Mandatory Compliance Update

Legal Obligations Money Laundering Due Diligence HIPLA Proof Of Ownership Proof of Funds Disclosure of Material Information

Know Your / Our Obligations

(You need to renew these annually)

• Be registered with a Redress Scheme, The Property Ombudsman (TPO) /Property

Redress Scheme (PRS)

• Be registered with (Independent Commissioners Office (ICO) for Data Protection.

• Have Professional Indemnity Insurance

• Have Public Liability Insurance

• Be registered with HMRC for Money Laundering Supervision (MLS)

/ Economic Crime Supervision (ECS)

HMRC Fines for non compliance

• This is an example of some fines issued by HMRC recently to estate agents for breaching AML requirements

• Oneagent wasprosecutedfor tradingas anestate agent whilst not being registered with HMRC for MLS – he has been bannedfromactingasanestateagentfor2 years

• Anotheragent wasorderedto payafine of£53,400for failing to apply for registration.

• HMRCis currentlyinvestigatinganumberofothercasesof businesses failing to register whilst trading, which could lead toprison sentencesofuptwoyearsand anunlimited fine.

• HMRC has a duty to publish details of businesses that do not comply with theregulations.

Know Your / Our Obligations

• Have an Anti-MoneyLaundering(AML) Policy in place

• Have a Business Risk Assessment in place

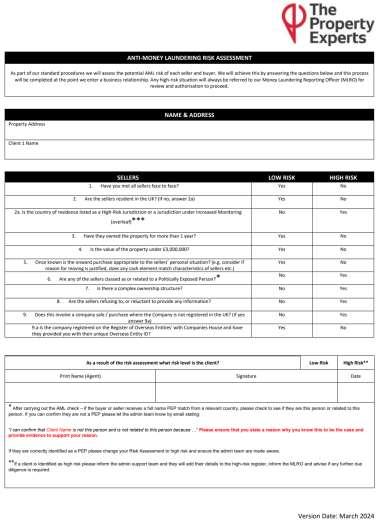

• Use a Risk Assessment for each Seller and Buyer

• Maintain a client High Risk Register

• Appoint a Money Laundering Officer (MLRO)

Notes regarding your obligations

• These obligations are mandatory requirements for The Property Experts and YOU as an agent –because you own your own Estate Agency business.

• They are not one off registrations or policies, the registrations need to be applied for annually and the policies need to be reviewed & updated regularly to ensure they are up to date with current guidelines and laws. As the owner of your own business it is your responsibility to ensure you are compliant

• At the end of this presentation it is important for you to review everything covered and ensure you have these items in place.

• If your business is inspected by HMRC, a Property Redress Scheme or Trading Standards you maybe asked to provide evidence.

• Redress Schemes – The Property Experts are registered with the TPO.

Notes regarding your obligations continued

• AML policy – you can use and adapt our AML policy, but make sure it is relevant for your business.

• Business Risk Assessment – again adapt for your business, this is an HMRC condition of MLS registration

• Risk Assessment – we have in place and we require these to be used by you for every buyer & seller – again an HMRC condition of MLS registration

• Wehave a high risk register for The Property Experts - an HMRC condition of MLS registration. You must maintain your own High Risk register for the buyers and sellers you deal with. If HMRC were to inspect your business to ensure you are complying with your own MLS registration you will be asked to show them this

• MLRO – as a company Sean Newman is our MLRO – but because you are your own registered entity too then you are your own MLRO – do you know the implications of being an MLRO?

• if AML protections are found to have been insufficient, a firm's MLRO may face significant fines and, in worst cases, a prison sentence – please note the fines are not just for facilitating Money Laundering, but if your AML protections are found to be insufficient you may be fined too. Failing to do a Risk assessment on a buyer or seller can be failing in your AML process and therefore could lead to a fine

• The processes we have in place are not to make things difficult for you but are there to protect our business from fines & prosecution.

Administration Teams Role

• They are not there to make your job harder.

• They are there to ensure we as a company and you as Self Employed Agents are compliant.

• The Administration Team are the gatekeepers of the Company’s standards and compliance obligations

• Please remember to treat them with kindness and respect

Money Laundering

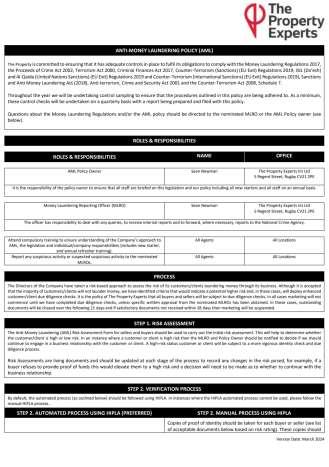

AML Policy

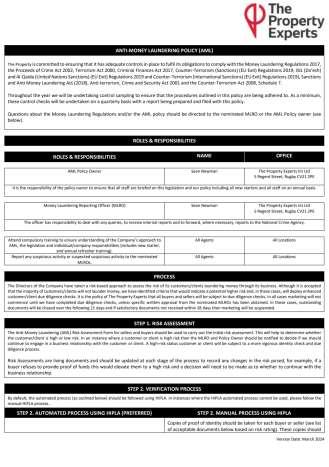

We are committed to ensuring that we have adequate controls in place to fulfil our obligations & to comply with the following.

• The Money Laundering Regulations 2017

• The Proceeds of Crime Act 2002

• TerrorismAct 2000

• Criminal Finances Act 2017

• Counter-Terrorism (Sanctions) (EU Exit) Regulations 2019 ISIL (Da’esh) and Al-Qaida (United Nations Sanctions) (EU Exit) Regulations 2019 and Counter-Terrorism (International Sanctions) (EU Exit) Regulations 2019)

• Sanctions and Anti Money Laundering Act (2018)

• Anti-terrorism, Crime and Security Act 2001

• The Counter-Terrorism Act 2008, Schedule 7.

