INCOME TAX IMPLICATIONS IN

JOINT DEVELOPMENT AGREEMENTS

JDAs facilitate efficient land usage. They enable construction in densely populated urban areas.

Landowners gain revenue without upfront investment. Developers gain access to prime locations.

Home owners stand to gain enhanced and improved area.

JDAs unlock value from underutilized land. They combat land scarcity in growing cities.

Faqir Chand Gulati v. Uppal Agencies Pvt. Ltd. and Anr. [2008] 15 STT 296 (SC)

Typical Prevelant JDAs

Evolving Models

Area Sharing

Revenue Sharing

Lumpsum

Consideration

-Project/ Development Management Agreement

- Co-development agreement

• Owner and Developer agree to share built up area in a particular ratio

• Area to be shared if identified post plan sanction

• Allocation agreement required for detailing the area share

• PoA to be executed and license is granted to allow development by Developer

• Developer given right to mortgage Developer’s interest in the property

• Owner to deposit original title deeds with the Financing Institution

• Developer responsible for all matters relating to construction

• Owner and Builder to share revenue at a decided ratio

• Various terms for sharing of ‘distributable revenue’ detailed in the agreement

• Agreement should be tripartite for owner to transfer undivided share in land and Developer to transfer built up area in favour of ultimate purchasers

• Opening and operating of joint/ escrow accounts

Notwithstanding anything contained in sub-section (1), where the capital gain arises to an assessee, being an individual or a Hindu undivided family, from the transfer of a capital asset, being land or building or both, under a specified agreement, the capital gains shall be chargeable to incometax as income of the previous year in which the certificate of completion for the whole or part of the project is issued by the competent authority; and for the purposes of section 48, the stamp duty value, on the date of issue of the said certificate, of his share, being land or building or both in the project, as increased by any consideration received in cash or by a cheque or draft or by any other mode shall be deemed to be the full value of the consideration received or accruing as a result of the transfer of the capital asset :

W.E.F. AY 2018-19

Notwithstanding anything contained in sub-section (1), where the capital gain arises to an assessee, being an individual or a Hindu undivided family, from the transfer of a capital asset, being land or building or both, under a specified agreement, the capital gains shall be chargeable to income-tax as income of the previous year in which the certificate of completion for the whole or part of the project is issued by the competent authority; and for the purposes of section 48, the stamp duty value, on the date of issue of the said certificate, of his share, being land or building or both in the project, as increased by any consideration received in cash or by a cheque or draft or by any other mode shall be deemed to be the full value of the consideration received or accruing as a result of the transfer of the capital asset :

W.E.F. AY 2018-19

• Retrospective application?

Notwithstanding anything contained in sub-section (1),

45. (1) Any profits or gains arising from the transfer of a capital asset effected in the previous year shall, save as otherwise provided in sections

54, 54B, 54D, 54E, 54EA, 54EB, 54F, 5 4 and 54H, be chargeable to income-tax under the head "Capital gains", and shall be deemed to be the income of the previous year in which the transfer took place.

• Resident vs Non-resident transferor?

• Individual jointly holding with a company?

Notwithstanding anything contained in sub-section (1), where the capital gain arises to an assessee, being an individual or a Hindu undivided family, from the transfer of a capital asset, being land or building or both, under a specified agreement, the capital gains shall be chargeable to income-tax as income of the previous year in which the certificate of completion for the whole or part of the project is issued by the competent authority; and for the purposes of section 48, the stamp duty value, on the date of issue of the said certificate, of his share, being land or building or both in the project, as increased by any consideration received in cash or by a cheque or draft or by any other mode shall be deemed to be the full value of the consideration received or accruing as a result of the transfer of the capital asset :

of a capital asset

• Is it a transfer?

• Is it a capital asset?

Being land or building

• Residential v Commercial? Agricultural v Non-Agricultural?

• Rights in land or building?

Shall be chargeable

• Chargeable to tax v year of transfer?

