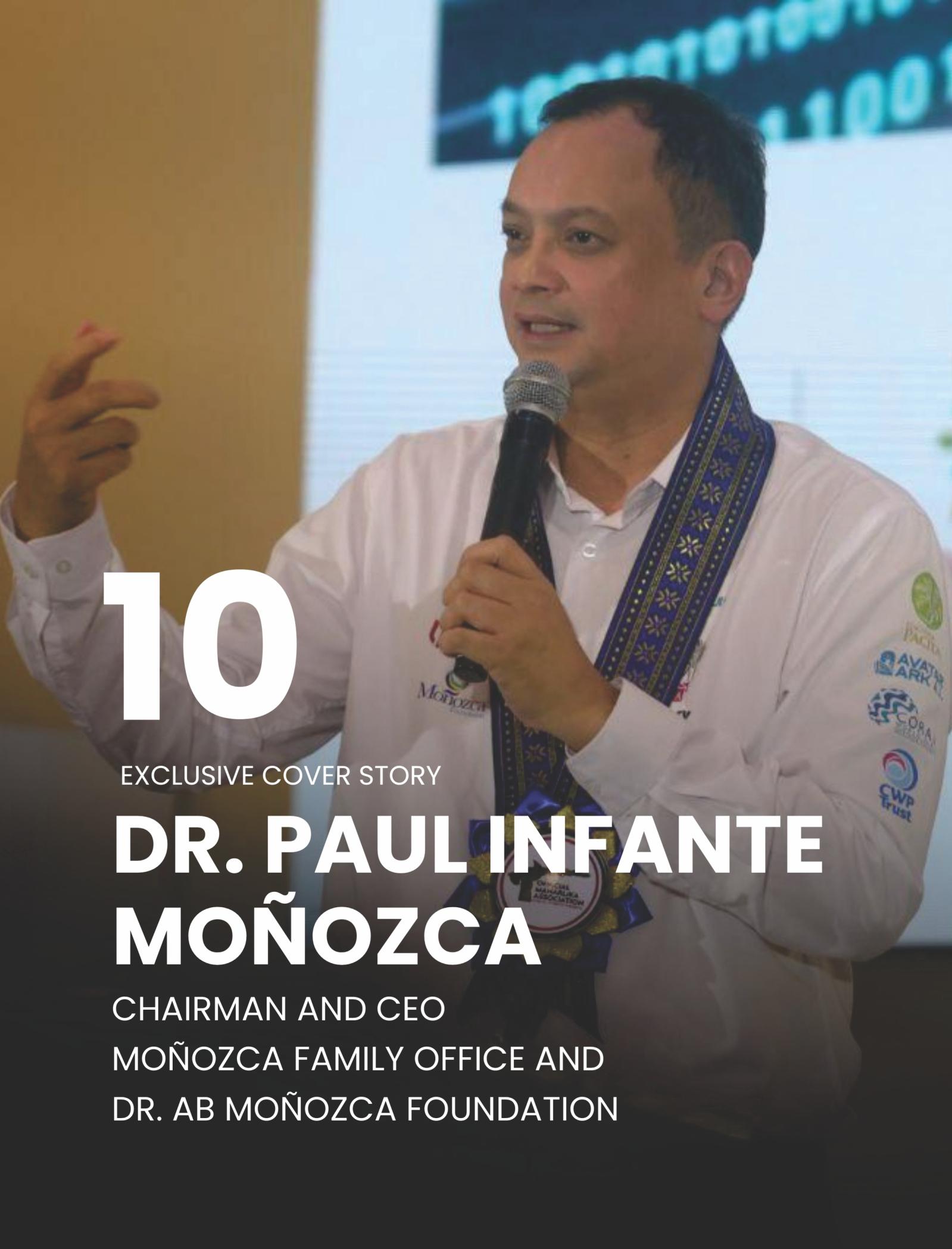

CHAIRMAN

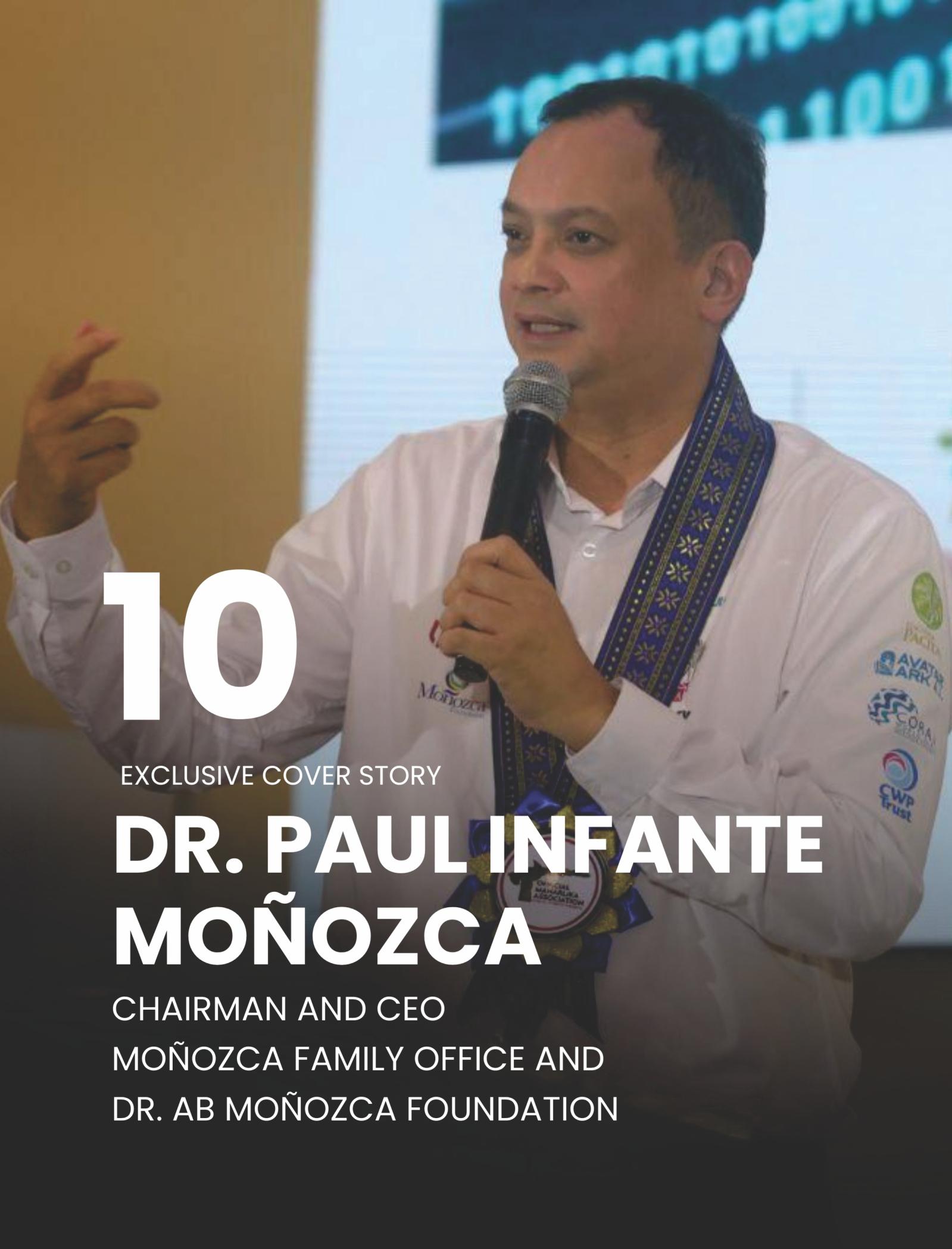

In the ever-evolving landscape of global business and philanthropy, few names command the level of respect and recognition as Dr. Paul Infante Moñozca. As Chairman and CEO of the Moñozca Family Office and its award-winning Dr. AB Moñozca Foundation, Paul has not only carried forward a three-generation legacy of doctors serving humanity but has also redefined what it means to combine philanthropy with enterprise on a global scale. With a net worth of €1.8 Billion and a warchest which moves markets, positioning him within the prestigious Billionaire Series 2025, Paul’s journey exemplifies how vision, values, and vast resources can be channeled toward creating lasting global impact.

chains,waterresources,andnaturalresource assets,eventuallyscalingtoenergyresourcesin partnershipwithcommunityandtribal cooperatives.Boldyetpractical,thesemoves demonstratedthatoriginalityandexecution,when combined,couldbuildaresilientfoundationfor growth.

