Bahamians conflict on broker’s US client pull

By NEIL HARTNELL Tribune Business Editor nhartnell@tribunemedia.net

Bahamian executives have given conflicting evidence over whether a local broker/ dealer used marketing deals with day trading schools to circumvent US laws against soliciting American clients. The Securities & Exchange Commission (SEC), in a newly-filed bid for summary judgment against Guy Gentile and his now-defunct Mintbroker International, seized on testimony by the latter’s ex-assistant manager which suggested it exploited promotional agreements with “marketing affiliates” to gain access to US trading

clients in such a way that it could argue there was no direct solicitation. Drameko Moore, in testimony given before the Supreme Court following the SEC’s request for Bahamian judicial assistance, disclosed he had discussed the potential ramifications of using these deals to attract American clients with other senior Mintbroker executives. He said he was told this strategy was “a way to get access to more US clients

GRAND LUCAYAN CRITICAL TO ‘TURN PSYCHOLOGY AROUND’

THE Grand Lucayan’s sale was yesterday branded “the big game changer” that Grand Bahama needs to both “turn the psychology around” and address its massive room inventory shortage.

Magnus Alnebeck, Pelican Bay’s general manager, told Tribune Business that finding the correct buyer to transform its largest existing resort is “the big deal” that needs to be sealed with the island’s “revival mode” triggered by projects such as Carnival’s $600m Celebration Key and signs of movement on Grand Bahama International Airport’s redevelopment.

Arguing that the Grand Lucayan represents the quickest possibility of restoring shuttered hotel rooms to active service, he said an incident twothree weeks ago illustrated the inadequacy of Grand Bahama’s inventory. When a Sunwing flight was unable to take off due to technical problems, Mr Alnebeck revealed it was a struggle to find sufficient rooms to accommodate 80 passengers stranded for that night. The Pelican Bay chief’s comments came amid an escalating political row over the Government’s protracted efforts to exit the Grand Lucayan ownership. However, Tribune Business sources, speaking on condition of anonymity, yesterday disclosed that the

Government has signed a non-disclosure agreement with another potential buyer of the resort. No sales agreement, or even a Letter of Intent, has been signed yet, and no deposit paid. However, this newspaper was told that the non-disclosure agreement (NDA) will enable the prospective purchaser to examine the Grand Lucayan’s financials and conduct extensive due

without there being any direct solicitation”.

However, Mr Gentile, in opposing the SEC’s summary judgment, called upon competing testimony from Janay Pyfrom-Symonette, Mintbroker’s chief marketing officer, in which she said she was ordered “at all times” not to advertise its services directly to US clients.

These testimonies go to the heart of the SEC’s case against Mr Gentile and his former Bahamian broker/

dealer, with the capital markets regulator alleging that they violated the Securities Exchange Act by operating as an unregistered broker in the US to solicit American clients. The federal agency claims that Mr Gentile’s deals with online day trading schools, such as WarriorTrading. com and DayTradingRadio. com, saw them advertise the Bahamian broker/dealer’s services to their students who were also offered “incentives”, discounts

and rebates to the fees it charged.

The result, the SEC alleges, saw Mintbroker, which operated under the name SureTrader and was previously known as Swiss America Securities, “balloon” from a three-man operation at its Elizabeth on Bay plaza offices on Bay Street into a 75-strong staff who effected “more than $1bn in customer transactions” at its peak before

