in the past two weeks alone. And, apart from sales, Ms Laing-Jones said Freeport’s rental market is set for a major boost with Carnival having released a Request for Proposal (RFP) seeking leased units for its workforce with effect from January 2025.

Demand will also be driven by the student population’s continued growth at Western Atlantic University’s Medical School, and this is likely to outstrip supply leading to accommodation shortages. With real estate values around one-third of comparable properties in Nassau, the Keys Bahamas broker added that many capital residents

with access to financing were trying to close deals in Freeport before prices increase from market forces stimulated by Grand Bahama’s potential economic revival.

“I’m telling everyone that any property find abandoned, whether it’s a duplex, triplex or whatever you can afford in real estate, buy it,” Ms LaingJones said. “The buyers are coming out of Nassau, the buyers are coming out of the US.

“I had a broker from Miami call me this

morning, and she wanted to spend a couple of days with me to find out what’s going on. Many of her clients have been talking about Grand Bahama, and she reached out to me to ask if she can come over for a couple of days to understand what’s going on and what opportunities may be available to her clients.

“Properties are closing left, right and centre. We’re going to close on a commercial building in

FOCOL Holdings’ top executive last night said it is targeting growth “in every sector of our business”, including gas stations and electricity generation, and added: “We’re preparing for the next 50 years.”

FTX Bahamian liquidators eye US legal ‘run rate’ fall

FTX’s Bahamian liquidators are hoping the legal fees “run rate” drops sharply due to the settlement with their US counterpart after incurring an estimated $56m total bill during their first 15 months of work.

The just-released minutes of the first creditors meeting for FTX Digital Markets, the collapsed crypto exchange’s Bahamian subsidiary, revealed that legal and professional fees for the three months

to end-January 2024 were likely to total $9.3m. When added to the $46.7m in fees incurred during the liquidation’s first 12 months, which have already been approved by the Supreme Court, those generated for the three-month period from November 1, 2023, onwards will take the total cost to $56m if accurate and accepted by the judge. “An update was provided on the amount of court-approved professional fees to date in the estate. In total, the court has approved $46.7m covering the period from the commencement of the provisional liquidation to October 31, 2023,” the minutes said. “The chairman estimated that time costs for legal and professional fees for the period 1 November, 2023, to 31 January, 2024, will be in the region of $9.3m.

the settlement to synchronise the claims process for FTX Digital Markets with that for the Chapter 11 debtors.”

The meeting’s chairman was Peter Greaves, who with his fellow Pricewa-

“It is hoped that the run rate of US legal fees is reduced considerably following the conclusion of the adversary proceeding per the global settlement agreement, although it was noted that it will be necessary to focus resources on the development of the claims adjudication and KYC portal in order to meet the requirements of

Dexter Adderley, the BISX-listed petroleum products supplier’s president and chief executive, told Tribune Business that “every dollar of capital that we raise will generate a proportionate increase in value for shareholders” as the company extended its $25m rights offering by two weeks to this Friday, April 5. Asserting that FOCOL’s Board was “thrilled” with the number of shareholders who have exercised their right to subscribe for a collective five million additional shares, worth $5 each, he said the directors had opted to extend the offering to “ensure all have a fair opportunity to buy shares”. FOCOL has yet to identify how the rights offering proceeds will be used, although many observers believe the funds could help finance its participation in the Government’s proposed Bahamas Power & Light (BPL) public-private partnership (PPP) through the likely provision of liquefied natural gas (LNG) fuel. Other possibilities include the Government’s Family Island and New Providence renewable energy tenders.

Mr Adderley gave a little more insight last night, telling this newspaper: “As our chairman pronounced it a few weeks ago, FOCOL is pregnant with opportunities. These opportunities cover every sector of our business. It ranges from the expansion and upgrade of the retail network, it includes expansion of our fleet of generation equipment. “That includes the 5 Mega Watt (MW) solar energy plant in Grand Bahama that we are preparing to break ground on in a few months.” He added that “probably for the first time in the industry’s recent history” FOCOL will introduce two new petroleum-transporting ships into service this summer, while also focusing on the “general expansion of our infrastructure that paves the way for cleaner fuels of the future”.

