Week of

October 20-24, 2025

MAKE A DIFFERENCE IN THE LIVES THAT FOLLOW

Week of

October 20-24, 2025

MAKE A DIFFERENCE IN THE LIVES THAT FOLLOW

Senior Life Newspapers is proud to support Write a Will Week through the publication of this booklet. This piece is distributed in conjunction with “Write A Will Week”, October 20-24, 2025. Valuable and useful information is available in helping to make life-changing decisions some day for those less fortunate.

We would like to thank the Charitable Gift Planners of Northeast Indiana for their assistance and support. Events of the week are noted on pages 7-9. Forms and information to benefit you are included as well. Please let us know if there is anything we can do next year to enhance the overall content of this booklet.

By Michelle Creager

Nonprofit charitable organizations highlight all that is good in America today. According to the National Council of Nonprofits, Charitable organizations provide a way for people to work together for a common good, a place where shared hopes and beliefs are transformed into action, and an atmosphere to shape our boldest dreams, highest ideals, and noblest causes.

Everyone benefits from the work of nonprofits in one way or another. Nonprofit organizations strengthen communities by providing the educational, health, and social services that citizens need and the government cannot fully provide.

There is a good chance that you have attended service at a house of worship, learned to swim at the YMCA, developed life skills through Girl Scouts or Little League, or enjoyed the family vacation at the zoo, all thanks to the work of nonprofit organizations.

Charitable nonprofits feed, heal, shelter, educate, inspire, enlighten, and nurture people of every age, race, religion, gender, and socioeconomic status. They foster community engagement, promote leadership, drive economic growth, and strengthen the fabric of our communities every single day.

However, operating a nonprofit isn’t easy. A nonprofit’s ability to secure sustainable long-term funding while providing generational stability is a challenge. Nonprofit organizations can only fulfill their missions when they have dedicated and passionate people who give their time, talents, and treasures. They count on legacy bequests to carry out their missions of creating more equitable and healthy communities.

Quite simply, supporting a nonprofit organization is a beneficial way to strengthen our community, share our blessings and help our neighbors who are in need. It provides a way for donors to leave behind more than just “things” when they pass. It allows a way for donors to communicate their values and beliefs to their heirs, while leaving them with a community improved by philanthropy.

Roughly, 80% of dollars contributed to nonprofits come from individual donors or their estates. [1] By donating to charity in the form of a charitable bequest in a Will, it alleviates this risk of needing the money for your own health needs, since upon the death of the donor, the funds would no longer be needed by him or her.

