THE TELLURIDE MARKET REPORT

The most definitive analysis of the Telluride Regional Real Estate Market

Hot tub with a view. Mandatory.

213 Josefa Lane, Aldasoro Ranch, Telluride

Welcome to the 2025 Telluride Market Report, the most definitive analysis of the Telluride regional real estate market. Throughout this report you will find an in-depth examination of the market, information about what sets The Agency apart from other brokerages, and a little bit about ourselves. We hope this report provides some insight into purchasing or selling real estate in Telluride. We welcome the opportunity to assist you with your real estate needs or simply show you around our beautiful town!

Cheers,

Kristen Muller & Stewart Seeligson Managing Partners of The Agency Telluride

Market Analysis

Market Activity

Inventory in Telluride

Inventory in Mountain Village

Seasons of Sales

Market Trends 2024 vs. 2023

Liquidity

Historical Comparison

Telluride

Mountain Village

Ski Ranches

Aldasoro Ranch

Idarado Legacy & Falls at Telluride

Regional Mesas

Telluride vs. Nearby Resort

Mountain Village vs. Nearby Resorts A Closer Look At Off-Market Deals

Kristen Muller

Stewart Seeligson

Notable

REGIONAL MAP + ABOUT THE TELLURIDE MARKET REPORT

REPORT STRUCTURE

This report analyzes trends of the Telluride regional market, examining activity of the region’s 14 unique segments.

REGIONS ANALYZED

For the purpose of this report, the “Telluride Regional Real Estate Market” refers to six geographical regions: the Town of Telluride, Mountain Village, Aldasoro Ranch, Ski Ranches, Idarado Legacy & Falls at Telluride, and nearby mesas (including Sunshine, Wilson, Specie, Iron Springs and Hastings).

PROPERTIES ANALYZED

Homes, condos over $250,000, and single-family home lots are included in the analysis; commercial properties, deed-restricted properties and bulk sales are not.

DATA SOURCE

All data is sourced from the Multiple Listing Service (MLS) of the Telluride Association of Realtors (TAR), which is considered reliable but not guaranteed.

Purchasing a second home in Telluride is a significant financial investment, yet most Owners live outside of the region which sometimes leads to an unfamiliarity with the current market dynamics. This report is intended to provide the detailed information most Buyers and Owners desire to assess their Telluride investment positions.

What Happened in 2024?

Demand for desirable properties remained strong throughout the year. Supply, however, remained constrained with Available Inventory hovering at levels 30% to 40% of the levels only five years ago. With demand outstripping supply, Average Sales Price shot northward setting records while the Number of Sales continued its four year decline. Despite the modest Number of Sales, 2024 was the fourth best year ever in terms of Total Dollar Volume with almost $780 million in overall sales on only 191 transactions.

The Impact of Available Inventory

For over twenty years, the Telluride regional real estate market was awash with properties for sale creating a decades long Buyer’s Market across most segments. Homes sometimes took several years to sell, often because Sellers were in no hurry and they waited for their price. Many segments had several years of supply on the market. That complacent market underwent an extraordinary change

beginning in 2020. The Pandemic catalyzed the biggest run on real estate that Telluride had ever seen. In less than twelve months the highly oversupplied levels of Available Inventory were wiped out across all segments.

Beginning in the summer of 2021, the Telluride regional real estate market began to operate in a new normal - a market with limited supply. From the middle of 2021 through the end of 2024, Average Sales Price appreciated a total of 85% on average. Some properties doubled in value during that period while others even tripled.

The decades-long Buyer’s Market is now an entrenched Seller’s Market. And as long as persistent demand for Telluride real estate continues in the face of historically low levels of Available Inventory, the Seller’s Market will prevail.

Records Broken

The overall Telluride regional market set a new high for the Average Sales Price at $4.1 million. Telluride logged its highest ever Sales Price Per Square foot with the $4,778 mark of a sale in the Riverwatch condo complex. Likewise, Mountain Village recorded the high mark for Sales Price Per Square Foot at $3,683 for a beautiful home set on four acres on the highly desirable Yellow Brick Road. Finally, the Mountain Village home segment set a new high mark for Average Sales Price at $10.1 million.

Projections for 2025

With expectations that the national economy will remain strong, the Telluride regional real estate market will continue to track the same trend lines as established in 2023 and 2024. Look for Available Inventory levels to hover at 30% to 40% of the levels from the 2005 to 2020 period. These lower levels of Available Inventory will maintain upward pressure on price, likely resulting in new records in Average Sales Price and, more importantly, new high marks for Average Sales Price Per Square Foot across many segments. Despite the Number of Sales turning in a modest performance, the appreciating sales prices will prop Total Dollar Volume near recent levels.

Is It Safe to Buy in this Market?

Ironically, today’s market conditions are good for both Sellers and Buyers. Sellers will find one of the most liquid markets in Telluride’s resort history because of the low levels of Available Inventory.

However, current market conditions also favor Buyers. The underlying upward pressure on price creates a safe environment as the property investments in the Telluride region are highly likely to continue their appreciation. Some Buyers sat on the sidelines in 2023 waiting for a correction and now they find a market that is up 25% or even more. A pause in the appreciation of prices may occur in the next few years, but it will do so at a materially higher price level than today.

The only time in recent history that Telluride experienced downward pressure on prices was during the Great Recession. The difference between those market conditions and those of today is that in 2008 there was drastic oversupply of properties on the market and today the market is in a prolonged period of limited Available Inventory which insulates this market against milder downturns.

Please feel free to contact me anytime with questions or comments about the material presented in this report.

Warm Regards,

Stewart Seeligson Managing Partner, The Agency Telluride

970.708.4999

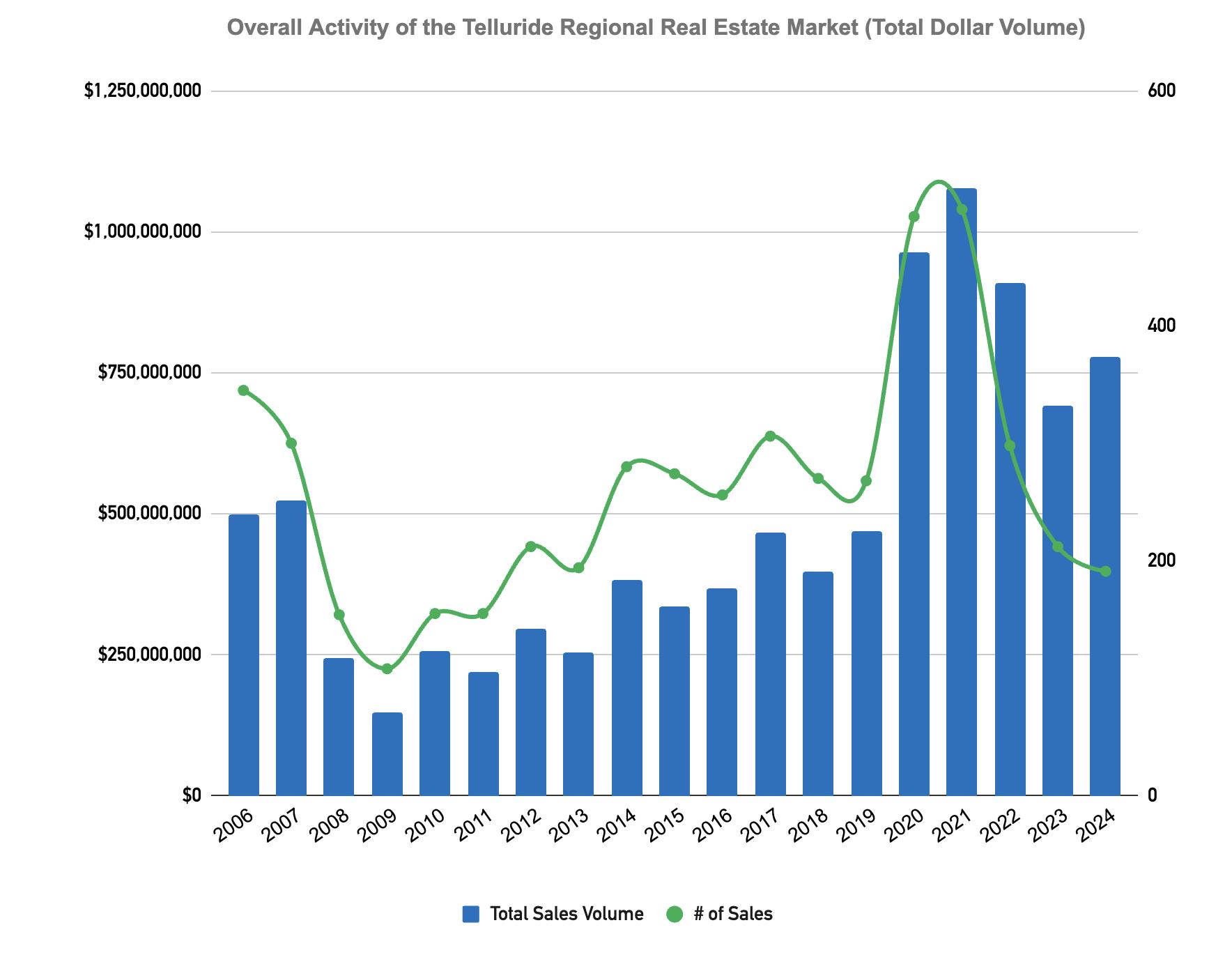

MARKET OVERVIEW - ACTIVITY

Activity of Telluride Regional Real Estate Market (Total Dollar Volume)

Astonishing records were set during 2020 and 2021 in terms of Number of Sales and Total Dollar Volume. The Number of Sales began to fall precipitously beginning in 2022 and continued through 2024. Despite the significant dropoff in the total number of transactions, Total Dollar Volume trended downward much more modestly in 2022 and 2023, then rose again in 2024. The Average Sales Price doubled from $1.95 million in 2020 to $4.1 million in 2024.

