Welcome

About The Magazine

Published quarterly to a circulation of 20,000 + industry professionals across Australia, New Zealand and the wider Asia-Pacific region, Supply Chain Insights Magazine is focused on helping you solve the complexities of today's supply chain. The digital magazine highlights the latest trends, operational strategies, technology advancements and best practice within the supply chain and logistics industry.

Welcome to Supply Chain Insights Magazineyour primary source of industry news, focused on innovation, technology and knowledge-sharing in the logistics sector.

In this edition of Supply Chain Insights, we go beyond the contract to examine what truly drives the success, or failure, of supply chain projects. Features Editor Mel Stark unpacks the critical factors that determine project outcomes, offering practical strategies for establishing clear communication, securing stakeholder alignment, and staying agile in the face of unexpected challenges.

Building on this, Bastian’s Stephanie Martinez offers insights from a recruitment perspective and discusses how the right people, supported by strong leadership and a clear plan, is what truly drives outcomes.

In this edition, we also hear from Shippit, who explore how Australia’s carrier network is responding to supply chain pressure in 2025, and DHL Group reveals the expansion of their Electric Vehicle (EV) Centre of Excellence (CoE) network to Australia. Pattern shares insights for brands evaluating new market opportunities during global trade turbulence, and Kmart Group announces plans to open a new Omnichannel Fulfilment Centre to support continued growth.

We hope you enjoy this edition and look forward to your feedback!

For more information or story suggestions, please contact: editor@supplychain-insights.media

For advertising enquiries, please contact: advertising@supplychain-insights.media

Visit our website: www.supplychain-insights.media

Over Half of Australian Carriers Say Last Mile is Their Biggest Challenge, Here’s How They’re Responding

News & Insights

Manhattan Associates

Delivers Powerful New Agentic AI Capabilities to Elevate Customer Experience

Manhattan Associates (NASDAQ: MANH) has announced its latest round of product enhancements, rolling out significant new capabilities across Manhattan Active Omni with updates designed to elevate customer experiences and speed of use.

Manhattan Active Omni continues to evolve with smarter tools for customer engagement, flexible fulfilment and advanced AI-powered support. The expansion of Manhattan Active® Maven for customer service means customer inquiries via chat or email can now be resolved faster, more accurately, and in over 30 languages.

Maven’s new support for order edits, invoice requests, returns, and digital products are already transforming how retailers communicate at scale. Alongside these enhancements, the Contact Centre’s new Customer Service Insights dashboard gives retailers the ability to measure service performance and benchmark it against the industry, while leveraging Agentic AI to uncover trending issues before they escalate.

“Retailers today are managing increasingly complex customer journeys and growing service expectations,” said Raghav Sibal, managing director for Australia and New Zealand at Manhattan Associates. “Our latest release focuses on using Agentic AI to bridge those gaps in real time, whether it’s anticipating order changes, identifying support trends, or enabling frictionless in-store payments. We’re giving retailers the tools to act faster and deliver smarter customer service.”

In retail environments, Manhattan’s mobile Point of Sale (POS) now supports Tap to Pay on iPhone, removing the need for external payment terminals and giving associates more freedom to complete sales anywhere

on the floor. Other enhancements improve item-level promotions, dynamic catalogue filtering, and the ability to flag items requiring customer alerts or age verification, allowing store teams to serve customers faster while improving the overall brand experience.

“In retail and logistics, speed without visibility is a liability. This latest release focuses on bridging those two requirements in real time,” added Sibal. “We’re giving retailers the online and in-store tools to respond faster and operate smarter,” he concluded. ●

For more information about Manhattan Active Omni, click here.

Dematic Boosts Supply Chain Agility with Innovative Shuttle Technology Tailored for APAC Region

Dematic, a global leader in supply chain automation, has announced the launch of its latest innovation in case handling technology, the FD Shuttle system. The highperformance, floor rail-free rack supported automated storage and retrieval solution is designed to meet the growing demands of modern storage technology across the APAC region.

Developed and manufactured locally, the Dematic FD Shuttle system is a stepchange in warehousing and production systems automation. Its lightweight design eliminates the need for traditional floor rail infrastructure, offering unmatched flexibility and rapid deployment for businesses looking

to scale operations, manage seasonal peaks, or streamline high-volume stock keeping unit (SKU) environments.

Capable of handling up to 1,000 cases per hour, with payloads of up to 50 kilograms and storage heights of over 20 metres, the FD Shuttle system delivers outstanding throughput and storage density and scalability. It supports single, double, and triple-deep configurations, and it operates with a wide range of carton, tote, and box sizes, making it ideal for e-commerce, electronics, pharmaceuticals, healthcare, and general merchandise.

“With the FD Shuttle system, we’ve removed some of the traditional barriers to warehouse automation,” says Steve Cheung, Senior Vice President (SVP) – President Asia, China & MEA, Dematic. “Its floor railfree structure provides our customers with significantly faster project delivery timelines and lower total cost of ownership. This solution specifically addresses the unique logistics challenges, diverse market requirements, and operational demands across the APAC region. Our local manufacturing and dedicated regional support ensure supply chain agility, scalability, and reliability.”

As the newest addition to Dematic’s

storage and retrieval portfolio, the FD Shuttle system builds on the success of previous solutions based on the Dematic Multishuttle®, Dematic Miniload, and AutoStore systems. The FD Shuttle system delivers the highest throughput, combining cost effective high-density storage and load versatility with an innovative, floor rail-free design. Its modular and scalable structure provides tremendous flexibility, allowing businesses to adapt faster to changing operational needs in high-demand sectors.

“The FD Shuttle system solves real-world challenges our customers face every day,” adds Cheung. “It relieves the pressures of modern supply chains— managing slower SKUs, rushing out urgent orders, adjusting to last-minute demand changes. It also has the precision needed for handling delicate or high value items with care. With local production and support, it’s a solution that’s built to grow with operations and keep pace with the complexity of the APAC market,” Cheung concludes. ●

more about

Learn

Dematic’s FD Shuttle System here.

Timelapse of BITZER's New Facility in Sydney

HVAC and refrigeration equipment company BITZER has practically completed the facility in St Marys.

HVAC and refrigeration equipment manufacturing company BITZER has practically completed its new 10,000sqm facility and head office in St Marys, Sydney. The new site has increased BITZER’s production capability, including a manufacturing area and significant racking fit-out.

TMX Transform worked on the project end-to-end, including property procurement and project management, along with project partners Prime Projects (NSW) Pty Ltd, Fife Capital, and Next Level Up Construction Services. ●

70% of Frontline Workers Report Rising Concerns with Injuries on the Warehouse Floor

Zebra Technologies, today released the findings of its latest Warehousing Vision Study titled, “Elevating Every Move: The Formula for High-Performance Warehousing.” Frontline workers clearly communicated the benefits of automating warehouse operations and the risks of not automating fast enough.

According to the study, 63% of warehouse leaders plan to implement artificial intelligence software and augmented reality within five years. In addition, 64% plan to increase spending on warehouse modernisation in the next five years, and 63% plan to accelerate their modernisation timelines by 2029.

Interact Analysis projects global warehouse square footage will increase by 27% to 42 billion square feet in 2030 from 33 billion square feet in 2023. Warehouse labour spend is also expected to show longterm expansion projected at a compound annual growth rate of 7% through 2030. As this expansion continues and daily

Transform your next project with TMX Transform’s expertise, click here.

order volumes increase, feedback shared by frontline workers suggests that warehouse leaders will need to move a bit faster to expand workforce capacity:

• 85% of associates say, “If my employer does not invest in technology to improve warehouse operations, we will not meet business objectives.”

• 74% of associates are concerned they are spending too much time on tasks that could be automated.

TIMELAPSE FOOTAGE COURTESY OF PRIME PROJECTS NSW PTY LTD Read

• 72% of associates are concerned about safety on the (increasingly busy) warehouse floor with 70% specifically worried about injuries.