TheFamilyOffice’senduringsuccessisgrounded inideasthattranscendtraditionalbusiness

models.Paulemphasizesforesight,a“thirdeye” asthedifferentiatingfactor.Whileindustries worldwideracetointegrateArtificialGeneral Intelligence(AGI),Paulandhisteamthink beyondit.Theyconsiderthebroaderimplications oftechnologicalsingularityonindustriesand humanityitself.“Thekeytogrowth,”heexplains, “isseeingbeyondAGIaspartofaddressing technologicalsingularity.”Thisabilityto anticipatetransitionsandalignstrategieswith long-termsurvivalhasallowedtheFamilyOffice toremainaheadofthecurve.

ForPaul,modernleadershipcomeswithitsown setofchallenges.Toooften,heobserves,leaders chasevaluationswhileforgettingthebasicsof businesswherebuildingassetsareprofitsarekey togrowth.Suchdependence,hecautions,dilutes ownershipandunderminessustainability.His philosophyisrefreshinglypragmatic:makeyour moneyfirst,proveyourbusinessmodel,andthen considerexpansionwithexternalpartners,donot bringinpartnerstooearlyinthegame.“Ifyou don’townitanymore,”heaskspointedly,“then howcanbringanybusinesstoruntheextramile withyou?”

ThisperspectiveunderscoreshisbeliefintheXfactor,anindividualororganization’sintrinsic strengththatenablessustainablegrowth.For Paul,leadershipisaboutgrowingattherightpace butaboutpurpose,ownership,accountability,and relationships.

AtthecoreofMoñozcaFamilyOffice’s organizationalsuccessliesitspeoplewho understandthatpurposecomesfirst,thisistrue especiallyforventurephilanthropy.Paulhas cultivatedaculturewherehumancapitalis treatednotmerelyasemployeesbutasco-

foundersandpartners.Recruitmentoftenbeginsatanearly stage,identifyingyoungtalentwhodemonstratethecapacityto takerisksanddeliverresults.Internationalexposure, mentorship,dedication,loyaltyandadaptabilityarehallmarks oftheFamilyOffice’stalentdevelopmentstrategy

Thisapproachhastangiblerewards.Selectedexecutivesearn salariesthreetofourtimestheindustryaverage,aninvestment thatreflectstheorganization’sbeliefinempowermentand purpose.“Theyfeelempoweredworkingforus,”Paulnotes, “andtheirlife’spurposeisdefinedclearly.”Thisemphasison empowermentensuresthatthesuccessnarrativeoftheFamily Officeisnotjustorganizationalbutpersonalforevery individualwithinit.

Diversity,equity,andinclusionarenotbuzzwordsforPaul;they arecentraltotheFamilyOffice’srelationship-drivenethos acrossreligions,cultureandrace.Collaboration,teamwork,and globalperspectivesshapeitsoperations.Trainingthebrightest mindsandcultivatingfutureleadersensuresapipelineoftalent thatreflectstheinterconnectednatureofthemodernworld.By fosteringdiversity,theFamilyOfficeenrichesitsabilityto addressglobalchallengeswithmultifacetedinsights.

TheFamilyOfficeisunapologeticallyopportunisticinits approach.Itsventuresaredesignednotonlytotransform industriesbutalsotoreinforceitsguidingprinciple:“Impact Humanity.”Whetherthroughinnovationsinagriculture, finance,ortechnology,theorganizationconsistentlypioneers solutionsthatredefinethewaytheworldworksandtoprotect humanity’snaturalresourcesitself.

