$5.76 $5.29 $5.46 $5.92

Gov’t to double its share of treasure

By NEIL HARTNELL Tribune Business EditorA MULTI-MILLION underwater explorer yesterday said it is “still evaluating the economics” after the Government moved to double its share from treasure salvaging in Bahamian waters.

David Concannon, Allen Exploration Group’s spokesperson, told Tribune Business via e-mailed reply it had been engaged in “ongoing discussions” with the Davis administration about revising the present formula that splits the proceeds from underwater treasure salvaging 75/25 between the explorer and the Government.

The majority of the economic benefits thus go to the explorer, and legislation tabled in the House of Assembly yesterday aims to change this so that they are split equally - or 50/50 - with the Government. Besides now receiving 50 percent of

• Tables Bill to give Bahamian people 50% of all finds

• Moves away from gaining majority share to equality

• Major explorer ‘evaluating economics’ of 50/50 split

the proceeds from all licensed treasure salvaging in Bahamian waters, the Government will also get “first preference” in selecting its share of the recovered artifacts as well as the right to retain those deemed vital to “natural patrimony”.

The Antiquities, Monuments and Museum (Amendment) Bill 2023, in its “objects and reasons” section,

Probe into ‘legitimacy’ of $7.7bn FTX withdrawals

• $219.5m cash ownership tangled by ‘commingling’

states: “This Bill seeks to amend the principal Act to provide for any recovered artifacts to be shared between the Government and the licensee, with each to receive 50 percent, and the Government to have first preference in selecting its share of the recovered artifacts.

“The Bill also seeks to amend the regulation making power to prescribe the maximum period for which a particular type of licence may be granted.” The changes are given effect by reforms to the existing Act’s section 13, with the Bill and its changes receiving their first reading in Parliament yesterday.

“Any artifacts recovered by a licensee under a licence to survey for, or recover, underwater cultural heritage shall be shared between the Government and the licensee with each to receive 50 percent of the total value measured by points, and the Government shall have first

SEE PAGE B4

Bahamas ‘into line’ on economic substance

By NEIL HARTNELL Tribune Business Editor nhartnell@tribunemedia.netTHE ATTORNEY General yesterday said reforms to bring The Bahamas’ economic substance regime “into line” are “not necessarily” designed to address the deficiencies that led to the country’s re-blacklisting by the European Union (EU).

Ryan Pinder KC, in messaged replies to Tribune Business, said legislation tabled yesterday in the House of Assembly was designed to update The Bahamas’ regulatory framework such that it matched the latest “standard” for corporate entities to have

a real “economic presence” in a jurisdiction.

“The Bill is an amendment to reflect updates to the economic substance regime. Not necessarily addressing the

SEE PAGE B5

Bahamas liquidators explore FTX

By NEIL HARTNELL Tribune Business Editor nhartnell@tribunemedia.netFTX’s remaining Bahamas-based staff were paid a collective $635,297 through to end-January 2023 as provisional liquidators explore “options” that may include restarting its trading platform, it was revealed last night Brian Simms KC, the Lennox Paton senior partner, and PricewaterhouseCoopers (PwC) accountants Kevin Cambridge and Peter Greaves, in their first interim report to the Supreme Court confirmed all bar 16 of FTX

‘restart’

Digital Markets’ employees had either left the collapsed crypto exchange or been terminated at end-January.

They added that virtually all the Bahamian subsidiary’s 49 expatriate employees, out of a total 83-strong workforce, fled the jurisdiction within hours of it being placed into provisional liquidation. This, the trio added, deprived them of potentially critical information on FTX Digital Markets operations and finances, with few subsequently co-operating with their investigations or accounting for company property in their possession.

SEE PAGE B6

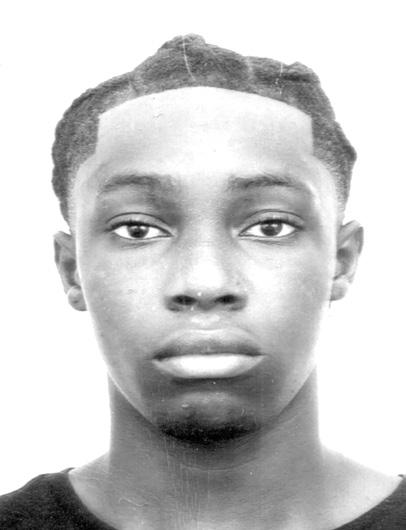

• Bahamian entity’s 2.4m clients in 230 ‘jurisdictions’ BRIAN

By NEIL HARTNELL Tribune Business Editor nhartnell@tribunemedia.netFTX’s Bahamian liquidators are probing whether $7.7bn was withdrawn from its local subsidiary via “legitimate” transactions as they yesterday revealed virtually all countries are represented in its 2.4m-strong client base.

Brian Simms KC, the Lennox Paton senior partner, and PricewaterhouseCoopers (PwC) accountants Kevin Cambridge and Peter Greaves, in their first interim report to the Supreme Court said they are having difficulty untangling FTX Digital Markets assets from those owned by clients because of the crypto exchange’s habit of “commingling” funds.

The trio, in particular, said they are examining whether $5.6bn worth of transactions between FTX Digital Markets and other entities in the group, and a further $2.1bn transferred to related parties, were improper or conducted for legal, appropriate reasons. And, pointing to the shambles that passed for corporate governance

CUTTING OFF WORKPLACE DISPUTES AT THE ROOT

Employees in the same workplace can often create discord through personal disagreements. Chances are that if you notice tension between employees, others within the office will too. Workplace discord comes in many forms, yet there is no one-size-fits-all solution for dealing with it. Such conflict not only threatens productivity, but creates tension in an environment that contributes to poor morale, absenteeism and even lower

rates of employee retention. What can you do?

A good manager should have the leadership skills required to handle discord in the workplace. They should not turn a blind eye, but look for solutions to create harmony through further discussion and dialogue. They must do their best to defuse the matter, and not take sides. In other words, diagnose the root cause and find out why coworkers are in conflict with each another. Such issues,

when not addressed, can fester over time and breed hostility. For the best results, a manager should eliminate all personal emotions from the situation so as to achieve an unbiased outcome. While it is impossible to prepare for every potential conflict, the practices listed below can help avoid and resolve common workplace clashes.

