BUYER'SGUIDE

TABLE OF CONTENTS

3

WHO WE ARE & WHERE TO START

Experience You Can Rely On

Why You Need A Realtor

4

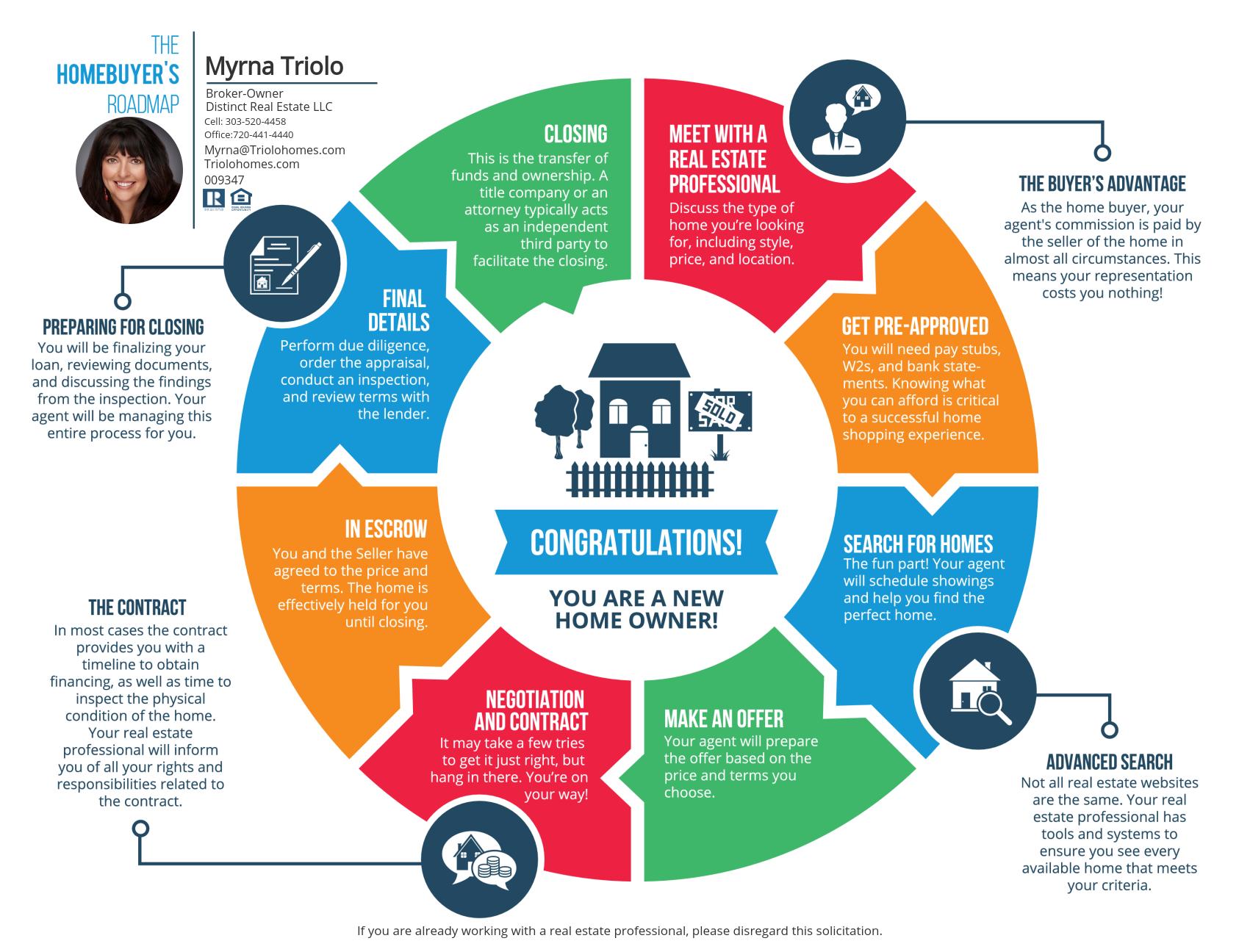

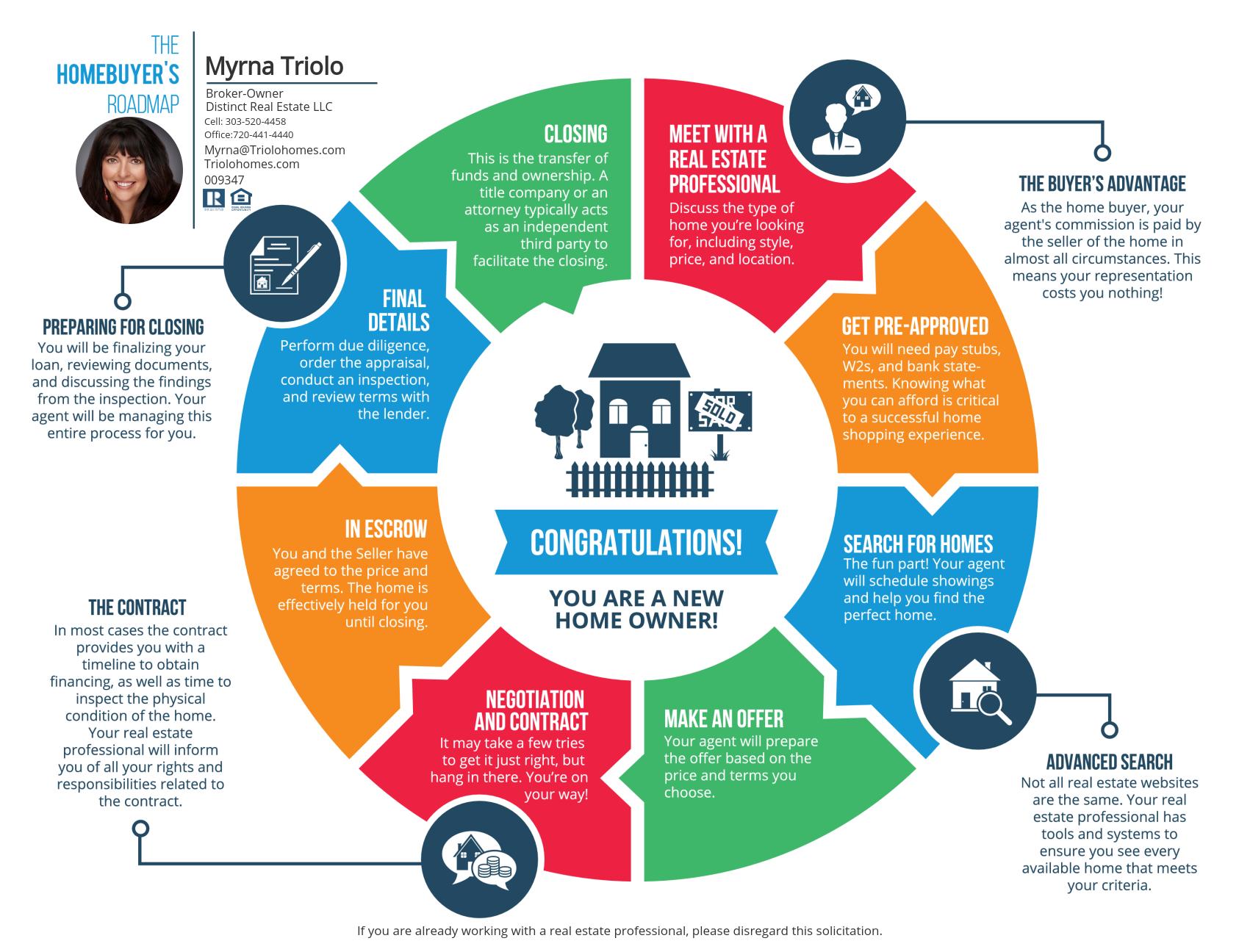

HOME BUYING PROCESS

Where do I start the Buying Process?

Why do I need a Realtor?

8

FINANCING APPLICATION, PREAPPROVAL, TYPES OF LOANS

It's important to decide how you will pay for your new home and expectations of cost

16

EXPECTED COSTS

How much should I save to buy a home

20

WHAT DOES INPECTION COVER

Can my home fail home inspection?

24

MODERN SOLUTIONS FOR BUYING & SELLING REAL ESTATE

How to become a 'Cash Buyer'

