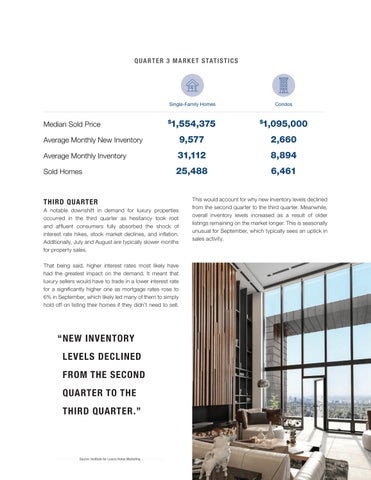

Q UA R T E R 3 M A R K E T S TAT I S T IC S

Single-Family Homes

Median Sold Price

1,554,375

$

Condos

1,095,000

$

Average Monthly New Inventory

9,577

2,660

Average Monthly Inventory

31,112

8,894

Sold Homes

25,488

6,461

THIRD QUARTER A notable downshift in demand for luxury properties occurred in the third quarter as hesitancy took root and affluent consumers fully absorbed the shock of interest rate hikes, stock market declines, and inflation. Additionally, July and August are typically slower months for property sales. That being said, higher interest rates most likely have had the greatest impact on the demand. It meant that luxury sellers would have to trade in a lower interest rate for a significantly higher one as mortgage rates rose to 6% in September, which likely led many of them to simply hold off on listing their homes if they didn’t need to sell.

“ N EW INVENTORY LEVELS DECLINED FROM THE SECOND QUARTER TO THE THIRD QUARTER.”

Source: Institute for Luxury Home Marketing

This would account for why new inventory levels declined from the second quarter to the third quarter. Meanwhile, overall inventory levels increased as a result of older listings remaining on the market longer. This is seasonally unusual for September, which typically sees an uptick in sales activity.