BOB eliminates ‘external influences’ of past rescue

By NEIL HARTNELL Tribune Business Editor nhartnell@tribunemedia.net

BANK of The Bahamas has “eliminated a lot of the external influences” that helped produce two taxpayer-funded rescues, its top executive has revealed, with the institution “on track” to hit this year’s $8m$9m profits target.

Kenrick Brathwaite, the BISX-listed lender’s managing director, told Tribune Business the root causes of its bail-outs are firmly “in the rear view mirror” as it no longer needs the $171m government bond injected into its balance sheet to remain in positive net worth territory.

Bank of The Bahamas’ financials for the 2023 halfyear to end-December show it would still have net equity, albeit modest, of $3.4m even without that bond’s inclusion as an asset. Still, despite Bank of The Bahamas ‘ net income for the six-month period increasing more than ten-fold year-overyear to $4.828m, compared to just $462,323 the year

before, Mr Brathwaite said he was not yet satisfied it has achieved sustained profitability.

While still awaiting Central Bank approval to re-start commercial lending, which proved the source of much of the problems that led to the past rescues under prior Boards and management, he voiced confidence that Bank of The Bahamas is “ready” to enter a market that will enable it to fully diversify its loan portfolio.

And, with the entire commercial banking industry struggling for loan book

DEBT JUMPS $256M ON IMF RIGHTS BORROWINGS

By NEIL HARTNELL Tribune Business Editor nhartnell@tribunemedia.net

By NEIL HARTNELL Tribune Business Editor nhartnell@tribunemedia.net

MUCH of the $256.2m increase in the national debt during the six months to end-December was driven by the Government’s “use” of $232.3m in IMF special drawing rights (SDRs), it has been revealed.

Accessing this financing, which last night drew further fire from the Opposition, helped drive the Central Bank’s share of public sector debt from 7.7 percent at end-June 2022 to 12.4 percent by year-end with SDRs doubling their

share to 3.8 percent over the same timeframe.

“Reflecting recent borrowing activity of the central government, the share of SDR denominated debt rose two-fold to 3.8 percent at end-December 2022 from 1.9 percent at end-September 2022,” the Ministry of Finance’s public sector debt bulletin for the 2022-2023 fiscal year’s second quarter revealed.

“Meanwhile, the Central Bank’s share of claims on the public sector advanced to 12.4 percent from 7.7 percent at end-June 2022.”

SEE PAGE EIGHT

FTX CREDITORS ‘FORTUNATE’ BAHAMAS ACTED ON HACK

By NEIL HARTNELL Tribune Business Editor nhartnell@tribunemedia.net

FTX’s US chief has admitted to the Delaware Bankruptcy Court that clients and creditors were “fortunate”

The Bahamas acted to safeguard assets from theft by hackers in a total reversal of his previous attacks.

2023, hearing during which he recalled the “chaos” surrounding efforts by both his team, the Securities Commission of The Bahamas and Bahamian provisional liquidators to protect digital assets held by the failed crypto exchange from being stolen or lost.

JOHN RAY

John Ray performed his latest u-turn during a February 6,

Blaming the vulnerability to hackers on “a lack of integrity” in FTX’s systems, he described

SEE PAGE FOUR

growth, with qualified borrowers much reduced in numbers, Mr Brathwaite said the BISX-listed institution is poised to next month “launch an aggressive strategy” to attract new mortgage, personal loan and credit card customers. And it is also “in the final stretch” of launching its first-ever debit card, which will be made available to clients in March.

Bank of The Bahamas’ non-performing loans, as a percentage of its total net portfolio, still remain higher than the industry average despite falling by

more than two percentage points - from 19.49 percent at end-June 2022 to 17.12 percent - during the final six months of 2022.

The latter figure remains almost ten percentage points higher than the commercial banking sector’s 2022 year-end average of 7.7 percent, but Mr Brathwaite voiced confidence that his institution’s ratio will “be in line with industry standards” by the time its 2023 financial year closes at end-June. He argued that Bank of The Bahamas’ numbers were skewed by several large loan delinquencies it is in the process of addressing.

“On the commercial side of things we’ve not yet been released by the Central Bank,” the Bank of The Bahamas chief said of the continued regulatory bar to commercial lending. “We’re just waiting on them with regard to their finishing and our responses. I think really a decision may have been made; it’s just not been conveyed to us yet. They’ve already done their review.”

‘Land locked’: Cable Beach restaurant help backfires

By NEIL HARTNELL Tribune Business Editor nhartnell@tribunemedia.net

A LANDLORD’S bid to prevent its Cable Beach restaurant tenant from becoming “landlocked and inaccessible” to customers has backfired after the Supreme Court rejected its claim to ownership of a key asset.

Sir Ian Winder, the chief justice, rejected efforts by the Social House’s landlord to obtain a title certificate for the restaurant’s 7,337 square-foot parking lot and instead ruled that the Government is the rightful owner.

His January 12, 2023, verdict also revealed that landlord Mortgage Holdings Ltd, a company owned by the late Heinz Wszolek’s family estate, had for several decades been paying real property

tax on a parking lot it did not own. This, though, was counter-balanced by the landlord and its various restaurant tenants having enjoyed the use of real estate the former had no right to for the same time period.

The Government, via Brian Bynoe, acting surveyor-general in the Department of Lands and Surveys, and Charles Zonicle, director of physical planning, successfully argued that the Social House’s parking lot had always been reserved for the expansion of public roads and had to be kept for “future improvements”. A notice of possession, and declaration of vesting, dating from late 1977 were produced to confirm the property was owned by the Bahamas’ treasurer.

business@tribunemedia.net MONDAY, FEBRUARY 13, 2023

SEE PAGE SEVEN SEE PAGE SIX

$5.76

$5.76

$5.46 $5.92

WE MUST BENCHMARK SWIFT JUSTICE SUCCESS

By RODERICK A SIMMS II

THERE are many moving parts to bringing about peace and justice for citizens of The Bahamas.

One action that the government has taken is the re-introduction of the “Swift Justice” programme, which is expected to make a comeback in the 2023 first quarter. Since it first launched in 2006, the programme’s standard operating procedure is unclear, yet it has been touted as a successful initiative in addressing the backlog of court cases.

The backlog of court cases is due to a few reasons such as an overflow of criminal proceedings and the need for better management of the courts.

Earlier this year, national security minister, Wayne Munroe KC, announced the appointment of a taskforce to review the process related to reducing the court case backlog. But whether Swift Justice is a success or not, the real issue at hand remains. The reality is that cases will continue to rise, and the backlog will remain, if we do not seek to address high crime and

poor rates of offender rehabilitation. In this segment, we will discuss Swift Justice and what follows this reform.

Patchwork

The current administration has often touted the success of the Swift Justice programme. But success has to be measured, and there is currently no real data available to understand how effective the initiative has been in delivering its objective.

While Swift Justice is a good step in the direction of bringing order to the court’s management, it is a mere patch on the bigger problem at hand.

Let us start with why the high rate of violent crimes leads to an overcrowded prison. If we implement a plan to address the middle of a problem, then we have forgotten about the root of the problem. This can ultimately lead us back to where we started.

We need to see a reduction in murders, sexual assaults, rape, home invasions and armed robberies. If we start to focus on achieving this, then we would start to see an improvement in the number of cases the judiciary is faced with.

Measuring success

An important aspect of the Swift Justice programme, and to prevent continued case backlogs, would be to collect substantive data on the former.

The programme should have a standardised operational procedure (SOP).

The SOP should provide us with targets or performance indicators. The data from those indicators should tell us the rate of completion, number of cases turned over a period time, actual versus targeted completion rates, categorisation of completion by types of cases, and time allotted (in days) for each case to have an average completion time.

These are some measures of success that would then allow the public to feel confident that Swift Justice is indeed effective in resolving the backlog of criminal cases. Without this data, how do we measure success?

The National Development Plan

In part of its “Peace, Justice and Strong Institutions goal”, the National Development Plan (NDP) provided us with a step-by-step approach on actionable steps to prevent

crime, manage crime, increase court capacity and implement improvements to help with the overall management of court proceedings. Before there is any mention of how to improve court proceedings, the plan focuses on a ‘zero tolerance’ approach as one of its strategies. This further makes the case that before jumping into the middle of the problem, work must be done prior. The “zero tolerance” approach focuses on several key actions, some of which include:

1. Develop model codes for magistrates and judges to deal with custody and protection issues in domestic violence case

2. Monitor progress of sexual offence cases through the justice system

3. Remove all tariffs and duties on home alarms and monitoring equipment

4. Strengthen the laws regarding sentencing of violent crimes, particularly home invasion

While these steps may be viewed as “major”, they do assist in helping to deter criminal behaviour. We may think that deterring a criminal is near impossible, but most criminals always see an opportunity in their

actions.

