Indian Accounting Standard (Ind AS) 7, Statement of Cash Flows, requires entities to provide information about historical changes in cash and cash equivalents through a cash flow statement. The objective is to present cash flows during the period classified into operating, investing, and financing activities, thereby enabling users of financial statements to evaluate the entity’s ability to generate cash, its liquidity position, and the timing and certainty of future cash flows. Proper disclosure ensures transparency and comparability in financial reporting.

This article highlights the frequently observed areas of non-compliance in cash flow disclosures under Ind AS 7. With the support of practical illustrations, examples, and recommendations, it aims to provide preparers and auditors with clear insights to ensure robust, accurate, and compliant financial reporting practices.

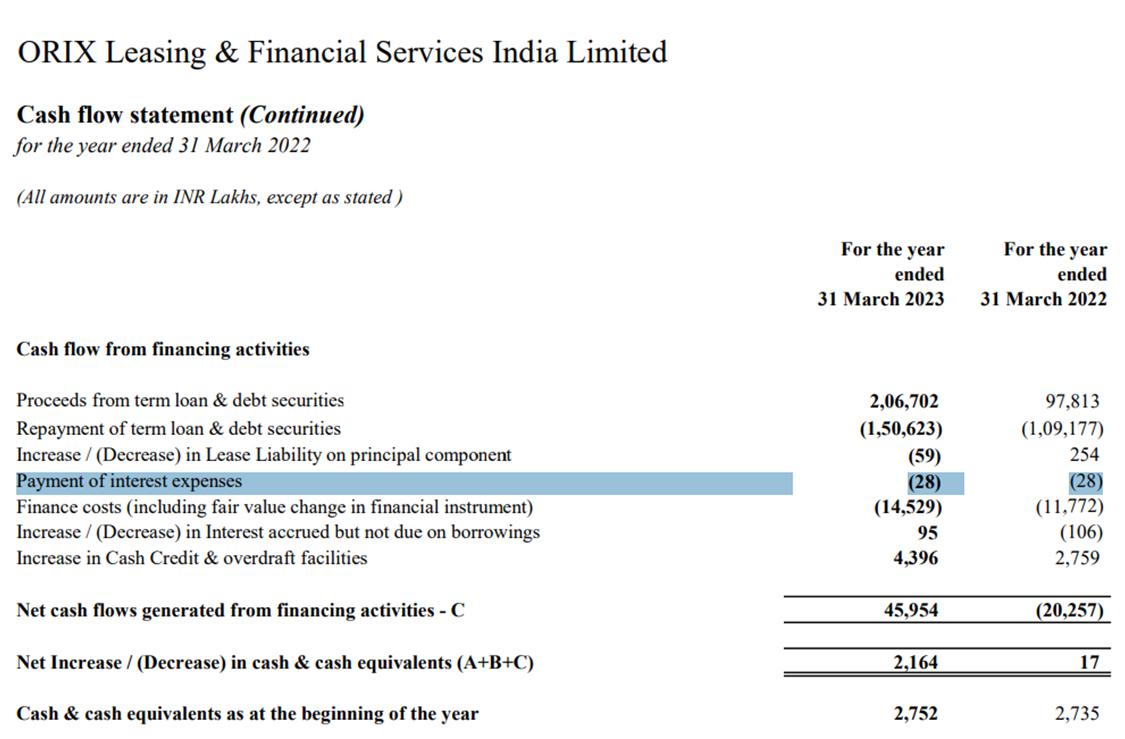

It was observed that the cash flow statement discloses total lease liability payments, including interest, under a single head. However, Ind AS 116, Leases, clearly indicates that the interest portion of the lease liability should be presented separately under financing activities.

In FY 2023-24, XYZ Limited disclosed total lease liability payments of Rs. 50,00,000 in the Cash Flow Statement, which included an interest portion of Rs. 8,00,000. However, the company did not separately present the interest component of Rs. 8,00,000, which, in accordance with Ind AS 116, should have been disclosed under financing activities in the Cash Flow Statement.