• 69% of associates reported there is a lack of qualified staff on the warehouse floor and express concerns about fatigue and physical exhaustion. ●

As a global leader in temperature-controlled logistics, Americold understands the importance of keeping operations moving. Partnering with the Connected Workforce Solutions (CWSTM) division at Dematic, they modernised their cold chain operations in Australia, upgrading wireless connectivity, voice-picking systems, and RF devices.

The transformation significantly boosted efficiency, accuracy, and productivity. Dematic’s robust solution included meticulous planning and mapping to ensure seamless WiFi coverage and device connectivity, maintaining smooth operations, even in sub-zero conditions.

Learn more at dematic.com/americold

Adairs Unlocks $5M in Annual Savings with Manhattan SCALE

Manhattan Associates (NASDAQ: MANH), the global leader in supply chain commerce, has successfully supported Adairs in transitioning its supply chain operations in-house with Manhattan’s dynamic warehouse management system (WMS) Manhattan SCALE.

As part of a strategic shift, Adairs moved away from a third-party logistics (3PL) model to take full ownership of its supply chain, taking full responsibility for costs, efficiency, and customer experience. This transition required the rapid deployment of WMS, and following a comprehensive evaluation, Manhattan SCALE was selected for its flexibility, automation integration, and omnichannel capabilities.

“Bringing our supply chain in-house was a major decision, driven by our desire for greater operational control and the ability to better serve our customers,” explained Justin Dowling, General Manager of Supply Chain at Adairs. “We wanted an off-the-shelf, ready-to-go solution that could be implemented with minimal customisation, and Manhattan SCALE has provided the successful technology backbone for this transition, allowing us to streamline operations,

improve inventory management, and scale effectively for peak demand."

The implementation of Manhattan SCALE was completed in just 12 months, with the system going live in July 2024 and the transition has already driven significant improvements across Adairs’ operations.

The

retailer has delivered an additional one million units to retail stores compared to the previous year, experienced a 24% increase in ecommerce order fulfilment, and processed 17% higher inbound volume.

The move has also resulted in significant cost savings, with Adairs reporting $5 million in annual savings. The enhanced system capabilities have enabled the company to consolidate its distribution operations and optimise its logistics network. Now, all orders, whether from online channels, retail stores, or corporate customers, are fulfilled from a single distribution centre, improving stock availability and ensuring a more seamless supply chain operation.

This three-way partnership ensured that the system was designed with real-world warehouse operations in mind and aligned with Adairs’ strategic goals. “This was not just a technology

project, it was a supply chain transformation,” said Justin Dowling, General Manager Supply Chain, Adairs. “From day one, our teams worked in close partnership with Manhattan to develop a solution that would not only meet our immediate needs but also future proof our operations.”

By prioritising operational input, Adairs successfully minimised disruptions during go-live and ensured rapid adoption among its warehouse staff and the system’s intuitive interface improved training efficiency, making it easier to scale labour for peak demand periods.

“Retailers need a supply chain that can support rapid changes in customer expectations while driving operational efficiencies,” said Raghav Sibal, Managing Director, ANZ, Manhattan Associates.

“By

implementing Manhattan

SCALE, Adairs has taken a proactive approach to modernising its operations and creating a more agile, resilient supply chain.

We’re proud to have played a role in Adairs’ transformation and look forward to supporting its continued growth.” ●

For more information, click here.

Metcash Modernises Distribution with Dematic Automation at Truganina

Metcash is one of Australia’s leading wholesale distributors, supplying independent retail brands such as IGA, Foodland, Cellarbrations, Mitre 10, and more.

With a strong national footprint and a focus on supporting local communities, Metcash plays a vital role in helping independent retailers stay competitive in a dynamic market.

Looking to future-proof its Victorian supply chain operations, Metcash set out to consolidate its fragmented infrastructure into a single, modern distribution centre (DC) in Truganina. By partnering with Dematic, Metcash implemented a goodsto-person (GTP) automation solution powered by Multishuttle technology, designed to lift efficiency, reduce operational costs, and create a scalable foundation for growth.

Upgrading an aging, fragmented network

For many years, Metcash’s Victorian operations were spread across a multi-shed facility in Laverton, supporting its grocery, liquor, perishable, and convenience businesses. While functional, the site relied on a mini-load automation system installed nearly two decades ago. As the system aged, sourcing spare parts became a growing challenge, and operational efficiency began to suffer. The site’s fragmented layout also made it harder to streamline processes and keep pace with rising demand.

Recognising the limitations of their legacy setup, Metcash made the strategic decision to bring its operations together under one roof. The goal was to build a modern, integrated DC that could improve picking speed, simplify workflows, and provide the flexibility needed to support continued growth across multiple retail channels.

“The challenges of operating across multiple sites made it clear we needed a smarter, more integrated solution,” says Victor Cleves, Head of DC Automation and Design at Metcash. “Bringing everything under one roof was about creating a foundation that could support both current demands and future expansion.”

Delivering a scalable, future-ready solution

Dematic was selected to deliver a highly flexible, compact GTP automation solution tailored for Metcash’s new 115,000 square metre distribution centre. At the core of the system was a highdensity Dematic Multishuttle, initially built with seven active pick stations and the ability to add an eighth as the business grows.

Dematic’s patented Inter-Aisle Transfer (iAT) technology provides high storage, retrieval, and picking flexibility, allowing bins to be dynamically shuffled, ensuring every pick station could access any stock keeping unit (SKU) in the system. This active flexibility was critical for enabling Metcash to ramp operations up or down as needed based on demand.

To support dispatch operations, Dematic installed Flex Shuttles in the sortation buffer, allowing Metcash to efficiently manage cartons of varying sizes and fulfil a wide range of customer order profiles. The Flex model uses advanced load handling technology, with flexible arms that adjust to different product sizes and gently grip items without needing trays. This flexibility was key to meeting Metcash’s diverse storage and picking needs, helping to maximise storage density and throughput within the site’s space constraints. It also ensured orders were processed in time to meet tight truck dispatch schedules and route commitments.

The system was also designed to handle liquor, a key requirement during the tender process. Dematic conducted successful live trials with wine bottles to validate the system’s ability to manage fragile

and varied product formats, giving Metcash added confidence in the solution’s capabilities.

“Operator wellbeing was also a key focus for our business,” Cleves explains. “Dematic’s Gen3 pick stations, especially the adjustable platforms and powered lift-and-rotation tables, made a huge difference in ergonomics and safety. It’s been a real game changer for our team.”

Integration was another crucial factor in the project’s success. The Dematic system was engineered to interface simultaneously with two distinct warehouse management systems (WMS), one managing Metcash’s grocery operations and the other for its liquor division. With demonstrated expertise in multi-system environments, Dematic approached the integration with confidence. This capability was critical for Metcash. Overcoming these technical hurdles was key to guaranteeing Metcash could streamline operations within the new Truganina facility and lay the foundation for future scalability.

Executing a seamless transition

Metcash’s transition to Truganina was carried out in four stages, including a dedicated phase for the automation cutover. Operations at the Laverton site ceased completely on a Thursday. By the following Monday morning, the new Truganina facility was live, operational, and fulfilling orders.

“This was a high-pressure transition that required careful planning, strong operational discipline, and a lot of support,” says Cleves. “Dematic delivered months of structured training and hands-on commissioning, gradually bringing our team into the process. By the time go-live came around, our operators had already been running parts of the system themselves, so they were confident and ready.”

Dematic’s service team worked weekends and ran double shifts to prepare the site, ensuring every element of the system was tested and optimised.

“Three experienced technicians who had supported Laverton were transferred to Truganina, bringing invaluable knowledge.

Delivering on time was only possible through close collaboration between Dematic and Metcash, with both teams fully aligned and working in sync throughout the lead-up to go-live.

