$5.60 $5.61 $5.45 $5.38

PI Crown Land battle splits Court of Appeal

By NEIL HARTNELL Tribune Business Editor nhartnell@tribunemedia.netTHE Bahamian entrepreneur seeking to restore Paradise Island’s lighthouse has split the Court of Appeal over his longrunning Crown Land lease battle with the Government.

Sir Michael Barnett, the court’s president, on Friday sided strongly with Toby Smith and his Paradise Island Lighthouse and Beach Club company by finding that “there was a binding agreement” for him to lease a total five acres for development of a beach break-type destination.

And the Court of Appeal’s most senior judge, asserting that he would order “specific performance of the lease” by the Government, also

• President sides strongly with Toby Smith

• Finds ‘binding’ deal but ditched for RCCL

• However, court majority finds for the Gov’t

found that the latter did not sign the agreement with Mr Smith because it “determined that it had found a better deal” - namely Royal Caribbean Cruise Lines’ Royal Beach Club project, which itself wanted to lease three of the same acres sought by the Bahamian entrepreneur. However, Sir Michael’s dissenting verdict did not

prove decisive, as his two fellow justices on the threestrong Court of Appeal panel rendered the majority decision in favour of the Government by finding the reverse - that no valid, legally binding lease agreement was in place. Appeal justices Gregory Smith and Michael Turner upheld the original Supreme Court verdict by Sir Ian Winder and said

they saw no reason to overrule, or interfere with, the Chief Justice’s analysis of the case or his legal conclusions.

Toby Smith declined to comment on the Court of Appeal verdict, or its implications for his longstanding battle with both the Government and

SEE PAGE B4

‘Bizarre’: France, Holland keep Bahamas blacklisted

By NEIL HARTNELL Tribune Business Editor nhartnell@tribunemedia.netFINANCIAL and legal executives yesterday slammed The Bahamas’ continued inclusion on national blacklists of European Union (EU) member states as “crazy” and “bizarre” given its recent delisting by that bloc.

John Delaney KC, the former attorney general, told Tribune Business that the separate decisions by both France and the Netherlands to keep The Bahamas on their own tax blacklists for the whole of 2024 - despite the EU’s

late February decision to remove this nation from its own - further exposed how “arbitrary” such tactics are. Both states are members of the 27-nation EU,

SEE PAGE B7

Bahamas’ FTX asset rescue cited for longer SBF jail time

By NEIL HARTNELL Tribune Business Editor nhartnell@tribunemedia.netUS prosecutors are exploiting the $426m transfer of digital assets to the safekeeping of Bahamian regulators to press for a harsher prison sentence for FTX founder Sam Bankman-Fried.

Damian Williams, the US federal attorney for southern New York, in court documents filed on Friday, is demanding a “two-level enhancement” to Mr Bankman-Fried’s jail term on the basis that he breached the worldwide asset freeze imposed by FTX’s Chapter 11 bankruptcy filing in transferring assets to the

Securities Commission of The Bahamas’ care. His call, part of a bid to persuade the New York court to impose a 40 to 50-year sentence on Mr Bankman-Fried, who was last year found guilty of perpetrating a multi-billion dollar crypto fraud, effectively turns the rationale for the transfer - for which the Securities Commission had obtained permission from the Bahamian Supreme Court - on its head. For Mr Williams’ filings not only ignore assertions that the transfers were conducted to protect client assets from hacking, but also neglect to mention recently-filed Supreme

SEE PAGE B3

Contractors ‘within 30 days’ of licensing legal challenge

By NEIL HARTNELL Tribune Business Editor nhartnell@tribunemedia.netBAHAMIAN contrac-

tors say they are “within 30 days” of launching Judicial Review proceedings over the Government’s failure to implement the Act and licensing regime designed to regulate the industry.

Leonard Sands, the Bahamian Contractors Association’s (BCA) president, told Tribune Business that the eight-year wait to give full effect to the Construction Contractors Act 2016 has been “going on too long” and industry operators are seeing “multimillion dollars going by the wayside” due to lost opportunities to work on major development projects and joint venture with foreign firms.

Asserting that these losses relate directly to the absence of the licensing regime, which would affirm the quality and competencies of Bahamian contractors, that the Act was supposed to put in place, he urged the Davis administration to act

“immediately” and remove all remaining obstacles to full implementation.

Clay Sweeting, minister of works and Family Island affairs, in messaged replies to this newspaper’s questions said recommendations to enhance and improve the Act were being forwarded to the Attorney General’s Office so that the necessary legal amendments can be made.

“The legislative committee at the Ministry of Works and Family Island Affairs recently completed a review of the legislation, and the recommendations

‘DESPERATE NEED’ TO UPDATE SECURITIES LAW

REGULATORS have argued that the main law governing the Bahamian capital markets’ regulatory regime needs to be modernised to account for 13 years of change.

Christina Rolle, the Securities Commission’s executive director, told an industry consultation that the regulator decided to “modernise” the Securities Industry Act in 2022 after evaluating stakeholder feedback. It enlisted Canadian drafters that contributed to the 2011 law for the task.

She said: “In setting out to overhaul the legislation we recognise that the regulatory framework was in desperate need of updating in a number of areas to bring it in line with evolution of industry practices and standards since 2011. “This recognition came through the Commission’s own observation and continuous benchmarking, as we thoroughly went through the feedback that we received and also tracked industry comments over the years.

“By 2022 we felt that it was time to address and modernise the legislation. We internally drafted effective instructions for the legislative overhaul

and engaged with the same Canadian drafters who were involved with the drafting of the 2011 legislation.”

Ms Rolle explained that the updated legislation provides clarification on several areas including investment powers, the securities and investments fund regime, digital assets and tipping-off provisions.

She added that the majority of enforcement provisions were “left untouched” as they are already within the current legislation’s scope but the redraft will clarify the authority.

Ms Rolle said: “Some of the key areas addressed in the legislative overhaul include clarification of

investment powers, provisions which recognise the need for the management of systemic risk and automatic penalties framework, long outstanding clarification between the securities and investment fund regimes, derivatives and derivatives framework, classification of digital assets and tippingoff provisions.

