Treasure Cay gets ‘break we’ve waited 35 years for’

By NEIL HARTNELL Tribune Business Editor nhartnell@tribunemedia.netTreasure Cay stands poised for “the break we’ve been waiting for for 35 years” after a Florida-based developer last night confirmed he has a “binding” deal to acquire the Abaco development.

Edward Burr, chairman and chief executive of GreenPointe Holdings, a Jacksonvilleheadquartered developer, told Tribune Business that the agreement with the Meister family creates “a unique opportunity” to not only “revive” what has been described as “the largest second homeowner community in The Bahamas and Caribbean” but the whole of North Abaco.

* Florida developer in ‘binding’ purchase deal with Meisters

* Pledges ‘unique opportunity’ to ‘revive’ wider North Abaco

* Unclear if previous purchaser’s litigation still an obstacle

A near-20 year homeowner at Treasure Cay himself, Mr Burr said he and his team were still finalising development plans but aimed to capitalise on the destination’s “rich history” to “build better than what we have”. While the level of investment and number of jobs that will be created have yet to be determined, the developer anticipates submitting its application for government approvals in “the near term”. Mr Burr told this newspaper the project is also seeking to “revitalise” wider North Abaco through the entrepreneurial and employment opportunities it will provide, restoring businesses and ensuring families become “self-sufficient” such that it halts the departure of persons seeking work elsewhere.

‘MAKE

“It’s not a negotiation. We have a binding

THE SWITCH’: 2.6% GROWTH BELOW FORECASTS

THE Bahamas must “make the switch” to focus on medium to long-term economic goals after it was revealed yesterday that 2023’s 2.6 percent real GDP growth came in below expectations.

Hubert Edwards, head of the Organisation for Responsible Governance’s (ORG) economic development committee, told Tribune Business that concentrating too heavily on near-term or year-over-year

results threatens to mask structural economic woes that must be tackled over multiple years such as education reform and Bahamas Power & Light/energy policy.

He spoke out after the Bahamas National Statistical Institute (BNSI) unveiled initial gross domestic product (GDP) growth estimates for 2023 that came in under both International Monetary Fund (IMF) and Central Bank of The Bahamas forecasts.

EASTER RUSH FOR FISHBUT RECORD HIGH COST

FISHERMEN say the cost of fish is at an all time high due mainly to the increase in gas and cost of business.

purchase and sales agreement with the Meisters to purchase Treasure Cay,” the GreenPointe chief confirmed. “We have been doing the proper due diligence and normal

things buyers do, and look forward to a successful conclusion to the process.” Confirming that much of the work to-date has involved “understanding the infrastructure and condition of the property as it is’”, especially given the near-catastrophic damage much of it sustained during Hurricane Dorian, Mr Burr said he has been visiting Treasure Cay personally for more than 20 years and has owned a home in the community since 2005.

“We’ve been doing as buyers do, understanding the issues with the property first,” he added. “We’re looking forward to the successful conclusion of this process and doing something that will revive and make better not only

Treasure Cay but also all of North Abaco.

“Everything is in process. We don’t have any final plans. We will be submitting concept plans to the Government along with our approvals.” Asked when the application for the necessary permits and approvals will be made to the Bahamas Investment Authority (BIA), Mr Burr replied: “There are so many moving parts, I hate to put a date on it, but it will certainly be in the near-term. I will say that... “We haven’t involved government much todate... It’s really taken a while to understand the asset. I think we have a good handle on that and

He said: “Well, I’ve already sold out of my fish. I brought my boat over from the island early this week and I sold out. But right now, I’m just going to stay put and make some money cleaning fish because I can’t buy no fish to resell the price is too high. But people was coming in all week and I sell out today so I’m happy.”

Another vendor said Easter is always a busy time for fishermen and predicted as the holiday draws closer more persons will

A fisherman at Potter’s Cay dock yesterday said he docked his boat in New Providence on Monday and has already sold out of fish. The vendor, from Andros, said he brings fish over every year to capitalise on shoppers eager to have fish for the Good Friday holiday. He said since the price of fish is currently so high he decided not to purchase fish to resell and opted to partner with another vendor and clean fish.

Return on investment not sole consideration

IN today’s fast-paced competitive business environment, every decision made must be backed by solid data and reasoning. One of the most crucial metrics for evaluating the effectiveness of investments is the return on investment, or ROI. This financial indicator reveals the true business value generated by your efforts.

Moreover, in an age where multiple marketing channels co-exist, such as social media, content marketing, paid advertising and e-mail marketing, it is essential to evaluate each business channel’s performance to determine which ones generate the highest returns.

What is ROI and why is it important for your business?

In simple terms, ROI shows how much money a business earns in relation to the amount it invests. Understanding ROI is essential for entrepreneurs as it enables them to evaluate the success of their investments and create data-driven decisions to maximise profits.

ROI principally measures the efficiency of an investment and provides a clear picture of whether it is profitable or not.

Is ROI the same as profit?

Profit measures the performance of the business, while return on investment (ROI) measures the profitability of an investment and helps businesses make informed decisions about where to allocate their resources. Try not to confuse ROI with the return on the owner’s equity, which is an entirely different conversation.

Moreover, business owners must weigh the anticipated ROI against factors such as risk, timelines and the company’s strategic goals. While an

By

By

DEIDRE BastiaN

investment with a high ROI might be more attractive, it is essential to evaluate the associated risks and the time taken to realise a return.

It is also worth noting that ROI should not be the sole determining factor in investment decisions. Businesses must take a holistic approach that includes qualitative factors such as brand reputation, competitive advantage and market trends.

By doing so, companies can make well-rounded choices that contribute to their overall success and long-term resilience.

Subsequently, ROI analysis enables businesses to spot under-performing investments, allowing them to make timely adjustments or even discontinue projects that are not yielding the desired results. This proactive approach helps to minimise a company’s financial losses.

Misconceptions While ROI is undoubtedly a prevailing metric, it is not immune to pitfalls such as an over-emphasis on short-term gains. One common pitfall is focusing solely on short-term ROI, as it is crucial to consider

both short-term and longterm returns.

Ignoring non-financial benefits: ROI primarily measures financial returns, but some investments may yield non-financial benefits such as improved customer satisfaction, brand reputation or employee morale.

Failing to account for these intangible factors can lead to an incomplete understanding of the investment’s true value.

Inaccurate data and assumptions: Overestimating revenue or under-estimating costs can lead to a skewed perception of an investment’s true returns, causing businesses to make ill-informed decisions.

Over-reliance on past performance: It is important not to assume that past performance will always predict future returns for the mere fact that market conditions and competition can change, affecting the reading of an investment.

In conclusion, businesses that are mindful of these pitfalls and misconceptions can leverage ROI more effectively in their decision-making process, while weighing quantitative and qualitative factors plus short-term and long-term implications.

Nonetheless, a good ROI is one that exceeds the average market return, which is what all businesses are aiming for.

Until we meet again, fill your life with memories rather than regrets. Enjoy life and stay on top of your game.

NB: Columnist welcomes feedback at deedee21bastian@gmail.com

Deidre M. Bastian is a professionally-trained graphic designer/brand marketing analyst, international award-winning author and certified life coach.

Boat rules needed to stop ‘bad actors’

PAUL Maillis, the National Fisheries Association’s (NFA) secretary, defended some of the government’s new amendments to the Boat Registration Bill and the Water Skiing and Motorboat Control Bill, saying “bad actors” who operate unlicensed charter and water sport services have made it difficult for law-abiding businesses.