“They [Dematic] knew the Metcash team and the systems inside out. That familiarity helped immensely during go-live,” explains Terry Jamieson, Business Development Manager, Dematic.

Despite the enormous complexity of the transition, the new site began fulfilling orders from day one without disruption. The result was a seamless transformation of Metcash’s Victorian supply chain, executed with zero downtime to customers.

Customer service and support

Dematic’s strong local presence in Australia and New Zealand was instrumental not only in securing the Truganina project but also in ensuring its success during and after implementation. With more than 345 service professionals across the region, including engineers, technicians, spare parts specialists, and a dedicated modernisation unit, Dematic provided the kind of rapid, reliable support that Metcash required.

“Having a strong local service team was a huge advantage for us,” says Andrew North, Metcash Victorian State Logistics Manager at Metcash. “It meant we had immediate access to the support we needed, whether it was for technical advice, parts, or on-site assistance. That level of responsiveness gave us real confidence during the transition and set us up for long-term success.”

The transition was also strengthened by continuity in personnel. Several technicians who had long supported Metcash at the Laverton site were transferred to the new facility, ensuring valuable institutional knowledge wasn’t lost.

Delivering long-term value

Since implementation, Metcash has realised significant performance improvements. The higher pick rates have enabled the company to consolidate operations into a single-shift model, enhancing resource utilisation and driving greater cost-efficiency. The system’s built-in redundancy has mitigated the risks previously posed by the older crane-based miniload setup, ensuring more reliable access to inventory.

Dematic also introduced a Lifecycle Cost Plan, providing Metcash with a clear forecast of expected capital expenditure and maintenance costs over five, ten, and fifteen years. This forward-looking approach allows Metcash to better plan and budget for future system upgrades, maintenance activities, and replacement parts, reducing the risk of unexpected costs and helping to protect the longterm performance of the automation investment.

“The new system has allowed us to significantly improve efficiency and better manage our labour requirements,” says North. “The visibility we now have around long-term maintenance and planning also means we can be more proactive with our servicing schedule and allows us to react quickly to retailer and market needs.”

Dematic’s relationship with Metcash continues through ongoing site support and modernisation projects. “The solution we put forward at tender is exactly what we delivered, which confirmed we had a strong understanding of what was needed from day one,” concludes Jamieson.

“We’ve worked hard to be the partner Metcash can depend on, from design through to daily support, we’ve built something together that’s not just functional, it’s future-proof.” ●

Find out more about Dematic’s GTP solutions here click here.

Wearables are Powering the New Age of Customer Fulfilment

The e-commerce boom isn’t slowing down any time soon, and heightened customer expectations are putting immense pressure on retailers and the supply chain to deliver more parcels faster than ever before.

20.1% of all retail purchases in 2024 are set to take place online, with the global e-commerce market expected to total over $7.9 trillion by 2027.

Today’s customers expect to receive or pick up their orders in record time, including same-day and two-hour windows. This expectation is blurring the line between warehouses and retail stores, with orders no longer being fulfilled from warehouses alone, but increasingly from the back of stores and micro-fulfilment centres located closer to customers.

Picking has also become a full-time job. To keep up with demand, workers must fulfil orders faster and faster, meaning the speed and accuracy of workflows have never been more important.

So, how are businesses coping with these ever-increasing demands? The answer is technology.

Warehouse and logistics leaders are always looking for ways to give their workers an instant productivity boost, process more orders, increase order accuracy, and meet the fastest delivery times, and one area seeing a huge investment is wearable technology.

Wearables are designed to keep workers’ hands free, as opposed to traditional handheld devices. Worn on either the wrist, hand or finger, these tiny powerhouses enable workers to pick and pack orders, load trailers, and move boxes faster than their handheld counterparts, moving packages through the supply chain faster and in safer conditions. This has critical effects for businesses further down the chain. For example,

retailers can move incoming shipments from the dock to shelves faster, so more products are available for in-store and online customers to purchase.

What happens when businesses don’t have the right technology to support their workers?

The increasing pressure on workers to process more orders in a shorter amount of time is one reason labour shortages are rife in the logistics sector. In short, people don’t want to work for a company that doesn’t equip them with the right technology to meet increasingly strict deadlines.

These “disconnected” workers are forced to take more steps and need more time to complete a task, eroding operational efficiency and making it harder to compete in today’s on-demand economy. For example, they might not know what their next task is or how to communicate with their colleagues without physically locating them, which creates an unnecessary burden on them.

An impressive 93% of warehouse associates agree that new technologies are essential for attracting and retaining talent, according to Zebra’s 2025 Warehousing

Vision Study, signalling a major shift in workforce priorities. Modern devices like wearables have become essential for simplifying tasks, reducing physical strain and ensuring smooth integration with automated systems. This connectivity enables workers to make more informed and faster decisions. As a result, the demand for technology has become a defining factor in the labour market, with today’s workforce viewing it as a valuable ally in creating a safer, more productive and satisfying work environment.

Zebra offers the widest range of wearables in the market, including the newly-launched WS501, the world’s smallest all-in-one Android enterpriseclass wearable mobile computer. Offering a range of mounting options (hand, wrist and finger), Zebra wearables meet the needs of practically any warehouse and logistics application, whether it's order picking, inventory put-away, loading and unloading shipments, or task management. ● ●

Learn more about Zebra’s range of wearables for warehousing and logistics here

Kmart Group Announces New Omnichannel Fulfilment Centre In Moorebank

KMART AND TARGET CEO JOHN GUALTIERI IS JOINED BY DEPUTY PREMIER AND MINISTER FOR WESTERN SYDNEY PRUE CAR FOR OFFICIAL OPENING

Kmart Group has announced plans to open a new 100,000 m² Omnichannel Fulfilment Centre at ESR’s Moorebank Intermodal Precinct, New South Wales. The facility will support the continued growth of both Kmart and Target by expanding distribution capacity and enhancing both customer and team member experiences.

Scheduled to be operational by the end of 2027, the facility will transform Kmart Group’s supply chain in New South Wales through a modern omnichannel fulfilment capability. It will enable increased capacity to support future growth, better availability for customers, better safety outcomes for team members and provide faster delivery times both to stores and customers.

Kmart and Target CEO, John Gualtieri, said the investment in the new Moorebank Omnichannel Fulfilment Centre will be an important part of the business’ long-term strategy to modernise its supply chain and simplify store operations.

“This commitment is an exciting milestone and represents a significant investment in our future supply chain. By modernising our fulfilment

capabilities, we’re increasing speed, efficiency and flexibility across our network. Ultimately, this is about delivering even more value to our customers, which is central to who we are,” said Gualtieri.

He also highlighted the continued importance of a strong store network matched by online in the Group’s growth strategy, something he also acknowledged was a key differentiating strength that the Group would continue to build on.

“With nearly 450 stores across Australia and New Zealand, our store network for Kmart and Target remains a core part of our customer offering,” added Gualtieri. “This new facility is key to delivering a seamless omnichannel experience, ensuring customers receive the products they need, when and how they want them. Whether shopping online or instore, our goal is to provide great quality products at the lowest prices, and this facility will help us do that more efficiently than ever.”

The entire Moorebank Intermodal Precinct, comprising 12 tenants including Kmart, is projected to deliver $11 billion in economic benefits over the 30 years following completion, including $3.6 billion to the economy of Southwest Sydney.1

The Precinct is expected to create more than 1,300 construction jobs during construction

phase, and once fully operational, it is projected to support approximately 6,800 direct and indirect jobs, including over 500 at Kmart Group – which will primarily consist of existing team members transferring to this new facility.

The new Omnichannel Fulfilment Centre has been designed targeting a minimum 5 Star Green Star v1.3 rating and incorporating smart lighting controls, water reuse systems as well as a thermally responsive colour palette.