“With respect to the Commission’s enforcement authority, you will find that the vast majority of the provisions have been left untouched. Even in cases where there are changes, for example, changes to clarify the Commission’s authority with respect to the directives that we issue, filing of criminal

BAHAMAS’ FTX ASSET RESCUE CITED FOR LONGER SBF JAIL TIME

FROM PAGE B1Court evidence that the Securities Commission is content to initiate a process that will see them ultimately handed over to John Ray, head of the 134 FTX entities currently in Chapter 11 protection in the Delaware bankruptcy court.

And, in a further blast at The Bahamas, Mr Williams and his prosecutorial team reproduced the 2.27am email sent by Mr Bankman-Fried on Thursday, November 10, 2022, to Ryan Pinder KC, the attorney general, in which he offered open up the crypto exchange to allow only Bahamian clients to withdraw their assets.

“As FTX struggled to meet customer demands, Bankman-Fried approved halting customer withdrawals from the exchange. Shortly thereafter, however, Bankman-Fried - who was residing in The Bahamas at the time - reopened withdrawals only for customers in The Bahamas in order to curry favour with the Bahamian government,” US prosecutors alleged, referring to the e-mail to Mr Pinder.

“Opening withdrawals exclusively for Bahamians resulted in millions of dollars being withdrawn from the exchange by Bahamians and FTX insiders located in The Bahamas, while other customers of FTX. com had no ability to access withdrawals.”

Court filings at the time suggested this enabled some 1,500 investors to withdraw a combined $100m in assets at a time

when FTX’s business was supposed to have been frozen by a combination of the provisional liquidation imposed by the Supreme Court and the Chapter 11 proceedings. It is unclear, though, whether all those 1,500 are “Bahamian”, while Mr Pinder at the time told Tribune Business that “no authorisation was given by any party” to Mr Bankman-Fried to open the exchange for withdrawals. However, Mr Williams and his team are citing this - and the asset transfer to the Securities Commission - as factors that should influence harsher sentencing for the FTX founder.

“On November 11, 2022, FTX, FTX US, Alameda and other related entities all filed for bankruptcy. As discussed in detail below, after FTX entered bankruptcy, Bankman-Fried told Wang that Bankman-Fried was still chief executive of the FTX Bahamian entity because the bankruptcy applied only to FTX and FTX US,” Mr Williams said of the FTX chief’s conversation with his fellow co-founder, Gary Wang. “Bankman-Fried took Wang to meet with Bahamian regulators. Prior to meeting with the regulators, Bankman-Fried told Wang that he was going to offer to transfer FTX’s remaining assets to the regulators to curry favour with officials in The Bahamas. “After Bankman-Fried met with Bahamian regulators outside Wang’s presence, Bankman-Fried and the

Bahamian regulators directed Wang to move FTX funds to a Bahamian cold wallet and Wang complied. Bankman-Fried told Wang to stall with those representing the US bankruptcy if they tried to engage Wang in securing additional assets, and to tell the lawyer that he was still with Bahamian regulators.

“As Wang moved the assets to the Bahamians, Bankman-Fried also sent messages to those trying to resume securing assets for the US bankruptcy stating that he and Wang were unavailable because they were still meeting with regulators. Ultimately the FTX assets that BankmanFried and Wang were able to access were transferred to the authorities in The Bahamas, not to the bankruptcy estate.”

Christina Rolle, the Securities Commission’s executive director, gave a completely different interpretation of what occurred in a December 29, 2022, affidavit, in which she said the regulator had no choice but to work with Mr Bankman-Fried and Mr Wang to protect investors from hacking attempts as they were the only ones who held the “keys” to access the assets.

Ms Rolle alleged that the Securities Commission was first warned about the hacking threat to FTX Digital Markets client assets three days later, when it conducted a “sworn examination” of Mr Bankman-Fried that lasted from 12.40pm to 3.08pm.

complaints and anti-money laundering/counter-terror financing breaches, these are already within the current scope of the legislation and what we are doing in the redraft is mainly a clarification of the authority, but does not amount to any new powers.”

Ms Rolle said the areas with a true expansion of the Securities Commission’s powers are administrative action and its ability to freeze assets. “The areas where there are new, and perhaps a true expansion of powers, are in the areas of the Commission’s ability to take administrative action as well as our ability to freeze assets,” she said.

The FTX founder told the regulator that himself and Mr Wang, who subsequently made a plea bargain deal with US prosecutors in which he admitted to several offences, had “spent much of the night trying to move assets out of harm’s way”.

This was corroborated by Brian Simms KC, the Lennox Paton senior partner, who in his capacity as FTX Digital Markets’ provisional liquidator said he had received reportsincluding information from Mr Bankman-Fried and Mr Wang - informing him of the hacking threat to clients of the crypto exchange’s Bahamian subsidiary.

This prompted the Securities Commission to seek, and obtain, Justice Loren Klein’s November 12, 2022, court order authorising it to take control of - and transfer - FTX Digital Markets’ client assets to a digital wallet under the regulator’s control for safe-keeping.

However, Mr Williams, in his sentencing submissions on Friday, alleged that Mr Bankman-Fried told Mr Wang to effect the transfers in defiance of both the US Chapter 11 freeze “and a directive from attorneys not to do so”.

The US attorney added: “Specifically, Wang testified that on November 12, 2022, the day after FTX’s bankruptcy, the defendant asked Wang to drive with him to the Bahamas’ Securities Commission. During that drive, the defendant told Wang that ‘ideally [they] should transfer [customer assets] to The Bahamas’ liquidators or The Bahamas’ regulators.

“The reason the defendant wanted to transfer FTX assets to Bahamas authorities, as opposed to the US bankruptcy, is because

‘they seemed friendly and seemed willing to let [the defendant] stay in control of the company’. Once they got to the Securities Commission, the defendant, his father, and his attorney met with the Securities Commission, while Wang waited.

“According to the defendant’s attorney, Krystal Rolle KC, the meeting, which began at noon, went for a little under three hours, and then they left and went back to the FTX offices. She did not testify about what was discussed at the meeting.

