‘No new tax measures’ for $4bn revenue goal

By NEIL HARTNELL Tribune

Editor

THE Government’s top finance official yesterday reiterated his optimism that “no new tax measures” will be required to grow its revenues by some 43 percent to over $4bn during the next four years.

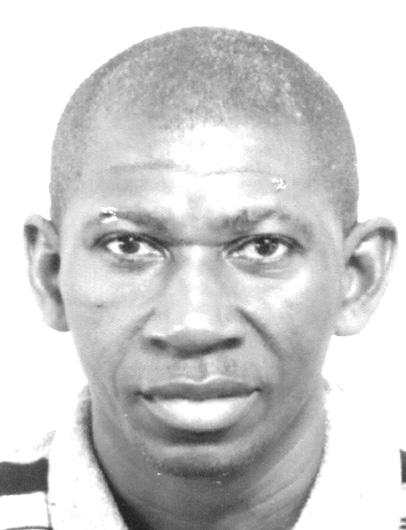

Simon Wilson, the Ministry of Finance’s financial secretary, told Tribune Business that closing the “VAT gap” and stricter compliance and enforcement are among the initiatives that will enable the Davis administration to expand the Public Treasury’s income by almost $1.2bn between now and the 2026-2027 fiscal year.

Speaking after the Government tabled its 2022 Fiscal Strategy Report in the House of Assembly, he also revealed

• Growth, ‘VAT gap’ close to drive $1.2bn jump

• Bahamas forecast to grow economy to $16bn

• GDP rise to finance bigger Gov’t, surpluses

plans to modernise the Department of Inland Revenue (DIR) via a joint review by the KPMG accounting firm and LTI. Mr Wilson, describing the latter as “a big Indian conglomerate”,

said the outcome was intended to transform the Government’s main revenue collection agency into a top-level tax administrator.

However, fiscal observers yesterday again voiced scepticism that the Government will hit its $4bn revenue goal - also representing its 25 percent revenue-to-GDP ratio target - without the imposition of any new and/or increased taxes. They argued that relying solely on economic growth to generate increased tax and fee income was unlikely to be enough to meet the Government’s objectives.

Hubert Edwards, the Organisation for Responsible Governance’s (ORG) economic development committee head, told this newspaper: “Having moves from around $2.4bn in revenues to

Gov’t revenues beat early goal by $50.6m

By NEIL HARTNELL Tribune Business Editor nhartnell@tribunemedia.net

THE Government’s top finance official yesterday said “close to $50m” in real property tax arrears has been collected during the 20222023 fiscal year’s first seven months as it seeks to crack down on tax and bill duckers

Simon Wilson, the Ministry of Finance’s financial secretary, told Tribune Business the Davis administration is encountering “more positives than negatives” in its push to resolve the country’s fiscal crisis by eliminating persistent annual fiscal deficits and restoring national debt sustainability.

“I’ll give you one number: Real property tax arrears,” he said. “For

this fiscal period we have collected close to $50m to-date. That tells you some of the success we have seen. We have got to work and focus on doing more. There are more positives than negatives. We are still seeing some negatives, but there are more positives.”

Mr Wilson spoke to this newspaper after the Government yesterday unveiled its Fiscal Strategy Report 2022 in the House of Assembly, which disclosed that total revenue collections for the first four months of the current fiscal year had beaten targets by $50.6m.

“As a result of improved economic conditions, coupled with revenue policy and revenue administration strategies articulated during

SEE PAGE B10

$2.8bn, to now make that jump to $4bn suggests there is significant underlying tax treatment going to be applied.”

The Fiscal Strategy Report shows the Davis administration is betting that growing The

Corporate income tax paper before Q1 end

By NEIL HARTNELL Tribune Business Editor nhartnell@tribunemedia.net

THE Government is hoping to release a public consultation paper on possible corporate income tax reforms before the 2023 first quarter’s end, it was revealed yesterday.

Simon Wilson, the Ministry of Finance’s financial secretary, told Tribune Business that the Davis administration was “very close” to releasing a so-called ‘green paper’ on The Bahamas’ options to comply with the global push for a minimum 15 percent corporate tax rate.

The Deloitte & Touch accounting firm was hired by the Government to examine the implications for the Bahamian economy and its financial services sector

BPL’s hedge mishandling to cost Bahamians $150m

By NEIL HARTNELL Tribune Business Editor nhartnell@tribunemedia.net

BAHAMIANS have been burdened with a $150m bill due to the mishandling of Bahamas Power & Light’s (BPL) fuel hedging strategy, it was revealed yesterday.

The full cost, branded “a significant unbudgeted liability” for the Government, was revealed in the just-released Fiscal Strategy Report, which said BPL’s arrears must be paid off to prevent electricity supplies being interrupted.

“The recent disclosure of approximately $150m of payment arrears of Bahamas Power & Light (BPL) represents a significant unbudgeted liability of the Government,” the report said. “To ensure continued provision of essential electrical services to the public, the Government has committed to ensuring payment of this liability by the corporation.”

This means the unpaid bills will have to be picked up by Bahamian households and businesses, either as taxpayers or BPL consumers. The report’s revelation is the first time that the full cost of the decision not to execute the trades underpinning BPL’s fuel hedging initiative, and not adjusting the energy monopoly’s fuel charge sooner, has been publicly disclosed.

To-date, only the $90m unpaid fuel bill owed to Shell, BPL’s supplier, has been disclosed. The Fiscal Strategy Report thus indicates that a further $50m-$60m of costs and payment arrears has been incurred, some of which may relate to loans advanced to BPL by the Government to enable it to hold its fuel charge at 10.5 cents per kilowatt hour (KWh) until October 2022.

BPL’s customers are now paying-off these arrears via fuel charge hikes that will peak at a 163 percent increase over last October’s bill between June and August this year, when consumption is at its peak due to the summer months. Much of the burden will fall on consumers using over 800 KWh per month, meaning that

business@tribunemedia.net THURSDAY, FEBRUARY 2, 2023

nhartnell@tribunemedia.net

Business

SEE PAGE B7

SEE PAGE B6 SEE PAGE B4

SIMON WILSON

$5.25 $5.29 $5.46 $5.16

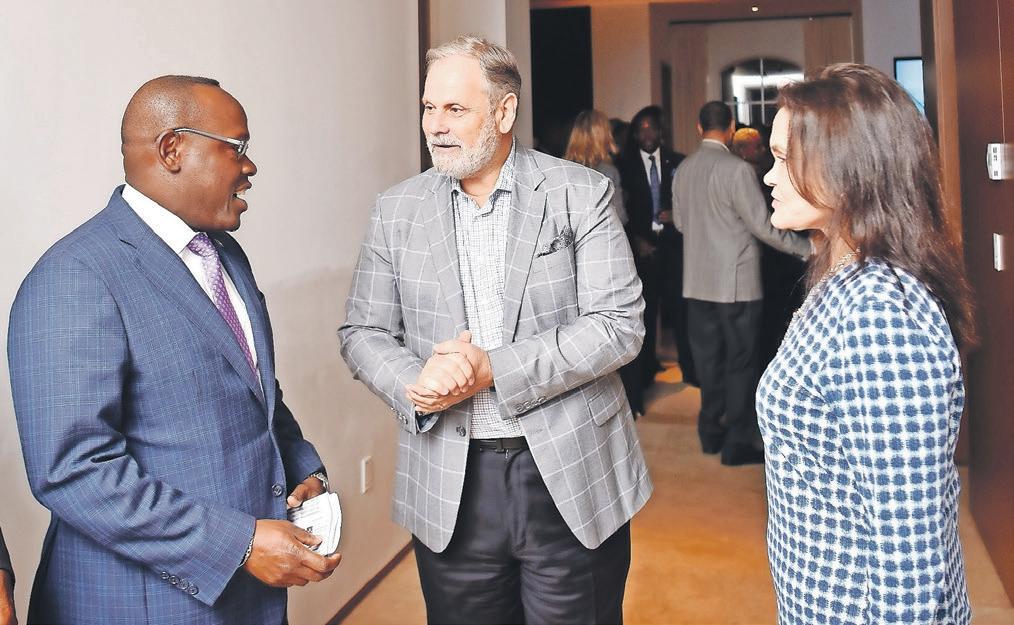

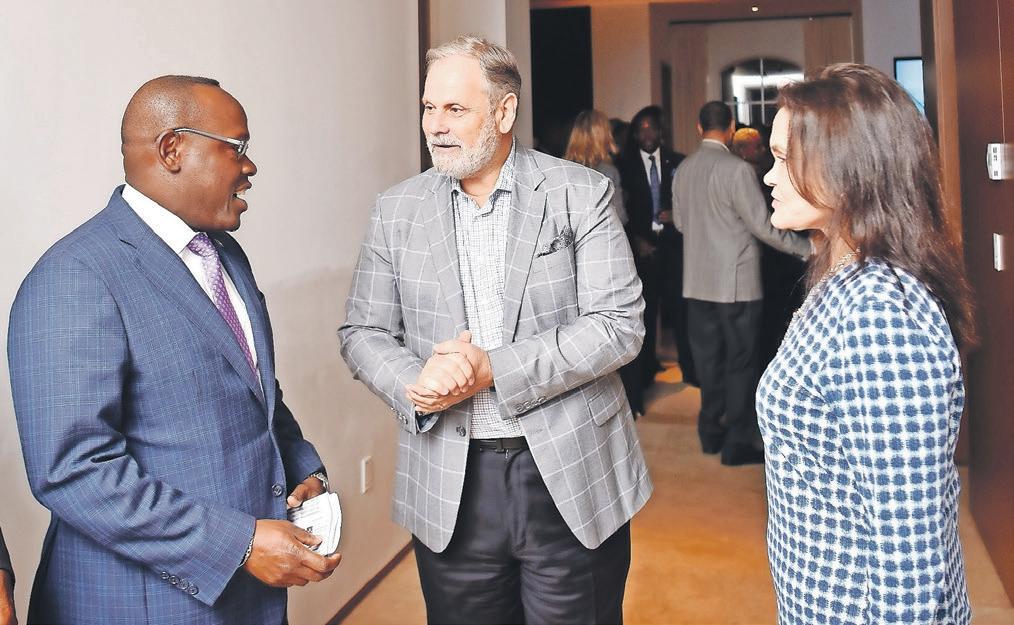

DPM PRAISES PARTNERS FOR 7M VISITORS IN 2022

THE DEPUTY prime minister has praised the Bahamian tourism industry for driving a post-COVID rebound that resulted in annual visitor numbers breaching the seven million mark for 2022.

