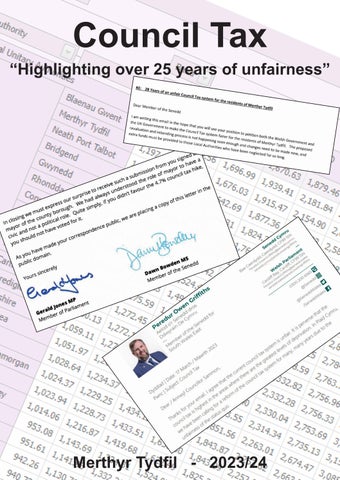

Council Tax

“Highlighting over 25 years of unfairness”

“Highlighting over 25 years of unfairness”

This document gives a brief look at 28 years of Council Tax figures across all 22 Local Authorities in Wales. The figures are from 1996/97 to 2023/24.

There is something wrong with the current system when those living in some of the most deprived areas of Wales are continually paying the highest rates of Council Tax. Local Authorities have been starved of vital funds for years and are then left to face the wrath of residents.

Welsh Government know the current system is unfair and in December 2021 the First Minister belatedly told how they were considering the first revaluation of residential properties since 2003.

A 12-week consultation period began on the 12th July 2022 and ended on the 4th October 2022 which covered three main areas

• a potential 2025 revaluation and rebanding.

• a review of council tax discounts, disregards, exemptions and premiums.

• and a review of the Council Tax Reduction Scheme.

In an interview with BBC Politics Wales, First Minister Mark Drakeford said he was attracted to land value taxation "as a fairer and better way of dealing with the way in which we pay for local services".

Such a system would see people pay council tax according to the value of the land they own, rather than the property built on it.

He said it could take a decade to move to such a system, but added Plaid and Labour ministers had "jointly committed to not allowing the unfairness of the current system to continue".

Rebecca Evans, Minister for Finance and Local Government, said: "We want to modernise the council tax system and make it fairer. We want to make council tax more progressive in its design and delivery."

Sian Gwenllian, Plaid Cymru's lead designated member working with the Welsh government, added: "We have long argued that the current system disproportionately impacts poorer areas and change is long overdue.

"We look forward to developing a fairer and more progressive system as we put our co-operation agreement with the Welsh government into action."

If the Welsh Government know that the system is unfair, and that the current system disproportionately affects those living in the most deprived areas, why are they waiting so long to make the system fairer for everyone?

The below letter was sent on the 12th July 2022 to Rebecca Evans MS, the Welsh Minister for Finance and Local Government, following a “Notice of Motion” by Independent Councillors.

Dear Minister,

I refer to a ‘Notice of Motion’ approved at a full Council meeting of Merthyr Tydfil County Borough Council on 2nd March 2022.

The ‘Notice of Motion’ approved unanimously by Council proposed “The 151 Officer supported by the Chief Executive Officer and Leader of the Council will send a joint Communication to Rebecca Evans MS Senedd Finance Minister to inform Welsh Government of our preference for Council Tax and Revenue Support Grant Reform”.

Following your meeting with Council Leaders on the 29th June 2022 to discuss council tax reform and your address at the Society of Welsh Treasurers Development Day on 1st July 2022, this is considered the opportune time to action the Council approved ‘Notice of Motion’.

The proposal within the ‘Notice of Motion’ is based on the Institute of Fiscal Studies (IFS) research included within the Welsh Government publication of February 2021, ‘Reforming Local Government Finance in Wales : Summary of Findings’. This research modelled a number of possible options for improving the progressiveness of council tax.

The Council in approving the ‘Notice of Motion’ supports the IFS Council Tax Reform option relating to a ‘Continuous and Proportional System’ removing the current banding structure and applying a fixed tax rate as a percentage of property values, but retaining existing discounts, premiums and exemptions.

Based on the IFS modelling, adoption of the ‘Continuous and Proportional System’ option for reform, would result in a 24% reduction in the tax base for Merthyr Tydfil, adversely impacting upon the Council’s revenue-raising ability. To offset this negative impact however, the IFS model suggests counter changes in the distribu-

tion of the Revenue Support Grant (RSG), resulting in a process of resource equalisation.

