Strategic Partners Guide

HOPE

WAVERING, FOR HE WHO PROMISED IS FAITHFUL. Hebrews 10:23, lsb

HOPE

WAVERING, FOR HE WHO PROMISED IS FAITHFUL. Hebrews 10:23, lsb

The John MacArthur Charitable Trust provides support for the development and expansion of key partner ministries that share the biblical and theological commitments of Dr. John MacArthur.

Reflecting five decades of Pastor John’s faithful ministry, the Trust is uniquely positioned to work closely with the leadership of these partners to strategically identify the most urgent and critical needs, and to coordinate joint efforts in achieving ministry objectives.

Guided by a leadership team committed to providing both operational and financial support to each partner ministry, the Trust seeks to uphold Dr. MacArthur’s legacy and encourage those serving the Lord around the globe—including pastors, teachers, lay leaders, missionaries, training centers, church plants, and college and seminary students.

FUNCTION

Exposition

MISSION

Imparting Biblical Truth

MEANS

Sermons

Broadcasts

Commentaries

Radio

Books

MacArthur Study Bible

MINISTRY

FUNCTION

Equipping

MISSION Applying Biblical Truth

MEANS

Academics

Student Life

Israel Bible Extension Campus

Mission Trips

Christian Service

MINISTRY

FUNCTION Preparation

MISSION Ministering Biblical Truth

MEANS Bible

Theology

Preaching & Teaching Internship

Mentoring Placement

MINISTRY

FUNCTION Proclamation

MISSION Extending Biblical Truth

MEANS Recruitment Training Sending Supporting Missionaries

MINISTRY

FAITH CHRISTIAN SCHOOL PSP

A flexible and primarily homebased option, Faith Christian PSP meets once per week on the campus of Grace Community Church. PSP includes weekly inperson instruction and access to unique enrichment courses.

GRACE ACADEMY

Grace Academy serves as an equipping educational partner with Christian families, proclaiming Christ and His Word to support students in their intellectual growth and character formation.

GRACE ADVANCE

Grace Advance exists to support developing churches in areas where biblical churches are needed.

GRACE COMMUNITY CHURCH

Grace Community Church exists to glorify God by proclaiming the gospel of Jesus Christ through the power of the Holy Spirit, for the salvation of the lost and edification of the church.

GRACE MINISTRIES INTERNATIONAL

Grace Ministries International focuses its efforts towards leadership training, church strengthening, church planting, and Bible translation work.

GRACE TO YOU

Grace to You uses mass media to expose John’s teaching to as wide an audience as possible “for the equipping of the saints for the work of service, to the building up of the body of Christ;” (Eph. 4:12).

LEGACY CHRISTIAN ACADEMY

Legacy Christian Academy

— a premier K-12 Christian, independent, private school — educates students in a manner that prepares them to be innovative, thoughtful, serviceoriented, 21st century leaders with strong biblical character.

THE MASTER’S ACADEMY INTERNATIONAL

The Master’s Academy International is committed to fulfilling the Great Commission by training indigenous church leaders to be approved pastorteachers, able to equip their churches to make biblically sound disciples.

THE MASTER’S FELLOWSHIP

The Master’s Fellowship is an association of pastors and churches bound together by love for the living Word as revealed in the written word.

THE MASTER’S SEMINARY

The Master’s Seminary trains men for pastoral ministry—to preach the Word of God, reach the world for Christ, and teach others to do the same.

THE MASTER’S UNIVERSITY

The Master’s University exists to empower students for a life of enduring commitment to Christ, biblical fidelity, moral integrity, intellectual growth, and lasting contribution to the Kingdom of God worldwide.

Since 2018, the John MacArthur Charitable Trust has helped donors streamline their giving to the areas of greatest need within our family of ministries. To date, the Trust has awarded more than $100 million in support of our partner ministries.

Beyond simplifying the giving process, the Trust is committed to helping individuals and families maximize the impact of their generosity while also taking full advantage of available tax benefits.