• Period of holding?

• Cost Inflation Indexation?

• Reinvestment timeline?

Notwithstanding anything contained in sub-section (1), where the capital gain arises to an assessee, being an individual or a Hindu undivided family, from the transfer of a capital asset, being land or building or both, under a specified agreement, the capital gains shall be chargeable to income-tax as income of the previous year in which the certificate of completion for the whole or part of the project is issued by the competent authority; and for the purposes of section 48, the stamp duty value, on the date of issue of the said certificate, of his share, being land or building or both in the project, as increased by any consideration received in cash or by a cheque or draft or by any other mode shall be deemed to be the full value of the consideration received or accruing as a result of the transfer of the capital asset :

Certificate of completion

• What if there is no CC practically?

Meaning of project

• Phase wise development? “Issued”

• Application date v Issue date or date of CC?

• Change of SDV between two dates?

"specified agreement" means a registered agreement in which a person owning land or building or both, agrees to allow another person to develop a real estate project on such land or building or both, in consideration of a share, being land or building or both in such project, whether with or without payment of part of the consideration in cash

Rights in land or building

Allotment of area in some other project

Miniscule area + Substantial monetary payment

Meaning of real estate project/ Plotted development

Timing of taxation of monetary consideration

Implications if FMV>SDV

Payment under specified agreement.

194-IC. Notwithstanding anything contained in section 194-IA, any person responsible for paying to a resident any sum by way of consideration, not being consideration in kind, under the agreement referred to in sub-section (5A) of section 45, shall at the time of credit of such sum to the account of the payee or at the time of payment thereof in cash or by issue of a cheque or draft or by any other mode, whichever is earlier, deduct an amount equal to ten per cent of such sum as income-tax thereon.

194-IA v 194-IC

Payment to non-resident

TDS on consideration in kind

TDS on transfer before CC

TDS on payment of consideration to company – specified agreement

Timing of TDS

TDS on transit rent/ hardship allowance, etc.

45(5A) provisions shall not apply

Is proviso applicable only if entire area is sold before CC?

If assessee transfers his share in the project

On or before issue of completion certificate

Should gains be computed for entire area even if only part is sold prior to OC?

Gains deemed to be income of the previous year in which transfer takes place

Caution point – Nature of asset being transferred is ‘rights’

In the context of 194-I/ 194-IC

Sarfaraz S. Furniturewalla Vs Afshan Sharfali Ashok Kumar -

• Sarfaraz S. Furniturewalla Vs Afshan Sharfali Ashok Kumar - [2024] 166 taxmann.com 425 (Bom) [15-04-2024];

• ITO Vs N. Rose Developers (P.) Ltd. - [2025] 171 taxmann.com 652 (Mum - Trib.)[30-012025];

• Nathani Parekh Constructions Pvt. Ltd. - ITA No.4174; Hardship allowance, rent, corpus, etc.

• Narayan Devarajan Iyengar Vs ITO - [2023] 152 taxmann.com 188 (Mum - Trib);

• Lawrence Rebello - IT Appeal No. 132./Ind./2020;

• Ajay Parasmal Kothari Vs ITO - [2024] 159 taxmann.com 570 (Mum - Trib.);

• Jitendra Kumar Soneja Vs ITO - [2016] 72 taxmann.com 318 (Mum - Trib);

Case Study

• Asset acquired in 2010-11 – at Rs 50 lakhs

• Asset transferred under JDA

• Stamp duty value in year of completion certificate (say 2024-25) was Rs. 2 crore

• New asset proposed to be transferred in 2030-31

• What would be the cost of acquisition of this new asset?

