Malaysia is the second-largest oil and natural gas producer in Southeast Asia, just behind Indonesia. The country's strong exploration and field development activities have long attracted major international oil and gas players. As Malaysia tries to sustain its oil and gas sector while managing energy transition pressures, the PETRONAS–PETROS issue has become key to shaping the future of upstream investment in the country.

PETRONAS was established by the Malaysian government under the Petroleum Development Act 1974 (PDA 1974) as the country sought to manage its hydrocarbon resources. PETRONAS has been mandated as the sole custodian of Malaysia's hydrocarbon resources allowing it to undertake centralised planning across oil and gas activities in the country. On the other hand, PETROS is a company established by the state of Sarawak to strengthen the state's role in managing its own resource sector. The coexistence of federal and state level energy companies highlights the complexity of an oil and gas industry that heavily relies on integration and long-term co-ordination.

The ongoing issues between the two entities could disrupt the supply chain thereby posing risks to supply reliability. To sustain energy security, this will depend on integrated management between the federal government and the states rather than sole ownership by a single entity. If the fragmented policy environment continues, it could undermine the resilience of Malaysia's energy security.

The primary issue in the dispute is regulatory certainty over who should manage hydrocarbon resources in the state of Sarawak. Under the PDA 1974, PETRONAS is responsible for managing hydrocarbon resources within Malaysia including in Sarawak. However, Sarawak asserts its right to manage gas resources under the Malaysia Agreement 1963 and the Distribution of Gas Ordinance (DGO). Stable government policy is crucial for investors as oil and gas projects involve high capital expenditure and long lifecycles. These issues have created ambiguity in frameworks such as licensing and gas allocation which has delayed FID for some projects. This delay in FID could see more projects delayed signalling a decline in sector competitiveness despite strong resource potential. This ripple effect is already visible in the industry. For example, ConocoPhillips has pulled out of the Salam-Patawali project showing how unclear policies can make investors cautious and cause project delays.

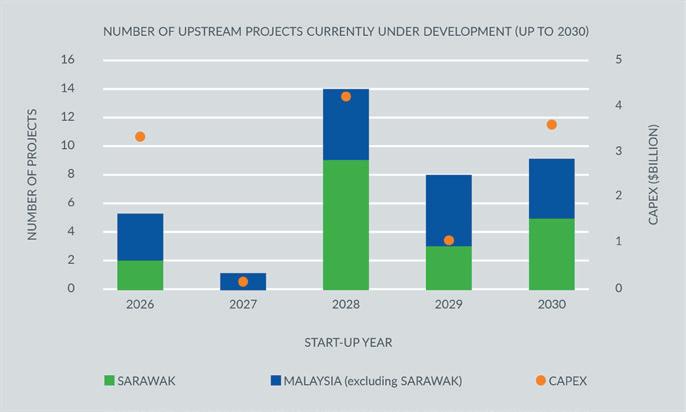

These issues could also create challenges for Malaysia particularly in terms of energy security. Sarawak plays a critical role in the national gas supply and hosts the majority of upstream developments in Malaysia. According to EICDataStream, 37 upstream projects are being tracked for start-up in Malaysia between 2026 and 2030 representing an estimated investment of US$12.3bn. Of these, 19 projects are located in Sarawak.

Another issue arising from the PETRONAS–PETROS dispute is market competitiveness. Since its establishment, PETRONAS has worked to balance domestic needs with export commitments. This effort has led to price stability and long-term contract reliability that led investors' confidence to invest in the country. However, the introduction of statelevel control mechanisms could affect market efficiency. To maintain market competitiveness, both the federal and state governments should ensure transparency in frameworks for resource allocation that benefit all parties including PETRONAS, PETROS and investors.

Recent developments suggest a potential pathway towards resolution. The joint declaration signed by the prime minister of Malaysia and the premier of Sarawak in May 2025 represents a step towards greater federal–state collaboration. If implemented effectively, this arrangement could establish a hybrid governance model in which PETRONAS continues to fulfil its mandate under the PDA 1974 while PETROS is recognised as the sole gas aggregator under the DGO. For operators with interests in Sarawak, such as Shell and PTTEP, clearer alignment between federal and state authorities could reduce regulatory uncertainties and support renewed investment momentum as companies now face lower risk and greater confidence to invest in Sarawak. This is evidenced by PTTEP's January 2025 decision to advance the Malaysia Greenfield Initiative project signalling that the company retains confidence to invest in Sarawak.

In conclusion, the PETRONAS–PETROS issue highlights fundamental challenges in governance and market co-ordination. The resolution of this issue could significantly impact Malaysia's energy security and market competitiveness. A stable regulatory framework is essential to ensure that both companies can achieve their mutual interests. The objective should not be to determine an absolute winner but for both companies to work together to realise the national interest.

Muhammad Zulhakim Energy Analyst, Asia Pacific – Oil and Gas zulhakim.zulkifli@the-eic.com

We begin this month with a final call for the 10th edition of the EIC Survive and Thrive Insight Report. This is your opportunity to share your company's success story with the global industry. The process is completely free for members, offers massive promotional benefits and automatically enters your business into the World Energy Supply Chain Awards (WESCAs). I encourage you to interview with us and help us celebrate the strategies driving growth in our sector. Register your company here: www.the-eic.com/ MediaCentre/Publications/SurviveandThrive

Looking ahead to next month, we are gearing up for the return of Bankable Energies on 17 March 2026 at the Hilton London Bankside, UK. This event has become a vital meeting point for the global investment community, project developers and policymakers. It is the place to be if you are looking to discuss the real-world solutions needed to unlock investment for future projects. To secure your spot or learn more, please visit: www.the-eic.com/Events/BankableEnergies/Home

I am also pleased to highlight a major step forward in how we support your global expansion: the launch of EIC International Pavilions. Following a successful debut at Rio Oil & Gas, this new exhibition format provides a high-visibility, branded presence for members at key events worldwide. We have confirmed plans for Hydrogen Technology World Expo and Oil & Gas Asia, offering you a supported, premium platform to connect with decision-makers across new regions.

Inside this edition of Inside Energy, you will find a wealth of updates from our global network, including a spotlight on technology from Powertherm Contract Services Ltd. Its piece details how advanced thermal audit technology is helping the industry identify wasted energy.

Along with the latest member news and updates from our offices around the world, I hope this edition gives you the insights and connections you need to drive your business forward.

Stuart Broadley CEO, EIC

Operator: Bulgarian Energy Holdings Value: US$7.7bn

A consortium of Laurentis Energy Partners, BWXT Canada and Canadian Nuclear Partners has signed a contract for the design, construction and commissioning of the two new units.

For information on these and more than 16,000 other current and future projects we are tracking please visit EICDataStream

Offshore Wind Farms

B-Wind and C-Wind Polska

Operator: Ocean Winds Value: US$2.3bn

Ocean Winds has secured €2bn (US$2.31bn) to reach FiD on the wind farm. The financing package for the initiative is supported by the European Investment Bank (EIB), providing nearly one-third of the entire project finance, as well as Instituto de Credito Oficial Espanol (ICO) and 13 commercial banks.

Lion Oil Field

Operator: Navitas Petroleum Value: US$2.05bn

A final investment decision has been made for the Sea Lion 1 project in the North Falkland Basin. The project requires US$1.8bn to reach first oil and US$2.1bn to completion.

Operator: Starlight Engine Ltd Value: US$1.5bn

The conceptual design for the project has been completed with Kyoto Fusioneering and Starlight Engine also releasing the Conceptual Design Report. They aim to start construction in 2028.

Afif 1 Solar PV Plant

Operator: ACWA Power Value: US$1bn

ACWA Power has announced the financial close for 15,000MW of renewable energy projects across Saudi Arabia, covering five solar PV plants and two wind power plants with a combined capacity of 12,000MW solar and 3,000MW wind.

Operator: CF Industries Holdings Inc Value: US$4bn

Wasco Engineering has secured a US$150-200m contract entailing engineering, procurement and fabrication of pre-assembled process modules for the project. Key execution scopes will be undertaken at Wasco's expanded Batam facility, supported by the Dubai Jebel Ali site.

Are you up to date on the latest project developments in the energy market? The EIC’s leading market intelligence database – EICDataStream – contains information on energy projects and associated contracting activity from the inception stage all the way through to construction and commissioning.

