6 minute read

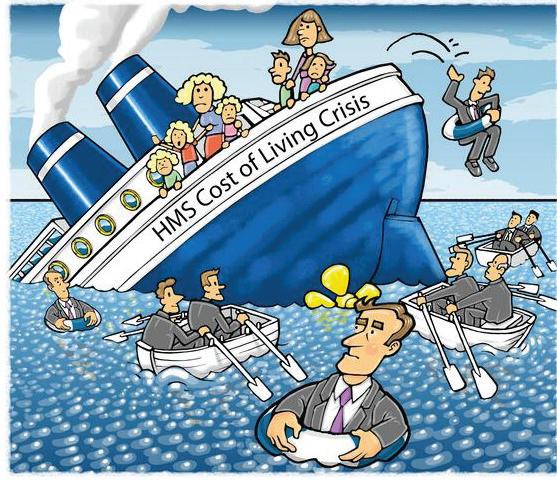

A GLOBAL FINANCIAL TSUNAMI?

The U.S. federal debt ceiling has rung alarm bells in the global financial order. Who are the winners and losers?

Advertisement

As the pivot of the global economy since the end of World War II, upheavals in the U.S. have global implications, with no country able to avoid its negative impacts.

This is hardly surprising, for the U.S. accounts for almost a quarter of the global GDP, one-fifth of the global FDI and more than a third of stock market capitalisation.

As an export destination, the U.S. acts as a receptor for one-fifth of countries worldwide. The U.S. dollar is the dominant currency in global trade and financial transactions. Changes in U.S. monetary policy impact investor sentiment and play a major role in driving global financing conditions.

In the same vein, the U.S. is also not immune to disruptions affecting other economies; growing interconnectedness due to globalisation has ensured this.

The U.S. economy is equally dependent on the growth of the global economy as its giant multinational companies have a worldwide footprint and a presence in every continent.

A LOOMING DEBT CRISIS?

The U.S. hit its debt ceiling in January this year, an event which should concern the global financial order as it impacts its stability. A U.S. default has immediate impacts and could have catastrophic effects on both domestic and global economies.

The current debt has grown due to a range of tax cuts, government funding of wars and a drop in revenues as a result of the 2007-09 financial crises and the COVID-19 pandemic.

This crisis comes when most countries expect a slowdown in economic growth, with smaller countries like Sri Lanka and Pakistan barely afloat.

The debt ceiling or the debt limit is the amount of money the U.S. Treasury can borrow in the form of securities, including bills and savings bonds, to finance existing federal operations.

Over the past two decades, the U.S. has already touched or come close to the debt limits 20 times owing to a range of factors, including higher spending or tax cuts and lower revenues during various economic crises.

In the past, Congress has undertaken a variety of steps to deal with the situation; it has either increased the debt limit to allow for increased federal borrowing or temporarily suspended the debt limit seven times since 2013.

The current debt has grown due to a range of tax cuts, government funding of wars and a drop in revenues as a result of the 2007-09 financial crises and the COVID-19 pandemic. Both these events, the financial crisis and the pandemic, led to monetary and fiscal responses, including slashing interest rates to near zero and stimulus spending to revive the economy.

A combination of these measures has invariably increased the gap between fiscal spending and revenues.

Treasury Secretary Janet Yellen told Congressional leaders that the government had already begun taking “extraordinary steps” to manage cash reserves effectively, which would last until June 5, thereby delaying the default until then.

Playing Politics

There is a political dimension to this economic quicksand as well. The Senate is controlled by the ruling Democrats, while the House of Representatives is held by the Republicans, who have leveraged the debt ceiling issue as a political bargain, demanding cuts on “irresponsible spending”.

A deadlock on this issue would impact investor, and consumer confidence and a spending cut by the government would spiral the economy faster into a recession.

If the U.S. government is unable to meet some of the critical expenses, such as payment to bondholders, it could wind up in default.

This has been cast as a scenario which would cause irreparable damage to the U.S. economy, lead to investor loss of confidence and impact global financial stability resulting in a potential global financial crisis.

The dollar dominates the world’s foreign currency reserves. In case of a default by the U.S., the dollar’s value would strengthen against other countries, creating ripple effects in other parts of the world.

