Edition 02 / June 2025

Don’t Disturb, Access Granted THE BLOCK TIMES

The International Chamber of Virtual Assets

In a space moving faster than regulation can catch up, where founders speak in innovation and policymakers speak in caution, translation isn’t just helpful — it’s essential. At TheBlock., we sit at the intersection of capital, compliance, and culture, turning complexity into clarity, and ambition into alignment. Our Chamber exists to bridge the disconnects that stall progress — between builders and regulators, between investors and ecosystems, between innovation and infrastructure.

We believe that money isn’t just a resource. It’s a language — one that requires fluency in policy, legal frameworks, and market dynamics to be fully understood and properly deployed. That’s why we’ve built a system where deals don’t get lost in translation. From structured advisory to curated events, strategic talent matching to education that moves beyond theory, every layer of TheBlock. is engineered to speak the languages that matter — and connect them.

This isn’t about translation in the literal sense. It’s about context. Interpretation. Precision. When a startup walks into a room with a regulator, or when capital flows into a new jurisdiction, it’s our

job to ensure everyone is speaking the same language — the one that leads to execution. Because in a borderless industry, true access isn’t just about knowing the right people. It’s about knowing how to move with them.

Translation, in our world, means transforming innovation into regulated opportunity. It means taking the pioneering spirit of virtual assets and embedding it into the frameworks that make markets sustainable and scalable. It means ensuring that when entrepreneurs build, they are not building in isolation, but in a living, breathing ecosystem that can support their growth — legally, financially, and operationally. At TheBlock., we don’t just interpret the future. We help construct it.

The next evolution of virtual assets will not be defined by who can shout the loudest, but by who can align the smartest. As new markets open, new regulations come into play, and new forms of capital enter the ecosystem, the winners will be those who can navigate complexity with fluency — who can translate opportunity into movement, and movement into maturity. At TheBlock., we are proud to be the translators, the architects, and the builders behind that future.

THE BLOCK TIMES

THE BLOCK

This is the international chamber of virtual assets

Virtual assets were always global. What they lacked was structure. TheBlock. was built to change that. As an international chamber for virtual assets, we provide the infrastructure, access, and alignment that innovators need to scale — and institutions need to engage.

We’re not just a platform. We’re a system. From regulated licensing support and capital introductions to immersive events and cross-sector alignment, TheBlock. connects the real builders to the right frameworks. In a space defined by noise, we’ve built a chamber defined by clarity.

From founders and family offices to regulators, law firms, and ecosystem operators — TheBlock. brings together those who are serious about building, funding, and governing the future of digital finance. We don’t offer visibility for the sake of it. We focus on credibility, movement, and outcomes. Our members are here to raise capital, enter new markets, educate the industry, and deliver scalable innovation.

This isn’t a trend. It’s a transition. And we’ve built the chamber to power it.

We’ve learned that momentum isn’t created through hype — it’s created through precision. That’s why every engagement at TheBlock. is curated. Our deal flow isn’t accidental, it’s engineered. Our talent pool isn’t crowdsourced, it’s trusted. And our ecosystem

doesn’t rely on chance meetings — it’s built through intentional design. We don’t believe in exposure for exposure’s sake. We believe in results.

Through over 350 activations across eight countries, we’ve proven that structured environments lead to scalable outcomes. Whether it’s a regulatory roundtable, a token design workshop, or a founder dinner with multi-generational capital, each experience is tailored to produce impact. Our network isn’t about who you know — it’s about who knows what you need, and how to deliver it.

In a space where “borderless” is often mistaken for “structureless,” TheBlock. brings order. Not through restriction, but through enablement. We empower founders to navigate policy, institutions to explore innovation, and communities to learn with context. Because access — real access — isn’t a perk. It’s infrastructure. And in this economy, infrastructure is everything.

The chamber model isn’t just about gathering people. It’s about building with them. At TheBlock., our value is in the system we’ve created — one that transforms opportunity into strategy, and vision into velocity. This is where policy meets product, where capital meets context, and where innovation meets its next stage of maturity.

The International Chamber of Virtual Assets

Our Impact and Performance

“TheBlock. was built on one simple idea: the future of finance can’t be built in isolation. We’re here to connect the right minds, move fast, and create real-world impact, from regulation to execution.”

THE BLOCK | Editorial

Inside TheBlock. A Chamber Built for Movement

TheBlock. was founded on a simple idea — that virtual assets needed more than innovation. They needed infrastructure. Regulation. Trust. Real-world grounding.

So we built a chamber. Not a directory. Not a hub. A functional structure that connects capital with compliance, founders with regulators, and vision with execution.

Our vision is clear: a future where virtual assets are a primary driver of the global economy, and TheBlock. and its members are the ones shaping it.

Our mission is to provide the structure, access, and intelligence needed to accelerate that future. Whether it’s through capital, regulation, or cross-border collaboration, we’re here to make scaling in the virtual asset space less risky, less fragmented, and more intentional.

Headquartered in Dubai, and now active across key markets worldwide, TheBlock. operates as a gateway for institutions, startups, and ecosystem builders to engage with the digital asset economy — strategically, credibly, and globally.

Our members include blockchain foundations, venture capital funds, legal experts, tokenization platforms, governments, and service providers. Every relationship is vetted. Every interaction is designed to create outcomes, not just noise.

From over 353 events hosted yearly to $5.7 billion in facilitated deal flow, we’ve proven that a chamber can be more than symbolic. It can be operational. And it can work at scale.

We’ve established offices across Zug, Vienna, Los Angeles, Toronto, London, Dubai, Abu Dhabi, and Turkey — to ensure our reach is as global as the innovation we support.

This is not about where the industry was. It’s about where it’s going. And TheBlock. exists to help shape that path.

We don’t follow momentum. We create it.

THE BLOCK TIMES

The International Chamber of Virtual Assets

What Happens When Real Assets Go Digital?

The tokenization of real-world assets (RWAs) is more than a technological shift — it’s a reframing of how ownership, liquidity, and participation work in the modern economy. What used to be locked up in paperwork and long settlement cycles is now becoming programmable, transferable, and accessible on-chain.

At TheBlock, we don’t just talk about tokenization — we work with the projects building it, the regulators shaping it, and the investors funding it. From real estate and treasuries to collectibles and credit, the next asset class is not hypothetical. It’s already live — and it’s moving fast.

By helping our members navigate licensing, structure token offerings, and connect to capital, we’ve created a chamber where real assets get real traction. The old world of static value is giving way to digital rails that unlock yield, liquidity, and fractional ownership.

This is where access meets infrastructure. And it’s why the next wave of financial innovation won’t just happen online — it will be backed by the real world, and powered by communities like ours.

The profound effectiveness of our unique Access model lies in its inherent and dynamic adaptability; it is designed to be responsive and bespoke rather than a rigid, one-size-fits-all solution. Individuals and organizations become members of TheBlock. not because they are merely seeking to align themselves with a fleeting industry trend or to gain superficial association with a popular movement. Instead, their engagement is driven by a clear recognition of specific, often complex, fundamental gaps within their own operations, strategy, or market positioning that are hindering their progress. These are not trivial issues but core challenges that require sophisticated, tailored solutions, and our members join with the explicit expectation that our model can provide the precise support needed to bridge these critical deficiencies, whether they lie in strategic network development, resource acquisition, regulatory navigation, or market intelligence.

This deeply personalized and strategically integrated approach to providing access is not a peripheral service or something we delegate to external parties; it is absolutely core to the fundamental way we operate and defines our very identity as an organization. The cultivation and management of these access points, the strategic thinking behind each connection, and the commitment to tailoring support are all handled in-house by our dedicated team. This internal stewardship guarantees a level of quality control, a depth of understanding regarding our members’ evolving needs, and a seamless, integrated experience that would be impossible to achieve through outsourcing. Ultimately, it is this unwavering commitment to providing adaptive, curated, and strategically vital access as an intrinsic part of our operational DNA that not only delivers tangible results for our members but also fosters a profound sense of partnership and trust, which is precisely why our members choose to stay and grow with us over the long term.

THE BLOCK TIMES

Dubai didn’t sleep. Neither did we — real access works overtime.

