Lease setback strikes PI lighthouse entrepreneur

By NEIL HARTNELL Tribune Business Editor nhartnell@tribunemedia.net

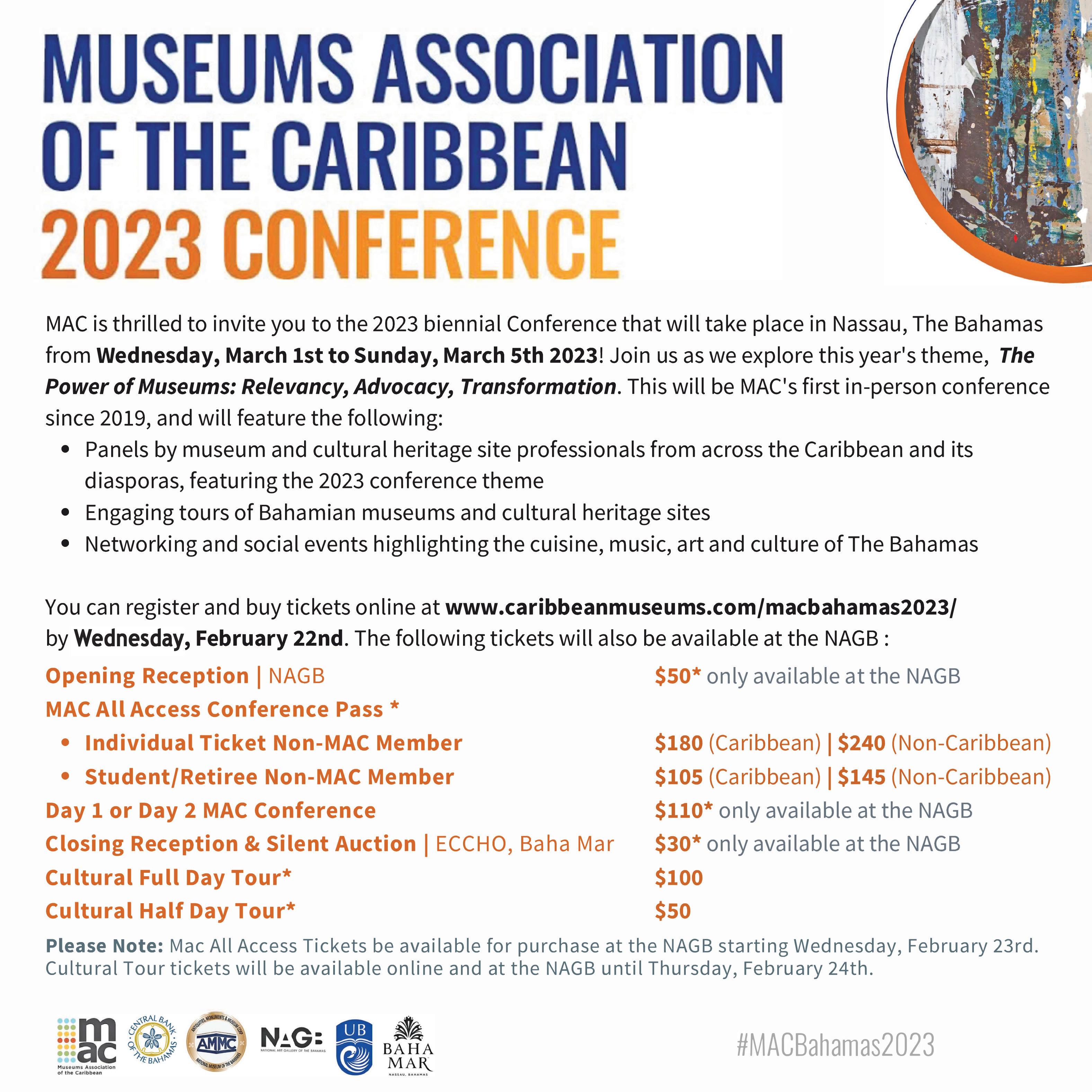

A BAHAMIAN entrepreneur battling to restore Paradise Island’s lighthouse yesterday suffered a setback in his fight with the Government and Royal Caribbean after the Supreme Court found he does not possess a valid Crown Land lease.

Sir Ian Winder, the chief justice, ruled that “regrettably” there was no binding lease agreement between Toby Smith’s Paradise Island Lighthouse and Beach Club and the minister thenresponsible for Crown Lands (ex-prime minister, Dr Hubert Minnis) because the latter did not execute the necessary paperwork by applying his signature.

Mr Smith last night declined to comment when contacted by Tribune Business, so his next moves - including the likelihood of an appeal - are uncertain. However, the chief

justice’s verdict potentially removes much of the leverage he held over both the Government and cruise giant as a result of the ongoing legal proceedings. His position would have been immeasurably strengthened had Sir Ian found in his favour, but Mr Smith now faces the prospect of having to negotiate with both the Government and Royal

Caribbean - and having to rely on their goodwill - for his project to survive and move forward in its present form in the absence of valid Crown Land leases. An appeal, though, would keep the two subject parcels - involving a collective five acres - tied up at least temporarily in the courts.

Mr Smith had based much of his three-year legal fight

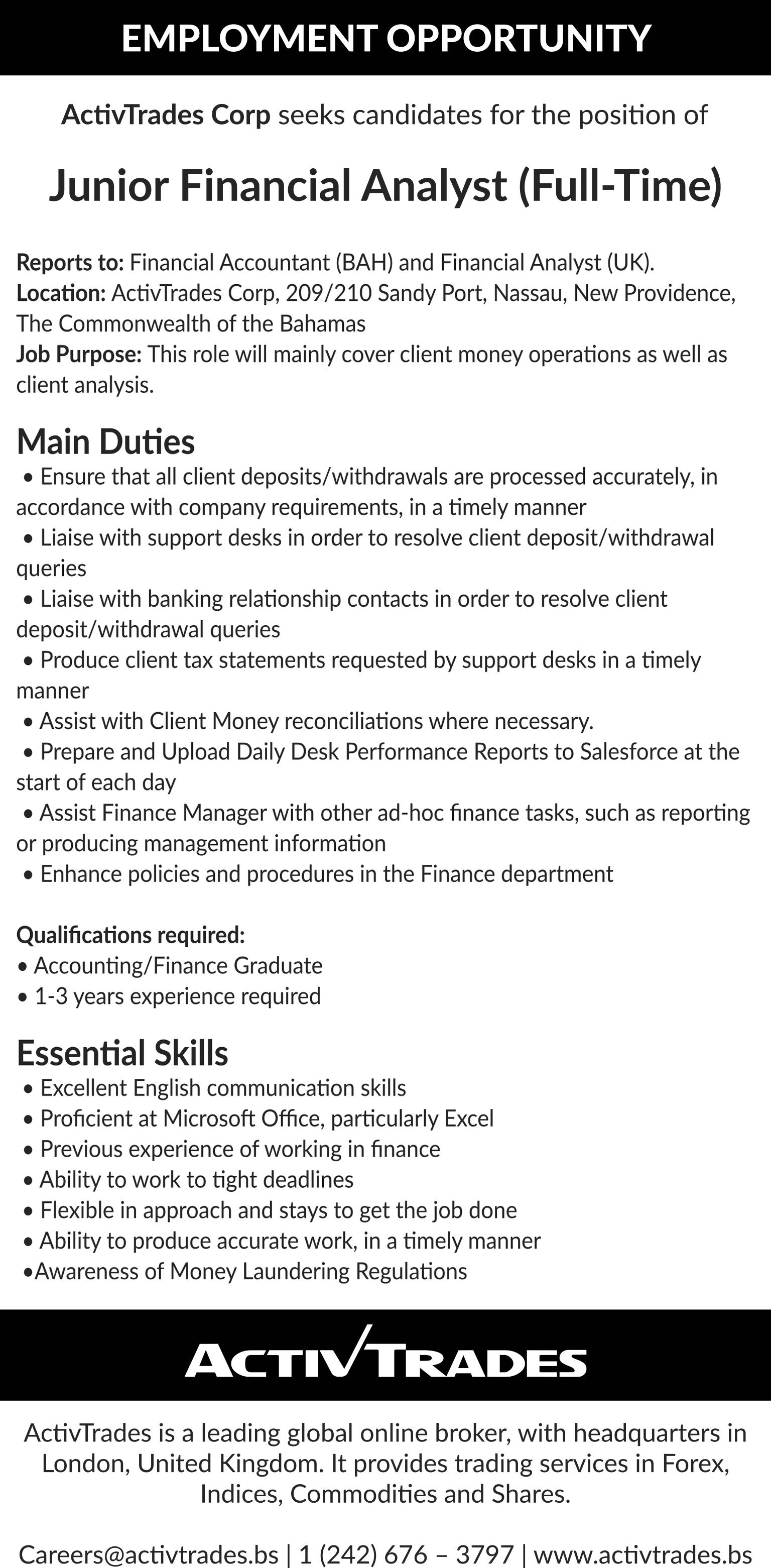

Fidelity targets $25m annual profits despite 2022’s miss

• Chief Justice rules Crown Land deal not valid

• Not binding because Minnis did not execute

• Verdict boost for Royal Caribbean’s plans

on a January 7, 2020, letter from Richard Hardy, acting director of the Department of Lands and Surveys, which was headlined “approval for Crown Land lease” over the two tracts he wanted. These covered a two and threeacre parcel, respectively, and included the lighthouse at Paradise Island’s western end

SEE PAGE B5

Cable’s $10.69m profits swing amid refinancing drive on Aliv

By NEIL HARTNELL Tribune Business Editor nhartnell@tribunemedia.net

CABLE Bahamas yesterday unveiled a positive $10.69m bottom line turnaround for the first half of its 2023 financial year despite encountering frustration over the pace of Aliv’s debt refinancing.

Franklyn Butler, the BISX-listed communications

provider’s president and chief executive, told Tribune Business that it was aiming to improve profitability “quarter by quarter” after the three months to end-December 2022 delivered further net income to back up the prior period’s performance. While the $894,000 second quarter may seem relatively modest, it represented a more than $7m positive swing from the $6.261m loss incurred

during the same period the prior year. And, for the halfyear to end-December, it took Cable Bahamas’ profits above the $4m mark compared to a $6.69m loss in 2021.

Key indicators were trending in the right direction, with revenue and operating income up year-over-year, while operating expenses, depreciation and amortisation and interest

SEE PAGE B7

Bahamas liquidators set to access ‘elusive’ FTX data

By NEIL HARTNELL Tribune Business Editor nhartnell@tribunemedia.net

FTX’s Bahamian liquidators believe they will soon gain access to critical records that have “so far eluded them” while avoiding the risk of costly and time-consuming legal battles in Delaware.