Speaking to Tribune Business, he said operators have become “frustrated” with unlicensed vendors that operate on the “black market” undercutting the prices of tours and endangering visitors through negligence. He explained that licensed operators have to pay significant registration fees, business licence fees, and must now show proof of insurance and produce maintenance records while unlicensed operators intentionally offer guests the same service for less money. He said: “It’s frustrating for

TREASURE CAY

FROM PAGE B1

are putting in plans. I think we’ve done a good job of getting an understanding of that and are working on the plans themselves, ready to move forward.”

As for what attracted him to acquire the project, which is thought to have some 595 undeveloped acres and possibly a further 1,000 in additional land, he added: “My love for Treasure Cay would be the first motivation, and the opportunity to bring the talent, resources and skills of my company, GreenPointe, to revitalise what was Treasure Cay and make it better. We feel we can build better than what we had. “Certainly we have had friends, and have known people residing in North Abaco, and I’ve watched many of them leave North Abaco because they cannot make a living because there are no jobs in North Abaco.

I think we can do a great job of restoring business opportunities and helping to make people self-sufficient and to revitalise most of North Abaco.”

Mr Burr and GreenPointe appear to have the expertise, track record and necessary financing to do what is required in reviving Treasure Cay. Their focus is “to create sustainable, high-value communities throughout the south-eastern United States”, according to the company’s website.

lawful businesses who are going through the onerous task of getting insurance, of properly training their employees of registering their boats and of ensuring that their boat is safe. “It’s immensely frustrating for them, knowing that there’s people operating in the same space, sometimes on the same beach, that are not paying any of those things or doing any of those things, dropping their prices, because they don’t have to pay what the lawful charter operators are paying, and therefore undercutting the market.

“Because they don’t have to charge those higher prices to recover some of what they would of spent in the back end, they’re trying to get a competitive advantage over the lawful businesses. As a business and as an industry that’s not sustainable. You can’t have unlawful actors undercutting decent, law-abiding, hard-working business folks” He said the more stringent requirements are due to “bad actors” and a

It lists some 18 communities on both the west and east coast of Florida that GreenPointe has either developed, or is developing, with many described as “mixed-use, masterplanned” developments featuring hundreds of homes spread across sites ranging in size from several hundred to almost 2,000 acres. Waterfront developments, country clubs, and condominium projects are also included in the portfolio.

Robert Meister, who together with his brother, Stefan, currently owns the development via Treasure Cay Ltd, did not respond to Tribune Business messages seeking comment - directly or via intermediaries for their New Providence-based Blue Lagoon businessbefore press time last night.

Multiple sources spoken to by this newspaper, speaking on condition of anonymity, said most persons aware of the deal have been signed to non-disclosure agreements (NDAs).

One contact said “you’re very hot, you’re not cold” when contacted over suggestions that completion of Treasure Cay’s acquisition was close.

“Our community is really suffering,” they added. “The Meisters haven’t invested any money in the community for years. We really need this to go through.”

Another source familiar with developments surrounding Treasure Cay

“dereliction of enforcement” and argued tour operators need more stringent regulations than commercial fishermen as most people on board commercial fishing vessels are experienced veterans, while guests on board tour and recreational vessels may be inexperienced.

He said: “The bad folks, the ones that are negligent and harm the reputation of our country, they’ve caused this. And dereliction of enforcement over many, many years has caused this. And there has to be some form of correction.

“When it comes to commercial fishing, the people that go to sea those are mostly veterans of the sea with experience, and they’re only dealing with themselves, veterans handling other veterans.

“Whereas when you’re dealing with charters, you’re dealing with people who may or may not have ever been on the ocean before. And it’s paramount that people who are handling these people are a knowledgeable, experienced, trained, understand

said they anticipated a formal announcement could be made on the purchase in about a month. “Yes, a deal has been under contract now for about a year,” they confirmed. “Everything is looking positive and the Meisters want to sell. The gentleman [Mr Burr] wants to buy. “He’s a very seasoned developer from Jacksonville, Florida, and owns a house he built in Treasure Cay on the marina. He’s been in Treasure Cay since 2005. He’s been developing on the east and west coast of Florida for 25 to 30 years with successful communities featuring amenities such as golf courses. He’s a very good candidate for Treasure Cay. We’re all very excited.”

Confirming Mr Burr’s identity, he added: “It would be the break we’ve been waiting for for 35 years since the late Mr Meister announced he wanted to sell Treasure Cay. Over the years we’ve seen many, many buyers come and never close on it.

“Robert and Stefan [Meister] are busy with their own endeavours at Salt Cay in the Dominican Republic. They have no need or desire to keep Treasure Cay or redevelop it. This gentleman wants to buy it, they want to sell it, and the Government would love to see all these tax dollars come back to the Public Treasury....

“The gentleman we have is the right guy - very savvy,

sharks, understand bad weather, understand engine problems, understand boat problems, so that they’re not putting people’s lives at risk.”

Mr Maillis said by strengthening registration requirements the Port Department can “front end regulate” industry players and ensure that persons who choose to operate unlicensed charters at least meet the minimum safety requirements. He said: “We have to start somewhere and I think one of the reasons why they started with the Port Department imposing a lot of these restrictions is because they want to front end regulate these individuals.

“So basically, if you’re only going to scoot by and do the bare minimum of getting recreational boat registration, we’re gonna reserve the power to have some form of verification process that you are who you say you are.“They know some people have been running charters years never registered as a charter

very ethical, very humble. We’re all very optimistic. We’ve heard we’ll have new roads, and there will be a fantastic development of the marina and golf course. He’s seen Treasure Cay in its hey day, and knows what works and doesn’t work,” the source continued.

“The marina business was very important to the resort, and brought a lot of energy with sports fishing boats in and out. There was a lot of excitement and energy going on that’s not there now. The marina was destroyed in Dorian.

“It was a 150-slip marina, and employed a lot of people. We have a lot of single family homes, but it would be nice to have the hotel back, and the marina is definitely what needs to happen first.”

Treasure Cay is said to have around 1,200 homeowners, of whom 120 are Bahamian families.

person. So now when you come in to register the same now you have to show me X, Y and Z so I think that’s one way to regulate it.”

He acknowledged that the Defence Force is busy patrolling for poachers, immigrants and smugglers and are often hesitant to stop charters and ask for registration or conduct inspections but highlighted the importance of patrolling of public beaches and popular tourist areas to ensure operators are licensed.

He said: “The Defence Force has its hands full between poachers, between the endless flow of desperate Haitian migrants coming from down south, we have human trafficking, narcotics, guns and ammunition flowing into our country. “And you know, they don’t want to have to bother people driving around in a 19 foot Boston Whaler with the Bimini top on with some happy looking tourists on there. That’s not the ideal type of situation they want to be involved with, but the reality is there needs to be

However, one potential obstacle to any said to Mr Burr and GreenPointe holdings is the litigation that was launched against both the Meisters and the Government by controversial Austrian investor and Lyford Cay resident, Dr Mirko Kovats, after his $22.325m deal to acquire Treasure Cay was blocked by the authorities.

Dr Kovats, who has permanent resident status in The Bahamas, initiated Judicial Review proceedings against the Government on October 27, 2022, after the Bahamas Investment Authority (BIA) rejected his purchase. He claimed an astonishing $3bn-plus in damages against the Government. And the Austrian financier also initiated legal action against the Meisters and their company, Family Adventure Holdings, demanding that they uphold

more inspections. “There needs to be routine inspections of a lot of charter people operating on public beaches and in public areas where tourists are looking for services.

“This needs to be something that’s not just placed on the Defence Force but also on the police Marine Patrol unit as well, to ensure that there is cohesion and continuity of patrols and enforcement in these areas.”