Chester Cooper, also minister of tourism, investments

and aviation, spoke during a reception for resorts and industry operators at the Nexus Club, Baha Mar, on Monday, January 30. A similar event was held in Freeport last week.

“It is largely because of relationships we have built with partners and

stakeholders like you that we have seen the success we have in bouncing back from the pandemic,” the deputy prime minister said. “And there is simply no way that the Ministry of Tourism can go along day after day without acknowledging the tremendous partnerships

that make it possible for the islands of The Bahamas to have a vibrant tourism industry.”

Mr Cooper reported that air arrivals between September and December 2022 beat the previous record set pre-COVID in 2019. Overall cruise arrivals returned to pre-pandemic levels, reaching 5.4m. Cruise arrivals between July and December 2022 surpassed 2019 levels, with the later month seeing a record 735,000 passengers descend on The Bahamas’ shores.

“This is all fantastic news. Make no mistake about it. But I’ll tell you better news. We plan to beat those numbers this year,” Mr Cooper said. He announced that the Ministry of Tourism, between March and October 2022, is committed to attending travel trade shows in Berlin; the Arabian Travel Market; the Caribbean Marketplace; IMEX – Frankfurt, America; and others to drive new business to The Bahamas.

“We plan to go into all these united with you

because we can accomplish so much more when we combine our resources and efforts,” Mr Cooper said. He also revealed shifts in the responsibilities of the ministry’s executives abroad, aimed at having an additional impact on Bahamas tourism.

“More offerings means more linkages and more empowerment for The Bahamas,” the deputy prime

minister said. “And although we all make this look easy, we know that it takes an incredible amount of work to pull it all together. We can see that the eyes of the world are turning toward The Bahamas more and more, and new opportunities are opening up for us all. I encourage you all to maintain focus and work even harder so that we can achieve limits yet unseen.”

Economic Affairs ministry plans budget strategies

MICHAEL Halkitis, minister of economic affairs, met with department heads and Board chairpersons from the various agencies in his portfolio during a one-day internal workshop to discuss budget strategies for the next two to three years. The talks focused on developing comprehensive Budget and new expenditure listing, and addressing the need to unify all agencies and units’ strategic direction by concentrating all energy and resources towards the Government’s mandate.

The agencies represented included the Ministry of Finance, Ministry of Eco-

nomic Affairs, Department of Transformation & Digitisation, Bahamas Bureau of Standards & Quality, Small Business Development Centre, Financial Services, the Bahamas National

Statistical Institute, Consumer Affairs and the Consumer Protection Commission. The workshop was held on Wednesday, January 25, at SuperClubs Breezes.

PAGE 2, Thursday, February 2, 2023 THE TRIBUNE

Photo:Kristaan Ingraham/BIS

CHESTER Cooper is pictured with Graeme Davis, Baha Mar’s president; and Audrey Oswell, Atlantis president and managing director.

Photo:Kemuel Stubbs/BIS

PINTARD SLAMS ‘NONSENSICAL’ FISCAL STRATEGY REPORT DELAY

THE Opposition’s leader yesterday blasted the “nonsensical explanation” given by the Prime Minister for why the Government was two-and-a-half months late in releasing its key fiscal strategy document.

Michael Pintard branded the rationale given by Philip Davis KC in the House of Assembly as “implausible”, questioning why the leader of a sovereign nation would breach a legally-mandated disclosure deadline simply to avoid disrupting a Standard & Poor’s (S&P) review.

However, the Prime Minister, in turn, slammed the timeline for releasing the Fiscal Strategy Report as being one of the Fiscal Responsibility Act’s “fundamental flaws”. He argued that the deadline stipulated by that Act - that the report be disclosed annually by the third Wednesday in November - was “simply no feasible” this time because it would have “interfered” with S&P’s bi-annual

review of The Bahamas’ creditworthiness. Responding to Mr Pintard’s frequent attacks on the Government’s failure to comply with this legal requirement, Mr Davis said: “In accordance with the Fiscal Responsibility Act 2018, the Fiscal Strategy Report is to be tabled in Parliament on the third Wednesday of November of each year.

“While in Opposition, and since coming to office as the Government, we have articulated on multiple occasions the fundamental flaws in the Fiscal Responsibility Act — including this very same timeline.” Last year’s release date would have been November 16, and Mr Davis justified the delay on the basis that timely disclosure could have impacted an S&P review that ultimately halted a run of successive downgrades suffered by The Bahamas’ creditworthiness.

“This date, Madam Speaker, was simply not feasible, for at this time The Bahamas was in the middle of its S&P bi-annual credit rating review. Tabling such

a document would have interfered with the independent review process,” he said. S&P, the credit rating agency, released the results of its review - and the decision not to further downgrade The Bahamas - some six days later on November 22.

“This event was very significant for our country as, for the first time in almost a decade, positive signs were observed in The Bahamas’ credit rating,” Mr Davis said. “While the S&P rating did not provide an improved credit rating for The Bahamas, it did provide for an improvement in the credit outlook from ‘negative’ to ‘stable’.

“I point this out to emphasise that this constitutes a reversal of the country’s deteriorating credit position. Our plans to restore the country’s fiscal health are working. Given the significance of this report and its implications for the Government’s fiscal policies, projections and debt sustainability, the 2022 Fiscal Strategy Report and Debt Management Strategy were deferred to allow for

inclusion of this significant outcome in our projections, policies and strategy.”

However, there have been instances more recently than a decade ago when both S&P and Moody’s have moved The Bahamas’ outlook from ‘negative’ to ‘stable’ while also holding off on any rating downgrade.

Mr Pintard, for one, was not buying the Prime Minister’s explanation. “I thought it was so ridiculous as I listened to him,” he told Tribune Business. “It is most unfortunate to hear the Prime Minister give the most implausible explanation, and I’m giving him credit by saying ‘implausible’.

“I’d hate to think the leader of a sovereignruled country would time the release of a report on the basis of a credit rating agency review. It’s a nonsensical explanation in my mind. The Government has been consistently late on a series of reports they have to release despite how aggressive they were in Opposition, calling on the previous administration to

be compliant with reporting deadlines.”

Moving past the delayed release, Mr Pintard said “more significant” now is to obtain a date from the Government on when the Fiscal Strategy Report will be debated in the House of Assembly. Obie Wilchcombe, minister of social services and urban development, promised that a date for the debate will be forthcoming during yesterday’s House proceedings, although none was given.

The Free National Movement (FNM) leader indicated he was especially eager to obtain a debate date given that the 2021 Fiscal Strategy Report was not subjected to such scrutiny. He added that the Davis administration’s rationale for passing on last year’s debate was they were “not going to waste Parliament’s time, even though they are obligated by law to do so”.

Mr Pintard, noting that many projections in the 2021 Fiscal Strategy Report were seemingly abandoned four months later when the 2022-2023 Budget was

National debt forecast to peak at $11.462bn

By NEIL HARTNELL Tribune Business Editor nhartnell@tribunemedia.net

THE Government yesterday forecast that the national debt will peak at $11.462bn in the next fiscal year with its ratio as a percentage of economic output declining steadily to 67.1 percent by 2026-2027.

The Davis administration’s 2022 Fiscal Strategy Report revealed it is relying almost solely on economic growth to keep key indicators, including debt and recurrent spending as a percentage of gross domestic product (GDP), in check while also financing a continued expansion in the size of government that is outpaced by revenue growth.

The $1.2bn expansion to $4bn in annual revenues by 2026-2027 is also intended to slash 2022-2023’s $564m fiscal deficit to just $105.5m next year, before the ‘red ink’ is eliminated entirely and the Government produces consistent Budget surpluses of $287.3m, $209.8m and $242.2m over the next three years. A surplus is achieved when the Government’s income exceeds its spending.;

Prime Minister Philip Davis KC, addressing the House of Assembly yesterday, said the Government is aiming for its first Budget surplus in the 20242025 fiscal year. It is also aiming for revenue yields to improve to more than 24

percent of GDP that same year, and for “a measured reduction” in government spending to less than 23 percent of GDP.

Meanwhile, the Government’s medium-term debt management strategy report, also unveiled yesterday, exposed the increasing preference of Bahamian investors for its short-term paper given the perception of increased fiscal risks. The proportion of government bonds maturing in one year or less near-doubled yearover-year in 2022 to more than 10 percent of the outstanding debt stock.

“Market appetite for domestic bonds remained strong throughout fiscal year 2021-2022 and into the opening quarter of fiscal year 2022-2023, favoured by the elevated levels of excess cash in the banking system,” the report said.

“Of the $4.137bn in outstanding bonds at end-September 2022, the creditor profile was dominated by private sector investors (52 percent), many of whom tend to have a long- term investment preference. Next were commercial banks (24.7 percent) with liquidity requirements typically concentrated in the short to medium-term investment horizon, followed by public corporations (12.6 percent) and the Central Bank (7.2 percent).