THE BLOCK | Editorial

At TheBlock., our philosophy transcends the conventional understanding of merely hosting events; it is an ethos deeply embedded in the meticulous creation of environments where true progress is not just discussed, but actively ignited. We don’t simply book impressive venues and manage the surface-level lo-gistics of a gathering. Instead, we meticulously build chambers of consequence. These are far more than fleeting assemblies; they are purposefully designed and carefully curated ecosystems where significant, often pivotal, dialogues take place. Within the-se chambers, critical connections are forged – not by chance, but by design – and the very future of the digital asset space is actively shaped through collaborative ideation and strategic alig-nment. Our strategically conceived experience centers, often si-tuated at the epicenters of global innovation, exist precisely for moments like these. These are critical junctures, inflection points where the true, lasting value lies not in the performative specta-cle of who commands the stage, but in the collective expertise, the concentrated influence, and the shared forward-looking vi-sion of who’s in the room. The profound emphasis is always on substantive, high-impact interaction, on the quiet yet powerful exchanges between decision-makers and innovators – the kind of focused engagement that drives real, measurable progress, rather than fostering an atmosphere of passive observation or fleeting social encounters.

We firmly believe, and operate on the foundational principle, that meaningful access is earned, not announced. This isn’t a privile-ge that can be bought or claimed; rather, it is the organic result of consistent, unwavering dedication to quality, a proven and demonstrable ability to convene precisely the right individuals at the right time, and a deep, nuanced understanding of the com-plex and ever-evolving needs of the blockchain

ecosystem. This commitment means we aren’t driven by the pursuit of superficial noise or fleeting visibility for its own sake. Our focus is steadfast-ly on cultivating profound trust – trust earned through discretion, neutrality, and consistent value delivery – and on facilitating tan-gible outcomes that resonate powerfully and create lasting ri-pples long after the specific event concludes. These outcomes manifest as new ventures funded, groundbreaking partnerships formed, regulatory frameworks clarified, and innovative solutions architected. And in Dubai, during the high-energy, transformative crucible of TOKEN2049, we earned this access and this trust – over and over again. Each meticulously curated session, from in-timate VVIP investor roundtables to broader regulatory forums, each strategic introduction that bridged previously disconnec-ted entities, and each successfully facilitated, outcome-oriented discussion was a clear testament to this core principle. These moments collectively reinforced our role not just as event organi-zers, but as a trusted, indispensable nexus for capital, pioneering innovation, and critical regulatory insight.

The energy throughout these enga-gements was palpable, an almost electric charge signaling a sig-nificant acceleration of trends and transformations that we at TheBlock. have long anticipated and actively worked to foster. And TheBlock. was right in the middle of it all, not as passive ob-servers on the sidelines, but as proactive, engaged architects and a vital, dynamic conduit. We see our role as helping to meti-culously weave together the diverse and often complex threads of this rapidly evolving, increasingly integrated global future. Our unwavering commitment is to continue identifying, creating, and fostering these crucial interactions, these chambers of con-sequence, that collectively propel the entire industry forward towards greater maturity, adoption, and positive global impact.

Side Events. One Mission. 150

While most were choosing which stage to sit in, we were moving through the rooms where conversations turned into capital. Over the course of TOKEN2049 week, TheBlock. team showed up at more than 150 side events — from private breakfasts and investor roundtables to protocol lounges and late-night sessions.

Not to be seen, but to connect. To map the ecosystem, understand the pain points, and bring it all back to our chamber. That’s access. That’s TheBlock.

We walked in with intention and walked out with insight — collecting real signals from the noise. These moments, often unplanned yet deeply strategic, reaffirm our commitment to staying embedded in the movement, shaping it from within, and channeling it into value for our members and partners.

The International Chamber of Virtual Assets

Experiences & Spaces

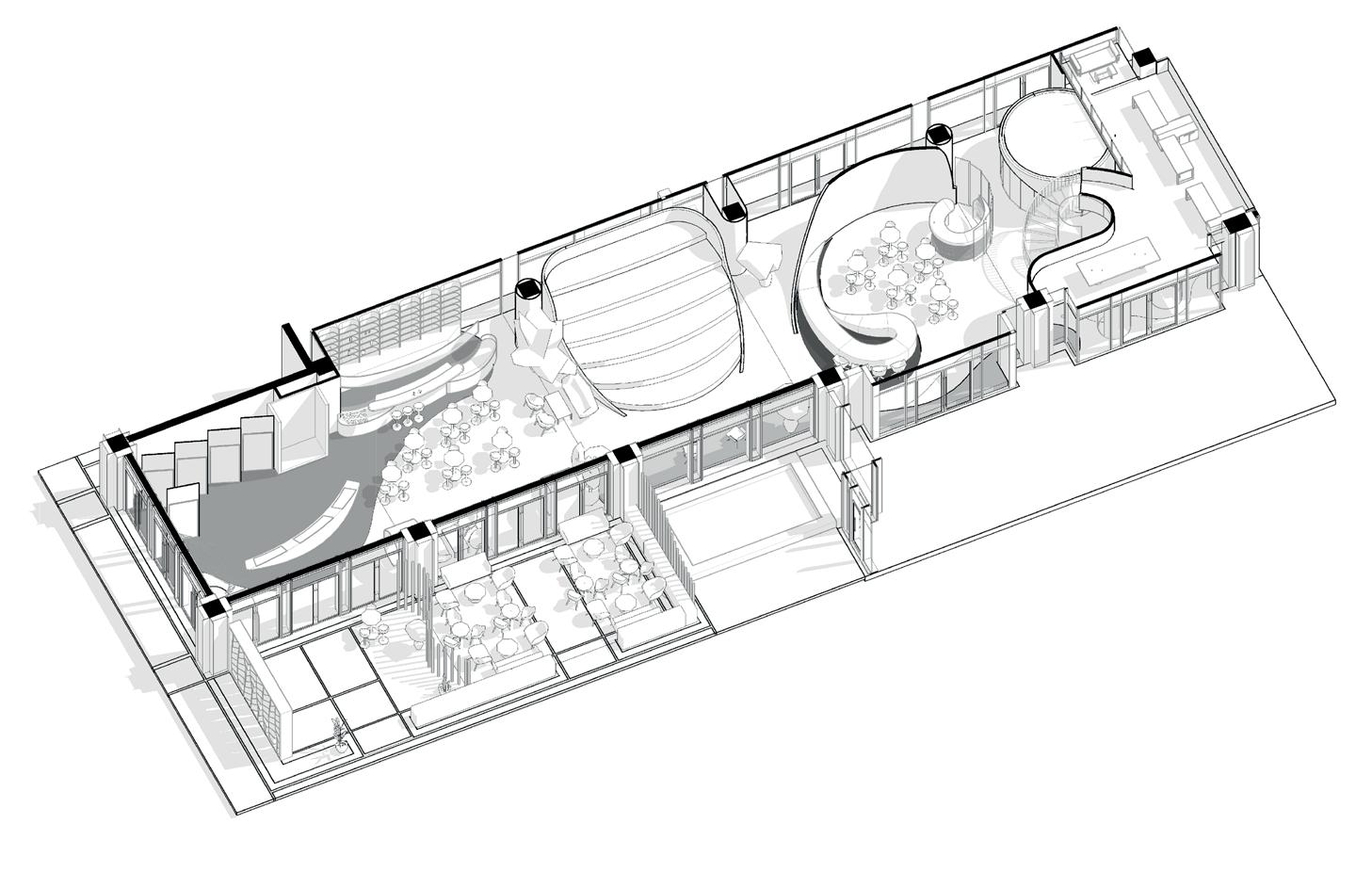

TheBlock. Tower – our capital, compliance, and licensing headquarters in Dubai’s Convention Tower.

TheBlock. Decentral – an immersive experience and events center in One Central, built for activation.

The World Builds Here A Permanent Exhibition Center

Over 3M visitors, 3M+ brand impressions, and a global ecosystem under two roofs.

THE BLOCK | Editorial

The future of the virtual asset economy doesn’t just happen online. It happens here—inside purpose-built venues designed to bridge ideas with execution. At TheBlock., we believe physical space still plays a vital role in driving momentum. That’s why we’ve developed two flagship hubs in Dubai: The Virtual Asset Chamber Exhibition Center at Convention Tower in Dubai World Trade Centre and TheBlock. Experience Center at One Central.

