See What’s in Store!

“With 15 offers from all the major mortgage lenders in the country, I chose The Money Store. Why? The supportive culture, leadership, pricing, products, technology, and marketing are incomparable, and they continue to deliver on their promises. I truly love it here!”

John Abraham | Peoria, Illinois

NMLS ID # 526102

2023 Production: 462 units | $74.8M volume

2023 Rankings: #37 nationally by Scotsman Guide | #1 IHDA Originator

The right culture makes a company feel like a home, which is why we take pride in maintaining our positive atmosphere with a philosophy of trust, respect, and support.

• Friendly and fun environment

• Welcoming, diverse, and inclusive workplace

• Informal yet professional vibe

• Open-minded and forward-thinking mindset

• Accessible, solution-oriented management

• Collaborative and supportive staff

• Valuable development resources and coaching calls

Our experienced, talented, and accessible leadership team is here to support you and drive our continued innovation.

Peter Alvarez

Chief Operations Officer

A 39-year veteran of the mortgage industry, Peter oversees the management and growth of The Money Store while maintaining our efficiency, productivity, and successful work environment.

David Zilberman

Chief Financial Officer

David has 20 years of industry experience and serves as the company’s top financial strategist. His key responsibilities include secondary marketing, investor relations, product development, and sales support.

John Palmiotto Chief Production Officer

John is focused on growing the business while strengthening our culture of TRS: trust, respect, and support. He draws from nearly three decades of sales experience in mortgages.

Coleen Bogle

Chief Marketing Officer

Coleen leads The Money Store’s marketing efforts and is dedicated to expanding and improving the promotion of our company and originators. She has over 15 years of mortgage industry experience.

Laura oversees company risk areas, including legal, compliance, licensing, quality control, and policies and procedures. She has more than 25 years of related experience.

Natalie manages credit risk, oversees underwriting, addresses audits, and ensures that The Money Store originates saleable loans. She benefits from 39 years of industry experience.

Alex leads the company’s technology strategy, implementation, and operations. A former mortgage originator and owner-operator, he has 29 years of experience in the mortgage tech space.

Mitzie has more than 20 years of industry experience across various management roles. She directs production administration, appraisal desk, general administration, and onboarding.

“One of the many factors contributing to my successful 14-year career at The Money Store is our top management team. They possess deep knowledge of the mortgage industry and consistently exhibit agility in making quick and smart decisions to adapt effectively to market shifts whenever needed.”

Kevin Zhu | Orlando, Florida

“I love our highly competitive pricing and ability to make rapid decisions as needed. We keep costs down and minimize red tape by avoiding extra layers of middle management. I also like that I can influence change at the company to quickly adapt to any market situation, product need, or procedural requirement.”

Alyssa Beller | Puyallup, Washington

By maintaining a lean organization, aggressive rates, and robust resources, The Money Store provides a strong platform to compete against lenders of all sizes.

• Limited corporate overhead

• Consistent and transparent pricing

• Competitive margins

• Vast, flexible product catalog

• Direct with all agencies

• Powerful technology tools

We put trust in our originators, which is why we believe in cutting red tape and giving you greater freedom to run your business the way you want.

• Minimal layers of management

• Instant access to decision makers

• Both retail and retail-plus models allowed

• In-house custom marketing support

We are dedicated to ensuring the prosperity of our company, employees, and clients through our commitment to our core principles.

• Embrace change and opportunity

• Deliver first-class customer service

• Recruit and retain quality staff

• Develop and reward employees

• Pursue controlled, sustainable growth

to my clients and professional partners.

Amy Procaccino | Hamilton, New Jersey

When you join The Money Store, our comprehensive onboarding process makes your transition quick, easy, and stress-free.

“The Money Store saved my business. Transitioning over 40 loans in just eight days from a failing bank was daunting. But they stepped in swiftly, underwriting files in hours and providing new closing documents within days. They even secured my clients the same or better rates. As a result of The Money Store going above and beyond, my reputation was preserved. Peter and David are the best in the industry!”

Shelby Weston | Oklahoma City, Oklahoma

NMLS ID # 226832

2023 Production: $90.3M volume | 348 units Scotsman Guide Top Originator (2023)

Offer Acceptance:

Transition plans and support initiated the moment you decide to join

1

Marketing Prep: Marketing onboarding manager to assist you in announcing your move, setting up tech preferences, and more

2

Constant Communication: Regular updates on equipment, training, and more

Department Welcome Call: Introduction to team members from various departments who will assist with your transition

4

3 5

Day 1 Orientation:

Immediate system orientation, with ongoing training to follow

6

Forever Support:

Accessible managers and hands-on assistance at your fingertips throughout your career with us

Our best-in-class operations team is dedicated to processing your loans quickly, accurately, and transparently so you can focus on growing your business.

• Highly efficient in-house processing and underwriting

• Files underwritten in an average of 24 hours*

• Loans closed in an average of 17 days*

• Accessible operations leadership

• Dedicated disclosure team

• Common sense underwriting

• TBD underwrites available

• Hybrid e-closings

* Based on typical business conditions and may not apply during periods of exceptional loan volume or atypical circumstances.

“I have all the tools and support I need here. Loan processors take ownership and tackle their tasks. Underwriters work with me to discuss and restructure files instead of killing deals. Management is ready to help whenever I call. Our entire group works together to provide the level of service and urgency my clients and partners expect.”