Professionalism: Do not avoid dialogue. True leaders listen to employees

and allow them to speak. Employees are more likely to co-operate when they are being listened to, which helps to resolve the issue more quickly.

Lead by example: Avoid the temptation to respond with anger when facing warring staff. If you feel that your judgment may be skewed towards an employee, seek a confidant’s input as an objective opinion can help.

Another key to eliminating discord in a workplace

is to give disgruntled employees space to discover the basis upon which their dispute was founded. Encourage an employee to employ their autonomy and create space to freely find what they can collaborate on together, if possible. This ensures that all parties understand each other’s perspectives on what has caused their feud such that they strike a balance and move forward on any shared challenge.

It is almost impossible to make people do anything they do not want to, or accept a situation they do not wish to accept. Conflict within the workplace, or even between two people, is inevitable. But understanding its cause and working to reduce the conflict is the job of a leader.

Whatever the case, a company wants to hire employees who are able to connect with its vision

away from conflict. And it is expected that they show up to do great work, respect co-workers and share in the company’s success. Until we meet again, fill your life with memories rather than regrets. Enjoy life and stay on top of your game.

NB: Columnist welcomes feedback at deedee21bastian@gmail.com

About Columnist: Deidre M. Bastian is a professionally-trained graphic designer/brand marketing analyst, author and certified life coach

RBC named as top private bank

ROYAL Bank of Canada

(RBC) says it has been named as the Caribbean’s best private bank by Global Finance Magazine

Besides receiving the regional award, RBC also captured the best private bank award in The Bahamas, Barbados and Trinidad & Tobago.

“I am extremely proud of our team for being recognised for another year of exceptional commitment to our clients, communities and one another,” said Dwight Burrows, RBC’s regional vice-president for private banking in the Caribbean.

“These achievements directly reflect their hard work and dedication to putting our clients at the centre of everything we do. It also demonstrates the power of a collaborative, innovative and client-focused approach to delivering differentiated solutions that go beyond traditional banking for our private banking clientele.”

The Global Finance editorial review board selected this year’s winners based on input from industry analysts, corporate executives and technology specialists who validated RBC’s expertise.

THE DEPUTY prime minister yesterday rejected accusations by trade union leaders that he is neglecting their concerns and ignoring calls for intervention in workplace disputes.

Chester Cooper, also minister of tourism, investments and aviation, told Tribune Business he was “always available” to meet with organised labour representatives at an agreed time after union leaders publicly voiced their displeasure over progress - or the alleged lack of itin resolving the grievances of air traffic controllers at Lynden Pindling International Airport (LPIA).

Obie Ferguson, the Trades Union Congress (TUC) president, said: “We have a hurdle, and that is the deputy prime minister. He is in fundamental breach of the Memorandum of Understanding. He has refused to meet with air traffic controllers. If air traffic stopped tomorrow, this country is closed down.

Simple.”

The air traffic controllers’ concerns are understood to relate to security protocols at LPIA, particularly the search procedures they undergo before being admitted to the control tower. It is thought the controllers, and their union representatives, believe the searches are too intrusive and invasive, especially for female controllers.

Mr Cooper, though, refuted the union concerns. “The Government is a friend of the labor movement,” he said in response to this newspaper’s inquiries. “We have executed more industrial agreements in the last year than the previous government did in five years. We have an open door policy with labour unions. I am available always to meet with Mr Obie Ferguson or any other union at a mutually agreed time.”

The Memorandum of Understanding referred to

by Mr Ferguson was signed between the then-Opposition Progressive Liberal Party (PLP) and the two main umbrella union bodies, the TUC and National Congress of Trade Unions of The Bahamas (NCTUB), in August 2021 prior to that year’s general election. It was viewed a the time by some as a mere “gimmick” to gain votes. However, now-prime minister Philip Davis KC denied this at the time and described the Memorandum of Understanding as “historic”. He said: “Today we are here, and we sign an (agreement) with the two umbrella unions signalling the unification of labour as well.”

Mr Ferguson, though, yesterday asserted that Mr Cooper has declined to meet with the unions to address the air traffic control situation. He blasted: “He has refused to meet over the last 12 months, so we tried to meet with him. We gave him the scenario, he would say: ‘I will revert’.

“We don’t represent politics; we represent workers and those who support workers. We’re not going to go along and allow the deputy prime minister to believe that he’s operating all by himself. He must meet respectfully with the trade unions that affected him, in particular. I for one do not like to threaten anybody. What we will do? We will do.

“We put him to be deputy prime minister, and he doesn’t recognise what we doing. What the potential will be? I wouldn’t make an announcement that Monday morning we can do certain things, because by nature, I don’t function like that. My colleagues do. They would know. And they will be a part of that process as to what precisely we will do. What I can say to you, though, we will not allow this to continue,” Mr Ferguson added.

“Everything has been going well, up to this point.

All the outstanding unions are in negotiations, even if they have not completed the industrial agreement, they are in negotiation.”

Mr Ferguson also alleged that Mr Cooper has refused to meet with union representatives to renegotiate industrial agreements involving Grand Lucayan workers, while also discontinuing the union dues paid by those workers. He said: “So, the workers in Grand Bahama under Lucayan. We had an industrial agreement there and it expired.

He discontinued the dues that is paid to the union in Freeport.

“The workers called me and said: Mr Ferguson, what is going on?’ I said: ‘Well, you know, just get ready. We got to do something.’ You don’t want to sign the new agreement, the one was there, it expired. You don’t want to sign that. He then obviously gave instructions to whoever not to pay the union dues, which is the dues by law signed-off by the parties.”

However, Tribune Business was yesterday given a different version of events surrounding the Grand Lucayan workers from that detailed by Mr Ferguson. Previously unionised staff were terminated during the COVID-19 pandemic and, when the resort subsequently re-opened, non-union staff were hired.

Kyle Wilson, the Bahamas Electrical Workers Union’s president, said:

“Outside of the current prime minister, you have to give him his props, but

he’s only one person. The chain is only as strong as its weakest link. I don’t care how strong Brave is. I don’t care what he does for this country. One person could destroy all of his work.

“The deputy prime minister must be careful not to tear down the work that the current administration is doing so far, and not to damage the fabric of labour. Because once you lose that, people aren’t going to forget and they won’t trust you any more.”