Together, these twin venues form the architectural backbone of our ecosystem. They host everything from investor roundtables and regulatory forums to hackathons, startup exhibitions, and exclusive product launches. With over 40,000 annual visitors and 30,000+ direct engagements at TheBlock. Decentral Experience Center, these spaces aren’t for show— they’re where partnerships begin, capital gets mobilized, and deals get done.

The Virtual Asset Chamber Exhibition Center, located within Dubai World Trade Center, serves as a living exhibition for what’s next in Web3. Permanent brand activations by ecosys-

tem members coexist with rotating showcases from startups, institutions, and regulators. It’s not uncommon to walk past a hackathon on one floor and a closed-door capital discussion on another. With an annual visitor base of over 2.7 million at DWTC, the exposure potential is unmatched.

Meanwhile, TheBlock. Decentral Experience Center at One Central delivers intimacy and intention. Designed to host workshops, high-level advisory sessions, and community experiences, it functions as our heartbeat—the space where members reconnect, regulators weigh in, and founders exchange lessons in real time. The programming is curated. The access is controlled. The outcomes are real.

For our members, these venues aren’t just event locations— they’re operating leverage. Whether you’re onboarding investors, presenting a tokenized product, or negotiating your next strategic expansion, our spaces provide the context, credibility, and connectivity you need to make it count. We’ve seen startup pitches evolve into global partnerships within these walls. We’ve watched first-time founders become recurring contributors to policy discussions just a few events later.

Both spaces also serve as engines of visibility. With over 3 million brand impressions annually across physical signage and digital broadcasting, our venues help members move from presence to prominence. They’re not backdrops—they’re platforms. Spaces where your brand isn’t just seen, but remembered.

And this is only the beginning. With more global activations coming, TheBlock’s venues will continue to scale their reach, deepen their programming, and drive our chamber’s mission forward: to make access actionable and bring the virtual asset economy closer to reality.

In a world still struggling to convert talk into traction, we’ve built the infrastructure to do both. This is where ideas become actions. This is where the future finds its floor plan.

Inside the Chamber That Connects It All

TheBlock. isn’t an accelerator or a platform. It’s the International Chamber of Virtual Assets— connecting the categories that make the industry work.

Our Backers represent venture capital firms, family offices, institutional investors, and funds that believe in early alignment and long-term partnership. On the Support side, we bring in law firms, tax advisors, regulatory experts, and operational partners — because growth without compliance is short-lived.

The Chamber model at TheBlock. is designed to create natural collaboration between the people building the infrastructure and those regulating, funding, or scaling it. Unlike open-access networks, every member of TheBlock. is vetted and placed in a structure that reflects their purpose in the ecosystem.

Our Builders include blockchain protocols, infrastructure developers, custodians, and technology operators — those laying down the foundation for the next chapter of finance. Our Starters are solving everything from tokenization to payments to gaming mechanics.

We also bridge the real world. Entertainment partners, luxury groups, lifestyle platforms, and concierge networks make up our Entertainment category, opening up lifestyle and event integrations that elevate brand value and member experience. Finally, Connectors: public and private sector bridges, media groups, educational bodies, and PR firms — the infrastructure around the infrastructure. Together, these members form the Chamber. And together, they drive measurable movement in an industry that needs structure, not just participation.

THE BLOCK TIMES

It’s become popular to say that the virtual asset space is borderless. That anyone, from anywhere, can plug into the next wave of the internet. But while the tech may be decentralized, access still isn’t. Borders still matter — not just geographically, but institutionally. Most projects can’t walk into a regulator’s office. They can’t secure a meeting with a fund on short notice or find legal advisors who actually understand the intersection of blockchain innovation and real-world compliance. And yet, these are the things that move deals forward. Not hype. Not tweets. Real relationships. Real infrastructure.

That’s why we built TheBlock. — not to chase trends, but to create a structure around them. The space doesn’t need another platform or listing site. It needs an operating system for real progress — one that makes credibility portable, opportunity visible, and momentum transferable across industries, borders, and stakeholders. We didn’t want to be another noisy node in the space. We wanted to build the place where noise turns into action. Where vision becomes strategy. Where innovation meets readiness.

Across eight countries, over 350 curated events, and more than 217 projects supported, we’ve proven that structure can unlock scale. And we’re not talking about theory. We’re talking about a founder from Seoul finding regulatory clarity in Dubai. A family office in Zurich discovering a clean token deal in Singapore. A compliance specialist in London helping launch a protocol in Brazil. This is what curated access looks like. It’s not a feed or a forum. It’s a network that delivers outcomes. Through our Inner Circle, capital providers, policymakers,

international activations — we turn conversations into commitments and collisions into collaborations.

The next wave of virtual assets will not be powered by the loudest voices or the flashiest decks. It will be shaped by the most prepared ones. The ones that walk into the room with alignment already in place. The ones who know where the regulatory lines are drawn and how to navigate them. The ones with partnerships that aren’t performative, but operational. Because this industry isn’t going to mature through isolated moves. It’s going to grow through coordinated movement — and that’s what we’re enabling.

TheBlock. isn’t a destination. It’s a structure designed to make every other destination easier to reach.

Because what we’ve learned — again and again — is that you don’t scale by shouting louder. You scale by aligning deeper. Deeper with policy, so your project doesn’t hit regulatory walls. Deeper with capital, so your raise is more than just money — it’s smart money. Deeper with legal, so you’re protected long after the launch. Deeper with infrastructure, so you’re not rebuilding the wheel every time you enter a new market. And that’s what TheBlock. delivers: a Chamber where alignment isn’t a buzzword — it’s the design principle.

legal experts, and founders are brought together under one architecture — one that’s designed for movement, not stagnation. Our Talent Pool enables vetted hiring in high-trust environments, solving one of the most overlooked barriers to scaling: the right people. And our education initiatives, built with leading academic institutions and policy centers, ensure that our ecosystem doesn’t just grow — it grows with clarity.

We’ve also learned that community is not enough without intention. So we’ve built out dual headquarters in Dubai, each with a distinct role: TheBlock. Tower as a hub for capital, regulatory alignment, and deal flow, and TheBlock. Decentral as our cultural engine, where community, creativity, and compliance converge. Through these physical spaces — and through our

Access, in our world, is not a dropdown option. It’s a discipline. It requires constant calibration — between market trends and legal frameworks, between innovation and risk, between scale and trust. That’s why our model doesn’t rely on mass invites or “open to all” platforms. We vet every introduction, every opportunity, every partner. Not to exclude — but to protect the value of participation. Because when you bring the right people together under the right principles, velocity increases. So does confidence.

We’ve also built this Chamber with global vision and local relevance. What works in the UAE may not work in Europe. What’s compliant in Singapore may be experimental in North America. But our network is designed to navigate that complexity — translating across jurisdictions, matching intent with context, and ensuring that opportunity isn’t lost in translation. We’re not trying to make every region the same. We’re building bridges between them.

And finally, our philosophy is long-term. We’re not optimizing for press coverage or the next cycle. We’re building for durability — for the industry leaders who will still be here in 5, 10, even 20 years. That’s why we’ve invested in physical spaces, long-term partnerships, deep educational programs, and strategic advisory capacity. Because the next version of this ecosystem won’t be about noise. It’ll be about infrastructure. The kind that holds when markets shift, narratives change, and only the well-structured remain standing.

The Influence Economy: How KOLs Are Shaping the Future of Web3

In the traditional landscape of marketing and influence, the metrics of power were predominantly quantifiable through media impressions, the scale of advertising expenditures, and the coveted seconds of television airtime. These conventional channels represented a more centralized and controlled dissemination of information. However, the advent of Web3 has ushered in a paradigm shift, democratizing influence and relocating its nexus to the dynamic, decentralized realms of social media platforms like Twitter (now X), the rapid-fire discussions within Telegram threads, and the persistent, organic cultivation of real-time community engagement. Within this evolved ecosystem, Key Opinion Leaders—commonly referred to as KOLs—have undergone a significant transformation. Their role has expanded far beyond the initial perception of being mere crypto influencers, who might have focused on surface-level promotion. Now, they are increasingly recognized as pivotal players, integral to the successful execution of product launches, directly impacting the trajectory and valuation of token movements, and even shaping the discourse and direction of regulatory narratives that govern the burgeoning Web3 space. Consequently, they are no longer viewed as external marketing channels to be leveraged, but rather as deeply embedded stakeholders, with a vested interest in the health and growth of the ecosystem itself.