• Access details on over 16,000 CAPEX projects across all energy sectors

• Identify business opportunities and inform your business development strategies

• Explore a truly global database, updated daily by an international team of analysts

• Stay up to date with project developments, including information on tenders and awards

• Get insights into what your existing clients are doing and identify potential new clients

• Have a direct interface with analysts for local knowledge and insights

• Access insight and country reports with in-depth data on specific sectors and markets

EICSupplyMap maps the capabilities of supply chain companies that operate across all energy industries. These industries cover renewables, oil and gas, power, nuclear and energy transition technologies like energy storage, carbon capture and hydrogen.

• Identify the supply chain local to your region, giving you the opportunity to engage with potential new clients.

• Find the supply chain capability in 12 regions, now covering the UK, Germany, Spain, Italy, UAE, Oman, Saudi Arabia, Malaysia, Singapore, Indonesia, US and Brazil.

• An in-depth look at profiles of more than 10,000 energy sector supply chain companies.

• Make smarter decisions by targeting your offering to international developers/operators and contractors matching your capability with international energy projects.

THREE60 Energy names Ryan McPherson as Decommissioning Director

THREE60 Energy, a leading provider of life cycle solutions, has appointed Ryan McPherson as decommissioning director, further strengthening its management team.

Ryan brings more than 25 years of international energy sector experience to the role. He has held senior positions with both operators and service companies, leading large-scale projects across engineering, project delivery and major asset management. His career has taken him across the UK and Europe including Hungary and the Netherlands, as well as further afield in Algeria, Egypt and Mexico, giving him extensive insight into complex and diverse operating environments.

He will lead delivery of THREE60's recently awarded bp decommissioning contract – the first of its kind in the UKCS. This revolutionary approach is set to reshape how assets are decommissioned in the North Sea and establish a new benchmark for decommissioning globally.

THREE60 Energy is a leading global provider of innovative engineering, technology and energy transition solutions across the asset life cycle from design to decommissioning. Through a 1,000-strong workforce, THREE60 is a trusted partner for ambitious companies of all sizes. The company combines expert engineering, operations and project management with proprietary technologies and products to unlock value for its customers. With deep expertise in oil and gas, nuclear, onshore and offshore wind, alongside a growing position in carbon capture and storage, hydrogen and geothermal, THREE60 is helping deliver the energy transition.

THREE60 also supports the defence industry across all sub-markets (land, navy, marine, aerospace, etc.) and services the industrial and marine sectors through a complementary group of businesses. By underpinning its services with advanced digital solutions, THREE60 remains committed to offering emissions reducing solutions.

I’m excited to be joining THREE60 Energy at such a pivotal moment. The company has an outstanding reputation for delivery across the asset lifecycle, and I look forward to applying my international experience and project leadership to further grow our decommissioning services. Most importantly, I’m proud to be part of an industry-first project that will define how decommissioning is carried out – not just in the North Sea, but around the world.

Ryan McPherson, Decommissioning Director, THREE60 Energy

Ryan joins us at an exciting time for the business as we commence work on the bp contract. His strong technical background, combined with his proven leadership across global projects, makes him an invaluable addition to the team. I’m confident he will play a key role in enhancing our decommissioning capabilities and delivering value to our customers.

Stephen Diplock, Managing Director, Operations, THREE60 Energy

Across the industrial sector, significant energy losses often go unnoticed through uninsulated or poorly maintained systems. Recognising the scale of this challenge, Powertherm Contract Services Ltd uses advanced thermal audit technology to identify and eliminate wasted energy.

Powertherm's engineers are certified by the European Industrial Insulation Foundation (EiiF) to carry out TIPCHECK (technical insulation performance check) audits – the structured and standardised method for assessing the effectiveness of industrial insulation systems. Using EiiF's tools and energy efficiency classification (BS EN 17956), TIPCHECK experts quantify energy losses and calculate potential savings in cost, energy and CO2 emissions.

Alongside BS EN 17956, the TIPCHECK methodology follows BS EN 16247, the standard for professional energy audits. Together, these standards ensure accurate assessments of insulation performance, reliable energy-loss calculations and clear A-G energy efficiency classification.

TIPCHECK combines thermal imaging, temperature measurements and specialised energy assessment software to evaluate insulation performance across industrial systems. Engineers collect onsite data from valves, tanks and other components, then calculate the actual heat loss compared to an optimally insulated system. Get

This analysis identifies where energy is being lost and estimates the potential savings achievable through targeted insulation improvements.

These audits provide clients with actionable data, enabling informed decisions on insulation upgrades that deliver measurable results. In many cases, payback periods are achieved within a year or less.

A recent Powertherm TIPCHECK on the HP-steam circuit at a COMAH tier 1 UK refinery, highlighted the potential of targeted insulation improvements. The audit identified critical areas, such as uninsulated valves, where significant energy was being wasted; with cost savings of around £250,000 per year and a reduction of more than 1,100 tonnes of CO2 emissions (p.a.) – achieving a return on investment within just two months.

With in-house TIPCHECK certification, Powertherm is helping UK industry realise the untapped potential of thermal insulation as a route to improved energy efficiency and net zero.

Learn more about Powertherm's insulation and energy auditing services: www.powertherm.co.uk/services/industrial-insulation/

357 Dysart Road Grantham Lincolnshire NG31 7NB UK

Contact

James Tupper, Head of Marketing

Telephone +44 (0)1476 576280

Email james.tupper@bgbinnovation.com

Web

www.bgbinnovation.com

BGB is a UK manufacturer of rotary solutions including slip rings (pitch control, signal and power), fibre optic rotary joints (FORJ), brushes and brush holders, spares and repairs.

Primary sectors include renewable energy (primarily wind technology), wastewater, radar and aerospace.

Based in Grantham, Lincolnshire, BGB has two UK manufacturing and test facilities as well as one further site in Virginia, US.

NEW GLOBAL MEMBER

Ellimetal NV

Schutterslaan 7 3670 Oudsbergen Belgium

Contact

Pieter Nicolaï, Business Development & Marketing Manager

Telephone +32 11 61 01 61

Email nicolai.p@ellimetal.com sales@ellimetal.com

Web

www.ellimetal.com

Ellimetal is a Belgian manufacturer, offering pressure vessels, silos and storage tanks engineered and built entirely in-house at its two workshops. With a dedicated engineering team and full project control, Ellimetal delivers tailor made solutions that meet the highest technical and safety standards.

Since 2022, Decometa air coolers have strengthened the Ellimetal Group, expanding its capabilities even further. Customers value the personal approach, craftsmanship and proven reliability as an approved vendor for leading end users and EPC contractors. Ellimetal stands for engineering passion, manufacturing excellence and trusted performance across multiple industries.

NEW GLOBAL MEMBER

Geoactive

2 Discovery Drive Westhill Aberdeen AB32 6FG UK

Contact Claire Sim, Global Marketing Manager

Email claire.sim@geoactive.com

Web www.geoactive.com

Geoactive delivers advanced subsurface geoscience software for remote inspection and decisionmaking across the energy asset lifecycle. Its flagship platform, Interactive Petrophysics (IP), is an industry-standard solution for precise log data processing, featuring intuitive parameter selection, drag-and-drop 3D visualisation and over 30 specialised modules for scalable workflows.

Complementing IP, Interactive Correlations (IC) integrates regional well data for geological insight, supporting exploration, appraisal and reservoir characterisation. Together, IP and IC provide a complete well data solution, combining detailed analysis with broader geological context to enhance understanding, reduce costs and improve collaboration. Geoactive empowers efficient, accurate and strategic subsurface data interpretation worldwide.

RMV Valves Limited

Unit 17, The Trade Yard Barmston Road, Beverley East Yorkshire HU17 0LA UK

Contact Chris Moore, Head of Operations, Supply Chain & Production

Telephone +44 (0)1482 263200

chris@rmvvalves.com

Web

www.rmvvalves.com

RMV Valves offers an alternative solution for a wide range of corrosion-resistant valves, offering design, manufacturing, procurement, assembly, test, sales and project management. Supported by a global sales support team covering the UK, Europe, Middle East, North America and Asia, together combining nearly 100 years expertise of valves and technical solutions to the oil and gas (onshore and offshore), petrochemical, marine, naval marine, power generation, desalination and fire suppression industries.

RMV Valves' products cover manual and actuated gate (UL approved up to 18”), globe, check (swing, lift, dual plate), ball (floating and trunnion), butterfly (concentric, double and triple eccentric), bellow sealed stop valves, hydrants and strainers from ½” (DN15) up to 24” (DN600).