Gov’t to double its share of treasure

preference in selecting its share of the recovered artifacts,” the Bill stipulates.

It adds that, “notwithstanding” the terms set out in that clause, “the Government and the licensee shall agree in writing that government’s retention of any underwater cultural heritage artifacts, which are important to the protection of the natural patrimony, may exceed the Government’s 50 percent share in certain years with the imbalance to be corrected by future divisions”.

This means that, while in certain years the Government’s share of treasure salvaging proceeds may exceed 50 percent as it secures artifacts deemed important to Bahamian culture and history, this will be smoothed out in future years. The Bill’s reforms also allow for setting term limits on an underwater salvaging/exploration licence through providing for an unspecified “maximum period for which a particular type of licence may be granted”.

The Bill thus makes good on the pledge by Ryan Pinder KC, the attorney general, in June 2022 to

upgrade the AMMC Act in relation to The Bahamas’ “underwater cultural heritage”. However, the 50/50 proceeds split contained in the new legislation is different from what he said was the Government’s intent to “reverse” the existing 75/25 split so that itself - and not the explorer - received the majority share of any proceeds.

Allen Exploration, in response, said at the time it would cease treasure salvaging in Bahamian waters immediately if the Government took such a major share as this would plunge underwater explorers into a loss-making position and make their activities economically unworkable. It added that its millionaire principal, Carl Allen, owner of Walker’s Cay in the north Abacos, was “not in the business of turning money into heat by lighting dollar bills on fire”.

It thus appears that both the Government and underwater salvage industry may have reached a compromise via the Bill’s 50/50 proceeds split. Exploration outfits incur huge daily costs to support the nature of their activities, especially those related to vessels, equipment and manpower due

to the nature of their activities, while taking on all the investment and associated risks.

Tribune Business was yesterday informed by Bahamians who have worked in, and with, the underwater exploration industry that the 75/25 proceeds split in the sector’s favour is standard practice in Florida and other jurisdictions where it is present so that it can gain sufficient return on investment.

However, the Government will likely retort that itself - and the Bahamian people as tax-paying citizens - deserve a greater share of the rewards from their natural patrimony and historical assets that lie within the country’s territorial waters. It can also argue that the revised legislation creates a better, fairer deal in the Bahamian public’s interest.

Meanwhile, Allen Exploration’s Mr Concannon yesterday said the group’s principals have yet to “make money” on either the salvaging of the Nuestra Senora de la Maravillas, the sunken Spanish treasure galleon that some have described as “the most valuable shipwreck in the Western Hemisphere”, or

the Grand Bahama museum opened last year to showcase their discoveries.

“I have not seen the legislation tabled today, but we have had ongoing discussions with the Government about amending the current Act and revising the split,” Mr Concannon told Tribune Business. “As I [said] last summer, reversing the split to 75/25 in favour of the Government would be unworkable and Allen Exploration would stop its activities in The Bahamas. We are still evaluating the economics of a 50/50 split.

“So far, none of the recovery activities or the museum have made money for Mr and Mrs Allen. They don’t sell anything they have recovered. The museum was opened in August and entry was free to all Bahamians and students for quite some time. Establishing the museum in its current location is as difficult as could be expected for opening any new business in this location, whether it’s an ice cream stand of a historical museum.”

Turning to the planned legal reforms, he added: “As part of our discussions with the Government, we were asked to comment on various aspects of what could be in the amended legislation. Some things, like a greatly reduced licence area, limitations on the number of licences and significantly increased licence fees, would adversely impact our operations, but we have not been able to assess the exact financial impact yet.”

None of those was included in the Bill tabled yesterday, although Mr Pinder had indicated such reforms were being considered when he addressed the Senate in June 2022 during his contribution to the Budget debate. “The Government is seeking to update The Bahamas’ legislation relative to

underwater cultural heritage by amending the Antiquities, Monuments and Museums Act (AMMA) along with amendments to the associated regulations,” he said then.

“The proposed amendments specifically relate to licensing requirements, costs, timeframes, geographical areas and the current government licensing revenue split with respect to salvage licensees. Right now, the Government gets 25 percent of the assets that people dive for and dig up. We will reverse that. We will get the majority interest in cultural assets underwater in this country.”

Mr Pinder later clarified to Tribune Business that the revised split had to be determined by the Davis Cabinet. “Cabinet would decide what the actual split will be, but we anticipate that it will be the majority position,” Mr Pinder said last June. “It will be rebalanced in favour of the Government. That goes before the Cabinet. The Cabinet will decide the actual split.”

However, it appears the Government, while doubling its share by onequarter to 50 percent (one half), has opted for equality rather than the majority. Allen Exploration’s Mr Concannon said: “We would like to continue having open and honest conversations with the Government to craft solutions that work well for everyone.

“All of the conversations we have had with the Government to-date have been very positive. We believe we have a good working relationship with the Government, and we would like to see this continue. As far as I know, there have not been any discussions about Allen Exploration being ‘grandfathered in’ if changes are made.

“Frankly, I think it is too soon to have this discussion,

but it is a legitimate topic of discussion depending on how things play out. Like I said, we have a good relationship with the Government, and we would feel free to continue having open and honest conversations about any relevant topic,” he continued.

“The recovery and conservation activities are ongoing, weather permitting. I do not have information on the latest discoveries, but I know these are regularly shared on social media and at the museum. The recovery work is slow but encouraging.”

Tribune Business was yesterday told that the former Minnis administration was encouraged to push for the same 50/50 proceeds split, and enact the same reforms to the Act, now being pursued by the Davis administration. However, it signed-off on Allen Exploration’s licence before making such moves, and thus was locked in to the 75/25 arrangement.

The Bahamas, and successive administrations, have long struggled to get to grips with underwater exploration and treasure salvaging within this nation’s territorial waters, which resulted in a long-standing moratorium on new licences until the one granted to Allen Exploration.

Lacking the necessary expertise and resources to conduct proper oversight, together with the required regulatory regime, The Bahamas has allowed many of these sites to be pillaged and ransacked by unauthorized foreign salvors. This has resulted in many Bahamian artifacts appearing at overseas auctions and sales without this nation receiving a cent in benefits for them.