AML Policy

AML Policy

AML Policy

Brief overview of AML Policy

• Please read and refer to it, make sure you are familiar with it – it is a working document and is there to assist you

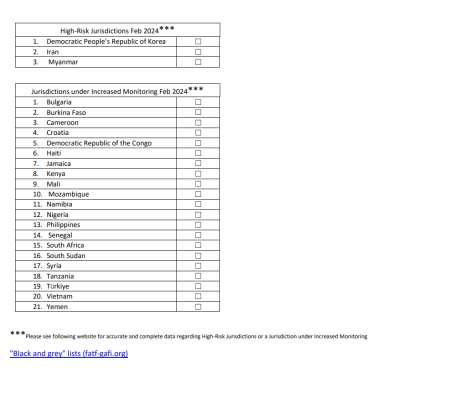

• We have taken a risk-based approach to assess the risk of our buyers and sellers laundering money through our business.

• It is accepted that the majority of buyers and sellers will not launder money, we have identified criteria that would indicate a potential higher risk and, in these cases, will deploy enhanced due diligence checks. It is our that all buyers and sellers will be subject to due diligence checks.

• In all cases, marketing will not commence until we have completed due diligence checks, unless specific written approval from the nominated MLROs has been obtained. In these cases, outstanding documents will be chased over the following 21 days and if satisfactory documents are not received within 28 days then marketing will be suspended.

• In all cases proof of funds will be obtained prior to a Memorandum of Sale (MOS) being sent out

AML Policy

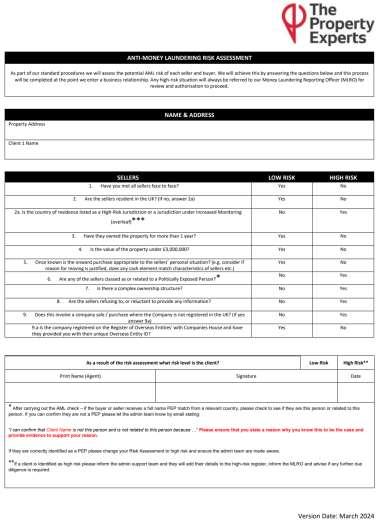

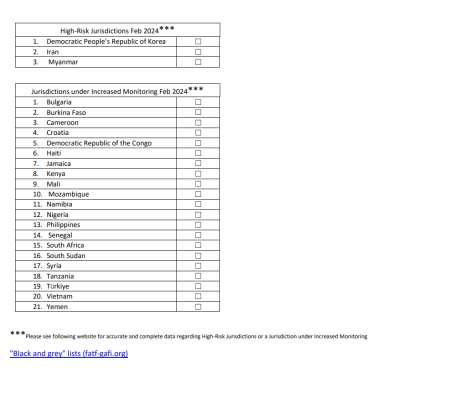

Step 1 – Risk Assessment

• Please complete a Risk Assessment for each seller and each buyer – if you have one question where the answer is determined to be high risk – then that buyer or seller is ‘HIGH RISK’ - its not ‘oh we’ll take a view on it’ – we will add that person to our company high risk register, but please add to your own High Risk Register

• This document must be uploaded to CRM

AML Policy

Also known as Due Diligence or Know Your

Customer Checks

–

– HIPLA

Step 2

Verification Process

Due Diligence / Know Your Customer Checks

It is our legal duty to make sure that a buyer or seller is who they say they are.

• We must ask you for proof of current address and identity.

• For buyers we must see proof of funds

• For sellers we must confirm they are the legal owners of the property they are instructing us to sell

Proof of name:

• current passport

• residence permit

• current UK/EU photo driving licence

• HMRC (Inland Revenue) Tax Notification

• state pension or benefits book/notification letter

Proof of address:

• a current council tax bill from local authority

• rent card or tenancy agreement from your local authority

• recent mortgage statement

• bank statement

• utility bill (not mobile)