W.R. Grace & Co

7500 Grace Drive Columbia Maryland 21044 US

Contact Peter Murdza, Senior Manager, Marketing Communications

Telephone +1 410 531 4000

peter.murdza@grace.com

Web www.grace.com

Grace, a Standard Industries company, is a leading global supplier of specialty chemicals and solutions that enable industries to enhance modern life. Its customers use the company's catalysts, engineered materials, process technologies and fine chemicals to manufacture everyday products – like renewable fuels, pharmaceuticals and food packaging – better, faster and smarter.

Renowned for technical expertise, technology leadership and reliability, Grace helps customers navigate the evolving energy landscape. The company advances circularity by enabling advanced recycling pathways and licensing technologies that support recycled content and recyclability. With a commitment to customer success and value creation, Grace leverages science to create a better, more sustainable world. By delivering a broad range of expertise, technologies and solutions, Grace is uniquely positioned to meet the evolving needs of industry.

Via Podgora, 26 31029 Vittorio Veneto (TV) Italy

Contact

Claudio Stefano Tarenzi, Business Unit Director –Process Heating

Telephone +39 0438 4901

Email claudio.tarenzi@zoppas.com

Web www.zoppasindustries.com

Zoppas Industries Heating Element Technologies (ZIHET), an Italian company with a six-decade legacy, specialises in the creation of intelligent electric heating solutions that contribute to sustainable environmental development. With a global presence boasting over 8,000 employees and 15 production sites across Europe, America and Asia, ZIHET plays a pivotal role in various application areas that permeate daily life. These applications span from coffee machines and electric cars to satellites, forming an integral part of both household and industrial settings.

ZIHET is acknowledged by its clientele as a strategic partner in developing optimised heating solutions. This recognition stems from the company's robust technical expertise, cultivated through experience across multiple sectors, and a comprehensive technology portfolio. ZIHET's commitment to innovation aligns with its role as a reliable and forward-thinking collaborator in the pursuit of heating solutions tailored to meet the specific needs of its clients.

ABB has announced the completion of its acquisition of Gamesa Electric's power electronics business in Spain from Siemens Gamesa, originally announced on 18 December 2024. Financial terms were not disclosed. The business reported annual revenues of approximately €145m for the fiscal year ended 30 September 2025.

The acquired portfolio includes power conversion products such as wind converters for doubly-fed induction generators (DFIG), industrial battery energy storage systems (BESS) and utility-scale solar inverters. The transaction brings in around 400 employees, including key resources in Spain, India, China, the US and Australia and two converter factories in Madrid and Valencia. ABB has also entered into a supply and services agreement with Siemens Gamesa.

The acquisition increases the total capacity of ABB's serviceable installed base of wind converters by approximately 46GW and supports the profitable growth strategy of the motion business area. With over 45 years of experience in power electronics, Gamesa Electric brings deep technical expertise in solar and renewable applications and strong customer relationships.

According to the International Energy Agency, electricity generation from renewables is expected to increase 60% from 9,900TWh in 2024 to 16,200TWh in 2030. In fact, renewables are expected to surpass coal by the end of 2025 (or by mid2026 at the latest, depending on hydropower availability) to become the largest source of electricity generation globally. Solar PV alone accounts for over half of this increase, followed by wind at roughly 30%.

Amarinth, a world-leading, net zero designer and manufacturer of low lifecycle cost centrifugal pumps and associated equipment, primarily for the offshore and onshore oil and gas industries; nuclear and renewable energy generation; defence; desalination and process and industrial markets, has secured £8m in orders over the last 12 months for its proven API 685 magnetic drive pump range, engineered for zero-leakage performance in the world's most demanding applications, underscoring the industry’s confidence in its products operational safety and environmental integrity.

Utilising a magnetic drive, hermetically sealed design, the Amarinth API 685 range eliminates the need for traditional dynamic mechanical seals, a potential point of failure in conventional pumps. By using a powerful magnetic coupling to transmit torque through a stationary, leak-proof containment shell, the pump ensures that the process fluid is completely isolated from the atmosphere. This sealless architecture provides a robust, long-term solution for zero-leakage applications, significantly enhancing site safety and environmental compliance.

This commitment to engineering excellence is validated by recent orders. Within the last 12 months, Amarinth has secured £8m in orders for horizontal OH2, vertical VS4, and vertical in-line OH3 API 685 magnetic drive pumps. The selection of Amarinth's technology for these critical applications, combined with extremely demanding delivery schedules, showcases the company's ability to provide leading-edge, reliable solutions under the most challenging project conditions.

ASCO unveils a refreshed identity, one that reflects its emergence as a global leader

Logistics, materials and operations management firm, ASCO, has unveiled a refreshed identity, one that reflects its emergence as a global leader. Chief Executive Mike Pettigrew shares how this new positioning captures the company's expanding role across the world's most vital industries.

For me, this moment represents something bigger than a brand refresh. We're at a genuinely transformative point in our history as a company. It's given us the opportunity to take stock, to look closely at the industries we support, from oil and gas to mining, metals, defence, renewables and beyond and to recognise just how quickly these sectors and the world is shifting. Operating environments are growing more complex, meaning expectations around agility, accuracy and safety have never been higher. Our clients need partners they can trust, partners who understand the realities on the ground and can deliver with confidence.

Our refreshed identity is simply a reflection of an ASCO that has been doing exactly that for years. It isn't about changing who we are, rather communicating our strengths clearly and positioning ourselves for the international growth and wider industry reach that has already begun.

We're a business of scale that goes beyond logistics. Yet when I look at that scale, the numbers are only the headline, the real story sits behind them. We oversee 2.5m square metres of warehousing space, manage more than 50 warehouses worldwide, operate 19 global logistics hubs and run a significant transport fleet, all underpinned by capability built over decades.

What sets us apart is how we combine strategy and advising, with hands-on delivery. It keeps large capital projects moving, providing greater certainty and efficiency.

Our customers want more than consultancy; they want a partner who can get to the heart of the problem. They often present a symptom, but the real issue lies beneath; once we uncover it, we can resolve it and unlock cost savings, efficiencies and better ways of working. For example, a customer may think they need more warehouse space, when what they really need is better inventory management. One customer recently described us as "an efficient, productive industrial machine." That kind of praise matters to me because it's real and hard-earned.

Last year was defined not by loud announcements but by significant results. We've grown into markets where clients have been asking for deeper support, including our work with TotalEnergies in Suriname.

We've strengthened partnerships from Australia to Namibia. As part of the rebrand, we're bringing NSL, Seletar, NORM Solutions and OBM, ASCO acquired brands with long histories, under the single ASCO name. One unified identity. One global standard. One team.

The people, expertise and service remain the same, but we're removing complexity so clients can clearly see the full scale of what we deliver.

Last year also brought several major achievements. We've continued our expansion into priority international markets, many of which we've served for decades including Norway and Canada.

In Norway, we're working with Saipem on Equinor's Irpa project at our Sandnessjøen base, where we're storing and shipping more than 2,000 giant 37 metre, 20 tonne pipes.

Just south in Mosjøen, we're supporting Alcoa, one of the world's largest aluminium producers. We’ve also expanded our diversified services, including launching our environmental services line in Australia, where we’re now leading the market in NORM management as the country accelerates towards a major decommissioning phase.

Across the Atlantic, our Canadian operations continue to scale. We're delivering logistics, materials management and environmental services from Alberta to Newfoundland. Our newly acquired Conklin site, supported by new equipment being readied for deployment, strengthens our capabilities even further.

But challenges remain. Every industry we support is grappling with workforce shortages, supply chain strain and rising compliance demands. Too often, I have seen how logistics is seen as a support function. In truth, if the supply chain fails, nothing else moves forward.

Whether you're building the world’s biggest offshore wind farm, or maintaining a decades-old industrial facility, the fundamentals don't change. Success depends on integrated systems, skilled people and disciplined processes. I've seen firsthand how consistent these fundamentals are across sectors.

The Engineering Construction Industry Training Board (ECITB) has appointed eight new members to form the second generation of its Innov8 Group for early and mid-career professionals.

Facilitated by the ECITB, members of the multi-generational, crosssector leadership network provide key strategic insight from their unique perspective as professionals within the engineering construction industry (ECI).

As well as offering insights in meetings held at least four times a year, the role of the group includes taking part in events or STEM outreach activities on behalf of the ECITB and the wider industry to help raise awareness of careers in engineering construction.

