We are pleased to present you with our annual membership services directory. Our goal is to provide independent agents with the necessary tools to run successful agencies and to better serve their customers. Inside of this directory, you will find detailed information, including costs and ordering procedures for many of the products and services offered through the MIAA, IIABA and PIA National.

Thank you to our company partners for their continued support of the independent agency system. We encourage you to consider our partners first when making decisions that impact your agency. A list is included in this directory, as well as on our website. Please take the time to thank them for all they do for YOUR association!

Lastly, a big thank you to our volunteer Board of Directors who give so much of themselves for the betterment of our industry! We appreciate your support!

Sincerely,

Lisa L. Veregge, CAE President

O U R S T O R Y

The MIAA is a not-for-profit trade association representing independent insurance agencies across the State of Maine.

We provide our membership with the highest level of representation and support services available in the industry. Our efforts are directed towards the effective delivery of valuable products and services, to insure, enhance and enable our members to better serve their clients.

The MIAA is a member of the Independent Insurance Agents and Brokers of America (IIABA) and the National Association of Professional Insurance Agents (PIA).

The IIABA was founded in 1896 and is a voluntary association of independent state associations. The IIABA or Big “I” as it is known is the largest producer association in the country, representing approximately 280,000 independent insurance agents and their employees in 28,000 agencies across the nation.

The National Association of Professional Insurance Agents (PIA) represents independent insurance agents in all 50 states, Puerto Rico and the District of Columbia. They operate cutting-edge agencies and treat their customers like neighbors, providing personal support and service.

Together, the IIABA, PIA and MIAA provide the most comprehensive package of high-quality, professional products and services available in the industry today. These services include, but are not limited to the following:

Agency Management

Education

Insurance/Financial Plans

Legislative

Industry Relations

Marketing Tools

Public Relations

Product Discounts

Publications

Seminars & Conventions

Technology

Collectively, we feel that these programs are an invaluable, and virtually indispensable aid to the independent insurance agency.

The long-range goals and policies of the MIAA are established by our Executive Committee.

The decision-making process includes the active involvement of our Board of Directors, which consists of 15 agents from all areas of the state.

Our mission is to represent, support and promote independent insurance agents.

The Concord Group!

Mark Bailey, AAI

Readfield Insurance Agency

PO BOX 660 Manchester, ME 04351

207-620-7276

Mbailey@readfieldinsurance com

Thomas Bearor

Varney Agency | Ins & Bonding

32 Oak St

Bangor, ME 04401

207-262-0109

tbearor@varneyagency com

John Bilodeau, CPCU, CIC

Bilodeau Insurance Agency

92 Pleasant Street

Brunswick, ME 04011

207-721-8347

john@bilodeauins.com

ld Clark, Jr. Agency

m Street

s, ME 04619 54-8800

clarkinsurance@myfairpoint net

Jonathan Nagy

Peoples Insurance Agency

PO Box 300

Monmouth, Me 04259

207-777-1877

jonathan@peoples-ins com

Jim Chalmers

Chalmers Insurance Group

100 Main St

Bridgton, ME 04009

207- 647-3311

jchalmers@chalmersinsurancegroup com

Stacy Johansen, CIC Downeast Insurance, LLC

151 Main St Richmond ME 04357

207-373-1683

sjohansen@downeastinsurance.com

Brad Stokes

Morton & Furbish Agency PO Box 130

Rangeley, Me 04970

207-864-3334

bstokes@mfinsurance net

Lynda Holt, ACSR

Benefits Coordinator & RLI Administrator

Quinn Veregge Communications & Social Media Coordinator

Shannon Gorman, AAI Director of Education & Conferences

Lisa Veregge, CAE President & CEO

Gayle McPherson Insurance & Financial Administrator

Dan Bernier Lobbyist

“Our agency was approached by our Selective territory manager, Gregg Porter, to roll a portion of our flood business from another carrier to Selective. We were pleasantly surprised at how easy and seamless the whole pr ocess was. Gregg came into our office and basically did all the work for us. We had a high success rate and couldn’t be happier with Selective. Their customer service representatives and underwriters are very knowledgeable, friendly and always helpful. We are very satisfied with the whole experience and with Selective!” – IIABL Member

Selective makes the transfer process easy and profitable for IIABA members. Selective does not use any third party administrators for our processing, which allows us to tailor a transfer plan that works for both you and your customers. Our team will work directly with your agency to collect the required underwriting documents. Then our rollover underwriting team will handle the processing, including sending out a letter to your customers letting them know of the change We also provide you with a real-time rollover tracking report to help monitor the status of the transfer.

Selective offers competitive commissions and transfer incentives for rollover business

Selective began writing flood insurance in 1984 and has been the IIABA endorsed flood carrier since 2001. Point, click, roll and join us today!

To discuss transfer opportunities, or to place new lood business with

Selective, contact: Don Burke National Flood Marketing Manager Selective Insurance

The IA Magazine is the award-winning magazine published monthly for Big 'I' members only The content, available in print and online, gives you up-to-date articles on relevant & timely topics. Free to members.

IIABA’s bi-monthly newsletter filled with articles on issues that affect the entire independent agency system Free to members

The Big 'I' Virtual University is the smarter way to build your knowledge base through online education and research and more that 18,000 pages to find answers to tough questions Free to members

Each issue of this bi-weekly email newsletter includes articles on personal lines, commercial lines, agency management, sales and marketing, customer service, and technology and the Internet Free to members

Weekly email newsletters for Big “I” Markets (BIM) users Full of insightful/reader-friendly content regarding product information and user testimonials, Two for Tuesday is the number one resource for BIM users to stay abreast of the latest products, services and ideas for application Free to members

ACT News provides you with information on the current trends in technology for insurance agents It also features technology tools and resources available to members. Free to members.

Dive into a wealth of risk management resources available to Swiss Re Corporate Solutions policyholders Access claims prevention tools and resources along with current news and information Free to Swiss Re/ Westport Insureds.

Access tools and information that can help minimize the change of an E&O Incident

Whether you are looking for qualified leads or need help marketing your agency, Trusted Choice has tools and resources available to you, many free of charge

Members automatically get access to these materials that will benefit your business and in turn your bottom line

Let us customize a campaign ad in a format of your choice, from radio, TV and various print materials Trusted Choice marketing materials are designed with your agency in mind, and our in-house designer will customize these materials for you for free.