Yet the sector holds much-needed economic and fiscal potential for The Bahamas should it get it right. One industry source, asked about the sector’s potential value to The Bahamas, simply responded: “Billions”. They added: “The second and third most valuable wrecks in the entire western hemisphere are located off Grand Bahama.

“It would be an entire industry. It has the ability to effectively put Freeport back on the map. You’re talking about billions in artifacts, and I mean billions. You’ve got from conservation of artifacts to research to study to inventory. The question is where is the transparency and the accountability.”

Bahamas ‘into line’ on economic substance

uncooperative status from the EU,” he explained. The Commercial Entities (Substance Requirements) (Amendment) Bill 2023 is designed to enhance and speed-up information reporting and sharing with other jurisdictions, as well as setting out a path for non-compliant entities to remedy their deficiencies, the timeline for doing so, and sanctions that can be imposed.

“This Bill seeks to bring the Commercial Entities (Substance Requirements) Act into line with the amended standard on substantial economic presence requirements,” the legislation’s “objects and reasons” section states. “It provides for simplified exchanges of electronic returns and more efficient timelines for compliance with the Act.”

The Government body responsible for overseeing economic substance reporting, which is presently the Ministry of Finance, can now “spontaneously” or instantly exchange such reports with the home “tax residence” jurisdiction of a Bahamas-domiciled entity and its legal/beneficial owner.

And, if a Bahamian company or corporate vehicle is non-compliant with economic substance laws, it will have 28 days to remedy the defects. Failure to do so will result in an audit inspection, and if this does not happen within 21 days of the Government’s order, a $150,000 administrative fine will be levied. If the audit uncovers further non-compliance, a notice detailing what must be corrected will be issued. The subject entity will then have 14 days to comply, and failure to do so could result in the imposition of an up to $300,000 administrative fine and, ultimately, being struck-off the Companies Register. This was said to “provide for more efficient measures for compliance with the Act”.

Mr Pinder, meanwhile, said the Government was already working on separate

initiatives to secure The Bahamas’ removal from the EU’s tax blacklisting by overhauling the electronic portal that facilitates economic substance reporting by entities domiciled in this nation.

“The EU non-cooperative status is as a result of the failed implementation of the economic substance regime by the prior FNM administration,” he reiterated, pinning the blame firmly on the Minnis government. “Their implementation plan utilising Inland Revenue was a failure.

“We have agreed with a service provider to provide a new purpose-built economic substance reporting portal. The implementation and customisation is underway. The solution selected is a successful platform used throughout the region. It is designed and implemented by the same provider that put in place the beneficial ownership reporting portal, which works.”

The EU blacklisted The Bahamas because it was unable to correct deficiencies in its economic substance reporting regime prior to the April 2022 deadline. This relates to the Commercial Entities (Substance Requirements) Act 2018, which requires companies conducting “relevant activities” to confirm they are carrying out real

business in The Bahamas via annual electronic filings. These companies must show they are doing real, legitimate business in a jurisdiction and are not merely brass plate, letterbox fronting entities acting to shield taxable assets and wealth from their home country authorities. Tribune Business previously reported that deficiencies with the economic substance reporting portal, and an inability to interrogate, test, analyse and inspect the data, was the critical factor behind the EU blacklisting.

Mr Pinder, addressing the Senate at end-October 2022, said: “To give some context, the deficiencies primarily lie in the reporting portal and methodology that was put in place. The former FNM government looked to put the substance reporting through the Department of Inland Revenue framework.

“This method was ineffective and presented many problems with the actual administration of the reporting. In fact, at a point in time the reporting was being done on a manual entry basis as the entire platform was nonfunctional. A complete failure of implementation, which led to the blacklisting of the country by the EU.” This, though, subsequently became a political controversy.

Ministers in the former Minnis administration have previously refuted assertions that nothing was done to correct these deficiencies. They argued that the company which originally developed the portal was contracted to fix the weaknesses, and a plan was left in place prior to the September 2021 general election to remedy the EU’s concerns.

Kwasi Thompson, former minister of state for finance

and others, have instead argued that the Government’s failure to follow through on this and act more rapidly led to the EU blacklisting. They have also asserted that the departure of Stephen Coakley-Wells, who headed the Ministry of Finance’s international tax unit, and the disbanding of the unit itself may have meant no one in government was focused on the EU issue.

The Government also did not explain why three letters signed by Prime Minister Philip Davis KC were sent to the EU over a six-week period between December 2021 and January 2022 promising that The Bahamas would comply with its demands by the April 2022 deadline. This suggests that either the scope of work was underestimated or that there was an execution failure.

• Monitor operations to ensure compliance with safety or security policies or regulations. Observe individuals’ activities to gather information or compile evidence.

• Operate surveillance equipment to detect suspicious or illegal activities.

• Discuss performance, complaints, or violations with supervisors.

• Monitor establishment activities to ensure adherence to all gaming regulations and company policies and procedures.

• Observe gaming operations for irregular activities such as cheating or theft by employees or patrons, using audio and video equipment.

• Report all violations and suspicious behaviors to supervisors, verbally or in writing.

• Act as oversight or security agents for management or customers. .

• Be prepared to work within a shift system

• Retain and file audio and video records of gaming activities in the event that the records need to be used for investigations.

• Perform other related duties as assigned by Management.

Interested persons must require surveillance experience, certification, training, communication skills, attention to detail, ability to work independently and should apply at Jarol Investments Limited Head Office, Prince Charles Drive (Across from Restview) between the hours of 9am to 5pm. Or send your CV to careers@ chancesgames.com Subject: Surveillance Officer – Your Name

Open to:

Embassy of the United States

Vacancy Announcement

The American Embassy in Nassau is accepting applic ations for the following position: Trades Helper

All Interested Applicants / All Sources

Duties:

Assists skilled technicians i n the perfom1ance of maintenance and repair work. The incumbent will also be assigned tasks to include material handling, painting, custodial type work, common laborer work, and grounds maintenance and gardening work.

Interested candidates are required to possess the following skills and qualifications:

• Education: Completion of Seconda ry school is required.

• Experience: A minimum of two (2) years of maintenance or construction semi-skilled work experience in skilled trades such as mechanical (HVAC and Plumbing), electrical, carpentry, with significant focus on building systems.

• Language: English (Limited knowledge) Written/Speaking/Reading. This may be tested.

• Skills & Abilities: Must have had a valid, current driver's license for a minimum of five (5) years.

