Critical Analysis of Section 37 of the Income Tax Act, 1961

CA ROHAN SOGANI

CA ROHAN SOGANI

Overview of Section 37 Conditions for Allowability under Section 37

Meaning of ‘Wholly and Exclusively for the Purpose of Business’

CSR ExpenditureSection 37 vs. Section 80G Capital vs. Revenue Expenditure- Test for Determination

Meaning of ‘Offences/ Prohibited by Law’

Fallout of Explanation 3 to Section 37(1) Case Studies

CA Rohan Sogani 22nd December 2023 DISCUSSION POINTS CA Rohan Sogani 14th March, 2024 2 of 27

CA Rohan Sogani 22nd December 2023 OVERVIEW OF SECTION 37 (1/2) Section 37 is a “RESIDUARY PROVISION”. Sub-section (1) allows deductibility of REVENUE and NON-PERSONAL EXPENDITURE, excluding those covered under SPECIFIC SECTIONS 3 of 27 CA Rohan Sogani 14th March, 2024 Expenses not covered explicitly Personal Expense O Revenue expense P Section 37(1)

OVERVIEW OF SECTION 37 (2/2)

EXPLANATIONS to Section 37(1) inserted from time to time for clarifying the intent of the legislature

Explanation 1

Explanation 2

Explanation 3

• Inserted vide Finance Act, 1998 w.r.e.f. 1-4-1962.

• Inserted vide Finance Act, 2014 w.e.f. 1-4-2015.

• Inserted vide Finance Act, 2022 w.e.f. 1-4-2022.

• Expenses related to offences or prohibited activities are inadmissible.

• CSR Expenditure not allowable.

• Further Clarification on Explanation 1.

CA Rohan Sogani 22nd December 2023

4 of 27 CA Rohan Sogani 14th March,

2024

Expenditure shall be allowed in computing the income chargeable under the head “PGBP“, if it satisfies following conditions CUMULATIVELY:

it is NOT an expenditure of the nature described in SECTIONS 30 to 36

it is NOT in the nature of CAPITAL EXPENDITURE

it is NOT in the nature of PERSONAL EXPENSES

it is laid out or expended WHOLLY AND EXCLUSIVELY for the purposes of the business or profession.

CA Rohan Sogani 22nd December 2023 CONDITIONS FOR ALLOWABILITY - SECTION 37 (1/4)

EXPLANATIONS

CONSIDERED 5 of 27 CA Rohan Sogani 14th March, 2024

1, 2, 3 TO BE

MEANING OF TERM ‘ANY EXPENDITURE’

Allowance under Section 37 is granted to ‘ANY EXPENDITURE' that meets the criteria outlined in Section 37(1).

Core definition of 'expenditure' revolves around the concept of 'SPENDING' indicating the act of ‘PAYING OUT OR AWAY’ of money. In essence, 'expenditure' denotes the IRREVERSIBLE OUTFLOW OF FUNDS.

CA Rohan Sogani 22nd December 2023 CONDITIONS FOR ALLOWABILITY - SECTION 37 (2/4)

. 6 of 27 CA Rohan Sogani 14th March, 2024

‘Expenditure’

vs. ‘Loss’

Distinction exists between “disbursement/ expenditure” and a “loss”.

Expenditure

• Conscious act of paying out or spending.

Loss

• Fortuitous or arises from external factors

• Deliberate choice for outflow of resources.

• Entirely involuntary i.e. loss occurs irrespective of a person's will

BUSINESS EXPENDITURE must be incurred “WHOLLY AND EXCLUSIVELY” for business for allowance, while a BUSINESS LOSS, to qualify, must be of a NON-CAPITAL NATURE and not only connected with the trade but also incidental to the trade itself [CIT

Rohan Sogani 22nd December 2023

CA

J. K. Cotton Spinning & Weaving

4 Taxman 1 / 123 ITR 911 (All.)].

of 27

Rohan Sogani 14th March, 2024

ALLOWABILITY - SECTION 37

v.

