HAVE HOME PRICES BOTTOMED?

While low housing inventory stymies sales, bidding wars prop up prices

Alex Veiga ASSOCIATED PRESSLOS ANGELES — The U.S. housing market remains in a deep sales slump, but the worst declines may be over when it comes to home prices.

While home sales have fallen 22.3 percent through the first seven months of the year versus the same stretch in 2022, prices are being propped up by buyers competing for a near-record low inventory of properties on the market.

The national median sales price rose to $406,700 last month, marking its first annual increase since January and the second month in a row that it’s been above $400,000, the National Association of Realtors said Tuesday.

Home prices didn’t start falling on an annual basis until February, and even then the decline was modest, with the steepest drop 3 percent in May. That fivemonth streak of annual drops ended last month, when the median sales price rose 1.9 percent versus July last year. It’s now a eye-popping 45 percent higher than it was in July 2019.

So, where do prices go from here? Homebuyers hoping for a big drop may be disappointed.

“At least when it comes to

30-year mortgage rate jumps to 7.23 percent, highest

since 2001

ASSOCIATED PRESS

LOS ANGELES — The average long-term U.S. mortgage rate climbed further above 7 percent this week to its highest level since 2001, another blow to prospective homebuyers grappling with rising home prices and a stubbornly low supply of properties on the market.

Mortgage buyer Freddie Mac said Thursday that the average rate on the benchmark 30-year home loan jumped to 7.23 percent from 7.09 percent last week. A year ago, the rate averaged 5.55 percent.

It’s the fifth consecutive weekly increase for the average rate, which is now at its highest level since early June 2001, when it averaged 7.24 percent. Back then, the median sales price of a previously occupied U.S. home was $157,500. As of last month, it was $406,700.

High rates can add hundreds of dollars a month in costs for borrowers, limiting how much they can afford in a market already unaffordable to many Americans. They also discourage homeowners who locked in low rates two years ago from selling.

The average rate on 15-year fixed-rate mortgages, popular with those refinancing their homes, also rose to 6.55 percent from 6.46 percent last week. A year ago, it averaged 4.85 percent, Freddie Mac said.

Mortgage rates have been rising along with the 10-year Treasury yield, which is used by lenders to price rates on mortgages and other loans.

home prices, it looks like the housing recession is already over,” said Lawrence Yun, the NAR’s chief economist, adding that he sees a greater chance of an increase in prices versus a decline in the coming months.

Mike Simonsen, president of Altos Research, which tracks data on the U.S. residential real estate market, echoed that outlook.

“For people who are on the sidelines there’s nothing in the data yet that suggests home prices are falling further,” Simonsen said.

A shortage of homes for sale has kept the market competitive, driving bidding wars in many

places, especially for the most affordable homes. About 35 percent of homes sold in July fetched more than their list price, according to the NAR. That’s in line with sales data for April through June.

While still low by historical standards, the inventory of homes on the market has been ticking higher as the average rate on a 30-year mortgage has risen to well above 7 percent, discouraging more would-be homebuyers. If mortgage rates remain elevated and inventory continues rising, the combination could weigh on home prices and cause the national median sales price

to dip this fall, said Lisa Sturtevant, chief economist at Bright MLS.

“I think we’re going to see an overall kind of pullback in a segment of buyers for whom 7 percent mortgage rates are just off the table,” she said. “At the same time, we’ve started to see some movement on listings. And so, while I think we might have hit a bottom in terms of prices, I think it’s possible that we’ll see another dip in prices this fall for those couple of reasons.”

Other housing experts see little change in the U.S. median home price this year.

“Given that it still takes an out-

sized share of paychecks to buy a home at today’s prices and mortgage rates, but inventory remains low, I would expect home prices to move largely sideways,” said Danielle Hale, chief economist at Realtor.com.

Despite the resiliency of home prices throughout the market’s downturn, the current slump has shown few signs of easing.

Sales of previously occupied U.S. homes fell 2.2 percent in July from the previous month to a seasonally adjusted annual rate of 4.07 million, NAR said. That’s the slowest pace since January and below the 4.15 million pace that economists were expecting, according to FactSet.

Existing home sales sank 16.6 percent compared with July last year. It was also the lowest home sales pace for the month of July since 2010.