The most significant transformation lies in the increased sophistication and multifaceted engagement of these Key Opinion Leaders. Many are no longer just commentators but are active investors themselves, providing crucial early-stage financial backing to promising projects. Their involvement often extends to serving on advisory boards, where they contribute strategic insights and leverage their networks for the benefit of the ventures they support. Furthermore, they frequently co-host interactive sessions, such as Twitter Spaces, alongside project founders, fostering direct communication and transparency with the community. A key strategy now involves the proactive building and nurturing of dedicated communities even before a token is officially listed on any exchange, creating an engaged and expectant user base. Their influence can be instrumental in securing coveted listings on major cryptocurrency exchanges, which significantly enhances a token’s liquidity and accessibility. They also play a crucial role in driving Decentralized Autonomous Organization (DAO) proposals, actively participating in and shaping the governance structures of Web3 projects. It is not uncommon for these KOLs to possess a deeper, more nuanced understanding of the intricacies of specific projects and market trends than traditional journalists, and they often demonstrate an agility in identifying and acting on opportunities that surpasses even established Venture Capital firms.

For new projects attempting to launch and gain traction in today’s increasingly fragmented and competitive market, aligning with credible KOLs has transitioned from a beneficial option to an almost indispensable necessity. They are far more than simple promotional tools; they function as powerful network accelerators, capable of catalyzing growth and adoption at an unprecedented rate. Whether the entity is a Layer 1 blockchain aiming to build robust liquidity and attract developers, a Decentralized Finance (DeFi) protocol actively seeking Liquidity Providers (LPs) to ensure its viability, or a Real World Asset (RWA) startup striving to capture attention amidst a cacophony of competing narratives, the strategically right KOL can unlock critical doors, drive substantial user traffic, and onboard new users with a speed and cost-effectiveness that traditional advertising budgets can seldom achieve. Their endorsement often acts as a signal of credibility, encouraging early adoption and fostering trust within the wider community.

Consequently, there is a growing and palpable pressure on Web3 projects to exercise greater diligence in their selection of KOL partners. The emphasis is shifting towards collaborating not just with any KOL, but specifically with the right ones—those individuals who demonstrably prioritize their long-term reputation and credibility over immediate, short-term financial gains. This evolving landscape is where organizations, dedicated ecosystems, and specialized vetting platforms, such as TheBlock (as mentioned in the original text, though this is a generic reference here), are beginning to play a crucial role. They aim to create trusted and transparent bridges, connecting legitimate project builders with reputable KOLs who can genuinely elevate their visibility and contribute to their sustainable success, while mitigating the risks associated with less scrupulous actors.

Ultimately, the dynamic and ever-evolving KOL landscape will undoubtedly continue its trajectory of transformation. Emerging trends such as AI-generated influencers, the rise of pseudonymous but highly influential brand entities, and the burgeoning development of tokenized creator economies are already making their presence felt and will likely reshape the mechanics of influence in the years to come.

ARVA Awakens: Dubai’s Regulatory Leap for Real-World Assets

Here’s what it mandates:

In a year already full of regulatory buzz, the Virtual Asset Regulatory Authority (VARA) of Dubai has dropped a game-changer: the ARVA framework.

At first glance, ARVA might look like just another acronym in a sea of Web3 jargon. But under the surface, it signals the most structured, comprehensive legal recognition of tokenized real-world assets (RWAs) to date. It’s not just a new compliance checkbox—it’s a new asset category. And for founders, fund managers, and institutions in the tokenization race, it changes the rules of the game.

What is an ARVA?

The term stands for Asset-Referenced Virtual Asset, and it’s designed for tokens backed by tangible, off-chain assets—real estate, gold, cash flows, commodities, and other real-world value. But unlike the vague classifications of past token standards, ARVA is explicit, enforceable, and—most importantly— regulated.

• Redemption rights must be direct and fee-free for users. This means you’re not just holding a synthetic representation of an asset—you’re legally entitled to redeem it for the real thing.

• Reserves must be held with regulated custodians, legally segregated, and regularly audited. Independent verification is non-negotiable.

• The term “stablecoin” is now protected. Only tokens classified under ARVA with eligible backing can use it—shutting the door on hundreds of loose interpretations across the industry.

• Monthly reporting is mandatory, and if you’re classified as a “significant issuer,” your requirements increase drastically.

• Capital adequacy rules apply. Issuers must prove they have the funds and structure to back what they issue.

For the first time, we’re seeing a serious attempt at creating stable, transparent infrastructure for RWAs—backed not just by tech but by enforceable regulation. In other words, Dubai isn’t just open for business; it’s building the blueprint.

Why this matters globally

While the U.S. struggles with regulatory clarity and Europe debates the limits of MiCA, VARA has leapfrogged into a leadership role by doing what few regulators have dared: creating a new, defined legal wrapper for a digital asset type that blends the old and new financial worlds.

This framework doesn’t just protect investors—it unlocks institutional confidence. And it sends a clear message: tokenization can’t scale without trust, and trust requires structure.

What’s next?

ARVA-compliant tokens are expected to become a benchmark for stablecoin issuers, real estate tokenization platforms, and yield-bearing assets moving into on-chain infrastructure. Venture capital is already shifting, with more capital eyeing RWA rails than altcoins.

For tokenization startups, this is the moment to stop thinking about launchpads and start thinking about licensing. For investors, this may be the signal that Dubai isn’t just friendly to Web3—it’s becoming its legal engine.

Tokenization Is Not a Trend—It’s the Infrastructure Layer of the Next Financial Era

It starts with a simple idea: if you can own something, you should be able to tokenize it.

Real-world assets (RWAs)—from real estate and commodities to equity, invoices, and IP—are being wrapped into tokens and plugged into decentralized systems. What was once just theoretical in whitepapers is now being piloted by governments, funds, and Fortune 500s. Tokenization is no longer hype. It’s happening.

TheBlock. has seen the wave firsthand.

With 11B+ in deal flow pipeline and dozens of tokenization startups in our ecosystem, the appetite is clear. But so are the pain points. Legal clarity is murky. Custody is fragmented. Onboarding is broken. That’s where real infrastructure matters—linking token issuance, custody, compliance, and capital under one strategic roof.

The new asset stack

In the emerging RWA landscape, we’re seeing the rise of the “token stack”:

• Issuance Platforms: Cap tables, tokens, and smart contract design.

• Custody + Compliance: Who holds the asset? How is it regulated? Who checks the math?

• Liquidity Networks: Secondary trading venues, AMMs for RWAs, and cross-border rails.

• Data & Valuation Feeds: Oracle systems, appraisal connections, and real-time pricing.

• This stack needs to interconnect—and that’s where innovation is happening.

What will win?

Regulatory-first models. Platforms that integrate with traditional finance instead of rejecting it. And companies that treat tokenization not as a trend but as a 10year infrastructure play.

In the end, tokenization is not about crypto. It’s about access.

It’s about giving a 19-year-old in Nairobi the ability to invest in a warehouse in Frankfurt. Or letting an SME in Dubai tokenize their invoice and receive funding from a DAO in Tokyo. It’s about liquidity. Transparency. Interoperability.

The tools are here. The infrastructure is forming. The only question is: who’s ready to build on it?

The International Chamber of Virtual Assets

Assets You Can Touch. Deals You Can’t Ignore.

THE BLOCK | Editorial

For an extended period, the Web3 sphere has been animated by the promise of widespread tokenization, envisioning a future where virtually any asset could be represented digitally on a blockchain. However, it’s a well-understood market principle that mere promises and aspirational visions, no matter how compelling, do not inherently drive market dynamics or create tangible value; rather, it is concrete execution and demonstrable progress that catalyze genuine shifts. The long-anticipated transformation is, at last, becoming a palpable reality. Real-world assets (RWAs) are decisively moving beyond the realm of speculative headlines and theoretical discussions. They are increasingly becoming bankable, meticulously trackable through transparent on-chain ledgers, and actively deployed within functioning ecosystems. This crucial transition is being spearheaded by individuals and organizations possessing the acumen and strategic foresight to convert nascent momentum into fully-fledged, operational markets, thereby bridging the gap between innovative concepts and practical application.