Located within the Moorebank Intermodal Precinct, reported as Australia’s largest intermodal logistics hub, Kmart Group will further advance its sustainability objectives through rail-based container transport that significantly reduces road freight emissions, while contributing to and benefiting from the Precinct’s broader environmental initiatives, including a 100-hectare protected conservation area.

The Hon. Prue Car, Deputy Premier and Minister for Western Sydney, joined Kmart Group at the official announcement:

“The Precinct is a major boost for the local community, creating hundreds of jobs and contributing to the long-term economic growth of south-west Sydney. This will create opportunities for local workers, and I am pleased this investment will mean local families benefit from long-term employment close to home.”

Phil Pearce, ESR Australia & New Zealand CEO, and Deputy CEO ESR Group said: “We’re delighted to welcome Kmart Group to Moorebank Intermodal Precinct, a nationally significant logistics hub purpose-built to power Australia’s future supply chains. Kmart’s new facility reflects the strength of Western Sydney as a destination for investment and job creation, and it underscores the role Moorebank will play in delivering long-term economic, environmental and social benefits to the region.”

James Baulderstone, National Intermodal CEO said: “The Moorebank Precinct was created to enable companies like Kmart to invest alongside the Australian Government and play an essential role in modernising our nation’s critical supply chain by providing essential products to homes and families securely and affordably. Kmart Group’s decision to locate such an important part of its distribution network to Moorebank is a further endorsement of this long-term vision and we look forward to working together.”

The new Moorebank facility marks a significant milestone in Kmart Group’s ongoing investment in Australia’s retail and logistics future, strengthening the Group’s ability to serve millions of customers across the country every week. ●

The Formula for HighPerformance Warehousing

In today's rapidly evolving warehouse landscape, the pressure to deliver operational excellence has never been more intense. Warehouses have transformed from backend support functions to strategic drivers of business performance. As supply chains become increasingly complex and customer expectations continue to rise, businesses face the challenge of embracing technological innovation while maintaining practical, sustainable operations.

Zebra‘s new 2025 Warehousing Vision Study surveyed 1700 decision-makers and employees in the sector. The survey revealed a strong investment in automation and workforce enablement technologies to increase efficiency and productivity. Those who act swiftly will not only keep pace but set the standard for next-generation warehousing.

This modernisation is fuelled by the need for greater visibility across the supply chain, faster order fulfilment, and a lower margin of error. Businesses that invest in modern, integrated systems now are creating warehouses that are not just efficient but also agile and scalable, setting the pace for the future of warehousing.

The pressure to modernise operations is only intensifying, with 70% of decision-makers surveyed acknowledging its urgency. In response, 65% plan to increase funding in warehouse modernisation over the next five years. With customers demanding shorter delivery timeframes than ever before and labour shortages crippling the supply chain, organisations who fail to invest in technology risk falling short of their business objectives.

Tech Boosts Employee Satisfaction and Reduces Errors

89% of surveyed warehouse employees report they feel more valued when they are provided with automated technology tools, while 74% reported they spend too much time on tasks each day that could be automated. These insights highlight a growing opportunity to empower workers through technology and automation. By reducing repetitive or physically demanding tasks, technology can improve workers’ morale and maximise their output.

Error mitigation also remains a top priority for warehouse leaders, given that small mistakes can cause significant efficiency and cost implications, with 71% of decision-makers citing error reduction as their primary driver for automation. Automating basic

tasks allows warehouses to maximise productivity in high-volume processes such as picking, packing, and shipping, while reducing the overall number of errors.

AI Is Powering the Warehouse Revolution

Artificial intelligence (AI), augmented reality (AR), and predictive analytics are rapidly emerging as foundational elements for future-ready warehouse strategies, offering outcomes that extend beyond automation. From predicting stock shortages to preventing safety incidents, AR and AI enable intelligent, real-time decision-making across operations. With 63% of decision-makers planning to implement AI and AR, it's clear that businesses recognise their long-term value.

These technologies help warehouse operators optimise workflows, improve accuracy and make smarter, real-time decisions. For example, AI on handheld devices can identify safety hazards, refine quality control by spotting anomalies and optimise inventory by forecasting demand and maximising space. The shift to data-driven decision-making is empowering warehouses to become more responsive and proactive, rather than reactive.

In the next five years, 57% of decision-makers plan to implement machine learning, 65% intend to utilise predictive analytics, and 68% will introduce generative AI. They see the most impact in areas such as safety, quality control, and inventory management. By linking these technologies directly to measurable outcomes, such as fewer workplace incidents or improved stock availability, the return on investment becomes more tangible and compelling.

Overall, while advanced tools like AI are definitely on the rise, foundational solutions such as inventory and asset visibility still remain essential for maintaining strong operations.

By integrating innovative AI technologies with existing processes, warehouse operators can remain agile, efficient and ready to adapt to market demands.

Warehouse Workers are Embracing Technology

Frontline workers' relationship with technology has transformed dramatically in the last decade. With a growing affinity for technology, employees increasingly view it as a powerful tool to improve accuracy, safety and productivity, and many are actively advocating for its adoption. This shift underscores the deep integration of technology into daily life, reshaping workforce expectations and fostering enthusiasm for new advancements.

An impressive 93% of employees agree that new technologies are essential for attracting and retaining talent, signalling a major shift in workforce priorities.

Modern devices like wearables, mobile computers, and mobile robots have become essential for simplifying tasks, reducing physical strain, and ensuring smooth integration with automated systems. This connectivity enables workers to make more informed and faster decisions. As a result, the demand for technology has become a defining factor in the labour market, with today's workforce viewing it as a valuable ally in creating a safer, more productive and satisfying work environment.

Decision-makers are seizing this opportunity by providing employees with cutting-edge technology and investing in training and upskilling programs. These initiatives ensure that staff aren’t just handed new tools, they are empowered to use them confidently and effectively. This leads to smoother transitions, higher adoption rates, and better outcomes.

Accelerating Warehouse Modernisation

If the pace of change wasn’t already fast enough, 63% of decision-makers actually plan to accelerate their modernisation initiatives in the next five years through investments in labour optimisation, AI and workflow automation. Companies are prioritising visibility and streamlined processes, recognising that aligning new technologies with clear business objectives is key to achieving efficiency and performance gains.

While these advancements promise enhanced visibility, cost savings and error reduction, modernisation also comes with challenges like team coordination, tech support and legacy system integration. By addressing these obstacles strategically, businesses can build a resilient foundation for sustained success.

Opportunity-Driven Warehousing

Warehouse leaders may not control the pace of change, but they can turn it into a competitive advantage. Strategically investing in technology can enhance decision-making, streamline workflows and build a foundation for sustainable growth. Success comes from combining innovative tools with a skilled workforce, where human-centric automation empowers frontline workers to excel. By aligning people, processes, and technology, the warehouse transforms from a traditional fulfilment hub into a powerful driver of efficiency and long-term growth. ●

Learn more about Zebra’s 2025 Warehousing Vision Study here.

Key Factors That Can Make or Break a Supply Chain Project

WRITTEN BY STEPHANIE MARTINEZ, PARTNER, BASTIAN

If there was ever any doubt about the critical role supply chains play in business durability, the disruptions over the last 5 years have certainly obliterated it. Supply chain has exponentially shifted from a behind-the-scenes function to a board-level priority. Businesses now recognise that strong yet adaptable supply chains are not just operational necessities, they're strategic imperatives.

This shift has led to an explosion of supply chain transformation projects: from digitalisation and sustainability initiatives to regionalisation and risk mitigation strategies. But while the appetite for change is high, the success rate remains mixed.

As a recruiter who specialises in supply chain talent, I've had a front-row seat to both the successes and the failures. Time and again, I’ve seen the same factors emerge as the difference between a project that hits its targets and one that struggles

to stay afloat. Here’s what I’ve consistently seen set successful projects apart, along with insights from experts in the field.

