BUYERS GUIDE

Whether you’re a first-time home buyer or someone who already owns multiple properties, buying a home is a major life decision and a substantial investment. With an ever changing range of listings to sort through and an intricate process to navigate, buying a home may seem intimidating.

Each agent of The Bridge Group is trained and fully-equipped with the knowledge needed to provide a world-class experience for our clients and to be a trusted advisor you can count on for guidance throughout the transaction and beyond. We lead with integrity and quality service to advise, strategize, and negotiate each home as if it were our own.

Whether it’s our proven sales approach, effective marketing campaigns, or utilization of our extensive network, at The Bridge Group, no detail is ever overlooked.

Our motto from the beginning has been developing relationships over transactions.

That’s why we make it our mission to connect buyers to a place they can call home and people to their dreams.

Many agents skip this initial interaction with their clients, but here at The Bridge Group, we hope to use this meeting to better understand your needs. We know that buying, selling, or leasing a home is an extremely important part of our client’s life, and you need to be pointed in the right direction. Thankfully, The Bridge Group is here to serve you.

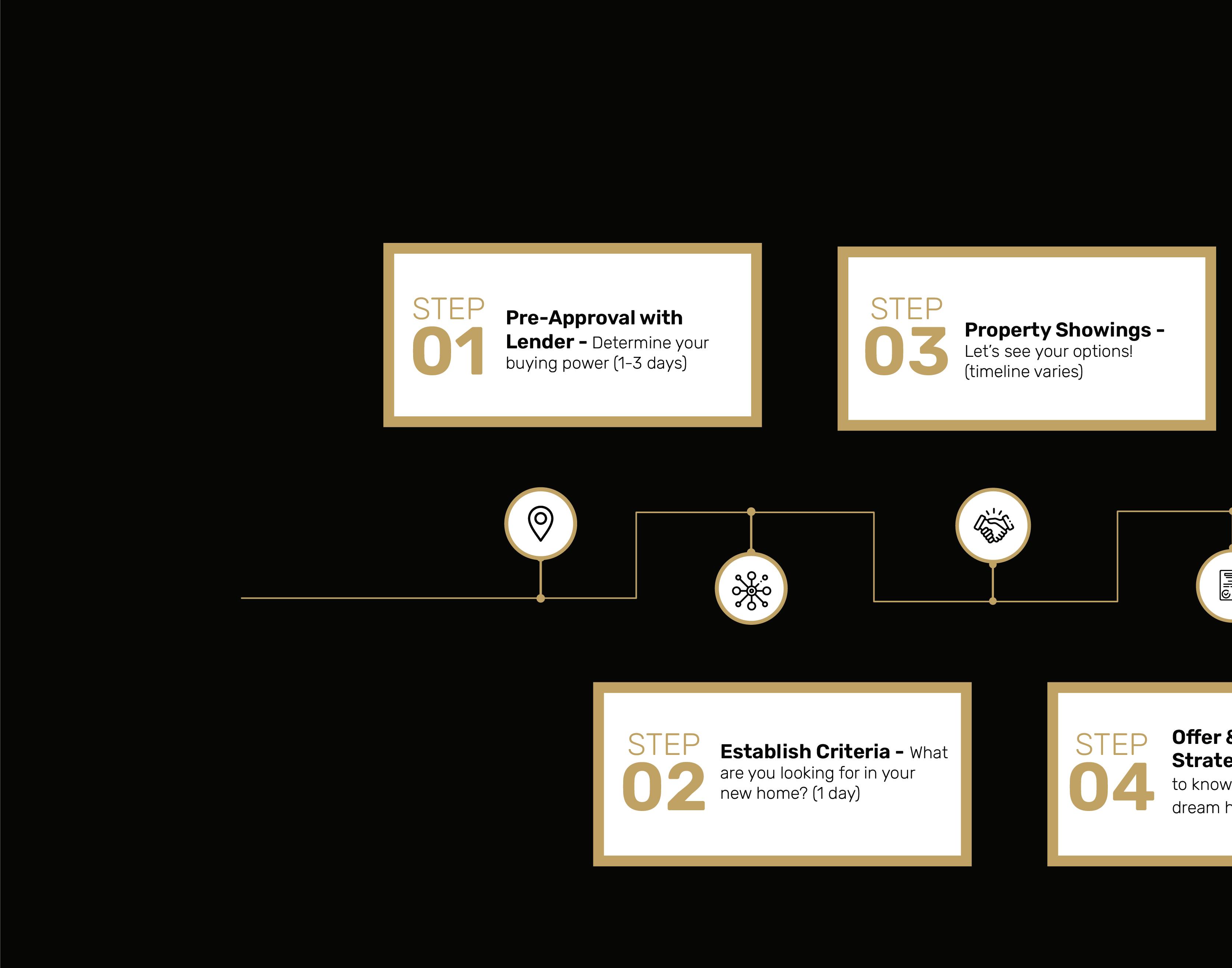

We are your personal real estate guide throughout the buying process. There are 36 steps to buying a home and we are here to provide a white-glove experience to walk you through each one. We will help you identify and clarify your real estate goals in relation to the local market.

We provide local and specific insight essential to getting you the best property for the best price without the headache. We are aware of trending areas, offer strategies, new development properties, neighborhood amenities and tax rates. We can also keep you updated on off-market properties that have not been listed.