“The proportion for insurance companies, which tend to match their

long-term liability structure, moved lower to 3.5 percent from 4 percent in September 2021. Based on the maturity structure, 72.7 percent of the portfolio was held in the over 15 -year bucket, with an approximate doubling in the proportion for the oneyear or less tranche to 11.3 percent from 5.7 percent at end-June 2021,” it added.

“Besides the gain in the over one to five-year tranche to 5.6 percent, lower shares were registered for the over five to ten-year (8.4 percent) and the over ten-15 year (1.9 percent) maturity buckets.” The medium-term debt management strategy report also conceded the need for reforms that broaden the investor base for the Government’s domestic bonds and improve market efficiency.

“Despite a diverse investor base in the Bahamian dollar bond market (comprising financial institutions, businesses, private individuals, credit unions, pension funds), the Government acknowledges the need to encourage new market players and achieve greater efficiency in the bond issuance process,” the report added.

“To this end, several initiatives are underway which focus on liquidity, transparency, secondary market trading, settlement mechanisms and investor diversification. Among these are the upcoming transition to an online

auction for Bahamas Government Securities Depository-registered participants, the concurrent establishment of a new noncompetitive bidding scheme carve-out for retail investors, and the introduction of a savings bond to promote a savings culture and support financial inclusion.”

The report also highlighted why, for the time being, the Government is avoiding the international bond markets given the unfavourable environment generated by interest rate hikes in the US and other developed countries, increased spreads and the negative investor sentiment displayed towards emerging market nations such as The Bahamas. This is despite “market outreach” efforts resulting in an eight percentage point yield reduction on the country’s short-term debt.

“The Bahamas witnessed significantly higher yields on its international bonds, by an average of approximately 520 basis points, through early November 2022,” it said. “Since the beginning of the COVID19 crisis, The Bahamas synthetic 10-year US dollar yield firmed progressively to reach a maximum of 14.7 percent in August 2022, and has gradually decreased since then.

“Although foreign currency debt refinancing needs remain manageable over the medium term, The Bahamas international

yield levels have made the Eurobond market an unattractive source of funding.

In late October 2022, the Debt Management Office launched a market outreach to the international investor base to realign market perception with the country’s healthy macroeconomic fundamentals and explain the Government’s

unveiled last May, told this newspaper: “We don’t find their actions to be consistent with their words.... The kind of actions they took were different from what was outlined in that Fiscal Strategy Report.”

The Prime Minister, meanwhile, touted the latest Fiscal Strategy Report as “the most comprehensive and clearly articulated strategy the country has ever produced”. He added that this was based on reviews of the document before publication by international financial institutions and economists.

“These are not just technical achievements — they represent real progress for The Bahamas, progress that Bahamians are going to feel,” Mr Davis said. “Progress on our fiscal goals supports our efforts to build a diversified economy, one that will generate more inclusive opportunities and prosperity. Progress on fiscal goals means progress for people.”

diversified funding strategy for 2022-2023.

“This event... has helped to achieve a reduction of yields on the short end of the curve, with a decrease of more than 800 basis points for the 2024 Eurobond since October 2022. In the shortterm, The Bahamas intends to access alternative funding sources on both external and domestic markets, including structured credits involving multilateral lenders, to secure funding at a lower cost.”

THE TRIBUNE Thursday, February 2, 2023, PAGE 3

By NEIL HARTNELL Tribune Business Editor nhartnell@tribunemedia.net

DEBT REPORT’S ‘WORRYING STORY’ FOR THE BAHAMAS

A GOVERNANCE reformer says a recentlyreleased report on Caribbean debt levels tells a “worrying story” for The Bahamas and its regional counterparts as they battle to overcome the fall-out from countless hurricanes and COVID.

Hubert Edwards, head of the Organisation for Responsible Governance’s (ORG) economic development committee, told Tribune Business that the

Inter-American Development Bank (IDB) study, ‘Dealing with debt-less risk for more growth in Latin America and the Caribbean’, has “three major highlights”.

He added: “In a decadeand-a-half the debt burden of the region has near doubled. This holds true for The Bahamas. Debt-to-GDP in 2008 was 25 percent. The debt [increase], which was necessary to face the vagaries of the recent pandemic and global financial crisis, is now poised to unleash its own version of pain. Debt servicing as a proportion of government revenue is significant and is likely to rise.

“The institutional support necessary to effectively manage and help lessen the pain and burden of the debt taken on is far from primed and ready and, consequently, there is the inevitability that some countries in the region will, in the near to midterm, feel the debilitating pressure of debt on their economies. Successive governments have simply failed to implement reforms necessary to support and facilitate growth and reduce spending.

“Generally, what is at risk here, and this is certainly the case for The Bahamas, is not the ability to repay

the debt but the risk of reduced growth potential as a result of the level of debt and the attendant pressure that the lack of growth will itself create on government finances.”

Pointing to the need for “discipline” by policymakers to rein in spending, Mr Edwards added: “The reality is that the discipline needed in the arena of spending and policy reform is emerging too slow, if at all, to have the desired impact on managing the way forward. With The Bahamas quickly reverting to its historical growth potential, pre-current debt levels, it will be hard

Corporate income tax paper before Q1 end

FROM PAGE B1

and, when asked how close the launch of public consultation is, Mr Wilson replied: “I will say before the end

of the first quarter of this year.”

The Government’s 2022 Fiscal Strategy Report, released yesterday, detailed how the G-7 and its

members are driving the “minimum corporate tax” initiative as a mechanism to prevent large multinational enterprises avoiding/ evading tax by transferring

revenues and profits from the country where they are earned to a lower tax state.

“In December 2021, the Organisation for Economic Co-Operation and Development released its ‘Pillar Two’ model for the implementation of a global minimum corporate tax of 15 percent, applicable to Multinational Enterprises (MNEs),” the report said. “This effort, supported by 137 countries, is designed to [prevent the erosion of countries’ tax bases] and is estimated to increase global tax revenues by $150bn.

Vacancy Announcement

The American Embassy in Nassau is accepting applications for the following position: Supply Clerk (Expendables)

Open to:

All Interested Applicants/ All Sources

Duties:

Manages the delivery, issuance, storage, disposal, and inventory control of expendable supplies. The position is in the General Services Section and under the supervision of the GSO Property Supervisor or Designee Interested candidates are required to possess the following skills and qua lifications:

• Education: Completion of high school education is required.

• Experience: A minimum of two (2) years of experience in supply/warehousi nwexpendable s or property/supply management is required.

• Language: English level Ill (good working knowledge) Written/Speaking/Reading. This may be tested.

• Skills & Abilities: Computer competencies including basic skills in Microsoft Office applications. This may be tested. Must have had a valid, current driver's license for a minimum of five (5) years. Must be able to lift a maximum of 51 lbs. (23kg) under OSHA standards.

The complete Vacancy Announcement and Application forms are available online on the Electronic Recruitment Application (ERA) located on the following website: https://bs.usembassy.gov/embassy/jobs

Applications will not be accepted at the Security Gate o f the Embassy, by Mail, E-mail or other means of delivery.

Opening Period: Mondav Januan 23 - Fridav February 3, 2023. Due to the high volume of applications, unsuccessful candidates will not be contacted.

“Within the context of the proposed global requirement for the implementation of a global minimum corporate minimum income tax, the international accounting firm, Deloitte, has been engaged to provide an assessment of the cost, regulatory reform and implementation strategy should such a framework be desirable. A green paper is now being prepared to initiate the public consultation process.”

The Fiscal Strategy Report also identified the Government’s unfunded, multi-billion civil service pension liabilities as a significant risk moving forward

pressed to secure improvements in the economy beyond the current robust reconsolidation.

“This, with a new experience with respect to levels of debt, puts the country at risk financially, creates serious pressure on an already-narrow fiscal space and limits the ability to implement planned policies in development-promoting sectors. Bearing in mind that the report speaks to the entire Latin American region, one has to make mental adjustments for the nuances of The Bahamas and the lesser grouping of the Caribbean.”

although proposed reforms will take time to make an impact. “An initial review and assessment of the Government’s existing defined benefit pension scheme has been completed by the accounting firm, KPMG, which outlines the need for reform and modernisation,” it added. “Pension payments for fiscal year 2021-2022 equate to $166.2m (5.5 percent of recurrent expenditure) and are budgeted to increase to $170.7m in fiscal year 2022-2023 (5.7 percent of recurrent expenditure). To limit the risk associated with future pension liabilities, government is advancing with the strategy where all new employees will only be eligible to participate in a defined contribution plan, with a limit on the growth in pensionable salaries for existing employees.

“This strategy is estimated to improve cash flow by $6m over ten years, and will also include reform of SOE (state-owned enterprises) pension schemes.” The Fiscal Strategy Report, though, conceded that the risk presented by these unfunded pension liabilities has been known for more than a decade.

“The Government has historically maintained a non-contributory defined

Mr Edwards added: “The Bahamas is better placed than most countries to deal with its circumstances. Part and parcel of that ability, though, must address the historical lethargy of spending, institutional and sectorial reforms. The fiscal balance sheet of the country continues to demonstrate weaknesses, and given the breadth of observed need, will require either a shift in spending discipline or measures to expand revenue beyond current potential.”

benefit pension scheme for the benefit of qualifying permanent public service officials, inclusive of uniformed branches. The public service pension programme is separate, and in addition to the defined contribution pension scheme managed by the National Insurance Board (NIB) for the general public,” it added. In 2012, government engaged a private consulting firm to review the existing public service pension scheme to determine the sufficiency of pension reserves to meet future obligations, estimating any potential pension deficits and recommend corrective action. Government intends to proceed with the recommendations made by KPMG to limit the risk associated with future pension liabilities.”

KPMG in 2013 estimated the unfunded, ‘pay-as-yougo’, civil service pension liabilities at around $1.5bn. These liabilities were estimated then to increase to $2.5bn by 2022, and $4.1 billion by 2032, unless reforms are enacted.