Senior Executive Direction & Buy-in

No supply chain project can succeed without clear, committed leadership. When senior executives genuinely support a project, not just with funding but with time, attention, and internal advocacy, the momentum and clarity it brings are immeasurable. From a recruitment angle, I often look at how a project is positioned internally.

Is

there a clear vision communicated to the

team? Are stakeholders aligned? If the leadership isn’t driving the project with purpose, even the best talent will struggle to deliver results.

"In my experience, the best senior leadership visits to site were those with candid, honest conversations on the shop floor, rather than running formal presentations. A true servant leadership approach does more than remove roadblocks; it builds trust, strengthens alignment, and genuinely demonstrates committed leadership." – Sam Gualtieri, Supply Chain Strategy & Program Manager, FMCG

“I’ve found if a sponsor really believed in a project and wanted it to succeed, they will find the time and energy to support it. I had a great example at Coca-Cola Amatil, where the Supply Chain Director at the time really supported innovation - so we were able to run a Hackathon. It was very successful, and he was able to host the event and create support from areas we wouldn't have been able to access without his involvement.” – Julie Cox, SAP Delivery Manager, Endeavour Energy

Clarity of Scope and Objectives

Vague or shifting objectives are a silent killer of supply chain projects. A lack of clarity breeds confusion, scope creep, and misaligned KPIs.

The best candidates ask probing questions about project goals before they accept an assignment. If the answers are woolly, it’s a red flag.

My advice to hiring managers: if you can’t explain your project's purpose in a paragraph, you’re not ready to recruit for it.

"Hiring without a clear project mandate is like assembling a

team for game day with no rules.

Talent alone can’t compensate for ambiguity, and if left unresolved, I’ve found team members will tend to fill the gap with their own conflicting interpretations, including roles and responsibilities.” – Sam Gualtieri, Supply Chain Strategy & Program Manager, FMCG

“Create your requirements prior to embarking on the software selection process.

If you have multiple sites with nuanced/ differences in requirements, ensure you understand the degree of difference prior to software design. Make certain as an organisation that there is explicit internal agreement on the degree to which customisations are tolerated, or processes must change to enable a vanilla implementation. In a global design, minimum requirements must have nuances built in if required.” - Sadie Thomas, Director, SBT Consulting

Cross-Functional Collaboration

Supply chain projects touch every part of the business, from finance and IT to sales and customer service.

Success hinges on how well these departments work together.

The best talent I place are those who can act as bridges across functions. It’s not just about technical

skills, it’s about communication, diplomacy, and influence. If your team is siloed, bringing in people who can break down barriers is vital.

"The catalyst for getting any project off the ground is when different functions effectively converge around a clear objective.

It’s at that intersection where the magic happens and business cases come to life. I learnt this very early on in my career and has held true in every capital request I’ve led.” – Sam Gualtieri, Supply Chain Strategy & Program Manager, FMCG

“You can't put a purely technical person in front of all areas of the business. Knowing how to change the language to suit the audience is crucial, not just in supply chain.” Julie Cox, SAP Delivery Manager, Endeavour Energy

Change Management and Communication

A technically perfect solution will still fail if no one uses it properly. That’s why change management is a non-negotiable component of supply chain projects.

Too often, we see companies treat communication as an afterthought. The reality? Your people need to know why a change is happening, how it affects them (for the better), and what support they’ll receive. Investing in change leaders and internal comms specialists is money well spent.

"In my experience, projects of any size often struggle during execution if stakeholders haven't been engaged from the outset. A key success factor is integrating a skilled operations lead early on, someone who understands the inner workings of the factory and can assist with effectively communicating changes, facilitate training, and ensure a smooth ramp-up." – Sam Gualtieri, Supply Chain Strategy & Program Manager, FMCG

“User engagement is key to success. If the users are stressed because they weren’t properly trained on the software, or if issues pop up due to poor testing, they’ll reject the system. The reputation cost to a project is far greater than any delay caused by extra training and testing.” - Sadie Thomas, Director, SBT Consulting

“Change needs to be included up front in scoping of the project. It can make or break your project.” Julie Cox, SAP Delivery Manager, Endeavour Energy

Final Thoughts

Supply chain projects are inherently complex, but their success often comes down to human factors. Having the right people, supported by strong leadership and a clear plan, is what truly drives outcomes. ●

Planning Beyond the Contract: Keys to SuccessfulDelivering Supply Chain Projects

SUPPLY CHAIN INSIGHTS FEATURE

Simply signing a contract doesn’t guarantee its success. It also takes strong communication, steadfast strategy, and a willingness to adapt to change.

Supply Chain Insights highlights the key factors that can make (or break) a supply chain project, and the strategies to see things through.

A successful supply chain project requires clear communication, stakeholder engagement strategies, strong corporate values, and personnel dedicated to keeping projects on track in the face of changing environments and scopes of work.

According to Jennifer Horton, Director of Projects and Sites for supply chain solutions provider, Dematic great teamwork, clear communication and rigorous processes are crucial to success in supply chain projects.

“When project teams are formed, they start their project journey early, and they plan together. They think creatively, they respect each other, they get excited for the journey ahead, and then when they've got that excitement, they deliver successful projects,” she says. “When I talk about project teams, I'm not just talking about within Dematic. I'm talking about the team that forms between the client and Dematic as a partnership. When they come together, they're delivering a project for that client, and they see that the outcome is a joint effort. It's not just us and them.”

So, what contracts, priorities and processes are the key to success?

“It’s important to make sure that, from a process standpoint, there's enough due diligence done before the project starts.”

RAGHAV SIBAL, MANAGING DIRECTOR ANZ AT MANHATTAN ASSOCIATES

Ensuring Success Beyond the Contract

For a project to deliver its intended value, there are factors beyond the contract which supply chain leaders should stay aware of. As much as any business would like it to be so, a watertight contract doesn’t always lead to a seamless project.

Supply chain projects are often cross-functional, involving a range of teams and stakeholders from within the warehouse to global boardrooms. Therefore, ensuring they are all on board is paramount to success.

“It’s important to make sure that, from a process standpoint, there's enough due diligence done before the project starts,” says Manhattan Associates Managing Director ANZ, Raghav Sibal.

“The last thing we want is to be working towards certain goals before finding the overall high level end-to-end process is not fully defined, and here we are designing at a more detailed level what a solution can achieve.”

To remove the occurrence of misalignment along the chain, TMX Director of Program & Transformation Management, Alvin Fernandes, highlights the value of specialist roles to monitor project development.

“Implementation success coaches can accelerate delivery, remove roadblocks and ensure the right stakeholder and SMEs are included throughout the process. The involvement of business-as-usual employees owning part of the transformation is crucial in ensuring success and embedment postimplementation,” he says.

Similarly, Dematic’s Jennifer Horton says involvement in a project should not be limited to managers and board members, but everyday employees too.

“If the end users are included in the project journey, and the associated change, and they see the operational value in the system – ie. how the system can benefit their daily life and the organisation – then the project will deliver what it was intended to deliver, because they feel some ownership,” she says. “When they're proud of the facility and they feel they've contributed to it, then they’ll want to own their success and want it to work well. This will all contribute to the project delivering its intended value.”

Keeping Stakeholders Engaged and Aligned

The supply chain is arguably the broadest industry in the world, and as such, most projects involve a complex array of stakeholders. These perspectives can be used to develop a holistic view of any business and implement projects which benefit countless employees. On the other hand, transformational supply chain projects also challenge stakeholders to consider both their team and company-wide improvement.

The finance team is concerned with return on investment, the operations team needs solutions to improve daily processes, and the C-Suite needs everyone to get along and commit to success.

“Different stakeholders have different lenses to define success,” TMX’s Alvin Fernandes says. “Good project governance is the key to defining success criteria. Doing so and managing these with flexibility within a framework will balance the outcomes and ensure all stakeholders have the same direction of travel from the onset.”

