Gov’t holds firm as $259m deficit near-double target

By NEIL HARTNELL Tribune Business Editor nhartnell@tribunemedia.net

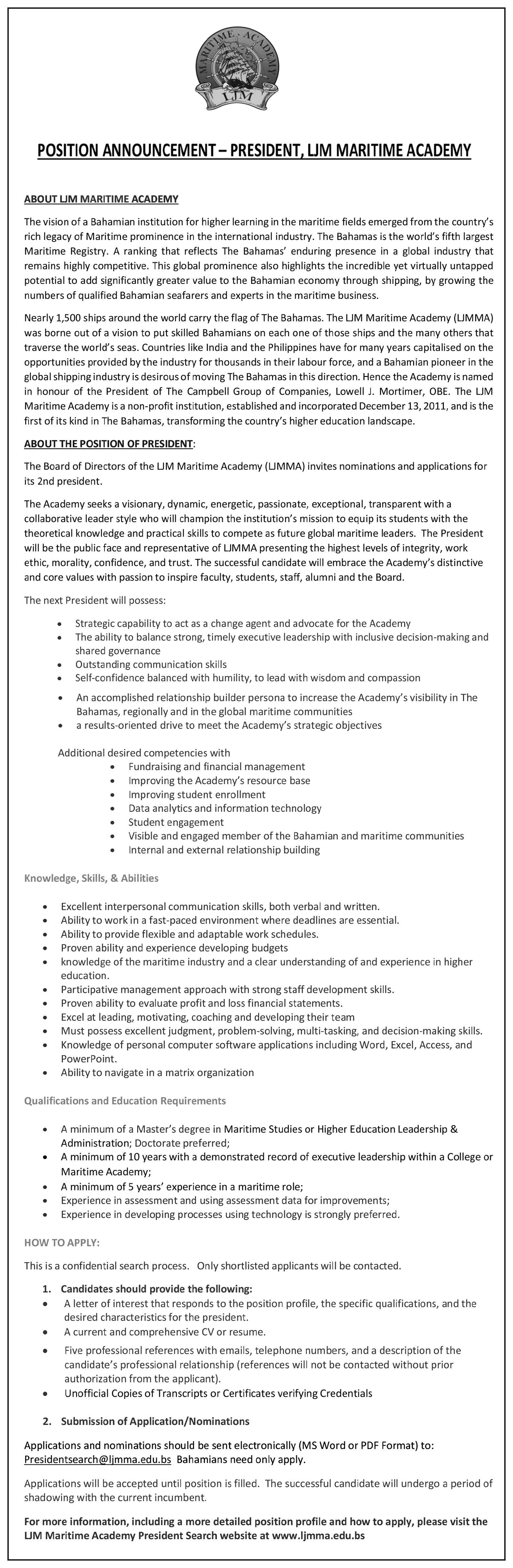

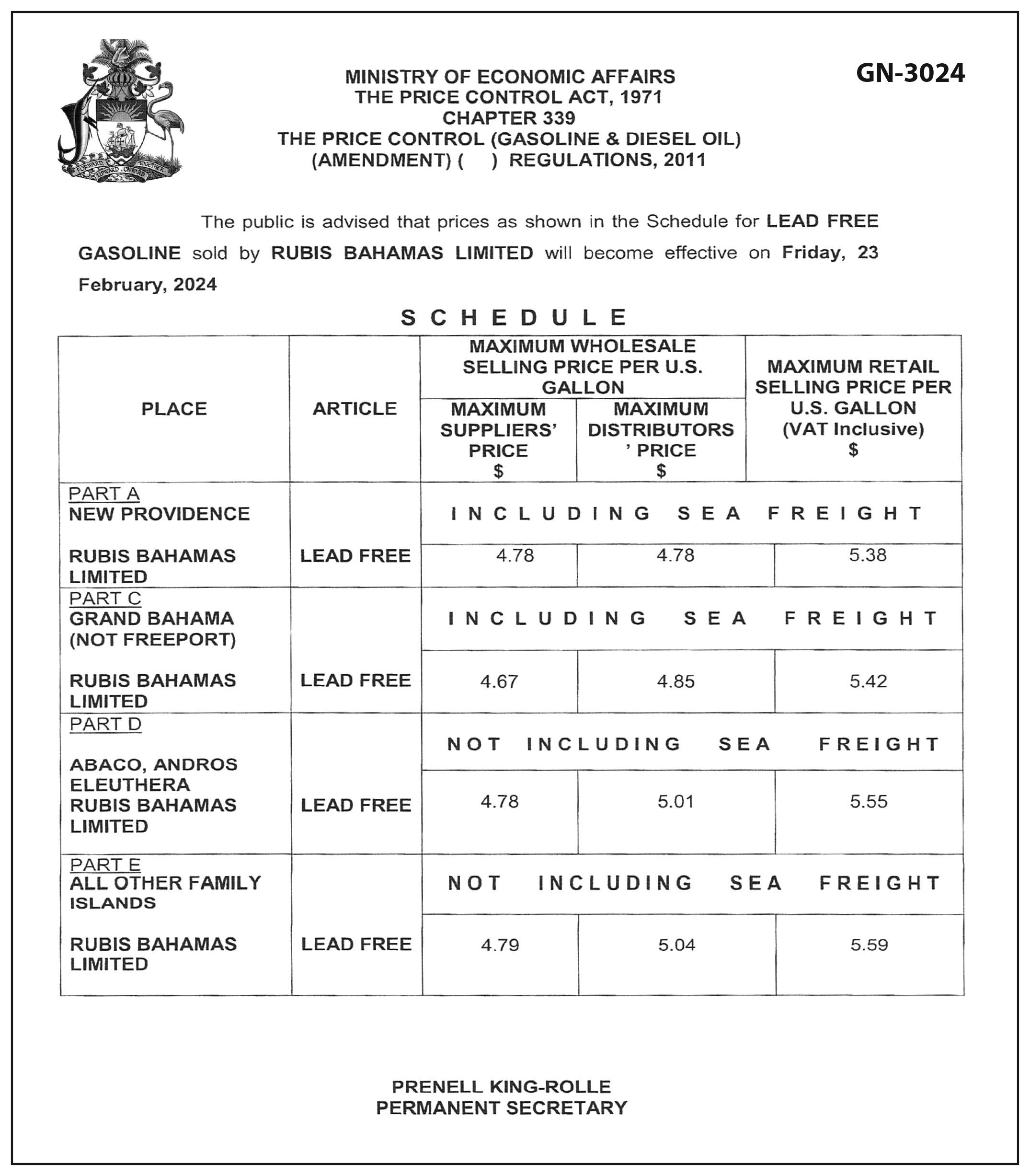

THE Government has not adjusted any of its 2023-2024 fiscal targets despite revealing yesterday that its $258.7m half-year deficit was almost double the full 12-month goal.

Philip Davis KC, in unveiling the mid-year Budget statement in the House of Assembly, disclosed that the deficit for the six months to end-December 2023 was equal to 197 percent of the $131.1m full-year target that was set last May.

However, documents accompanying the Prime Minister’s presentation showed no changes or adjustments to any of the original revenue, spending or deficit numbers. Simon Wilson, the Ministry of Finance’s financial secretary, told Tribune Business last night he remains “very confident” the Government can meet its targets for the public finances despite overshooting the full-year target by $127.6m in just six months.

Pointing to “healthy double digit growth” in revenues, with collections

meeting forecast from November 2023 onwards, the Government’s top finance official said the Budget’s cyclical meant it was impossible to predict the full-year outcome based on the first six months’ performance.

Economic activity during that period, which covers the second half of the calendar year, tends to be relatively weaker prior to the Christmas/ New Year holiday season and has a corresponding effect on the Government’s finances. Instead, it tends to receive the bulk of its revenues during the calendar year’s first half, which coincides with the peak winter

‘Very aggressive’ crackdown on $200m smuggling, evasion

By NEIL HARTNELL Tribune Business Editor nhartnell@tribunemedia.net

THE Government’s top finance official last night pledged “a very aggressive” approach to cracking down on smuggling and tax avoidance schemes believed to cost The Bahamas a combined $200m annually.

Simon Wilson, the Ministry of Finance’s top official,

And the tax authorities are also seeking to “arrest the spread” of tax evasion and avoidance schemes involving VAT, Customs duties and Business Licence fees. Mr Wilson told this newspaper that besides firms registering for VAT, but never providing a single filing or payment, companies were also employing accounting tricks in a bid to escape paying the Government its due share. He spoke out after the

Gov’t eyes $140m ‘accrual’ over corporate income tax

By NEIL HARTNELL Tribune Business Editor nhartnell@tribunemedia.net

THE Government is exploring how Bahamasbased companies that will pay the new 15 percent corporate income tax can “accrue” a projected $140m in revenues before the enabling laws are enacted. Philip Davis KC, in unveiling yesterday’s midyear Budget statement, laid out the road map for how The Bahamas plans to comply with the G20/ OECD global “minimum” tax drive as failing to do so would cost this nation a valuable source of new tax revenues from economic activity conducted within its borders.

Other countries, which serve as host jurisdiction for the parents of Bahamasbased corporate entities, would instead be able to levy the 15 percent rate on profits remitted from this nation if it does not implement what Mr Davis described as the Qualified Domestic Minimum Top-Up Tax (QDMTT).

This will give effect to The Bahamas’ commitment, given under the previous Minnis administration, that it will fully comply with an initiative targeted at imposing a minimum tax rate on multinational entities and their subsidiaries who are part of a corporate group generating 750m euros or more in annual turnover.

With the Government aiming to bring legislation that will give effect to the 15 percent corporate income tax to Parliament after the summer recess, Mr Davis signalled his administration is seeking to ensure it loses none of the forecast net $140m in new revenues that will be generated while avoiding the imposition of “retroactive” taxation.