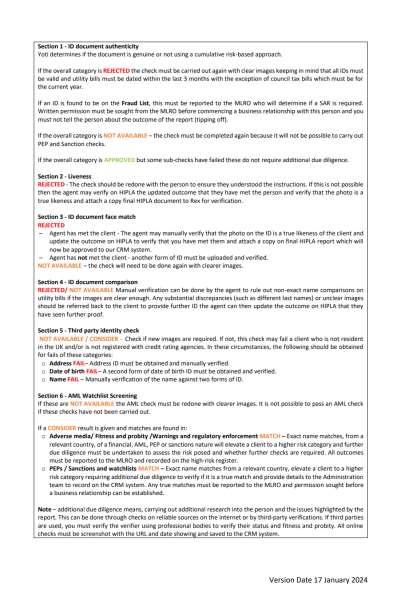

Verification Process – HIPLA

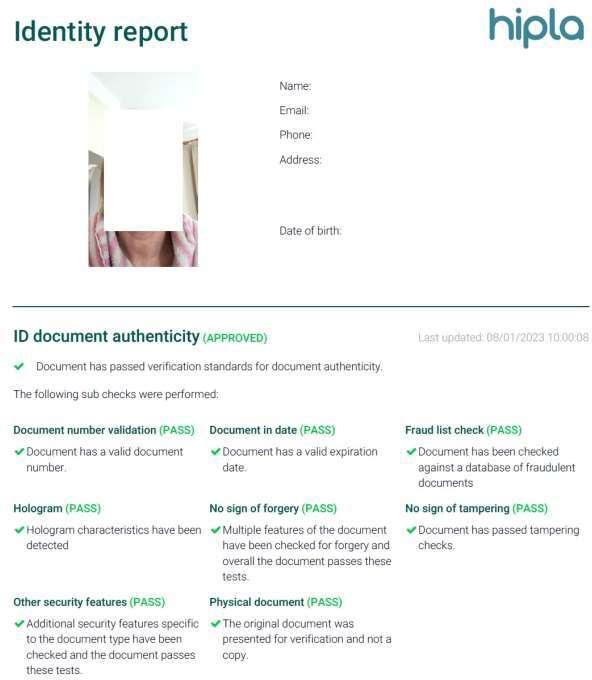

We use HIPLA for verifying a buyers or sellers identity

We have a HIPLA Policy & Procedure in place

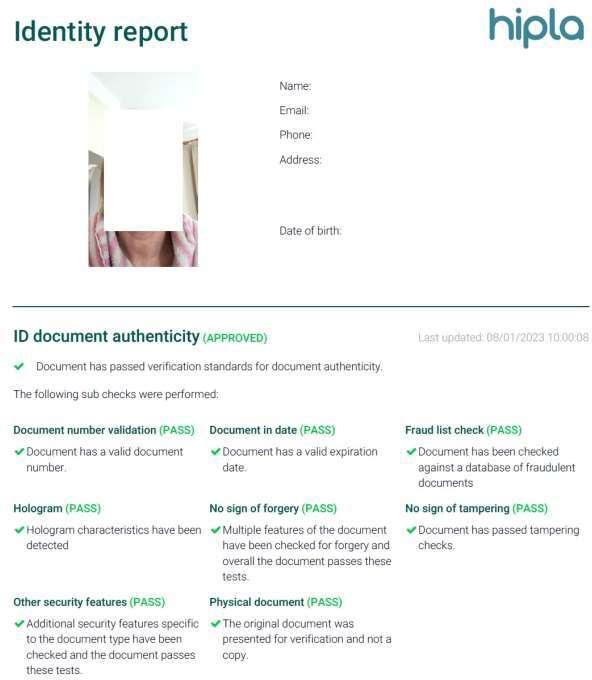

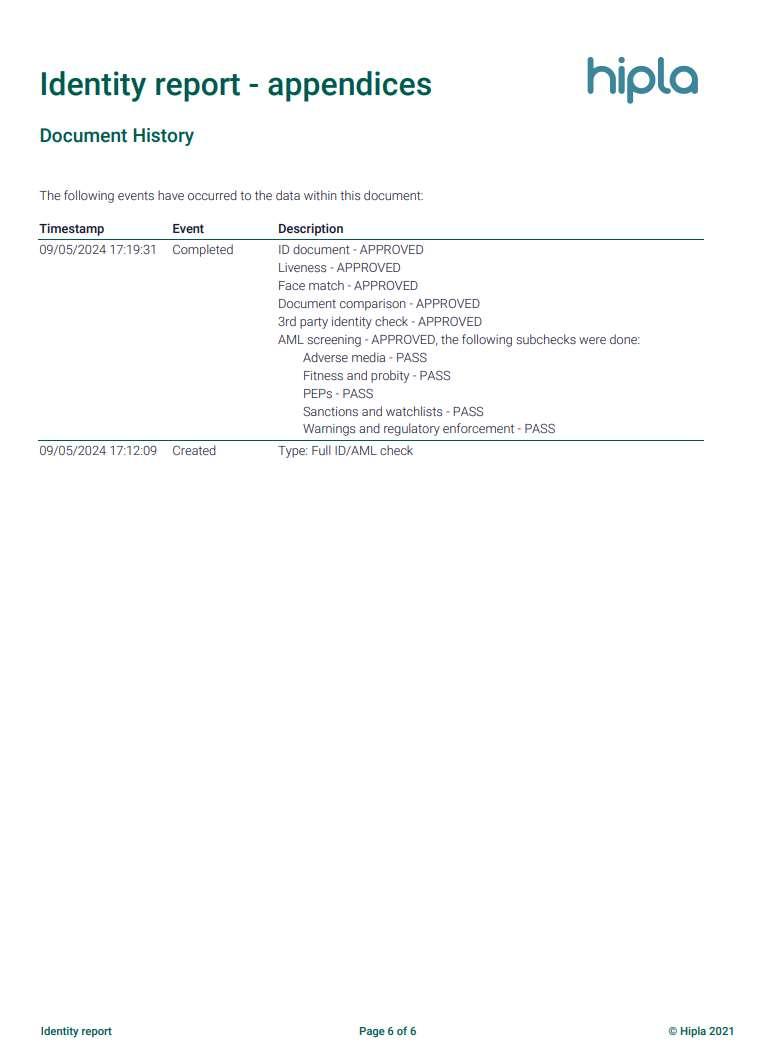

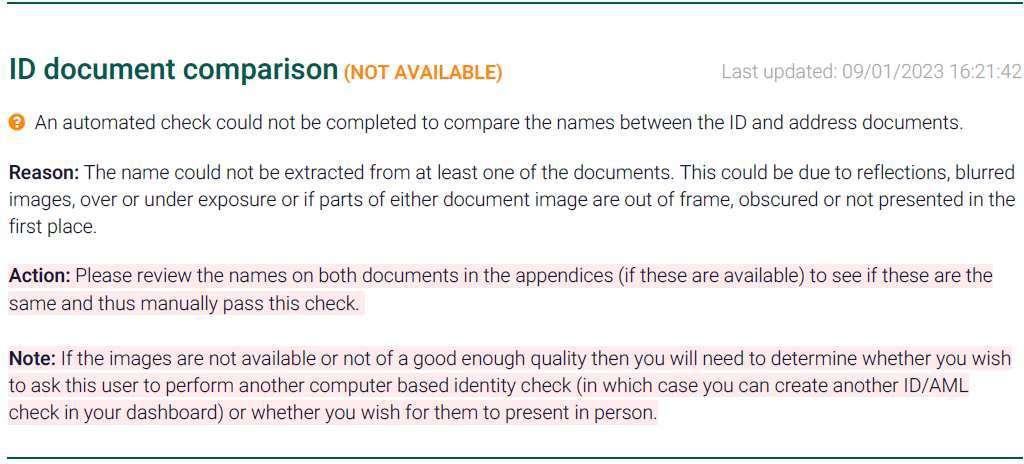

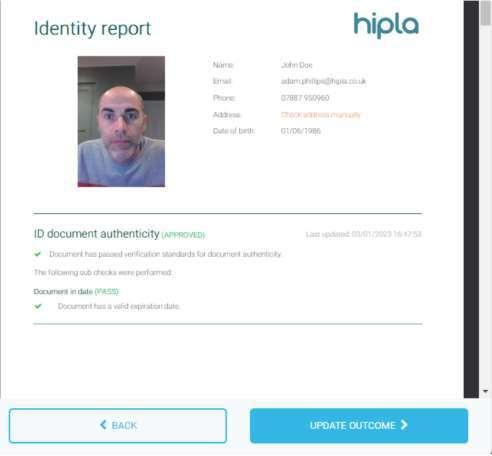

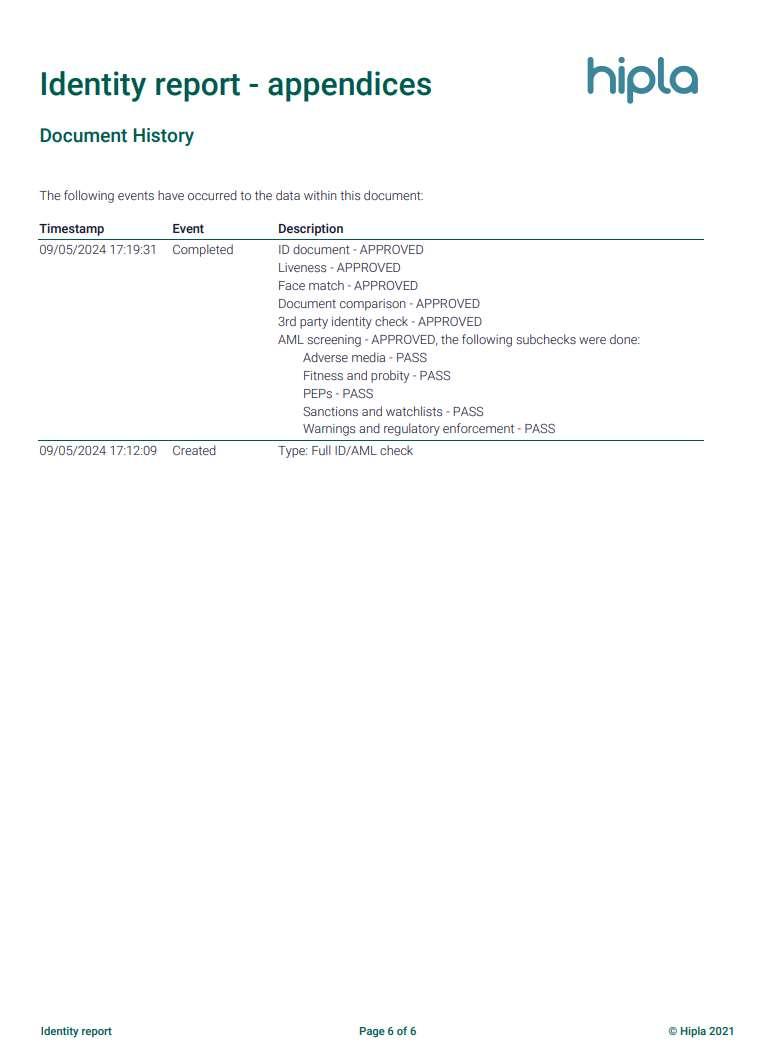

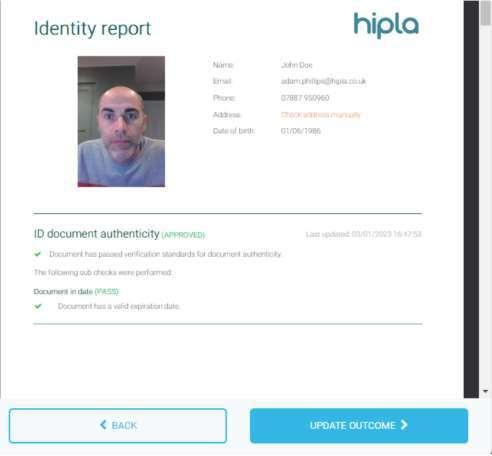

HIPLA Identity Report

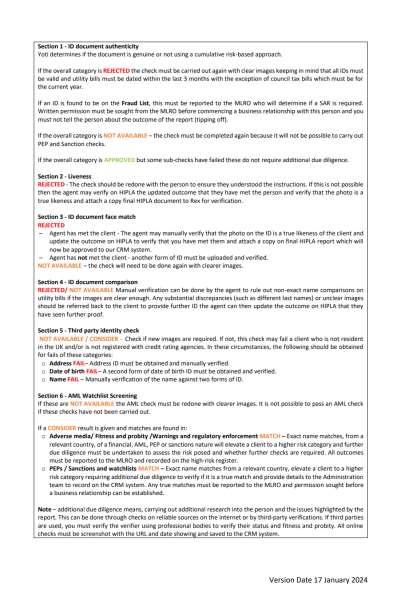

HIPLA ID report is made up of the following sections – all need a pass

You receive an email alerting you that an ID Report is complete – this is your prompt to download the file and check it. This is your responsibility to add to the CRM under the contact. The Admin team have access to these documents too – but the ultimate responsibility is yours. As you have an obligation under your registration with HMRC for Money Laundering Supervision (MLS)