business@tribunemedia.net WEDNESDAY, APRIL 3, 2024

Kevin Cambridge,

Brian Simms KC, the Lennox Paton senior part-

form the liquidator trip overseeing

Digital Markets wind-up. A significant portion of the combined $56m in legal and professional

will have been earned By NEIL HARTNELL Tribune Business Editor nhartnell@tribunemedia.net

terhouseCoopers (PwC) accountant and partner,

and

ner,

FTX

fees

FREEPORT

SEE PAGE A16

Editor nhartnell@tribunemedia.net

SEE PAGE A16

By NEIL HARTNELL Tribune Business Editor nhartnell@tribunemedia.net SEE PAGE A17 A SUPREME Court judge has ruled that the Bahamian and Cuban governments must battle to resolve a 24 year-old legal dispute over a $90,000 cheque. Senior justice Deborah Fraser, in a March 27, 2024, verdict, determined that the Governmentthrough the Treasurer and the Attorney Generalshould replace the initial corporate plaintiff on the basis that it was struck off the Companies Register and ceased to exist as of August 23, 2019. The legal justification for her ruling was based on section 273 of the Companies (Amendment) Act 2019, which mandates that assets and property belonging to a dissolved company “vest in the Treasurer for the benefit of The Bahamas”. With Dom’s International Importers now struck off, its claim to the disputed $90,000 sum now passes to the Government as a potential asset should it win the legal battle. However, standing in the Treasurer’s way is Havanaturs (Bahamas), the Cuban government-owned travel agency, which senior justice Fraser ruled should be “joined” as a party to the action given its competing claim to the near quarter-of-a-century old cheque. Havanaturs (Bahamas), which has facilitated travel to Cuba for thousands of Bahamians and foreign nationals from its East Bay Street offices, is alleging that a former manager “removed a blank cheque book” without authorisation and used it to obtain $100,000 for himself as “compensation for wrongful dismissal”. As a result, the travel agency is asserting that the $90,000 belongs to it. The judgment reveals that, at end-August 1999 when the events giving rise to the dispute occurred, Havanturs (Bahamas) was flush with cash having more than $1.91m split between its two bank accounts. The legal battle was triggered more than 24 years ago on January 7, 2000. This was when Dom’s International Importers initiated an action against the then-CIBC Bahamas (this was before the Barclays deal) accusing it of Bahamas and Cuba to battle on $90k cheque By NEIL HARTNELL Tribune Business Editor nhartnell@tribunemedia.net SEE PAGE A17 Gov’t eyes jet ski safety crackdown By NEIL HARTNELL Tribune Business Editor nhartnell@tribunemedia.net SEE PAGE A16 ROBERT SANDS DEXTER ADDERLEY $5.60 $5.61 $5.75 $5.60

FOCOL targets wide growth in ‘preparing for the next 50 years’

BAKERY REVEALS RECORD EASTER HOT-CROSS SALES

A BAHAMIAN bakery yesterday revealed it enjoyed its best Easter todate by selling just under 600 dozen homemade hot cross buns.

Mark Grant, owner of Heavenly Creations by Chef Mark, said customer turnout was bigger than anticipated and his business sold out of the first 200 dozen just 30 minutes after opening last Thursday.

“It was the best year for us so far based on the turnout. We were able to do about slightly under 600 dozen. Unfortunately, some persons had to walk away disappointed who are waiting in line once we sold out,” he said.

“It was pretty much way more. We were expecting a big crowd, but the way that it went… it was overboard based on what we started with. We started with 200 dozen and in half an hour it was gone, and persons waiting in line for an hourand-a-half, two hours.

Some people made it clear they were not moving until that bread came out of the oven, but it was worth the wait.”

Chef Mark explained that bakeries have had to increase their prices due to the rising cost of supplies.

He added that ingredients such as spices, dried fruit and baking pans have increased significantly so many bakers raised their prices by a few dollars to offset the costs.

He said: “So as the costs increase, we increase because of the costs at the

vendors. We had bakers that went from $12 to $15 because just the pans alone, they are like $2 for the pans and the covers. Plus, raisins get expensive, the spices you use depending on what you put on it.

“For us we went all the way with it by adding features such as stuffing it and adding different flavours, so we were able to charge between $25 and $30 a dozen. So, the pricing wasn’t really a distraction for us because we adjusted for any prices that would have went up slightly from what we charged last year.”

Chef Mark said he plans to invest in industrial equipment so that he can continue to build on this year’s success, and is looking forward to baking more treats next Easter. “I’m looking forward to doing it again next year,

and hopefully we can invest in getting industrial equipment that’ll make it a bit easier, especially the rolling as it’s a tedious component,” he added.

Tasia Ferguson, owner of Sweet Jennie’s Bakehouse, said that although she chose to limit her orders this year she saw stronger sales than in 2023 and sold out.

She said: “Compared to last year, it was a bit more but I had limited my orders because I was just coming off of an illness. So I didn’t want to take too much orders.”

Ms Ferguson said she has been in business since 2021, and has conducted an annual cost analysis which shows the steady increase in ingredients prices over the years. The cost of staples such as flour has increased from $30 a bale in 2021 to

Bahamian hospitality veteran to head Resorts World Bimini

A NASSAU native, and 40-year hospitality industry veteran, has been named general manager at Resorts World Bimini.

The resort brand, in a statement, said Gregory Stubbs will oversee operations at the Bimini hotel’s 305 guest rooms and suites, four on-site pools, Serenity spa, restaurants and bars, Fisherman’s Village shopping experience and a 4.5 acre private beach and lounge.