This particular edition of our insights moves beyond the often-ephemeral hype cycle that can characterize emerging technologies. Our primary focus here is on the sophisticated systems, robust frameworks, and practical applications that are now taking root in the wake of initial excitement. We are witnessing significant institutional movements, such as national treasuries beginning to explore and implement the tokenization of government securities, fundamentally altering how public debt is managed and traded. Similarly, traditional equities are progressively transitioning towards peer-to-peer exchange models, disintermediating conventional financial institutions and offering greater accessibility. Furthermore, real estate, a traditionally illiquid asset class, is being creatively transformed into a yield-bearing, on-chain investment opportunity, unlocking new avenues for capital deployment and income generation. The prevailing question is no longer if these transformative changes are occurring, but rather where these innovations are most actively taking place and, crucially, who the key enablers and pioneering entities are that are driving this evolution. From the development of universally accepted token standards to the intricate legal structuring required for compliant asset tokenization, the virtual asset industry is demonstrably beginning to adopt and speak the rigorous language demanded by institutional-scale operations and regulatory expectations.

This is precisely the domain where TheBlock. aims to make its most significant contribution. Our innovative Chamber model is designed to convene a diverse array of critical stakeholders—including regulatory bodies, innovative builders and developers,

established banking institutions, investment funds, and influential policy shapers—all within a single, cohesive, and collaborative structure. At this present juncture, this integrated structure is laser-focused on the paramount objective of bringing RWAs to life in a meaningful and scalable way. This commitment extends far beyond theoretical explorations or the publication of whitepapers; it translates directly into tangible actions such as facilitating capital deployment into RWA projects, providing expert navigation through complex compliance landscapes, and fostering essential cross-jurisdictional alignment to ensure seamless international operations and regulatory coherence.instead, we are dedicated to enabling and ac-

celerating tangible movement and market development in the RWA sector.

Welcome to the Chamber, the dedicated nexus where the transformative potential of tokenization converges with demonstrable market traction and real-world impact.

THE BLOCK TIMES

Artist of the Month

Tehran-based artist Sadaf Seyed redefines modern Iranian visual storytelling. With exhibitions from Dubai to Miami. Sadaf began her artistic journey by exploring light and shadow through figurative painting, gradually developing a distinct visual language marked by simplified spaces, geometric forms, and a restrained color palette inspired by traditional Iranian painting. Her work seeks a dialogue between past and present.

Platform of the Month

As CEO and Co-founder of Fuze, Mo Ali Yusuf is leading one of the region’s most dynamic digital asset infrastructure providers. Under his leadership, Fuze has scaled rapidly, securing regulatory licenses and major partnerships while enabling banks, fintechs, and enterprises across MENA to offer secure, compliant crypto services. Mo is helping bridge traditional finance with the future of digital assets

Most Promising Web2to-Web3 Transition Startup of the Month Founder of the Month

Bitget takes the spotlight this month with two major advancements reinforcing its position in the evolving crypto landscape. First, the launch of XAUT (Tether Gold) for spot and futures trading marks a key step toward merging traditional finance with digital assets. By offering a gold-backed token, Bitget enables users to diversify with a stable, real-world asset—right within a crypto-native environment. Meanwhile, Bitget Onchain is redefining hybrid trading by blending the simplicity of a centralized exchange with the flexibility of DeFi. It offers access to a wide range of tokens, including memecoins, through a streamlined interface. What sets it apart is its curated token listings, backed by in-depth analytics and real-time trend indicators.

MatterFi is redefining crypto security with infrastructure that makes digital finance safer for both humans and AI. By offering a foundational layer for wallets and custody systems, MatterFi helps fintechs and financial institutions build secure, compliant, and user-friendly services. Their Convergence Engine blends on- and off-chain usability with enterprise-grade protection— solving one of crypto’s most persistent trust gaps.

Good Game Group

Good Game Group is redefining the gaming industry by fusing mainstream content, community, and commerce with the power of Web3. From launching its $GDGM token on Avalanche to building physical gaming hubs and producing a global gaming reality show, Good Game is creating a unified ecosystem for the 3.3B+ gamer market. Backed by TheBlock.’s regulatory and strategic support, the company is well-positioned to lead the next generation of immersive, token-powered entertainment.

Capital Meets Credibility: Inside TheBlock’s Investor Circle

In a landscape flooded with hype, vaporware, and endless pitch decks, TheBlock. is offering something different: access, not noise. The Investor Circle is a members-only initiative designed to streamline capital flow, bring clarity to investment opportunities, and connect serious investors with the next generation of blockchain ventures. THE BLOCK |

More Than a Mailing List

At its core, the Investor Circle isn’t just a distribution list for pitch decks. It’s a curated gateway into live, ongoing deals that have already cleared internal vetting standards within TheBlock.’s ecosystem. From token raises and equity rounds to strategic capital partnerships, every opportunity that hits the Circle comes with context, structure, and dealroom-level access.

Why It Exists

Too often, great startups get lost in the noise. Likewise, serious investors don’t have time to sift through 500 poorly structured pitches to find the one with actual merit. The Investor Circle exists to cut through that clutter—connecting capital with clarity. It’s how Web3’s best founders and most credible funds are now meeting in Dubai and beyond.

What Makes It Different

• Signal, Not Spam: All listed raises undergo a pre-vetting process. That means less fluff, more fundable.

• Real-Time Access: Live deal briefs, structured fundraising data, and direct founder access—no intermediaries, no bottlenecks.

• Cross-Border Deal Flow: From Singapore to Zug, the Circle hosts global capital rounds with local market intelligence baked in.

• Strategic Pairing: Beyond capital, the Circle connects startups with market makers, legal support, and go-tomarket infrastructure.

Who’s Inside

The Circle includes over 100 active capital allies, from family offices and early-stage VCs to institutional investors focused on virtual assets. Several are already licensed entities under VARA, giving TheBlock. a regulatory edge in connecting com-

pliant capital with compliant projects.

Raising Through the Circle Startups in TheBlock. Chamber can submit raise mandates to be considered for Circle exposure. Those accepted receive a bundled offering: narrative positioning, investor warm-ups, virtual pitch days, and performance metrics. Recent success stories include DePIN infrastructure projects, RWA platforms, and early-stage Layer 2 plays—all matched with strategic capital from the region and beyond.

What’s Next

The next evolution of the Investor Circle is now underway. As TheBlock. expands its global offices and regulatory presence, the Circle is opening dedicated verticals—RWA, DeFi, Gaming, and Infrastructure—with custom capital funnels for each. For the founders in our ecosystem, the Investor Circle is not just about raising capital—it’s about raising the right capital. For investors, it’s about being in the room before the round goes public.

The International Chamber of Virtual Assets

The Six Pillars That Power TheBlock.

Access isn’t a feature. It’s a foundation. It’s built through six interconnected pillars designed for real outcomes at TheBlock.

BLOCK | Editorial

Access at TheBlock. is conceptualized not merely as a selection of disparate services from a menu, but as a comprehensive, deeply interconnected system. It is a deliberately and strategically engineered structure that proactively brings together all the essential elements required for robust, sustainable growth—including capital, expertise, market reach, and regulatory clarity—unifying them under a single, cohesive, and meticulously aligned framework. This systematic and integrated approach ensures that the support provided is not only holistic but also powerfully synergistic, where the whole becomes far greater than the sum of its parts. Within this dynamic system, our deal flow is meticulously engineered and actively managed across three distinct, yet complementary streams: one focusing on early-stage innovation, another on growth-stage scaling, and a third on strategic ecosystem partnerships. Each stream is precisely designed to efficiently and effectively connect viable, pre-vetted capital with promising, high-potential opportunities, and to consistently pair demonstrable credibility with tangible market momentum and traction. We consciously and consistently eschew inefficient, time-consuming, and often unfruitful methods such as open, indiscriminate pitch calls or unsolicited cold introductions, which often lead to misaligned expectations and wasted resources. Instead, our methodology is firmly rooted in rigorous diligence and precision: every project seeking engagement or investment is subjected to a comprehensive multi-stage vetting process assessing its team, technology, market fit, and scalability. Every investor within our trusted network is carefully curated and onboarded to ensure profound alignment with our overarching ethos and the specific, evolving needs of our members. Consequently, every connection facilitated, every introduction made, is delibera-

te, strategic, and highly intentional, thereby maximizing the potential for meaningful, long-term collaboration and mutual, compounding success.