Extract of Para 50: In the statement of cash flows, a lessee shall classify:

(a)

(b) cash payments for the interest portion of the lease liability within financing activities, applying the requirements in Ind AS 7, Statement of Cash Flows, for interest paid;

(c) …

2.1.2 Recommendation

To comply with Ind AS 116, the entity should present the interest component of lease liabilities separately under financing activities in the Statement of Cash Flows.

Extract of the annual report for the reference of correct disclosure of Lease Liability payment and Interest payment:

2.2. Inconsistencies in Cash Flow Disclosures – Mismatch in Loss on Sale of PPE and Net Presentation of Borrowings, Leading to Non-compliance with Ind AS 7

2.2.1 Observation

It was noted that the loss on sale of Property, Plant and Equipment (PPE) shown under operating activities in the Statement of Cash Flows did not match the figure disclosed under “Other Expenses” in the notes, and no explanation for this difference was provided. In addition, the company reported “Long-term borrowings (repaid) / taken” on a net basis as one line item under financing activities, instead of separately showing cash inflows and outflows on a gross basis, as required by Ind AS 7.

For FY 2023-24, XYZ Ltd. disclosed a loss on sale of PPE of Rs. 12,00,000 under Other Expenses in the notes, while only Rs. 10,00,000 was adjusted in the Statement of Cash Flows under operating activities. No explanation was provided for the Rs. 2,00,000 difference.

Further, under financing activities, the company reported “Long-term borrowings (repaid)/taken” on a net basis of Rs. 5,00,000, without disclosing separately the gross inflow of Rs. 20,00,000 from new borrowings and the gross outflow of Rs. 15,00,000 for repayments.

Para 17: The separate disclosure of cash flows arising from financing activities is important because it is useful in predicting claims on future cash flows by providers of capital to the entity. Examples of cash flows arising from financing activities are:

(a)

(b) ….

(c) cash proceeds from issuing debentures, loans, notes, bonds, mortgages and other short-term or long-term borrowings;

(d)

(e)

Para 21: An entity shall report separately major classes of gross cash receipts and gross cash payments arising from investing and financing activities, except to the extent that cash flows described in paragraphs 22 and 24 are reported on a net basis.

2.2.3

The company should ensure consistency between amounts disclosed in the Statement of Cash Flows and related notes, with clear explanations for any differences. Additionally, financing activities such as raising and repayment of borrowings should be presented on a gross basis in compliance with Ind AS 7, thereby enhancing transparency and ensuring adherence to disclosure requirements.

Continuing with the above example, we have shown below the incorrect and correct disclosure.

Operating Activities Loss on sale of PPE adjusted: Rs. 10,00,000

Loss on sale of PPE adjusted: Rs. 12,00,000 (with explanatory note for reconciliation with Notes to Accounts) Financing Activities Long-term borrowings (net): Rs. 5,00,000