Mr Stubbs joined the Resorts World Bimini team in 2013 as assistant director of food and beverage where, following two years of honing his skill-set, he was promoted to director of the same department.

In 2018, Mr Stubbs was appointed assistant general manager at Resorts World Bimini and has played an important role in the

$50 in 2023 and now $55 in 2023.

She said: “I had done an analysis of when I first started baking hot cross buns in 2021, and now this is my fourth year. In 2021, I paid $30 for a bale of flour which is ten five-pound bags, and I paid $50 last year and $55 this year.

“Things are steadily increasing by up to 25 percent. The eggs were $113 a case. Last year I had purchased organic eggs from a local farmer but they didn’t have sufficient to supply me this year. Butter in 2021 was $72 per case, now it’s a little over $100. Sugar has remained stable since it increased in 2022, but flour, eggs, butter they are big costs for bakeries.”

Ms Ferguson said the cost of pans and lids increased significantly this year, with

100 plastic lids increasing from about $85 to $132. She said: “The foil pans, they were basically the same price as last year - $86 for a case of 100 count. In prior years they were $75 a case and the lids for them were about $10 more. This year the lids were $132 for the case and the pans were $87. Some places went up to $232 for 100-count pans and lids.”

Due to the cost increases, Ms Ferguson charged $18$20 per dozen this year but loyal customers were understanding of the overall increase in food costs and still chose to buy their preferred treats. “The loyal people know your product and know that’s what they want, they pay for it,” she added.

Resorts ‘meet or exceed’ Easter tourism targets

property’s operational success.

“Greg Stubbs has a long history with Resorts World Bimini and knows it better than any candidate could. We’re looking forward to seeing him in this role as general manager,” said Victor Karavias, senior vice-president of operations at Resorts World Bimini.

“He is an undeniable expert in the market, having served not just at Resorts World Bimini but throughout The Bahamas. Stubbs brings a wealth of cultural knowledge, leadership and strong food and beverage experience. He will play a crucial role in ensuring every guest has a wonderful and memorable experience while visiting the beautiful island of Bimini.”

Mr Stubbs attended the Bahamas Hotel & Training College from 1982 to 1990. In 1992, he received his examination and certification from the Wine & Spirit Education Trust. He also obtained multiple distinctions from the American Hotel & Motel Association.

“This is a wonderful progression of my career and I am especially honoured as a Bahamian native to take on this role and serve as general manager,” said Mr Stubbs. “Together, the team and I are ready to create personalised resort experiences for every guest, every time at Resorts World Bimini.”

By FAY SIMMONS Tribune Business Reporter jsimmons@tribunemedia.net

BAHAMIAN resorts were yesterday said to have met or exceeded their Easter performance targets and are expecting a strong 2024 second quarter.

Robert Sands, Bahamas Hotel and Tourism Association’s (BHTA) president, said all major resorts saw an “extremely strong” close to the first three months of 2024 with Easter bookings meeting or exceeding goals.

Speaking to Tribune Business, Mr Sands said bookings into the summer are “very positive and encouraging” with this trend likely to carry on throughout the year once there are no unexpected shocks to the tourism industry. He said: “Our Easter was extremely strong. Very, very strong. And I think most, if not all, hotels met or exceeded their forecasts for that period.

“Forward bookings are also looking very positive and encouraging. So, we keep our fingers crossed and trust that we have no unexpected headwinds so that our positive momentum can continue not only for the second quarter, but for the entire rest of the year.”

Earlier this year, deputy prime minister, Chester Cooper, who is also minister of tourism, investments and aviation, said first quarter bookings were expected to outpace 2023 by 14 percent. He added that a report by the Forward Keys

consultancy revealed that arrivals for the three months to end-March 2024 are expected to exceed the comparative period for 2023 with mid-year bookings ahead of the first six months for last year by 12 percent.

Last week, Joy Jibrilu, the Nassau/Paradise Island Promotion Board’s chief executive, said the sector had rebounded strongly from the negative publicity from the US and Canadian travel warnings with airline seat capacity for February some 32 percent ahead of 2023 comparatives at 6,838 seats per day.

She said: “As it relates to Easter, coming off the last week of January and first week of February it was quite a hair-raising time not knowing what direction we were trending in. The rebound has been incredible, and all our partners have seen very strong bookings for Spring Break and March.

“All of them are trending above what they have forecast, so we’re going to end up with a very strong March and April. The future outlook is very strong too. We met last week with all the airline partners last week at Routes Americas and all were saying the same thing.

“All of them were very pleased with the destination and its performance, so we’re very pleased across the board, especially on the heels of that travel advisory when all the members were hit and we were like: ‘My goodness. What’s going to happen?” This is a very good position for us to all find ourselves in.”