26

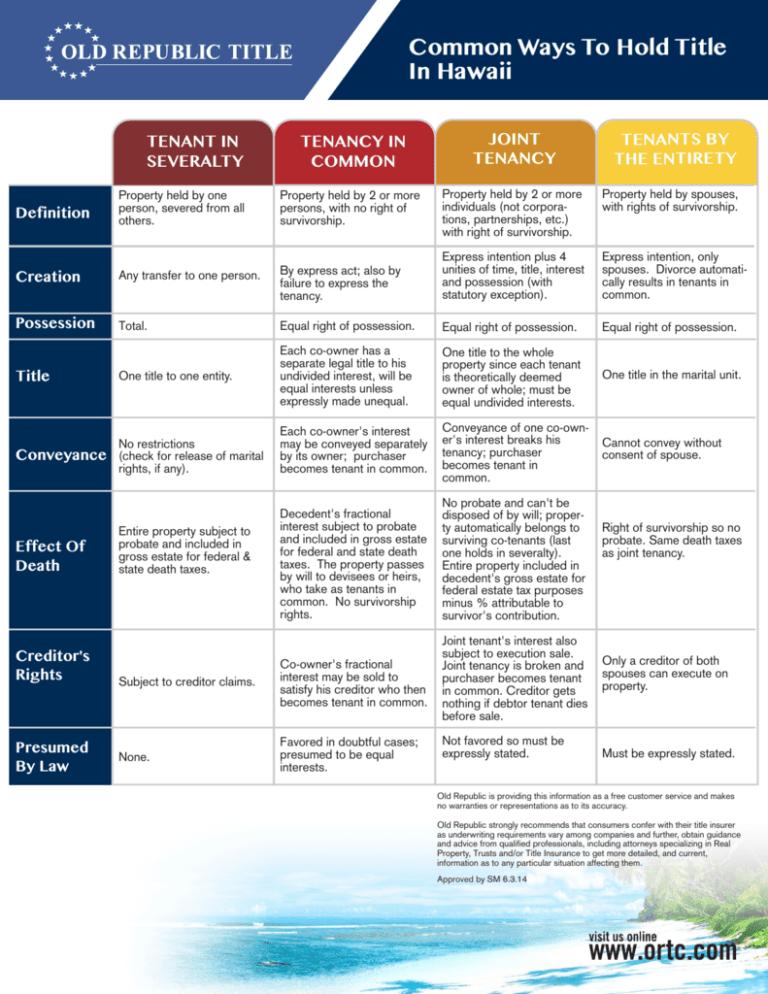

HOLDING TITLE

Know how to take ownership rights over your property,

28

TYPES OF AGENCY

Who represents who Advantages of a Buyers Agency

34

BUYER'S QUESTIONNAIRE

Getting to know you and your real estate needs

38

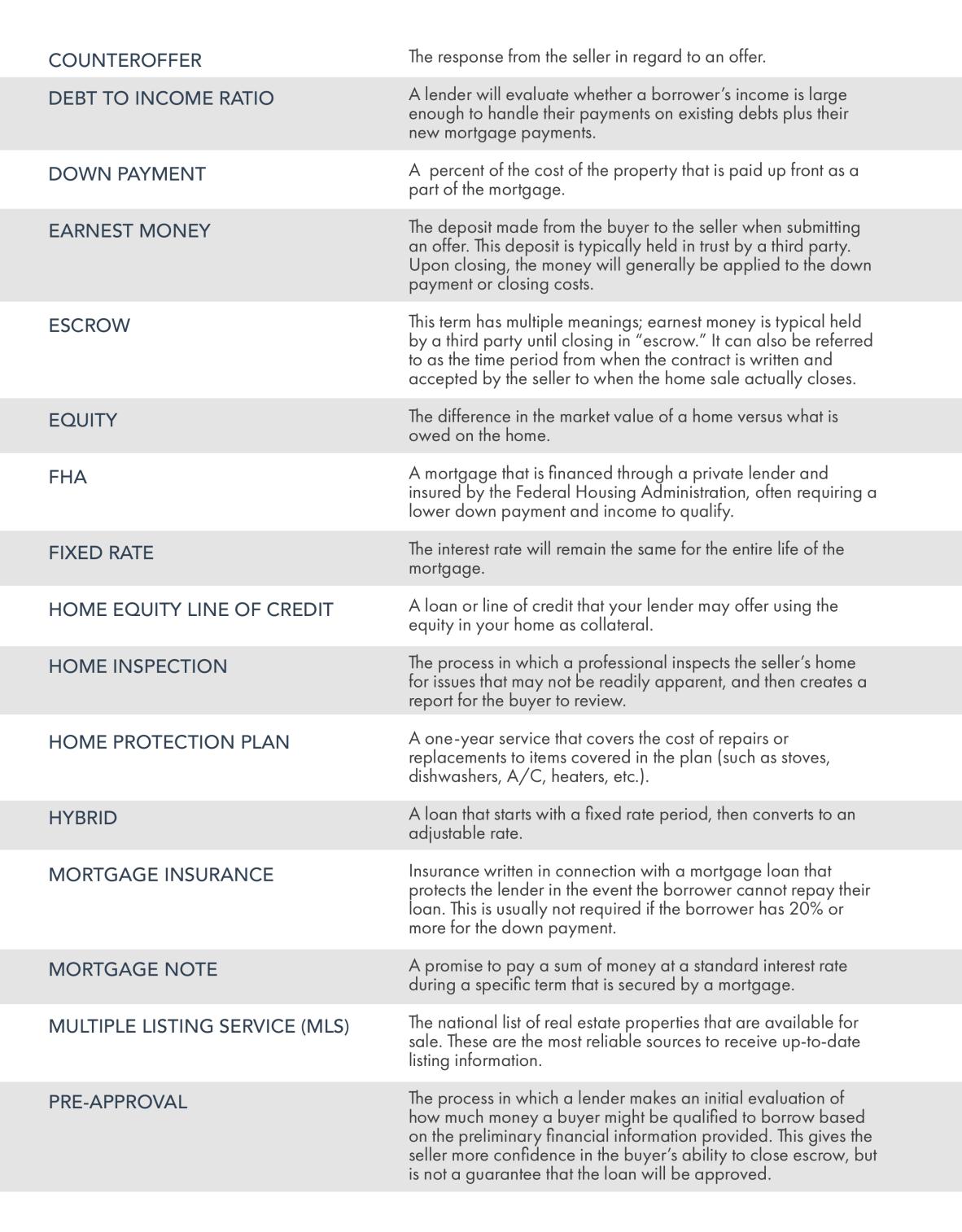

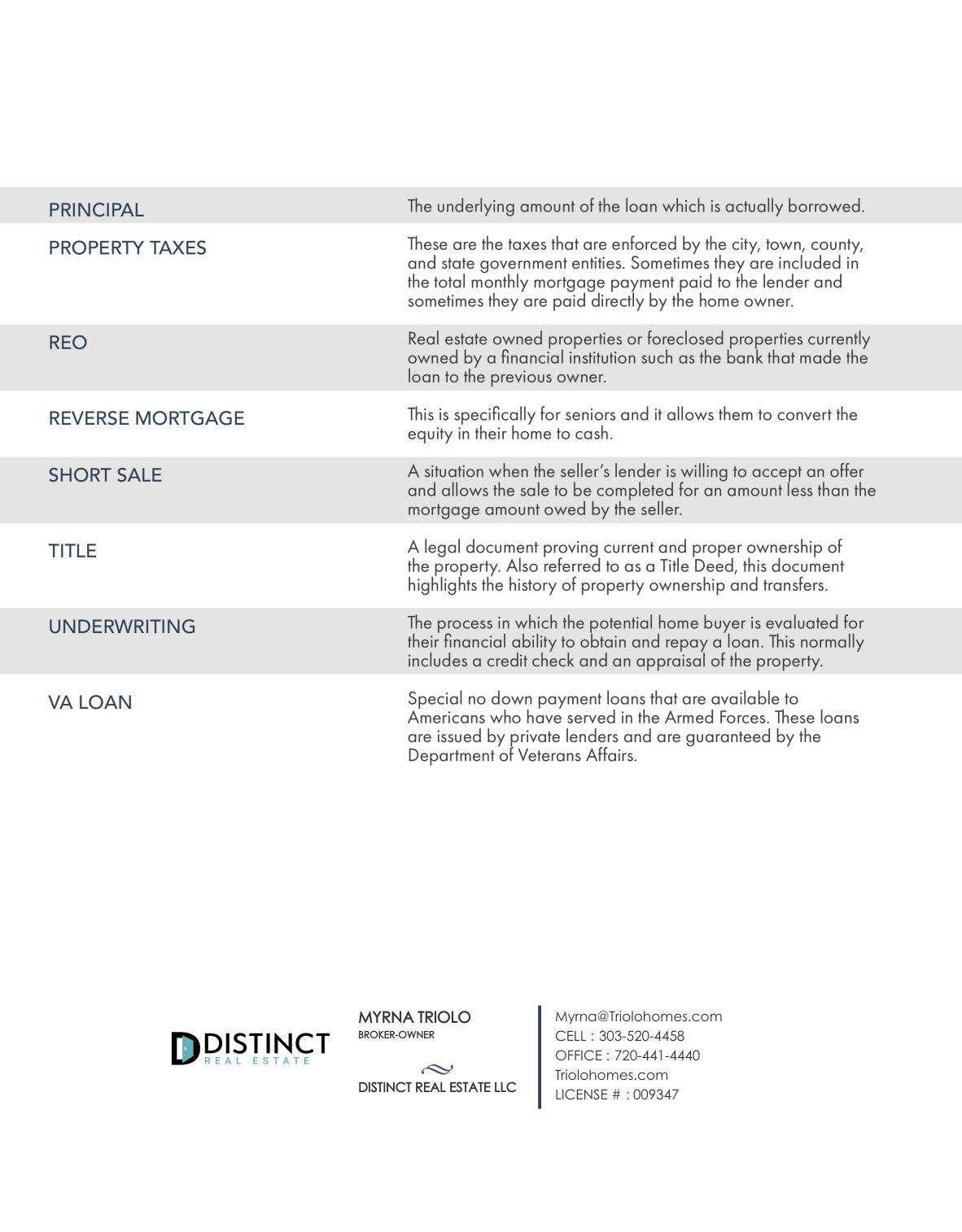

REAL ESTATE TERMINOLOGY

Understanding common real estate terms

About Theda McDonald

Theda is the co-owner of Distinct Real Estate LLC and is known for her market knowledge, negotiation/communication skills, and superior customer service that collectively creates clients for life. Her many years of management experience help her navigate through even the most difficult situations and carries the Certified Residential Specialist Designation, which only 3% of all REALTORS® hold. Theda currently sits on the Board of Directors with the Denver Metro Association of Realtors and has been recognized as an Excellence Awards recipient and 5280 Top Producer.

Theda is a member of the Denver Metro Association of Realtors, the Colorado Association of Realtors, and the National Association of Realtors In addition to helping the company’s brokers advance their careers, she serves the diverse real estate needs of clients throughout metro Denver’s northern corridor.

“I strive diligently to lead our team in Westminster in an ethical and professional manner,” Theda said. “I’m also equally focused on helping home buyers and sellers achieve their goals. I have lived in the Westminster and Broomfield areas for over 40 years and my two sons graduated from Broomfield High School, so I am very knowledgeable about the real estate market and the most desirable neighborhoods. I believe it is my duty to provide full service to my clients and to educate them through each step of the real estate process. By doing so, I have built a network of satisfied customers who provide numerous referrals throughout the year, which is greatly appreciated.”