Number of Sales

Overall

MARKET OVERVIEW - ACTIVITY

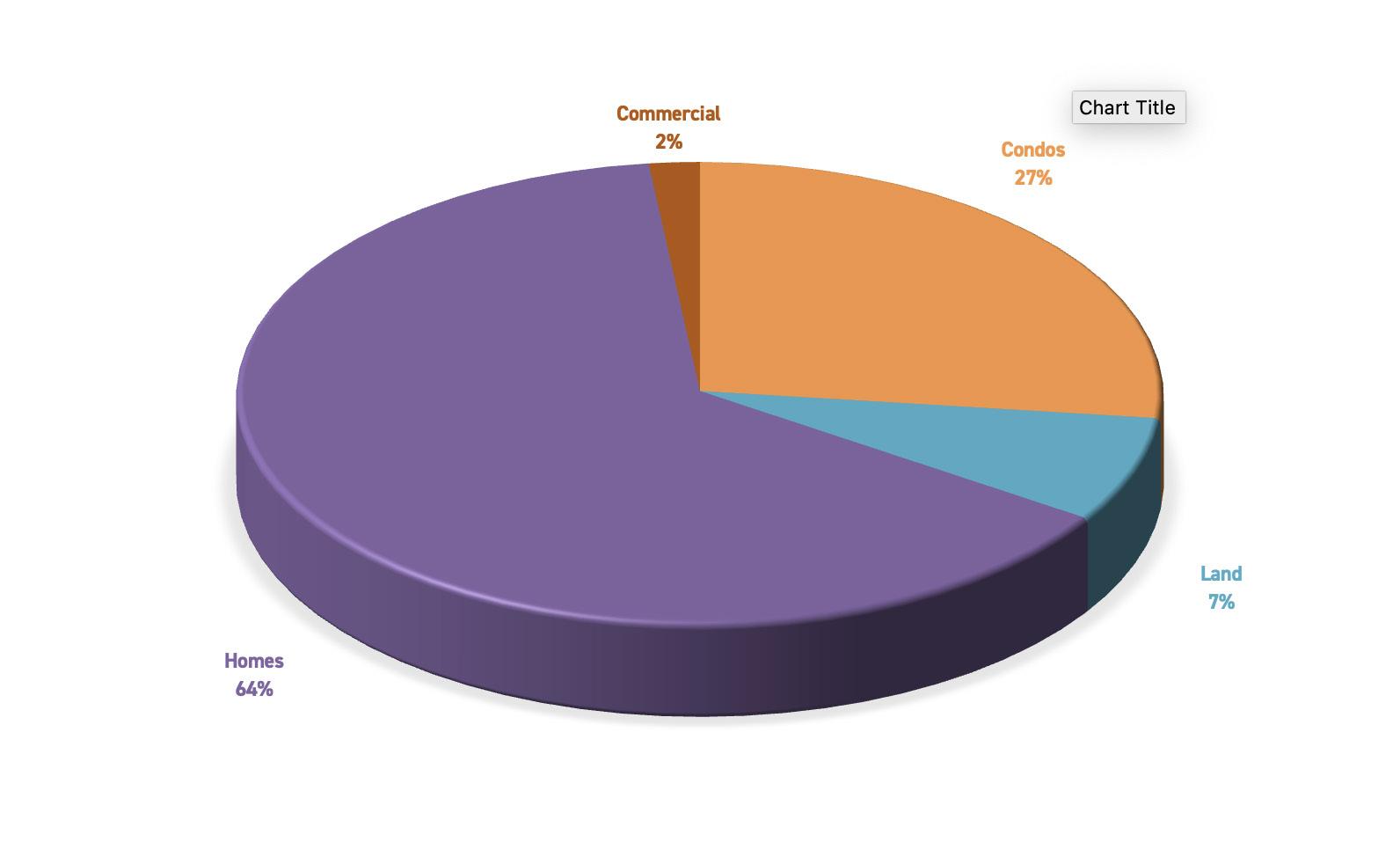

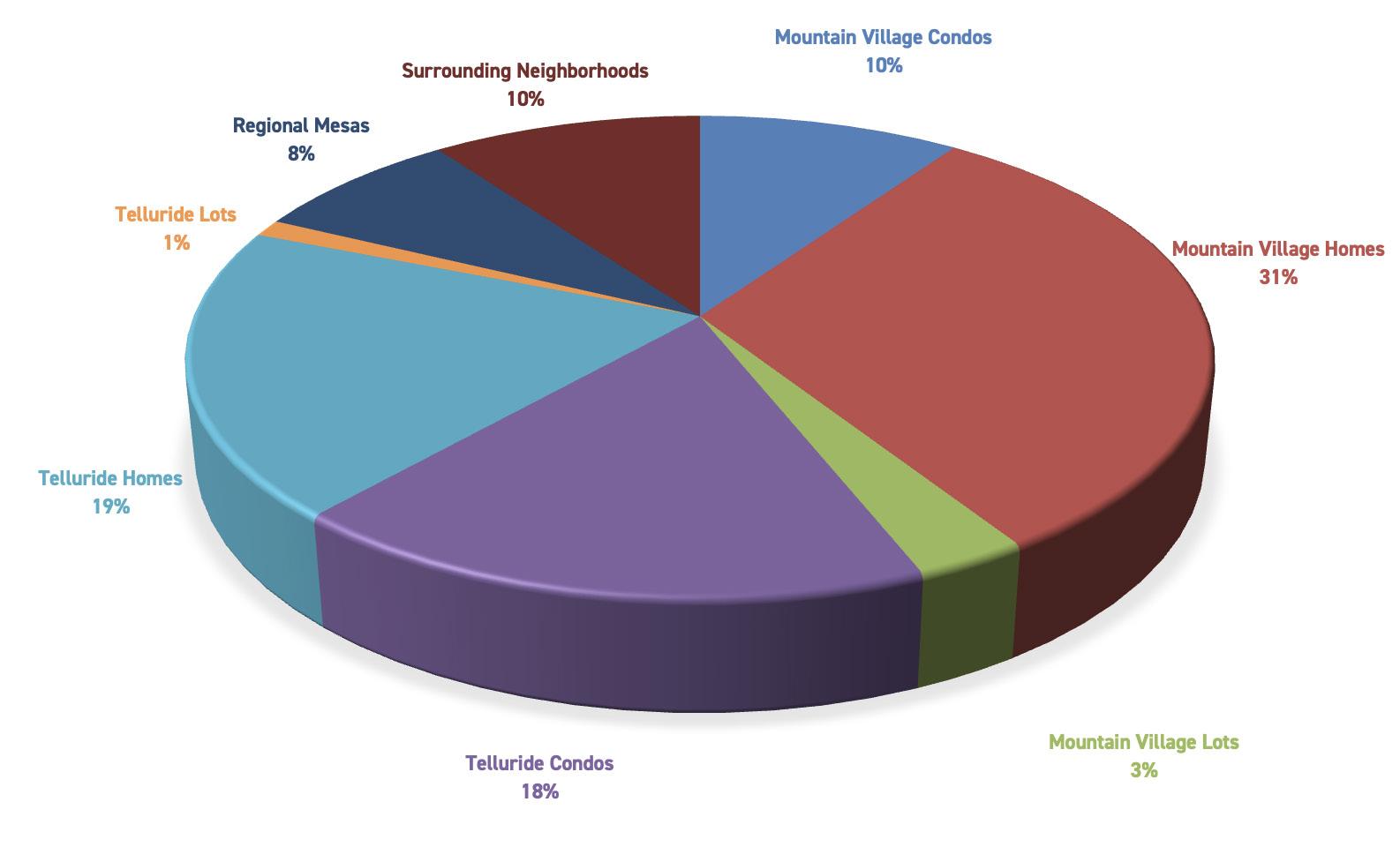

Activity of Telluride Regional Real Estate Market by Property Type (Total Dollar Volume)

Activity of Telluride Regional Real Estate Market by Segment (Total Dollar Volume)

* “Surrounding Neighborhoods” includes Aldasoro Ranch, Ski Ranches and Idarado Legacy & Falls at Telluride, and “Regional Mesas” includes Sunshine, Wilson, Specie, Iron Springs and Hastings Mesas.

MARKET OVERVIEW - AVAILABLE INVENTORY IN THE TOWN OF TELLURIDE

Available Inventory in the Town of Telluride

One of the most important metrics for understanding the dynamics of a marketplace is the levels of Available Inventory over time. If there is a growing number of Buyers in a market compared to the number of Sellers then Available Inventory levels will decline. But when there is an increasing number of Sellers versus Buyers then Available Inventory levels will increase. Furthermore, falling levels of Available Inventory will put upward pressure on price while rising levels of Available Inventory will level prices out or put downward pressure on price.

Available Inventory for the Town of Telluride trended downward for the twelve year period beginning 2009 bottoming in early summer 2021. From the bottom of 2021, Available Inventory levels bounced back somewhat but soon thereafter flattened out. Relative to 2009, Available Inventory levels remain severely depleted. On April 1, 2009 almost 300 properties were offered for sale while on December 31, 2024 there were only 53 properties on the market representing an 82% drop in Available Inventory during the fifteen year period. Available Inventory for homes fell by 80%, condos by 82% and lots by 82% since 2009.

In the real estate industry, the primary way to address falling levels of Available Inventory is to build more homes and condos. But limited opportunities exist for the development of new homes and condos in the Town of Telluride because the town is nearly fully built out - very few vacant parcels remain. Furthermore, the Town of Telluride is bordered on three sides by National Forest and to the west the Valley Floor has a conservation easement which prohibits development through expansion. Therefore, the traditional means of alleviating excessive demand over supply with new development is not available to the Town of Telluride.

MARKET OVERVIEW - AVAILABLE INVENTORY IN MOUNTAIN VILLAGE

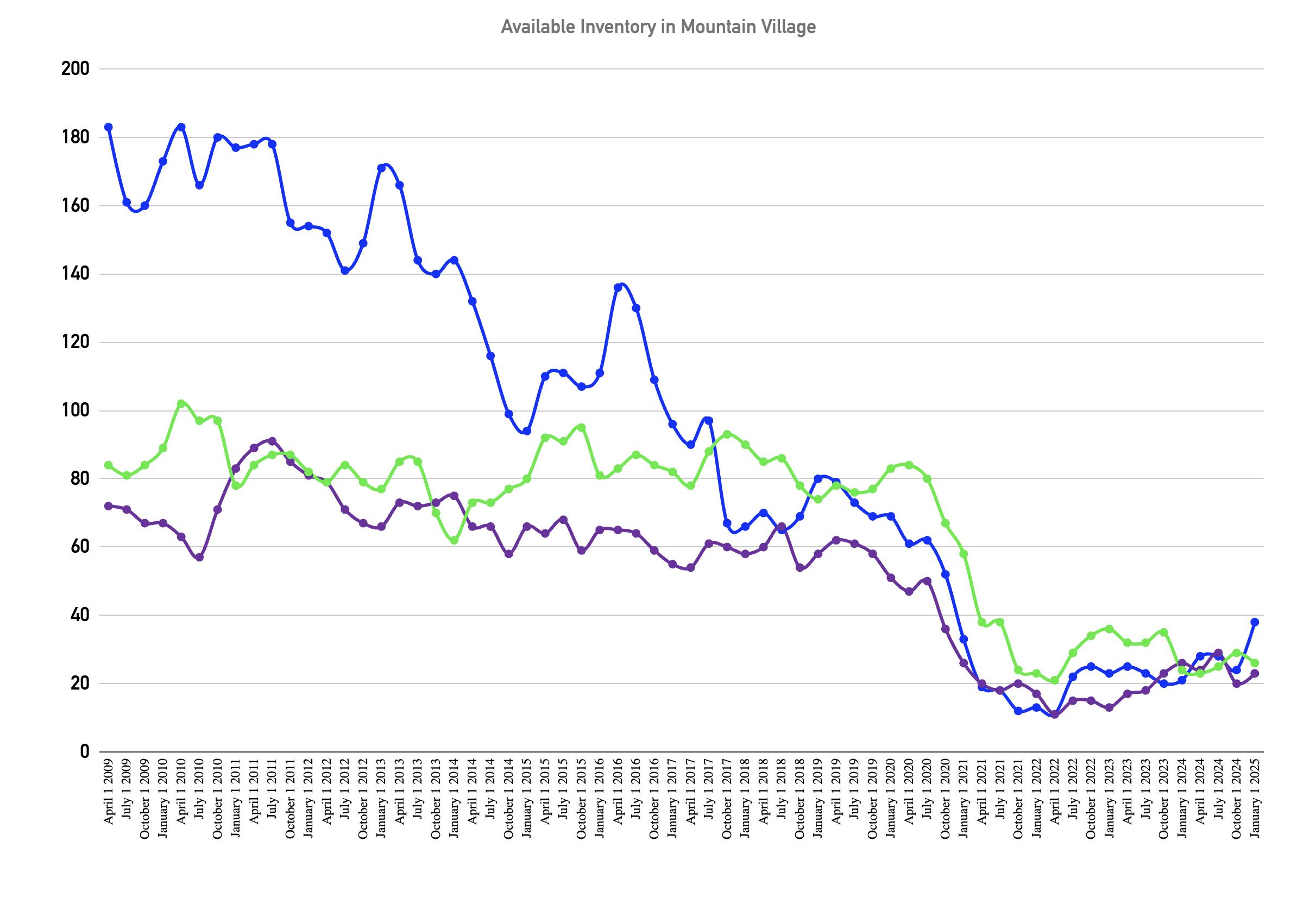

The graph above tells the extraordinary story of Mountain Village in terms of diminishing levels of Available Inventory from 2009 through 2024.

In 2009, Mountain Village was awash in properties for sale across the home, condo and single-family home lot segments. In the early days of the Great Recession, the Available Inventory reached its zenith with almost 400 properties on the market as of January 1, 2009. During the course of the next thirteen years that number fell to as low as 43 properties on April 1, 2022 and since has inched its way back to an average of about 75 properties. As of December 31, 2024 there were 87 properties on the market.

Each segment has taken its own course to the low levels of today. Mountain Village homes and lots maintained a mostly stable level of Available Inventory until the post pandemic buying frenzy which began in July of 2020. The Available Inventory for homes in Mountain Village was as high as 91 homes in 2011 and as low as 11 homes in 2022 while lots peaked at 102 in 2010 and bottomed at 22 in 2022.

Condos experienced the most precipitous fall of all segments in Mountain Village. In 2009, Trails Edge, Elkstone, Cassidy Ridge and Town Homes on the Creek all completed construction driving Available Inventory to 227 units on January 1, 2009. The number fell by 95% to only 11 units on April 1, 2022.

Available Inventory in Mountain Village

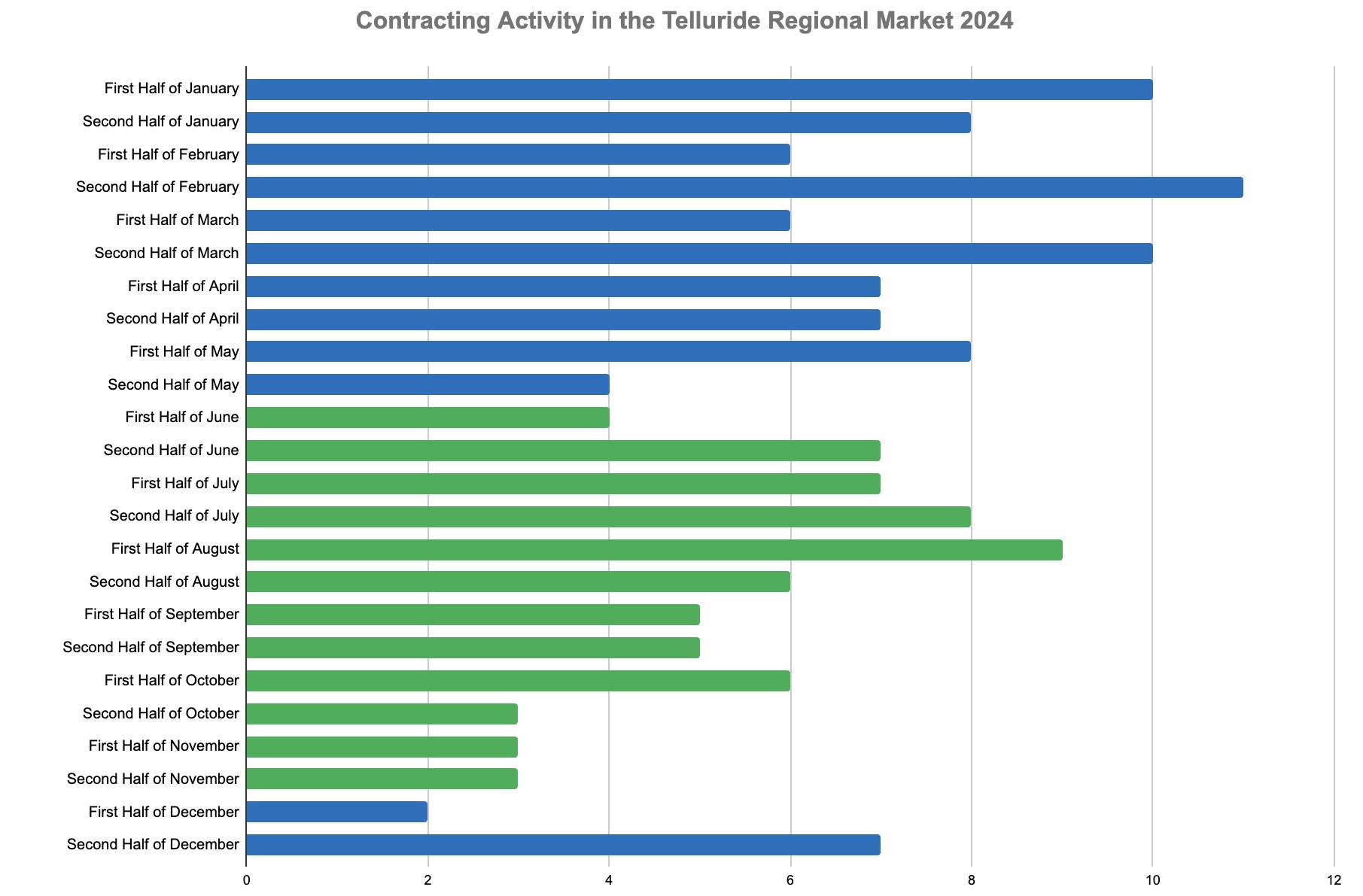

MARKET TRENDS - SEASONS OF SALES

The seasonality of the Telluride regional real estate market for contracting properties diverged from traditional patterns during the Post Pandemic buying spree of 2020-2022 when demand for properties led to purchasing throughout the year rather than winter and summer selling seasons. Traditional purchasing patterns returned in 2023. Activity was tilted toward summer with 55% of purchases contracting as a result of summer marketing activities versus 45% from winter marketing activities. In 2024, however, those purchase patterns swung the other way with 57% of the property purchases contracting as a result of winter marketing activities.