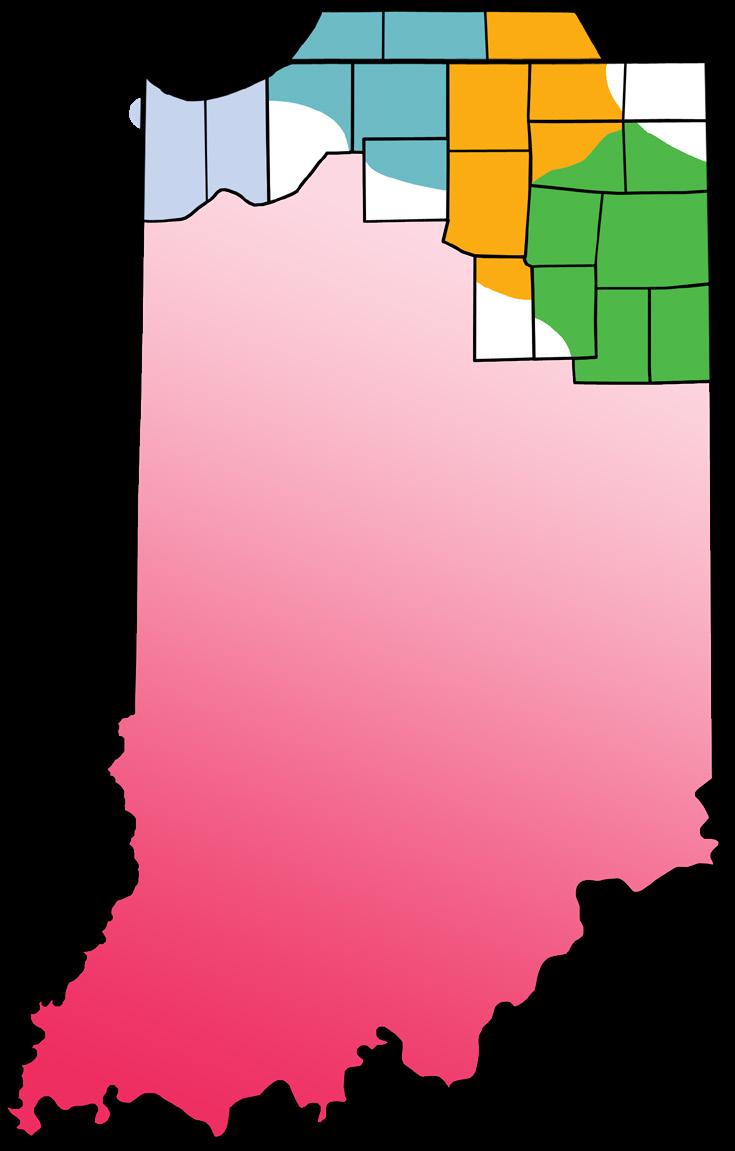

With this guide you will find the wonderful local organizations that are impacting Northeast Indiana. By adding a bequest to one, or several of them, you can participate in the Write a Will event at no cost to you.

Nonprofits are all around us and touch millions of lives each day thanks to the generous and selfless gifts provided by those invested in the community and proud to help those less fortunate than themselves.

[1] Giving Statistics

https://www.charitynavigator.org/index.cfm?bay=content.view&cpid=42

This article provided by 1st Source Bank

You’ve built a good life for yourself and, naturally, you want to pass it on. But just as it takes hard work and planning to acquire wealth, it also takes a well thoughtout estate plan to preserve those assets for future generations.

An attorney, financial advisor/accountant, or trust administrator are professionals who can help you put together an estate plan that reflects your unique needs and goals, helping you to sort through difficult questions, avoid common mistakes, and plan your estate with confidence and peace of mind.

Here are a few do’s and don’ts to keep in mind when putting together an estate plan:

• Don’t Write Your Own Will - Estate planning is too complicated to do it yourself, and the laws that govern it vary from state to state. So don’t rely on a generic form you found online when there are professionals who can customize a plan for you. All too often, small mistakes made by do-it-yourselfers can lead to an invalid Will and family members spending thousands of dollars fighting over your estate.

• Don’t Procrastinate - Delays only hurt the ones you love. The time to plan your estate is now, even if you’re not sure who gets what or who you want to be in charge. An estate plan that meets 80% of your goals is better than no plan at all.

• Don’t Forget To Update Beneficiary Designations - It’s a good idea to check your beneficiary designations periodically to make sure they’re current. Major assets could easily go to the wrong person if you’ve recently had a major life change. In a worst-case scenario, these assets could even end up in probate and subject to the claims of creditors.

• Do Consult A Financial Advisor - If you own valuable assets, the best way to protect them (and minimize your tax burden) is through a properly executed estate plan.

• Do Fund Your Revocable Living Trust - As soon as possible after your trust agreement is signed, fund it. Otherwise, the plan won’t work if you become disabled, and your assets will end up in probate when you die.

Your meeting with your attorney at any of the partner "Write a Will" sites will be scheduled for approximately 1530 minutes. For best use of your appointment, complete the form for Will Preparation (a copy is available on page 6).

Bring it with you to your appointment. The information your attorney will need to complete your Will includes:

• Your marital status and, if married, the name of your spouse; also, is your spouse a U.S. citizen? Do you have a prenuptial agreement?

• Names and birthdates of all your children whether they will inherit or not

• Name and address of the charitable organization(s) you name in your Will

• Names of other persons who will benefit from your Will, and their relationship to you

• A general list of your assets and how those assets are titled; for example, is your house or bank account in your name only, or are there other owners? If you have an IRA or retirement account, who are your beneficiaries?

