7 minute read

2.6 Strategic Planning Investigations

2.6.1 Technical Studies

In late-2020, Council engaged various consultants to establish a robust evidence base to assist with Precinct planning:

• Shire Economic Health Check

(Prepared by .ID Consulting, December 2020)

• Shire Economic Profile

(Prepared by .ID Consulting, December 2020)

• COVID-19 Business Implications

(Prepared by McCrindle, December 2020)

• Investment Attraction Study

(Prepared by McCrindle, December 2020)

• Strategic Centres Discussion Paper

(Prepared by Mecone, January 2021)

• Retail Floorspace Analysis

(Prepared by SGS Economics and Planning, February 2021)

• Commercial Floorspace Demand

(Prepared by SGS Economics and Planning, October 2021)

• Transit Centres Parking Requirements Report

(Prepared by PeopleTrans, January 2021)

• Housing Market Report

(Prepared by Bis Oxford Economics, December 2020)

• Public Domain Audit and Analysis

(Prepared by Aspect Studios, January 2021)

• Big Data Analytics

(Prepared by Place Intelligence, April 2021)

These studies confirm that currently, Rouse Hill is predominately a population serving retail centre, with a limited diversity of employment activity. Rouse Hill represents the smallest local economy of the Shire’s three Strategic Centres, bringing in approximately $449 million worth of Value Added* in 2019 (in comparison to $5.05 billion for Norwest and $1.11 billion for Castle Hill).This contribution reflects the centre’s smaller size, early stages of development and status as an emerging centre for which the surrounding residential catchment has not yet fully developed.

The open space orientated design of the Town Centre Core and the high level of urban and retail amenity has been key to its success. However, the demand for commercial premises is expected to grow, alongside residential development in the surrounding catchment area. While there is generally consistent demand for residential outcomes, balancing the demand for residential growth whilst safeguarding capacity for employment growth beyond the immediate and short term horizon is key to growing economic competitiveness moving forward. The potential development of the Rouse Hill Hospital is a significant economic opportunity to leverage a health and commercial Precinct. This, together with the growing population catchment, integration with the older retail area of Rouse Hill, existing open space amenities surrounding Caddies Creek and infrastructure connections such as the Sydney Metro Northwest and planned connection to Western Sydney Airport, provides the right ingredients for Rouse Hill to emerge as a truly competitive mixed use centre.

2.6.2 Economic Analysis

The key economic findings from the investigations and evidence base relevant to Rouse Hill are summarised below.

A Population Serving Centre

The wider area of Rouse Hill (from Annangrove Road to Samantha Riley Drive) accommodated almost 3,700 jobs in 2016. Retail trade and accommodation and food services accounted for most of the population serving employment (70%), underscoring the dominance of the Rouse Hill Town Centre as a retail and leisure destination. The health and education sectors were the other main sources of employment (16%) with more limited employment in knowledge intensive (12%) and industrial categories (1%) (as shown in Table 2).

The centre has continued to grow post 2016, with further development activity such as bulky goods retail development occurring along Commercial Road, which has supported growth in population serving jobs. Whilst such development solidifies Rouse Hill as a major retail hub within the North West region, it is critical for the centre to diversify its employment base if it is to be economically sustainable over the long term.