Confirming that domestic Bahamian companies which fall below the 750m euro threshold, or are not part of multinational groups that qualify, will not be impacted, the Prime Minister said: “This is a tax that affects only multinational

SEE PAGE B7

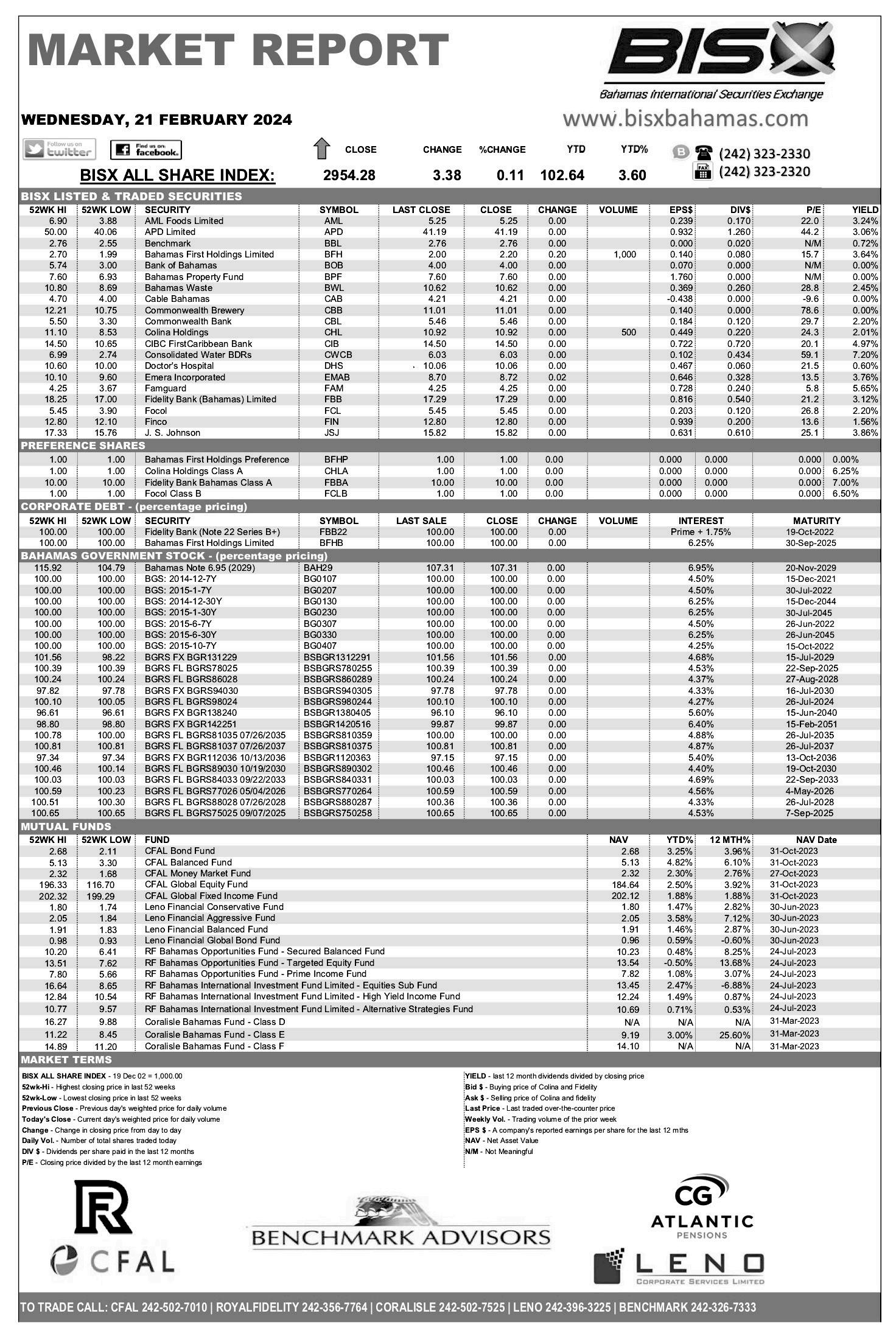

business@tribunemedia.net THURSDAY, FEBRUARY 22,

2024

SIMON WILSON MICHAEL

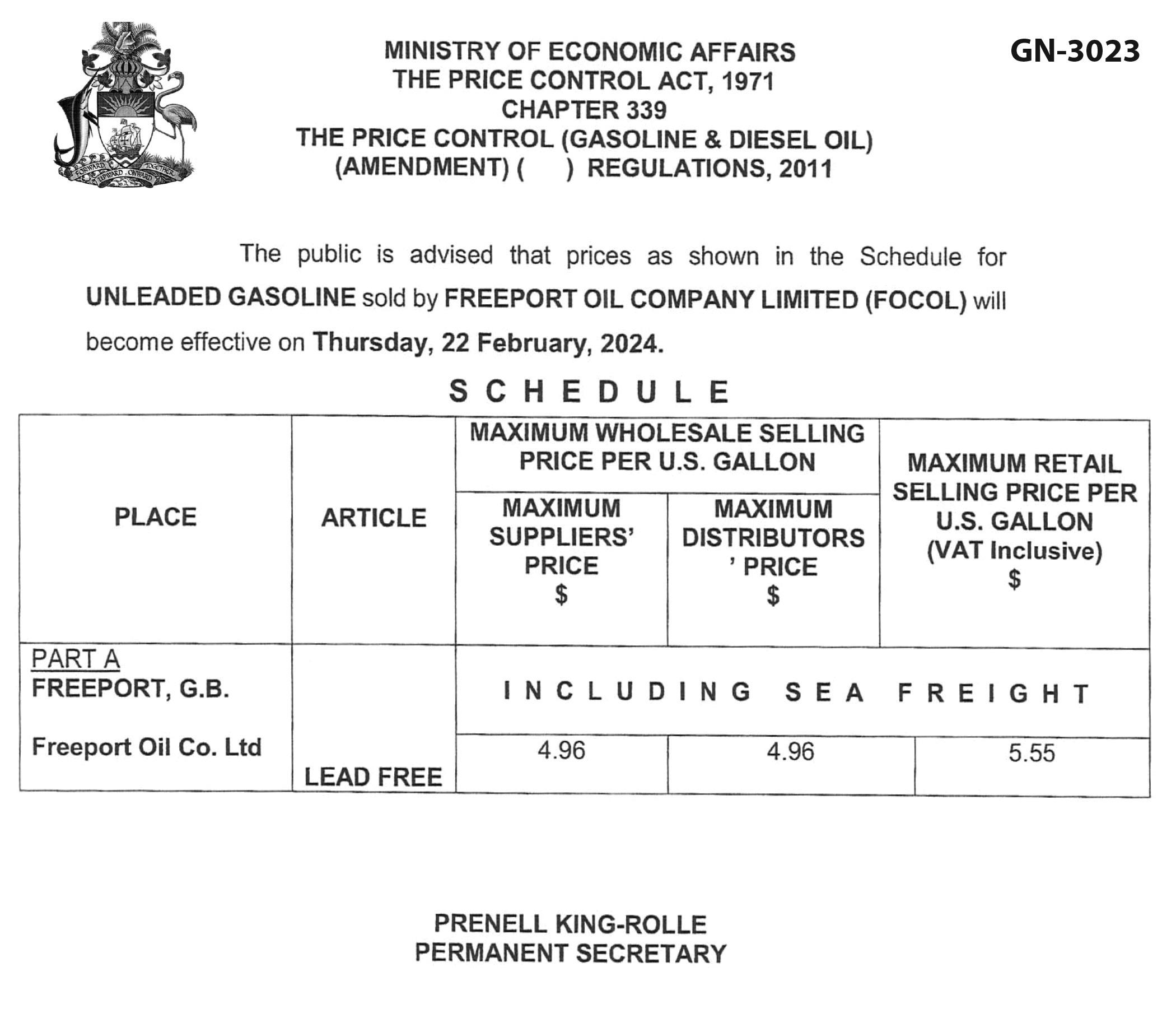

HUBERT EDWARDS $5.30 $5.31 $5.37 $5.28

SEE PAGE B6 PHILIP DAVIS KC

PINTARD

EMBRACE THE CLOUD TO THRIVE IN DIGITAL TIMES

In the dynamic realm of technology, where innovation is the heartbeat of progress, one game-changing evolution is propelling businesses into a new era—the rise of cloud computing. It is not just a shift in infrastructure; it is a digital revolution, reshaping the very essence of how businesses operate and thrive in the fast-paced landscape of the 21st century.

Gone are the days of being tethered to onpremises servers and rigid infrastructure. The cloud is ushering in a new era of flexibility, scalability and collaboration, setting the stage for companies to break free from traditional constraints and embrace a future where adaptability is the key to success.

Let us delve into the heart of this transformation and explore how cloud computing is not just a technological buzzword but a powerhouse reshaping the destiny of businesses in the digital age.

At its core, cloud computing eliminates the need for companies to invest heavily in on-premises servers and infrastructure. Instead, it offers a flexible and scalable model where computing resources - from storage to processing power - are delivered as services over the Internet. This shift is not just about technological convenience; it is about fundamentally reshaping the way businesses function in the digital age.

Flexibility is a hallmark of cloud computing. Businesses can scale their resources up or down based on demand, avoiding the limitations of fixed on-premises infrastructure. This agility is particularly crucial in today’s fast-paced and dynamic business environment, where adaptability often determines success. The cost-effectiveness of cloud computing cannot be overstated. Traditional infrastructure demands

ROYE II KEITH

significant upfront capital investment, not to mention ongoing costs for maintenance, upgrades and expansions. Cloud services operate on a pay-as-you-go model, allowing companies to pay only for the resources they use. This democratisation of computing power enables small and large enterprises alike to access cutting-edge technology without breaking the bank.

Moreover, the collaborative potential of cloud computing is reshaping the way teams work together. With data and applications accessible from anywhere with an Internet connection, geographical constraints become irrelevant. Remote collaboration, a growing trend even before the recent global shift towards remote work, is facilitated seamlessly by cloud technology.

Security concerns have been a roadblock for some hesitant companies, but reputable cloud service providers invest heavily in security measures. These providers often employ advanced encryption, authentication protocols and regular security updates, offering a level of protection that can surpass what individual businesses might be able to achieve on their own.

Cloud computing is not just a cost-saving measure;

it is a catalyst for innovation. The cloud provides a platform for businesses to leverage advanced technologies such as artificial intelligence, machine learning, and big data analytics. This accessibility to cutting-edge tools empowers companies to derive valuable insights, automate processes and stay ahead in an increasingly competitive landscape.

As businesses transition to the cloud, the benefits are clear, but the journey requires careful planning and consideration. A thoughtful approach to data migration, collaboration with reliable service providers and adherence to data protection regulations are crucial steps in ensuring a smooth and secure transition.

Cloud computing is not merely a technological trend; it is a fundamental reshaping of the business landscape. As companies embrace the cloud, they position themselves for greater flexibility, cost efficiency, collaboration and innovation. The future of business infrastructure is undeniably intertwined with the nimbus of the cloud, a transformative force shaping the way we work and thrive in the digital era.

PAGE 2, Thursday, February 22, 2024 THE TRIBUNE

II--

LOSS-MAKING SOES ‘WILL NOT BE SHUT DOWN OR PRIVATISED’

to require strong support from the public purse,” the Prime Minister said.

THE Prime Minister yesterday argued that loss-making state-owned enterprises (SOEs), which account for almost twothirds of the Government’s unpaid invoices and arrears, should “not be shut down or privatised”.

Philip Davis KC, unveiling the mid-year Budget in the House of Assembly, said his administration remained open to publicprivate partnerships (PPPs) and private sector involvement with entities such as Bahamasair and the Water & Sewerage Corporation that received a collective $237.643m in taxpayer subsidies for the six months to end-December 2023.

Pledging to make all SOEs “efficient and sustainable”, and “profitable where practical”, Mr Davis outlined his administration’s philosophical and policy approach to a sector that has constantly bled Bahamian taxpayers through having to provide annual nine-figure subsidies to keep them afloat.

“State-owned enterprises provide significant social benefit, and support Bahamians across our archipelago, but continue

“There are some activities which are unlikely to turn a profit, but still are deemed important to the culture, character and quality of life of a nation.

“For example, a regular flight to some of our smaller islands, such as Rum Cay or Ragged Island, is unlikely to attract sufficient private investment. This is a major reason why we have our national flag carrier, Bahamasair, whose flights across our archipelago support our national development.

“Similarly, the Broadcasting Corporation of The Bahamas is able to assert that when it comes to the reach of their coverage, ‘only the sun covers The Bahamas better than ZNS Bahamas’,” he added.

“We do not believe SOEs should be shut down or privatised. This does not preclude private sector partnership and participation. Instead, we seek to make them as effective, as efficient and as sustainable as possible, long into the future, and profitable as well, where practical.