Access our database of pre-made consumer marketing materials including articles, images for social media or infographics to share with potential and current clients

Training Modules available to help improve your agency

Advertising 101– A nine part series designed to help you understand, design and execute a successful advertising campaign

The Power of 30 Seconds - Designed to help you maximize the experience of customers calling your agency on the phone

Leveraging Your Membership WebinarLearn how to differentiate your agency from the competition.

Digital Reviews

Digital Reviews provide a one-on-one consultation and detailed report on how you can improve your agency website and social media outlets

Trusted Choice will reimburse a portion of expenses incurred by Trusted Choice agencies in cobranding advertising and marketing materials

TrustedChoice com leverages the power of the internet to connect with consumers to help your agency grow. Members receive the basic subscription free but think about upgrading to the Advantage Profile Think of Advantage as your agency ’ s second digital door. The platform creates thousands of connections a month, giving you more opportunities to get in front of local insurance buyers you didn’t even know were looking

Real-time, one-to-one referrals.

Connect with real buyers, not stale leads with the only digital solution that delivers real-time, one-to-one referrals to you Unlike lead lists, real people with real insurance needs connect directly with a local agent at the right digital moment

Referrals based on appetite.

Writing the right business is easy with our Appetite Engine which filters digital referrals based on the types of business your agency wants to write, down to the six-digit NAICS code The added bonus? It helps new producers learn the business while writing the business

Trusted Choice® has ready to use agent materials. The Content-to-Share section on the Trusted Choice Agent Resource Website offers graphics, video and articles on a variety of insurance topics, specialty products and more. Search by topic or type of content.

Trusted Choice does the work so you can focus more on your clients.

Visit https://trustedchoice.independentagent.com/content-to-share/ to start using content today!

Through aggressive lobbying efforts, IIABA protects your interests in Washington, DC

The Big 'I' Advocacy teams fights to prevent legislation that will hurt your business and is nationally known for their effectiveness.

With the ability to disseminate information quickly, agents are kept apprised of the latest legislation impacting them and can then take this information and effectively and efficiently communicate their support, opposition, and comments to their elected officials

Do you have a connection with a current State Representative? Contact Lisa@maineagents net to discuss how you can help!

MIAA advocates at the state level on policies and regulations that impact the independent agency system MIAA oversees monitoring and lobbying at the Maine Legislature

The Big 'I' Legislative conference puts agents up front and person with Congressional Delegates through agency visits and guest speakers at the conference This is an event that you have to see to believe and is worthwhile for participates to see how the process works

Join us on the hill April 30 - May 2, 2025! See our events page for details.

Both the state (MIAPAC) and federal PACs (InsurPac & PIAPac) mean action and activity The funds are used to support those State and Federal Legislators, who view those issues important to the independent agent in the same way as we do

Zack Frechette- United Insurance, Portland

Wendy Tapley- Tapley Insurance, York

Mike Varney- Varney Agency, Scarborough

James Chalmers- Chalmers Insurance Group

Diane Champoux- Champoux Insurance, Lewiston

Ron Guerin- Varney Agency, Scarborough

Dennis Hilton- Cheney Insurance, Damariscotta

Chris Anderson- FA Peabody, Houlton

Mark Bailey, Readfield Insurance, Manchester

EJ Dorsey- United Insurance, Fort Fairfield

Savannah Harriman, Tapley Insurance, York

Stacy Johansen, Downeast Insurance, Richmond

Stephen Kasprzak- Kasprzak Insurance, North Waterboro

Danielle Marquis- HB Insurance, Oakland

Tim McGonagle- United Insurance, Portland

Laurie Noel - Cross Insurance, Windham

Jasmyn Rose- Cheney Insurance, Damariscotta

Ed Therrien- United Insurance, Presque Isle

Ken White- FA Peabody, Hampden

FOUNDER CLUB $150-$249

Laurie Billings- Sevigney Lyons Insurance, Wells

Dottie Chalmers-Cutter, Chalmers Insurance, Bridgton

Josh Fifield- Clark Insurance, Portland

Ashley Rosborough- JT Rosborough Agency, Ellsworth

Glenn Tilton- Harold W Bishop Agency, Boothbay Harbor

Lisa Veregge- MIAA, Hallowell

John Bilodeau- Bilodeau Insurance Agency, Lewiston

GENERAL CONTRIBUTORS $149 & UNDER

Lucas Anderson- FA Peabody, Westbrook

Carissa Chipman- Chalmers Insurance, Gorham

Alyssa Connelly- Dawson Insurance Agency, Bangor

Amber Dangler- HB Insurance, Oakland

Michael Donohue- Acadia Insurance, Westbrook

Travis Duval- United Insurance, Fort Kent

Mikaela Nida-Eldridge- Rousseau Insurance Agency, Biddeford

Shannon Gorman- MIAA, Hallowell

Michelle Ibarguen- Cross Insurance, Portland

Melissa Jalbert- The Hanover Insurance Group, Portland

Mike Jamison- Clark Insurance, Portland

Jessica Kezer- Cross Insurance, Bangor

Ryan Lefebvre- The Concord Group, Bedford, NH

Meesha Luce- Allen Insurance & Financial, Rockland

Ryan Madore- United Insurance, Augusta

Kelly Pfeffer- Patriot Insurance, Yarmouth

Ashley Purington- Gosline Insurance, Gardiner

Jay Soule- Yarmouth Insurance, Yarmouth

Lauren Stiles- HUB International, Cumberland Foreside

Brad Stokes, Morton & Furbish, Rangeley

Conor Sullivan- MEMIC, Portland

Eleni White- JT Rosborough, Ellsworth

Rob Wheeler- J Edward Knight, Boothbay Harbor

Finding and hiring the right staff to maintain and grow your business in an important key to your success, and likely your biggest challenge. MIAA is now partnered with CareerPlug, our recruiting software of choice to support all MIAA members in hiring CareerPlug provides an easy-to-use system that automates many of the tedious, manual steps of the hiring process

Every MIAA member receives a free CareerPlug account that comes with a branded careers page, pre-built job templates, and a configured hiring process CareerPlug's built-in evaluation tools help you confidently identify, interview, evaluate and hire the right person

If you have urgent hiring needs, we highly recommend that you upgrade the free account to paid Pro subscription at an exclusive partnership rate of of $595/year (that's less than $50 per month) for unlimited job postings to top job boards (Indeed, ZipRecruiter, GoogleJobs, Facebook Jobs, etc.), paperless onboarding, and use of personality assessments.