Cristina Nunes | Brentwood, California

Win more clients and close more loans with our wide array of competitive programs, flexibilities, and pricing.

Conventional

No Overlays | Agency AMI: HomeReady and Home Possible | Fannie and Freddie Direct | High-Balance | Jumbo

Government

FHA | VA | USDA | Ginnie Direct

Housing Finance Agencies

Low Down Payment | Down Payment Assistance | First-Time Homebuyer

Niche

ARM | Piggyback | Non-Warrantable Condo | Condotel | Second Home | Investment Home | Alt-Doc | Interest-Only | Non-QM (in-house and brokered options, including DSCR) | Adverse Credit | Foreign National

Rate Lock

Lock & Shop: buyer lock for up to 90 days while shopping | Extended Lock: buyer lock for up to 360 days with a sales contract | Lock & Sell: homebuilder lock on up to three properties for up to 90 days, then transfer to buyers

Construction and Renovation

One-Time-Close Construction | USDA Construction | FHA 203(k) Renovation | Fannie Mae

HomeStyle Renovation | Renovation HELOC

Refinance

Cash-Out | Rate and Term | VA IRRRL | Second Mortgage | HELOC

Reverse

Conventional Reverse | HECM | HECM for Purchase

Cultivate preferred lender relationships with homebuilders by leveraging our superior builder products and support.

New construction expertise in both sales and fulfillment

Extended Lock and Lock & Sell rate lock programs

MSA/desk rental setup and maintenance

Condominium approval support

Extensive builder marketing and support

“A successful national builder division starts with top-level commitment. The Money Store supports loan officers in the new home purchase business with strategic products and platforms. Our industry-leading rate lock products and sales and fulfillment expertise ensure our loan officers grow their business and help homebuilder partners close on time.”

Ryan Rosenthal | Builder Division Manager

NMLS ID # 482510

Our award-winning in-house marketing agency is ready to supercharge your brand recognition and lead generation with its team of experts, array of resources, and collection of tools.

• Experienced marketing and design professionals

• On-demand marketing request and technology support

• Library of hundreds of print and digital marketing pieces

• Custom materials by request

• Automated “set and forget” email campaigns

• Promo items and event support

• Partner co-marketing resources

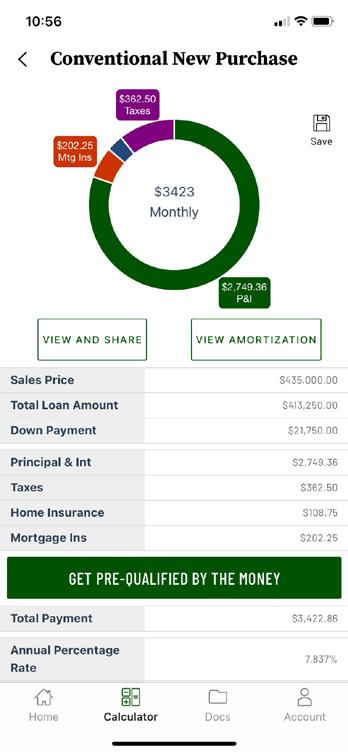

Maximize your production and reach with our trailblazing origination and marketing technology suite.

Digital mortgage process via website or mobile app

Loan pricing engine

Loan origination platform

Mortgage program guidelines search tool

Loan servicing with your name, photo, and contact info on loan statements

Customer satisfaction surveying, rating, and sharing platform

Automated home equity tracking service to engage partners and past clients

Customer relationship management (CRM) and marketing platform

Don’t see your favorite tech tool? We’re regularly evaluating our technology to help our loan officers stay competitive.

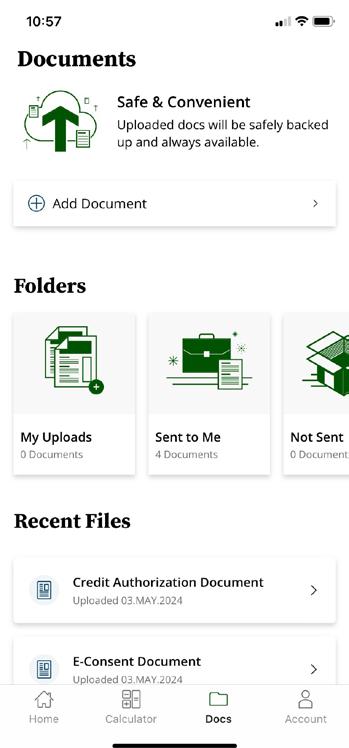

The Money Store mobile app provides a faster and more convenient home financing experience for you and your clients and partners.

Originator Features:

• Issue instant preapprovals

• Pull credit on borrowers

• Price loans

• View appraisals immediately

• Check loan statuses

• Co-brand with partners

• And more!

Borrower Features:

• Apply in 10 minutes or less

• Get preapproved

• Access mortgage and real estate tools

• Scan and upload documents

• E-sign forms

• View loan status

• And more!

If you have your sights set high, there’s a place waiting for you in the Circle of Excellence – our group for top-producing originators.

• Membership earned by hitting annual volume or unit goals

• Members rewarded with a group trip to a tropical getaway

• Past destinations include Grand Cayman, Aruba, and Cabo San Lucas