He said operators have a duty to protect visitors and ensure they are safe as they partake in water sports.

He said: “We have a duty to our tourists to ensure that they are safe, they come to this country. Many of them pay a lot of money and when they come they don’t know right from left. When they see two boats on the beach, which one’s the better one to choose if they both look the same?

“But the reality is, one may be infinitely more safe, because its crew is better trained, more responsible and compliant with the regulations.”

the February 2021 sales contract or, in the alternative, return his $2.233m deposit equivalent to 10 percent of the purchase price.

“No one is talking about that any more,” one Treasure Cay source said of Dr Kovats and his litigation.

“The Government knew they would have to deal with that situation from the very beginning. He’s not a developer. You can’t have people who don’t want to develop acquire places like Treasure Cay.

“It’s critical you have the right developer in place to develop or redevelop the resort and employ Bahamians and provide the tax dollars needed to run the country.

“You can’t have someone buy and hold on to it indefinitely.

“There was never a second that the Government of The Bahamas considered approving him.”

Police chief sees 46-year ties break down on truck

FROM PAGE B1

collection contract from the Department of Environmental Health Services (DEHS) in 2018 under the Minnis administration.

The Millers and Mr Higgs entered into a February 6, 2019, collateral agreement to secure the latter’s obligation to repay the couple for funding the truck’s purchase. The payments were to be made in installments of $5,000 per month for the first eight months to September 28, 2019, and then $4,000 per month thereafter through to February 28, 2023.

However, the Millers alleged that Mr Higgs frequently failed to pay the monthly installments in full and on time. They claimed that he paid $2,000 on January 20, 2020, just prior to the COVID-19 pandemic and nothing further has been received since. The businessman was said to have returned the Mack truck to them on February 7, 2021, and “refused to pay any further sum in accordance” with the agreement.

The chief superintendent and his wife alleged they have “suffered tremendous loss” as a result, with Mr Higgs failing to respond to demands for payment. As a result, the couple initiated legal action for the $150,000 in total payments allegedly owed, interest and costs, and sought a further $6,115 to cover repair costs to the truck.

Mr Higgs, though, vehemently rejected their accusations in his filed defence, claiming the couple were trying to “extort monies” from him, and counter-claimed

for $106,800 representing sums he allegedly paid to them for the truck’s purchase. He also asserted that the truck’s $50,000 purchase price was paid for in full, yet the Millers kept requesting payments from him.

Sir Ian Winder, the chief justice, breaking down the competing arguments, wrote in his verdict: “[James], a chief superintendent of the Royal Bahamas Police Force, and the defendant, a businessman, are childhood friends of some 46 years, fellow parishioners and occasional business associates.

“In 2018, the defendant approached James to become a ‘partner’ with him in a garbage collection business after he had been approved by the Department of Environmental Health Services (DEHS) to conduct residential waste collection services but he did not have a garbage truck at the time.

“Further to the terms of an approval letter from the DEHS, dated December 10, 2018, granted to him, the defendant needed to present a truck to the DEHS for inspection and approval by January 31, 2019, as a pre-condition to being awarded a contract,”

Sir Ian continued. “The defendant lacked the funds to purchase the garbage truck which he required. James, who had not been in the garbage business before, also did not have the necessary funds. James, therefore, consulted Esther, his wife, a retired police officer, about assisting the defendant as she had received a lump sum of money on her retirement.”

The couple agreed to help Mr Higgs “using some of Esther’s retirement money”. Sir Ian added: “The plaintiffs thought that [it] represented a good business opportunity for them. Esther’s money would be staked on the arrangement; James would play the role of intermediary; and the defendant would operate his garbage collection business using a Mack truck and would pay the plaintiffs from his revenues.”

Mr Higgs identified the Mack truck he wanted after inspecting it in the US, with the couple relying on his judgment. Mrs Miller bought the vehicle on January 10, 2019, for $26,000, with Mr Higgs covering the $1,800 freight costs to ship it to The Bahamas. He also claimed to have paid $3,000 towards the purchase, representing a $2,000 deposit and $1,000 cash payment, but this was not supported by evidence.

The Mack truck arrived in The Bahamas on February 5, 2019, and Mrs Miller entered into an arrangement with Bahamas Customs to pay $20,883 in import duties. Upon its release, Mr Higgs was handed the vehicle for use in his business. However, he then discovered defects with the truck’s rear that required a welder to ‘skim’ the floor and resheet the bottom.

No invoices were produced to document the cost of repairs, and Mr Higgs did not bill the Millers. Because the former needed the truck to be titled in his name to show the DEHS he qualified for the garbage contract, Mrs Miller signed a ‘Bill of Sale’ to

transfer the ownership. Mr Higgs was duly awarded a DEHS garbage collection contract said to pay $8,000 per month, but this was not substantiated.

To “protect their investment”, the Millers also had Mr Higgs sign a February 6, 2019, ‘collateral agreement’ that included the ‘bill of sale’ showing the $50,000 transfer to the latter. Mr Higgs was allowed to use the Mack Truck for the garbage collection business in return for the monthly payments made to the Millers.

Mr Higgs claimed he signed the ‘collateral agreement’ without reading it “as he relied on James, who he trusted”, but made no reference to the Justice of the Peace who witnessed its signing. As a result, Sir Ian voiced doubt over his version of events.

“It is doubtful that a businessman would sign a seven-page collateral agreement, Bill of Sale in his favour and a Bill of Sale in favour of James for $10 without at least seeking to obtain a cursory understanding of what had been or was to be agreed, even with a friend,” the Chief Justice said. “It would have been obvious to a reader on even a cursory examination that what was contemplated was not a simple sale of the truck.”

Sir Ian, having assessed the evidence and watched both sides perform under cross-examination by the other’s respective attorneys, said he preferred the Millers’ testimony to that of Mr Higgs. “Neither the plaintiffs nor the defendant gave entirely satisfactory evidence but the plaintiffs impressed me as being more truthful and sincere than the defendant,” he added.

The Millers alleged that, between February 28 and September 28, 2019, they received $16,000 or just 40

percent of the $40,000 total payments that Mr Higgs was supposed to make.

Between October 28 and December 28, 2019, he allegedly made $6,000, or half, of the $12,000 he was supposed to pay.

And, from January 2020 to December 2020, Mr Higgs was again said to have paid just 50 percent, or $24,000 of the $48,000 due under the collateral agreement because he was paying $2,000 rather than $4,000 per month as required.

As a result, the Millers were “underpaid” by a collective $54,000.

Mr Higgs testified that he made monthly payments via cheque ranging from $2,000 to $10,000, plus cash payments between $13,000 to $16,000 to James Miller. Sir Ian said evidence of what was paid, and when, was “lacking” but he accepted that the businessman made his last payment of $2,000 on January 30, 2021, and that he both underpaid and was late.

Mr Higgs purchased two extra garbage trucks for his business in 2020, and therefore had no need to continue with the one financed by the Millers. In February 2021, he called Mr Miller to send someone to collect the Mack truck because he did not need it any more.

The couple loaned the vehicle out for four to five months in 2022, earning $27,000 in gross revenues and $8,000 profit after labour and diesel costs.

The truck was sold in June 2023 after the DEHS refused to allow them to use it for garbage collection services.

Sir Ian ruled that Mr Higgs was bound by the terms of the collateral agreement, which he breached by paying the Millers’ $54,000 less than what was due. The

businessman, though, alleged that he gave the couple “reasonable notice” that he was terminating the contract in October 2020, and they accepted this by collecting the Mack truck.