2020 Sales: 75% Summer | 25% Winter

2021 Sales: 45% Summer | 55% Winter

2022 Sales: 43% Summer | 57% Winter

2023 Sales: 55% Summer | 45% Winter

2024 Sales: 43% Summer | 57% Winter

Contracting Activity in the Telluride Regional Market 2024

MARKET TRENDS - 2024 VS. 2023

The chart below illustrates the overall state of the Telluride regional real estate market during 2024. The red arrows of Total Dollar Volume and Number of Sales indicate the slowing market following the post pandemic real estate boom. The green arrows, measuring prices per transaction, show the ongoing effect of the severely depleted levels of Available Inventory which kept upward pressure on price.

Market Trends - 2024 vs. 2023

Surrounding Neighborhoods* Regional Mesas**

*Surrounding Neighborhoods includes Aldasoro Ranch, Ski Ranches and Idarado Legacy & Falls at Telluride.

**Regional Mesas includes Sunshine, Wilson, Specie, Iron Springs and Hastings Mesas.

Telluride

Mountain Village

MARKET TRENDS - LIQUIDITY

Liquidity is the measure of how quickly an asset can be turned into cash. Equities in the stock market are the most liquid of all assets because they can be sold for cash in seconds or even nanoseconds. Art is generally considered the most illiquid of all assets because of the difficulty in selling art quickly with real estate coming in second among the most illiquid assets. It simply takes time to turn real estate into cash especially when compared to a share of stock.

The most meaningful metric of liquidity for real estate is Days on Market which tracks how many days were required to put a property under contract once marketed. Multiple variables determine how liquid a market is including the general state of the national economy and the Available Inventory of an individual segment. A strong national economy combined with very few properties for sale would likely yield the most liquid of real estate markets and therefore the fewest Days on Market.

The bar graph above illustrates the change in liquidity in the Telluride market for different segments from 2006 to 2024. For example, in 2006 it required 407 days on average to contract a home in Mountain Village. That number grew to an astonishing 805 days in 2014 and then fell to 174 days in 2022 with the onset of the Post Pandemic real estate rush. In 2024, the average Days on Market required to sell a home in Mountain Village drifted back up to 260 days.

The bar graph also indicates that, in general, condos are more liquid than homes. In 2024, the Mountain Village condo segment and the Town of Telluride segment both required 138 days on average to contract a condo.

Average Days on Market of Properties in Telluride and Mountain Village

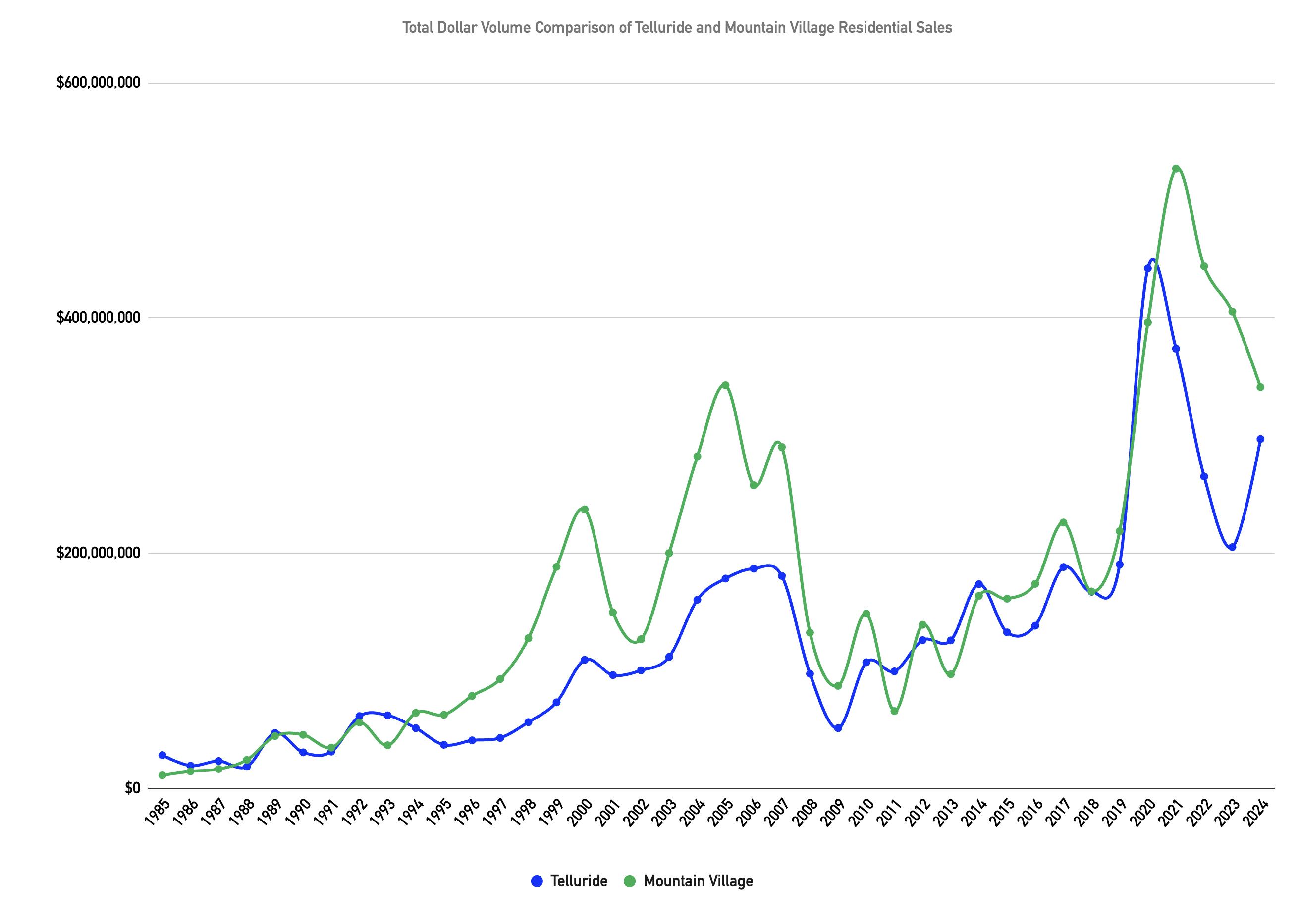

MARKET TRENDS - HISTORICAL COMPARISON OF TOTAL DOLLAR VOLUME

Up to 85% of the annual Total Dollar Volume for the region traditionally derives from sales in Telluride and Mountain Village. The annual Total Dollar Volume difference between Telluride and Mountain Village signals buyer preference and Available Inventory. As the graph indicates, the preference is cyclical over time.

After the nine year period of 2012 to 2020 of closely correlated demand, buyer demand suddenly swung heavily toward Mountain Village properties in 2021 and continued to outpace Telluride for the next three years. In 2024, the Total Dollar Volume in Mountain Village fell by 16% to $341 million while Telluride sales grew by 45% to nearly $300 million greatly narrowing the gap between the two municipalities.

Total Dollar Volume Comparison of Telluride and Mountain Village Residential Sales