According to Parth Thakker, Sales Leader Software Solutions at Zebra Technologies sometimes misalignment within a customer’s hierarchy needs to be addressed before a project can continue.

Business

leaders often raise different priorities because their own performance is based on different metrics. When they combine on the same project, a clash of ideologies may happen and the project’s timelines and budgets may blow out to accommodate all parties.

Manhattan’s Raghav Sibal adds: “One thing that really differentiates a successful project from a project that will take longer and cost more money,

is that the scope is not managed properly. If the end goal and the vision of what we're trying to achieve is not well defined upfront, the scope just keeps growing, and we end up with what is called scope creep.”

Zebra’s Parth Thakker outlines his approach to avoid scope creep and improve stakeholder engagement.

“It's best to start by building a consensus before the project begins,” he says. “I'm a big believer of a structured engagement on whatever project that you're delivering. This includes formal kickoffs, steering committees, and weekly progress reports – think of it as running a large, multi-million dollar deployment, instead of just a small pilot project. It's equally important to be able to educate on what happened last week, what's happening this week, and the stepping stones required to ultimately deliver results.”

Adapting to Change Mid-Contract

Just as watertight contracts don’t guarantee success, they’re also not immune to changing midway through a project. According to Dematic’s Jennifer Horton, change is “inevitable on any project, so it’s crucial to ensure the right support is put in place to manage it.”

A 2021 Gartner survey found that ‘Resistance to change from decision stakeholders’ posed the greatest challenge to successfully executing supply chain transformation.

"Large transformational programmes are multiyear journeys where the business will change significantly before reaching the end point," TMX’s Alvin explains. "You have to implement stage gates to reassess what's changed between each phase. It's like going to a supermarket without a shopping list - what you thought you needed at the beginning is completely different by the end, because you don't know what you need to plan for during the week."

To ease the fear of change within an organisation and make transformation a more successful process,

Raghav recommends installing a single authority who can manage changes in the project scope.

“Designating a design authority, scope manager or change manager can become super important because then everything has to flow through that one individual and all approvals are made in one place,” he says. “Without them, requests come from five different directions, everyone wants the world and the project spins out of control. Performing a costbenefit analysis of any change in scope is important because certain changes are good and valuable for the business while others hinder the process.”

Change can also occur not as a result of stakeholder input, but in response to new findings over the course of the project.

Data may change, new research may be released, or demand for the type of transformation may dissipate.

For this reason, Parth says each project should be built with a strong change management component rather than including it as an afterthought.

Warning Signs and How to Address Them

While changes in direction can enhance a project and reveal helpful insights for the future, they can also threaten the project’s success. Of course, project teams can do all their due diligence, keep stakeholders aligned, and maintain agile processes headed by expert change managers. However, none of these measures can absolutely guarantee success and it’s important to recognise when results start to skew.

All four industry experts agree that regular meetings to compare and contrast KPIs are the best measure against project failure.

“I'm a big believer of a structured engagement on whatever project that you're delivering.”

PARTH THAKKER, SALES LEADER SOFTWARE SOLUTIONS, ZEBRA TECHNOLOGIES

“Change is inevitable on any project, so it’s crucial to ensure the right support is put in place to manage it.”

DIRECTOR OF PROJECTS AND SITES, DEMATIC

“Large transformational programmes are multi-year journeys where the business will change significantly before reaching the end point.”

ALVIN FERNANDES, DIRECTOR OF PROGRAM & TRANSFORMATION MANAGEMENT, TMX

JENNIFER HORTON,

“Having strong and consistent project processes or frameworks is the starting point for a healthy project,” Jennifer says. “Prior to the project starting through that sales phase, we’re identifying risks in the project, and keeping open communication internally as well as with the client, as a critical step in risk mitigation.”

Some of the warning signs shared by the experts interviewed include subdued stakeholder engagement, consecutive reports showing limited progress, or the pace of progress in an agile workflow decreasing substantially.

"The worst call you want to get is that escalation from your stakeholder," Zebra’s Parth notes. "When things do go off course - and that's normal - the best intervention is to admit what happened and bring in what I call a 'tag team' approach. You need someone to run the project like they're the CEO of it, bringing all stakeholders together with daily touchpoints until you're back on track."

If any warning signs appear, then a predetermined escalation path should be activated, and a realignment session may be required.

“The challenges are made clear to the stakeholders ahead of those sessions, so that when they come together, it's a quick meeting,” Raghav adds. “We don't want these sessions to become big deliberations because alternatives should have already been discussed.”

Yet another example that communication is key when it comes to supply chain success. From the design phase, through building and execution, plenty of supply chain projects can shift from their original plans. What’s far more important to success is having the plans in place to respond to new information and maintain a course to completion, as a team and as an organisation. ●

Automation and its Role in Accelerating Postal and Parcel

Reinvention is underway in the postal and parcel sector and automation is playing a significant role.

Labor shortages and rising costs have fast-tracked automation, with robotic sorting and autonomous deliveries becoming more appealing. But transformation also unlocks growth, efficiency, and competitive edge.

TMX Director of Supply Chain, Max Reynolds, says while customer experience and preference for choice and convenience grows, operators need to consider the technology required to facilitate that delivery.

“While consumer expectations keep rising, we’re also seeing a greater willingness to pay for premium service,” said Reynolds. “Giving customers the option to choose a delivery window, rather than simply pushing for speed, can help to avoid failed deliveries. But that flexibility relies on the ability to hold or buffer items until they’re ready to go.”

Automation, traditionally used in warehouses and distribution centres, is now being deployed in last-mile environments. This tech doesn’t just enable timed deliveries, it also improves delivery sequencing, so vans can be loaded in the exact order parcels need to be delivered.

“Automation comes in many forms and can be deployed at varying degrees. For example, bulk movements and pointto-point transfers of products can be fully automated using Automated Guided Vehicles, Autonomous Mobile Robots, monorails or simple conveyors, eliminating the need for low-value manual effort,” Reynolds added. “Alternatively, deployment of supporting automation can help to better enable human operators and boost efficiency. Take put-to-light systems, where a location lights up to show where to place an item. This removes the need to read labels or handheld devices and can significantly cut down task cycle times.”

Automation has a broad scope. For example, workforce planning is also undergoing major transformation.

Traditional models are reactive and often inaccurate, but predictive analytics are rewriting that playbook.

Workforce planning has long been a guessing game, hiring seasonal employees only to find you need twenty more or half

as many the next week. But with real-time demand forecasting and predictive analytics, businesses can dynamically adjust staffing to match actual needs, eliminating waste.

“In some cases, automation can provide opportunities to gain labour efficiencies of greater than fifty percent when implementing a well-considered and fit-forpurpose solution, while also reducing manual handling risk and increasing operational resilience,” he concluded. ●

Learn how a smart supply chain can deliver for postal

The Cost of Inaction in Australian Retail Supply Chains: Why ‘Good Enough’ No

Longer Cuts it

WRITTEN BY RAGHAV SIBAL, MANAGING DIRECTOR FOR AUSTRALIA & NEW ZEALAND

MANHATTAN ASSOCIATES

In Australia’s retail sector, doing nothing is no longer a safe option. In fact, when it comes to supply chains, sticking with what’s always worked could now be costing more than making a change.

Retailers are facing a tough climate with higher customer expectations, tighter margins, ongoing supply chain disruptions, and the constant pressure to deliver better, faster, cheaper. Yet many are still relying on ageing systems and outdated processes. They might not be crashing, but they’re holding businesses back. And that’s becoming an expensive problem.

The idea that you can wait to modernise until something “breaks” doesn’t hold up anymore. The cracks are already showing in slower fulfilment, rising logistics costs, missed sales, and customers who don’t come back. As retail becomes more connected and competitive, “just functioning” isn’t enough. If your supply chain isn’t keeping up, it’s dragging everything else down with it.