A one-stop resource for independent insurance agencies to identify, hire and assess top-performing producers and CSRs with the added benefit of Human Resources for agencies Big I Hires offers:

A one-stop resource for independent insurance agencies to identify, hire and assess topperforming producers and CSRs with the added benefit of Human Resources for agencies.

Lean on research from the industry's top performing agencies for strategies to improve the quality and capabilities of your employees so they can do the best job for your clients See where your agency stacks-up and tap into our studies, education and resources to set the course for success

First conducted in 1993 and updated annually to reflect new challenges and pressures facing the industry, the Best Practices survey conducted by the Big "I" and Reagan Consulting analyzes the performance of the nation's leading agencies to uncover the methods, procedures, techniques, strategies, and business practices they use to achieve superior results.

The Best Practices Study also establishes benchmarks against which agency performance can be measured and offers guidelines on how to use the study as a tool to help improve operations and maximize potential. The tools are a great resource for agency managers or principals who are interested in reviewing their operations to enhance agency performance and profitability

The heart of Best Practices is the annual report and other tools and resources are available under the umbrella all working towards the goal of an efficient and more profitable agency

Discover the opportunities and benefits of embracing diversity When you utilize our research, education and resources you will create an organizational culture that will better serve diverse markets The mission is to engage and develop a sustainable diverse agency network.

Big I offers free on-line Diversity & Inclusion training to members!

Create a Strong E&O Culture Using 6 Key Components

by Curtis M. Pearsall, CPCU, AIAF, CPIA

President – Pearsall Associates, Inc., and Consultant to the Utica National Insurance Program

Your agency’s goal should be to creating a strong E&O culture through constant and steady improvement in your E&O loss prevention approach. These tips can help:

1. Be consistent. Develop a procedure manual or identify 10 essential procedures to benefit your agency. Assign a segment of your staff to do this to foster greater buy-in.

2. Review tasks regularly. A large workload and not handling issues in a timely manner can increase the potential for E&O matters to develop. Review tasks with each staff member at least monthly and reassign tasks as needed.

3. Report claims promptly. A common issue relating to claims involves reporting to excess carriers. Develop a “Best Practices Guide” for the Claims staff. Keep in mind that agencies don’t have the authority to approve or deny claims, carriers do.

4. Document communications. Document and retain every communication involving a client’s insurance program in the client file. Memorialize discussions back to the client by written communication. This will benefit your agency if a problem develops and the client’s version of the conversation differs from yours. Remember, “If it’s not in the file, it didn’t happen.”

5. Use exposure analysis. Most claims involve a client suffering an uninsured loss. Help them understand their exposures and offer insurance solutions. This helps reduce your E&O exposure and can result in growth for your agency. Include a section addressing “other coverages to consider including, but not limited to, the following” in your proposals.

6. Check policies. Many agencies assume policies issued by the carrier or from a wholesaler are correct. Don’t. Develop a policy-checking process for new and renewal business, especially in the Commercial Lines segment, beyond “the premium is what was quoted.”

Additional Articles

·What and When am I Supposed to Document?

·Failure to Obtain/Maintain Proper Coverage

·Do Your Producers Know the Rules?

·When Using Wholesalers, You Don’t Want to Assume

This information and any attachments or links are provided solely as an insurance risk management tool They are derived from information believed to be accurate Utica Mutual Insurance Company and the other member insurance companies of the Utica National Insurance Group (“Utica National”) are not providing legal advice or any other professional services. Utica National shall have no liability to any person or entity with respect to any loss or damages alleged to have been caused, directly or indirectly, by the use of the information provided You are encouraged to consult an attorney or other professional for advice on these issues.

“Wow! So much easier than copying the check, scanning and sending, mailing overnight, etc ”

“TotalPay has saved us so much time and makes collecting payments much easier. By doing everything online, we don’t have any more hassling with mail and checks”

• Paying

• Provides

• Enables

• Eliminate time spent on premium payment collections • Provides opportunity for reduced account expenses

•

•

Big "I" Members under $50 million in revenues receive ACORD Forms subscriptions automatically with their IIABA and/or PIA Membership

Order Big "I" and Trusted Choice logo t-shirts, baseball caps, calendars, business cards, and stationery from The Mines Press and you'll know that your promotional gifts and correspondence will deliver the message of quality, as well as care.

AVYST is a fast and easy solution that will allow you to quickly prepare submissions Each form has intelligence that allows information to be keyed once and shared across all other applications and forms for that client! Type it once and you're done

eForms Wizard expedites the completion of hundreds of included ACORD forms for the commercial lines, personal and high-value clients, professional lines, agriculture, bonds, proof of insurance and more! Agents are able to build, share and edit forms across their team and send forms as a secure PDF to multiple underwriters when ready This easy-to-use solution will allow your agency staff to prepare submissions quickly and easily, eliminate redundant entry and collaborate with others to compelte applications

Big "I" Members receive exclusive discount pricing on the premier personality testing product in the industry Caliper offers a comprehensive personality assessment, which enables Caliper consultants to tell you whether an individual has the qualities needed to make it in management, supervisory, sales and similar high-level positions within your agency The Caliper Service Profile can quickly determine whether someone has the skills necessary to succeed in customer service and similar positions. IIABA members receive discounts on all Caliper testing services and products

How many times have you hired agents whom you're sure have tons of potential for selling, but once hired, they seem to fizzle out, or consistently sell fewer policies than you need? Let Sales Call Reluctance Testing help! Big "I" Members are eligible for a 10% discount on each Sales Call Reluctance Test you purchase

Every organization, regardless of size or number of employees, should have basic human resource policies and procedures in place to both ensure legal compliance and serve as a resource for employees and their supervisors Big I Hires has partnered with Affinity HR Group to provide Big "I" members with a full array of HR support tools that are customized to meet the unique needs of your agency Big "I" Members are eligible for discounts on Affinity HR Group products and services.