“But, according to Wang, the defendant said ‘the meeting went well’, ‘the Securities Commission believed ... things he told her’, and ‘they were going to order us to transfer the assets ... to The Bahamas’,” Mr Williams added.

“While the defendant and Wang were driving back to FTX’s offices, the defendant said that the ‘bankruptcy lawyers that had taken over FTX’ in the US were ‘asking [him] to finish transferring the remaining assets to the US, and [the defendant] told [Wang] that [they] should try to stall them’.”

Mr Bankman-Fried and Mr Wang then began to effect the asset transfers, according to US prosecutors. “According to Rolle, at some point they were shown an order on a laptop that purported to require the transfer of the assets to the Bahamas authorities,” Mr Williams and his team said in a seeming reference to the Supreme Court order.

“Then, over several hours, until approximately 2am, Wang and the defendant transferred the remaining customer assets to The Bahamas authorities. The process took a while because the Bahamian regulators were struggling to figure out how to do a cryptocurrency transfer.

“In the case of the expansion with respect to taking administrative action, this is based on the Commission’s experience over the years and will not deny a registrant due process. They do, however, allow the Commission to address non-interpretive issues in a more effective and efficient manner.

“With respect to asset freezing powers, these are necessary to bring the Commission in line with regulatory best practices and international standards.”

Michael Halkitis, minister of economic affairs, said the Bill is necessary to

SEE PAGE B10

“While Wang and the defendant were transferring the assets, they received instructions from the US bankruptcy attorneys not to transfer assets to the Bahamian regulators. Over a Signal chat, the defendant told the US bankruptcy team that the Securities Commission was directing them to transfer the assets to them.

“Ryne Miller, an attorney for FTX who was working with the US bankruptcy team, instructed BankmanFried, who by that time was no longer an executive of FTX, that there was ‘a significant question of who owns the assets’ and that the defendant ‘cannot transfer any funds that are the subject of the bankruptcy estate’,” prosecutors alleged.

“Miller added: ‘Before folks transfer to Bahamas, absolutely consult with me and I will bring in the appropriate counsel’. The defendant, however, instructed Wang to ‘ignore the instructions and continue transferring the funds’. Ultimately, millions of dollars in assets were transferred.”

Ironically, the same assets that US prosecutors are complaining about are now due to be transferred to Mr Ray. Mr Simms, the Lennox Paton senior partner, in a January 12, 2024, affidavit supporting the Bahamian liquidators’ bid for Supreme Court approval of the settlement with Mr Ray, disclosed that the Securities Commission is “content” to hand over the assets it secured. This will enable the FTX Digital Markets trio to fulfill one part of their agreement with Mr Ray in that they would use “commercially reasonable efforts” to ensure the digital assets held by the Securities Commission are ultimately transferred to their US counterpart.

Royal Caribbean, when contacted by Tribune Business yesterday. However, while doubtless a setback in that it represents a second legal reversal, the fact it was not a unanimous Court of Appeal decision may yet keep him in the fight.

The Bahamian entrepreneur now has 20 days in which to decide whether to seek permission for an appeal to the Londonbased Privy Council, the highest court in the Bahamian judicial system. Sir Michael’s status, and strength of his dissenting opinion, may well pave the way for such an appeal given that the Privy Council typically only hears cases that raise key legal issues or matters of public interest/importance.

The Davis administration previously requested that Toby Smith “reapply”

for the necessary government permits and approvals so that his project can proceed after he lost the original Supreme Court case. However, little is likely to change until it is known whether the Privy Council will hear an appeal. Appeal justice Smith, writing the majority verdict, said the dispute centred on a 21-year lease that the then-Minnis administration allegedly granted Toby Smith for the use of two Crown Land parcels - one two acres in size, the other three - on the western end of Paradise Island in the Colonial Beach area.

Noting that the initial application was made more than a decade ago in 2012, appeal justice Smith added that some six years later the Bahamas Investment Authority (BIA), via a May 23, 2018, letter informed Toby Smith that his $2m beach club project

had been approved. However, rather than the 17 acres initially sought, the Crown Land lease was to cover just five.

Then, on January 7, 2020, Richard Hardy, acting director of the Department of Lands and Surveys, sent Toby Smith and his company a letter headlined “approval for Crown Land lease”. This covered a two and three-acre parcel, respectively, with the first adjacent to the lighthouse at Paradise Island’s western end and the other for the ‘beach break’ destination.

The letter contained instructions on how the attached lease documents were to be signed, dated, sealed and notarised, then returned to the Department of Lands and Surveys. Once the minister responsible for Crown Lands, who was thenprime minister Dr Hubert Minnis, signed a copy of the

General Manager & Owners Representative

A private and well-established gated resort-community in the family islands is seeking to employ a Bahamian General Manager.

Benefits: Bonus Plan / Housing Allowance / Relocation Assistance / Medical Insurance Coverage / Travel Allowance / Vehicle / Gas

Preferred 5+ years experience in a resort style environment role or similar position involving senior leadership.

Previous experience working in a family island resort environment would be great.

Key Competencies:

• Excellent Attention to Detail

• Exceptional Customer Service and Problem-Solving Abilities

• Excellent Leadership and People Skills

• Ability to Communicate across Board and Line Staff Levels Proficiently

• Ability to Thrive in a Fast Paced and Striving Environment.