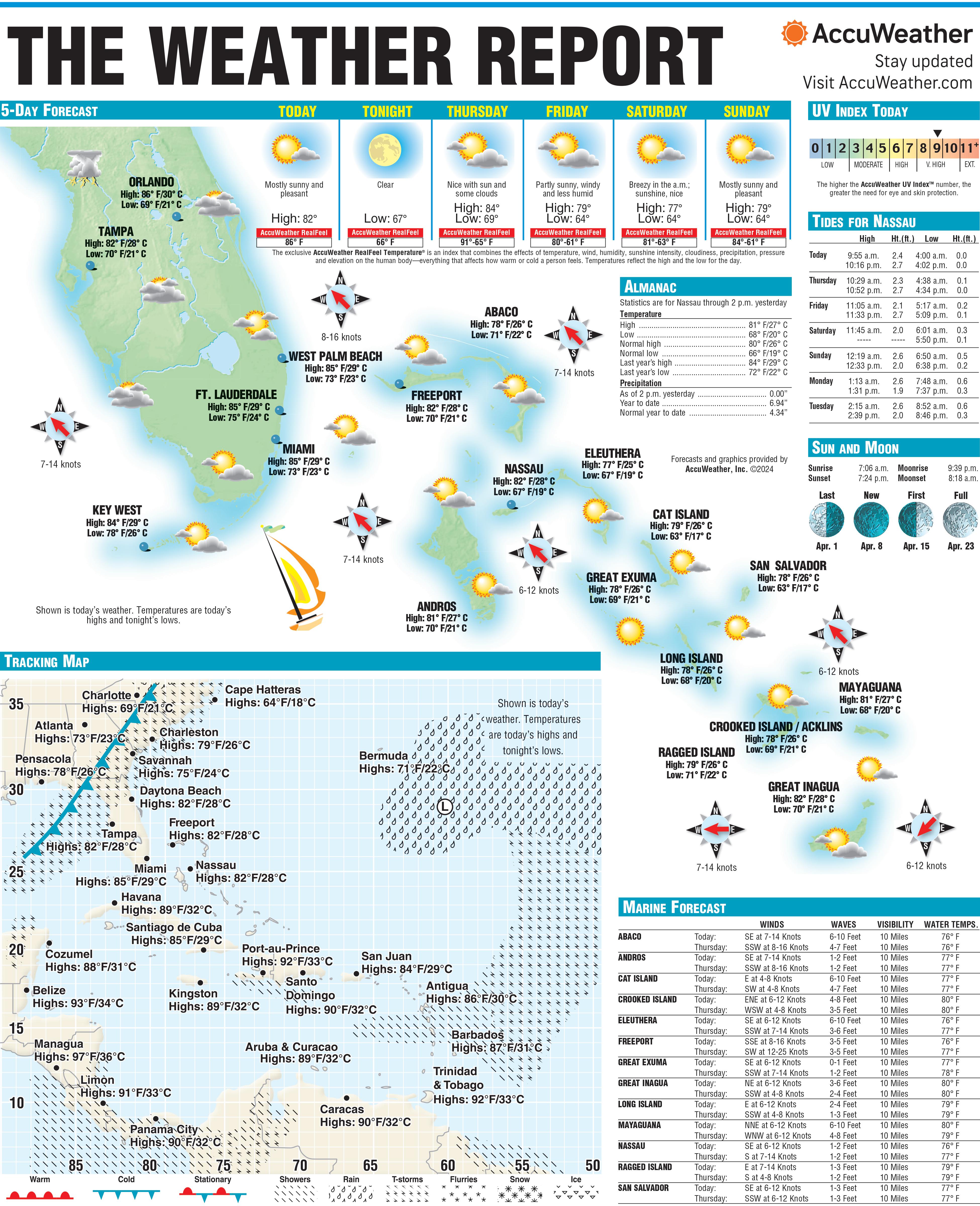

THE Government collected a smaller percentage of its full-year revenue target than the prior year during the six months to end-December 2023, it was revealed yesterday, even though that month’s deficit fell $27m.

The Ministry of Finance, unveiling the December and half-year fiscal performance, said the 29.1 percent year-over-year decline in that month’s deficit to $65.9m was driven solely by reduced spending as total revenues declined by a “marginal” 1.1 percent compared to the prior year comparatives.

However, December’s flat revenue performance - when combined with the amount of taxes and other income collected during 2023-2024’s first six months - will likely raise fears that the Davis administration

is unlikely to hit full-year targets that have been branded “aggressive” and overly-ambitious by international and domestic observers alike.

The Government’s total revenues for the 2023-2024 fiscal year’s first half stood at $1.32bn, representing 39.2 percent of the Budget target, while tax revenuesat $1.169bn - had achieved 40.1 percent of the full-year goal. Although both figures were higher than the prior year’s numbers, in percentage terms they full short of the 44.9 percent and 44 percent, respectively, that were achieved in 2022-2023.

VAT, meanwhile, which accounts for almost 48 percent or half the Government’s recurrent income, reached the fiscal year’s mid-point at $646m or 40.6 percent of the fullyear’s $1.591bn target. While ahead of the prior year’s $600m comparative by $45.8m, or 7.6 percent,

in percentage terms it was below the 42.5 percent collected at the prior year’s mid-point.

VAT revenues also under-shot target by some $160m in 2022-2023, yet this income source has to grow by a much greater 27 percent or $339m over the $1.252bn collected in last year to hit the current target of $1.591bn.

December’s report also showed that total revenues, and taxes collected, had increased by 3.4 percent and 6.6 percent, respectively, year-over-year at the 2023-2024 half-way point. Yet this growth rate remains well below the 16 percent year-over-year expansion that the Government must achieve to hit its $3.319bn target for the full year. The Davis administration, though, received better news on its total expenditure, which

GRAND Bahama’s Chamber of Commerce president yesterday said that despite “living in a world of doubt for so long” he does not believe local businesses are disinterested in Carnival’s $600m project.

James Carey, reacting to Chester Cooper’s assertion that participation by Grand Bahama businesses in the bidding processes for the cruise line’s Celebration Key development was “shockingly low”, told Tribune Business that initial enthusiasm may not have been that strong because the island has been “beaten so badly” over the past 20 years. While not privy to information the deputy prime

minister may have, he added that he has attended several bid-related events staged by Carnival where there were “full houses” of entrepreneurs and private sector representatives seeking opportunities to participate in areas ranging from the provision of goods and services to retail, entertainment and food and beverage outlets. “I don’t know if it was shockingly low but the enthusiasm perhaps was not there,” Mr Carey told this newspaper. “The Grand Bahama community has been beaten so badly and for so long, they’ve been living in a world of doubt for so long, but I believe they will rise to the occasion and make their expressions of interest to Carnival. “We’re waiting for Carnival

to come back and give an indication of who will likely be awarded space in the new facility. There’s sufficient interest. I’ve been to a couple of events that Carnival had, and they’ve been full houses with a lot of interest expressed.

“I’ve not had access to the information the deputy prime minister may be looking at, but I certainly don’t have the impression local business houses have chosen not to apply. I don’t have that impression at all. Maybe it’s his way of encouraging the populace to be more interested. It’s good to encourage them,” the GB Chamber chief continued.