RoughNotes Advantage Plus is an online sales and service resource designed to help your agency better serve your customers Using this tool will lead to increased sales by improving your staffs knowledge of a prospects operation enabling them to better identify and cover customer exposures. Use the Big "I" member promo code "IIABA" to receive a $200 discount!

Imperial PFS, the nation’s leading premium finance company, is now available to MIAA member for commercial and personal lines business!

Contact Dave Round 518-222-7579 david round@ipfs com

This marketing platform combines authentic communication tools, dedicated success specialist and AI to help you build lasting relationships with your clients

MIAA members receive waived onboardinga $450 value!

InsurBanc is an independent community bank that was founded by agents exclusively for agents Organized in 2001 by the Big “I" specifically to serve independent insurance agents, InsurBanc has developed a distinctive culture helps you optimize growth opportunities and manage your agency efficiently InsurBanc can help you with custom products designed to underwrite your success

Agency Financing Perpetuation Acquisition Working Capital

Producer Development Debt Refinancing

Owner-Occupied Real Estate Equipment Leasing

A staffing solution for insurance firms. WAHVE delivers 'pretiring' talent to fill most insurance positions and at a cost savings All MIAA members receive 50% start up discount!

When you're looking for technology solutions for your agency, turn to Big I‘s Agents Council for Technology The industry's leading technology experts provide blueprints on disaster planning, cybersecurity, customer experience, and other emerging trends to help your agency Look to ACT when you are looking for best practices or if you want to influence the industry's technology direction, join an ACT meeting or virtual work group

Handling sensitive information is now one of the most critical responsibilities faced by the modern insurance agency IIABA Members have access to a multitude of resources to protect their agencies and help them navigate Cyber that is constantly changing with technology advancements and regulation You can access: How Best Practice Agencies Handle Tech Webinar:

Cyber Guide for Agencies

Cybersecurity Made Simple Webinar

Cyber News and Updates

How to Protect Your Agency Data Guide

Cyber Coverage for Your Agency and Clients

Cyber Hygiene Toolkit

IIABA’s Legal Council reviews agency company contracts to ensure that they are fair and equitable to both parties. Reviews contain recommendations for improvements to the contract language if applicable Members have access to an online library of reviewed agreements at https://www independentagent com/legaladvocacy/Members-Only/ContractReview/default aspx

Big “I” Professional Liability program and Swiss Re Corporate

Solutions pride ourselves on offering the strongest coverage form in the marketplace that continues to evolve to meet the changing needs of agents. Review the preferred policy form and you will find that these are just a few of the coverage benefits:

Rated A+ Superior by AM Best

State of the art coverage form exclusive to Big "I" Members Claimsmade coverage with full prior acts

Coverage for the sale of both Property/Casualty and Life/Health insurance products

Limits of liability up to $30 million

Broad definition of covered professional services and activities, including negligent referrals

Comprehensive definition of insured

Aggregate deductibles available

Defense cost outside the limit

$25,000 1st Party Personal Data Breach in addition to the policy limit

$1,000,000 3rd Party Personal Data Breach sublimit

No consent to settle (hammer) clause as long as policy is in force

Crisis Management coverage; up to $20,000 per policy period for fees, costs, and expenses incurred within 6 months of a crisis event, in addition to the policy limit.

Deductible reduction up to $25,000 per claim, no limitation on the number of claims

Catastrophe Expense

$25,000 per incident, $50,000 per policy period, in addition to policy limits

Regulatory defense

$100,000 per policy period in addition to the limit of liability

Key Employee Assistance, $5,000 reimbursement in event of death or unexpected medical incapacitation of a key employee

Pre Claim Assistance covering expenses as a result of investigating a potential claim

Insolvency for carriers with B or better AM Best rating

True worldwide protection

Several options to earn premium discounts up to 20%

F o r Y o u r A g e n c y

The program is adopted countrywide by IIABA. The Big “I” professional liability program offers a comprehensive program, for insurance agents, structured using a modular approach, providing solid core coverage as well as coverage units to insure against other exposures of concerns Rating is done by the gross premium volume with credit applied for expertise and loss control attendance

Since 1966, Utica has been a leader in providing quality protection for agencies in the US Their long term relationship with state associations brings additional talent and expertise to the task of protecting you and your business. Rating is done by the number of employees with credits applied for expertise and loss control attendance

I N S U R A N C E P R O D U C T S

The Big “I” Employee Benefits program provides full service group benefits for our member agents. The program is underwritten by The Guardian Life Insurance Company of America, a multi-line insurance group with many years of experience in the business and administered by a dedicated service team just for Big “I” Members. Offering Group Life, Group Short & Long Term Disability, Group Dental and Group Vision Guaranteed issue with certain requirements being met

Big "I" Retirement Services is here to help you choose a plan best meets your needs The Big 'I' has worked with more than 1,000 agencies to help them achieve their retirement goals. With over 25 years in the retirement business, the Big "I" serves as a strong advocate for participating agencies Whether it concerns a complicated transition from another provider, or perhaps a sale of the agency, the Big 'I' knows your business, understands your market, and can grasp your needs

One of the many advantages of being a member is having access to a variety of highquality, competitively priced insurance plans offered through the PIA Services Group Insurance Fund (The PIA Trust) By offering products unlike those available in the open market at rates not available on the open market, the Fund gives you the opportunity to provide yourself, your employees and families with the insurance coverage they deserve

The products offered through the Trust are basic term life, voluntary life, dependent term life, business overhead expense coverage, short & long term disability, accidental death & dismemberment & hospital indemnity

E R R O R S A N D O M I S S I O N S

Utica National works to help you protect the assets and reputation you have worked hard to build. That means giving you access to protocols and advice that can help you minimize the chance of an E&O incident.

We offer these online resources at no additional cost to policyholders.

AGENCY SELF-ASSESSMENT Use this tool to find gaps that could cause an error or omission and get advice on how to remedy those holes.

LOSS CONTROL ARTICLES Provides advice on mitigating or avoiding E&O claims.

LESSONS LEARNED Benefit from real claims examples as well as insights on what you should and shouldn’t do to reduce the likelihood of an E&O claim

TRAINING AND EDUCATION Provides tutorials geared for those new to an agency or those wanting a refresher

CYBERSURANCE Utilize the training provided to help your agency protect its computers and the personal data entrusted to you from hackers.