Members also participate in projects focused on areas including labour market insights, mentoring, attraction and retention, diversity and inclusion, advocacy and industry foresighting.

The current, first generation of group members, chaired by Kent plc structural engineer Chinwe Odili, will remain on hand for guidance and mentoring as Innov8 alumni.

The new Innov8 members are:

• Finlay Duthie: graduate engineer at STATS Group who completed a degree in mechanical engineering and began his career in the project engineering department.

• Alasdair Steven: graduate engineer at NRS Dounreay who completed a chemical engineering degree at the University of Strathclyde, where he was involved in its ambassadorship.

• Sarah Hague: finished second year of graduate engineer role at Technip FMC at the end of 2025 to become a design engineer. Has a Master's in mechanical engineering.

• Katie Bennett: graduate process engineer at energy consultancy Xodus Group, where she is the STEM lead for London. Has a Master's in advanced chemical engineering.

• John MacGregor: graduate engineer at Subsea7 in its structural engineering team developing structural designs. He is working towards IMechE chartership.

• Natalia Bieniewska: graduate process engineer at Xodus Group in its process and facilities team. She has a chemical engineering degree from Newcastle University.

• Abishan Ahilan: structural engineer in Kent plc's UK engineering consultancy division, where he is STEM co-ordinator and graduate rep. Has a Master's in mechanical engineering.

• Niall Gibb: worked in oil and gas for 12 years before completing the wind turbine cross-skill pilot programme in May 2025 and transitioning to the renewables sector. He now works for Vestas gaining authorisation as an offshore commissioning supervisor.

The ECI spans sectors that focus on the construction, maintenance and decommissioning of heavy industry, including oil and gas, nuclear, power generation, renewables, chemicals, food and drink, pharmaceuticals, carbon capture and storage, hydrogen and water treatment.

When it was first set up, the ECITB Innov8 Group comprised of individuals from within the ECI who were following a new entrant pathway within their respective organisations and had completed at least one year of workplace development.

To open the group up to different perspectives, the group is now made up of people within the first 15 years of their careers in industry.

Input from Innov8 members has helped the ECITB increase the effectiveness of our engagement with industry. The group plays an integral role in shaping our careers work, industry training and development. By listening to fresh views on engineering construction careers, we can help our industry attract a new generation of engaged, diverse and dynamic engineers.

Andrew Hockey, Chief Executive, ECITB

Find out more about the new members of the ECITB's Innov8 Group at: https://www.ecitb.org.uk/workingfor-industry/ecitb-innov8-group/

i

For more information: www.ecitb.org.uk

Ellis Patents Ltd, the Yorkshire-based global leader in the design and manufacture of safety-critical cable cleats, is proud to announce that it has been named Large Business of the Year at the 2025 York Business Awards.

The award recognises organisations with exceptional financial performance, sustained growth, strong leadership and a commitment to innovation and community responsibility. ELLIS stood out for its continued expansion in global markets, investment in automation and manufacturing capacity and its unwavering commitment to its people and the environment.

Over the past three years, ELLIS has experienced significant international growth – particularly within the fastevolving energy sector – supported by new strategic hires in marketing and international sales.

Fibron Cable leads the way towards net zero by installing 1,428 solar panels on the roof of its factory. This impressive 714kWp system is expected to save 118,093kg of carbon emissions every year and is just one of a number of measures taken by Fibron Cable to reduce its impact on the environment and to offer customers more sustainably manufactured umbilicals and cables. By introducing a range of waste separation and recycling initiatives, the amount of waste going to recycling this year has increased by an impressive 129% compared with 2023. Fibron has also changed its energy tariff to one that means it only uses electricity from renewable resources. All of Fibron's company cars are EVs. They also offer an incentive to employees to switch their private vehicles to low-emission or zeroemission models.

Despite major operational investment, the company has retained and upskilled its 70-strong workforce, creating more skilled and diverse roles and maintaining a company-wide profit share scheme.

ELLIS was also praised for its strong sustainability achievements, having reduced its net zero score by 56% in the past year while continuing to reinvest in facilities, technology and environmental improvements at its Yorkshire site.

At Fibron's head office, there are six EV charging points in the carpark, allowing employees to charge their electric cars at work using green electricity.

Having reviewed the options, Fibron negotiated a very competitive deal to upgrade its forklifts to electric vehicles. Not only will this reduce carbon emissions, but it will also improve the air quality in the yard.

The biggest single investment was the installation of no fewer than 1,428 solar panels on the roof of the factory.

ELLIS is headquartered in Rillington, North Yorkshire and manufactures all products in the UK. The company supplies sectors including renewable energy, utilities, rail, data centres and nuclear power and is widely regarded as a world leader in cable cleat technology.

68% of the electricity generated is expected to be used on site and the remaining 32% will be exported to the national grid. With annual savings of around £100,000, the payback for this investment is less than 4 years. As a result of these initiatives, Fibron has been certified to ISO 14001 – the internationally recognised standard for environmental management systems.

i For more information: https://fibron.com/

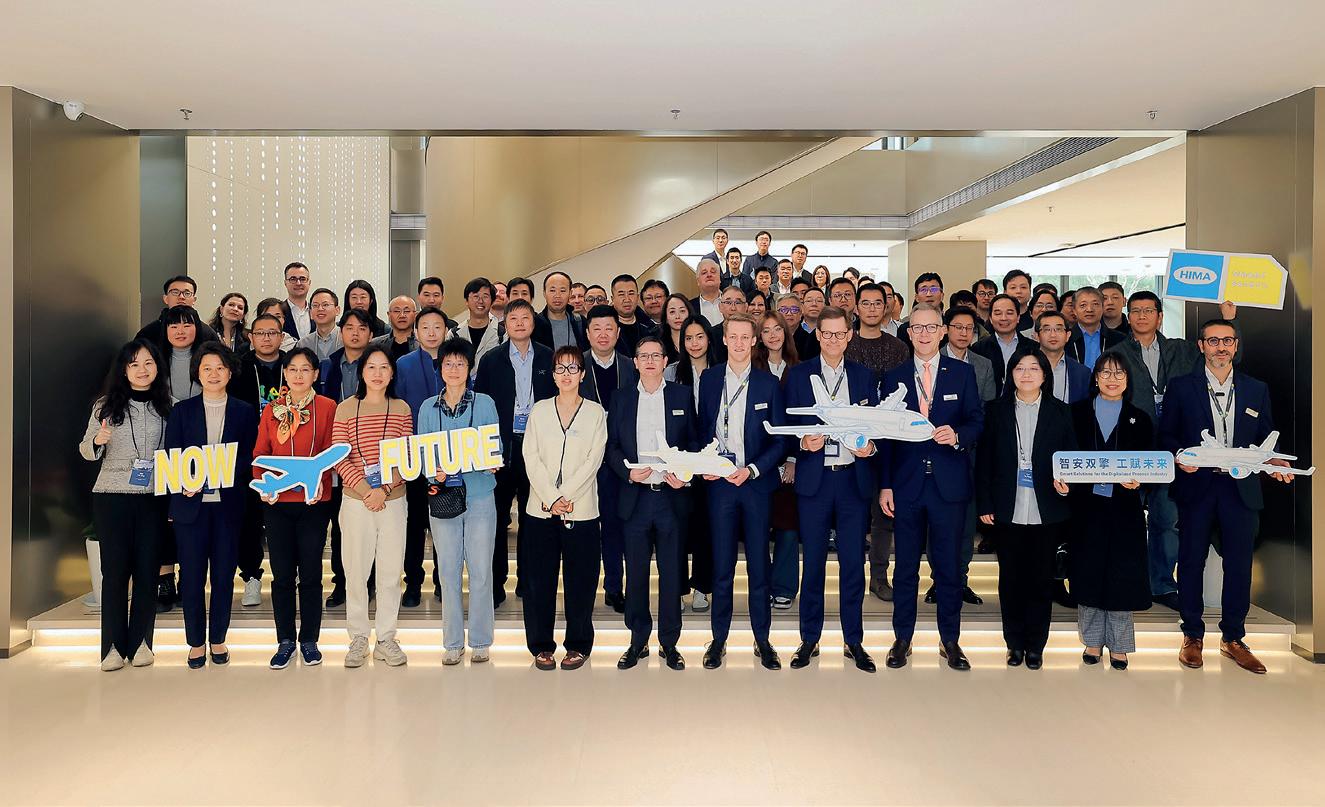

Flexitallic, a global leader in static sealing solutions, has successfully held its second Channel Partner Event in China, welcoming delegates from across the world for a threeday programme designed to strengthen partnerships, share technical insights and showcase manufacturing excellence.