• You can leave your beneficiaries a specific dollar amount or a percentage of your estate. You can also make bequests of specific items, such as jewelry or furniture. Your attorney will discuss each of these options.

At the end of your appointment, your attorney will explain what to expect and when your document(s) will be ready to sign. You should follow-up with your attorney. CGPNI is not involved in the follow-up.

Remember, your Will will be prepared at no charge if you name at least one charity to receive a gift from your Will when you die. If you do not name a charity in your Will, you must be prepared to pay the cost of the Will. The attorney will discuss this with you.

You may also ask your attorney to prepare other documents for you in addition to a Will. Please be aware the attorney has the right to charge a fee for the additional work.

NOTE: This is general information only. You should rely on your attorney's advice in all matters regarding your estate plan. The CGPNI committee does not prepare Wills and is not engaged in the practice of Law.

An Initiative of the CHARITABLE GIFT PLANNERS OF NORTHEAST INDIANA www.cgpni.com

2025 CGPNI Committee

President................................................... June Harkness, CFRE, Comfort Crew for Military Kids

Vice President Jennifer Zurbuch, Lutheran Life Villages

Treasurer ........................................................... Alex Andorfer, CPA Leonard J. Andorfer & Co.

Secretary Makenzie Tomlinson, Tax Manager/CPA, FORVIS Mazars

Communications Chair Emily Lahr, Stillwater Hospice

Write a Will Week Chair Alec Smith, STAR Bank

Program Chair ...................................................Bethany Clapper, Purdue Fort Wayne

Membership Chair

Matt Konow, CFRE, Concordia Lutheran High School

At-Large Member........................ Ashley Stoneburner, CFRE, Fort Wayne Museum of Art

At-Large Member Rudy Mahara II, National Christian Foundation

At-Large Member.................................... Logan Timbrook, CPA SYM Financial Advisors

Complete this form to present to the attorney for your Simple Will with Charitable Gift. Please print

Your name as you will sign on your document_________________________________________

Your marital status ___________________ Name of spouse: _____________________________

Do you have children? ________ How many? __________ Are any children minors? __________

BENEFICIARIES OF YOUR ESTATE AT DEATH: Amount or Percent

1. Charities

a. Official Name Address

b. Official Name Address

2. Others (Name) Relationship Amount or Percent WHO WILL SERVE AS YOUR EXECUTOR?

1. Name_____________________________ Address ________________________________________

2. Alternate _________________________ Address ________________________________________

How will your tangible personal property (i.e. furniture, jewelry, etc.) be distributed? Spouse _______ Children in equal shares ________ Sold and proceeds added to remainder of estate_________

Other _______________________________________________________________________________________

You may arrange for additional provisions or other documents for a fee: Power of Attorney, Advance Directives for Health Care, Appointment of Guardian, Trust provisions. Please consult your attorney.

YOUR DOCUMENT MAY BE EXECUTED AT A LATER DATE BY APPOINTMENT An Initiative of the CHARITABLE GIFT PLANNERS OF NORTHEAST INDIANA www.cgpni.com

CENTRAL SITE – FORT WAYNE PARKS AND RECREATION COMMUNITY CENTER

(call for appointment)

233 W. Main St. Fort Wayne, IN 46802 www.fortwayneparks.org

260-427-6460

October 22: 9:00-11:00 am

Attorney: Janell Sprinkle Beers Mallers LLP

CANCER SERVICES OF NORTHEAST INDIANA

(call for appointment) 6316 Mutual Dr. Fort Wayne, IN 46825 www.cancer-services.org

Contact: Jessica Misserbiev 260-484-9560 • jmisserbiev@cancerservices.org

October 23: 1:00-6:00 pm

Attorney: Catherine S. Christoff Christoff & Christoff Attorneys

ERIN’S HOUSE FOR GRIEVING CHILDREN

(call for appointment or visit www.cognitoforms.com/ErinsHouse1/ WriteAWillWeek2025 ) 5670 YMCA Park Dr. W. Fort Wayne, IN 46835 www.erinshouse.org

