The International Financial Services Centres (IFSCs) in India, particularly at GIFT City, are designed to cater to the needs of international financial institutions and businesses. These centres offer a conducive regulatory environment for banking units, enabling both Indian and foreign banks to operate with a global focus. IFSC banking units (IBUs) and IFSC banking companies (IBCs) can be set up by eligible Indian and foreign banks, subject to specific licensing and regulatory requirements. An effort has been made in this write-up to provide the provision relating to banking units in IFSC in a simplified manner.

International Financial Services Centre” means an International Financial Services Centre set up before or after the commencement of this Act, under section 18 of the Special Economic Zones Act, 20051

An International Financial Services Centre (IFSC) is a specialised area within a Special Economic Zone (SEZ) that is developed to establish a global financial hub. It allows financial entities to set up operations and offer various financial services, such as corporate banking, insurance, investment and fund management, and securities trading, to individuals and businesses across borders.

The primary objective of creating an IFSC is to attract foreign investors and encourage their investments in India. This facilitates the inflow of foreign funds into the Indian market and generates local employment opportunities. To entice global participants, providing infrastructure facilities, technological capabilities, and regulatory requirements that meet international standards is crucial.

International Financial Services Centres (IFSCs) host a range of business activities, such as banking, insurance, capital market operations, asset management, and ancillary/support services.

(a) Banking

(b) Insurance

(c) Capital Market

1 Section 3(g) of IFSCA Act, 2019

(d) Asset Management

(e) Ancillary/Support Services

4. Who can set up the IFSC banking unit?

(a) Indian Bank

(b) Foreign Banks

5. What are the business activities carried out by IFSC Banking unit?

(a) Borrowing & Lending

(b) Trading & Clearing member

(c) Deposits

(d) Bank Guarantee/Short term loans

(e) ECB/Trade Finance

(f) Derivative Products

To establish a Banking Unit within an International Financial Services Centre (IFSC) in India, both Indian and foreign banks must navigate a structured regulatory framework to ensure compliance and financial stability. This involves obtaining a license or permission from the relevant authority, typically the International Financial Services Centres Authority (IFSCA), which governs the operations within these specialized financial zones.

6.1-1 Regulatory Approval:

Banks must apply for and secure permission from the IFSCA. This regulatory step ensures that only entities that meet stringent standards of financial health, governance, and operational capability can operate within an IFSC.