“I don’t know the actual numbers that have applied, and it’s still early because Carnival has not confirmed

anything as yet. I don’t

business@tribunemedia.net WEDNESDAY, MARCH 27, 2024

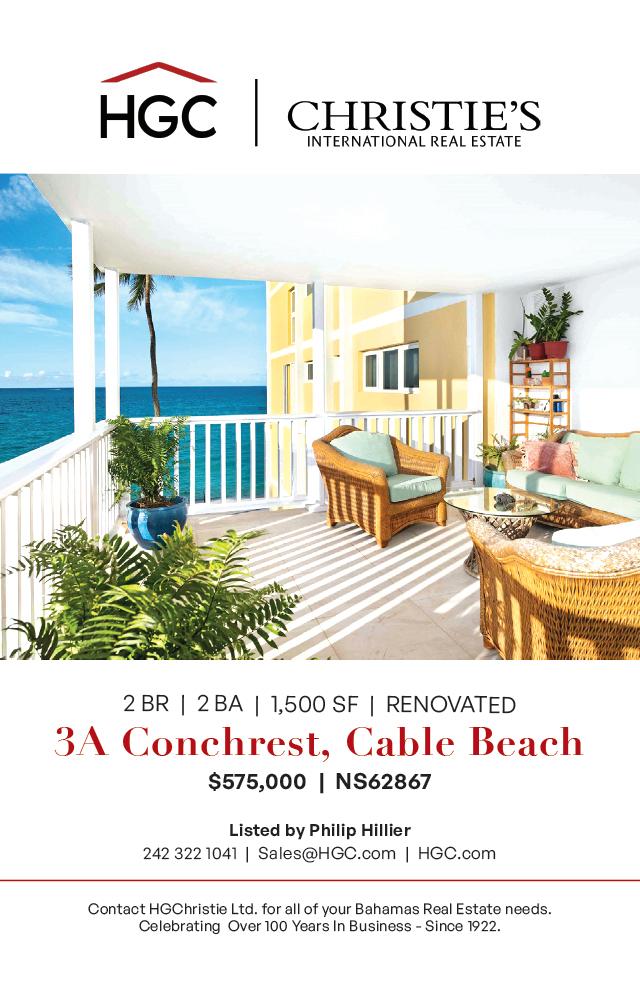

anticipate that confirmations will start coming back before the middle of the year but I know any number of persons have put in requests for opportunities. “And we have people who, certainly on the ground, have been in this type of activity, different touristic activities for years, so they know this works. And I hope, whatever it takes, they will embrace it” Mr Cooper at the weekend warned Grand Bahama businesses not to be “passive observers” of the island’s economic revival after their initial participation in Carnival’s $600m port project was “shockingly low”. Addressing the Grand Bahama Chamber of Chamber chief: Carnival bids gaining ‘full houses’ * Mintbroker executives give SEC testimony before Supreme Court * Regulator seizes on day trade marketing deals to circumvent law * But marketing chief ordered ‘at all times’ not to solicit US clients SEE PAGE B5 GUY GENTILE By NEIL HARTNELL Tribune Business Editor nhartnell@tribunemedia.net By NEIL HARTNELL Tribune Business Editor nhartnell@tribunemedia.net A VIEW of the Grand Lucayan Hotel. SEE PAGE B6 GOV’T COLLECTS SMALLER AMOUNT OF FULL-YEAR REVENUE IN FIRST HALF SEE PAGE B6 By NEIL HARTNELL and FAY SIMMONS SEE PAGE B6 $5.60 $5.61 $5.75 $5.60

Don’t ignore broader picture in BPL reform

AMID mounting concerns and questions surrounding the Government’s purported decision to transfer the generation, transmission and distribution of electricity at Bahamas Power and Light (BPL) to external entities, the undeniable truth persists: The nation’s power provider is in a state of crisis and needs urgent revival.

Despite its many challenges, BPL remains an historical emblem; a legacy asset that evokes a sense of nationalism for many Bahamians. But the stubborn desire to keep various functions at the ailing power company under sole government control has perhaps done more to undermine its efficiency over the past several decades than anything else.

Despite many Bahamians’ ambivalence toward the prospect of outsourc ing certain functions at BPL, a pragmatic assess ment of such a strategy is warranted, and measured consideration should be given to the benefits it may bring to overall operations at BPL, its customers and the broader economy. The need for consistently reliable, affordable and cleaner energy transcends mere financial relief for ordinary citizens; it held just about $50m in cash according to the stateowned utility’s 2019 annual report,

NATIONAL TRAINING AGENCY UNVEILS ITS LATEST RECRUITS

THE National Training Agency (NTA) yesterday unveiled the 16th group of recruits for its Mandatory Workforce Preparation Programme.

Presently, the Ministry of Finance earmarks around $40m annually for electricity expenses. Undoubtedly, a reduction in electricity costs would liberate tens of millions of dollars, thereby allowing the Government to redirect funds toward more economically productive projects.

Moreover, lower electricity costs for businesses would invariably benefit Bahamian consumers, shifting their purchasing power towards

40 cents per kWh, was twice the world average of 13 cents per kWh for commercial and 14 cents per kWh for residential.

Notably, 9.6 percent of electricity is unbilled. Public-private partnerships (PPPs), the Inter-American Development Bank emphasised, could play an important facilitating role in attaining the higher level of investment required to address inefficiencies at state-owned enterprises, including BPL.

This is not The Bahamas’ first rodeo regarding handing over key national assets to external entities to manage.

And the country’s track record with such endeavours has reaped benefits for Bahamians.

For example, the Government’s divestiture of a controlling stake in The Bahamas Telecommunications Company (BTC) in 2011 has led to a more competitive

are numerous. For one, they place the focus on all elements of the business, balancing costs with services to ensure the entity remains efficient.

Governments historically bow to the pressures of customers when it comes to state-owned enterprises (SOEs). PPPs remove that pressure because the fiduciary responsibility will be to act in the best interest of the company and its shareholders.

Management cannot ignore cash flow and dividends because they have shareholders to satisfy and, on the other hand, it cannot ignore quality standards in the long-term because it must satisfy its partnership agreement with the Government.