We provide you with access to a network of highly skilled and experienced professionals that you will need along the way: mortgage brokers, inspectors, new home builders, insurance brokers, technicians, handymen, and more!

We schedule showings that align with your schedule by setting you up with a customized home search portal that keeps you up to date immediately on new listings/open houses that fit your criteria.

We attend showings with you and can advise on the property as needed. We also run a comparative marketing analysis to help you form a winning offer strategy.

We accommodate your schedule and today’s fast-paced real estate environment by having showing partners available for your convenience.

We submit offers on your behalf and negotiate with the seller/seller’s agent to secure an ideal home for you and to get you the best possible deal in today’s market.

We manage the contractual process and the back-and-forth negotiation between you and the sellers all the way up until closing.

We coordinate your closing, final walk-through and all the odd’s and ends needed until you get new home KEYS in your hand!

We will always be a future resource for you as you move into your home or need future real estate advice!

If you are buying the property with cash- congratulations you can skip to the next step!

The best way to start the home buying process is by determining your buying power. You can do this by getting pre-approved from a mortgage lender. This will help you determine a comfortable monthly mortgage payment and down payment option.

Connect with a good loan officer. See our recommended vendor list in this booklet for a few great ones. Have your recent tax returns, bank statements, and paycheck records ready to go!

Calculate with the lender how much you would like to spend on a home and discuss all your down payment/closing cost options.

Obtain a copy of your pre-approval letter and send to your realtor.

Finally, some things to consider include property taxes and HOA fees since they differ per property.

