theTBrealtygroup.com JUNE 2023 REALTY GROUP THE TO

POWER MOVE YOU

2 Power to Move You

FEATURES

6 How your credit card debt affects borrowing costs

12 Would you recommend buying a home with a rental unit?

16 Expert advise: rental cash damming 101

22 CMHC CEO rejects idea of extended mortgage amortization period

26 Spring

PROPERTIES

8 Markham For Sale

14 1069 Sadybrook Lane, California

1/8th Ownership

20 210 - 80 Port Street For Sale

21 48 North Forster Park Drive

SOLD

24 1002 - 90 Stadium Road Executive Lease

25 9 Webb Avenue For Sale

30 3351 Oak Hammock Court, Florida For Sale

44 Ramara For Sale

ALL

5

JUNE 2023

34 What

the mortgage options for the self employed? 36 OAF

The McMichael Canadian Art Collecton by Julia Baird-Oryschak 38 Poached Shrimp Cocktail 40 Lox Crostini 42 OAF - Life Time Mississauga

Samantha McGrath 43 Spanish Fizz - Sangria for two 46 Balancing rights and expectations: A case study on joint property ownership

Stronger together: A love letter to our donors

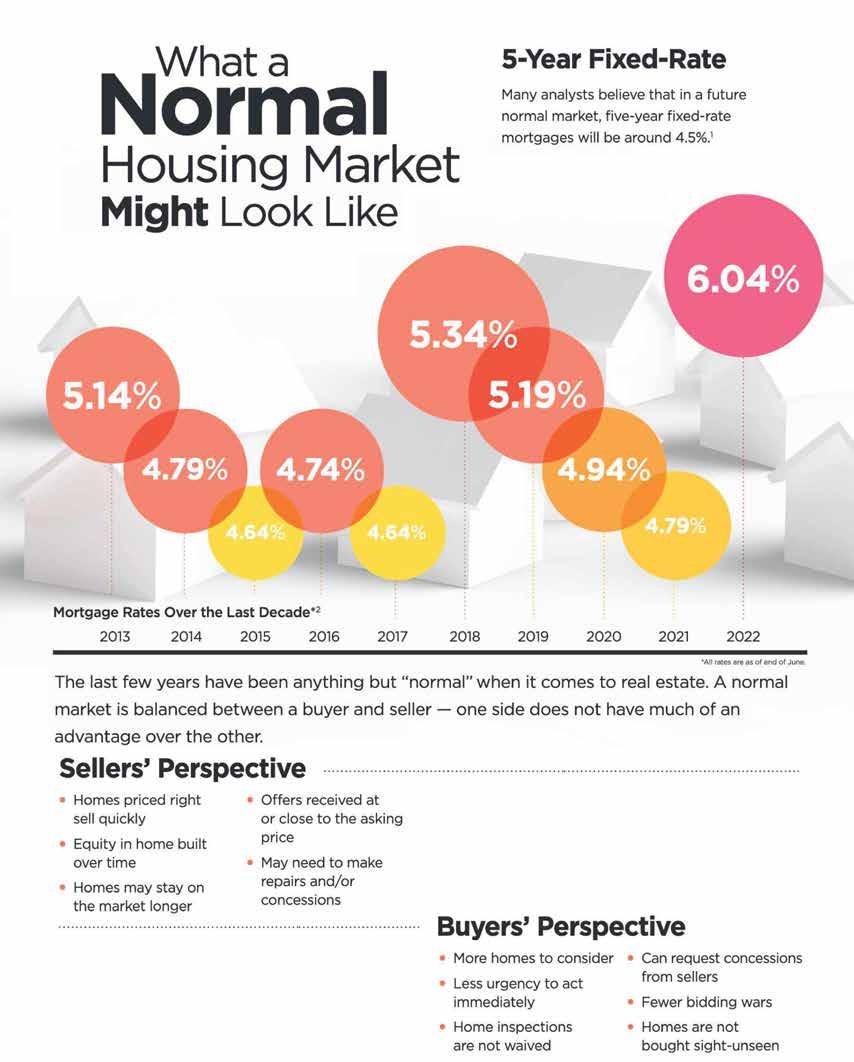

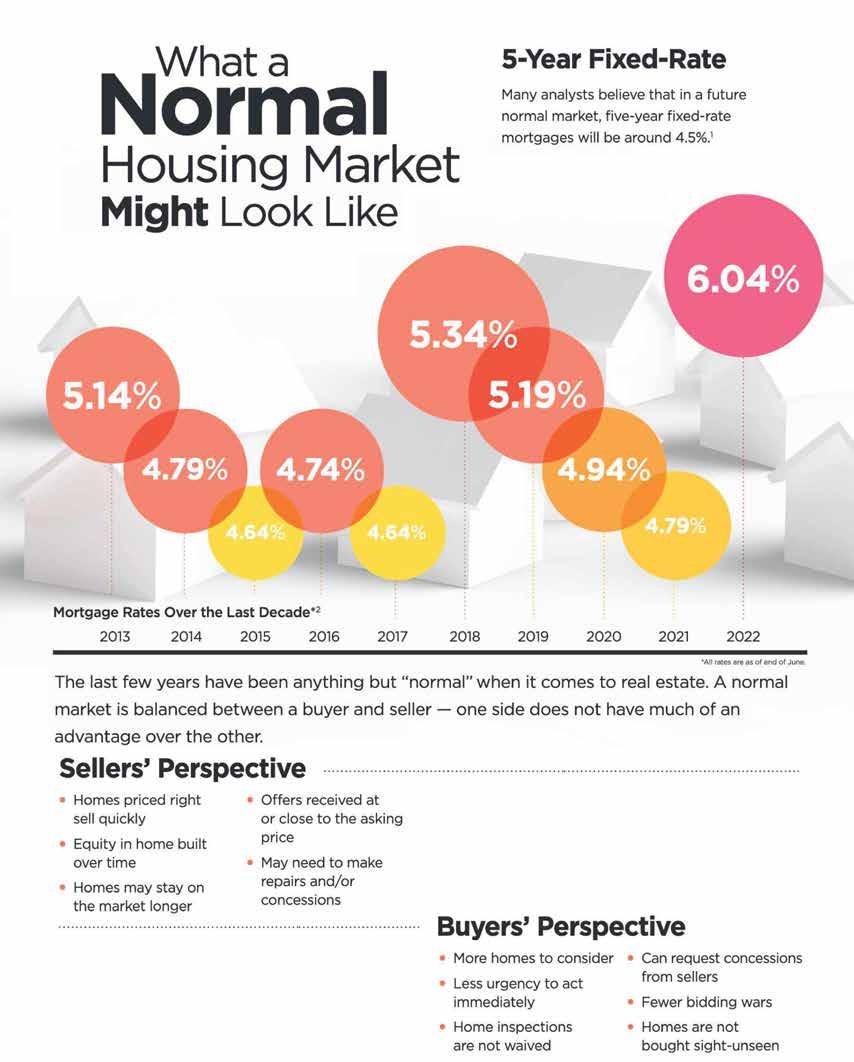

What a normal housing market might look like

into action - 12 backyard DIY projects to get the most out of your outdoor space 32 OAF - Will by Will Smith By Theresa Baird

are

-

By

50

52

ABOUT REAL ESTATE

Why is the TB Realty Group one of the best in its’ marketplace?