The annual sales decline was steepest in markets across the Northeast and Midwest, where sales slumped 20 percent or more, the NAR said.

One positive for home hunters: The inventory of homes for sale rose 3.7 percent in July from June, ending the month with 1.11 million homes on the market. That was still down 14.6 percent from a year earlier, however.

Homes listed for sale in July typically sold within just 20 days, with 74 percent staying on the market for less than a month.

All told, the number of homes on the market amounted to a 3.3-month supply at the current sales pace. In a more balanced market between buyers and sellers, there is a 5- to 6-month supply.

FIFTH CIRCUIT COURT NOTICE AND NOTICE TO CREDITORS P. NO. 5CLP-23-0000037 ESTATE OF JOHN DAVICHICK, DECEASED FILED,StatementofIntestateInformal AppointmentofPersonalRepresentativefiled 4/11/23,showingtheIntestacyofthesaiddecedent, showingpropertywithinthejurisdictionofthisCourt, andthatLORIPIPITONE,whoseaddressis2447 LexingtonPl,Livermore,CA94550,isappointedas

Personal Representative of said estate.

Allcreditorsoftheabove-namedestatearehereby notifiedtopresenttheirclaimswithpropervouchersor dulyauthenticatedcopiesthereof,eveniftheclaimis securedbymortgageuponrealestate,tosaid appointee,attheaddressshownabove,withinfour(4) monthsfromthedateofthefirstpublicationofthis notice, or they will be forever barred.

DAVID K. AHUNA 9540 Attorney for Personal Representative (TGI1426349 8/11, 8/18, 8/25/23)

DATED: Honolulu, Hawaii, August 9, 2023

OWNER’S NOTICE OF COMPLETION OF CONTRACT

NOTICEISHEREBY GIVENthatpursuantto theProvisionsofSection 507-43,oftheHawaii RevisedStatutes,the constructionbyKauai PremierBuilders/Todd DornyofthatcertainNew ConstructionResidential situatedat4975Kaulu Street,Koloa,HI96756, TMK:(4)2-6-16:086,has been completed.

Auna Estates LLC Owner(s) (TGI1427012 8/18, 8/25/23)

OWNER’S NOTICE OF COMPLETION OF CONTRACT

NOTICEISHEREBY GIVENthatpursuantto theProvisionsofSection 507-43,oftheHawaii RevisedStatutes,the constructionbyMARK GUATHIER,MATTHAMAI, DOUGPICKLESofthat certainDeckExtension, situatedat5-7107B KuhioHwy,Hanalei,HI, TMK:RP5-8-011-0080002, has been completed.

JOHN F. DOLAN REVOCABLE TRUST Owner(s) (TGI1426954 8/18, 8/25/23)

NOTICE OF FORECLOSURE SALE

HAWAI’I PAROLING AUTHORITY

MEMBER, HAWAI’I PAROLING AUTHORITY $58.58/HOUR TEMP PART-TIME

Qualification:InaccordancewiththeHawai’iRevisedStatutes(HRS)§353-61&§353-63,applicants mustbequalifiedtomakedecisionsthatwillbecompatiblewiththewelfareofthecommunityandof individualoffenders,includingthebackgroundandabilityforappraisalofoffendersandthe circumstances which offenses were committed.

PreferredExperience:CriminalJusticeSystem(Federal,State,Cityand/orCounties),judicialprocess, social work, corrections, probation, parole work.

TermsofOffice:Thisrecruitmentisfortwo(2)vacantboardmemberpositions.Thetermsbothexpire on 6/30/27.

Requirements: (1)Mustbeabletoworkupto128hourspermonth;(2)musthavetheabilityand meanstoattendhearingsatvariousfacilitiesandonallislandsonflexiblescheduleasneeded; (3)abilitytouselaptopcomputer,iPad&smartphone;(4)validdriver’slicense;(5)submitAnnual Financial Disclosure; and (6) attend and complete State Ethics Training.