They are not to be deemed as individuals who do not have a thought process. But our court system and laws do not drive the effectiveness they need to be punishing criminals. Therefore, criminals are aware of the consequences and have accepted that they would be tolerable if condemned.

The plan points out the need for a new Family Court system, new protocols that target violent crime and a tracking system for sexual offence cases. It also speaks to rehabilitation efforts so that once offenders are convicted the system improves, distinguishing between major and how less serious offences are handled. Building a new prison is also mentioned to improve capacity to help segregate

offenders.

Conclusion

In conclusion, we want to hear more on what is being done to prevent crime, which would - by extension - stop the increase in criminal proceedings.

Already for the month of January, murders were reported every week. Therefore, we see the imminent need to focus on reducing and preventing crime first.

And, if we do decide to re-introduce Swift Justice, then what data do we have to show us that it is effective? After all, accountability will allow room for improvement and bring about real change.

• Former Chamber of Commerce Family Island Division director, e-mail: RASII@ME.com

DIGITAL AGRICULTURE INITIATIVE MOVING TO IMPLEMENTATION

EFFORTS to create a “digital village” that will enable Bahamian farmers to incorporate technology into their businesses have moved into the implementation phase, it has been announced.

The latest developments, which were marked during a February 7, 2023, launch event for farmers and other agricultural stakeholders in Eleuthera, come one year after the Ministry of Agriculture, Marine Resources and Family Island Affairs and the United Nations’ Food and Agriculture Organisation (FAO) signed the agreement for the village’s creation.

It represents a key element in both sides’ joint drive to improve the Government’s capacity for creating an environment

that enables digital agriculture solutions and scale innovations for farmers.

Dr Crispim Moreira, the FAO representative in Jamaica, The Bahamas and

Belize, said at the launch event: “I encourage you farmers to be open to this change. This is an opportunity to integrate your traditional knowledge, and use the technology as a vehicle to improve on what exists.

“To be clear, no

technology can replace the rich local and traditional knowledge that farmers have relied on for decades. What it will do is enhance and improve the practices and techniques for you to reap more benefits and, of course, more profits from your efforts.” The project will work with the private sector to identify, implement and adapt digital agriculture solutions along targeted value chains identified by the Ministry of Agriculture, Fisheries and Family Island Affairs.

Critical to the initiative’s success will be the creation of Territorial Digital Centres, which will be supported by public-private partnerships (PPPs). The digital centres will be set up within a cluster of rural communities, and will be designed to offer a full suite of services for the creation of a digital ecosystem.

The centres are expected to serve as a hub for a digital consulting service, a rural and agricultural e-commerce platform and digital financial services. They will serve as the catalyst for stronger linkages between rural and urban areas, and drive the transformation of a more sustainable agri-food system and an innovative agribusiness sector.

Dr Moreira asserted that “rural agricultural development is on the rise”. The FAO representative added: “We are embarking on an economic, social and cultural revolution. This digital ecosystem will build bridges from the local to the global. A perfect example of this is the project’s e-commerce platform that will connect farmers to more markets and opportunities to sell produce at fair prices”.

Clay Sweeting, minister

of agriculture, marine resources and Family Island affairs, said: “For a long time, I have been speaking about technology and how it can really help to boost our national food systems. We are so happy that many Bahamians are open to trying new innovations that will benefit our country. Eleuthera is a great place to start, and we look forward to duplicating the programme in several other Family Islands.” An agribusiness Policy and legislative framework will be developed to advance growth in the agriculture and fisheries sector, with particular emphasis on agro-technology. The collaboration between national stakeholders, led by the ministry, will also produce a strategy for digital agriculture extension services that will target 30 officers to be trained in this area.

BAHAMIAN CROWDFUND PLATFORM: HAITI PROPOSAL GAINING TRACTION

A BAHAMIAN crowdfunding platform yesterday said its proposal to help Haiti out of its economic and social crisis is gaining traction in international circles.

ArawakX, in a statement issued ahead of this week’s CARICOM heads of government meeting, where regional leaders will grapple with the multiple problems sparked by Haiti’s governance and law and order collapse, said its proposal has been circulated in United Nations (UN) circles and endorsed by Dame Gloria Starr Kins, dean of the UN Correspondents Association (UNCA).

“We were invited to a meeting with Dame Gloria and other prominent UN officials, and various prominent Haitians in New York city, because there is a lot of concern on how Haiti is to develop given their economic situation. We advanced the plan that

properly structured capital markets are the way forward”, said D’Arcy Rahming senior, co-founder of ArawakX. “The answer to Haiti’s crisis is commerce, not guns.

“We believe that the Haitians living in Haiti and the Haitian diaspora are the best experts to fix their own economy. The ArawakX plan is simple; collaborate with international fund administrators who plan to develop Haitian businesses. The businesses will be properly vetted by ArawakX and, after they become investable with the right corporate governance, the fund will serve for institutional and high net worth individuals to contribute internationally as lead investors.

“Then shares can be offered to the general public over the ArawakX platform, thus enabling financial inclusion.” UNCA was described by ArawakX as an organisation of more

than 200 journalists from dozens of countries, representing scores of publications and broadcasters from all regions of the world, plus major global news agencies.

ArawakX said it offers a financial technology (FinTech) platform with which countries and municipalities can bring together resources in the private, public and non-profit sector to create quality transaction flows between investors and persons looking to raise money for businesses. ArawakX is regulated by the Securities Commission.

Dame Starr Kins said: “Peace through economic development will create jobs for Haiti. Due to Haiti’s abundant natural resources, there is a need for more agricultural products for locals not just for export. There are also opportunities for investing in education and vocational schools.”

PAGE 2, Monday, February 13, 2023 THE TRIBUNE

RODERICK SIMMS II

A LAUNCH event for the Digital Village Initiative was held in Eleuthera last week.

Architects chief loses building permit appeal

By NEIL HARTNELL Tribune Business Editor nhartnell@tribunemedia.net

THE Institute of Bahamian Architects (IBA) president has pledged to “definitely” use any available appeal options after a court found there was “an abundance of evidence” to reject his building permit Judicial Review.

Gustavus Ferguson told Tribune Business he would need to first meet with his attorneys, and determine whether there were any avenues for appeal, after the Court of Appeal upheld the Supreme Court’s decision not to allow him to bring proceedings against the Government’s building control officer.

Appeal justice Jon Isaacs, in a February 8, 2023, verdict unanimously backed by his fellow judges, determined that it was “reasonable” for thenbuildings control officer, Craig Delancey, to require one of Mr Ferguson’s building permit applications to first be reviewed by a structural engineer after it raised concerns and unanswered questions with the regulator.

The buildings control officer was said to be empowered by the Buildings Regulations Act and Bahamas Building Code to do so, but Mr Ferguson told this newspaper he still disagrees with such findings despite the verdict of both courts. “I would hope there’s an option to appeal it,” he said.

“If the option is there, definitely that will be taken. I will likely not hesitate to use it of available. That’s certainly one of the questions I will be asking the lawyer to elaborate on. Time is of the essence and the clock is already ticking. Hopefully I will be in a position to speak with him this week.

“As far as I’m concerned, it was a one-off case. I took this case because of a client of mine. We were being put through unprecedented procedures that were really unheard of. I took it through the court system because we had exhausted all other avenues to have it resolved. The whole issue was that the Building Code speaks to architects, engineers and technicians being able to submit structural applications. It’s not just limited to engineers. That’s the real bone of contention.”

Mr Ferguson’s dispute with Building Control stemmed from the use of Nudura, an insulated concrete form (ICF) product, in a townhouse he had

SUSTAINABLE TOURISM NOW THE ‘FASTEST GROWING’ NICHE

By YOURI KEMP Tribune Business Reporter ykemp@tribunemedia.net

By YOURI KEMP Tribune Business Reporter ykemp@tribunemedia.net

SUSTAINABLE tourism has become the “fastest growing” segment of The Bahamas’ most important industry in COVID-19’s aftermath, a leading official says.

designed. The product had been approved for use in The Bahamas by Building Control, subject to certain conditions that included an engineer’s review and the provision of structural details.

Building Control imposed these conditions on Mr Ferguson’s town home permit application, but he took the position that such conditions ought not to be imposed on a plan submitted by a licensed architect. The IBA president argued that the request, and decision to place his permit on hold, violated the Buildings Regulations Act, Bahamas Building Code, and resulted in the Building Control Officer exceeding his authority.