OneoftheFamilyOffice’smostdisruptiveendeavorshasbeen inaddressingtechnologicalsingularity.ThroughtheBankof Humanity,adecentralizedcentralbankforautonomousregions, theyarepioneeringtokenizationtoenabledirectcommunityleveltrade.Thisvisionextendsintohospitality,agriculture, foodsecurity,naturalresources,avatardataandbeyond.Ina worldgrapplingwithrapidtechnologicalchange,Paulandhis teampositionthemselvesasbridgesto“variousclustersof humanity.”

Adaptability has been central to the Family Office’s sustained competitiveness. Executives are constantly exposed to international environments where they devise creative, sustainable solutions to pressing global issues. Food security, for example, is a recurring focus, particularly in regions vulnerable to external influence. Through decentralization, the Family Office has played a pivotal role in freeing up natural resources once controlled by colonial systems and have supported both community and tribal owners.

Their most recent innovation, the relaunch of Bargain Bay Membership Shopping Inc. (BBMS) is a testament to their forward-thinking approach. By integrating Web3 Metaverse immersive experiences and the Parmon Payment Network (PPN), BBMS offers shoppers a futuristic platform. With the inclusion of the use of Digital Assets and Avatar Continuity of Conscience (COC) protocols, the platform provides rewards through a private sector-led Universal Basic Income (UBI) program, supported by autonomous regions, sultanates and global donors. This bold initiative exemplifies how the Family Office merges philanthropy with business to create scalable, sustainable impact.

“The loss of jobs due to AI and Technological Singularity urgently needs subsidy, that’s Universal Basic Income (UBI). This will minimize crime and lack of purpose whilst our world adjusts to new controls. This has been advocated by the most brilliant minds since the 1700’s and now we need to implement this.” As he comments on UBI.

As the world grapples with rapid technological shifts, economic volatility, and social inequalities, leaders like Dr. Paul Infante Monozca illuminate the path forward. His unique blend of entrepreneurial acumen, philanthropic vision, and unyielding commitment to humanity sets him apart as a true global changemaker.

The Moñozca Family Office, under his stewardship, is not merely a financial entity it is a movement. A movement that champions foresight, empowers human capital, leverages diversity, and disrupts industries with one ultimate goal: to impact humanity.

In an age where quarterly results and shareholder expectations often define business leaders, Paul Monozca’s narrative is refreshingly expansive. It reminds us that true leadership transcends profit margins in venture philanthropy. It lies in building legacies that endure, creating opportunities that uplift, and envisioning a future where humanity thrives in harmony with technological progress.

● Educationaccessplatform.A portfoliocompanyusesadaptivelearning algorithmstotailorskill-buildingforlowincomestudents.Thefamilyoffice championedimpactKPIsandsupported partnershipswithcommunitycollegesto translatemicrocredentialsintorecognized certifications.

Eachcasedemonstrateshowtheoffice combinescapital,AI,andhuman-centered designtoachieveoutcomesthatwouldbe hardertounlockthroughcapitalalone.

Governance,transparency,and succession

Astheofficeexpandedintonewdomains, governancematured.Keypractices include:

● Independentadvisoryboards. Externalexpertsinethics,AI,and impactinvestingreviewproposals andprovideaccountability

● Transparentreporting.Annual reportsmapfinancialreturnsand socialoutcomes,withthird-party verificationforimpactclaims. Transparencyhelpsbuildtrust withstakeholdersandthepublic.

● Successionplanningwith purpose.Transitioningleadership isframedasastewardship problem.Successionplans includecapabilitydevelopment, sharedvaluesworkshops,and stakeholderconsultationsto ensurecontinuityofmission.

Thesegovernancestructuresprotectthe familyenginefrommissiondriftand reputationalrisk.

Risks,tensions,andhowtheyare managed

Bridgingwealth,AI,andhumanityisnotrisk-free.Some challengesandtheMoñozcaresponses:

● Technologyoutpacingethics.AIcapabilities evolvequickly Thefamilyinvestedin continuouslearning,ethicsfellows,rotating advisors,andscenarioplanningtokeep governancecurrent.