However, the Millers argued that Mr Higgs “unilaterally terminated” the deal and they had to collect the truck to protect their investment.

The Chief Justice rejected Mr Higgs’ argument that he attempted to terminate the contract, instead ruling that he “repudiated the collateral agreement” in February 2021 when he said he had no more use for the vehicle.

“While the defendant was excused from future performance of his primary obligations under the collateral agreement when the plaintiffs accepted his repudiation of the collateral agreement, he became and remains liable to pay damages to the plaintiffs for the loss sustained in consequence of his nonperformance in the future,” Sir Ian added.

Mr Higgs argued that the cancellation of his DEHS garbage collection contract in September 2021, immediately after the general election, removed the “foundation” of his deal with the Millers because it made it impossible for him to fulfill its terms. As a result, the claim he owes them monies for 2021, 2022 and 2023 should be deemed “unsustainable”.

Sir Ian said he gave “anxious consideration” to this issue, but decided that the Millers’ damages ought not to be reduced because of the September 2021 contract loss.

He calculated their damages at $111,900, while rejecting Mr Higgs’ $106,800 counterclaim because there was no evidence he gave this sum towards the truck’s purchase.

Easter rush for fish - but record high cost

flock to purchase seafood. He said: “The people is coming out to get their fish and lobsters and conchs, it’s that time of year. Easter is always a busy time. Things are just starting to pick up now but I know tomorrow as the holiday gets closer more people will come.”

He complained about the struggles local fishermen face to stay in business with rising costs and said the “government don’t care about fishermen”.

He explained the fishing community felt “insulted” by the government

choosing to raise the boat registration fee last year, when operation costs were “sky high” and even though the fee increase has now been adjusted they have not forgotten government’s decision to tax them.

He said: “This government don’t care about fishermen. The cost of diesel gone up and stay up, you can’t go nowhere without gas in ya boat right, I mean this the highest it’s been and then all they want do is tax us. And the thing is we is have to go out there for weeks, sometimes months at a time away from our families to make sure

we have fish to sell. “And the fellas working for me diving, they put their lives on the line every time they jump off this boat. So even though they trying to fix it I still think it’s wrong they did put extra tax on we fishermen at a time when operating a boat sky high.”

Paul Maillis, the National Fisheries Association’s (NFA) secretary, told Tribune Business the cost of fish is high this year due to the low priced lobster season, the increase in fuel costs and the overall high cost of doing business. He said: “It’s an unfortunate reality for the

customers that they have to bear the brunt of all the increasing fees all around because you think about the fees as they were, you think about the fact that the lobster price was low so a lot of fishermen needed to make up some of that loss on the fish side. “And then also, the fuel prices have been insane over the past two to three years. At one point in 2023, the price was up over $6 a gallon for diesel on New Providence and even more on the Family Islands, so that that caused a lot of front-end expenses and businesses expenses don’t easily go back down.”

He said larger fishing businesses have also incurred extra costs with their business licence requirements. He said that while it is “unfortunate” the additional costs are being passed on to consumers the fishing business today is “very expensive and it’s very risky”. He said: “Another challenge was with the new business licence requirements has lent a lot more stress and financial burden on businesses. You know, it’s there’s now a much more comprehensive form of recertification that

involves all the government branches from NIB to that to VAT so it’s much harder to get your tax compliance certificate it’s much more onerous. “So for businesses especially larger fishing businesses there’s a lot of compliance that needs to be paid for and that’s unfortunately going to be passed on to the consumer. So it’s very unfortunate. The ideal situation is that fish would be a more affordable food source than other things like chicken for but the reality is that the fishing business is very expensive and it’s very risky these days.”

‘MAKE THE SWITCH’: 2.6% GROWTH BELOW FORECASTS

FROM PAGE B1

The Fund, in its late November 2023 statement on the latest Article IV consultation with The Bahamas, projected that real GDP - a measure of total economic output that strips out inflation’s impact - would be around 4.3 percent last year as the economy completed its recovery from the COVID19 pandemic.

And John Rolle, the Central Bank’s governor, said as recently as late January: “In 2023, it is estimated that the economy grew in the 4 percent range, which is a levelling off from the significant post-pandemic recovery of around 14 percent in 2022.

“This captured a very robust boost in the cruise sector’s contribution, a completion of the occupancy recovery in the stopover sector, and healthy appreciation in the average pricing for stopover accommodations, among both hotels and vacation rental properties. In 2024, the growth is expected to be within the low 2 percent range, still moderately above the estimate of the economy’s medium-term potential.”

However, according to the Statistical Institute, real GDP growth in 2023 was just 2.6 percent - an outcome that was around $200m lower than both the Central Bank and IMF had forecast. Still, that growth rate represented a $330m expansion in Bahamian economic output to $12.831bn, which pushed this nation beyond the preCOVID GDP record of $12.616bn set in 2018.

“According to the 2023 annual estimates, economic activity in The Bahamas increased significantly by 9.2 percent in nominal terms and by 2.6 percent

in real terms as business activity experienced modest gains,” the National Statistical Institute said in a statement.

“When compared to 2022, the majority of industries showed marginal growth, while tourism-related industries experienced sizable growth. In 2023, the total value of goods and services produced in the Bahamian economy was estimated at $14.3bn in nominal prices, and $12.8bn in real prices.”

Mr Edwards, while acknowledging that the 2.6 percent real GDP figure signalled “the economy grew a little bit slower” than expected, told this newspaper that it still represented a rate slightly higher than the country’s annual average.

“That tells you there is some momentum being created in the economy in terms of the consolidation and kind of correction from Dorian and COVID,” he said. “That’s a positive. The question going forward is always going to be how we move this from 2.6 percent to 3 percent or 3.5 percent consistently.

“Obviously there are some opportunities outlined in the IMF Article IV report, and those revolve around taking a serious look at areas for reform, taking a serious look at how we marshall this growth for the long-term. We’ve kind of focused too much on year-over-year growth over our medium to long-term position.

“When we look at the information we’re getting from the Inter-American Development Bank [country strategy], the results we are getting for education, it suggests we have some long-term structural issues that are not going to be fixed over one or two fiscal periods,” Mr Edwards continued. “We need to kind

of switch the narrative in a fundamental way, looking at where the numbers are going to be longer than one year out. We need to take a medium and longer term view. There are going to be problems from year-to-year. If we are not sufficiently focused on where the longterm results ought to be, we might make sub-optimal decisions to target this year as opposed to where we are in year three.

“We need to rethink how we manage the economy going forward. That involves taking a very honest and transparent look at all the things we know are problems - education, the National Insurance Board, BPL and wider energy policies. Those issues have a significant impact on the economy and we need to fix them.”

Mr Edwards argued that the Bahamian economy’s “better than expected” rebound from COVID has created room to “re-orientate policy and start to make sure we are in a better long-term position. It’s time to make the switch”.

He cited the Government’s projected $131.1m or 0.9 percent of GDP fiscal deficit for 2023-2024, which “is totally out the window at this point in time”, as an example of short-term thinking. “If we stay too long in that position we are going to come to a hard conclusion that everything is failing, instead of looking at the trajectory,” Mr Edwards explained.

“The deficit is growing at a reduced rate. That’s a positive. We need to take a broader narrative so that citizens in the country understand we are on the path coming back from where we were.. A path needs to be laid out very clearly so that it shows processes are working in parallel.

“Some reforms the Government is working on are not necessarily going to translate into success in one or two years, in the longterm they will work for the betterment of the country and that’s where we need to get to.”