PAGE 18, Wednesday, April 3, 2024 THE TRIBUNE

By FAY SIMMONS Tribune Business Reporter jsimmons@tribunemedia.net

ADVERTISE TODAY! CALL THE TRIBUNE TODAY @ 502-2394

GREGORY STUBBS

Bahamian wedding planner receives global appointment

A BAHAMIAN destination wedding planner has been appointed as industry advancement director of the Certified Wedding Planners (CWP) Society. The move comes after Cindy Coakley-Knowles spent more than 32 years in the hospitality industry, working in managerial positions at several resorts in Nassau and gaining recognition as a certified hospitality educator and a Cacique Tourism Award Management finalist. She has also worked as a labour activist, career counsellor, lecturer and children’s rights activist.

A recent three-term president of the Bahamas Bridal Association, Mrs CoakleyKnowles is internationally certified and is the lead planner and co-founder - with her husband - of Destination Angels International, a wedding and events planning company that has been operating for 15 years. She is married to Thomas O’Brian Knowles Jnr and they have two boys, Thomas III and Thaddeus.

Trusted by more than 8,000 members, the CWP Society, based in Georgia in the US, is the world’s largest membership of wedding planners and a leading wedding certification programne. As one of the organisation’s industry advancement directors, Mrs Coakley-Knowles has direct responsibility for The Bahamas and Florida (Northwest).

Gov’t eyes jet ski safety crackdown

FROM PAGE A20

environment in a harmonious, safe [way] and making sure the guests are satisfied”.

However, the BHTA president was quick to add: “No decision has been made. This has simply been some fact-finding on behalf of the Government of The Bahamas. Certainly, it’s an issue that hoteliers have been pressing for a long period of time. Safety is one, I think, that’s the single biggest issue. “Hotels recognise this [jet skis] is a service tourists want, but it has to be conducted in an environment that all parties are satisfied with and benefit from, and all parties are safe. There were a number of things discussed - location; code of discipline; liability insurance coverage. All of this,

identification numbers on watercraft, making sure they have identification of the operators etc.” Watersports and watercraft, and jet ski operators in particular, have long been perceived as a poorly-regulated sector and a potential threat to The Bahamas’ reputation as a safe tourism destination. The US State Department, in its present Bahamas travel advisory, tries to discourage Americans - who account for up to 90 percent of the visitor base - from patronising the industry due to “safety concerns”. “Activities involving commercial recreational watercraft, including water tours, are not consistently regulated. Watercraft may bepoorly maintained, and some operators may not have safety certifications. Always review and heed

local weather and marine alerts before engaging in water-based activities,” the US State Department advisory states.

“Commercial watercraft operators have discretion to operate their vessels regardless of weather forecasts. Injuries and fatalities have occurred. Due to these safety concerns, US government personnel are not permitted to use independently operated jet ski rentals on New Providence and Paradise Island.

Mr Sands yesterday described the Ministry of Transport and Port Department initiative as “a work in progress”. He added that “two sets of meetings” have been held thus far with industry stakeholders, and it was expected that “one or two” more will take place so efforts can be finalised.

“I don’t think it would be fair to discuss the preferred result while we [are still] hearing the views of all parties,” the BHTA president told Tribune Business “At the end of the day, we are looking for common ground. We’re looking for this to be done in a safe and co-ordinated manner away from the hustling of guests and so forth, but also so that the operators can benefit from the supply and demand of the service.

“A lot of tourists want the service as well, and to come up with agree, identified locations where this can be conducted and managed in a responsible way. I think it’s a move in the right direction.... The jet ski operators offer a service many tourists want, but they have to be managed, have a code of conduct, and

we know that the country’s reputation is satisfied and the whole safety issue with tourists is satisfied.”

The ‘code of conduct’ would likely apply, and operate, in similar fashion to the one that is being launched for the Bahamian taxi industry this Friday at Baha Mar. Mr Sands said: “The taxi drivers play a paramount role as ambassadors for tourism.”

Wesley Ferguson, the Bahamas Taxi Cab Union’s president, earlier this week warned this newspaper that “a lack of enforcement” could undermine the industry’s new ‘code of conduct’. He said he wants it to be more than simply “a signed piece of paper” with the authorities employing it as a tool to crack down on misbehaving individuals and apply due penalties for infractions.

“This is very, very important for the industry,” he explained. “As you might be aware, I have been

FOCOL targets wide growth in ‘preparing for the next 50 years’

FROM PAGE A20

Asked whether he was referring to LNG specifically, Mr Adderley replied: “We’re preparing our infrastructure for whatever the customer demands and that includes all fuels. Essentially we’re preparing the organisation - the organisation is going through significant growth - and we’re preparing it for the next 50 years. “This is coming on the heels of the fact that for our last fiscal year we reported our biggest net income in the history of the group. The opportunities continue to come. We’re looking to embrace the new opportunities... The new capital, new raises, go into new projects which fund new streams of income for the company.” FOCOL Holdings, in its rights offering document, is forecasting that profits will grow by more than $8m

By FRANK BAJAK AP Technology Writer

over the next three years, increasing from last year’s $32.621m to $40.833m by 2026. Profit for the current 2024 year is forecast at $34.026m, and for 2025 at $37.226m.