Cost of Acquisition of Share in land / building (i.e. New Asset acquired) Full value of consideration as per section 45(5A) Not applicable if share transferred before CC

• Historical cost of land – INR 1 crore

• AY 2018-19 – Registered JDA entered for surrendering land (held as LTCA) and receiving constructed area

• Landowner and developer to share constructed area in 40:60 ratio (i.e. 40% constructed area to be received by landowner)

• AY 2024-25 – Completion certificate received

• Historical cost of land – INR 1 crore

• AY 2018-19 – Registered JDA entered for surrendering land (held as LTCA) and receiving constructed area

• Landowner and developer to share constructed area in 40:60 ratio (i.e. 40% constructed area to be received by landowner)

• AY 2024-25 – Completion certificate received – lets say SDV of 40% share is 9 crore (split as 5 crore for constructed area and 4 crore for underlying 40% land)

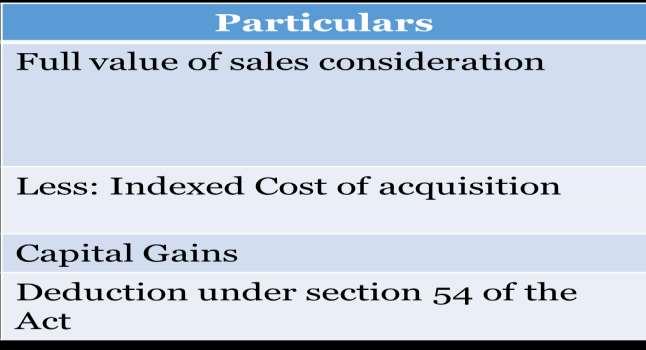

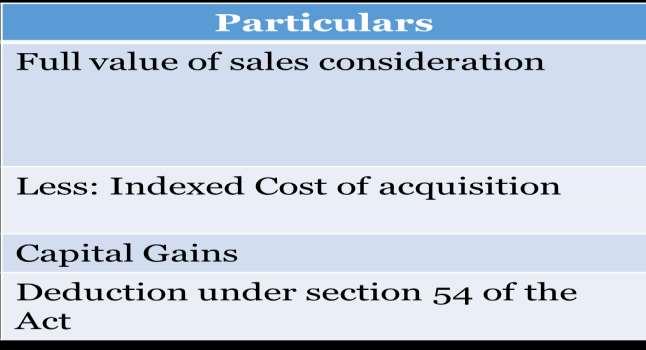

Computation of capital gains – AY 2024-25

Particulars

Full value of sales consideration

Less: Indexed Cost of acquisition

Capital Gains

Deduction under section 54 of the Act

Remarks 5 crore SDV as on CC date SDV of only 40% constructed area to be received 60 lakhs (Cost of 60% land) 40% land is not transferred

Indexation upto AY 2018-19/AY 202122 (discussed earlier)

Challenge on account of possession given after 3 years (discussed earlier)

• AY 2018-19 – Registered JDA entered for surrendering existing flat of 1,000 sq ft (held as LTCA) and receiving constructed area of 1,200 sq. ft.

• AY 2021-22 – Completion certificate received

Computation of capital gains – AY 2021-22

Amount

SDV of incoming flat (1,200 sq. ft.) flat

Full SDV of flat considered without excluding land component

Cost of acquisition of flat

Entire flat value considered Difference

Challenges if possession is given after 3 years

• AY 2018-19 – Registered JDA entered for surrendering existing flat of 1,000 sq ft (held as LTCA) and receiving constructed area of 1,200 sq. ft.

• AY 2021-22 – Completion certificate received

Computation of capital gains – AY 2021-22

SDV of 1,200 sq. ft. constructed area + and SDV of land share (allocable to surplus area received, if any)

Land share of SDV to the extent allocable to 1,000 sq. ft received to be excluded

Cost of building/ construction and outgoing land share, if any Entire land may not be transferred (Valuation report)

Difference

Challenges if possession is given after 3 years

Section 2(47) "transfer", in relation to a capital asset, includes,—

(i) the sale, exchange or relinquishment of the asset ; or

(ii) the extinguishment of any rights therein ; or

(v) any transaction involving the allowing of the possession of any immovable property to be taken or retained in part performance of a contract of the nature referred to in section 53A of the Transfer of Property Act, 1882 (4 of 1882) ; or

(vi) any transaction which has the effect of transferring, or enabling the enjoyment of, any immovable property.