The IMF, for its part, said in 2016: “Government pensioners (15 per cent of the public work force) receive pension payments from the Budget that, on average, stood at 1 per cent of GDP and 7.3 per cent of tax revenue per year in 1994–2014. “The accrued pension liabilities [will total] $1.5 billion in 2021 (17.9 per cent of GDP). Pension payments and liabilities are projected to reach $230 million (1.5 per cent of GDP) and $3.7 billion (24 per cent of GDP), respectively, by 2030.”

The payments to civil service pensioners come directly out of the Government’s annual Budget, as no specific scheme has been set aside for them. The IMF’s 2018 Article IV report projected a $2.2 billion increase in these unfunded liabilities over the 18 years to 2030, which translates into an average increase of $122 million per year.

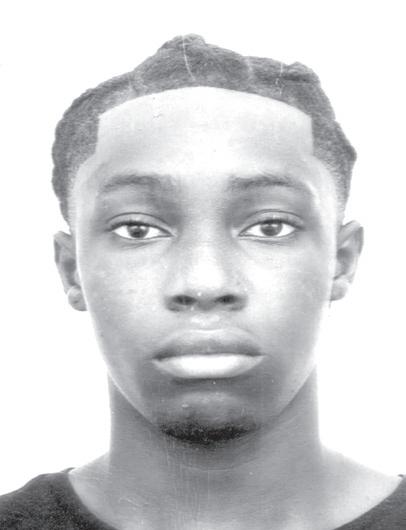

Jarol Investments Limited is seeking to fill the following position: Surveillance Officers (Nassau)

• Monitor operations to ensure compliance with safety or security policies or regulations. Observe individuals’ activities to gather information or compile evidence.

• Operate surveillance equipment to detect suspicious or illegal activities.

• Discuss performance, complaints, or violations with supervisors.

• Monitor establishment activities to ensure adherence to all gaming regulations and company policies and procedures.

• Observe gaming operations for irregular activities such as cheating or theft by employees or patrons, using audio and video equipment.

• Report all violations and suspicious behaviors to supervisors, verbally or in writing.

• Act as oversight or security agents for management or customers. .

• Be prepared to work within a shift system

• Retain and file audio and video records of gaming activities in the event that the records need to be used for investigations.

• Perform other related duties as assigned by Management.

Interested persons must require surveillance experience, certification, training, communication skills, attention to detail, ability to work independently and should apply at Jarol Investments Limited Head Office, Prince Charles Drive (Across from Restview) between the hours of 9am to 5pm. Or send your CV to careers@ chancesgames.com

Officer

PAGE 4, Thursday, February 2, 2023 THE TRIBUNE

By YOURI KEMP Tribune Business Reporter ykemp@tribunemedia.net

Subject:

Name

Surveillance

– Your

•• *•• * •** •• •• *•• * * ** ** •** •** ** ** * * ** ** * * ** ** ** ** * * Embassy of the United States

GB PROVIDERS URGED: ‘GET THEM OFF THE SHIP’

GRAND Bahama’s tourism business has rebounded to 80 percent of pre-COVID volumes, the deputy prime minister has confirmed, as he urged the private sector to create fresh activities and “get them off the ship”.

Chester Cooper, also minister of tourism, investments and aviation, said “the future for tourism looks great, and the future for Grand Bahama looks phenomenal” when addressing industry participants during a reception at the Lighthouse Pointe resort last week.

“We will continue to address the needs of tourism in Grand Bahama. We will continue to work on the airlift, and we will continue to work on the overall capacity and marketing of Grand Bahama island,” he promised, while urging the sector to develop new tours, excursions and activities for visitors to participate in.

Mr Cooper referred to a recent “report” in which visitors complained about not having enough to do once they leave the cruise ship while docked in Nassau and Grand Bahama. “This year we project that 500,000 visitors will come by cruise… that’s more than 40,000 a month,” said the deputy prime minister “But I have to tell you, Grand Bahama, that the people are not getting off the ship because they say there is nothing much to do.

“I call on you, therefore, to create more things to do.

Create more opportunities and get them off the ship. We can bring them here, but we cannot extract the monies from their pockets. We’re relying on you to do that. So, continue to create the opportunities. Tell the stories of the history and the charm of Grand Bahama. Take them out east and out west, and let them meet the true charm and the warmth of the Bahamian people so they can feel our heart.”

Mr Cooper said 2022 saw a 350 percent increase in visitor arrivals to Grand Bahama, which came as little surprise given that prior comparatives were still being impacted by COVID restrictions, while the cruise industry did not resume sailing until June/July 2021.

“When we compare these numbers against prepandemic and pre-Dorian levels, we can tell you that we have returned 80 percent, and that the rebound year-over-year is one of the most significant rebounds that we have seen in any of the other islands of The Bahamas,” said Mr Cooper.

“Grand Bahama has seen a renovated domestic airport terminal. You’ve seen the return of Sunwing’s nonstop jet service; you will see more airlift very soon from Italy, Tampa, Fort Lauderdale, Atlanta. You will see new routes and increased air capacity.

“Work will begin at the Grand Bahama International Airport before March 31, 2023, and we will sell

CHESTER COOPER, deputy prime minister and minister of tourism, investments and aviation (centre); Ginger Moxey, minister for Grand Bahama (second from right); Senator James Turner (left); and Latia Duncombe, tourism director-general (right), pose for a photo with Captain Keith Culmer during a reception for tourism industry partners at Lighthouse Pointe resort.

$800m Abaco project branded a ‘God-send’

By YOURI KEMP Tribune Business Reporter ykemp@tribunemedia.net

ABACO’S Chamber of Commerce president yesterday said the $800m investment project targeted at South Abaco will be a “God-send” for the area’s residents.

Daphne DegregoryMiaoulis told Tribune Business that the Town Hall meeting with Kakona’s developer and government officials produced a “good turnout” with attendees receptive to the project and voicing little to no reservations.

“If they do everything that they say they’re going to do, then I think it’ll be great,” Mrs Degregory-Miaoulis said. “I think that it’s fantastic that they’re going to repair and restore the lighthouse because it is very valuable.

“They say they’re definitely environmentally conscious or, in other words, any development is going to affect the environment but they are doing what they can

to not damage the environment unnecessarily.”

She added: “This project is a God-send, and I’m hopeful that if they remain open and their disclosure is accurate, and people are able to monitor their environmental pledges; if they have environmental monitors involved along the way like the National Trust, then I’m remaining hopeful about it.”

The Sandy Point and Crossing Rocks area in south Abaco needs the improved infrastructure that a development such as Kakona can deliver, but residents also need to benefit from the acquisition and transfer of vital skills so they can sustain the project long-term.

Mrs Degregory- Miaoulis said: “The south needs development, young people need jobs. I would like to see that, obviously.

“We have a limited amount of available skilled labour, but I would like to see where they engage locals first wherever possible, or where they have to import help or hire non-locals that they also bring young local

men or women in where they can sort of train them.”

The Chamber chief warned, however, that while $800m may sound like a sizable investment, from what the developers are projecting it might not go as far as envisioned. “They can spend a lot of money in construction, and then building, especially with the cost of building today. It’s very high,” she added.

“I don’t know what portion of the $800m is going to be used in actually changing the environment, or the landmass. I don’t know. But the restoration of the lighthouse would be important, and we would have to have more in-depth information on how that $800m would be spent. But the cost of building a first-class resort is more than what it used to be.”

The restoration of the Hole in the Wall Lighthouse is importance to south Abaco residents because they want to turn into a fulltime tourist attraction while maintaining it as a functioning lighthouse.

Our company has been around gaming for over 30 years and pride ourselves on quality service and customer relationships. We are moving forward in the market and such are looking for qualified, dedicated, people friendly customer services representatives.

We are accepting applications to fill the following position: Assistant Island Manager (Eleuthera)

Duties include, but not limited to:

• Overseeing adherence to company policies and procedures by employees.

• Auditing cashiers work to ensure accuracy.

• Maintain a safe and secure working environment for customers and staff.

• Maintaining confidentiality of sensitive data.

• Evaluating, assessing and managing the performance of each employee.

• Ensuring that the opening and closing of shops in a timely manner.

• Ensure safe keeping of company funds.

• Overseeing the selection and recruitment of new employees.

• Perform other duties as assigned by Management.

Interested person mail their resume to P.O. Box F-40886 or email to careers@chancesgames.com

the Grand Lucayan hotel. But I’m not making no announcements. Once bitten, twice shy. When the money’s in the bank, I will come back and tell you. That’s how we’re gonna do it this time.”

Mr Cooper admitted much work remains to improve Grand Bahama’s tourism product, but he reassured that his ministry’s leadership team was committed to doing the necessary work. He pointed out that its sales team hailed not only from Nassau, but from the US, Canada and Europe.

“This team met in Nassau for the past few days. They’ve been mulling our strategy for the next few months, and that means the future for Grand Bahama is moving forward,” he added. Ginger Moxey, minister for Grand Bahama, said: “All of the entities represented here have a vested interest in our island’s tourism product. Your products and services are the framework and fabric of Grand Bahama’s tourism industry. Your contributions are significant, and they greatly enhance our visitors’ experience.

“I believe that we all share a common goal, and that is to see Grand Bahama become grand again. And by working together we can achieve one of the key objectives of this Davis/ Cooper administration, which is to revitalise Grand Bahama’s tourism industry.”

NOTICE

IN THE ESTATE OF ESBON SEBASTIAN CARTWRIGHT, late of Hamilton’s in the settlement of Long Island one of the Islands of the Commonwealth of the Bahamas.. Deceased.