● Missiondilution.Asassetsgrow,pressureto prioritizefinancialreturnscanerodepurpose. ThePurposeClauseandaseparate“Impact Allocation”actascounterweights,preserving spaceformission-drivenbets.

● Communitydistrust.Deployingtechnologyin vulnerablecommunitiescanraiselegitimate concerns.Theofficeemphasizesparticipatory design,co-creatingprogramswithbeneficiaries, andfundinglocalcapacitytomaintaintrust.

● Marketvolatility.Long-termimpactinvesting canbehitbyshort-termmarketcycles.The familyusespooledcapitalstructuresand flexibletimehorizonstorideoutcycleswithout abandoningmission.

TheMoñozcaofficetreatsthesenotasone-offobstacles butasgovernanceexercises,continuallyiteratedrather thanpermanentlyresolved.

Thebroaderrippleeffects

Whenafamilyofficewithresources,influence,and institutionalrigorcommitstobridgingwealth,AI,and humanity,theeffectsgobeyondbalancesheets.The Moñozcamodelnudgesmarkets:itsignalsto entrepreneursthatethicalAIandmeasurableimpactare investable;itpressurespeerstoelevategovernance;and itdemonstratesthatprofitabilityandpurposecan coexist.

Moreover,theoffice'stransparencyandlearningposture generatepublicgoods:open-sourcemeasurementtools, sharedlearningreports,andcross-sectorcollaborations thatacceleratecollectiveproblem-solving.

For the Moñozca Family Office, legacy is not a sealed vault of past achievements; it's a living institution that adapts, learns, and leans into responsibility. By marrying disciplined wealth management with careful AI adoption and deep human-centered commitments, the family is crafting a model for 21st-century stewardship, one where capital amplifies dignity, not just dividends.

This is not a blueprint that fits every family, nor a promise that success is guaranteed. It is, however, a concrete example of what's possible when money is seen as a tool for generational opportunity and moral imagination. If more family offices adopt the same curiosity about technology, about ethics, about the people whose lives are touched by their capital, the result could be a redefinition of legacy itself: less as inheritance stored and more as a future shaped, responsibly and thoughtfully, for the many generations to come.