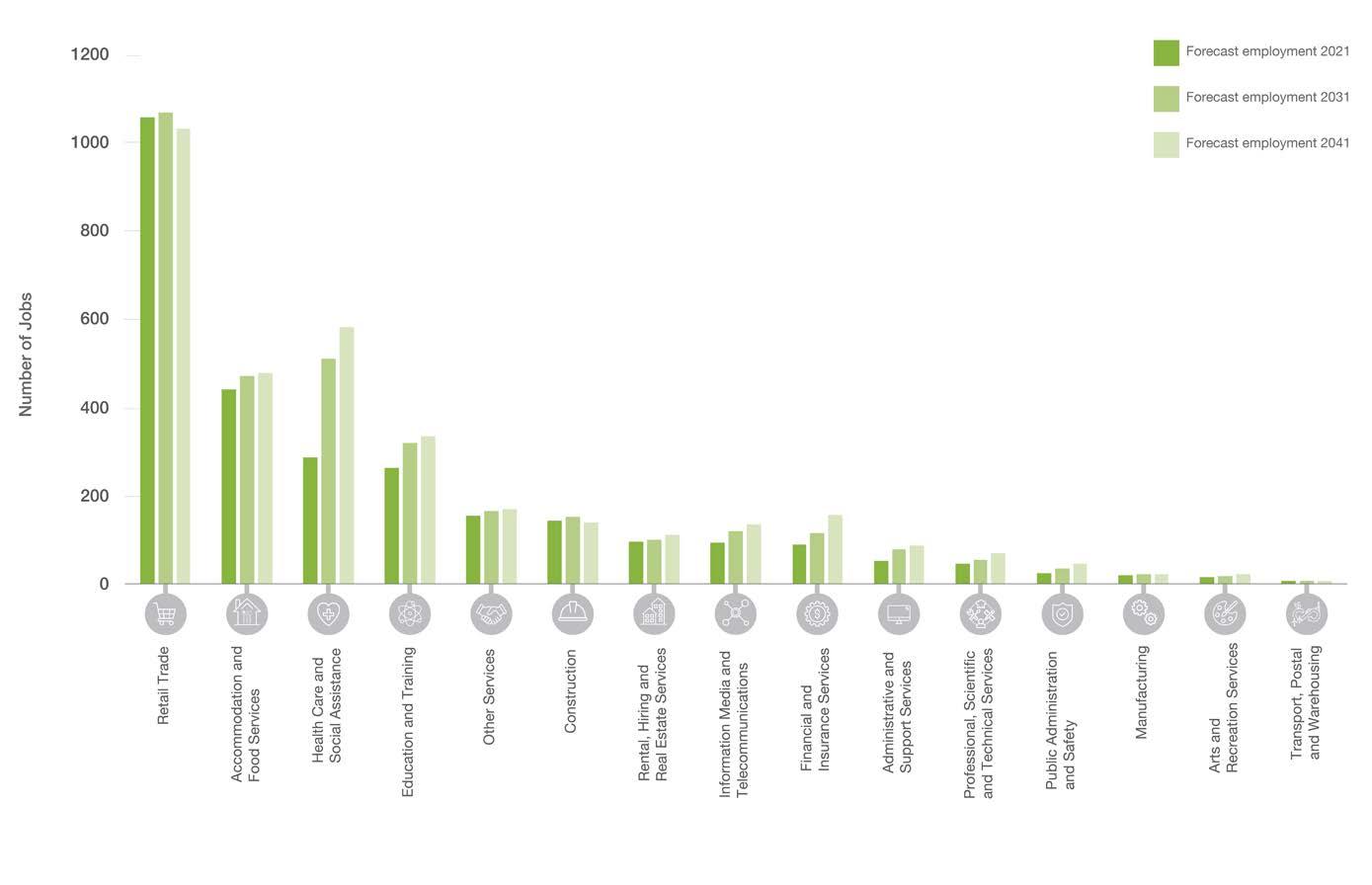

The baseline scenario for jobs growth anticipates that over the next 10 years the Rouse Hill Town Centre will grow by an additional 750 jobs and by 2041 an additional 900 jobs (SGS, 2021).

These projections are well below the targets set in the Central City District Plan of an additional 5,800-6,800 jobs to 2036 and would not deliver on key employment objectives to maintain the current ratio of jobs to the growing Shire workforce.

They do however provide an understanding of the key industries that currently provide employment to be targeted. A ‘business as usual’ trend would see that in 2041, the key industries would continue to be Retail Trade, Health Care and Social Assistance, Accommodation and Food Services Education and Training (as shown in Figure 13).

Enabling Rouse Hill to Emerge as a True Mixed Use Centre

The investment in the Sydney Metro Northwest has strengthened the Shire’s links to the Eastern City, and it is now well placed to capitalise on ‘city shaping’ projects such as the Western Sydney Airport, Sydney Metro West and Parramatta to Norwest mass transit connection.

Future job growth for both the Shire and Rouse Hill, above ‘business-as-usual’ trends, will rely upon targeting key knowledge industry sectors of Professional, Scientific and Technical Services, Hospitals, Tertiary Education and Advanced Manufacturing (medical and surgical equipment). Maximising the economic potential of the future Rouse Hill Hospital will be critical to achieving this. This investment creates an opportunity for an emerging health Precinct and an innovation cluster at Rouse Hill, with consequential opportunities for professional, research and advisory services.