We believe that with the proper regulatory framework, outsourcing critical operations at BPL would result in the delivery of quality cost-effective services to the consumer.

Set to begin in April, the 15-week initiative is aimed at preparing young people aged between 16 and 26 to successfully enter the workforce. They will be trained in areas such as job preparation and first impressions; organisational governance; managing workplace diversity; developing communication skills; and the art of customer service.

The National Training Agency said:

“In addition to NTAinspired courses, the trainees are carried through specialised training: City & Guilds and/or skills training.

“Based on their career choices, the trainees would be placed into the skills training portion of the programme where they would have the opportunity to develop service-based and hands-on skills.

“On the other hand, there are times where trainees have specific career goals.

“Hence, those individuals would go through the internationally-accredited City & Guilds programme. Both of these avenues will ensure that trainees are properly prepared to succeed in today’s workforce.”

PAGE 2, Wednesday, March 27, 2024 THE TRIBUNE

TO ADVERTISE TODAY IN THE TRIBUNE CALL @ 502-2394

Minister’s further boating reform ‘if we have our way’

By FAY SIMMONS Business Reporter

A CABINET minister yesterday said there will be further reforms “if we have our way” to the Boat Registration Act and Water Skiing and Motorboat Control Act given maritime industry concerns.

Jomo Campbell, minister of agriculture and marine resources, said concerns over the Bill’s

requirements for mandatory insurance, maintenance records and an annual survey have been taken into consideration by the Government after they were raised by fishermen and other boat owners. He added that he has spoken to Gregory Bethel, acting director of marine resources, about the difficulties fishermen face in insuring older vessels or producing detailed maintenance records for boats they repair themselves.

Mr Campbell said he will meet with the Ministry of Finance to discuss a solution in the coming weeks. “Well, what I can say in that regard is that is something that came up in a conversation with the director and myself, and we will be having a further meeting on that with the relevant persons at Ministry of Finance as early as in about two weeks’ time.

So we should be able to update you on that in very short order,” Mr Campbell said.

He added that a key component of consultation is listening to the complaints of stakeholders and meeting with relevant persons to find a solution. “So that’s why consultation,” Mr Campbell said. “And, you know, even if consultation really means, or we call it ‘getting row’, but the key is to listen.

“The only way to learn is to listen and so we listen. Whether it’s, you know, a soft voice or a loud voice, but we listen and

then we take it back to the relevant heads. But certainly, when we sit back with Finance, we’re going to look at ways to make life much easier for persons who are really, you know, the backbone of our society, the farmers and the fishermen.”

When asked if there will be possible amendments to the Bills, which have already been passed by the House of Assembly, Mr Campbell replied: “Well, if we have our way.”

DPM addresses GB Chamber’s banquet

THE Ministry of Agriculture and Marine Resources yesterday received a donation of four drones from the United Nations Food and Agriculture Organisation (FAO) to help maximise land use.

Jomo Campbell, minister of agriculture and marine resources, said the drones will allow farmers to survey land capabilities as well as lend support to various departments including marine resources and forestry.

Mr Campbell said the FAO will provide training sessions to ensure Bahamian officials use the new technology for the department’s benefit, and that data gathered from the drones will be used to conduct an agricultural census to fully understand this nation’s production capability.

He added: “The FAO isn’t just dropping off these rolls. There will also be training sessions for some of our staff that use these drones for our country’s benefit.

“It is indeed necessary that we that we continue to work together and remain on the cutting edge to solve any issues that may arise from evidence we gather for more research. This will also assist us in conducting an agricultural census and understanding our food production capabilities.”

“These drones can assist us in setting the priorities for research, and also how we make the most use of the land that we have,” he explained. “They can also help us to access our marine resources, such as our vast oceans and mangroves that are crucial to our very existence. Other ministries, which deal with the environment and forestry, will also have access to these drones.”

The Ministry of Agriculture and Marine Resources also unveiled its national advisory committee on agriculture yesterday. Mr Campbell explained that this is a Cabinet-appointed body comprised of 40 persons including members, island representatives and technical advisory assistants.

Godfrey Eneas, the committee’s chairman, said this is the largest membership to-date. More persons have been included to ensure all the Family Islands are represented. Mr Eneas added

that many Family Island members are “in the field” and therefore know what is needed to expand agriculture on their island and find ways to capitalisze on the tourism sector by providing produce for guests. He said: “The National Advisory Committee never comprised more than ten people. It was very small and we wanted to widen it up and add more people to the table because too many of our Family Islands were left out, and the many issues that affect them like climate change.

“There’s a lot of infrastructure work to be done, in terms of upgrading the infrastructure in the agricultural sector, and these are the people who are in the industry. Many of the Family Island members are in the field and they know what is needed to help us capture the expanding tourism market that we have.” Mr Eneas said the committee plans to target cutting The Bahamas’ food import bill and, through producing more crops and

livestock, the country can be more self-sufficient.

He added: “One of our number one challenges is to address this huge import bill.

“In 2007, the food import bill in The Bahamas was $500m.

“Seventeen years later, it is almost $1bn. That is too much money for us to be sending out of the country. We need to harness that factor, and the way we do it is through more production, crop production, livestock production.”

N O T I C E

LGAM HOLDINGS LIMITED (In Voluntary Liquidation)

NOTICE IS HEREBY GIVEN as follows:-

A. In accordance with Section 138(4) of the International Business Companies Act, 2000 (No. 45 of 2000) LGAM HOLDINGS LIMITED (the “Company”) is in dissolution.