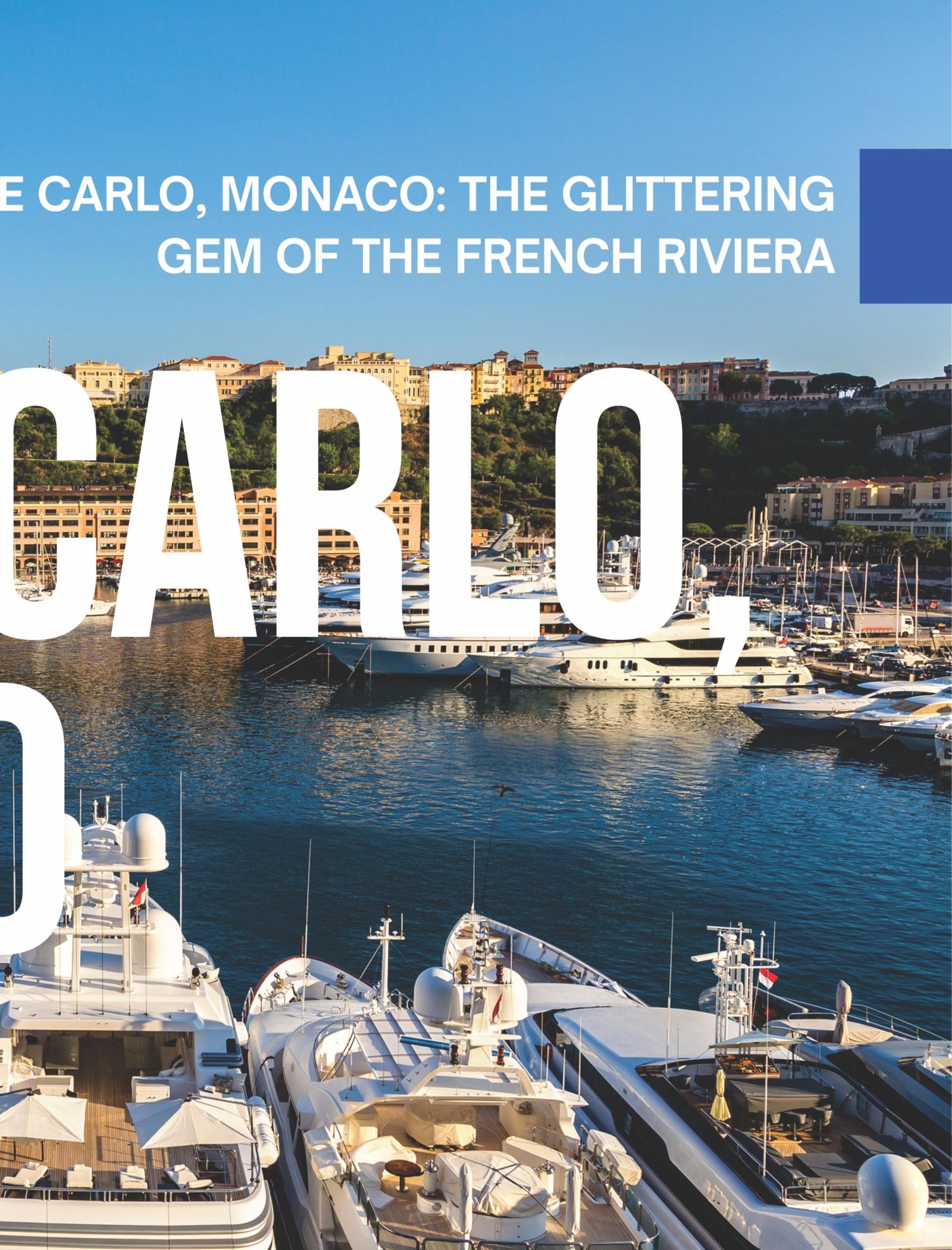

Fromthepalaceterraces,panoramicviewsofMonteCarlo andtheMediterraneanstretchasfarastheeyecansee,a reminderofhowthistinysovereignstatecommandsavast auraofinfluenceandbeauty

Nearby,theMonacoCathedralhousesthetombsof PrinceRainierIIIandPrincessGrace(formerlyGrace Kelly),whosefairy-taleromancecontinuestoenchant visitors.HerlegacyenduresthroughoutMonaco,where eleganceandgraceremaincentraltoitsidentity.

AGreenOasis:TheExoticGardenandOceanographic Museum

Forallitsurbansophistication,MonteCarloalsooffers breathtakingnaturalescapes.TheJardinExotiquede Monaco(ExoticGarden),perchedonacliffside,isa wonderlandofsucculents,cacti,andMediterraneanflora. Withitselevatedpathsandpanoramicviews,thegarden feelslikeapeacefulrefugefromthecity'shustle.

Justashortdistanceaway,theOceanographicMuseum ofMonacostandsasatributetoscience,exploration,and marineconservation.FoundedbyPrinceAlbertIin1910, themuseum'simpressivecollectionincludesaquariums, coralexhibits,anddeep-seaspecimens.Itsclifftoplocation makesitoneofthemoststrikingmuseumsinEurope,part art,partscience,andentirelyinspiring.

MonteCarloisaparadiseforfashionlovers.TheCarré d'Or(GoldenSquare)districtrivalsParisandMilanwith itscollectionofhigh-endboutiquesandflagshipstores. LouisVuitton,Chanel,Cartier,Hermès,andDior,every luxurylabelimaginablelinethemarblepavementsnear thecasino.

Foramorelocaltouch,theMétropoleShoppingMonteCarloblendsluxuryretailwithelegantarchitecture. Beneathitscrystalchandeliersandmarbleinteriors,you'll findeverythingfromhautecouturetofinejewelry.Even window-shoppingfeelslikeanindulgentexperiencehere.

Betweenshoppingsprees,relaxat Café de Paris MonteCarlo,thecity'smostfamousterracecafé.It'stheperfect spotforpeople-watchingasFerrarisandBentleysglideby, capturingtheessenceofMonteCarlo'seffortlesschic.