• ID Document Authenticity

• Liveness

• ID Document Face Match

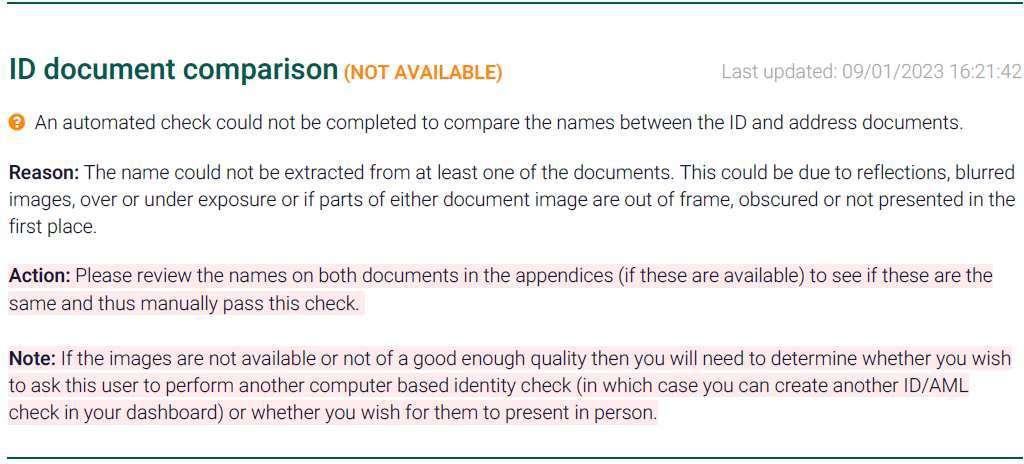

• ID Document Comparison

• Third Party Identity Check

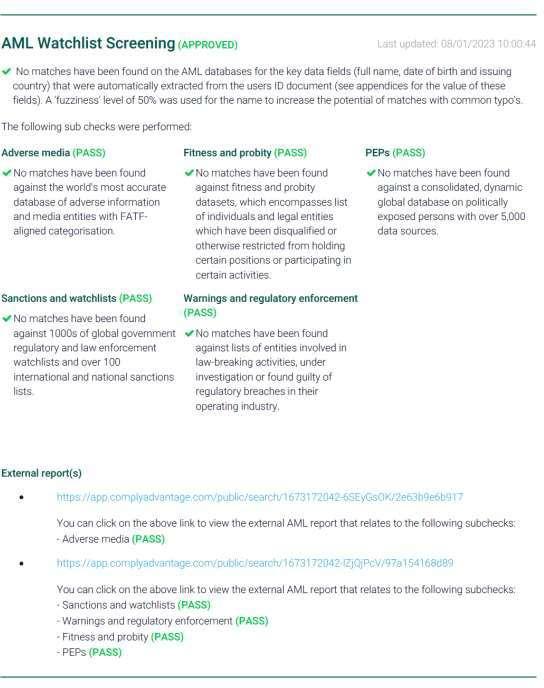

• AMLWatchlist Screening

• External Reports

• Identity Report Appendices

HIPLA Identity Report

The following slides show what a HIPLA report should look like if it is a pass

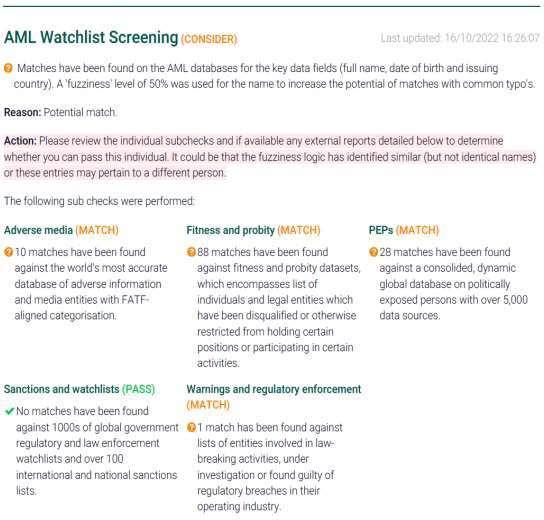

HIPLA Identity Report

The following slides show examplesofHIPLA ID reports thatneedaction bythe agent.

Please ensure you always download the PDF Identity Reportandcheck it– thisis yourresponsibility.

Anything in red requires action and it gives you advice on the action you should take as well as the reasons why ithas eitherbeenrejected or failed

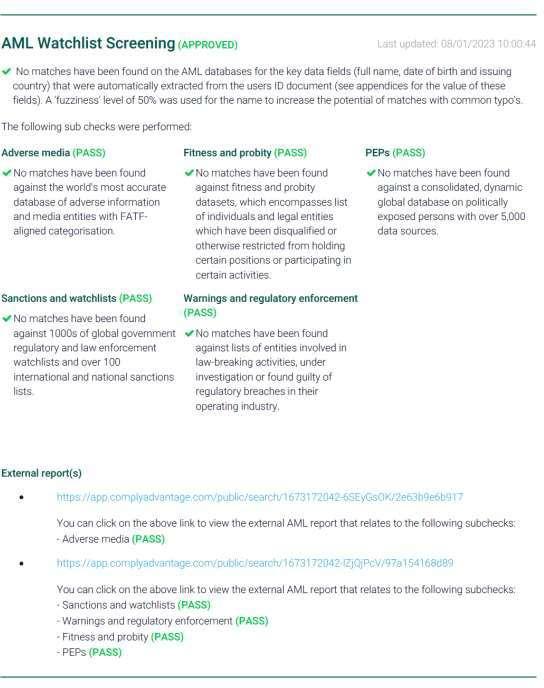

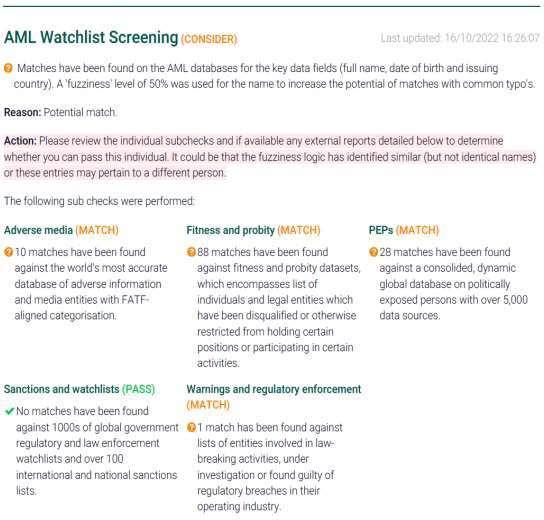

AML Watchlist Screening

• This check has found matches for Adverse Media, Fitness & Probity, PEPs, and warnings and regulatory enforcement.

