Enhance Audit Quality with SA 315 & SA 330 Compliance

Enhance Audit Quality with SA 315 & SA 330 Compliance

Auditing is not just about reviewing financial statements; it is about ensuring their accuracy, reliability, and compliance with professional standards. Two critical auditing standards, i.e. SA 315 and SA 330, form the foundation of a risk-based audit approach. SA 315 focuses on identifying and assessing risks of material misstatement, while SA 330 requires auditors to respond appropriately to those risks. However, quality reviews have repeatedly highlighted deficiencies in how auditors document risks, assess internal controls and design audit procedures in response to identified risks.

This article integrates key observations of non-compliance from SA 315 and SA 330, clarifies the issues faced by auditors, and provides guidance to improve audit effectiveness. By addressing these gaps, auditors can ensure compliance with the highest professional standards and enhance the overall quality of audits.

• Para 25 – The auditor shall identify and assess the risks of material misstatement at:

a) The financial statement level

b) The assertion level for classes of transactions, account balances, and disclosures

• Para 26 – The auditor shall identify risks throughout the process of obtaining an understanding of the entity and its environment, including relevant controls that relate to those risks.

A significant issue in audit documentation is the failure to properly record identified risks and link them to the financial statements. In many instances, auditors use generic checklists that provide a broad overview but fail to explain the rationale behind the classification of risks as significant or nonsignificant. Moreover, the documentation often lacks a connection between risks and the corresponding financial statement areas, making it difficult to determine whether audit procedures are appropriately designed to address the risks.

Risk identification should not be limited to a checklist approach; it requires a thorough analysis explaining why a particular risk is deemed significant. Each identified risk must be explicitly linked to relevant assertions, financial statement items, and the potential for material misstatement. The audit file should provide a narrative discussion, supported by data, about the nature of the risk and how it affects financial reporting. The risk assessment must also be aligned with the audit strategy, ensuring that responses are proportionate to the level of risk identified. Clear documentation should include references to industry-specific risks, historical financial trends, and management discussions, creating a well-supported risk assessment process.

3.1 Relevant SA 315 Provisions

• Para 12 – The auditor shall obtain an understanding of internal control relevant to the audit.

• Para 18 – The auditor shall obtain an understanding of the information system, including the related business processes relevant to financial reporting.

• Para 20 – The auditor shall obtain an understanding of control activities relevant to the audit, which are necessary to assess the risks of material misstatement.

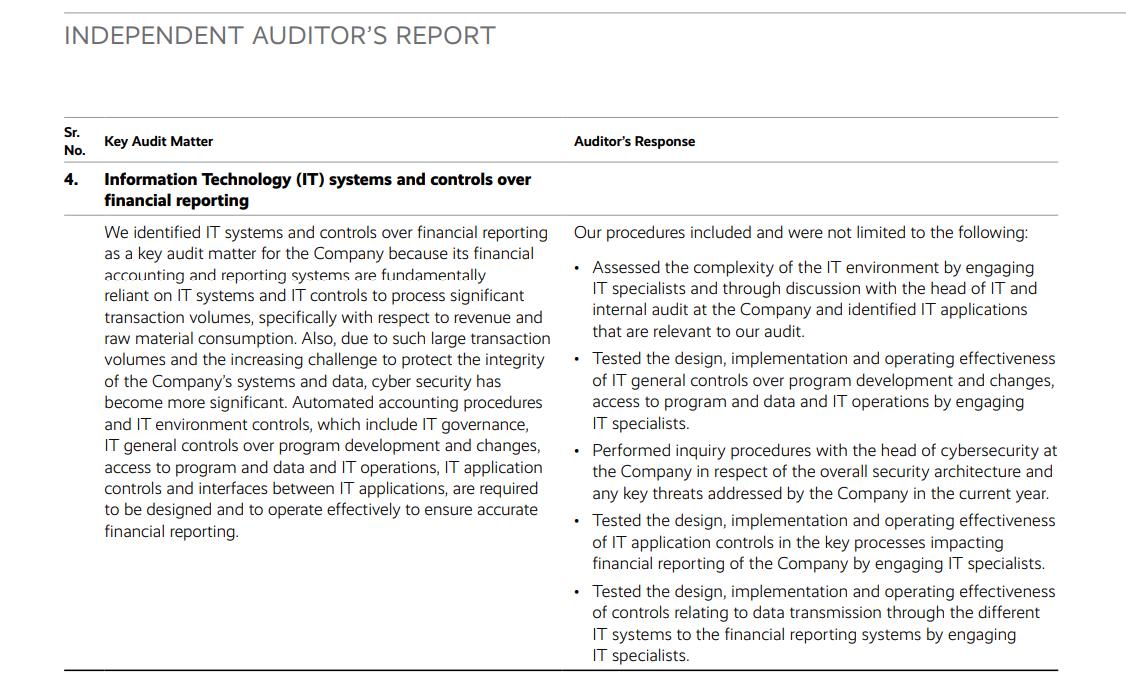

Internal controls, particularly IT-related controls, are frequently overlooked in audits. Many auditors do not test automated controls or IT-dependent processes, relying instead on manual verification. Additionally, some auditors place excessive reliance on internal auditors without independently evaluating their work. This lack of rigorous control testing weakens the audit’s effectiveness and increases the risk of undetected material misstatements.