“Net income for the year ended September 30, 2023, was $32.6m compared to $21.4m in the prior year, representing an increase of $11.2m or 52 percent,” the company said. “FOCOL’s 2023 performance represents a return to the company’s pre-pandemic level of earnings combined with early signs of growth across various business segments. “The combination of a rebound in the local economy and early results from new investments initiatives contributed to the steady upward trend in the company’s overall performance... Investments in fixed assets were made to strengthen the company’s infrastructure in the wholesale and

retail business segments. Additional investments were made in power generation assets during the year.”

Asked where renewable energy fits in FOCOL Holdings’ strategy, Mr Adderley said: “We see renewable energy as one of the key elements of the future of the industry, the clean energy landscape, and we are very proud to participate in that sector. Certainly we are looking to leverage our current infrastructure to support this new industry, and pivot towards cleaner fuels and a cleaner stream of energy.

“The exact number and what portion that is depends on how successful we are in pursuing opportunities out there. It’s a core focus for us. Just to put some additional context to that, we have 25 employees currently being trained in renewable energy systems to install, operate and

sincerity about the company's knowledge of the targeted breach, which affected multiple U.S. agencies that deal with China. It concluded that "Microsoft's security culture was inadequate and requires an overhaul" given the company's ubiquity and critical role in the global technology ecosystem. Microsoft products "underpin essential services that support national security, the foundations of our economy, and public health and safety." The panel said the intrusion, discovered in June by the State Department and dating to May "was preventable and should never have occurred," blaming its success on "a cascade of avoidable errors." What's more, the board said, Microsoft still doesn't know how the hackers got in. The panel made sweeping recommendations, including urging Microsoft to put on hold adding features to its cloud computing environment until "substantial security improvements have been made." It said Microsoft's CEO and board should institute "rapid cultural change" including publicly sharing "a plan with specific timelines to make fundamental, security-focused reforms across the company and its full suite of products."

maintain them. It’s the same technicians and engineers installing fuel pumps being trained to install inverters.” FOCOL yesterday said the “majority” of shareholders have subscribed to the rights offering, and the two-week extension will now allow all its existing investors - including officers and directors - to seek to acquire the remaining shares.

“We are absolutely thrilled that the majority of our shareholders have exercised their rights to purchase these additional shares,” Mr Adderley said. “We do know some shareholders were unable to exercise their rights despite their desire to do so. In keeping with our commitment to maximise opportunities, our directors decided to extend the offering. They recognise there was only 30 days to respond to the offering.”

He added that this was the first time that FOCOL Holdings has issued new shares for 25 years, or a quarter-of-a-century, the last occasion being its initial public offering (IPO) in 1999. “A few additional days wouldn’t hurt,” Mr Adderley said. “The directors thought it appropriate to exercise their authority to extend it to Friday.”

Shareholders who do not take up their rights, or exercise their full allocation, will find their holdings in FOCOL diluted. The prospectus shows Sir Franklyn Wilson, the company’s chairman, as holding around 36-37 percent of its issued and ordinary shares. Total shares held by Board members and executives are equal to 49.643m, not far off half the outstanding and issued stock.

The rights issue, which involves a total five million new shares potentially being issued at $5 each,

complaining over the past couple of months about having a bunch of new taxi drivers entering the system. Some of them are well behaved, some of them are not. There’s some misbehaviour in the taxi industry.”

Asserting that the code will raise driver standards, help to weed out rogue elements, and improve the guest/visitor experience for those who use taxis, Mr Ferguson said he was unsure whether some are unaware of the “rules and regulations” set to be imposed or they simply do not care. He added that the code, which is supposed to “outline core values and behaviours of franchise holders and drivers”, will give the Road Traffic Department and its supervisors “clear directions and guidelines so that when an infraction is committed they would know what the penalties are and their course of action”.

and could take outstanding stock to 105.2m if fully subscribed. “Management is cognisant of climate change initiatives focused on reducing worldwide carbon emissions,” the prospectus said.

“Locally, the Government of The Bahamas implemented mandates to increase the usage of renewable sources of energy to 30 per cent by year 2030. The company continues to expand into the renewable energy sector by integrating it into our current business model.

“We are encouraged by the record level of visitor arrivals during 2023. We are also encouraged by the announcement of several major resort development projects throughout The Bahamas and the Turks & Caicos Islands which are expected to further stimulate construction sector growth. Continued growth in the tourism and construction sectors will enhance the company’s future profitability.”