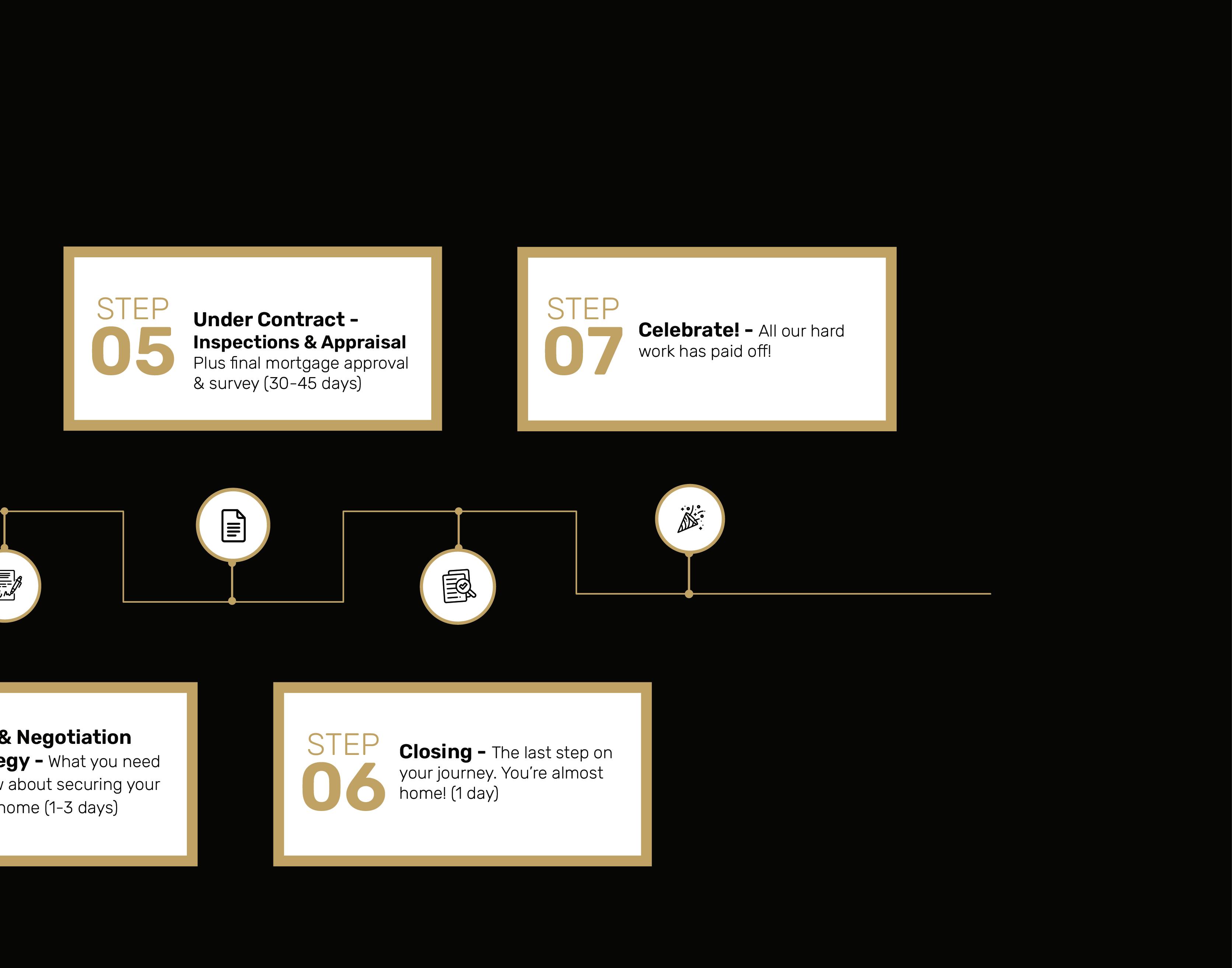

Let’s start with the fun part, deciding what you want in a home!

How many bedrooms? Bathrooms?

How far are you willing to commute?

Do you want a move-in ready home or are you willing to do a few renovation projects?

Do you have any must haves or deal breakers?

Create a list of the top two or three neighborhoods that you want to live in.

Shown to the right is a preview of our buyer criteria sheet. This chart will help us better identify your must-haves and deal breakers