Our experiences are crafted to be far more impactful and transformative than conventional industry events or standard networking functions; they are meticulously designed encounters, engineered with specific objectives to foster significant, high-value interactions and to drive tangible strategic

A visionary initiative established to position Dubai as the global epicenter of blockchain and digital asset innovation.

progress for all participants. Whether it’s an exclusive, private gathering of discerning, thesis-driven investors focused on a niche emerging sector, or a closed-door, Chatham House Rule policy meeting bringing together key industry leaders, regulators, and academics to deliberate on pressing regulatory matters and co-create solutions, every single setting, agenda item, and participant list is purposefully and thoughtfully created. The explicit and unwavering aim is to elevate conversations far beyond superficial networking or surface-level exchanges, actively guiding participants towards substantive, in-depth discussions that yield actionable insights, clear strategic

roadmaps, and concrete, measurable outcomes. Across our distinguished flagship venues — TheBlock. Tower, a state-ofthe-art hub designed for executive engagement, strategic workshops, and high-level deal-making, and TheBlock.

Finally, our bespoke strategic advisory services act as the critical integrating force to close the loop, translating the rich insights, unique opportunities, and valuable connections generated from all other pillars of TheBlock. into clear, actionable, and customized strategies for our members. From expertly guiding companies through the intricate complexities of jurisdictional entry into new and challenging international markets—navigating diverse cultural nuances and regulatory landscapes—to providing hands-on, practical licensing support across various global regulatory regimes, and assisting with the sophisticated, nuanced design of innovative token economic models that are both groundbreaking and fully compliant with evolving standards, we are deeply dedicated to helping our members translate their bold ambitions into concrete, impactful actions. This is not abstract, theoretical consultation; it is practical, actionable, and results-oriented guidance delivered by a team of seasoned veteran operators who have personally navigated these very challenges and successfully built and scaled ventures themselves. This invaluable expertise is offered for the explicit purpose of achieving real, measurable growth, mitigating risks, and establishing a solid, resilient foundation for enduring future success in a rapidly changing global market.

From Internet Pioneer to Web3 Visionary: David Lucatch Joins TheBlock. as Chief Investment Officer

THE BLOCK | Editorial

In a bold move to deepen its capital leadership and sharpen its investment focus, TheBlock. has announced the appointment of David Lucatch as its Chief Investment Officer. A name that reso- nates across tech, media, and blockchain, Lucatch brings over four decades of entrepreneurial grit, investment acumen, and innovation to the International Chamber of Virtual Assets.

This isn’t just a new hire. It’s a statement.

Where Startups Meet Strategy

At TheBlock., David has taken the helm of the Investor Circle, a curated ecosystem of discerning capital providers, and will spearhead our strategic capital activities. His core mission revolves around meticulously identifying and nurturing the next gene- ration of groundbreaking tokenized startups. This involves more than simple matchmaking; David will be instrumental in forging robust, enduring bridges between these innovative ventures and credible, strategically aligned capital sources, ranging from venture capital firms and family offices to sophisticated private equity and Web3-native investment DAOs. His role is defined by a critical dual mandate: firstly, to rigorously vet and validate the most promising founders and their organizations, assessing not only their vision but also their execution capabilities and resilience. Secondly, and equally important, he will work diligently to ensure that the investors engaging with these growth centric enterprises are deeply aligned with the principles of long-term, utility-driven innovation, thereby fostering sustainable growth rather than speculative, short-term gains. This approach is designed to cultivate a healthier, more robust ecosystem where genuine value creation is paramount, guiding startups from concept to significant market impact through strategic funding and insightful mentorship.

The Track Record That Speaks Volumes David’s distinguished journey as a builder and innovator commenced significantly before Web3 emerged as a recognized concept, tracing back to the nascent stages of the digital age. During the pioneering era of the internet—Web1—he demonstrated profound foresight by leading the development of Canada’s original national eCommerce gateway. This was a monumental undertaking that involved establishing the foundational infrastructure crucial for the widespread adoption of digital payments and the subsequent evolution of online banking services across the nation. This early work in creating secure and scalable transaction systems laid a critical groundwork that would underpin Canada’s burgeoning digital economy, showcasing his ability to build transformative, infrastructural solutions from the ground up. This foundational experience in the mechanics of digital value exchange provided him with a unique perspective on the fundamental building blocks required for new technological paradigms.

Transitioning into the Web2 era, as the internet matured and data became a central commodity, David astutely positioned himself at the dynamic intersection of Artificial Intelligence and mass media. It was here that he architected and developed one of the earliest and most sophisticated machine learning-powered Large Language Model (LLM) platforms. This pioneering system was engineered to understand and generate human-like text at scale, a feat that was groundbreaking for its time. The platform’s capabilities were ultimately leveraged to power user engagement and personalize experiences for an immense audience exceeding 200 million active users monthly, primarily through integrations with prevalent social media and messaging platforms.

Since the early days of Web3, David has focused his energies on the intersection of decentralization, finance, media, entertainment, sports, AI, and compliance and continues to explore and execute opportunities with emerging high growth companies.

What He’s Bringing to TheBlock.

As CIO, David is not just overseeing investments—he’s designing a capital engine. This includes:

• Capital Filtering: Ensuring startups that raise through TheBlock. meet institutional-grade standards.

• Investor Circle Expansion: Scaling TheBlock.’s elite group of VCs, family offices, and HNWIs.

• Mentorship & Structuring: Helping startups prepare for global markets through the lens of legal readiness, tokenomics, and user acquisition.

• Thought Leadership: As a frequent speaker, award recipient, and NY Emmy-nominated producer, David brings deep storytelling prowess to the ecosystem.

A Global Perspective Rooted in Dubai

With offices in the UAE, North America, and Europe, TheBlock. is perfectly positioned to facilitate cross-border capital flow. David’s background working with regulators—including his role with the Ontario Securities Commission SME Committee—adds a powerful compliance layer to the Chamber’s investment operations.

His appointment also underscores TheBlock.’s evolving role: not just a chamber, but a full-stack launchpad for projects moving from pitch to public.

The Final Word

In David Lucatch, TheBlock. has gained more than a CIO—it has acquired a bridge. A bridge between generations of technology, between capital and founders, and between the old world of finance and the new world of tokenized economies.

One foot in regulation. One foot in innovation. That’s what the future of capital looks like at TheBlock.

Around the Chamber

What are our members building? Where have they been? Who are they partnering with? This section features quick snapshots of Chamber members making moves.

Avalanche and EVEN Redefine Direct-to-Fan Music

EVEN, the fast-growing music platform built for direct-to-fan releases, is launching its own dedicated Avalanche Layer 1 blockchain using AvaCloud. Designed to shift the traditional streaming model, EVEN allows artists to release music directly to their fans, giving them full control over pricing, ownership, and engagement.

The platform has already attracted global talent, with names like J. Cole, LaRussell, 6LACK, and Jessie Reyez releasing music through EVEN. This new integration with Avalanche gives EVEN the technical foundation to scale rapidly—supporting over 50,000 artists joining each week, enabling real-time token-gated access, and ensuring transparent revenue distribution.

With its own custom chain, EVEN can build tools that give artists better insights into their audiences while reducing complexity around blockchain infrastructure. Artists no longer need to rely on streaming algorithms or label intermediaries. Instead, they can earn more from smaller fanbases, engage more deeply with their communities, and maintain full ownership of their work. The partnership also reinforces Avalanche’s growing position as the blockchain of choice for real-world consumer applications, from ticketing to loyalty programs and now music. The move by EVEN to build on Avalanche is a clear signal that mainstream creative platforms are turning to Web3 infrastructure to deliver both performance and scale.

As a member of TheBlock., Avalanche continues to lead by example—bringing cultural, creator-first experiences into the virtual asset economy, and redefining what infrastructure looks like when built for the next generation of digital creators.

Fuze Secures $12.2M to Expand Regional Crypto Infrastructure Polymesh and BitGo Partner to Advance Institutional-Grade RWA Infrastructure

Fuze, the UAE-based digital assets infrastructure company and member of TheBlock., has successfully raised $12.2 million in its Series A funding round. The round was led by Galaxy and e& capital, bringing Fuze’s total funding to $20 million and setting the stage for accelerated regional and international growth.