Theda earned her real estate license in 2004. She has used her past management skills and many years of experience to focus on her business and putting a highly experienced team together to assist clients in a “Distinct" way. People matter, above all else! You matter! Theda believes that a person’s influence and success is determined by how abundantly they place other people’s interests first, which is a motto to live and work by from ‘The Go-Giver'.”

“My clients are my partners, and we work together as a team,” she said. “There are many essential pieces that must fit together in order to realize a successful real estate transaction, such as teamwork, participation, listening skills, knowledge, experience, and trust. My clients are truly my partners and I appreciate every one of them. Life is a journey and a balancing act between one’s career and personal life. I am blessed to love my career.”

WHY YOU NEED A REALTOR

As a licensed real estate professional, a Realtor provides much more than the service of only helping you find your ideal home.. Realtors are expert negotiators with other agents, seasoned financial advisors with clients, and knowledgeable of local neighborhoods. They are members of the National Association of Realtors (NAR) and must abide by a Code of Ethics and Standards of Practice enforced by the NAR. A professional Realtor is your best resource when buying a home.

ANY HOME

MONEY

I can save you endless amount of time, money, and frustration I know the housing market inside and out and can help you avoid the "wild goose chase"

I can help you with any home, even if it's listed elsewhere, or if it's being sold directly by the owner or new construction.

GUIDANCE

I will walk you though the many steps in the timeline of the transaction. The typical closing tie frame once under contract, could be be between 20-45 days

KNOWLEDGE

I am an excellent source for specific information about the community, details on home inspections and pricing I am experienced at presenting offers and can help you through the process of negotiations.

REPRESENTIATION

It is important to know how agency works and who is representing who As your Agent, I am legally required to represent you and have your best interests at hand.

LENDING

I know the best lenders in the area and can help you understand the importance of being pre-approved for a mortgage. I can also discuss down payments, closing costs, and monthly payment options the suit you

THE POWER OF PRE-APPROVAL

*Lender has reviewed your finances & determined how much you're qualified to borrow

Factors That May Impact Pre-Approval

Income Assets Debt Employment Credit History

Benefits of Getting Pre-Approval

Reveals the maximum home buying budget & what you'll need for a down payment and estimated closing costs. Your offer is more desirable and has a competitive edge in a bidding war.

You can be more confident in your ability to secure a home loan.

THE LOAN APPLICATION

Documents You'll Likely Need

For all borrowers listed on the application:

Copy of your driver's license

Copy of your Social Security card

Names & addresses of each employer (past 2 years)

Gross monthly salary (base only - overtime and bonus list separately)

Tax Returns (past 2 years)

Bank statements for all your checking and savings accounts (last 2 months of bank statements)

Names, addresses, account numbers, balances & monthly payments of all open loans.