Delights:

Monaco'scuisineisafusionofFrenchfinesseandItalian warmth,seasonedwiththeflavorsoftheMediterranean. FromMichelin-starredrestaurantstoseasidebistros, MonteCarlo'sdiningsceneisajourneyofsensorydelight.

Atthetopofthelistis Le Louis XV–Alain Ducasse,locatedin theHôteldeParis.ItsmenucelebratesRivieraflavorswith disheslikeProvençalvegetables,langoustines,andlocalfish, allexecutedwithexceptionalartistry

Formorecasualdining, Maya Bay offersAsian-inspired cuisineinaserene,exoticsetting,while Cipriani Monte Carlo servesItalianclassicswithflair.Seafoodloverswillfind paradiseat Les Perles de Monte-Carlo,locateddirectlyonthe harbor.

Andofcourse,everymealpairsperfectlywithaglassoflocal rosé,bestenjoyedunderthegoldenRivierasunset.

TheNightComesAlive:MonteCarloAfterDark

Whenthesunsets,MonteCarlotransformsintoaglittering wonderlandofnightlifeandelegance.The Buddha-Bar Monte-Carlo setsthetonewithitseclecticdécorandchilled beats,while Jimmy'z Monte-Carlo,oneofEurope'smost famousnightclubs,attractsinternationalDJsandastylish crowdthatdancesuntildawn.

Forsomethingmorerefined,the Casino de Monte-Carlo's Salle Europe hostseleganteveningsofmusicandgaming, whilethe American Bar insideHôteldeParisofferslivejazz andvintagecocktailsinanatmosphereoftimeless sophistication.

Thecity'snightlifeperfectlymirrorsitsdaytimecharm: vibrant,exclusive,andunforgettable.

BeyondtheBorders:DayTripsfromMonteCarlo

WhileMonteCarloitselfismesmerizing,itslocationonthe FrenchRivieramakesitanidealbaseforexploringnearby treasures.

● ÈzeVillage:Just20minutesaway,thismedieval hilltopvillageoffersbreathtakingviewsandartisan boutiques.Don'tmissthe Fragonard Perfume Factory orthe Exotic Garden of Èze

● Nice:Aquicktrainrideaway,Niceoffersamore relaxedRivieravibewithcolorfulmarketsandpebble beaches.

● CannesandAntibes:Perfectfordaytrips,both townsblendcoastalbeautywithculturalrichnessand seasidecharm.

● ItalianRiviera:HeadeastandcrossintoItalyto discoverthecoastaltownsofVentimigliaand Sanremo,aseamlesstransitionfromFrenchtoItalian Mediterraneanelegance.

To some, Monte Carlo might appear as a city defined by extravagance, the yachts, the casinos, the couture. But look closer, and you'll find a place deeply rooted in heritage, artistry, and community. The locals take immense pride in their principality's achievements, from environmental initiatives to cultural preservation.

Monte Carlo isn't just about luxury; it's about living beautifully. It's a celebration of craftsmanship, history, and the art of refinement. Whether you're sipping coffee by the harbor, attending an opera, or simply watching the sun set behind the Riviera hills, you feel part of something timeless.

Conclusion: The Enduring Magic of Monte Carlo

Monte Carlo defies its small size with a presence that's larger than life. It's a destination that seduces the senses, where every turn reveals a new vista, every building whispers history, and every evening sparkles with possibility.

From its royal palaces and high-speed races to its quiet gardens and moonlit harbors, Monte Carlo embodies the essence of elegance and adventure. It's a place where the past and the future coexist gracefully, and where luxury feels less like excess and more like an art form.

Whether you come to play, explore, or simply marvel, one thing is certain: Monte Carlo will leave its mark on your heart long after you leave its golden shores.

KeyeconomicimpactsofSWFsinclude:

● Scalinglong-termprojects.SWFscancommitcapitaltomulti-decadeprojectslikerenewables,transmission, andcarbonmitigation,projectsthatrequirepatientbalancesheetsthatordinaryprivateinvestorsfind unattractive.