Brian Simms KC, the Lennox Paton senior partner, in a February 6, 2023, affidavit argued that the co-operation agreement thrashed out between himself and his colleagues, and the FTX US team headed by John Ray, was the best mechanism for avoiding protracted delays in the winding-up of the collapsed

crypto exchange’s Bahamian subsidiary. Urging the Supreme Court to “sanction” the co-operation deal, which it now has, Mr Simms effectively said the agreement was the only way he and fellow provisional

SEE PAGE B9

Digital provider calls for Bahamas CSME sign-on

By YOURI KEMP Tribune Business Reporter ykemp@tribunemedia.net

A DIGITAL payments provider yesterday argued that the Bahamas should join the Caribbean Single Market and Economy (CSME) to break down barriers facing local firms seeking to expand into the region.

Nicholas Rees, Kanoo’s chairman, told Tribune Business that The Bahamas not being a signatory to the CSME increases the cost for local firms wishing to do business in other Caribbean jurisdictions.

“We expect to be in multiple Caribbean islands. We are advanced in a number of Caribbean territories. We don’t want to name any territories as yet because we have provisional licenses in two additional territories, and we’re finalizing an acquisition in a further territory,” he said. Mr Rees said difficulties encountered in expanding to other Caribbean jurisdictions include a lack of “tax treaties”, which are “essential” among CARICOM countries. “The Bahamas does not fully benefit from those tax treaties that the other CARICOM members

• Merchant services to help drive increase

• Net income near $22m if ‘one-offs’ stripped

• CEO: ‘Core deposits’ increased by $20m

By NEIL HARTNELL Tribune Business Editor nhartnell@tribunemedia.net

FIDELITY Bank (Bahamas) is targeting $25m in net profits for 2023 despite failing to achieve the same goal last year, its top executive revealed yesterday.

Gowon Bowe, the BISX-listed lender’s chief executive, told Tribune Business he expected the bank’s buoyant merchant services business to drive increased returns for the full year after it was largely responsible for producing a 65 percent increase in fee and commission income to $6.145m in 2022.

And, speaking after Fidelity Bank (Bahamas) unveiled its unaudited financials for the year to end-December 2022, he added that the $20.116m net income was likely to be adjusted upwards as a result of lower loan loss provisions than those shown yesterday.

Explaining that the institution had taken a “conservative” approach to provisioning as it has yet to complete the associated modelling, Mr Bowe said this - combined with the stripping out of some $1.75m in one-off merchant acquisition and marketing costs - would take Fidelity Bank (Bahamas) close to being on par with 2022’s $22.17m profits.

Asked about the bank’s bottom line ambitions for 2023, he told this newspaper: “We are projecting that $25m again. We feel we are

business@tribunemedia.net FRIDAY, FEBRUARY 17, 2023

SEE PAGE B4

SEE PAGE B6

FRANKLYN BUTLER

BRIAN SIMMS KC

PARADISE ISLAND LIGHTHOUSE

GOWON BOWE

$5.76 $5.76 $5.46 $5.92

WHY WE MUST CHERISH OUR SMALL BUSINESSES

Here are seven reasons to support micro and small businesses.

1. Small businesses promote healthier communities

Small businesses benefit local economies, and are essentially the bedrock of the Bahamian economy. It is believed that countries with strong micro and small business sectors have thriving economies, since much of the revenue gains are pumped back into the local community. The multiplier effect results in more jobs, entrepreneurship and stronger communities.

2. Small businesses are driving innovation

Small businesses are at the forefront of innovation

because they are on the ground, hearing and solving real issues that consumers face on a daily basis. A recent US study reveals that micro and small businesses produce more than 16 times more patents per employee than large companies. All of those new, emerging technologies benefit our quality of life by introducing transformative new products and services — not just the next big thing. If you consider that some of the major technology giants started as garagebased micro businesses, we can certainly appreciate the power of the MSME.

3. Small businesses are contributing heavily to job growth

FERGUSON IAN

It is not the growth of large businesses that produces the majority of Bahamian jobs. While the Government and the larger

hotel chains have huge amounts of employees, those numbers still pale in comparison to the collective number of workers attached to micro and small businesses.

Most persons reading this article owe local businesses a “thank you” for their role in our economy — and for our pay cheques.

4. Small businesses are good for the environment Green living is not just a trend any longer, and the pressure is on for businesses to adopt more sustainable manufacturing and production practices. Micro and small businesses are more open to adopting ecofriendly business models as they answer to their sustainably-savvy consumers,

and have the degree of flexibility that larger companies do not.

5. Small businesses have fans They may be small, but they have more than a few cheerleaders. Everyone loves a good underdog story, and wants to see David win the fight against the big giant. This still encourages many to spend money with the local grocer through the week as a means of encouraging them to stay in the ring. Micro and small businesses usually tend to be owned by locals, and everyone recognises the blessing in buying Bahamian.

6. Small businesses give women a fair chance

Larger companies are still overwhelmingly male dominated. Micro and small businesses give women a fair shake at ownership. With some of the entry barriers removed and less capital needed, women have a reasonable chance to make their mark.

• NB: Ian R Ferguson is a talent management and organisational development consultant, having completed graduate studies with regional and international universities. He has served organsations, both locally and globally, providing relevant solutions to their business growth and development issues. He may be contacted at tcconsultants@coralwave.com.

Port partners with Aliv to honour women scientists

THE Grand Bahama Port Authority’s (GBPA)

Keep Grand Bahama Clean organisation has teamed with Aliv to honour women and girls who excel in the sciences.

“Science is elementary to our very existence, and the importance of attracting and retaining women and girls in the diverse field of science here at home and around the world cannot be overstated,” said the GBPA’s vice-president of building and development services, Nakira Wilchcombe.

“Our health and the health of our planet – today and in the future – relies on scientific research and development in a range of disciplines, so it is fitting that the United Nations (UN) has focused the 2023 International Day of Women and Girls in Science on sustainable development goals.”

The awards ceremony marked the International Day of Women and Girls in Science, which was held last Friday, February 10. Among the guests was Ginger

Moxey, minister for Grand Bahama. “In proud partnership with ALIV, Keep Grand Bahama Clean welcomed honorees, dignitaries, media and some of our island’s brightest young female science students to this inaugural event where we celebrate 16 Grand Bahamian women for their work in, and advocacy of, the sciences,” said Mrs Wilchcombe. “Science is vital to a healthy and sustainable economy in Freeport, and it is our great honour to promote and celebrate our own – both accomplished scientists and scientists-in-the-making.” Among those honoured were: Dr Catherine Adderley; LaKeisha Anderson; Samantha Colton; Dr Pamela Etuk; Berthamae McPhee-Duncanson; Shayvonne Moxey-Bonamy; Gia Minns; Nikita Mullings; Letitia Parker; Dr Charlene Reid-Morris; Dr Shamel Rolle-Sands; Bronwen Smith; Meritta Strachan; Annaleta Swann; Dr Chante Wildgoose; Gail Woon.

Mrs Wilchcombe was also honoured for her own 20-year contributions in the areas of environmental science, sustainable planning and development, regulatory compliance, and policy formation. She helped create the Keep Grand Bahama Clean initiative and is a contributing author/ editor to a number of environmental publications and reports.

“In keeping with the International Day of Women and Girls in Science this month, Keep Grand Bahama Clean is also pleased to sponsor and launch an essay competition among Grand Bahama’s female students,” added Mrs Wilchcombe.

“Through this competition, we have asked young women to share their perspectives, experiences and ideas on science using the essay topic: ‘As The Bahamas celebrates 50 years of Independence, how far have our women come in the field of science, and what role do Bahamian women play in the further advancement of science in the country?’.”

PAGE 2, Friday, February 17, 2023 THE TRIBUNE

VAT HEALTH CLAIMS CHANGE MAY DRAIN FOREIGN RESERVES

THE changed VAT treatment on health insurance claims payouts could further drain The Bahamas’ foreign reserves by driving patients to seek care outside the country, a senior executive warned yesterday.

Julian Rolle, BAF Financial’s managing director, told a Rotary West of Nassau luncheon that Bahamians with private health insurance may opt to have surgeries and more expensive treatments performed outside this nation given that from April 1, 2023, they will become responsible for paying 100 percent of the VAT due on their care costs.

Presently, persons with private medical insurance only pay VAT on the co-pay or deductible, which is typically 20 percent of the care or medication costs. However, the Ministry of Finance and Department of Inland Revenue are altering the VAT treatment of health insurance claims payouts such that insurers will no longer be able to recover the 10 percent levy by claiming it as an ‘input’, thus enabling them to net it off against the output VAT paid to the Government.

In practice, patients - as the end-consumer - will now also become responsible for paying VAT on the 80 percent share of medical costs paid by insurers. The latter will almost certainly pass this sum on to consumers, with the end result being that the proportion of medical costs borne by patients will now increase.

Mr Rolle explained that shifting the VAT burden from health insurer to consumer will inevitably increase medical cost expenses for the latter.

He gave the example of a patient purchasing $100 worth of medicines, where private insurance covers 80 percent of the cost and the individual is responsible for

the $20 co-pay/deductible balance. Only the latter presently attracts 10 percent VAT, costing the patient some $2 in taxes and resulting in their total bill coming to $22. But, from April 1, with insurers unable to recover the VAT payable on their $80 share, the client will now be responsible for paying the additional $8 in tax as well. This will take the sum due from the patient from $22 to $30, an $8 or more than 36 percent increase. Given that medications have to be refilled regularly, this represents a recurring and increased financial burden at a time when Bahamians are already struggling to make ends meet due to the cost of living crisis.

Mr Rolle said: “If the cost goes up by 36 percent on rent, or school fees, I’m sure no one in this room would like it. I certainly don’t want my medication to increase by 36 percent. The same rules apply to bigger numbers. If the service costs

you $10,000 because you’re in the hospital, now that’s going to cost you $13,600.

“As a part of the education campaign and the BIA (Bahamas Insurance Association), we can include numerous examples on our website to make sure that before they educate the public, the DIR’s (Department of Inland Revenue) new VAT rules will cause disruption to local healthcare providers as well.

“The new interpretation of the rules increases the cost of using health insurance to access services from Bahamian providers. The insureds can escape this additional tax by opting to receive treatment overseas. This will reduce the clientele of local Bahamian healthcare providers and increase the drain on our foreign exchange reserves as well.” However, the extra travel and accommodation costs involved will still likely deter some from seeking overseas care.

The revised VAT treatment will also require

doctors, other medical practitioners and pharmacies to adjust their accounting and point of sales systems to collect the tax and remit it to the Government now that the insurers will no longer be able to claim it as an input expense.

“That means now, when you walk into your pharmacy, they need to be charging you differently. Everybody’s got a computer system. All of these need to be changed,” Mr Rolle said. “When that happens over

at Doctor’s Hospital and at your physician, all of those changes will need to take place.

“These changes and systems is another thing that will undoubtedly increase the cost of services. What was once a simple process of charging a co-pay to someone with insurance will now involve charging VAT on services, which in some cases have yet to even be determined.”