• Strong Ability to Motivate, Train and Develop Managers and Line Staff

• Demonstrated success in Building and Maintaining Positive Workplace and Cultures

Comprehensive In-Depth Knowledge:

• Homeowners Association Regulations and Bi-Laws

• Proficient in Budget Management & Financial Analytics

• Luxury Estate Management & Maintenance

• PMS Systems and Estate Rate Planning

• Online Travel Agents/Systems ( Experience working VRBO / Expedia)

• Property Landscaping & Disease Treatment

• Luxury Private Estate Rental and Marketing Experience

• Restaurant Operations / Food & Beverage Costs

• Menu Planning Creation & Costing

• Point Of Sale Systems (Micros a Plus)

• Private Upscale Function, Event Planning & Execution

• Excellent Knowledge of Local Labor Laws

• Familiarity with VAT & Local Property Tax Laws is a Plus

All interest applicants are asked to forward their resume to crystalbluewater24@gmail.com on/before Friday, March 29, 2024. Only short-listed candidates will be contacted.

lease was to be returned to Toby Smith. The Bahamian entrepreneur signed the lease forwarded by Mr Hardy, and returned it to the Government for execution two days later on January 9, 2020. Dr Minnis, though, did not sign the lease on the Government’s behalf as it emerged that Royal Caribbean had rival designs on the threeacre Crown Land parcel for its own Royal Beach Club project.

Toby Smith, aware of the competing cruise line interest, wrote to Dr Minnis on February 12, 2020, to voice growing concern over the situation. “As you are aware, I have been requesting a meeting with you for the past more than two years,” Mr Smith wrote. “Unfortunately, I have been reduced only being able to chat with you briefly on your way to the House of Assembly and Cabinet.

“I would appreciate to have a formal meeting with you as is afforded to others. In such a chats (sic), in the past and today, you advised me that the land that I am asking for in the Crown Land lease would not be compromised with ‘Carnival, Royal Caribbean Cruise Lines or any other cruise company’.”

Toby Smith added that Dr Minnis had referred him to Joshua Sears, his senior policy adviser, on “several occasions” but the latter had provied no update on the lease “other than it awaits your signature”. Clearly anxious, the entrepreneur requested that the Government provide him with a “comfort letter” to give certainty and confirm that all terms in the lease, as set out in Mr Hardy’s letter, “remain a binding agreement”.

“You mentioned today that my ‘land matter will be dealt with at the same time that you deal with Royal Caribbean Cruise Lines’ land matter on March 2, 2020,” Mr Smith told Dr Minnis.

“As you are aware, my application is almost eight years in the making. I have patiently waited for a favourable outcome so I am rather surprised that my lease is now somehow commingled with a foreign party’s expression of interest that is only recent.

“Further, I understand directly from Royal Caribbean Cruise Lines’ legal counsel that they have applied for the whole area of Crown Land situated on the western portion of Paradise Island, which wishes to encompass the land that I have applied for and contained within the Crown Land lease agreement. This has me deeply concerned......

“We are not about to be marginalised by a large

cruise ship company when we have invested eight years and are a 100 percent Bahamian-owned and operated company.” However, Mr Smith met with thenattorney general Carl Bethel KC, Candia Ferguson, then director of investments at the BIA, and Mr Sears on February 27, 2020, to be told he had no binding Crown Land lease agreement.

This triggered Toby Smith’s legal action. However, appeal justice Smith said he could “find no fault with this objective analysis” of Mr Hardy’s letter by the Chief Justice. He found that it showed the lease transaction had not been completed, as it made no mention of rental payments and the first year’s cheque was not attached to the return.

And Sir Ian said Toby Smith’s request for a “comfort letter” effectively “betrays [his] own view that the document was subject to execution by the minister” - the position always taken by the Government. Analysing all this, appeal justice Smith said he could find no fault with the Chief Justice’s assessment.

“I therefore am of the view that there was no agreement for a lease as between Paradise and the Minister responsible for Crown Lands,” he wrote, also agreeing with the Government’s argument that the absence of a ministerial signature and seal meant the lease was invalid under the Conveyancing and Law of Property Act.

“On the facts as found by the trial judge, Mr Smith had no expectation that there was a binding agreement until the minister signed the documents (or at the very least gave him a ‘comfort letter’ as he requested,” appeal justice Smith said, gaining backing from appeal justice Turner.

“It would, in my view, be untenable for the contrary to be true, especially in The Bahamas. Namely, that the Crown could divest itself of limited Crown Lands other than by the deliberate and formal granting of a lease.

“From a government perspective, it could hardly be argued that a present or prior government should be bound by the acts of its alleged ‘agents’ when they may not have any knowledge of or control over the acts of such agents. The requirement of direct ministerial control over the disposition of scarce Crown Lands seems imperative in the context of The Bahamas.”

Sir Michael, though, disagreed. Describing Mr Hardy’s letter as being of “major importance”, the Court of Appeal president said the letter was headlined “approval for Crown lease” and did not say or suggest there were any matters left to be agreed between the parties.

“In my judgment, the critical question in this appeal is whether the letter of January 2020 evidenced a binding agreement between the appellant and the minister for the lease of five acres of land on Paradise Island,” Sir Michael wrote. “The Chief Justice formed the view that there was no concluded agreement.

“It is difficult to see how it can be said that there was no concluded agreement. The lease sent on January 7, 2020, had been prepared by the respondent’s [Attorney General’s] lawyers on the respondent’s instructions. There was nothing further to be negotiated and agreed....

“The document reflecting the terms of the agreement was sent by the respondent to the appellant for signature. All that was left was for the respondent to sign and seal the lease. He did not do so because the Government determined that it had found a better deal.”

Finding that everything revolved around Mr Hardy’s letter, Sir Michael added: “There is no suggestion that there were any terms not yet agreed or which required further discussions. The negotiations were complete and the terms of the agreement were incorporated in the lease prepared by the respondent and sent by the respondent to the appellant for execution.

“If the lease did not represent the terms of the agreement, the respondent would not have sent it to the appellant for execution by it and state that upon its return it would be executed by the minister and a counterpart sent by the minister to the appellant for safekeeping. That is completely inconsistent with a continuing or ongoing negotiation as pleaded” in the Government’s defence.

Going further, Sir Michael concluded: “With respect, the suggestion that a government cannot be bound by actions of its alleged ‘agents’ lacks credulity. It is inconceivable that the director of lands and surveys would obtain a lease from the Attorney General’s Office setting out the terms of a lease and send it to the appellant without the knowledge and consent of his minister.

“This is against the background that the correspondence establishes that there was an agreement in principle to give a five-year lease, as is evidenced from the Memorandum of Understanding. In my judgment, there was a binding agreement and I would allow the appeal. I would order specific performance of the lease which was sent with the letter of January 7, 2020.”