Understanding and testing internal controls is fundamental to an effective risk assessment process. Auditors must go beyond assessing manual controls and evaluating IT-related controls, primarily in organizations that rely heavily on automated systems for financial reporting. IT general controls, application controls, and system-generated reports should be tested to ensure the integrity of financial data. If auditors choose to rely on the work of internal auditors, they must independently assess the scope, objectivity, and reliability of that work. All reliance on internal controls should be justified with supporting documentation, including test results and an evaluation of control effectiveness. A well-documented control assessment ensures that the auditor’s risk response is appropriately designed to address potential weaknesses.

4.1 Relevant SA 330 Provisions

• Para 5 – The auditor shall design and implement overall responses to address the assessed risks of material misstatement at the financial statement level.

• Para 6 - The auditor shall design and perform further audit procedures whose nature, timing, and extent are based on and are responsive to the assessed risks of material misstatement at the assertion level.

Even when risks are correctly identified, audit procedures often fail to address them directly. Many auditors apply standard substantive procedures such as vouching, confirmations, and analytical reviews without tailoring these procedures to the specific risks identified. Additionally, control testing is frequently ignored, with auditors defaulting to substantive procedures without determining whether internal controls could be relied upon. This disconnect between risk assessment and audit procedures results in inefficiencies and weakens the overall audit approach.

Audit responses should be designed to address the risks identified during the assessment process. If a particular risk is assessed as high, auditors should implement additional testing procedures, such as detailed walkthroughs, recalculations, and extended sampling. When relying on internal controls, auditors must perform control testing to ensure their effectiveness before reducing substantive procedures. Every audit procedure should be directly linked to a risk, with clear documentation explaining the appropriate approach. This ensures that audit work is targeted and effective in addressing potential misstatements.

• SA 240, Para 27 – The auditor shall treat assessed risks of material misstatement due to fraud as significant risks.

• SA 330, Para 21 – When the approach to a significant risk consists only of substantive procedures, those procedures shall include tests of details.

Many audits fail to consider fraud risk, particularly when management overrides controls adequately. Journal entry testing is often missing, and in cases where it is performed, the selection criteria for testing is unclear. Auditors frequently overlook the potential for biased management estimates, aggressive revenue recognition practices, and unusual transactions that may indicate fraud. This weak approach to fraud risk assessment increases the chances of material misstatements going undetected.

A comprehensive fraud risk assessment should include detailed testing of journal entries, particularly those made at the end of the reporting period. Auditors must evaluate accounting estimates to detect potential bias and scrutinize non-routine transactions for signs of fraud. Discussions with management about fraud risks and any inquiries made to those charged with governance should be documented. By implementing a structured fraud assessment process, auditors can identify and mitigate fraud risks properly.

6.1

Relevant SA 230 and SA 330 Provisions

• SA 230, Para 8 – Audit documentation must be sufficient for an experienced auditor to understand the work performed.

• SA 330, Para 28 – The auditor shall document the linkage of audit procedures with the assessed risks.

Many audit files lack structure, making it difficult to track how risks were assessed and addressed. Cross-referencing between risk assessments, audit procedures, and financial statements is often missing, leading to gaps in the audit trail.

Audit files should be well-structured, with clear cross-referencing between risk assessments, audit responses, and supporting evidence. Documentation should provide a logical flow, demonstrating how audit procedures addressed identified risks. By maintaining a comprehensive and organized audit file, auditors improve transparency and facilitate external quality reviews.

Addressing the deficiencies in SA 315 and SA 330 compliance is essential for improving audit quality. Auditors can provide more effective and reliable assurance by enhancing risk documentation, evaluating internal controls, strengthening fraud detection, and ensuring comprehensive audit documentation. Implementing these best practices will reinforce trust in financial reporting and uphold the integrity of the audit profession.

Founded 1972

Evolution From a small family business to a leading technology-oriented Publishing/Product company

Expansion

Launch of Taxmann Advisory for personalized consulting solutions

Aim

Achieve perfection, skill, and accuracy in all endeavour

Growth

Evolution into a company with strong independent divisions: Research & Editorial, Production, Sales & Marketing, and Technology

Future

Continuously providing practical solutions through Taxmann Advisory

Editorial and Research Division

Over 200 motivated legal professionals (Lawyers, Chartered Accountants, Company Secretaries)

Monitoring and processing developments in judicial, administrative, and legislative fields with unparalleled skill and accuracy

Helping businesses navigate complex tax and regulatory requirements with ease

Over 60 years of domain knowledge and trust

Technology-driven solutions for modern challenges

Ensuring perfection, skill, and accuracy in every solution provided

Income Tax

Corporate Tax Advisory

Trusts & NGO Consultancy

TDS Advisory

Global Mobility Services

Personal Taxation

Training

Due Diligence

Due Dilligence

Advisory Services

Assistance in compounding of offences

Transactions Services

Investment outside India

Goods

Transaction Advisory

Business Restructuring

Classification

Due Diligence

Training

Advisory

Trade Facilitation Measures

Corporate

Corporate Structuring

VAT Advisory

Residential Status

Naveen Wadhwa

Research and Advisory [Corporate and Personal Tax]