“We have provided comprehensive expenditure guidelines to state-owned enterprises, in order to promote financial accountability and to align their

business practices with national fiscal objectives. In addition, we have provided formal training for Board members of SOEs and we are seeking to roll-out a comprehensive programme to improve financial accountability.”

Mr Davis had earlier revealed that SOEs accounted for $104.5m, or some 62-plus percent, of the Government’s known but unpaid $166m financial obligations at the 2023-204 Budget year’s mid-point. Of that figure, “55.9 percent, or $50.6m was to the Water and Sewerage Corporation; $27.7m to Public Hospitals Authority; $6.1m to the Broadcasting Corporation of the Bahamas; and $5.9m to Bahamasair Holdings”.

Mr Davis pointed out that a number of these obligations had been met since year-end 2023. He also suggested that “higher-than-anticipated” Bahamian dollar financing sums had enabled the Government to reduce the amount of foreign currency borrowing initially contemplated in its annual borrowing plan for the 2023-2024 fiscal year.

“For the balance of the fiscal year, the significant financing activities will include the drawdown of a $50m Caribbean Development Bank (CDB) policy

loan, refinancing of the remaining maturing bonds with new issuances and rolling over existing short-term debt,” Mr Davis said.

“As outlined in the 2023-2024 Budget and the 2023-2024 borrowing plan, the Government established that its financing needs would comprise deficit financing of $131.1m together with amounts to cover approximately $2.067bn in maturing debt, which excluded the $908.8m in rollovers of the shortterm Treasury bills and notes.

“Regarding how we anticipated meeting these requirements, on the external side we programmed borrowing $700m from banks and a combination of $295.9m from the international financial institutions - mainly the IDB and the Caribbean Development Bank.

“Then, the projected uptake from domestic sources was targeted at $1.203bn to be derived from $967.3m in new bond and Treasury bill issuances and another $235.5m from the rollover of the SDR (special drawing rights) short-term facility from the Central Bank.”

Mr Davis also disclosed that the Government is about to unveil draft

legislation, and embark on consultation, over planned public service pension reforms that will see new civil service hires for the first time contribute to financing their own retirements.

“We are engaging in other initiatives to reduce our fiscal risk. For example, we are advancing efforts to introduce a contributory pension scheme for public sector employees to ensure that all can benefit upon retirement, which helps to limit the risk associated with future pension liabilities on the Government,” the Prime Minister said.

“Public consultation on the draft legislation for the creation of a contributory pension plan for all public sector employees will commence before the end of the month.”

The Government has long had its woes with unfunded civil service pension liabilities, which previous research by the KPMG accounting firm suggested would likely have reached $2bn by this stage without any reforms. Civil servants presently contribute nothing to their retirement, which are being funded by Bahamian taxpayers at the sum of $134.744m in the 2023-2024 Budget.

The IMF, in its Article IV report in 2018, agreed that the current system

- where civil servants contribute nothing to funding their retirement - is “unsustainable”. And it called five years ago for “decisive measures.... to reduce debt”, singling out public sector pensions and health as two areas deserving close attention.

“The civil servants’ pension system is unsustainable,” the Fund warned. “Government employees draw pensions at retirement without contributing to the system while employed.

Staff analysis in the 2016 Article IV Staff report noted that accrued government pension liabilities totaled $1.5bn in 2012, and would rise to $3.7bn by 2030 as the population ages.”

The IMF called for reforms that involve “moving to a contributory regime in the near term, and to a defined-contribution scheme in the mediumterm”. This would require civil servants to contribute a portion of their salary to funding their retirement, rather than having this financed 100 per cent by the taxpayer through the Budget as is done currently.

PINTARD URGES PRIVATE SECTOR PARTNERS FOR TROUBLED SOES

By FAY SIMMONS Tribune Business Reporter jsimmons@tribunemedia.net

THE Opposition’s leader yesterday argued that loss-making state-owned enterprises (SOEs) such as ZNS would be “better off” in a public-private partnership (PPP) structure.

Michael Pintard, speaking after the mid-year Budget was presented in the House of Assembly, said he has seen “no evidence” that the Davis administration can be more efficient with managing SOEs and said several would be better off run by the private sector.

He added: “We have seen no evidence of his administration’s capacity to be more efficient with the state-owned enterprises, or make them more effective.

There is no evidence of it.

In fact, we are on record as saying that we believe there

are several state-owned entities that are better off in a public private partnership, governed by a policy that we can touch and feel.” Mr Pintard said ZNS should adopt a public service broadcasting model, and added: “I believe most Bahamians would agree that ZNS ought to transition to a PBS kind of format, and that we have adequate and competent media houses in the Commonwealth of the Bahamas that can hold governments accountable.

“If the Government want to tell private companies how to behave, could you imagine what they are now doing through ZNS? And so that is one of those state-owned enterprises that can be reconfigured so that we are not marginalising employees; we’re giving them another way of focusing their talents.”

Mr Pintard also questioned Bahamasair’s

continued operation of routes that do not provide adequate returns, such as Haiti and Cuba. He argued that the airline would be more productive if it allowed other carrier to take on less profitable services.

“There is an opportunity to again make that airline far more productive, and we have other entities that provide a similar service that can, in fact, provide service on routes that Bahamasair need not necessarily be on,” Mr Pintard said.

“And as we will do in the in the upcoming months,

we want to talk about the route that presently goes to Haiti and goes to Cuba, and many of the issues that we are fully aware that’s happening on those routes that do not provide the kind of resources and returns to the Bahamian people that we believe we ought to be receiving.

“The question the Prime Minister and the minister of tourism would have to answer is why are we not getting the returns on the route to Haiti? Why are we not getting the returns on the route to Cuba, that some who have worked in

Bahamasair strongly make the point that we should, in fact, be receiving,” he added. “So these are some examples of state-owned enterprises that we believe the Prime Minister is talking about, but our view is philosophically different and the figures, we believe, support the view that we have.”

Mr Pintard said he is “always fearful”’ of the Davis administration’s PPPs, adding: “We are always fearful of the Prime Minister’s partnership with private sector

groups, because right now he’s doing a series of PPPs that he has not explained to the public what policies are governing the PPPs, and he’s not explained the terms of the PPPs.

“What we are understanding is that the interest rate, at which we would have to pay back the money in some of these PPPs, is more than double the interest rate he could have gotten from IDB or other places. So, we’re not confident about this is plan for the state-owned enterprises.”

THE TRIBUNE Thursday, February 22, 2024, PAGE 3

By NEIL HARTNELL Tribune Business Editor nhartnell@tribunemedia.net

‘Very aggressive’ crackdown on $200m smuggling, evasion

“When it comes to VAT, Customs and Business Licence enforcement, the Ministry of Finance has adopted a data-driven approach, supported by the creation of an analytical unit in the Ministry of Finance,” Philip Davis KC said.

“The results so far have been impressive, as the work of the unit has uncovered multiple and significant instances of tax avoidance, which may not have enabled them to avoid the taxes they thought that they were avoiding.

“Within just the last three months, the Government has seized over $400,000 in cash and close to $1m in alcohol, part of a large alcohol smuggling operation. Our efforts against alcohol and tobacco smuggling are intensifying. In fact, we believe the country loses close to $100m a year through alcohol and tobacco smuggling. Thus we are committing significant resources to combat this source of revenue loss.”

Mr Davis continued:

“Our efforts as well have discovered numerous tax avoidance schemes, which we are actively combatting

through audits and investigations. The potential loss in revenue is in the order of another $100m.

“The Ministry is also working with consultants to build analytical tools to detect tax fraud. These tools would allow work which is now done manually to be automated. The net result of these efforts would be an increase in overall revenue in VAT, Customs and Business Licence fees.”

Mr Wilson, acknowledging that the tax authorities are very concerned about the potential revenue loss from such activities, promised that the Ministry of Finance and other agencies are “going to be very aggressive” in pursuing alcohol/tobacco smuggling and tax evaders.

Speaking to the former, he said: “There are two ways to measure it. Obviously, the value of goods we seize, but the next way to measure it is the increase in sales from the compliant importers and distributors. It’ll take us a while to see if there is a shift. If we are successful, compliant importers should see an increase in sales.”

Acknowledging that alcohol and tobacco smuggling

“requires special focus”, Mr Wilson added: “There’s some other avoidance schemes which operate which we are working to try and arrest the spread of. The typical avoidance scheme will be to file on a cash basis and not an accrual basis. Some companies do that.

“They recognise revenues on a cash basis on the taxable supply of goods, and recognise expenditure on an accrual basis, so they are reducing the amount of VAT they pay to the Government. There’s also non-filers, persons who simply don’t file and pay their taxes. They register for VAT and drop off the map, so to speak, and don’t file, don’t pay. We have a number of different schemes that we have to resolve.”

Mr Davis, meanwhile, said real property tax yields and collections should be improved by a $90m or 36 percent increase in the combined value of annual billings since his administration was elected in 2021. Describing what he referred to as “considerable progress in improving our tax system”, he added:

“Let’s take real property tax, for example. “I want to note that the vast majority of back taxes owed are owed by foreign property owners-. This is not an issue affecting most Bahamians. For real property tax, I can report that billings are in excess of $340m compared to less than $250m at the beginning of this term. “This translates into a higher expected tax yield. In addition, the Department has accelerated its property collection efforts, inclusive of the use of the power of sale for foreignowned and commercial properties.”

Mr Davis also hailed the Maritime Revenue Enhancement Task Force, established by the Ministry of Finance in July 2023, for collecting $1.2m worth of revenue during its first three months as part of efforts to combat tax evasion and avoidance in that industry.

Suggesting that there has been “excessive revenue loss” from the sector, the Prime Minister said: “This Task Force is strengthened by the Ministry of Finance’s collaboration with the Royal Bahamas Police

CEOS OF OPENAI AND INTEL CITE ARTIFICIAL INTELLIGENCE’S VORACIOUS APPETITE FOR PROCESSING POWER

By MICHAEL LIEDTKE

AP Technology Writer

TWO tech CEOs scrambling to produce more of the sophisticated chips needed for artificial intelligence met for a brainstorming session Wednesday while the booming market’s early leader reported another quarter of eye-popping growth.

The on-stage conversation between Intel CEO

Pat Gelsinger and OpenAI CEO Sam Altman unfolded in a San Jose, California, convention center a few hours after Nvidia disclosed its revenue for the November-January period nearly quadrupled from the previous year.

Intel, a Silicon Valley pioneer that has been struggling in recent years, laid out its plans for catching up to Nvidia during a daylong conference. Gelsinger

kicked things off with a opening speech outlining how he envisions the feverish demand for AIequipped chips revitalizing his company in a surge he dubbed the “Siliconomy.”

“It’s just magic the way these tiny chips are enabling the modern economic cycle we are in today,” Gelsinger said. OpenAI, a San Francisco startup backed by Microsoft, has become one

of technology’s brightest stars since unleashing its most popular AI innovation, ChatGPT, in late 2022. Altman is now eager to push the envelope even further while competing against Google and other companies such as Anthropic and Inflection AI. But the next leaps he wants to make will take far more processing power than what’s currently available.

and Defence Forces; Customs, Immigration and Port Departments; the Department of Marine Resources and the Bahamas National Trust.