NOTICE is hereby given that all persons having any claims against the abovenamed Estate are required, on or before the 10th day of March, A.D. 2023 to send their names and addresses, and particulars of their debts or claims, to the undersigned, and if so required by notice in writing from the undersigned, to come in and prove such debts or claims, or in default thereof they will be excluded from the benefit of any distribution AND all persons indebted to the said Estate are asked to pay their respective debts to the undersigned at once.

AND NOTICE is hereby also given that at the expiration of the mentioned above, the assets of the late ESBON SEBASTIAN CARTWRIGHT will be distributed among the persons entitled thereto having regard only to the claims of which the Executrix shall then have had notice.

AND NOTICE is hereby given that all persons indebted to the said Estate are requested to make full settlement on or before the date hereinbefore mentioned.

Dated this 2nd day of February, A.D., 2023. c/o PYFROM & CO Attorneys for the Executrix, No.259 Shirley Street, P.O. Box N 8958, Nassau, N.P., Bahamas

THE TRIBUNE Thursday, February 2, 2023, PAGE 5

CHESTER COOPER, deputy prime minister and minister of tourism, investments and aviation (centre); Ginger Moxey, minister for Grand Bahama (second from right); Senator James Turner (left); and Latia Duncombe, tourism director-general (right), pose for a photo with Captain Keith Culmer during a reception for tourism industry partners at Lighthouse Pointe resort.

‘No new tax measures’ for $4bn revenue goal

Bahamas to a $16bn-plus economy, based on nominal annual gross domestic product (GDP), will be sufficient to drive the necessary revenue growth that will finance the forecast increase in government spending as well as generate an annual Budget surplus of more than $200m for the three years from 2024-2025 onwards. This will also enable the Government to avoid imposing new and/or increased taxes, and there was no mention of any such measures in the Fiscal Strategy Report, with the revenue-side focus placed almost entirely on compliance, enforcement and cracking down on tax cheats and bill duckers.

However, this will only become reality if the Bahamian grows by 20.9 percent in nominal GDP terms between this fiscal year and 2026-2027. This would take economic output from $13.236bn to $15.996bn, an increase of more than

$2.7bn over four years, using a measure that does not strip out the impact of inflation.

The economic growth estimates, according to the Fiscal Strategy Report, were said to have been derived by the Ministry of Finance’s Computable General Equilibrium (CGE) model, which analysed the likely expansion prospects for five industries - trade, financial services, tourism, “transformation” and “other”.

The “transformation” sector was said to include total output from industries such as “manufacturing, construction, agriculture, forestry, fishing, mining, gas, water, quarrying and electricity production”. Trade comprises the wholesale and retail sectors, with financial services also incorporating real estate, and “other” featuring activities such as transport and storage; information and communication; social security; public administration;

education; human health and social work.

Unveiling an upbeat analysis for all five categories, the Fiscal Strategy Report said: “Over the medium-term, the transformation sector is forecast to experience nominal growth of 18.3 percent over the period fiscal year 2022-2023 to fiscal year 2026-2027.

“Sectoral growth is attributed to improvements in agricultural activity, particularly with as a result of increased use of technology in agricultural production.

The sector will continue to benefit from increased government support to farmers and fishermen via grants and concessions in an effort to promote food security [and] the proliferation of innovative entities such as Eden Farms, focused on hydroponic food production.”

The “trade” sector was forecast to grow by a similar 17.3 percent over the same four-year period, with tourism expanding by 45.1 percent due to

The American Embassy in Nassau is accepting applic ations for the following position:

Trades Helper

a combination of visitor demand for The Bahamas as well as continued foreign direct investment (FDI) in resorts and hospitality industry. Growth in financial services, aided by high-end real estate purchases by foreigners, was pegged at 19.3 percent.

Much depends on hitting these growth targets in the absence of any new tax measures. Mr Wilson confirmed the Government’s fiscal forecasts do not include potential revenues generated by the sale and trading of The Bahamas’ proposed blue carbon credits, a priority initiative for the Davis administration that it has been vigorously pursuing since taking office in September 2021.

This was hinted at by the Fiscal Strategy Report’s “transmittal letter”, signed by Mr Davis and Mr Wilson, which said: “While a key strategy for Government has been the pursuit of the monetisation of the nation’s blue carbon credits, the technology remains novel.

“As such, Government intends to continue pursuit of this important revenue opportunity made available through prior targeted investments in environmental conservation. As this opportunity materialises, future fiscal frames will be updated to include this feature.”

And nor do the projections include any economic and fiscal benefits from The Bahamas’ ambitions to become a digital assets hub, which have cooled - at least temporarily - due to the international scrutiny this nation has faced due

to the FTX crypto currency exchange’s collapse.

“The passage of the Digital Assets and Registered Exchanges Act 2020 (DARE Act) was pioneering legislation which placed The Bahamas at the forefront of the financial services sector with respect to creating an enabling environment for growth of the evolving crypto and digital aspects of the financial services sector,” the Fiscal Strategy Report said.

“Given the novel and rapidly evolving nature of this new industry, the preparation of macroeconomic and fiscal forecasts of the impact of this industry are highly speculative in nature. As such, the potential macroeconomic and fiscal impacts of this industry have not yet been included in the forecasts provided herein.”

As a result of these treatments, the Government could yet enjoy an unbudgeted boost that enables it to hit the report’s revenue targets. These forecast that the Government’s revenues will rise from the $2.8bn predicted this fiscal year to $4bn in 2026-2027, with total spending increasing - albeit at a slower rate of 11.6 percent - over the same period from 2022-2023’s $3.368bn to $3.76bn.

Comparisons with last year’s Fiscal Strategy Report show that total revenue and spending forecasts for 2025-2026 have both been increased by more than $200m in the latest version, indicating that the size of government will continue to grow.

Mr Wilson told Tribune Business that the $1.2bn revenue increase over the

Open to:

All Interested Applicants / All Sources

Duties:

Assists skilled technicians i n the perfom1ance of maintenance and repair work. The incumbent will also be assigned tasks to include material handling, painting, custodial type work, common laborer work, and grounds maintenance and gardening work.

Interested candidates are required to possess the following skills and qualifications:

• Education: Completion of Seconda ry school is required.

• Experience: A minimum of two (2) years of maintenance or construction semi-skilled work experience in skilled trades such as mechanical (HVAC and Plumbing), electrical, carpentry, with significant focus on building systems.

• Language: English (Limited knowledge) Written/Speaking/Reading. This may be tested.

• Skills & Abilities: Must have had a valid, current driver's license for a minimum of five (5) years.

The complete Vacancy Announcement and Application forms are available online on the Electronic Recruitment Application (ERA) located on the following website: https://bs.usembassy.gov/embassy/jobs

Applications will not be accepted at the Security Gate of the Embassy, by Mail, E-mail or othe1· means of delivery.

Opening Period: Mondav January 30 - Friday Februarv 10, 2023.

Due to the high volume of applications, unsuccessful candidates will not be contacted.

next four years was justified based on the work being done to increase yields and crackdown on leakages, loopholes and delinquent payers. “We are doing a VAT gap analysis,” he explained. “We believe that better compliance programmes would lead to far more yield.

“The information we have, the preliminary information we have, is we could achieve the 25 percent [revenue-to-GDP target] without new tax measures. It comes out of the compliance programme. We have a couple of things going on which we think will help us achieve that $4bn.

“We have KPMG and LTI, which is a big Indian conglomerate, doing a review of the Department of Inland Revenue’s operations and procedures, and the need to move the Department a step up to what they call a third-level tax administration authority - top tier. There are some good building blocks there, but we think it will be a worthy investment. We believe a modernised Department of Inland Revenue will be good for us.”

Mr Wilson said some revenue enhancement measures were already “bearing fruit”, especially when it came to real property tax collections, which are “outpacing last year”. He declined to be drawn on how large the “gap” between current and maximum VAT collections is, adding: “We’re doing a study on the VAT gap because we think one exists. We haven’t finished it, and it will help us build our strategy.”

Seasoned fiscal observers, though, remained sceptical that the Fiscal Strategy Report forecasts will be hit. ORG’s Mr Edwards acknowledged that increased economic growth will inevitably raise government revenues, but said: “The question you would ask in interrogating that is how likely is it to get to that $16bn level in GDP? We have to wait and see. Without that, to get to that $4bn, there would have to be tax treatment.”

Gowon Bowe, Fidelity Bank (Bahamas) chief executive, told Tribune Business that the forecasts seemed “ambitious and optimistic”. If the GDP growth numbers were not achieved, he warned that this could have “dangerous consequences” for the country’s debt and deficit numbers, both of which are a function of economic output, as well as the country’s creditworthiness.

CALL 502-2394 TO ADVERTISE IN THE TRIBUNE TODAY!

Jarol Investments Limited is seeking to fill the following position: Accounts Clerk (Nassau)

• Maintains accounting records by making copies; filing documents.

• Counting cash and verifying amount received with Z reports.

• Maintains accounting database by entering data into the computer; processing backups.

• Preparing bank deposits.

• Protects organization’s value by keeping information confidential.

• Updates job knowledge by participating in education opportunities.

• Accomplishes accounting and organization mission by completing related results as needed.

• Compiling daily cash collection report.

Interested persons should email their resume to careers@ chancesgames.com. or visit our Head Office on Prince Charles Drive (across from Restview Funeral Home) between the hours of 9 a.m. to 5 p.m.

PAGE 6, Thursday, February 2, 2023 THE TRIBUNE

FROM PAGE B1

****** ** ** * ****** * ** ** ** ** • • ** ** * * * * *• • ** •• * * ** ** * Embassy of the United States

Vacancy Announcement

businesses and higher-earning households will likely take the brunt.

