Landlords using companies to buy property

What are the pros and cons?

Residential Property

Income Tax

• What rate of income tax? 20%/40%/45% or more.

• Loan interest relief restriction.

Capital Gains Tax

• 28% tax on the growth in the property value.

Property

Inheritance Tax

• IHT £600,000 at 40% = £240,000.

Stamp Duty Land Tax

• Normal SDLT rates + 3%.

• Non-resident extra 2%.

Reduce/loss personal allowance if income > £100,000

Each individual has their own tax rate bands

Income tax rates are different in Scotland

Action - Know your tax rate!

• Income self-assessment tax return – 31 Jan but MTD!

• Income Tax payments: 31 Jan (or 31 Jan and 31 July).

• Start date - April 2024.

• Start to prepare for:

• quarterly reporting – 30 day deadline

• digital records.

• Consider software.

• Capital Gains Tax Returns and tax payment – 60 Days.

• Corporation Tax on any rental profits 19% tax rate (increasing for some to 25% from April 2023).

• Relief for loan interest.

Rental Co Ltd

• Corporation Tax on capital gains - 19% tax rate (to 25% from April 2023).

• Income Tax on extraction from Company –dividend 8.75%, 33.75%, 39.35%. – increased from April 2022.

Note:

• ATED – Annual Tax Return needed, but exemption from tax charge.

• SDLT + 3% (can be 15% or 17%).

• Inheritance Tax 40%.

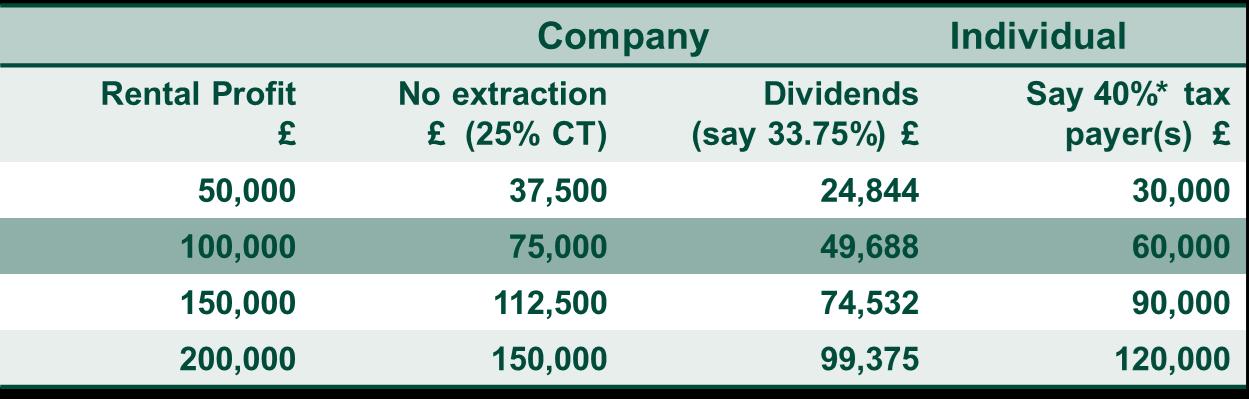

Figures in table show amount received after tax.

• Income from property – capital gains excluded.

• Owning personally can be better if extracting all profits.

• Owning in company can be better if repaying corporate debt or restrict extraction.

*Effective tax rate higher if loan interest restriction.

• Company accounts to Companies House – 9 Months.

• Corporation Tax returns to HMRC – 12 Months.

• Corporation Tax payments: 9 months and 1 day.

• Annual Tax on Enveloped Dwellings Return – 30 days from purchase or 30 April.

• Do a cost benefit analysis – how much is the tax benefit vs extra costs?

• Do you need a dividend? Dividend planning.

• Pay down capital repayments quicker - Retained profits and repayments of capital are charged to Corporation Tax and not Income Tax.

• Compliance effort and complexity is greater.

• Costs of running a Company incl. accounts and tax returns.

• Plus others…

Loan from shareholder

e.g. £500k + costs

Tax aspects of funding the acquisition.

• Deposit via loan account.

• Bank finance – CT deduction.

• SDLT + 3%.

• ATED relief return – 30 days.

Rental Co Ltd

£1m property

Bank finance

e.g. £500k

Who could own the shares?

• Involve the wider family.

• Children and grandchildren.

• Family Trust.

• Set up the structure from the beginning.

Rental Co Ltd

Consider:

• Dividends – Income tax.

• Inheritance Tax.

Typical structure: Inheritance tax example

Trust A

B 25%

- Loan account gift

- £500k deposit – gift that to children

IHT saving @ 40% = £200k survive 7 years.

- Share value from set-up - nil

- Share value on growth - £1m Growth, 50% to parents. 50% to trust.

Rental Co Ltd

IHT saving - 50% x £1m growth @40% = £200k

New property purchases

• Cost benefit analysis – run the numbers.

• The larger the profit/loan the more likely a company is tax efficient.

• Structure the shareholdings – income and inheritance taxes.

Existing property

• What is the current financial position? Calculation.

• What benefit is there of change?

• What is the cost (financial and tax risk) of the change?