Distributors travelled from Norway, Sweden, Finland, Poland, Romania, Serbia, Greece; Iraq, Kuwait, Nigeria; Brunei, Malaysia, Singapore, Thailand, Vietnam, Indonesia, the Philippines; Japan and China – reflecting the global reach of Flexitallic's partner network. Representatives from Flexitallic UAE, Thailand, the UK and China also attended.

Hosted in Suzhou, a city in Jiangsu province, around 100km northwest of Shanghai, the Channel Partner Event brought together delegates for a series of presentations, application insights delivered by Flexitallic engineers, product updates, strategic discussions and networking opportunities.

A key highlight was a tour of Flexitallic Gasket Technology's (FGT) Suzhou manufacturing plant, a high-volume facility specialising in the production of spiral wound gaskets. Delegates were given an insight into the plant's capabilities, quality systems and ongoing investment in global manufacturing excellence.

The group also visited long-standing FGT customer Neway Valve (Suzhou) Co Ltd, one of the world's leading industrial valve manufacturers. Alongside the technical agenda, delegates took part in several networking activities, including a tour of Suzhou's ancient canal system.

HIMA Group, a global leader in safetyrelated automation solutions, has further strengthened its presence in China with the relocation to its new Shanghai office. The facility was officially inaugurated on 5 December during a special ceremony followed by a safety symposium attended by customers, partners and government representatives.

The opening marks a significant step in HIMA's strategic expansion, underscoring the company's dedication to supporting China's fast-growing industries with functional safety solutions.

Today, HIMA employs 80 highly qualified team members across China, working in close collaboration with global HIMA experts.

The new Shanghai workspace provides a modern hub for customer engagement, technical collaboration and innovationdriven projects across China. Its new Customer Solutions Center supports a broader range of trainings and testing needs, while the new multi-functional meeting area enhances professional communication with customers.

The upgraded office environment also improves employee comfort and efficiency, fostering greater creativity and productivity.

In line with HIMA's sustainability strategy, the materials used for the event, are green, environmentally friendly and recyclable. At six booths HIMA showcased cutting-edge technologies in functional safety, including digital lifecycle management, APL, SafeHMI, digital engineering, cybersecurity, turbine machinery control (TMC Solution) and HIPPS.

The relocation follows another recent milestone: the opening of the HIMA Zhanjiang Service Center in Guangdong province in 2024, supporting customers in southeast China, including the BASF Verbund site.

Building on the strong foundation it has established in China, HIMA will further strengthen its commitment to the Chinese market by investing additional resources in fostering local innovation, accelerating the digital transformation of its operations and advancing sustainable technologies. These efforts support both China's priorities and the company's global environmental, social and corporate governance objectives.

Lucy Electric, an international leader in cutting-edge switchgear design and the manufacture of sophisticated automated electrical distribution systems, has appointed Andy Ryan as head of sales for its newly launched EV infrastructure division, Lucy Electric EV Infrastructure.

The launch of Lucy Electric EV Infrastructure will capitalise on the growing global market for highcapacity EV charging infrastructure placing increased demand on electrical network capacity in many cities, regions and nations. Combining worldleading engineering expertise with deep knowledge and understanding of local energy systems challenges, Lucy Electric is pioneering innovative, holistic solutions to accelerate the rollout for EV charging installations. With the increasing demand for EV infrastructure, Andy's role will be instrumental in supporting Lucy Electric's expansion into the global EV infrastructure market, delivering the electrical network infrastructure that enables the rapid connection of highcapacity EV charge points essential to decarbonising transport systems across the world. Lucy Electric EV Infrastructure's integrated monitoring and scalable charging solutions are designed to help cities and utilities rapidly prepare for the step-change increase in electricity demand as drivers make the EV switch.

Leading logistics and supply chain solutions provider Peterson has kickstarted a project to support the development of East Anglia 3 – a wind farm that will provide power for one million homes.

The seven-month contract with Siemens Energy sees Peterson responsible for aviation and emergency and response rescue vehicle (ERRV) requirements delivered from Norwich Airport and the Port of Lowestoft.

Peterson will manage around 30 flights a month, with associated ERRV sailings, for Siemens Energy, delivering the contract in partnership with ODE Asset Management.

Peterson is also working with its long-term customer Jack-up Barge to manage its crew co-ordination and changes from Norwich Airport, including immigration, accommodation and transfer requirements.

Peterson’s experience in major offshore wind development projects also includes its fully integrated lead logistics role for GE Vernova as part of the Sofia Offshore Wind Farm development at Doggerbank.

Our logistics expertise has been honed over many decades and we understand the complexities of major development projects such as this and are able to deftly respond with agile services.

Jason Hendry, Interim Managing Director UK, Peterson

Peterson has been helping to build a better world for over 100 years. Peterson has grown to become a trustworthy global partner for logistics, advisory, technology and training. The company now provides a comprehensive range of quality services to customers in over 80 countries.

After 32 years of dedicated service, managing director Bill Aitken has retired from Red Rooster Lifting, marking the end of a significant chapter in the company's history. Stepping into the role is Paul Shewan, whose 15-year progression from the workshop floor to managing director reflects both continuity and the company's long-standing commitment to developing talent from within.

Bill joined Red Rooster Lifting in 1993 and quickly became a central figure in shaping the company's direction, culture and technical capability. His leadership oversaw decades of steady growth while strengthening the organisation's reputation for reliability across multiple industry sectors.

Among Bill’s proudest accomplishments are building a skilled and committed team and fostering strong relationships with customers and international partners. A defining milestone was securing the company’s first major hire contract for Doosan Babcock at Drax Power Station. The project helped cement Red Rooster's technical credibility and remains a highlight of his time as managing director.

Stepping into the role is Paul Shewan, who joined Red Rooster Lifting in 2008 at the age of 22 as a mechanical fitter. Over the years, Paul has developed broad experience across the business – from hands-on assembly and testing to project management and production leadership.

One of his standout achievements was involvement in the design, manufacture and build of custom 10-tonne pneumatic crane systems for the Culzean project in the North Sea. These bespoke systems incorporated complex engineering calculations, rack-and-pinion drives and enhanced safety features, demonstrating the technical insight and problem-solving approach Paul brings to his new role.

Since becoming production director in 2021, Paul has strengthened Red Rooster's manufacturing capability and supported continued technical development. As managing director, he plans to expand the company's international presence, diversify beyond the UK's oil and gas sector and build on its reputation for custom-built lifting equipment and rental lifting solutions.

• More than 2,500 active weld zones were delivered for multiple days.

• Supported by roughly 1,667 Superheat SmartPak™ units.

• Powered by 417 machines at peak, each averaging six zones per console.

• Delivered by over 360 Superheat field professionals and 35 SmartCenter employees globally at peak.

During the 2025 fall turnaround season, Superheat achieved an incredible milestone, surpassing 2,500 active weld zones on multiple peakvolume days. This marks the highest service week in Superheat history and highlights the expertise of its people and the co-ordinated management of equipment across every division.

This accomplishment reflects Superheat's focus on preparation, communication and consistent execution from start to finish. With strategic improvements, strong alignment between field operations and SmartCenter personnel and expanded use of digital tools, every group contributed to safe and efficient performance from planning through to delivery.

You can count on Superheat to get the job done when you need it most. Contact the company to begin your next onsite heat treatment project.

THREE60 has announced a new longterm contract with Vår Energi ASA for the provision of temporary contract workers. The agreement represents a continued and valued partnership between the two companies.

The contract runs until 2030 and includes options for up to six additional years, reflecting Vår Energi's confidence in THREE60's capabilities and consistent delivery. Under the agreement, the THREE60 Norway team will supply skilled personnel to support Vår Energi's operations across the Norwegian Continental Shelf. The scope covers temporary contract workers across multiple disciplines, including offshore, subsurface and drilling & wells.

This award builds on several years of successful collaboration between THREE60 and Vår Energi, reinforcing a shared commitment to safe, sustainable operations and continuous improvement.