Founded in 2023, Fuze delivers Digital Assets-as-a-Service infrastructure to financial institutions, fintechs, and payment platforms across MENA and Türkiye. Its offering allows traditional institutions to launch regulated crypto products, process digital payments, and access large-volume OTC trading—all within a compliant and scalable framework.

The firm has quickly become a major regional player, with over 300 institutional clients and more than $2.2 billion in processed transactions. Fuze’s product suite now includes a whole stack of stablecoin infrastructure solutions and a payments gateway called FuzePay, designed to meet the increasing demand for digital asset integration across traditional sectors.

With backing from strategic partners like e&, the company is aligning with the broader fintech and telecom convergence across the Middle East. Fuze’s emphasis on localized infrastructure and regulatory compliance reflects its ambition to be the preferred onshore partner for digital asset innovation.

As global institutions look to enter the virtual asset space, Fuze continues to demonstrate that native infrastructure, regional understanding, and a long-term mindset are the defining traits of next-generation financial services leaders in the region.

Polymesh, the purpose-built Layer 1 blockchain designed for regulated assets, has joined forces with BitGo, one of the industry’s leading custodians, in a partnership that sets a new benchmark for real-world asset (RWA) tokenization.

Announced earlier this month, the collaboration establishes Polymesh as the first RWA blockchain to be formally integrated into BitGo’s tokenization strategy—marking a key milestone following BitGo’s acquisition of Brassica and its deeper push into digital asset infrastructure.

The partnership brings together BitGo’s trusted custodial framework with Polymesh’s specialized compliance-ready blockchain. Together, they provide an end-to-end solution for institutions looking to tokenize and manage real-world assets on-chain. Two prominent issuance platforms are already set to adopt BitGo’s custodial services for their projects built on Polymesh, further validating the demand for a compliant and secure RWA infrastructure.

With institutions seeking more than just access—they require custody separation, risk mitigation, and robust regulatory alignment—BitGo and Polymesh are delivering exactly that. Polymesh’s native features, such as onchain identity, flexible custodial models, and multi-party settlement workflows, offer the reliability institutions need without overreliance on complex smart contracts.

As tokenization continues to move from proof of concept to active deployment, this partnership underscores the growing role of purpose-built blockchains and qualified custodians in bridging traditional finance with digital rails. For Polymesh, it’s another step in solidifying its position as the blockchain of choice for regulated real-world assets.

THE BLOCK TIMES

Crystal Intelligence Acquires Scam Alert to Combat Crypto Fraud at Scale

Crystal Intelligence has made a strategic move to address one of the most pressing issues in the digital asset space: crypto scams. With the acquisition of Scam Alert, a public platform originally developed by Whale Alert, Crystal expands its reach beyond institutional analytics into victim support and public safety.

While Crystal remains a leading blockchain analytics provider for B2B clients, the rising number of direct requests from scam victims prompted a more human-centered initiative. Scam Alert will now operate under Crystal’s umbrella, offering victims a secure and accessible space to report fraud, either anonymously or openly.

Crystal’s efforts go beyond fraud detection—they’re building a community response to crypto crime. With backing from Whale Alert, Polygon, Tether, and the Ethereum Foundation, Scam Alert has the potential to become a global industry standard for transparent and victim-focused scam reporting.

As crypto adoption scales, Crystal’s focus on protecting the ecosystem highlights a key evolution in the industry: infrastructure isn’t only about technology—it’s also about trust.

Real Estate, Simplified

Titl is transforming real estate by making it simple, secure, and fast. By eliminating paperwork, legal hurdles, and delays, and leveraging advanced technology, Titl brings clarity and ease to every property transaction, built for today, ready for tomorrow.

University

Good Game Levels Up with Strategic Moves Through TheBlock.

The University of Nicosia (UNIC), globally recognized for pioneering blockchain and digital currency education, continues to bridge academia with real-world impact through its involvement with TheBlock.

Following their presence at the Dubai Police Summit, where UNIC showcased its thought leadership in blockchain forensics and public sector innovation, the university took the conversation further—hosting a private closed-door session at TheBlock. headquarters. The event, led by Dr. Charis Savvides, brought together top legal, regulatory, and industry minds to explore the evolving landscape of compliance, education, and institutional adoption in Web3.

From executive education and legal frameworks to academic research and cross-sector collaboration, UNIC’s presence inside TheBlock. adds institutional rigor to a space often moving faster than policy. In a region building the future of digital economies, their work helps ensure that foundations are strong, ethical, and enduring.search and cross-sector collaboration, UNIC’s presence inside TheBlock. adds institutional rigor to a space often moving faster than policy. In a region building the future of digital economies, their work helps ensure that foundations are strong, ethical, and enduring.

Realiz is a global collective of finance, blockchain, and industry experts working to redefine securitization. Headquartered in Luxembourg, the company is transforming the investment landscape by harnessing innovation to make financial markets more accessible, efficient, and diversified. Realiz opens new opportunities for asset owners and investors, building a smarter, more inclusive financial future.

Polymesh, the purpose-built Layer 1 blockchain designed for regulated assets, has joined forces with BitGo, one of the industry’s leading custodians, in a partnership that sets a new benchmark for real-world asset (RWA) tokenization.

Announced earlier this month, the collaboration establishes Polymesh as the first RWA blockchain to be formally integrated into BitGo’s tokenization strategy—marking a key milestone following BitGo’s acquisition of Brassica and its deeper push into digital asset infrastructure.

The partnership brings together BitGo’s trusted custodial framework with Polymesh’s specialized compliance-ready blockchain. Together, they provide an end-to-end solution for institutions looking to tokenize and manage real-world assets on-chain. Two prominent issuance platforms are already set to adopt BitGo’s custodial services for their projects built on Polymesh, further validating the demand for a compliant and secure RWA infrastructure.

As tokenization continues to move from proof of concept to active deployment, this partnership underscores the growing role of purpose-built blockchains and qualified custodians in bridging traditional finance with digital rails. For Polymesh, it’s another step in solidifying its position as the blockchain of choice for regulated real-world assets.

Pioneering the Future of Tokenized Finance in Europe

Assetera is a fully regulated, decentralized trading platform transforming real-world assets into digital, tradable instruments. Licensed under MiFID II and registered as a VASP in the EU, it offers 24/7 access to tokenized financial products with instant settlement via Atomic Swaps. By merging robust compliance with cutting-edge blockchain infrastructure, Assetera is bridging traditional finance and Web3.

Cregis Sets a New Standard in Digital Asset Security

THE BLOCK TIMES

The

Cregis, a global digital asset infrastructure provider and one of the latest members of TheBlock., has achieved a major compliance milestone: SOC 2 Type 1 certification. This globally recognized benchmark confirms Cregis’ rigorous internal controls and unwavering commitment to client trust, data protection, and operational resilience.

From multi-sig wallet architecture to real-time risk monitoring and strict compliance protocols across regions, Cregis offers a secure foundation for exchanges, financial institutions, and Web3 enterprises managing high-value digital transactions. The SOC 2 audit—conducted by a top-tier independent firm— validated Cregis’ controls around availability, privacy, and processing integrity.

But Cregis isn’t stopping there. With SOC 2 Type 2 already underway, and plans to deepen international compliance efforts, the company is doubling down on its mission to become the most trusted name in crypto asset security.

As part of TheBlock.’s growing Chamber network, Cregis brings a new layer of infrastructure expertise to members navigating regulatory requirements and scaling custodial operations globally. Their momentum is a testament to the power of building trust, not just technology.

Redefining the Future of Investing in Europe and Beyond

Bitpanda is a leading European investment platform on a mission to reinvent the world of finance by making investing accessible to everyone, everywhere. In a financial ecosystem often marked by complexity, exclusivity, and high costs, Bitpanda stands out as a user-first platform designed to be safe, simple, and inclusive. Whether it’s commission-free stocks, cryptocurrencies, or precious metals, Bitpanda gives users the freedom to invest in what they believe in, starting from just $1.

Digital First is dedicated to making your business more efficient through close cooperation that uncovers core challenges and opportunities. By conducting comprehensive competition analysis, they identify the best paths for growth and tailor custom software solutions designed to boost productivity. With over 15 years of experience, Digital First delivers high-quality, reliable software crafted to bring your vision to life.

