Bahamas requires $16bn economy ‘to make sense’

By NEIL HARTNELL Tribune Business Editor nhartnell@tribunemedia.net

By NEIL HARTNELL Tribune Business Editor nhartnell@tribunemedia.net

THE BAHAMAS must grow its economy to $16bn, expanding its size by around one-third, if its future is “to make sense” in the absence of government austerity, a governance reformer urged yesterday.

Robert Myers, the Organisation for Responsible

Governance’s (ORG) principal, admitted that increasing economic output by some $4bn was “a big deal” but asserted it is the only way to support “the size of government” after successive administrations showed no will to cut back on taxation and public spending.

Speaking after the World Bank yesterday forecast that the Bahamian economy will grow by 4.1 percent in 2023,

he told Tribune Business he was “not interested in percent ages” and that the country’s focus should be placed on the size of real annual gross domestic product (GDP) as the key performance measure.

With Bahamian GDP growth projected to slow to 3 percent in 2024, Mr Myers said the country remains “a long way off” from the 6-7

percent rate he has constantly argued is necessary to both slash existing unemployment by 50 percent and to absorb the 5,000 high school graduates who enter the workforce every year.

Second US aviation group calls for Bahamian airline sanctions

By NEIL HARTNELL Tribune Business Editor nhartnell@tribunemedia.net

‘Future generations and youth let down’ over NIB

By NEIL HARTNELL Tribune Business Editor nhartnell@tribunemedia.net

THE National Insurance Board (NIB) must be given more independence from government, a pension specialist urged yesterday, adding: “Successive administrations have let the youth and successor generations down.”

Larry Gibson, chief operating officer of CG Atlantic Pensions, who has long advocated for comprehensive pension and

social security reform in The Bahamas, told Tribune Business that it was impossible to avoid such conclusions given that the need to implement critical reforms at the country’s only social security scheme has been known for more than two decades.

Suggesting that “inertia”, and a failure to act, by both political parties has left NIB on the brink of a crisis, he argued that The Bahamas “doesn’t have the

Fishermen urge: ‘Spare no expense’ on sunken vessel

By NEIL HARTNELL Tribune Business Editor nhartnell@tribunemedia.net

BAHAMIAN fishermen have urged the Government “to spare no expense” in preventing any environmental damage from the sinking of a cargo vessel off south Abaco just prior to the New Year.

Paul Maillis, the National Fisheries Association’s (NFA) secretary, in an interview with Tribune Business also urged the authorities to “not take a soft hand” in ensuring that those responsible for the MV Onego Traveller or their insurers ultimately cover all the costs incurred by The Bahamas in protecting its marine environment, tourism and fisheries industries from any pollution fall-out.

“It’s something we’ve been watching very closely,” he said of the vessel’s sinking. “I know that area, Hole in the Wall, and all the way up to Cross Harbour is a very important commercial fishing area. That area, from the point of Hole in the Wall up to Cross Harbour, is a very important potting, diving and pelagic fishing source.

“It’s a very special area because of the reef near the coast. Any oil or chemicals that are released on to the iron shore will be impacting the coral reef. It’s a very special reef, and to see any potential pollution spoil that would be very disheartening. It’s an area that has a lot of heavy tanker shipping pass through it, so all the time you have ballast water, bilge pumps rinsing and oil

A SECOND aviation industry group yesterday backed calls for sanctions to be imposed on Bahamian airlines flying to the US unless this nation reforms its allegedly “unjust” overflight fees.

The National Air Carrier Association (NACA), which represents lowcost airlines servicing this nation such as Frontier Airlines and Spirit Airlines, gave its support and approval to Airlines for America’s demand that the US Department of Transportation impose restrictions on the ability of Bahamasair, Western Air and others to service US destinations unless The Bahamas backs down.

George Novak, NACA’s president and chief executive, in a January 10, 2023, letter to US Department

of Transportation officials blasted what he described as “excessive overflight fees” being levied on its members and other US airlines by the Bahamas Air Navigation Services Authority (BANSA).

“NACA agrees that the charges for air navigation services currently being levied by The Bahamas significantly exceed the cots to The Bahamas of providing those services,” Mr Novak wrote, “due in large part to the fact that the Federal Aviation Administration (FAA)

has historically provided approximately 75 percent of air traffic services for Bahamian air space.

“These charges are clearly inconsistent with The Bahamas’ obligations under Article 10 of the USBahamas Air Transport Agreement to ensure the fundamental fairness of the user charges imposed on carriers. NACA agrees that US carriers are discriminated against viaa-vis other system users because US carriers pay into the FAA’s Airport and Airway Trust Fund to

support air traffic control and related facilities, and then are charged by The Bahamas for the provision of the same and related facilities already provided by the FAA.”

Reiterating the Airlines for America complaint that Bahamian-owned airlines and other US carriers “do not have these duplicative payments levied against them when they operate through The Bahamas’ air space”, Mr Novak and NACA demanded that sanctions be imposed on the ability of local carriers to access the US unless this nation “immediately” cease collecting the current fees as structured.

Echoing its fellow industry group in branding The Bahamas’ fees structure as “unjust, discriminatory, anti-competitive and unreasonable”, NACA called for the ability of

By NEIL HARTNELL Tribune Business Editor nhartnell@tribunemedia.net

THE Government must not allow its borrowing of $233m in IMF Special Drawing Rights (SDRs) from the Central Bank to be perceived as “a panic exercise”, a Bahamian commercial banker has warned.

Gowon Bowe, Fidelity Bank (Bahamas) chief executive, told Tribune Business that the Government cannot afford to conduct its financing activities “in a vacuum” as he queried why the Central Bank Act was not reformed to facilitate the transaction prior to the two sides agreeing to it.

Suggesting that the situation again highlighted the need for a comprehensive debt management strategy that the Government sticks to, he added that the administration’s move to access the International Monetary Fund

(IMF) SDRs could “cause concern in some quarters if it is seen to be reactionary” and not part of an overall plan.’

Pointing out that the SDRs are typically a short-term financing facility that the Central Bank has to repay to the IMF, Mr Bowe pointed out that the monetary policy regulator is now reliant on the Government to repay it first. And the borrowing also seemed to run contrary to the Central Bank Act itself, which was drawn up and enacted at

business@tribunemedia.net WEDNESDAY, JANUARY 11, 2023

SEE PAGE B5

SEE PAGE B4

SEE PAGE B8 SEE PAGE B6

LARRY GIBSON

GOWON BOWE SEE PAGE B6 • ORG chief admits ‘big deal’ to expand GDP by 1/3 • But only way to support Gov’t size with no austerity • World Bank reaffirms 4.1% growth; falls to 3% in ‘24

• Urges that local carriers’ US access be ‘curtailed’ • Dispute over Bahamas overflight fees intensifies • Dutch national flag carrier also voices objections $233m IMF rights can’t be viewed as ‘panic exercise’ Life. Health. Home. Auto. Marine. At your fingertips … 24/7. Sign up today at www.portal.colina.com. $5.85 $5.86 $5.83 $5.21

PETER GOUDIE

ROBERT MYERS

Higgs & Johnson gives New Year’s promotions

HIGGS & Johnson has confirmed the appointment of one new partner and four senior associates with effect from New Year’s Day.

The law firm, in a statement, said its latest partner is real estate specialist Ja’Ann M. Major. She is deputy chair of its real estate and development practice group, with a particular focus on conveyancing, mortgage transactions and foreign investments.

Ms Major, who joined Higgs & Johnson in 2011, represents domestic and international clients in the purchase, sale and transfer of residential and commercial properties, and advises on the relevant regulatory procedures and approvals. Her practice extends to Immigration law, probate and estate matters,

commercial law and maritime and shipping law. She currently serves as a director on the Bahamas Maritime Authority Board.

Promoted to senior associate are Andre W. Hill (commercial law); Keith O. Major (litigation); Rhyan A. Elliott (litigation); and Trevor J. Lightbourn (litigation). Philip C. Dunkley K.C, Higgs & Johnson’s senior partner, said: “These promotions mark a personal achievement for the attorneys and recognition of their hard work and dedication to the firm.

“Given their reputation, invaluable experience and expertise, we are confident that they will further strengthen and enhance our firm’s capabilities to provide the best legal solutions and services to our clients.”

Share your news

The Tribune wants to hear from people who are making news in their neighbourhoods. Perhaps you are raising funds for a good cause, campaigning for improvements in the area or have won an award. If so, call us on 322-1986 and share your story.

ROADWORK-HIT BUSINESSES SEEKING ‘COME BACK TO VILLAGE ROAD’ BOOST

By YOURI KEMP Tribune Business Reporter ykemp@tribunemedia.net

A “COME back to Village Road” incentives package is needed to revive businesses that have been damaged by the yearlong roadworks impacting that corridor and the surrounding area, an entrepreneur is arguing.

Michael Fields, president of Four Walls Squash and Social Club, told Tribune Business that incentives such as as real property tax breaks need to be extended to both businesses and homes in the area - including on side streets where infrastructure and premises were impacted due to traffic diversions.

“We have a meeting with the minister for economic affairs, Michael Halkitis, on January 16, but outside of that everything is still the same on Village Road. There is very little progress. They are still digging as recently as Sunday,” he added.

With no further communication on from the Government on when the roadworks will be completed, with the target date having shifted multiple times from the initial September 2022 to December, and now to the first week in