Mr Rolle continued: “The BIA can state insurance

companies did not change the policy on paying VAT. The Department of Inland Revenue indicated insurance companies were not the beneficiary of services. “One would think that this is somebody changing the profit of the insurance company. However, this is another math problem. Let’s look at the math on this one: The VAT that the insurance company collects from me every day

SEE PAGE B6

POSITION AVAILABLE

Small/ Medium Resort is searching for a candidate to fill a position of a Night Auditor. The ideal candidate must be able to handle both the duties of the front desk agent and accounting duties. The auditor accounts for the day’s business and remains available to serve the overnight needs of customers.

Responsibilities:

• Posts room charges and taxes to guest accounts.

• Posts guest charge purchase transactions not posted by the front office cashier.

• Checks figures posting and documents for accuracy.

• Verifies all account postings and balances.

• Tracks room revenues, occupancy percentages, and other front office statistics.

• Run end of day process in property management software (PMS).

• Understand principles of auditing, balancing, and closing out accounts.

• Knows how to operate PMS and other front office equipment.

• Understand and knows how to perform check-in and check-out procedures.

Core Competencies:

• Excellent oral and written communication skills

• Ability to execute duties with accuracy and proficiency

• Demonstrate a keen eye for details

• Ability to work under pressure and follow company guidelines

• Strong interpersonal skills and ability to maintain a harmonious relationship with co-workers

• Ability to maintain confidentiality

• Reliable, dependable and flexible team-player

Required Qualifications:

• Bachelor’s Degree in Accounts

• 2 + years’ experience in field or similar position

• Excellent computer skills and proficiency

Submit Resume to info@sandyport.com

P.O. Box SP-63162, Nassau, Bahamas, fax (242) 327-6512

Head of Facilities and Maintenance

This is a rare and exciting opportunity to join an outstanding and ambitious team at Inspired who recently opened premium school on the island of New Providence in The Bahamas. The school has already proven to be incredibly successful and is now moving into its second year.

We are looking for an exceptional Head of Facilities and Maintenance, who brings outstanding experience, high standards and a solution focused approach. You will be able to demonstrate the ability to assist in the key decision making related to systems, their commissioning and critical infrastructure required for our new, state of the art school campus in Western New Providence. Working with the site delivery team, consultants and others, as Head of FM you will be central to ensuring a smooth transition of the project from live construction to practical completion and handover. Amongst other responsibilities you will: deliver monthly and annual strategic reporting and planning; produce a multi-year campus maintenance plan; coordinate all maintenance related works to the campus and its facilities; support the site team throughout the current construction process, whilst always ensuring regulatory compliance and adherence to global best practice.

King’s College School offers the highest quality modern facilities in a purpose-built state-of-the-art facility on an expansive 10-acre campus, ensuring that students benefit from a learning environment that has been designed for how students learn in the modern day.

Facilities include football pitches, tennis and padel courts, as well as dance, drama, and art studios. There will also be state-of-the-art science labs, a multi-purpose hall, a 25m swimming pool, an adventure park playground, and plenty of green spaces and shaded areas for students to enjoy.

When joining King’s College School, The Bahamas, you will join the family of the award-winning Inspired Education Group, the leading global group of premium schools, with over 80 schools operating in 23 countries. We offer a competitive salary and benefits and access to best practice and career pathways with some of the very best schools worldwide.

To apply please send a CV and letter of motivation to admin@kingscollegeschool.bs

THE TRIBUNE Friday, February 17, 2023, PAGE 3

By YOURI KEMP Tribune Business Reporter ykemp@tribunemedia.net

NIGHT AUDITOR

Fidelity targets $25m annual profits despite 2022’s miss

really in the $22m range, and with the growth that we have seen on the fees and commissions with merchant services, we can increase profitability.

“We’ve set for 2023, in our January Board meeting, a target profitability of $25m. They tease me that I may have been prophetic, but just a year in advance.”

Fidelity Bank (Bahamas) had forecast that it would achieve a $25m ‘bottom line’ in 2022, although it subsequently revised these projections to between $22.5m to $23m towards the end of 2022.

The profits shown in the unaudited financials came in under the revised targets, but Mr Bowe said there was no cause for alarm. “We have two elements that are still being considered,” he explained, noting that they are not audited financial statements. “The expected

loss on the credit portfolio. With the improvement seen in credit quality over the last year, and the reduction in the loan portfolio, we expect there to be some release from the provisions.”

The Fidelity chief did not quantify this sum, although the unaudited financials showed a 14 percent or $843,000 year-over-year increase in loan loss provisions to $6.844m, but added: “We have taken what I call the conservative view for the unaudited submissions. The specific provisions we know are correct. The model, which requires inputs and judgment, there’s going to be a bit more work to complete that, which should be done by the end of the month.

“We’re very confident that the profitability will only go up.” Mr Bowe, though, conceded that 2022 did not finish with the anticipated increase in new

loan approvals ahead of the Christmas shopping season.

“The contributing factor was that fourth quarter loan book growth was not what we had projected,” he explained.

“We saw positive signs in October and November, but persons did not continue that through December. December was a relatively flat month in terms of credit growth. We lost a bit of the quarter’s momentum.” Fidelity Bank (Bahamas), in common with many of its commercial bank rivals, struggled to grow its loan book again in 2022.

The unaudited financial statements showed the loan portfolio shrunk by 7.4 percent, or more than $29m, in 2022 as it fell from $401.585m at year-end 2021 to $372.034m. “When we look at the Central Bank statistics, lending for the year continued to contract.

We’re not immune to that.

The industry is experiencing

where repayments are exceeding new credit that is being extended,” Mr Bowe explained. The $2.4m year-over-year increase in fee and commission income drove the rise in Fidelity Bank (Bahamas) operating income for 2022 to $59.27m compared to $57.338m the year before. A decline in interest income, and reduced interest expenses, effectively cancelled each other out to leave net interest income almost perfectly flat against 2021 comparatives at $52.941m.

The lender’s bottom line was narrowed due to a near-$4m jump in operating expenses, which increased by 11.2 percent from $35.174m to $39.128m. General and administrative expenses were the main culprit, growing by 24.2 percent or almost $3.3m to $16.891m as opposed to $13.6m in 2021. There was

also a $700,000 rise in staff salaries and benefits.

Explaining the general and administrative expenses hike, Mr Bowe said: “We have one-off costs with the merchant acquiring business. If you look at it in terms of the net impact, fee and commission income almost doubled, which is attributed to merchant acquisition efforts.”

Pointing out that Fidelity Bank (Bahamas) had decided to take these costs upfront, rather than spread them out or amortise them over several years, he said merchant acquisition costs were among “two drivers” of the general and administrative expenses rise.

“The merchant acquisition costs, we believe $1m are nor recurring when we look at where we are,” Mr Bowe told Tribune Business. “And with the marketing and public relations, there was a $750,000 increase on that one. We are focusing attention on data mining the public relations effort by saying which areas were more effective, and which are more traditional and can be reduced. We’ve seen the PR campaign in 2022 be very fruitful in terms of brand recognition.

“When we strip those out, before any adjustments to the provisioning modelling, we will be on par with the prior year. If you take the lower profit amount with a grain of salt, if you will, there’s opportunity. If you see the fees and commissions income, we’re on the right track.”

While Fidelity Bank (Bahamas) saw its total deposit base shrink by

almost $123m year-overyear in 2022, suffering a near 15 percent decline to $656.88m, Mr Bowe said this was no cause for alarm as “core customer” deposits actually expanded by $20m.

“We don’t seem to be able to effectively shed deposits,” he added. “Despite seeing deposits from clients decline, that’s really institutional client money kept on demand. That moves up and down. Our core deposits went up by $20m, and institutional investors went down by $120m. That’s not money we consider to be core deposit money. That support is still intact.”

Noting that Fidelity Bank (Bahamas) produced a return on equity of 22 percent last year, Mr Bowe said it was vital that this remain above 20 percent in most years to build a buffer against shocks from natural disasters and pandemics.

“From a regulatory standpoint there’s justifiable concerns when they see the return on equity dropping below 15 percent because any year can be like a COVID year or a significant natural disaster that could have an impact on provisions,” he explained.

“Sometimes there’s not appreciation by the tax authorities and persons who are not shareholders that you do need that level of return because there are years when there is a confluence of losses. It’s an industry that is taking significant risk and needs to stay stable. We are a safe haven for deposits. Depositors don’t want you taking risks that put their money in jeopardy.”

Share your news

The Tribune wants to hear from people who are making news in their neighbourhoods. Perhaps you are raising funds for a good cause, campaigning for improvements in the area or have won an award. If so, call us on 322-1986 and share your story.

The Winterbotham Trust Company Limited is looking to fill the position of Assistant Corporate Services Administrator

Main Function: Provides for the efficient ongoing administration of corporate clients and support to Management.

Position will report to the Corporate Services Supervisor. In this challenging position you will be responsible for but not limited to the following tasks:

• Assist with the ongoing administration of foreign and domestic companies

• Primary liaison with third party providers for corporate client matters

• Preparation and filing of Annual Returns, Statements and Declarations

• Legalization of documents with various foreign consulates

• Preparation of minutes/resolutions

• Assisting with company Dissolutions and Good Standings

• Preparation of Share Certificates

• Processing license applications for entities registered with Winterbotham

• Ensuring accurate client billing and statements of accounts

• Ensuring ongoing and accurate update of Company Database.

• Ensuring compliance with company and regulatory requirements

• Be alert to current and new operating procedures and legislation relevant laws, rules and guidelines

• Responding to client inquiries

• Other duties as assigned.

The successful applicant must have the following qualifications:

• Associates’ Degree in Business Administration, Economics, Banking & Finance or Accounting or equivalent

• Minimum of two (2) years’ experience in financial services or similar position

• Knowledge of various relevant industry Acts eg. The IBC and Companies Acts, FCSP and External Insurers Acts

• Above average fluency with spoken and written English at a professional level

• Basic knowledge of math and some accounting principles

• Computer literate (MS Office products and Microsoft Windows operating system)

• Strong organization and communication skills

• Team Player

• Capability to work under pressure

Applications/resume should be sent by e-mail to: jobs@winterbotham.com

Under reference “Assistant Corporate Services Administrator”

ABSOLUTELY NO TELEPHONE INQUIRIES WILL BE ACCEPTED

Persons not meeting the above requirements need not apply

Please note that only individuals short-listed for an interview will be contacted

Deadline for applications Wednesday, February 22nd, 2023

PAGE 4, Friday, February 17, 2023 THE TRIBUNE

FROM PAGE B1

LEASE SETBACK STRIKES PI LIGHTHOUSE ENTREPRENEUR

and a ‘beach break’ destination in the Colonial Beach area.

The Bahamian entrepreneur signed the lease forwarded by Mr Hardy, and returned it to the Government for execution by the minister responsible for Crown Lands, who was then Dr Minnis. The latter, though, did not sign the lease on the Government’s behalf as it emerged that Royal Caribbean Cruise Lines had rival designs on two of the Crown Land acres also sought by Mr Smith for its own $110m Royal Beach Club project.