The National Statistical Institute, analysing the main growth drivers using the “value added” approach that breaks it down by industry, said tourism’s continued expansion pushed the major gains in 2023. Accommodation and food services increased its economic output by $226m or 26 percent year-over-year.

“This growth is directly connected to the increase in tourism arrivals. As indicated by the Ministry of Tourism, the number of air and cruise tourist arrivals showed an increase of 24 percent with 7.8m visitors in 2022 compared to 9.7m in 2023,” its report said.

Construction’s contribution to economic growth expanded by $113m or 22

percent, aided by greater foreign direct and capital investment, while arts, other services, household employment and “extraterritorial organisations” expanded their output by $97m or 10 percent.

“This sector of the economy includes hotel casinos and sporting facilities, which also benefited from increased tourist activity,” the Statistical Institute said.

“Transportation and storage increased by $98m (16 percent) as air and land transportation grew substantially” with the end to COVID travel restrictions and mandates.

Turning to the “expenditure approach” for measuring GDP growth, the report added: “Household consumption grew by almost $621m (8 percent). Food and non-alcoholic beverages were responsible for the lion’s share of the increased household expenditure, with the rising cost of these expenditures resulting in the gap between

nominal and real growth in this grouping.

“General government consumption, which includes public administration and defense, public education and public health, increased by $87m (4 percent).

The overall increase in general government consumption reflects the Government’s increased consumption of goods and services, compensation of employees and consumption of fixed capital goods.

“The increase in compensation of employees included public service-wide promotions and increments for civil servants. Exports of goods and services increased by $200m (5 percent) over 2022.

“This growth was led by tourism expenditure which represents the bulk of exports of services. Tourist arrivals and the resulting spending within the economy offset the reduction of exports of goods.”

Yellen says China’s rapid buildout of its green energy industry ‘distorts global prices’

By FATIMA HUSSEIN Associated Press

By FATIMA HUSSEIN Associated Press

WASHINGTON (AP)

— Treasury Secretary Janet Yellen called out China’s ramped-up production in solar energy, electric vehicles and lithium-ion batteries, calling it unfair competition that “distorts global prices” and “hurts American firms and workers, as well as firms and workers around the world.”

“I will press my Chinese counterparts to take necessary steps to address this issue.”

China is the dominant player in batteries for electric vehicles and has a rapidly expanding auto industry that could challenge the world’s established carmakers as it goes global.

The International Energy Agency, a Paris-based intergovernmental group, notes that in 2023 China accounted for around 60% of global electric car sales.

Yellen, who is planning her second trip to China as Treasury secretary, said yesterday in Georgia that she will convey her belief to her Chinese counterparts that Beijing’s increased production of green energy also poses risks “to productivity and growth in the Chinese economy.”

Yellen delivered remarks Wednesday afternoon at Suniva — a solar cell manufacturing facility in Norcross, Georgia.

The plant closed in 2017 in large part due to cheap imports flooding the market, according to Treasury.

It is reopening, in part, because of incentives provided by the Democrats’ Inflation Reduction Act, which provides tax incentives for green energy manufacturing.

The firm’s history is something of a warning on the impact of oversaturation of markets by Chinese products — and a marker

of the state of U.S.-China economic relations, which are strained due to investment prohibitions, espionage concerns and other issues.

China on Tuesday filed a World Trade Organisation complaint against the U.S. over what it says are discriminatory requirements for electric vehicle subsidies.

The Chinese Commerce Ministry didn’t say what prompted the move.

U.S. Trade Representative Katherine Tai said in response to the complaint that the U.S. subsidies are a “contribution to a clean energy future” while China

“continues to use unfair, non-market policies and practices to undermine fair competition.”

The European Union, also concerned about the potential threat to its auto industry, launched its own investigation into Chinese subsidies for electric vehicles last year.

“In the past, in industries like steel and aluminum, Chinese government support led to substantial overinvestment and excess capacity that Chinese firms looked to export abroad at depressed prices,” Yellen said.

“This maintained production and employment in China but forced industry in the rest of the world to contract.”

“These are concerns that I increasingly hear from government counterparts

in industrialized countries and emerging markets, as well as from the business community globally,” she said. The tone of Yellen’s speech stands in contrast to Chinese leader Xi Jinping, who met with American business leaders in Beijing Wednesday and called for closer trade ties with the U.S. amid a steady improvement in relations that had sunk to the lowest level in years.

Xi emphasized Wednesday the mutually beneficial economic ties between the world’s two largest economies, despite heavy U.S. tariffs on Chinese imports and Washington’s accusations of undue Communist Party influence, unfair trade barriers and theft of intellectual property.

Chinese leader Xi issues a positive message at a meeting with US business leaders as ties improve

BEIJING (AP) — China’s nationalist leader, Xi Jinping, called for closer trade ties with the U.S. during a meeting yesterday with top American business leaders in Beijing that came amid a steady improvement in relations that had sunk to the lowest level in years.

Xi emphasized the mutually beneficial economic ties between the world’s two largest economies, despite heavy U.S. tariffs on Chinese imports and Washington’s accusations of undue Communist Party influence, unfair trade barriers and theft of intellectual property.

China’s economy has struggled to recover from severe self-imposed restrictions during the COVID-19 pandemic that it lifted only at the end of 2022.

But Xi said that China was again contributing to world economic growth in the double digits percentage-wise.

“Sino-U.S. relations are one of the most important bilateral relations in the world. Whether China and the United States cooperate or confront each other has a bearing on the wellbeing of the two peoples and the future and destiny of mankind,” Xi was cited as saying by China’s official Xinhua News Agency.

Participants at the meeting included Stephen A. Schwarzman, the billionaire head of investment firm Blackstone.

Trade and tariffs have increasingly drawn attention in the run-up to the U.S. presidential election, and the Biden administration has shown little sign of moderating punitive measures against Chinese imports imposed by his predecessor and assumed rival in the November polls, Donald Trump.

U.S. officials have renewed concerns over Chinese industrial policy practices and overcapacity, and the resulting impact on U.S. workers and companies, that they blame in part on China’s massive trade surplus that amounted to more than $279 billion last year, its lowest level in about a decade.

Following the meeting, the U.S.-China Business Council said in a statement that it was honoured to have a dialogue with the country’s top leader to “discuss our concerns over the decline in trade,

investment, and business confidence, as well as our desire to help improve engagement and commercial exchange between our two countries.”

“We stressed the importance of rebalancing China’s economy by increasing consumption there and encouraged the government to further address longstanding concerns with cross-border data flows, government procurement, better protection of intellectual property rights, and improved regulatory transparency and predictability,” the Washington-based council said. Its president, Craig Allen, was among the guests that met Xi.

China’s economy has been bogged down by a crisis in its property market in which builders are struggling under mountains of debt, and buyers are paying off loans on apartments that may never be completed.

Other issues, such as an aging population and high youth unemployment, are prompting China’s leaders to lean more heavily on boosting export manufacturing to make up for weak demand at home.

At the same time, scores of foreign firms, including Apple, rely on China-based manufacturers as key links in their supply chains, along with the country’s 1.3 billion consumers for a high percentage of their global sales.

China’s formerly highly abrasive tone

United States has softened in recent months, particularly since Xi and Biden met in San Francisco in November.

Officials such as United States Secretary of State Antony Blinken have visited, and Treasury Secretary Janet Yellen is reportedly due to to travel to China again to meet top leaders next month.

But Xi’s administration has maintained a hard line on issues it considers its “core interests.”