Mills Co. Ltd. [1980]

7

CA

CONDITIONS FOR

(3/4)

CONDITIONS FOR ALLOWABILITY - SECTION 37 (4/4)

‘Expenditure’ vs. ‘Loss’

In the case of M. P. Financial Corporation v. CIT [[1986] 26 Taxman 42 / [1987] 165 ITR 765 (MP)], it has been observed that the term "expenditure" may, under specific circumstances, encompass:

• an amount that essentially represents a loss;

• even if that amount has not gone out of assessee’s pocket.

The phrase 'any expenditure' within Section 37 is interpreted to include both:

• 'expenses incurred' and

• amount classified as 'losses', even if such amount has not gone out of assessee’s pocket

[CIT vs. Woodward Governor India (P.) Ltd. [2009] 179 Taxman 326 / 312 ITR 254 (SC)].

Rohan Sogani 22nd December 2023

CA

8 of 27

Rohan Sogani 14

March,

CA

th

2024

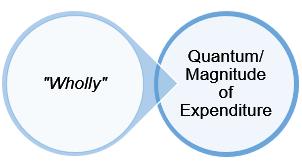

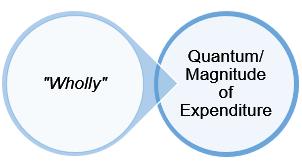

Phrase "Wholly And Exclusively" does not equate to “NECESSARILY”

Assessee to determine WHETHER A PARTICULAR EXPENDITURE IS WARRANTED in the conduct of business.

CA Rohan Sogani 22nd December 2023

OF ‘WHOLLY AND EXCLUSIVELY FOR THE PURPOSE

MEANING

OF BUSINESS’ (1/5)

Expenditure

undertaken VOLUNTARILY and WITHOUT ABSOLUTE NECESSITY. 9 of 27 CA Rohan Sogani 14th March, 2024

may be

MEANING OF ‘WHOLLY AND

EXCLUSIVELY

FOR THE PURPOSE OF BUSINESS’ (2/5)

State of Madras vs. G. J. Coelho [(1964) 53 ITR 186 (SC)] - established test stating that expenditure incurred under a transaction closely intertwined with the business can be considered an integral part of conducting the business.

Bombay Steam Navigation Co. (1953) (P.) Ltd. vs. CIT (1965) 56 ITR 52 (SC) - Expenditure may qualify as revenue expenditure, laid out wholly and exclusively for the purposes of the business

S. A. Builders Ltd. vs. CIT(A), [2007] 158 Taxman 74 / 288 ITR 1(SC)Phrase "for the purposes of the business or profession" as employed in Section 37(1) encompasses a broader scope than the expression "for the purpose of earning profits”

CA Rohan Sogani 22nd December 2023

10 of 27 CA Rohan Sogani 14th March, 2024

CIT v. Delhi Safe Deposit Co. Ltd. [1982] 8 Taxman 1 / [1982] 133 ITR 756

(SC) - True test of an expenditure laid out wholly and exclusively for the purposes of trade or business is it is incurred by the assessee:

• as INCIDENTAL TO HIS TRADE;

• for the purpose of KEEPING THE TRADE GOING and of making it pay and;

• NOT IN ANY OTHER CAPACITY THAN THAT OF A TRADER.

Rohan Sogani

nd December 2023

EXCLUSIVELY

CA

22

MEANING OF ‘WHOLLY AND

FOR THE PURPOSE OF BUSINESS’ (3/5)

11 of 27 CA Rohan Sogani

th March, 2024

14

MEANING OF ‘WHOLLY AND EXCLUSIVELY FOR THE PURPOSE OF BUSINESS’ (4/5)

QUESTIONING EXPENDITURE'S REASONABLENESS: POSSIBLE?

It is not for the revenue to question the COMMERCIAL EXPEDIENCY of the expenditure.

COMMERCIAL EXPEDIENCY is a matter entirely left to the judgment of the

assessee [CIT vs. Globald Motor Service (P.) Ltd. (1975) 100 ITR 240 (Mad.); CIT vs. Sapthagiri Traders Ltd. [2009] 180 Taxman 605 / [2008] 305

ITR 438 (Mad.); CIT vs. Textool Co. Ltd. [2009] 184 Taxman 217 / 315 ITR 91 (Mad.)].