In a statement, Microsoft said it appreciated the board's investigation and would "continue to harden all our systems against attack and implement even more robust sensors and logs to help us detect and repel the cyber-armies of our adversaries."

In all, the state-backed Chinese hackers broke into the Microsoft Exchange Online email of 22 organizations and more than 500 individuals around the world including the U.S. ambassador to China, Nicholas Burns — accessing some cloudbased email boxes for at least six

THE TRIBUNE Wednesday, April 3, 2024, PAGE 17

CINDY COAKLEY-KNOWLES

IN

scathing

ment of Microsoft

security and

a Biden

appointed review

issued a report

saying "a

by the tech giant let

backed

operators

accounts of

cials

The

shoddy cybersecurity

tices,

lax

and

lack

A

indict-

corporate

transparency,

administration-

board

Tuesday

cascade of errors"

state-

Chinese cyber

break into email

senior U.S. offi-

including Commerce Secretary Gina Raimondo.

Cyber Safety Review Board, created in 2021 by executive order, describes

prac-

a

corporate culture

a

of

weeks and downloading some 60,000 emails from the State Department alone, the 34-page report said. Scathing federal report rips Microsoft for shoddy security, insincerity in response to Chinese hack Incorporated under the International Business Companies Act, 2000 of the Commonwealth of The Bahamas. Registration number 211296 B (In Voluntary Liquidation) Notice is hereby given that the above-named Company is in dissolution, commencing on the 2nd day of April A.D. 2024. Articles of Dissolution have been duly registered by the Registrar. The Liquidator is Mr. Daniel Liam Rummery, whose address is R Simao Alvares 656, AP 32, CEP: 05417-020, Sao Paulo, SP, Brazil. Any Persons having a Claim against the above-named Company are required on or before the 2nd day of May A.D. 2024 to send their names, addresses and particulars of their debts or claims to the Liquidator of the Company, or in distribution made before such claim is proved. Dated this 2nd day of April A.D. 2024. DANIEL LIAM RUMMERY Liquidator NOTICE Skippy Partners Ltd. I.T Position Opportunity Position requirements Include: Must be able to install and trouble-shoot server Ability to resolve problems independently All candidates must submit resumes to sw.employmemt@hotmail.com JOB OPPORTUNITY EMPLOYMENT OPPORTUNITY Ambulatory Medical facility in Freeport is seeking, Quali ed and Registered Pharmacist with a minimum of 5 years experience. Contact Human Resource Manager 373-7400 ext. 235 or accounts@lucayanmedical.com

Freeport real estate sees 25% surge before market ‘explodes’

a couple of weeks. It was sitting there for $1.5m and the guy called me and said: ‘Let’s get it’. There’s momentum here on Grand Bahama and we just need to be ready.”

Ms Laing-Jones told Tribune Business that inquiries from potential buyers are “probably up about 20 percent in the past couple of weeks”, with many simply requesting details on what’s available and the dollar value they are prepared to meet. “We have a lot of cash buyers in the market,” she added.

“It’s very active compared to past years. I would think in this first quarter we probably have increased as a percentage about 10-15 percent over the prior year. It’s the busiest I’ve seen for a long time. There’s a lot of buyers out there; a lot of Bahamians out of Nassau for sure.

“I would think it would be 50/50 Nassauvians and foreign buyers. When they can purchase a property in Grand Bahama for $300,000, they’re probably

looking at $1m in Nassau.” Trevor Johnson, broker and appraiser with Churchill & Jones Real Estate, confirmed the growing interest in Freeport by capital residents.

“We have seen quits a few persons from Nassau coming over and trying to catch the market before it explodes and takes off,” he told this newspaper. “The market is ripe and ready. I guess they’re trying to catch it before Carnival opens next year and prices uptick, and it won’t be too late for them to get in at the beginning.

“Contracts are becoming more and more every day. People are buying waterfront properties, and folks here are buying older buildings, dilapidated buildings and refurbishing them and putting them back on the market. I would say the rental market has picked up about 25 percent and sales about the same.”

However, with the multiple investment projects already underway or anticipated to start in Grand Bahama, and the size of the construction and, ultimately,

full-time workforces that will be required, Mr Johnson conceded: “We have a housing shortage here and will have a serious influx of workers.

“We’re stressed right now looking for apartment rentals. There are a lot of workers coming from Nassau to participate in finishing the Carnival cruise port, and the medical school students are taking up a lot of rentals as well. We have a shortage of rentals in lower and middle income neighbourhoods.”

A Freeport resident since 1969, Mr Johnson acknowledged that it has “been an uphill battle for us, but I’m a real patriot and will be the first one to hang the flag out”. He added that market activity is the busiest he has seen it in 20 years since Frances and Jeanne, and a succession of other hurricanes, devastated the island.