It is important to balance longer term demand for commercial floorspace, which will continue to increase as the Centre evolves and as the surrounding residential catchment develops, against desire for short term residential development.

This Precinct Plan identifies the expected capacity for commercial growth, and together with Council’s Economic Growth Plan, will uphold a pivotal role in the evolution of Rouse Hill as a more diversified centre.

Retail Floor Space Demand

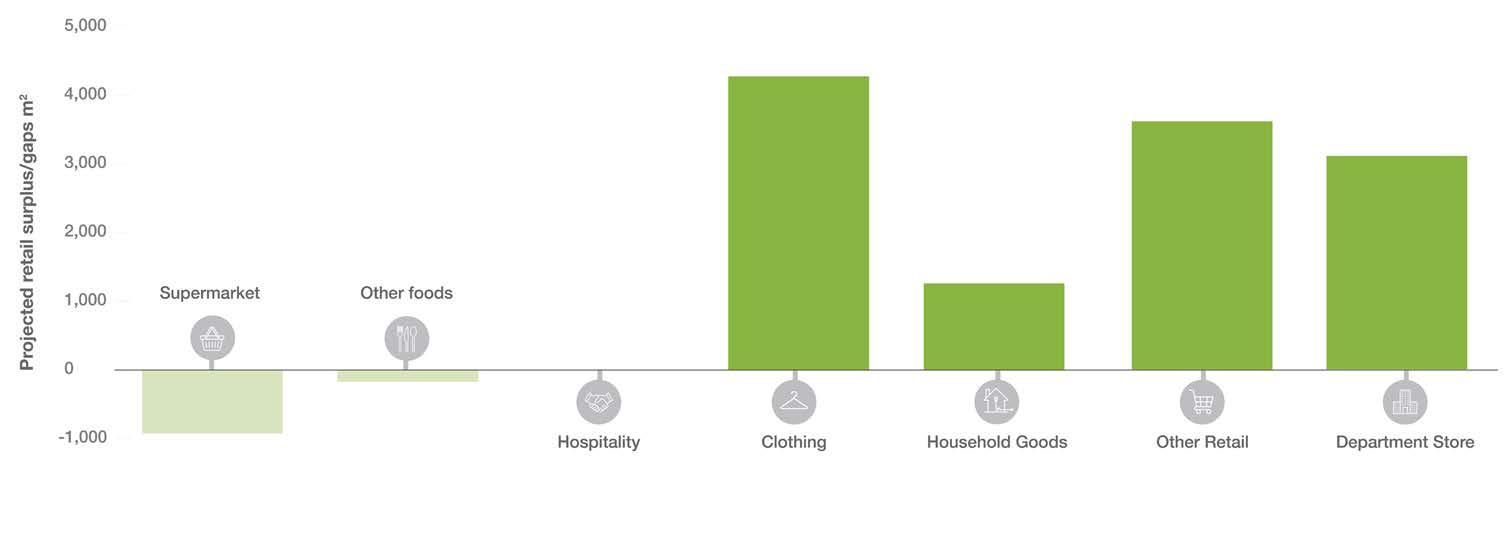

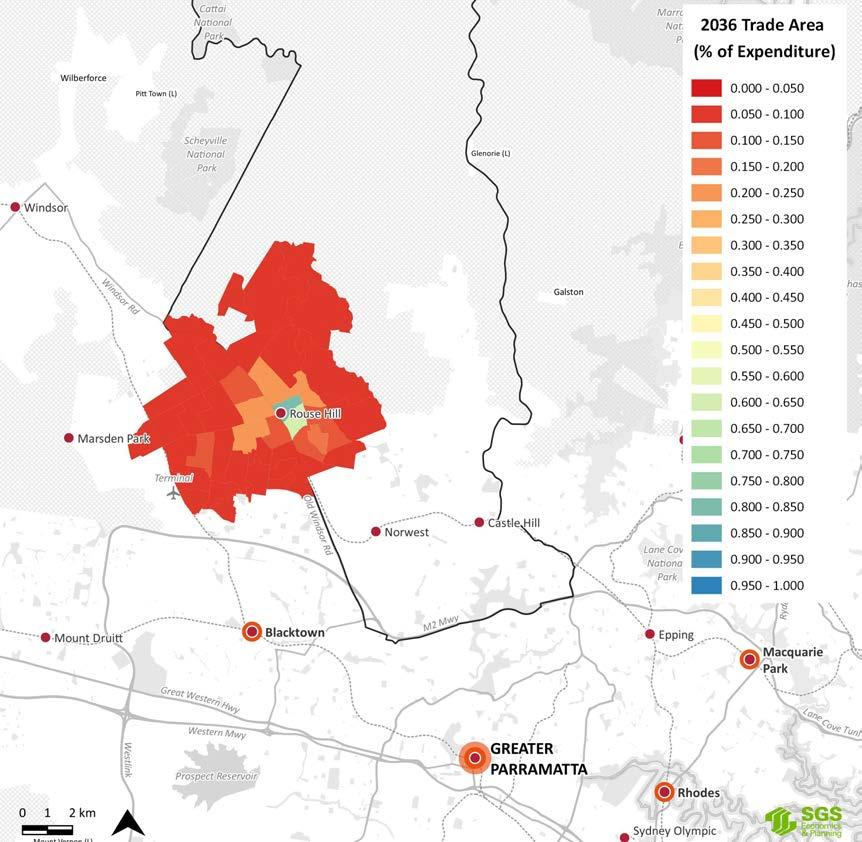

The estimated current retail floor space is 71,000m² with future floor space supply of approximately 13,200m² (SGS, 2021). The Rouse Hill Strategic Centre is projected to have a retail floorspace surplus of around 12,000m² to 2036, primarily due to the potential of new local centres that will emerge in growth areas drawing away market share. These findings account for anticipated future supply across existing and planned centres.