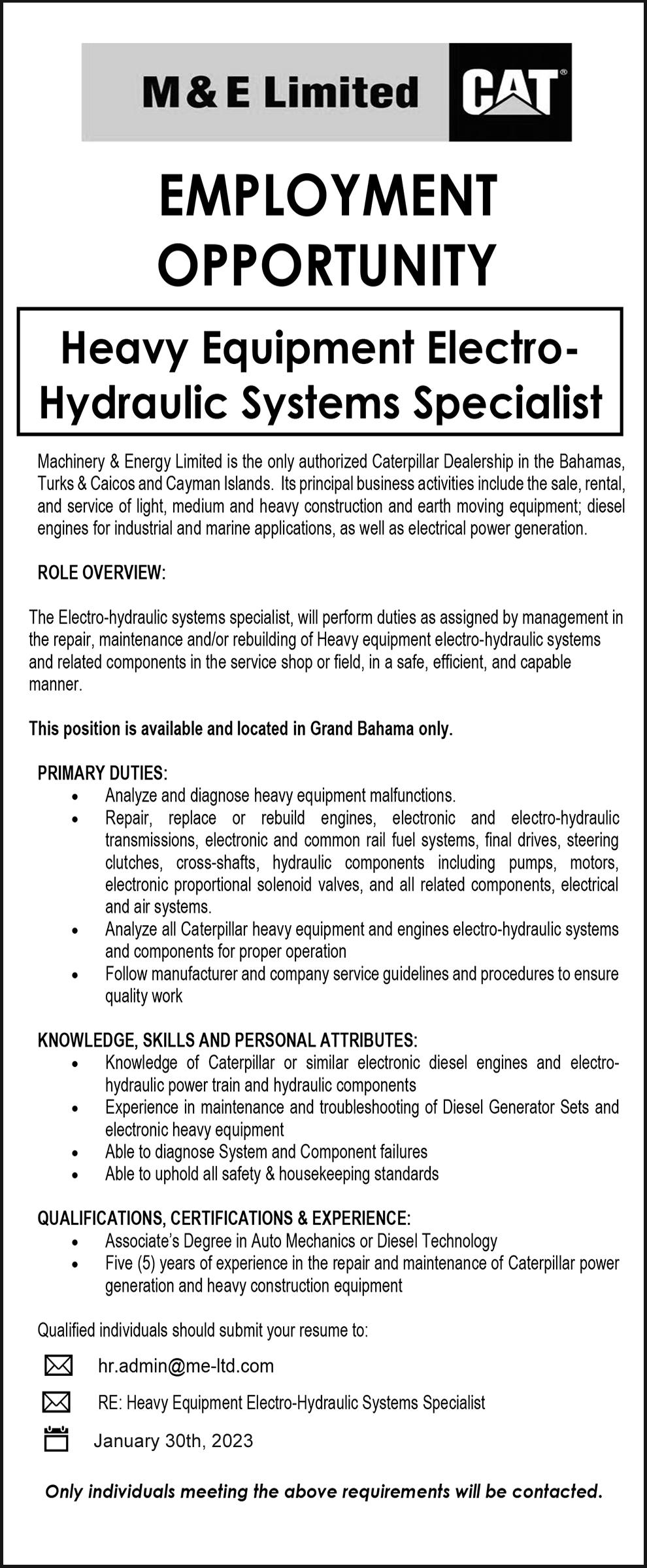

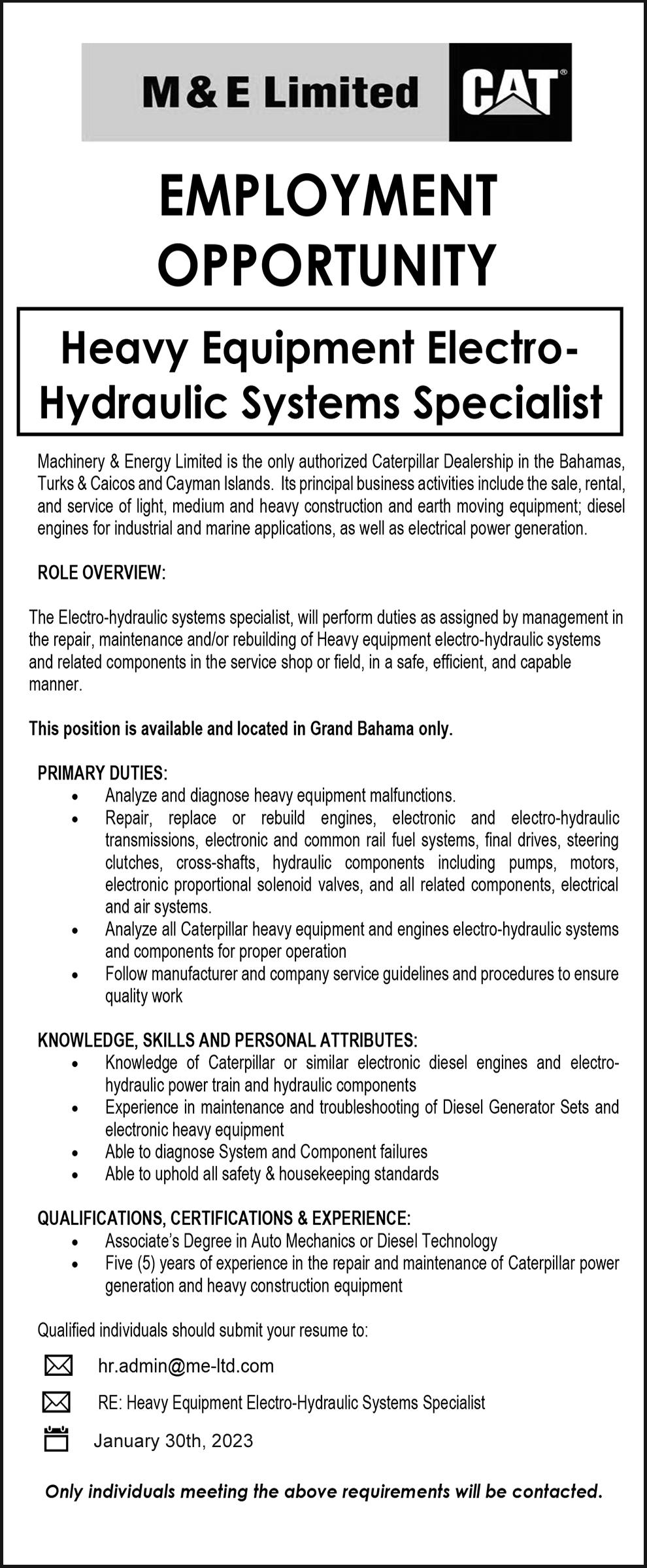

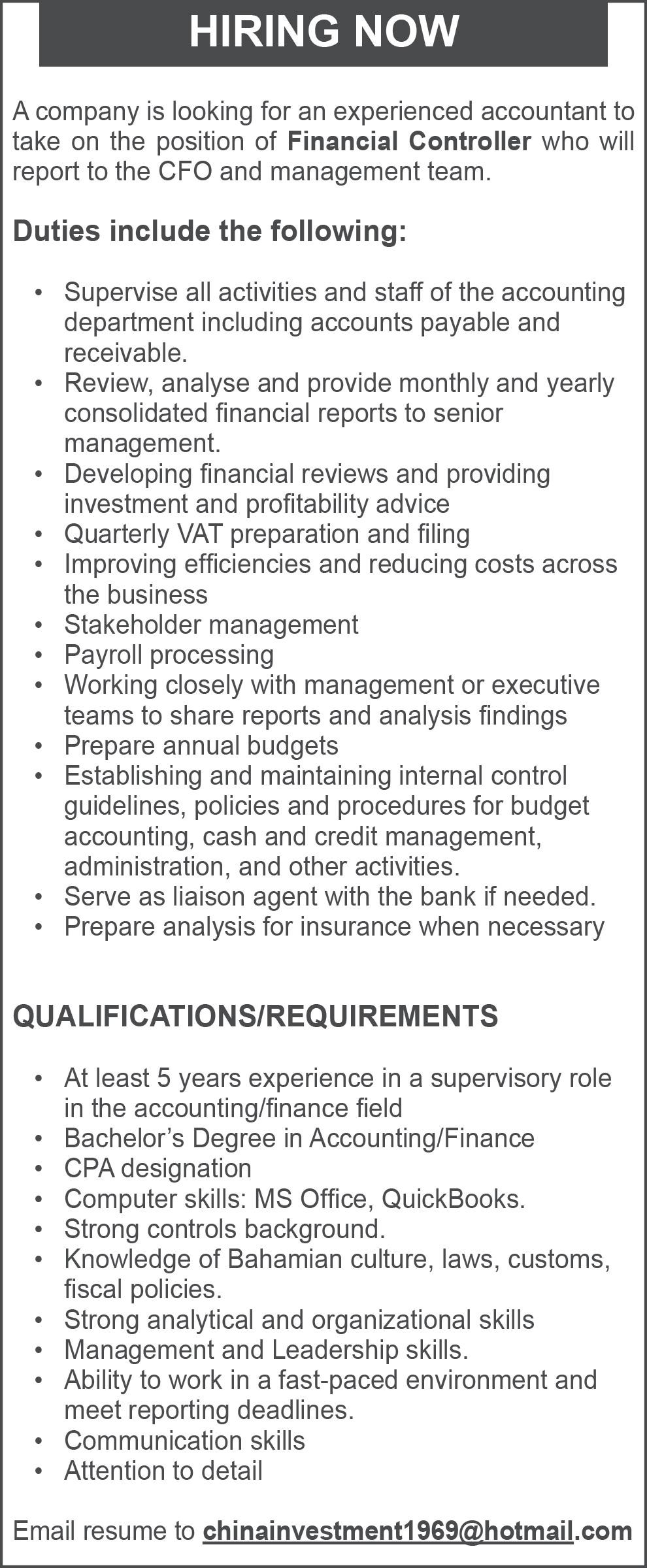

JOB OPPORTUNITY

Lead Math Teacher Needed.

A pre-eminent, well-established, independent, international school in Nassau is seeking a full-time qualified MATH TEACHER. Candidates should have sound classroom experience; a passion for innovative education; a professional attitude towards work; a friendly and cooperative disposition; a willingness to work in a team environment; a determination to grow professionally; and strong communication & organisational skills. Successful candidates will be required to:

● To provide strategic leadership for the development and management of MATHS throughout the school.

● To identify areas for improvement linked to the School Improvement Plan and local and national initiatives.

● To develop and monitor schemes of work for MATHS across the whole school and ensure successful implementation which meets curriculum requirements

● To provide, monitor and evaluate the use of resources related to MATHS.

● To have an overview of and contribute to the planning and delivery of continu ous professional development and training related to MATHS.

● To monitor, assess and develop the roles of the class teachers in MATHS.

● To develop strategies for the use of MATHS to promote new teaching methods and improve learning throughout the school and monitor effectiveness in raising standards of teaching and learning.

● To monitor and evaluate pupil progress throughout the school in MATHS and set goals for MATHS across the school.

● To provide opportunities for working with parents and give specialist advice on MATHS.

● To arrange and promote MATHS curriculum activities within the school.

February, Mr Fields voiced scepticism that the latest deadline will be met.

He said: “We’re going to talk to Mr Halkitis about some firm dates from the Ministry of Works because hopefully Mr (Alfred) Sears (minister for works and utilities) will be there as well. But also we want to talk about a concession plan. “If the roads get shut down for a couple of weeks or a month, and they stick with the project, that’s fine. But when it’s a gross inconvenience, and really to a point where businesses have been shut down for a year, there has to be some compensation plan to stimulate businesses back in that area.”

“We also need matching grants that they give through the Small Business Development Centre (SBDC). These are things they already have in place. We’re also looking at a reduction in Bahamas Power and Light bills for businesses to get back on their feet,” Mr Fields continued.

“So we’re looking at some sort of tax concessions; maybe access to some sort of loan facility, some sort of grants for property owners, where they will be able to repair their buildings because everybody’s building is in shambles right

now and also the driveways and so forth with all the heavy equipment gone. And also roads that have been detoured with people getting mud in their yards and stuff. We also want them to help promote customers to come back to Village Road.”

Village Road businesses previously said they were seeking VAT credits, plus Business Licence and real property tax waivers, to compensate for the damage inflicted by roadworks that they argued have caused consumers to avoid the area “like the plague”.

Some 15 companies signed their names to a letter authored by Mr Fields where it was suggested that the Government provide “refurbishment grants” for residents and business owners to repair damaged premises, vehicles and other facilities impacted by the project. It also called for Bahamas Power & Light (BPL) bill discounts, and “full sponsorship” of a collaborative marketing campaign to entice consumers back to the Village Road area.

Mr Fields told Tribune Business that Village Road needs to attract not only businesses that have been forced to leave the area, but also entice customers to come back and patronise

businesses that have suffered for months.

“Some of these concessions need to be extended to the side streets because a lot of the detours went through the off-streets, and all of that heavy traffic and all of that heavy equipment left the roads in shambles, but certainly there should be some consideration to some of the streets that were affected by the detours,” he added.

It is not unheard of for the Government to provide tax breaks and other concessions for businesses impacted by long-running roadworks projects. The last Christie administration did so for the New Providence Road Improvement Project that impacted multiple businesses in numerous areas of the island more than one decade ago.

Acknowledging the roadworks’ importance, Mr Fields in his letter nevertheless said “an economic stimulus package” will be a vital tool in helping the area’s businesses to rebound in the New Year.

“The sprawling construction and protracted delays have placed a crippling strain on local businesses, which employ hundreds of Bahamians,” he wrote.

“The Government has recognised the importance of business relief in the past, and the risks of unwieldy roadworks literally putting Bahamians out of business completely. The current losses come at a time when the ordinary cost of doing business continues to rise, on top of the fact that we have all just barely emerged from the full impact of the pandemic.

“Small businesses have recently faced increases in electricity costs, property taxes, wages and inflation. When the work is complete, businesses will also incur high costs to clean up our properties, repair damages, and re-engage customers.”

Mr Fields continued: “Between the open trenches, unpaved roads, detours, strained traffic management and dust, customers are avoiding Village Road like a plague. The original target for completion, which was September 2022, and even the revised date of November, would have allowed local businesses to benefit from the holiday bump that most rely upon.

“Each missed deadline has serious implications for businesses, and there is little belief that the latest end-of-month forecast for completion will be met given the lack of clear communication and the conditions on the ground. With no clear end in sight, our reserves are depleted, our business planning efforts have become futile, and we continue to experience tremendous losses.”

Jarol Investments Limited is seeking to fill the following position:

Surveillance Officers (Nassau)

• Monitor operations to ensure compliance with safety or security policies or regulations. Observe individuals’ activities to gather information or compile evidence.

Operate surveillance equipment to detect suspicious or illegal activities.

• Discuss performance, complaints, or violations with supervisors.

Monitor establishment activities to ensure adherence to all gaming regulations and company policies and procedures.

Observe gaming operations for irregular activities such as cheating or theft by employees or patrons, using audio and video equipment.

• Report all violations and suspicious behaviors to supervisors, verbally or in writing.

• Act as oversight or security agents for management or customers. . Be prepared to work within a shift system

• Retain and file audio and video records of gaming activities in the event that the records need to be used for investigations.

• Perform other related duties as assigned by Management.

Interested persons must require surveillance experience, certification, training, communication skills, attention to detail, ability to work independently and should apply at Jarol Investments Limited Head Office, Prince Charles Drive (Across from Restview) between the hours of 9am to 5pm. Or send your CV to careers@chancesgames.com

Subject: Surveillance Officer – Your Name

PAGE 2, Wednesday, January 11, 2023 THE TRIBUNE

ADVERTISE TODAY! CALL THE TRIBUNE TODAY @ 502-2394

Please Forward your resume and introduction letter by email to hrbahamas2014@gmail.com

By YOURI KEMP Tribune Business

BAHAMIAN small businesses will struggle to absorb any National Insurance Board (NIB) contribution rate increase due to the multiple other expenses hikes they are grappling with currently, a sector consultant has warned.

Mark Turnquest, president of the 242 Small Business Association and Resource Centre, told Tribune Business his members and clients are still “trying to get our feet on the ground” following COVID19 while acknowledging that NIB rate increases are “inevitable” to rescue the country’s only social security scheme.

Pointing out that many small businesses, such as clothing and electronics retailers, are already absorbing up to 30 percent increases in their labour costs since they all have staff impacted by the recent minimum wage increase, he said he “understands” that an NIB increase must come.