THREE60 Energy is a leading solutions company specialising in engineering, operations and systems across the asset life cycle in multiple sectors. Headquartered in Aberdeen, UK, the company also has regional headquarters in Malaysia, the US, Norway and UAE.

i For more information: www.three60energy.com

We want to use every opportunity to connect with our members, so please follow us on LinkedIn –EIC (Energy Industries Council)

Below you’ll find a selection of some of the exciting EIC activities and useful industry information we’ve shared through our social media channels.

EIC (Energy Industries Council)

In this Energy Insights podcast, Stuart Broadley EIC CEO is joined by Regional Director Amanda Duhon to reflect on the EIC’s 30-year journey in the US: https://lnkd.in/dEVUdtpX

EIC (Energy Industries Council)

The EIC's Africa Hydrogen report explores Africa's potential to become a global leader in green hydrogen, driven by vast wind and solar resources: https://lnkd.in/eTBksbGh

EIC (Energy Industries Council)

We announce the first speakers for Bankable Energies; Siemens Energy, Green Giraffe Advisory, EET, Close Brothers Asset Finance and Societe Generale: https://lnkd.in/e6mnq3em

5 March Business Presentation

Macaé Breakfast: OPEX Opportunities TBC with Ocyan 11 March Business Presentation

17 March Regional Showcase

Bankable Energies 2026 Hilton London Bankside 17 March Overseas Exhibition

Wind Expo Japan 2026

Tokyo Big Sight, West Hole, Japan 17 March LIVE e-vents

CIS Market & Project Update

Fuelling Prosperity: Opportunities across the Saudi energy market

March Business Presentation

Breakfast Opportunities with McDermott

Cannon West Houston 25 March Regional Showcase

North West Cluster – Powering the Future

Liverpool City Centre

25 March Business Presentation EICDataStream/AssetMap training

26 March Regional Showcase Women in Energy Arup Office, Edinburgh

The countdown is on for Bankable Energies 2026.

We are excited to confirm a strong line-up of partners including Close Brothers Asset Finance as Investment Partner, Oneglobal Broking as Insurance Partner, Energy Voice as Media Partner, GRID & reNEWS as Promotional Partners and KLM as Travel Partner.

Following a successful inaugural event, Bankable Energies has quickly established itself as a mustattend forum for energy investment stakeholders. Join us in London for an exclusive drinks reception on the evening of 16 March, bringing together speakers, partners and senior industry stakeholders ahead of the main conference on 17 March 2026.

This event is dedicated to one of the most pressing challenges facing the global energy transition: how to turn clean and low-carbon projects into investable, financeable realities.

Bringing together developers, investors, financiers, policymakers and the wider supply chain, Bankable Energies focuses on the practical steps needed to move projects from ambition to delivery, addressing risk, capital, policy and execution head-on.

The Bankable Energies Report provides an in-depth look at what makes energy projects bankable in the real world.

Drawing on insights from energy leaders and executives – spanning supply chain companies, banks, insurers and advisors – the report highlights the critical ingredients that make projects financeable, while also identifying the frictions that keep many stalled at FEED and pre-FEED stages.

The Bankable Energies Report will be officially launched during the Bankable Energies Conference on 17 March 2026.

Why Bankable Energies matters

Despite unprecedented ambition and policy support, many energy projects continue to stall before final investment decision (FID). Bankable Energies exists to close that gap.

The event explores what makes projects bankable, including:

• How risk is allocated and mitigated across the project lifecycle.

• Which financing structures are working and which are not.

• The role of policy certainty, regulation and government intervention.

Jo Campbell

• Lessons learned from projects that have successfully reached delivery.

Bankable Energies attracts a highly engaged, decision making audience, including project developers and owners, institutional investors and infrastructure funds, banks, lenders and export credit agencies, policymakers and regulators, EPCs, OEMs and technology providers, legal, insurance and advisory firms. This creates a unique environment for meaningful discussion, partnership building and deal shaping conversations. The agenda is built around keynote discussions, high level panels and in depth case studies that explore projects moving from development into delivery.

Confirmed and invited contributors to the programme include senior representatives from: DESNZ, EET Fuels, Eni, Equinor, Flotation Energy, Green Giraffe Advisory, HM Treasury, HSBC, LanzaJet, Lloyds Bank, Low Carbon Contracts Company, National Wealth Fund, Siemens Energy, Sizewell C, Société Générale, SSE Renewables, Santander, Worley and Xodus.

Join us at Bankable Energies, register here: www.the-eic.com/Events/BankableEnergies/Home

Don't miss this opportunity to connect with industry leaders, gain actionable insights and shape the future of investable clean energy projects. Register today to secure your place at Bankable Energies and join the conversation with senior stakeholders driving the next wave of low-carbon investment.

There are still opportunities for organisations to align their brand with the energy transition, gain direct access to decision-makers and showcase expertise to a highly targeted audience. For more information, please contact global.events@the-eic.com

Jo Campbell

Director of Global Events and Campaigns jo.campbell@the-eic.com

Join the EIC International Pavilions at the world's largest energy events to showcase your business

As the EIC’s global community continues to grow, we are pleased to announce the launch of EIC International Pavilions, a new exhibition series designed to support all EIC members and supporters in accessing key international energy markets.

Building on the long-standing success of the EIC UK Pavilion, the EIC International Pavilions represent the next step in the EIC's commitment to helping companies raise their profile, connect with decisionmakers and develop new business opportunities worldwide. This new series brings the same trusted delivery model, expertise and on-the-ground support to a broader range of global exhibitions.

The first EIC International Pavilion has officially launched at Rio Oil & Gas, marking the beginning of this new initiative. Further International Pavilions will follow in early 2026, with confirmed plans for Hydrogen Technology World Expo and Oil & Gas Asia, providing members with multiple opportunities to showcase their capabilities across different regions and energy sectors.

Exhibiting as part of an EIC International Pavilion offers companies a highly visible presence within a professionally branded group stand, positioned in prime locations to attract high-quality visitors.

Participants benefit from strong collective branding, increased footfall and enhanced promotion before and during each event.

Beyond visibility, the EIC International Trade team provides comprehensive support throughout the exhibition journey. From initial planning and logistics to stand build, local market intelligence and onsite co-ordination, exhibitors are guided at every stage. This allows companies to focus on what matters most: engaging with potential partners, strengthening relationships and winning new business.

Networking is also a key element of the International Pavilion experience. Exhibitors gain access to exclusive opportunities such as hosted receptions, facilitated introductions, buyer meetings and shared lounge spaces for meetings and informal discussions. These activities are designed to maximise meaningful engagement with key stakeholders in each market.

The launch of EIC International Pavilions reflects the EIC's ongoing commitment to supporting its members' international ambitions and responding to the evolving needs of the global energy sector. This is the first phase of a wider programme, with additional exhibitions and regions to be announced as the series develops.

Members and supporters interested in taking part in upcoming EIC International Pavilions are encouraged to keep an eye on future announcements or contact the International Trade team for further information.

Camilla Tew Director, International Trade camilla.tew@the-eic.com

The next couple of months will see our team attending a number of industry events, so I'd like to take this opportunity to share what's coming up in our calendar this month.

On 4 and 5 February, the team will be participating in several external events. I will be joining the Foresight Event in Liverpool with our membership manager, Andrew Scutter.

There, I'll provide an update on the UK energy landscape, including key project highlights and a comparison of final investment decisions (FIDs) in the renewable and energy transition markets.

Meanwhile, John Petchey, Rebecca Swain and Emma Cuthbertson will be representing the EIC at Subsea EXPO in Aberdeen – be sure to stop by and say hello to the team.

ETZ Offshore Wind Masterclass

Wednesday 18 February

Aberdeen

We're proud to continue supporting our colleagues at ETZ by delivering their Masterclass Programme. This session will focus on the major offshore wind developments transforming the North Sea.

Join us to hear from Venterra Group, Seaway7 and TechnipFMC and take the opportunity to connect, collaborate and accelerate the growth of Scotland's offshore wind supply chain.

Opportunities in Teesside

Wednesday 25 February

Middlesbrough

The region is rapidly establishing itself as a trailblazer in decarbonisation, leading the way with world-class projects in hydrogen, carbon capture, offshore wind and renewable power.

This year, we will also explore the growing nuclear opportunities emerging in the area, including developments in small modular reactors and their potential role in supporting long-term energy security and industrial decarbonisation.

Delegates will hear from Northern Endurance Partnership, Alfanar, Bureau Veritas and other industry leaders.