22

12 of 27 CA

14th March, 2024

Rohan Sogani

CA

nd December 2023

Rohan Sogani

(5/5)

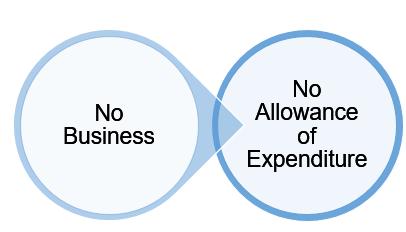

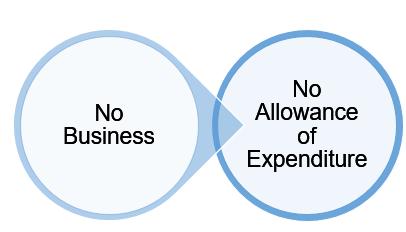

If during the relevant period, there was no business, the question of allowability of expenses would not arise [S.P.V. Bank Ltd. vs. CIT [1981] 5 Taxman 155 / [1980] 126 ITR 773 (Ker.); J. R. Mehta vs. CIT [1980] 4 Taxman 522 / 126 ITR 476 (Bom.)].

CA Rohan Sogani 22nd December 2023

13 of 27 CA Rohan Sogani 14th March, 2024

MEANING OF ‘WHOLLY AND EXCLUSIVELY FOR THE PURPOSE OF BUSINESS’

NO BUSINESS, NO ALLOWANCE

CA Rohan Sogani 22nd December 2023 CSR EXPENDITURE- SECTION 37 VS. SECTION 80G (1/3) SECTION 135 of the COMPANIES ACT, 2013 – APPLICABILITY TO BE SEEN WITH REFERENCE TO IMMEDIATELY PRECEDING FINANCIAL YEAR EXPLANATION to Section 37(1) Expenditure incurred on the activities related to CSR referred to in Section 135 shall be not deemed to be incurred for the purpose of PGBP. 14 of 27 CA Rohan Sogani 14th March, 2024

CSR EXPENDITURE- SECTION 37 VS. SECTION 80G (2/3)

S. No. Section 37(1)

Section 80G

1.

As per Section 14, all the income shall, for the purposes of charge of income tax and computation, be classified under 5 heads.

Once total income is calculated, thereafter, deductions are provided as per provisions of Chapter VI-A.

2.

Section 37(1) provides allowability of expenditure, as deduction, which has been incurred for the purpose of business and profession.

Section 80G falls under Chapter VI-A, and the same shall be deducted for the purpose of computing taxable income.

3. CSR Expenditure is not allowed as expenditure.

CSR Expenditure is allowed as deduction subject to clause (iiihk) [Swatchh Bharat Kosh] and clause (iiihl) [Clean Ganga Fund] of Section 80G.

15 of 27 CA

14

CA Rohan Sogani 22nd December 2023

Rohan Sogani

th March,

2024

CSR EXPENDITURE- SECTION 37 VS. SECTION 80G (3/3)

Case Laws

S. No. Case Laws

1. FNF India (P.) Ltd. v. Asstt. CIT [2021] 133 taxmann.com 251 (Bang. - Trib.)

2. JMS Mining (P.) Ltd. v. Pr. CIT [2021] 190 ITD 702 /130 taxmann.com 118 (Kol.Trib.)

3. Societe Generale Securities India (P.) Ltd. v. Pr. CIT [2023] 157 taxmann.com 533 / [2024] 204 ITD 796 (Mum. - Trib.)

4. Optum Global Solutions (India) (P.) Ltd. v. Dy. CIT [2023] 154 taxmann.com 651 / 203 ITD 14 (Hyd.- Trib.)

CA

CA Rohan Sogani

22

14th March, 2024

16 of 27

Sogani

Rohan

nd December 2023

REVENUE EXPENDITURE VS. CAPITAL EXPENDITURE (1/4)

Capital or the Revenue expenditure has NOT BEEN DEFINED in the Act.

A clear-cut dichotomy cannot be laid in respect of REVENUE OR CAPITAL expenditure in the absence of statutory definition.