Mr Smith has always maintained that, as a Bahamian entrepreneur, he was shoved aside to make way for a major foreign investor even though he had received his approvals and allegedlybinding Crown Land leases first. As a result, he initiated legal action against the Government - namely the attorney general - for breach of contract and exemplary damages over its purported failure to uphold a binding lease agreement.

The Chief Justice, in yesterday’s ruling, noted that Mr Smith initially applied in April 2012 to lease 17 acres of Crown Land at Paradise Island’s western end for a project that included “restoration and upkeep of the lighthouse”. Paradise Island Lighthouse and Beach Club was incorporated in 2018, and on May 23 that year, Mr Smith was informed by the Bahamas Investment Authority (BIA) that he had been approved to lease five acres for a 21-year term.

“Smith’s evidence was that in or about 2012 he noticed that the lighthouse at Paradise Island was ‘derelict and abandoned’,” Sir Ian recorded in his ruling. “He says he decided to save and preserve the lighthouse, considering it to be a cultural asset. His aspiration was to restore it along with the Keeper’s Quarters.

“He also intended to install docks for ease of access, as well as develop and build a beach club for tourists and residents. In this

vein, he carried out some research which revealed that the lighthouse and its surrounding land belonged to the Crown.”

The Crown Land ultimately offered was less than one-third of what had been originally requested for a $2m project designed to offer lighthouse tours, and recreational and entertainment, as part of a beach break destination designed to lure both Bahamians and visitors. A Memorandum of Understanding (MoU) was signed with the Antiquities, Monuments and Museums Corporation (AMMC) on October 2, 2018, and Mr Smith’s project seemed to be moving forward.

Mr Hardy’s January 7, 2020, letter enclosing the lease agreement duly arrived and was signed by Mr Smith, who returned it to the Department of Lands and Surveys for execution. The yearly rent was fixed at $5,224 per acre or $1 per paying visitor - whichever was greater. “Smith executed the lease agreement on behalf of Paradise and returned it to the Department of Lands and Surveys on January 9, 2020, for execution by the minister,” the Chief Justice noted. “The minister did not execute the lease agreement.

On February 27, 2020, he met with then-attorney general Carl Bethel KC, Candia Ferguson [then-director of investments- and Joshua Sears.”

The latter was Dr Minnis’ senior policy adviser. “During the meeting Smith was told that there was no agreement between Paradise and the minister responsible for Crown Lands,” Sir Ian said. “Smith says that at that meeting he was informed that the January 7, 2020, letter, MoU and draft lease agreement that he received were of no effect and not valid.

“Smith’s evidence is that the lease did not materialise as the land outlined in the lease provided to Paradise was instead promised to Royal Caribbean Cruise Lines for their development.” This prompted Mr Smith to initiate his legal

claim challenging the Government’s position and assertions, and to seek judicial validation that he had a lease that was binding and legally enforceable.

“The central issue to be determined in this action is whether there was an agreement for a lease between Paradise and the minister responsible for Crown Lands, and therefore an enforceable lease,” Sir Ian wrote. “This calls for a determination as to whether the lease delivered to Paradise, absent the signature and/ or execution of the minister, constitutes a valid and/or enforceable lease agreement once signed by Paradise.”

Mr Smith argued that Mr Hardy’s letter and the attached lease, which he signed, proves there was an agreement and “an equitable lease” in place. The Government, though, rejected this interpretation by arguing that Mr Hardy’s letter was “part of the continued negotiations” and “an ongoing approval process”. It argued that the absence of a ministerial signature and seal meant the lease was invalid under the Conveyancing and Law of Property Act.

Siding with the Government, Sir Ian ruled: “Having considered the evidence as a whole, I am not satisfied there was a valid agreement entered into as I find the agreement was subject to execution, and/or there was no part performance. Regrettably for Paradise there must be a meeting of the minds for there to be an agreement.”

The Chief Justice described Mr Hardy’s letter as “more akin to an offer” as it contained proposed lease terms and a description of the property. He added: “I am not satisfied, however, that it was an unconditional offer” because it depended on the minister’s execution to become valid.

And Sir Ian found that Mr Smiths’ February 12, 2020, letter to Dr Minnis, where he voiced fears about being double-crossed in favour of Royal Caribbean, “betrays its own view that the document was subject to execution by the minister”.

The Winterbotham Trust Company Limited is looking to fill the position of Corporate Services Administrator

Main Function: Provides for the efficient ongoing administration of corporate clients and support to management and will report to the Corporate Services Supervisor.

In this challenging position you will be responsible for but not limited to the following tasks:

• Assist with the ongoing administration of foreign and domestic companies

• Primary liaison with third party providers for corporate client matters

• Preparation and filing of Annual Returns, Statements and declarations

• Legalization of documents with various foreign consulates

• Preparation of minutes/resolutions

• Assisting with company dissolutions and Good standings

• Preparation of Share Certificates

• Processing license applications for entities registered with Winterbotham

• Ensuring accurate client billing and statements of accounts

• Ensuring ongoing and accurate update of Company database.

• Ensuring compliance with company and regulatory requirements

• Be alert to current ad new operating procedures and legislation relevant laws, rules and guidelines

• Responding to client inquiries

• Other duties as assigned.

The successful applicant must have the following qualifications:

• Associates’ Degree in Business Administration, Economics, Banking & Finance or Accounting or equivalent

• Minimum of three (3) years’ experience in financial services or similar position

• Knowledge of various relevant industry Acts eg. The IBC and Companies Acts, FCSP and External Insurers Acts

• Above average fluency with spoken and written English at a professional level

• Basic knowledge of math and some accounting principles

• Fluency in Spanish and Portuguese (optional)

• Computer literate (MS Office products and Microsoft Windows operating system)

• Strong organization and communication skills

• Team Player

• Capability to work under pressure

Applications/resume should be sent by e-mail to: jobs@winterbotham.com

Under reference “Corporate Services Administrator”

ABSOLUTELY NO TELEPHONE INQUIRIES WILL BE ACCEPTED

Persons not meeting the above requirements need not apply Please note that only individuals short-listed for an interview will be contacted

for applications

Mr Smith wrote that Dr Minnis had advised him that “the land I am asking for in the Crown Land lease would not be compromised with Carnival, Royal Caribbean or any other cruise company”.

The Chief Justice also noted Mr Smith writing “there is no update other than it awaits your signature” in reference to the lease, while describing the Crown Land as something “that I have applied for”. As a result, he dismissed Mr Smith’s claim.

It now remains to be seen whether Royal Caribbean had supplied the Davis administration with a revised project proposal that reduced the seven acres of Crown Land it had secured from its Minnis predecessor via an effective 150-year lease. It had been suggested that the cruise line would accept five acres, and relinquish two that were the subject of Mr Smith’s claim.

However, the Government neither confirmed nor denied that Royal Caribbean had submitted such revisions although it said talks over the latter’s Royal Beach Club destination were continuing. Chester Cooper, deputy prime minister and minister of tourism, investments and aviation, told this newspaper in a statement: “Government is in ongoing dialogue with Royal Caribbean in relation to its proposed development on Paradise Island.

“This does not include any discussion in relation to land that is in dispute. The matter with Toby Smith remains

before the court and we are not at liberty to speak to it.”

Prime Minister Philip Davis KC, while in Opposition, had pledged that he would cancel any Crown Land lease in favour of Royal Caribbean. This promise came when Mr Smith asserted that he secured his deal before the cruise giant, and that the former Minnis administration sought to ditch his project to make way for Royal Caribbean after realising its mistake. Royal Caribbean has amassed around 13.5 acres on Paradise Island’s western end by buying out private landowners in the area, or taking options on their properties,

but its efforts to lease the seven Crown Land acres brought it into conflict with Mr Smith.

The Royal Beach Club is forecast to generate $26m in extra annual visitor spending, a figure that rises to $650m when extended over the initial 25-year lease term. Royal Caribbean previously said its $110m Paradise Island investment will boost overall visitor spending by $1bn over a ten-year period, although it is uncertain where this impact falls.

The cruise line, though, has repeatedly said that the Royal Beach Club does not have space to accommodate all its Nassau visitors and it has no intention of keeping them there for the day. It added that they will be able to circulate freely in Nassau.

THE TRIBUNE Friday, February 17, 2023, PAGE 5

FROM PAGE B1

Deadline

Wednesday,

22nd,

February

2023

Digital provider calls for Bahamas CSME sign-on

FROM

benefit from, so I hope that that would be exciting for all Bahamian businesses and entrepreneurs to look at in terms of, you know, they want to expand their businesses,” he added.

“CARICOM territories share various economic benefits in terms of cross investments from one territory to the next. For example, the expatriation of dividends and royalties are taxed, and so within the CARICOM network that is not available for non-CSME members and such that further economic incentives can be delivered to the market that can foster and create a trade amongst us.”

Signing on to the CSME is something The Bahamas should “significantly” look at because of the benefits to local firms, Mr

VAT health claims change may drain foreign reserves

Rees said. “We all share common commonalities across all the Caribbean regions, and we all have different, different challenges. I think in combining resources and our minds collectively across the region, we can solve each other’s solve each other’s problems,” he added.

The Bahamas has previously rejected signing on to the CSME due to fears that it will permit the free movement of people and worsen an already significant Immigration problem. The Bahamas has been similarly skittish about becoming a full member of the World Trade Organisation (WTO), fearing that it will open up the economy to foreign firms including those reserved for “Bahamians only.”

JOB OPPORTUNITY

FROM PAGE B3

or every month hasn’t changed. My premium is $300. It was always $300, and I’ve always paid $30 of VAT. The insurance company will pay that same $30 over to the Government.

“The claim that is paid by the insurance company is changed due to the change in the interpretation of the law. So what does that mean?

The insurance company would have paid $8 in VAT on my medication. They would have deducted that payment from the $30 that is collected on my premium, and the insurance company would have then paid $22 directly to the government and given the $8 over to the pharmacy for them to forward it to the Government.

“So the outflow from the insurance company hasn’t changed. We

pay the Government $30. Nothing has changed, nothing has moved. The only thing here that’s really increased is the Government will now get $30 directly from the insurance company and now they will also get $8 from the patient.”

The Ministry of Finance is arguing that it is “clearly against the VAT Act” for insurers to claim back the 10 percent levy on medical claims payouts by netting it off against the VAT paid on the premium - a practice allegedly costing the Public Treasury millions of dollars. It added that one audit of an unnamed health insurance provider in 2021 showed it had “received over $20m illegally” through this mechanism. Its, and the Department of Inland Revenue’s, position is that VAT is payable on medical insurance claims payouts because these

are being made on behalf of the end-user - the consuming patient - and thus should attract the tax. Health insurers are currently claiming this as ‘input’ VAT, offsetting it against their ‘output’ tax on premiums and effectively allowing the likes of Colina, Family Guardian and CG Atlantic to claim it back from the Government.