Bankable Energies

Tuesday 17 March

London

Stephen

Now in its second year, this event will bring together the global investment community, key project developers and policymakers to address the shift needed to attract investment and drive projects forward. Join us as we explore solutions to unlock funding for future projects, discuss the policy and regulatory frameworks required to accelerate new energy initiatives and highlight strategies for managing the risks associated with emerging projects.

North West Cluster – Powering the Future Fuel of the North West

Wednesday 25 March

Liverpool

The event will explore key topics, including hydrogen production, carbon capture and storage and the current state of the low-carbon industrial sector. Join us to gain exclusive insights into transformative projects, discover cutting-edge innovations and uncover valuable supply chain opportunities across this major UK industrial hub.

Women in Energy

Thursday 26 March

Edinburgh

The programme explores personal career journeys, workplace culture and leadership development, with a strong focus on practical actions that individuals and organisations can take to support diversity and inclusion. Attendees will leave inspired, informed and better equipped to drive positive change within their teams and across the wider sector.

Our team is here to support yours – whether through networking, the provision of data, or by amplifying your voice on issues that matter to your business. Working with our External Affairs team, we are pleased to invite our members from across the UK to join a new forum: the Directorate for Energy Supply Chain on Monday 16 March, in London from 2:00-4:00pm. To find out more and to register your interest in joining the group, please email me directly.

Kim Stephen Regional Director, UK kim.stephen@the-eic.com

We look forward to welcoming many of you to our first EIC Connect event of 2026 in the Kingdom of Saudi Arabia, delivered in collaboration with the Asharqia Chamber. The event will take place in Dammam on Tuesday 10 February 2026 and is free to attend for EIC and Asharqia Chamber members. Building on the overwhelming success of recent years, we are delighted to present a comprehensive and insightful programme that reflects the scale and ambition of the Saudi energy market. EIC Connect KSA offers a unique platform to explore opportunities across the entire energy spectrum in Saudi Arabia. Whether you are new to the market or considering exports for the first time, this is a must-attend event for organisations looking to engage with one of the world's most dynamic and fast-evolving energy markets. EIC Connect UAE will return on 12 May 2026, giving you another key date to mark in your calendar. In addition, we are planning to host EIC Connect Qatar in September 2026, following the tremendous appetite and strong engagement seen at last month's Wood and Bilfinger event in Doha.

This year's Annual Golf Day, taking place on Thursday 5 March 2025, is now sold out. We look forward to an excellent day of both golf and networking as teams compete for the prestigious Helen Aittis Trophy, at what continues to establish itself as a key event in the UAE golf calendar. Applications remain open for the 10th edition of our EIC Survive & Thrive Insight Report which is on course to have a record number of entries. Recognised as a critical tool to voice the energy sector globally, this opportunity is open for companies to share their experiences where you are automatically entered into our World Energy Supply Chain Awards held towards the end of the year at a black tie event. Participating companies have benefitted from the sustained publicity that comes from sharing their stories, and many have gone on to win prestigious awards in recognition of their amazing leadership and results. If you need more information, please feel free to reach out to me.

As we move into what promises to be another busy year, I want to personally thank you for the continued support, engagement and openness you bring to the EIC community. The team and I are very much here to support you, whether that's helping you connect, navigate the market, or make the most of the opportunities ahead. Your feedback and ideas are always welcome and I look forward to working closely with many of you over the months ahead.

Ryan McPherson

Regional Director, Middle East, Africa, Russia & CIS ryan.mcpherson@the-eic.com

Abu Dhabi Future Energy Company Masdar and German renewables leader RWE have been awarded Contracts for Difference (CfDs) to develop 3GW of offshore wind capacity at the Dogger Bank South wind farms in the UK, representing an investment of around £11bn towards one of the country's largest offshore wind projects. The contracts will support strengthened UK energy security, accelerated decarbonisation, regional supply chains and local jobs. Commissioning of the two 1.5GW phases is anticipated in 2031 and 2032, reinforcing Masdar's long-term commitment to the UK renewable market.

Italy's Eni is accelerating exploration and development activity across North Africa, strengthening its position as a key supplier of gas to regional and European markets. The company plans additional drilling in Libya and Egypt, while increasing production from established assets such as Egypt's Western Desert and Zohr field. By leveraging existing infrastructure and LNG export capacity, Eni aims to bring new volumes to market more quickly and cost-effectively. The strategy underlines Eni's focus on near-term gas supply, regional partnerships and maximising output from core North African assets.

I don’t know about you, but 2025 seemed to pass by incredibly quickly, more like a sprint than a marathon.

That said, it was an eventful year, starting with the success of the EIC Connect

Borneo event in February, which has been EIC's most successful event within this region. It was followed by the change of leadership where we saw the departure of Azman Nasir, a highly respected and admired leader who had served EIC with dedication for 11 years.

Now, let’s talk about 2026 and beyond. As I've learned and studied how our organisation operates, it's become clear that we have significant opportunities to elevate EIC APAC from where we are today to where we aspire to be in the future. The good news is that we are building on a strong and solid foundation, which makes our journey forward not only possible, but much easier and more promising.

So, where do we want to be, you might ask? The answer is simple, to be truly Asia Pacific. Currently, as we are based in Malaysia, it is only natural that our first priority is to establish a strong and reputable presence here. The outcome speaks for itself, of the approximately 150 Asia Pacific members we currently have, 75% are from Malaysia and I believe we have successfully strengthened and solidified our brand here.

EIC APAC sat down as a team and drafted an ambitious programme of 39 activities and events, including expeditions to 11 countries over the next 15 months, extending into the first quarter of 2027. These destinations include Indonesia, Singapore, India, the Philippines, China, Australia, Vietnam, Thailand, Brunei and of course, Malaysia.

In fact, we have already planned three major Connect events in China, Indonesia and Borneo as part of our flagship initiatives, along with a range of supporting roles across various energy programmes throughout the Asia Pacific region.

Can we do it? I have full confidence that we have the right team in place to turn these plans into reality. We will be more structured and strategic in our approach and we will plan ahead with greater clarity and purpose. We will draw on lessons learned from the past as valuable guidance for the future, while continuing to engage closely with all of our stakeholders to further strengthen our position.

So, I’m truly excited for what 2026 has in store, and I hope you are too. Let’s charge forward together into 2026.

Syed Saggaf

Regional Director, Asia Pacific syed.saggaf@the-eic.com

Uniper has signed an offtake agreement with AM Green for the project, amounting to 500,000tpa green ammonia with first shipments targeted by 2028 from its first phase. The green ammonia is targeted to be utilised as a feedstock and a potential hydrogen carrier. Renewable ammonia will help decarbonise industrial sectors such as chemicals, fertilisers, refining as well as shipping.

Vantris Energy has won two offshore transportation and installation (T&I) work orders from PETRONAS worth a combined RM1.4bn (US$345.21m). The contracts cover the Sepat Integrated Redevelopment Project offshore Terengganu and the Belud South Greenfield Development Project offshore Sabah. Work is set to begin in Q1 2026 with completion expected by 2027 and 2029 respectively.

The North and Central America region launched the newly anticipated event series, EIC Breakfast in Houston, designed to provide attending delegates a market update, in addition to an update from highlighted companies on current and upcoming project activities, outlook for the supply chain and supplier engagement. Delegates had a strategic opportunity to network with speaker companies over light breakfast and refreshments.

On 20 November the EIC welcomed the series’ first speakers: Guardian Decommissioning and Subsea7. Since the launch of the series, the EIC has since held the series’ second instalment and welcomed Bechtel and SLB on 2 December.

A special thank you to our distinguished speakers: Louise Honner, MBA, GoM SCM category manager, Subsea7; Iain Murray, Esq, president, Guardian Decommissioning; Justine Burgett, manager of contracts, Bechtel; Bridger Elliott, supply chain operations manager and manager of procurement, Bechtel; Luke van der Waals, North America offshore supply chain manager, SLB; Ahmed AbdelKarim, North America offshore sourcing specialist, SLB; and Dilpreet Grewal, North America offshore sourcing specialist, SLB.

Beyond the region's new in-person series we also hosted our first EIC LIVE event on 15 January 2026 for a US Offshore Wind 2026 Market Update. EIC's analysts delved into the sector's complex landscape shaped by federal uncertainty under the current administration all while highlighting that several state governments are reinforcing their commitment to the sector through targeted support measures, including new funding initiatives. Thank you to our speaker Beatriz Corcino, energy analyst (CAPEX), EIC.