49 Reasons to own your home

Power to Move You 3

52 Different types of housing markets

Dear Readers,

As the warmth of June envelops us, I am thrilled to present to you the latest edition of “The Power to Move You.” Within these pages, we have curated a collection of insightful articles, captivating features, and exciting real estate listings, all aimed at empowering you with the knowledge and inspiration you need in the ever-evolving world of real estate.

This month, our team of experts has explored a diverse range of topics that touch upon different facets of the housing market and beyond. From understanding the dynamics of a normal housing market to the impact of credit card debt on borrowing costs, we have covered it all. You will also find articles delving into mortgage options for the self-employed and the pros and cons of buying a home with a rental unit. Additionally, our expert advice section provides valuable insights on rental cash damming, ensuring you make informed decisions.

In this issue, we are excited to feature exclusive interviews and profiles that shed light on the industry’s trailblazers. Learn from the experiences and wisdom of renowned personalities, including a captivating review by Theresa Baird on Our Agents Favourites - Will by Will Smith. We are also proud to showcase exceptional properties available for sale, lease, or fractional/ co-ownership. Discover the listings that might just be the perfect fit for you or someone you know.

“The Power to Move You” isn’t just about real estate; it’s about embracing a holistic lifestyle. We’ve included articles that delve into the world of art, delectable recipes to tantalize your taste buds, and thought-provoking discussions on joint property ownership and the importance of community support.

I extend my heartfelt gratitude to our readers, who continue to inspire and motivate us. Your enthusiasm fuels our passion for bringing you the most relevant and engaging content. We hope that this issue sparks new ideas, provides valuable insights, and helps you make informed decisions. Thank you for your unwavering support. Enjoy this edition of “The Power to Move You,” and may it empower you to create the life you envision.

Warm regards,

4 Power to Move You REALTY GROUP theTBrealtygroup.com Theresa Baird Broker Keller Williams Real Estate Associates, Brokerage 103 Lakeshore Road East, Mississauga 647-298-0997 | tbaird@tbaird.com

Your Home Sold GUARANTEED Or I’ll Buy It!* * Some conditions apply. Inquire for details.

Why Is the Realty Group One of the Best in its’ Marketplace?

Julia and the team were a pleasure to work with. From the start and throughout the entire process, she's shown an unmatched level of professionalism. She's very responsive, knowledgeable and understanding. She's very passionate about what she does and that translates in all of her efforts made. I'd eagerly choose to work with Julia again in the future!

Zofia

-

A big thank you to Lindsay and Theresa for helping me sell my condo and purchase my new home! When it came to selling my condo, they staged everything perfectly and provided all furniture and decor items. The multimedia photos and video were professional and showcased each room perfectly. For purchasing, Lindsay was always available for home tours, had fast responses to my questions, and was patient in my journey of finding my next home. She took the time to understand exactly what I was looking for and what was important to me which was clear when she presented different listings. They both made this process so enjoyable and less stressful by being so warm and professional.

-

Ashley

Theresa Baird and Lindsay Meadwell recently assisted us with the sale of our Port Credit condo. We had the pleasure of working with them previously and had every confidence that this time would be no different. From our initial contact to informing us of current market conditions and trends, preparing our place for sale with expert staging, and marketing, through to managing showings and offers, they were attentive, professional, and a pleasure to work with every step of the way. We highly recommend Theresa and Lindsay to anyone looking for real estate agents who go above and beyond to get the job done, efficiently and professionally. Thanks for making our sale a success!

- Michael & Randy

I would like to thank Lindsay and Theresa for their outstanding service. Their handling of my Real Estate transaction was done in a most professional way, and to my fullest satisfaction. I would not hesitate to recommend them to anyone. I wish you both a successful future and thank you again for your help and service.

- Theo

Power to Move You 5

HOW YOUR CREDIT CARD DEBT AFFECTS BORROWING COSTS

No surprise… consumer debt – including credit card debt, interest rates, and borrowing costs are at record-high levels in Canada. What may be a surprise though, is the affect your credit report and credit score can have on your borrowing costs, including mortgage financing.

Before you start looking for new or renewed mortgage financing, make sure your credit report is in good shape. Here’s how…

The Basics: Your Free Credit Report

Start by accessing your free credit report online from Equifax and TransUnion, using this secure Government of Canada link: https://www.canada.ca/en/financial-consumer-agency/services/credit-reports-score/ order-credit-report.html. Check both Equifax and TransUnion reports before you apply for any new financing. Some lenders only report to Equifax, some report to TransUnion, and some report to both.

Understand Your Credit Score

Your credit score is a three-digit number. In Canada, your credit score ranges from 300 to 900. A credit score between 780 – 900 is considered excellent. Your

credit score impacts the interest rate offered on mortgage financing and most other forms of financing.

Five Types of Accounts that Report to Equifax and TransUnion

• credit cards lines of credit loans/leases

• mortgages

• mobile phones

Credit cards affect your score the most.

The Importance of Your Credit Card Utilization Rate and Making Payments

Your utilization rate (your balance versus your limit) is just as important as your payment history. Making the minimum payment is essential. Paying your balance every month in full will save you from paying painful dou-

Written by Tracy Irwin Source: http://tracyirwinmortgages.com/blog/how-your-credit-card-debt-affects-borrowing-costs/

6 Power to Move You

ble-digit interest rates. But this isn’t enough to generate a high credit score. The lower you keep the balances on a regular basis, the better. You can improve your credit by making multiple payments each month or by using cash and debit more often.

Read the ENTIRE Credit Report

Reduce the risk of fraud by reviewing your credit report in full. Fraud continues to be the number one growing crime in Canada. In 2022, the RCMP reported $530 million worth of victim losses due to fraud representing a 40% increase from the unprecedented $380 million in losses in 2021.

Many people look only at their score and completely forget about checking personal information, such as address and phone number. Potential fraudsters will start by changing your contact information. The more often you check, the safer you and your credit will be.

Talk To Your Creditors

Setting up a payment plan can help minimize damage to your credit should a collection or judgment be registered on your credit report. It may be possible to negotiate a reduced lump-sum payment with anything other than government debt. Be sure to get written confirmation that the account has been settled. It’s much easier to dispute leftover balances or errors when you have supporting documentation.

One Last Thing…

People often wonder why they should choose a Mortgage Broker over a banking institution. The short answer is: mortgage brokers work for you! Their fees are paid by the lender, not you. Mortgage brokers are certified professionals who search for the best mortgage terms by accessing a huge network of lenders including major banks, but also trust companies, finance companies and credit unions.

Power to Move You 7

FOR SALE MARKHAM

8

to Move You

Power

This stunning home boasts elegance and luxury at every turn. Custom built estate home with exceptional land size (181ft x 181ft) in prestigious area in Markham with all amenities you desire! Over 5,000 square feet of living space with 18 car parking spaces. (3 car garage and 15 drive parking spaces). Stunning architecture and classic interiors. Huge finished basement apartment with separate entrance.