The BIA is arguing that the Ministry of Finance is wrong to treat the payment of clients’ medical expenses and the care received from providers as two separate services. Its case is that since health insurance and medical services are both VAT-able, health insurance claims should continue to be taxdeductible for health underwriters, otherwise the Government would be knowingly applying two layers of VAT.

in the grocery business

should

Email resume to charles@acgbahamas.com Only persons with

N

N O T I C E IS HEREBY GIVEN as follows:

(a) ETAMI ENTERPRISES LIMITED is in voluntary dissolution under the provisions of Section 138 (4) of the International Business Companies Act 2000.

(b) The dissolution of the said company commenced on the 14th February, 2023 when the Articles of Dissolution were submitted to and registered by the Registrar General.

(c) The Liquidator of the said company is Bukit Merah Limited, The Bahamas Financial Centre, Shirley & Charlotte Streets, P.O. Box N-3023, Nassau, Bahamas

Dated this 17th day of February, 2023

N O T I C E IS HEREBY GIVEN as follows:

(a) RIVER FOCUS LIMITED is in voluntary dissolution under the provisions of Section 138 (4) of the International Business Companies Act 2000.

(b) The dissolution of the said company commenced on the 14th February, 2023 when the Articles of Dissolution were submitted to and registered by the Registrar General.

(c) The Liquidator of the said company is Bukit Merah Limited, The Bahamas Financial Centre, Shirley & Charlotte Streets, P.O. Box N-3023, Nassau, Bahamas

Dated this 17th day of February, 2023

Bukit Merah Limited Liquidator O T I C E RIVER FOCUS LIMITED

C E IS HEREBY GIVEN as follows:

N O T I

(a) YIN FAMILY’S COMPANY LIMITED is in voluntary dissolution under the provisions of Section 138 (4) of the International Business Companies Act 2000.

(b) The dissolution of the said company commenced on the 14th February, 2023 when the Articles of Dissolution were submitted to and registered by the Registrar General.

(c) The Liquidator of the said company is Bukit Merah Limited, The Bahamas Financial Centre, Shirley & Charlotte Streets, P.O. Box N-3023, Nassau, Bahamas

Dated this 17th day of February, 2023 Bukit Merah Limited

PAGE 6, Friday, February 17, 2023 THE TRIBUNE

PAGE B1

Liquidator

O T I C E YIN FAMILY’S COMPANY LIMITED

N

Bukit Merah Limited Liquidator O T I C E ETAMI ENTERPRISES LIMITED

N

apply

be

and

Grocery Store Managers needed

experience

must

energetic, organized

detail oriented.

expense had all declined. However, Mr Butler said interest and preference share dividend payouts could be further reduced if Aliv’s high-priced debt is refinanced.

Cable Bahamas holds a 48.25 percent interest in the mobile operator, plus Board and management control, with the Government owning the 51.75 percent majority equity interest. Both hold their respective stakes via Aliv’s parent, HoldingCo, and Mr Butler yesterday hinted at some slight frustration that Aliv’s refinancing has not progressed more rapidly.

“We anticipate that could drop even further,” he told this newspaper of Cable Bahamas’ interest and dividend payments, as well as Aliv’s losses. “We’d like to refinance their [Aliv’s] debts as well. We’re kind of at a stalemate with the shareholder as to how to do that. We’re paying 8 percent on that, and in the next

four years a lot of that debt matures. “As we can work to the refinancing of that debt, or reduction of that debt in the next four years, it will put the group in an even stronger position. That’s not a one year or one-off type of thing.” Asked what he meant by “stalemate”, Mr Butler replied: “We are still working with them [the Government] to refinance some of the debt that Aliv has on its balance sheet.

“Government takes forever. We don’t have any differences. We had anticipated by November/ December we would have that refinancing addressed as we took on $50m in extra debt. Right now Cable is carrying that and it’s just driving up our financing costs. If we price that in, it gets even better.” The first $4m principal payment on Aliv’s debt was made in December 2022.

Cable Bahamas’ mid-2022 refinancing, which raised $219m compared to the target $169m, has provided a solid platform for the company’s growth ambitions

NOTICE

NOTICE is hereby given that JOEL DIEUFORT OLIBRICE of Hay Street, New Providence, The Bahamas is applying to the Minister responsible for Nationality and Citizenship, for registration/naturalization as a citizen of The Bahamas, and that any person who knows any reason why registration/ naturalization should not be granted, should send a written and signed statement of the facts within twenty-eight days from the 17th day of February, 2023 to the Minister responsible for nationality and Citizenship, P.O. Box N-7147, Nassau, Bahamas.

NOTICE

NOTICE is hereby given that NELLIN ANDRE of Porkfish Drive, Solider Road, New Providence, The Bahamas is applying to the Minister responsible for Nationality and Citizenship, for registration/ naturalization as a citizen of The Bahamas, and that any person who knows any reason why registration/naturalization should not be granted, should send a written and signed statement of the facts within twenty-eight days from the 17th day of February, 2023 to the Minister responsible for nationality and Citizenship, P.O. Box N-7147, Nassau, Bahamas.

NOTICE

NOTICE is hereby given that DEVANO ASHTON HENDFIELD of General Delivery Sea Grape, Eight Mile Rock, Freeport, Grand Bahama. is applying to the Minister responsible for Nationality and Citizenship, for registration/ naturalization as a citizen of The Bahamas, and that any person who knows any reason why registration/naturalization should not be granted, should send a written and signed statement of the facts within twenty-eight days from the 17th day of February, 2023 to the Minister responsible for nationality and Citizenship, P.O. Box N-7147, Nassau, Bahamas.

NOTICE is hereby given that MORRIS ALEXANADER LINDSAY of P.O. Box SP-60726 #6 Nelson Street, Yellow Elder Gardens, New Providence, The Bahamas is applying to the Minister responsible for Nationality and Citizenship, for registration/naturalization as a citizen of The Bahamas, and that any person who knows any reason why registration/ naturalization should not be granted, should send a written and signed statement of the facts within twenty-eight days from the 10th day of February, 2023 to the Minister responsible for nationality and Citizenship, P.O. Box N-7147, Nassau, Bahamas.

by replacing higher-interest preference shares with lower cost ones. And the BISX-listed communications provider has made no secret of its desire to put the extra capital to good use by assisting Aliv with its refinancing.

Elsewhere, Mr Butler described Cable Bahamas’ $80m fibre-to-the-home rollout across New Providence as an infrastructure upgrade that will be “game changing” and “transform the customer experience”. He added: “We are now deep into the South Beach area. We have started in Adelaide. We have about 200 test customers who are testing the service.

“We are just waiting to complete more of the back office integration. That is one area where we are slightly behind from a plan perspective. We wanted to be deeper into the commercial launch.” Mr Butler said Cable Bahamas is providing customers with an online portal where they can sign up for service and see where fibre-to-the-home is being rolled out.

The Cable Bahamas chief added that he also has an app on his phone that shows where the network has been installed, saying: “I can tell you street by street where we have live services.” Describing fibre-to-the-home’s ultimate impact, he argued: “I think it’s going to be huge. We believe it’s really going to allow us to do some pretty creative partnerships. There is a partnership we intend to launch with a big security provider.”

Mr Butler said Cable Bahamas is poised to become one of the few distributors outside the US for Ring security products, and added: “We know what is happening with crime and everything else. We think this is a way to drive digital transformation and the Internet of Things (IOT), connecting modems with SIM cards so you have coverage on IOT to protect your home.”

Cable Bahamas’ second quarter revenues rose 10.8 percent year-over-year, jumping over $5.5m to $57.797m, and driven largely

by its Aliv and business solu-

tions segments. Mr Butler said its fixed services, namely traditional voice services and cable TV were “pretty much flat”, growing by 1 percent.

“We’ve been focused on synergies between the group,” he added. “We believe we’re going to continue to see better operating margins. We’re looking to see where we can consolidate fixed and mobile leadership and for marketing purposes. We’ve made good progress on that, and expect that to continue in the next few quarters.”

Mr Butler explained that the leadership consolidation, for example, involved having one consumer head for both fixed and mobile products as opposed to two heading each. “We’re trying to group buy as opposed to individually buy for Aliv and REV,” he added. “If we buy for the group we get our dollar to go a bit further. We’ve been pretty intent about that over the last few quarters, and we expect that to continue for the next four or five quarters.”

Operating expenses for the 2023 half year were down by close to $1.5m compared

VACANCY

Office Attendant/Cleaner

Contractual Services Needed:

• Ensuring that all office facilities are clean at all times.

to the year before, while amortisation and depreciation were relatively flat. As a result, Cable Bahamas’ operating income for the six months to end-December 2022 increased by 87.7 percent year-over-year, surging from $8.857m to $16.625m. Interest expense, due to the reduction in Cable Bahamas’ bank debt, was cut by 43.8 percent year-over-year to $4.785m as opposed to $8.514m in the prior year. However, dividend payments on the group’s preference shares rose by 42.4 percent to $8.378m from $5.883m “I think we are pretty much where we hope to be from a budget perspective; probably slightly ahead on revenue, but our operating expenses lie pretty much where we’d expect them to be.... We are pretty attentive to the customer base. We kind of know where our pain points are. We anticipate growth to continue, but know we have a competitor that is not going to lie down and play dead. We have to remain vigilant and ensure customers appreciate there is a difference.”

• To maintain cleanliness of offices, office equipment and furniture and clean those as and when required.

• Dusting and polishing, cleaning all furniture and accessories.

• Keeping inventory of office supplies

• Cleaning the interior of the windows and mirrors.

• Clean and sanitize bathing spaces, sinks and toilets; vacuuming, sweeping and mopping.

• Monitoring the physical and functional state of general equipment (for example coffee brewer, microwave and fridge and where faults are detected bringing this to the attention of the Office Manager.

• Supporting the Office Manager in preparing for meetings.

• Managing the kitchen/staff rooms and ensuring its proper use.

• To attend to scheduled and/or notified of expected visitors and promptly serve them with water, tea/coffee and other needs as requested.

• Ensure all areas are stocked with adequate supplies

• Any additional office cleaning services as requested and agreed between the parties.

Skills:

• Minimum 2 years’ experience with cleaning

• Must be confidential and trustworthy

• Excellent attention to detail

• Ability to work independently

• Good verbal and oral writing skills

• Good at following directions

• Ability to lift heavy loads

Interested persons should forward their resumes by Wednesday Feb.22nd, 2023 to bahamashr@uvltd.

REPORT

NOTICE is hereby given that EDDICIA EVA ARTHUR of South Beach, New Providence, The Bahamas is applying to the Minister responsible for Nationality and Citizenship, for registration/naturalization as a citizen of The Bahamas, and that any person who knows any reason why registration/ naturalization should not be granted, should send a written and signed statement of the facts within twenty-eight days from the 10th day of February, 2023 to the Minister responsible for nationality and Citizenship, P.O. Box N-7147, Nassau, Bahamas.