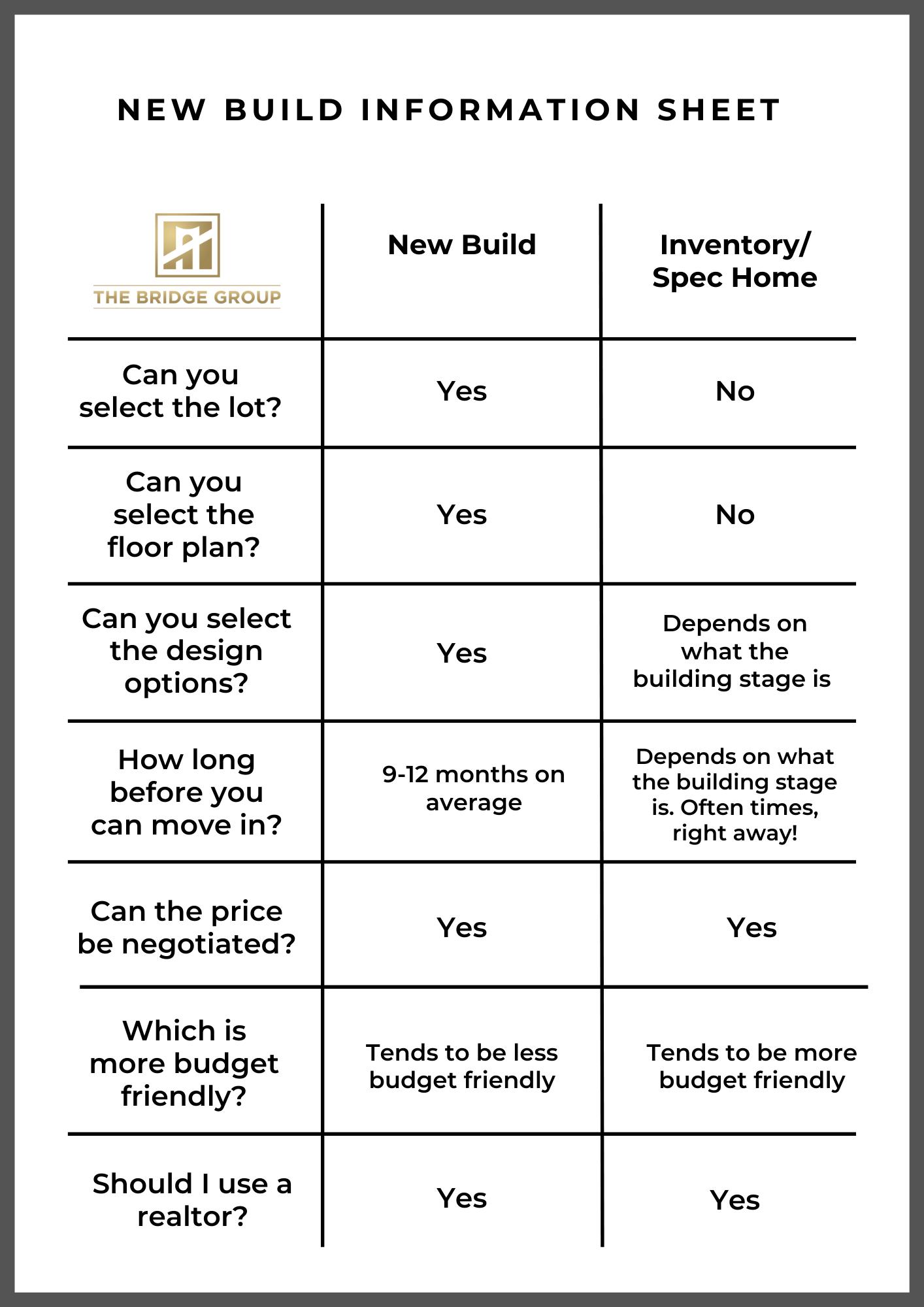

Many buyers consider new construction for reasons including low-cost maintenance, high-rated energy efficiency, the convenience of being move-in ready, the protection of a builder warranty, and modern floor plans.

Find out if new construction or building is a right fit for you by looking at the options on the chart to the right.

1. We help you find the right builder.

2. We advocate for you.

3. We assist with negotiations.

4. We can advise on resale value.

Our expert set of eyes are always on your build throughout the construction process!

As a homebuyer, you can search for homes online all day long, but you‘ll need a real estate professional to help schedule showings and for advice. Discuss with your Bridge Group Agent what times or days are best for you to view homes so they coordinate and be flexible to your schedule. Remember your agent can schedule a virtual showing for you as well!

1. During showings, you’ll get to tour the home and the neighborhood so you can get a feel for the space and visualize yourself living there.

2. This is also the time to inquire about the home’s specific details including HOA amenities if applicable.

3. If you tour a home in your desired location and price range and like what you see, reach out to us so we can make an offer fast.

Once you find the right home, it’s now time to discuss your offer strategy!

You’ve found the home you’ve been dreaming of…now what? At this point, we will want to move quickly to prepare and present an offer.

1. Your agent prepares comparative market analysis to determine estimated property value.

2. We will help you coordinate with your lender to run monthly payment estimates to make sure the home is within budget.

3. Obtain and review sellers disclosure.

4. Contact your agent to determine if they have any other written offers or an offer deadline.

Sales price

Down payment

Earnest money amount

Option Period: number of days and amount

Closing Date

Type of Loan

Number of days for financing contingency

Owner’s Title Policy paid by seller or buyer

Survey: seller provided or buyer pay for a new one

HOA transfer or closing fees paid by whom and how much

Additional Options/ Considerations:

Home warranty amount (if any)

Seller contribution amount (if any)

Non-realty items (if any)

Exclusions (if any)

Appraisal Addendum (if any)

Seller leaseback (if any)

Agent and transaction team prepare official offer.

You sign the offer electronically.

Agent and transaction team send to listing agent along with pre qualification letter.

Agent will stay in close contact with listing agent to confirm receipt and get feedback as to our offer strength (if in a multiple offer situation).

When your offer is presented, the seller’s options are to:

ACCEPT: If, after reviewing your written offer, the sellers sign, then you will have an executed contract!

COUNTER: If the sellers like some aspects of your offer, they may present a written (or verbal) counteroffer that includes the changes the sellers want to make. You are then free to accept their counteroffer, reject it, or make your own counteroffer.

Once everything is agreed upon and executed - Congratulations! It is time to move on to the “under contract” steps…

At The Bridge Group, not only will your agent walk you through this process, but our full transaction team is available to help with paperwork and deadline reminders to get you to closing.