Under the ‘Continuous and Proportional System’, it is projected that changes in grant funding to fully offset changes in tax bases would lead to an additional £4.6 million (4.2%) RSG for Merthyr Tydfil. In addition, it is projected that Merthyr Tydfil would experience the highest reduction in average council tax bills (circa 20%) reflecting its status as one of the Local Authorities with the lowest average property values in Wales. As a result, the average net council tax bill for Merthyr Tydfil is estimated to fall by £200 under the ‘Continuous and Proportional System’.

In contrast, if Council Tax reform takes the form of a ‘Pure Revaluation’, using updated property values to assign properties to council tax bands, the average net council tax bill for Merthyr Tydfil is projected to increase by £7.

In conclusion, the Council supports a more progressive Council Tax system, one which reflects the IFS modelled ‘Continuous and Proportional System’. This would narrow gaps in property values between high-price and low-price parts of Wales, acting to reduce geographical wealth inequality. For example, it is projected that average property values in Merthyr Tydfil would increase by circa £9,900. In addition, a projected reduction in the net council tax bill of £200 would be most welcome when Merthyr Tydfil’s council tax is currently the second highest in Wales.

Your urgent consideration of the Council’s position is respectfully requested as a more progressive council tax system would undoubtedly be of significant benefit to the residents of the County Borough of Merthyr Tydfil.

Yours sincerely

Government in Westminster Conservative John Major

Government in Wales

NONE

Information has been taken from the following website: https://statswales.gov.wales

Merthyr Tydfil ranked as sixth highest council tax rate out of the twenty two Local Authorities in Wales.

6th highest out of 22

Government in Westminster Labour Tony Blair

Government in Wales

NONE

Information has been taken from the following website: https://statswales.gov.wales

Merthyr Tydfil ranked as second highest council tax rate out of the twenty two Local Authorities in Wales.

2nd highest out of 22

Government in Westminster Labour

Tony Blair

Government in Wales NONE

Information has been taken from the following website: https://statswales.gov.wales

Merthyr Tydfil ranked as second highest council tax rate out of the twenty two Local Authorities in Wales.

2nd highest out of 22

Government in Westminster Labour

Tony Blair

Government in Wales Labour

Alun Michael

Information has been taken from the following website: https://statswales.gov.wales

Merthyr Tydfil ranked as second highest council tax rate out of the twenty two Local Authorities in Wales.

2nd highest out of 22

Government in Westminster Labour

Tony Blair Government in Wales Labour

Rhodri Morgan

Information has been taken from the following website: https://statswales.gov.wales

Merthyr Tydfil ranked as second highest council tax rate out of the twenty two Local Authorities in Wales.

2nd highest out of 22

Government in Westminster Labour

Tony Blair

Government in Wales Labour

Rhodri Morgan

Information has been taken from the following website: https://statswales.gov.wales

Merthyr Tydfil ranked as second highest council tax rate out of the twenty two Local Authorities in Wales.

2nd highest out of 22

Government in Westminster Labour

Tony Blair

Government in Wales Labour

Rhodri Morgan

Information has been taken from the following website: https://statswales.gov.wales

Merthyr Tydfil ranked as second highest council tax rate out of the twenty two Local Authorities in Wales.

2nd highest out of 22

Government in Westminster Labour

Tony Blair

Government in Wales Labour

Rhodri Morgan

Information has been taken from the following website: https://statswales.gov.wales

Merthyr Tydfil ranked as second highest council tax rate out of the twenty two Local Authorities in Wales.

2nd highest out of 22

Government in Westminster Labour

Tony Blair

Government in Wales Labour Rhodri Morgan

Information has been taken from the following website: https://statswales.gov.wales

Merthyr Tydfil ranked as second highest council tax rate out of the twenty two Local Authorities in Wales.

2nd highest out of 22

Government in Westminster Labour Tony Blair

Government in Wales Labour Rhodri Morgan

Information has been taken from the following website: https://statswales.gov.wales

Merthyr Tydfil ranked as third highest council tax rate out of the twenty two Local Authorities in Wales.