Michael Pintard, the Opposition’s leader, yesterday told Tribune Business that the $150m sum identified by the Fiscal Strategy Report “seems to be consistent with what we’ve been saying”. The revelation coincided with another attack launched by Mr Pintard on Alfred Sears, minister of works and utilities, in the House of Assembly over the increased energy costs inflicted on Bahamians by the Davis administration’s decision not to execute the purchase of cut-price fuel.

The Free National Movement (FNM) leader asserted that “no amount of moonwalking or backpedalling will rescue you” from the consequences, but Mr Sears successfully persuaded House speaker, Patricia Deveaux, to strike Mr Pintard’s use of the word “conceal” from the record after he claimed the Government sought to cover-up its handling of the fuel hedge.

Mr Sears vehemently denied that he deliberately attempted to mislead the House of Assembly, only

for Mr Pintard to charge that he “counted” eight occasions in the House of Assembly where the minister responsible for BPL had denied he was briefed on the fuel hedge only to later confirm he did receive such materials.

BPL’s fuel hedging initiative, rather than being a gamble or bet as some have portrayed, was designed by the utility’s former Board and management as a mechanism to counter global oil market volatility and spikes by providing stable, predictable fuel charges and rates for consumers. It was designed to give the utility, and its consumers, some breathing room while they waited for BPL’s $535m bond refinancing and new power plant deal with Shell North America. The status of those latter two initiatives remains unclear, although the bond appears to have been shelved for now until global market conditions improve. The fuel hedge was thus part of a much wider strategy designed to transform BPL, and which Tribune Business understands was presented to Mr Sears upon taking ministerial office so that he was aware of all key issues facing the utility.

to cost Bahamians $150m

Under the Minnis administration, BPL exploited low global oil prices at COVID-19’s peak to lock in cheap fuel costs via a hedging strategy. The Davis administration and BPL have repeatedly said the initial fuel hedging structure, put in place by the Inter-American Development Bank, remains in place, which is correct. The December 2020 hedge covered a total 3.565m barrels of oil for BPL that were priced at $40 each and split into three tranches.

This transaction hedged 75 percent of BPL’s fuel needs for 2022, 50 percent of its requirements for 2023, and 25 percent of 2024’s needs via the IDB’s upfront hedge. These were were not hedged 100 percent because BPL needed to monitor global oil price movements so that it did not end up hedging at a price above market costs and thus end up losing money.

BPL was supposed to hen support the original hedge by purchasing the extra fuel volumes to fully address its needs through 2022-2024. This was to be done via a series of trades, known as call options, that would have enabled BPL to obtain fuel - covering the

20 percent balance for 2022, 50 percent for 2023 and 75 percent for 2024 - at prices below then-prevailing oil market rates had they been executed.

It was these trades, scheduled to have been executed in tight windows in September 2021 and December 2021 just after the Davis administration took office, that were not carried out. As a result, BPL was increasingly buying fuel at higher market spot rates, and its fuel charge needed to increase to cover the costs.

Instead, this was artificially held at 10.5 cents per kWh through to October 2022 via the combination of government support and $90m Shell non-payment. Whitney Heastie, BPL’s former chief executive, had sought to get in front of the

required fuel charge hikes by raising this to more than 13 cents per KWh in early 2022, but this was rejected by the Government in a decision that has only made the magnitude of the correction greater.

However, Tribune Business was also told that the Government and BPL last year lacked the $40m in free cash needed to finance the cut-price oil purchases that would have saved electricity consumers millions. Officials said the cash-strapped position at both the Public Treasury and BPL in September 2021 meant there was simply no liquidity available to finance the acquisition of more below-market oil to further underpin BPL’s fuel hedge.

While the Opposition has attacked the Government’s

failure to execute the trades for costing Bahamian businesses and households higher electricity costs they did not have to incur, this newspaper was told that this does not account for the bigger picture BPL faced at that time with a $246m loan due to mature in February 2022 and no funds to repay it.

Well-placed sources said there were some “fundamental points” justifying the Ministry of Finance’s advice to policymakers not to execute the trades that were being strongly advocated for by BPL’s then-Board and management. These concerns related to the availability of necessary financing, as well as the actual design of the hedge and the costs associated with it and the actual transaction.

THE TRIBUNE Thursday, February 2, 2023, PAGE 7

FROM PAGE B1 BPL’s hedge

mishandling

Gov’t revenues beat early goal by $50.6m

the 2022-2023 Budget, revenue collections for the first four months of the fiscal year have exceeded Budget targets by $50.6m. While the improved revenue performance provides important context for the fiscal forecasts in future years, 2022-2023 fiscal forecasts remain as stated in the Budget,” the report said. Noting that “any potential revenue windfalls from” the sale and trading of The Bahamas’ blue carbon credits have been excluded from the Government’s fiscal forecasts, the report said it is instead focusing on enforcement and compliance measures such as “the increased occurrence of VAT audits” by the Revenue Enhancement Unit and a “targeted” initiative

aimed at collecting VAT, real property tax and Business Licence fee arrears owed to the Government.

Post-clearance audits of major importers by the Customs Department will increase, while the collection of VAT on vacation rental property lease payments is scheduled to start during the 2022-2023 fiscal year’s second half. The reassessment of New Providence property values, and reinstatement of Business Licence revenues for banks, is also expected to drive revenue increases in these areas.

And the Fiscal Strategy Report revealed that the Government is seeking to gain $75m from matching a company’s VAT filings with Customs import declarations to detect discrepancies

between different tax payments. “With the current electronic Business License filling system, the Government has the ability to perform industry comparisons, and identify trends such as variances with VAT filings and Custom imports,” it explained. “This allows real-time assessment of fillings prior to approval and enhancement of the post-approval audit process. Over the medium-term, these initiatives are expected to bring in an estimated $75m in revenue collections.”

Mr Wilson, meanwhile, confirmed that the Government wants to introduce electronic VAT invoicing and payment for all public services and agencies early in the 2023-2025 fiscal year in a bid to cut

revenue leakage and boost efficiencies.

“We have identified a vendor for the e-billing for VAT,” he disclosed. “We are finalising discussions with the vendor, and hopefully will have it done by the end of this fiscal year, so by early in the next fiscal period it will be in place.”

“As Government continues its expansion of digitisation of services, over the medium-term government intends to introduce the e-invoicing and payment of VAT in a phased manner across all government agencies and services. Based on experiences from other countries who have implemented similar reforms, this process is anticipated to significantly reduce VAT revenue leakage and loss over the

medium-term,” the Fiscal Strategy Report said.

Explaining that the initiative will “simplify” the VAT billing and remittance process”, the report added:

“Similar to the design and strategy of similar programmes launched in other countries, such a strategy will allow for more efficient use of risk-based audit resources and the inclusion of artificial intelligence in the selection of audit cases.”

Elsewhere, the Fiscal Strategy Report indicated the Government is seeking to streamline “unnecessary” investment incentives and concessions, and will also “strive” to eliminate poorly-targeted tax relief schemes that persons who can afford to pay often exploit.

It promised that officials will “continue to monitor and review the Government’s tax concession regime structure to identify and reduce areas of unnecessary foregone revenue. The guiding principle for this policy will continue to remain a reliance on sound economic policy and international best practice.

“As such, the Government will strive, over the

medium-term, to limit broad-based tax concessions which benefit persons with a ‘willingness to pay’ and offer more relief programmes targeted at those in need,” the Fiscal Strategy Report added.

Noting that the Government’s MyGateway online portal for public services has now received 100,000 customer requests, the Fiscal Strategy Report committed to funding micro, small and medium-sized enterprises (MSMEs) through the provision of $50m per year.

“During the worst of the COVID-19 lockdowns and curfew measures, MSMEs were an important source of income, with the number of licensed MSMEs expanding by 24.4 percent from 38,227 in 2020 to 47,550 in 2021,” the Fiscal Strategy Report said.

“Appreciating the value of MSMEs to the Bahamian economy, government intends to continue providing funding of $50m per year to further support the growth of MSMEs in addition to other traditional support to the farming and fishing community.”

NOTICE is hereby given that JOSE ETIENNE of Montrose Avenue, New Providence, The Bahamas is applying to the Minister responsible for Nationality and Citizenship, for registration/naturalization as a citizen of The Bahamas, and that any person who knows any reason why registration/ naturalization should not be granted, should send a written and signed statement of the facts within twenty-eight days from the 2nd day of February, 2023 to the Minister responsible for nationality and Citizenship, P.O. Box N-7147, Nassau, Bahamas.

PAGE 10, Thursday, February 2, 2023 THE TRIBUNE

FROM PAGE B1

NOTICE

INTENT TO CHANGE NAME BY DEED POLL PUBLIC NOTICE

The Public is hereby advised that I, DELROY ANTHONY STAMP

AKA SHAWN A. BURROWS of Springfield, Massachusetts, The United States of America, intend to change my name to SHAWN ANTHONY BURROWS STEWART If there are any objections to this change of name by Deed Poll, you may write such objections to the Chief Passport Officer, P.O.Box N-742, Nassau, Bahamas no later than thirty (30) days after the date of publication of this notice.

NOTICE

NOTICE is hereby given that OLIVE WILKINSON, of Munnings Drive Nassau, Bahamas is applying to the Minister responsible for Nationality and Citizenship, for Registration Naturalization as a citizen of The Bahamas, and that any person who knows any reason why registration/naturalization should not be granted, should send a written and signed statement of the facts within twenty-eight days from the 26th day of January 2023 to the Minister responsible for nationality and Citizenship, P.O. Box N-7147, Nassau, New Providence, The Bahamas.

INTENT TO CHANGE NAME BY DEED POLL

The Public is hereby advised that I, JESSE JACANO LEE PAUL of Garden Hills #2 situated in the Southern District of the Island of New Providence, one of the Islands of the Commonwealth of The Bahamas, intend to change my name to JESSE JACANO LEE KEMP. If there are any objections to this change of name by Deed Poll, you may write such objections to the Chief Passport Officer, P.O. Box N-742, Nassau, N.P., Bahamas no later than thirty (30) days after the date of publication of this notice.