Mr Ferguson’s Judicial Review bid sought the hold’s removal, and an Order compelling the regulator to process his building permit application, as well as damages. But Edwin Yuk Low, a 14-year Ministry of Works veteran and senior structural engineer, reviewed the drawings and “identified a number of shortcomings” that totalled nine in all. Building Control subsequently conveyed this to Mr Ferguson’s attorney via an August 6, 2019, letter.

Building Control based its case on the rules accompanying the Buildings Regulations Act, which give it the authority to require that a structural engineer perform calculations to address “stresses” if the person submitting the drawings is not an engineer. However, Mr Ferguson centred his argument on the Bahamas Building Code which stated that engineering calculations “shall be prepared by a licensed architect or architectural technician or an engineer recognised by the minister”.

Appeal justice Isaacs, reviewing the Act, Code and accompanying rules, found: “It is readily apparent that the Buildings Control Officer must be allowed to perform his statutorily mandated duties with the least amount of interference, and the only limitation placed upon him when he is considering an application for a building permit is that any request for information or particulars about the building operation he makes must be reasonable....

As I see it, the one issue that requires our attention under this ground is: Was the Buildings Control Officer’s requirement that a recognised structural

engineer design and provide specific structural details about the proposed building system reasonable in the circumstances?”

Turning to the arguments, he said of Mr Ferguson’s position: “The appellant’s position is that [the] Bahamas Building Code allows him, as a licensed architect, to submit an application for a building permit where engineering calculations are required to be supplied by the applicant, and that it is only in those instances where mechanical or electrical installations are intended to be placed within any portion of the building and there are calculations to be made that involve computations based on structural stresses calculations, that the Buildings Control Officer can properly require that an engineer recognised by the minister prepare those calculations.

“This is an attractive argument but it ignores section 5(2) of the Buildings Regulation Act which says, inter alia, that an applicant is to ‘furnish such other or further information or particulars relating to the building operation as the Buildings Control Officer may reasonably require’. Notwithstanding that the Code may avail him in his challenge to the request, he must demonstrate that the requirement for an engineer’s input is unreasonable in the circumstances.”

Mr Ferguson had failed to do this, according to the Court of Appeal, with appeal justice Isaacs finding: “The appellant contended that the deficiencies identified by Mr Low could have been explained by him. That may well be so, but it does not detract from the Buildings Control Officer’s power and discretion to require conformity with the conditions for the use of the approved product.

“The appellant is not an engineer, locally recognised or otherwise. Hence, he is not qualified to provide the certification required by the Buildings Control Officer as a condition for the issuance of a permit. Far from the evidence not supporting the judge’s decision, there is an abundance of evidence that clearly support it. In the premises, I am satisfied that this ground is without merit.”

Dr Kenneth Romer, the Ministry of Tourism’s deputy director-general and acting director of aviation, said during a tour of the Junkanoo Museum that sustainable tourism is the biggest economic driver for The Bahamas right now with cultural tourism a close second.

“While sustainable tourism does not attract the quantity of visitors, they certainly attract the quality of visitors,” he said, “persons who want to go into some of the off-beaten path destinations, who will spend longer times in the destinations. The visitor spend is going to increase also. Sustainable tourism is an emerging market for us. We’re putting a lot of our support behind

sustainable tourism and cultural heritage tourism also.

“The support for cultural and heritage tourism is one of the key priorities for the minister of tourism, investments and aviation, finding ways to create those unique experiences for our visitors but, equally important, finding ways to support local entrepreneurs and stakeholders who are helping us to promote the brand of The Bahamas.

“Certainly, we are looking at ways to explore opportunities coming out of Atlanta, more significantly Savannah, Georgia, and looking at ways to partner through our sister cities, looking at ways for us to increase our brand presence in that market and, overall, just looking at ways to support our local entrepreneurs and stakeholders,”

Dr Romer continued.

“Cultural tourism is going to play a huge role in all of that. Coming out of the pandemic, we found that there were increased opportunities for visitors to

steal away to some of the smaller, unique experiences, whether they are sustainable tourism models, or whether they also speak to creating, moving away from that mass tourism concept.”

The Tourism Development Corporation will play a significant role in helping cultural tourism to mature into a staple feature of the tourism product offering as “millions” is going towards ensuring this nation is properly branded and marketed.

Dr Romer added: “What we’re doing is we’re taking a very hands-on approach in terms of immersing ourselves in visitor experiences. We do know that this (Junkanoo Museum) is a popular site for visitors. It ranks very high at TripAdvisor. Sometimes we hear about these things, but you want to be very practical in our approach of getting into the fields, seeing for ourselves how we could support at an even greater level, these entrepreneurs and cultural icons and heroes.”

THE TRIBUNE Monday, February 13, 2023, PAGE 3

To advertise in The Tribune, contact 502-2394 We are seeking to employ the position of Landscape Manager here at February Point Resort Estates in beautiful Great Exuma. We are hoping to find candidates with a minimum of 2-3 years’ experience. We offer a competitive salary and excellent benefits; housing will also be considered. Interested persons should send their resume to: teneeshia@februarypoint.

REALTOR HONOURS AGENTS FOR RECORD-BREAKING 2022

A BAHAMIAN realtor says it has rewarded sales agents for what it described as a record-breaking 2022 performance.

Lana Rademaker, Bahamas Sotheby’s International Realty’s chief brokerage officer, said in a statement that among the honorees were Nick Damianos as the company’s top producer and listing agent; Mark Hussey as the top producer for the Nassau sales team; and Tiffany Forbes as the

the situation facing himself and his team in the immediate aftermath of the crypto exchange’s collapse as “pure hell” and said he had never encountered this during decades spent salvaging the likes of Enron and other bankrupt companies.

Describing FTX as “a very loose environment, one that is probably a case study for how not to have a controlled environment for crypto”, Mr Ray told the Delaware court: “It’s very vulnerable. We had hot wallets in a system where multiple people had access to passwords.... wallets, you know, sitting in a system that is accessible virtually by anyone who could access that data system.

“So there are multiple access points into an environment that literally held billions of dollars’ worth of the company’s assets. And, as you can see, there are a few different, you know, words set out in red print there, you know, pre-petition. This environment allowed insiders to

top producer among the Baha Mar residential sales team. Abaco’s top producer and top listing agent was Jane Patterson. Angelika Bacchus earned the title of top producer and top listing agent in the Eleuthera market, while the Circle of Excellence Award was given to a group of top-performing sales agents, including Vanessa and Christopher Ansell of The Ansell

Group, Samira Coleby, Madeline Wilkinson, Christina Cunningham and Sarah Chemaly.

Ms Rademaker said the Baha Mar Residences sales team saw strong residential sales with their relocation to the resort’s casino floor. The company also expanded its team, adding five new sales agents and five administrative team members, with the company optimistic about its 2023 prospects.

FTX CREDITORS ‘FORTUNATE’ BAHAMAS ACTED ON HACK

freely transfer assets of the company with no accountability and no tracing.

“Literally, one of the founders could come into this environment, download half a billion dollars’ worth of wallets on to a thumb drive, and walk off with them and there would be no accounting for that whatsoever. Virtually unthinkable, really, in a controlled environment.”

Mr Ray, who had previously accused the Bahamian government, Securities Commission and provisional liquidators of conspiring and colluding with FTX’s disgraced founder, Sam BankmanFried, said he and his team had barely completed their Chapter 11 bankruptcy protection first day filings before being alerted to potential hacks.

“One of our team, one of our advisors, not someone inside the company, one of our advisors that we had hired, detected movement of crypto off of our wallets.

So, immediately, effectively, on the filing we had, you know, an issue with the crypto being stolen from the company,” Mr Ray added.

“At the same time, you know, there were efforts. At the time we didn’t fully realise what was transpiring, but there was efforts by the [Bahamas] provisional liquidators to also secure assets for the protection of customers. This was all happening simultaneously. So, your normal first day petition, as chaotic as sometimes can be, this was something that I have never experienced.

“It all stems from the failure of this system, and a lack of integrity related to this system. We were fortunate enough, because of the professionals we had, to stop the crypto being stolen. We were fortunate, of course, that the provisional liquidators were also able to capture some of this value held in custody in The Bahamas that, presumably, could have also been stolen in this time period.

“Those hacks went on virtually all night long. I

think they somehow ceased around 4 to 5am the following day. We had over 100 people on the phone trying to stop these hacks because at that point you have no passwords. You don’t know where the wallets are in this environment.”