Those include its claims to virtually the entire South China Sea, the self-governing island democracy of Taiwan — a close American ally — and its heavy-handed rule of outlying regions such as Hong Kong, Tibet and Xinjiang. An ardent nationalist and son of one of the founders of the People’s Republic, Xi appears determined to maintain strict party control while drawing in foreign investment to shore up the economy.

“The respective successes of China and the United States create opportunities for each other,” Xi was quoted as saying by Xinhua.

“As long as both sides regard the other as partners, respect each other, peacefully coexist and join together for win-win results, China-United States relations will improve,” he stated.

NEW YORK (AP) — U.S. stocks rose to a record yesterday after breaking out of their three-day lull.

The S&P 500 climbed 44.91 points, or 0.9%, to 5,248.49. It was the first gain for the index since setting its last all-time high on Thursday.

The Dow Jones Industrial Average jumped 477.75, or 1.2%, to 39,760.08, and the Nasdaq composite gained

83.82, or 0.5%, to 16,399.52. Both finished a bit shy of their own records. Merck climbed 5% after federal regulators approved its treatment for adults with pulmonary arterial hypertension, a rare disease where blood vessels in the lungs thicken and narrow. Cintas, a provider of work uniforms and office supplies, was another force pushing the S&P 500 upward. It jumped 8.2% after reporting stronger profit for the latest quarter

NOTICE

NOTICE is hereby given that JEANNETTE SON-DONFREID of Andros Avenue, Nassau, The Bahamas applying to the Minister responsible for Nationality and Citizenship, for Registration Naturalization as a citizen of The Bahamas, and that any person who knows any reason why registration/ naturalization should not be granted, should send a written and signed statement of the facts within twenty-eight days from the 22th day of March 2024 to the Minister responsible for nationality and Citizenship, P.O. Box N-7147, Nassau, New Providence, The Bahamas.

NOTICE is hereby given that ALEX JOSEPH of Golden Isles Road, Nassau, The Bahamas applying to the Minister responsible for Nationality and Citizenship, for Registration Naturalization as a citizen of The Bahamas, and that any person who knows any reason why registration/ naturalization should not be granted, should send a written and signed statement of the facts within twenty-eight days from

than analysts expected. Shares of Trump Media & Technology Group, meanwhile, continued their wild ride and rose another 14.2%.

The company behind the money-losing Truth Social platform has zoomed well beyond what critics say is rational, as fans of former president Donald Trump keep pushing it higher.

Robinhood Markets climbed 3.7% after unveiling its first credit card, which is reserved for its subscription-paying Gold members, along with other new products.

On the losing end of Wall Street was Nvidia,

which slumped to a second straight loss after screaming 91% higher for the year so far.

It sank 2.5%, as some investors may have locked in profits before closing their books on the year’s first quarter. Nvidia has been one of the biggest winners of Wall Street’s frenzy around artificial intelligence.

GameStop tumbled 15% after delivering a profit for the latest quarter and a drop in revenue from the prior year. It’s the original meme stock, predating Trump Media by years, where its price has often moved more on the sentiment of smaller-pocketed investors than on traditional fundamentals like its profit and revenue.

In the bond market, Treasury yields slipped on a day with few economic reports to shake things up.

The yield on the 10-year Treasury fell to 4.19% from 4.23% late Tuesday.

This week’s highlight for the bond market may be

arriving Friday, when the U.S. government releases the latest monthly update on spending by U.S. consumers. It will include the measure of inflation that the Federal Reserve prefers to use as it sets interest rates. Both the U.S. bond and stock markets will be closed that day for Good Friday. That could cause some anticipatory trades to bunch up on Thursday. It will be the last trading day of the year’s first quarter, which could further roil things. The S&P 500 is on track for a fifth straight winning month and has been roaring higher since late October.

The U.S. economy has remained remarkably resilient despite high interest rates meant to get inflation under control. Plus, the Federal Reserve looks set to start lowering interest rates this year because inflation has cooled from its peak.

But critics say a broader range of companies will need to deliver strong profit

growth to justify the big moves in prices. Progress on bringing inflation down has also become bumpier recently, with reports this year coming in hotter than expected.

Still, the broad expectation among traders is for the Federal Reserve to begin cutting its main interest rate in June.

Stocks generally tend to do the best when more than half the world’s central banks are easing interest rates, according to Ned Davis Research. The world is not there yet, but several central banks have already begun cutting recently, like Switzerland’s, and it could happen later this year.

In stock markets abroad, indexes were mixed across Europe and Asia. Chinese stocks were some of the worst performers. Stocks tumbled 1.4% in Hong Kong and 1.3% in Shanghai.

AP Business Writers Matt Ott and Elaine Kurtenbach contributed.

Ex-Olympian wins Rose Island appeal

ByTHE planning appeals board has determined there is “no basis to interfere” with an ex-Olympic swimmer’s plans to expand his Rose Island beach day excursion catering to tourists.

The Subdivision and Development Appeals Board, in written verdict issued this week, noted that there were “five similar commercial undertakings within a one-mile radius” of Christopher Vythoulkas’ Piggly Wiggly Bar & Grill site.

And, despite the objections of his near neighbours, Larry Treco, president of CGT Contractors & Developers, and Gregoire Tremblay, the Board determined that there are no covenants or other restrictions preventing commercial activity on Rose Island. As a result,

ECONOMIC ACTIVITY UP 2.6% IN REAL TERMS, REPORTS BNSI

By FAY SIMMONS Business Reporter jsimmons@tribunemedia.netTHE Bahamas National Statistical Institute (BNSI) released the 2023 advance estimates of Gross Domestic Product yesterday.

Terah Newbold, supervisor of National Accounts at BNSI, said economic activity “increased significantly” with 9.2 percent growth in nominal terms.

She said: “According to the 2023 annual estimates, economic activity in the Bahamas increased significantly by 9.2 percent in nominal terms and by 2.6 percent in real terms as business activity experienced modest gains. When compared to 2022, the majority of industries showed marginal growth, while tourism-related industries experienced sizable growth.

“In 2023, the total value of goods and services produced in the Bahamian economy was estimated at $14.3 billion in nominal prices, and $12.8 billion in real prices.”

Speaking to reporters, Ms Newbold confirmed the growth seen in 2023 is the largest seen since the pandemic.

She said: “Yes. The figures indicate that this is the largest growth in terms of nominal annual growth.”

the duo’s appeal against the prior Town Planning Committee’s approval for a boat charter tour site with bar and grill facilities “stands dismissed”.

“The Board reviewed the decision of the Town Planning Committee, the respective deeds of conveyance related to Lot 23, Rose Island, the Treco lot (Lot 22) and the Tremblay lot (Lot 26), reviewed photographic evidence presented and heard testimony from the appellants and the second respondent [Mr Vythoulkas],” the Appeals Board said in its ruling.

“Having regard to the various commercial activity with the vicinity of Lot 23, evidence produced and confirmed as agreed by all parties that there are at minimum five similar commercial undertakings within a one mile radius of the proposed business site and the fact that Rose Island Estates is comprised

of unencumbered lots free from restrictions or conditions related to commercial activity upon any of the lots within the subdivision, including those of the appellants, there appears to be no basis to interfere with the decision of the Town Planning Committee, including the conditions imposed.

“Accordingly, this appeal stands dismissed.” Mr Vythoulkas could not be reached for comment last night, but all sides have the right to appeal the Board’s decision to the Supreme Court and judicial system. The former swimmer, who represented The Bahamas in the summer games in Athens in 2004, previously said the opposition to his plans had cost him excursion business from the Rosewood resort.

He added that two other bar and grill operations had opened p on Rose Island over the past 16

months replicating what he is seeking to do with Piggly Wiggly. In his January 23, 2023, letter to the Town Planning Committee outlining the project, Mr Vythoulkas said the venue would not be used to host “concerts, events or loud obnoxious parties”.