ONLINE COURSES AND STREAMING VIDEOS Get access to topics such as Appropriate Email and Internet Use, Dealing with Difficult Situations, and Diversity and Discrimination Issues

New material is added regularly so there is always something current to review and benefit from.

Visit Utica National’s Customer Care site to access your free risk management information at www.uticanational.com/customercare.

If you have questions, contact your state agents’ association or your underwriter at 800-598-8422.

Big “I” Flood’s partner Selective offers a unique and unparalleled approach to servicing flood customers nationwide Having been rated A (Excellent) by A.M. Best since 1930, and the endorsed flood carrier by IIABA, Selective provides the experience, dedication and service required to stand up against the competition

PIA Flood Market

PIA members earn great commissions on flood insurance sales with The Hartford a flood insurance processing center that does most of the heavy lifting for them

MIAA Staff Member Gayle McPherson is ready and willing to help you with your Market Access questions You can contact her at Gayle@maineagents net

BIM offers a suite of top tier products for you! Only for Big 'I' members, this program has no fees, no minimums and ownership of expirations Visit www bigimarkets com

The A & M personal umbrella is a stand-alone policy admitted with A+ rated by A.M. Best Company It does not require that underlying policies to be underwritten by A & M This personal umbrella provides up to $10M limit of umbrella liability coverage over the insured’s underlying policies. This Personal Umbrella policy can be written to cover up to 6 unit apartment buildings, vacant land and farm land with primary liability coverage on a personal form.

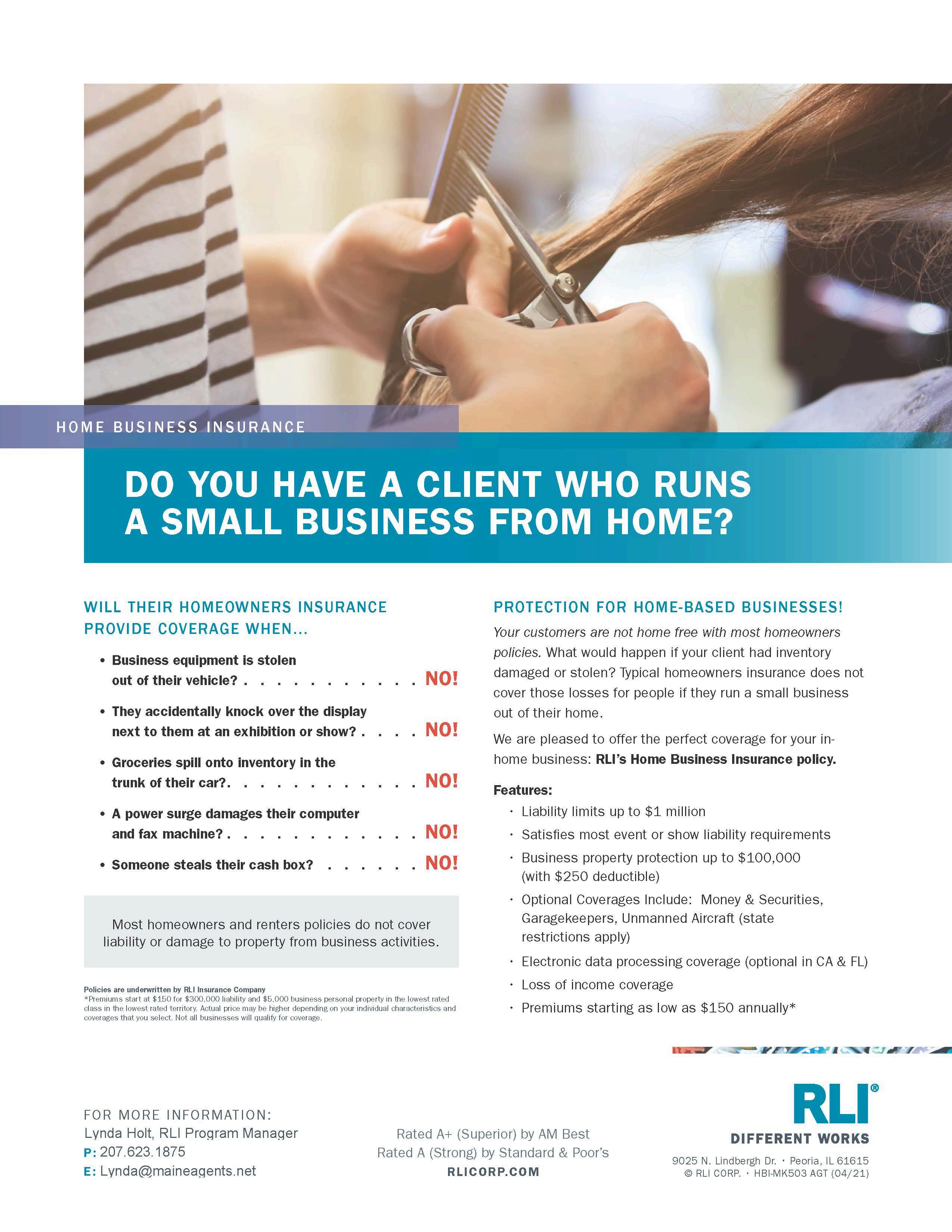

RLI's Home Business Policy provides affordable coverage for those people who operate small home-based businesses It is specifically targeted for over 100 retail and services risks operated from the insured's residence and presenting minimal product liability, professional liability and/or off-premises exposures

Eagle Agency provides Big “I” members with direct access to preferred personal lines and/or commercial lines with minimal volume commitment The program strives to fit the member’s personal lines needs by incubating until the member qualifies for a direct appointment. Eagle Agents:

Maintain Ownership of Business

Get direct access into the carrier’s portal

Earn graduated commissions based on volume

May get carrier appointment based on volume and profitability

MIAA Staff Member Lynda Holt is ready and willing to help you with your RLI questions You can contact her at Lynda@maineagents net

The stand-alone RLI Personal Umbrella Liability policy helps protect an insured against financial ruin if they are sued, even paying for defense costs Because it’ a standalone policy, underlying policies can be with another carrier or even multiple carriers

Support MIAA by participating in our outstanding educational offerings We know there are many providers in the marketplace but we are asking for your business!

Support us (buy local!) so we can continue to bring quality choices to meet your education needs.