raised: Rs. 20,00,000 Repayment of borrowings: (Rs. 15,00,000

2.3.1 Observation

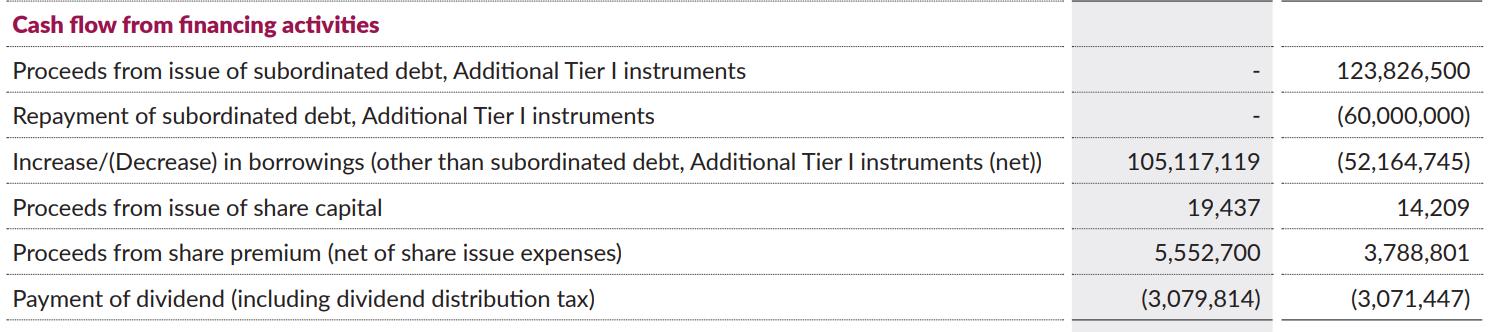

It was noted that in its Statement of Cash Flows, the company used the terms “Increase/ Decrease” under Investing and Financing Activities instead of the prescribed “Proceeds from/Payments to.” Additionally, it presented “Increase/(Decrease) in loans/financial assets” as a single net figure under Financing Activities. However, Ind AS 7 requires cash flows to be reported on a gross basis (except in limited cases involving quick turnover, large amounts, and short maturities). Hence, the company’s current disclosure does not comply with the requirements of Ind AS 7.

2.3.2 Relevant Provision under Ind AS 7

Para 21: An enterprise should report separately major classes of gross cash receipts and gross cash payments arising from investing and financing activities, except to the extent that cash flows described in paragraphs 22 and 24 are reported on a net basis.

2.3.3 Recommendation

The company should revise the terminology in its Cash Flow Statement to “Proceeds from/ Payments to” for consistency with Ind AS 7. Additionally, loans and financial assets should be disclosed separately on a gross basis, rather than netting off inflows and outflows, to ensure compliance and improve transparency in financial reporting.

Extract of the annual report for the reference of correct use of terminology and disclosure of loans separately:

2.4.1 Observation

On review of the financial statements, it was noted that the company has recognised non-cash expenses such as provision for bad and doubtful debts, bad debts written off,

sundry balances written off, and stores and spares written off during the year under Other Expenses and Inventory Notes. However, these non-cash transactions were not adjusted to Net Profit while determining the Cash Flow from Operating Activities. Further, interest income earned from bank deposits, disclosed under Other Income, has also not been deducted from profit before tax in the computation of operating cash flows. This results in non-compliance with the requirements of Ind AS 7 regarding the correct presentation of cash flows.

Para 20: “Under the indirect method, the net cash flow from operating activities is determined by adjusting profit or loss for the effects of:

(a) Changes during the period in inventories, operating receivables and payables.

(b) non-cash items such as depreciation, provisions, deferred taxes, unrealised foreign currency gains and losses, and undistributed profits of associates; and

(c) All other items for which the cash effects are investing or financing cash flows.

The company should adjust all non-cash expenses, such as provisions, write-offs, and inventory write-downs, to Net Profit while computing Cash Flow from Operating Activities. Further, interest income from bank deposits should be deducted from profit before tax and presented separately under investing activities. This will ensure compliance with Ind AS 7 and provide a more accurate presentation of operating cash flows.

XYZ Limited reported the following in FY 2024-25:

In the Statement of Cash Flows (Operating Activities):

• Net Profit before Tax should be increased by Rs. 2,00,000 (non-cash expenses: 1,50,000 + 50,000).

• Net Profit before Tax should be reduced by Rs. 2,00,000 (interest income).

• Interest income of Rs. 2,00,000 should be disclosed separately under Investing Activities.

Extract of the annual report for the reference of correct adjustments of Non-cash expenses:

2.5. Incorrect

2.5.1 Observation

It was observed from the Statement of Profit & Loss that the company recognised the loss on re-measurement of defined benefit plans under Other Comprehensive Income (OCI). However, this loss was inappropriately adjusted with the profit for the year while determining Cash Flow from Operating Activities. Since OCI items are not routed through the profit or loss account, they should not be considered in the reconciliation of profit to derive net cash flows from operating activities. This indicates non-compliance with the requirements of Ind AS 7.