• You need to look at each section and decide if thisinformationreferstoyourbuyerorseller, andwhatimpactit mayhaveontheprocess of buying orsellingtheproperty,i.e canyou still deal with this person

• Take a risk based approach in your decision makingprocess.

• Youmustbackupyourdecisionmaking processwithevidencethatsupportswhy you havereachedacertainconclusionandthat you have followed the AML Policy, evidence is keyandeverythingontheCRM

Links on a HIPLA report

• HIPLA provides links for you to view the reports. But HIPLA does not make the decision for you – it advises you.

• The things towatch out for are a buyer or seller being on the Financial Sanctions List, or adversemediaregarding fraudulentactivity.

• A Politically Exposed Person (PEP) result means we treat the client as a High Risk Client

Changes to HIPLA

On the HIPLAagent dashboard there is an ‘Outcome’ status can be shown.

The green arrow shows that you have passed the ID check and that it has changed from orange to a green pass.

Proof Of Ownership

Why?

What?

How?

•

•

•

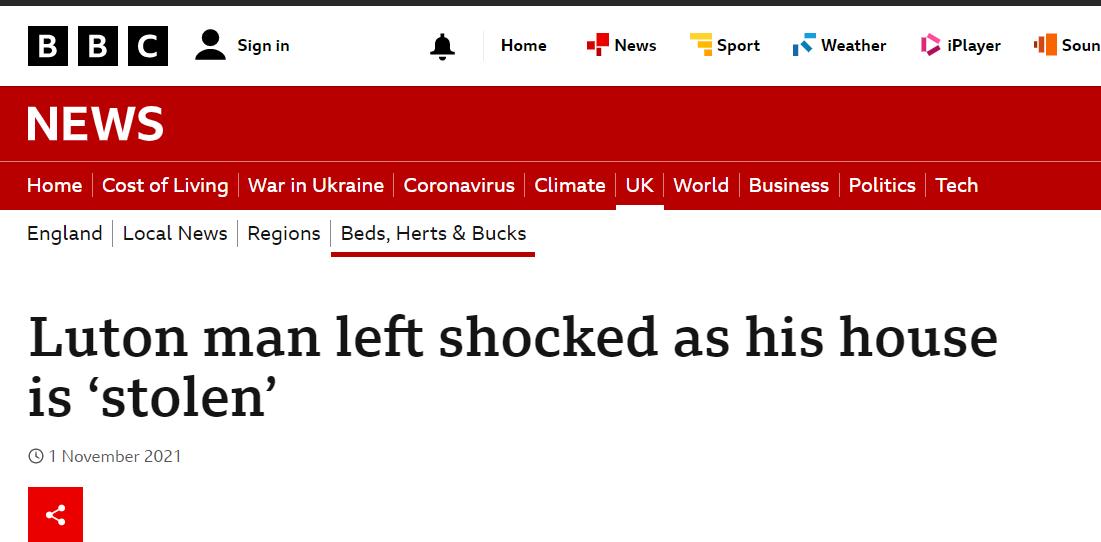

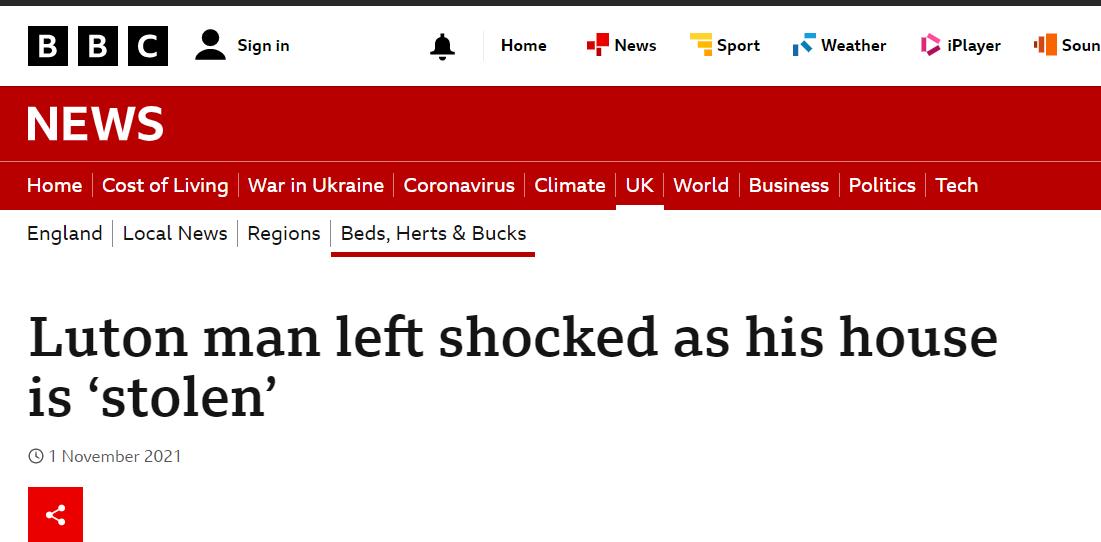

Proof of Ownership - Why

• In August 2021, a property in Luton was sold and completed without the ownersknowledge– the ownersidentity hadbeen stolenand used to sellthe house and the fraudsterwasableto bank the proceeds.

