BEAT HIGH RATES — TAKE OVER SOMEONE’S LOAN

Tara Siegel Bernard THE NEW YORK TIMESHome prices were already high when Ellen Harper, a software architect living in Atlanta, started searching for a house in 2021. But she couldn’t have anticipated the quick surge in interest rates the following year, and even with a large down payment, the new math made her uneasy.

Earlier this year, however, she stumbled upon what felt like a portal to the not-so-distant past: listings of thousands of homes that come with a low-rate mortgage, which can be transferred from the existing homeowner to a new homebuyer, known as an assumable mortgage.

Harper, who is in her 50s, managed to snag one of these homes, closing two weeks ago on a four-bedroom brick colonial in Fairburn, Georgia, with a $1,400 monthly payment. It’s an amount she’ll be able to comfortably afford into retirement, thanks in large part to a 2.49 percent mortgage rate. That’s less than half the current rate of 7.09 percent on 30-year-fixed loans, the most popular type of mortgage.

“I didn’t want to get a bad mortgage and be in a ball-and-chain situation where all I would be able to do is pay the mortgage,” Harper said. She found her home through Roam, a startup that went live in September that lists homes with assumable low-rate loans and assists buyers through the process. “There were other homes; they were nice and everything,” she added, “but I went for the lowest rate I could find.”

Assuming a mortgage isn’t some type of gimmick; it’s a built-in benefit on certain government-backed mortgages, as long as the new owners qualify. The process won’t work for all would-be buyers because there are several hurdles they may need to clear before they can claim the keys, often including a hefty down payment. For home sellers, it can be advertised alongside marble countertops, to attract more potential buyers.

Finding an assumable mortgage

Last popular in the 1980s, when mortgage rates topped 18 percent, many real estate professionals are unaware that assumable mortgages are even possible. But as mortgage rates continue to rise, word is spreading. Realtor. com, a home listing website, recently started tagging assumable properties and making them searchable. And more companies are seizing the opportunity, compiling lists or maps of eligible properties and charging homeowners a fee to help navigate what can be a nerve-wracking assumption process.

An estimated 12.2 million loans, or 23 percent of active mortgages, are assumable, according to Intercontinental Exchange, a data and technology firm, though most conventional mortgages are not. It’s an embedded feature in mortgages backed by the Federal Housing Administration, which are widely used among first-time homebuyers, as well as those from the Department of Veterans Affairs.

The number of assumptions completed is just a fraction of all home sales, but it’s growing. There were more than 6,000 completed in 2023, up 139 percent from 2022. This year, there were already 3,896 assumptions completed.

Many homeowners with lowrate loans probably aren’t quite ready to give them up: Nearly twothirds of assumable mortgages with rates below 4 percent were taken out within the last 3 1/2 years, according to Black Knight. Several stars need to align when attempting to assume a mortgage. Since many homes have rapidly appreciated in price, and the assumed loans are partially paid down, there may be a significant gap between the purchase price and the remaining mortgage. That means potential homebuyers may need hefty

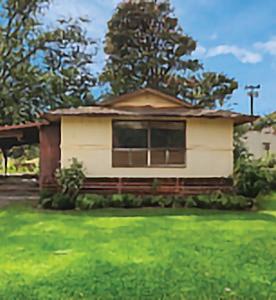

Ellen Harper, who was able to obtain a mortgage at less than half the current rate of 7.09 percent on 30-year-fixed loans, the most popular type of mortgage, is seen in the kitchen of her new home in Fairburn, Ga., on May 5, 2024.

down payments, or at least be able to qualify for a second mortgage, which will be at a much higher rate.

Another hurdle is finding a seller willing to entertain such an offer, and hoping the mortgage servicer holding the loan will process the assumption in a timely manner.

Several new companies are attempting to smooth the process, including Roam, which recently received $3 million in an investment led by the venture capital firm Founders Fund, and Tony Xu, CEO of DoorDash, among others.