NOTICE

NOTICE is hereby given that JADE ALEXANDER DUVERNOR of Joe Farrington Road, New Providence, The Bahamas is applying to the Minister responsible for Nationality and Citizenship, for registration/naturalization as a citizen of The Bahamas, and that any person who knows any reason why registration/ naturalization should not be granted, should send a written and signed statement of the facts within twenty-eight days from the 2nd day of February, 2023 to the Minister responsible for nationality and Citizenship, P.O. Box N-7147, Nassau, Bahamas.

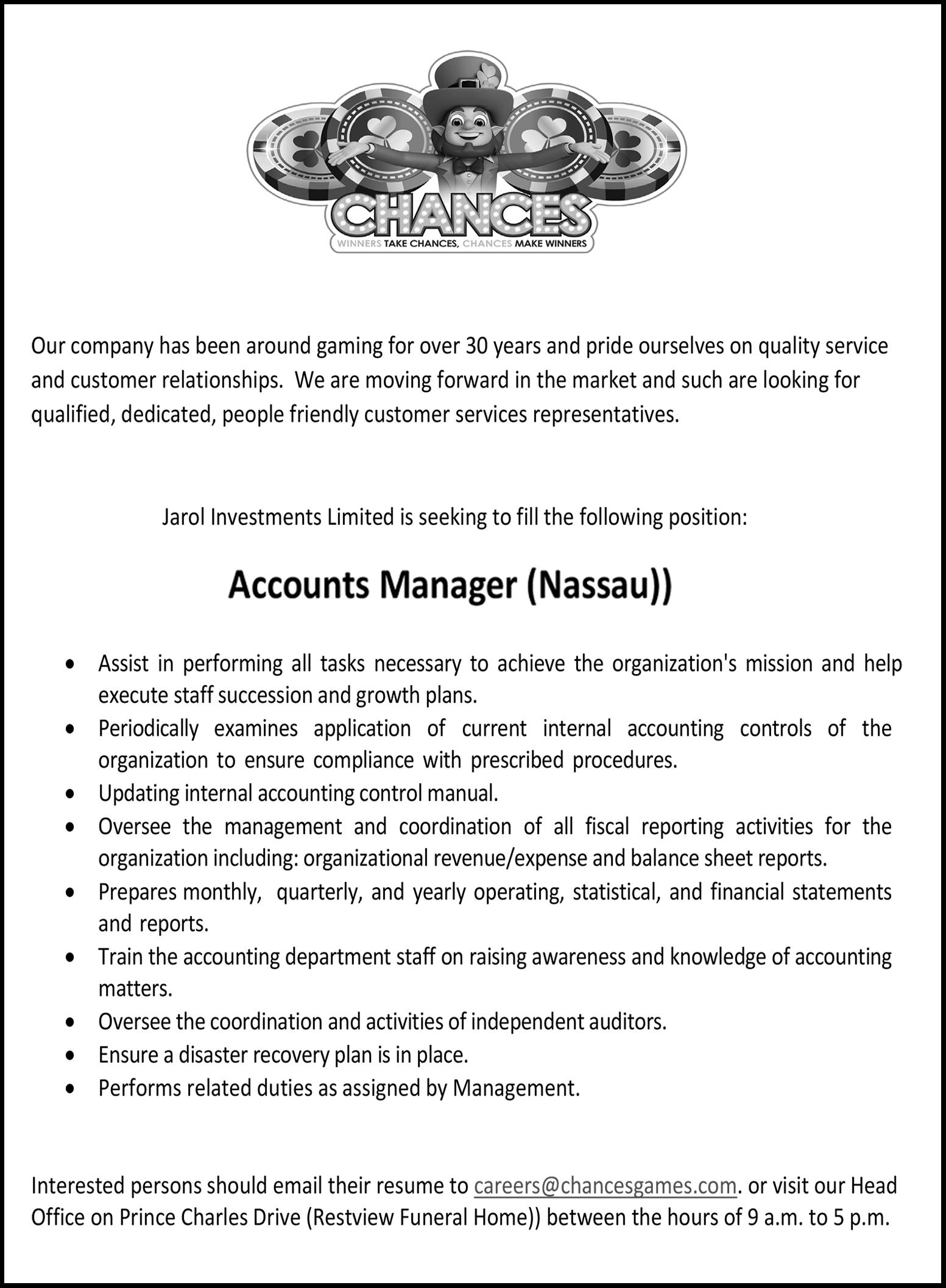

STOCKS HIT SUMMER HIGHS AS FED SEES PROGRESS ON INFLATION

By STAN CHOE AND DAMIAN J. TROISE AP Business Writers

WALL Street climbed Wednesday to its best level since the summer following the latest hike to interest rates by the Federal Reserve, which said it’s finally seeing improvements in inflation.

The S&P 500 rallied back from an early 1% loss to rise 1% after Fed Chair Jerome Powell said the economy is on the path toward getting inflation lower. The Dow Jones Industrial Average erased a drop of 500 points to rise 6, while the Nasdaq composite jumped 2%.

As expected, the Fed raised its benchmark interest rate by 0.25 percentage points to its highest level since late 2007. It’s the smallest such increase in the Fed’s blizzard of rate hikes since March.

What’s more important for markets is where interest rates are heading next.

Much of Wall Street is hoping that cooling inflation since the summertime means the Fed may raise rates just a bit more, before taking a pause and then possibly cutting rates toward the end of the year. Rate cuts can ease pressure on the economy and juice investment prices.

The Fed’s Powell did reiterate Wednesday that “ongoing increases” in interest rates will be needed to bring inflation down to the Fed’s target level. And he said it was still way too early to declare victory over inflation.

But he also said, “We can now say, I think for the first time, that the disinflationary process has started.” That got Wall Street thinking about a future with no more rate increases.

“He had the opportunity to use his voice to tamp down market expectations, and he didn’t do it,” said Katie Nixon, chief investment officer at Northern Trust Wealth Management. “Anyone that had taken a bet that the Fed was going to come out hard on financial positions lost that bet.”

Higher interest rates try to snuff out inflation by slowing the economy

and dragging on prices for stocks and other investments. The Fed has already pulled its key overnight rate to its highest level since 2007, at a range of 4.50% to 4.75%, up from virtually zero early last year.

At stake is the economy, which many investors see likely heading down one of two paths: either a relatively short and shallow recession or a much deeper and more painful one. Building hopes for the former helped stocks rally through January to a strong start of the year.

Powell indicated he’s on the more optimistic side.

“My base case is that the economy can return to 2% inflation without a really significant downturn or really big increase in unemployment,” he said.

He also said he did not foresee any rate cuts this year.

Others in the market are not as optimistic. A third pathway for the economy is also possible, said Rich Weiss, senior vice president at American Century Investments: one that happened during the 1970s where inflation reignited after the Federal Reserve let up on interest rates too soon. “We’re headed into a recession one way or the other, whether the Fed eases up on the brakes or not,” Weiss said. “So you might as well kill inflation while you’re doing it. I think it’s nonsensical to think the Fed is going to magically take their foot off at exactly the right time and slide into a short and shallow downturn and the stock market will come through unscathed.”

One area influencing expectations for the Fed is the job market, which has remained resilient. While strength there helps workers, a worry is that it could lead to too-high gains in wages that give inflation more fuel.

Reports on Wednesday gave a mixed picture on hiring. Private payrolls rose by 106,000 in January, according to ADP. That’s a slowdown from a month earlier and was below economists’ expectations.

But a separate report from the U.S. government indicated more strength. It said the number of job openings increased to 11 million in December, better than expected.

Treasury yields fell as Powell spoke, an indication of expectations for an easier Fed.

The two-year yield, which tends to track expectations for the Fed, fell to 4.11% from 4.21% late Tuesday. The 10-year yield, which helps set rates for mortgages and other important loans, fell to 3.42% from 3.51% late Tuesday.

A lackluster earnings reporting season also continues on Wall Street, with more mixed profit reports arriving from big U.S. companies.

Electronic Arts tumbled 9.3% after it gave forecasts for upcoming results that fell short of Wall Street’s expectations.

On the winning side was Advanced Micro Devices, which rose 12.6% even though its profit tumbled 98% in the fourth quarter from a year earlier. Its results were better than analysts expected.

All told, the S&P 500 rose 42.61 to 4,119.21, its highest close since August. The Dow gained 6.92, or less than 0.1%, to 34,092.96, and the Nasdaq jumped 231.77 to 11,816.32.

PAGE 12, Thursday, February 2, 2023 THE TRIBUNE

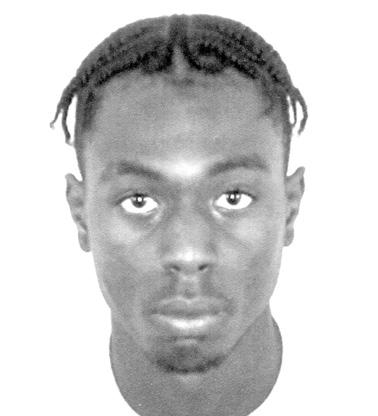

TRADERS work on the floor at the New York Stock Exchange in New York, Wednesday, Feb. 1, 2023.

Photo:Seth Wenig/AP

PUBLIC NOTICE

NOTICE is hereby given that DESHAWN McKENDY CHARLOT, of Stew Fish Drive, Carmicheal Road Nassau, Bahamas is applying to the Minister responsible for Nationality and Citizenship, for Registration Naturalization as a citizen of The Bahamas, and that any person who knows any reason why registration/ naturalization should not be granted, should send a written and signed statement of the facts within twenty-eight days from the 26rd day of January 2023 to the Minister responsible for nationality and Citizenship, P.O. Box N-7147, Nassau, New Providence, The Bahamas.