The Securities Commission presently has custody of $426m out of $1.612bn, or 25 percent, of total digital/crypto assets secured to-date for creditors of FTX’s international arm. The sum held by the Bahamian regulator represents the assets it transferred to its control, in a secure digital wallet, in early November just days after FTX Digital Markets was placed into provisional liquidation by the Supreme Court.

The Securities Commission obtained an emergency court Order approving the transfer amid fears that the collapsed crypto exchange was being hacked, and the assets lost or stolen, but its actions initially came under fire from Mr Ray, However, after striking a co-operation deal with the Bahamian joint provisional

BAHAMAS CYBER SECURITY RESPONSE PLAN DISCUSSED

VISITING delegations have helped provide recommendations on how

The Bahamas can respond to cyber security threats though the creation of a National Computer Incident Response Team. The Bahamas’ National Computer Incident Response Team (CIRTBS) hosted representatives from the Organisation of American States (OAS) and CIRT Trinidad (TT CSIRT) from January 31 to February 2, 2023, while on a trip to Nassau,

Bahamas. The parties held meetings aimed at providing recommendations on implementation strategies for the establishment of The Bahamas’ unit.

The sessions included a review of the technical design documents, the Bahamas’ National Cybersecurity Strategy and CIRT services and policies that would help govern the operation. The OAS offered to provide collaboration opportunities that The Bahamas may benefit from.

liquidators, he was quoted in a statement confirming that the Securities Commission had acted properly in safeguarding assets for the benefit of creditors.

This has now been reinforced by Mr Ray’s testimony before the Delaware Bankruptcy Court, which last week approved the cooperation agreement with the Bahamian provisional liquidation trio of Brian Simms KC, the Lennox Paton senior partner, and PricewaterhouseCoopers (PwC) accountants, Kevin Cambridge and Peter Greaves. Tribune Business previously reported that the Bahamian provisional liquidators are to gain control of $46m in Tether stablecoins as part of the “co-operation” deal with Mr Ray, which is intended to create a “path forward” to resolve all remaining disputes. Tether is a stablecoin, with its value pegged one:one with the US dollar, thus making it a critical recovery source that can help finance the liquidation’s costs.

The agreement will also see the Bahamian trio

“take the lead” in selling the $256.3m worth of high-end local real estate that FTX acquired prior to its spectacular implosion in early November 2022. They will be responsible for “arm’s length” marketing of these properties to potential buyers “utilising the services or one or more brokers”.

The deal stipulates: “The parties agree that the value in the properties owned by FTX Property Holdings will be realised over time in one or more arm’s length marketing processes utilising the services of one or more mutually acceptable brokers in a manner and on a timeframe designed to maximise the recovery.”

This, the agreement said, could be effected by a Supreme Court liquidation process running concurrently with the Chapter 11 proceedings or some other “mutually acceptable arrangement”. It added: “The joint provisional liquidators.... shall take the lead in managing the properties, determining the appropriate strategy for the monetisation of the properties, identifying buyers and conducting the marketing process.”

PAGE 4, Monday, February 13, 2023 THE TRIBUNE

FROM left, rear, Alexandro Mullings (senior analyst); Diego Subero (cyber security consultant, OAS); Kerry-Ann Barrett (cyber security policy specialist, OAS)); Angus Smith (TT-CSIRT manager); Shanae Wright (office co-ordinator); Levan Rolle (junior analyst). Front, Melissha Ellis (junior analyst); Sametria McKinney (CIRT manager)

Photo: CIRT-BS

CLOCKWISE from top left, Nick Damianos, Mark Hussey, Angelika Bacchus, Jane Patterson and Tiffany Forbes.

from page one

Earthquakes and history

By RICARDO EVANGELISTA

LARGE earthquakes have been a persistent threat to human civilisations throughout history, causing destruction and altering the course of entire societies. The impact of these quakes extends far beyond the immediate physical damage, affecting social and economic systems in ways that can last for years or even decades.

In this article, we will examine the social and economic impact of several significant earthquakes that have occurred throughout history and consider why earth tremors remain a major concern today.

One of the earliest recorded quakes occurred in 365 AD in Crete. It caused massive damage and was reported to have had far-reaching effects on trade and commerce in the region. The destruction inflicted upon the cities and towns of the island, along with disruptions to agriculture, led to famine and poverty for many years following the disaster.

The 1755 Lisbon earthquake in Portugal was another significant event that had a profound impact on European history. The tremor, which measured an estimated 8.7 on the Richter scale, caused extensive

damage and death, with the city of Lisbon, a major centre of trade and commerce, being especially hard-hit. The aftermath of the earthquake was a pivotal moment in Portuguese and European history, as the destruction of Lisbon had a profound effect on Portugal’s economy and its colonies, contributing to a decline in the country’s power and influence in the world.

The 1906 San Francisco earthquake in the US was another event that had a lasting impact on the country and the world. The earthquake, which measured 7.8 on the Richter scale, caused extensive destruction in the city and disrupted trade, commerce and agriculture. The aftermath of the catastrophe led to a wave of immigration from the affected area to other parts of the country, impacting the demographics and economy of the US. The Great Kanto earthquake of 1923 in Japan was one of the most devastating tremors of the 20th century, with a magnitude of 7.9 and an estimated death toll of over 140,000.

The earthquake caused extensive destruction in Tokyo and the surrounding area, and was a turning point in Japanese history, contributing to the country’s transformation from a feudal society to a modern industrialised nation.

The 1960 Great Chilean earthquake, with a magnitude of 9.5 on the Richter scale, was one of the largest in recorded history. It caused great devastation in Chile and had a significant effect on the country’s economy, with the aftermath leading to a shift from an agrarian-based economy to a more modern and industrialised one. The event also had an impact on the global economy, as Chile was a major supplier of copper and other minerals.

The 2011 Tohoku earthquake and tsunami in Japan was another example of the devastating power that quakes can have on modern societies. It had a magnitude of 9.0, causing widespread damage and loss of life, with the tsunami leading to additional destruction along the coast, including at the Fukushima nuclear power

ACCOUNTING FIRM IN NEW DIRECTOR HIRING

A BAHAMIAN accounting firm has hired a new director who will be responsible for staff development, risk advisory and audit and assurance.

Medgar Bonimy, a certified public accountant (CPA), has been hired by ECOVIS Bahamas to fulfill those roles with effect from today. The announcement was made by the ECOVIS Bahamas partners, James Gomez and Noreen Campbell.

“The Partners of ECOVIS Bahamas welcome Medgar Bonimy to the firm, and are pleased to have her as an integral part of its leadership team. The name ECOVIS, a combination of the words economy and vision, expresses both its international character and its focus on the future and growth. Because of her academic achievements and many years of successful professional practice and community service, Ms Bonimy fits well into this equation,” Ms Gomez said.

“Ms Bonimy’s professional outlook and progress indeed reflect the ecology of ECOVIS, both locally and internationally, so we

MEDGAR BONIMY

expect her to operate seamlessly and collegially in the firm,” Ms Campbell added. “Medgar started her career in public accounting about 20 years ago with a ‘Big Four’ accounting firm, earning early international exposure. “How successful she was in this regard is evident in her rise in the ranks at that firm. She was promoted to senior manager of audit and assurance and, later, to senior manager of financial advisory services.”

Ms Bonimy holds a Bachelor of Business Administration (accounting and management information systems) from Florida Atlantic University, and a master of science degree in human resource management from Nova Southeastern University.

She also earned a diploma in secondary education in business studies from the University of The Bahamas. She is a certified public accountant licensed in the Commonwealth of Virginia, a chartered accountant licensed under the Bahamas Institute of Chartered Accountants (BICA), certified fraud examiner (CFE) and a certified international risk manager.

Ms Bonimy’s professional and community affiliations include membership in the Bahamas Institute of Chartered Accountants (BICA), the National Society of Leadership and Success at the University of The Bahamas and of the Kiwanis Club of Fort Montagu, where she currently serves as president until September 2023. She also volunteers as a math tutor to students in grades seven to 12.

ECOVIS is a global accounting and consulting firm with its origins in continental Europe. It has about 9,300 people operating in more than 80 countries. Its focus lies in the areas of tax consultation, accounting, auditing and legal advice.

plant, where radioactive material was released. The incident forced a rethinking of energy strategies for several countries. Germany, for example, decided to abandon its nuclear programme, becoming more dependent on Russian gas - a development that continues to affect the

global geo-political balance.

The social, political and economic impact of large earthquakes throughout history has been significant.

These disasters have disrupted trade, commerce and agriculture, provoking famine and poverty, but also creating opportunities for innovation and

development that alter the course of entire civilisations. And even today, as tragically demonstrated by last week’s tremor in Turkey and Syria, earthquakes remain a major concern for modern societies, and it is important for governments and organisations to be prepared for their potential impact.