• Section 53A : Part performance- Where any person contracts to transfer for consideration any immovable property by writing signed by him or on his behalf from which the terms necessary to constitute transfer can be ascertained with reasonable certainty, and the transferee has, in part performance of the contract, taken possession of the property or any part thereof, or the transferee, being already in possession, continues in possession in part performance of the contract and has done some act in furtherance of the contract, and the transferee has performed or is willing to perform his part of the contract then, notwithstanding that the contract, though required to be registered, has not been registered, or, where there is an instrument of transfer, that the transfer has not been completed in the manner prescribed thereof by the law for the time being in force, the transferor or any person claiming under him shall be debarred from enforcing against the transferee and persons claiming under him any right in respect of the property of which the transferee has taken or continued in possession, other than the right specifically provided by the terms of the contract;

Contract for consideration In Writing Signed by transferor Pertain to transfer of immovable property

Possession of property in furtherance of contract

Performed or is willing to perform his part of contract

Incidence of Capital Gains

On date of entering JDA

Year in which possession is given On receipt of consideration On date when builder commences activity On registration of DA

• Charturbuj Dwarakadas Kapadia Vs CIT - [2003] 129 Taxman 497 (Bom);

• CIT Vs Dr T.K Dayalu - [2011] 14 taxmann.com 120 (Kar);

• Dr Arvind Goverdhan - I.T. APPEAL NOS. 1353 TO 1356 (BANG.) OF 2015, ORDER DECEMBER 13, 2017;

• ITO Vs Mrs P.A.Sarala - [2015] 58 taxmann.com 290 (Chennai - Trib);

• ACIT Vs A.Ram Reddy - [2012] 23 Taxmann.com 59 (Hyd);

• H B Jairaj - ITA No 20 of 2005 C/W ITA No 21 of 2005, 60 DTR ;

• CIT Vs Ved Prakash Rakhra - [2012] 26 taxmann.com 166 (Kar) ;

• Smt. Prameela Krishnan v. ITO [2014] 42 taxmann.com 185 (Karnataka)

• Potla Nageswar Rao Vs DCIT - [2014] 50 taxmann.com 137 (Andhra Pradesh);

• Jasbir Singh Sarkaria, In re - [2007] 164 taxmann 108 (AAR - New Delhi);

• R Kalanidhi v. ITO- [2010] 122 ITD 388 (Chennai-Trib.);

• CIT Vs K. Jeelani Basha - [2002] 122 Taxman 509 (Mad)[04-03-2002];

• CIT Vs Smt. Najoo Dara Deboo - [2013] 38 taxmann.com 258 (All);

• Mrs. Aarti Sanjay Kadam Vs ITO - [2018] 97 taxmann.com 284 (Mum - Trib);

• CIT Vs Attam Prakash & Sons - [2008] 175 Taxman 499 (Delhi);

• Shri Sadia Shaikh - (Tax Appeal No. 11 & 12 of 2013) rendered on 2nd December 2013 reported in (2014) 56(I) ITCL 147 (Bom HC ) (High Court of Bombay at Goa);

• Giridhar G Yadalam Vs CWT - [2016] 65 taxmann.com 148 (SC) ;

• CIT Vs Chemosyn Ltd. - [2015] 64 taxmann.com 219 (Bom);

• Ronak Marble Industries - [IT Appeal No. 3318 (Mum) of 2015, dated 14-03-2017;

• PCIT Vs Infinity Infotech Parks Ltd - [2018] 96 taxmann.com 274 (Cal.);

• N. A. Haris Vs ADCIT - [2021] 124 taxmann.com 354 (Bang - Trib.);

• S. Ranjith Reddy Vs DCIT - [2013] 35 taxmann.com 415 (Hyd - Trib);