B. The dissolution of the Company commenced on the 26th

THE TRIBUNE Wednesday, March 27, 2024, PAGE 3

day of March, 2024 when its Articles of Dissolution were submitted to and registered by the Registrar of Companies of the Commonwealth of The Bahamas. C. The Liquidators of the Company are TONI Y. GODET and CELESTE F. MITCHELL both of Harbour House, Western Road, Lyford Cay, P. O. Box N-7776 (Slot 193), New Providence, The Bahamas. D. Creditors having debts or claims against the above-named company are required to send particulars thereof to the undersigned at P. O. Box N-7776 (Slot 193), New Providence, The Bahamas to be received on or before the 12th day of April, 2024. In default thereof, they will be excluded from the benefit of any distribution made by the Liquidators. Dated the 27th day of March, 2024. TONI Y. GODET and CELESTE F. MITCHELL Liquidators The Public is hereby advised that I, KERRI NASH GRANT also know as BASIL FRITZGERLAD GORDON of P.O Box N-3699 #91 Church Hill Avenue, Nassau, The Bahamas intend to change my name to KERRI NASH BOWLEG. If there are any objections to this change of name by Deed Poll, you may write such objections to the Chief Passport Officer, P.O.Box N-742, Nassau, Bahamas no later than thirty (30) days after the date of publication of this notice. INTENT TO CHANGE NAME BY DEED POLL PUBLIC NOTICE NOTICE DECO INVESTMENT HOLDINGS LTD. In Voluntary Liquidation Notice is hereby given that in accordance with Section 138(4) of the International Business Companies Act. 2000, DECO INVESTMENT HOLDINGS LTD. is in dissolution as of February 23 2024. International Liquidator Services Ltd. situated at 3rd Floor Whitfield Tower, 4792 Coney Drive, Belize City, Belize is the Liquidator. L I Q U I D A T O R To Publish your Financials and Legal Notices Email: garthur@tribunemedia.net

jsimmons@tribunemedia.net AGRICULTURE GAINS DRONES TO MAXIMISE LAND USAGE By FAY SIMMONS Business Reporter jsimmons@tribunemedia.net

CHESTER COOPER, deputy prime minister and minister of tourism, investments and aviation, was the keynote speaker at the annual installation of Grand Bahama Chamber of Commerce officers and directors banquet on Saturday, March 23. Held in the Grand Lucayan ballroom, Mr Cooper was accompanied by his wife Cecilia. The minister for Grand Bahama, Ginger Moxey, along with executives of the Grand Bahama Port Authority (GBPA), Chamber president James Carey, Chamber executive director Mercynth Ferguson, and businesspeople from the island were also in attendance.

(Photos: Vandyke Hepburn/BIS)

Bahamians conflict on broker’s US client pull

eventually being placed into full Supreme Courtsupervised liquidation at end-2021. “The potential customers targeted by SureTrader (Mintbroker) advertising on affiliate websites were US customers,” the SEC asserted, drawing on Mr Moore’s testimony. “SureTrader’s affiliate programmes ‘were a way to get access to more US clients without there being any direct solicitation’. SureTrader did not treat the applications from US customers any differently than customers from other locations.”

Mr Moore, under questioning from Ronique Carey of the Attorney General’s Office, which was representing the SEC, confirmed he was “familiar” with websites that were part of SureTrader’s affiliate programme such as WarriorTrading, the Sykes Challenge, Investorsunderground.com and Mojodaytrading.com.

He added that one of the instructors from those sites was “basically treated as a VIP client in the sense that whatever services or needs he had, he was able to contact my line directly to receive that service faster than the normal route of receiving that service”.

Mr Moore, who now works for Deltec Bank & Trust’s digital assets subsidiary, Delchain, added that clients attracted via the likes of Warrior Trading received “some sort of discount” which he initially described as “a special code”.

Testifying before Renaldo Toote, the Supreme Court’s deputy registrar, he said: “They would receive some of sort of discount, but I don’t remember exactly what that amount was. A promo code, that’s what it was.”

Mr Moore, under questioning from Ms Carey, said he did not discuss the advertising deals with day trading schools or solicitation of US clients with Mr Gentile. However, he admitted having such a conversation “between 2014 and 2015” with Mintbroker’s thencompliance manager, Philip Dorsett, and deputy director, Justin Ritchie.

“The response that I vaguely remember receiving was that - from the top - the sentiment was that the affiliate programmes were a way to get access to more US clients without there being any direct solicitation,” Mr Moore said.

“The affiliate programme was put in place to... so that the company could get into some sort of partnership or agreement with other companies that had trading clients that were possibly looking for a software provider or a trading platform to day trade on.

“And SureTrader was a company that provided

those services. So, the affiliate programme was to basically give clients that joined SureTrader using the promo code provided - or I guess the promo code of whichever company they were a part of - some sort of incentive or discount once they joined SureTrader.”

After completing his evidence, Mr Moore was admonished by the Supreme Court “not to discuss anything that transpired today with anybody”.

Mr Gentile, though, moved swiftly to rebut this using Ms Pyfrom-Symonette’s testimony to the Supreme Court which was given as part of the same judicial assistance process.

“The SEC has put forth no evidence of solicitation other than the circumstantial evidence that a large percentage of SureTrader customers were US persons,” the former Mintbroker principal said in legal documents filed with the south Florida district court on Monday. “In fact, SureTrader’s chief marketing officer, Janay Pyfrom, made clear in her deposition” that she was forbidden to market to US clients. Under cross-examination by Philip McKenzie KC, the Davis & Co attorney and partner representing Mr Gentile and Mintbroker, she said: “I was not allowed to advertise in any way to US customers or to US residents...” Asked by Mr McKenzie whether the Bahamian broker/dealer’s policy was “to exclude” US clients, Ms Pyfrom-Symonette replied: “Yes: At all times.”