• So, we must ensure that we carry out our due diligence on our ‘Know yourcustomer’checks and ‘proofofownership’checks

• The Land Registry paid out a total of £3.5m in compensation for fraud in 2020

Proof of Ownership – What?

We should take reasonable steps to satisfy ourselves that the seller is entitled to instruct us.

For example –

• Land Registry title deeds

• Declaration or Deed of Trust

• Death Certificate & Will

• Deed of Variation

• Power of Attorney

• Confirmation from a Solicitor – But you must carry out your due diligence on the solicitor and see copies of everything they have used to reach that conclusion. You can’t solely rely on Third Party confirmation.

Advice from Paul Offley

• We can accept shared checks from a third party, but to comply with HMRC the third party needs to provide us with copies of evidence they have seen.

• The legal entity (that’s us and you) remains liable, so if challenged we have to be able to provide our due diligence on the proof of ownership and why we believe the seller is entitled to sell the property.

• We can decline to accept third party checks and insist on completing the checks ourselves especially for high risk cases or cases where we are more concerned.

Proof of Ownership - How?

• HIPLA – On the Digital Legal Pack we can download the Title Deeds and Title Plan from Land Registry

• Alternatively you can download and pay for these yourself from Land Registry

• Obtain original Title Deed documents from your seller

• Obtain evidence from a solicitor (keep advice from Paul in mind)

AML

Record & Document Results

• Once the process has been finished you will need to update the high risk register with any buyer or seller that is identified as High Risk either from our risk assessment or as a result of the AML check. This is to be reviewed on a monthly basis by the MLRO/AML Policy Holder.

• You must do the same too

• All documents and evidence must be uploaded to the CRM system.

POLICY Step 3 –

The Property Experts Business Risk Assessment

• As a business we also need a Business Risk Assessment.

• The following is ours – you need one too.

• Not having a Business Risk Assessment for Money Laundering could leave you subject to a fine by HMRC

• It basically outlines our ‘Normal Business’ and what we deal with

The Property Experts Business RiskAssessment

Buying and selling property is a method employed by criminals to ‘integrate' the proceeds of crime into the economy.

• The majority of the sellers will reside in the property we are being asked to sell

• We will meet the majority of our buyers who will be purchasing the property for their own use

• Most of our buyers will be UK based

• There will be occasions when we are instructed by UK businesses

• We do not expect to be involved with property transactions from clients who are based in one of the ‘high risk’ countries.

• We do not accept instructions from any person who we know is on the UK financial sanctions list

• We do not accept any cash payments of any kind

The Property Experts Business Risk Assessment (continued)

• We have processes in place to complete risk assessments of our sellers and buyers

• We have appropriate levels of training in place for our teams

• We may get the odd transaction that has complex structures of ownership but we will apply increased risk and due diligence in these cases

• Buyers will use various means of finance to complete their purchase. We will always seek to confirm the source of such funding in accordance with our policy.

• We have control testing measures in place at regular intervals throughout the year

• We do not deal with any Lettings transactions

• Given the current conflict between Russia and Ukraine we have reviewed transaction levels and do not anticipate any transactions from sellers or buyers being connected with Russia.

Proof Of Funds

This is a legal requirement

Proof of Funds

Obtaining proof of funds is a legal requirement under the anti-money laundering regulations. Failure to follow our AML procedure ie - we are required to obtain proof of funds prior to issuing the memorandum of sale, is a breach of the regulations and you could be personally liable for a fine from HMRC.

• There have been some big fines issued recently by HMRC for not following an AML policy & procedure

• If you want to take the risk and issue MOS without obtaining POF, the Administration team require an email confirming you are happy to be personally liable for any regulatory consequences due to your noncompliance with our AML policy and for you to attached a copy onto our CRM.

How can a buyer provide proof of funds?

• An agreement in principle/mortgage in principle

• Bank statements of deposit amount (for mortgage buyers)

• Bank statements of your cash amount (for cash buyers)

• Further bank statements from past months/years to show how the money has built up over time

• Evidence of selling a property (if using the funds to buy the new property) ie MOS

• If they've been gifted the money, a letter from whoever gifted the money

• Evidence of money being left in a will

• Receipts of shares being sold

• In more unique circumstances a lottery win requires proof; gambling winnings requires receipts/evidence of winnings.

Proof Of Funds - explained

• Using all Cash from resale – please provide your selling agent details including the best point ofcontactandnumber alongwiththememorandumofsale ofyourproperty.

• Usinganycashinbankaccount/trusts/shares-pleaseprovidefullbank/trust/shares statement this will need to detail your full name and address. The statement needs to showthe fullamountof moniesyouare usingtowardsthepurchase.

• Mortgage- if you are using a mortgage, please provide an Agreement in Principle (AIP) or Decision in Principle (DIP). If your lender does not supply an Agreement in Principle (AIP) or Decisionin Principle(DIP)certificateyoucanget theverificationfromyourmortgage advisorbyemail.They willneedtoclarifytheyhaveseenfundsandtrustyouareina financialpositionto afford yourpurchase.

• Gifted Monies- If you are using gifted monies. For example from parents, we will need a letter or emailfromthe people who are gifting the money, stating whom the person is, how muchmoneyisbeinggifted,whotheyaregiftingit to,whatthemoneyisbeingput towards andwhattherelationis ofthatpersontoyourself.Wewillalsoneedtosee a bank statementoftheaccountthatisbeingused,againthiswillneed toshowthe person’s full name and address along with the full amount of monies being gifted.

Proof Of Funds - explained

• Bank Statements must have the buyers name and address on, they cannot be screenshots of a balance – that could be anyone's bank account, or fraudulently obtained.