MIAA Staff Member Shannon Gorman is ready and willing to help you with your Education questions You can contact her at shannon@maineagents net

We offer training in several delivery options to meet your needs

IN PERSON seminars - limited options based on registration numbers

MIAA has partnered with top notch vendors and instructors to bring LIVE webinars approved for CE to your office/home You can earn CE with no travel expenses and in the safety of your office or home We are continually filing NEW live webinars and have all the topics you need to meet the State Producer requirements. We also offer E&O live webinars and Ethics courses each month of the year Join so many of your peers and check out the offerings on our education calendar When you take MIAA courses Shannon will typically file your CE within 24 hours of the course with the State of Maine Insurance Bureau

MIAA Offers many courses and bundles that will meet your Maine Producer requirement CE needs Please purchase these through our website to receive an additional discount

If you utilize WebCE PLEASE register for your on demand courses through the link on our website. You get an additional discount and the MIAA gets a revenue share. WIN - WIN for you and for the MIAA!

The in-house education program is a convenient, cost effective way for your agency to custom design the continuing education program that is geared for your employees and their specific needs In-house classes give you and your employees the benefit of completing courses on YOUR terms! Virtual Training is Available

Find the courses you need by using the MIAA online Education Calendar

ACCESS THE MIAA ONLINE EDUCATION CALENDAR.

MIAA is a DIAMOND ELITE EXCELLENCE in EDUCATION National Award Winner 13 years in a row.

Getting your staff licensed is incredibly important for every agency and MIAA has you covered! We have a host of options designed to get your staff licensed.

MIAA offers an intensive three-day course to help you better prepare for the Property/Casualty Licensing exam Students are provided the materials in advanced to read and study before attending the class. Two days are spent reviewing the class concepts (based on the Pearson Vue outline) and one full day is spent on the Maine law portion of the material The class is interactive and fun! The study guide includes an online practice exam

January 21-23 - ZOOM

April 15-17 In person at the MIAA Office

July 9-11 - ZOOM

October 14-16 - In person at the MIAA Office

NOTE: If the In person registrations are low we will switch to online only You will be notified in advance of the course if we move to zoom.

REGISTER FOR MIAA PRELICENSING REVIEW CLASSES

PURCHASE PRELICENSING WEBINARS

PRE-LICENSING REVIEW SELF STUDY (P&C AND L&H)

Prefer to do Self-Study? Property/Casualty & Life/Health Licensing Books are available to order from the MIAA website. The MIAA study guide includes the Maine Laws and online practice exam

PURCHASE SELF STUDY MATERIALS

This two-day class takes a deeper look at the coverage parts of necessary personal lines insurance forms The course starts with the 2011 edition of the homeowners' form and works its way through personal lines floaters, dwelling fire forms, the personal auto, flood, personal umbrella, and even some of those miscellaneous coverage forms such as recreational vehicles, special events, and more The class will use real-life questions from insureds and actual claim scenarios to engage attendees in discussion and learning

Course Dates:

Feb 5 & 6 Virtual via ZOOM August 26 & 27 In person, MIAA Office

Presented by Dawn Halkyard, CPCU

This three-day class is designed to cover a wide array of businesses; from a small office, a one-person contractor, to a large trucking fleet or national manufacturer. This course will break down the standard ISO forms most businesses need, from property, general liability, workers' compensation, auto, and more In addition to reviewing coverages found, or not found, in the forms, the class will highlight some of the common areas for agent E&O and spend some time on service basics including the use of surveys and checklists, and certificates of insurance

Course Dates:

May 6-8 In person at the MIAA Office

Presented by Dawn Halkyard, CPCU

MIAA offers a wide range of general coverage topics approved for Maine CE We will be offering some in person seminars with most of our offerings still via a virtual platform

Continuing Education Personal Lines Analysis Schools are approved for 12 ME CE Credits

CEs are subject to change without notice. The state requires that all registrants attend each course in its entirety to receive continuing education credits. Partial credit is not given for partial attendance. Late arrivals will not receive any continuing education credits.

Continuing Education Commercial Lines Analysis School are approved for 18 ME CE Credits.

CEs are subject to change without notice. The state requires that all registrants attend each course in its entirety to receive continuing education credits. Partial credit is not given for partial attendance. Late arrivals will not receive any continuing education credits.

REGISTER FOR MIAA COURSES

Continuing Education General Seminars are approved for ME CE Credit

CEs are subject to change without notice. The state requires that all registrants attend each course in its entirety to receive continuing education credits. Partial credit is not given for partial attendance. Late arrivals will not receive any continuing education credits.

The MIAA brings to you a variety of E&O courses for CEC and for policy credits for both Utica and Westport. We offer a variety of new 3-hour live webinar courses through our online partners These are approved by Westport and Utica for loss control credits for your E&O policy If you have questions, please contact Gayle McPherson at gayle@maineagents net

With these webcasts, you can watch any course, from anywhere on demand You have access to all written materials and the course for up to 40 days.

Note we currently have available the following on demand training:

Agency Management

Business Management & Strategy

Communication

Ethics - non CE

Global & Cultural Effectiveness

Leadership & Navigation

Professional Development

Soft Skills

Note: These are NOT approved for CE

Looking for industry training for new employee, sales or leadership skills training My Agency Campus is the perfect solution! The MIAA has partnered with New Level Partners to bring online training to new hires in the insurance industry.

My Agency Campus training is on-demand, interactive and cost-effective! Select a specific curriculum package based on individual needs Exercises and quizzes provide an interactive learning experience. Individuals have four months to complete a selected curriculum. Options include:

Business Skills Training

Leadership Training

Sales Training

New Hire Training

Job Role Training

REGISTER FOR E&O CLASSES

REGISTER FOR MY AGENCY CAMPUS OPTIONS

TheMIAAbringsyoumanyoptionswhenitcomestoobtainingNationally recognizedInsuranceDesignations.

WehavediscountcodesfortheInstitutesDesignationsandwealsooffer webinarclassesformanyotheroptions.

PleasereachouttoShannonifyouwanttochataboutthedifferent offeringsavailableandwhatwouldbethebestfitforyour designationjourney.

Earningadesignationisfabulousforprofessionaldevelopmentandyou canalsoobtainCEatthesametime.