In FY 2023-24, XYZ Limited reported a profit for the year of Rs. 1,00,00,000. The company recognised a re-measurement loss on defined benefit plans of Rs. 5,00,000 under OCI. However, while preparing the Cash Flow Statement, the company incorrectly deducted this Rs 5,00,000 from the profit for the year under operating activities.

2.5.2 Relevant Provision under Ind AS 7

Para 20: Under the indirect method, the net cash flow from operating activities is determined by adjusting profit or loss for the effects of:

(a) changes during the period in inventories, operating receivables, and payables;

(b) non-cash items such as depreciation, provisions, deferred taxes, unrealised foreign currency gains and losses, and undistributed profits of associates; and

(c) all other items for which the cash effects are investing or financing cash flows.

The company should exclude re-measurement losses of defined benefit plans recognised in OCI while preparing the Cash Flow Statement. Only those items that affect profit or loss should be adjusted in deriving net cash flows from operating activities. This will ensure compliance with Ind AS 7 and present a fair view of cash flows.

Continue with the above example, the Cash Flow from Operating Activities should begin with the profit of Rs. 1,00,00,000, without adjusting the ₹5,00,000 OCI loss, as it does not represent a cash outflow.

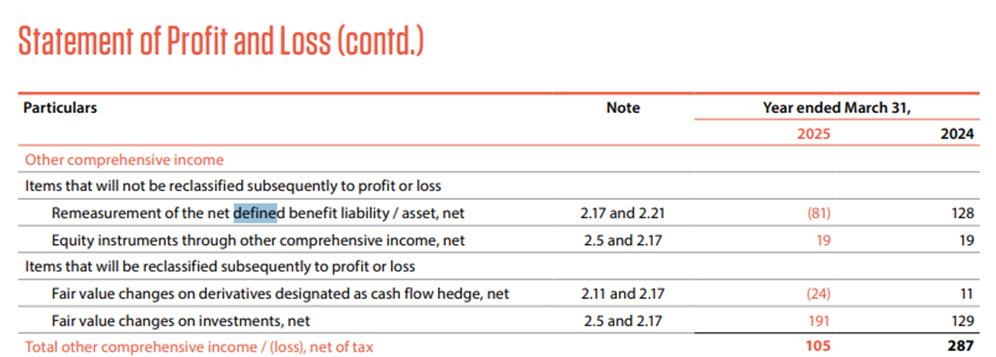

In FY 2025–26, Infosys Limited re-measured its defined benefit plan and recognised a loss, as presented in the extract of the Statement of Profit and Loss below.

Further, the extract of the Cash Flow Statement shows that the loss on re-measurement has not been deducted from the Profit and Loss account while determining cash flows from operating activities.

2.6. Mismatch of Interest Income Disclosure Between Cash Flow Statement & Statement of Profit & Loss

2.6.1 Observation

It was noted from the note on Other Income that the company has disclosed interest income for the current and previous years. However, the amount of interest income adjusted with profit before tax in the Cash Flow Statement, while determining cash flows from operating activities, does not match the amount disclosed in the Statement of Profit & Loss. Further, the company has not provided any explanation or reconciliation for this mismatch. This indicates a lack of clarity and inadequate disclosure in compliance with the requirements of Ind AS 7.

2.6.2 Relevant Provision under Ind AS 7

Extract of Para 20: Under the indirect method, the net cash flow from operating activities is determined by adjusting profit or loss for the effects of:

(a) …

(b)

(c) all other items for which the cash effects are investing or financing cash flows.

2.6.3

The company should ensure consistency between the interest income reported in the Statement of Profit & Loss and the adjustment made in the Cash Flow Statement. Where differences arise due to timing, classification, or other factors, a proper reconciliation or explanatory note should be provided. This will enhance transparency and ensure compliance with Ind AS 7 disclosure requirements.