TELLURIDE MARKET

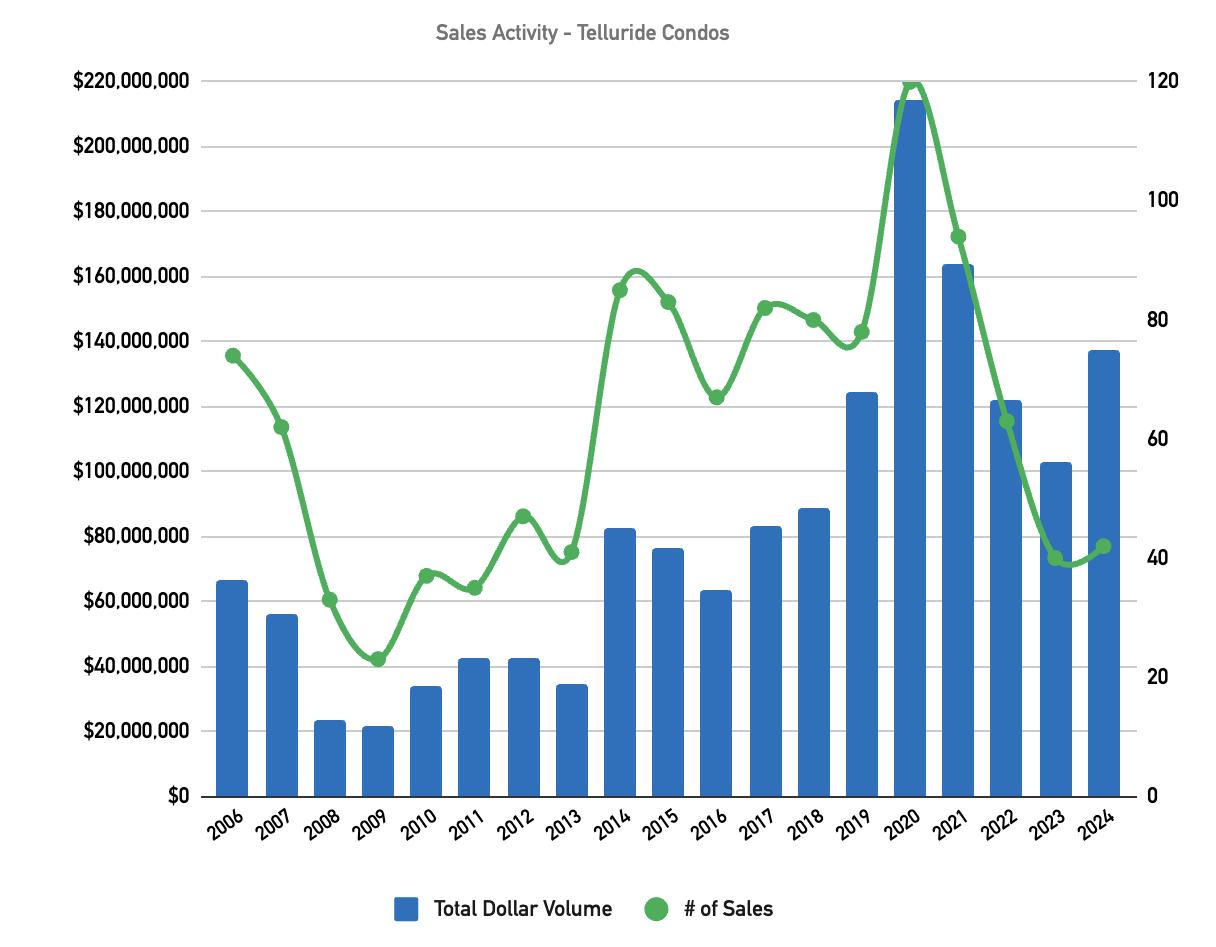

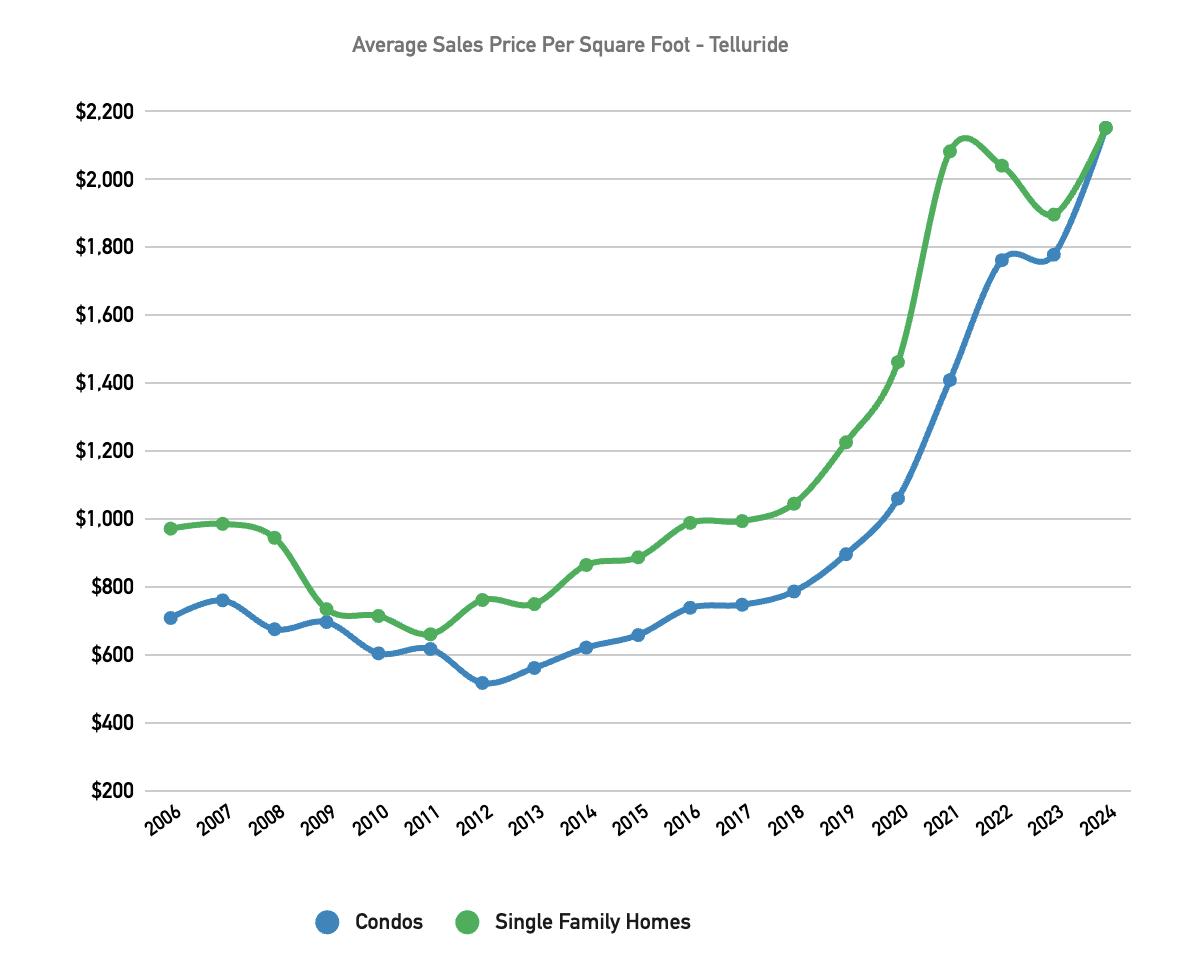

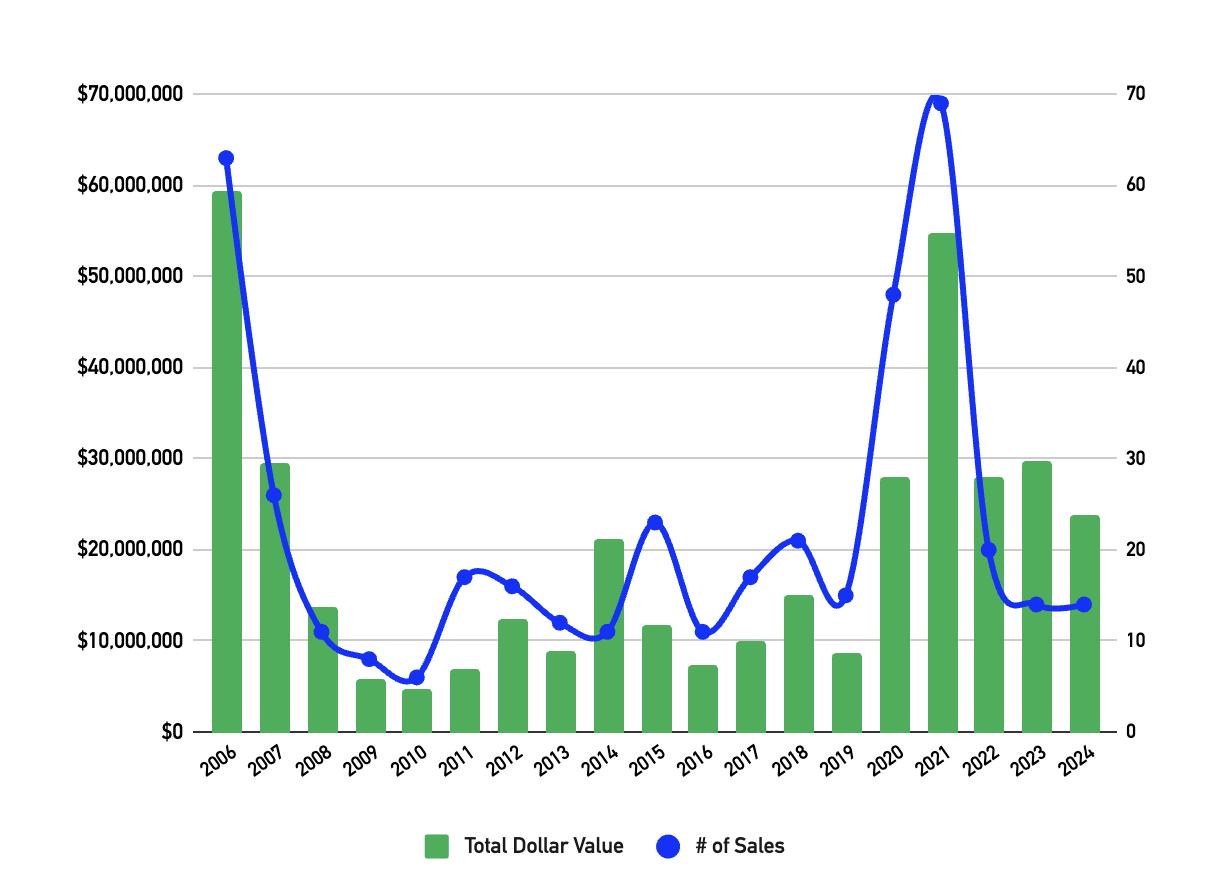

Although the Town of Telluride only generated 42 condo sales, the Average Sales Price continued its ascent in 2024 to a record-breaking $3.3 million per sale. The mark was also set for the highest ever Sale Price Per Square Foot at $4,778. The highest priced condo sold for $12.2 million.

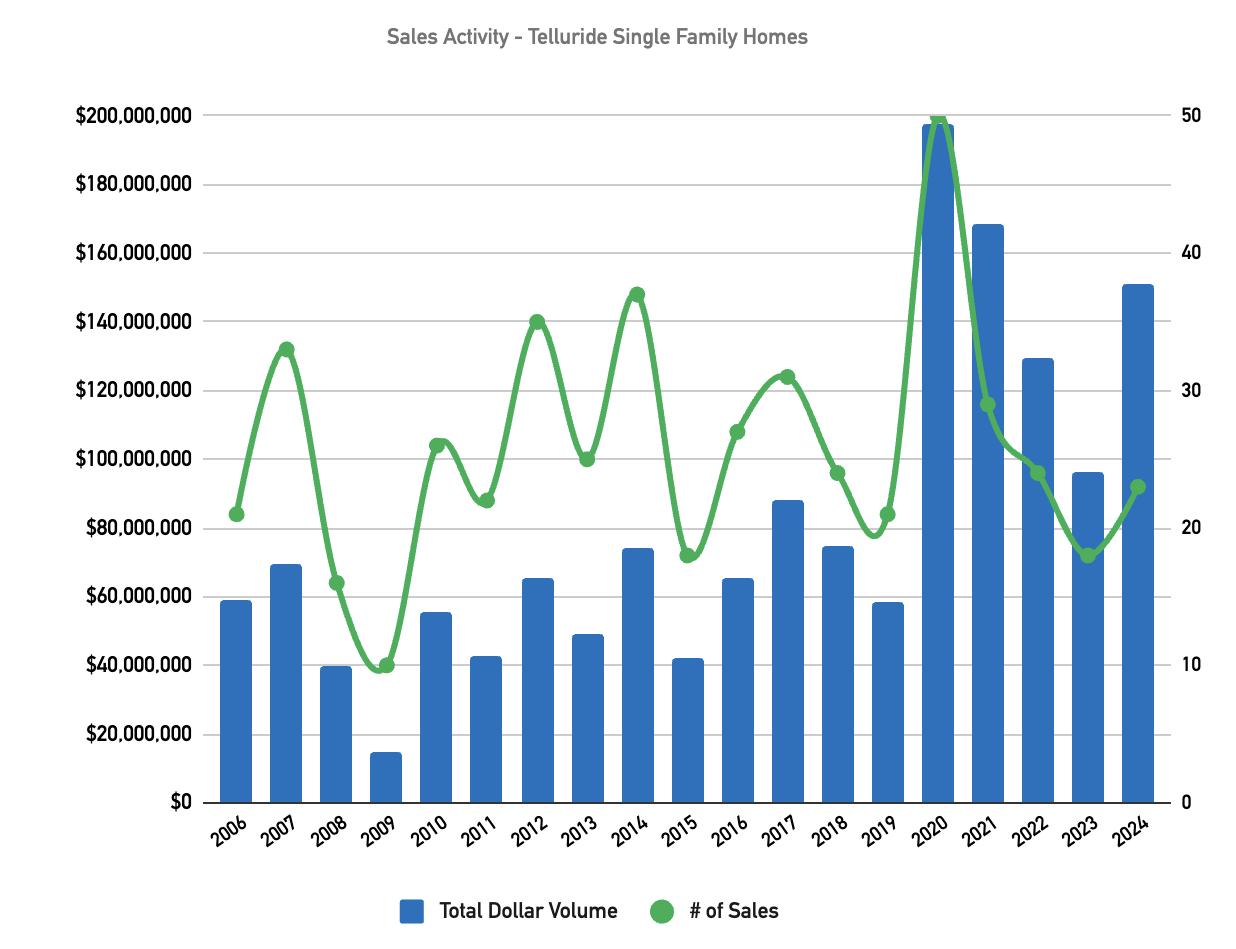

After three consecutive years of a Number of Sales decline, the Town of Telluride bounced back in 2024 with 23 home sales producing $151 million in Total Dollar Volume with an Average Sales Price of $6.6 million. The highest priced home to sell closed for $12.2 million.

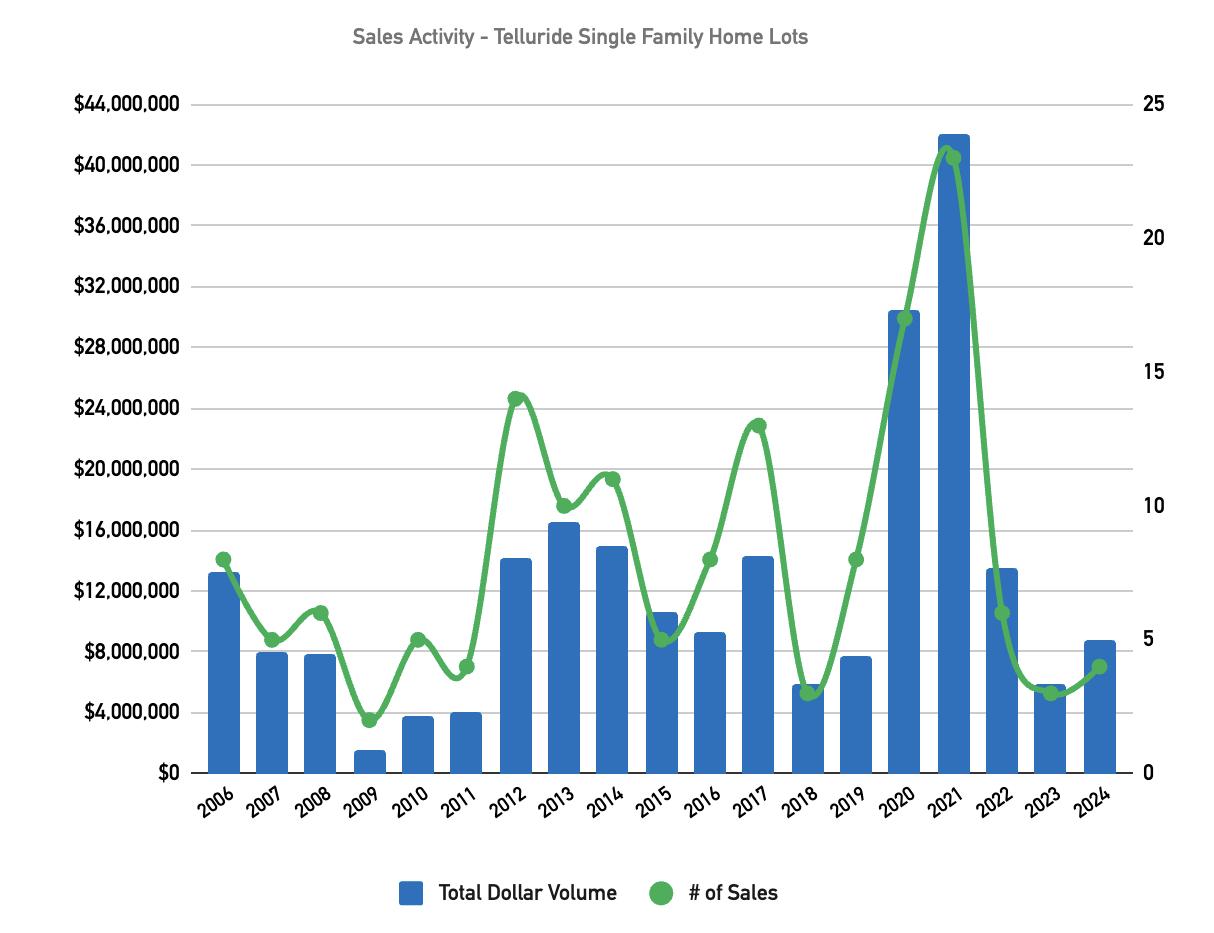

Low levels of Available Inventory continued to hamper the lot segment. Only 4 lots sales were recorded in 2024. The highest priced lot sold for $3.2 million on Pandora Avenue.

In 2024, the condo segment finally caught the home segment as the Average Price Per Square Foot for both was $2,153, the highest ever recorded for each segment.