Disclosing that he has all other necessary approvals, including those relating to food and health and sanitation, he added that he was merely expanding the services available at a beach location to where he already brings cruise passenger clients. Disclosing that Piggly Wiggly Beach Bar & Grill will be located on Rose Island’s lots 23 and 24, he added that one of these land parcels was already owned by his family while a lease agreement has already been executed for the other. “As per the conveyance, there are no restrictive covenants or conditions and there are

currently four existing beach bars with food and beverage operations on Rose Island,” Mr Vythoulkas wrote. “Piggly Wiggly Beach Bar & Grill will operate to serve food and beverages to guests of our existing private charter boat business. Our charter boat business operates two scheduled daily tours where we collect our booked guests from the cruise ships. Each charter group enjoys a brief tour of Nassau and Paradise Island before venturing to Rose Island to sightsee and enjoy the beach.

“As we do currently stop at lot number 23 Rose Island for our beach time/ swim tour of each tour, we now wish to simply prepare and serve our guests a grilled/BBQ lunch and beverages before returning them to port. There are existing structures on the property which were built in 1986 and are well

maintained. We have obtained approvals from the police, sanitation and food and health for the site, handling, preparation and sale of food and beverages.

“At no time will Piggly Wiggly Beach Bar & Grill be an operation open to the general public, and we will not be hosting concerts, events and loud, obnoxious parties. Specifically, relaxation and the beauty of The Bahamas is the focal point of our charter/excursion experience.”

Mr Vythoulkas said the operator also plans to partner with the Bahamas Reef Environmental Educational Foundation (BREEF), Bahamas Air and Sea Rescue, the Bahamas National Trust and the Bahamas Meteorological Department, with the the latter placing a weather station and video cameras at the site to help monitor weather conditions for private and small vessels.

783 MILLION PEOPLE FACE CHRONIC HUNGER. YET THE WORLD WASTES 19% OF ITS FOOD, UN SAYS

By CARLOS MUREITHI Associated PressNAIROBI, Kenya (AP)

— The world wasted an estimated 19% of the food produced globally in 2022, or about 1.05 billion metric tons, according to a new United Nations report.

The U.N. Environment Programme’s Food Waste Index Report, published yesterday, tracks the progress of countries to halve food waste by 2030.

The U.N. said the number of countries reporting for the index nearly doubled from the first report in 2021.

The 2021 report estimated that 17% of the food produced globally in 2019, or 931 million metric tons (1.03 billion tons), was wasted, but authors warned against direct comparisons because of the lack of sufficient data from many countries.

The report is co-authored by UNEP and Waste and Resources Action Programme (WRAP), an international charity.

Researchers analysed country data on households, food service and retailers. They found that each person wastes about 79 kilograms (about 174 pounds) of food annually, equal to at least one billion meals wasted worldwide daily.

Most of the waste — 60% — came in households.

About 28% came from food service, or restaurants, with about 12% from retailers.

“It is a travesty,” said co-author Clementine O’Connor, the focal point for food waste at UNEP. “It doesn’t make any sense, and it is a complicated problem, but through collaboration and systemic action, it is one that can be tackled.”

saying that famine is imminent in northern Gaza and approaching in Haiti.

Food waste is also a global concern because of the environmental toll of production, including the land and water required to raise crops and animals and the greenhouse gas emissions it produces, including methane, a powerful gas that has accounted for about 30 percent of global warming since pre-industrial times.

Food loss and waste generates eight to 10 percent of global greenhouse gas emissions. If it were a country, it would rank third after China and the U.S. Fadila Jumare, a Nigeriabased project associate at Busara Center for Behavioral Economics who has studied prevention of food waste in Kenya and Nigeria,

said the problem further disadvantages many people who are already food insecure and cannot afford healthy diets.

“For humanity, food waste means that less food is available to the poorest population,” said Jumare, who wasn’t involved in the report.

Brian Roe, a food waste researcher at Ohio State University who wasn’t involved with the report, said the index is important to tackling food waste.

“The key takeaway is that reducing the amount of food that is wasted is an avenue that can lead to many desirable outcomes — resource conservation, fewer environmental damages, greater food security, and more land for uses other than as landfills and food production,” said Roe, who wasn’t involved in the report.

The report showed notable growth in coverage of food waste in low- and middle-income countries, the authors said.

But it may fall to wealthier nations to lead in international cooperation and policy development to reduce food waste, they said.

The report said many governments, regional and industry groups are using public-private partnerships to reduce food waste and its contributions to climate and water stress. Governments and municipalities collaborate with businesses in the food supply chain, whereby businesses commit to measure food waste.

The report said food redistribution — including donating surplus food to food banks and charities

— is significant in tackling food waste among retailers.

One group doing that is Food Banking Kenya, a nonprofit that gets surplus food from farms, markets, supermarkets and packing houses and redistributes it to schoolchildren and vulnerable populations.

Food waste is an increasing concern in Kenya, where an estimated 4.45 million metric tons (about 4.9 million tons) of food is wasted every year. “We positively impact the society by providing nutritious food and also positively impact the environment by reducing the emission of harmful gases,” said John Gathungu, the

group’s co-founder and executive director.

The report’s authors said they found that the differences in per capita household food waste between high-income and lower-income countries were surprisingly small.

Richard Swannel, a coauthor and director of Impact Growth at WRAP, said that shows food waste “is not a rich world problem. It’s a global problem.”

“The data is really clear on this point: that here is a problem right around the world and one that we could all tackle tomorrow to save ourselves money and reduce environmental impact,” he said.

that

and appropriate to

a

opinion. The risk of not detecting a material misstatement resulting from fraud is higher than for one resulting from error, as fraud may involve collusion, forgery, intentional omissions, misrepresentations, or the override of internal control.

Obtain an understanding of internal control relevant to the audit in order to design audit procedures that are appropriate in the circumstances, but not for the purpose of expressing an opinion on the effectiveness of the Bank’s internal control.

Evaluate the appropriateness of accounting policies used and the reasonableness of accounting estimates and related disclosures made by management.

Conclude on the appropriateness of management’s use of the going concern basis of accounting and, based on the audit evidence obtained, whether a material uncertainty exists related to events or conditions that may cast significant doubt on the Bank’s ability to continue as a going concern. If we conclude that a material uncertainty exists, we are required to draw attention in our auditors’ report to the related disclosures in the statement of financial position or, if such disclosures are inadequate, to modify our opinion. Our conclusions are based on the audit evidence obtained up to the date of our auditors’ report. However, future events or conditions may cause the Bank to cease to continue as a going concern.

Evaluate the overall presentation, structure and content of the statement of financial position, including the disclosures, and whether the statement of financial position represent the underlying transactions and events in a manner that achieves fair presentation.

We communicate with those charged with governance regarding, among other matters, the planned scope and timing of the audit and significant audit findings, including any significant deficiencies in internal control that we identify during our audit.