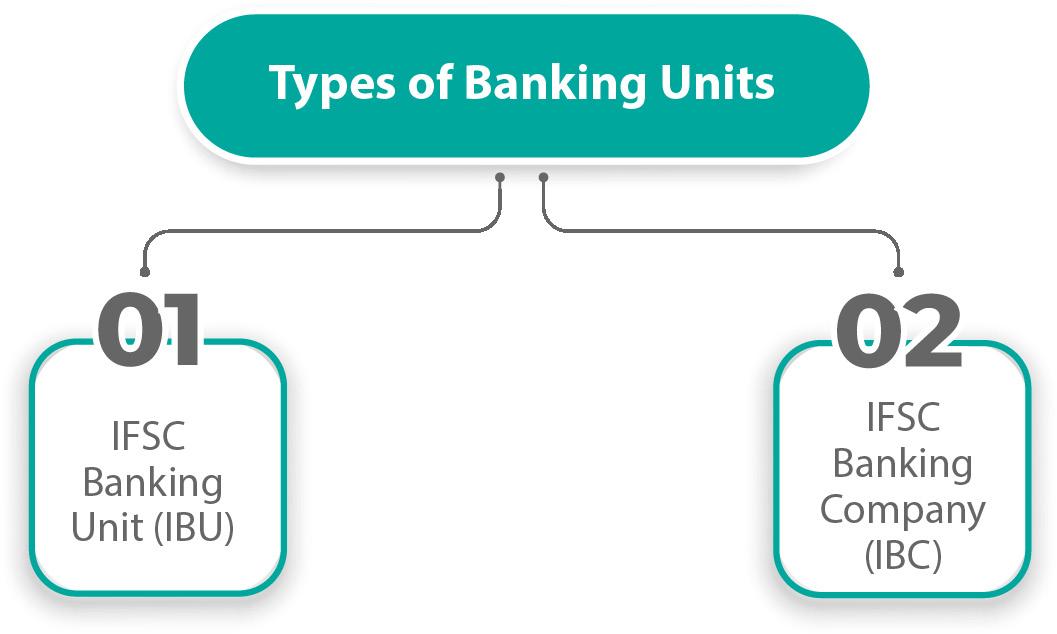

6.1-2 Types of Banking Units:

(a) IFSC Banking Unit (IBU): An IBU is essentially a branch of a bank set up within an IFSC to carry out permissible banking activities, typically catering to the needs of international clients, such as global corporations, financial institutions, and non-resident Indians.

(b) IFSC Banking Company (IBC): An IBC is a more integrated entity, potentially offering a broader range of services compared to an IBU. It might be set up as a whollyowned subsidiary of the parent bank, providing a more permanent presence in the IFSC.

6.1-3 Conversion of IBU to IBC:

(a) Existing IBU Conversion: A parent bank that has already established an IBU in an IFSC may seek to convert this unit into an IBC. This conversion is not automatic and requires prior approval from the IFSCA.

(b) Application Process: The bank must submit a detailed application outlining its operational plans, financial health, and compliance strategies. The IFSCA will review the application and assess whether the proposed conversion aligns with regulatory standards and the IFSC’s strategic goals.

6.1-4 Compliance and Governance:

Both IBUs and IBCs must adhere to the regulatory framework established by the IFSCA, which includes compliance with international financial standards, antimoney laundering (AML) regulations, and other relevant laws. This ensures that operations within the IFSC are transparent, secure, and contribute positively to the global financial ecosystem.

6.1-5 Permissible Activities:

IBUs and IBCs can engage in various activities such as lending, borrowing, trade finance, investment banking, and wealth management. The specific range of activities may vary based on the license obtained and regulatory approvals.

6.1-6 Clientele:

The primary clients for these units are typically international entities, including multinational corporations, offshore financial institutions, and non-resident Indians, thereby contributing to the globalization of financial services offered by the IFSC.

(a) Strategic Location: IFSCs are designed to be financial hubs that connect domestic financial markets with the global economy, providing a strategic advantage for banks looking to expand their international footprint.

(b) Regulatory Benefits: The regulatory framework of IFSCs often includes incentives such as tax benefits, relaxed currency regulations, and streamlined compliance requirements, making them attractive destinations for banking operations.

(c) Enhanced Services: By operating in an IFSC, banks can offer a more extensive range of services to their international clients, leveraging the sophisticated infrastructure and business-friendly environment of these centres.

Establishing Banking Units in an IFSC represents a significant step for Indian and foreign banks aiming to enhance their global presence and operational capabilities. By obtaining the necessary regulatory approvals and adhering to the compliance framework, these banks can tap into new markets, offer diverse financial services, and contribute to the overall growth and stability of the inter.

The applicant shall satisfy the following requirements for the grant of license or permission by the Authority to set up an IFSC Banking Unit:

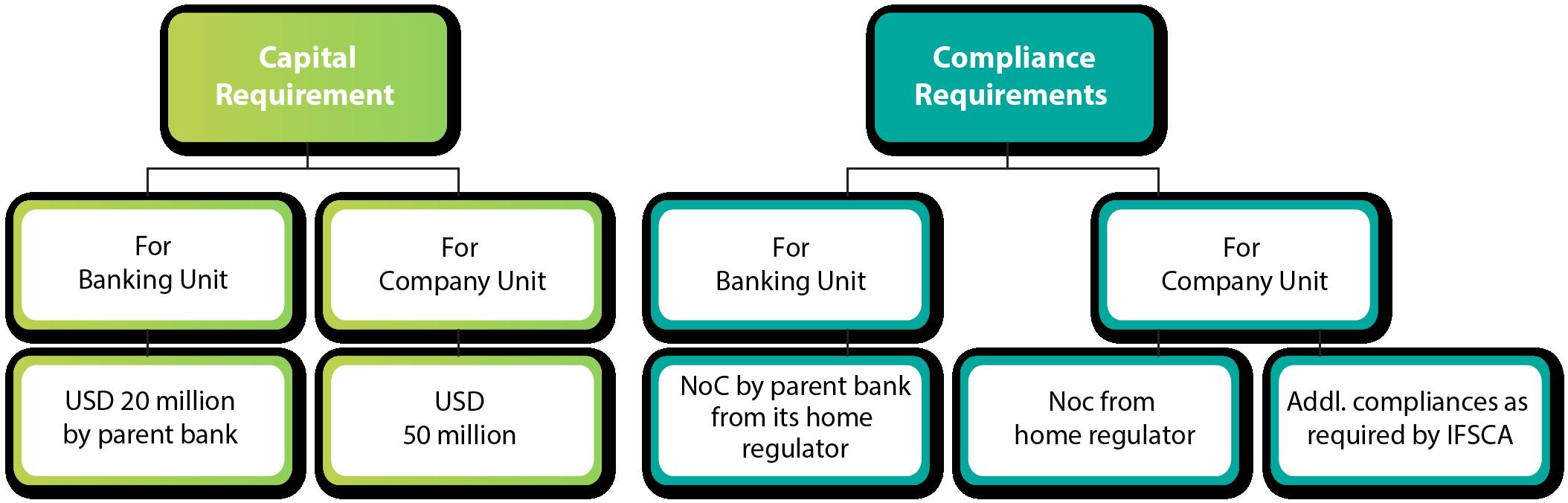

1. Minimum Capital Requirement for IBU

2. No Objection Letter and Liquidity Provision

• The parent bank must provide the necessary capital for the IBU, at least USD 20 million or another specified amount.

• This capital must be maintained at the parent bank as specified by the authority.

• The parent bank must obtain a No Objection Letter from its home regulator. The parent bank must submit an undertaking to provide liquidity to its IBU as needed for operations.

The applicant shall satisfy the following requirements for the grant of license or permission by the Authority to set up an IFSC Company Unit:

1. Additional Requirements for IFSC Banking Company • The minimum capital required is USD 50 million or another specified amount, calculated and maintained as per the authority's guidelines. A No Objection Letter from the home regulator is required to set up the unit as a subsidiary company.

2. Special Provisions for Foreign Banks

• Foreign banks without a presence in India must comply with additional requirements specified by the authority.

After considering the application, the authority may grant a license or permission. If the authority decides not to grant the license, it will provide the applicant with reasons and allow 30 days for filing written submissions. If the authority remains unsatisfied upon reviewing the submissions, it will reject the application and communicate the decision in writing within 30 days.

A parent bank may establish its representative or global administrative office in the IFSC under suitable mechanisms and conditions specified by the IFSCA.

The prudential regulatory requirements mandate that Banking Units, whether operating as International Banking Units (IBUs) or International Banking Centers (IBCs), adhere to norms and guidelines prescribed by the Authority. Additionally, IBUs must comply with directions from their Home Regulator unless otherwise specified. These provisions aim to ensure the stability and proper functioning of banking operations in adherence to international and local standards.

Liquidity ratios are critical financial metrics that Banking Units must maintain to ensure adequate liquidity and financial stability. The Authority specifies these ratios, which include the Liquidity Coverage Ratio (LCR) and the Net Stable Funding Ratio (NSFR). In certain circumstances, the parent bank can maintain these ratios for International Banking Units (IBUs) with the prior approval of the Authority.