Ms Laing-Jones echoed Mr Johnson on the rental concerns, saying: “The majority of the contractors coming in are looking for housing for up to 100 persons and it’s almost impossible to find. They

have to be all over the place; you couldn’t keep them in one area. A couple of contractors couldn’t come because they couldn’t find the housing.

“It will be like when they built the Grand Lucayan, when we had so many rentals and all the agents were making money because we couldn’t find enough housing for people needing it. Certainly we have a supply issue. We have had a supply issue since Dorian and COVID. We definitely need more rental units. We’re encouraging everyone to build a unit, update, restore, repair your unit. There’s not much time.

One Freeport-based source, speaking on condition of anonymity, confirmed to Tribune Business that the city’s property market is showing signs of reviving after two decades in the doldrums following the Royal Oasis closure in 2004 and Hurricanes Frances and Jeanne. “There’s new buyers. I have three deals today between $600,000 and $1.5m with sales agreements to be signed. Deposits are

BAHAMAS AND CUBA TO BATTLE ON $90K CHEQUE

FROM PAGE A20

“breach of contract” for not honouring a manager’s cheque made payable to itself.

The cheque, for $90,000 and dated August 31, 1999, was made payable by the former Havanaturs (Bahamas) manager, Mr Garcia, and endorsed to Dom’s International Importers but CIBC (Bahamas) did not honour it when it was presented for payment on September 3, 1999.

The Canadian-owned bank, in its legal reply, requested that the travel agency replace it as defendant. Floyd Watkins, the late former Delaporte MP and Havanturs (Bahamas) then-attorney, alleged in a November 2000 affidavit that Mr Garcia “claimed $100,000 as compensation for wrongful dismissal

against Havanaturs and retained a blank check.

“A year after his dismissal, Nelson Garcia used the blank cheque to purchase the manager’s cheque to compensate himself. Mr Watkins further averred that Havanaturs’ bank account was suspended and ceased to be operational from November 1998 to August 1999,” senior justice Fraser recorded.

However, following a further flurry of legal filings, the cheque dispute “became dormant” for 17 years after 2003. It was revived on July 30, 2020, when Havanaturs (Bahamas) filed its “intention to proceed” even though Dom’s International Importers - not itself - was the named plaintiff in the matter. Following failed bids to obtain summary judgment, and have the case struck out for want of prosecution,

the Cuban governmentowned travel agent sought to be “joined” as a plaintiff against CIBC (Bahamas) and replace Dom’s International Importers in this role. It also demanded that the bank pay it $90,000, and argued that the case should be decided solely on the evidence it had presented. CIBC Bahamas, in its evidence said it had “no interest” in the $90,000. It was allegedly told by Havanturs (Bahamas) in August 1999 not to honour the cheque because it was not authorised by the company, a position that was reiterated by the late Mr Watkins, who “undertook to indemnify CIBC against any claims, losses or damages for which it might suffer as a result of not honouring the said cheque”. Dom’s International Importers principal was identified as Don Brown,

and CIBC pledged that it “does not collude in any manner” with either party and was willing to hand the $90,000 over to the rightful party as determined by the Supreme Court. Mr Watkins, in evidence filed in November 2000, asserted that “upon his departure, Mr Garcia claimed compensation for wrongful dismissal in the amount of $100,000. Havanaturs repudiated that claim whereupon Mr Garcia without lawful authority removed a blank cheque book of Havanaturs.

“Due to Mr Garcia’s failure/refusal to return the blank cheque, the then-manager for Havanaturs, Jorge Pensado, made a formal complaint to the police..... Mr Watkins was surprised that Mr Garcia was able to purchase the bank draft from CIBC when CIBC was fully aware of the situation

in place. There’s activity and people are buying. I have felt it for the past two months but am only really seeing it now,” they said. “Buyers have been absent for almost two years. They are mostly residents looking around now. We’re going to boom. The airport is going now and Carnival is causing some excitement because they’ve got people looking for apartments.”

James Sarles, principal and broker with James Sarles Realty, said Freeport and Grand Bahama now have “a positive story to tell” potential buyers due to the up to $2bn worth of investment projects in the pipeline. He conceded that the city was still “banking on” its “future potential”, and many developments will take years to come to fruition, but there was growing belief this time might be for real.

“The hurricanes are behind us, we have the infrastructure here. People are recognising that,” Mr Sarles said. “I’ve always said we’re always the bridesmaid, never the bride, but it seems like this could

involving Mr Garcia’s departure from Havnaturs one year earlier.

“The bank draft number 0176819 made payable actually to ‘Nelson Sarsia’ in the amount of $90,000 was induced to be drawn by Havanaturs as a result of fraudulent misrepresentations made by Mr Garcia.”

However, before deciding whether Havanaturs (Bahamas) should be joined as a party to the action, senior justice Fraser found: “As Dom’s International Importers has been struck off the Register any assets that it may possess are now vested in the Treasurer of The Bahamas.

be Grand Bahama’s turn. We’re getting a lot of people from the US, especially the boating community, who realise it’s near impossible to build new dockage there....