The complete Vacancy Announcement and Application forms are available online on the Electronic Recruitment Application (ERA) located on the following website: https://bs.usembassy.gov/embassy/jobs

Applications will not be accepted at the Security Gate of the Embassy, by Mail, E-mail or othe1· means of delivery.

Opening Period: Mondav January 30 - Friday Februarv 10, 2023.

Due to the high volume of applications, unsuccessful candidates will not be contacted.

Bahamas liquidators explore FTX ‘restart’

FROM PAGE B1

“During the collapse of the FTX Group, and following the negative media publicity surrounding the difficulties being experienced by the FTX Group, many of The Bahamasbased expatriate workers departed the country before the joint provisional liquidators were able to liaise with them and have subsequently not made themselves available for questioning,” the report revealed.

“Furthermore, a number of key individuals have not made themselves available for questioning due to the ongoing criminal investigations.... Many of these employees have not accounted to the joint provisional liquidators in respect of their whereabouts or FTX Digital property that they may hold and, with the exception of a few individuals, many of the expatriate employees have been unavailable in The Bahamas for work during the period of the provisional liquidation.”

The Bahamian provisional liquidation trio added that they retained 33 FTX Digital Markets employees for 11 weeks, or almost

three months, following their November 10, 2022, appointment to “maximise optionality” in reorgansing the failed crypto exchange. This, though, could not be sustained beyond end-January as FTX had ceased to function although “the possibility of restructuring the company” remains live.

“Following their appointment, the joint provisional liquidators concluded that it was necessary to meet the ordinary salary requirements of certain employees of the company to facilitate the pursuit of a reorganisation and assist in the investigation of FTX Digital’s affairs; albeit the joint provisional liquidators did so without personally adopting their contracts,” the report said.

“Accordingly, salary costs, medical insurance and, where elected, pension entitlements have been met for a total of 33 employees as an expense of the provisional liquidation and covering the period November 2022 to January 2023, inclusive. Amounts totalling $635,297 have been met by the company in respect of these employment costs.”

COMMONWEALTH OF THE BAHAMAS 2022/PRO/npr/00842

PROBATE DIVISION

NOTICE

IN THE ESTATE OF LENOX ALEXANDER CARTWRIGHT of #30 Flax Terrace, Malcolm Road in the Southern District of the Island of New Providence one of the Islands of the Commonwealth of The Bahamas.

Notice is hereby given that all persons having any claim or demand against the above estate are required to send the same duly certified in writing to the undersigned on or before the 9th day of March A.D., 2023 after which date the Executor will proceed to distribute the assets after having regard only to claims of which they shall then have had notice.

And Notice is hereby also given that all persons indebted to the said estate are requested to make full settlement on or before the date hereinbefore mentioned.

BOWLEG MCKENZIE ASSOCIATES CHAMBERS Attorneys for the Administrator #67 RowClem House Marathon Road. Marathon Estates, Nassau, The Bahamas

Terminated employees were informed of their fate on January 17, 2023, in accordance with the Employment Act’s statutory two-week notice period, and they will rank among the priority creditor classes if they have any outstanding debts owed to them by FTX such as unpaid wages, pension contributions and accrued holiday allowance.

“The joint provisional liquidators currently continue to employ a total of 16 individuals to assist with the ongoing investigations into the company and the possibility of restructuring its business. Terms with each of these persons were entered into on an individual basis and contracts were effective from November 10, 2022,” Mr Simms and the PwC duo wrote.

That restructuring could involve the possible restart, restructuring or sale of FTX’s international trading platform that was overseen by FTX Digital Markets. The platform, its associated technology and intellectual property rights to it are a potentially major recovery source for creditors and clients. For this reason, it is being argued that the provisional liquidation should extend beyond the traditional six months to allow time for this.

“There has been interest expressed to the joint provisional liquidators by various third parties who wish to invest in and/or otherwise purchase certain parts of the FTX Digital business, including the FTX international platform. The joint provisional liquidators have held discussions with those third parties, where considered appropriate,” the Bahamian trio said.

Warning that FTX Digital Markets’ licence, and any value in it, would likely be lost if the exchange was placed into full liquidation, they added they they were exploring “the development of options to maximise returns to creditors via a platform reorganisation, which could include restarting the FTX international platform in some format.

“The joint provisional liquidators are co-operating with the Chapter 11 debtors in this regard, but it is thought likely that it will take three to four months to agree a plan that will then take time to implement.” The Bahamian trio added that talks with interested parties were in their “infancy”.

Probe into ‘legitimacy’ of $7.7bn FTX withdrawals

under FTX co-founder, Sam Bankman-Fried, and his close associates, they added that “limited controls” meant they were currently unable to determine how much of the $219.5m cash held in various FTX Digital Markets bank accounts belonged to the Bahamian subsidiary as opposed to its investor clients.

Giving an insight into the scale of FTX’s collapse, which is likely to keep global attention focused on The Bahamas, Mr Simms and the PwC accountants wrote: “Based on limited information available to the joint provisional liquidators to date, they believe that FTX Digital may have over 2.4m customers, including 10,500 institutional customers, in over 230 jurisdictions worldwide” as befits the world’s former third-largest crypto currency exchange.

The “230 jurisdictions” cited is more than the 195 sovereign countries in the world today, although the latter figure does not include the likes of Taiwan, the Cook Islands, Niue and dependent territories, such as the Cayman Islands, British Virgin Islands (BVI) and Turks & Caicos. Many FTX clients are likely to have held their accounts and investments through entities domiciled in the likes of the Cayman Islands and British Virgin Islands.

This, though, highlights the truly global reach of FTX’s collapse which has left almost no part of the world untouched. It also exposes the depth of work ahead of the Bahamian provisional liquidators, especially in probing whether some $7.7bn in total outflows from the local subsidiary were genuine.

“The joint provisional liquidators have also identified over $5.6bn in inter-company transfers from FTX Digital custodial accounts to FTX Trading, and $2.1bn in related party transfers from FTX Digital custodial accounts to Alameda. It is possible, however, that these transfers could relate to legitimate withdrawals from the FTX international platform,” the trio revealed.