WHAT WOULD HAPPEN TO YOUR ASSETS IF YOU DIED TODAY?

This booklet provides just a glimpse into the comprehensive services offered by the MacArthur Trust. From estate strategy to business succession and transition strategies, our team of trusted advisors is here to help you steward your assets wisely. We offer personalized solutions for your personal and business finances—so you can move forward with confidence, knowing your legacy will reflect your cheerful heart of biblical generosity and commitment to support faithful ministry.

Donating appreciated stocks, mutual funds, or securities to the MacArthur Trust offers significant benefits. You can enjoy an income tax deduction, avoid capital gains tax, maximize your gift’s impact, retain your cash, and increase your charitable deduction— all while seeing the results of your generosity now.

HOW IT WORKS

Provide your broker or financial advisor with the MacArthur Trust’s account information and complete any required transfer forms.

Your broker transfers the shares directly to the Trust’s brokerage account.

The MacArthur Trust will provide you with an acknowledgment letter, and your tax advisor can help you determine the deductibility of your gift.

When you donate appreciated stocks or mutual funds held for more than one year, you avoid paying capital gains taxes on the increase in value. This can be a substantial tax savings compared to selling the securities yourself and donating the cash proceeds.

You can generally claim a charitable deduction for the full fair market value of the donated securities, up to certain IRS limits (typically up to 30% of your adjusted gross income for appreciated securities). This allows you to reduce your taxable income while maximizing your charitable impact.

Because you avoid capital gains taxes and can deduct the full market value, you can often afford to make a larger donation than if you sold the asset and donated the after-tax proceeds.

Suppose you bought a stock for $2,000 and it’s now worth $10,000:

A Donor-Advised Fund (DAF) is a powerful giving tool that offers maximum tax benefits, amplifies the impact of your generosity, and streamlines the charitable giving process.

Think of a DAF as a dedicated charitable account for all your giving. Rather than writing multiple checks throughout the year, you

make contributions to your DAF—receiving an immediate tax deduction at the time of the gift.

Your contributions are then invested, allowing them to grow tax-free. When you’re ready to give, the Trust distributes the funds on your behalf—making your giving both strategic and seamless.

Contribute cash, stocks, real estate, or other assets—on your schedule and as often as you choose. The Trust manages all the administrative details, making the process hassle-free.

Receive an immediate tax deduction for your contributions. Additionally, you’ll avoid capital gains tax on gifts of appreciated assets such as stocks and property.

Your contributions are invested and can grow over time, increasing your long-term charitable impact. All investment growth is tax-free.

The Smiths established a Donor-Advised Fund (DAF) with the John MacArthur Charitable Trust by contributing $71,500 in appreciated real estate, $21,500 in stocks, and $7,000 in cash—a total of $100,000. They received an immediate tax deduction for their gifts, which were invested and generated an additional $4,300 while the Smiths prayerfully considered how and when to direct their support.

When the time came, the Smiths recommended grants from their DAF to the Trust. The Trust took care of all the administrative details, ensuring the funds were seamlessly distributed to the family of ministries on their behalf.

$50,000 $30,000 $20,000

A Charitable Gift Annuity (CGA) enables you to support our partner ministries while receiving both a current tax deduction and guaranteed income for life. Upon your passing, the remaining value of your gift is directed into an endowment to benefit our family of ministries for generations to come.

CGAs are an excellent option for individuals of retirement age who wish to give generously while enjoying the stability of a reliable income stream. Generally, the older you are when you establish a CGA, the higher your annual payout. Payout rates also vary between individuals and couples. Annuity rates and income tax deduction depend on current ACGA and IRS rates.

Enjoy fixed, reliable payments for life—regardless of how long you live—even if they exceed the original value of your gift.

For married couples, payments can continue uninterrupted for the surviving spouse, providing lasting financial security.

Receive an immediate income tax deduction in the year you make your gift, along with potential ongoing tax benefits.