THE TRIBUNE Monday, February 13, 2023, PAGE 5

PILLARS tumbled in Jerash, Jordan, in the Middle East.

‘Land locked’: Cable Beach restaurant help backfires

The chief justice, though, criticised the failings that had resulted in Mortgage Holdings and the late Mr Wszolek for decades paying real property tax on land they did not own. “It is regrettable that Mortgage has been paying, and the Crown collecting, real property tax on the subject property for a considerable period,” Sir Ian wrote.

“Notwithstanding the breadth of the Government, its respective arms need to better work together to avoid such conflicts. The flip side, obviously, is that Mortgage has had use of the property during the period without paying any compensation.”

Sir Ian’s ruling carries potential negative consequences for both landlord and the Social House, as well as any future tenants. Loss of the parking lot as an asset/amenity will undermine the site’s value as a retail or dining location if guests are unable to easily

access it, while the Social House’s business model would face severe disruption if the Government insists on its ownership rights and demands that all other parties vacate.

Representatives for Mortgage Holdings Ltd declined to comment yesterday on the basis that they have yet to discuss Sir Ian’s verdict, and the potential fall-out, with their attorneys. Dino Berdanis, the Social House’s general manager, told Tribune Business that loss of the parking lot’s use by his clients “would be a problem” but added that much depends on what the Government decides to do in moving forward.

Unaware of Sir Ian’s verdict until informed by this newspaper, he said of the potential parking lot loss: “Obviously it would be a big problem for us. Parking is something that the restaurant needs for sure. We’ll have to inquire as to what is happening with our landlord. My position is it obviously wouldn’t

be a good thing for our business.”

All is not lost for the Social House and its landlord. Mortgage Holdings Ltd has the option to appeal Sir Ian’s decision, and one likely outcome is that it could work out a deal with the Government to lease the parking spot from it for the benefit of its restaurant tenant.

Parking in that area of Westward Villas, which lies 130 feet south of West Bay Street, or the lack of it is understood to have been a consistent issue. It is understood nearby residents have complained about clients of multiple businesses in the area, which include a Starbucks and the Italian restaurant, Capriccio, as well as the Social House, parking vehicles alongside their walls and blocking their entrances.

The Social House, which specialises in sushi, frequently attracts an upmarket crowd from across New Providence featuring both Bahamian professionals and expatriates. “It’s a popular spot. They’re always busy,” one source said of the restaurant. “I was there the other night and the parking was just crazy with all the

people in the Social House, Starbucks and Capriccio.

“This [the ruling] could really hurt their business. They’ve potentially got a problem. They’ve got a real problem. It will be interesting to see what they do.” A nearby resident, speaking on condition of anonymity, said that if the Government decides to block use of or access to the present parking lot “they won’t be able to operate. It’s impossible.

“But I don’t think the Government will strong arm them and say you can’t park there by Friday. It’s a very busy and popular site. It’s been many things, including a sandwich bar. This one has been the most successful and busy restaurant.” Previous tenants at the Social House site include another popular haunt of the past, Indigo Cafe, plus the Pot & Cake Restaurant.

Mortgage Holdings initiated the events leading to Sir Ian’s ruling when it filed its May 17, 2018, petition to “quiet” the title to the parking lot - and subsequently obtain a certificate of title - via the Quieting Titles Act. That law requires petitioner’s to advertise their intent publicly, so that persons with rival ownership claims can contest it, and

this prompted the Government’s “adverse claim” on January 12, 2021.

Chantelle Euteneuer, the late Mr Wszolek’s daughter, in her capacity as Mortgage Holdings’ president, said the company acquired the property now housing the Social House on July 26, 1983. “Mortgage Holdings has always rented lot number two to restaurants, and the current tenants are the owners of Social House restaurant,” she asserted.

“Social House and past tenants have always used the above-captioned property as the parking lot for the business, which would otherwise be land-locked and inaccessible from the road.” Mrs Euteneuer said Mortgage Holdings had always maintained the parking since the acquisition in 1983.

And “since December 9, 2004, Mortgage Holdings has regularised all real property tax payments” for the parking lot, with no one else using the property without its permission or a lease agreement. She was backed by Brett Lashley, a Central Bank deputy currency manager, who testified that he had always known the site to be used as a restaurant during the 21 years he

resided at Skyline Heights. Mortgage Holdings, in its written submissions, argued that it was “immaterial” that the Government claimed the parking lot to be reserved for a road when it and its tenants have enjoyed “uninterrupted use” for more than 30 years. That is now in its 40th year, and Mortgage Holdings alleged that the Limitation Act 1995 prevented the Government from bringing its rival claim. That Act stipulates that the Government must bring legal action to recover land within 30 years of “the right to action”. Mortgage Holdings alleged this 30-year period expired when it filed its Quieting Titles petition on May 17, 2018. However, Sir Ian found that because it took possession of its property in 1983, the Limitation Act 1995 was not yet in effect and therefore does not apply to this case.

Instead, he ruled that the Real Property Limitation (Crown) Act 1873 was the relevant legislation. This gave the Government some 60 years, or until 2043, to bring its rival claim which thus fell well within the legal limit. As a result, Mortgage Holdings position was dismissed.

IN KENYA, AN ELECTRIC TRANSPORT PLAN FOR CLEAN AIR, CLIMATE

NAIROBI,

Kenya

Associated Press

ON THE packed streets of Nairobi, Cyrus Kariuki is one of a growing number of bikers zooming through traffic on an electric motorbike, reaping the benefits of cheaper transport, cleaner air and limiting planetwarming emissions in the process.

“Each month one doesn’t have to be burdened by oil change, engine checks and other costly maintenance costs,” Kariuki said.

Electric motorcycles are gaining traction in Kenya as private sector-led firms rush to set up charging points and battery-swapping stations to speed up the growth of cleaner transport and put the nation on a path toward fresher air and lower emissions. But startups say more public support and better government schemes can help further propel the industry.

Ampersand, an Africanbased electric mobility company, began its Kenyan operations in May 2022. The business currently operates seven batteryswapping stations spread across the country’s capital and has so far attracted 60 customers. Ian Mbote, the startup’s automotive engineer and expansion lead, says uptake has been relatively slow.

“We need friendly policies, taxes, regulations and incentives that would boost the entry into the market,” said Mbote, adding that favorable government tariffs in Rwanda accelerated its electric transport growth. Ampersand plan to sell 500 more electric motorbikes by the end of the year.

Companies say the savings of switching to electric and using a battery-swap system, rather than charging for several hours, are key selling point for

customers.

“Our batteries cost $1.48 to swap a full battery which gives one mobility of about 90 to 110 kilometers (56 to 68 miles) as compared to the $1.44 of fuel that only guarantees a 30 to 40 kilometer ride (19 to 25 miles) on a motorcycle,” Mbote said.

Kim Chepkoit, the founder of electric motorbike-making company Ecobodaa Mobility, added that “electricity costs are going to be more predictable and cushioned from the fluctuation of the fuel prices”.

Ecobodaa’s flagship product is a motorcycle with two batteries, making it capable of covering 100 miles on one battery charge. The motorcycle costs 185,000 shillings ($1,400) without the battery, about the same as a conventional motorbike.

Other cleaner transport initiatives in the

country include the Sustainable Energy for Africa program which runs a hub for 30 solar-powered charging stations for electric vehicles and battery-swapping in Kenya’s western region.

Electric mobility has a promising future in the continent but “requires infrastructural, societal and political systemic changes that neither happen overnight nor will be immune to hesitance”, said Carol Mungo, a research fellow at the Stockholm Environment Institute.

The move to electric transport “will require African governments to rethink how they deliver current services such as reliable and affordable electricity” and at the same time put in place adequate measures to address electric waste and disposal, Mungo added. Some financial incentives are on the way.

PAGE 6, Monday, February 13, 2023 THE TRIBUNE

from page one

BOB eliminates ‘external influences’ of past rescue

“We’re just waiting on them to tell us what they’re thinking.”

Bank of The Bahamas was rescued via two taxpayer-funded bail-outs in 2014 and 2018, which resulted in ‘toxic’ commercial loans being removed from its balance sheet in exchange for government bonds worth a collective $267m. The bank has been barred from this loan segment ever since, and Mr Brathwaite said its re-entry would “do a lot of things for us”. He added: “It allows a full diversification of the portfolio. It provides a certain sector of the economy, the business sector, an additional bank to deal with. From an economic standpoint, it’s critical we get there. We believe we can operate in that space and provide funding for a lot of small and medium-sized businesses.”