Roam runs a website similar to Zillow’s, except all of the listings, currently in 18 cities across seven states, have assumable mortgages under 6 percent and are large enough to cover at least half of the purchase price.

The company has partnered with real estate agents who are

knowledgeable about assumable loans in the markets where it operates. Its transaction coordinators will call the mortgage servicer until the deal gets done. Roam’s help doesn’t come cheap: It charges 1 percent of the home sales price.

In Harper’s case, her broker submitted her offer five different times because the seller and his listing agent were quite skeptical. That’s when her real estate agent, Kevin Hosner with Chapman Hall Realtors in Atlanta, got creative. They promised to pay the seller $2,000 more if they didn’t close within 60 days. Roam used that as inspiration for a new guarantee: If the assumption isn’t processed within 45 days, the company will pay the homeowner’s mortgage on a prorated basis until it does. Harper ultimately paid $357,000, with a down payment of roughly $170,000.

Both the FHA and VA have caps in place on how much mortgage servicers can charge for assumptions.

Running the numbers

For buyers, seeking out lowrate mortgages may seem like a no-brainer. But there’s a lot to consider, including the prospect of qualifying for a second mortgage, something that could potentially gum up the closing process or kill the deal altogether.

Raunaq Singh, the CEO of Roam, said the uncertainty of securing a second loan was a frequent stumbling block; some mortgage servicers who held the assumable loan would extend additional credit, but not always. To address the issue, Roam recently started working with Spring EQ, a national lender, that will provide second loans to Roam customers with credit scores of at least 640 and down payments of at least 15 percent.

Imagine a home that cost $400,000, which comes with an assumable mortgage of $280,000. The homebuyer would need to come up with $120,000 to close the gap, either with cash or loans.

A buyer who puts 20 percent down, or $80,000, still needs another $40,000, plus closing costs.

Here’s how the math shakes out: The homebuyer’s total monthly payment would be $1,761, compared with $2,237 monthly for a new mortgage with a 7.5 percent rate. That includes the assumable mortgage payment of $1,230 (with a 3 percent rate) and a second loan, of $336 (with a 9.5 percent), according to Roam’s calculations. There’s another ongoing cost included in the monthly payment:

On FHA loans, the homebuyer would also need to pay a mortgage insurance premium of $194, which is an FHA program fee to cover the lender’s losses if the borrower defaults.

Mortgage insurance usually covers the risks associated with a low down payment. But here, even borrowers putting lots of money down will still need to pay the fee for the life of the loan, though there are exceptions.

People assuming VA loans must pay a one-time fee of 0.50 percent of the loan amount to the agency, but there aren’t any ongoing insurance costs. There are other limitations, however. If a buyer who isn’t a veteran assumes the mortgage, the seller could lose all or part of his or her entitlement to another VA loan until the old one is paid off.

Still, for many would-be buyers, it’s worth it.

Ryan Carrillo was one of many homeowners who wanted to move but didn’t want to surrender his 2.75 percent mortgage.

Once he learned his FHA-insured mortgage was assumable, he figured he could try to find another one. But he quickly became frustrated trying to find assumable listings.

That led to an idea that he shared in a text to an entrepreneurial friend, Louis Ortiz. In August, the two unveiled Assumable. io, a small homegrown operation. It now includes a website with 26,000 active listings and charges $1,850 to help aspiring borrowers through the process that Carrillo is about to embark on for his own family. He and his wife, who had their first child in January, are moving from Phoenix to Texas to be closer to relatives.

ARRUDA ESTATES I; and DOES 1 through 20, Inclusive (Case No. 5CCV-23-0000050) 6411 Kawaihau Road, Unit #5, Kapaa, Hawaii 96746 (also appearing of record as 6467 A Kawaihau Road, Kapaa, Hawaii 96746) TMK: (4) 4-6-007-027-0004

OPEN HOUSES: NONE AUCTION DATE: June20,2024at12:00p.m.onthefrontstepsoftheKauai JudiciaryComplex,FifthCircuitCourtBuilding,3970Kaana Street, Lihue, Hawai‘i 96766.