Chartered Accountant (All India 24th Rank)

14+ years of experience in Income tax and International Tax

Expertise across real estate, technology, publication, education, hospitality, and manufacturing sectors

Contributor to renowned media outlets on tax issues

Vinod K. Singhania Expert on Panel | Research and Advisory (Direct Tax)

Over 35 years of experience in tax laws

PhD in Corporate Economics and Legislation

Author and resource person in 800+ seminars

V.S. Datey Expert on Panel | Research and Advisory [Indirect Tax]

Holds 30+ years of experience

Engaged in consulting and training professionals on Indirect Taxation

A regular speaker at various industry forums, associations and industry workshops

Author of various books on Indirect Taxation used by professionals and Department officials

Manoj Fogla Expert on Panel | Research and Advisory [Charitable Trusts and NGOs]

Over three decades of practising experience on tax, legal and regulatory aspects of NPOs and Charitable Institutions

Law practitioner, a fellow member of the Institute of Chartered Accountants of India and also holds a Master's degree in Philosophy

PhD from Utkal University, Doctoral Research on Social Accountability Standards for NPOs

Author of several best-selling books for professionals, including the recent one titled 'Trust and NGO's Ready Reckoner' by Taxmann

Drafted publications for The Institute of Chartered Accountants of India, New Delhi, such as FAQs on GST for NPOs & FAQs on FCRA for NPOs.

Has been a faculty and resource person at various national and international forums

the UAE

Chartered Accountant (All India 36th Rank)

Has previously worked with the KPMG

S.S. Gupta Expert on Panel | Research and Advisory [Indirect Tax]

Chartered Accountant and Cost & Works Accountant

34+ Years of Experience in Indirect Taxation

Bestowed with numerous prestigious scholarships and prizes

Author of the book GST – How to Meet Your Obligations', which is widely referred to by Trade and Industry

Sudha G. Bhushan Expert on Panel | Research and Advisory [FEMA]

20+ Years of experience

Advisor to many Banks and MNCs

Experience in FDI and FEMA Advisory

Authored more than seven best-selling books

Provides training on FEMA to professionals

Experience in many sectors, including banking, fertilisers, and chemical

Has previously worked with Deloitte

Taxmann Delhi

59/32, New Rohtak Road

New Delhi – 110005 | India

Phone | 011 45562222

Email | sales@taxmann.com

Taxmann Mumbai

35, Bodke Building, Ground Floor, M.G. Road, Mulund (West), Opp. Mulund Railway Station Mumbai – 400080 | Maharashtra | India

Phone | +91 93222 47686

Email | sales.mumbai@taxmann.com

Taxmann Pune

Office No. 14, First Floor, Prestige Point, 283 Shukrwar Peth, Bajirao Road, Opp. Chinchechi Talim, Pune – 411002 | Maharashtra | India

Phone | +91 98224 11811

Email | sales.pune@taxmann.com

Taxmann Ahmedabad

7, Abhinav Arcade, Ground Floor, Pritam Nagar Paldi

Ahmedabad – 380007 | Gujarat | India

Phone: +91 99099 84900

Email: sales.ahmedabad@taxmann.com

Taxmann Hyderabad

4-1-369 Indralok Commercial Complex Shop No. 15/1 – Ground Floor, Reddy Hostel Lane Abids Hyderabad – 500001 | Telangana | India

Phone | +91 93910 41461

Email | sales.hyderabad@taxmann.com

Taxmann Chennai No. 26, 2, Rajan St, Rama Kamath Puram, T. Nagar

Chennai – 600017 | Tamil Nadu | India

Phone | +91 89390 09948

Email | sales.chennai@taxmann.com

Taxmann Bengaluru

12/1, Nirmal Nivas, Ground Floor, 4th Cross, Gandhi Nagar

Bengaluru – 560009 | Karnataka | India

Phone | +91 99869 50066

Email | sales.bengaluru@taxmann.com

Taxmann Kolkata Nigam Centre, 155-Lenin Sarani, Wellington, 2nd Floor, Room No. 213

Kolkata – 700013 | West Bengal | India

Phone | +91 98300 71313

Email | sales.kolkata@taxmann.com

Taxmann Lucknow

House No. LIG – 4/40, Sector – H, Jankipuram Lucknow – 226021 | Uttar Pradesh | India

Phone | +91 97924 23987

Email | sales.lucknow@taxmann.com

Taxmann Bhubaneswar

Plot No. 591, Nayapalli, Near Damayanti Apartments

Bhubaneswar – 751012 | Odisha | India

Phone | +91 99370 71353

Email | sales.bhubaneswar@taxmann.com

Taxmann Guwahati

House No. 2, Samnaay Path, Sawauchi Dakshin Gaon Road

Guwahati – 781040 | Assam | India

Phone | +91 70866 24504

Email | sales.guwahati@taxmann.com