• Fibars Infratech Pvt. Ltd v. ITO- [2014] 46 taxmann.com 313 (Hyd - Trib.);

• ABVS Prakash – 1 ITA No 462/Hyd/2013;

• Binjusaria Properties (P) Ltd Vs ACIT - [2014] 45 taxmann.com 115 (Hyd - Trib);

• Dilip Anand Vazirani Vs ITO - [2015] 57 taxmann.com 142 (Mum - Trib);

• CIT Vs Eastern Ceramics Ltd - [2013] 38 Taxmann.com 68 (Bom);

• Sumeru Soft (p) Ltd Vs ITO - [2017] 82 taxmann.com 5 (Chennai-Trib);

• CIT v. Dr. Arvind S. Palke [2018] 89 taxmann.com 307 (Bombay);

• Smt. Lakshmi Swarupa v. ITO - [2018] 100 taxmann.com 148 (Bang. - Trib.);

• Pr. CIT v. Fardeen Khan – [2018] 96 taxmann.com 398 (Bombay)

• K.V. Satish Babu [HUF] v. ITO - [2023] 152 taxmann.com 396 (Bangalore - Trib.)

• Futura Polyster Limited v. ITO - [2020] 118 taxmann.com 243 (Mumbai - Trib.)

• CIT v. Dr. T.K Dayalu – [2011] 14 taxmann.com 120 (Karnataka);

• Coromandel Cables(P.) Ltd Vs ACIT – [2016] 71 taxmann.com 346 (Chennai - Trib);

• R. Kalanidhi Vs ITO – [2010] 122 ITD 388 (Chennai);

• Jasbir Singh Sarkaria, In re - [2007] 164 Taxman 108 (AAR - New Delhi);

• CIT Vs K. Jeelani Basha - [2002] 122 Taxman 509 (Mad)[04-03-2002];

• T. Prabhakar Rao (HUF) – ITA Nos. 1583 to 1592/H/17, Dated- 25/05/2018;

• Abdul Wahab Vs DCIT – [2015] 57 taxmann.com 27 (Bang -Trib);

Also refer –

• Hindoosthan Spinning and Weaving Mills – ITA No. 3820/Mum/2003

CIT v Balbir Singh Maini [2017] 86 taxmann.com 94 (Supreme Court)

• A JDA was entered into between a cooperative housing society (Society) and two developers (Developers) on 25 February, 2007. Agreement was unregistered.

• Two instalments against conveyance of land parcels (partial) were paid. However, the arrangement did not go further for want of approvals. The tax authorities sought to tax the future instalments not received.

• In 2001, the Registration and Other Related Laws (Amendment) Act, 2001 and the TOPA were amended to the effect that unless the document containing the contract to transfer for consideration any immovable property (for the purpose of section 53A of TOPA), is registered, it shall not have any effect in law (other than it being received as evidence in a suit for specific performance or as evidence of any collateral transaction not required to be effected by a registered instrument).

• Hence, conditions of transfer as per section 2(47)(v) was regarded as not fulfilled.

• Whether assessee is liable to capital gain in 2004-05? Whether Section 53A of TOPA is attracted?

• License given to another to enter upon the land for the purpose of developing the land into flats and selling the same cannot be said to be ‘possession’ within the meaning of Section 53A, which is a legal concept, and which denotes control over the land and not actual physical occupation of the land. This being the case, Section 53A of the T.P. Act cannot possibly be attracted to the facts of this case for this reason alone.

Computation of Consideration

Cost of Construction Stamp Duty Value of Incoming Asset Stamp Duty Value of Outgoing Asset Fair Market Value

• Prabhandam Prakash v. ITO - [(2008) 22 SOT 58 (Hyd.-Trib)

• N. A. Haris Vs ADCIT - [2021] 124 taxmann.com 354 (Bang - Trib.)