Power to Move You 9

Beautiful landscaping with green house. New furnace, sauna, stainless steel appliances, and 2 fireplaces. This gorgeous home features 5 bedrooms upstairs, 3 additional bedrooms downstairs and 6 bathrooms.

Believe it or not, this perfect place is just waiting for you to pick up the phone and call Theresa today.

10 Power to Move You

Power to Move You 11

WOULD YOU RECOMMEND BUYING A HOME WITH A RENTAL UNIT?

The short answer is, it depends. There isn’t a one-size-fits-all answer. If this is something you are considering, I would recommend that you reflect on a few things – namely your finances, your lifestyle preferences and, of course, the market.

Crunch your numbers and assess how much financial responsibility you are willing to take on. Begin by going mortgage shopping to confirm how much you can get pre-approved for. Then, review your other expenses and priorities and set a budget you are comfortable with. Ask your real estate agent to check whether you will be able to find a home that meets your needs within that budget. This may help inform whether you would still like to offset your costs with a rental unit. If you are not sure, consider seeking advice from your agent or financial expert.

Be honest with yourself about your lifestyle preferences. Are you comfortable with another individual or family living in your basement unit? Is your home generally quiet or do you host a lot of guests, which could make

things noisy for a tenant? Are you fine with sharing your driveway with the tenant? Give these questions some serious thought and discuss with your family members before arriving at a decision.

Remember that the market fluctuates over time. Currently mortgage rates are rising across Ontario and more buyers are finding it difficult to qualify for one. Inflation rates are also steadily climbing. Because of these economic conditions, some buyers will find purchasing a home with a rental unit appealing at this time.

This is understandable, given that it can help reduce costs, make things more affordable, and even increase investment returns in the long term.

Written by Joseph Richer

Source: https://www.reco.on.ca/ask-joe-question/would-you-recommend-buying-a-home-with-a-rental-unit/

12 Power to Move You

If you choose to buy a property with a rental unit, be sure to become familiar with all relevant local bylaws and building codes. This includes making sure that the unit meets all legal requirements.

It would also be a good idea to learn about what your rights and responsibilities would be as a landlord. A great place to start learning about this is the Landlord and Tenant Board website. I highly recommend that you discuss this with a real estate agent and lawyer as well.

I would strongly encourage you to ask your lawyer to

check if the home is zoned to permit a multi-unit dwelling and meets all the necessary building, fire, and electrical safety requirements.

Have your agent ask the seller’s agent for all relevant paperwork, including copies of municipal permits and inspections for the unit.

This is crucial because if you have a unit that is not compliant, you could be held liable if safety codes aren’t met and there is a fire, flood or structural collapse that results in damage to a tenant’s property or causes injury.

Power to Move You 13

1/8th

14

to Move You

FOR SALE |

ownership 1069 SHADYBROOK LANE NAPA, CALIFORNIA, USA

Power

It’s hard to take your eyes off the stunning Napa Valley views stretching all the way to San Francisco and Sonoma. Easily move the party to the massive deck by sliding open the glass doors in the living and dining space.

The 4 bedroom, 4 bathroom home comes fully furnished and professionally decorated. It’s easy to see yourself sipping a glass of wine and watching the sunset in this picture-perfect setting.

15

Power to Move You

CLICK HERE TO VIEW THIS LISTING

EXPERT ADVICE: RENTAL CASH DAMMING 101

What Is Rental Cash Damming? Cash damming is a strategy to convert the personal debt, whose interest is not tax-deductible, to business/investment debt, whose interest is deductible.

This technique uses the cash flows from a rental property to gradually convert personal mortgage debt into more tax-efficient debt to cover the rental property expenses.

This is achieved using the cash flows from the rental to pay down the non-deductible primary residence mortgage. The equity is then drawn out via a line of credit to pay the rental property’s expenses.

Who Is In The Best Position To Take Advantage Of Rental Cash Damming?

The rental cash damming strategy is ideal for homeowners who have a mortgage on their principal residence with at least 15 years remaining on their amortization, and who also own (or plan to own) a residential investment property.

There are other variations on the cash damming technique that may be appropriate for Canadians who are self-employed, and/or wish to invest in the capital markets, but for the purpose of this article, we will focus exclusively on the benefits for real estate investors.

Seek Professional Guidance Before Attempting…

Although cash damming has been technically approved by the Canada Revenue Agency, the actual implementation of the strategy has a few moving parts, and it’s highly recommended to seek guidance from a mortgage professional who understands and can advise on more advanced financial techniques.

To find out more, we caught up with Jason Henneberry, founder of Strategy Hub, for his advice on important

Written by Heather McDowell

Source: https://www.canadianrealestatemagazine.ca/expert-advice/expert-advice-rental-cashdamming-101-335334.aspx

16 Power to Move You

considerations when deciding if rental cash damming is an appropriate strategy for portfolio growth.

“Most homeowners don’t realize their mortgage is perhaps the most powerful and flexible financial tool they have at their disposal”, says Jason. “The problem is most Canadians just don’t know how to use it to their advantage.”

Over the course of his career, Jason has helped hundreds of families implement advanced financial techniques, and he recently launched a new homeowner education series about rental cash damming, which can be found on Strategy Hub here.

How Does It Work?

The concept behind the strategy is commonly understood among Canada’s affluent homeowners. The financial technique has been utilized for decades by wealthy Canadians to support the tax-efficient management of debt, and to maintain their financial advantage.

According to Jason, “Cash damming has grown in

prominence in recent years as a tried-tested-andtrue methodology for real estate investors seeking to generate additional tax benefits, which can be used to pay down their mortgages faster and get further ahead financially”.

Instead of directly using the income generated by the investment property to cover the rental expenses, the cornerstone of the rental cash damming approach is to use the rental income to pay down the real estate investor’s primary residence mortgage as a first step, and then borrow the funds required to cover the expenses on the rental property.

The result is a rapid paydown of their non-deductible primary residence mortgage, which is essentially converted into a tax-deductible investment loan that is used to run their landlord business.

The converted debt generates new incremental tax benefits that can be used to pay off their mortgages faster, and ultimately reinvested to build additional wealth for the future.

Power to Move You 17

Cash Damming Fundamentals

Before implementing the strategy, you’ll need to make sure you have a few key things in place, including dedicated bank accounts and a mortgage that allows you to re-borrow your principal as you pay it down.

Cash damming requires: Two separate bank accounts to keep deductible and non-deductible cash flows separate. A re-advanceable home equity line of credit that is secured by the primary residence.

The cash damming approach uses the gross rental income to: Pay down your non-deductible primary residence mortgage. Draw from the line of credit to service the rental property expenses. Use the tax refunds from the strategy to pay off your mortgages faster.

With this methodology, investors and rental-property owners pay off their primary residence mortgage in record time and finance one hundred percent of their landlord business expenses.

Their overall debt load remains the same, but it becomes more tax efficient. Over time, the additional tax refunds and interest savings that are generated by the strategy can add up to tens of thousands, even hundreds of thousands of dollars in savings over the life of their mortgage.