IDEAS

The New York Stock Exchange’s recorded losses at an overall high level last Friday. Data from the US industry sectors was poorly received by investors. The data does not support expectations of forced interest rate cuts by the US Federal Reserve. While producer prices rose twice as much as expected in February compared to the previous month, retail sales increased by less than predicted. In addition, the number of weekly initial jobless claims has surprisingly fallen.

But so far the major stock indices have performed well since the beginning of 2024. The Dow Jones has gained almost 4 percent since January, the S&P is up over 8 percent and the NASDAQ is higher by 7 percent. Good news for investors.

Yet one of our ‘Magnificent Seven’ stocks has not

Share your news

had a happy 2024 story so far. Apple (AAPL.US) has lost around 7 percent of its stock market value since the beginning of the year. It looks like the company lacks the next big platform for growth.

Apple’s revenue fell slightly in 2023. Sales of iPhones, its most important product with a share of around 52 percent of total sales, slumped by 24 percent in China at the beginning of 2024. Apple’s market share in China is plummeting. The changes between generations of devices are now so fragmented that it practically does not matter whether you own an iPhone 13 or 15. And consumers do not know what model they are using, since it makes no major difference. In these

uncertain times, customers also skip a new model, save their money and wait for the next larger update and improvement.

Apple’s chief executive, Tim Cook, has a potential growth driver with the Apple Vision Pro VR headset, but due to the low sales volumes this will not play a role in hardware or software sales in the foreseeable future.

The technology giant will also not be able to compensate for this lack of vision with a sharp increase in its service revenue, which so far accounts for around 20 percent of Apple’s topline income. A big threat is the Digital Markets Act (DMA) in the European Union (EU) and the danger that it will cost Apple the

The Tribune wants to hear from people who are making news in their neighbourhoods. Perhaps you are raising funds for a good cause, campaigning for improvements in the area or have won an award. If so, call us on 322-1986 and share your story.

lucrative deal it has with Google.

Google pays Apple around $18bn a year to be pre-installed as the default search engine on iPhones, iPads and Macs. However, due to the DMA, Apple must now let users in the EU choose their search

engine. It is questionable whether Google will continue to pay so much if users choose Google search voluntarily anyway.

A possible new Siri with Artificial Intelligence (AI) functionality might be only available on new IPhones. And, in combination with

Airpods, Apple

the willingness of Apple users to share data, the savvy investor should keep a close eye on Apple. And, even though Apple gave up on their car idea, Apple Car Play is still a most desirable feature in every new car.

Contractors ‘within 30 days’ of licensing legal challenge

provided by the other contractors associations in The Bahamas, with a view to amending provisions in the Act to ensure efficiency and accuracy,” the minister confirmed.

“In particular, under Section 10(2) (d) (iii), the grandfather’s clause had expired, and it is important that this along with other sections of the legislation be amended. We are currently compiling all of the recommendations from the various contractors’ associations, along with the recommendations from the legislative committee, to forward on to the Attorney General’s Office.”

Mr Sweeting acknowledged the multiple benefits that full implementation of the Construction Contractors Act will bring, including better consumer protection and redress against shoddy workmanship and fraudulent practices, as well as fostering greater trust in Bahamian contractors and their capabilities by local and international developers.

However, he did not respond to Tribune Business questions on the likely timeline for completing adjustments to the existing Act and bringing them into effect, or how great a priority this is for the Davis administration. Prime Minister Philip Davis KC, in his role as minister of works during the last Christie administration, led the Act’s passage through Parliament in 2016.

However, the law and the regulatory regime it was supposed to usher in have never been given full effect. Desmond Bannister, as minister of works in the Minnis administration, told this newspaper at the time that he wanted to make sure the Construction Contractors Act would work as intended, and was capable of being enforced, with all concerns addressed before it was implemented.

As a result, while the Act was passed by Parliament, it is unclear whether it was ever ‘gazzetted’ and laid in the House. While a registrar of contractors was appointed, the Board that is to oversee the registration/licensing

process, and the self-regulation of contractors, has never been appointed. Members were to be nominated by both the Government and the private sector.

Mr Sands told Tribune Business that Mr Sweeting’s comments showed little had been done to advance the Act for six months. “That was the situation about six months ago. That’s where it’s pretty much at,” he added. “I think the Government of The Bahamas needs to not quickly, but immediately, address it. Immediately. Not in the near future, but immediately.” Justifying his call, the BCA president said there was an obligation on the Government to follow its own laws. And, “going further”, he said it could be argued that every construction contract the Government has entered into since the Act took effect on May 8, 2017, could be deemed “voidable” and subject to Judicial Review because none of the contractors involved are licensed according to the law.

Suggesting the situation is no different from the

licences required to practice by attorneys and doctors, Mr Sands said many Bahamian contractors who already want - and qualify - to be licensed are being denied this opportunity because the necessary mechanisms for this to happen have not been activated.

“There’s no place for you to apply for a licence,” he explained. “I got a call on Thursday from a lady from Florida. She has her own company here in The Bahamas. They’re moving down to The Bahamas, bringing their assets, and are about to start a project in six months. She’d like to know the steps to get licensed. “I said that unfortunately, while the law exists, no appropriate regime for you to apply for the licence exists. She said: ‘The law was passed in 2017. What do you mean I can’t get a licence?’. I’ve spoken to the minister, Mr Sweeting, and I told him that they don’t appreciate the gravity of the situation. That there is a law that is not being followed by the law makers.”

Mr Sands added: “The BCA is now minded to seek legal redress against the Ministry of Public Works. I want to be licensed but I can’t. Since 2016 I have had members who want to be licensed but cannot. Is that a benefit we are being denied? Is there not an obligation on the ministry and minister to ensure that a right that exists we can exercise?

“We present a legal argument on Judicial Review as the first part, and that our rights are being infringed as

contractors because we cannot be licensed. There’s a financial quantity that we intend to pursue because there are persons standing in losses of hundreds of millions of dollars because they don’t have a licence that persons coming into the country require for them to engage in joint venture partnerships.