“This collaborative effort seeks to recover and collect delinquent revenue, and create and enforce new ways to retrieve revenue loss in the maritime field. Let me give you just one example. We discovered a foreign yacht company with more than 50 vessels which had not paid any fees for two full years.

“Over the past six months, the Task Force has carried out ‘Operation Revenue Fortification’, which began in Bimini and has expanded to Abaco, the Berry Islands and the Exuma Cays. Notable progress has been made over the past few months,” the Prime Minister continued.

“An online platform was introduced into Port departments in Abaco and the Berry Islands, as well as in the administrator’s office in Great Harbour Cay. The platform enables these offices to receive credit card and bankers cheque payments, along with cash payments.

The imbalance between supply and the voracious appetite for AI chips explains why Altman is keenly interested in securing more money to help expand the industry’s manufacturing capacity. During his talk with Gelsinger, he dodged a question about whether he is trying to raise as much as $7 trillion — more the combined market value of Microsoft and Apple — as was recently reported by The Wall Street Journal.

“The kernel of truth is we think the world is going to need a lot more (chips for) AI compute,” Altman said. “That is going to require a global investment in a lot of stuff beyond what we are thinking of. We are not in a place where we have numbers yet.”

Altman emphasized the importance of accelerating the AI momentum of the past year to advance a technology that he maintains will lead to a better future for humanity, although he acknowledged there will be downsides along the way.

“We are heading to a world where more content is going to be generated by

“The Maritime Revenue Enhancement Task Force was able to collect $1.2m in maritime revenue in just the first three months of operations.” Mr Davis, while conceding the challenges with the Department of Inland Revenue’s tax portal in early 2024, added that the tax authorities plan to seek out new information technology (IT) related efficiencies.

“Recently, the Department of Inland Revenue (DIR) experienced challenges while upgrading the tax portal. I am happy to report that these issues have been resolved. The DIR stands out among its peers in the Caribbean for the volume of business we are able to conduct online,” the Prime Minister said.

“However, there is still room for improvement. The Ministry of Finance is developing a strategy for a ‘One Tax Bahamas Portal’. The implementation of this strategy will require a significant investment in technology and human resources, an investment that will pay dividends many times over as we improve efficiencies for government and taxpayers alike.”

AI than content generated by humans,” Altman said. “This is not going to be only a good story, but it’s going to be a net good story.”

Perhaps no company is benefiting more from the AI gold rush now than Nvidia. The 31-year-old chipmaker has catapulted to the technological forefront because of its head start in making the graphics processing units, or GPUs, required to fuel popular AI products such as ChatGPT and Google’s Gemini chatbot.

Over the past year, Nvidia has been a stunning streak of growth that has created more than $1.3 trillion in shareholder wealth in less than 14 months. That has turned it into the fifth most valuable U.S. publicly traded company behind only Microsoft, Apple, Amazon and Google’s corporate parent, Alphabet Inc.

Intel, in contrast, has been trying to convince investors that Gelsinger has the Santa Clara, California, company on a comeback trail three years after he was hired as CEO.

We are seeking to employ a Food & Beverage Manager here at February Point Resort Estates in beautiful Great Exuma. We are hoping to find candidates with a minimum of 2-3 years’ experience.

We offer a competitive salary and excellent benefits.

Interested persons should send their resume to: teneeshia@februarypoint

PAGE 4, Thursday, February 22, 2024 THE TRIBUNE

FROM PAGE B1

TAKES AIM AT BLACKLISTING ‘ECONOMIC DISENFRANCHISEMENT’

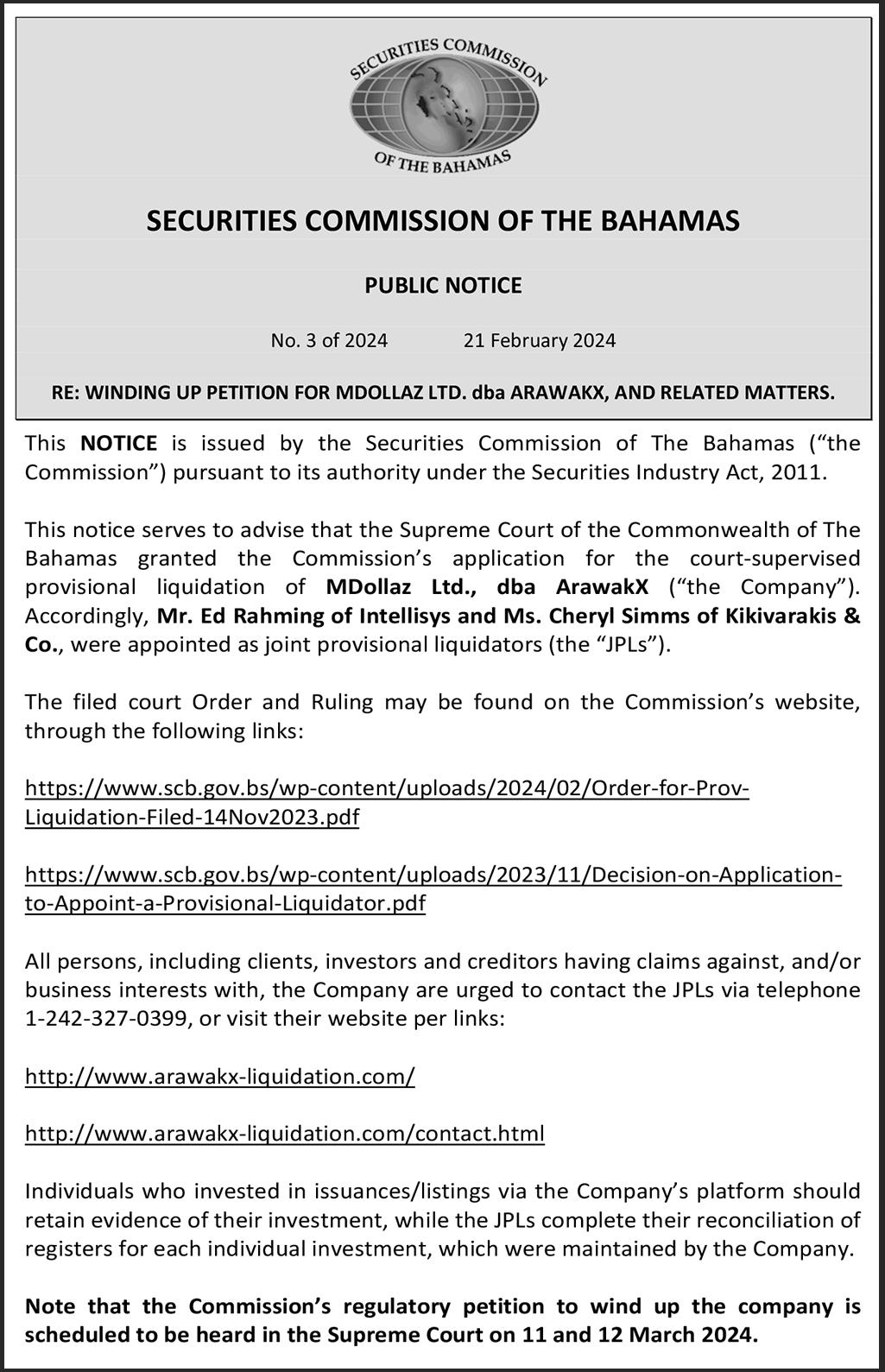

THE Attorney General has slammed the “arbitrary blacklisting” of The Bahamas and other international financial centres for “perpetuating a cycle of economic disenfranchisement”.

Ryan Pinder KC, who will represent the wider Caribbean in efforts to draft a United Nations (UN) convention to govern all global tax matters, reiterated The Bahamas’ belief that “biased and contradictory policies” have undermined the country’s economic growth and stripped it of its development rights.

Speaking before the UN “ad-hoc committee” charged with drafting the UN convention, and on the same day that The Bahamas escaped the European Union’s (EU) tax blacklist, he hailed the move as a “monumental initiative” that has the power to wrest control of global tax policy and direction away from the likes of the 27-nation bloc and the OECD.

“For over six decades, the international tax policies as formulated and dictated by the OECD (Organisation for Economic Co-Operation and Development)

RYAN PINDER KC

RYAN PINDER KC

neglected or failed to address the inherent challenges and the differences in development dynamics faced by the Global South,” Mr Pinder argued.

“Developing countries like The Bahamas have grappled with the disequilibrium of the international financial architecture, coupled with inconsistent, biased and contradictory tax policies, which have stifled development and growth, and undermined the integrity of principles of international humanitarian law with respect to the right to development.

“The Bahamas – reliant on tourism and financial services – stands vulnerable to external economic shocks and the pernicious impacts of the climate crisis. The dichotomy

between the Global Northdesigned international financial architecture and the imperatives for sustainable, resilient prosperity in the Global South is starkly evident in international tax initiatives,” the Attorney General added.

“Moreover, the arbitrary blacklisting of vulnerable countries compounds their plight, perpetuating a cycle of economic disenfranchisement. We view backlisting initiatives as contrary to our right to development.”

Voicing optimism that the committee, and convention that it is charged with drafting, will level the playing field in global tax matters, Mr Pinder said: “The Bahamas has long been a leading voice for the creation of a United Nations Tax Convention.

“It is our view that this ad-hoc intergovernmental committee offers a form of renewed multilateralism, predicated on an integrated approach and equitable representation, which is imperative to addressing the systemic inequities plaguing global governance, particularly the current international tax order.

“The Bahamas is optimistic that this committee will create equity and development capacity where it did not exist before, while

ensuring the development of early protocols to combat tax-related illicit financial flows,” he added.

“It is clear that if we are to achieve the sustainable development coals, we must have the political will to build systems that are inclusive, diverse and equitable. “The Bahamas looks forward to playing an integral role in this important process. Our aim is to achieve the development of robust draft terms of reference for a United Nations framework convention on international tax co-operation that adequately addresses the inherent constraints and development approaches of the Global South and Small Island Developing States (SIDS) like The Bahamas.”

Mr Pinder told Tribune Business that meetings on the proposed UN tax convention will take place throughout the week and continue throughout 2024. And he disclosed that The Bahamas is also preparing “a concept paper” to make the case for how repeated financial services blacklistings effectively represent a breach of its citizens’ human rights.

“With respect to the advancement of backlisting exercises as being a

breach of our human rights, and specifically our right to development, we are preparing a concept paper with analytical data to demonstrate the human right impacts and costs,” the Attorney General added. He said this would address issues such as “financial diversion”, where penalties from blacklistings divert funds away from essential public services and projects, plus impacts such as correspondent bank de-risking, job losses and “disaster recovery limitations”.

“Blacklisting hampers access to international finance, for instance, from international insurers for disaster recovery, affecting multiple human rights, including the right to life, adequate housing, water and sanitation, food, health, work, livelihood and the rights of displaced persons,” Mr Pinder added.

“Our working team has meet with the United Nations Special Rapporteur on the right to development to introduce our concept and further discuss their support and collaboration. The meetings have been very positive.”

Meanwhile, Kwasi Thompson, the Opposition’s finance spokesman, backed the Government’s

blacklisting stance. He said: “It remains our position that The Bahamas and other similar developing states are not always treated fairly and equitably by institutions of the OECD and European Union.