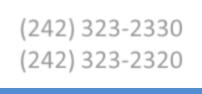

THE TRIBUNE Thursday, February 2, 2023, PAGE 13 WEDNESDAY, 1 FEBRUARY 2023 CLOSECHANGE%CHANGEYTDYTD% BISX ALL SHARE INDEX: 2639.230.110.00-5.83-0.22 BISX LISTED & TRADED SECURITIES 52WK HI52WK LOWSECURITY SYMBOLLAST CLOSECLOSECHANGE VOLUMEEPS$DIV$P/E YIELD 7.005.30 AML Foods Limited AML 6.95 6.950.00 0.2390.17029.12.45% 53.0040.06 APD Limited APD 39.95 39.950.00 0.9321.26042.93.15% 2.761.60Benchmark BBL 2.76 2.760.00 0.0000.020N/M0.72% 2.462.31Bahamas First Holdings Limited BFH 2.46 2.460.00 0.1400.08017.63.25% 2.852.25Bank of Bahamas BOB 2.84 2.840.00 0.0700.000N/M0.00% 6.306.00Bahamas Property Fund BPF 6.30 6.300.00 1.7600.000N/M0.00% 9.808.78Bahamas Waste BWL 9.75 9.750.00 0.3690.26026.42.67% 4.502.90Cable Bahamas CAB 4.26 4.260.00 -0.4380.000-9.7 0.00% 10.657.50Commonwealth Brewery CBB 10.25 10.250.00 0.1400.00073.20.00% 3.652.54Commonwealth Bank CBL 3.58 3.580.0014,0000.1840.12019.53.35% 8.547.01Colina Holdings CHL 8.54 8.540.00 0.4490.22019.02.58% 17.5012.00CIBC FirstCaribbean Bank CIB 15.99 15.990.00 0.7220.72022.14.50% 3.251.99Consolidated Water BDRs CWCB 2.93 3.010.08 0.1020.43429.514.42% 11.2810.05Doctor's Hospital DHS 10.50 10.500.00 0.4670.06022.50.57% 11.679.16Emera Incorporated EMAB 9.74 9.780.04 0.6460.32815.13.35% 11.5010.75Famguard FAM 11.22 11.220.00 0.7280.24015.42.14% 18.3014.50Fidelity Bank (Bahamas) Limited FBB 18.10 18.100.00 0.8160.54022.22.98% 4.003.55Focol FCL 3.65 3.650.00 0.2030.12018.03.29% 12.109.85Finco FIN 11.94 11.940.00 0.9390.20012.71.68% 16.2515.50J. S. Johnson JSJ 15.76 15.760.00 0.6310.61025.03.87% PREFERENCE SHARES 1.001.00Bahamas First Holdings PreferenceBFHP 1.00 1.000.00 0.0000.0000.0000.00% 1000.001000.00 Cable Bahamas Series 6 CAB6 1000.001000.000.00 0.0000.0000.0000.00% 1000.001000.00 Cable Bahamas Series 9 CAB9 1000.001000.000.00 0.0000.0000.0000.00% 1.001.00Colina Holdings Class A CHLA 1.00 1.000.00 0.0000.0000.0006.25% 10.0010.00Fidelity Bank Bahamas Class A FBBA 10.0010.000.00 0.0000.0000.0007.00% 1.001.00Focol Class B FCLB 1.00 1.000.00 0.0000.0000.0006.50% CORPORATE DEBT - (percentage pricing) 52WK HI52WK LOWSECURITY SYMBOLLAST SALECLOSECHANGEVOLUME 100.00100.00Fidelity Bank (Note 22 Series B+)FBB22 100.00100.000.00 100.00100.00Bahamas First Holdings LimitedBFHB 100.00100.000.00 BAHAMAS GOVERNMENT STOCK - (percentage pricing) 115.92104.79Bahamas Note 6.95 (2029) BAH29 107.31107.310.00 100.00100.00BGS: 2014-12-7Y BG0107 100.00100.000.00 100.00100.00BGS: 2015-1-7Y BG0207 100.00100.000.00 100.00100.00BGS: 2014-12-30Y BG0130 100.00100.000.00 100.00100.00BGS: 2015-1-30Y BG0230 100.00100.000.00 100.00100.00BGS: 2015-6-7Y BG0307 100.00100.000.00 100.00100.00BGS: 2015-6-30Y BG0330 100.00100.000.00 100.00100.00BGS: 2015-10-7Y BG0407 100.00100.000.00 100.1599.96BGRS FL BGRS76026 BSBGRS760265 100.15100.150.00 100.12100.12BGRS FL BGRS88037 BSBGRS880378 100.03100.030.00 94.1594.09BGRS FX BGR132139 BSBGR1321391 93.3693.360.00 101.55101.42BGRS FX BGR124228 BSBGR1242282 101.45101.450.00 103.49103.38BGRS FX BGR118027 BSBGR1180276 102.70102.700.00 92.6792.67BGRS FX BGR131239 BSBGR1312390 92.5592.550.00 90.9890.98BGRS FX BGR132249 BSBGR1322498 90.9590.950.00 94.8094.80BGRS FX BGR134140 BSBGR1341407 93.9493.940.00 100.39100.39BGRS FX BGR138230 BSBGR1380306 100.39100.390.00 96.8496.84BGRS FX BGR138240 BSBGR1380405 96.1096.100.00 100.32100.32BGRS FL BGRS81035 BSBGRS810359 100.66100.660.00 100.34100.34BGRS FL BGRS81037 BSBGRS810375 100.17100.170.00 100.57100.57BGRS FL BGRS84033 BSBGRS840331 100.15100.150.00 MUTUAL FUNDS 52WK HI52WK LOW NAV YTD%12 MTH% 2.592.11 2.593.87%3.87% 4.903.30 4.904.87%4.87% 2.271.68 2.273.03%3.03% 203.47164.74 195.65-3.84%-3.84% 212.41116.70 180.14-15.19%-15.19% 1.771.71 1.773.07%3.07% 1.981.81 1.988.44%8.44% 1.881.80 1.884.42%4.42% 1.030.93 0.95-7.23%-7.23% 9.376.41 10.188.63%8.63% 11.837.62 13.6115.01%15.01% 7.545.66 7.732.87%2.87% 16.648.65 13.13-20.87%-20.87% 12.8410.54 12.06-4.33%-4.33% 10.779.57 10.62-0.31%-0.31% 16.279.88 16.27N/AN/A 11.228.45 11.223.00%25.60% 14.8911.20 N/A N/A N/A MARKET TERMS BISX ALL SHARE INDEX - 19 Dec 02 = 1,000.00 YIELD - last 12 month dividends divided by closing price 52wk-Hi - Highest closing price in last 52 weeks Bid $ - Buying price of Colina and Fidelity 52wk-Low - Lowest closing price in last 52 weeks Ask $ - Selling price of Colina and fidelity Previous Close - Previous day's weighted price for daily volume Last Price - Last traded over-the-counter price Today's Close - Current day's weighted price for daily volume Weekly Vol. - Trading volume of the prior week Change - Change in closing price from day to day EPS $ - A company's reported earnings per share for the last 12 mths Daily Vol. - Number of total shares traded today NAV - Net Asset Value DIV $ - Dividends per share paid in the last 12 months N/M - Not Meaningful P/E - Closing price divided by the last 12 month earnings TO TRADE CALL: CFAL 242-502-7010 | ROYALFIDELITY 242-356-7764 | CORALISLE 242-502-7525 | LENO 242-396-3225 | BENCHMARK 242-326-7333 Colonial Bahamas Fund Class D Colonial Bahamas Fund Class E Colonial Bahamas Fund Class F CFAL Global Equity Fund Leno Financial Conservative Fund Leno Financial Aggressive Fund Leno Financial Balanced Fund Leno Financial Global Bond Fund RF Bahamas Opportunities Fund - Secured Balanced Fund RF Bahamas Opportunities Fund - Targeted Equity Fund RF Bahamas Opportunities Fund - Prime Income Fund RF Bahamas International Investment Fund Limited - Equities Sub Fund RF Bahamas International Investment Fund Limited - High Yield Income Fund RF Bahamas International Investment Fund Limited - Alternative Strategies Fund INTEREST Prime + 1.75%

31-Dec-2021 31-Dec-2021 MATURITY 19-Oct-2022 20-Nov-2029 31-Dec-2022 31-Dec-2022 6.95% 4.50% 31-Dec-2022 31-Dec-2022 4.50% 6.25% 31-Dec-2021 31-Dec-2022 31-Dec-2022 31-Dec-2022 31-Dec-2022 31-Dec-2022 31-Dec-2022 31-Dec-2022 31-Dec-2022 31-Dec-2022 15-Dec-2021 30-Jul-2022 15-Dec-2044 30-Jul-2045 26-Jun-2022 26-Jun-2045 15-Oct-2022 31-Dec-2022 22-Sep-2033 18-Jan-2026 26-Jul-2037 26-Jul-2035 15-Oct-2039 FUND CFAL Bond Fund CFAL Balanced Fund CFAL Money Market Fund CFAL Global Bond Fund 6.25% 30-Sep-2025 31-Dec-2022 6.25% 4.50% 6.25% 4.25% NAV Date 4.87% 4.68% 4.56% 4.81% 5.29% 5.14% 5.60% 26-Jul-2037 4.42% 15-Jul-2039 15-Jun-2040 4.66% 4.82% 13-Jul-2028 13-Oct-2027 15-Oct-2049 17-Jan-2040 15-Jun-2030 5.65% 5.35% 5.00% (242)323-2330 (242) 323-2320 www.bisxbahamas.com

MARKET REPORT

NOTICE