TERMS OF SALE: Noupsetprice.Propertysold“asis”conditionatpublic auctionwith10%ofhighestbidpayableincash,certifiedor cashier’scheckatcloseofauction,balancepayableupon deliveryoftitle.Potentialbiddersmustbeabletoprovide proofofhis/herabilitytocomplywith10%ofbid requirementpriortoparticipatinginthepublicauction. Buyershallpayallcostsofclosingincludingescrow, conveyanceandrecordationfee,conveyancetaxesandis responsibleforsecuringpossessionofthepropertyupon recordation,includingthecostofeviction.Buyermaybe liableforsixmonthsofunpaidregularmonthlycommon assessmentsnottoexceed$1,800.00.SALESUBJECTTO COURT CONFIRMATION.

For further information call: Shauna Lee Cahill-De Costa (808) 652-3289 shaunaleecahill@gmail.com (TGI1454474 5/10, 5/17, 5/24/24)

NOTICE OF PUBLIC HEARING

PursuanttoHawaiiAdministrativeRulessection16-133-30,theDepartmentof CommerceandConsumerAffairs(“DCCA”)heldapublichearingonFebruary2, 2017,ontheApplicationforRenewaloftheCableTelevisionFranchiseforthe IslandofKauai(“Application”),submittedbyOceanicTimeWarnerCableLLC,now knownasSpectrumOceanic,LLC(“Spectrum”).DCCAisholdinganotherpublic hearingtoprovidethepublictheopportunitytosubmitcurrentandup-to-date testimonyonSpectrum’sapplicationtorenewitscabletelevisionfranchiseforthe Island of Kauai.

The public hearing will be held on the following date, time, and location: Date: Wednesday, May 29, 2024 Time: 5:00 p.m. Location: Lihue Civic Center Moikeha Conference Room 2 4444 Rice Street Lihue, HI 96766

Thepurposeofthispublichearingistoaffordinterestedpersonsthe opportunitytosubmitoralorwrittendata,views,orarguments,onSpectrum’s application.AllinterestedpersonsareencouragedtoreviewtheApplicationand otherdocumentssubmittedatthelocationslistedbelowpriortothepublichearing and to attend the public hearing.

Copiesoftheapplicationwillbeavailableforreviewduringnormalbusiness hoursattheRegulatedIndustriesComplaintsOffice(“RICO”),DCCA,3060Eiwa Street,Lihue,Hawaii96766andattheCableTelevisionDivision(“CATV”),DCCA, 335MerchantStreet,Room101,Honolulu,Hawaii96813.Theapplicationmay also be found at: http://cca.hawaii.gov/catv/cable_operators/oceaniccable/oceanic-time-warnercable-kauai-franchise-renewal/

Allinterestedpersonsshallbeaffordedtheopportunitytosubmittheiroralor writtencommentsatthetimeofthepublichearing.Whethertestimonyis presentedorallyornot,interestedpersonsareencouragedtoputtheircommentsin writing and submit them to CATV via the following: In person at the public hearing; Email to: cabletv@dcca.hawaii.gov ; Fax: (808) 586-2625; or μ U.S. Mail to: Cable Television Division Department of Commerce and Consumer Affairs P.O. Box 541 Honolulu, HI 96809

AllwrittencommentsshouldbesubmittedtoCATVbyWednesday,June5,2024, 4:30 p.m.

Individualswhorequirespecialneedsaccommodationsforthepublichearing mayrequestassistancebywritingorcontactingCATVattheaddressaboveorat (808)586-2620,atleast10workingdayspriortothescheduledpublichearing. Formoreinformation,contactDCCA-CATVattheaddressesorphonenumber

(TGI1453800 5/3, 5/10/24)