Giving Credit Where Credit Is Due.

It’s worth noting that to make this strategy work, a real estate investor or rental property owner should have a high credit score. This is because the lender products that are required to execute the strategy are only available to AAA borrowers in order to qualify for this type of mortgage structure.

Being able to access lending products that offer more advanced features and functionality is one of the main reasons it’s so important to maintain a solid credit rating.

One technique used by savvy investors to ensure their credit score remains pristine and as high as possible is through regular monitoring and diligent investigation of any outliers. It’s not uncommon for personal finances to impact professional goals and, by extension professional life.

What Are The Advantages Of The Rental Cash Damming Strategy?

The single biggest advantage is tax savings. Specifically, this approach allows rental property owners and investors to re-organize their cash flows more efficiently to:

Reduce their primary residence mortgage by rapidly paying it down with cash flow from the rental portfolio. Convert non-deductible personal debt to more tax-efficient business debt. Apply the tax-deductible interest charges as new deductions against their income. Generate free tax refunds and apply for those refunds as additional pre-payments on their mortgage to accelerate their amortization. Re-invest the savings to build additional wealth for their future.

Having helped many families put this strategy to work, Jason has a few tips for sourcing guidance and support on how best to get started… “I highly recommend investors seek guidance from professional advisors who understand the mechanics behind the strategy before implementing the cash damming technique”.

A Mortgage Broker will be able to help you select the right mortgage structure that allows for expedited repayment terms, and automatic re-advancement of principal to streamline the debt conversion process. If you don’t already own a rental property, or are planning to purchase a new rental, your local Realtor should be able to help you source properties to maximize the cash flows that can be applied to the strategy. Check with a certified tax professional to make sure you are cash damming tax-deductible rental property expenses to ensure 100% eligibility of your deductions and refunds.

It’s also worth noting, for self-employed individuals and market investors, that it’s possible to cash dam business and other investment expenses that may be suitable for interest deduction; whenever in doubt, it’s always a good idea to confirm your eligible expenses with a tax professional first.

Keep in mind this strategy takes time. There’s no magic bullet, so patience is essential. For this technique, the debt conversion process typically takes between 6-12 years. While the overall benefits of the strategy can knock years off your mortgage and save you tens of thousands

18 Power to Move You

in interest and taxes. Cash damming requires proper planning, self-control, and steadfast implementation.

In Conclusion

Cash damming may appear straightforward in theory, but it can be complicated in practice. As with any financial strategy, it’s important to make sure you fully understand how it works, and the many steps required to successfully execute the technique. For optimum results and to ensure proper implementation, it’s best to seek guidance from a mortgage professional and a tax specialist who fully understand the strategy.

Power to Move You 19

210 - 80 PORT STREET, MISSISSAUGA - FOR SALE

This stunning condo in Mississauga’s Port Credit Village includes beautiful views of Lake Ontario from the living room and den windows. A welcoming atmosphere embodied by the open concept floor plan, bright and airy rooms and two balconies. The panoramic rooftop terrace is but one of the many features of this wonderful modern building. Don’t miss out on the one of a kind opportunity.

20 Power to Move You

CLICK HERE TO VIEW THIS LISTING

SOLD

We are thrilled to announce the recent sale of a remarkable bungalow on North Forster Drive in old Oakville. This wonderful property has found its new owners and is no longer available on the market. If you desire exceptional results and are in need of a reliable real estate team that can deliver the same level of success for you, we invite you to get in touch with the TB Realty Group. Our track record speaks for itself, and we are dedicated to achieving outstanding outcomes for our clients.

Power to Move You 21

48 NORTH FORSTER PARK DRIVE, OAKVILLE - FOR SALE

CMHC CEO REJECTS IDEA OF EXTENDING MORTGAGE AMORTIZATION PERIOD

Canada’s federal mortgage insurer is not in favour of extending the maximum amortization period for new mortgages, arguing that measures to cut monthly payments would also stoke demand and spur higher home prices.

Currently, borrowers have a maximum of 25 years to pay down their mortgage if they make a down payment of less than 20 per cent of the property’s purchase price. They are also required to pay for mortgage insurance, which protects banks from losses if borrowers are unable to pay their mortgage

Although some borrowers with variable-rate mortgages have seen their amortizations temporarily grow beyond 25 years as interest rates have risen, Canada Mortgage and Housing Corp. chief executive Romy Bowers says she is not looking to make expanded mortgage terms a permanent feature for new buyers.

“It’s better to focus on increasing the supply versus making it easier for people to borrow more money,”

Ms. Bowers told The Globe and Mail. “We feel, from a policy perspective, it’s probably not the best move in a supply constrained environment.”

Ms. Bowers said increasing the amortization period for insured mortgages would create more demand for housing and increase the purchasing power of individuals, which would just get “capitalized into the cost of housing.”

The maximum amortization period is 30 years for a borrower who makes a minimum 20-per-cent down payment on the purchase price of their property.

For years, the Trudeau government has tried to make it easier for first-time homebuyers to purchase

Written by Rachelle Younglai - Real Estate Reporter for the Globe and Mail

Source: https://www.theglobeandmail.com/business/article-cmhc-max-length-new-insured-mortgages/

22 Power to Move You

property. It has introduced tax incentives and government loan programs, but has shied away from extending the amortization period – the length of time it takes to pay down a mortgage.

However, over the past year, as the Bank of Canada hiked its benchmark interest rate to 4.5 per cent from 0.25 per cent, most borrowers with an existing variable-rate mortgage have had their amortization period automatically extended. That is because most variable-rate borrowers have fixed monthly payments and when interest rates increased, a higher portion of their monthly payment went toward interest and less toward principal reduction.

As a result, many variable-rate borrowers had to either increase their monthly payment or had their amortization period extended well beyond 30 years.

As of the end of January, many of the country’s big banks had a large chunk of their residential loan portfolios with amortization periods of more than 30 years. A year ago, when the central bank’s benchmark interest

rate was still 0.25 per cent, amortization periods remained below 30 years.

Ms. Bowers said CMHC is managing risks associated with lengthening amortizations and said those extended insured loans represented a tiny fraction of the agency’s portfolio. She said CMHC is in constant talk with lenders, who have been reaching out to borrowers to see if they can handle higher monthly payments.

The most recent data show that the mortgage arrears rate for Canadian banks was 0.15 per cent in February. Ms. Bowers said losses typically arise from unemployment, rather than the shock of higher interest rates.

CMHC’s fourth-quarter financial results show that a growing share of its insurance is covering homes for which the loans are close to underwater, or are already. Ms. Bowers said that has occurred because of the recent drop in home prices, and not because homeowners are adding higher interest payments to the size of their original loan.

Power to Move You 23

Romy Bowers, President and CEO of CMHC, is photographed at the Globe and Mail Centre on May 10. Fred Lum/The Globe And Mail

1002 - 90 STADIUM ROAD, TORONTO - EXECUTIVE LEASE

This amazing executive condo lease is luxury living at its best. With over 2,000 square feet of living space, modern design and the gorgeous views of Lake Ontario and the marina, you are transported into a world of style and sophistication. Steps away from Toronto’s waterfront community and the city’s best shops, restaurants and entertainment venues, your best life is only a phone call away.