“There’s a loss of revenue we can file for. This is a major thing. I’ve tried to reach out to the Prime Minister. We have lots of contractors here having to live on half income because they don’t have a licence. The law is in place. They should be able to get a licence.”

Mr Sands said he disagreed with arguments that the Construction Contractors Act does not apply because it has not been fully implemented. Asked when Judicial Review proceedings would be launched, he replied: “We are in the next 30 days of making such an application. That’s how close we are.

“We have sought counsel, we have sought a second opinion. We are readying to file. It affects hundreds of members, multi-million dollars are going by the wayside, members are suffering substantial loss of income. We cannot let this continue any more. We are a country of laws. We hate to go here, but have to at this point in time. It’s been going on too long and we want our licences.”

Mr Sweeting, acknowledging the Construction Contractors Act 2016’s benefits, said: “By regulating contractors, the Act provides mechanisms for consumer

protection.

Homeowners and property owners are safeguarded against fraudulent practices and substandard work.

“Part VI of the act offers recourse for property owners to make complaints to the Board in [such] cases like to have their matters resolved through a disciplinary process. For consumers and investors, a regulated construction industry offers greater confidence. Knowing that contractors are licensed and regulated provides assurance of quality and reliability, which can stimulate investment and development in the region.”

Mr Sweeting added that “clear and fair regulations can make The Bahamas more attractive to international contractors with specialised skills, contributing to the local economy and transferring knowledge to the Bahamian workforce”, while the Act “provides requirements for insurance, which helps to protect clients from financial losses due to contractor default, bankruptcy or incomplete projects”.

“The Act levels the playing field by ensuring that all contractors operate under the same regulations and standards. This prevents unqualified or underinsured contractors from undercutting professionals who invest in proper licensing, insurance and training,” the minister said.

“After reviewing the legislation, we found clauses to be amended. We also discovered there were other associations to be considered. We gathered recommendations and then took them to the legislative committee.”

‘Bizarre’: France, Holland keep Bahamas blacklisted

but the bloc’s determination that The Bahamas had remedied alleged deficiencies in its ‘economic substance’ reporting regime and was worthy of removal has made no impact on France or the Netherlands’ national policies.

Indeed, according to a note from Deloitte & Touche’s French affiliate, France decided on February 17, 2024, to maintain The Bahamas as one of five jurisdictions subject to full defensive measures - including punitive withholding taxes on payments such as interest, dividends and royalties - for the whole of this year with that decision to only be reviewed come 2025.

The French move was decided just three days BEFORE the EU resolved to delist The Bahamas on February 20, 2024. As for the Netherlands, the decision to maintain The Bahamas’ blacklisting was taken on December 29, 2023, and also remains in effect without change for a whole year.

“Inclusion of a jurisdiction on the Dutch blacklist applies for the entire calendar year 2024 with an annual revisit of the list effective the following calendar year,” one Dutch accounting firm said. Those jurisdictions targeted are ones with no or a low rate corporate income tax of 9 percent or less, which means The Bahamas’ plan to implement the 15 percent minimum global corporate tax rate may be of some help.

However, in the meantime, The Netherlands will impose similar measures to France via withholding taxes at a 25.8 percent rate, controlled foreign company rules and other strictures designed to discourage business with The Bahamas and other low-tax states.

While national blacklistings are less comprehensive and impactful than those imposed by multinationals, such as the EU and Organisation for

Economic Co-Operation and Development (OECD), they nevertheless pose a reputational risk and undermine the ‘ease of doing business’ with entities and individuals from those nations by adding to the cost and time associated with financial transactions.

“It entirely shows how arbitrary the unilateral as opposed to the multilateral blacklisting is,” Mr Delaney told Tribune Business of France and The Netherlands’ actions. “In fact, in my view, the multilateral blacklistings leave a lot to be desired.

“The unilateral blacklistings have a degree of opaqueness to them. It’s incredibly unfair for the affected countries. It’s incredibly unfair and disruptive for the financial centres that are affected, in a very

significant way impacting their international trade and commercial affairs.”

Mr Delaney said the French and Dutch moves highlighted the need for the United Nations (UN) or some other body to take over governance of global tax matters and policy from the likes of the EU/OECD and their individual members, which have dominated the issue since the 1990s. The Bahamas is among the nations spearheading such a push presently at the UN.

“Bodies like the UN need to intervene in this sort of field to regulate this sector,” he added, “given the adverse impact it has on jurisdictions such as ours, both from a market perception perspective and a cost point of view in terms of countries responding to it with administrative adjustments to meet whatever the requirements or demands are.”

The former attorney general said it was “particularly troubling” that blacklisting initiatives always single out small, vulnerable international financial centres (IFCs) and never include or scrutinise developed countries such as G20, EU and OECD members.

Paul Moss, president of Dominion Management Services, told Tribune Business it was “incredible”

and “bizarre” that France had blacklisted The Bahamas for the whole of 2024 despite being among the nations that, just three days later, decided to remove this country from the EU version.

“It just shows you the double standards,” he argued. “It does show that

it’s all arbitrary. You have to ask yourself whether they are serious about the impacts of blacklisting other than to destroy The Bahamas’ ability to participate in financial services.

“Clearly it’s very arbitrary for France to have taken this position. They have agreed to take us off the EU list,

delisted those countries, but then say this is our list and we’ll keep you on. It’s crazy. It shows you these entities are not serious. This will certainly have an impact on those persons who do business with France. They do whatever the hell they want. It’s amazing to me.”

