OSPREY LANDING

Strategically located between the Town of Jackson, Wilson, and world-renowned Teton Village, this rare commercial/residential offering sits directly on busy Moose Wilson Road—ensuring maximum exposure and daily traffic from locals and visitors alike. Situated just off the scenic bike path and minutes from the Aspens, this property offers unmatched access to all the Westbank has to offer.

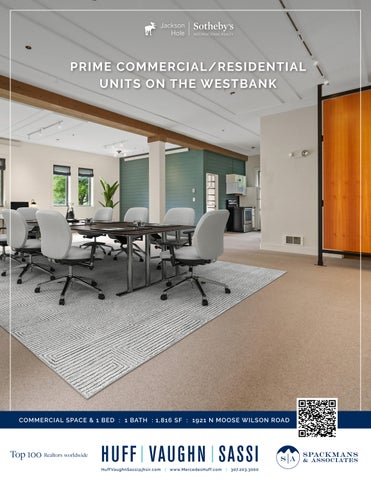

The main level features 966 sq. ft. of prime commercial space with a private office, full kitchen, and a beautifully remodeled bathroom—ideal for a variety of professional or retail uses. Upstairs, the updated two-bedroom deed-restricted residential unit provides a light-filled open layout, spacious rooms, and modern finishes—perfect for comfortable on-site living employee housing or rent to a local working in Teton County, Wy.

Whether you’re an investor, business owner, or a local entrepreneur seeking a live/work setup in one of Jackson Hole’s most coveted corridors, this is a truly unique opportunity in a location that rarely comes available.

DEED RESTRICTED 2 BEDROOM APARTMENT

DEED RESTRICTED 2 BEDROOM APARTMENT

DEED RESTRICTED 2 BEDROOM APARTMENT

1921 N MOOSE WILSON Road 101, Wilson, 83014

Provided as a courtesy of Jill Sassi-Neison, Huff/Vaughn/Sassi

Jackson Hole Sotheby's International Realty 185 W Broadway PO Box 3281 Jackson, WY 83001 Mobile - (307) 690-4529 jill sassi@jhsir com

Non-Public: No

Category: Commercial w/Improvements

Land SqFt:

Start Showing Date:

Business Type: Professional Acres: 0 01

Building Total SqFt: 1,816

Space Avail SqFt: 1,816

Stories: 2 Senior Community YN: Horses Allowed: No

List Price Per SqFt: Sold Price Per SqFt:

Common Name: County: Teton

Area: 03 - W Snake N of Wilson

Subdivision: Osprey Landing Zoning: Commercial Flood Zone: Flood Class: Ann Assn Fee $: 12,106 32 Association Fee Frequency: Annually

Taxes: 7,540 86

Tax Year: 2024

Possession: Negotiable Latitude: 43 507021 Longitude: -110 847247

In-House Listing #:

Legal Description: UNIT 101, OSPREY LANDING

Public Remarks: Prime commercial/residential unit on the Westbank located directly on Moose Wilson Road, just off the bike path The high visibility commercial space on the main level is 966 sq ft and consists of a private office, full kitchen, and a fully remodeled bath Upstairs, the updated twobedroom deed-restricted residential unit has an open layout with spacious rooms and plenty of natural light This is a rare opportunity to own commercial real estate in a prime location close to the Aspens, Teton Village and the town of Wilson

Miscellaneous: Transferable Lease: Y Water: Well Sewer: Public

Agent Owned: Y

Seller Concessions:

Listing Price: 2,695,000

LO: Jackson Hole Sotheby's International Realty

Comm/Loc Details: CC&R's Construction: Modular Exterior: Combo; Steel; Wood

Roof: Other Air Conditioning: None Heat: Cove Heaters

Information is deemed to be reliable, but is not guaranteed. © 2025 MLS and FBS. Prepared by Jill Sassi-Neison, Huff/Vaughn/Sassi on Monday, July 14, 2025 2:43 PM. The information on this sheet has been made available by the MLS and may not be the listing of the provider