Average Sales Price Per Square Foot - Telluride

Sales Activity - Telluride Single-Family Home Lots

Sales Activity - Telluride Condos

Sales Activity - Telluride Single-Family Homes

MOUNTAIN VILLAGE MARKET

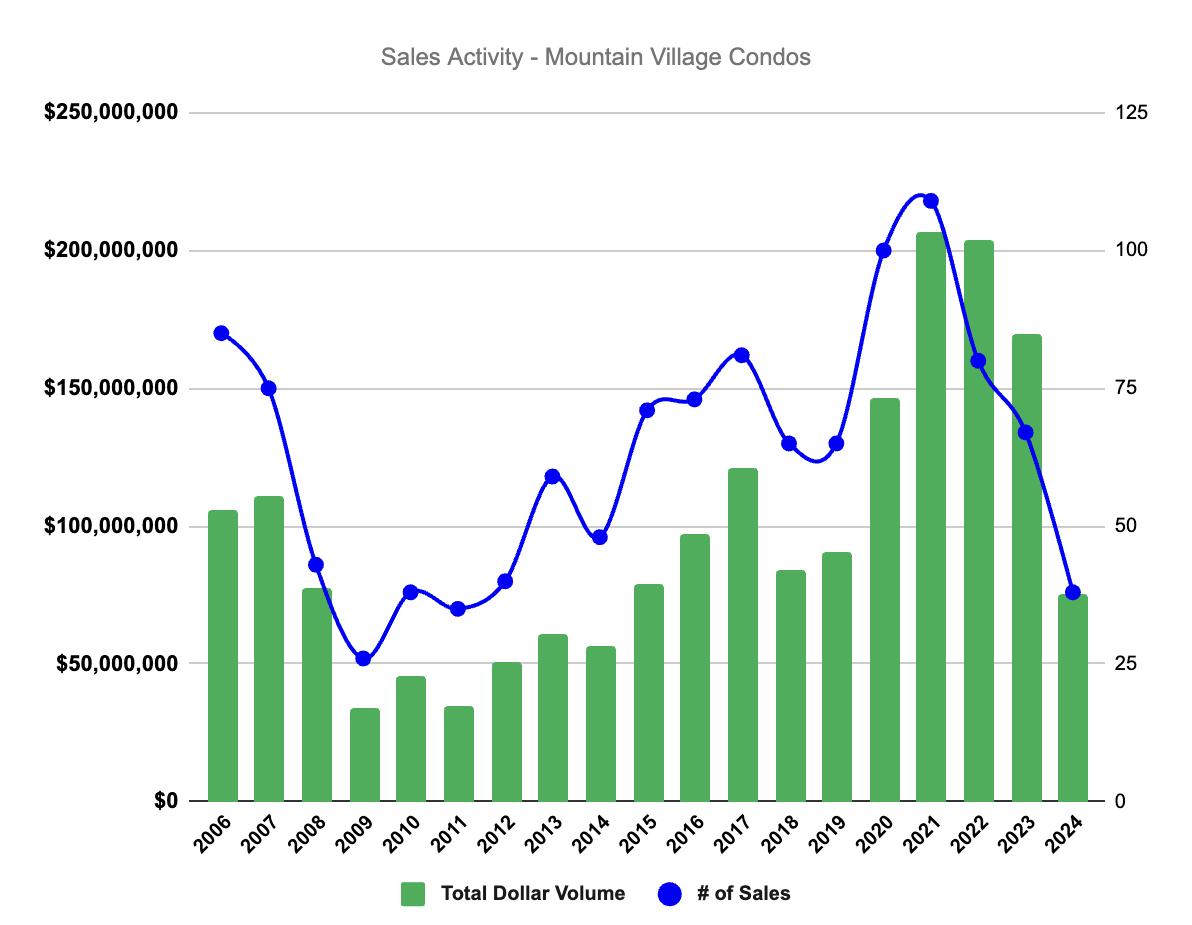

In 2024, the Mountain Village condo segment struggled with its weakest performance in almost a decade as measured by Total Dollar Volume and Number of Sales. Average Sales Price declined by almost 20% to $2.1 million compared to the previous year. The highest priced condo sold for $8.7 million, the third highest priced to ever sell.

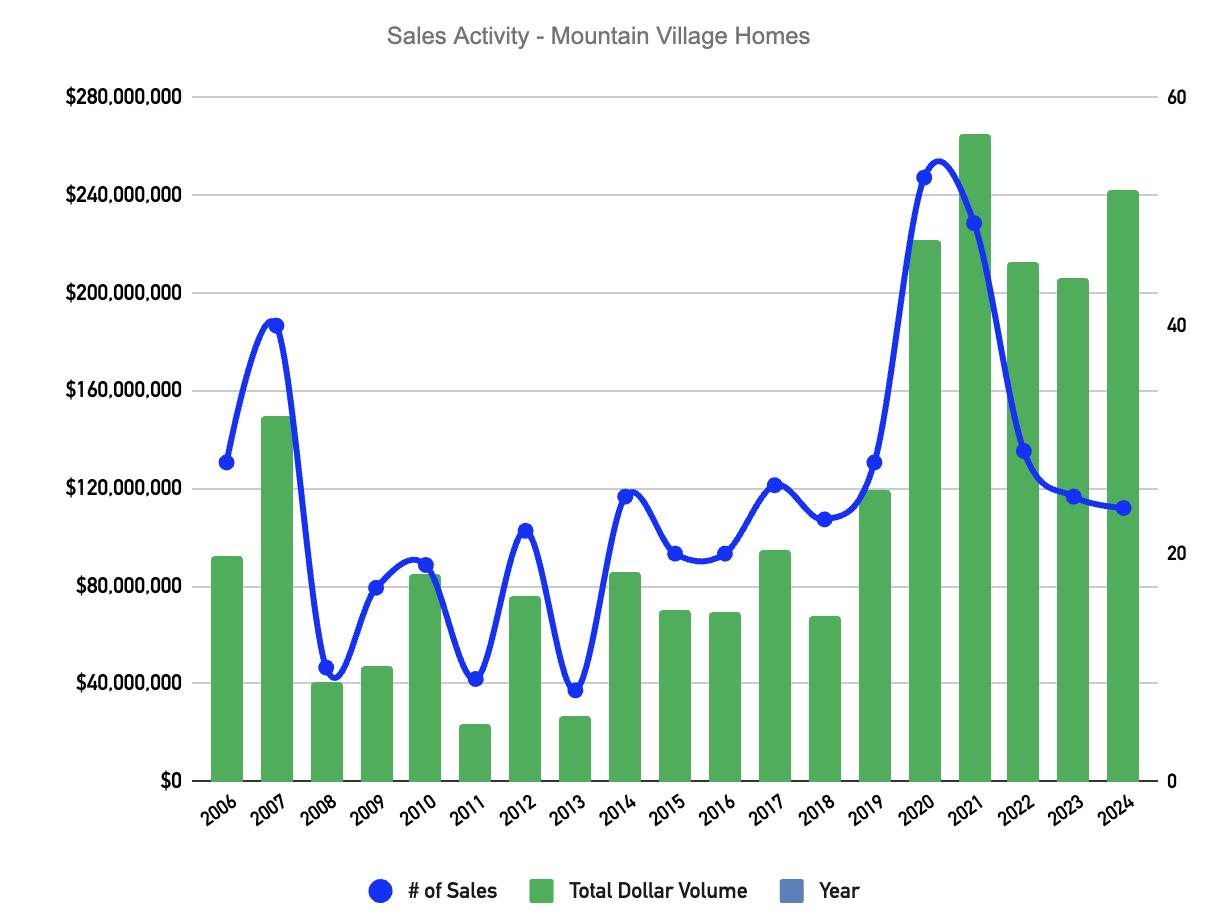

After ten years of Price Per Square Foot closely tracking with each other, homes pulled ahead of condos significantly in 2024 with a best ever $1,589 average. The highest priced Per Square Foot sale was $3,683 set by a home on Yellow Brick Road.

Despite a downward trending Number of Sales, the Total Dollar Volume buoyed to produce $242 million in 2024 while setting the record for Average Sales Price at $10.1 million. The highest closing price for a home was $20 million, setting a record.

The 14 lot sales during 2023 to 2024 contrast sharply with 2020 to 2021 when 117 lots sold. Four of the 14 lots sold in 2024 were located in The Ridge subdivision. The most expensive lot to sell closed at $2.7 million on Benchmark Drive.

Sales Activity - Mountain Village Homes

Sales Activity - Mountain Village Condos

Sales Activity - Mountain Village Single-Family Home Lots

Average Sales Price Per Square Foot - Mountain Village

SKI RANCHES MARKET

Located just south of Mountain Village, the Ski Ranches development contains 203 lots, most of which have been developed into single-family homes. This eclectic neighborhood is a favorite among locals and second-homeowners alike because it’s more affordable than Mountain Village and only a few minutes from the Telluride Ski Resort.