Many among Bank of The Bahamas’ 3,000 minority shareholders, as well as external observers, will be both sceptical and reluctant about its commercial

lending ambitions given the recent past. Mr Brathwaite, though, had no such fears. “We’ve done a lot of things internally to at least mitigate some of those risks and issues we’ve had in the past,” he told Tribune Business

“There’s been a complete separation of the business and risk. We’ve hired persons with knowledge of the risk side of things and the business side of things. We’ve changed and evolved our internal policies. We’ve removed a lot of the influences from external sources that may have impacted on what was done in the past. We’ve done a lot of things to make us ready. We’re prepared to enter the market.”

Mr Brathwaite did not specify what he meant in referring to “external influences”, although many observers will likely interpret it as meaning political pressures given that the Government - via the National Insurance Board (NIB) and the Public Treasury - own a combined 82.6 percent of Bank of The Bahamas. They also held the majority interest when the bank had to undergo its

taxpayer-funded rescues, and the Government still appoints the majority of the Board.

“There were a lot of issues that had to be addressed, and we’re addressing all those issues that caused the bank to be in the position it was in,” the Bank of The Bahamas managing director said.

“I’m confident we are at a point where we have put those things in the rear view mirror and understand the structure we have in place now will not allow a repeat.”

Meanwhile, the Bank of The Bahamas chief said the first-half performance had left the bank “on target” to hit its full-year 2023 financial projections. Describing the six months to end-December 2022 as “pretty good”, he added:

“I think that as long as the economy continues to rebound, and we have the cost base we had prior to the pandemic, then we’re going to be fine.

“We’re on track for profits as per our budget at the beginning of the year. Our expectation is that we will achieve the budgeted figures for the year. It’s just

about double what we have now. We’re looking at $8m$9m for the year, and think we’re going to be on target for that.”

However, Mr Brathwaite conceded that more work lies ahead. “I think we have not yet reached a position of sustained profitability,” he told this newspaper.

“There’s a few things in there affecting the financial figures that we continue to work on year in, year out. We are moving to a better place where, in the future, we expect sustained profitability based on recurring income.”

Bank of The Bahamas, in common with its competitors, saw a small near-$5m decline in its net loan book during the final six months of 2022 as its overall size decreased to $363.82m. Planning to reverse this, Mr Brathwaite said: “That market is very volatile and very competitive, especially the consumer side of things, but we are introducing a campaign to seek to address those numbers.

“Mortgages, consumer loans and credit cards, we are aggressively putting a strategy together to arrest those numbers. I would

expect it to be launched by March. That’s going to be geared towards the consumer market, and will include all aspects as part of the package. Hopefully we will be able to address and arrest those areas while the numbers are still flat, while understanding the competitive market will have some bearing on us.

“We’re in the final stretches of launching a debit card. We’ve never had a debit card before. We expect that to be in full force by March.”

Mr Brathwaite said all banks faced the collective problem that the pool of qualified borrowers has not expanded from preCOVID times, and “that’s the pot we’re all fighting for for consumer loans”. Being permitted to re-enter commercial lending, he added, was vital to reducing reliance on a consumer/ personal loan space that all lenders are presently battling for.

Despite its steady improvement, Bank of The Bahamas’ non-performing loans at 17.2 percent of its net loan book continue to be much higher than the industry’s average of 7.7

percent at end-December 2022. This means that some $62.286m worth of credit was 90 days or more past due on loan repayments at end-December 2022.

“We expect those to be in line with industry,” Mr Brathwaite said. “The commercial side is out of line with industry. The other areas are falling more into line with industry standard. We expect to have them resolved in the near future. Our projections call for them to be in line with industry standards by the end of the financial year, June 30.

“With the commercial, we’re only talking a few large accounts. One account has a significant impact on the ratios. Once we address those, which we expect we will be able to, then you will see an immediate turnaround in arresting the ratios.” Mr Brathwaite said the more than two percentage point drop in the bank’s non-performing loan ratio during the six months to end-December 2022 had resulted from the sale of properties and other collateral linked to this credit.

GAS PIPELINE TO VEGAS RESUMES OPERATING AFTER SHUTDOWN

LAS VEGAS

Associated Press

A PIPELINE facility in California that was forced to shut down deliveries of gasoline and diesel from the Los Angeles area east to areas including Las Vegas and Phoenix due to a leak, resumed operations on Saturday, according to the pipeline’s operator. The source of the leak was isolated within its Watson Station in Long Beach, California, and the facility began to deliver fuel by Saturday afternoon, according to pipeline operator Kinder Morgan. The amount and cause

of the leak were under investigation, said Kinder Morgan communications manager Katherine Hill. Clark County officials said they believed supplies would not be affected by the leak.

“As the pipeline is expected to be fully operational by this evening, I again urge Las Vegas residents to refrain from panic buying fuel,” said Nevada Gov. Joe Lombardo, who had declared a state of emergency to help mitigate the impact of the leak.

Kinder Morgan said the leak was discovered on Thursday afternoon at a company station near

Los Angeles and that its CALNEV and SFPP West pipelines were shut down while the Houston-based pipeline operator worked to resolve the issue.

The pipeline provides fuel storage facilities in southern Nevada with unleaded and diesel fuel, according to Clark County officials. Another pipeline operated by UNEV Pipeline LLC serves the Las Vegas area from northern Utah.

The Kinder Morgan website says its 566-mile CALNEV pipeline transports gasoline, diesel and jet fuel from Los Angeles refineries and marine terminals through parallel

14-inch and 8-inch diameter pipelines to Barstow, California, and the Las Vegas area.

Hill said later that only

the larger, 14-inch pipeline to Las Vegas had been shut down.

Airports it serves include Nellis Air Force Base and

Harry Reid International in Las Vegas and Edwards Air Force Base in California’s Mojave Desert, the company said.

THE TRIBUNE Monday, February 13, 2023, PAGE 7

from page one

Debt jumps $256m on IMF rights borrowings

The Bahamas’ total public sector debt stood at $12.387bn at year-end 2022, having increased by $256.2m or 2.1 percent during the six months to end-December 2022. The report makes clear that, with net external debt held by foreign lenders/ investors declining by $135.4m during the three months to year-end, an increase in debt held domestically was largely responsible for driving the overall rise.

“Since end-June 2022, domestic debt posted an increase of $400.3m (6.9 percent) to $6.196bn at end-December 2022, which correlated to a 2.4 percentage point gain in share to 56.1 percent of the total government debt. This outcome was primarily explained by the $224.5m accretion to foreign currency domestic

debt obtained from domestic sources, which was linked to the $232.3m SDR-denominated facility [that] the Government secured from the Central Bank.”

The debt report contained a link to a government press release on the International Monetary Fund (IMF) SDR transaction from last month, in which it rejected assertions by the Opposition and others that this constituted “borrowing” or “printing money” as misleading.

“The Government is not borrowing from the Central Bank and creating money. Instead, the Government is using resources provided by the IMF for a legitimate purpose as outlined by the IMF in its guidance notes on the treatment and use of the SDRs,” the Government said then.

Simon Wilson, the Ministry of Finance’s financial

secretary, could not be reached for comment before press time last night. However, Kwasi Thompson, the Opposition’s finance spokesman, seized on what he argued was the discrepancy between the January press release and the public debt report’s reference to “recent borrowing activity” in relation to the SDRs.

Arguing that the report “contradicts” the earlier Ministry of Finance statement, he added: “The report clearly shows that the increase in the Government debt was due to the SDR-tied transaction just as we had claimed all along. Both the Central Bank and the Government are recording it as a loan (government debt) that must be repaid.”

The Government’s use of SDRs, which is tantamount to accessing The Bahamas’ foreign currency reserves, has been surrounded

with controversy since it was first revealed by the Central Bank.

Michael Pintard, the Opposition’s leader, had argued that the transaction potentially breaches Section 21 of the Central Bank Act which sets limits on how much the monetary policy regulator can lend or advance to the Government. It can only make temporary loans that mature within 91 days and have “market-based” interest rates attached, while the amount involved is also capped.

Combined with total issued Treasury Bills, and securities issued or guaranteed by the Government and its corporations, total outstanding loans to the former by the Central Bank cannot exceed 30 percent of the Government’s “average” or “estimated” revenue - a sum around $800m-$900m. “Reflecting the

Government’s recent borrowings, creditor balances for the Central Bank advanced to 14.2 percent of the total ($878.4m) from a nearly stable 8.8 percent in the previous two quarters, and resulted in corresponding lower share for the other creditor groupings,” the debt report said. It added that Central Bank advances due to mature within the next six months, and which either have to be rolled over or repaid, stand at $355m.

