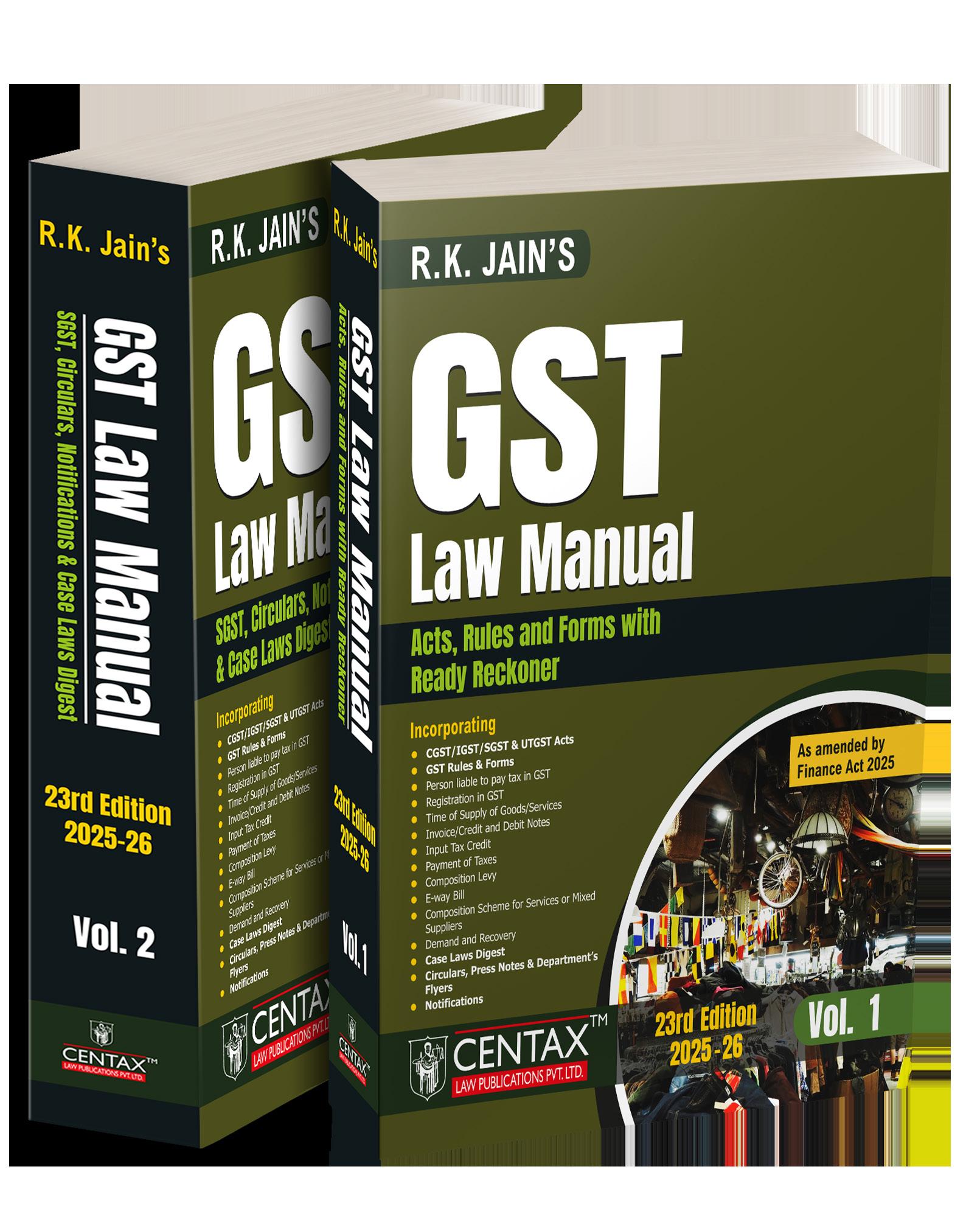

Published by : CENTAXTM LAW PUBLICATIONS PVT. LTD.

59/32, New Rohtak Road, New Delhi-110 005 INDIA

Tel. : 011-40749999, E-mail : sales@centax.co.in Website : centaxonline.com

© CENTAXTM

[ As amended by Finance Act 2025 ]

First Edition 2017 (June)

Second Edition 2017 (July)

Third Edition 2017 (Aug.)

Fourth Edition 2017 (Nov.)

Fifth Edition 2018 (Feb.)

Sixth Edition 2018 (May)

Seventh Edition 2018 (Sept.)

Eighth Edition 2019 (Feb.)

Ninth Edition 2019 (Apr.)

Tenth Edition 2019 (July)

Eleventh Edition 2019 (Sept.)

1st Reprint 2019 (Sept.)

2nd Reprint 2019 (Oct.)

Twelfth Edition 2020 (Feb.)

Reprint 2020 (Feb.)

Thirteenth Edition 2021 (Feb.)

Fourteenth Edition 2021 (July)

Fifteenth Edition 2022 (Feb.)

Sixteenth Edition 2022 (Aug.)

Seventeenth Edition 2023 (Feb.)

Eighteenth Edition 2023 (June)

Reprint 2023 (Sept.)

Nineteenth Edition 2024 (Mar.)

Twentieth Edition 2024 (July)

Twenty First Edition 2024 (Nov.)

Twenty Second Edition 2025 (Feb.)

Twenty Third Edition 2025 (April)

Price : ` 3995/(for a set of two vols.)