• They must be recent Bank Accounts – a buyer may have had a £1m in their bank 3 months ago – but it may have been spent!

• Basically when it comes to Proof of Funds and the evidence provided to you, the view you should take is ‘can I stand up in a court of law and honestly say that I know where these funds havecomefromandthattheyhavenotbeenfraudulentlyobtained’

Advice from Paul Offley

• We can accept shared checks from a third party, but to comply with HMRC the third party needs to provide us with copies of evidence they have seen.

• The legal entity (that’s us and you) remains liable, so if challenged we have to be able to provide our due diligence on the source of funds and why we believe any funds are not subject to any suspicious activity.

• We can decline to accept third party checks and insist on completing the checks ourselves especially for high risk cases or cases where we are more concerned.

Property Experts Checklist for a Memorandum of Sale (MOS)

1 Offer Received & added to CRM

Buyershavecompleteda'MakinganOfferForm'

Agenttoupload'MakinganOfferForm'toCRMonContactfile

OfferconfirmedinwritingtoVendorandBuyer

2 Vendors confirm they will accept the offer DONOTCLICKTHEPROPERTYTOSSTCORUNDEROFFER

AgenttocompleteRiskAssessmentforeachBuyeranduploadtoCRM

AgentissueHIPLAID/AMLinvitationstoBuyersandaddtothecontactontheCRM

AgentrequestsProofofFunds*fromBuyersforthetotalpurchaseprice+StampDutyanduploadtoCRM

3 Agreeing the Sale

Agenttocheck¬edownthefullchainupwardsanddownwards, withaddresses,detailsofthespecificagentdealingwiththesale,phonenumbersandemailaddtotheCRM

AgenttoobtainSolicitordetailsforBuyers&SellersandaddtoCRM-toincludeName,Firm,Address,Emailaddress,Contactno Fixtures&Fittings-Listinfullallitemstobeincludedinsalepriceasagreedwithallparties

Timescale–Agreedbybothparties–TargetexchangebyDateandcompletionDate

4 Sending out your MOS AgenttoaddtheVendorLegalDetailsonthelegaltabalongwiththeSalesMemoCoveringLetterDetails.

5 Making a property SSTC / Under Offer

TheagentwillthenchangetheofferStatustoOfferAccepted(SSTC). ThepropertywillthenaddtotheStreamontheCRM.TheSupport teamwillthensendoutthepro-formainvoicetothevendor'ssolicitorandvendorandaddtotheclipboards.

Screenshots of an account is not acceptable, as this does not include the client’s details. We will need a full statement which contains the name and address of the buyer.

* Proof of Funds - What is required

If the buyer is using equity from the sale of a property, we will need to see an annual mortgage statement from their mortgage lender showing the redemption figure and their memorandum of sale.

Where monies are in trade/investment accounts/vehicles please ensure your clients declare any notice periods to release funds. These can take as long as 90 days which can significantly delay the completion of a sale.

If the funds are subject to a re-mortgage or the liquidation of a property or asset such as a business sale, please clarify the details.

If the funds are being raised via a director’s loan from a business, we will need a letter of intent from the client's accountant on headed paper from their firm confirming that the business has the capacity to raise those funds plus the amount required.

Disclosure of Material Information

National Trading Standards

Disclosure of Material Information –

National Trading Standards

• Under current legislation, as set out in the Consumer Protection from Unfair Trading Regulations 2008, estate and letting agents have a legal obligation not to omit material information from property listings. But current practices around disclosure are not consistent across the industry.

Part A: information for sales listings

Current legal requirements

For sales listings, Part A information includes:

• Council Tax band or domestic rate information

• Purchase price, displayed numerically not POA

• Tenure

• Freehold

• Share of Freehold

• If Leasehold you must specify

• Current ground rent and any review period

• Current service charge information

• Length of lease (also known as the Term)

• EPC

• If Shared Ownership, disclose the details of the share being sold

• What the rent part is for shared ownership

Part B

For Part B and Part C of Disclosure of Marketing Material.

Part B – Information that must be established for all properties.

Property Type

Property Construction

Number and types of Room

Electricity Supply

Water Supply

Drainage and Sewerage (where the sewerage system discharges to and whether it has an infiltration).

Part B (Cont’d)

Heating (these now include air and ground pumps).

Broadband how is it delivered to the Property:Fibre, (Fibre to the Cabinet FTTC) Cable (FTTP Fibre to the Premises, also known as Fibre Optic or Fibre Cable) Copper (ADSL) wire)

Mobile Signal/Coverage

https://www.ofcom.org.uk/phones-telecoms-and-internet/advice-for-consumers/advice/ofcom-checker

Parking (including the cost of parking permits and whether the property has electric vehicle (EV) charging. (Allocated Parking, Visitor Parking, Off Road Parking)

Parts C

Part C – Information that may or may not be established, depending on whether the property is affected or impacted by the issue in question.

A lot of the answers to these questions you will find in the Digital Legal Pack (DLP)which the vendor has completed (which you must look through on every listing)

Building Safety (provide any details of any defects or hazards at the property and whether essential works have been recommended and carried out.

Planning Permission

Parts C (Cont’d)

Restrictions – Restrictive Covenants that affect the use of the property.

Rights and Easements

Flood Risk (is there a flood risk, have they been flooded in the last 5 years? If yes, any defences have been installed and if the property is near the coast, whether there is any risk of coastal erosion).

Coastal Erosion – As above.

Accessibility/Adaptations (the adaptations or features that have been made to provide easier access to and within the property. Features i.e lift access, ground floor, wet room, wide doorways.

Part C (Cont’d)

Coalfield or Mining Area (identify if the property is impacted by an past or present mining activity)

Solar Panels – Providing details about the installation that a buyer/lender will need to know.

Japanese Knotweed – Applies to the area adjacent to or abutting the property.