“We need everything to keep moving. We need the hotel [Grand Lucayan], we need the airport. It’s years in the making all these things, but people see it in advance and it’s a positive story to tell. There’s a lot of unemployment and a lot of things we need here, but if you are asking me if we’re on the right trajectory for the first time in a while, we are.”

Mr Sarles urged Grand Bahama residents and businesses to prepare for what is to come, with the island able to “get its footing” once again if all promised investments come to fruition. “We have to get our level of service up, we have to raise our standards,” he added. “We have to accommodate these projects, accommodate these people. It’s a chance for sleepy Freeport to step up to the plate.”

“There is $90,000 in abeyance and it is unclear if the funds belong to Dom’s International Importers or to Havanaturs..... I believe the appropriate step in this matter is to have the Treasurer of The Bahamas joined in the action to make any representations it may wish to make relating to the $90,000, which it may or may not be entitled to in these proceedings,” she continued.

“Based on the evidence before me it may well be that Havanaturs is entitled to the $90,000 and, as such, I shall join it in the action.... As Havanaturs has a vested interest in the matter and would like the matter to be determined, I shall order that it serve this order and all pleadings and applications filed herein on the Treasurer and the Attorney General within 21 days of the date of this hearing.”

“This necessarily means that, as Dom’s International Importers’ former directors/ representatives have not come forward in relation to this matter, I believe the only appropriate action is for the treasurer of the Commonwealth of The Bahamas (and, of course, the Attorney General) be joined to this action before any further action transpires.

meeting minutes

by FTX Digital Markets’ US attorneys, White & Case, who have had to defend the Bahamian liquidators against frequent attacks and legal filings by John Ray, head of the 134 FTX entities currently in Chapter 11 bankruptcy protection in Delaware.

The hope is that US legal fees will be much reduced now that the Bahamian trio have worked out a settlement agreement with Mr Ray that will ultimately see both liquidation estates combine recovered assets in one pool so that they can be returned their rightful owners - former FTX clients, investors and vendors.

The $56m figure also pales in comparison to the more than $300m bill incurred by Mr Ray’s team and legal advisers. In FTX Digital Markets’ case, PwC is thought to have employed a large multi-jurisdictional team spanning the entire globe to unravel the complexities of the crypto exchange’s collapse, with the Supreme Court acting as a check against runaway costs that dilute the value of creditor recoveries. Now that hostilities with Mr Ray have ended, the Bahamian liquidators can now focus on processing creditor claims, adjudicating and vetting these submissions to make sure they are legitimate and accurate, and then returning assets to ex-FTX clients.

The meeting minutes

reveal that the deadline for FTX Digital Markets creditors to submit those claims is likely to be pushed back by at least a month from the original May 15, 2024, target, but both the Bahamian liquidators and Mr Ray are aiming to make the first distribution of assets before year-end 2024. “The global settlement agreement allows for customers to choose in which liquidation process they wish to claim [The Bahamas or Mr Ray’s in the US], but they can only ever receive a distribution from one,” the

PAGE 16, Wednesday, April 3, 2024 THE TRIBUNE

FROM PAGE A20

said. “Customers will have to elect which process to participate in when submitting a claim. “The provisional deadline for claim submission and election was set for 15 May, 2024, by the global settlement agreement, but it is now expected to be extended to at least June 2024 based on recent developments. “The claims portal is accepting claims. All creditors are able to register an account, link their claims account to their FTX.com account, accept or dispute their account balance, have their claim adjudicated, and complete the KYC (Know Your Customer)

The meeting

revealed

were informed their

balances, and thus sums

to them,

be based on their valuations as at November 11, 2022, which is when FTX collapsed into Supreme Court-supervised liquidation in The Bahamas and Chapter 11 bankruptcy protection in the US. The liquidators conceded this was “a departure from the claim value reference date under Bahamian law”, but explained: “To harmonise processes and to avoid complexity between the Chapter 11 debtor estate and the FTX Digital estate, the court approved the use of 11 November, 2022, as the claim reference date.” FTX Digital Markets’ claims portal went live on March 1, and the meeting minutes added: “The joint official liquidators and the Chapter 11 debtors have a shared goal to make the first interim distribution by the end of 2024 to creditors with admitted claims and satisfactory KYC documentation... “The joint official liquidators will focus now on claims submissions, adjudications and reconciliation of claims between the FTX Digital Markets and the Chapter 11 debtor estates, as well as settle the opt-in election process and monetisation of assets to maximise and accelerate distributions.” FTX Bahamian liquidators eye US legal ‘run rate’ fall FROM PAGE A20

and AML (anti-money laundering) processes.”

minutes

creditors

account

due

will