Whether you're pursuing your CPIA credential or simply looking to improve your marketing skills, you've come to the right place

CPIA Insurance Success Seminars will help you plan and improve your sales techniques to convert your prospects into customers. Learn to generate qualified leads that translate to more sales, and more commissions

Position for Success (CPIA 1) - 7 CE Credits - March 6

Implement for Success (CPIA 2) - 7 ME CE Credits - March 14

Sustain Success (CPIA 3) - 8 ME CE Credits - March 20

Full attendance at all three seminars allows participants to earn the CPIA (Certified Professional Insurance Agent) designation; no exam is required and you can begin using the designation immediately following the completion of the three programs Anyone may attend any one seminar of interest

Reaccredication Courses - May 15 & Nov 21

The CPIA program has been approved in all states that have mandatory continuing education. Click here for CE approvals.

CEs are subject to change without notice. The state requires that all registrants attend each course in its entirety to receive continuing education credits. Partial credit is not given for partial attendance. Late arrivals will not receive any continuing education credits.

The Certified Insurance Counselor (CIC) Program is a nationally acclaimed continuing education designation program Its course content and practical application make it the most essential program for both agency and

company personnel To complete the designation, you will need to complete five out of the seven options below and pass the comprehensive essay examination that follows each institute You are not required to take the two additional institutes but you will find them to be excellent update options.

Agency Management

Commercial Casualty

Commercial Property

Commercial Multiline

Life & Health

Personal Lines

Insurance Company Operations

The Certified Insurance Service Representative (CISR) program is a practical program that stresses the understanding and analysis of risks and exposures. A student should have a basic knowledge of insurance

The CISR program consists of 5 one-day courses that cover all phases of the CSR's daily work

• Agency Operations

• Commercial Casualty

• Personal Residential

• Personal Auto

• Commercial Property

You may take the courses in any order and each course is followed by a one-hour exam Anyone may attend the courses and receive the CEUs without taking the exam However, if you wish to attain the designation, you must pass each of the 5 exams To earn the CISR designation you must successfully complete the program and pass the exams within three calendar years following the passage of the first exam.

The CIC program has been approved in all states that have mandatory continuing education Click here for CE course approvals

CEs are subject to change without notice. The state requires that all registrants attend each course in its entirety to receive continuing education credits. Partial credit is not given for partial attendance. Late arrivals will not receive any continuing education credits.

The CISR program has been approved in all states that have mandatory continuing education. Click here for CE Course approvals

CEs are subject to change without notice. The state requires that all registrants attend each course in its entirety to receive continuing education credits. Partial credit is not given for partial attendance. Late arrivals will not receive any continuing education credits.

The Construction & Risk Insurance Specialist (CRIS)

The Construction Risk and Insurance Specialist (CRIS) program is a specialized curriculum focusing on the insurance and risk management needs of construction projects and contractors Those who complete the program are entitled to display the CRIS certification to certify their knowledge of construction insurance and risk management and dedication to the industry.

Benefits:

Gain specialized expertise in construction insurance and risk management

Knowledge to make wiser insurance and risk management decisions for their employees and work more effectively with their agents/brokers

Increase competence, confidence, and credibility of insurance professionals who sell to contractors

Core Courses

Commercial Liability Insurance for Contractors

Contractual Risk Transfer in Construction

Commercial Auto, Surety, CIPs, and Miscellaneous Lines

Property Insurance for Contractors

Workers Compensation for Contractors

Check the MIAA Education calendar for 2025 dates

The Management Liability Insurance Specialist (MLIS) program is a continuing education curriculum that provides an in-depth understanding of management liability exposures and insurance coverage When you complete the program you will be entitled to display the MLIS certification to certify your expertise in the fundamentals of professional liability insurance and the more specific nuances of directors and officers (D&O) liability, employment practices liability (EPL), and fiduciary liability exposures and insurance

Benefits:

Enhance the ability to efficiently create and distribute effective insurance programs

Learn ways to increase sales

Broaden your organization's market reach

Learn to deliver customer derives that drives increased retention

Core Courses

Cyber & Privacy Exposures & Ins Coverage

Fiduciary Liability Exposures & Ins Coverage

Understanding D&O Exposures

How To Insure D&O Liabilities

Employment Practices Liability Exposures & Ins Coverage

Check the MIAA Education calendar for 2025 dates

Once you complete the Designation there are digital badges available to promote your accomplishment on LinkedIn, Social Media and more!

MIAA members receive special discounts for designation programs tailored to your needs at each step in your career.

Deepen your knowledge of insurance products and build your client-centric skillset Achieve these goals and more as you earn Micro-Certs and The Institutes Designations… Plus, do it all in as little as 25 minutes a day! MIAA Members will receive a 10% discount* on AAI & ACSR online courses offered through The Institutes. Enter discount code BIGIME10 in the payment method area during checkout.

Establish a clear professional advantage and fulfill your commitment to customer service with the AAI program.

Assess and manage your clients’ risks with coverage solutions

Create a plan for success as an agent

Attract and retain clients through tailored solutions

Maximize technological solutions to manage your book of business and agency

Sharpen your understanding of coverage solutions to protect your clients personal and commercial liabilities

Understand the role of insurance in personal financial planning

Exceed client expectations to gain trust and loyalty

Understand the levels of client expectations and methods to exceed those expectations Develop strong skills for each communication channel

Recognize and minimize agency errors and omissions

Explore personal coverage including property, liability, and auto

Answer questions around commercial coverage options

Uncover and close coverage gaps

MIAA members receive a 10% on all Designations with the Institutes!

Gain the confidence and professionalism you need to stand out with CPCU®, the most trusted credential in risk and insurance.

Customize your CPCU with our Commercial and Personal Lines tracks

Build your mastery of cyber risk, financial data and statement analysis, and legal aspects of risk management

Implement corporate finance principles to protect your clients

All courses 100% online, on-demand, self-study

Associate in Claims (AIC)

Associate in Commercial Underwriting (AU)

Associate in Insurance (AINS)

Associate in Risk Management (ARM)

for ALL Designations AND SO MANY MORE DESIGNATIONS!!

*Discount excludes exam fees, custom courses, corporate bulk orders, prepaid agreement enrollments, and non-discountable materials. Discount cannot be combined with any other offers, including corporate discounts.