NIB’s 11th actuarial review, published last year, recommended that the contribution rate be increased by two percentage pointsfrom the current 9.8 percent to 11.8 percent - last July, with further hikes implemented every two years through to July 1, 2036, in a bid to “restore the short and medium-term financial sustainability of the scheme”.

Prime Minister Philip Davis held off from enacting such an increase at that time to allow businesses and households more time to recover from the COVID pandemic, arguing that he did not want further burden them and the wider economic recovery.

But, taking its cue from the actuarial review, NIB’s Board of Directors has now followed its conclusions by recommending to the Davis Cabinet that the contribution rate be increased by between three-quarters of a percentage point and 1.5 percent. It had wanted this to be implemented from January 1, 2023, and is now hoping for July 2023 after this deadline was missed. The recommended increase is smaller than that suggested by the 11th actuarial review.

Mr Turnquest said: “We all know it is a two-factor problem; the national problem that we have, and the

small business problem, so there’s a balancing act. We know that NIB has to increase, but we are concerned with how much it will be increased this year, in particular, because we’re just rebounding from COVID-19.

“We’re just trying to get our feet on the ground from the inflation, the shipping costs that were just killing us in 2022. Now we have a 24 percent minimum wage increase from $212 to $260 per week, and that [has already] increased our NIB contributions.”

While Mr Turnquest has not yet spoken to his membership about the impact from a possible NIB contribution rate hike, he confirmed they know such an increase is “inevitable”. The only question is when it will be implemented, and how much the increase will be.

“The challenge is the more salaries you have, the more you have to pay,” he added. “So that contribution increase is going to hit all of us. Everybody is going to be hit, but our take is that if you don’t increase it it’s going to be a worse position next year and, if you do, you are going to be in a worse position this year.

“So it has to be done. We understand that the increase must take place, but we just want it to be done in stages equally. We would rather an increase

every year at a standardised rate than a sharp increase year over-year.”

NIB’s present contribution rate is 9.8 percent, split 3.9 percent/5.9 percent between employee and employer, with the latter paying the majority. The 11th actuarial report is recommending that this rate increases by 72.4 percent, in percentage terms, in the near-term to 16.9 percent by 2029 before more than doubling over the long-term.

The last time NIB’s contribution rate increased was in 2010, when it rose from 8.8 percent to 9.8 percent under the last Ingraham administration.

This was the first - and only - time that the rate had increased since NIB was founded in 1974.

Dwayne Higgs, WHIM Automotive’s general manager, questioned why NIB’s contribution rate has not been indexed to inflation.

“What needs to happen is successive governments need to just stop touching the fund to do other things with it rather than using it as some sort of pension fund for retirees; what it was meant for,” he added.

NIB’s reserve fund is now forecast to be exhausted one year earlier than previously projected, in 2028 as opposed to 2029, and the report recommended that the Government focus on shoring up the social

security system’s shortterm viability through “adequately financing” its pensions arm which represents longer-term benefits. This drove the recommendation to increase NIB’s contribution rate by two percentage points to 11.8 percent by July 1. NIB also suffered a $190m deficit blow-out triggered by COVID-19, which resulted in its reserve fund slumping to $1.54bn at yearend 2020. NIB’s reserve fund shrank by almost 11 percent, or nearly $189m, in just 12 months as it was forced to liquidate investments to meet unemployment payouts and other forms of COVID-related

assistance when the Bahamian economy collapsed virtually overnight.

The figures reveal that short-term benefits payouts, which would have included NIB’s 13-week unemployment assistance initiative, more than tripled yearover-year - increasing by 209 percent from $41.868m in 2021 to $129.84m - due to the scale of terminations and furloughs sparked by COVID-19 lockdowns and other restrictions.

As a result, total benefits expenditure soared to $405.876m for the 12 months to end-December 2020, representing a 30.2 percent year-over-year jump from 2019’s $311.64m, with the increase driven

almost entirely by unemployment and other short-term relief payouts.

And the benefits surge coincided with a 21.3 percent plunge in NIB’s contribution income from employers and their workers, which declined by more than $51m from $287.131m in 2019 to $225.984m the following year. Monies received from employers dropped by almost 20 percent, falling from $166.986m to $134.075m in 2020, while contributions from the self-employed fell by close to 22 percent. They plummeted from $116.11m in 2019 to $90.994m.

THE TRIBUNE Wednesday, January 11, 2023, PAGE 3

BUSINESSES FACING STRUGGLE ON NIB

SMALL

RATE HIKE

Reporter ykemp@tribunemedia.net • Eligible for HPC Physical Therapy Licensure • 3 years pelvic health experience • BLS + CPR certification current • Recognized pelvic health certification Send inquiries via the “Contact” tab on www.vivaptwellness.com website Minimal Requirement Viva Physio & Wellness is looking for A Pelvic Health Therapist JOB OPPORTUNITY A mid-sized law firm seeks a Receptionist/Scanner/Filer/Office Assistant Requirements/Qualifications: • Answer and field phone calls in a professional manner; • Scan and file documents in a professional and timely manner; • Provide general administrative support to staff; • Perform any other duties as assigned from time to time; • Is computer literate and organized; and • Has a high school diploma or equivalent. Resumes should be submitted by email to: hrlawresume@gmail.com

To even come close to his target economic output, the ORG principal added that the Government must prioritise “streamlining” the approvals process for domestic and foreign investment and unclog the “logjam” that frequently results in months or years passing between a Heads of Agreement signing and when a project actually has “shovels in the ground”. While agreeing that the World Bank’s growth targets were very achievable for The Bahamas, despite

the threats posed by high inflation and the threat of a US recession, Mr Myers said this nation was presently enjoying strong expansion only because it was recovering the near-24 percent economic shrinkage lost to COVID-19 in 2020.

“The key is that we’ve got to get GDP up to $15$16bn a year,” he told this newspaper. “A percentage is not really what we should be looking at. We should be looking at what our GDP is, and it should be $15-$16bn, not $12bn. Then with the

tax structure and size of government, it starts to make sense or more sense.

“We still need to achieve faster growth with it, but if GDP climbs to $15bn$16bn and is ahead of public spending growth we can get on the right track. That number needs to get to $16bn in real dollars. We need $16bn in GDP. I don’t care about percentages; I care about real dollars. I care about shovels in the ground, not percentages.

“We should be focused on $16bn, $17bn, $18bn, and that will take a lot of

effort on the part of the private and public sectors, together with the education of workers so that they do the right thing. We’ve got to work at it. We’re not doing that. We’re still very lethargic,” Mr Myers added.

“In real growth, getting from $12bn to $16bn is a big deal, but we have to grow the economy because nobody seems willing to do austerity measures. The FNM didn’t do it, and the PLP isn’t doing it for the most part. If they’re not doing that, we’d better get the economy to $15bn to $16bn. That’s 30 percent growth. That’s what we need to do. What the World Bank is saying is that we’re a long way off that.

“There has been no effort by any government, current or previous, to put any austerity targets in place. The alternative to no austerity is growing the economy at an even higher rate and, if we get that to happen, there will be no need for austerity.”

Based on Central Bank data for the national debt, which was pegged at $11.167bn at end-September 2022 and equivalent to 89 percent of economic output, Bahamian GDP would be around $12.5bn. If that is accurate, economic output would still need to expand by some 28 percent or just under $3.5bn to hit the upper range of Mr Myers’ target.

The ORG principal’s argument is that an enlarged economy would be better placed to support, and finance, the present size of government in the absence of fiscal austerity such as spending cuts, new and/or increased taxes or a combination of these measures.

However, the Davis administration will argue

that its forecasts, which show a $564m fiscal deficit for 2022-2023 becomes a $278.8m surplus by 20242025, prove it is targeting the consolidation that Mr Myers and others are seeking. And the deficit for the 2022-2023 first quarter, or initial three months of the year, stood at just over $20m.

Meanwhile, Mr Myers said the Government and its agencies need to become more efficient and speed up the processing of approvals for Bahamian and foreign investment projects if his GDP target is to ever be achieved. “If we do not have austerity measures in place, it’s got to be growth, growth, growth, and that means project approvals which all these agencies need to be on it,” he told Tribune Business

“There’s not reason why you shouldn’t be able to get an answer back in two weeks’ from the Ministry of Works, Department of Physical Planning, the Department of Environmental Planning and Protection (DEPP), Water & Sewerage and BPL. Any of them. They need to put effort into that, and then it becomes a matter of is the developer properly financed, rather than waiting around for 18-24 months to get approvals after the Heads of Agreement.

“That’s the problem. It takes too long. There’s a log jam there. The more growth we want, the more log jam were going to have. We’ve got to get all these sound projects that are on the board active. We’re good at talking about them but can’t get them approved. The process is very arduous. It’s very laborious and can easily be streamlined. After they’ve done their Heads of Agreement it goes

into the abyss, the public sector abyss, and that needs to change.”

Mr Myers said the Adelaide Pines project in south-western New Providence, in which he is one of the partners, was still waiting for final approvals around one year into its development. “It takes a tremendous amount of time and effort,” he explained. “We’re pretty close, but it’s a long process getting all the details figured out.

“There needs to be more effort to get these projects moving. They’re signing Heads of Agreements with these developers. It’s one thing to approve them, but it doesn’t affect GDP until they get going. There’s got to be shovels digging. The faster they can approve things and get people employed, and taxes generated, the better for the Government. The Government should be most motivated to get this going, but the bureaucracy is very challenging.”

The ORG chief said speeding-up the approvals process was becoming ever-more critical as rising US and global interest rates increase financing costs, which could influence developers to put their plans on hold. When asked what specific steps could be taken to “streamline” these efforts, Mr Myers declined to provide details but said he could “put a paper out” on that issue.

Calling for a system that allowed policymakers to monitor the progress made by investors in obtaining the necessary approvals, so the necessary intervention can occur to eliminate red tape and get developers to move, Mr Myers said: “That’s the kind of fury and intent we need to get GDP up. If we don’t, it’s just going to be business as usual.... Everybody talks about it but nobody’s doing it, including myself. It’s very hard to move the needle.”

0.1840.12019.53.35%

0.4490.22019.02.58%

0.7220.72022.14.50%

0.1020.43428.714.81%

0.7280.24015.42.14%

PAGE 4, Wednesday, January 11, 2023 THE TRIBUNE

BAHAMAS REQUIRES $16BN ECONOMY ‘TO MAKE SENSE’ FROM PAGE B1 CALL 502-2394 TO ADVERTISE TODAY! MONDAY, 9 JANUARY 2023 CLOSECHANGE%CHANGEYTDYTD% BISX ALL SHARE INDEX: 2645.570.000.000.510.02 BISX LISTED & TRADED SECURITIES 52WK HI52WK LOWSECURITY SYMBOLLAST CLOSECLOSECHANGE VOLUMEEPS$DIV$P/E YIELD 7.005.30 AML Foods Limited AML 6.95 6.950.00 0.2390.17029.12.45% 53.0040.03 APD Limited APD 39.95 39.950.00

2.761.60Benchmark BBL 2.76 2.760.00

2.462.31Bahamas First Holdings Limited BFH 2.46 2.460.00

2.852.25Bank of Bahamas BOB 2.61

Property Fund BPF 6.30

Waste BWL

Bahamas CAB

Brewery CBB

Bank CBL

Holdings CHL

FirstCaribbean Bank CIB

Water BDRs CWCB

11.2810.05Doctor's Hospital DHS 10.50

11.679.16Emera Incorporated EMAB 9.52

11.5010.06Famguard FAM 11.22 11.220.00

18.3014.50Fidelity Bank (Bahamas) Limited FBB 18.10

4.003.55Focol FCL 3.98

11.509.85Finco FIN 11.40

16.2515.50J. S. Johnson JSJ 15.76

PREFERENCE SHARES 1.001.00Bahamas First Holdings PreferenceBFHP 1.00

1000.001000.00 Cable Bahamas Series 6 CAB6 1000.001000.000.00

1000.001000.00 Cable Bahamas Series 9 CAB9 1000.001000.000.00

1.001.00Colina Holdings Class A CHLA 1.00 1.000.00

10.0010.00Fidelity Bank Bahamas Class A FBBA 10.0010.000.00

1.001.00Focol Class B FCLB 1.00 1.000.00

CORPORATE DEBT - (percentage pricing) 52WK HI52WK LOWSECURITY SYMBOLLAST SALECLOSECHANGEVOLUME 100.00100.00Fidelity Bank (Note 22 Series B+)FBB22 100.00100.000.00 100.00100.00Bahamas First Holdings LimitedBFHB 100.00100.000.00 BAHAMAS GOVERNMENT STOCK - (percentage pricing) 115.92104.79Bahamas Note 6.95 (2029) BAH29 107.31107.310.00 100.00100.00BGS: 2014-12-7Y BG0107 100.00100.000.00 100.00100.00BGS: 2015-1-7Y BG0207 100.00100.000.00 100.00100.00BGS: 2014-12-30Y BG0130 100.00100.000.00 100.00100.00BGS: 2015-1-30Y BG0230 100.00100.000.00 100.00100.00BGS: 2015-6-7Y BG0307 100.00100.000.00 100.00100.00BGS: 2015-6-30Y BG0330 100.00100.000.00 100.00100.00BGS: 2015-10-7Y BG0407 100.00100.000.00 93.7093.70BGRS FX BGR121138 BSBGR1211386 93.7093.700.00 100.0089.08BGRS FX BGR127149 BSBGR1271497