Execution Date

Closing Date

Option Period End Date

Approval of Financing Deadline

Survey Report Due Date

Leaseback End Date (if applicable)

Write and deliver checks to title company (earnest money & option).

Inspections

Schedule inspections & negotiate repairs during option period.

Roof

A/C

Electrical

Plumbing

Foundation

(If Pool) Pool Structure / Pumps

Appraisal

Lender orders appraisal (if financing).

Title company sends title commitment.

Title has seller survey approved or title company orders new survey.

You work with lender to ensure mortgage approval.

Order home warranty if applicable.

Order home insurance.

Schedule utilities.

Schedule movers.

Move to closing steps.

We will coordinate a closing time with you and the title company that is convenient for you to attend in person. Ask in advance what options you have for closing if you can not attend in person that day.

Your lender will provide your closing cost amount, which you will need to bring in the form of a cashier’s check or wire (NOTE: you will need to call your trusted contact at the title company to confirm wiring instruction before sending due to a rise in wire fraud!). Don’t forget to bring your non-expired government issued identification, too.

Within 48 hours of closing, you’ll do a final walkthrough of the property to make sure repairs, if any, were made and that the home is vacant if no leaseback exists.

The closing table consists of signing required documents from your lender and the title company to finalize the loan and transfer ownership of the home from the seller’s name to yours. After closing & funding, you can get the keys and are officially a homeowner of your new property!

APPRAISAL - A written estimate of a property’s current value.

CLOSING COSTS - Fees associated with buying a house that your lender charges and/or you rack up from various third parties.

CONTINGENT - A status in which a house has accepted an offer but relies on meeting certain criteria, such as passing a home inspection or appraisal.

CONVENTIONAL MORTGAGE - A mortgage loan not insured by the government or guaranteed by the Veterans’ Administration. It is subject to conditions established by the lending institution and state statutes.

COMMISSION - A percentage of the sale that is paid to the real estate professional. In most situations, commissions are paid by the seller of the property.

DOWN PAYMENT - The amount of your home’s purchase price you pay upfront.

EARNEST MONEY - A deposit made by the potential home buyer to show that he/she is serious about buying the house.

ESCROW - A legal holding account. Items “in escrow” (money or property) can’t be released until all conditions are met between both of the parties.

FHA MORTGAGE - A mortgage that is insured by the Federal Housing Administration (FHA). FHA loans are designed to make housing more affordable.

FORECLOSURE - A property seized by the mortgage lender due to the homeowner failing to make full payments on their mortgage. In hopes to recover the balance of the home loan, the lender will sell the house.

FSBO A.K.A. For Sale by Owner - A FSBO is a property that is being sold by the current homeowner without the aid of a real estate agent.

INSPECTION - An inspection of the home in which a professional inspector determines the current condition of the home and its systems.

LENDER - A mortgage lender is a financial institution or mortgage bank that offers and underwrites home loans. They set the terms, interest rate, repayment schedule and other key aspects of your mortgage.

LISTING - A list of information about a home that is currently on the market.

MLS A.K.A. Multiple Listing Service - The MLS is a database that includes all available homes for sale in a particular area.

OPTION PERIOD - An agreed-upon period of time, after the buyer and seller have signed the real estate contracts, during which the buyer can terminate the contract for any reason without risking their earnest money.

PMI (Private Mortgage Insurance) - The monthly insurance payment a lender must pay if the down payment is less than 20% of the sale price.

PRE- APPROVAL - An evaluation by a lender that determines if the potential buyer qualifies for a loan and, if so, the maximum amount the lender would be willing to lend.

REO An acronym for “Real Estate Owned - A REO property is owned by the bank due to a foreclosure. REO properties can be purchased from the bank; however, they are often sold “as is”.

SELLER ASSISTANCE - Money given from the seller to the buyer at settlement to pay for part of the closing costs. The amount varies depending on what the mortgage company allows.

TITLE COMPANY - A title company helps protect you from past ownership conflicts with a home or real estate property. The title company verifies that the seller has the legal right to sell the property to a buyer. A title company can also issue a policy, called title insurance, that protects homeowners and lenders from conflicts (like title claims) that may arise from the property’s previous owners.

TITLE - A document that represents your legal right to own, use and control estate real property. So, to legally transfer ownership of a home, you must determine that the home title is free of defects, which means no one else has claims to owning the property.