Names, account numbers, balances & monthly

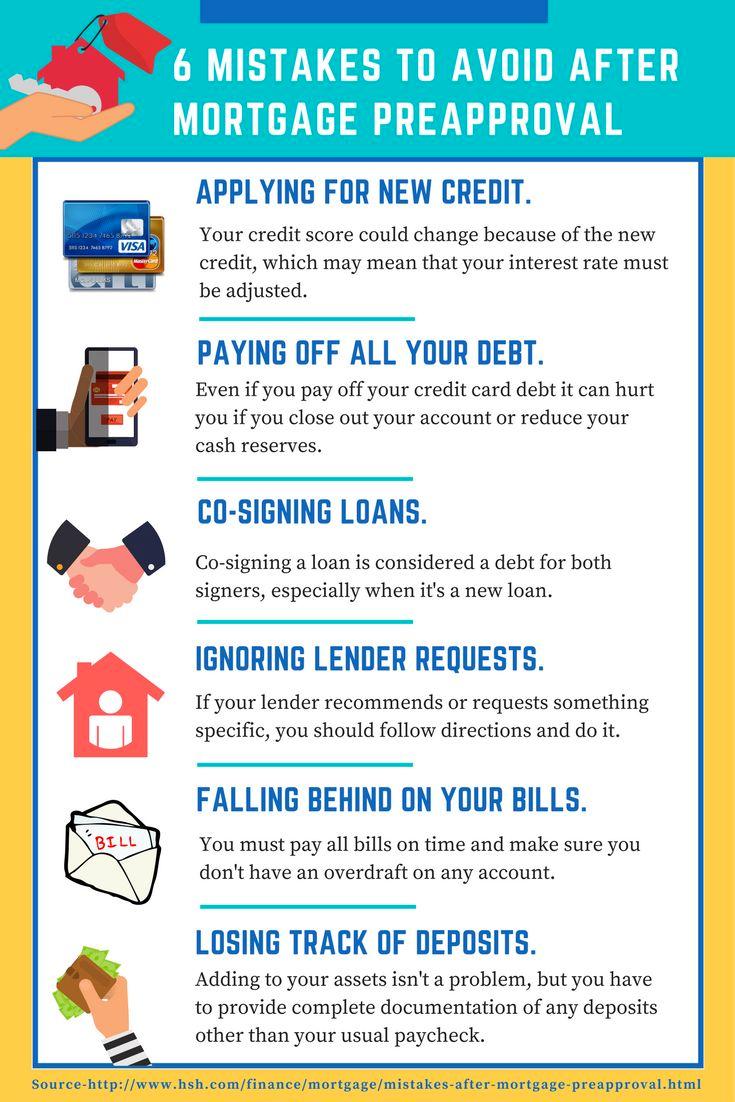

MISTAKES TO AVOID after

pre-approval

COMMOM TYPES OF

Conventional Loans are the most popular home loan because they are less restrictive, there are fewer required fees, and fewer terms to qualify.

FHA Loans is a type of loan that can allow you to buy a home with looser financial requirements. You may qualify for an FHA loan if you have debt or a lower credit score. Popular with many first-time homebuyers for these reasons.

Jumbo Loan is a mortgage used to finance properties that are too expensive for a conventional conforming loan. The maximum amount for a conforming loan varies from county to county. Loan limits are determined by the Federal Housing Finance Agency (FHFA). Homes that exceed the local conforming loan limit require a jumbo loan.

VA loans are designed exclusively for active and former military members and their families. Backed by the U.S. Department of Veterans Affairs, these loans offer great advantages to those who are serving, or who have served in the U.S. Armed Forces.

Home Loans

USDA Loan Although they’re named after the U.S. Department of Agriculture, USDA loans are not solely for farmers. The USDA loan is intended to make homeownership a reality for low to moderate-income families in rural areas.

CHFA Loans: Colorado Housing and Finance Authority (CHFA) is Colorado’s trusted partner for affordable and responsible homeownership. Through a statewide network of approved lenders, CHFA offer home purchase loans and grants; and second mortgage loans for down payment and/or closing cost assistance. They also sponsor free homebuyer education across the state to help prepare you for homeownership.

Down Payment Assistance Programs (DPA): helps homebuyers with grants or low-interest loans, reducing the amount they need to save for a down payment. There are more than 2,000 of these programs nationwide. State, county, and city governments run many of them. DPA programs vary by location.

Questions

to Ask When Choosing A

Lender

Loan terms, rates, and products can vary significantly from one company to the next. When shopping around, these are a few things you should ask about.

General Questions:

What are the most popular mortgages you offer?

Why are they so popular?

Are your rates, terms, fees, and closing costs negotiable?

Do you offer discounts for inspections, homeownership classes, or automatic payment setup?

Will I have to buy private mortgage insurance? If so, how much will it cost, and how long will it be required?

What escrow requirements do you have?