94.8093.36BGRS FX BGR134140 BSBGR1341407

100.71100.01BGRS FL BGRS70023 BSBGRS700238

91.9191.91BGRS FX BGR127139 BSBGR1271398

92.6792.67BGRS FX BGR131239 BSBGR1312390

90.9890.98BGRS FX BGR132249 BSBGR1322498 90.9590.950.00 94.8094.80BGRS FX BGR134140 BSBGR1341407 93.9493.940.00 100.39100.39BGRS FX BGR138230 BSBGR1380306 100.39100.390.00 96.8496.84BGRS FX BGR138240 BSBGR1380405 96.1096.100.00 100.32100.32BGRS FL BGRS81035 BSBGRS810359 100.66100.660.00 100.34100.34BGRS FL BGRS81037 BSBGRS810375 100.17100.170.00 100.57100.57BGRS FL BGRS84033 BSBGRS840331 100.15100.150.00 MUTUAL FUNDS 52WK HI52WK LOW NAV YTD%12 MTH% 2.582.11 2.583.48%3.87% 4.883.30 4.884.49%5.32% 2.261.68

N/A N/A N/A MARKET TERMS BISX ALL SHARE INDEX - 19 Dec 02 = 1,000.00 YIELD - last 12 month dividends divided by closing price 52wk-Hi - Highest closing price in last 52 weeks Bid $ - Buying price of Colina and Fidelity 52wk-Low - Lowest closing price in last 52 weeks Ask $ - Selling price of Colina and fidelity Previous Close - Previous day's weighted price for daily volume - Last traded over-the-counter price Today's Close - Current day's weighted price for daily volume Weekly Vol. - Trading volume of the prior week Change - Change in closing price from day to day EPS $ A company's reported earnings per share for the last 12 mths Daily Vol. - Number of total shares traded today NAV - Net Asset Value DIV $ - Dividends per share paid in the last 12 months N/M - Not Meaningful P/E - Closing price divided by the last 12 month earnings TO TRADE CALL: CFAL 242-502-7010 | ROYALFIDELITY 242-356-7764 | CORALISLE 242-502-7525 | LENO 242-396-3225 | BENCHMARK 242-326-7333 Colonial Bahamas Fund Class D Colonial Bahamas Fund Class E Colonial Bahamas Fund Class F CFAL Global Equity Fund Leno Financial Conservative Fund Leno Financial Aggressive Fund Leno Financial Balanced Fund Leno Financial Global Bond Fund RF Bahamas Opportunities Fund - Secured Balanced Fund RF Bahamas Opportunities Fund - Targeted Equity Fund RF Bahamas Opportunities Fund - Prime Income Fund RF Bahamas International Investment Fund Limited - Equities Sub Fund RF Bahamas International Investment Fund Limited - High Yield Income Fund RF Bahamas International Investment Fund Limited - Alternative Strategies Fund INTEREST Prime + 1.75% MARKET REPORT 31-Dec-2021 31-Dec-2021 MATURITY 19-Oct-2022 20-Nov-2029 30-Nov-2022 30-Nov-2022 6.95% 4.50% 30-Sep-2022 31-Oct-2022 4.50% 6.25% 31-Dec-2021 30-Nov-2022 30-Nov-2022 31-Oct-2022 30-Nov-2022 30-Nov-2022 30-Nov-2022 30-Nov-2022 31-Oct-2022 31-Oct-2022 15-Dec-2021 30-Jul-2022 15-Dec-2044 30-Jul-2045 26-Jun-2022 26-Jun-2045 15-Oct-2022 25-Nov-2022 22-Sep-2033 23-Feb-2038 26-Jul-2037 26-Jul-2035 17-Jan-2040 FUND CFAL Bond Fund CFAL Balanced Fund CFAL Money Market Fund CFAL Global Bond Fund 6.25% 30-Sep-2025 30-Sep-2022 6.25% 4.50% 6.25% 4.25% NAV Date 4.87% 4.68% 5.24% 4.81% 5.35% 5.14% 5.60% 15-Jan-2049 5.50% 15-Jul-2039 15-Jun-2040 4.53% 5.00% 29-Jul-2023 15-Jan-2039 15-Oct-2049 17-Jan-2040 15-Jun-2030 5.65% 5.35% 5.00% (242)323-2330 (242) 323-2320 www.bisxbahamas.com

0.9321.26042.93.15%

0.0000.020N/M0.72%

0.1400.08017.63.25%

2.610.00 0.0700.000N/M0.00% 6.306.00Bahamas

6.300.00 1.7600.000N/M0.00% 9.808.78Bahamas

9.75 9.750.00 0.3690.26026.42.67% 4.502.90Cable

4.26 4.260.00 -0.4380.000-9.7 0.00% 10.657.50Commonwealth

10.25 10.250.00 0.1400.00073.20.00% 3.652.54Commonwealth

3.58 3.580.00

8.547.00Colina

8.53 8.530.00

17.5012.00CIBC

15.99 15.990.00

3.251.99Consolidated

2.93 2.930.00

10.500.00 0.4670.06022.50.57%

9.520.00 0.6460.32814.73.45%

18.100.00 0.8160.54022.22.98%

3.980.00 0.2030.12019.63.02%

11.400.00 0.9390.20012.11.75%

15.760.00 0.6310.61025.03.87%

1.000.00 0.0000.0000.0000.00%

0.0000.0000.0000.00%

0.0000.0000.0000.00%

0.0000.0000.0006.25%

0.0000.0000.0007.00%

0.0000.0000.0006.50%

89.7289.720.00

93.9493.940.00

100.71100.710.00

100.00100.000.00

92.5592.550.00

2.262.74%3.02% 205.22164.74 190.45-6.40%-6.95% 212.41116.70 169.68-20.12%-15.15% 1.761.71 1.762.49%2.79% 1.941.78 1.935.71%7.96% 1.881.79 1.863.39%3.91% 1.030.93 0.93-8.94%-9.55% 9.376.41 10.107.82%9.00% 11.837.62 13.4413.58%15.81% 7.545.66 7.712.57%2.83% 16.648.65 13.25-20.10%-19.25% 12.8410.54 12.03-4.50%-4.64% 10.779.57 10.59-0.55%-1.61% 16.279.88 16.27N/AN/A 11.228.45 11.223.00%25.60% 14.8911.20