Contact: Anna Freels 260-423-2466 anna@erinshouse.org

October 23: 11:00 am-6:00 pm (appt length 20 min)

Attorney: Josh White Barnes & Thornburg LLP

FORT WAYNE MUSEUM OF ART INC� (by appointment only)

311 E. Main St., Fort Wayne, IN 46802 www.fwmoa.org

Contact: Emily Uphoff 260-422-6467 • emily.uphoff@fwmoa.org

October 22: Lunch n’ Learn with Leah Good from Troyer & Good 11:30 am-1:00 pm with private appointments afterward Attorney: Leah Good/Troyer & Good PC

FORT WAYNE RESCUE MISSION (by appointment only)

404 E. Washington Blvd. Fort Wayne, IN 46802 www.fwrm.org

Contact: Janelle Taylor 260-426-7357 x166

jtaylor@fwrm.org

October 20-24 normal business hours

Attorney: Zachary Witte/Witte Elder Law

FORT WAYNE ZOO

(Call to schedule an appointment)

3411 Sherman Blvd. Fort Wayne, IN 46808 fwzoo.com

Contact: Clarissa Reis

260-427-6800 • clarissa.reis@fwzoo.com

Call for dates and times

Attorney: Charles Backs/Barnes & Thornburg LLP

LUTHERAN LIFE VILLAGES

(call for appointment)

The Apartments at Anthony Boulevard 6723 S. Anthony Blvd. Fort Wayne, IN 46816 www.lutheranlifevillages.org

Contact: Jennifer Zurbuch

260-447-0800 x2149

jzurbuch@lutheranlifevillages.org

October 21: 9:00 am-11:00 am

Attorney: Heidi Adair/Beers Mallers, LLP

LUTHERAN LIFE VILLAGES

(call for appointment)

The Village at Kendallville 351 N. Allen Chapel Rd. Kendallville, IN 46755 www.lutheranlifevillages.org

Contact: Jennifer Zurbuch 260-447-0800 x2149 jzurbuch@lutheranlifevillages.org

October 22: 2:00 pm-4:00 pm

October 23: 1:00 pm-4:00 pm

Attorney: Scott Federspiel/Nugen Law; Chad Rayle/Rayle Law, LLC

LUTHERAN LIFE VILLAGES

(call for appointment)

Piper Trail 8151 Glencarin Blvd., Fort Wayne, IN 46804

www.lutheranlifevillages.org

Contact: Jennifer Zurbuch

260-447-0800 x2149

jzurbuch@lutheranlifevillages.org

October 22: 2:00 pm-4:00 pm

Attorney: Danielle Swan/Beers Mallers, LLP

LUTHERAN LIFE VILLAGES

(call for appointment)

The Village at Pine Valley 9802 Coldwater Rd. Fort Wayne, IN 46825

www.lutheranlifevillages.org

Contact: Jennifer Zurbuch

260-447-0800 x2149

jzurbuch@lutheranlifevillages.org

October 23: 9:00 am-11:00 am

Attorney: David Anthony/Burt Blee

LUTHERAN MINISTRIES MEDIA DBA WORSHIP ANEW

(by appointment only)

Offices of Worship Anew, on the campus of Concordia Theological Seminary 5 Martin Luther Dr., Fort Wayne, IN 46825

www.worshipanew.org

Contact: Donna Evans

260-471-5683

donna@worshipanew.org

(Limited appointments available)

413 E. Jefferson Blvd. Fort Wayne, IN 46802

www.matthew25online.org

Contact Lauren Tosland

260-469-0468

October 16 - Call for times

PBS FORT WAYNE

(by appointment only)

2501 E. Coliseum Blvd. Fort Wayne, IN 46805 www.pbsfortwayne.org

Contact: Erin Arnold

260-482-6850 • erinarnold@wfwa.org

Call for dates and times

Attorney: TBD

(call for appointment)