“The Bahamas is often made to comply with standards that local jurisdictions in these same OECD and EU countries do not have to meet. We stand in solidarity with the Government as it continues to press for fair and equitable treatment for the Bahamas in the global arena...

“Most importantly, going forward, this administration must commit to working with Bahamian industry stakeholders in the financial services sector to develop and execute a forward looking, multi-year strategic plan to shape a competitive and successful financial services sector that remains ahead of the EU and OECD dictates,” Mr Thompson added.

“We must continue to examine the opportunities in this space and remain ahead of the marketplace in a manner consistent with commitments we make to comply with international tax and regulatory standards.”

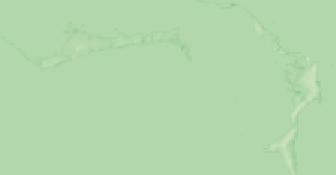

BAMSI graduates urged to exploit $170m fly fish sector

THE first 40 graduates from a newlylaunched Bahamas Agriculture & Marine Science Institute (BAMSI) certification course have been urged to fully exploit the $170m flats fishing industry.

Chester Cooper, deputy prime minister and minister of tourism, investments and aviation, told the first cohort from the flats fishing and nature tour guide certification initiative: “The nature-based sector is seeing high demand from

visitors. This certification gives you the capacity to create businesses of your own and contribute to the development of your communities and country.”

The two courses, which are a joint partnership between BAMSI, the Ministry of Tourism and the Ministry of Agriculture, represent the first and only certification programmes in The Bahamas and the world. The first group was made up primarily of residents from Andros, comprising 95 per cent of

the total, with the remaining students coming from Inagua, Abaco, Long Island and Harbour Island.

“Graduates, your attainment of national certification as flats fishing and nature tour guides means you now have the capacity to carve out a distinctive niche within the naturebased tourism arena,” Mr Cooper said. “You can not only now better protect the environment, but you

SEE PAGE B6

THE TRIBUNE Thursday, February 22, 2024, PAGE 5

Tribune Business Editor nhartnell@tribunemedia.net

AG

By NEIL HARTNELL

BAMSI GRADUATES

tourism season and Business Licence fee payments.

Increased departure taxes on cruise ship passengers and other levies also kicked-in from New Year’s Day. Asked how strongly the Government’s income has held up for the 2024 calendar year-to-date, Mr Wilson said: “The revenues from November have been performing in line with expectations largely.

“In some areas more work is required, but overall we see healthy double digit growth in revenues.

We have to move and continue working. We cannot rest on our laurels. The Prime Minister referred to the primary surplus showing that, from a cash perspective, we’re doing OK but we cannot become too comfortable.

“There’s more work to be done. We still have three-and-a-half to four more months of hard work.

The first six months have demonstrated that, from a revenue perspective, we’ve held the line in this slower period so we’ve got to continue working.”

Mr Davis did not dwell long on the first-half deficit during his mid-year Budget statement yesterday, instead moving swiftly to try and focus attention on the primary surplus achieved by his administration. The primary balance strips out interest payments

AS $259M DEFICIT

to measure whether the Government’s revenues are covering all its fixed-cost spending bar debt servicing.

“During the period, the Government experienced a net deficit of $258.7m, which represented a decrease of $19.1m relative to the previous comparable period. At the half-way mark in this fiscal year, the deficit exceeded the (fullyear) Budget forecast by $127.6m,” the Prime Minister acknowledged.

“However, the primary balance improved from $3m in the first half of the 2022-2023 fiscal year to $42.4m for the first half of the2023-2024 fiscal year. The primary balance is the best measure of fiscal health. That is the best measure, and it is expected to continue in that fashion.”

Echoing Mr Wilson’s position, Mr Davis said the primary surplus indicated the Government is enjoying positive cash flows. He suggested it was the public finance equivalent of the private sector’s definition for earnings before interest, taxation, depreciation and amortisation (EBITDA).

The full GFS deficit, by contrast, measures by how much the Government’s spending exceeds its revenue income although it does not include debt principal repayment. It also serves as indicator of how much net new borrowing the Government has to undertake to close this gap, which for the

six months to end-December 2023 was almost $259m, and make ends meet.

Others, though, yesterday voiced scepticism that the Davis administration will hit its 2023-2024 fiscal goals. Michael Pintard, the Opposition’s leader, blasted that it was “pure fantasy” for the Government to still believe it will hit the $131.1m full-year deficit target based on its first-half performance, and accused Mr Davis of “busting his Budget”.

Describing the deficit revelations as “the big take away” from the midyear Budget statement, Mr Pintard told Tribune Business: “As the Opposition warned, as the rating agencies warned, if the Prime Minister continued on the path he was going on his projections of being able to meet his targets were pure fantasy.

“We don’t believe the Government has any real commitment to that because very few, if any, of the measures he needed to take he took. He busted his Budget.... When we compare it [the half-year deficit] to the full-year, it is already at $258.7m, some $127m more. It is a dramatic increase in terms of having gone beyond the targeted numbers.”

Hubert Edwards, the Organisation for Responsible Governance’s (ORG) economic development committee head, told this

newspaper that while the 2023-2024 full-year deficit is likely to come in closer to the International Monetary Fund’s (IMF) $379m forecast than the Government’s $131.1m, achieving the former is “certainly positive” still.

This is because $379m would still represent a $150m-plus deficit reduction compared to 2022-2023’s $533m worth of ‘red ink’. And Mr Edwards warned against the “mistake” of simply assuming the full-year deficit will be double the half-year’s, and exceed $500m, due to the fact the Government will now be earning the bulk of its annual revenues.

“It’s likely to terminate in that $300m range,” Mr Edwards predicted of the deficit. “If it comes in at or below the IMF’s projection it still represents a continued downward trajectory. That stands as a positive, and we should look at it against a projection [the Government’s] as being too much on the aggressive side given all the circumstances we faced.”

The Prime Minister yesterday hailed that both total revenue and tax collections for the 2023-2024 first half had increased compared to the prior year. “For the first six months of the year, preliminary total revenue collections are assessed at $1.3bn, which represented a $43.8m increase over the same period of the prior

year. To date, revenue collections accounted for 39.2 percent of the annual budget target,” he said.

“Stronger collections are expected in the second half of this fiscal year, reflecting the cyclical nature of the fiscal year. In addition, the revenue yield in the second half of the fiscal year will benefit from new measures such as the increase of the cruise departure tax and the new Business Licence Act.

“This Act introduces new fees for International Businesses Companies (IBCs) for the first time. We have not forecasted any major uplift as IBCs, by their very nature, are mobile.” Total tax revenues, meanwhile, increased by almost $73m to hit 40.1 percent of the full-year Budget target.

However, the first half total revenue and tax collections, as a percentage of the full-year total, are behind the 44.9 percent and 44 percent achieved during the prior year period featuring the six months to end-December 2022. And, while government revenues may be up year-over-year, there are further signs that it is behind its revenue growth targets for the current fiscal year. VAT accounted for $47.2m, or more than half, of the $73m year-over-year growth in tax revenues to come in at $646m for the six months to end-December 2023. This accounted for more than half, or 55.2

percent, of the Government’s total tax revenues and was equal to 40.6 percent of the full-year target.

However, while VAT revenues were up by 7.9 percent year-over-year, this growth rate has to hit a much greater 27 percent or $339m over the $1.252bn collected in 2022-2023 to hit this year’s target of $1.591bn. And full-year total revenue and tax collections must also expand by a much faster 16 percent if the Government is to achieve its $3.319bn revenue target for the full year.

As for spending, Mr Davis signalled that the Government is achieving its stated goal of holding this flat against the previous year. Recurrent spending on the Government’s fixed costs, including public service salaries, rents and debt servicing, rose by just $8.481m year-over-year to reach $1.427bn.

A key driver of the increase was “an increase in compensation of employees by $18.2m to $417.6m, representing 48.8 percent of the Budget target. Increased spending in this component is explained by higher employment costs because of planned promotions, and other staff and salary adjustments during the period”. Social assistance spending was also increased by 44.3 percent.

can also grow our tourism industry.”

Data produced by the Ministry of Tourism showed that “in 2022 flats fishermen in Andros alone made a direct contribution of around $25m to the economy”, the minister added.

Jomo Campbell, minister of agriculture and marine

resources, told the 40 graduates: “You have undergone extensive training and have proven yourselves to be knowledgeable and competent in your respective fields. Your expertise will undoubtedly contribute to providing exceptional experiences for visitors. “Being a guide requires not just technical expertise, but also the ability

to connect with people to create memorable experiences. Through completing this programme, you have demonstrated your abilty to inspire, educate and entertain, ensuring that every person who chooses to explore our waters and surroundings leaves with a deeper appreciation and understanding of our natural resources.”

Tyrel Young, BAMSI’s executive chairman, said: “As graduates of these national certification programmes, you are now equipped with the knowledge and skills necessary to showcase our nation’s treasures to visitors from around the world.”

Dr Raveenia RobertsHanna, BAMSI’s president, said the 40 graduates are the first to have undergone training approved by the National Accreditation and Equivalency Council of the Bahamas (NAECOB). She added that the programme had also garnered international interest and acclaim.

“The Government of The Bahamas has clearly prioritised the redevelopment of the agriculture sector with the establishment and support of BAMSI to drive economic growth through educational empowerment. There is a vision and,

indeed, we have hope,” she added. “The Bahamas is at a crucial stage of development and growth, and must rely on the collective talents and commitment of all to remain sustainable and current.

“The role BAMSI plays in the growth and development of our country is not to be underestimated. The Institute has made tremendous strides since our opening on September 29, 2014. We have definitely answered the clarion call to provide relevant education and training in agriculture, marine sciences, aquaculture, environmental science and agribusiness and related disciplines in an environment that nurtures student success.”

Dr Roberts-Hanna said 30 per cent of the graduates are women. “Some of our graduates are currently participating in an international fly fishing trade

show,” she said. “Some are already gainfully employed within the sector and making meaningful contributions, and others have become entrepreneurs, spotting and fishing the next big thing. I am proud to say as enshrined in our motto, we truly feed minds and grow greatness here at BAMSI”.

The next intake of students for the flats fishing and nature tour guide programmes is set to begin in July 2024.

The graduation ceremony, which was held at BAMSI’s North Andros campus under the theme, ‘Soar higher…reel in your success’, was also attended by Leonardo Lightbourne, MP for North Andros and the Berry Islands; Leon Lundy, MP for Central and South Andros; Senator Randy Rolle; Prescott Smith, president of the Bahamas Fly Fishing Industry Association; members of BAMSI’s Board of Directors, and other stakeholders and community leaders from Andros.