● Stabilizingnationalfinances.Incommodity-exportingcountries,SWFssmoothrevenuevolatilityby convertingcommodityincomeintodiversifiedfinancialassets.

● Geopoliticalandeconomicstatecraft.SomeSWFspursuestrategicobjectives,technologytransfer,job creation,ordomesticindustrialpolicy,whichcanalignnationaleconomicgoalswithglobalinvestment activity.

SWFs'scalegivesthemleverage:theycanunderwritebig-tickettransactions,participateinconsortiumsthatde-risk private-sectorprojects,andcatalyzeco-investors.Theirentranceintoprivatemarketshasalsoincreaseddeal competitionandpushedprivatefundmanagerstoinnovateonfeestructuresandco-investmentterms.

Recentyearshaveseencallsfor:

● Greatertransparency.AdvocatespressSWFs topublishholdingsandgovernancepractices (somefundsalreadydo),andactivistspushfor clearerdisclosureofhedgefundpositionswhen theymateriallyaffectpubliccompanies.

● Strongerstewardshipcodes.Institutional investors,includingSWFs,arebeingaskedto adoptstewardshipprinciplesthatbalance financialreturnswithsocialoutcomes,atrend visibleinsomefunds'publiccommitments.

● Regulatorycoordination.Cross-bordercapital flows,state-linkedinvestments,andactivist campaignsmeanregulatorsmustcoordinate internationallytomonitorsystemicexposures andnationalsecurityrisks.

Thesechangesreflectagrowingpublicexpectation:if youdeploycapitalatscale,thepublic,taxpayers, workers,andsmallerinvestors,deservetoknowhow decisionsaremadeandwhatthebroadersocietalimpacts willbe.

Scenariosforthenextdecade

Lookingforward,threeplausiblescenariosshowhow hedgefundsandSWFscouldshapetheeconomy:

1. ComplementaryGrowth:SWFsfundlargescaledecarbonizationandinfrastructure,while hedgefundscatalyzeefficiencygainsinlegacy firms.Productivityrises,andtransitions acceleratewithmanageablevolatility.

2. TurbulentRealignment:Aggressiveactivism, crowdedtrades,andgeopoliticalfrictioncreate episodicmarketstress.SWFsbecometactical, protectingdomesticindustries,whilehedge funds'leverage-inducedshocksincrease volatility

3. ConcentratedControl:Afewmegainstitutions,publicandprivate,capture dominantstakesincriticalsectors.Innovation continues,butgainsconcentrate,provoking

politicalbacklashandtougherregulation.

Whichpathunfoldswilldependonregulation,the alignmentofincentives,andwhetherthesepower playersprioritizepubliclegitimacyalongsidereturns.

Whatpolicymakersandmarketparticipantsshould watch

Forpolicymakersandpractitioners,theimplicationsare concrete:

● Monitorcross-holdingsandcollateralexposures toanticipatecontagionpathways.

● Promotetransparencyandstewardshipnorms forlargeinstitutionalholders.

● Encouragepublic–privateframeworksthatalign SWFs'strategicmissionswithcompetitive marketsandguardrailsagainstpolitical interference.

● Ensureactivistengagementsbalanceefficiency withlong-termemploymentandinvestment outcomes.

Conclusion:architectsofthefuture,ifsteeredwisely

Hedgefundsandsovereignwealthfundsarenotdestinymakersbythemselves,buttheircapital,andthe strategiestheypursue,willbecentraltohoweconomies evolve.Whenpatientcapitalandactivistexpertisealign towardproductive,inclusiveinvestments,theycan acceleratetransitionsthatliftproductivityandwellbeing. Butwhenincentivesmisalignortransparencylags,that sameforcecanmagnifyinequality,volatility,and politicalbacklash.

Wearelivingthroughareconfigurationofcapital's architecture.Thequestionformarkets,citizens,and policymakersiswhetherthatarchitecturewillbeshaped todeliversharedprosperity,orwhetheritwillbecomea closedcircuitthatconcentratesgains.Theanswerwill determinenotjustwhowinsinthenextinvestment cycle,buthowbroadlythebenefitsoftomorrow's economywillbeshared.