What kind of bill-pay options do you offer?

Loan-specific Questions:

What would be included in my mortgage payment (homeowners insurance, property taxes, etc.)?

Which type of mortgage plan would you recommend for my situation?

Who will service this loan your bank or another company?

How long will the rate on this loan be in a lock-in period? Will I be able to obtain a lower rate if the market rate drops during this period?

How long will the loan approval process take?

How long will it take to close the loan?

Are there any charges or penalties for prepaying this loan?

How much will I be paying total over the life of this loan?

Sean Boehmer

Mortgage Loan Officer

NMLS ID: 459697

Direct: 720.939.8384

sboehmer@spirefinancial.com

Brian Jacob Dewald

Branch Manager

NMLS # 209467

Direct: 303.908.3891

bdewald@fairwaymc.com

Alicia Alpenfels

SENIOR LOAN CONSULTANT

NMLS #: 296651

Direct: 303 710 5992

aalpenfels@planethomelending.com

Kevin Fuoco & Gina DeSantis Loan Officers

NMLS #391381 / #391376

Direct: 303.549.4145

kevinginateam@intercaplending.com

EXPECTED COSTS WHEN BUYING A HOME

Earnest Money - varies however, typically around 1% of purchase price. To be applied towards your closing costs.

$600,000 Property = $6,000

Down Payment - typically between 3.5% - 20% based off loan type & purchase price.

$600,000 Property = $120,000

Home Inspection - depends on a few factors such as the age of the home, the square footage, the systems that are in the home and additional services that you might want to add, Avg. $400- $600

Closing Costs - Overall, homebuyers should expect to spend about two percent of their home's purchase price on closing costs.

$600,000 Property = $6,000 - $12,000

Appraisal - The appraisal can cost between $500-$1,000

CLOSING COSTS Who pays SELLER’S

COST BUYER’S COST

Mortgagees title policy and endorsements

Record warranty deed

Tax certificate

State document fee

Loan closing fee

Real estate closing fee (typically 1/2)

Realty tax service fee charge

First year homeowners insurance premium

2 to 3 months hazard insurance reserves

Tax reserves (1 to 2 month)

Origination and discount fee

Survey, appraisal, credit report

Interest on the loan

Mortgage insurance premium

Water and sewer adjustments

Flood certificates

HOA dues and or transfer

fees

Loan payoff

Owners title policy premium

Release tracking fee

Outstanding taxes

Real estate taxes (Jan. 1 to Closing date)

Water & Sewer Adjustments

Real estate closing fee (typically 1/2)

Commissions

HOA dues, fees, assessments, etc.

Seller concessions & nonallowable by charges for VA loans

NOTE: This may not be a complete list of fees for your transaction, listed are only the most common.

Cost Of Waiting

WHY PAY RENT WHEN YOU COULD BUILD Home Equity RENT VS. BUY

How much are you willing to spend in rent over 15 years?

Wouldn't you rather build equity in your own home?

Buying a home could be the largest investment you will ever make. You will want to learn as much as you can about the house before you buy it

Your home inspection is not designed to criticize every minor problem or defect in the home. It is intended to report on significant damage or serious problems that require repair. If the inspector finds any potentially serous problems, they may recommend that you have a professional from that specified field inspect the situation.

Your home cannot "pass or fail" an inspection, and it is not the inspector's role to indicate whether they think the home is worth the money you are offering. The inspector's job is to make you aware of the repairs that are recommended or are necessary.

The seller may be wiling to negotiate completion of repairs or a credit for completion of repairs, or you may decide that the home takes too much time and money. With a professional inspection, you will have the information that you need to make that decision

In choosing a home inspector, consider one that has been certified and qualified as an experienced member of a trade association

I recommend being present at the inspection. You will be able to understand the inspection report clearly and know which areas need attention Plus, you can get answers to any questions you may have. Most importantly, this is an opportunity for you to see the home through the eyes of an objective third party.

Electrical Systems HVAC Systems Foundation Radon Tests Plumbing & Sewer Scope Roof

MODERN HOME BUYING & SELLING SOLUTIONS FOR EVERY SCENARIO

Modern Home Buying & Selling Solutions

Cash Offer

Get approved, through our 3rd Party Lender so that we ’ re ready to make the strongest offer possible one that’s all cash Find your dream home Make an all-cash offer. Lender will use their funds to make an all-cash offer on the house on your behalf and close in as few as 8 days.

Rent or Own, the choice is yours

Choose a home for sale and rent it! Rent your dream home while you save for a down payment You can buy the home whenever you ’ re ready, or walk away and cash out your savings.