Banking Units must adhere to the norms and guidelines regarding the Leverage Ratio as specified by the Authority. The Leverage Ratio is a key regulatory metric that ensures banks maintain a minimum level of capital relative to their total assets, thus promoting financial stability and reducing the risk of excessive leverage.

Banking Units must comply with the norms and guidelines regarding exposure ceilings as specified by the Authority. Exposure ceilings limit the maximum amount a bank can lend to a single borrower or group of connected borrowers, mitigating concentration risk and promoting diversified lending practices.

Banking Units, specifically International Banking Units (IBUs) and International Banking Centers (IBCs), must adhere to reserve requirements as specified by the Authority. These requirements include exemptions from the Cash Reserve Ratio (CRR) for certain liabilities and mandated reserve ratios for deposits raised from individuals, ensuring the stability and compliance of banking operations within regulatory frameworks. An IBC shall maintain such reserves and in such manner as are mandated under the Banking Regulation Act, 1949 and the Reserve Bank of India, 1934.

Banking Units are required to operate without the support of a Lender of Last Resort (LOLR). This provision implies that banking units cannot rely on the central bank or any other authority to provide emergency funding in times of financial distress or liquidity crises. This policy encourages Banking Units to maintain robust risk management and sufficient liquidity reserves to withstand financial shocks independently.

Banking Units are mandated to conduct business in specified foreign currencies with individuals or entities, whether residents or non-residents, as directed by the Authority. However, with proper authorisation, Banking Units may also conduct business in Indian Rupees (INR), provided the transactions are settled in the specified foreign currencies. These regulations aim to standardise currency usage and ensure effective financial settlements.

The Authority designates specific foreign currencies in which Banking Units can conduct business. These typically include major global currencies like USD, EUR, GBP, and others that are widely accepted in international transactions.

Banking Units can open accounts in specified foreign currencies for individuals and corporate or institutional entities, regardless of whether they are resident in India or abroad. This regulation aims to facilitate smoother transactions connected to permissible current or capital account activities as stipulated by the Reserve Bank of India’s Liberalised Remittance Scheme (LRS). The following sections provide a detailed analysis of the conditions and permissions granted to individuals and entities regarding foreign currency accounts.

Regulation 12 prohibits cash transactions to ensure traceability and prevent illicit activities. Individuals can open current, savings, or term deposit accounts, while entities can open current or term deposit accounts, subject to conditions specified by the Authority. These measures enhance financial transparency and compliance, with Banking Units responsible for ensuring adherence to the rules. The conditions may include documentation requirements and transaction limits, aiming to maintain the integrity and security of the financial system. Compliance with these provisions is mandatory to uphold financial discipline.

Banking Units may engage in activities specified under clause (e) of sub-section (1) of Section 3 of the Act and Section 6 of the Banking Regulation Act, 1949. These activities include typical banking operations such as accepting deposits, lending, and other financial services, provided they are not explicitly prohibited by the Home Regulator or the Authority.

Certain activities may be expressly prohibited by either the parent bank’s Home Regulator or the Authority. Banking Units must comply with these prohibitions to ensure adherence to regulatory standards and maintain the integrity of financial operations.

The Authority may specify terms and conditions or guidelines related to the design, execution, and risk management of these activities. Banking Units must follow these guidelines to mitigate risks and ensure safe and sound banking practices.

To eliminate any ambiguity, Regulation 13(2) states that providing “Referral services” is a permitted activity under these regulations. This clarification ensures that Banking Units can confidently include referral services in their range of activities without breaching regulatory compliance.

Know Your Customer (KYC) and Anti-Money Laundering (AML) measures are critical for maintaining the financial system’s integrity. Banking Units must follow stringent guidelines issued by the Authority to combat money laundering, terrorist financing, and other financial crimes.

Banking Units must regularly furnish information relating to their operations to the Authority. This information is to be provided in the manner and form specified by the Authority, ensuring consistency and comprehensiveness in reporting. The aim is to ensure that the Authority has up-to-date and accurate data on the operations of Banking Units.