PAGE 6, Thursday, February 22, 2024 THE TRIBUNE

GOV’T HOLDS

NEAR-DOUBLE TARGET FROM PAGE B1

FIRM

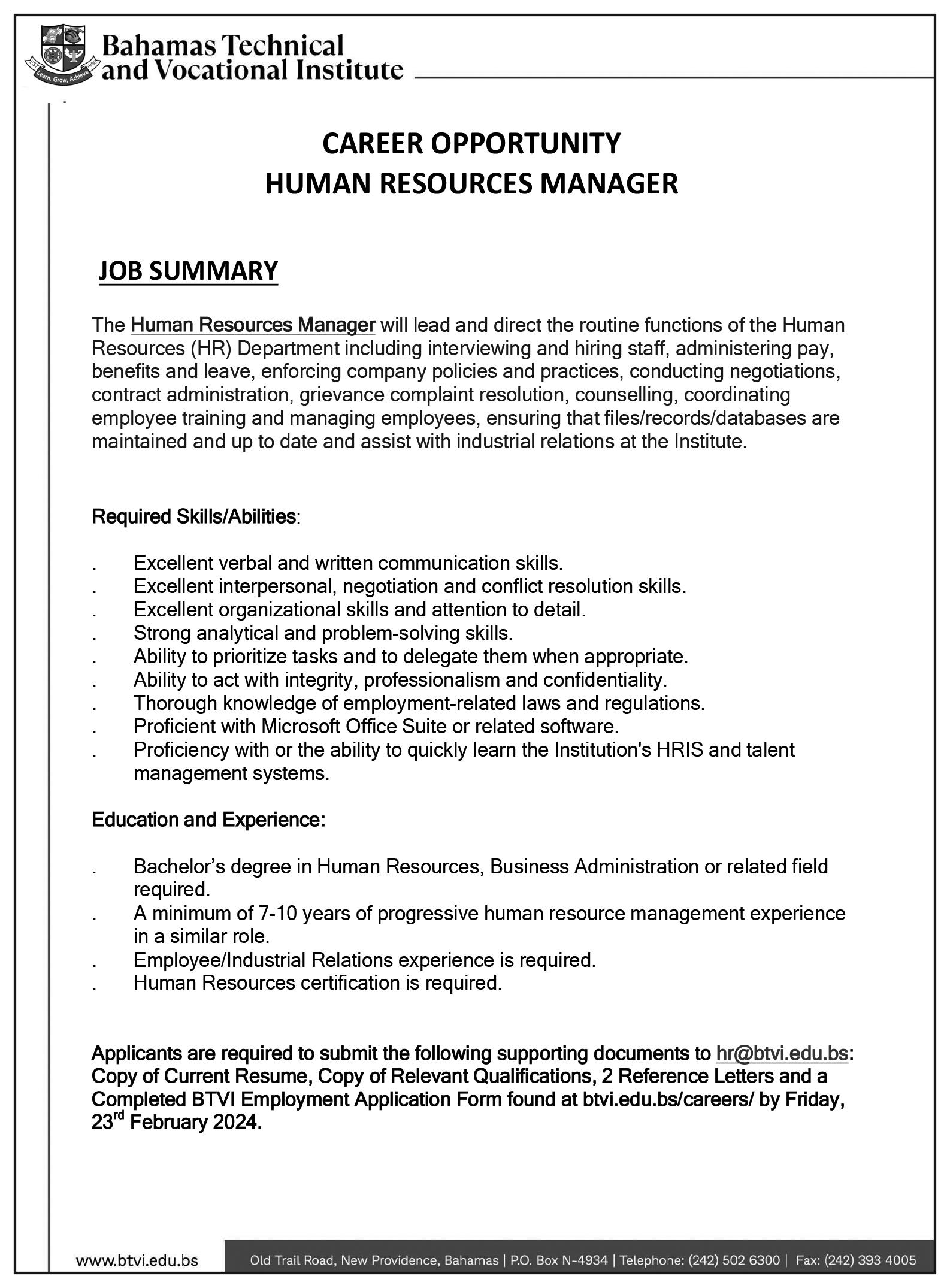

BAMSI GRADUATES URGED TO EXPLOIT $170M FLY FISH SECTOR FROM PAGE B5 COMPLIANCE ASSISTANT If you’re interested in developing a career in Financial Crime Risk Management, we invite you to apply for the position of: Main Duties and Responsibilities: • Maintain the financial crime risk management related databases of the Bank. • Ensure all record keeping requirements are adhered to. • Assist with the administration of the Financial Crime Risk Management Training Program. • Perform customer due diligence, including the detection and reporting of Know Your Customer (KYC) identity deficiencies/concerns. • Perform and participate in quality control reviews required by the Financial Crime Risk Management Program of the Bank. • Utilize risk-based tools and monitoring systems to identify and report on any unusual or suspicious activity. Requirements/Qualifications: • Possess an Associate Degree in Business Administration, Law & Criminal Justice, Banking & Finance, or related field OR BIFS Certificates in Anti-Money Laundering & Compliance Systems (Introduction and Intermediate). • Employed a minimum of two (2) years in the financial services industry. • Knowledgeable of Know Your Customer (KYC) compliance requirements. • Proficient in Microsoft Office Suite, in particular Excel, Word and Outlook programs. • Possess good written and verbal communication skills. • Detail-oriented. • Able to multi-task and meet stipulated deadlines • Able to maintain strong working relationships. Job Summary: The Compliance Assistant is responsible for providing support for the implementation and administration of the Financial Crime Risk Management Program of Fidelity Bank (Bahamas) Limited. Friday, March 1st, 2024 Please submit before: HUMAN RESOURCES Re: Compliance Assistant, 51 Frederick Street P.O. Box N-4853 | Nassau | F: 328.1108 careers@fdelitybahamas.com All applications will be held in strict confidence. Only short listed candidates will be contacted.

Gov’t eyes $140m ‘accrual’ over corporate income tax

only multinational enterprises earning more than 750m euros annually.

“We are talking about very, very big companies. The QDMTT is a way to make sure these very big companies pay at least a minimum amount in taxes on their profits in every country where they do business. The implementation of [the OECD’s] Pillar Two in The Bahamas would unlock a new revenue source, with initial estimates expected to exceed more than $140m annually.”

Mr Davis explained that failing to implement the minimum corporate tax would effectively mean The Bahamas handing over the right to collect taxes on economic activity within its jurisdiction to other countries.

“May I add here, Madam Speaker, that if we do not implement this Pillar Two tax on that multinational entity that is doing business in The Bahamas; if we don’t collect it here, they’ll have to pay that same tax in their home jurisdiction, and

many of the multinationals doing business here prefer to pay us,” the Prime Minister said.

“We ought not to allow that opportunity to pas because they have to pay it anyhow. Why should they not pay it in the jurisdiction in which they are operating? We are thankful for our collaboration with those in this space...”

It is likely this ability of home country jurisdictions to tax if The Bahamas does not do so that has motivated the Government to explore how local companies that will pay it can “accrue”, or set aside in escrow, the funds that will be generated until Parliament passes the enabling law into statute.

“We are reviewing options that would entail the Pillar Two multinationals accruing those taxes for 2024 in The Bahamas,” the Prime Minister said, acknowledging the difficulties bound up with the Government’s desire to preserve its revenues as taxes are “really not retroactive”.

“We are trying to create a platform, or create an

initiative, where they can accrue for 2024 what will come to us even though the law, which will probably be.....” he added, urging the Opposition to “understand it before you speak to it”. Chester Cooper, deputy prime minister, quipped: “Stay on the wall.”

Simon Wilson, the Ministry of Finance’s financial secretary, told Tribune Business that while the Government does not have “a true handle” on how many Bahamas-based companies will be caught in the 15 percent corporate income tax it is likely “a pretty small number”. The candidates would likely include the major hotels and resorts such as Atlantis (Brookfield), Baha Mar (Chow Tai Fook Enterprises), Sandals and the likes of the RIU and Warwick, both of which are part of international chains. The Canadian-owned banks, Royal Bank of Canada, CIBC and Scotiabank, will also probably qualify along with a number of operators in the international financial services sector.

GEORGIA HAS THE NATION’S ONLY MEDICAID WORK REQUIREMENT. MISSISSIPPI COULD BE NEXT

By MICHAEL GOLDBERG Associated Press

AFTER years of refusing to expand Medicaid, some of Mississippi’s Republican leaders now say they are open to the policy — if they can require new enrollees to have a job. That approach could hinge on presidential politics and an ongoing legal battle in Georgia.

In a statement to The Associated Press, Lt. Gov. Delbert Hosemann said Mississippi must consider all options to improve its labor force participation rate and poor health outcomes, both of which are among the worst in the

country. Hosemann said Georgia, the only state that requires Medicaid recipients to meet a work requirement, could be a model for Mississippi.

“We need healthy working Mississippians,” Hosemann said. “Georgia’s successful implementation of a work requirement cleared a path for this conversation in Mississippi.”

Georgia and Mississippi are among 10 states that haven’t expanded Medicaid eligibility to include people earning up to 138% of the federal poverty level, or $20,120 annually for a single person. In 2023, Georgia created a less generous program that offered expanded

coverage to adults earning up to 100% of the poverty level, or $14,580 for a single person.

Georgia’s program only offers expanded coverage to able-bodied adults if they are working, volunteering, studying or in vocational rehabilitation. The state developed its plan after the Trump administration permitted 13 states to impose work requirements on some Medicaid recipients.

The Biden administration revoked all those waivers in 2021, in part because of the COVID-19 pandemic. The Centers for Medicare and Medicaid Services said people should not face roadblocks to getting health

The likes of the Bahamas Telecommunications Company (BTC), whose parents are Cable & Wireless Communications (CWC) and Liberty Latin America, plus Commonwealth Brewery, which is 75 percent majority-owned by Heineken, as well as the oil majors Rubis and Esso (Sol Petroleum) may also be caught.

Mr Wilson, meanwhile, reassured that companies caught by the 15 percent corporate income tax will not be subject to ‘double taxation’ as they will be exempt from also paying Business Licence fees on their gross turnover. “They obviously won’t pay the Business Licence fee,” he added. “If you fall into the QDMTT you will not pay Business Licence.”

Confirming that the $140m revenues cited by Mr Davis represented net new money for the Government and Public Treasury, Mr Wilson said that designing the accrual mechanism referred to by Mr Davis remains “a work in progress”. However, he signalled that making

care. But Republican Gov. Brian Kemp’s administration won a federal court fight in 2022 to preserve Georgia’s plan, partly because it applies to new enrollees and not current Medicaid recipients.

The program is set to expire at the end of September 2025. Earlier this month, Georgia sued the Biden administration to try to keep its plan running until 2028. A bill that would tie a work requirement to Medicaid eligibility has also passed the South Dakota

taxation take effect retroactively was not an insurmountable problem. “We have been advised that the retroactive implementation of taxes is not that uncommon in the developed word, and that these large companies who will be impacted would also be aware of it, and there are certain benefits to that approach,” Mr Wilson told Tribune Business.

Setting out the Government’s corporate income tax timetable, Mr Davis yesterday said: “We have two inter-related goals – to make sure The Bahamas captures the tax revenues of these very large multinationals doing business here, and to use the fiscal space created by the new revenue to, among other things, provide substantial relief for Bahamian taxpayers.”

No indication was given of what that relief might look like, although Mr Davis said: “The goal is to have draft legislation available by the end of May 2024, at which time we will meet to present the Budget proposals for the upcoming

Senate and is awaiting a House hearing.

Even if a Republican is elected president in November, new Medicaid waivers granted by CMS could face legal challenges, said Robin Rudowitz, director of the Program on Medicaid and the Uninsured at KFF, a health policy research group. “While former President Donald Trump would likely look favorably on work requirements, he has also vowed to try again to repeal and replace the

2024-2025 fiscal year. We hope to speak to that in the Budget presentation.

“We intend to issue the draft for public consultation over the summer monthsthat is the legislation we hope to have ready by May - and then move to finalise the document for submission to Parliament after the summer recess.”