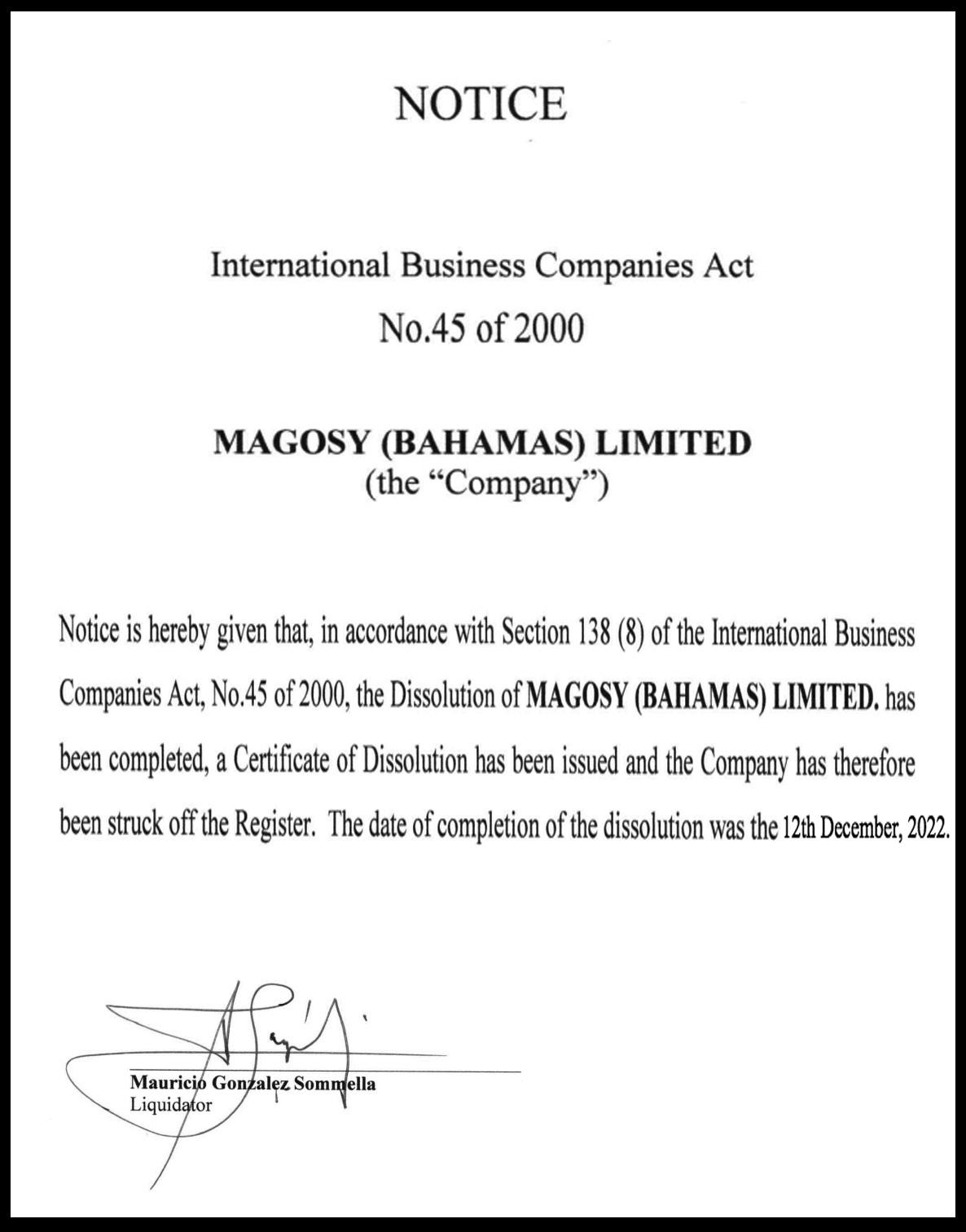

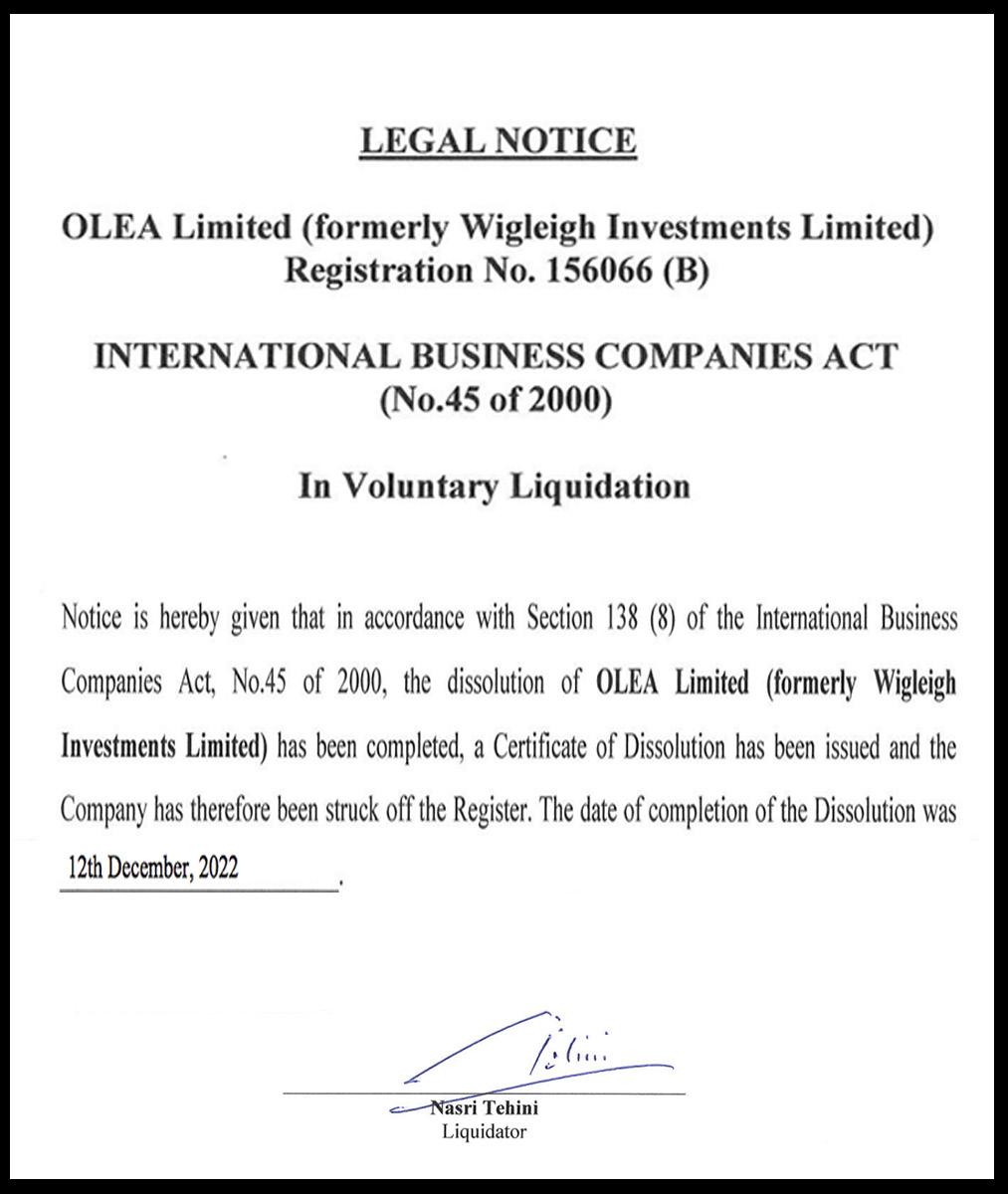

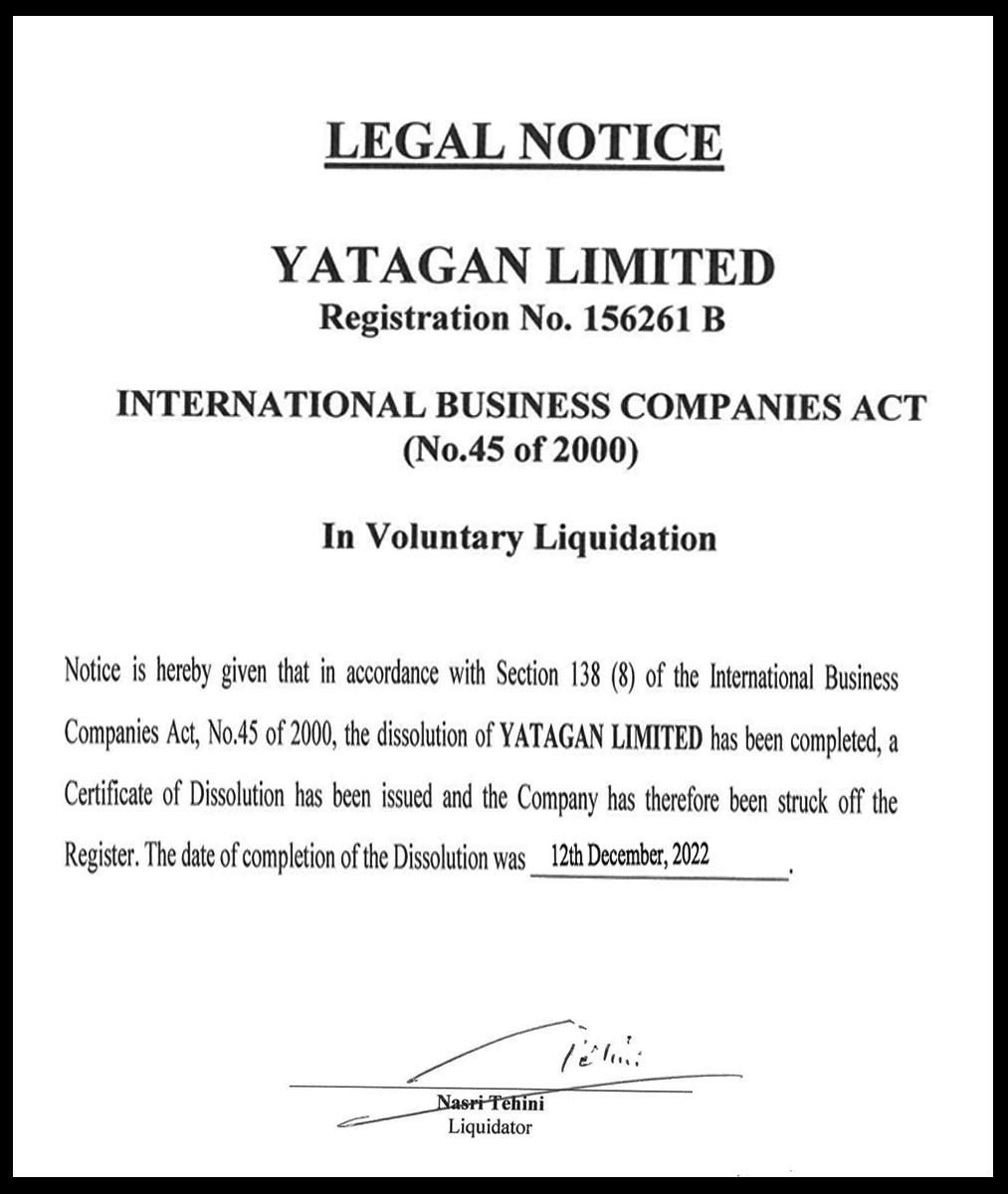

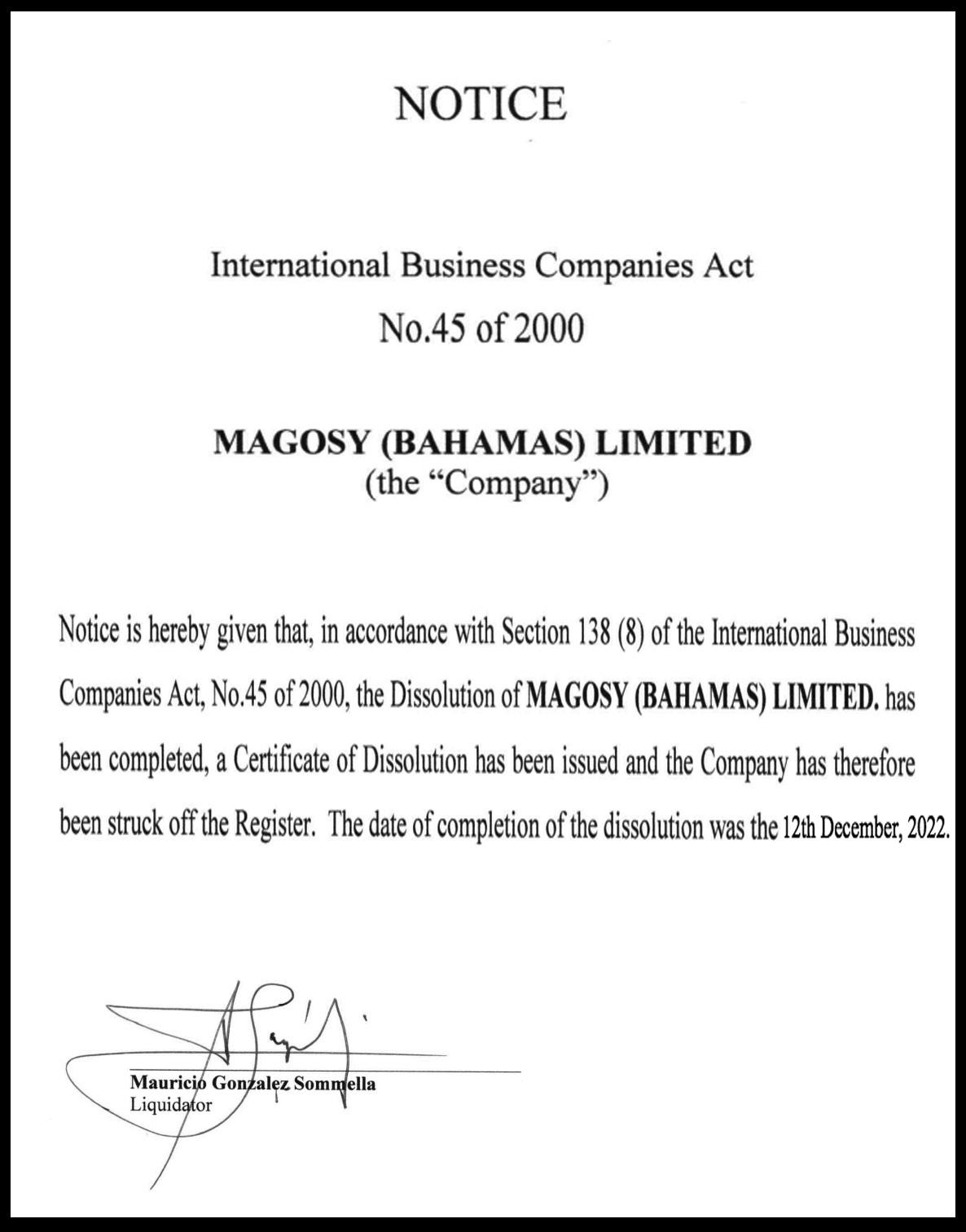

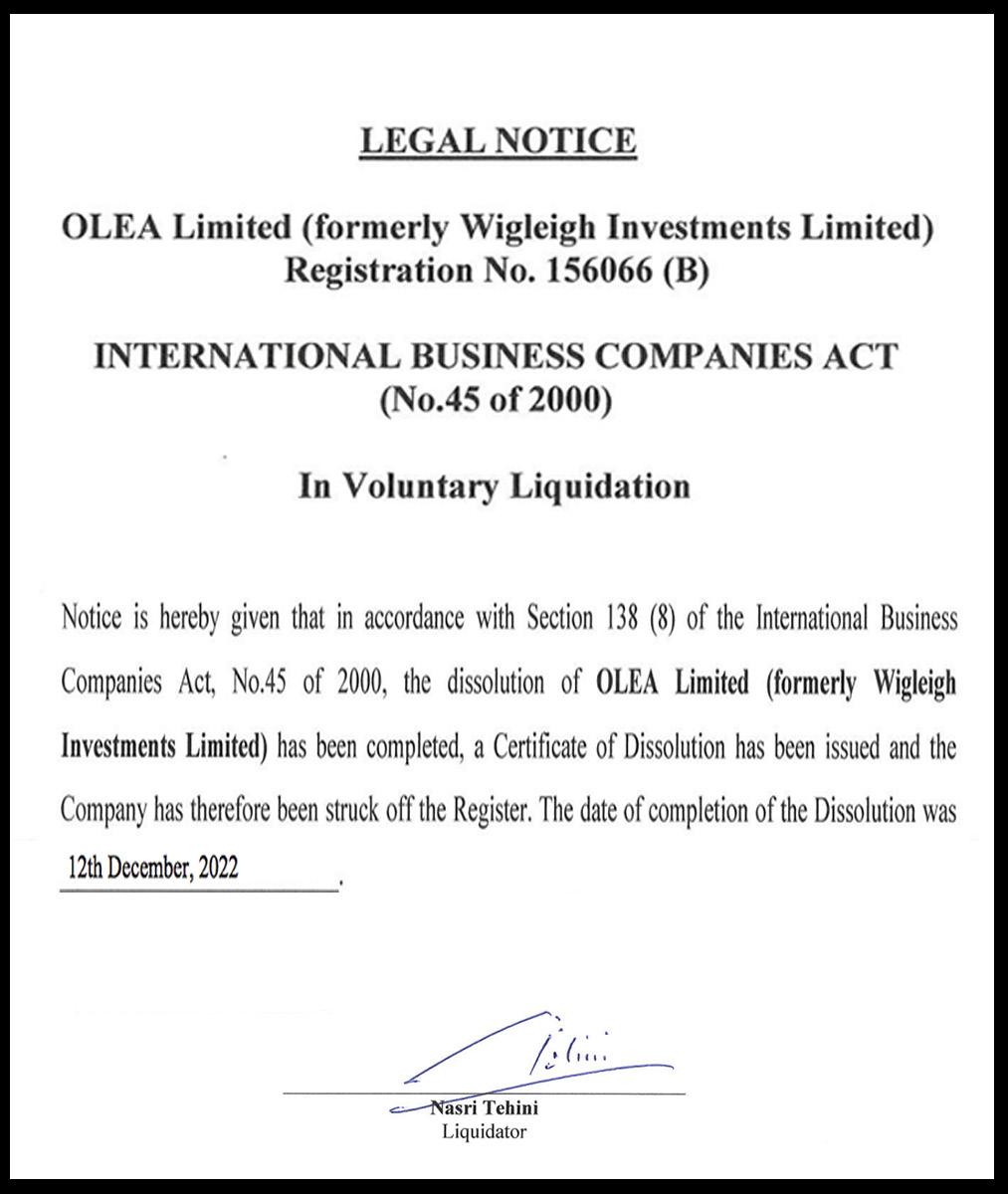

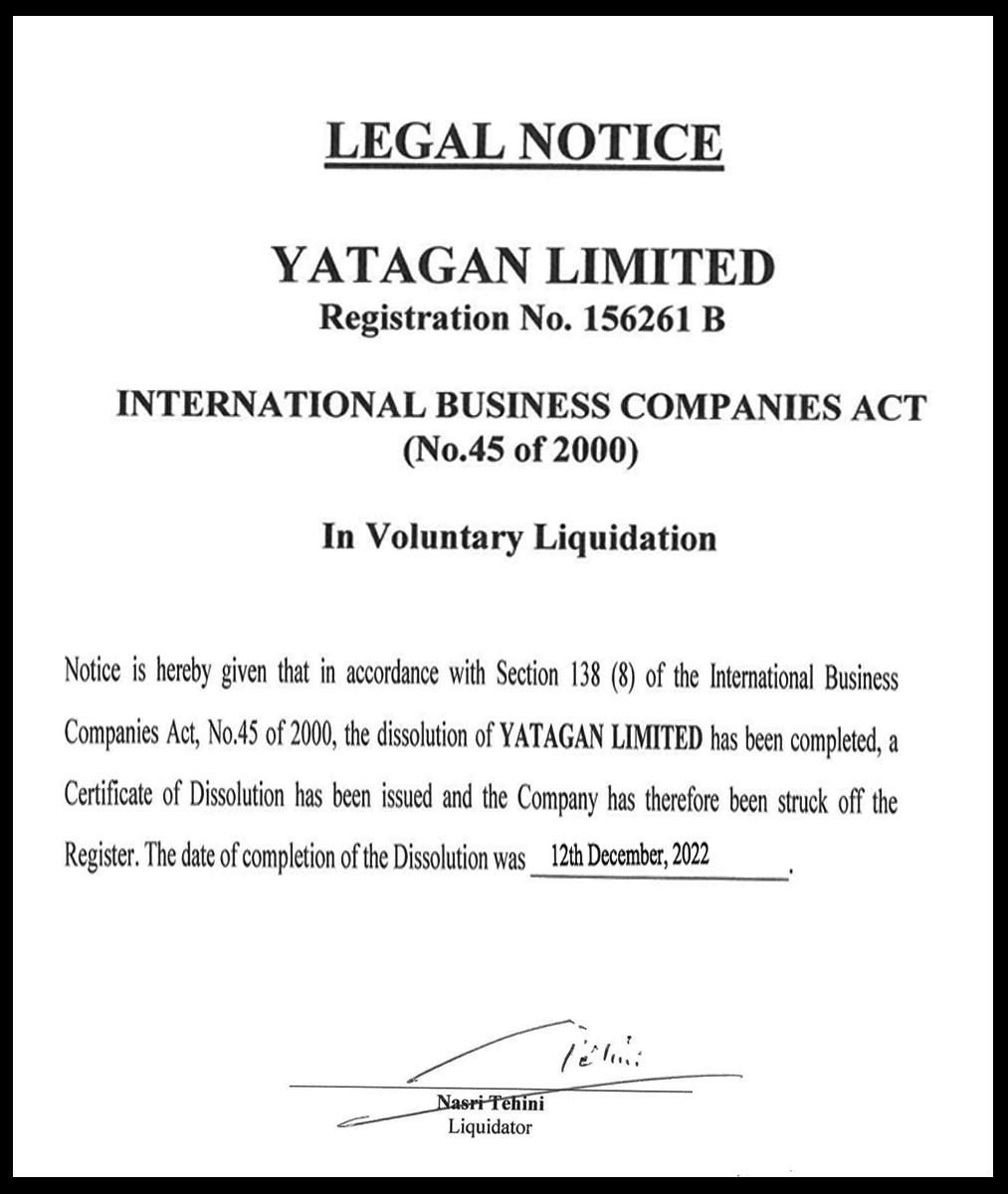

NOTICE

NOTICE is hereby given that CARLINE JOSEPH of John Road, Nassau, The Bahamas is applying to the Minister responsible for Nationality and Citizenship, for registration/ naturalization as a citizen of The Bahamas, and that any person who knows any reason why registration/naturalization should not be granted, should send a written and signed statement of the facts within twenty-eight days from the 4th day of January, 2023 to the Minister responsible for nationality and Citizenship, P.O. Box N-7147, Nassau, Bahamas.

NOTICE NOTICE FINPOINT INVESTMENT GROUP LTD.

Notice

Dated this 5th day of January A.D. 2023

NOTICE is hereby given that OCTERVIL JN BAPTISTE

of

West

Ridge,

Nassau, Bahamas,

The

Bahamas is applying to the Minister responsible for

Nationality

and Citizenship, for registration/naturalization as a citizen of The Bahamas, and that any person who knows any reason why registration/ naturalization should not be granted, should send a written and signed statement of the facts within twenty-eight days from the 11th day of January, 2023 to the Minister responsible for nationality and Citizenship, P.O. Box N-7147, Nassau, Bahamas.

Incorporated under the International Business Companies Act, 2000 of the Commonwealth of The Bahamas. Registration Number 177106 B (In Voluntary Liquidation)

is hereby given that the above-named Company has been dissolved according to the Certificate of Dissolution issued by the Acting Assistant Registrar General on the 5th day of December A.D. 2022.

Peter

D. Maynard

EY SURVEY FINDS FUND MANAGERS DELIVERING

A GLOBAL survey by the EY accounting firm found 75 percent of investors felt fund managers had met or beaten expectations in volatile financial markets experienced throughout 2022.

EY, in a statement, said its 2022 Global Alternative Fund Survey showed that most investors believe alternative asset fund managers are delivering value through positive short-term performance and promising long-term positioning.

Other findings from the survey, which gained responses from 226

managers and 61 investors between May and August 2022, are that managers face pressure to seek growth and market differentiation through new product development, while talent management and addressing gaps in regulatory compliance remain top priorities.

Jeff Short, EY’s wealth and asset management leader for The Bahamas, Bermuda, British Virgin Islands and Cayman Islands, said: “Uncertainty, market conditions and changing investor preferences are creating new

luxury” of further delaying contribution rate increases and other changes until the economy fully recovers from COVID-19. That was the stance adopted by Prime Minister Philip Davis when the reform issue first arose last year.

And, speaking after it emerged that NIB’s current Board has added its voice to those calling for a contribution rate increase, Mr Gibson told this newspaper that governance reforms - which would make the scheme more autonomous and less prone to use as “a kitty” employed to finance pet government projects - were a little-discussed aspect that also needs to be prioritised.

“To be honest, if they could get the Government out of it and put it in some sort of independent body, headway can be made,” he said. “We need greater focus on the cost of running NIB. We need more longterm planning, and not a funding mechanism or kitty for the Government.

“It really needs to have a much higher degree of independence from the Government in its day-today operations and affairs. But nobody is discussing this. That conversation is never had. It’s really been used like a development bank in terms of funding the Government’s policies and projects and what have you.”

NIB’s Board, echoing the social security system’s 11th actuarial review, was this week said to have recommended to the Davis Cabinet that contribution rates be increased by between three-quarters of a percentage point and 1.5 percentage points from January 1, 2023. That would have raised the combined rate to between 10.55 percent and 11.3 percent, but the Government did not approve it, so the Board is

now awaiting a move come July 1, 2023.

Many observers, especially following the 11th actuarial review’s publication, have viewed an NIB contribution rate increase as inevitable, the only questions being the timing of the move and by how much.

The Davis administration, following its predecessors, has sought to hold off as long as possible but the delay will only make the magnitude of the correction greater.

Mr Gibson told Tribune Business: “You could kick the can down the road, but the can is against the wall.

All you’re doing is bending the can. I was in the food store the other day, and I saw a colleague of mine.

He reminded me that we were on some sort of committee in 2004, had exactly the same conversations [on NIB’s problems] then and absolutely nothing has happened since.

“It was the same issues, same recommendations but successive governments have, on the NIB question, you’re going to have to conclude that they have let the youth and successor

generations down. It ain’t for lack of knowledge of what to do. It’s total inertia going on for 20 years.

“Twenty years on from all the analysis and work and review, the only thing we get out of it is that you are 20 years older and nothing has changed. No government seems to want to do anything; a large amount of inertia by successive governments.”

The International Labour Organisation (ILO), in the 11th actuarial report on NIB’s solvency and sustainability, warned there is no choice but to immediately increase contribution rates beyond the existing 9.8 percent otherwise the country’s future may be endangered by the chronic underfunding.