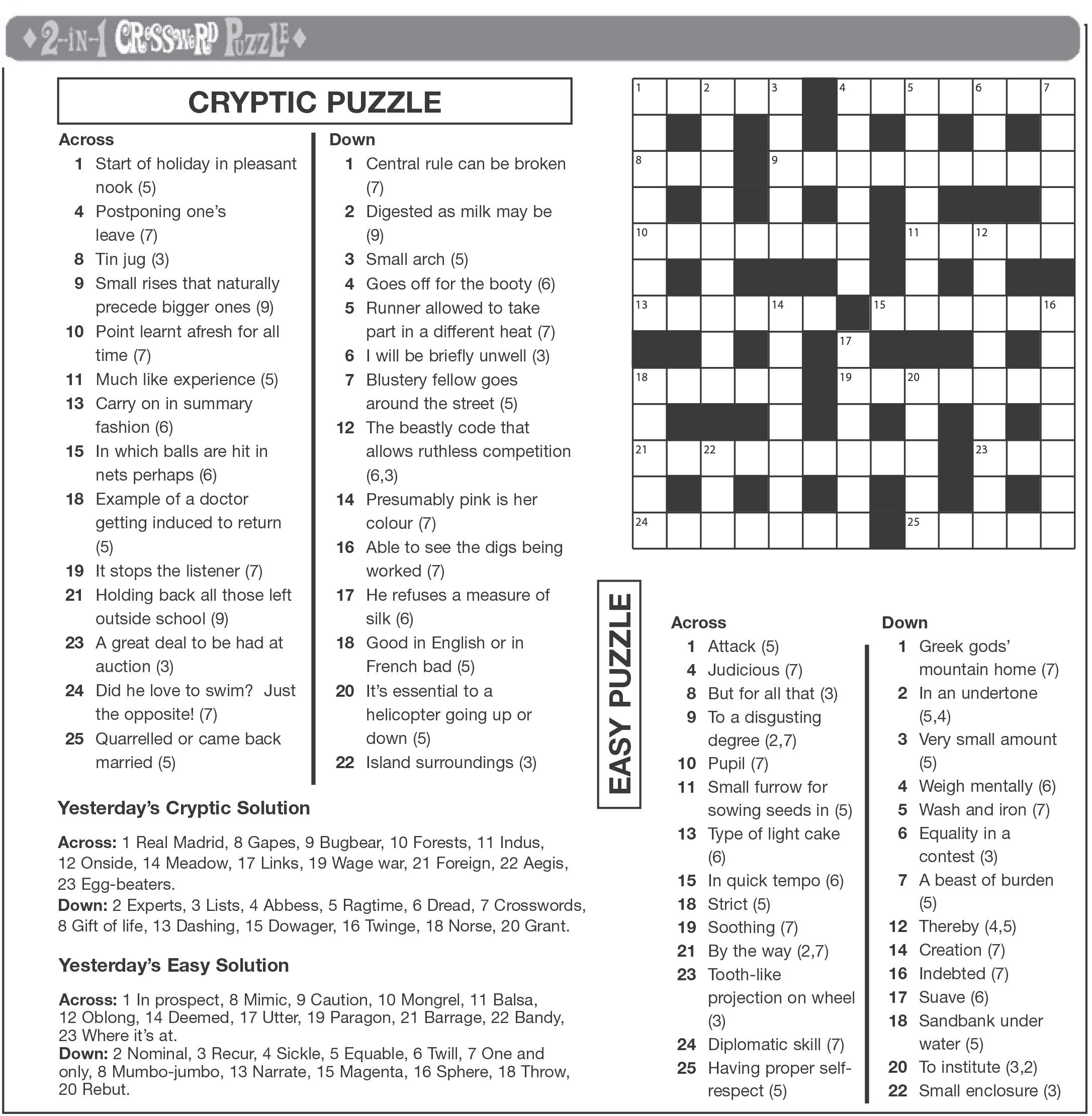

CROSSWORD PUZZLE

Friday, March 29th, 2024

Blessed Good Friday

TRUMP

PROSPECTS, TAKING ON THE ‘MEME STOCK’ MANTLE

NEW YORK (AP) —

Reddit and Trump Media are the first notable social media companies to begin trading publicly in the last five years. They’re also, thanks to the rabid reception among investors coupled with the companies’ fuzzy profit outlooks, the latest meme stocks.

Meme stocks are typically shares in companies whose underlying business fails to justify a surge in their price. The action is often driven by small investors who for some reason pile into a stock, be it belief that a struggling company can turn itself around, a disdain for so-called short sellers — or fidelity to a former president. Or simply opportunism.

Reddit’s initial public offering last week was the most anticipated debut so far this year, and it didn’t disappoint, rising 48% on the first day. The stock gained an additional 30% Monday.

Then Trump Media stole Reddit’s thunder by jumping as much as 59% on its first day of trading Tuesday, before cooling off and closing with a gain of 16%. On Wednesday, the stock gained an additional 14% to close at $66.22. Former President Donald Trump holds a majority stake in Trump Media that could bring him billions.

Analysts and academics are comparing the surge in Reddit and Trump Media to the meme stock craze in 2021 that boosted shares of companies such as video game retailer GameStop and movie theater operator AMC Entertainment.

Although there are differences between the two groups, the companies did have two prominent similarities: It was hard to look at the financials and predict a path to long-term profitability. But small investors bought in nonetheless.

Trump Media lost $49 million in the first nine months of last year, when it took in just $3.4 million in revenue and had to pay $37.7 million in interest expenses. In a recent regulatory filing, the company said it will lose money “for the foreseeable future.”

Research firm Similarweb estimates that Truth Social had roughly 5 million monthly visits in February of this year. By comparison, Facebook had 15.2 billion visits, while Reddit had 2 billion. Reddit, like its social media peers, relies on user growth and advertising revenue, but it has yet to turn a profit in its nearly 20-year history that has also been beset by management turmoil and user backlashes. About 76 million users checked into one of Reddit’s roughly 100,000 communities in December, according to a regulatory disclosure.

While Reddit and Trump Media can be considered newer technology companies, GameStop and AMC were considered to be somewhat antiquated when small investors latched onto them in late 2020 and early 2021. GameStop struggled while selling video games and consoles in stores without a digital alternative, and AMC lost billions of dollars as movie fans embraced streaming and

the pandemic kept them out of theaters.

Granted, GameStop had the backing of Ryan Cohen, founder of the e-commerce pet food company Chewy, who investors likely thought could modernize GameStop’s business. But a number of investors were individuals who belonged to the Reddit community Wall Street Bets and bought shares in order to “stick it to” to big institutions that had made bets the stock would drop. As the stock took off, even more investors seized the opportunity to buy.

Many of those investing in Trump Media are also small-time investors either trying to support Trump or aiming to cash in on the mania. They helped the stock of Digital World Acquisition more than double this year ahead of its merger with Trump Media, which took its place on the Nasdaq stock market. As the stock jumped Tuesday, one user urged conservatives to “get behind the DJT stock and send it over $100 per share” to “drive the liberals insane!”

Data from Vanda Research show that retail investors bought $6.5 million of Trump Media shares on its first trading day and $7.9 million of Reddit shares for its debut.

The frenzy surrounding GameStop and AMC eventually died down. GameStop’s market value peaked above $20 billion in January 2021; it’s now just above $4 billion after Cohen’s turnaround has for the most part failed to materialize. AMC’s market value has dropped from a high of around $29 billion to about $1.5 billion. While both carry on — GameStop even reported a small profit for the fiscal year ended in January — analysts question their longevity.

Following the release of GameStop’s earnings report Tuesday, Michael Pachter, an analyst at Wedbush Securities, wrote in a note to investors that steeper revenue declines for the company could lead to large losses and possibly bankruptcy.

“If we’re right, GameStop has a likely runway of no more than five years,” Pachter said.

Even so, Pachter is even more skeptical of the fervor over Trump Media in the market. He notes that GameStop had revenue of more than $5 billion back in 2020 while Trump Media’s revenue is under $5 million.

“GameStop was the meme stock of a lifetime, but Trump Media has put it to shame,” Pachter said in an email.