THE TRIBUNE Friday, February 17, 2023, PAGE 7

CABLE’S $10.69M PROFITS SWING AMID REFINANCING DRIVE

FROM PAGE B1

ON ALIV

NOTICE

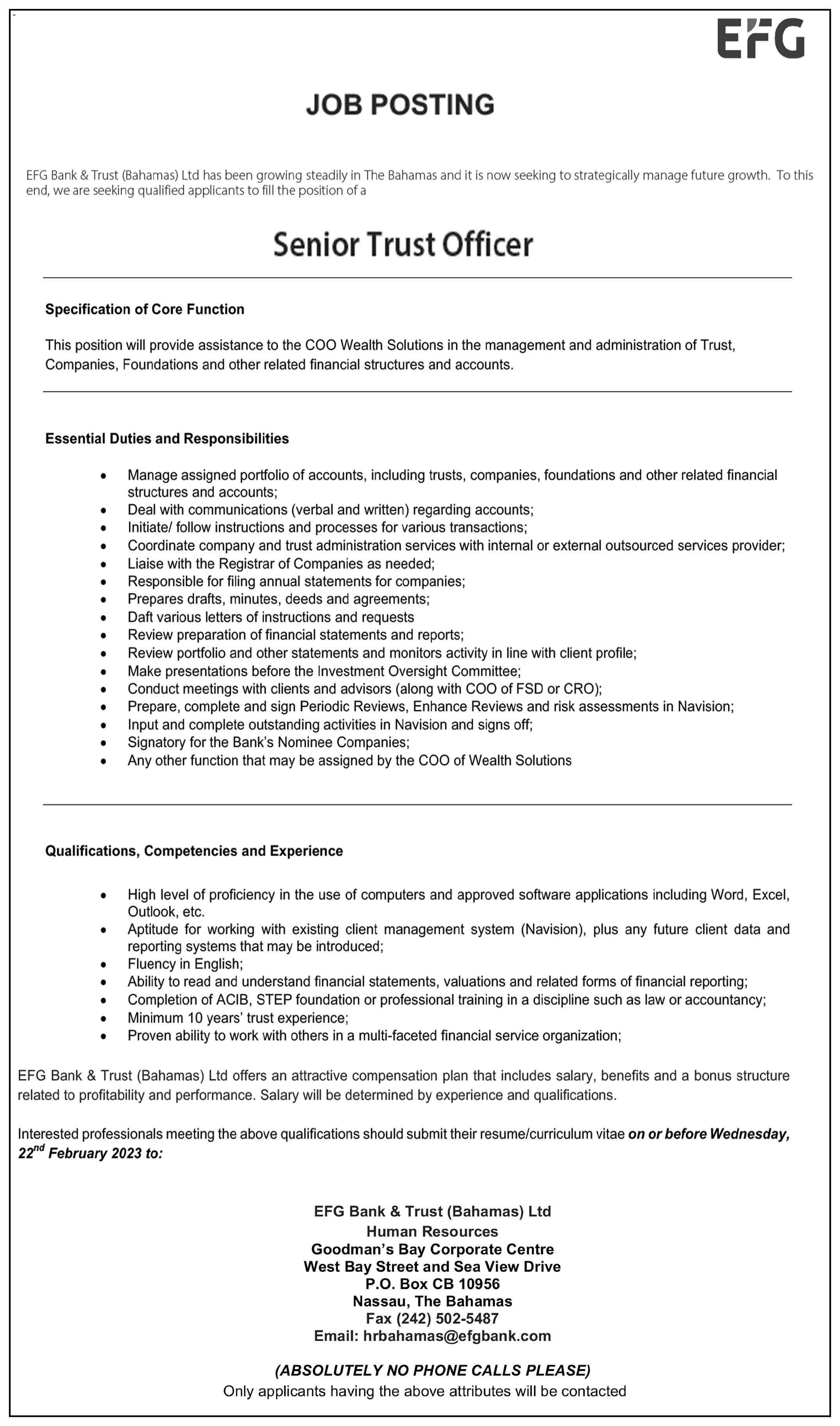

NOTICE THURSDAY, 16 FEBRUARY 2023 CLOSECHANGE%CHANGEYTDYTD% BISX ALL SHARE INDEX: 2669.67-3.29-0.1224.610.93 BISX LISTED & TRADED SECURITIES 52WK HI52WK LOWSECURITY SYMBOLLAST CLOSECLOSECHANGE VOLUMEEPS$DIV$P/EYIELD 7.005.30 AML Foods Limited AML 6.95 6.950.00 0.2390.17029.12.45% 53.0040.06 APD Limited APD 39.95 39.950.00 0.9321.26042.93.15% 2.761.60Benchmark BBL 2.76 2.760.00 0.0000.020N/M0.72% 2.652.31Bahamas First Holdings Limited BFH 2.65 2.650.00 0.1400.08018.93.02% 3.102.25Bank of Bahamas BOB 3.02 3.020.00 0.0700.000N/M0.00% 6.306.00Bahamas Property Fund BPF 6.30 6.300.00 1.7600.000N/M0.00% 9.808.78Bahamas Waste BWL 9.65 9.650.00 0.3690.26026.22.69% 4.503.25Cable Bahamas CAB 4.26 4.09 (0.17) 7,600-0.4380.000-9.3 0.00% 10.657.50Commonwealth Brewery CBB 10.23 10.230.00 6000.1400.00073.10.00% 3.652.54Commonwealth Bank CBL 3.58 3.580.0016,6420.1840.12019.53.35% 9.307.01Colina Holdings CHL 8.50 8.500.00 3000.4490.22018.92.59% 17.5012.00CIBC FirstCaribbean Bank CIB 15.99 15.990.00 0.7220.72022.14.50% 3.252.05Consolidated Water BDRs CWCB 3.07 3.05 (0.02) 0.1020.43429.914.23% 11.2810.05Doctor's Hospital DHS 10.50 10.500.00 0.4670.06022.50.57% 11.679.16Emera Incorporated EMAB 9.93 9.83 (0.10) 0.6460.32815.23.34% 11.5010.75Famguard FAM 11.20 11.200.00 0.7280.24015.42.14% 18.3014.50Fidelity Bank (Bahamas) LimitedFBB 18.10 18.100.00 0.8160.54022.22.98% 4.003.55Focol FCL 3.98 3.980.00 0.2030.12019.63.02% 12.1010.00Finco FIN 12.10 12.100.00 0.9390.20012.91.65% 16.2515.50J. S. Johnson JSJ 15.76 15.760.00 0.6310.61025.03.87% PREFERENCE SHARES 1.001.00Bahamas First Holdings PreferenceBFHP 1.001.000.00 0.0000.0000.0000.00% 1.001.00Colina Holdings Class A CHLA 1.001.000.00 0.0000.0000.0006.25% 10.0010.00Fidelity Bank Bahamas Class A FBBA 10.0010.000.00 0.0000.0000.0007.00% 1.001.00Focol Class B FCLB 1.001.000.00 0.0000.0000.0006.50% CORPORATE DEBT - (percentage pricing) 52WK HI52WK LOWSECURITY SYMBOLLAST SALECLOSECHANGEVOLUME 100.00100.00Fidelity Bank (Note 22 Series B+)FBB22 100.00100.000.00 100.00100.00Bahamas First Holdings LimitedBFHB 100.00100.000.00 BAHAMAS GOVERNMENT STOCK - (percentage pricing) 115.92104.79Bahamas Note 6.95 (2029) BAH29 107.31107.310.00 100.00100.00BGS: 2014-12-7Y BG0107 100.00100.000.00 100.00100.00BGS: 2015-1-7Y BG0207 100.00100.000.00 100.00100.00BGS: 2014-12-30Y BG0130 100.00100.000.00 100.00100.00BGS: 2015-1-30Y BG0230 100.00100.000.00 100.00100.00BGS: 2015-6-7Y BG0307 100.00100.000.00 100.00100.00BGS: 2015-6-30Y BG0330 100.00100.000.00 100.00100.00BGS: 2015-10-7Y BG0407 100.00100.000.00 100.4599.95BGRS FL BGRS91032 BSBGRS910324 99.9599.950.00 100.12100.12BGRS FL BGRS88037 BSBGRS880378100.03100.030.00 94.1594.09BGRS FX BGR132139 BSBGR1321391 93.3693.360.00 101.55101.42BGRS FX BGR124228 BSBGR1242282 101.45101.450.00 103.49103.38BGRS FX BGR118027 BSBGR1180276 102.70102.700.00 92.6792.67BGRS FX BGR131239 BSBGR1312390 92.5592.550.00 90.9890.98BGRS FX BGR132249 BSBGR1322498 90.9590.950.00 94.8094.80BGRS FX BGR134140 BSBGR1341407 93.9493.940.00 100.39100.39BGRS FX BGR138230 BSBGR1380306 100.39100.390.00 96.8496.84BGRS FX BGR138240 BSBGR1380405 96.1096.100.00 100.32100.32BGRS FL BGRS81035 BSBGRS810359100.66100.660.00 100.34100.34BGRS FL BGRS81037 BSBGRS810375100.17100.170.00 100.57100.57BGRS FL BGRS84033 BSBGRS840331100.15100.150.00 MUTUAL FUNDS 52WK HI52WK LOW NAV YTD%12 MTH% 2.592.11 2.593.87%3.87% 4.903.30 4.904.87%4.87% 2.271.68 2.273.03%3.03% 203.47164.74 195.65-3.84%-3.84% 212.41116.70 180.14-15.19%-15.19% 1.771.71 1.773.07%3.07% 1.981.81 1.988.44%8.44% 1.881.80 1.884.42%4.42% 1.030.93 0.95-7.23%-7.23% 9.376.41 10.188.63%8.63% 11.837.62 13.6115.01%15.01% 7.545.66 7.732.87%2.87% 16.648.65 13.13-20.87%-20.87% 12.8410.54 12.06-4.33%-4.33% 10.779.57 10.62-0.31%-0.31% 16.279.88 16.27N/AN/A 11.228.45 11.223.00%25.60% 14.8911.20 N/A N/A N/A MARKET TERMS BISX ALL SHARE INDEX - 19 Dec 02 = 1,000.00 YIELD - last 12 month dividends divided by closing price 52wk-Hi - Highest closing price in last 52 weeks Bid $ - Buying price of Colina and Fidelity 52wk-Low - Lowest closing price in last 52 weeks Ask $ - Selling price of Colina and fidelity Previous Close - Previous day's weighted price for daily volume Last Price - Last traded over-the-counter price Today's Close - Current day's weighted price for daily volume Weekly Vol. - Trading volume of the prior week Change - Change in closing price from day to day EPS $ A company's reported earnings per share for the last 12 mths Daily Vol. - Number of total shares traded today NAV - Net Asset Value DIV $ - Dividends per share paid in the last 12 months N/M - Not Meaningful P/E - Closing price divided by the last 12 month earnings TO TRADE CALL: CFAL 242-502-7010 | ROYALFIDELITY 242-356-7764 | CORALISLE 242-502-7525 | LENO 242-396-3225 | BENCHMARK 242-326-7333 4.42% 15-Jul-2039 15-Jun-2040 4.66% 4.82% 13-Jul-2028 13-Oct-2027 15-Oct-2049 17-Jan-2040 15-Jun-2030 5.65% 5.35% 5.00% 6.25% 30-Sep-2025 31-Dec-2022 6.25% 4.50% 6.25% 4.25% NAV Date 4.87% 4.68% 4.37% 4.81% 5.29% 5.14% 5.60% 26-Jul-2037 FUND CFAL Bond Fund CFAL Balanced Fund CFAL Money Market Fund CFAL Global Bond Fund 15-Dec-2021 30-Jul-2022 15-Dec-2044 30-Jul-2045 26-Jun-2022 26-Jun-2045 15-Oct-2022 31-Dec-2022 22-Sep-2033 15-Aug-2032 26-Jul-2037 26-Jul-2035 15-Oct-2039 31-Dec-2021 31-Dec-2022 31-Dec-2022 31-Dec-2022 31-Dec-2022 31-Dec-2022 31-Dec-2022 31-Dec-2022 31-Dec-2022 31-Dec-2022 INTEREST Prime + 1.75% MARKET