3rd highest out of 22

Government in Westminster Labour

Tony Blair

Government in Wales

Labour Rhodri Morgan

Information has been taken from the following website: https://statswales.gov.wales

Merthyr Tydfil ranked as third highest council tax rate out of the twenty two Local Authorities in Wales.

3rd highest out of 22

Government in Westminster Labour Gordon Brown

Government in Wales Labour Rhodri Morgan

Information has been taken from the following website: https://statswales.gov.wales

Merthyr Tydfil ranked as third highest council tax rate out of the twenty two Local Authorities in Wales.

3rd highest out of 22

Government in Westminster Labour

Gordon Brown

Government in Wales Labour Rhodri Morgan

Information has been taken from the following website: https://statswales.gov.wales

Merthyr Tydfil ranked as third highest council tax rate out of the twenty two Local Authorities in Wales.

3rd highest out of 22

Government in Westminster Labour Gordon Brown

Government in Wales Labour Rhodri Morgan (10th Dec 2009) Carwyn Jones

Information has been taken from the following website: https://statswales.gov.wales

Merthyr Tydfil ranked as third highest council tax rate out of the twenty two Local Authorities in Wales.

3rd highest out of 22

Government in Westminster Conservative David Cameron

Government in Wales

Labour Carwyn Jones

Information has been taken from the following website: https://statswales.gov.wales

Merthyr Tydfil ranked as third highest council tax rate out of the twenty two Local Authorities in Wales.

3rd highest out of 22

Government in Westminster Conservative David Cameron

Government in Wales Labour Carwyn Jones

Information has been taken from the following website: https://statswales.gov.wales

Merthyr Tydfil ranked as third highest council tax rate out of the twenty two Local Authorities in Wales.

3rd highest out of 22

Government in Westminster Conservative David Cameron

Government in Wales Labour Carwyn Jones

Information has been taken from the following website: https://statswales.gov.wales

Merthyr Tydfil ranked as third highest council tax rate out of the twenty two Local Authorities in Wales.

3rd highest out of 22

Government in Westminster Conservative David Cameron

Government in Wales Labour Carwyn Jones

Information has been taken from the following website: https://statswales.gov.wales

Merthyr Tydfil ranked as third highest council tax rate out of the twenty two Local Authorities in Wales.

3rd highest out of 22

Government in Westminster Conservative David Cameron

Government in Wales

Labour Carwyn Jones

Information has been taken from the following website: https://statswales.gov.wales

Merthyr Tydfil ranked as third highest council tax rate out of the twenty two Local Authorities in Wales.

3rd highest out of 22

Government in Westminster Conservative David Cameron

Government in Wales

Labour Carwyn Jones

Information has been taken from the following website: https://statswales.gov.wales

Merthyr Tydfil ranked as third highest council tax rate out of the twenty two Local Authorities in Wales.

3rd highest out of 22

Government in Westminster Conservative

Theresa May

Government in Wales Labour Carwyn Jones

Information has been taken from the following website: https://statswales.gov.wales

Merthyr Tydfil ranked as third highest council tax rate out of the twenty two Local Authorities in Wales.

3rd highest out of 22

Government in Westminster Conservative

Theresa May

Government in Wales Labour Carwyn Jones

Information has been taken from the following website: https://statswales.gov.wales

Merthyr Tydfil ranked as third highest council tax rate out of the twenty two Local Authorities in Wales.

3rd highest out of 22

Government in Westminster Conservative

Theresa May

Government in Wales Labour Carwyn Jones (12th Dec 2018) Mark Drakeford

Information has been taken from the following website: https://statswales.gov.wales

Merthyr Tydfil ranked as third highest council tax rate out of the twenty two Local Authorities in Wales.

3rd highest out of 22

Government in Westminster Conservative Boris Johnson

Government in Wales Labour Mark Drakeford

Information has been taken from the following website: https://statswales.gov.wales

Merthyr Tydfil ranked as third highest council tax rate out of the twenty two Local Authorities in Wales.