Choose the payment schedule that works best for you—monthly, quarterly, semiannually, or annually.

Mr. and Mrs. Jones decide to establish a $30,000 Charitable Gift Annuity to support the MacArthur Trust’s family of ministries. Based on their age, they qualify for a 5.0% annuity rate, providing them with $1,500 in annual income.

In addition to the dependable lifetime payments, the Smiths receive an immediate income tax deduction of approximately $7,800, along with ongoing tax advantages each year. Their $1,500 annual payment will continue for as long as either of them lives—even if the full value of their original gift has already been paid out.

5.0% $1,500

Everything we have is entrusted to us by God. Kingdom-minded estate planning reflects our role as faithful stewards, using His gifts for His glory—not only during our lifetime but also beyond it. An estate plan is a vital set of legal documents that addresses key decisions related to end-of-life matters.

Through a well-prepared estate plan, you can:

• DISTRIBUTE YOUR ASSETS ACCORDING TO YOUR VALUES AND WISHES

• PROVIDE CLEAR INSTRUCTIONS FOR YOUR CARE IN THE EVENT OF INCAPACITATION

• APPOINT A GUARDIAN FOR MINOR CHILDREN

• LEA VE A LASTING LEGACY BY SUPPORTING THE MINISTRIES AND CAUSES YOU CARE ABOUT

• REDUCE LEGAL EXPENSES, INCLUDING COURT COSTS AND ATTORNEY FEES

To learn more about estate planning and charitable giving, please contact one of our philanthropic advisors at (661) 525-5777 or info@jmacarthurtrust.org.

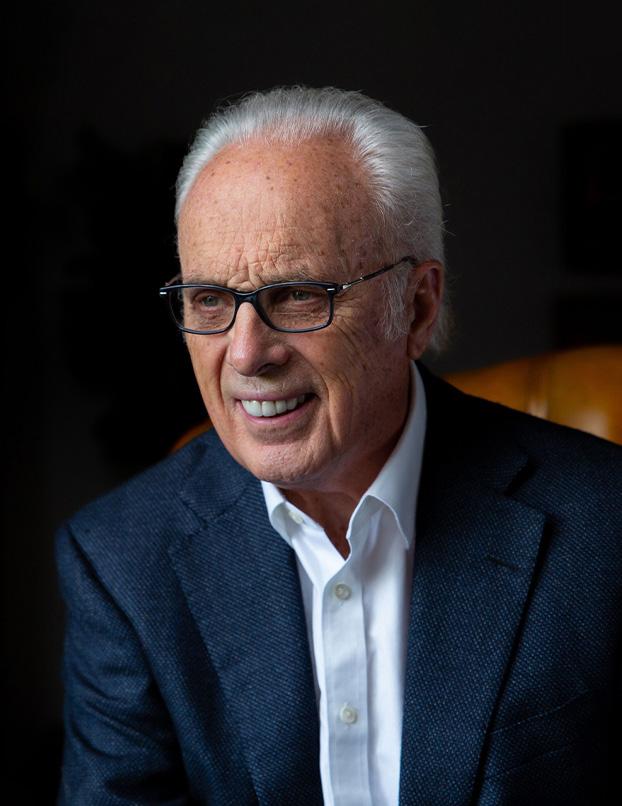

I STARTED WITH THE KNOWLEDGE AND CONVICTION THAT THERE WAS ONLY ONE REALITY GOD PROMISED TO BLESS – HIS WORD. SCRIPTURE IS CLEAR THAT BY HIS WORD AND THE POWER OF THE HOLY SPIRIT THROUGH FAITHFUL BELIEVERS THE LORD WILL DO “EXCEEDINGLY ABUNDANTLY BEYOND ALL THAT WE CAN ASK OR THINK.” AND WHAT HE DOES WILL ALWAYS BE FOR HIS GLORY.