The Steel Dynamics Keith E. Busse Alumni Center 1528 E. California Rd. Fort Wayne, IN 46825

www.pfw.edu

Contact: Eve Colchin 260-481-6659 emcolchin@gmail.com

October 20: 9:00 am-12:00 Noon

October 22: 9:00 am-12:00 Noon

Attorney: Josh White/Barnes & Thornburg LLP

(call for appointment)

Schedule an appointment with our volunteer attorney at your convenience in the privacy of his office at: Hunt Suedhoff Kearney, LLP 803 S. Calhoun St., 9th Floor Fort Wayne, IN 46802 www.svdpfortwayne.org

Contact: Lara Schreck lara@svdpfortwayne.org 260-456-3561

Call for dates and times

Attorney: Joshua Burkhardt/Hunt Suedhoff Kearney LLP

(call for appointment)

Peggy F. Murphy Community Grief Center 5920 Homestead Rd. Fort Wayne, IN 46814

www.stillwater-hospice.org

Contact: Kaitlin Sanders-Krieger 260-435-3222 kaitlinsanders-krieger@ stillwater-hospice.org

October 20: 10:00 am-12:00 Noon

October 21: 2:00-4:00 pm

October 22: 5:30-7:30 pm

Attorneys: Troy Kiefer, Danielle Swan and Jesica Thorson/Beers Mallers, LLP

WBCL RADIO/RHYTHM & PRAISE 94�1

(by appointment only)

1115 W. Rudisill Blvd. Fort Wayne, IN 46807 www.wbcl.org

Contact: Dana Green

260-745-0576 • dana@wbcl.org

October 20-24 - Call for times Serving Indiana, Ohio & Michigan residents. Multiple attorneys Attorneys: TBD

WELLSPRING INTERFAITH SOCIAL SERVICES, INC�

(call for appointment)

1316 Broadway, Fort Wayne, IN 46802

www.wellspringinterfaith.org

Contact: Ermina Mustedanagic 260-422-6618

ermina@wellspringinterfaith.org

October 22: 10:00 am – 12 Noon

Attorney: Thomas Hardin Shine & Hardin, LLP

YWCA NORTHEAST INDIANA (call for appointment)

1313 W. Washington Center Rd., Fort Wayne, IN 46825 ywcanein.org

Contact: Jill Vaught 260-424-4908

jvaught@ywcanein.org

October 21: 2:00 pm -7:00 pm

Attorney: Josh White Barnes & Thornburg LLP

To avoid waiting, you are encouraged to call ahead to make an appointment at the site of your choice. (Some sites require a pre-set appointment.)

Created in 1995, the Charitable Gift Planners of Northeast Indiana (CGPNI), formerly the Planned Giving Council of Northeast Indiana, is a nonprofit organization made up of charitable gift planning professionals such as attorneys, financial and estate planners, trust administrators, and investment and insurance specialists. Our members also include representatives from many local nonprofit organizations, including academic, religious, health, arts and culture, and social service organizations. The CGPNI is a member council of the National Association of Charitable Gift Planners (formerly the Partnership for Philanthropic Planning).

The mission of CGPNI is to facilitate, coordinate, and encourage the education and training of the planned giving community, and to facilitate effective communication among its many different professionals.

For more information and/or a membership application, Contact: Matt Konow, CFRE, mkonow@clhscadets.com or visit our website at www.cgpni.com

shutterstock.com

Betty Foster, Ad Sales, Senior Life Newspaper

Cindy Mihingo, Graphic Designer, The Papers

Plan Today, Protect Tomorrow: Write a Will During “Write a Will Week”

Emily Lahr

It may not be the most comfortable topic to think about, but creating a will is one of the most important steps you can take to protect your loved ones and ensure your wishes are honored. “Write a Will Week” is the perfect time to take this thoughtful, practical step.

A will isn’t just for the wealthy—it ensures that your family, friends, and cherished causes are cared for exactly as you intend. Without a will, state laws determine how your assets are distributed, which can lead to delays, confusion, and stress for those you leave behind.