3rd highest out of 22

Government in Westminster Conservative

Boris Johnson

Government in Wales Labour Mark Drakeford

Information has been taken from the following website: https://statswales.gov.wales

Merthyr Tydfil ranked as second highest council tax rate out of the twenty two Local Authorities in Wales.

2nd highest out of 22

Government in Westminster Conservative Boris Johnson

Government in Wales Labour Mark Drakeford

Information has been taken from the following website: https://statswales.gov.wales

Merthyr Tydfil ranked as second highest council tax rate out of the twenty two Local Authorities in Wales. 2nd highest out of 22

Government in Westminster Conservative

Boris Johnson

Liz Truss

Rishi Sunak

Government in Wales Labour

Mark Drakeford

Information has been taken from the following website: https://statswales.gov.wales

Merthyr Tydfil ranked as second highest council tax rate out of the twenty two Local Authorities in Wales.

2nd highest out of 22

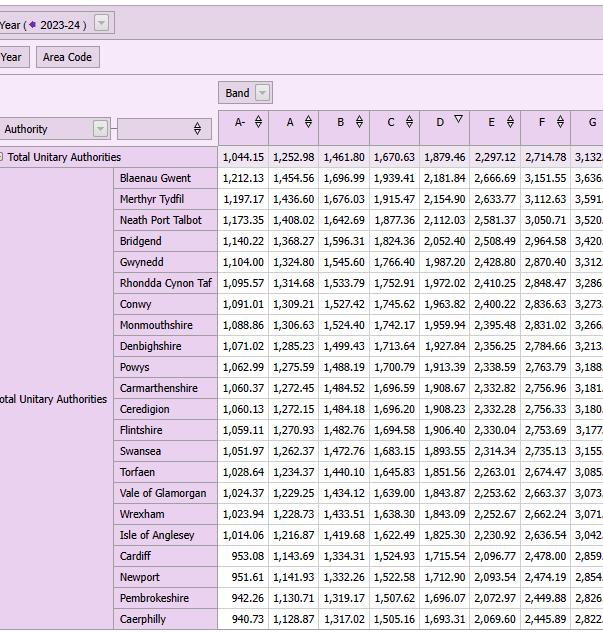

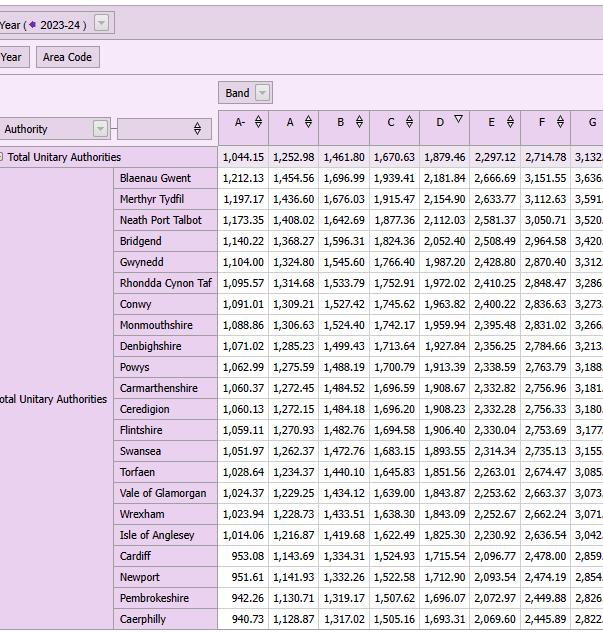

Below are the official Stats Wales figures which are an update of the figures on the previous page.

Comparison in Council Tax increases for all 22 Local Authorities in Wales.

Government in Westminster Conservative Rishi Sunak

Government in Wales Labour Mark Drakeford

Information has been taken from the following website: https://statswales.gov.wales

Merthyr Tydfil ranked as second highest council tax rate out of the twenty two Local Authorities in Wales.

2nd highest out of 22

2018/19 was the first year the Independent Group set the Budget and the subsequent Council Tax rate for Merthyr Tydfil.

The following chart is a comparison of Council Tax increases between all 22 Local Authorities in Wales from 2018/19 until 2023/24.

2018/19 was the first year the Independent Group set the Budget and Council Tax rate for Merthyr Tydfil.