Recent data helps quantify the cost of this inaction. The Unified Commerce Benchmark for Specialty Retail in Australia, produced by Incisiv in partnership with Manhattan Associates, looked at 29 leading retailers across the country. It split them into categories based on how well they’re delivering connected, customer-focused experiences. The

difference between the top and the bottom is stark.

Retailers classed as “Leaders” in unified commerce, those with strong integration across digital and physical channels, are growing revenue at two to three times the pace of their peers. They’re also converting more shoppers and keeping customers coming back. On the other end of the spectrum, the “Challengers”, retailers slower to adapt, are struggling to deliver the experiences modern shoppers expect.

It’s not just about brand perception or customer loyalty. The financial gap is real.

For every

billion dollars in annual revenue,

moving from Challenger to Leader status could unlock an additional A$17 million. That’s a huge upside and a clear sign that the cost of standing still adds up fast.

So, What’s Getting in the Way?

In many cases, it’s not a lack of intent, it’s a lack of alignment. Retailers might be investing in digital or launching new sales channels, but if their systems don’t talk to each other, or their supply chain can’t flex to match demand, it creates friction. This results in disconnected experiences, frustrated customers, and missed opportunities.

Meanwhile, today’s shoppers aren’t just looking for convenience. They expect visibility, choice, and values that align with their own. The benchmark report found that 83% of Australian consumers prefer retailers that offer integrated online and instore experiences. More than half (53%) value brands that are both culturally aware and compliant with local regulations. Sustainability is now a baseline expectation, not a bonus, with many customers willing to pay more for products that are ethically sourced and environmentally friendly.

Retailers who don’t offer transparency on things like product origin or delivery timelines are increasingly at risk of being left behind. The pressure is on to offer not just speed, but a better, more thoughtful experience.

The research also showed a noticeable gap in what it calls “differentiating experiences”, things like real-time inventory visibility, split shipments, or flexible pick-up options. These aren’t fringe features. For leading retailers, they’re business as usual. For

others, they remain out of reach.

But it’s not impossible to close the gap. Brands like Officeworks, Cotton On, and Bunnings have shown what’s possible when you treat unified commerce as a long-term strategy, not a one-off project. These businesses have put in the work to connect their operations, align teams around customer outcomes, and build systems that can flex with demand.

Where Does That Leave Supply Chain Professionals?

The next move is theirs. If retailers want to meet growing customer expectations while keeping costs in check, the supply chain can’t be left playing catchup. It needs to be the engine room of transformation. That means rethinking outdated systems, investing in platforms that scale, and making smarter, faster decisions powered by real-time data.

Tools

like AI and automation

can now forecast demand more

accurately,

reduce waste, and streamline fulfilment. Cloud-based platforms make it easier to manage stock, orders, and returns across multiple channels. The technology exists and the business case is clearer than ever.

But adopting these tools isn’t simply a technical upgrade. It’s a mindset shift. Transformation needs buy-in across the business, and it needs to be viewed as a long-term investment, not a one-off cost. The goal isn’t just to improve efficiency. It’s to build resilience, adapt faster, and earn customer loyalty in a market where expectations won’t stop rising.

Australia’s retail environment is unique with vast distances, a diverse customer base, and complex regulations make logistics challenging. But that’s exactly why unified commerce matters. When done right, it helps retailers cut through the complexity, serve customers more consistently, and set themselves apart from the competition.

The bottom line? The longer you wait, the harder and more expensive it gets to catch up. Leaders are already pulling ahead. And in a landscape this competitive, that gap can turn into a gulf quickly.

The cost of doing nothing is no longer just theoretical. It’s showing up in the numbers. And it’s only going to grow. ●

For more information on how unified commerce can strengthen your supply chain and improve customer experience, click here.

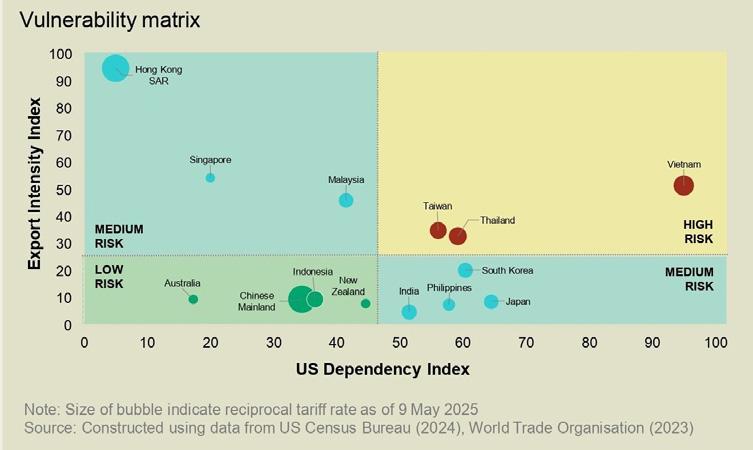

Tariffs, Turbulence and Transformation: How Australian Brands Must Rethink Globalisation in a New U.S. Trade Era

WRITTEN BY MERLINE MCGREGOR, MANAGING DIRECTOR, PATTERN AUSTRALIA

The global trade winds are shifting, and for Australian brands with eyes on the United States (U.S.) market, the forecast is turbulent.

The reintroduction of steep U.S. tariffs on Chinese imports – and the ongoing debate over how far they’ll go – has already triggered ripple effects well beyond America's borders. While Australian exports to the U.S. aren't the direct target of these duties, the structural reverberations are being acutely felt by brands across our region. Margins are tightening, cash flow is constrained, and long-held assumptions about international expansion are being tested like never before.

Whether these latest changes hold or are walked back again, it’s clear that trade has become more unpredictable than ever. This is not a short-term disruption. It signals a deeper, lasting shift in the evolution of global trade.

A Tectonic Shift in Global Strategy

For many Australian brands, the U.S. has traditionally symbolised the gold standard for international expansion. However, recent tariff volatility is forcing a fundamental re-evaluation. For the past few months, including at our recent Accelerate conference in the U.S., there’s been a recurring theme: brands are considering shifting their focus. The question is no

longer “How do we launch”, or “How do we scale in the U.S.?” but rather, “Should the U.S. still be our first port of call?”

Brands are not pivoting to abandon American ambitions, but protecting themselves against geopolitical uncertainty and building operational resilience. Many brands are now actively assessing market entry into the UK, EU, and parts of Asia. Markets like Singapore, with affluent and digitally savvy consumers, are being viewed as promising alternatives. Others, like Malaysia, are being considered cautiously due to lower spending power, but larger populations.

Even US brands, who have never had to seriously consider alternative markets are looking further afar to redirect products into new territories, thereby derisking themselves from tariff uncertainty.

In today’s climate, globalisation demands diversification. Relying on a single market or supply source is currently not a viable strategy.

Tariffs and the Cost Avalanche

New research shows tariffs have increased landed costs for Australian exporters to the U.S. by as much as 35%, particularly in product categories like apparel and home goods. The once-safe tactic of drop-shipping Chinese-manufactured products to U.S. consumers has become not only economically unviable but also operationally risky.

Australia’s free trade agreement with the U.S. has offered some protection over the years, but that safety net is starting to show its limits. Depending on where products are made or sourced, some Australian brands are already feeling the pinch.

The increasing freight costs and pressure on margin structures are intensifying the commercial pressure on Australian retailers. Brands are being forced to revisit product classification strategies— like the famous case of Converse sneakers being reclassified as slippers to reduce tariff burdens— and to renegotiate terms with retail partners and distributors.