24 Power to Move You

CLICK HERE TO VIEW THIS LISTING

Once upon a time there was a luxurious home that was waiting for its one true family to experience all that it has to offer. An outstanding chef’s kitchen that leads to an incredible two-storey family room, filled with natural light from the large windows throughout the main floor. The expansive backyard deck is perfect for entertaining guests or just relaxing with the family. Call today and make this your happily ever after.

Power to Move You 25

9 WEBB AVENUE, BRANTFORD - FOR SALE

CLICK HERE TO VIEW THIS LISTING

SPRING INTO ACTION 12 Backyard DIY Projects To Get the Most Out of Your Outdoor Space

What better season than spring to try your hand at some DIY backyard projects? The combination of warmer temperatures and increasingly longer days makes it the perfect time to get crafty. Plus, if you put these tasks in motion now, your backyard will be all set once summer hits.

These easy-to-do upgrades can help you get the most out of your outdoor space and make your backyard much more exciting to spend time in. From homemade pallet furniture to painted “rugs,” here are some expert-recommended DIY projects that will quickly boost the appeal of your backyard.

1. Switch out mulch for decorative stone

Elevate your backyard landscaping by switching out mulch or pine straw for decorative stone or river rock. Bryan Clayton, CEO and co-founder of GreenPal, says stones not only look better but they’re easier to clean as well.

“It’s also a one-time investment, whereas mulch and pine straw have to be retouched up every year,”

says Clayton. “So you actually make money on this landscaping enhancement.”

2. Create your own outdoor bar

If you want to make your backyard the place to hang out this summer, install a crafty outdoor bar. Artem Kropovinsky, an interior designer and founder of Arsight in New York City, says you can build a bar with pallets, plywood, screws, and paint. You can also shop for inexpensive outdoor bars online or at your local home goods store.

Decorate your bar with string lights, signs, and plants for a personal touch. Be sure to keep it stocked with drinks, glasses, ice, and snacks when friends come over.

Written by Brittany Natale. Photography by Decorative Landscaping, Getty Images,Randy Thueme Design, Emma B. Home and Smith & Vansant Archhitects PC

Source: https://www.realtor.com/advice/home-improvement/backyard-diy-projects-to-get-the-most-out-ofyour-outdoor-space/

26 Power to Move You

3. DIY pallet furniture

If you have any leftover wooden pallets, you can easily transform them into design-forward backyard seating. “Pallets are versatile and can be repurposed into outdoor furniture,” explains Richard Callahan, owner of El Paso Artificial Grass & Turf in El Paso, TX. “You can easily design a couch or table.”

To do so, Callahan says to first sand them down, give them a coat of paint, and assemble them to your desired size. “Then add some outdoor cushions to complete,” he says.

4. Create a small sanctuary

“Create a mini sanctuary by putting a chair or two with a small table in a corner of your yard or balcony,” says Heather Evans, a master gardener based in Bristol, RI. “Surround them with native plants that attract butterflies and hummingbirds.”

Evans shares that she’s partial to Adirondack chairs. “The untreated cedar ones age to a beautiful gray, but even plastic ones are comfortable,” Evans says.

5. Tire planters

“Creating planters out of car tires is one DIY project that never seems to go out of style,” says Andre Kazimierski, CEO of Improovy Painters Madison in Madison, WI.

Kazimierski points out that tire planters are incredibly versatile - you can decorate them however you’d like - and are easy to assemble. “It also prevents tires from ending up as waste, so it doubles as eco-friendly,” Kazimierski says.

6. Paint the patio tiles

Want to give your backyard a quick refresh? Paint your patio tiles. “All you need to do is mix floor paint with Valspar latex,” says Mariya Snisar, the head of interior design at Renowell. “Of course, you will also need to clean the tiles first.”

If you want the new paint job to last longer, Snisar recommends applying a primer layer before painting.

7. Paint an outdoor ‘rug’

“Instead of replacing your dingy outdoor rug with another one that will likely only last a few seasons, consider painting a faux rug directly on your deck or patio,” says Beth Martin, an interior designer based in Charleston, SC. You can do this by purchasing paint and a paint stencil. “This easy and budget-friendly weekend project will last for

Power to Move You 27

years,” Martin says. “You’ll also never have to wait for a soggy outdoor carpet to dry out after a storm.”

8. Use lightweight planters for easy moving Want to beautify your landscape without making more permanent changes? Two words: lightweight planters.

“When you choose lightweight planters, you can move them around to chase or avoid the sun,” says Sarah Fishburne, director of trend and design at The Home Depot. “Container plantings also bring

more attention to your backyard and whatever feature you want to accent.”

9. Create a game area

Bring game night outside by investing in patio furniture made for games like poker and chess. “During spring and summer, outdoor games can help you add a little more entertainment to your backyard,” says Fishburne.

10. Create a pea gravel patio

Pea gravel patios are a fun (and affordable) way to spruce up your backyard using little effort. “Not only is it a great way to add a new outdoor gathering spot, but it’s also an easy project that even DIY beginners can handle,” says Jake Eicher, the nationa l sales representative at Portella. “With just a few materials, you can transform an unused corner of your backyard into a relaxing oasis.”

11. Coordinate outdoor cushions with flower colours

Pick up outdoor cushions that match your landscape if you’re looking for an easy way to make your backyard look more put-together. “Treat your backyard like a room in your home,” says Fishburne.

28 Power to Move You

“Pick out a few pillows in shades coordinating with containers and flowers.” The best part: The weather-resistant fabrics hold up all season long.

12. Hang a hammock

Set yourself up for a summer full of afternoon catnaps by hanging a hammock. After everything is installed, be sure to put some finishing touches on it. “Add some pillows and blankets to make it cozy,” Kropovinsky says.

Power to Move You 29

3351 OAK HAMMOCK COURT BONITA SPRINGS, FLORIDA

FOR SALE

30 Power to Move You

The sunny south is calling you to relax and enjoy your mile wide views and tranquil privacy. The lounging deck, beautiful pool and spa overlook the 13th green. Perfect for family and friends, this home features ensuites in all the guest suites, an open floor plan creates a bright and airy enviroment and so much more... What are you waiting for?

Power to Move You 31 CLICK HERE TO VIEW THIS LISTING certified international property specialist

32 Power to Move You

OUR AGENTS FAVOURITES

WILL

By Will Smith

Theresa found Will Smith’s book, titled Will, to be an absolute favourite read for several reasons. Opting for the audiobook version, narrated by the charismatic Will himself, added an extra special touch to her reading experience. As one of the most dynamic and globally recognized entertainment forces of our time, Will Smith opens up fully about his life in this brave and inspiring memoir, creating a powerful connection with readers.

Throughout the book, Will takes readers on an incredible journey, sharing his learning curve and revealing how he aligned outer success, inner happiness, and human connection. It’s a captivating tale of personal growth and transformation that resonated deeply with Theresa. The fact that Will tells the story himself, in his own voice, made the experience even more intimate and authentic.