While planning for the future, consider including charitable bequests. A gift to a nonprofit like Stillwater Hospice is a meaningful way to leave a lasting impact. As a nonprofit dedicated to providing compassionate end-oflife care and grief support in northeast Indiana, Stillwater Hospice relies on the generosity of donors to continue offering comfort and guidance to families during life’s most difficult moments. Your bequest helps ensure that every patient receives expert, loving care—regardless of their ability to pay.

Including a charitable gift in your will is simple and flexible. You can designate a specific dollar amount, a percentage of your estate, or even a particular asset. And by planning ahead, you gain peace of mind knowing your loved ones are cared for, and your values continue to make a difference.

This “Write a Will Week,” take a moment to create or update your will. Protect your family, safeguard your wishes, and consider leaving a legacy of compassion by including Stillwater Hospice. Your thoughtful planning today can bring comfort and hope to countless families tomorrow.

For guidance on including a charitable bequest to Stillwater Hospice, visit stillwater-hospice org/donate or contact our team for support.

Leave a legacy that inspires wonder, protects wildlife, and connects families for years to come.

Do you remember the first time you saw a giraffe up close? Or the sound of a lion’s roar echoing through the trees?

These moments stay with us – sparking joy, curiosity, and a lifelong connection to the natural world. They shape who we are.

At Fort Wayne Zoo, we’re more than a zoo. We’re a place where conservation meets education, where families bond, and where future generations learn to care for the planet. Since opening in 1965, we’ve welcomed over 25 million children and families to our 40+ acre campus – a place where memories are made, and futures are inspired.

For many, traveling abroad or even across the country to connect with wildlife isn’t possible. But at the Zoo, guests can engage with over 1,500 incredible animals in 69 habitats, representing 188 species from around the globe. At its core, Fort Wayne Zoo addresses several interconnected issues – all tied to our mission of connecting kids and animals, strengthening families, and inspiring people to care about the natural world around them.

This fall, during Write a Will Week – aligned with National Estate Planning Awareness Week – we invite you to reflect on what matters most and consider how your legacy can help shape the future of Fort Wayne Zoo. By including a gift to the Zoo in your will, you become an essential part of the story that continues to unfold.

“I included the Zoo in my will because I want my grandchildren – and their grandchildren – to experience the same joy I did.”

- Tom Ackmann, longtime Zoo supporter

We invite you to consider how your story can intertwine with ours – and with the countless stories yet to be written by those who will walk through our gates in the years to come.

Learn more about legacy giving and how to get started. Reach out to our development team at development@ fwzoo.com.

Please call Jessica Misserbiev at (260) 484-9560 to make your appointment.

Leave more than memories. We can guide you through wills and estate planning that honors your intentions and secures your family’s future.

A last Will and Testament is more than a way to pass on your home, savings, or treasured possessions. It’s your chance to make a lasting impact.

By including a charitable gift in your will, you can provide for your loved ones and extend hope to those in need for years to come.

Schedule your free will drafting meeting today by contacting Janelle Taylor, jtaylor@fwrm.org.

Plan for the Future. Leave a Legacy.

Wellspring is proud to host a local attorney for Write a Will Week, offering you the opportunity to create your will at no cost.

We hope you’ll consider leaving a legacy to Wellspring, where your gift can provide food for hungry families, safe spaces for children to learn and grow, and support for neighbors working toward a better future.

We hope you’ll consider leaving a legacy to Wellspring, where your gift can provide food for hungry families, safe spaces for children to learn and grow, and support for neighbors working toward a better future.

We hope you’ll consider leaving a legacy to Wellspring, where your gift can provide food for hungry families, safe spaces for children to learn and grow, and support for neighbors working toward a better future.

For over 57 years, Wellspring has walked alongside low-income families in Allen County. Your legacy can help us continue our mission for generations to come.

For over 57 years, Wellspring has walked alongside low-income families in Allen County. Your legacy can help us continue our mission for generations to come.

For over 57 years, Wellspring has walked alongside low-income families in Allen County. Your legacy can help us continue our mission for generations to come.

Appointments are limited!

Appointments are limited!

Appointments are limited!