• ITO Vs N S Nagaraj - [2014] 52 Taxmann.com 511 (Bang - Trib);

• CIT Vs Khivraj Motors - [2015] 62 Taxmann.com 305 (Kar);

• CIT Vs Ved Prakash Rakhra [2012] 26 taxmann.com 166 (Kar);

• Smt. P. Pratima Reddy Vs ITO - [2012] 25 Taxmann.com 264 (Hyd);

• CIT Vs Vasavi Pratap Chand - [2018] 99 taxmann.com 403 (Delhi);

• Udai Hospitals Pvt Ltd - ITAT “B” Bench - ITA No. 1755/Hyd/2017;

• Pr. CIT v. Smt. Sarojini M. Kushe P.V.S. Beedies (P.) Ltd. [2022] 135 taxmann.com 365 (Karnataka)

• Pr. CIT v. CPC Logistics Limited - [2022] 134 taxmann.com 197 (Karnataka)

• Shankar Vittal Motor Co. Ltd. - ITANo.35/Bang/2015;

• B V Narayana Reddy - ITA No. 1616/Hyd/2012 Dated - 10-12-2014

• Circular F.No. 225/58/2016/ITA.II dated 29/02/2016 issued by CBDT;

• Revenue to be recognized as per method of accounting regularly followed by the assessee – Section 145

• Project completion method v Percentage of completion method

• ITO vs. Vilas Babanrao Rukari (HUF) [2018] 93 taxmann.com 465 (Pune - Trib.) [25-05-2018]Where business profits were to be taxed in hands of assessee land owner in subsequent year when flats under project were fully developed and handed over to flat buyers, capital gains arising on conversion of assessee's land into stock-in-trade prior to development agreement would also be taxed in hands of assessee in said subsequent year

Manner of transfer

Purpose of handing over possession

Exclusive right to sell developed units

Manner of sale consideration

Right to mortgage land

Manner of conferring legal title on ultimate customers

Supplementary documents; i.e. PoA, MoU AOP risk GST, Stamp Duty Dispute resolution and exit mechanism

45(5A) Retrospective Application Case Study

• Assessment Year 2016-17 – JDA entered

• AY 2020-21 – Possession of constructed area given

• No capital gains offered to tax up to AY 2020-21

• Whether section 45(5A) can be prospectively applied to the transaction entered in AY 2016-17?

Clarificatory and Beneficial Substantive charging provision v/s

• Amit Vishnu Pashankar Vs DCIT [2021] 131 taxmann.com 118 (Pune - Trib)

• Adinarayana Reddy Kummeta Vs ACIT [2018] 91 taxmann.com 360 (Hyd - Trib.)

• Smt. Naga Padmaja Vangara Vs ITO [2022] 145 taxmann.com 115 (Hyd - Trib.)

• K. Vijaya Lakshmi Vs ACIT [2018] 91 taxmann.com 253 (Hyd - Trib)

• Smt. G. Sailaja [ITA No. 51 and 570/ Hyd/ 2016]

• DCIT v Agamati Ram Reddy [ITA No. 1774/Hyd/2017]

• Pankaj Kumar, Mohamid Abdul Hai, Hasmat Hai v CIT [[Civil Writ Jurisdiction Case No. 20926 of 2019 and others]

• Whether there is transfer?

• Refer to section 2(47) of the Act

• What is the period of holding of the asset? Short term v Long term?

• Date up to which indexation will be available

• Reinvestment timeline for 54/ 54F purposes from date of transfer?

• Circular no. 791, dt 02.06.2000

Case Study (Period of holding):

• Asset acquired in -2023-24

• JDA entered -2024-25 (1 year);

• Completion Certificate received 2027-28 (4 years)

Indexation upto date of transfer

• Best & Crompton Engineering Ltd. v. Asstt. CIT [2014] 50 taxmann.com 51 (ChennaiTrib.)

Indexation upto date of taxability

• Sakthi Sugars Ltd - IT.A.Nos. 866/Mds/2016

• Mather & Platt Pumps Ltd. ITA No. 351/PN/2009