Fulfilment Rethink: From Global to Local

Another knock-on effect of tariff volatility is the acceleration of local fulfilment strategies. Players like Temu and Shein, known for aggressive global pricing, have responded by investing heavily in domestic warehousing to bypass tariffs and maintain speedto-market. For instance, Temu’s shift to “local-tolocal” fulfilment in Australia has cut delivery times from over 10 days to under six. Decentralisation is proving key to building resilience.

Australian brands are following suit. There’s been a marked uptick in interest around multi-market

warehousing, bonded zones, and alternate shipping models like Delivery Duty Paid (DDP) versus Ex Works (EXW). Brands are weighing the trade-offs between air freight and sea freight, increasingly leaning toward the latter to preserve margin at the cost of speed.

For some, these changes have implications beyond logistics, impacting pricing architecture, merchandising calendars, and promotional strategies.

Discounting behaviour, for instance, is under review: Do brands reduce markdowns to protect margin? Or accelerate sales to fund new manufacturing lines in regions like India and Vietnam?

The Next 6–12 Months: Tactical Moves for Long-Term Gains

Navigating the months ahead will require Australian brands to stay agile in the face of immediate volatility, without losing sight of the bigger structural shifts underway. This includes reclassifying products in smarter ways to minimise the impact of tariffs. It also means reassessing which international markets to prioritise based on consumer stability and spending power, and diversifying supply chains beyond China, with renewed interest in India, Vietnam, and parts of Eastern Europe.

Staying competitive will require sharper market

intelligence to guide pricing and positioning, particularly when entering or expanding into unfamiliar territories. At Pattern, we're supporting clients as they assess the potential impact of tariff changes, reconsider fulfilment strategies, and evaluate new market opportunities. While we’re not customs experts, our focus as ecommerce strategists is to help brands respond quickly and confidently, even as the landscape continues to shift

A Wake-Up Call For the Decade Ahead

These developments should not be viewed as temporary trade turbulence. This has been a wakeup call for many brands and a reminder that it’s not possible to build a global business based on yesterday’s assumptions.

Rather than seeing this as a setback, brands should perceive it as a strategic reset. Australian brands can compete, and win, on the global stage. Success demands a shift in mindset from traditional product marketing to strategic supply chain thinking. Brands must prioritise trust, speed, and adaptability alongside price. Most critically, long-term success hinges on making bold decisions now to secure a competitive edge in the future.

This isn’t just about getting through the latest round of tariffs. It’s a chance for brands to reset, rethink where and how they grow, and build a business that can hold its own, no matter what comes next. ●

To learn more about futureproofing your brand, click here.

DHL Group Establishes Electric Vehicle Centre of Excellence in Australia

the sites are integrated into a nationwide transportation network, allowing for direct dispatch to dealers and service centres.

DHL Supply Chain ANZ CEO Steve Thompsett commented, “We’re so pleased to expand our EV COE network to Australia and to support the development of the electric vehicle ecosystem locally. We announced in November last year that upgraded warehouses in Sydney and Melbourne would house batteries, and now we welcome the addition of Brisbane.”

“We aim to pioneer the development of the electric vehicle market in Australia. With the support of our global network, we are enabling a one-stop shop for EV logistics, improving the efficiency of aftersales services for Electric Vehicle players and beyond in the country.”, said Fathi Tlatli, global auto-mobility sector president, DHL customer solutions and innovation.

In conjunction with the New Energy Growth Initiative announced in its Strategy 2030, DHL Group will continue to focus on the EV sub-sector. In response to the growing need for circularity in the Auto-Mobility industry, DHL Group has the vision to develop battery end-of-life solutions in collaboration with specialised players in Australia.

The end-to-end solution for Auto-Mobility includes:

• Fully flexible and EV-compliant warehousing for aftermarket, from temporary storage solutions to longer term, and from variable to dedicated storage, enabling turnkey solutions based on customers’ needs.

• Warehouse Management System with fully capable Electronic Data Interchange (EDI) integration and an option for a cloud-based visibility portal for real-time updates and inventory control.

• Value-added services and sorting solutions, including inventory control, order fulfillment, non-hazardous repackaging, and more, with maximum flexibility to meet specific requirements.

• Delivery management, including shuttle services and specialised transport services using DHL’s transport network within Australia.

• End-to-end supply chain: Easy combination with compliant international transportation solutions in and out of Australia based on DHL’s global network, including temperature and humidity monitoring for EV batteries. The transportation network is capable of handling various products, such as battery materials, finished electric vehicles (Completely Built Units), Battery Energy Storage Systems, and industrial equipment.

• Customs brokerage: Customers can leverage DHL’s global network for reliable and fast goods clearance, ensuring full compliance and a comprehensive understanding of the rules and regulations in all countries where it operates. ●

For more information, click here.

The Future of Supply Chains in Asia: Building Resilience Through Automation and Innovation

Asian supply chains are entering a new era, as global trade grows, and pressure mounts to become faster, smarter, and more resilient. In this environment, supply chain leaders must go beyond traditional models and embrace digital transformation to gain an advantage over the competition.

The Asia Pacific region is responsible for almost half of global manufacturing, and the Association of Southeast Asian Nations (ASEAN) is forecast to become the next global manufacturing hub – establishing itself as a strategic region in worldwide supply chain networks.

ASEAN is a regional intergovernmental organisation comprising 10 countries: Brunei, Cambodia, Indonesia, Laos, Malaysia, Myanmar, the Philippines, Singapore, Thailand, and Vietnam.

In 2023, these nations received a combined US$230 billion in foreign direct investment (FDI), despite the world economy’s overall decline.

This influx signals a fundamental shift as companies diversify their supply chains and establish new production corridors throughout Southeast Asia.

The change presents opportunities for businesses to modernise their supply chain operations with advanced logistics and automation technologies.

Dematic SVP – President Asia, China, and MEA, Steve Cheung, says businesses must embrace supply chain innovation before they are left behind.

"Our business exists to optimise supply chain efficiency and reduce delivery lead times utilising smart automation solutions," he says.

"We see more and more companies investing in robotics and automated systems, as it gives them the agility required to adapt their supply chains, handle diverse product ranges, and respond to market demands more quickly and effectively at a fraction of traditional costs. Companies that don't modernise their supply chain infrastructure risk being left behind in an increasingly connected global marketplace."

Investment in the Region

On top of the significant FDI into ASEAN, the region's supply chain infrastructure also saw greenfield investment project announcements double in 2023 (ASEAN). This signals robust expansion of logistics networks, distribution centres, and manufacturing facilities that will reshape global supply chain geography over the coming decade and beyond.

To support this supply chain transformation, Dematic has recently expanded its Asian footprint with a new facility in Jinan, China. The new plant manufactures automated logistics products and develops cutting-edge supply chain solutions, with an annual capacity of up to 500 Automated Storage & Retrieval (AS/ RS) cranes and conveyor systems designed to optimise goods movement and warehouse operations across the region's evolving distribution networks.

“I championed the new Jinan facility because it enables us to build supply chain

resilience by manufacturing closer to our APAC customers. The COVID pandemic was a wake-up call when transportation costs from Europe and the U.S. surged five to six times higher," Steve says.

"Our Jinan investment has proven essential as trade tensions and geopolitical disruptions persist. These challenges highlight why APAC manufacturers need agile supply chains and partners who can deliver solutions locally, reducing dependency on long-distance logistics.”

Automation and Flexibility

As stated in an Accenture’s report, Rethinking the course to manufacturing’s future, “By 2040, the most advanced factories won’t be managed – they will be orchestrated.”

The report surveyed hundreds of factory managers from around the world and found that 51% saw ‘Completely automated warehouses’ as likely or very likely to be implemented by 2040.

Similarly, 52% expected the same of Gen AI-based self-learning machines.

Steve states that AI is more than a passing trend, and that Dematic is poised to enable the advancement of manufacturing and supply chains in the region.

“Some technologies are popular because they’re novel and different, but AI and automation are truly becoming the new way of logistics,” he says.