While Will Smith’s rise from a West Philadelphia kid to a rap star and then a Hollywood legend is undoubtedly remarkable, the book goes beyond that. It delves into the challenges he faced within his own family, where he thought he had achieved ultimate success. However, they felt like star performers in his circus, unintentionally caught up in a seven-day-a-week job. This realization

marked a turning point in Will’s education, proving that his journey of self-discovery was far from over.

Co-authored with Mark Manson, known for his bestselling book The Subtle Art of Not Giving a F*ck, Will is a profound exploration of self-knowledge. It serves as a reckoning of the sacrifices one makes and the things left behind in the pursuit of personal will. Will Smith’s emotional mastery becomes an inspiration for readers, as he shares valuable insights that can help anyone on their own journey of self-discovery. While most of us may not experience the pressure of performing on the world’s biggest stages, we can all relate to the idea that our methods and motivations may need adjustment along the way.

Combining universal wisdom with an astonishing life story, Will stands out as a one-of-a-kind book. The genuine wisdom it imparts, coupled with its entertaining and astonishing narrative, places it in a league of its own, much like its incredible author, Will Smith. Theresa Baird cherished the opportunity to delve into this memoir, finding it both relatable and captivating, ultimately making it a favourite among her reads.

Reviewed by Theresa Baird

Power to Move You 33

CLICK HERE FOR A FREE LISTEN

WHAT ARE THE MORTGAGE OPTIONS FOR THE SELF EMPLOYED?

For this weeks tip, I wanted to pull the curtain back and talk about how we help self employed borrowers get approved for their mortgage. Self Employed borrowers have always been the most difficult demographic to get approved for a mortgage. But in my view, the most rewarding. Self employed people are the backbone of our economy. They’re entrepreneurs, and take risks to grow their business and provide good paying jobs to Canadians. The risks they take are often at the expense of their personal and financial well being. For that reason, we need to have more programs available to help them get mortgage financing. Due to government regulations and guidelines, it’s more difficult for business owners to get approved for mortgages vs a T4 employee.

The challenge is most business owners try to minimize their personal incomes so they don’t have a large tax bill at the end of the year. Unfortunately, in the eyes of mortgage lenders, it makes things much harder for them to get approved for a mortgage. Is it impossible to get approvals? Not at all, so I wanted to provide a high level overview of a few ways that we’re able to assist self employed borrowers.

Bank Statement program - We look at the business deposits for the last 6 months and multiply it by 2 and

come up with an annual income. Then we deduct business expenses such as salaries, leases,supplies, from that revenue and the difference is the personal income we use on the application. The lenders who offer this program are not interested in seeing the T1 generals, or NOAs, all they care about is the revenue in the bank accounts. Higher rates, plus admin fees are usually applicable under these programs. But when you compare the income needed to qualify for a mortgage over a 2 year period, and look at the tax bill on that income, the higher rates will end up being much cheaper.

Written by Steve Kornbluth Source: TMG Safebridge Mortgage Solutions

34 Power to Move You

Business for self programs - Most banks have some kind of self employed program. One of my favourites is for incorporated individuals. For this program, we look at the business financials, and add 40-60% of their Net income after taxes to their personal income to assist in qualifying for the mortgage.

Sole Proprietor programs - For those not incorporated, banks will review the T1 generals, and gross up personal income by 15-20%, or add back certain expenses to the borrowers income to help qualify for a larger mortgage.

Net worth program - If the business owner shows minimal personal income, but has lots of assets out -

side of real estate, we can use the assets to help get an approval. For example, If their personal income only qualifies for a 400k mortgage, and they want a 1mm mortgage, we have to show they have that extra 600k in liquid investments/cash/GICs to get approved for the 1mm mortgage.

Although these all aren’t perfect solutions, it’s definitely progress to help our self employed clients get the financing they need. If you have any self employed clients who have struggled with financing in the past, please have them reach out, and I can go over some of their options.

Power to Move You 35

THE McMICHAEL CANADIAN ART COLLECTION

10365 Islington Avenue, Kleinburg

If you’re looking for a fun cultural activity checkout the The McMichael Canadian Art Collection in Kleinburg. The art gallery is home to famous Canadian art works and features stunning grounds. Their restaurant overlooks the forest and features an incredible menu - the perfect place for lunch! After strolling through the gallery, you can explore the grounds around the area. There are many walking trails that follow the Humber River.

Reviewed by Julia Baird-Oryschak, Real Estate Agent

36 Power to Move You

FAVOURITES

OUR AGENTS

Power to Move You 37

POACHED SHRIMP COCKTAIL

INGREDIENTS

1 pound uncooked jumbo shrimp, shell and tail on, deveined

1 quart court bouillon

⅔ cup cocktail sauce

Court Bouillon

1 quart water

1 cup white wine

1 medium onion

1 medium carrot

2 ribs celery

1 bay leaf

Pinch peppercorns, crushed

Pinch dried thyme

4 parsley stems

1 lemon, halved

1 teaspoon salt

Cocktail Sauce

½ cup ketchup

2 teaspoons tamarind paste

1 teaspoon prepared horseradish

½ teaspoon Worcestershire sauce

½ teaspoon Crystal hot sauce

Pinch black pepper

38 Power to Move You

DIRECTIONS

BOUILLON PART

In a saucepan, combine all the ingredients for the court bouillon. Bring to a boil. Cover with a lid, and reduce to simmer for 30 minutes. Strain off any solids and return liquid to saucepan. Check and maintain temperature between 125 to 135 degrees F for poaching.

SEAFOOD PART

Lower shrimp into prepared court bouillon and poach shrimp until just cooked, approximately 3 to 4 minutes. Remove shrimp from liquid and let cool to the touch, then remove peel. Chill shrimp for service.

In a blender or glass measuring cup, combine all ingredients for the cocktail sauce. Using an immersion or stand blender, puree all the ingredients. Taste and season with additional pepper or hot sauce to your desired tastes. Serves 4.

Power to Move You 39

LOX CROSTINI

INGREDIENTS

1 rustic French baguette

Olive oil, as needed

½ cup (4 ounces) whipped caper cream cheese

1 pound salt-cured salmon, thin sliced

Black sesame seeds and fresh dill, for garnish

Salt-Cured Salmon

1 pound salmon fillet, skin on

2 ounces sea salt

¼ teaspoon white pepper, ground

DIRECTIONS

0.5 ounce fresh dill, rough chopped

1 ounce vodka (optional)

Whipped Caper Cream Cheese

4 ounces cream cheese

1 tablespoon minced green onions

2 teaspoons minced nonpareil capers

¼ cup whole milk

Check the salmon for any bones and remove if needed.

Mix salt and white pepper together in a bowl, then sprinkle half the mixture onto a plastic wrap–lined plate or baking dish. Place salmon skin-side down on a plate, in the mixture. Cover the flesh of the salmon with remaining salt mixture and sprinkle with dill and vodka. Cover tightly with plastic wrap, and refrigerate for 24 hours.