Example

During FY 2023-24, the company disclosed interest income of Rs. 10,00,000 under “Other Income” in the Statement of Profit & Loss. However, only Rs. 8,00,000 was adjusted against profit before tax in the Cash Flow Statement. The company should provide a reconciliation explaining the Rs. 2,00,000 difference, such as accrued but not received interest, to avoid disclosure inconsistencies.

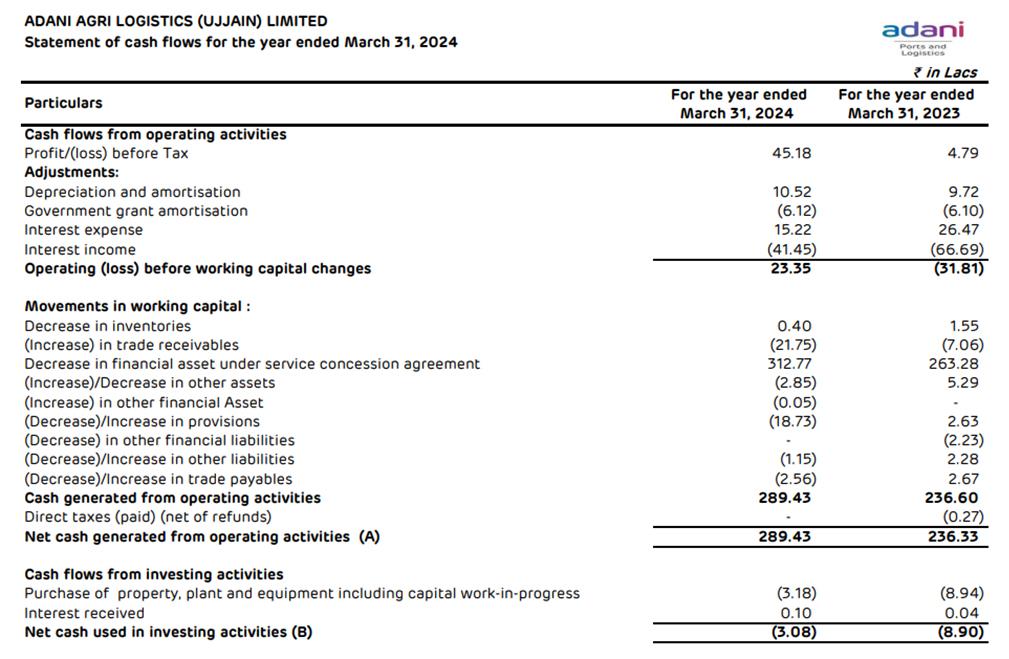

2.7.1

It was noted from the Statement of Cash Flows that the company adjusted construction income and construction costs while determining cash flows from operating activities. However, the equivalent amount of construction cost has been presented as an increase in receivables under the service concession agreement in the cash flows from investing activities. Since these are operating receivables for the company, such classification under investing activities is not appropriate. Moreover, no explanatory note was provided to justify this presentation, leading to inconsistency with Ind AS 7.

Example

In FY 2023–24, XYZ Ltd. reported construction income of Rs. 80 crore and construction cost of Rs. 75 crore, which were adjusted under operating activities. However, the equivalent increase in receivables of Rs. 75 crore under the service concession agreement was shown under investing activities in the Cash Flow Statement.

2.7.2

Extract of Para 14: Cash flows from operating activities are primarily derived from the principal revenue-producing activities of the entity. Therefore, they generally result from the transactions and other events that enter into the determination of profit or loss.

Examples of cash flows from operating activities are:

(a) cash receipts from the sale of goods and the rendering of services;

(b) …

(c) cash payments to suppliers for goods and services;

(d)

(e) …

(f)

(g) Cash receipts and payments from contracts held for dealing or trading purposes.