31-Dec-2021 31-Dec-2021 MATURITY 19-Oct-2022 20-Nov-2029 31-Dec-2022 31-Dec-2022 6.95% 4.50% 31-Dec-2022 31-Dec-2022 4.50% 6.25% Colonial Bahamas Fund Class D Colonial Bahamas Fund Class E Colonial Bahamas Fund Class F CFAL Global Equity Fund Leno Financial Conservative Fund Leno Financial Aggressive Fund Leno Financial Balanced Fund Leno Financial Global Bond Fund RF Bahamas Opportunities Fund - Secured Balanced Fund RF Bahamas Opportunities Fund - Targeted Equity Fund RF Bahamas Opportunities Fund - Prime Income Fund RF Bahamas International Investment Fund Limited - Equities Sub Fund RF Bahamas International Investment Fund Limited - High Yield Income Fund RF Bahamas International Investment Fund Limited - Alternative Strategies Fund (242)323-2330 (242) 323-2320 www.bisxbahamas.com

Bahamas liquidators set to access ‘elusive’ FTX data

liquidators, accountants Kevin Cambridge and Peter Greaves, could gain access to the financial and other records critical to progressing FTX Digital Markets’ winding-up.

This data was all under the control of Mr Ray and his team, who had no hesitation in exploiting this leverage in efforts to determine which jurisdiction - The Bahamas or Delaware - would take the dominant role in FTX’s global liquidation, sale and/ or restructuring. Within days of the Bahamian provisional liquidation trio’s appointment, their access - and that of all remaining FTX Digital Markets employees - to the cloudbased data was cut-off by Mr Ray’s Chapter 11 effort.

Pointing out that it was hard to link digital assets transactions to specific FTX entities without access to these records, Mr Simms asserted: “It is accordingly difficult to identify what FTX Digital Markets assets and liabilities are without an electronic paper trail. FTX Digital Markets does not currently have access to that paper trail because the majority of its books and records are controlled by the Chapter 11 debtors.”

Unless they were able to strike the co-operation agreement with Mr Ray, the senior Lennox Paton partner warned that there “would be strong resistance to the joint provisional liquidators’ application for disclosure and turnover of documents” before the Delaware Bankruptcy Court.

“The joint provisional liquidators also had no desire to see substantial costs in legal fees being incurred, and time and opportunities disappear, while litigating the motion,” Mr Simms said, explaining the rationale for the co-operation deal to protect asset recoveries for FTX creditors/ investors.

With both sides having also executed a January 30, 2023, non-disclosure agreement (NDA) to govern information sharing, and the Bahamian and Delaware courts approving the co-operation deal, they are now in a position to move forward.

“Finally, therefore, the joint provisional liquidators and their advisors should shortly obtain access to valuable and critical information about FTX Digital Markets that has so far eluded them,” Mr Simms alleged. “The agreement and the NDA

are undoubtedly in the interests of the provisional liquidation of FTX Digital Markets, its customers and creditors.

“Without the agreement and the NDA, there is a real risk of lengthy, protracted litigation in the Delaware Bankruptcy Court to obtain access to information on the international platform and FTX Digital Markets records which will be immensely time-consuming and expensive. Litigation would also undoubtedly delay the progress of the liquidation of FTX Digital Markets and the urgent attention to the myriad of issues that need to be addressed.

“Moreover, given the mingling of FTX Digital

Markets’ records with those of the Chapter 11 debtors and the lack of clarity over the ownership of certain assets, the agreement and the NDA together provide a reasonable attempt to move things forward consensually in order that all parties have access to information that was available to each of them prior to the provisional liquidation of FTX Digital Markets and the Chapter 11 cases and so that the parties can also begin the difficult process of realising assets and identifying persons entitled to them.”

FTX’s Bahamian operation has been branded “a big piece of the puzzle that needs to get resolved” with the provisional liquidators

successfully obtaining US legal recognition for their ongoing investigations.

Bankruptcy judge, John Dorsey, signed the order granting the Bahamian trio Chapter 15 status, which will enable them to conduct investigations and pursue assets belonging to the local subsidiary with the full backing of the US legal system. He did so after their US legal representative, Chris Shore of the White & Case law firm, provided an update on the Bahamian provisional liquidators’ work to-date. In doing so, Mr Shore also revealed that the Bahamian Supreme Court has ratified the co-operation agreement thrashed out between

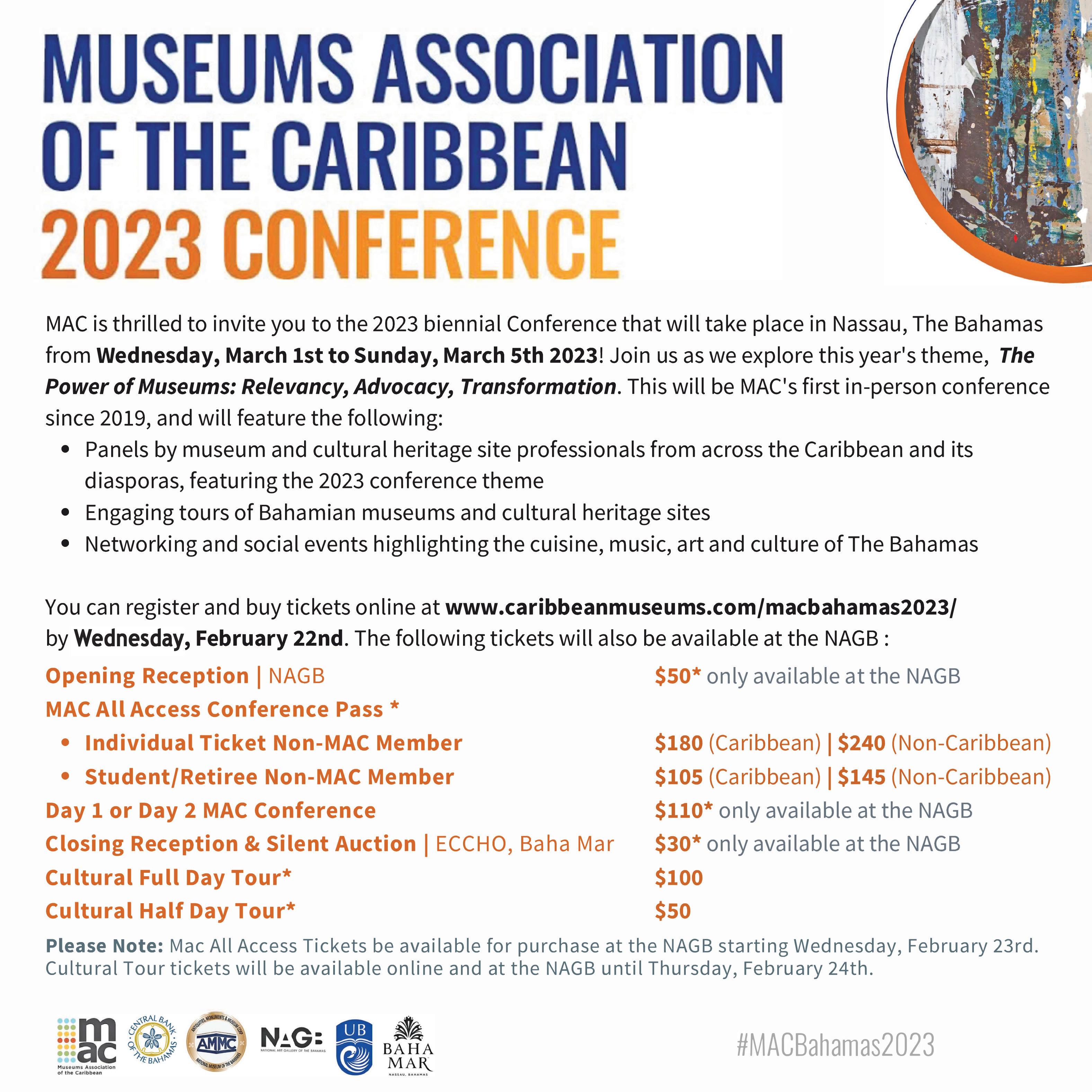

THE WEATHER REPORT

the provisional liquidators and John Ray, the Chapter 11-appointed head of 134 FTX-related entities that are currently under the Delaware court’s supervision. Besides giving the Bahamian trio the go-ahead to consummate the co-operation deal, it also emerged that the Supreme Court on Tuesday recognised one of Mr Ray’s team as the representative of those Chapter 11 entities so that he can act on their behalf in any legal proceedings in this nation. And Tribune Business understands that the Supreme Court has also agreed to extend FTX Digital Markets’ provisional liquidation for a further six months as requested. Rounding off what was a good outcome for the Bahamian provisional liquidators, Judge Dorsey also backed their arguments and those of Mr Ray in rejecting the US Justice Department’s bid to appoint an independent examiner to probe FTX’s collapse. He agreed that it would result in a duplication of effort and unnecessary costs to the liquidation estates, which were likely to reduce investor/creditor recoveries by more than $100m.

tracking map

Shown is today’s weather. Temperatures are today’s highs and tonight’s lows.