Confirming that Mintbroker employed an Internet Protocol (IP) pop-up blocker to identify, and alert it, to potential US clients, she added: “The implementation for me was on the website. So anybody that came in from a US IP address would have to clearly state that they were US, and then they had to meet conditions to interact with the firm.

“But, from an implementation point of view, the IP address which SureTrader [used] would block the website and then they would have to state that they are from the US.”

Mr Gentile, seeking to strengthen his defence, also cited an August 2015 e-mail exchange with Ms PyfromSymonette over a potential affiliate setting up advertising for SureTrader.

“Pyfrom asked Gentile whether he agreed that Pyfrom should inform the potential ‘affiliate’ that ‘[i] t’s important that in any campaign it is clearly indicated that ‘services are not intended for US persons’ and that the United States is not targeted in their PPC [pay-per-click campaign]’,” the Mintbroker chief said.

“Gentile responded: ‘Yes. I agree.’ Pyfrom forwarded a similar exchange

to Gentile in September 2015 after she made clear ‘it would best for affiliates to limit their ads to the top three countries’ - the UK, Canada and Australia. There was to be “strictly no advertising to the US”, and Ms Pyfrom added: “We can make keyword recommendations. However, we are not as strict as it relates to this.”

The former Mintbroker principal said: “Gentile chimed in: ‘Please make sure they are not showing ads in the US’. In December 2015, Pyfrom and Gentile exchanged e-mails about advertising provided by Yieldmo Inc. Gentile directed Pyfrom to ‘ensure this [advertising campaign] has no US impressions’, and the ‘count[r]ies targeted’ included Canada, Australia, the United Kingdom, Italy, Israel and Brazil.”

The SEC, though, is far from convinced and is alleging that Mr Gentile and Mintbroker benefited significantly from circumventing US laws. “SureTrader was in the business of being a broker/ dealer from no later than December 2011 until at least November 2019, when its clearing firm changed the services it provided to SureTrader,” it alleged in legal filings.

“SureTrader ballooned from a three-man shop to become a broker/ dealer employing about 75 employees with more than 40,000 customer accounts and assets of more than $10m. SureTrader has effected transactions ‘in excess of $1bn on behalf of its customers’. During the Relevant Period in the complaint, US customers comprised at least 50 percent and, at times 80-85 percent, of SureTrader’s customer base.”

Mr Gentile enjoyed a colourful - and sometimes controversial - time in The Bahamas. His broker/ dealer was used as “bait” by the Federal Bureau of Investigations (FBI) to allegedly help snare numerous international securities fraudsters, with his Bahamian offices ‘bugged’ to record video and sound. These activities resulted in several guilty pleas and convictions. Mr Gentile and his company exited the Bahamas at end-2019 when faced with regulatory actions and investigations by the Securities Commission of The Bahamas. However, in so doing, he bought sufficient time to voluntarily wind-up he broker/dealer himself and remove all its assets from The Bahamas.

That came after Philip Davis KC, then the Opposition’s leader, acting on Mr Gentile’s behalf filed a successful Judicial Review challenge that thwarted the Securities Commission’s efforts to take regulatory action against SureTrader for several months.

Wednesday, March 27, 2024, PAGE 5

FROM PAGE B1

Gov’t collects smaller amount of full-year revenue in first half

FROM PAGE B1

declined by 10.7 percent or $30.3m year-over-year during December to fall from $282.1m to $251.8m. Recurrent spending, which covers the Government’s fixed costs, also fell by $31.1m to $229.4m as opposed to $260.5m in December 2022.

This suggests the Government is having some success in controlling and containing its costs, although social assistance and pensions had exceeded more than half the full year’s budgeted amount at the mid-way point, coming in at $120.4m against a $236.5m total allocation.

Putting it altogether, the spending containment drove a 29.1 percent reduction in December’s

monthly deficit, with the ‘red ink’ gap between expenditure and income falling from $92.9m in 2022 to $65.9m. This was the third consecutive month in which the Government’s deficit fell year-over-year, but for the full six months the combined $258.7m worth of ‘red ink’ was almost double the $131.1m full-year target. The half-year deficit was equivalent to 197.4 percent of the full 12-month goal, but represented a $16.9m or 6.1 percent decline on the $275.6m deficit incurred at the 2022-2023 midway point.

Fuelled by a line of credit obtained by Deutsche Bank, the direct central government debt also expanded by $174.3m in December.

“Proceeds of borrowings totaled $764.5m, of which 64.9 percent was in foreign currency and 35.1 percent was in Bahamian dollars,” the Ministry of Finance’s report said. “Of the $590.3m in debt repayment, 52.7 percent was in foreign currency and the remaining 47.3 percent in Bahamian dollars.

“Preliminary data on the fiscal outturn for December 2023 showed a 29.1 percent decrease in the estimated deficit to $65.9m from $92.9m a year earlier. This outcome reflected a 10.7 percent ($30.3m) decrease in spending to $251.8m alongside a marginal 1.7 percent ($3.3m) fall in revenue receipts to $185.8m.” December’s VAT revenues rose by $10.7 m or

14.5 percent, jumping from $73.9m year-over-year to $84.6m. “Next in importance were international trade and transactions that yielded $41.7m.

Non-tax revenue collections totaled $23.8m, with the bulk derived from the sale of goods and services,” the Ministry of Finance said.