‘CAPITAL’ DENOTES ‘PERMANENCY’ and, therefore, it refers to getting something tangible or intangible, property, corporeal or incorporeal rights, so that they could be of lasting or enduring benefit to the enterprise.

‘Revenue expenditure’ on the other hand is OPERATIONAL in perspective and solely intended for the FURTHERANCE of the enterprise

of transaction is important.

CA Rohan Sogani 22nd December 2023

NATURE/FACTUAL POSITION

17 of 27 CA Rohan Sogani 14th March, 2024

REVENUE EXPENDITURE VS. CAPITAL EXPENDITURE (2/4)

Accounting Treatment of Expenditure – Not Relevant

Entries in the books of accounts are NOT DECISIVE of the nature and character of expenses. Legal right is not SELF ESTOPPED BY THE ACCOUNTING TREATMENT

adopted by the assessee. It is not material and relevant how the company treated these expenses in its books of accounts but what is material and relevant is the ALLOWABILITY OF THESE EXPENSES AS REVENUE EXPENSES as per provisions of the Income Tax Act, 1961.

[Kedarnath Jute Mfg. Co. Ltd. v. CIT [1971] 82 ITR 363 (SC)]

CA

Rohan Sogani 22nd December 2023

CA

of 27

18

Rohan Sogani

th March, 2024

14

CA Rohan Sogani 22nd December 2023 REVENUE EXPENDITURE VS. CAPITAL EXPENDITURE (3/4) Tests Emerging from Judicial Precedence 19 of 27 CA Rohan Sogani 14th March, 2024 TEST

1 Acquisition of Fixed Asset TEST 2 Frequency of payment TEST 3 Enduring Benefit

4 Fixed Capital

TEST

TEST

Bharti

CA

Expenses towards “acquisition of concern” is capital in nature; “carrying on a concern” is revenue in nature

Enlargement of Structure vs operation of existing apparatus

Mere Payment of an amount in instalment does not convert or change capital payment into revenue payment

Single Transaction cannot be split in an artificial manner into capital and revenue

Rohan Sogani 22nd December 2023 REVENUE EXPENDITURE VS CAPITAL EXPENDITURE (4/4)

CA

of 27

Hexacom Ltd. [2023] 458 ITR 593 (SC)[16-10-2023] 20

Rohan Sogani 14th March, 2024

MEANING OF ‘OFFENCES/ PROHIBITED BY LAW’(1/1)

EXPLANATION 1 to Section 37(1), any expenditure which is:

OFFENCE,

PROHIBITED BY LAW are inadmissible expenses under PGBP.

A key pre-amendment principle was COMPENSATORY PAYMENTS were allowed, PENAL PAYMENTS were not, as affirmed by the Supreme Court in cases like Mahalakshmi Sugar Mills Co. Ltd. vs CIT [1980]123 ITR 429 (SC) and CIT vs Hyderabad Allwyn Metal Works Ltd. [1988] 36 Taxman 88 / 172 ITR 113 (AP).

22

14th

Rohan Sogani

CA

nd December 2023

27 CA Rohan Sogani

21 of

March,

2024

FALLOUT OF EXPLANATION 3 TO SECTION 37(1) (1/2)

Explanation 3 was inserted to further clarify Explanation 1 to Section 37(1). It clarifies that "expenditure incurred by an assessee for any purpose which is an offence or prohibited by law" includes expenditure:

for purposes considered OFFENCES UNDER CURRENT LAWS IN INDIA OR OUTSIDE INDIA;.

providing BENEFITS OR PERQUISITES, VIOLATING applicable laws by the recipient.

to COMPOUND AN OFFENCE under prevailing laws IN INDIA OR OUTSIDE INDIA.

Section 37(1) not only prohibits expenditures related to offenses under Indian law but also extends to OFFENSES UNDER LAWS OUTSIDE INDIA.