Powering the Future of Fractional Ownership and Digital Asset Markets Empowering Business Growth Through TailorMade Software Solutions

Tokenise has developed the technology and obtained the licenses to fractionalize ownership of assets, enabling communities to invest in opportunities within a secure and fully regulated trading environment.

Launched by VERO Labs in 2024, Tokenise as a Service (TaaS) is a private-label business solution for digital asset issuance, brokerage, compliance, and secondary market trading. Built on VERO’s proprietary technology, TaaS empowers client partners to provide a fast, reliable, and secure end-to-end digital asset trading platform for customers and communities.

Cointelegraph Joins TheBlock. as Strategic Media Partner

Cointelegraph, one of the most recognized names in blockchain and Web3 journalism, has officially joined TheBlock. as a strategic media partner and member of the Chamber. The move marks a new chapter in how media and market infrastructure can align to support industry growth, particularly across regulation, tokenization, and global expansion.

As part of this partnership, Cointelegraph will establish a dedicated presence inside TheBlock.’s headquarters at Dubai World Trade Center, embedding its team within the region’s most active virtual asset ecosystem. The collaboration extends across joint panels, regulatory summits, member interviews, and curated content campaigns—making Cointelegraph a core part of the Chamber’s information and education strategy.

In a space where signal often gets lost in noise, this partnership brings focus. It connects builders to platforms, ideas to audiences, and local stories to global relevance.

Premium Chauffeur Service for the Modern Business Traveller

Blacklane is a global chauffeur service designed to bring peace of mind to business travelers navigating a fast-paced world. Their commitment to safety, reliability, and seamless technology positions them as a leader in the next generation of stressfree corporate travel. Since 2017, they have been offsetting the carbon emissions of every ride, blending a five-star guest experience with a strong focus on sustainability.

The International Chamber of Virtual Assets

Bridging Web3

Technology with RealWorld Impact

IOPn is a UAE-based tech company unlocking Web3’s potential with real-world solutions. Built on OPN Chain—a fast, secure Layer 1 blockchain—IOPn enables digital identity, asset ownership, and blockchain-powered programs like the UAE Golden Visa. With partners like RAK DAO, IOPn is building a borderless future where opportunity is open to all.

Advancing Web3 Technologies Through Community and Collaboration

The Luxembourg House of Web3 is a non-profit organization dedicated to promoting and advancing Web3 technologies within Luxembourg. It serves as a collaborative community where education, research, development, and innovation are at the forefront.

Fueling Disruptive Innovation for Global Impact

CerraCap Ventures backs disruptive companies with the potential to lead global markets. Focused on strong business fundamentals, CerraCap applies a rigorous evaluation process to identify startups ready to scale. Leveraging deep connections with Fortune 500 enterprises, the firm helps its portfolio validate solutions, drive enterprise sales, and access world-class engineering talent. Its Advisory Board provides hands-on mentorship to management teams, accelerating growth and operational excellence. With a sharp focus on Healthcare, Cybersecurity, and Analytics, CerraCap creates cross-portfolio value and advances innovation across sectors.

Investing in the Future of Fintech Innovation

BitRock Capital is a leading investment firm focused on fintech innovations that are transforming traditional financial services. They invest in high-growth areas including supply chain finance, payments, wealth management, and fintech infrastructure such as AI, blockchain, big data, and cloud technology.

Established to bridge the gap between technology adoption and public understanding, the organization strives to make Web3 accessible and comprehensible for everyone in Luxembourg. Operating as a decentralized autonomous organization (DAO), it emphasizes transparency and active community involvement in all its initiatives.

Shaping Internet Culture and Web3 in the Middle East

Arts DAO is a leading internet lifestyle brand and the largest Web3 and internet culture community in the Middle East. At the forefront of digital innovation and creative expression, Arts DAO brings together a diverse collective of creators, collectors, and tech enthusiasts shaping the future of decentralized culture.

More than just a community, Arts DAO is a movement—with its own flagship event, Arts DAO FEST, celebrating the intersection of art, technology, and Web3. From NFTs to blockchain-powered experiences, Arts DAO is building a cultural hub where creativity meets the digital frontier.

Experts Driving Innovation in Blockchain Technology

Oxhead Alpha is a blockchain technology firm specializing in cryptography, distributed systems, and enterprise infrastructure. With deep technical expertise, they build secure, scalable solutions that help businesses navigate and thrive in the decentralized digital landscape.

Innovating Coliving Through FinTech

Portio blends innovation and coliving to create a smarter way to invest in housing. Through Portio Capital, it offers fractional ownership in curated projects, enabling both large and small investors to participate. Powered by blockchain tokenization and secondary market liquidity, Portio is redefining how people live—and invest—in the future of housing.

Revolutionizing Crypto Security for Humans and

AI

MatterFi is transforming crypto security with cutting-edge infrastructure designed to make digital finance safer for both humans and AI. By providing a foundational layer for wallets and custody solutions, MatterFi empowers fintechs and financial institutions to create secure, compliant, and intuitive services. Its Convergence Engine seamlessly integrates on- and offchain functionality with enterprise-level protection, bridging one of the most enduring trust gaps in crypto.

THE BLOCK TIMES

Powering Business

Growth Through Smart Accounting

Nephos is redefining how businesses approach growth by replacing outdated spreadsheets with streamlined, cloud-based accounting solutions that offer greater control and clarity. With a forward-looking approach and smart digital tools, Nephos empowers decision-makers to focus on impact, not admin. Whether you’re an existing client or exploring better financial systems, their team assesses your current processes to unlock efficiency and free you to focus on the bigger picture. By simplifying annual accounting and internal workflows, Nephos makes growth not just possible — but rewarding.

A Global Hub for Business and Innovation Since 1979

Dubai World Trade Centre (DWTC) is the region’s premier convention and exhibition venue, connecting people, products, and ideas through a vibrant schedule of international trade shows and flagship events. As a designated free zone with award-winning commercial real estate, DWTC is a key driver of Dubai’s economic growth, generating an estimated AED 200 billion in output and welcoming over 30 million business visitors in the past 40 years.

Empowering Investors with Honest Financial Insight

Since 2014, Real Vision has provided millions of investors with expert analysis, honest insights, and powerful tools to navigate the financial markets. More than just a content platform, it’s a global community that connects professionals and everyday investors, helping them make smarter decisions and take control of their financial future. Through in-depth interviews, actionable market education, and a private global network of elite investors, Real Vision is redefining how modern investors learn and engage with finance.

Connecting the Web3 Community Since 2017

Since 2017, Crypto OGs has been at the heart of the global crypto scene, attending over 300 events and building a powerful network of industry pioneers. With a strong social media presence and deep connections to key decision-makers, Crypto OGs serves as a premier gateway for Web3 projects looking to establish themselves. Leveraging its extensive network and expertise, Crypto OGs helps projects gain visibility and credibility within the rapidly evolving blockchain ecosystem.

Luna PR is an award-winning public relations and marketing agency that has offices worldwide, with its headquarters in Dubai. Founded in 2017, Luna PR has since served prominent companies in the Web3, fintech, emerging tech, and gaming industries. The agency’s portfolio of clients spans startups to established multinational corporations. With a team of over 100 employees across 3 continents, Luna PR connects tomorrow’s technology with today’s audience.

UAE-Based Legal Consultancy Specializing in Emerging Sectors

Karm is a legal consultancy firm headquartered in the UAE, officially launched at the 2018 Global Legal Forum held at Peace Palace, The Hague—the hub of the international legal community. Karm focuses on Corporate and Commercial law, with expertise spanning Blockchain, Fintech, Insurtech, Medtech, Real Estate, and Data Protection/Cyber Laws, offering tailored legal solutions for today’s evolving industries.

Where Content Meets the Future

Web3TV is redefining digital entertainment by spotlighting the forefront of blockchain, AI, the metaverse, and Web3 innovation. As a leading platform for next-gen content, Web3TV empowers both seasoned creators and emerging voices to share insights, stories, and groundbreaking projects shaping the decentralized world. From exclusive interviews and expert commentary to immersive coverage of the latest trends, Web3TV is where the future of media comes to life.

The International Chamber of Virtual Assets

Licenses Don’t Build Themselves. We Do.

TheBlock. Advisory supports founders, funds, and financial institutions in navigating licensing, structuring, and compliance— locally and globally. From VARA in Dubai to top jurisdictions worldwide, we help you move from intent to issuance.