“Aggregate expenditure contracted by 10.7 percent from prior year to an estimated at $251.8m. This comprised $229.4m in recurrent outlays and $22.3m in capital expenditure.

“Key areas of spending included personal emoluments ($71.8m), the purchase of goods and services ($41.6m), interest payments ($44.8m), subsidies ($35.1m) and the

acquisition of non-financial assets ($22.1m).”

The ministry continued: “Of the $162.1m in tax collections, the key contributors were VAT receipts ($84.6m); international trade and transactions taxes ($41.7m); other taxes on goods and services ($21.5m); and property taxes ($13.7m).

Non-tax revenue of $23.8m was mainly comprised of the sale of goods and services ($19.5m), with three-quarters provided by Immigration and Customs administrative-related fees.

“The $229.4m in recurrent spending for the month represented a decrease of 12 percent ($31.2m) from the corresponding period in the prior year. Personal emoluments were relatively flat at

$71.8m, although spending increased to 28.5 percent of the total expenditure.

“Public debt interest payments were higher by $10.3m at $44.8m, reflecting increases in the debt stock and interest costs.

Outlays for the use of goods and services declined by $8.1m to $41.6m.

Subsidies fell by $16.9m to $35.1m, owing to timing differences in transfers to state-owned enterprises. Payments related to social assistance and transfers rose by $3.1m to $19.8m.

“Capital expenditures increased by 4.1 percent ($0.9m) to $22.3m. The bulk of these outlays (98.7 percent) was employed to acquire non-financial assets, and the remaining 1.3 percent represented capital transfers.”

GRAND LUCAYAN CRITICAL TO ‘TURN PSYCHOLOGY AROUND’

FROM PAGE B1

diligence on the resort while also advancing negotiations with the Government. “The Government has signed an NDA with somebody on the hotel,” one source said, speaking on condition of anonymity. “It’s an American group, very well-heeled. The group has the wherewithal and they have got big plans. The general terms have been discussed. The town is hot.”

The Grand Lucayan has again become a focus of political controversy after Michael Pintard, the Opposition’s leader, on Monday blasted the Davis administration’s failure to secure sale in the two-and-a-half years since it took office in September 2021.

This provoked a rapid, withering response from Chester Cooper, deputy prime minister and

minister of tourism, investments and aviation, who branded Mr Pintard “not a serious person” and who “will clearly say anything he believes will lend him a shred of political relevance”.

Mr Cooper focused much of his rebuttal on the Minnis administration, in which Mr Pintard was a Cabinet minister, and its decision to acquire the Grand Lucayan for $65m from Hutchison Whampoa’s property arm in 2018. The acquisition, and subsequent taxpayer subsidies to cover the resort’s operating costs, are thought to have cost the Bahamian people a sum getting close to $200m.

“Under our administration, the Grand Lucayan resort remains open, has been maintained in good physical condition, employs over 150 Grand Bahamians

and has occupancy levels and revenues significantly exceeding last year, let alone in any year under the stewardship of the Cabinet in which he [Mr Pintard] sat,” Mr Cooper added. He pledged that the resort “has never been more attractive to investors. There continues to be strong interest and, at the appropriate time, we will say more”. But, away from the political theatre, Mr Alnebeck described the Grand Lucayan and Grand Bahama International Airport as “a chicken and egg situation” where each needs the other to succeed.

“Both of them have to happen and then we’ll see some movement in the place,” he told Tribune Business. “I think revival mode has started, but it will take a long time to get back to where the island

was. That’s going to take time. The island can’t get any worse than it was after COVID, as we had not finished cleaning up anything after Dorian and the place looked awful.

“It’s definitely looking better than a year ago, and things are happening. The big deal is the hotel getting sold. That will be the big game changer. Every investor who comes to Grand Bahama, whether a small investor or a large investor, they tend to end up in the Lucayan area staying at Pelican Bay or end up in one of the restaurants down there.

“They are driven past the Grand Lucayan where they have 1,100 rooms empty and ask the taxi driver: ‘What is happening there?’ Until that psychology is turned around, and there is less talk about

what happened in the past and more talk about what is happening, then things will happen. When there’s momentum, and you see things coming up, then you have a positive feeling.”

Reiterating that the Grand Lucayan “has to be sold”, Mr Alnebeck added:

“That is the only thing that can put a substantial amount of rooms back into inventory in a short time in Grand Bahama. The building of a new hotel, that will take a long time. There are parts of the Grand Lucayan, depending on what [a buyer] wants to do with it, that shouldn’t take that long.

“When we have more inventory to sell, and a strong product, we will have more airlift, see more people around and have a positive feeling. It’s [more inventory] desperately needed, and not only for tourists. Even though the Shipyard’s new docks are not in, we have had some very big groups come in connected with the dry docks.

“Two weeks ago, three weeks ago, the Sunwing flight had a technical problem and could not take off, and suddenly we had to find 80 rooms on a Saturday night in Grand Bahama. That was not that easy because we didn’t have the rooms to accommodate them. We were able to accommodate a big portion of it at Pelican Bay, and there were rooms elsewhere, but it was not an easy thing to do,” he said.

“We definitely need more rooms, and the type of product that drives demand. Then we’ll see more airlift, more activity and then we’re going to be fine.”

As for Grand Bahama International Airport’s redevelopment, demolition of the old main terminal has begun with sources suggesting that a signing ceremony for the project is expected to take place imminently.

This newspaper was told that the airport has been scaled down from an initial $200m project to $100m, with the funding set to be provided by UK Export Finance, the British government arm responsible for providing trade and export guarantee credits to that nation’s exporters. The financing will be channelled through Bahamas Hot Mix’s (BHM) UK arm, which will be involved in the construction.