Call today to reserve your spot 260-422-6618 x101

Call today to reserve your spot 260-422-6618 x101

Call today to reserve your spot 260-422-6618 x101

Thursday, October 23, 2025 1:00 p.m. – 6:00 p.m.

Writing your Will isn’t about dying. It’s about taking care of the people and causes you love.

When you hear the word “estate” you may think of a large home on a rambling piece of land, something only wealthy people have. An estate is a person’s collection of accumulated assets like real estate, cars, and cash, meaning you likely have an estate of your own. A Will is an important legal document that tells your family what to do with your estate when the time comes.

Regardless of your financial means, a charitable gift included in your Will is the largest gift you will ever make to a cause you care about.

Cancer Services of Northeast Indiana is a local nonprofit serving people with cancer, and we treat gifts from Wills with care. These sizeable gifts can be added to an endowment, with the principal remaining intact while Cancer Services uses the income to advance the mission. You can earmark your gift to support a service close to your heart – such as making sure every person has a compassionate advocate walking alongside them, help paying for cancer-related bills, or practical things like wigs and walkers. Finally, your gift can be unrestricted, allowing Cancer Services to apply the funds to the greatest need.

Cancer Services encourages everyone to think ahead and be prepared by participating in the 2025 Write a Will event.

Catherine S. Christoff, JD, Cum Laude, with Christoff & Christoff Attorneys will offer her expertise from 1 pm to 6 pm on Thursday, October 23, 2025, at Cancer Services, 6316 Mutual Drive. Catherine will meet with you one-on-one and create a simple Will at no cost. The only requirement is you include a charitable gift in your Will.

While we hope you will consider making a gift to Cancer Services, you may give to any charitable cause close to your heart.

Please call Jessica Misserbiev at (260) 484-9560 or email JMisserbiev@cancer-services.org to schedule an appointment to prepare your Will.

A family from our Villages of Inverness campus on a trip to the Fort Wayne Zoo.

At Lutheran Life Villages, we believe in celebrating life at every stage, and part of that celebration is ensuring your legacy is secure. That's why we emphasize the importance of Write a Will Week in October. It's a common misconception that wills are only for older adults. In reality, everyone, regardless of age, can benefit from planning their future and articulating their wishes.

Consider one of our employees in her twenties. Even at her young age, she is already thinking about the impact she wants to leave on the world. She took the proactive step to create her will, designating a portion of her estate to benefit Lutheran Life Villages. Her thoughtful gesture ensures her values will continue to support the community she cherishes.

Then there's a long-standing, dedicated member of our LLV family. Through her many years of service, she has witnessed firsthand the profound impact of our care. She updated her will to include a generous provision for Lutheran Life Villages. Her legacy will play a crucial role in guaranteeing that future generations of our residents will receive the same compassionate and high-quality care they deserve.

And finally, one of our beloved residents decided to solidify her commitment to our community. Having experienced the exceptional care at LLV herself, she wanted to ensure that future residents would benefit from the same experience she has had. She made arrangements in her will to leave a lasting legacy that will directly support the continued excellence of our services.

These stories highlight the diverse reasons and ages for which a will is a powerful tool. To assist our community members, Lutheran Life Villages has partnered with five local estate-planning attorneys who are generously donating their time to help you create or update a simple will during Write a Will Week. See details in our advertisement on page 16.

We encourage everyone to take advantage of this invaluable opportunity to secure your legacy and make a lasting difference.

Sponsored by the Charitable Gift Planners of Northeast Indiana

Your Attorney will advise you about your Will & Charitable Gift

UNRESTRICTED BEQUEST:

I give to (legal name of institution, address) the sum of $______ Dollars (or _____% or fraction of my adjusted gross estate) as a charitable gift for its general purposes.

RESTRICTED BEQUEST:

I give to (legal name of institution, address) the sum of $______ Dollars (or ___% of my adjusted gross estate) as a charitable gift to be used for (describe the purpose for the gift).

BEQUEST OF RESIDUARY ESTATE:

After making the above gifts to my family and specific persons, I give all remaining property owned by me at death, wherever located, to (legal name of charity, address).