John Rolle, the Central Bank’s governor, previously revealed to Tribune Business that the Memorandum of Understanding (MoU) between the monetary policy regulator and Ministry of Finance stipulates that the Davis administration must change the Central Bank Act to facilitate the IMF SDR transaction.

“The Central Bank worked closely with the Government in concluding these arrangements to access the SDRs,” the governor told this newspaper via an e-mailed reply.

“Under the MOU there is an undertaking by the Government to amend the Central Bank Act to cover the use of the 2021 allocations.

“As explained in our public release, the assessment of the foreign reserves adequacy has continued to improve given the ongoing recovery in tourism.

“There is even less uncertainty around the

sustainability of the reserves than in 2021. Compared to one year ago, the opportunity cost of not making any use of the SDRs is therefore significantly greater.

“However, it is not a need that is expressed in terms of foreign reserves adequacy.”

Mr Wilson previously said the MoU would provide the Government with access to cheap foreign currency financing that is an estimated 700 basis points below prevailing market rates.

Based on the $233m valuation presently assigned to the SDRs, he added that this seven percentage point differential could generate close to $20m in annual interest savings for hard-pressed Bahamian taxpayers compared to the likely rates if the Government had to borrow in the international capital markets.

Mr Wilson also argued that the Government’s SDR borrowing was aligned with the IMF’s stated reason for issuing them, which was use for “fiscal purposes”. This is partially backed by the Central Bank’s August 2021 release, which says: “Countries can decide whether policy buffers would be used to increase the flexibility of fiscal and monetary policies, including for pandemic-related deficit financing, debt management operations, promoting external debt sustainability, financial stability or balance of payments needs.”

NOTICE

In the Estate of CHERYL MARIE BARRY, late of Coral Heights East situated in the Western District of the Island of New Providence in the Commonwealth of The Bahamas deceased.

NOTICE IS HEREBY GIVEN that any persons having any claims against or any interest in the above named Estate are required on or before the 13th day of March, 2023 to deliver their names addresses and particulars of their debts, claims or interest to the undersigned and to come in and prove such debts, interest or claims, or in default thereof, they will be excluded from the benefit of any distribution AND NOTICE is hereby given that at the expiration of the date hereinbefore mentioned, the assets of the Estate of the said, CHERYL MARIE BARRY deceased, will be distributed among the persons entitled thereto.

DATED the 10th day of February, 2022. Personal Representative of the ESTATE OF CHERYL MARIE BARRY c/o DELEVEAUX GODET & CO. Chambers No. 72 Nassau Street Nassau, N.P., The Bahamas

NOTICE

IN THE ESTATE of MURIEL LOUISE EDWARDS late of the Western District of the Island of New Providence, one of the Islands of The Commonwealth of The Bahamas, deceased.

Notice is hereby given that all persons having any claim or demands against the above named Estate are required to send their names, addresses and particulars of the same duly certified in writing to the undersigned on or before the 13th day of February A.D., 2023, and if required, prove such debts or claims, or in default be excluded from any distribution; after the above date the assets will be distributed having regard only to the proved debts or claims of which the Executor shall then have had Notice.

And Notice is hereby given that all persons indebted to the said Estate are requested to make full settlement on or before the aforementioned date.

MICHAEL A. DEAN & CO., Attorneys for the Executor Alvernia Court, 49A Dowdeswell Street P.O. Box N-3114 Nassau, The Bahamas

PAGE 8, Monday, February 13, 2023 THE TRIBUNE

from page one

The Public is hereby advised that I, NEIKA TAMICA RUSSELL of Jubilee Gardens, New Providence, Bahamas intend to change my name to NEKO TAMICO RUSSELL. If there are any objections to this change of name by Deed Poll, you may write such objections to the Chief Passport Officer, P.O.Box N-742, Nassau, New Providence, Bahamas no later than thirty (30) days after the date of publication of this notice.

NOTICE

NOTICE is hereby given that SEAN MAC LOUISIUS of Washington Street, New Providence, The Bahamas is applying to the Minister responsible for Nationality and Citizenship, for registration/ naturalization as a citizen of The Bahamas, and that any person who knows any reason why registration/naturalization should not be granted, should send a written and signed statement of the facts within twenty-eight days from the 6th day of February, 2023 to the Minister responsible for nationality and Citizenship, P.O. Box N-7147, Nassau, Bahamas.

NOTICE

NOTICE is hereby given that WILDES LOUISDOR of Carmicheal Road, New Providence, The Bahamas is applying to the Minister responsible for Nationality and Citizenship, for registration/ naturalization as a citizen of The Bahamas, and that any person who knows any reason why registration/naturalization should not be granted, should send a written and signed statement of the facts within twenty-eight days from the 6th day of February, 2023 to the Minister responsible for nationality and Citizenship, P.O. Box N-7147, Nassau, Bahamas.

NOTICE

Maguila Ltd.

Incorporated under the International Business Companies Act, 2000 of the Commonwealth of The Bahamas.

Registration Number 208505 B (In Voluntary Liquidation)

Notice is hereby given that the above-named Company is in dissolution, commencing on the 9th day of February, A.D. 2023.

Articles of Dissolution have been duly registered by the Registrar. The Liquidator is Marcelo Ruston, whose address is Rua Dr. Jorge De Oliverira Countinho 440, Ap. 51, Cep: 12246060, Parque Res Aquarius III, Sao Jose Dos Campos, SP - Brazil. Persons having a Claim against the above-named Company are required on or before the 10th day of March, A.D. 2023 to send their names, addresses and particulars of their debts or claims to the Liquidator of the Company, or in default thereof they may be excluded from the benefit of any distribution made before such claim is proved.

Dated this 9th day of February, A.D. 2023.