John MacArthur

Financial security and charitable giving go hand-in-hand with a Charitable Remainder Trust (CRT). This giving solution is an excellent option for securing your retirement while making a lasting Kingdom impact. CRTs provide an immediate tax deduction, create lifetime income for you (or your loved ones), and also support JMCT. There are two types of Charitable Remainder Trusts, known as CRUTs and CRATs.

A CRUT works by placing your assets in a trust during your lifetime. A fixed percentage of the trust’s value is paid out to you and your beneficiaries each year. After a specified time period, or after you and your beneficiaries pass, the remainder of the trust is transferred to JMCT.

A CRAT allows you to place assets in a trust during your lifetime. Each year, a fixed dollar amount—determined when the trust is established—is paid to you and your beneficiaries. After the designated term, or after you and your beneficiaries pass away, the remaining assets are transferred to JMCT.

|

While not guaranteed, Charitable Remainder Unitrusts (CRUTs) offer the potential for increased annual distributions—providing the opportunity for greater income over time.

02 | Take Advantage of Tax Savings

Receive an immediate charitable tax deduction when you establish and fund your CRUT, offering meaningful financial benefits alongside your giving.

Thirty years ago, Mr. and Mrs. Moyer invested $150,000 in the stock market. Thanks to steady growth, their investment has now grown to $750,000. Looking to increase their retirement income, minimize taxes, and support the mission of the MacArthur Trust, the Moyers instructed their attorney to transfer the appreciated stock into a Charitable Remainder Unitrust (CRUT) established through JMCT.

By doing so, they receive an immediate charitable income tax deduction, avoid approximately $90,000 in capital gains taxes, and begin receiving annual payments equal to 6% of the trust’s value—$45,000 a year—for the rest of their lives. Upon their passing, the remaining value in the trust will go on to support the ministries of the MacArthur Trust.

IRA Charitable Rollovers are a smart and effective giving option for seniors. If you are age 70½ or older, you can make a tax-free gift directly from your IRA to the John MacArthur Charitable Trust. In 2025, individuals can give up to $108,000 (indexed annually), and couples may contribute up to $216,000.

This type of gift—known as a Qualified Charitable Distribution (QCD)—can count toward your Required Minimum Distribution

(RMD) without increasing your taxable income. While QCDs do not qualify for an income tax charitable deduction, they can significantly reduce your adjusted gross income (AGI), offering a valuable tax benefit—even if you do not itemize deductions.

To qualify as a QCD, the funds must be transferred directly from your IRA to the Trust. If you withdraw the funds first and then donate them, the gift will not meet the requirements for a QCD.

Mrs. Landis gives a portion of her IRA’s RMD as a gift (QCD) to the MacArthur Trust.

Mrs. Landis gives her entire IRA’s RMD as a gift (QCD) to the MacArthur Trust.

Mrs. Landis gives her entire IRA’s RMD (QCD) plus $5,000 as a gift to the MacArthur Trust.

$15,000 $15,000 $15,000 $10,000 $15,000

+ $5,000 $15,000

REQUIRED MINIMUM DISTRIBUTION — The amount of funds you are required to withdraw from your IRA every year after you turn 73.

QUALIFIED CHARITABLE DISTRIBUTION — A charitable donation that counts toward your RMD and can begin at age 70 ½.

A beneficiary designation allows you to give assets like a life insurance policy or retirement plan to the MacArthur Trust after your passing. It is one of the easiest and most tax-efficient ways to support Kingdom work, because updating a beneficiary designation doesn’t require changes to your will or trust.

Naming the John MacArthur Charitable Trust as a beneficiary is typically as simple as completing a single form—and usually does not require changes to your will, trust, or overall estate plan.

Depending on the type of asset, beneficiary gifts can significantly reduce or even eliminate income taxes for your heirs and may also lessen potential estate tax burdens.

Beneficiary designations are fully revocable during your lifetime, giving you the freedom to adjust your plans while ensuring your future gift reflects your intentions.