Mr Davis then moved to reassure Bahamian companies that do not meet the G-20/OECD qualifying threshold that they will not face corporate income tax - at least for now. “We believe that, currently, addressing only Pillar 2 multinational enterprises is the proper approach. We won’t deal with domestic Bahamian companies at this time,” he added.

“Any consideration of a wider business income tax would only happen if it is a more equitable approach for Bahamian businesses, and would only be done after proper consultation, with considerable lead time in order for Bahamian businesses to properly prepare.”

Affordable Care Act, which would include Medicaid expansion,” Rudowitz said. Georgia’s narrow coverage expansion with a work requirement waiver has seen limited Medicaid enrollment, far short of the coverage levels that could be achieved if the state adopted the full expansion allowed under the ACA, Rudowitz said. That is because most Medicaid recipients are either working or face barriers to work, which limits enrollment, she continued.

BUSINESS DEVELOPMENT MANAGER

Sterling Bank & Trust Limited is a boutique bank located in Paradise Island, The Bahamas with ambitious plans to grow and expand its business. The Bank is looking for a suitable candidate to fll the position of Business Development Manager to promote the growth of assets and liabilities franchise within its Off-shore banking environment.

Position Overview

The Business Development Manager is responsible for overseeing the process of business development within the Bank to promote its longevity. Duties will include working closely with other company executives and management teams, meeting with potential business partners and maintaining existing client relationships while monitoring market trends to pursue new business ventures.

Main Responsibilities:

The Business Development Manager is required to be self-motivated enough to reach out and bring in new business. He or she will typically have the following responsibilities:

• Attracting new clients by innovative means and overseeing the process of onboarding;

• Working with team members to identify and manage company risks that might prevent growth;

• Identifying and researching opportunities that may be available in new and existing markets;

• Preparing and delivering presentations for potential clients; Fostering a collaborative environment within the business as a whole;

• Communicating with clients to understand their needs and offer solutions to their problems;

• Creating positive, long-lasting relationships with current and potential clients;

• Organizing and spearheading outbound campaigns to create business opportunities;

• Maintaining client activities reports, where applicable;

• Developing and presenting proposals customizes for clients’ specifc business needs; Ensuring excellent customer service through regular client follow up;

• Managing virtual and in-person business meetings;

• Taking full responsibility for developing new business – from prospecting to implementation;

• Developing rapport with key decision makers;

• Managing overall relationship proftability and portfolio risk with responsibility for proftable growth of the portfolio; and Ensuring compliance with all policies and procedures, including Know Your Customer (KYC) and Anti Money laundering (AML) requirements in all dealings with existing and potential clients within the Off-shore banking environment.

Skills & Qualifcations:

Minimum 5 years of experience in business development in any Off-shore Bank. Should be a graduate in Finance, Management or any equivalent qualifcation. An energetic, forward-thinking and creative individual with high ethical standards and an appropriate professional image.

Solid knowledge of local and international regulations and standards in the fnancial services industry, KYC/AML and risk, excellent grasp of reporting requirements for FATCA and CRS, etc.

Sound technical skills, analytical ability, good judgment and strong operational focus.

The above statements are intended to describe the general nature and level of work performed in this position. They are not intended as an exhaustive list of all responsibilities, duties and skills required.

Interested candidates may send their resume with a covering letter to the following address:

To Apply: Please email your resume to hr@sterlingbt.com on or before 29th February 2024.

Only applications received to this email address will be accepted and those shortlisted will be contacted. Please no telephone call.

THE TRIBUNE Thursday, February 22, 2024, PAGE 7

FROM PAGE B1

Industries mixed over up to 75% boating fee cuts

the new legislation tabled in the House of Assembly, will increase again to $925.

The Boat Registration (Amendment) Bill, unveiled by Jobeth ColebyDavis, minister of transport and energy, contains several wrinkles compared to the version introduced last July as it creates several new boat length categories.

For example, persons bringing in a new boat that is 19 feet or less in length will now pay a first-time registration fee of $700 as opposed to the previous $1,000 - a 30 percent cut.

However, the Government has now split the next vessel size category - 20 feet to 39 feet - in two.

This means that while owners of boats between 20-28 feet will enjoy a $900 first-time registration fee reduction, as it drops from $3,000 to $2,100, those in the 29 feet to 39 feet bracket will pay $3,500. That latter figure represents a $500 increase on what they would have paid under the previous structure.

The same applies to annual registration renewal fees, with the 29 feet to 39 feet category now paying $860 as opposed to the previous $700. And Mr Lisgaris said other aspects of the new Bill also appeared to be unduly burdensome for tour and charter boat owners and operators.

He challenged why the new Bill is requiring operators to undertake an annual marine survey when the insurance industry’s requirement is for one to be conducted every five years, and questioned why they are being forced to take an additional examination.

“This 2024 Boat Registration Amendment Bill for commercial operators is totally disappointing,” Mr Lisgaris said. “It was seriously suggested that

tour boat providers would receive relief and, sadly, that is not the case. No significant decreases were made, and in most instances registration fees have actually increased. “Also included in this 2024 amendment is the requirement for an annual marine survey. Unfortunately, this makes matters even worse than before. Most recent and lowestquoted survey for this [36-foot charter] vessel is $540, so that makes a 36-foot charter vessel at least $1,465 to register annually compared to $260 in 2022.

Insurance companies require a marine survey to be conducted every five years, which is the standard. Why do we need a Port inspection and marine survey to be conducted annually? Marine surveys are primarily conducted to determine the market value of a vessel,” he argued. “Isn’t the Port Authority’s main concern to make sure that commercial vessels are deemed seaworthy and equipped with lifesaving equipment? Considering the Port does their own inspections, why are operators now being required to undergo an additional examination?

“We can look to vehicle registration for comparison,” Mr Lisgaris added. “According to Road Traffic’s website, the highest category for vehicle registration (based on weight) is $760. These vehicles traverse our roads all day, adding to the wear and tear of the streets. An annual fee of this scale is more understandable given the infrastructure the Government has to maintain for this mode of transport.

“The same, by and large, cannot be said of vessels. Further, these vehicles (again, according to the

Government’s website) do not appear to be subject to a roughly $500 per annum inspection fee. This is by no means an attempt to pull down a fellow sector, but more to demonstrate the inequity legitimate boat operators are facing.”

Turning to his concerns about the lack of enforcement and regulation, Mr Lisgaris said: “We’re approaching the third month of 2024 and we still see unregulated vessels conducting business on a daily basis. These are operators who have never, and will likely never, pay any commercial registration fees no matter what the rates are due to a lack of repercussions. “We have competitors who have blatantly refused to pay the new fees since they were implemented in December 2023 and who are likely still operating. Illegally. Sadly, we see little law enforcement presence on the water after repeatedly making calls and reports to the Port and Defence Force.

“As an example, to my knowledge, Green Cay off Rose Island is still closed to swimmers due to the deadly shark attack. Yet numerous tour vessels take tourists snorkelling and swimming there without any penalty. I understand that law enforcement agencies cannot witness everything, but they must patrol the harbour and other popular tourist sites to make sure charter vessels are compliant and our guests are safe. “Calls have been made for vessels to have dated registration stickers, a common practice for vessels from other countries, and similar to our vehicles, to make it easier to identify unregistered vessels. Unfortunately, to date, no public dialogue has transpired on this proposal.”

HOTEL SEEKS PROFESSIONAL DANCERS

Te ideal candidates will have a minimum of Level 2 ballet certifcation and training in contemporary, jazz and ethnic dance styles. Responsibilities include performing in our nightly shows, collaborating with choreographers to create and perform original works and participating in rehearsals.

Interested candidates should submit their resume, headshot, and a video reel showcasing their dance skills. We look forward to hearing from you!

email: hhrr.nas@riu.com

Fishermen, though, were in more buoyant mood after the revised Water Skiing and Motor Boat Control (Amendment) Bill 2024 carved out the sector by providing its own fee schedule separate from pleasure craft users.

Keith Carroll, the National Fisheries Association’s (NFA) president, told Tribune Business that annual registration renewal fees for his vessel, which falls into the 50-foot to 59-foot category, had been slashed by 75 percent from $2,300 to $575. The latter figure, he added, while representing a 187.5 percent jump on the prior $200, was within the magnitude of increase deemed acceptable by the sector.

“It looked like good news for the fishermen,” Mr Carroll added. “I’m happy, and according to the fishermen in the chats it sounds like everyone’s very pleased. I think the way I see the fees, I think the Government took the fishermen’s advice and they did what we wanted. We’re very pleased with it.

“We knew the fees needed an increase but not the way they went about it. They didn’t give one good reason why they did that. I know all the boats are getting registered now. I haven’t registered my own, but I will call the inspector tomorrow [today] and get mine licensed up.

“It’s big for the fishermen. We knew it had to go up. We can live with what it is now. There’s nothing to complain about now. I think that in the future when the Government plans to do anything that affects the fishermen they should meet with us and they wouldn’t have this problem,” Mr Carroll added. “Consult with the fishermen, call us. They might not agree with what we say,

but we cannot go to sleep and wake up tomorrow and something that affects us and nobody has talked to us about it.”

Paul Maillis, the Association’s secretary, told Tribune Business that the fee amendments represent “one less burden upon us in terms of preparing for the upcoming” Nassau grouper season.

“From the beginning we’ve been saying we understand some sort of increase was to be expected,” he added. “We’re pleased they’ve

created a specific category for commercial fishing vessels...

“It could have come sooner, but later is better than sooner. We’d like to commend them [the Government] and look forward to going to get vessels properly registered in preparation for the grouper season. It’s a battle that we didn’t want to have to fight but, at the end of the day, it’s all about how we correct something that is not working properly and I’m glad we’ve gone ahead with that.”

PAGE 8, Thursday, February 22, 2024 THE TRIBUNE

FROM PAGE B1

IRAN ACCUSES ISRAEL OF SABOTAGE ATTACK THAT SAW EXPLOSIONS STRIKE A NATURAL GAS PIPELINE

By JON GAMBRELL

Associated Press

AN Israeli sabotage attack on an Iranian natural gas pipeline last week caused multiple explosions on the line, Iran's oil minister alleged Wednesday, further raising tensions between the regional archenemies against the backdrop of Israel's war on Hamas in the Gaza Strip.

The accusations by Iran's Oil Minister Javad Owji come as Israel has been blamed for a series of attacks targeting Tehran's nuclear program.

The "explosion of the gas pipeline was an Israeli plot," Owji said, according to Iran's state-run IRNA news agency. "The enemy intended to disturb gas service in the provinces and put people's gas distribution at risk."

"The evil action and plot by the enemy was properly

managed," Owji added, without providing any evidence to support his claims. Israel has not acknowledged carrying out the attack, though it rarely claims its espionage missions abroad. The office of Prime Minister Benjamin Netanyahu, a longtime foe of Iran, did not respond to a request for comment.

The Feb. 14 blastshit a natural gas pipeline running from Iran's western Chaharmahal and Bakhtiari province up north to cities on the Caspian Sea. The roughly 1,270-kilometer (790-mile) -long pipeline begins in Asaluyeh, a hub for Iran's offshore South Pars gas field.