EXPLANATION 1 was introduced retrospectively by the Finance Act, 1998, w.e.f. 01.04.1962. EXPLANATION 3 has been specified to be effective from 01.04.2022

CA Rohan Sogani 22nd December 2023

22 of 27 CA Rohan Sogani 14th March, 2024

FALLOUT OF EXPLANATION 3 TO SECTION 37(1) (2/2)

clause (ii) in this EXPLANATION mainly aimed to address issues related to FREEBIES GIVEN TO DOCTORS IN THE PHARMA INDUSTRY, which were previously allowed in some ITAT judgments, despite a CBDT circular deeming such favours against medical code of conduct.

Clause (iii) in the Explanation 3 disallows COMPOUNDING FEES. Compounding involves settling an offence by paying compensation instead of facing penal consequences.

LAWS LIKE THE COMPANIES ACT AND SEBI, where compounding mechanisms exist for minor lapses, and penalizing businesses for claiming deductions on such levies, pose challenges in navigating the extensive compliance regime.

14

23

Rohan Sogani

nd December 2023

CA

22

of 27

Rohan Sogani

CA

th March, 2024

CASE LAWS (1/2)

S. No Issue Case Law Allowable Expenditure or Not

1. Payment of Ransom M/s Khemchadmotila Jain Tobacco Producers Pvt. Ltd. (2011-TIOL-540HC-MP-IT)

High Court ruled that kidnapping for ransom falls u/s 364A of the IPC, which penalizes such actions. However, as no law prohibits ransom payment and the Director's Tour was for a legitimate business purpose, so ALLOWABLE.

2. Payment of money for settlement procedure

CIT v. Desiccant Rotors International Pvt. Ltd 201 Taxman 144 (Delhi) (HC)

Assessee claimed a deduction u/s 37 for settling a patent infringement dispute with a customer. It was upheld that the payment was compensatory and not a penalty, as it arose from a settlement to compensate for losses incurred by the customer due to patent infringement. Hence, ALLOWABLE.

3. Expenditure incurred on eviction.

CIT V M/s Airlines Hotel Pvt. Ltd. (2012-TIOL-242-HC-MUM-IT)

Hotel owner, engaged in a legal dispute over bar and restaurant management, made a settlement payment to secure possession of the premises and incurred legal expenses. HC allowed the deduction, stating it as commercial expediency to remove hindrance.

CA Rohan Sogani 22nd December 2023 24 of 27 CA Rohan Sogani 14th March, 2024

CASE LAWS (2/2)

S. No Issue Case Law Allowable Expenditure or Not

4. Payment of interest & damages Prakash Cotton Mills (P.) Ltd. v CIT [1993] 67 Taxman 546 (SC)

The textile manufacturer claimed deduction u/s 37(1) for interest and damages related to delayed sales tax and ESI contributions. The SC held that the assessing authority should examine the nature of the statutory imposts, ALLOWING deduction for compensatory elements and DISALLOWING penal components.

5. Payment of penalty for violation of extra-territorial laws Mylan laboratories Ltd v Dy. CIT [2020] 113 taxmann.com 6 (Hyd.Trib.)

The assessee, a pharmaceutical company, faced disallowance of litigation costs by the AO under Explanation 1 to Section 37(1) due to a fine imposed by the EU Commission. The Tribunal ruled in favour of the assessee, stating that the payment, akin to disgorgement, wasn't penal in nature, ALLOWING it as a business loss or expenditure u/s 28 and 37.

6. Payment of secret commission Tarini Tarpaulin Production v CIT [2002] 124 Taxman 876 (Orissa)

The court DISALLOWED the deduction claimed by the assessee for secret commissions, citing the retrospective effect of the Explanation.

CA Rohan Sogani 22nd December 2023 25 of 27 CA Rohan Sogani 14th March, 2024

CA Rohan Sogani 22nd December 2023 QUERY? rohan@soganiprofessionals.com rohansogani@gmail.com +91-9829029998 CA Rohan Sogani 6th February 2024 26 of 27 CA Rohan Sogani 14th March, 2024

CA Rohan Sogani 22nd December 2023 THANK YOU CA Rohan Sogani 6th February 2024 27 of 27 CA Rohan Sogani 14th March, 2024 Thank You! For More Information, Visit: https://taxmann.com/ Download Taxmann App Follow us on Social Media