Manchester Airport Group, which manages London Stansted, East Midlands and Manchester airports in the UK, will be Grand Bahama International Airport’s operating partner under a long-term lease agreement. Tribune Business understands that the airport’s main passenger terminal will be moved to the east, with the current building converted into a Customs and freight terminal as part of cargo hub ambitions.

Mr Pintard yesterday voiced concerns that the Government has not “narrowed down”, and appears unclear, over the timeline for the airport project as well as its scale and precise layout. He also suggested that “internal conflicts within the Government”, especially involving the Attorney General’s Office and Ministry of Tourism, Investments and Aviation, had delayed and slowed down progress on the development.

Chamber chief: Carnival bids gaining ‘full houses’

FROM PAGE B1

Commerce, he added that he wanted to hear no complaints from the island’s private sector about all the opportunities going to foreign firms or their Nassau rivals if they allow such developments to “pass them by”. Mr Carey agreed that companies which do not take advantage of the opportunity should not complain, but said he is hopeful the numbers at the close of the Carnival’s bidding process will reflect a greater interest from local businesses. He said: “I think what the deputy prime minister was really saying to Grand Bahamians is don’t let Nassau people come in who tend to be more aggressive, whereas we are a bit more laid back. “Don’t wait for New Providence guys who are

more aggressive to come in, and they don’t complain as much. As he says, don’t complain to me that you don’t have an opportunity to do business because you’re letting it go by. But I’m hoping that he’s using old data and that would have changed.”

Mr Carey continued: “Grand Bahama is coming alive finally, and we realise what is really happening and that there are real opportunities.

“The question is: Are we prepared to be able to embrace the opportunity because we need just more than a desire to be able to fund any development that you want to do.

“So you know, I really don’t know what the status is coming out of Carnival, but I do know that the businesses in Grand Bahama, they’ve been waiting for this type of new opportunity.”

PAGE 6, Wednesday, March 27, 2024 THE TRIBUNE

IDB’s Bahamas financing average to drop to $96m

By NEIL HARTNELL Tribune Business Editor nhartnell@tribunemedia.net

THE Inter-American Development Bank (IDB) is predicting that annual disbursements to finance Bahamas-based projects will decline slightly to an average $96m over the five years through 2028.

The multilateral lender, unveiling its plans for financing Bahamas-based development projects in the 2024-2028 country strategy with this nation, said the annual amount of money released will

likely drop by 13.5 percent compared to the $111m seen during the previous strategy.

It is also forecasting that sovereign-guaranteed approvals will hit $850m during the five years to 2028 as it moves to support the Davis administration in implementing its Blueprint for Change as well as the National Development Plan: Vision 2040.

As a consequence of all this lending, expected to total $480m, the IDB said the proportion of The Bahamas’ national debt owed to it will increase from 5.8 percent at end2022 to 7.08 percent by 2028. “The IDB group foresees sovereign guaranteed approvals of $850m over the period from 2024–2028,” the country strategy report said.

“Average disbursements of $96m per year, including from the inherited portfolio, are expected. This

will lead to disbursements totaling $480m over the five-year period compared to the annual average of $111m for a total of approximately $555m over the previous country strategy period. Expected average annual approvals over the period amount to $170m.

“These estimates assume compliance with the bank’s macroeconomic safeguards and access to policy-based loan resources over the country strategy period.... Furthermore, there is considerable scope to leverage incremental financial support from other international financial institutions and bilateral donors. By 2028, the country’s debt to the IDB group is expected to amount to about 7.08 percent of GDP, compared to 5.8 percent at end-2022.”

Elsewhere, the IDB country strategy criticised the absence of data that would enable the

Government to develop policies targeting those most vulnerable to poverty and inequality. “Inadequate updated poverty measures and household surveys covering household expenses and incomes remains a challenge, as the latest household expenditure survey was conducted in 2013,” it added. “Social indicators for The Bahamas are high compared to other Latin American and Caribbean countries, but they are still behind countries with comparative levels of per capita income. Progress has been made in recent decades.

“The Bahamas’ HDI (human development index) score increased by 2.1 percent between 2000 and 2019, and between 1990 and 2019 life expectancy at birth increased by 3.7 years, mean years of schooling increased by 0.5 years, and expected years

of schooling increased by 0.8 years,” the IDB continued.

“Compared to the average of countries with very high HDI scores, both life expectancy (73.9 vs. 79.6 years) and expected years of schooling (12.9 vs. 16.3 years) in The Bahamas are low.

“The pandemic has resulted in a deterioration of social outcomes, though the lack of recent household surveys and upto-date data represent a major obstacle in designing appropriate policies to alleviate poverty and inequality and to bring services to those who need them the most.”

Linking all this together, The Bahamas’ country strategy said:

“Improving data is critical to improving the design of targeted interventions that foster human development, social protection and citizen security.

Household survey data are long out of date, and while labour force surveys are conducted, they are not published on a regular basis.

“Since 2013, there have been no new iterations of the household survey in The Bahamas, thus there are no updated official measures of poverty. Production of these data provides a valuable tool to policymakers for the design of targeted interventions for social protection, and publication of the data promotes broader public understanding of the country’s social situation.

“This is even more imperative since COVID19 has tremendously impacted livelihoods. Evidence from the IDB’s 2020 online socioeconomic survey showed that reduction of income from job losses and business closures severely affected lower-income households.”

PAGE 8, Wednesday, March 27, 2024 THE TRIBUNE

TO ADVERTISE TODAY IN THE TRIBUNE CALL @ 502-2394