Para 20: “Under the indirect method, the net cash flow from operating activities is determined by adjusting profit or loss for the effects of:

(a) changes during the period in inventories, operating receivables, and payables;

(b) non-cash items such as depreciation, provisions, deferred taxes, unrealised foreign currency gains and losses, and undistributed profits of associates; and

(c) all other items for which the cash effects are investing or financing cash flows

The company should classify receivables arising from service concession arrangements under operating activities, as they form part of the entity’s normal operating cycle. Any adjustments or deviations should be properly disclosed with explanatory notes to ensure transparency and compliance with Ind AS 7. Proper classification will improve the reliability of the cash flow presentation and provide users with a more accurate view of the company’s operating performance.

Continuing with the above example, as per Ind AS 7, these receivables form part of the company’s standard operating cycle and should have been disclosed under operating activities instead of investing activities.

Extract of the annual report for showing the correct

2.8.1 Observation

It was observed that the company reported “Provision for tax (net of advance tax)” under the note on Current Tax Liabilities (Net). The reduction in this provision compared to the previous year indicates that advance tax payments were made during the year. However, no such payments have been disclosed in the Cash Flow Statement, which is inconsistent with the disclosure requirements of Ind AS 7.

2.8.2

Para 35: Cash flows arising from taxes on income shall be separately disclosed and shall be classified as cash flows from operating activities unless they can be specifically identified with financing and investing activities.

2.8.3 Recommendation

The company should ensure that all cash outflows related to income taxes, including advance tax payments, are separately disclosed under operating activities in the Cash Flow Statement, in compliance with Ind AS 7. Additionally, adequate explanatory notes should be provided to reconcile the movement in tax liabilities with the amounts reported in the Cash Flow Statement.

Cash flow disclosures play a vital role in ensuring the transparency, reliability, and comparability of financial statements. The common non-compliance issues highlighted, ranging from misclassification, inadequate adjustments, and inconsistent disclosures to omissions, demonstrate how even small errors can distort an entity’s true liquidity position. By aligning practices with the requirements of Ind AS 7 and related standards, and by adopting clear reconciliations and accurate classifications, companies can not only achieve compliance but also enhance the quality of financial reporting. Ultimately, robust and transparent cash flow disclosures strengthen stakeholder confidence and support better decision-making.

Founded 1972

Evolution From a small family business to a leading technology-oriented Publishing/Product company

Expansion

Launch of Taxmann Advisory for personalized consulting solutions

Aim

Achieve perfection, skill, and accuracy in all endeavour

Growth

Evolution into a company with strong independent divisions: Research & Editorial, Production, Sales & Marketing, and Technology

Future

Continuously providing practical solutions through Taxmann Advisory

Editorial and Research Division

Over 200 motivated legal professionals (Lawyers, Chartered Accountants, Company Secretaries)

Monitoring and processing developments in judicial, administrative, and legislative fields with unparalleled skill and accuracy

Helping businesses navigate complex tax and regulatory requirements with ease

Over 60 years of domain knowledge and trust

Technology-driven solutions for modern challenges

Ensuring perfection, skill, and accuracy in every solution provided

Income Tax

Corporate Tax Advisory

Trusts & NGO Consultancy

TDS Advisory

Global Mobility Services

Personal Taxation

Training

Due Diligence

Due Dilligence

Advisory Services

Assistance in compounding of offences

Transactions Services

Investment outside India

Goods

Transaction Advisory

Business Restructuring

Classification

Due Diligence

Training

Advisory

Trade Facilitation Measures

Corporate

Corporate Structuring

VAT Advisory

Residential Status

Naveen Wadhwa Research and Advisory [Corporate and Personal Tax]

Chartered Accountant (All India 24th Rank)

14+ years of experience in Income tax and International Tax

Expertise across real estate, technology, publication, education, hospitality, and manufacturing sectors

Contributor to renowned media outlets on tax issues

Vinod K. Singhania

Expert on Panel | Research and Advisory (Direct Tax)

Over 35 years of experience in tax laws

PhD in Corporate Economics and Legislation

Author and resource person in 800+ seminars

V.S. Datey

Expert on Panel | Research and Advisory [Indirect Tax]