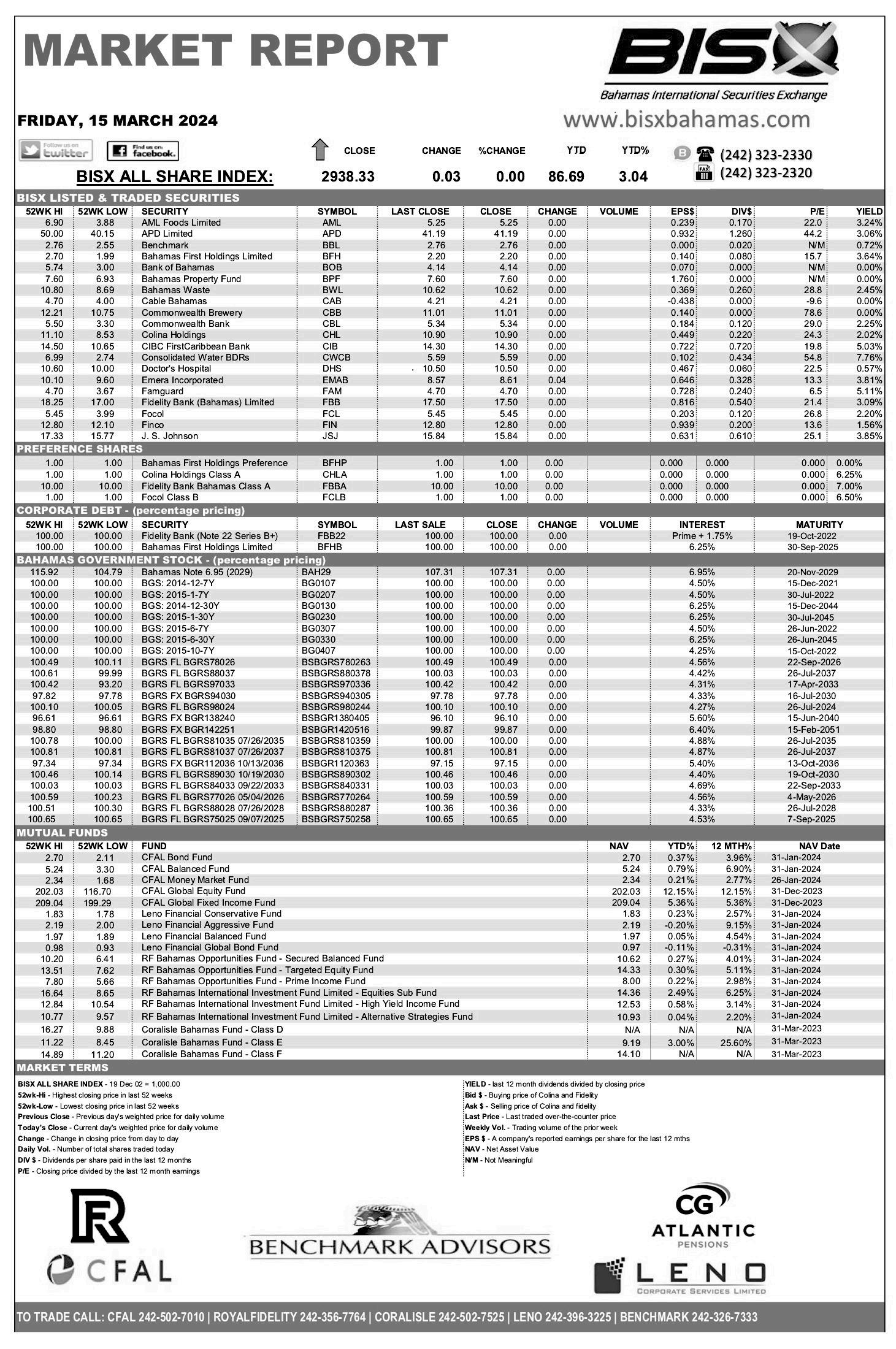

THE post-COVID price rebound enjoyed by BISXlisted stocks moderated in 2023 although the total value of all securities traded across the exchange rose by 19.3 percent to $77.93m.

The Bahamas International Securities Exchange (BISX), unveiling its 2023 full-year trading activity report, disclosed that its All-Share Index improved

REBOUND EASES AS SECURITIES TRADES HIT $78M

by just under half the rate of increase seen during the prior year. For 2023, it increased by 7.81 percent or 206.58 points to close at 2,851.64, whereas in 2022 it rose by a much greater 18.71 percent or 416.82. The All-Share Index, which captures only primary market or equity listings, and excludes debt securities such as bonds and

preference shares, also does not provide a full measure of shareholder returns since it only covers share price appreciation. Dividend payments are not included. However, bonds and preference shares combined with equity stocks to drive what BISX reported was a near-$700m increase in its total market capitalisation to $10.755bn at year-end 2023 as opposed to $10.058bn just 12 months earlier. The total worth of all listed equities rose from $6.008bn at year-end 2022 to $6.237bn, while debt securities saw their collective value rise from $4.049bn to $4.517bn.

“As at December 31, 2023, the market was comprised of 20 ordinary shares with a market capitalisation of $6.237bnm” BISX affirmed. “In addition,

there were four preference shares with a market capitalisation of $60m, and five BGS (Bahamas Government Stock) and corporate bonds with a face value of $349m and 231 BRS (Bahamas Registered Stock bonds) with a face value of $4.15bn.”

When it came to actual trading activity, BISX said that while volumes were down the value of securities traded had increased yearover-year by more than $12.5m. “

“Trading volume for the 12-month period January 2, 2023, to December 31, 2023, was 4.877m securities for a value of $77.93m. Trading volume for the 12-month period January 2, 2022, to December 30, 2022, was 8.863m securities for a value of $65.302m,” BISX said.

The Public Workers’ Co-operative Credit Union Limited announces that its 44th Annual General Meeting will be held on Friday, May 31st, 2024. The venue and time to be announced.

Applications are invited from members in good standing who may wish to run for the following vacant positions:

Board of Directors (3 vacancies); Supervisory Committee (2 vacancies) and Credit Committee (2 vacancies).

Nominations forms are available at our Nassau and Freeport offices or by emailing sthompson@pwccu.org.

Completed Nomination forms, along with a cover letter and resume must be submitted by 4 pm on Monday, May 6th, 2024, either by delivering to any of our offices or via the email listed.