THE TRIBUNE Friday, February 17, 2023, PAGE 9

FROM PAGE B1 Shown is today’s weather. Temperatures are today’s highs and tonight’s lows. ORLANDO Low: 55° F/13° C High: 87° F/31° C TAMPA Low: 54° F/12° C High: 82° F/28° C WEST PALM BEACH Low: 69° F/21° C High: 86° F/30° C FT. LAUDERDALE Low: 70° F/21° C High: 84° F/29° C KEY WEST Low: 72° F/22° C High: 83° F/28° C Low: 69° F/21° C High: 83° F/29° C ABACO Low: 73° F/23° C High: 79° F/26° C ELEUTHERA Low: 72° F/22° C High: 80° F/27° C RAGGED ISLAND Low: 76° F/24° C High: 81° F/27° C GREAT EXUMA Low: 75° F/24° C High: 80° F/27° C CAT ISLAND Low: 72° F/22° C High: 83° F/28° C SAN SALVADOR Low: 72° F/22° C High: 82° F/28° C CROOKED ISLAND / ACKLINS Low: 76° F/24° C High: 80° F/27° C LONG ISLAND Low: 75° F/24° C High: 81° F/27° C MAYAGUANA Low: 72° F/22° C High: 83° F/28° C GREAT INAGUA Low: 74° F/23° C High: 83° F/28° C ANDROS Low: 72° F/22° C High: 82° F/28° C Low: 72° F/22° C High: 83° F/28° C FREEPORT NASSAU Low: 70° F/21° C High: 85° F/29° C MIAMI

5-Day Forecast Mostly sunny and breezy High: 83° AccuWeather RealFeel 86° F The exclusive AccuWeather RealFeel Temperature is an index that combines the effects of temperature, wind, humidity, sunshine intensity, cloudiness, precipitation, pressure and elevation on the human body—everything that affects how warm or cold a person feels. Temperatures reflect the high and the low for the day. A starlit sky Low: 69° AccuWeather RealFeel 70° F Sunny to partly cloudy and nice High: 84° AccuWeather RealFeel Low: 70° 90°-70° F Mostly sunny and pleasant High: 82° AccuWeather RealFeel Low: 69° 85°-69° F Mostly sunny and comfortable High: 82° AccuWeather RealFeel Low: 70° 88°-70° F Mostly sunny High: 84° AccuWeather RealFeel 87°-68° F Low: 69° TODAY TONIGHT SATURDAY SUNDAY MONDAY TUESDAY almanac High 81° F/27° C Low 70° F/21° C Normal high 77° F/25° C Normal low 64° F/18° C Last year’s high 77° F/25° C Last year’s low 64° F/18° C As of 1 p.m. yesterday 0.00” Year to date 1.22” Normal year to date 2.23” Statistics are for Nassau through 1 p.m. yesterday Temperature Precipitation sun anD moon tiDes For nassau New Feb. 20 First Feb. 27 Full Mar. 7 Last Mar. 14 Sunrise 6:43 a.m. Sunset 6:05 p.m. Moonrise 4:37 a.m. Moonset 3:15 p.m. Today Saturday Sunday Monday High Ht.(ft.) Low Ht.(ft.) 4:53 a.m. 3.0 11:26 a.m. -0.1 5:13 p.m. 2.3 11:22 p.m. -0.6 5:51 a.m. 3.2 12:21 p.m. -0.3 6:12 p.m. 2.5 6:45 a.m. 3.3 12:21 a.m. -0.8 7:07 p.m. 2.8 1:12 p.m. -0.6 7:37 a.m. 3.4 1:18 a.m. -0.9 8:00 p.m. 2.9 2:01 p.m. -0.8 Tuesday Wednesday Thursday 8:26 a.m. 3.3 2:12 a.m. -0.9 8:51 p.m. 3.0 2:48 p.m. -0.9 9:14 a.m. 3.2 3:05 a.m. -0.8 9:42 p.m. 3.1 3:33 p.m. -0.8 10:01 a.m. 2.9 3:58 a.m. -0.6 10:32 p.m. 3.0 4:19 p.m. -0.7 marine Forecast WINDS WAVES VISIBILITY WATER TEMPS. ABACO Today: SE at 10-20 Knots 4-7 Feet 10 Miles 76° F Saturday: NNE at 10-20 Knots 4-7 Feet 8 Miles 76° F ANDROS Today: SE at 8-16 Knots 1-2 Feet 10 Miles 76° F Saturday: E at 6-12 Knots 0-1 Feet 10 Miles 76° F CAT ISLAND Today: SE at 8-16 Knots 4-7 Feet 10 Miles 79° F Saturday: ESE at 7-14 Knots 3-5 Feet 10 Miles 79° F CROOKED ISLAND Today: ESE at 12-25 Knots 4-7 Feet 10 Miles 79° F Saturday: E at 10-20 Knots 3-6 Feet 10 Miles 79° F ELEUTHERA Today: SE at 8-16 Knots 4-7 Feet 10 Miles 78° F Saturday: ESE at 4-8 Knots 3-5 Feet 10 Miles 78° F FREEPORT Today: S at 10-20 Knots 1-3 Feet 10 Miles 77° F Saturday: NNE at 12-25 Knots 3-5 Feet 8 Miles 77° F GREAT EXUMA Today: SE at 10-20 Knots 1-2 Feet 10 Miles 78° F Saturday: E at 7-14 Knots 0-1 Feet 10 Miles 78° F GREAT INAGUA Today: E at 12-25 Knots 3-6 Feet 10 Miles 80° F Saturday: E at 12-25 Knots 3-5 Feet 10 Miles 80° F LONG ISLAND Today: E at 12-25 Knots 3-6 Feet 10 Miles 79° F Saturday: E at 10-20 Knots 2-4 Feet 10 Miles 79° F MAYAGUANA Today: ESE at 12-25 Knots 5-9 Feet 10 Miles 78° F Saturday: E at 10-20 Knots 4-8 Feet 10 Miles 78° F NASSAU Today: SE at 10-20 Knots 1-3 Feet 10 Miles 77° F Saturday: ESE at 4-8 Knots 0-1 Feet 10 Miles 77° F RAGGED ISLAND Today: E at 12-25 Knots 4-7 Feet 10 Miles 79° F Saturday: E at 10-20 Knots 3-5 Feet 10 Miles 79° F SAN SALVADOR Today: SE at 10-20 Knots 1-3 Feet 10 Miles 79° F Saturday: ESE at 6-12 Knots 1-2 Feet 10 Miles 79° F uV inDex toDay The higher the AccuWeather UV Index number, the greater the need for eye and skin protection. Forecasts and graphics provided by AccuWeather, Inc. ©2023

N S E W 4-8 knots N S E W 10-20 knots N S E W 10-20 knots N S E W 10-20 knots N S E W 10-20 knots N S W E 12-25 knots N S W E 12-25 knots N S E W 8-16 knots

ANOTHER DISAPPOINTING INFLATION REPORT THUMPS WALL STREET

By STAN CHOE AP Business Writer

WALL Street tumbled Thursday, and stocks fell by the most in four weeks following more evidence that high inflation is staying stickier than expected.

The S&P 500 dropped 1.4% after a report said inflation at the wholesale level slowed by less last month than economists forecast. It echoed a report on prices at the consumer level from earlier this week that suggested inflation isn’t cooling as quickly and as smoothly as hoped.

The Dow Jones Industrial Average lost 431 points, or 1.3%, while the Nasdaq composite dropped 1.8%.

Stocks have been churning recently as worries about sticky inflation joust against data suggesting the economy remains more resilient than feared. The worry is that persistently high inflation will push the Federal Reserve to get even more aggressive on

interest rates. Higher rates can drive down inflation but also drag on investment prices and raise the risk of a serious recession.

Such fears have been most clear in the bond market, where yields have leaped this month as traders raise their forecasts for how high the Fed will take interest rates.

The yield on the two-year Treasury, which tends to track expectations for Fed action, rose to 4.67% from less than 4.60% before the inflation report’s release and from less than 4.10% earlier this month. It’s near its highest level since November, when the yield reached levels last seen in 2007.

Thursday’s inflation report showed that prices at the wholesale level were 6% higher last month than a year earlier. While that was a slowdown from December’s rate, it was worse than what economists expected. Perhaps more concerning was that

inflation accelerated in January on a month-to-month basis even after stripping out prices for food, energy and other layers.

The inflation report thudded onto Wall Street along with a batch of other data painting a mixed picture of the economy.

Fewer workers applied for jobless benefits last week than expected, a sign that layoffs remain low across the economy. That’s good news for workers and another signal of strength for the job market, but the Fed worries it could also add upward pressure on inflation.

Other reports showed a measure of manufacturing activity in the mid-Atlantic region plunged this month, while homebuilders broke ground on fewer homes last month than economists expected.

Altogether, the reports cast some doubt on Wall Street’s hopes that the Federal Reserve could manage to slow the economy just

PEOPLE walk past the New York Stock Exchange on Wednesday, June 29, 2022 in New York. Wall Street is making only modest moves following a hotly anticipated report on inflation Tuesday, Feb. 14, 2023 as investors try to square what it will mean for the economy and interest rates.

enough to stamp out inflation but not so much that it creates a severe recession.

Hopes for a “soft landing” for the economy nevertheless remain firmly in the market, with the S&P 500 still up 6.5% since the turn of the year.

“I would go further and say ‘no landing,’” said Nate Thooft, senior portfolio manager at Manulife Investment Management.

“It’s almost as if there’s no softness perceived, or it’s so minimal that it’s not really

viewed as recessionary at all.”

Those hopes have helped the stock market remain relatively resilient even as the bond market moves sharply on expectations for a firmer Fed.

Thooft said there’s a chance both markets could ultimately be proven correct, that the Fed could keep rates higher for longer while the economy avoids a recession, but he’s skeptical. He thinks what’s more likely is a shallow recession

or slowdown in growth, but one that lasts longer than markets may be prepared for.

Recently, he was thinking weakness in the economy could last just a few months. But his expectations for a “higher-for-longer” Fed have him now thinking it could last up to a year. Strong recent reports on inflation and the job market have forced Wall Street to align its forecasts for rates closer to the Fed’s.

DOORDASH SEES RECORD ORDERS AND USERS, BUT LOSSES GROW

By DEE-ANN DURBIN

AP Business Writer

DOORDASH said

Thursday that it saw a record number of orders and active users in the fourth quarter as it expanded overseas and gained market share at home. The San Francisco-based delivery company said its monthly active users grew 28% to a record 34 million during the October-December period. DashPass

members __ who pay $9.99 per month for free delivery on most orders __ grew 50% to 15 million.

DoorDash’s gross order value __ or the total of all orders on its platform __ rose 29% to an all-time high of $14.4 billion. That beat Wall Street’s forecast of $14 billion, according to analysts polled by FactSet.

Some of that growth came from Wolt Enterprises, the Finnish delivery service DoorDash acquired last year for $8.1 billion.

Wolt operates in 22 countries where DoorDash previously had no presence, including Germany, Sweden, Hungary and Israel.

But Ravi Inukonda, DoorDash’s vice president of finance __ who will become DoorDash’s chief financial officer on March

1 __ said DoorDash is also growing in the U.S., where its market share has climbed to near 60%. Excluding Wolt, DoorDash’s gross

order value rose 20% to $13.4 billion.

The company said new partnerships __ like recently announced delivery agreements with the beauty product chain Sephora and Dick’s Sporting Goods __ are drawing new customers and increasing orders from existing ones. DoorDash said its U.S. grocery business doubled in the fourth quarter.