Holds 30+ years of experience

Engaged in consulting and training professionals on Indirect Taxation

A regular speaker at various industry forums, associations and industry workshops

Author of various books on Indirect Taxation used by professionals and Department officials

S.S. Gupta

Expert on Panel | Research and Advisory [Indirect Tax]

Chartered Accountant and Cost & Works Accountant

34+ Years of Experience in Indirect Taxation

Bestowed with numerous prestigious scholarships and prizes

Author of the book GST – How to Meet Your Obligations', which is widely referred to by Trade and Industry

Manoj Fogla

Expert on Panel | Research and Advisory [Charitable Trusts and NGOs]

Over three decades of practising experience on tax, legal and regulatory aspects of NPOs and Charitable Institutions

Law practitioner, a fellow member of the Institute of Chartered Accountants of India and also holds a Master's degree in Philosophy

PhD from Utkal University, Doctoral Research on Social Accountability Standards for NPOs

Author of several best-selling books for professionals, including the recent one titled 'Trust and NGO's Ready Reckoner' by Taxmann

Drafted publications for The Institute of Chartered Accountants of India, New Delhi, such as FAQs on GST for NPOs & FAQs on FCRA for NPOs.

Has been a faculty and resource person at various national and international forums

the UAE

Chartered Accountant (All India 36th Rank)

Has previously worked with the KPMG

Taxmann Delhi

59/32, New Rohtak Road

New Delhi – 110005 | India

Phone | 011 45562222

Email | sales@taxmann.com

Taxmann Mumbai

35, Bodke Building, Ground Floor, M.G. Road, Mulund (West), Opp. Mulund Railway Station Mumbai – 400080 | Maharashtra | India

Phone | +91 93222 47686

Email | sales.mumbai@taxmann.com

Taxmann Pune

Office No. 14, First Floor, Prestige Point, 283 Shukrwar Peth, Bajirao Road, Opp. Chinchechi Talim, Pune – 411002 | Maharashtra | India

Phone | +91 98224 11811

Email | sales.pune@taxmann.com

Taxmann Ahmedabad

7, Abhinav Arcade, Ground Floor, Pritam Nagar Paldi

Ahmedabad – 380007 | Gujarat | India

Phone: +91 99099 84900

Email: sales.ahmedabad@taxmann.com

Taxmann Hyderabad

4-1-369 Indralok Commercial Complex Shop No. 15/1 – Ground Floor, Reddy Hostel Lane Abids Hyderabad – 500001 | Telangana | India

Phone | +91 93910 41461

Email | sales.hyderabad@taxmann.com

Taxmann Chennai No. 26, 2, Rajan St, Rama Kamath Puram, T. Nagar

Chennai – 600017 | Tamil Nadu | India

Phone | +91 89390 09948

Email | sales.chennai@taxmann.com

www.taxmann.com

Taxmann Bengaluru

12/1, Nirmal Nivas, Ground Floor, 4th Cross, Gandhi Nagar

Bengaluru – 560009 | Karnataka | India

Phone | +91 99869 50066

Email | sales.bengaluru@taxmann.com

Taxmann Kolkata Nigam Centre, 155-Lenin Sarani, Wellington, 2nd Floor, Room No. 213

Kolkata – 700013 | West Bengal | India

Phone | +91 98300 71313

Email | sales.kolkata@taxmann.com

Taxmann Lucknow

House No. LIG – 4/40, Sector – H, Jankipuram Lucknow – 226021 | Uttar Pradesh | India

Phone | +91 97924 23987

Email | sales.lucknow@taxmann.com

Taxmann Bhubaneswar

Plot No. 591, Nayapalli, Near Damayanti Apartments

Bhubaneswar – 751012 | Odisha | India

Phone | +91 99370 71353

Email | sales.bhubaneswar@taxmann.com

Taxmann Guwahati

House No. 2, Samnaay Path, Sawauchi Dakshin Gaon Road

Guwahati – 781040 | Assam | India

Phone | +91 70866 24504

Email | sales.guwahati@taxmann.com