Visit www.maineagents.net to learn more (Education/Designations)

Participants are encouraged to focus on internal and external factors affecting the development of effective business development plans 7 CEC’s

M

r c h 1

Participants will be provided with specific tools for analyzing consumer needs; they will learn to gather prospect information and more 7 CEC’s

Participants will focus on fulfilling the implied promises contained in the insuring agreement 8 CEC’s

The MIAA and the AIMS Society have partnered to bring you the CPIA Designation Program The courses are being offered in Maine and can be taken as individual 1 day courses, or you can join us for all 3 days and earn a designation There is no exam required The material is great for new to the industry agents but even experienced agents leave learning something new! Each course does have sections that will discuss an agency’s E&O and how to avoid potential claims

LOCATION: ZOOM Presentation 8am – 4:30pm

PRESENTED BY: Dawn Halkyard, CPCU 30 minute lunch & 10 min breaks each hour Zoom presentation – strongly encourage a camera & microphone for these participatory courses

REGISTER Online at Maineagents net

Does the thought of hiring a new employee leave you overwhelmed? Are you seeing turnover, or posting a job,but just aren’t finding the “right” person?

Find the right recruits with Big "I" Hires, a one-stop resource for independent insurance agencies to identify, hire and assess top-performing Producers and CSRs.

Recruiting Support

IdealTraits can help agencies of all sizes hire top performing sales and staff with the ability to post jobs, receive candidates, send assessments and identify the right recruit through a variety of recruiting sites.

POST JOBS FREE ON MULTIPLE JOB BOARDS WITH ONE SUBMISSION!

Receive Your Candidates

Job Posting

Unlimited Candidates

Unlimited Assessments

Applicant Tracking

FIND AND RECRUIT. SUBMIT, RECEIVE AND REVIEW ASSESSMENTS.

Identify and hire who is best for your agency

/ 90 DAY ACCESS

/ 1 YEAR

PROMPT, LOCAL SERVICE –

Superior customer service and expertise by your Big “I” state association, who serves as your agent with underwriting authority offering prompt turnaround of quotes and policy delivery.

MORE PREMIUM DISCOUNTS –

Qualifying agents can save over 50% in premium discounts including risk management, claims free, agency operations improvement review, efficiency, and carrier concentration credits.

DEDUCTIBLE SAVINGS – Loss only deductible available along with deductible reduction feature offering up to 100% savings of deductible (up to $25,000) per claim.

EASE OF BUSINESS – Our qualifying policyholders enjoy the benefit of automatic renewal available with no applications along with online applications when required.

CLAIMS HANDLING – Prompt and thorough claims handling by an experienced staff made up primarily of licensed attorneys who stand ready to support policyholders with any potential incident or claim.

FLEXIBLE UNDERWRITING –

Targeting agencies of all sizes and unique operations including both P&C and L&H-only agencies.

CAPACITY – Limits up to $30M

RISK MANAGEMENT TOOLS –Policyholders have FREE access to the exclusive website E&O Guardian (eoguardian.com) and the E&O Claims Advisor Newsletter.

STABILITY - Nationally endorsed program with over 30 years experience and the largest and most stable independent insurance agency E&O program in the country, rated A+ (Superior) by AM Best.

EXCLUSIVE - A Big “I” member exclusive policy form and premium credits filed on a Risk Purchasing Group basis give Big “I” members tailored coverage.

MEMBER OVERSIGHT - A Professional Liability Committee, comprised of IIABA members, oversees and directly influences the program. Our program was designed by agents for agents.

AGENT ADVOCACY - Supports lobbying efforts protecting your industry by contributing a percentage of every premium dollar to the funding of important advocacy efforts of the IIABA.

Big “I” policyholders have easy access to an E&O risk manager when those “tricky” situations arise. Even if it’s not so tricky, but you just want to run it by someone, your risk manager is available

Your risk management department tracks the most common mistakes leading to E&O claims. With this knowledge, a series of short, informational webinars have been developed addressing these most problematic issues They are available anytime you need them.

Every month policyholders are provided access to our newsletter dedicated to guiding agents around the E&O landmines. It’s a topical, timely, unique value for policyholders.

As you know, business moves quickly and the “status quo” doesn’t stay status quo long. Occasionally, a new challenge arises that requires quick attention. When policyholders are faced with a new challenge, we conduct a “hot issues” webinar to help you navigate the new situation

Procedures manuals, job descriptions, client letters are all available for 24/7 access on a dedicated website for policyholders

Access to cyber coverage and cyber risk management; exclusive access to agency technology resources through ACT; and the Virtual University – the association’s education provider

Did you know that your Big “I” membership provides your agency access to powerful tools and discounts on our strategic non-insurance partners’ products and services?

Talogy/Caliper offers hiring assessments that help identify which person is best suited for a given job based on their intrinsic motivation relative to the role’s responsibilities

IIABA members receive 10% off hiring profiles & staff development tools.

calipercorp com/iiaba

Start collecting esignatures and online payments all at once while streamlining signing processes and lowering costs DocuSign’s simplicity allows for easy integration into your existing workflows

IIABA members receive 20% off Standard & Business annual plans.

docusign com/iiaba

Gain access to coverage checklists, commercial and personal lines risk analysis systems, important customer file documentation and more starting at just $700/agency annually ($200 savings)!

IIABA members pay deeply discounted rates compared to similar products.

independentagent com/roughnotes

InsurBanc specalizes in insurance agency financing and cash management solutions

Do business with a bank founded by and for independent agents.

insurbanc com

Open or link your IIABA UPS Savings account to receive discounts and call 1-800-MEMBERS to take advantage of UPS Smart Pickup® service free for one year.

Big “I” members save up to 34% on shipping.

savewithups.com/iiaba

Big "I" members can save up to 40% off of monthly fees with Insure Response, our U S -based insurance agency call answering service partner Forward your phones to Insure Response's insurance savvy team during lunch hours, after hours, over the weekend, on holidays or 24/7!

Save thousands annually with your Big "I" discount.

insureresponse com/iiaba

Order your Big “I” and Trusted Choice logo calendars, business cards and promotional items from The Mines Press and you’ll know that your correspondence will deliver the message of quality as well as care

Doing business with Big “I” members for over 35 years.

insurance minespress com

For more information on these member discounted programs, contact brett sutch@iiaba net or visit independentagent com/businessresources