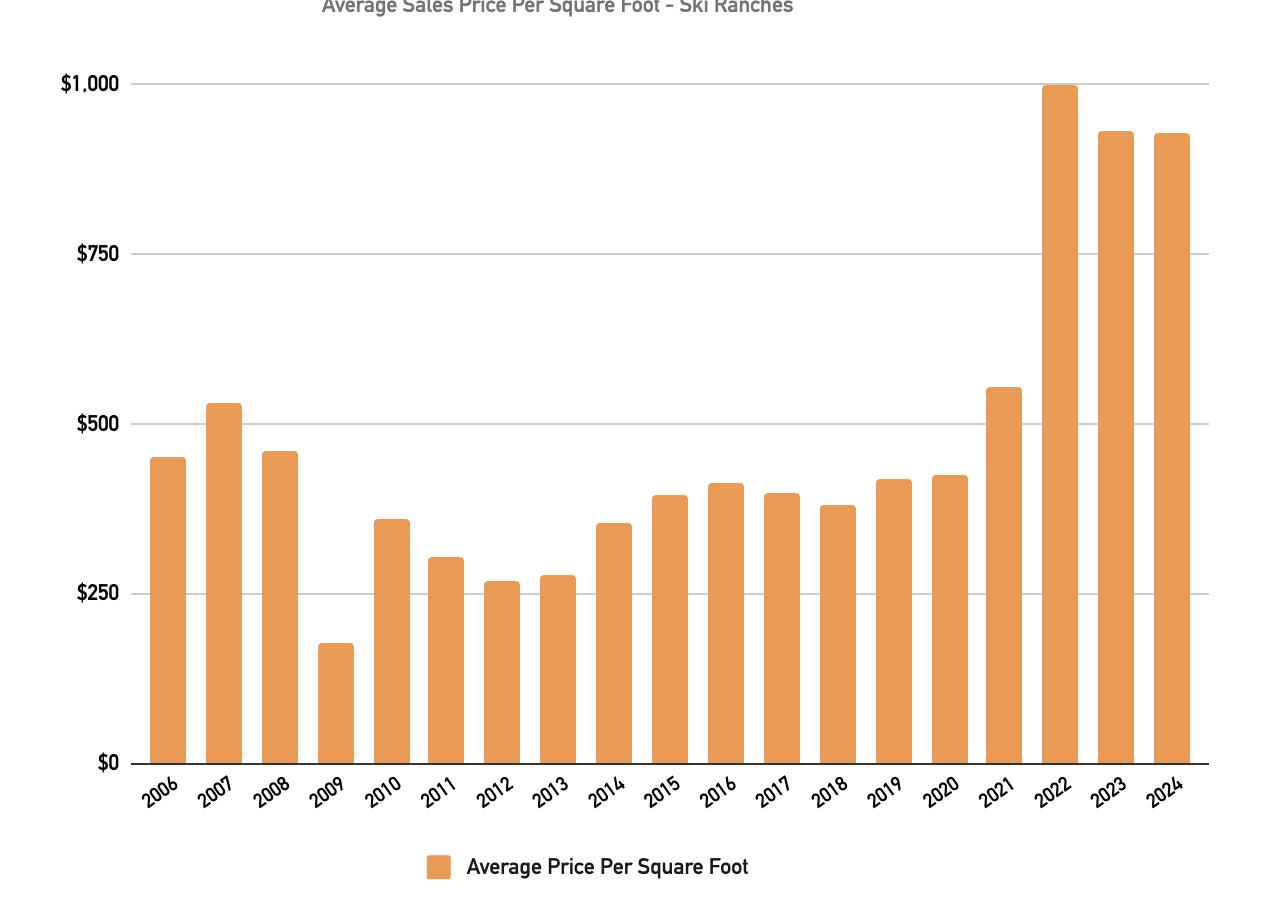

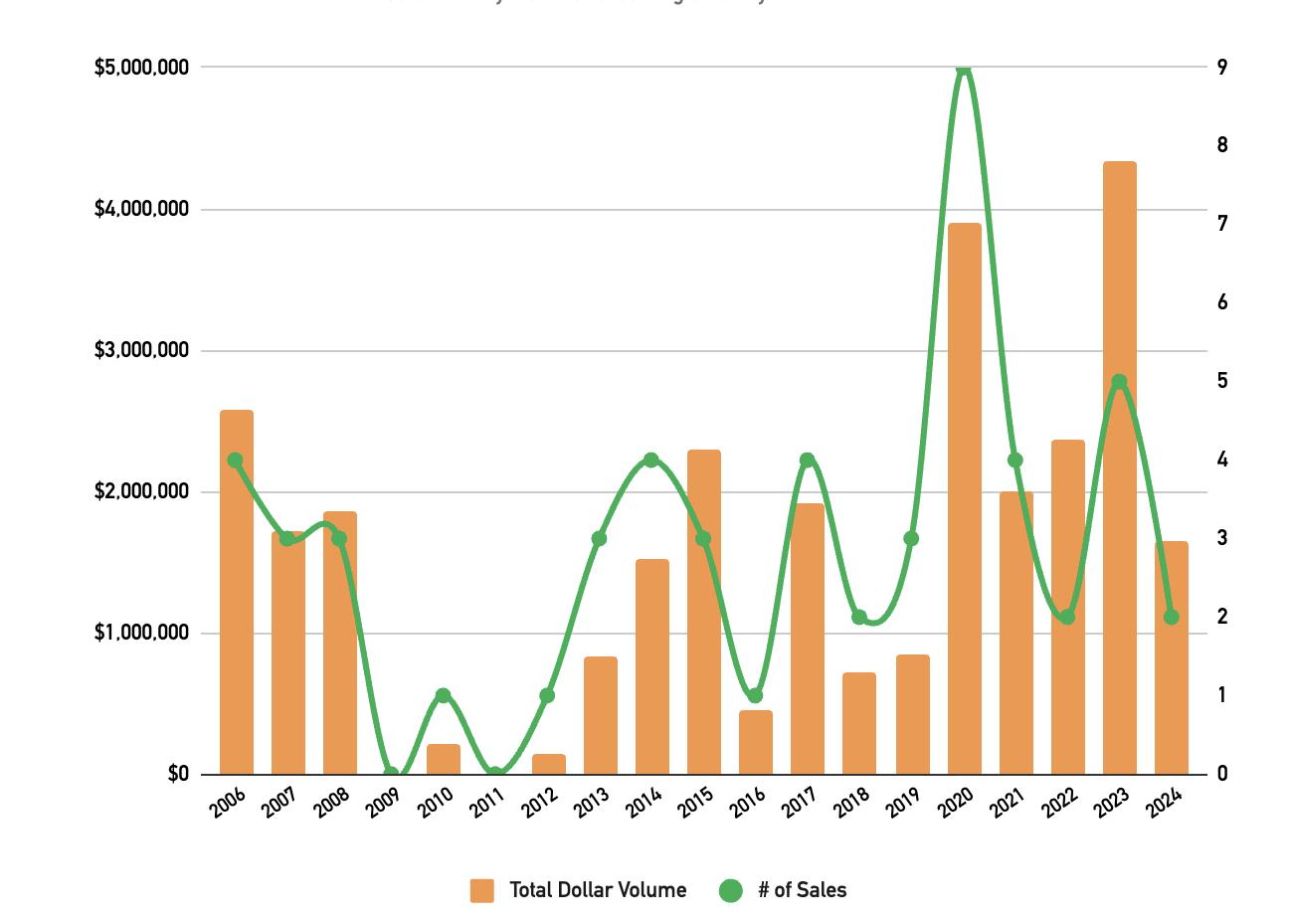

Sales Activity - Ski Ranches Homes

Despite rising levels of Available Inventory in the second half of the year, lot sales dropped to only two sales. The highest priced lot sold for $900,000.

The volatility of Number of Sales in the Ski Ranches continued while the Average Sales Price fell to $2.9 million from a high of $4.6 million set in 2022. The most expensive home to sell closed at $3.5 million.

After 16 years of never breaking $600 per square foot, the metric shot up in 2022 to over $900 and has stayed above that mark for the third consecutive year. The highest Price Per Square Foot was $1,080 recorded by a home sale on Sunrise Circle.

Sales Activity - Ski Ranches Single-Family Home Lots

Average Sales Price Per Square Foot - Ski Ranches

ALDASORO RANCH MARKET

Developed in the 1980s, Aldasoro Ranch is home to 166 properties, each ranging from 3 to 10 acres. The subdivision is characterized by some of the best views in the entire region, and almost every home is less than 15 minutes from downtown Telluride and the Telluride Ski Resort.

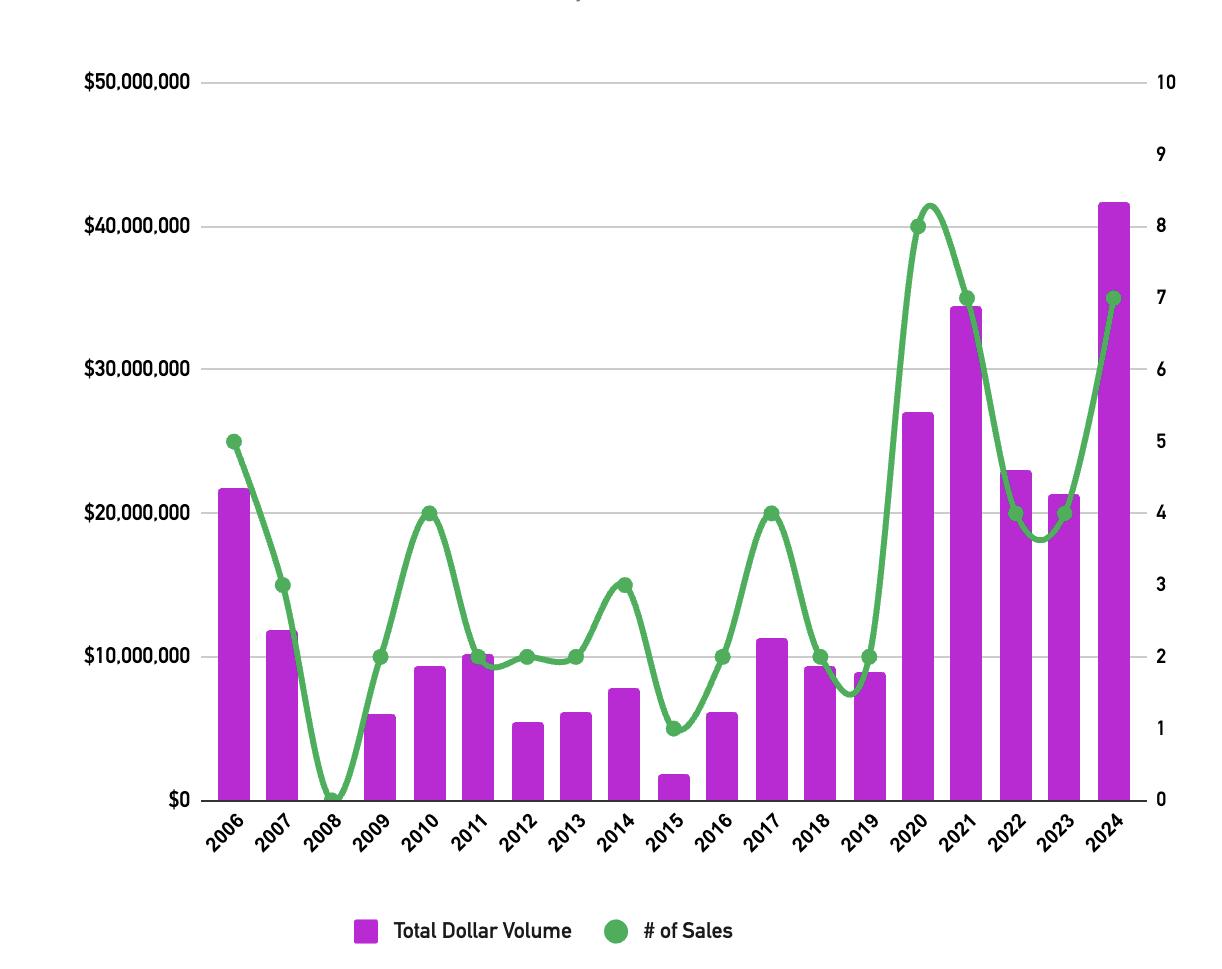

After a stunning level of Number of Sales in 2021, that metric has fallen dramatically since to only 3 sales in each of 2023 and 2024. The decline has been largely driven by extremely limited Available Inventory. The most expensive lot sold in 2024 closed at $1.65 million.

After two consecutive years of only 4 home sales, 2024 bounced back with 7 closings setting records for Total Dollar Volume at $41.6 million and Average Sales Price at $6.0 million. The highest priced sale closed at $8.4 million on Serapio Drive.

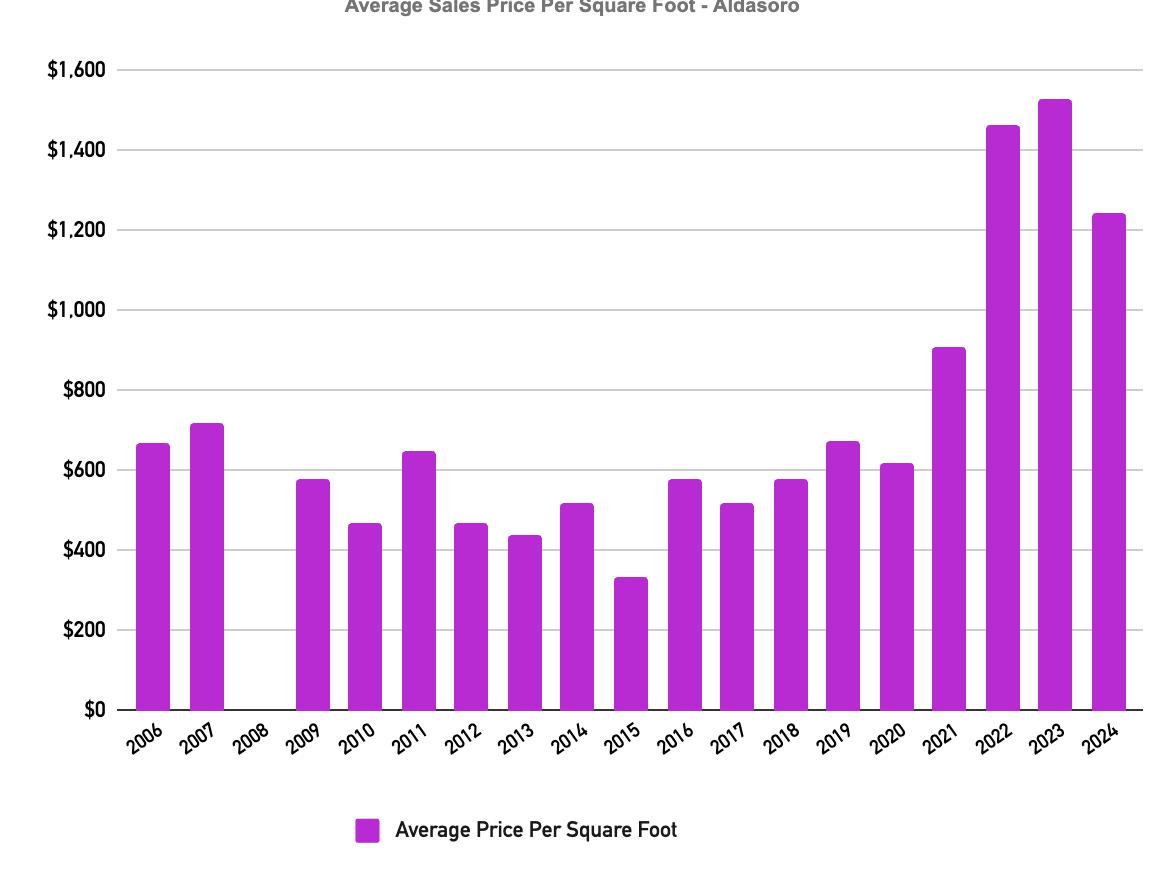

After piercing $1,500 for the first time in 2023, the metric fell back to $1,244 but still stayed above $1,000 per square foot for the third consecutive year. The highest Price Per Square Foot was $1,554 set by a home on Aldasoro Boulevard.

Sales Activity - Aldasoro Homes

Average Sales Price Per Square Foot - Aldasoro

Sales Activity - Aldasoro Single-Family Home Lots

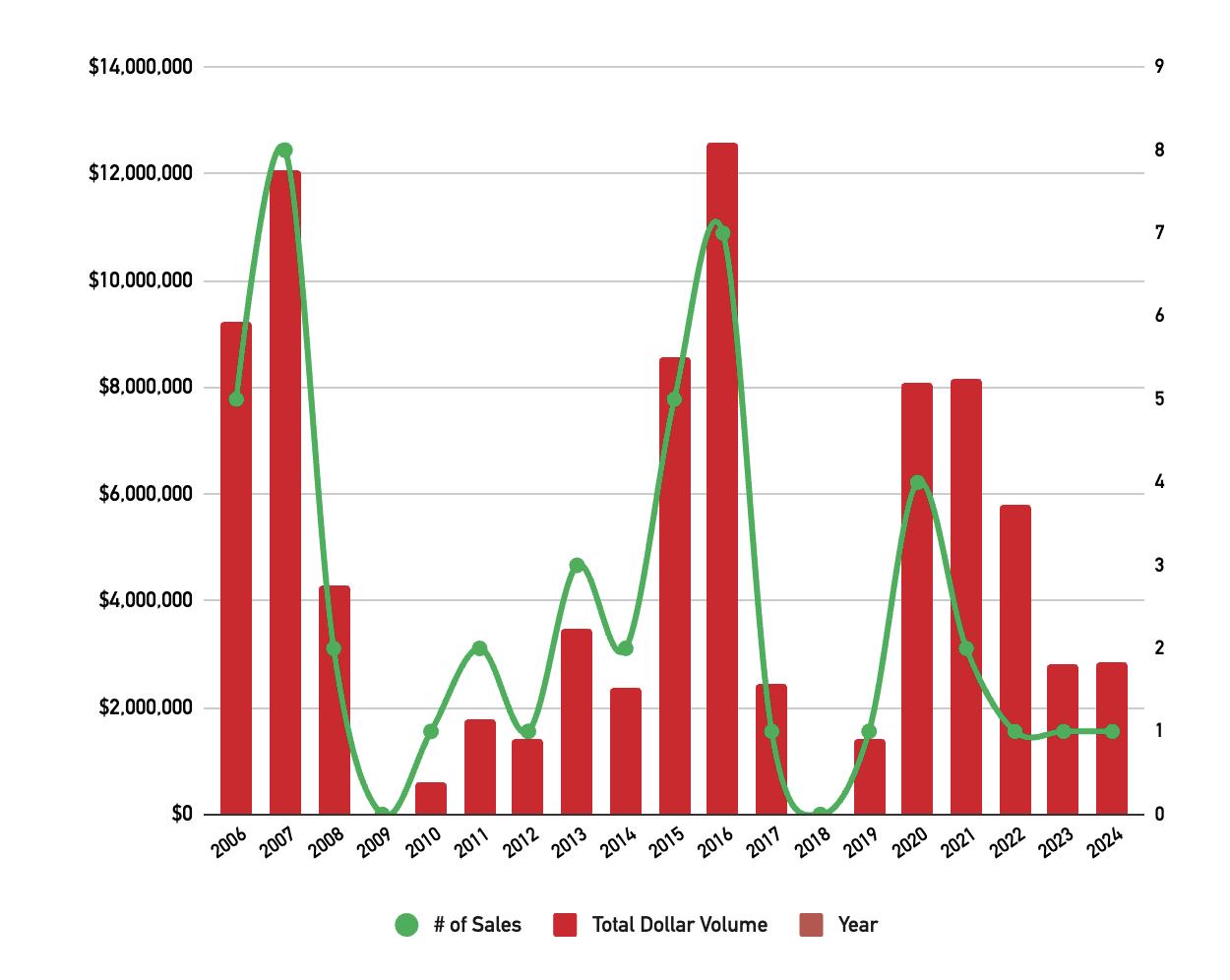

IDARADO LEGACY & FALLS AT TELLURIDE MARKET

Located five minutes outside of the Town of Telluride along the San Miguel River, Idarado Legacy is one of the newest subdivisions in the Telluride region. Spread over 125 acres, the neighborhood includes 37 Single-Family Home Lots, ranging from 0.58 to 15 acres.