To our members and non-members, we encourage all to join us for the highly anticipated second annual Women's International Day High Tea proudly sponsored by Kelvin TOP-SET. This in-person event welcomes a panel of women leading the energy industry for an evening of discussion and celebration at Houston's renowned restaurant Kiran's. Seats for this event are limited, so please do not miss your opportunity to join us and reserve your seat by visiting: www.the-eic.com/EventDetail/dateid/4766. Additionally, profile raising opportunities for this celebration are available, please email: houston@the-eic.com to further discuss.

As a reminder, we encourage you to visit MyEIC to ensure you receive our regional communications and we look forward to welcoming you to an upcoming 2026 event.

Amanda Duhon

VP & Regional Director, North & Central America amanda.duhon@the-eic.com

The US Bureau of Land Management (BLM) is collecting comments through a 30-day public scoping period on 64 proposed oil and gas parcels in Montana and North Dakota, covering 29,058 acres. This step is part of preparations for a lease sale expected in August 2026, as public input is required before companies can apply for drilling permits. Separately, the BLM recently leased 19 parcels totalling 4,116 acres in Montana and North Dakota, raising US$8.6m. The sale was held under the One Big Beautiful Bill Act (OBBBA), which lowered the minimum federal onshore royalty rate from 16.67% to 12.5% to reduce costs and improve financial viability of projects. The BLM has also confirmed a further oil and gas lease sale on 12 March 2026, offering eight parcels across 506 acres in Arkansas, Louisiana, Michigan and Mississippi.

As the mandatory July 2026 review of the United States-Mexico-Canada Agreement (USMCA) approaches, policy discussions indicate that the process may involve revisions beyond a reaffirmation. The agreement currently governs trade flows representing nearly US$2tn in US goods and services trade. Key areas under consideration include rules of origin, tariff policies, investment screening and economic security co-ordination. Ongoing tariff measures imposed since early 2025 add to policy uncertainty, particularly for supply chains. Given the importance of crossborder trade for energy infrastructure, equipment manufacturing and power market integration, maintaining regulatory stability will be critical for US competitiveness.

Please go to page 22 to see upcoming events around the world

February begins with a Meet the Buyer event and two webinars hosted by EIC South America.

EIC is pleased to announce Meet the Buyer with C-Innovation on 10 February. It is an integrated marine services company specialising in project management and advanced solutions for all types of projects. It has become a world leader in light well intervention without risers (RLWI) and inspection, maintenance and repair (IMR) services.

On 11 February, join us to discuss the South American Hydrogen Report Launch with Hytron, which is uniquely positioned to capitalise on Brazil's hydrogen momentum. The company works in synergy with Neuman & Esser's expanding facility in Belo Horizonte, where a R$70m investment is underway to scale production of low-carbon hydrogen generators and advanced compressor systems for industrial gases, including hydrogen (H2) and carbon dioxide (CO2).

Opportunities on the Equatorial Margin is the topic to be explored on the 24 February webinar, which will receive Bram Offshore. The company has cultivated extensive expertise in delivering complex logistical support to offshore operations.

Acting president Delcy Rodríguez called on lawmakers to approve reforms to the oil sector aimed at attracting foreign investment. Speaking during her first state of the nation address since the removal of Nicolás Maduro, Rodríguez urged diplomats to present the plans to potential investors. Meanwhile, the US administration has stated it intends to oversee future Venezuelan oil export revenues indefinitely.

In a related move, the US military seized another Venezuela-linked tanker in the Caribbean, the seventh such seizure since President Trump began efforts to enforce its economic sanctions. According to President Trump, Washington plans to exert longterm control over Venezuela's oil resources as part of a US$100bn strategy to revive the country's deteriorating oil industry.

We'd like to go back and take a look at the last 2025 Breakfast in Rio: Upstream Opportunities with Equinor and McDermott, pictured above. Equinor provided a strategic overview of its investments, highlighting its ambition to maintain production levels and invest up to US$6bn annually. They drew attention to rising costs in the subsea segment and the importance of collaboration with suppliers. McDermott shared how the company has been active throughout the oil and gas project chain – from engineering and manufacturing to installation, as well as decommissioning initiatives. The company highlighted its global presence and presented ongoing projects in Brazil, including subsea installations for the Wahoo tieback and participation in Atlanta Phase 2 and Papa Terra, both for Brava Energia.

Stay tuned for the next Breakfast to be announced soon.

Clarisse Rocha, Director – Americas clarisse.rocha@the-eic.com

José Antonio Kast's presidential election marks a shift towards a right-wing government while keeping Chile aligned with its ongoing energy transition. The new president has stated his support for expanding renewable power generation, alongside stronger transmission and larger-scale energy storage to ensure energy security. Kast aims to reduce permitting delays and streamline mining and energy project approvals, potentially affecting critical mineral development such as lithium, which underpins battery storage technologies. The new government also set targets to back the development of green hydrogen as an export industry, supported by private capital and regulatory certainty.

In its ninth year, EIC's Survive and Thrive initiative continues to research the 15 most popular growth strategies used by the world's energy supply chain in challenging market conditions. New and important findings have been revealed, such as the trend for businesses and skilled workers to relocate in their droves to the Middle East, in response to short term and inconsistent energy policies and project delays in many other parts of the world, attracted by the longer term and all-energy technology polices and the much higher supply chain growth rates in the Middle East.

The report features 139 success stories and insights from 138 EIC member companies and underscores the need for all regions to learn the lessons of the Middle East.

Exporting to new markets remains the least used growth strategy due to excessive risks, cost and time to market. Companies called for more government support and funding with market access. The #1 growth strategy was to develop client-facing solutions and services, with 82% of these companies working directly with operators and Tier 1 EPCs.

Please see our success stories overleaf or visit the EIC website to view the complete report: www.the-eic.com/MediaCentre/Publications/SurviveandThrive

The World Energy Supply Chain Awards aim to recognise excellence from all companies and organisations across the energy industries globally. In their business cases featured in the Survive & Thrive Insight Report, the EIC member companies can demonstrate how they faced a specific challenge and introduced a new business solution or any initiative that drove successful results.

AWARD CATEGORIES

Collaboration

Culture

Digital & AI

Diversification

Energy Transition

Environmental Sustainability & Social Impact

Export

Innovation

Optimisation

People & Competency

Resilience

Scale Up

Service & Solutions

Technology

Transformation EIC Insight Report 2025 Volume IX

Story type

#culture (main category)

#people & competency

Benefits

▸ Staff turnover reduced by 50% and high for job satisfaction scores.

▸ Programme implemented in other parts of TÜV SÜD.

Key findings

Ewan Fisher Head of Organisational Change

How is TÜV SÜD thriving?

Through a comprehensive internal change programme named ‘Fix, Focus, Grow,’ TÜV SÜD National Engineering Laboratory (NEL) has transformed its workplace culture and operational efficiency. This cultural evolution has reduced voluntary staff turnover by over 50%, enhanced cross-functional collaboration, and created a management system that streamlines processes while improving service quality. Indeed, such has been the programme’s success, it is now being rolled out to other parts of the TÜV SÜD organisation.

The challenge – As the UK’s Designated Institute for Flow, and a world leader in testing, inspection and advisory services, TÜV SÜD NEL operates state-of-the-art facilities in East Kilbride, Scotland. Despite housing formidable technical expertise and holding a global reputation, by 2021-2022, the organisation faced several internal challenges impeding employees work experience, its performance and growth.

Following the COVID-19 pandemic, leadership identified various issues that needed to be addressed. The organisation was hampered by outdated systems and processes, alongside a tired working environment that didn’t reflect the worldclass nature of its technical capabilities. Such practices were not allowing employees to focus 100% on the customer to drive forward future flow measurement solutions.

These factors contributed to cultural issues, in some cases exacerbating siloed working practices, limiting collaboration. With many long-serving employees, TÜV SÜD NEL’s intergenerational workforce is one of its key strengths, providing a wealth of knowledge and experience to call on. Some of the working practices in place presented significant obstacles to change and collaboration, preventing the business from unlocking this potential.

With the corporate drive to operate as ‘One TÜV SÜD’ globally, and the wider energy industry’s ongoing transition, there was both internal and external impetus for transformation. The challenge was how to implement meaningful change that would not

only address inefficiencies but do so while enhancing workplace culture.

The solution – In response, TÜV SÜD NEL launched a comprehensive change programme in 2022.