ACCOUNTS THAT WORK WITH BENEFICIARY DESIGNATION GIFTS

RETIREMENT ACCOUNTS

Contribute assets from a traditional IRA, Roth IRA, 401(k), 403(b), or similar retirement plan.

DONOR-ADVISED FUND (DAF)

Direct any remaining balance in your DAF to the Trust upon your death.

BANK & INVESTMENT ACCOUNTS

Designate the remaining balance of your checking, savings, or brokerage accounts as a gift upon your passing.

COMMERCIAL ANNUITIES

If your annuity has residual value after your lifetime, you can designate the Trust to receive the remainder.

LIFE INSURANCE

Name the John MacArthur Charitable Trust as a beneficiary of all or a portion of your policy’s death benefit.

REAL ESTATE

In many states, you can transfer ownership of your home or land to the Trust through a “transfer on death” deed—ensuring a smooth and meaningful gift.

Nearly every asset can become a tool to glorify God and support the mission of the John MacArthur Charitable Trust and its family of ministries.

STOCKS, MUTUAL FUNDS, BONDS

Simple and versatile, gifts of cash or cash equivalents provide immediate support to the ministries you love and are easy to give.

Donating appreciated securities allows you to avoid capital gains tax while increasing the overall impact of your gift for the Kingdom.

Gifts from IRAs, 401(k)s, or 403(b)s can offer substantial tax advantages—helping meet Required Minimum Distributions (RMDs), lowering adjusted gross income (AGI), and maximizing charitable impact while easing the tax burden on heirs.

Your business can become a channel for gospel work. Whether for succession planning, retirement strategy, or personal stewardship, business interests can be structured to honor Christ through charitable giving.

Gifts of appreciated property can provide a charitable deduction based on fair market value. In many cases, you can continue using the property for life while establishing a lasting legacy through your gift.

Donating mineral interests offers an income tax deduction and may eliminate tax on royalties. You can also retain lifetime payments while designating the remainder for ministry.

From automobiles and jewelry to collectibles and other personal treasures, these assets can be turned into meaningful ministry support—allowing you to receive a tax deduction while leaving a Christ-centered legacy.

For farmers, ranchers, and those in agribusiness, gifts of grain or livestock are powerful tools for Kingdom impact. These gifts may offer significant tax benefits while advancing faithful, gospel-driven ministry.

Donors who itemize may receive an immediate charitable tax deduction and potentially avoid capital gains tax. Any unused deduction can typically be carried forward for up to five additional tax years.

The donor may recommend grants for immediate ministry impact or allow the funds to grow over time to increase their future effectiveness. CHARITABLE GIFT

Donors who itemize may receive a partial charitable tax deduction and potentially bypass capital gains tax. Annual payments typically consist of a blend of taxable income and tax-free return of principal.

Donors who itemize may qualify for an immediate charitable tax deduction, potentially reduce applicable estate taxes, and avoid capital gains tax on appreciated assets.

The MacArthur Trust will receive the remaining value of the asset at the time of the donor’s death.

Generates a reliable annual income stream that grows over time, enabling a sustained and expanding impact. ESTATE PLAN BEQUEST

May help lower estate taxes, if applicable, and reduce income tax obligations for beneficiaries.

For many donors, bequests provide a meaningful way to make their most impactful gift to the John MacArthur Charitable Trust.

CHARITABLE REMAINDER UNITRUST (CRUT)

CHARITABLE REMAINDER ANNUITY TRUST (CRAT)

Donors who itemize may qualify for a partial tax deduction and could potentially avoid capital gains tax on appreciated assets.

Donors who itemize may receive a partial tax deduction and, if the asset has appreciated, potentially avoid capital gains tax.

Lowers the donor’s adjusted gross income—one of the few charitable giving strategies that offers tax benefits for those who do not itemize deductions.

The Trust will receive the remaining value of the asset after the designation period ends.