It called for a two percentage point increase in the current NIB contribution rate, split 3.9 percent/5.9 percent between employee and employer, to be

and issues taking place on property and makes necessary reports and notifies the Assistant COO.

• Checks all security/surveillance reports for accuracy and completeness and ensure timeliness.

• Ensure compliance with department and Company policies and procedures.

• Create and update weekly department schedule.

• Continually evaluate Team Members for alertness, appearance, and proper performance of duties.

• Observes, supervises and instructs shift officers in the performance of their duties.

Determines personnel requirements and makes assignments at the beginning of each shift.

• Ensure effective onboarding and training for Security/Surveillance Officers. Provide security and protection for customers, team members, property and assets.

• Reacts promptly to disturbances where Security/Surveillance is required.

• Maintain a high level of confidentiality

• Be familiar with all Chances web shops throughout the Bahamas.

• Takes appropriate action, when required, of individuals suspected of illegal activities.

• Perform related duties as assigned by management.

challenges for hedge fund managers.

“Those who demonstrate resilience amid the shifting landscape, while also offering products that can generate returns from short-term market dislocations, are well positioned to attract inflows. Our survey provides the industry with a better understanding of the trends that drive their business and highlights performance, differentiation and positioning, talent, product development, regulatory compliance and operations.”

“Talent management has become a high priority for fund managers, as competition for skilled and highly-qualified employees continues to heat up,” said Tiffany Norris-Pilcher, EY Bahamas partner and regional emerging platform leader. “Investors attach great importance to their managers’ ability to retain and attract high-quality talent, and are increasingly scrutinising talent management programmes with a sharp focus on diversity, equity and inclusion.”

let down’ over NIB

fourth reports, plus the version that was presented to Mr Davis almost 20 years ago when he was NIB chairman. “We need to bite the bullet and not delay it any longer,” he added of the reform need.

“Yes, these are tough times, these are inflationary times, but you’re going to have to do it. At least you can do it at a time when there is some bounce back in the economy, Look at it that way. We’re coming back from a very swift and deep contraction in the economy but there’s so much more work to be done. Let’s not fool ourselves.”

numerous cost increases all set to strike at once - particularly soaring Bahamas Power & Light (BPL) bills where the fuel charge is set to peak at a level 163 percent above its formerlyhedged figure this summer.

implemented from July last year. That recommendation, too, was never taken up by the Government, with the report calling for a series of rolling rate increases every two years through to 2036 to help stabilise and shore up NIB and its $1.5bn reserve fund.

Mr Gibson said the latest actuarial review was likely to be saying nothing different from the third and

Describing NIB as an “essential safety net”, Mr Gibson said The Bahamas could not allow it to fail because of the dire financial and social repercussions that would occur for thousands of Bahamians, especially those who have retired, as there is nothing that could fill the void it would leave behind and replace it.

However, an NIB contribution rate increase in 2023 would likely be especially ill-timed for multiple businesses given that they are already struggling to absorb

Peter Goudie, head of the Bahamas Chamber of Commerce and Employers Confederation’s (BCCEC) labour division, said: “I think people are going to have to try and cope as best they can and, if necessary, just cut back. We’ve got all these costs and inflation on top of it. I don’t know how well people are going to survive, but they’re going to have to cut back if need be.

“The biggest issue is going to be the BPL increase. It’s just horrible...... The Government has got to deal with this, though. You cannot have NIB run out of money. It just hurts so many people, especially seniors that don’t have the ability to work any more. I think it’s going to be a very rough year. Everything is coming at the same time.”

THE TRIBUNE Wednesday, January 11, 2023, PAGE 5

JEFF SHORT TIFFANY NORRIS-PILCHER

and youth

FROM

B1 THE NATIONAL INSURANCE BOARD (NIB) HEADQUARTERS ADVERTISE TODAY! CALL THE TRIBUNE TODAY @ 502-2394 Reinforces company goals and vision to all direct reports and continually implements this strategy into overall communications.

Supervises, directly and/or indirectly, all Security/Surveillance team members including: selection, training, work direction, safety, communication, counseling, disciplining, performance evaluations and records. Oversight and training for emergency response procedures such matters as fires, bomb threats, power outages, and other serious matters or emergencies.

Directs and monitors the security and safety of customers, employees, facilities, and grounds. Reviews security/surveillance investigations concerning all incidents

‘Future generations

PAGE

•

•

Interested persons must require surveillance experience,

communication skills, attention to detail, ability to

and should apply at Jarol Investments Limited Head

from Restview) between the hours of

Or send your CV to careers@chancesgames.com Subject: Assistant Security Manager – Your Name

seeking to fill the following position: Assistant Security Manager (Nassau)

certification, training,

work independently

Office, Prince Charles Drive (Across

9am to 5pm.

Jarol Investments Limited is

SECOND US AVIATION GROUP CALLS FOR BAHAMIAN AIRLINE SANCTIONS

FROM

local airlines to provide services in the US to be “curtailed or suspended”, or face “other countervailing measures” deemed fit by the US Department of Transportation.