The lots are distributed into three neighborhoods: Liberty Bell (9 lots), Pandora (24 lots) and Bridal Veil (4 lots). The data in this report combines Idarado Legacy with the adjacent subdivision of Falls at Telluride (4 lots), 3 of which are developed with a home.

Limited Available Inventory in 2024 restrained the neighborhoods to a single sale of $13.8 million or $1,463 per square foot. No homes were on the market at year end.

Only two lots were on the market in 2024 and one of the two sold closing at $2.85 million. The other lot of 15.2 acres is offered at $5.5 million.

Sales Activity - Idarado Legacy & Falls at Telluride Homes

Sales Activity - Idarado Legacy & Falls at Telluride Lots

REGIONAL MESAS MARKET

Telluride Regional Mesas offer opportunities to own rustic properties ranging from modestly-sized parcels to several-thousand-acre ranches, all within an hour of Telluride. Each mesa has a distinct character of terrain, vistas and weather, but all are rural and remote. As such, mesa properties tend to be less liquid than other geographic segments.

The analysis below considers sales activity of Sunshine, Wilson, Specie, Hastings and Iron Springs Mesas. A detailed analysis of the individual mesas is beyond the scope of this report, but meaningful insights can be gained by looking at their combined transaction activity. The Price Per Square Foot of mesa sales is not analyzed because the metric loses meaning if significant adjustments aren’t made to each highly-unique transaction.

In 2024, activity of homes on the mesas rebounded with a 45% increase in the Number of Sales and a nearly 80 percent increase in Total Dollar Volume. The highest priced sale of a mesa home was $8.5 million located on Wilson Mesa.

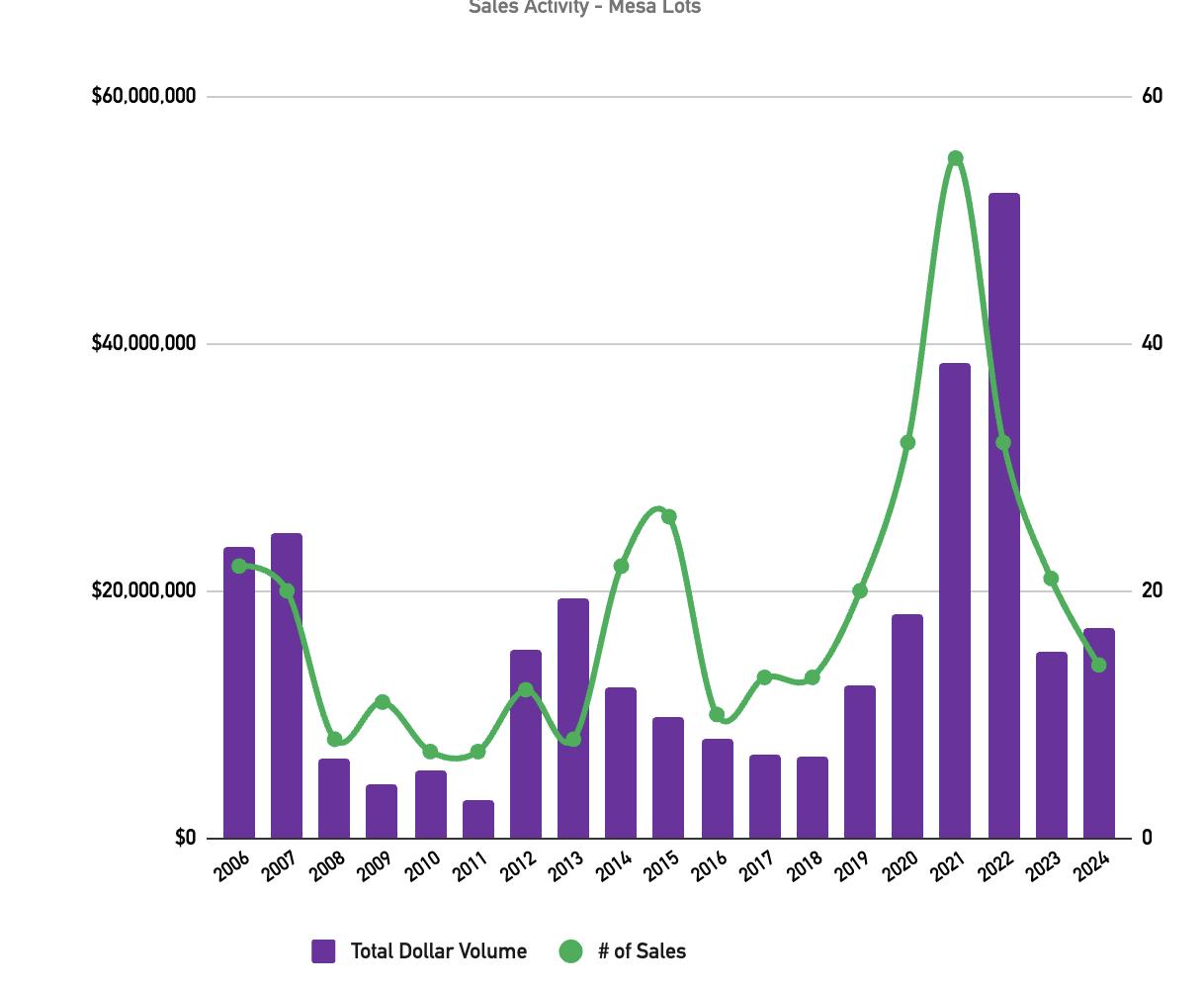

Sales activity for mesa parcels continued its dropoff from the 2021-2022 peak. Only 14 parcels sold for a Total Dollar Volume of $17 million. A 170 acre tract on Wilson Mesa commanded the highest price at $10.4 million.

Sales Activity - Mesa Homes

Sales Activity - Mesa Vacant Parcels

MARKET COMPARISON: TELLURIDE VS. NEARBY RESORTS

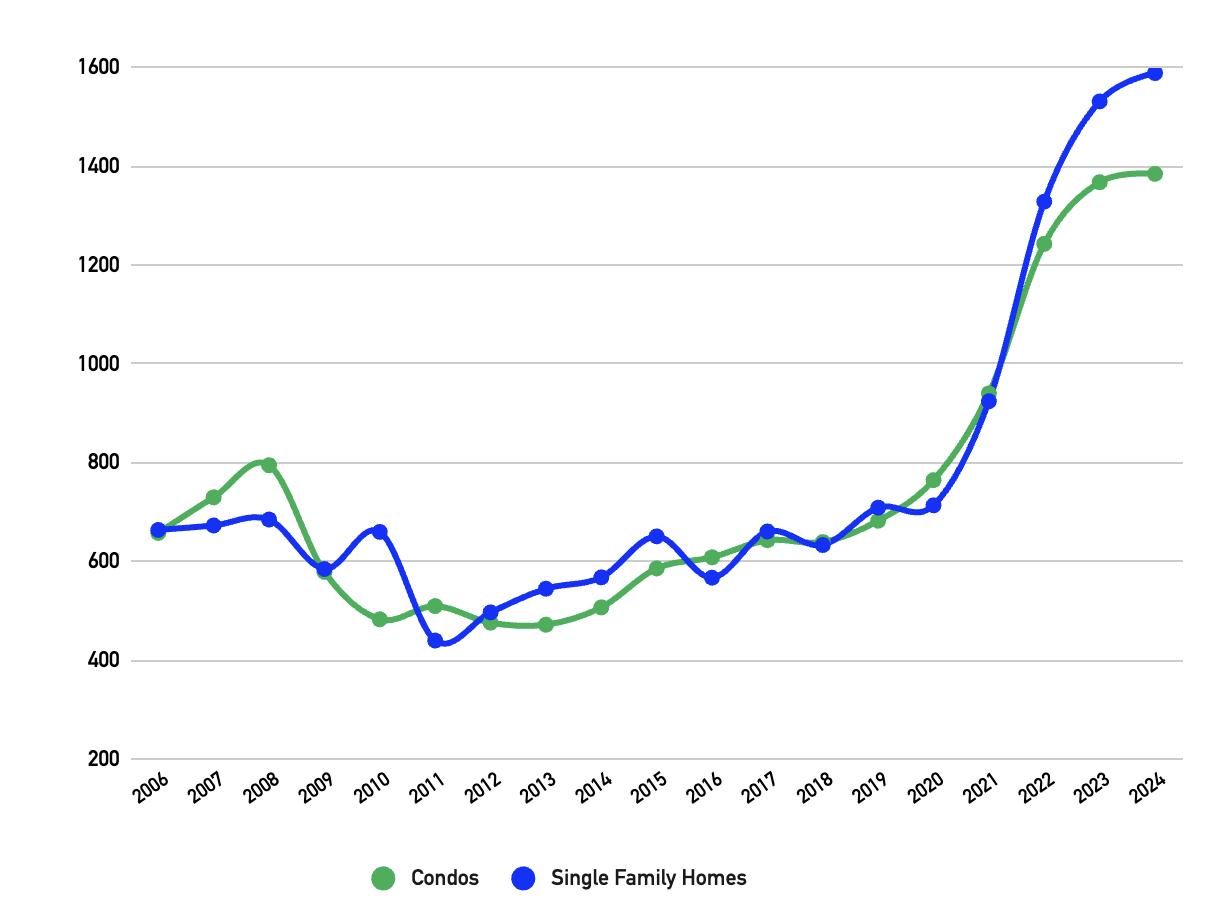

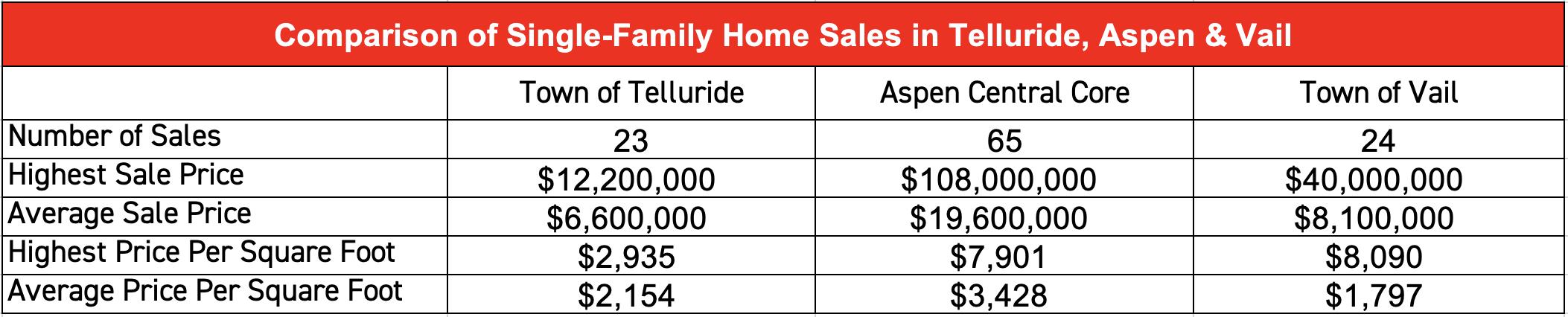

The three premium luxury ski resorts in Colorado are Aspen, Vail and Telluride. Twenty years ago, Telluride was still relatively new to the scene compared to the other two stalwarts and the price of real estate reflected that newness. Vail was roughly twice the price per square foot as Telluride and Aspen’s prices were significantly greater than those of Vail. Over the last two decades, Telluride matured as a resort destination increasingly attracting a more wealthy demographic. In 2024, the Town of Telluride pulled slightly ahead of Vail on an Average Sales Price Per Square Foot basis while Aspen is about 50% more than the Town of Telluride and almost double Vail.