ISBN : 978-93-91055-88-2

Printed at : Tan Prints (India) Pvt. Ltd. 44 Km. Mile Stone, National Highway, Rohtak Road Village Rohad, Distt. Jhajjar (Haryana) India

E-mail : sales@tanprints.com

Disclaimer

Every effort has been made to avoid errors or omissions in this publication. In spite of this, errors may creep in. Any mistake, error or discrepancy noted may be brought to our notice which shall be taken care of in the next edition. It is

be responsible for any damage or loss of action to any one, of any kind, in any manner, therefrom. It is suggested that to avoid any doubt the reader should cross-check all the facts, law and contents of the publication with original Government

No part of this book may be reproduced or copied in any form or by any means [graphic, electronic or mechanical, including photocopying, recording, taping, or information retrieval systems] or reproduced on any disc, tape, perforated media or other information storage device, etc., without the written permission of the publishers. Breach of this condition is liable for legal action.

For binding mistake, misprints or for missing pages, etc., the publisher’s liability is limited to replacement within seven days of purchase by similar edition. All expenses in this connection are to be borne by the purchaser.

All disputes are subject to Delhi jurisdiction only.

basis by the recipient of the 1 the provisions of the said Act shall apply to such recipient, namely :TABLE (1)(2)(3)

Cashew nuts, not shelled or peeled

Bidi wrapper leaves (tendu)

Tobacco leaves

2 other than those of citrus fruit namely:—

(a)O f peppermint (Menthapiperita);

(b)Of other mints: Spearmint oil (exmenthaspicata), Water mint-oil (ex-mentha aquatic), Horsemint oil (ex-menthasylves(ex-mentha citrate),

Any person who worm cocoons for supply

3 Raw cotton - State Government, Union Territory or any local authority

Rules, 2010, made under the provisions of sub-section (1) of section 11 of the Lotteries

Any ChapterUsed vehicles, seized waste and scrap [Central Government [ex-

State Government, Union territory or a local author-

Any Chapter

Metal scrap

1Any service supplied by any person who is located in a non-taxable territory to any person Any person Located in a non-taxable territory Any person located in the taxable territory 2 (GTA) 2[, 3

force in any part of India; or

(c) any co-operative society established by or under any law; or

Goods and Services Tax Act or the the State Goods and Services Tax Act or the Union Territory Goods and Services Tax Act; or

(e) any body corporate established, by or under any law; or Goods Transport in force in any part of India; or

(c) any co-operative society established by or under any law; or

Central Goods and Services Tax Act or Act or the State Goods and Services Tax Act or the Union Territory Goods and Services Tax Act; or

(e) any body corporate established, by or under any law; or

or Union territory; or

Explanation. territory.

territory. †[other

Union territory or territory.

(ii) services in relation to an aircraft or a vessel, inside or outside the precincts of a port or an airport;

1 Services supplied by the Central Government $ under the Central Goods and Services Tax Act, Central Government, State Government, Union Territory or local authority Goods and Services Tax Act, 2017 read with

2 Any person ‡ person

3 Services supplied by any person by way of Any person form of upfront amount (called as premium,

Any person

7Services supplied by a director of a company or a body corporate to the said company or the A director of a company or a body corporate The company or a body corporate located in

[11Supply of services by a music composer, Music composer,

[11ASupply of services by an author by way of AuthorPublisher located in the taxable territory : shall apply where,the Central Goods and Services Tax

declaration, in the form at Annexure I, within the time limit prescribed therein, with the jurisdictional CGST or SGST commissioner, as the case may be, that he exercises the option and to comply with all the provisions Act, 2017 (13 of 2017) as they apply

or services or both and that he shall not withdraw the said option within a period of 1 year from the date of

prescribed in Annexure II on the

1[12Supply of services by the members of Members of Committee constituted by the India

2[13

partnership or limited liability partnership Individual Direct (DSAs) other than a body corporate, partnership or limited liability

3 territory

Correspondent (BC) to business correspondent Correspondent (BC) A business correspondent, located in the

Security services (services provided by way of supply of security personnel) provided to a

shall apply to, -

(i)(a) a Department or Establishment of the Central Government or State Government or Union territory; or (b) local authority; or

Goods and Services Tax Act, 2017 (12 of 2017) Any person other than a body corporate

where the cost of fuel is included in the

Any person, other than a body corporate who supplies the service to a body corporate and does not issue an invoice tax at the rate of 12 per cent to the service recipient

Any body corporate located in the taxable who deposits the in his name or in the name of any other person duly authorised on his behalf with an approved intermediary for the under the Scheme of SEBI

located in the taxable territory shall be treated as the person who receives the service for the purpose of this

any such facility, wholly or partly, in an immovable property, with or without the transfer of possession or also apply to the Parliament

To

(m) The term “Residential Real Estate Project (RREP)” shall mean a REP in which the carpet area of the commercial

(To be addressed to the jurisdictional Commissioner) or services or both;

Signature Name GSTIN

I/we have taken registration under the CGST Act, 2017 read with clause (v) of section 20 of IGST Act, 2017 and have exercised the option to pay tax on services of GTA in relation to transport of goods supplied by us 2[from the Financial Year ............................................. under forward charge and have not reverted to reverse charge mechanism].]

In exercise of the powers conferred by sub-section (4) of section 5 of the Integrated Goods and Services Tax Act, 2017 the Table below, received from an unregistered supplier shall pay tax on reverse charge basis as recipient of such goods or services or both, namely :-

1Supply of such goods and services or both [other than services by way of grant of development rights, long term lease of land (against upfront payment in the form of premium, salami, development charges etc.) or FSI (including additional FSI)] which constitute the shortfall from the minimum value of goods or services or both required to be purchased by a

Promoter.

2 1975 (51 of 1975).]

Promoter.

(51 of 1975) supplied to a promoter for construction of a project on which tax is payable or Promoter.

the piece of land upon which it is built.