QUARTERLY REPORT-Q2

OCT - DEC 2023

OCT - DEC 2023

Welcome to SFM’s Quarterly Report for Q2 (October-December 2023).

As usual, while much of Australia was winding down towards Christmas, the seafood industry was ramping up for its busiest time of year. We were delighted to see visitation for our 36Hour Seafood Marathon reach 149,000 – well in excess of our previous record visitation numbers. This was a fantastic way to conclude the quarter. Further to this, the 2023 calendar year as a whole also achieved record visitation numbers, in excess of 5.5 million. This bodes extremely well for the future of SFM.

As we forge ahead into the mammoth undertaking that the coming year presents for the business, we are equal parts excited and innervated by the prospect of being handed the keys to the new Sydney Fish Market, and look forward to showcasing Australia’s invaluable seafood industry in Sydney’s newest waterfront icon.

Construction of the new Sydney Fish Market progressed significantly in 2023. The year saw about 100 million litres of water drained from the cofferdam to allow for basement level construction, and almost 2,000 truckloads of concrete poured for the basement.

A number of key works were completed in this quarter, incuding the progression of the lower groups and upper ground structures, and continuation of Bridge Road works.

Want to learn more about the new Sydney Fish Market? Click here.

The first half of the financial year saw a particularly challenging trading environment, with supply issues at the end of the calendar year having a significant impact on margin received.

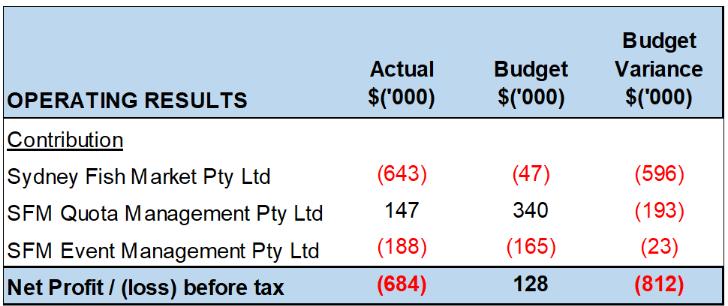

A summary of the financial performance to 31st December 2023 is shown below:

GroupLevel

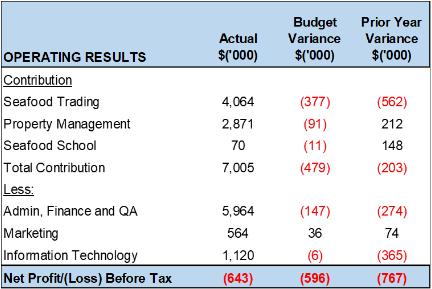

SydneyFishMarketPtyLtd

SydneyFishMarketPtyLtd

In terms of the income generating departments, key aspects are as follows:

December saw a disappointing trading month and although supply has increased over the 6 months from some states, overall there has been a softening of prices, particularly on auction sales.

Site visitation has continued to increase significantly, with 2023 seeing visitor numbers well above pre-COVID-19 figures, however this has had an adverse impact on site operating costs.

The school saw a strong return to profitability, predominantly due to the success of the private class experience offering, targeted at corporates.

NorthCoast

Volumes for December and for the quarter were largely affected by oversupply of crustacea like prawn, and undersupply of lobster. Fresh King Prawn varieties were up in volume, but this in turn had a negative impact on price.

On the flipside, numbers for the region were adversely affected by dwindling lobster supply due to poor weather and strong currents leaving traps empty, as well as a lot of product being sold in Co-Operatives' retail outlets, particularly during the busy holiday period.

Despite Rock Lobster prices hitting an average of $83/kg (12% higher than last year), supply was down almost 50% MTD. Overall value was 6% up for the quarter.

The South Coast showed a pattern of volume decline as the quarter went on, after good results in Q1. Supply of tuna from the South Coast continues to be stronger than the same period last year but the overall output from the region was hampered by a lack of Rock Lobster supply. Supply from the region was also impacted by a vessel heading north to Coffs Harbour chasing Swordfish. These two factors contributed to a decrease in volume of 14.5%.

