FULLER LEGACY

PLANNED GIVING NEWSLETTER | Fall/Winter 2022

For three quarters of a century, thousands of Fuller graduates have served Jesus and proclaimed the gospel around the world. These faithful servants have lived out their faith in their churches, communities, businesses, charities, schools, and homes. The theological foundation they received at Fuller has transformed countless lives for Christ.

As we look to the next 75 years, we aim to educate thousands more Christian leaders to be the hands and feet of God in this world. To ensure our students gain the necessary skills to lead effectively, Fuller is engaged in a $150 million fundraising campaign. We remain committed to integrating unchanging biblical theology with practical formation and new technologies and tools. Our future alums will serve as therapists, pastors, mission leaders, activists, artists, business people, and in all walks of life, bearing fruit for Christ well into the future.

You can celebrate the seminary’s 75th anniversary by making a legacy gift to Fuller in your will or estate plan. Your gift at this time, of any size, will help us reach our goal of 75 new members in the Grace and Charles Fuller Legacy Circle by June 2023. And, your generosity will provide critical resources for the next generation of Christian leaders.

Fuller Seminary opens in 1947 in Sunday school rooms of Lake Avenue Congregational Church in Pasadena.

The inaugural class contains 39 students and reaches 250 by 1953. Current enrollment is 3,000.

Fuller annually serves students from 75 countries and 110 denominations. A total of 5 presidents have led Fuller Seminary. Globally, 44,000 alumni help expand God’s kingdom.

The Grace and Charles Fuller Legacy Circle honors and recognizes faculty, students, alums, and friends who have made a commitment to Fuller’s future. You may become a member of the Grace and Charles Fuller Legacy Circle if you’ve named Fuller as a beneficiary of your:

· Will or Trust

· Life Insurance Policy

· IRA

· Other Retirement Assets

· Charitable Remainder Trust

· Charitable Gift Annuity

· Real Estate

If you are considering or have already included Fuller in your estate plan, please let us know so we can thank you and welcome you into the Grace and Charles Fuller Legacy Circle. Contact Dasha Thomas at dthomas@thefullerfoundation.org or 626.765.8431.

In less time than it takes to brew a pot of coffee, you can make a lasting impact at Fuller.

Here’s how:

One of the easiest gifts you can make is to name Fuller as a beneficiary of one of your assets, such as your retirement plan or life insurance policy. You can do it yourself; there’s no need to use an attorney or financial advisor to put your gift in place.

Follow these simple steps:

1. Contact the administrator of your retirement plan, insurance policy, or bank account for a “Beneficiary Designation” form or simply download a form from your provider’s website.

2. Decide what percentage of the account you wish to give to Fuller and name the seminary, along with the stated percentage, on the form.

3. Sign and return the form to your plan administrator or insurance company.

4. Tell us about your gift! We’d love to thank you and welcome you to the Grace and Charles Fuller Legacy Circle.

KEY BENEFIT: Beneficiary designations offer built-in peace of mind. Your current finances are not affected because you make the gift after your lifetime, and you can change your mind at any time. And, it may reduce the taxes on your estate.

EVEN a gift of 5-10 percent of your estate can make a big difference for Fuller’s students and faculty.

Whether you’re looking to secure a fixed income that doesn’t depend on the stock market or wanting to make a contribution that won’t affect your day-to-day budget, we have an option that is right for you.

By including a gift to Fuller in your will or trust, you can make a legacy gift now and part with your assets after your lifetime. Plus, it’s simple and offers great flexibility. Please contact us for our official bequest language to share with your attorney.

If you’re 70½ or older, you can use the IRA charitable rollover (sometimes referred to as a qualified charitable distribution) to make a tax-free gift to Fuller. You can transfer any amount up to $100,000. Beginning the year you turn 72, you can use your gift to satisfy all or part of your required minimum distribution. And to continue your support into the future, you can list Fuller as a beneficiary of a percentage of your IRA.

+ Scan here to learn more

By creating a CGA, you’ll receive income for life. After your lifetime, the remaining assets will help advance Fuller’s mission. CGAs offer several benefits:

• An income tax deduction for a portion of your gift

• Partially income tax-free payments for a period of time

• Estate and gift tax charitable deductions

With a CRT, you use cash or appreciated assets (such as stocks or real estate) to fund your trust and you decide on the percentage of the payments (within IRS limits) to yourself and/or others. The trust assets remaining at the end of the beneficiary’s lifetime go to Fuller. You also receive the following benefits:

• Potential for increased disposable income

• A partial charitable deduction based in part on the trust’s fair market value

• Up-front capital gains tax saving

• Professional management of the trust

To learn more about these and other ways to support Fuller, please contact Dasha Thomas at 626.765.8431 or dthomas@thefullerfoundation.org.

California residents: Annuities are subject to regulation by the State of California. Payments under such agreements, however, are not protected or otherwise guaranteed by any government agency or the California Life and Health Insurance Guarantee Association. Oklahoma residents: A charitable gift annuity is not regulated by the Oklahoma Insurance Department and is not protected by a guaranty association affiliated with the Oklahoma Insurance Department. South Dakota residents: Charitable gift annuities are not regulated by and are not under the jurisdiction of the South Dakota Division of Insurance.

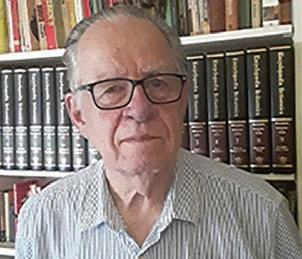

“As a young man, I was searching for some way to be better prepared for serving in God’s kingdom. I asked God for some sign that would indicate His will for me. The answer was Fuller. I decided to include Fuller in my will in the hopes that my legacy gift will provide support for future students on a similar journey in their service to God.” - Paul Birch, School of Theology 1962

Want to simplify and organize your charitable donations and ensure support of the causes you care about? A Fuller Donor-Advised Fund may be the solution. To learn more contact us at 626.765.8431 or giftplanning@thefullerfoundation.org or scan the QR code.

+ Scan here to learn more

Are you looking for a trusted investment and financial services partner? For more than thirty years, The Fuller Foundation and Fuller Investment Management Company (Fuller Investing) have been trusted partners with faculty, students, alums, trustees, friends, and supporters in providing highly personalized and customized investment solutions. Through shared Christian values, we seek to help you meet your financial, philanthropic, and investment goals. You will receive:

To learn more, please visit fullerinvesting.com or contact Todd Derrick (see below).

Todd Derrick

Vice President, Client Advisory Services 626.765.8450 tderrick@fullerinvesting.com

Dasha Thomas

Senior Director of Gift Planning 626.765.8431 dthomas@thefullerfoundation.org

Alyse Lee Director of Stewardship 626.765.8408 alee@thefullerfoundation.org

THE FULLER FOUNDATION • 135 N. OAKLAND AVE. • PASADENA, CA 91182 TAX ID #95-4124436 • THEFULLERFOUNDATION.ORG