We witnessed the same phenomenon some months back when the Federal Reserve raised interest rates. Even robust economies like China, the second biggest economy after the U.S., would not escape the negative impacts of such an event.

U.S. economists assure the global audience that a U.S. default is highly improbable. Congress will, in all likelihood, reach a deal under which the debt ceiling is raised now in exchange for promises spending cuts later.

A similar scenario was played out in 2011, and this is the outcome that Senate Minority Leader Mitch McCo nnell has forecast.

The U.S. government still has plenty of options to prevent a default, from account ing management to ignoring the debt ceil ing altogether. This could take place on the grounds that it violates the U.S. Constitution’s requirement for timely repayment of all federal debts.

CAN CHINA REPLACE THE U.S.?

A possible global economic meltdown will have many losers, and China will be part of the pile. However, China may not be as badly hit as most other countries because it runs a closed-off financial system that relies mainly on domestic savings and is protected from the swings in global financial instability by capital controls.

In 2008-09, the loss of trade finance and collapse in global demand sent China’s exports plummeting by nearly 20 per cent, and more than 20 million workers lost their jobs, but the behemoth recovered in no time.

The Chinese government plans long-term for all economic pitfalls and would have contingency measures ready to stave off any such catastrophe. It started a massive debt-financed economic stimulus program a decade and a half earlier.

Then, the debt level, at 140 per cent of GDP, was relatively low, and it still had significant needs for infrastructure and housing. However, that option is not so easily navigable today as debt has soared to nearly 300 per cent of GDP, and infrastructure and housing are seriously overbuilt.

The other big question analysts have been asking is if China could create a substitute system built around the yuan, also called the “renminbi.” In case the U.S. defaults.

The possibility seems remote despite Chinese efforts since 2008-09 to internationalise the renminbi. China’s efforts towards transitioning to a global currency have focused on liberalising its control of the yuan.

It has opened yuan trading centres in London and Frankfurt, but obviously, there have not been many takers. The U.S. dollar still dominates global official central bank reserves by a whopping 60 per cent compared to the renminbi, which accounts for just 2.8 per cent.

China’s government bond market is clearly not big, liquid, or integrated enough with the rest of the world to substitute for U.S. Treasury.

China has failed to internationalise the renminbi and remains relatively insulated from global financial shocks. The government still controls the routing of

From the Chinese perspective, this level of insulation is good. If economic conditions worsen in China, it will not be easy for Chinese citizens to take their money out and park it abroad.

And by regulating the inflow of funds into China, Beijing reduces the risk of global financial panic. But this degree of control obviously scares foreign investment in the currency as an alternative to the U.S. dollar.

In a symbiotic relationship with the U.S., China’s demand for Treasurys helps keep U.S. interest rates low. It allows the U.S. Treasury to borrow more at low rates.

It allows Congress to increase the federal spending that spurs U.S. economic growth. Owning U.S. Treasury notes helps China’s economy grow. Demand for dollar-denominated bonds raises the dollar value compared to the yuan.

This boosts demand for Chinese exports as they become cheaper, increasing sales and generating positive cash flows. China is the largest foreign holder of U.S. debt, which may give it some political leverage.

The U.S. Treasurys market remains an indispensable part of the global financial system since the United States can take on financial risks that no other country—even one as big as China—can and manage safely.

There is, perhaps, unfortunately, no alternative. There have been articles in the media about the “China threat”, but this does seem more like a cliché’ than a reality.

Assessment

The global financial order cannot ignore the implications of a U.S. debt default, and unsurprisingly, this has led to a great deal of nervousness in markets globally. The jury is still out on how serious the threat is. Undoubtedly, a default could have major repercussions on domestic and global markets. Therefore, it remains an uneasy calm as analysts examine the options available to the U.S. government.

The two major economies, the U.S. and China, are being pitted against one another in this global economic battle for supremacy. The likelihood of transforming towards a new financial system propped up by the Chinese currency still seems unlikely.

It seems unlikely that there could be a shift away from the U.S.-dominated financial market towards China in the near future. It is more important that American politicians solve the domestic debt problem as soon as possible and avoid negative spill overs instead of working to hype up the “China threat” theory.