No

“Trading volume for the three-month period October 1 to December 31, 2023, was 1.031m securities for a value of $9.093m Trading volume for the three-month period October 1 to December 30, 2022, was 1.26m securities for a value of $12.762m.” BISX said its All-Share Index’s 2023 performance compared favourably with that of major stock exchange indices, with its 7.81 percent appreciation placing it ahead of both the FTSE 100’s 3.19 percent improvement and MSCI Emerging Market Index’s 7.04 percent rise. However, it was some way short of the S&P 500’s 24.23 percent surge. “For the 12-month period ending December 31, 2023, the average daily trading volume was 20,321

securities, which resulted in an average daily trading value of $324,709.13.

By comparison, for the 12-month period ending December 30, 2022, the average daily trading volume was 36,231 securities, which resulted in an average daily trading value of $267,112,” BISX said.

“During the three-month period from October 1, 2023, to December 31, 2023, the average volume per trading day was 17,178 securities for a value of $151,542.61. By comparison, for the three- month period from October 1, 2022, to December 30, 2022, the average volume per trading day was 20,395 securities for a value of $209,816.”

JOB OPPORTUNITY

NOTICE

NOTICE is hereby given that

HISMANYA FERDINAND of P.O Box N.P 3363 3rd Street Grove, Nassau, The Bahamas is applying to the Minister responsible for Nationality and Citizenship, for registration/ naturalization as a citizen of The Bahamas, and that any person who knows any reason why registration/naturalization should not be granted, should send a written and signed statement of the facts within twentyeight days from the 11th day of March, 2024 to the Minister responsible for nationality and Citizenship, P.O. Box N-7147, Nassau, Bahamas.

NOTICE

NOTICE is hereby given that CHIMENE DOLCE of P. O. Box N-7060, Market Street, New Providence, The Bahamas is applying to the Minister responsible for Nationality and Citizenship, for registration/naturalization as a citizen of The Bahamas, and that any person who knows any reason why registration/naturalization should not be granted, should send a written and signed statement of the facts within twenty-eight days from the 18th day of March, 2024 to the Minister responsible for nationality and Citizenship, P.O. Box N-7147, Nassau, Bahamas.

NOTICE

INTERNATIONAL BUSINESS COMPANIES ACT, 2000 IGFCC Holdings Limited (IN VOLUNTARY LIQUIDATION)

NOTICE IS HEREBY GIVEN that in accordance with section 138(6) of the International Business Companies Act, 2000, as amended, the winding up and dissolution of IGFCC Holdings Limited is complete.

L. Michael Dean Sole Liquidator

Address:

O Box N-10697 Nassau, Bahamas

CULTURE TAKES FOCUS

AT HERITAGE FESTIVAL

BAHAMIANS will pay homage to their “rich and vibrant culture” when the 18th annual Bahamian Music & Heritage Festival is held at George Town’s regatta site on March 15-16.

Chester Cooper, deputy prime minister and minister of tourism, investments and aviation, said: “As Bahamians, we are truly appreciative of what we have as a people, and this festival helps us to

celebrate our rich and vibrant culture.”

Apart from music and arts, the festival’s activities are targeted at families and children. It will include storytelling sessions, singing, face painting and cultural games. Attendees will be able to enjoy Bahamian culinary delights at ‘Da Festival Kitchen’ and participate in various educational sessions, including straw plaiting, traditional

NOTICE

NOTICE is hereby given that GIOVANNI ANDEZ HARVEY of East Street South, New Providence, The Bahamas is applying to the Minister responsible for Nationality and Citizenship, for registration/naturalization as a citizen of The Bahamas, and that any person who knows any reason why registration/naturalization should not be granted, should send a written and signed statement of the facts within twenty-eight days from the 18th day of March, 2024 to the Minister responsible for nationality and Citizenship, P.O. Box N-7147, Nassau, Bahamas.

Bahamian bread making and bush tea brewing. They can also participate in demonstrations at the Yuma Arts Craft Centre, plus culinary and mixology competitions. Games such as hop scotch, jump rope, sack racing, nursery rhymes and songs and storytelling will also feature.

The main event will be a two-day concert with emcees Das Quay and DJ Code Red, as well as performances by Bahamian artists including Exuma Rake ‘n’ Scrape Band; Tempo Band; fire dancer, Shantee Dorsett - goddess of fire; Rhythm Band; Dimitri; Qpid; Ebony; Blaudy; and Geno D.

‘DESPERATE NEED’ TO UPDATE SECURITIES LAW

FROM PAGE B3

manage new risks presented by the “evolving financing landscape”.

He added: “The genesis of the Securities Industry

PUBLIC NOTICE

INTENT TO CHANGE NAME BY DEED POLL

The Public is hereby advised that I, RUDELLA SHERNIQUA THURSTON off P. O. Box SB-51508, #16 Silk Cotton Street, Pinewood Gardens, New Providence, Bahamas, intend to change my child’s name from KELSEY ANTON SAINPREUX to KELSEY ANTON THURSTON. If there are any objections to this change of name by Deed Poll, you may write such objections to the Chief Passport Officer, P.O. Box N-742, Nassau, New Providence, Bahamas no later than thirty (30) days after the date of publication of this notice.

Bill 2024 lies in the recognition of our evolving financial landscape. The advent of digital assets, the increasing complexity of financial markets and the ever-present challenge of managing systemic risks, demand a legislative response that is both comprehensive and adaptive.”

Mr Halkitis said consultation was central to the legislative overhaul and, by allowing stakeholders to contribute to the Bill, implementation and adherence should be “smooth”. He added: “The Bill seeks to update an overall legislative regime of the securities industry in

The Bahamas. Central to the ethos of this legislative endeavour is the principle of consultation.

“One of the key benefits of public consultation is its ability to build consensus around legislative initiatives. When stakeholders are invited to contribute their views and have a say in the drafting process, there is a greater sense of ownership and support for the resulting legislation.

“This collective sense of ownership is crucial for the smooth implementation of, and adherence to, new laws, particularly in sectors as dynamic and complex as the financial markets.”

Share your news

The Tribune wants to hear from people who are making news in their neighbourhoods.

Perhaps you are raising funds for a good cause, campaigning for improvements in the area or have won an award.

If so, call us on 322-1986 and share your story.