Peredur Owen Griffiths

Aelod o’r Senedd dros

Ddwyrain De Cymru

Member of the Senedd for South Wales East

Dyddiad | Date: 17 March / Mawrth 2023

Pwnc | Subject: Council Tax

Dear / Annwyl Councillor Sammon,

Senedd Cymru

Bae Caerdydd, Caerdydd, CF99 1SN

Peredur OwenGriffiths@senedd.cymru senedd.cymru/peredurowengriffiths

—

Welsh Parliament

Cardiff Bay, Cardiff, CF99 1SN

Peredur OwenGriffiths@senedd.wales senedd.wales/peredurowengriffiths

0300 200 6565

@Senedd

@SeneddWales

/SeneddWales

Thanks for your email. I agree that the current council tax system is unfair. It is perverse that the council tax is highest in the areas where there are the greatest levels of deprivation. In Plaid Cymru, we have been calling for a reform of the council t ax system for many, many years due to the unfairness of the status quo.

This is why we insisted it form part of the co -operation agreement that we signed with the Labour Party who have been reluctant to do anything about it till now. This is the wording o f what we agreed within the agreement:

C Council tax reform – Reform one of the most regressive forms of taxation – which disproportionately impacts poorer areas of Wales – to make it fairer

This is what I said when the consultation on this matter was ann ounced:

h https://www.plaidbg.wales/council tax

As I said before, this is not a new policy for us - it formed a key part of our 2016 Senedd election campaign. This is what we said at the time: h https://www bbc co uk/news/uk-wales-politics-35880769

Unfortunately, Labour won that election and nothing happened for the next five years despite them representing the areas hit hardest by high council tax.

For the sake of the communities we represent, I regret that we do not already have a fairer, less regressive system in place but I am heartened that the wheels of change are finally in motion. I look forward to the council tax being reformed. It cannot come soon enough.

If you would like to meet to discuss this matter further, please let me know as I would be happy to visit your ward.

One way of considering Welsh Index Multiple Deprivation data at the local authority level is to look at the proportion of areas within the local authority that are in the most deprived 10% (or 20% etc) of all areas in Wales. This method can be seen as identifying the concentration of the most deprived areas in a local authority, rather than an average level of deprivation.

The local authority with the highest proportion of areas in the most deprived 10% in Wales was Newport (20%, or 19 areas), followed by Merthyr Tydfil and Cardiff (19.4% and 19.2% respectively).

Blaenau Gwent had the highest percentage of areas in the most deprived 50% in Wales, at 80.9%, followed by Merthyr Tydfil at 72.2%

This information is available at the following website address: https://www.gov.wales/sites/default/files/statistics-and-research/2020-06/welsh-index-multiple-deprivation-2019-results-report.pdf

The argument for the Council tax Mechanism Change is, there were 6 options outlined by the Institute of Fiscal Studies in 2020;

1. Using updated property values to assign properties to council tax bands (‘pure revaluation’).

2. As option 1 but also making relative tax rates proportional to the median price of properties in each tax band (‘revaluation with proportional bands’).

3. As option 2 but adding additional tax bands at the bottom and top of the distribution (‘revaluation with extra and proportional bands’).

4. As option 1, adding additional tax bands at the bottom and top of the distribution and making the band relativities less regressive – though not, as in options 2 and 3, fully proportional (‘revaluation with extra bands and reduced regressivity’).

5. Applying a fixed percentage tax rate to updated (continuous) property values, but retaining existing discounts, premiums and exemptions (‘revaluation with a continuous and proportional system’).

6. As option 5 but also abolishing the single-person discount (‘revaluation with a continuous and proportional system without a single-person discount’).

Our Notice of Motion suggests option 5.

Option 5, a continuous and proportional system, which, in addition to revaluing properties, removes the banded structure and applies a fixed proportional tax rate to the exact estimated value of each property. However, this option maintains the current set of discounts, exemptions and premiums (including the single-person discount) as proportional reductions or additions to this fixed tax rate.

The impact of revaluation and reform of council tax will depend on whether Revenue Grant funding is adjusted to reflect changes in the tax base.