Marcelo Ruston Liquidator

THE TRIBUNE Monday, February 13, 2023, PAGE 9

INTENT TO CHANGE NAME BY DEED POLL

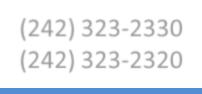

FRIDAY, 10 FEBRUARY 2023 CLOSECHANGE%CHANGEYTDYTD% BISX ALL SHARE INDEX: 2648.54-7.10-0.283.480.13 BISX LISTED & TRADED SECURITIES 52WK HI52WK LOWSECURITY SYMBOLLAST CLOSECLOSECHANGE VOLUMEEPS$DIV$P/E YIELD 7.005.30 AML Foods Limited AML 6.95 6.950.00 0.2390.17029.12.45% 53.0040.06 APD Limited APD 39.95 39.950.00 0.9321.26042.93.15% 2.761.60Benchmark BBL 2.76 2.760.00 0.0000.020N/M0.72% 2.652.31Bahamas First Holdings Limited BFH 2.46 2.650.19 1,5000.1400.08018.93.02% 3.002.25Bank of Bahamas BOB 2.98 2.980.00 1200.0700.000N/M0.00% 6.306.00Bahamas Property Fund BPF 6.30 6.300.00 1.7600.000N/M0.00% 9.808.78Bahamas Waste BWL 9.65 9.650.00 0.3690.26026.22.69% 4.502.90Cable Bahamas CAB 4.26 4.260.00 -0.4380.000-9.7 0.00% 10.657.50Commonwealth Brewery CBB 10.23 10.230.00 0.1400.00073.10.00% 3.652.54Commonwealth Bank CBL 3.58 3.50 (0.08) 5,0000.1840.12019.03.43% 9.307.01Colina Holdings CHL 8.50 8.500.00 0.4490.22018.92.59% 17.5012.00CIBC FirstCaribbean Bank CIB 15.99 15.990.00 0.7220.72022.14.50% 3.252.05Consolidated Water BDRs CWCB 2.96 3.020.06 0.1020.43429.614.37% 11.2810.05Doctor's Hospital DHS 10.50 10.500.00 0.4670.06022.50.57% 11.679.16Emera Incorporated EMAB 9.57 9.900.33 0.6460.32815.33.31% 11.5010.75Famguard FAM 11.20 11.200.00 0.7280.24015.42.14% 18.3014.50Fidelity Bank (Bahamas) Limited FBB 18.10 18.100.00 0.8160.54022.22.98% 4.003.55Focol FCL 3.98 3.980.00 0.2030.12019.63.02% 12.1010.00Finco FIN 12.10 12.100.00 0.9390.20012.91.65% 16.2515.50J. S. Johnson JSJ 15.76 15.760.00 0.6310.61025.03.87% PREFERENCE SHARES 1.001.00Bahamas First Holdings PreferenceBFHP 1.00 1.000.00 0.0000.0000.0000.00% 1000.001000.00 Cable Bahamas Series 6 CAB6 1000.001000.000.00 0.0000.0000.0000.00% 1000.001000.00 Cable Bahamas Series 9 CAB9 1000.001000.000.00 0.0000.0000.0000.00% 1.001.00Colina Holdings Class A CHLA 1.00 1.000.00 0.0000.0000.0006.25% 10.0010.00Fidelity Bank Bahamas Class A FBBA 10.0010.000.00 0.0000.0000.0007.00% 1.001.00Focol Class B FCLB 1.00 1.000.00 0.0000.0000.0006.50% CORPORATE DEBT - (percentage pricing) 52WK HI52WK LOWSECURITY SYMBOLLAST SALECLOSECHANGEVOLUME 100.00100.00Fidelity Bank (Note 22 Series B+)FBB22 100.00100.000.00 100.00100.00Bahamas First Holdings LimitedBFHB 100.00100.000.00 BAHAMAS GOVERNMENT STOCK - (percentage pricing) 115.92104.79Bahamas Note 6.95 (2029) BAH29 107.31107.310.00 100.00100.00BGS: 2014-12-7Y BG0107 100.00100.000.00 100.00100.00BGS: 2015-1-7Y BG0207 100.00100.000.00 100.00100.00BGS: 2014-12-30Y BG0130 100.00100.000.00 100.00100.00BGS: 2015-1-30Y BG0230 100.00100.000.00 100.00100.00BGS: 2015-6-7Y BG0307 100.00100.000.00 100.00100.00BGS: 2015-6-30Y BG0330 100.00100.000.00 100.00100.00BGS: 2015-10-7Y BG0407 100.00100.000.00 100.3299.95BGRS FL BGRS91032 BSBGRS910324 99.9599.950.00 100.12100.12BGRS FL BGRS88037 BSBGRS880378 100.03100.030.00 94.1594.09BGRS FX BGR132139 BSBGR1321391 93.3693.360.00 101.55101.42BGRS FX BGR124228 BSBGR1242282 101.45101.450.00 103.49103.38BGRS FX BGR118027 BSBGR1180276 102.70102.700.00 92.6792.67BGRS FX BGR131239 BSBGR1312390 92.5592.550.00 90.9890.98BGRS FX BGR132249 BSBGR1322498 90.9590.950.00 94.8094.80BGRS FX BGR134140 BSBGR1341407 93.9493.940.00 100.39100.39BGRS FX BGR138230 BSBGR1380306 100.39100.390.00 96.8496.84BGRS FX BGR138240 BSBGR1380405 96.1096.100.00 100.32100.32BGRS FL BGRS81035 BSBGRS810359 100.66100.660.00 100.34100.34BGRS FL BGRS81037 BSBGRS810375 100.17100.170.00 100.57100.57BGRS FL BGRS84033 BSBGRS840331 100.15100.150.00 MUTUAL FUNDS 52WK HI52WK LOW NAV YTD%12 MTH% 2.592.11 2.593.87%3.87% 4.903.30 4.904.87%4.87% 2.271.68 2.273.03%3.03% 203.47164.74 195.65-3.84%-3.84% 212.41116.70 180.14-15.19%-15.19% 1.771.71 1.773.07%3.07% 1.981.81 1.988.44%8.44% 1.881.80 1.884.42%4.42% 1.030.93 0.95-7.23%-7.23% 9.376.41 10.188.63%8.63% 11.837.62 13.6115.01%15.01% 7.545.66 7.732.87%2.87% 16.648.65 13.13-20.87%-20.87% 12.8410.54 12.06-4.33%-4.33% 10.779.57 10.62-0.31%-0.31% 16.279.88 16.27N/AN/A 11.228.45 11.223.00%25.60% 14.8911.20 N/A N/A N/A MARKET TERMS BISX ALL SHARE INDEX - 19 Dec 02 = 1,000.00 YIELD - last 12 month dividends divided by closing price 52wk-Hi - Highest closing price in last 52 weeks Bid $ - Buying price of Colina and Fidelity 52wk-Low - Lowest closing price in last 52 weeks Ask $ - Selling price of Colina and fidelity Previous Close - Previous day's weighted price for daily volume Last Price - Last traded over-the-counter price Today's Close - Current day's weighted price for daily volume Weekly Vol. - Trading volume of the prior week Change - Change in closing price from day to day EPS $ - A company's reported earnings per share for the last 12 mths Daily Vol. - Number of total shares traded today NAV - Net Asset Value DIV $ - Dividends per share paid in the last 12 months N/M - Not Meaningful P/E - Closing price divided by the last 12 month earnings TO TRADE CALL: CFAL 242-502-7010 | ROYALFIDELITY 242-356-7764 | CORALISLE 242-502-7525 | LENO 242-396-3225 | BENCHMARK 242-326-7333 Colonial Bahamas Fund Class D Colonial Bahamas Fund Class E Colonial Bahamas Fund Class F CFAL Global Equity Fund Leno Financial Conservative Fund Leno Financial Aggressive Fund Leno Financial Balanced Fund Leno Financial Global Bond Fund RF Bahamas Opportunities Fund - Secured Balanced Fund RF Bahamas Opportunities Fund - Targeted Equity Fund RF Bahamas Opportunities Fund - Prime Income Fund RF Bahamas International Investment Fund Limited - Equities Sub Fund RF Bahamas International Investment Fund Limited - High Yield Income Fund RF Bahamas International Investment Fund Limited - Alternative Strategies Fund INTEREST Prime + 1.75% MARKET REPORT 31-Dec-2021 31-Dec-2021 MATURITY 19-Oct-2022 20-Nov-2029 31-Dec-2022 31-Dec-2022 6.95% 4.50% 31-Dec-2022 31-Dec-2022 4.50% 6.25% 31-Dec-2021 31-Dec-2022 31-Dec-2022 31-Dec-2022 31-Dec-2022 31-Dec-2022 31-Dec-2022 31-Dec-2022 31-Dec-2022 31-Dec-2022 15-Dec-2021 30-Jul-2022 15-Dec-2044 30-Jul-2045 26-Jun-2022 26-Jun-2045 15-Oct-2022 31-Dec-2022 22-Sep-2033 15-Aug-2032 26-Jul-2037 26-Jul-2035 15-Oct-2039 FUND CFAL Bond Fund CFAL Balanced Fund CFAL Money Market Fund CFAL Global Bond Fund 6.25% 30-Sep-2025 31-Dec-2022 6.25% 4.50% 6.25% 4.25% NAV Date 4.87% 4.68% 4.37% 4.81% 5.29% 5.14% 5.60% 26-Jul-2037 4.42% 15-Jul-2039 15-Jun-2040 4.66% 4.82% 13-Jul-2028 13-Oct-2027 15-Oct-2049 17-Jan-2040 15-Jun-2030 5.65% 5.35% 5.00% (242)323-2330 (242) 323-2320 www.bisxbahamas.com

PUBLIC NOTICE

Briland developer moves to ease utility burden fear

By YOURI KEMP Tribune Business Reporter ykemp@tribunemedia.net

By YOURI KEMP Tribune Business Reporter ykemp@tribunemedia.net

A HARBOUR Island developer’s $150m expansion has attracted mixed reviews with some local residents and businesses concerned about the additional burden it will impose on already-stretched utility services.

However, others view the 4M Group’s Briland Club Residences & Marina development as “a breath of fresh air” for the island, while the project itself - headed by Michael Wiener, principal of 4M Harbour Island Ltd - said the concerns were unfounded as it will be supplying its own water and electrical power.

Gregory Higgs, owner/ operator of Higgs Construction, told Tribune Business many people have “complained” about 4M’s expansion. “I don’t like the way how that project is changing, I really don’t,” he said. Mr Higgs added that he has been

involved in several meetings with Briland residents who also have expressed their displeasure with its growth, and added: “We are going to go into a meeting about this in the next few days.” 4M’s development has evolved from a marina, and

accompanying residences and amenities, via an additional $150m spend that will result in the construction of an extra 93 estate homes, cottages and villas. This is in addition to the $112m already spent on the project.

Maxcine Wilson, owner/

operator of Briland Art, said she is concerned about the extra energy that will be needed to power the project and sustain the additional homes. “I hope they have plans to bring their own power or electricity solution,” she added.

“They’re definitely going to have to accommodate those things. I would not be shocked if they wouldn’t have things like solar panels and things like that, because with our island now we are already at the max with all types of different electricity and water issues that go on here. So they would have to be wise enough to add things that they’re going to need to be able to maintain things and to be able to function. So they have to think of all of those things.”