Alameda Research was Mr Bankman-Fried’s private hedge fund/trading vehicle that played a central role in the FTX group’s collapse. After its speculative, risky bets and investments failed to produce the anticipated returns, and with lenders starting to demand repayment, it is understood that Mr Bankman-Fried and his inner circle increasingly began to use FTX client monies without their knowledge or permission to repay these loan facilities.

The Bahamian provisional liquidators said that, in the aftermath of their early November

appointment, they had quickly sought to gain control of FTX Digital Markets’ bank accounts, cash and “tangible assets”. This, though, was not without its challenges.

“The joint provisional liquidators have confirmed that FTX Digital held accounts with multiple banks, and that the balance of those accounts, translated to US dollars at the prevailing exchange rates, were approximately $219.5m,” their Supreme Court report reveals.

“Requests have been made to the relevant banks to remit the balances held to accounts controlled by the joint provisional liquidators and, as at the date of this report, sums totalling $21.5m have been realised by the joint provisional liquidators with a further $54.5m pending transfer to the control of the joint provisional liquidators.”

To-date, that means the Bahamian provisional liquidators have gained control of just under 10 percent of FTX Digital Markets’ cash held at financial institutions. Of the sum recovered to-date, the vast majoritysome $21.2m - was handed over by BISX-listed Fidelity Bank (Bahamas), which is understood to have provided Bahamian dollar account facilities to enable the crypto exchange to pay its local bills. The other $300,000 came from Deltec Bank & Trust.

Of the “pending” $54.5m, some $10m is “retained in a restricted account relating to regulatory capital” at Fidelity Bank (Bahamas). That is understood to have been deposited at the Securities Commission’s request to fulfill requirements for FTX Digital Markets to provide regulatory capital. The other $44.5m is due to be handed over by two financial institutions “it is not appropriate” for the provisional liquidators to identify. The trio confirmed that the remaining $143.2m, out of the $219.5m, was seized from FTX Digital Markets’ US bank accounts by the US Justice Department.

“The joint provisional liquidators are currently seeking the release of these funds into their control,” they reported. “The joint provisional liquidators have met with the Department of Justice and continue to discuss and consider the options available to them to recover these funds, which they consider to be property of the FTX Digital estate.”

Then there is the problem of distinguishing who owns which funds. “Of the total of $219.5m identified by the joint provisional liquidators as monies held in FTX Digital’s accounts, around $137m is labelled as ‘FBO’ (for the benefit of) funds, [meaning] monies that should be held for the benefit of FTX Digital customers,” the Bahamian provisional liquidators revealed.

COMMONWEALTH OF THE BAHAMAS 2022/PRO/npr/00612 PROBATE DIVISION

NOTICE

IN THE ESTATE OF MICHAEL ELIAS ROLLE of Millineum Gardens in the Western District of the Island of New Providence one of the Islands of the Commonwealth of The Bahamas.

Notice is hereby given that all persons having any claim or demand against the above estate are required to send the same duly certified in writing to the undersigned on or before the 9th day of March, A.D., 2023 after which date the Administrator will proceed to distribute the assets after having regard only to claims of which they shall then have had notice.

And Notice is hereby also given that all persons indebted to the said estate are requested to make full settlement on or before the date hereinbefore mentioned.

BOWLEG MCKENZIE ASSOCIATES CHAMBERS

Attorneys for the Administrator #67 RowClem House Marathon Road. Marathon Estates, Nassau, The Bahamas

“However, upon review of the flow of funds, it appears that there were limited controls and governance in place to segregate customer fiat balances held by FTX Digital. It appears that client monies have been commingled such that it may not be possible to clearly identify sums that constitute client monies as opposed to general corporate funds.

“The joint provisional liquidators are investigating the position with counsel to conclude on the status of these monies, which the joint provisional liquidators understand will likely require an application for directions from the Supreme Court.” They also added that the question of who owns the assets on the crypto exchange’s international platform - clients, FTX Digital Markets or the FTX entities in Chapter 11 protection in Delaware - has yet to be determined.

Mr Simms and the PwC duo also revealed they presently only control “a small amount” of FTX-related digital assets, although they have asked Tether to transfer to their possession $46.7m worth of stablecoinbacked assets that were frozen following the crypto exchange’s collapse.

Some $323m worth of digital assets were removed from FTX’s international platform via hackers, while the Securities Commission of The Bahamas has custody of a further $426m that it secured to prevent them from being stolen. The hacked funds, as well as the $100m payout to a purported 1,500 “Bahamian” clients that violated the asset freeze imposed in the early days of the provisional liquidation, are among the key investigation targets.

“The joint provisional liquidators have undertaken preliminary investigative work on the frequent transactions with addresses and wallets that appear to have Alameda as a counterparty, by way of blockchain review and interviews with employees of FTX Digital,” their report added.

“From these preliminary investigations, the joint provisional liquidators have ascertained the following: Alameda appeared to provide liquidity to FTX Digital, in order to facilitate customer withdrawals, on a frequent basis and there have been indications of round-trip fund flows over the course of 2022 between addresses identified in the public domain as belonging

to Alameda and FTX International.”

The joint provisional liquidators’ report ultimately confirms they are in the early stages of probing FTX Digital Markets’ collapse, pursuing and seizing assets on behalf of clients/creditors, and unraveling the many riddles left behind by the crypto exchange’s co-founder, Mr BankmanFried, and his inner circle. Progress during the initial weeks following the trio’s appointment was hindered after FTX’s US chief, John Ray, and his team cut-off their access to the Bahamian subsidiary’s cloud-stored records and financial statements amid a near two-month battle as to who should lead, and have control, over the crypto exchange’s restructuring, sale and or winding-up.

The subsequent co-operation agreement between the Bahamian provisional liquidators and Mr Ray, for which both are seeking Supreme Court and Delaware Bankruptcy Court approval, respectively, should now give Mr Simms and his PwC colleagues access to the necessary data and accounting records to accelerate their probe.

Jarol Investments Limited is seeking to fill the following position: Accounts Clerk (Nassau)

• Maintains accounting records by making copies; filing documents.

• Counting cash and verifying amount received with Z reports.

• Maintains accounting database by entering data into the computer; processing backups.

• Preparing bank deposits.

• Protects organization’s value by keeping information confidential.

• Updates job knowledge by participating in education opportunities.

• Accomplishes accounting and organization mission

by completing related results as needed.