Inland NSW

Supply of farmed Murray Cod remains constrained as pond restocking continues. SFM visited the Griffith area in October and witnessed the expansion of pond infrastructure, and are therefore confident that the market will see a sharp increase in volume by the middle of 2024. The pattern still shows persistent lower volume, but SFM saw significant increases in pricing (>$3/kg) towards the end of the quarter.

Despite challenging supply conditions, especially the drop in high-priced species like Rock Lobster, NSW held firm with total value increasing 5% for the quarter and now providing 42% of total supply to SFM by value.

SFM visited Tasmania in December, forging strong links with key suppliers and industry stakeholders. Despite the quarter being down 21%, December was in fact up 74% as SFM arranged for more frozen product to be supplied.

Calamari season was flat; after a strong first two weeks in November, bad weather set in, and fishers reported seeing nothing in the water.

A relationship was developed with a new lobster supplier and SFM’s first 150kg Southern Rock Lobster Christmas order went through and was shipped directly into Adelaide. There appear to be plentiful opportunities in this region in live, frozen, and particularly fresh product in 2024.

Melbourne was a flat market throughout the quarter but did supply extra stock to SFM.

SFM visited Port Lincoln in November and established good relationships with suppliers of many species. In particular, SFM are seeing a large increase in Vongole supply and a building awareness of ranched Southern Bluefin Tuna. Calamari catches were standard for the December period and reached normal levels, despite softer prices in the beginning of the quarter. Crab quality was poor for the last half of the quarter, coupled with a large crab boat being off the water in December, and crab catches were down.

QLD supplied volume was strong for the quarter on year prior, while value was lineball. This is a reasonable result when considering the prevailing very soft economic conditions, as demand for high value species such as Mud Crab was much lower. Key species such as farmed Barramundi also have on-going price softness as supply exceeds demand.

Supply of Spanish Mackerel has remained consistent despite another significant quota reduction, but several suppliers are abandoning fishing as Queensland and Federal government reforms begin to impact the fishery.

This region continues to struggle for supplied volume, and turnover for December and the quarter, with both well down on year prior.

While volume traded for the quarter was well above that of the year prior, the value of sales was lower due to a shift in mix towards lower value species such as Sardines, Bream, Hussar, and Red Mullet, which sell for around $6-8/kg and less than the region’s other key species, Western Rock Lobster (approx. $55/kg).

NZ supply for the quarter continued to grow, albeit at a slower rate than previous quarters. Supply from NZ essentially does not meet demand from SFM buyers, both locally and interstate. This led to an overall volume increase of 6% combined, with a 2% increase in average prices and a total revenue increase of 8% over the previous corresponding quarter in 2022.

NZ King Salmon was the best performing species, with a near 20% increase in volume and a price increase of 7%. Other notable species seeing volume growth during December in particular were Bass Groper, Blue-Eye Trevalla, Yellowbelly Flounder, John Dory, and Hapuku.

Snapper was the notable exception, with volume dipping by 14%. Suppliers indicated that a combination of labour shortages during the festive season and poor fish condition was the reason for this decline.