Power Buyers for Sellers:

Through a 3rd Party Vendor, investment buyers purchase your property. They buy as-is. Sellers can even leave personal possession and trash they don’t want to bother with. Quick Close. Same as a cash buyer

Buy before you Sell. A home swap.

Buy your new home first. Put down a winning non contingent offer on your dream home and move in right away. Then sell your old house.

ThreeCommonWaystoHold Title

TYPES OFAgency

SELLER'S AGENT

Duties to Seller:

1.

2.

3

A seller's agent works solely on behalf of the seller

Duties include the utmost good faith, loyalty and fidelity

The agent will negotiate on behalf of, and act as an advocate for the seller

Duties to Buyer:

1.

The agent must disclose to potential buyers all adverse material facts about the property actually known by the broker

2.

Honest, fair dealing

BUYER'S AGENT

Duties to Buyer:

1.

2.

A buyer's works solely on behalf of the buyer

Duties which include the utmost good faith, loyalty and fidelity

3.

The agent will negotiate on behalf of and act as an advocate for the buyer

Duties to Seller:

1.

2.

Honest, fair dealing

The agent must disclose to potential sellers all adverse material facts concerning the buyer's financial ability to perform the terms of the transaction

TRANSACTION-BROKER

A transaction-broker assists the buyer & seller throughout a real estate transaction with communication, advice, negotiation, contracting and closing without being an agent or advocate for any of the parties However, a transaction broker does owe the parties a number of statutory obligations and responsibilities, including honesty and using reasonable skill and care in the performance of any oral or written agreement. A transaction-broker must also make the same disclosures as agents about adverse material facts concerning a property or a buyer's/tenant's financial ability to perform the terms of a transaction

The Advantages Of Having An Agent With New Construction

I represent YOU, the buyer. The builder Sales Agent represents the interests of the builder. I will be a trusted resource for real estate information and help you navigate the sometimes complex process of a new build.

As much as I love architecture, interior design and all that entails, I am not an expert in these areas. I will offer my expertise as much as possible. I will be able to be your sounding board, your advocate, and your boots on the ground. I will draw from my previous new construction project experiences to give advice and make suggestions. Assist in identifying a builder you can trust

Expertise in writing & understanding the contract

Closing assistance

Navigate the entire transaction.

REMEMBER - the builder requires that your Agent accompany you on your first visit to the Builder's sales office, or they will not recognize that you have representation or pay your representative's fee.

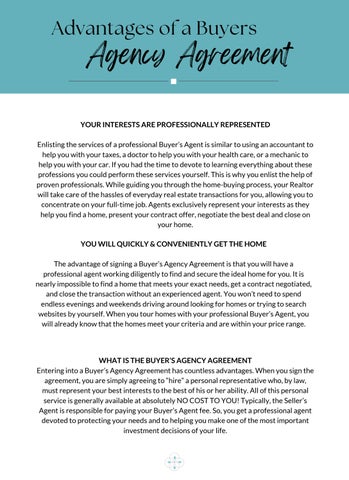

1. 2. 3. 4. 5. 6.Advantages of a Buyers Agency Agreement

YOUR INTERESTS ARE PROFESSIONALLY REPRESENTED

Enlisting the services of a professional Buyer’s Agent is similar to using an accountant to help you with your taxes, a doctor to help you with your health care, or a mechanic to help you with your car. If you had the time to devote to learning everything about these professions you could perform these services yourself. This is why you enlist the help of proven professionals. While guiding you through the home-buying process, your Realtor will take care of the hassles of everyday real estate transactions for you, allowing you to concentrate on your full-time job. Agents exclusively represent your interests as they help you find a home, present your contract offer, negotiate the best deal and close on your home.

YOU WILL QUICKLY & CONVENIENTLY GET THE HOME

The advantage of signing a Buyer’s Agency Agreement is that you will have a professional agent working diligently to find and secure the ideal home for you. It is nearly impossible to find a home that meets your exact needs, get a contract negotiated, and close the transaction without an experienced agent. You won’t need to spend endless evenings and weekends driving around looking for homes or trying to search websites by yourself. When you tour homes with your professional Buyer’s Agent, you will already know that the homes meet your criteria and are within your price range.

WHAT IS THE BUYER’S AGENCY AGREEMENT

Entering into a Buyer’s Agency Agreement has countless advantages. When you sign the agreement, you are simply agreeing to “hire” a personal representative who, by law, must represent your best interests to the best of his or her ability. All of this personal service is generally available at absolutely NO COST TO YOU! Typically, the Seller’s Agent is responsible for paying your Buyer’s Agent fee. So, you get a professional agent devoted to protecting your needs and to helping you make one of the most important investment decisions of your life.

ThedaMcDonald,Broker