Remove from refrigerator after 24 hours. Flip filet and refrigerate for an additional 24 hours.

After a combined total of 48 hours of refrigeration, remove salmon from refrigerator, drain accumulated liquid, then rinse curing mixture off the fish. Pat dry with a paper towel. Keep chilled for service.

SEAFOOD PART

Preheat the oven to 350 degrees F. Whip together the cream cheese with minced green onions and capers. Slowly add milk until fully incorporated to produce a creamy, non-lumpy final product.

Slice the baguette into ½-inch thick slices, brush with olive oil, and place on a baking sheet. Toast in preheated oven until slightly browned. Remove from oven and let cool fully before spreading prepared cream cheese mixture over the surface of the toasted baguette slice.

Cut thin slices from flesh-surface of cured salmon. Place a slice of lox on top of the cream cheese–layered crostini. Garnish with sesame seeds and fresh dill, and serve.

Makes 24

Written by Kristel Matousek. Photography by Kristel Matousek.

Source: https://article.homebydesign.com/pages/article/HBD_JUN_23_01/275454/index.html#

40 Power to Move You

Power to Move You 41

OUR AGENTS FAVOURITES

LIFE TIME MISSISSAUGA

3055 Pepper Mill Court, Mississauga

Life Time Mississauga is a premier athletic Club, located in central Mississauga. They take working out to a whole new level, and really take away any excuse you could possibly have: work shift work - they open at 4AM and close at Midnight on Monday through Friday and open at 5AM and close at 10PM on the weekends; have kids - they have the ultimate Kids Academy offering a huge variety of classes for kids to do while Mom and Dad workout, including Rock Climbing, Dodgeball, GameFace, Arts & Crafts, Yoga, STEAM activities and so much more; and if you are new to working out or getting back into the gym there are over 100 classes available and free introductory sessions with a Personal Trainer to help you learn about the offerings and how to get the most out of your workout.

Reviewed by Samantha McGrath, Real Estate Agent

Reviewed by Samantha McGrath, Real Estate Agent

42 Power to Move You

SPANISH FIZZ

Summer hangs and pitchers of Sangria may be the very best way to enjoy a sunny afternoon, but we mustn’t let perfect be the enemy of pretty darned great. If just two people (not a pitcher-worthy group) feel like a glass of Spain’s fruity wine punch, it’s easy to make a couple of servings of spritzy white Sangria, thanks to canned sparkling wine.

SANGRIA FOR TWO (Makes 2 drinks)

Since it calls for sparkling white wine instead of red, this light and fruity Sangria is even more tangy and refreshing than the more traditional version.

INGREDIENTS

1 can (240 ml) sparkling white wine, such as Joiy Sparkling (LCBO 486456, 250 ml, $5.25)

1 1/2 oz raspberry liqueur, such as Chambord Royale (LCBO 111443, $47.45)

1 oz fresh lemon juice

10 fresh berries or slices of other seasonal fruit

2 sprigs mint (optional)

DIRECTIONS

STEP 1: Fill two small wineglasses with ice.

STEP 2: Pour about 4 oz sparkling wine into each glass and then add 3/4 oz of Chambord to each.

STEP 3: Add 1/2 oz lemon juice and stir gently.

STEP 4: Add berries, dividing them equally between glasses.

STEP 5: Garnish each glass with a sprig of mint, if desired.

ENJOY!

Power to Move You

Power to Move You

43

43 LCBO Food & Drink magazine - Early Summer 2023 Source: https://lcbofoodanddrink.cld.bz/FD-EarlySummer2023/58/

FOR SALE RAMARA, ONTARIO

44

to Move You

Power

This exceptional 3 level waterfront townhome features 3 bedrooms, 4 bathrooms and hardwood flooring. Heated flooring in the bathrooms and kitchen. Look out onto the water from the 15 x 16 foot sundeck and explore the waterways from your boat on your own dock. A remarkable property is just waiting for you, call Theresa to find out more.

Power to Move You 45

BALANCING RIGHTS AND EXPECTATIONS: A CASE STUDY ON JOINT PROPERTY OWNERSHIP

When parties co-own a property, either as joint tenants or tenants in common, they retain the prima facie right to compel either a partition or sale of the property. However, a co-owner can be deprived of the right to compel a sale in circumstances of malice, oppression, or vexatious intent.

Specifically, the court has recognized that in order to prevent a partition or sale, there must be conduct that undermines the reasonable expectations of the parties. In Green et al. v. Gardeazabal, the court clarified what constitutes “reasonable expectations” in this regard.

FACTS

In mid-2021, the applicants, Ms. Green and Mr. Dutra, and the respondent, Ms. Gardeazabal, contemplated purchasing an investment property together. Prior to their purchase, the parties had discussed achieving a return on investment within two years of owning the property. Green and Dutra had also inquired with a mortgage broker and real estate agent about the possibility of a return on investment within one to two years. The parties then purchased a property in Severn, Ont.,

in April 2022, and each held a 50 per cent share as tenants in common, with Green and Dutra holding their 50 per cent share as joint tenants. There were no written contracts or agreements among the parties governing their joint venture.

Shortly after the purchase, Green and Dutra told Gardeazabal that they wished to sell the property. Green and Dutra gave Gardeazabal a number of options, including a potential buy-out of their interests. Instead of doing so or presenting a counteroffer, Gardeazabal indicated she would simply allow the mortgage to renew automatically to prevent Green and Dutra from getting out of it. Green and Dutra then brought an application for the sale of the property. Gardeazabal sought a dismissal of the application and an interim injunction preventing the sale until the end of April 2024.

Written by Shaneka Shaw Taylor Source: https://realestatemagazine.ca/balancing-rights-and-expectations-a-case-study-on-joint-property-ownership/

46 Power to Move You

GARDEAZABAL’S POSITION

Gardeazabal opposed the sale of the property on the basis that Green and Dutra’s conduct and representations before the purchase created a reasonable expectation that the parties would hold the property for at least two years. She had formed a company with Green and Dutra to handle property management and rentals and had rented the property for the summers of 2022 and 2023.

Gardeazabal stated that she relied on reasonable expectations to secure her portion of the down payment, which amounted to her life savings, and that after the parties purchased the property, Green and Dutra wanted to purchase other properties but could not finance these projects while they owned the subject property. She submitted that, as a result, Green and Dutra’s conduct was coercive and abusive and unfairly disregarded her interests.

GREEN AND DUTRA’S POSITION

Green and Dutra submitted that the evidence did not support Gardeazabal’s reasonable expectation claims, as there was no formal agreement as to how long the parties would own the property. They argued that any references to this timeline in their discussions were projections subject to the ordinary considerations of real estate investment. Further, any communication done prior to purchasing the property was done for the purposes of planning

or due diligence. Finally, Green and Dutra argued that neither of them acted in a coercive/abusive/unfair manner, and they no longer trusted Gardeazabal as they were concerned she did not account for all the funds she received from vacation renters.