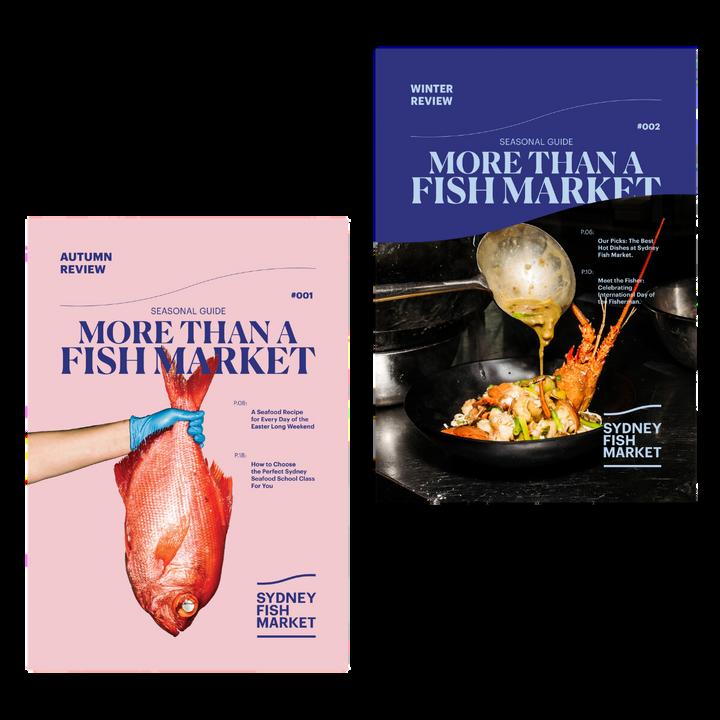

November 21st marked one year since the launch of Sydney Fish Market's new logo and brand identity. The brand, developed in consultation with Interbrand, has come to life over the past year across all of SFM and its sub-brands' marketing touchpoints, and in this time has received positive feedback from industry and consumers alike, including being recognised in numerous categories by Transform magazine in their 2023 ANZ Awards.

As is usual, a large number of media outlets attended Sydney Fish Market to capture the famous 36-Hour Seafood Marathon event. SFM and our spokespeople utilised the significant opportunity provided by this media coverage to promote lesser-known species and local suppliers wherever possible, focusing on bolstering the reputation of the Australian seafood industry in line with the key event peak.

SFM marked World Fisheries Day – a key date in the seafood industry calendar – by hosting the Parliamentary Friends of Seafood event at Parliament House. This event allowed members of the industry to discuss key issues with parliamentarians, as well as showcased the importance of the industry to the Australian economy.

Two members of the seafood industry are the recipients of Sydney Fish Market's Environmental Grant, awarded in celebration of World Fisheries Day (November 21).

Central Coast fisher Mitch Sanders and not-for-profit organisation OceanWatch have been awarded $5,000 each to support the implementation of better environmental practices in their respective areas of the seafood industry. Sydney Fish Market's Environmental Grant is awarded annually to support environmental initiatives in the fishing industry, and this year's winning initiatives are especially timely, addressing both the global issue of abandoned, lost and discarded fishing gear, as well as improving the water quality of Sydney Fish Market's closest waterway, Blackwattle Bay, through a living reef made of oyster shells.

Read more about the winning grant initiatives here.

Sydney Fish Market welcomed the opportunity to submit to the Department of Climate Change, Energy, the Environment and Water's enquiry about offshore renewable energy infrastructure and its potential impact on local fisheries.

Read our submission.

Sydney Seafood School had a slower start to the quarter than anticipated for public class bookings, although these picked up during November and December.

Classic Sydney Seafood School classes such as Seafood Barbecue, Spanish Paella, and Singapore Chilli Mud Crab remain the most popular. A new Mediterranean Odyssey class was also well subscribed.

Guest chef presenters in the period included Christine Manfield, Clayton Wells, Hayden Quinn and Emiko Davies, with Danielle Alvarez also returning to SSS for a sold out class. Our First Nations Christmas class in partnership with National Indigenous Culinary Institute was also fully subscribed.

After a strong marketing push to schools, SSS saw a notable increase in schools’ activity for Behind the Scenes auction tours coupled with breakfast in SSS, short demonstration only classes, and for full hands-on cooking experiences. SSS also reworked its full day schools’ offering in the period with both the student experience and class delivery front of mind.

New merchandise, including bespoke tea towels and paella kits, brought a welcome additional revenue stream for the Christmas period and will be marketed in an ongoing capacity throughout 2024.