Financing For Development – Final Project One of the things the Sustainable Development Goals (SDGs) have done is raise the bar of expectations and placed a call for a higher level of responsibility across governments, citizenries, businesses, consumers and the international community. Most of the conversations around the SDGs, even around the coursework have been centered on leveraging partnership opportunities for productivity. This means that the global community agrees that leveraging SDG 17(1) is the first step – dare I say, the key to accomplishing the development goals. Hence, the dilemma of creating sustainable financing opportunities and creating specific and appropriate incentives to align all interests and get all parties on board. This brings me to the topic of my discussion,

LEVERAGING SDG 17 TO END POVERTY AND

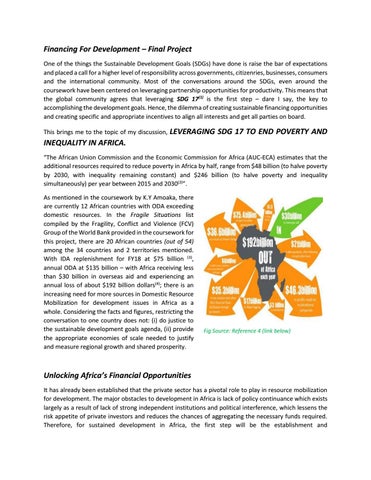

INEQUALITY IN AFRICA. “The African Union Commission and the Economic Commission for Africa (AUC-ECA) estimates that the additional resources required to reduce poverty in Africa by half, range from $48 billion (to halve poverty by 2030, with inequality remaining constant) and $246 billion (to halve poverty and inequality simultaneously) per year between 2015 and 2030(2)”. As mentioned in the coursework by K.Y Amoaka, there are currently 12 African countries with ODA exceeding domestic resources. In the Fragile Situations list compiled by the Fragility, Conflict and Violence (FCV) Group of the World Bank provided in the coursework for this project, there are 20 African countries (out of 54) among the 34 countries and 2 territories mentioned. With IDA replenishment for FY18 at $75 billion (3), annual ODA at $135 billion – with Africa receiving less than $30 billion in overseas aid and experiencing an annual loss of about $192 billion dollars(4); there is an increasing need for more sources in Domestic Resource Mobilization for development issues in Africa as a whole. Considering the facts and figures, restricting the conversation to one country does not: (i) do justice to the sustainable development goals agenda, (ii) provide the appropriate economies of scale needed to justify and measure regional growth and shared prosperity.

Fig Source: Reference 4 (link below)

Unlocking Africa’s Financial Opportunities It has already been established that the private sector has a pivotal role to play in resource mobilization for development. The major obstacles to development in Africa is lack of policy continuance which exists largely as a result of lack of strong independent institutions and political interference, which lessens the risk appetite of private investors and reduces the chances of aggregating the necessary funds required. Therefore, for sustained development in Africa, the first step will be the establishment and