• Compiling daily cash collection report.

Interested persons should email their resume to careers@ chancesgames.com. or visit our Head Office on Prince Charles Drive (across from Restview Funeral Home) between the hours of 9 a.m. to 5 p.m.

Customs system fail hits import economy

By YOURI KEMP Tribune Business ReporterTHE Bahamas’ import economy was shut down on Tudesday after Customs’ electronic goods clearance system crashed due to an unspecified software problem. Brokers were not slow in venting their frustration as Ralph Munroe, the Customs comptroller, confirmed to Tribune Business that the Electronic Single Window (ESW), known as Click2Clear, went offline

for most of the day and the department was unable to restore service. The issue was described as a “developer” problem, forcing Customs to seek help from the Click2Clear software provider. “What we’ve got really is a developer’s problem. It’s not our problem on this side, but the developer’s,” Mr Munroe said. “They are the developers, so they have to tell us what the real issues are. But, for the last couple of days, we have been having several issues with it.”

Share your news

The Tribune wants to hear from people who are making news in their neighbourhoods. Perhaps you are raising funds for a good cause, campaigning for improvements in the area or have won an award. If so, call us on 322-1986 and share your story.

Mr Munroe did not provide further details, and referred Tribune Business to Customs’ information technology unit for more information, but they declined to comment. That same unit, on a message to the private sector and other stakeholders, said: “Please be advised that Click2Clear is currently down. We are working with the Data Centre to resolve this issue. We will advise of restoration when services come back online.”

Customs brokers were also closed down by the system’s failure. David Humes, owner/operator of Integral Logistics, said: “Things are not well. I can’t work because the Click2Clear is down. The Department of Customs sent out a notification, but now you have to wait on them to tell us when it will be back up.”

No details were provided on when the system will be restored. This is not the first time that Click2Clear has experienced technical difficulties.

NOTICE

NOTICE is hereby given that BIANCA M. LIBERUS of Pinewood Garden, New Providence, The Bahamas, is applying to the Minister responsible for Nationality and Citizenship, for registration/naturalization as a citizen of The Bahamas, and that any person who knows any reason why registration/naturalization should not be granted, should send a written and signed statement of the facts within twenty-eight days from the 9th day of February, 2023 to the Minister responsible for nationality and Citizenship, P.O. Box N-7147, Nassau, Bahamas.

The system went down for several hours in early January 2023 without any explanation as to what caused that problem. While import volumes are traditionally soft during late January and early February, ahead of the ramp-up to the peak winter tourism season, every shipment cleared counts.

Mr Humes said: “The truth is, business hasn’t been that great with me, at least not this time of the year. I have about three shipments pending. The system has been down for most of the day, and the day before, and we don’t know what the problem is. All they are saying is they are having technical issues.”

Customs and the Ministry of Finance have been pushing for all brokers to install software that will enable them to integrate with Click2Clear. But brokers have complained about the costs associated with acquiring and purchasing the necessary software.

Mr Humes said he has not purchased the software yet as Click2Clear is still working without it. “Whatever integration policy the Department of Customs is supposed to have, that hasn’t been implemented yet, because if that was implemented I don’t really know what people would do. I really don’t know,” he added.

“It is not as simple as it was made out to be. This is my take on it. The people who designed the software are the people you should go to if you are implementing something new. That is just simple.”

MINISTER PLEDGES NIB REFORM DETAILS ‘SHORTLY’

By YOURI KEMP Tribune Business Reporter ykemp@tribunemedia.net

By YOURI KEMP Tribune Business Reporter ykemp@tribunemedia.net

THE Government has made a decision on potential National Insurance Board (NIB) rate increases and will provide the details “shortly”, a Cabinet minister says.

Myles Laroda, minister of state in the Prime Minister’s Office with responsibility for NIB, speaking ahead of the weekly full Cabinet meeting said the Davis administration has “a little bit of cleaning up to do” before unveiling NIB’s future direction amid projections that its $1.5bn reserve fund will be exhausted by 2028 without fundamental reform.

“That matter has been dealt with at Cabinet,” the minister said of a potential contribution rate increase.

“We are at a decision. We have a little bit of cleaning up to do with regards to the decision that was made.

“And we would be coming forth shortly with the direction of which NIB would go with regards to the rates and contribution rates, and other

recommendations that were made in the report that the executive management team of NIB has recommended to the Government that, in their view, needs to change.”

NIB’s Board, echoing the social security system’s 11th actuarial review, was earlier this month said to have recommended to the Davis Cabinet that contribution rates be increased by between three-quarters of a percentage point and 1.5 percentage points from January 1, 2023. That would have raised the combined rate to between 10.55 percent and 11.3 percent, but the Government did not approve it, so the Board is now awaiting a move come July 1, 2023.

The International Labour Organisation (ILO), in the 11th actuarial report on NIB’s solvency and sustainability, warned there is no choice but to immediately increase contribution rates beyond the existing 9.8 percent otherwise the country’s future may be endangered by the chronic underfunding.

It called for a two percentage point increase in the current NIB contribution rate, split 3.9 percent/5.9

percent between employee and employer, to be implemented from July last year. That recommendation, too, was never taken up by the Government, with the report calling for a series of rolling rate increases every two years through to 2036 to help stabilise and shore up NIB and its $1.5bn reserve fund.

Mr Laroda, meanwhile, also yesterday addressed an Inter-American Development Bank (IDB) study which found NIB employees enjoy an average $64,000 income and benefits package that is some $10,000 higher than that for a leading secondary school head teacher.

The minister suggested the $64,000 figure was far in excess of NIB’s average staff salary, which he suggested was around $40,000.

Mr Laroda said: “I think they just focused on a department, I think maybe the PMU (project monitoring unit). That would make the most sense.

“The executives, of which there are 12, the average salary is around $90,000. Then you have the managers below that. There’s 165 individuals in that category, and the average salary is

around $58,000. “The 460plus non-management staff is around $32,000, and so for a staff complement of around just probably south of 650 staff members, it’s around $39,000. You could round off to, say $40,000,

the average staff member’s salary at the NIB.”

Mr Laroda also suggested NIB’s administrative costs were higher than other Caribbean social security schemes because, unlike their countries, The Bahamas is an archipelago where

services have to be duplicated on multiple islands.