Its not about the mechanism is more about the ability of Merthyr to provide equivilent services to the public on a par with Monmouth, Cardiff and the Vale.

The following speech about the Local Authoritys ability to be agile with its finances which was made my Cllr Andrew Barry during the Full Council Meeting of 8th March 2023.

Because of our Risk Exposure to interest rate volatility, we fixed £60 million of debt with the Public Works Loan Board (PWLB)

£30 million was fixed in September, 3 tranches of £10 million each with interest rates of 3.93%, 3.96% and 4.01% maturing in 8 years, 9 years and 10 years respectively.

Within a week of those transaction, PWLB borrowing had become more expensive with interest rates increasing to circa 4.7%.

Within another week interest rates had increased further to circa 5.1% and then 5.4%.

By carrying out those transactions when we did, we avoided increased interest costs of £210k @ 4.7% , £330k @ 5.1% and up to £416k @ 5.4% based on those 3 interest rate increases.

A further £30 million was fixed in November for one year only at an interest rate of 3.89%. We took these transactions after engaging with our Treasury Management consultants Arlingclose. Although markets have calmed in recent months and inflationary pressures are due to fall, there are still, potential increases in interest rates likely

The transactions we undertook last Autumn have proved hugely beneficial for this Authority, which our staff are to be acknowledged and congratulated for their action.

Steve if you’ll send Staff and Arlingclose Consultants, this Independent’s Group’s thanks for their vigilance and swift action, in the prudent manner, in which, they’ve handled and continue to handle the public funds of residents of this County Borough.

Just a practical example Mr Mayor of what goes on behind the scenes that Members will hardly be aware of, and the public certainly won’t.

The UK Government has taken back £155.5m that was allocated to Wales because Welsh Government (WG) hasn’t spent it quick enough.

UK Government has set a limit on what WG can carry forward if money is left at the end of the year. Wales has a limit for the reserve at the end of the year of £350 million.

In 2020/21 financial earth WG underspend on its Revenue spending by £357.9 million. In previous years UK Gov has let WG carry these amounts forward to the next financial year.

This time they said NO, several proposals were put forward but none were accepted

November 2021

HM Treasury Officials advised the WG it could not retrospectively offset its Capital overspend with its Revenue underspend.

December 2021

The WG provided options to HMT with suggestions of how the excess could be utilised including reprofiling into future years and ring fencing to be used on specific programmes

March 2022

HM Treasury told the WG it “did not accept any of the suggestions and would apply its position as set set out out in November 2021

29th March 2022

The Minister for Finance and Local Government met with the then Chief Secretary to the Treasury to discuss the issue.

4th April 2022

The Minister for Finance and Local Government then wrote to the then Chief Secretary to the treasury to request he reconsider his decision

19th April 2022

The then Chief Secretary to the Treasury rejected the proposals of the Minister for Finance and Local Government

One of the suggestions by WG was to offset its Capital Overpend of £149 million with its £357.9 million underspend on its Revenue Budget this would still have left an underspend of £208.8 million.

Because of the limits of what Wales can roll over we have had £155.5 million taken from us and returned to Westminster. That equates to every public Sector worker in Wales a 1.5% pay rise for one year.

The Public Accounts and Public Administration Committee in the Senedd which scrutinises how WG uses public money has raised questions about WG’s conduct.

In their report they say “It’s difficult to understand why the WG waited so long to be told it could not do as it wished with the underspend and why such a request was made retrospectively. The WG appears to have assumed, based on previous HM Treasury decisions, that it could be granted flexibility to use the funding.

There are questions over whether asking the question of HM Treasury earlier may have enabled the funds to be used. The Committee conclude with “We do not expect to see a repetition of such funding being lost from Wales again and any future requests should be made sooner”.

MS Mark Isherwood, the Chair accused WG of ‘poor record keeping and mismanagement of public accounts”

The local authoritiy with the highest proportion of areas in the most deprived 10% in Wales was Newport, closely followed by Merthyr Tydfil. (See below chart)

Blaenau Gwent had the highest percentage of areas in the most deprived 50% in Wales, followed by Merthyr Tydfil. (See below chart)