Owji earlier compared the attack to a series of mysterious and unclaimed assaults on gas pipelines in 2011 — including around the anniversary of Iran's 1979 Islamic Revolution. Tehran marked the 45th

anniversary of the revolution just days before the pipeline blasts.

Israel has carried out attacks in Iran that have predominantly targeted its nuclear program. Last week, the head of the United Nations' nuclear watchdog warned that Iran is "not entirely transparent" regarding its atomic program, particularly after an official who once led Tehran's program announced the Islamic Republic has all the pieces for a weapon "in our hands."

Tensions over Iran's nuclear program comes as groups that Tehran is arming in the region — Lebanon's militant group Hezbollah and Yemen's Houthi rebels — have launched attacks targeting Israel over the war in Gaza. The Houthis continue to attack commercial shipping in the region, sparking repeated airstrikes from

the United States and the United Kingdom. Despite a month of U.S.led airstrikes, the Houthi rebels remain capable of launching significant attacks. This week, they seriously damaged a ship in a crucial strait and downed an American drone worth tens of millions of dollars.

On Wednesday, ships in the Red Sea off the Houthiheld port city of Hodeida in Yemen reported seeing an explosion, though all vessels in the area were said to be safe, according to the British military's United Kingdom Maritime Trade Operations centers. The UKMTO earlier reported

heavy drone activity in the area. The U.S. State Department criticized "the reckless and indiscriminate attacks on civilian cargo ships by the Houthis" that have delayed humanitarian aid including food and medicine bound for Ethiopia, Sudan and Yemen.

THE TRIBUNE Thursday, February 22, 2024, PAGE 9

TWO men look at flames after a natural gas pipeline explodes outside the city of Boroujen in the western Chaharmahal and Bakhtiari province, Iran, in early Wednesday, Feb. 14, 2024. Explosions struck a natural gas pipeline in Iran early Wednesday, with an official blaming the blasts on a “sabotage and terrorist action” in the country as tensions remain high in the Middle East amid Israel’s war on Hamas in the Gaza Strip.

Photo:Reza Kamali Dehkordi/AP

PRIVATE US SPACECRAFT ENTERS ORBIT AROUND THE MOON AHEAD OF LANDING ATTEMPT

By MARCIA DUNN AP Aerospace Writer

A PRIVATE U.S. lunar lander reached the moon and eased into a low orbit Wednesday, a day before it will attempt an even greater feat — landing on the gray, dusty surface.

A smooth touchdown would put the U.S. back in business on the moon for the first time since NASA astronauts closed out the Apollo program in 1972.

The company, if successful, also would become the first private outfit to ace a moon landing.

Launched last week, Intuitive Machines' lander fired its engine on the back side of the moon while out of contact with Earth.

Flight controllers at the company's Houston headquarters had to wait until the spacecraft emerged to learn whether the lander was in orbit or hurtling aimlessly away.

Intuitive Machines confirmed its lander, nicknamed

Odysseus, was circling the moon with experiments from NASA and other clients. The lander is part of a NASA program to kickstart the lunar economy; the space agency is paying $118 million to get its experiments on the moon on this mission.

On Thursday, controllers will lower the orbit from just under 60 miles (92 kilometers) to 6 miles (10 kilometers) — a crucial maneuver occurring again on the moon's far side — before aiming for a touchdown near the moon's south pole. It's a dicey place to land with all the craters and cliffs, but deemed prime real estate for astronauts since the permanently shadowed craters are believed to hold frozen water.

The moon is littered with wreckage from failed landings. Some missions never even got that far. Another U.S. company — Astrobotic Technology — tried to

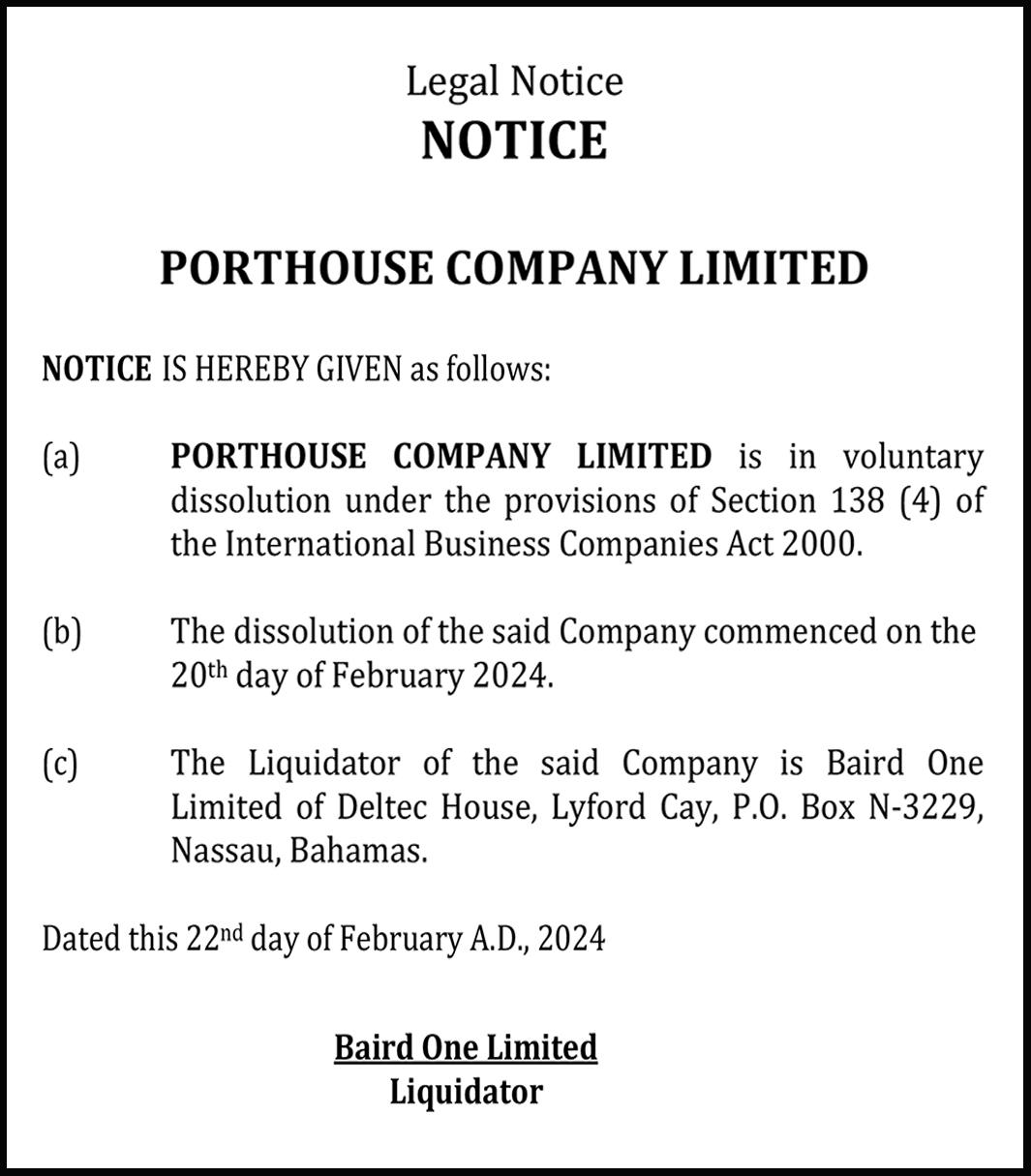

NOTICE

ASH & AM ASSETS LIMITED

N O T I C E IS HEREBY GIVEN as follows:

(a) ASH & AM ASSETS LIMITED is in voluntary dissolution under the provisions of Section 138 (4) of the International Business Companies Act 2000.

(b) The dissolution of the said company commenced on the 20th February, 2024 when the Articles of Dissolution were submitted to and registered by the Registrar General.

(c) The Liquidator of the said company is Bukit Merah Limited, The Bahamas Financial Centre, Shirley & Charlotte Streets, P.O. Box N-3023, Nassau, Bahamas

Dated this 22nd day of February, A. D. 2024

Bukit Merah Limited Liquidator

send a lander to the moon last month, but it didn't get there because of a fuel leak. The crippled lander came crashing back through the atmosphere, burning up over the Pacific.

A rundown on the moon's winners and losers:

FIRST VICTORIES

The Soviet Union's Luna 9 successfully touches down on the moon in 1966, after its predecessors crash or miss the moon altogether. The U.S. follows four months later with Surveyor 1. Both countries achieve more robotic landings, as the race heats up to land men.

APOLLO RULES

NASA clinches the space race with the Soviets in 1969 with a moon landing by Apollo 11's Neil Armstrong and Buzz Aldrin. Twelve astronauts explore the surface over six missions, before the program ends with Apollo 17 in 1972. Still the only country to

Machines/AP

send humans to the moon, the U.S. hopes to return crews to the surface by the end of 2026 or so, a year after a lunar fly-around by astronauts.

CHINA EMERGES

China, in 2013, becomes the third country to successfully land on the moon, delivering a rover named Yutu, Chinese for jade rabbit. China follows with the Yutu-2 rover in 2019, this time touching down on

NOTICE

SCINTILLATING SON HOLDINGS LIMITED

N O T I C E IS HEREBY GIVEN as follows:

(a) SCINTILLATING SON HOLDINGS LIMITED is in voluntary dissolution under the provisions of Section 138 (4) of the International Business Companies Act 2000.

(b) The dissolution of the said company commenced on the 20th February, 2024 when the Articles of Dissolution were submitted to and registered by the Registrar General.

(c) The Liquidator of the said company is Bukit Merah Limited, The Bahamas Financial Centre, Shirley & Charlotte Streets, P.O. Box N-3023, Nassau, Bahamas

Dated this 22nd day of February, A. D. 2024

Bukit Merah Limited Liquidator

the moon's unexplored far side — an impressive first. A sample return mission on the moon's near side in 2020 yields nearly 4 pounds (1.7 kilograms) of lunar rocks and dirt. Another sample return mission should be launching soon, but this time to the far side. Seen as NASA's biggest moon rival, China aims to put its astronauts on the moon by 2030.

RUSSIA STUMBLES

In 2023, Russia tries for its first moon landing in nearly a half-century, but the Luna 25 spacecraft smashes into the moon. The country's previous lander — 1976's Luna 24 — not only landed, but returned moon rocks to Earth.

INDIA TRIUMPHS ON TAKE 2

After its first lander slams into the moon in 2019, India regroups and launches Chandrayaan-3 (Hindi for moon craft) in 2023. The craft successfully touches down, making India the fourth country to score a lunar landing. The win

comes just four days after Russia's crash-landing.

JAPAN LANDS SIDEWAYS

Japan becomes the fifth country to land successfully on the moon, with its spacecraft touching down in January. The craft lands on the wrong side, compromising its ability to generate solar power, but manages to crank out pictures and science before falling silent when the long lunar night sets in.

PRIVATE TRIES

A privately funded lander from Israel, named Beresheet, Hebrew for "in the beginning," crashes into the moon in 2019. A Japanese entrepreneur's company, ispace, launches a lunar lander in 2023, but it, too, wrecks. Astrobotic Technology, a Pittsburgh company, launches its lander in January, but a fuel leak prevents a landing and dooms the craft. Astrobotic and Intuitive Machines plan more moon deliveries.

PUBLIC NOTICE

INTENT TO CHANGE NAME BY DEED POLL

The Public is hereby advised that I, VINCENT SAMUEL