The Bahamas now has two powerful US aviation lobby groups ranged against it. Airlines for America includes key carriers such as American Airlines, Jet Blue and Delta, all of which service The Bahamas’ market, as do Frontier and Spirit. NACA also represents the likes of Air Transport International, Atlas Air, AmeriJet, Breeze Airways, Miami Air International, Omni Air International and World Atlantic Airlines.

The Government has pledged to fight their complaint, which yesterday also received backing from KLM Airlines, the Netherlands’ national flag carrier. “We find it hard to accept how the process is currently set up at [in] The Bahamas,” said Johan Zandastra, KLM’s procurement officer for navigation charges.

Tribune Business also understands that the International Air Transport Association (IATA), the

lobby group for the global airline industry, has been vehemently opposed to The Bahamas’ overflight fee structure since it was unveiled in March and April 2021. The airline industry’s complaint, as led by the US carriers, is premised on three key issues.

First, given that the FAA still provides air navigation services above 6,000 feet in some 75 percent of Bahamian air space under a ten-year management agreement, the US airlines are alleging they are - in effect - being double taxed as they already pay the FAA to provide this. They are also alleging they are paying The Bahamas for services it is presently not providing, and are subject to fees not levied on domestic carriers, hence the “discrimination” charge.

Finally, the Airlines for America group, now backed by NACA, is also alleging that the present overflight fee structure breaches Article 10 in the Bahamas-US Air Transport Agreement, which calls for such levies to be “just, reasonable, not unjustly discriminatory, and equitably apportioned among categories of users”. The overflight fees are paid in

return for the right to use or fly through Bahamian air space.

However, those involved with the development and roll-out of The Bahamas overflight fees say the US airlines are seeking to effectively re-litigate an issue that was already settled more than a year ago. Suggesting that these carriers have become accustomed to paying nothing for transiting Bahamian air space, they accused the US airlines of seeking to bully this nation, and queried: “Does our air space have no value?”

One well-placed source, speaking on condition of anonymity, compared the situation with the US airlines to that encountered with the cruise lines when The Bahamas raised per passenger fees from less than $1. All complained bitterly about it, but eventually feel into line, and they added: “They [the US carriers] think they can simply stop paying. You can’t fly through a nation’s air space and not expect to pay for that. There are costs associated with providing safety and oversight.”

The Government hired consultants ALG, which undertook a six-month

consultation process with the aviation industry and other stakeholders to determine the overflight fees that The Bahamas would charge and what was reasonable. It was decided that The Bahamas has “a fairly complex air space”, resulting in different fees for carriers transiting this nation, those taking off and landing, and planes flying between different Bahamian islands.

Bahamian air space was also managed by three different countries - the US, Cuba and Bahamas. It is understood that the thenMinnis administration took the view that it was a single air space that could not be segmented, but the US airlines want only to pay for the portion that affects them and the services they use, dealing only with the FAA and “having no regard for The Bahamas” and its costs.

The Civil Aviation Authority Bahamas (CAAB), in notifying the aviation industry of the proposed fees in an August 31, 2020, paper, said they were competitive when benchmarked against the Caribbean region average using the distance of 223 nautical miles, which was described as the “average

overflight” distance through Bahamian air space. The Bahamas was pegged at $136, some $10 below the region’s $146 average.

“The chart shows that the proposed charging scheme is aligned with regional benchmarks, and therefore sets competitive fees for the airspace users,” the Bahamian aviation regulator said. “Landing fees have been calculated based on equality among airspace users, establishing the same cost per nautical mile for the average domestic and international flight - note that the international landing fee covers both the arrival and departure flights.

“When accounting for both the passenger levies and ANS (air navigation services) charges, the average charge per aircraft seat equates to less than $1.60 for domestic and international landings, as well as for overflight operations. Therefore, the proposed charging scheme has a minimum impact on the passenger ticket price and on the aircraft operators’ competitiveness.”

Explaining the rationale for introducing the overflight fee structure, the CAAB added: “The

Bahamas is recognised as one of a few nations that do not charge ANS charges. Hence, new revenue streams for the provision of air navigation services and regulatory oversight have been explored to promote the safety, security, economic viability and reliability of the aviation sector in The Bahamas.

“The new revenue streams will permit the CAAB to reduce the burden on fiscal resources currently funding these activities; [and] finance critical upgrades and modernise the air space structure and communication, navigation and surveillance (CNS) infrastructure.”

Other priorities included the financing of “strategic investments in the regulatory oversight activities of the aviation sector, thereby enhancing the compliance with the International Civil Aviation Organisation’s (ICAO) standards and recommended practices, and The Bahamas’ safety audit outcomes”, and improving “the ANS capabilities and manpower capacity in the country”.

Fishermen urge: ‘Spare no expense’ on sunken vessel

leaks. It’s not an area that has never had pollution before.”

The MV Onego Traveller, which is registered in Antigua and Barbuda, was

carrying ferix, a slightly corrosive chemical used for water treatment and fertilizer, when it sank between Christmas and New Year’s Day. “We want no expense to be spared in the clean

up,” Mr Maillis told Tribune Business “There’s going to be a huge object sitting on the bottom of the ocean with oil and potentially toxic chemicals seeping out of it. There could be dispersants, chemicals and pollutants put into the water. It’s sad to see. We want no expense to be spared, and the Government to properly handle this affair. Don’t take a soft hand with this type of thing.

“We know they’re trying to encourage foreign companies to register their ships here, but at the same time we’re trying to protect a valuable ecosystem, and not just an ecosystem but fisheries resources that form a huge part of our ecosystem. That area is a very important pelagic fishing zone for yellowfin tuna, wahoo and mahi mahi.”

Mr Maillis said the area surrounding the MV Onego Traveller’s resting place is important for both commercial fishing and charter boat tourism, and represented “the home fishing ground” for the Sandy Point community. “They

need to spare no expense, and apply pressure to ensure that the companies responsible for the vessel move forward efficiently and effectively,” he added.

“The Department of Environmental Planning and Protection (DEPP) needs to hold the polluters accountable. In international environmental law, there’s a common principle called the polluter pays, and we have that enshrined in the Environmental Planning and Protection Act. These companies have very large insurers. They should have no problem putting out the funds needed as quickly as possible and not dragging their feet.

“We should be firm with them. The Bahamas is trying to encourage shipping companies to keep using our waters and register their vessels here but, at the end of the day, they have a duty to uphold the law and the public is watching. I’m not saying they haven’t started this process or that they won’t do it. I’m only encouraging them to start that process.

We’re watching and looking for strong action on our behalf.”

Vaughn Miller, minister of the environment and natural resources, could not be reached for comment via phone and social media before press time last night. It is thus unclear whether the Government has established contact. and begun the process of seeking financial compensation, for the costs incurred in remediating the MV Onego Traveller’s environmental impact from its owner, charter company, operator and their insurers. There is also uncertainty if the wreck will be salvaged.

John Pinder, the central and south Abaco MP, last week dismissed fears that oil was leaking from the vessel. “I’d like to report there is no oil spill; that report is erroneous. The slick on top of the water is residue from the dissolving shipment that they were carrying, which is ferix, which is non-toxic; it is more like a corrosive,” he said.

Mr Pinder said authorities were immediately on the site to facilitate remediation efforts, adding he was very “optimistic” that there will be no long-term environmental fall-out. “The diesel and fuel that they were carrying was capped off. There are ships out there that are doing the containment. And they will be extracting the fuels off of the boat from fuel tanks, but they were capped off in time not to have an oil spill,” he said.

“The ship there that is doing the clean-up and extraction has all the skirting they need, and they have 1,000 feet in case of it touching the shore. So, we have all the necessary gear on site to perform the job at hand. I am very optimistic that everything will go well, and the clean-up will leave no long-term environmental effects. I was able to see that they are out there working non-stop to make sure that the fishing grounds are kept for future generations.”

PAGE 6, Wednesday, January 11, 2023 THE TRIBUNE

PAGE B1

FROM PAGE B1

SUPREME COURT DEBATES UNION TACTICS IN SPOILED CONCRETE CASE

By JESSICA GRESKO Associated Press

THE Supreme Court on Tuesday debated the limits of the pressure unions can exert during a strike in a case about cement truck drivers who walked off the job with the trucks full of wet concrete.

Chief Justice John Roberts at one point summed up the difference between causing a company to lose some money, which is legally permitted, and intentionally destroying property, which isn’t. It’s “the difference between milk spoiling and killing the cow,” he said.

The case comes to the justices following losses for organized labor at the high court in recent years. In 2018, the court’s conservative majority overturned

a decades-old pro-union decision involving fees paid by government workers.

More recently, the justices rejected a California regulation giving unions access to farm property in order to organize workers.

The current case could hurt unions by making it easier for companies to sue over harms caused by strikes, but several justices seemed inclined to rule only narrowly.

The case before the high court involves Glacier Northwest, which sells and delivers concrete to customers in Washington state.

On the other side is a local Teamsters union, which represents the company’s cement truck drivers.

During contract negotiations in 2017 the union called for a strike, and drivers walked off the job

while their trucks were full of concrete, which has to be used quickly and can damage the trucks if it’s not.

Glacier says the union timed the strike to create chaos and inflict damage. Glacier had to not only dump the concrete to prevent damage to the trucks but also eventually pay for the wasted concrete to be broken up and hauled away.

The company sued the union in state court for intentionally damaging its property, but the lawsuit was dismissed.

Noel Francisco, Glacier’s lawyer, told the justices that the union’s conduct isn’t protected under federal law for the same reason that “steelworkers can’t walk out in the middle of a molten iron pour,” “federal security guards can’t leave their posts in the middle

of a terrorist threat” and “a ferry boat crew can’t drive their boat out into the middle of the river and abandon ship.”

Biden administration attorney Vivek Suri told the justices that the federal National Labor Relations Act protects workers’ right to strike but that they must take reasonable precautions to avoid damage to property and didn’t in this case.

Union lawyer Darin Dalmat agreed some actions aren’t allowed as part of a strike.

“We absolutely agree you cannot burn down the factory,” he said. But in this case he said the drivers were instructed to be conscientious when they walked off the job, to bring their full trucks back to Glacier’s facility and to

FRENCH PM UNVEILS PENSION CHANGES, UNIONS CALL FOR STRIKES

By SYLVIE CORBET The Associated Press

FRENCH Prime Minister

Elisabeth Borne on Tuesday unveiled a contentious pension overhaul aimed at raising the retirement age from 62 to 64 by 2030, which prompted vigorous calls for strikes and protests from leftist opponents and labor unions.

Speaking in a news conference in Paris, Borne said the minimum retirement age to be entitled to a full pension will be gradually increased by three months every year, starting this year, in line with a longstanding pledge by President Emmanuel

Macron. In addition, people will need to have worked for at least 43 years to get a full pension, starting from 2027, she said.

“Working more will allow future retirees to get higher pensions,” Borne said.

“By 2030, our system will be financially balanced,” she added.

Those who started working before the age of 20 will be able to get early retirement, Borne added.

Specific categories of workers such as police officers and firefighters will also be able to retire earlier.

The government argues that French people live longer than they used to and therefore need to work

NOTICE WELLBAR INVEST LTD.

NOTICE is hereby given as follows:

(a) Wellbar Invest Ltd. is in Voluntary Dissolution under the provisions of Section 138(4) of the International Business Companies Act 2000.

(b) The Dissolution of the said Company commenced when the Articles of Dissolution were submitted to and registered by the Registrar General of the Commonwealth of The Bahamas.

(c) The Liquidator of the said Company is Beatus Limited, P.O. Box N7776-348, N.P., Bahamas.

Dated 9th January 2023

Beatus Limited Liquidator

NOTICE

CORALMAE INVEST LTD.

NOTICE is hereby given as follows:

(a) Coralmae Invest Ltd. is in Voluntary Dissolution under the provisions of Section 138(4) of the International Business Companies Act 2000.

(b) The Dissolution of the said Company commenced when the Articles of Dissolution were submitted to and registered by the Registrar General of the Commonwealth of The Bahamas.

(c) The Liquidator of the said Company is Beatus Limited, P.O. Box N7776-348, N.P., Bahamas.

Dated 9th January 2023

Beatus Limited Liquidator

NOTICE SPICEBUN LTD.

NOTICE is hereby given as follows:

(a) Spicebun Ltd. is in Voluntary Dissolution under the provisions of Section 138(4) of the International Business Companies Act 2000.

(b) The Dissolution of the said Company commenced when the Articles of Dissolution were submitted to and registered by the Registrar General of the Commonwealth of The Bahamas.

(c) The Liquidator of the said Company is Beatus Limited, P.O. Box N7776-348, N.P., Bahamas.

Dated 9th January 2023

Beatus Limited Liquidator

longer to make the pension system financially sustainable. All French workers receive a state pension.

Center-left and hard-left labor unions unanimously expressed their disapproval of the proposed changes after talks with Borne last week. Some are in favor of an increase in payroll contributions paid by employers instead.

The country’s eight main labor unions announced a national day of strikes and protests on Jan. 19.