Combined with small retail gaps identified in the Rouse Hill Village Centre (referred to distinctly from the Rouse Hill Strategic Centre in the SGS Report as the Mile End Road Village Centre), the projected surplus for the Rouse Hill Strategic Centre (as defined by this Plan) reduces to around 11,000m², mainly comprising the three commodities most affected by the growing presence of online retail (4,150m² clothing, 3,700m² other retail and 3,000m² department store), as shown in Figure 15.

However, a potential gap of around 950m² supermarket floor space is identified across the Rouse Hill Strategic Centre. Noting the analysis identifies retail gaps for the town centres of Box Hill and Gables, SGS (2021) suggests that Rouse Hill could ‘fill the gap’ and support additional supermarket floor space of 2,000m² in the longer term. This would assist in Rouse Hill maintaining its primacy in the Region.

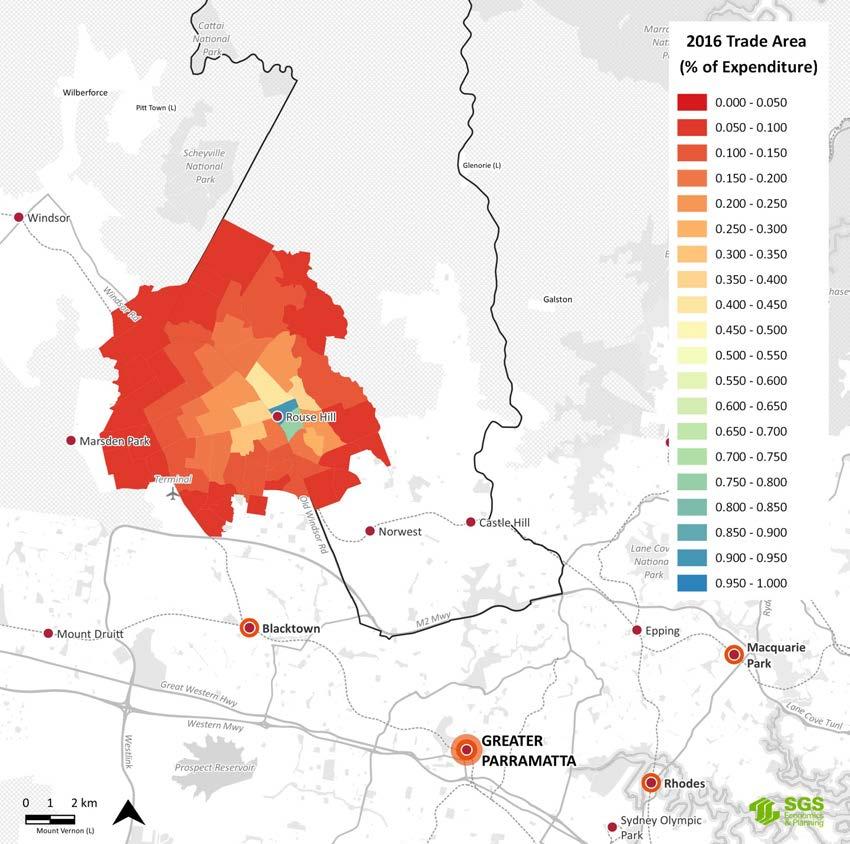

By 2036, the trade area of Rouse Hill is expected to diminish noticeably as shown in Figure 14, due to some commodity groups heading online and new retail centres opening within the Growth Areas to the north and east.