Yes, while the donor is living and of sound mind.

BENEFICIARY DESIGNATION

May help reduce estate taxes, where applicable, and lessen the income tax burden on beneficiaries.

The remaining value of the asset will be distributed to the Trust once the designated period concludes.

The gift can make an immediate impact for our partner ministries.

The Trust will receive the asset’s value upon the donor’s passing.

Yes, while the donor is living and of sound mind.

IS THERE AN INCOME PAYMENT TO THE DONOR OR DONOR’S LOVED ONES ASSOCIATED WITH THE GIFT?

No

Yes, there is a guaranteed fixed annual payment based on the donor’s age.

WHAT ASSETS WORK BEST FOR THIS TYPE OF GIFT?

Cash, securities, certain restricted stocks, mutual funds, private equity and hedge fund interests, real estate, privately held C-Corp and S-Corp shares.

Cash, securities, certain restricted stocks, mutual funds, private equity and hedge fund interests, real estate, privately held C-Corp and S-Corp shares.

WHEN WILL THE MACARTHUR TRUST RECEIVE THE GIFT?

When the donor makes a grant from his or her DAF to the Trust.

After the donor’s death.

No

The Trust will begin receiving annual distributions in one year or less, depending on the endowment agreement. No

Yes, there is a payment of at least 5% (available monthly, quarterly or annually) based on the current value of the asset.

Yes, fixed payments—available monthly, quarterly, or annually—are calculated based on the asset’s value at the time it was transferred to the Trust.

No

Cash, securities, real estate, other assets.

Any

Cash, publicly traded securities, some types of closely held stock (note: CRUTs cannot hold S-Corp stock), real estate, certain other complex assets

Cash, publicly traded securities, certain types of closely held stock (note: CRATs cannot hold S-corporation stock), real estate, and select other complex assets.

After the donor’s passing.

At the end of the designated period (up to a 20-year term or at the donor/beneficiary’s death)

At the conclusion of the designated period—either up to 20 years or upon the death of the donor or beneficiary.

No

Traditional IRA assets (Roth IRAs are ineligible)

Retirement plans, life insurance, bank and investment accounts, donor-advised funds, commercial annuities, and real estate.

Immediately after the gift is processed.

After the donor’s passing.

Mail a check made out to the “John MacArthur Charitable Trust” to 21726 Placerita Canyon Road Box #49, Santa Clarita, CA 91321

Visit www.jmacarthurtrust.org and click “Donate”

Masters Grace Fund DBA John MacArthur Charitable Trust Citibank, N.A. 399 Park Avenue, New York, NY 10022

ABA #: 021000089

FBO: Charles Schwab & Co., Inc. A/C #40553953 For Further Credit to Schwab Client Account #: 9682-5116

Provide your bank our brokerage account information: Masters Grace Fund DBA John MacArthur Charitable Trust Charles Schwab Account #: 9682-5116 DTC Clearing 0164, Code 40

The MacArthur Trust has its own DAF. This allows donors to give, receive a tax deduction in the year of the gift(s), but distribute the funds over time at the donor’s recommendation. Please contact us at info@jmacarthurtrust.org or 661.525.5777 for more information.

Please contact us at info@jmacarthurtrust.org or 661.525.5777 for more information on donating a real estate asset.

When naming the MacArthur Trust in your estate plan, please use the organization’s name via the IRS Master File: JOHN MACARTHUR CHARITABLE TRUST Employer Identification Number (EIN): 83-0981937

Employer Identification Number EIN

83-0981937

Organization Address

21726 Placerita Canyon Rd. #49 Santa Clarita, CA 91321

E-mail: info@jmacarthurtrust.org Phone: (661) 525-5777

Contact Us

Please contact us if you have any questions or if we can serve you in some way.

EMAIL info@jmacarthurtrust.org PHONE +1 (661) 525-5777

EMAIL 21726 Placerita Canyon Road, Box #49, Santa Clarita, CA 91321