NIB’s administrative costs were pegged at 19 percent of contributions, four times’ higher than in Trinidad. The minister replied: “I think sometimes we just need a look at the simple layout of Barbados and The Bahamas. Barbados is one land mass.

“Now, imagine The Bahamas, of which we have 19 islands. Imagine having staff for NIB in Nassau, Grand Bahama, Abaco, Eleuthera, Inagua, Mayaguana. There’s a lot of replications going on, and so you would need more staff members because you need somebody to be in charge of the office.

“So it’s easy to just go and pluck out, not comparing apples to apples and just comparing apples to oranges. The Bahamas is a unique place. We are an archipelago, and so the numbers in terms of management or supervisors will be higher because we have staff in each one of our islands that provide the service to that community.”

Unions demand culture inclusion at cruise port

By Fay SIMMONS jsimmons@tribunemedia.netTRADE union leaders yesterday demanded that a Bahamian culture and entertainment centre be located within the $300m Nassau Cruise Port project as they called for clarity on local artisan involvement.

Obie Ferguson, the Trades Union Congress (TUC) president, said: “We can’t find a sustained

cultural, nightclub or entertainment centre where the Bahamians can go and the tourists can go. The entertainment is on the ship. What happened to Bahamian entertainers; the limbo dancer, the fire dancer? Culture is critical for any country. The way you eat, the way you sing, the way you walk, the way you dress is all about culture.”

Linc Scavella, secretarygeneral for the Bahamas

NOTICE is hereby given that JULIEN PETIT-DOS of Ruby #35 Union Village, New Providence, The Bahamas is applying to the Minister responsible for Nationality and Citizenship, for registration/naturalization as a citizen of The Bahamas, and that any person who knows any reason why registration/ naturalization should not be granted, should send a written and signed statement of the facts within twenty-eight days from the 9th day of February, 2023 to the Minister responsible for nationality and Citizenship, P.O. Box N-7147, Nassau, Bahamas.

NOTICE is hereby given that JOSE ETIENNE of Montrose Avenue, New Providence, The Bahamas is applying to the Minister responsible for Nationality and Citizenship, for registration/naturalization as a citizen of The Bahamas, and that any person who knows any reason why registration/ naturalization should not be granted, should send a written and signed statement of the facts within twenty-eight days from the 2nd day of February, 2023 to the Minister responsible for nationality and Citizenship, P.O. Box N-7147, Nassau, Bahamas.

Musicians and Entertainers Union, said the Government must collaborate with his members when planning the port’s cultural activities. He said: “As far as we’re concerned, with regards to the project downtown, we need to know what’s happening with the entertainment down there.

“We need them to speak with us so we can know what’s going on from the ground floor, and so we can get the entertainment

organised. Also, we want a share in that. We want a stake in that.” However, the Nassau Cruise Port has made a deliberate effort to incorporate Bahamian culture and flavours into the project by setting up a committee featuring private and public sector representatives to oversee this aspect of its development.

The project is also set to feature an amphitheatre for the staging of events, plus a Junkanoo museum and multiple Bahamian-flavoured retail and restaurant spots. Mike Maura, Nassau Cruise Port’s chief executive, previously said the renovation is “expected to increase passenger capacity from

20,000 passengers to 33,000 passengers per day”. He added: “Nassau Cruise Port finished the year with 3.313m passengers arriving on 1,206 ships, while passenger forecasts for 2023 are over 4.1m and projected vessel calls are approximately 1,250.”

NOTICE is hereby given that DANIELLA BEAUCHAMP of Ruby Drive Winton Heights, New Providence, The Bahamas is applying to the Minister responsible for Nationality and Citizenship, for registration/ naturalization as a citizen of The Bahamas, and that any person who knows any reason why registration/naturalization should not be granted, should send a written and signed statement of the facts within twenty-eight days from the 9th day of February, 2023 to the Minister responsible for nationality and Citizenship, P.O. Box N-7147, Nassau, Bahamas.

NOTICE

NOTICE is hereby given that JADE ALEXANDER DUVERNOR of Joe Farrington Road, New Providence, The Bahamas is applying to the Minister responsible for Nationality and Citizenship, for registration/naturalization as a citizen of The Bahamas, and that any person who knows any reason why registration/ naturalization should not be granted, should send a written and signed statement of the facts within twenty-eight days from the 2nd day of February, 2023 to the Minister responsible for nationality and Citizenship, P.O. Box N-7147, Nassau, Bahamas.

www.bisxbahamas.com

NOTICE

NOTICE is hereby given that CHANTIL ISMA of Murphy Town Abaco, The Bahamas is applying to the Minister responsible for Nationality and Citizenship, for registration/naturalization as a citizen of The Bahamas, and that any person who knows any reason why registration/ naturalization should not be granted, should send a written and signed statement of the facts within twenty-eight days from the 9th day of February, 2023 to the Minister responsible for nationality and Citizenship, P.O. Box N-7147, Nassau, Bahamas.

NOTICE

NOTICE is hereby given that DARVILLE LEONARD of Pinedale Road, New Providence, The Bahamas is applying to the Minister responsible for Nationality and Citizenship, for registration/naturalization as a citizen of The Bahamas, and that any person who knows any reason why registration/ naturalization should not be granted, should send a written and signed statement of the facts within twenty-eight days from the 9th day of February, 2023 to the Minister responsible for nationality and Citizenship, P.O. Box N-7147, Nassau, Bahamas.

COMMONWEALTH OF THE BAHAMAS 2019/PRO/npr/00825

PROBATE DIVISION

NOTICE

IN THE ESTATE OF CHERYL SONJA MICHELLE AMBRISTER SMITH a.k.a CHERYL ARMBRISTER a.k.a. CHERYL SONJA SMITH of Danottage Estates in the Eastern District of the Island of New Providence one of the Islands of the Commonwealth of The Bahamas.

Notice is hereby given that all persons having any claim or demand against the above estate are required to send the same duly certified in writing to the undersigned on or before the 9th day of March, A.D., 2023 after which date the Executor will proceed to distribute the assets after having regard only to claims of which they shall then have had notice.

And Notice is hereby also given that all persons indebted to the said estate are requested to make full settlement on or before the date hereinbefore mentioned.

BOWLEG MCKENZIE ASSOCIATES CHAMBERS Attorneys for the Administrator #67