Whilst being cognisant of the impacts of additional centres, the status of Rouse Hill at the top of the hierarchy and the future growth expected post 2036 may alleviate oversupply with additional demand. Flexibility will be needed to ensure the centre can respond to changing consumer tastes and be strengthened by expansion of lifestyle and entertainment offerings. This will also be complemented by the proposed Rouse Hill Hospital in the future.

Industrial and Urban Services

Council’s Productivity and Centres Strategy (2019) identifies that the need for urban support services where people build, fix and repair things is not going to change and rather, will increase with more people moving into the area. Protecting and managing urban services land is therefore a priority, noting the scarce supply of such lands within the Strategic Centre and limited access to areas on Mile End Road and Resolution Place.

Proximity to local residential catchments and co-location with similar services are the key location determinants for urban services. Rouse Hill is highly accessible by both private vehicle and public transport and has strong exposure to the arterial road network via Windsor Road. It is served by a large and growing resident population with a high proportion of affluent households.

Protecting the pockets of industrial and successful urban services contained in the Precinct and improving accessibility gives people the opportunity to live and work close to these services.

2.6.3 Market Attractiveness

What Businesses Want

The Rouse Hill Strategic Centre has the potential to be part of a linear city that spans across the Greater Sydney Region, connecting the Region’s major employment Precincts, universities, hospitals and community services (Mecone, 2021). However, to achieve this and attract knowledge-intensive industries, it is critical that consideration be given to what businesses want and need to be successful.

The Discussion Paper prepared by Mecone in 2021 identified that office-based businesses are most sensitive to location and amenity with knowledge intensive business actively seeking to attract and retain skilled labour through their property decisions. Apart from the cost and suitability of premises for operational requirements, key selection criteria include:

• Employee Amenity: High levels of employee amenity are crucial in attracting and retaining businesses, as well as talent. This includes access to high quality hospitality, recreational facilities and other key services. Rouse Hill currently has a significant amenity offering with the existing Rouse Hill Town Centre and The Fiddler Hotel Precinct. High quality urban design and public domain areas would be highly desired by knowledge workers.

• Public Transport and Accessibility: Growing traffic congestion and work-life balance makes high quality public transport a key requirement for knowledge workers. The Rouse Hill Strategic Centre benefits from strong public transport accessibility, given its proximity to the Rouse Hill Metro Station and a variety of local and regional bus routes. Low traffic congestion and availability of parking were key attractors for industries when looking to relocate to The Hills.

• Skilled Workforce: Businesses that depend on skilled labour will select locations accordingly. The Shire has a large and growing skilled labour pool with a greater proportion of managers and professionals compared to the Greater Sydney average.

• Market Catchment: Businesses will gravitate to locations that are close to key customer and supplier pools. The perception of distance from Sydney CBD and knowledge intensive sectors in eastern and north shore suburbs is a challenge.

• Critical Mass: Critical mass of occupiers is needed for facilities that support worker amenity to be viable - cafes, restaurants, gym and fitness centres. Rouse Hill currently has only a small amount of commercial offices with inadequate critical mass. However, this is expected to change over the long-term with future uplift in the Strategic Centre.

• Suitability for Office Types: There is currently minimal office stock within Rouse Hill. Therefore, it is currently only suited to small, serviceoriented uses.

• Exposure and Surrounding Retailers: Rouse Hill benefits from strong exposure along Windsor Road, however the size and offering within the existing Town Centre make it more of a destination retail location. It is one of the largest retail Precincts in Western Sydney.

• Population Size and Demographics: Rouse Hill services a large and growing resident population with a high proportion of affluent households. The size of the Rouse Hill Town Centre and proximity to the North West Growth Areas and urban fringe means it services a significant trade catchment beyond the immediately surrounding suburbs.