RIGHTS UNDER THE PARTITION ACT

Justice Harper first canvassed the legal considerations governing the partition and sale of land pursuant to the Partition Act. Per sections two and three of the act, all tenants in common have a prima facie statutory right to compel a partition or sale. The presumption is in favour of partition, although a sale will be ordered if found to be more advantageous to the parties or if the land is not suitable for partition. The court has the discretion to refuse either a partition or sale; however, the party resisting the request has the onus of demonstrating the other party’s malice, oppression, or vexatious intent, such that the remedy sought would cause them hardship. In exercising this discretion, the court should account for any agreements between the parties about the land in question.

OPPRESSIVE CONDUCT AND REASONABLE EXPECTATIONS

Justice Harper then reviewed the legal concepts surrounding oppressive/coercive conduct and reasonable expectations within the context of the Partition Act.

Power to Move You 47

The oppression remedy, as it appears in corporate law, contains two elements:

1. Conduct that undermines the reasonable expectations of the parties;

2. Conduct that is coercive/abusive/unfairly disregards a party’s interests.

A claimant’s reasonable expectations to be treated a certain way will depend on the facts of the case, the relationship at issue, and the entire context of the matter. A party’s oppressive conduct is also usually merged or tied up with conduct that may defeat the reasonable expectations of the parties.

The court found this contextual approach should be considered when deciding whether or not to grant a remedy under the Partition Act, as a determination of oppressive conduct requires an examination of the relationship between the parties, their reasonable expectations, the nature of the conduct, and the impact on the person seeking to avoid a sale.

APPLICATION OF THE LAW TO THE FACTS

Justice Harper found that while the parties embarked on an investment venture, there was never any agreement among them on the terms of this venture, and any conversations, planning, or due diligence leading up to the purchase of the property did not amount to establishing a reasonable expectation to hold the property for at least two years.

While he noted that Gardeazabal did have an expecta-

tion of the length of time the property was to be held, this expectation was subjective, as setting a minimum time to hold an investment is not a reasonable expectation, given the nature of investing in real estate.

Justice Harper then went on to find that Green and Dutra did not act in a manner that was oppressive or in bad faith. They no longer saw the property as profitable, it did not suit their needs, and they had lost confidence in Gardeazabal’s ability to manage it. He further noted that when Green and Dutra communicated this to Gardeazabal, she did not consider any of the options Green and Dutra had given her to retain the property. In the end, Justice Harper ordered the sale of the property.

SUMMARY

Parties wishing to purchase an investment property together should document their expectations and intentions in writing and have such documentation reviewed by a lawyer before execution. Even with such documentation governing the relationship between parties, a court will take a contextual approach when assessing whether or not one party has behaved in an oppressive manner outside of another party’s reasonable expectations.

This context will include the nature of the real estate market, which means that any expectations the parties may have about a minimum amount of time to hold a real estate property will likely not be considered valid by the court.

48 Power to Move You

Power to Move You 49 Courtesy of Keep Current Matters (KCM)

STRONGER TOGETHER: A LOVE LETTER TO OUR DONORS

We love our donors. Each donation comes with a story, a reason for caring and a commitment to mental health. Each donation is an act of care. Those who give what they can, those who donate monthly, those who dedicate their birthdays and side hustles to raise money for us; those who make the ultimate gift through estate planning. Organizations coming together to raise funds through team events.

Your generosity fuels our fight for mental health as a human right. Your stories inspire us and bring help and hope.

WHY I GIVE: STORIES FROM SUPPORTERS

“I believe that leaving a legacy to CMHA is like making a gift to my family’s future. This makes sure there’s always a warm and supportive place for them, even when I’m not here.” – An anonymous legacy donor

“Patricia Anne Foster was a nurse; caring for others was her life’s work and her legacy. A simple decision to include CMHA in her will made it possible for Patricia to continue helping more people get the care they deserve, far into the future after her work is done. CMHA is honored to be entrusted with Patricia’s legacy which will spark hope for so many.” – Margaret Eaton, National CEO, CMHA

“We all endured a lot during the pandemic – more than many of us realize – and mental health is an increasingly critical issue in the workplace, our homes and throughout our communities. I am proud that CBRE employees voted to make CMHA our national charity of choice. Not everyone can ask for help. Our gift is a reminder to move through this world with compassion, to talk openly about mental health and to be ready to

offer support when people have the courage to ask for it.” – Jon Ramscar, President & CEO, CBRE Canada on why CBRE employees overwhelmingly chose CMHA as their charity of choice.

“I give to honour deceased family members who struggled with chronic, debilitating mental illness coupled with deep seated concerns about stigma. I get emotional thinking about how difficult it must have been to survive, let alone thrive, especially with scarce access to quality care. In my modest way, I’m putting a stake in the ground to say: why do we assign moral judgement to mental illness? Act for mental health – for all – now.” – Krista Slade, CMHA staff & monthly donor

“We’re all on our own mental health journey, but how much stronger together? I’m proud to see us all pulling to support mental health. In the last few years especially, we have come to see how essential community & human connection are for our mental health and wellbeing. I’m blown away by the generosity of Canadians.” – Andy Trewick, President & CEO, Graham Construction on the inspiration for Graham’s 5/5/5 for Mental Health raising more than $150,000 for programs in five provinces.

While each year 1 in 5 Canadians experience mental illness or a serious mental health concern, 5 in 5 of us have mental health. Together, we can create a future where everyone has access to the mental health care we deserve.

None of us can do this alone. Share your story. Act for mental health. Join the mental health movement and help us support Canadians in accessing the care we need and deserve. Visit www.cmha.ca/donate to make a difference today.

Source: https://cmha.ca/story/stronger-together-a-love-letter-to-our-donors/

50 Power to Move You

OUR MISSION

We are on a mission to raise $10,000 for CAMH (Centre For Addiction And Mental Health) and CADDAC (Centre For ADHD Awareness Canada). It is without a doubt that ADHD and mental health issues are common in our community and continue to be a contributing cause of death around the world.

The Centre for Addiction and Mental Health is a psychiatric teaching hospital located in Toronto and ten community locations throughout the province of Ontario. At CAMH, it’s their goal to provide hope and a path toward recovery from mental illness and substance use for anyone in need.

There are approximately 2 million individuals affected by ADHD in Canada. Individuals, families, and parents with children are left scrambling to cope, figuring out how and where to get support for their ADHD. As well, they are trying to figure out how to pay for expensive programs.

Our families have been directly affected by ADHD and Mental Health issues so in hopes that one day no one else will have to experience the angst of dealing with ADHD or any kind of addiction or depression, we have chosen to donate a portion of our professional fees to these charities. As well, when you refer a friend or family member to our team not only will they receive award-winning service, but they will also be contributing to these extremely worthy causes. Together we can help calm minds and ensure that everyone gets the support they need.

We encourage you to visit both of their websites at www.camh.ca and www.caddac.ca and check out the incredible work they are doing in our community and beyond!

Power to Move You 51

CLICK HERE TO ACCESS CAMH CLICK HERE TO ACCESS CADDAC

from the

Reviewed by Samantha McGrath, Real Estate Agent

Reviewed by Samantha McGrath, Real Estate Agent