Laurent Berger, head of the CFDT union, denounced “one of the most brutal pension reforms of the past 30 years.” Philippe Martinez, secretary general

of the CGT union, urged workers to “go on strike that day and the next days,” adding that the union is “committed to prevent that bill from passing.”

A heated debate in parliament also is to be expected, starting next month.

Macron’s centrist alliance lost its parliamentary majority last year — and most opposition parties are opposed to the changes.

Borne vowed to seek “compromise” with some other political groups. Macron’s centrist lawmakers hope to be able to ally with members of the conservative The Republicans party to pass the measure.

NOTICE TAPERVIEW LTD.

NOTICE is hereby given as follows:

(a) Taperview Ltd. is in Voluntary Dissolution under the provisions of Section 138(4) of the International Business Companies Act 2000.

(b) The Dissolution of the said Company commenced when the Articles of Dissolution were submitted to and registered by the Registrar General of the Commonwealth of The Bahamas.

(c) The Liquidator of the said Company is Beatus Limited, P.O. Box N7776-348, N.P., Bahamas.

Dated 9th January 2023

Beatus Limited Liquidator

NOTICE WILMINGTON INVEST SA

NOTICE is hereby given as follows:

(a) Wilmington Invest SA is in Voluntary Dissolution under the provisions of Section 138(4) of the International Business Companies Act 2000.

(b) The Dissolution of the said Company commenced when the Articles of Dissolution were submitted to and registered by the Registrar General of the Commonwealth of The Bahamas.

(c) The Liquidator of the said Company is Beatus Limited, P.O. Box N7776-348, N.P., Bahamas.

Dated 9th January 2023

Beatus Limited Liquidator

NOTICE ROBSHAW INVEST LTD.

NOTICE is hereby given as follows:

(a) Robshaw Invest Ltd. is in Voluntary Dissolution under the provisions of Section 138(4) of the International Business Companies Act 2000.

(b) The Dissolution of the said Company commenced when the Articles of Dissolution were submitted to and registered by the Registrar General of the Commonwealth of The Bahamas.

(c) The Liquidator of the said Company is Beatus Limited, P.O. Box N7776-348, N.P., Bahamas.

Dated 9th January 2023

Beatus Limited Liquidator

leave the trucks’ mixing drums spinning so that the concrete would not immediately begin to harden.

“Every day it deals with leftover concrete,” Dalmat said of Glacier.

The question for the court is about how the case should proceed. Glacier says its lawsuit shouldn’t have been dismissed and should have been allowed to go forward in state court. But the union says Glacier’s lawsuit can only go forward in state court if the federal National Labor Relations Board finds the union’s actions weren’t protected by federal law.

The court’s three liberal justices — Sonia Sotomayor, Elena Kagan and Ketanji Brown Jackson — each suggested some

sympathy for the argument that the NLRB should get the case first. The board has seen thousands of these cases, Kagan said and can “fit a case like this into a broader map of strike conduct and what’s protected and what’s not.”

But the justices also seemed skeptical that the union had acted appropriately. Jackson at one point compared the union’s conduct in this case to “the arsonist who says I’m going to walk away, but as I do, let me strike a match and burn down the factory.”

A decision in the case is expected by the end of June. The case is Glacier Northwest v. International Brotherhood of Teamsters Local Union No. 174, 21-1449.

NOTICE WINEHUT LTD.

NOTICE is hereby given as follows:

(a) Winehut Ltd. is in Voluntary Dissolution under the provisions of Section 138(4) of the International Business Companies Act 2000.

(b) The Dissolution of the said Company commenced when the Articles of Dissolution were submitted to and registered by the Registrar General of the Commonwealth of The Bahamas.

(c) The Liquidator of the said Company is Beatus Limited, P.O. Box N7776-348, N.P., Bahamas.

Dated 9th January 2023

Beatus Limited Liquidator

NOTICE SEATIME INVEST LTD.

NOTICE is hereby given as follows:

(a) Seatime Invest Ltd. is in Voluntary Dissolution under the provisions of Section 138(4) of the International Business Companies Act 2000.

(b) The Dissolution of the said Company commenced when the Articles of Dissolution were submitted to and registered by the Registrar General of the Commonwealth of The Bahamas.

(c) The Liquidator of the said Company is Beatus Limited, P.O. Box N7776-348, N.P., Bahamas.

Dated 9th January 2023

Beatus Limited Liquidator

NOTICE TRAINHEAT LTD.

NOTICE is hereby given as follows:

(a) Trainheat Ltd. is in Voluntary Dissolution under the provisions of Section 138(4) of the International Business Companies Act 2000.

(b) The Dissolution of the said Company commenced when the Articles of Dissolution were submitted to and registered by the Registrar General of the Commonwealth of The Bahamas.

(c) The Liquidator of the said Company is Beatus Limited, P.O. Box N7776-348, N.P., Bahamas.

Dated 9th January 2023

Beatus Limited Liquidator

LTD.

NOTICE is hereby given as follows:

(a) Carlarama Ltd. is in Voluntary Dissolution under the provisions of Section 138(4) of the International Business Companies Act 2000.

(b) The Dissolution of the said Company commenced when the Articles of Dissolution were submitted to and registered by the Registrar General of the Commonwealth of The Bahamas.

(c) The Liquidator of the said Company is Beatus Limited, P.O. Box N7776-348, N.P., Bahamas.

Dated 9th January 2023 Beatus Limited

THE TRIBUNE Wednesday, January 11, 2023, PAGE 7

Liquidator NOTICE CARLARAMA

$233m IMF rights can’t be viewed as ‘panic exercise’

least partially to limit its exposure and lending to the Government.

This exposure has been declining since the Act was passed, and the Fidelity chief said the SDR transaction should be part of a properly articulated, wider debt management initiative and borrowing plan. He indicated there were similarities with the $206.5m Goldman Sachs repurchase or ‘repo’ deal last year, where the Government used funds accumulated to repay future debt maturities as collateral for a foreign currency advance from the investment bank

“The reality is very much like the repo this should not be done in a vacuum,” Mr Bowe said of the $233m SDR borrowing. “It should be very clear that the

Government is using this as a bridge facility. It’s not a long-term facility.

“The issue that presents itself is if there is a proper dent management strategy it means all the evaluation associated with it has been done, and the Government has enacted the legislation and the framework around it is in place to facilitate the transaction. We have to be careful this does not seem, if you like, a panic exercise.

“While the facility is certainly one to be taken advantage of, is this one that came about and was quickly accessed and they didn’t do the necessary amendments to the legislation to ready the legal environment to actually facilitate the transaction?...

If this is seen to be reactionary it will cause concern in certain quarters.”

John Rolle, the Central Bank’s governor, last week revealed to Tribune Business that the Memorandum of Understanding (MoU) between the monetary policy regulator and Ministry of Finance stipulates that the Davis administration must change the Central Bank Act to facilitate the transaction.

Suggesting that the “opportunity cost” of not using the IMF-provided financing had “significantly” increased compared to when the SDRs were issued in August 2021, he said they are no longer needed to bolster The Bahamas’ foreign currency reserves given the strength of the country’s postCOVID tourism and wider recovery.

Mr Rolle nevertheless conceded the two sides had put the proverbial cart

before the horse by agreeing the transaction prior to giving it the necessary legal underpinning. “The Central Bank worked closely with the Government in concluding these arrangements to access the SDRs,” the governor told this newspaper via an e-mailed reply. “Under the MOU there is an undertaking by the Government to amend the Central Bank Act to cover the use of the 2021 allocations.”

The IMF SDR move thus continues the Davis administration’s strategy of finding creative ways to access low-cost foreign currency debt financing while avoiding the international capital markets. It started with the $206.5m Goldman Sachs repurchase or ‘repo’, and maintained this with a subsequent $385m bondof which some $200m was

guaranteed by the InterAmerican Development Bank (IDB).

Simon Wilson, the Ministry of Finance’s financial secretary, previously said the MoU would provide the Government with access to cheap foreign currency financing that was an estimated 700 basis points below prevailing market rates.

Based on the $233m valuation presently assigned to the SDRs, he argued that this seven percentage point differential could generate close to $20m in annual interest savings for hard-pressed Bahamian taxpayers compared to the likely rates if the Government had to borrow in

the international capital markets.

Mr Wilson also argued that the Government’s SDR borrowing was also aligned with the IMF’s stated reason for issuing them, which was use for “fiscal purposes”. This is partially backed by the Central Bank’s August 2021 release, which says: “Countries can decide whether policy buffers would be used to increase the flexibility of fiscal and monetary policies, including for pandemicrelated deficit financing, debt management operations, promoting external debt sustainability, financial stability or balance of payments needs.”

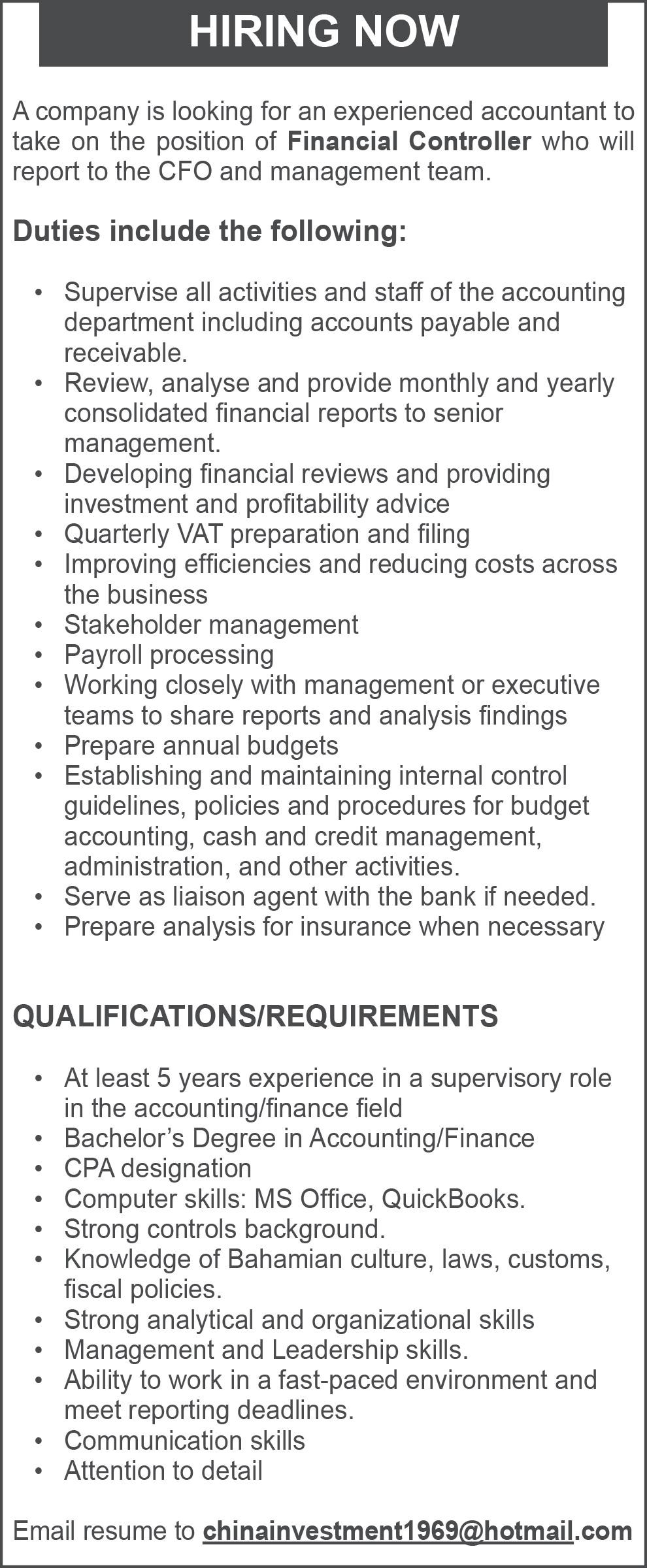

Employment Opportunity: President

The Organization: Templeton World Charity Foundation, Inc. (“TWCF”) is a global nonprofit foundation created by Sir John Templeton in 1996 in Nassau, The Bahamas. The Foundation supports a diverse group of researchers to discover new knowledge, develop new tools, and launch new innovations that make a lasting impact on human flourishing. The current grant portfolio of the Foundation comprises over 200 projects in more than 40 countries. TWCF is committed to a five-year strategy focused on innovations that enable human flourishing. Flourishing is a holistic concept that includes physical, mental, social, and spiritual well-being. Over the next five years, the Foundation will support a range of projects across three distinct stages: Discovery, Development & Launch. The Foundation facilitates partnerships with leading organizations across many sectors. Templeton World Charity Foundation has an annual grant payout of approximately 40M USD. The team consists of 12 employees today and 6 external advisors. In recent years, the foundation has established itself as a leading philanthropy that bridges the gap between fundamental scientific research, practical tools, and public action. For more information about Templeton World Charity Foundation and its active initiatives, visit our website at www.templetonworldcharity.org.

The Role