Aspen Mountain and downtown Aspen. Photo courtesy of aspenchamber.org

MARKET COMPARISON: MOUNTAIN VILLAGE VS. NEARBY RESORTS

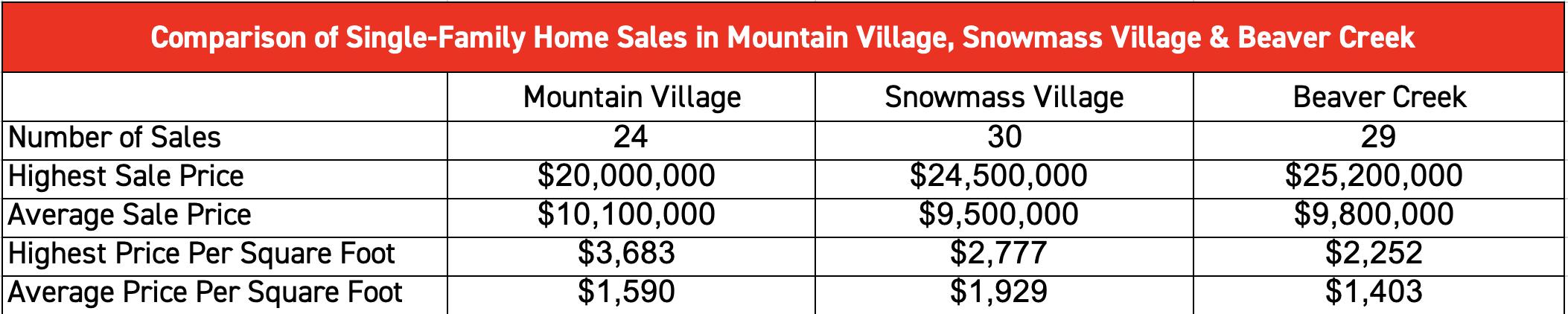

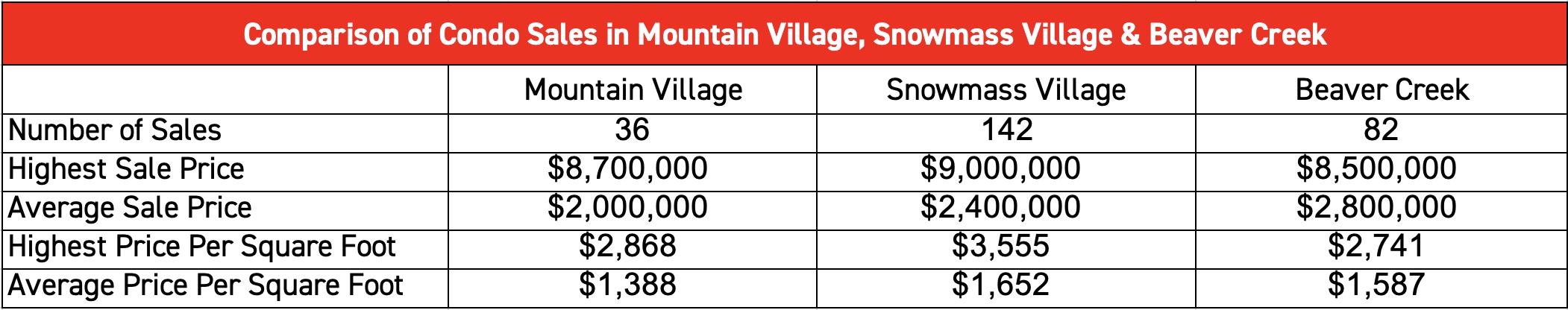

While the Town of Telluride is most similar to the Town of Vail and the Aspen Central Core, Mountain Village is better compared to their neighboring resorts in Snowmass and Beaver Creek. In 2024, prices for homes in Snowmass proved to command higher prices on an Average Sales Price Per Square Foot basis, yet the resorts were largely aligned. Condos were also comparable among the resorts with Snowmass commanding a slight premium.

Beaver Creek Resort. Photo courtesy of unsplash.com

Wealth Report

A CLOSER LOOK AT OFF-MARKET DEALS

Read more from The Agency

For high-net-worth sellers desiring privacy, offmarket deals can offer a swift and seamless sales process that eliminates the need for open houses and showings. For buyers, they can mean running up against less competition and fewer bidding wars.

These deals are not listed in traditional public channels such as the Multiple Listing Service and either reside on agents’ private lists, which are made

available to select clients, or change hands privately, owner to owner. Since most fall under the former category, an in-the-know agent is more important than usual.

“When it comes to high-end, multi-million-dollar properties, off-market deals provide privacy and exclusivity for sellers while allowing buyers a chance to avoid the competitive pressures of public listings,” says Mauricio Umansky, CEO of The Agency.

“However, policies like Clear Cooperation run the risk of limiting those choices. Above all, I advocate for policies that have built-in flexibility and allow our clients to navigate the market on their terms.”

In a real estate market with pent-up demand and not enough listings—which describes much of the world at the moment— off-market listings can help alleviate some stress for those who’ve been waiting on the

from The Agency Red Paper 2025 Annual Market & Wealth Report by The Agency

The Agency Telluride represented the seller in one of the highest priced off-market sales ever in the immediate Telluride region.

Red Paper:

Rocky Road, Mountain Village - Sold Off-Market

sidelines to buy. For example, in Salt Lake City, where demand continues to outstrip supply in the luxury market, off-market deals are happening much more frequently than they have in the past.

“People are flocking to Utah, and when we get a buyer, we almost immediately look for off-market properties,” says Joey Sutorius, a Managing Partner at The Agency Salt Lake City. “We pull up properties and send out letters to homeowners” to find them, he says.

He notes that the combination of price, privacy and ease of the arrangement are the main enticements. So is the fact that the public cannot see how long the property has been on the market, a key factor because luxury estates typically take longer to sell.

Plus, “off-market transactions are amicable transactions— there’s no pressure on the buyer to make a quick decision,” Sutorius says.

Adds Sam Palmer, an agent at The Agency Beverly Hills, money is not always a motivator in such sales.

“Typically, these types of owners aren’t desperate to sell,” he says.

“But if approached, they may say, ‘I paid $20 million for it last year, and if I can get $40 million now, I’ll sell.’ And buyers expect to pay a little bit of a premium for a special property.”

Because most off-market deals involve luxury properties, it goes without saying that a bargain isn’t a top priority for prospective buyers. “These deals don’t work for every property,” Palmer says. “It has to be a trophy asset that people know about and want to buy.”

Listing a home on the Multiple Listing Service “is oftentimes the last resort,” says Joey Parsi, an agent at The Agency Beverly Hills, who adds that “most clients will choose to list” rather than lower prices if the off-market deal doesn’t attract bids.

Off-market deals also occur when homeowners reach out to an agent and request a private sale.

In the luxury market in his area of Utah, where prices start at $1.25 million and properties average $450 per square foot, the initial success rate of Sutorius’ strategy, although low—200 letters typically yield three to four responses from homeowners—allows him and his team to build up a precise database of inventory and

opportunities for future buyers.

“We keep the list in a little black book in the back pocket,” he says, adding that three to four times a year, the dots connect and off-market sales are made.

His team also has started hosting large, highly publicized “sneak preview” events that spark conversations with neighbors about selling their properties, too.

Until the supply-demand equation balances—“Baby Boomers are one of the biggest bottlenecks because they have too much stuff and aren’t downsizing,” Sutorius says— he predicts “off-market deals will become more prevalent here,” helping release some of that pent-up demand.

On the west side of Los Angeles, where Palmer specializes in properties that trade for $20 million and more, off-market deals are already routine. Celebrities, in particular, value the anonymity they bring.

“They don’t want the public in their homes,” Palmer says. “And they don’t want the wrong agents coming through; they want the right agents, the select agents who deal with trophy properties and who can bring in the right buyers.”

“When it comes to high-end, multi-million dollar properties, off-market deals provide privacy and exclusivity for sellers while allowing buyers a chance to avoid the competitive pressures of public listings.”

The Agency’s 2025 Red Paper Annual Wealth Report

KRISTEN MULLER

As Managing Partner of The Agency Telluride, Kristen Muller combines fifteen years of luxury real estate marketing experience with over a decade of executive leadership and award-winning marketing expertise to deliver unrivaled client service.

Having worked as an executive marketing leader for some of the most prestigious luxury real estate brands, Kristen has extensive experience marketing ultra-luxury estate properties, legacy ranches, luxury resorts, and developments. This experience uniquely equips Kristen to develop custom marketing strategies to effectively promote properties across wide-ranging media channels.

Whether creating a new campaign to maximize exposure for a property, or advocating on behalf of her clients, Kristen upholds a superior level of service befitting of The Agency’s industry-disrupting ethos and world-class brand.

• Telluride Native

• 15 Years Luxury Real Estate Marketing Experience

• 10 Years of Executive Leadership Experience

• Real Estate Marketing Awards from RealTrends & Luxury Real Estate:

-Best Video Branding Strategy Award (2018)

-Best Print Marketing Award (2016)

-Best Digital Strategy Award (2015)

-Best Video Website Strategy (2015)

• Board Member- Luxury Home Tour Colorado (2022-2023)

• Member of the Who’s Who in Luxury Real Estate Global Network (2015-2023)

• BA Economics @University of Colorado Boulder

• MBA Marketing @Univeristy of Colorado – Sko Buffs!

Born and raised in Telluride, Kristen possesses a keen understanding of the local resort real estate market and the luxury hospitality sector. After spending more than 20 years away from Telluride in cities including Denver, Chicago, San Francisco and New York, Kristen returned to her hometown. “They say ‘Home is where the heart is,’ and Telluride has always been my first love. I enjoy being able to share all the beauty that this region has to offer with my clients.”

A devoted mentor, in her spare time, Kristen participates in Mentor Collective, which supports the professional advancement of young professionals. She also loves practicing yoga, savoring great food and wine, and exploring Colorado’s scenic hiking trails.

Kristen.Muller@TheAgencyRE.com 970.708.2788

STEWART SEELIGSON

Fueled by his passion for the mountain lifestyle, Stewart is a consistent market leader with a reputation for incredible results. A reliable advisor and source of up-to-the-minute market analysis, Stewart readily guides clients through Telluride’s ever-evolving real estate landscape. His calm, focused support allows clients to feel confident in their decisions and move forward in their transactions.

Stewart’s philosophy is to approach the business from a perspective of helping people address and overcome their individual real estate concerns. Stewart understands that buyers want assurance that they are making sound real estate investments and sellers want to know that a robust approach is taken when marketing their property so that the highest possible price can be achieved. Additionally, Stewart provides expert counsel through the complicated and sometimes emotional contract period leading to closing the transaction.

• 20 Years Telluride Real Estate Experience

• 9 Years Commercial Real Estate & Business Development Experience

• Perennial Top Producer in Telluride

• Top 100 Producing Broker in the State of Colorado

• Ranked within the Top 1,000 Real Estate Professionals in the US

• The Agency’s 2024 Chairman Award - Top 5%

• Board of Directors - Telluride Association of Realtors (6 years)

• President - Telluride Association of Realtors (2012 -2013)

• Realtor of the Year - Telluride Association of Realtors (2013)

• Commissioner - Telluride Historic Architectural Review Commission (2020-2022)

• Former Board Member of Telluride Young Life & Alpine Chapel

• Licensed Certified Public Accountant (1991)

• BBA Accounting @University of Texas

• MBA Finance, with honors @University of Texas – Hook ‘em Horns!

Beyond his many business successes, Stewart is known for cultivating meaningful, long-lasting professional and personal relationships and has garnered a loyal following of repeat and referral clientele. Stewart’s firsthand investment knowledge and proven track record make him highly qualified to speak on the Telluride market’s unique financial and lifestyle-oriented appeal.

Stewart’s love for Telluride runs deep. Raised in Dallas, he spent more than a dozen childhood summers in Telluride, taking in the region’s beauty while hiking, camping, and fly fishing. “Those summers instilled in me a great love of the outdoors and an appreciation for what makes the San Juan Mountains special. I take great pride in helping people discover all that Telluride has to offer and always put each client’s interests ahead of my own so they can find their perfect place in the mountains.”

Stewart@TheAgencyRE.com

970.708.4999

NOTABLE TRANSACTIONS

$18,900,000

$5,950,000

$12,830,000

$10,950,000

Rocky Road, Mountain Village

Main Street Redevelopment, Telluride

Element 52 Penthouse, Telluride

Villas at Tristant, Mountain Village

$4,400,000

Liberty Bell Lane, Telluride

Serapio Drive, Aldasoro Ranch

$8,400,000

$7,150,000

$15,000,000

Polecat Drive, Mountain Village

Polecat Lane, Mountain Village

$10,250,000

Buckskin Lane, Wilson Mesa

$15,000,000

Palmyra Drive, Mountain Village

Trails Edge, Mountain Village

$6,695,000

Salt Trail, Cornerstone Golf Club $3,450,000

THE AGENCY

The Agency is an aspirational, global lifestyle brand that has transformed the luxury real estate market. The Agency excels in the art of branding and marketing real estate, having positioned some of the most iconic, influential properties in the world. The Agency innovates marketing solutions for our clients, from crafting the stories of their properties to ensuring a digital footprint that draws the world’s eyes to the homes we represent.

GROWING MEDIA PRESENCE 1

The Agency is rapidly becoming a media powerhouse, with a growing portfolio of platforms that are redefining luxury real estate media, providing unparalleled insights, trends, and market intelligence to a global audience.

2024 PR HIGHLIGHTS: MAKING HEADLINES

In addition to earning recognition from top publications around the world, more than 2,000 articles were secured by The Agency’s award-winning in-house PR team in 2024, reaching an audience of more than 41 billion. We made headlines in top publications, including, but not limited to:

The New York Times

Mansion Global

The Wall Street Journal

Bloomberg

Inman

Robb Report

3

SOCIAL REACH

In 2024, The Agency continued to expand its digital presence and drive engagement across multiple platforms. From viral campaigns that generate millions of impressions to targeted social media efforts resulting in inquiries and sales, The Agency is redefining the role of social media in real estate.

65.1M

Total Impressions, Up By 600K Year Over Year

358,000+ 503K+ 2

Followers Across LinkedIn, YouTube, X, TikTok, Facebook and Threads