Reports must be submitted in US Dollars unless otherwise specified by the Authority. This standardization facilitates uniformity and ease of analysis for the Authority.

Regulation 16 mandates that Banking Units maintain their books of account, records, and documents in the foreign currencies specified at the time of their application. This requirement ensures that financial statements are coherent and comparable across different jurisdictions, facilitating international business and regulatory compliance.

The deposits held by banking units can be insured under certain conditions as stipulated by the Deposit Insurance and Credit Guarantee Corporation Act, 1961, and its associated rules and regulations. This Act aims to safeguard depositors by ensuring a level of protection for their deposits in the event of bank failure. The following sections will provide a detailed analysis of the relevant provisions, eligibility criteria, and extent of deposit insurance coverage.

In the context of derivative trading, banking units may exchange margins with counterparties to mitigate counterparty credit risk for non-centrally cleared over-the-counter (OTC) derivatives. This practice involves using specified foreign currencies, permissible listed debt securities, and sovereigns. The arrangement aims to reflect the mark-to-market exposure under legally enforceable netting agreements as specified by the regulatory authority. This document provides a detailed analysis of the applicable provisions and requirements.

In the growing landscape of International Financial Services Centres (IFSC), banking units have numerous opportunities to expand their services and offerings.

The unique regulatory environment of IFSCs allows banks to operate with greater flexibility and offer a wider range of financial products. Here are some key opportunities for banking units in IFSCs to take advantage of:

(a) Allowance for Indian Rupee External Commercial Borrowings (INR ECBs)

(b) Authorization to conduct Foreign Portfolio Investment (FPI) activities

(c) Acceptance of deposits from Qualified Resident and Non-resident Individuals

(d) Exemption from Cash Reserve Ratio (CRR) requirements on deposits, excluding those from Qualified Institutions (QI) and Qualified Resident Individuals (QRI)

(e) Provision of Non-deliverable Currency Contracts

(f) Issuance of Commitments and Guarantees

(g) Offering of Credit Enhancement and Insurance Services

(h) Availability of Post-Shipment Export Credit

(i) Permission to invest on your own account and on behalf of clients

Establishing IFSC banking units (IBUs) and companies (IBCs) in India provides significant opportunities for both Indian and foreign banks to engage in a wide range of financial activities. These units operate under stringent regulatory frameworks to ensure financial stability and compliance with international standards. Licensing requirements include a robust application process, minimum capital requirements, and compliance with home and host country regulations. The prudential norms encompass liquidity ratios, leverage ratios, exposure ceilings, and currency regulations. These measures ensure that IFSC banking units maintain financial discipline, manage risks effectively, and contribute to the growth of India’s financial sector.

Founded 1972

Evolution From a small family business to a leading technology-oriented Publishing/Product company

Expansion

Launch of Taxmann Advisory for personalized consulting solutions

Our Vision

Aim

Achieve perfection, skill, and accuracy in all endeavour

Growth

Evolution into a company with strong independent divisions: Research & Editorial, Production, Sales & Marketing, and Technology

Future

Continuously providing practical solutions through Taxmann Advisory

Editorial and Research Division

Over 200 motivated legal professionals (Lawyers, Chartered Accountants, Company Secretaries)

Monitoring and processing developments in judicial, administrative, and legislative fields with unparalleled skill and accuracy

Helping businesses navigate complex tax and regulatory requirements with ease

Over 60 years of domain knowledge and trust

Technology-driven solutions for modern challenges

Ensuring perfection, skill, and accuracy in every solution provided

Corporate Tax Advisory

Trusts & NGO Consultancy

TDS Advisory

Global Mobility Services

Personal Taxation

Training

Due Diligence

Due Dilligence

Advisory Services

Assistance in compounding of offences

Transactions Services

Investment outside India

Tax Advisory

High-quality

From