SelectionProcess: Applicationswillbereviewedaftertheapplicationdeadline,andqualifiedapplicants willbecontactedtobescheduledforanoralinterviewbeforeaselectionpanelwhosemembersare chosenaccordingtoHRS§353-61.Qualifiedapplicantswillalsoneedtoprovideanswerstowritten questionspriortotheoralinterview.Uponcompletionoftheoralinterviewandwrittenexamination, theselectionpanelwillselectthemostqualifiedapplicantstonominateforconsiderationbythe Governor.TheGovernorwillthenselecttwonomineesfromthelistofpotentialnomineesthatwillbe submitted to the Hawaii State Senate for confirmation.

PositionDescriptionandJobExpectations :ApplicantsareencouragedtoreviewthePositionDescription andJobExpectations.Qualifiedapplicantswillbeaskediftheyunderstandthescopeandnatureof thepositionduringtheinterview.ToobtainacopyofthePositionDescriptionandJobExpectationsgo to http://dps.hawaii.gov/hpa/

Please submit your application and resume online by Friday, September 8, 2023

1. Go to https://forms.ehawaii.gov/pages/board-survey/

2. Click on Department of Public Safety and then elect Hawai’i Paroling Authority

3. Click on Submit at the bottom of the page

4. Fill out application form

5. You will be required to provide three references

Please call (808) 587-1357 if there are any questions.

BANK OF

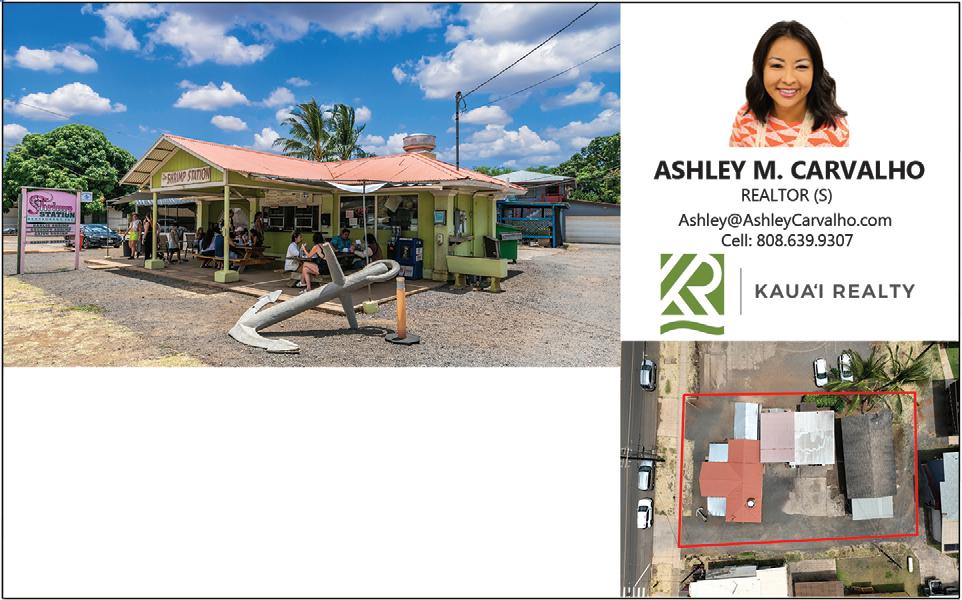

SALE: NoUpsetPrice.Propertysoldin“ASIS”conditionwithout anywarrantyoftitleoranyotherwarranty.Purchaserisresponsiblefor makinghis/herowninvestigationregardingtheproperty.Propertymaybe subjecttootherliens.Propertyissoldatpublicauctionwith10%of highestbidpayableincash,certifiedorcashier’scheckatcloseof auction,balancepayableupondeliveryoftitle.Potentialbiddersmustbe abletoprovideproofofhis/herabilitytocomplywith10%ofbid requirementpriortoparticipatinginthepublicauction.Buyersshallpayall costsofclosingincludingescrow,conveyancetaxesandisresponsiblefor securingpossessionoftheproperty,includingthecostofeviction,upon recordation. SALE SUBJECT TO COURT CONFIRMATION.

For Further information call: Melinda K. Mendes, Commissioner; Ph: (808) 212-6635 P.O. Box 3504, Lihue, Hawaii 96766 Email: attymkmendes@gmail.com

(TGI1427309 8/25, 9/1, 9/8/23)