UNRESTRICTED BEQUEST OF SPECIFIC PROPERTY, ENDOWMENT:

I give the following property to (legal name of institution, city and state) to be held as an endowment, the net income of which may, along with any appreciation (whether realized or unrealized), be spent for its general purposes: (describe property- real estate, gold jewelry, or valuable coin or art collection; insert specific description and where located.)

Created by Jane M. Gerardot. Visit our website at www. cgpni.com. This document provides general information only. You should rely on your attorney’s advice in all matters regarding your estate plan. The CGPNI committee does not prepare Wills and is not engaged in the practice of Law.

Written by Zachary Witte

A Last Will and Testament is more than a way to pass on your home, savings, or treasured possessions—it’s your opportunity to make a lasting impact. By including a charitable gift in your will, you can provide for your loved ones and extend hope to those in need for years to come.

Zachary A. Witte, Attorney at Law, in partnership with The Rescue Mission, is offering free will consultations during Write a Will Week, October 20–24, 2025. This is your chance to gain peace of mind while also leaving a legacy of generosity.

Support what matters most: Your gift can provide food, shelter, and hope through the Rescue Mission.

Leave a legacy of kindness: Even a modest gift can make a big difference in someone’s life.

Honor both family and community: You can care for loved ones while also supporting causes close to your heart.

A bequest is a simple yet powerful way to carry your values forward. It can take several forms:

• Specific Bequest – designate a particular asset (cash, real estate, jewelry, etc.).

• Residual Bequest – leave the remainder of your estate after debts and specific gifts are settled.

• Contingent Bequest – name a backup beneficiary if your first choice cannot inherit.

• Charitable Bequest – donate a portion of your estate to a meaningful organization like the Rescue Mission.

Each option ensures your wishes are honored and your legacy continues.

Estate planning is not just for the wealthy—it’s for everyone. Whether you’re writing your first will or updating an existing one, now is the time to make thoughtful decisions for your family and your community.

Contact Janelle Taylor, CFRE, CFRM, Senior Philanthropy Officer, at jtaylor@fwrm.org to schedule your appointment today.

Together, we can ensure your legacy brings peace of mind to you, security to your loved ones, and hope to those who need it most.

by Danielle Swan

Is a Will really necessary? Won’t my assets go to my spouse/children/loved ones anyway? I’ve already designated my accounts to go to my desired beneficiaries, is that not enough? These are all common questions that arise when people are trying to determine whether they need an elder law attorney to help with their estate plan.

There are 3 stages when people tend to think about whether they need an estate plan: (1) when they have children, (2) when they retire, and (3) when their spouse passes away. When a person becomes a parent for the first time, it becomes crucial to have a Will in place to express your wishes as to who will care for your children if something unexpected happens. When a person retires, it becomes apparent that they should put clear guidelines in place for how to protect their family if something unexpected happens. When a person’s spouse passes away, it often becomes very obvious if they have failed to plan for each stage along the way, and it is recommended that you avoid procrastination so that you do not end up in that stage at that point.

Estate planning in advance helps ensure that your wishes are carried out in the most efficient way possible, in light of existing tax and probate laws. Even if you have beneficiaries noted on certain accounts, that may not be the case. Advance estate planning can help avoid conflict and unrest among your family, while ensuring that your wishes are carried out exactly according to your instructions.

The “Write-A-Will” program is an excellent opportunity to plan for your future and give back at the same time. This service is at no cost to you when you include at least one charitable bequest in your Will. We look forward to working with you.

Join us for Write a Will Week, Oct. 20-22 and take a meaningful step toward securing your legacy—while supporting a cause close to your heart.

Local attorneys are volunteering their time to help you create or update a simple will, free of charge. In return, you’re invited to consider a charitable gift to Stillwater Hospice. Including Stillwater Hospice in your will ensures that compassionate care, comfort, and guidance continue for families across northeast Indiana—regardless of their ability to pay. Every legacy gift helps us provide expert care and grief support when it’s needed most.

For 137 years, Stillwater Hospice has walked alongside individuals and families during life’s most difficult moments. Your planned gift helps continue that mission for generations to come.