Welcome

About The Magazine

Published quarterly to a circulation of 20,000 + industry professionals across Australia, New Zealand and the wider Asia-Pacific region, Supply Chain Insights Magazine is focused on helping you solve the complexities of today's supply chain. The digital magazine highlights the latest trends, operational strategies, technology advancements and best practice within the supply chain and logistics industry.

Welcome to Supply Chain Insights Magazineyour primary source of industry news, focused on innovation, technology and knowledge-sharing in the logistics sector.

In this edition of Supply Chain Insights, Features Editor Mel Stark examines whether Australia’s transport industry is ready for the challenges of 2026. The feature story, 2026 Countdown: Is Australia’s Transport Industry Future-Ready?, brings together insights from TMX Transform, Manhattan Associates, and Dematic to explore what transformation really looks like when capital is constrained, uncertainty persists, and expectations continue to rise. From automation and AI to the need for more resilient networks, the article reveals both the hurdles and opportunities shaping the year ahead.

Continuing this conversation, Jonathon Kottegoda-Breden from Toll Group discusses why Australia must view Asia and Southeast Asia as strategic partners in building stronger, more connected networks. Meanwhile, Australia Post announces a powerful new integration with Shopify to deliver seamless shipping for businesses. And in an Australian first demonstration for a small-to-medium enterprise (SME), toilet paper brand Who Gives A Crap shares how they’ve proven that SMEs can electrify heavy freight.

We hope you enjoy this edition and look forward to your feedback.

For more information or story suggestions, please contact: editor@supplychain-insights.media

For advertising enquiries, please contact: advertising@supplychain-insights.media

Visit our website: www.supplychain-insights.media

News & Insights

More than One in Three Australian Supply Chain Leaders Say Cost Reduction is Their Biggest Challenge

Short-term survival tactics replace strategic planning as 38% focus on immediate costcutting.

New research from TMX Transform, a global end-to-end supply chain consultancy, reveals that cost pressures are forcing Australian supply chain leaders into damaging short-term thinking, with potentially serious consequences for national competitiveness and crisis resilience.

TMX Transform surveyed over 500 supply chain leaders across Australia to understand how cost pressures and customer demands are shaping strategic decision-making in the sector.

The findings paint a picture of supply chains under pressure, with leaders caught between rising costs and escalating consumer expectations. This is driving tactical responses rather than the strategic investment needed for long-term resilience and competitive advantage.

Cost pressures dominate supply chain priorities:

• 38% of supply chain leaders say cost reduction is the biggest challenge they face

• 20% say rising external costs, such as shipping and freight, are straining their operations

• One in four (26%) say if they could improve only one area of their supply chain it would be to reduce costs

• 20% say slashing costs is their highest priority over the next two years

Strategic planning is being seriously neglected:

Only 7% of supply chain leaders would prioritise end-to-end visibility as their top improvement area over the next two years, despite its proven ability to reduce costs and enhance customer experience

12% rank changing consumer behaviour as their second-highest external challenge, showing leaders are caught between keeping costs down and customers happy

Travis Erridge, CEO of TMX Transform, said: "Supply chain leaders are grappling with the impossible mandate to 'transform, but don't invest'. Our survey paints a grim picture of supply chains on starvation diets, focused on immediate cost cutting rather than building intelligent, resilient systems that deliver sustainable competitive

advantage. This short-termism is stifling innovation and impeding companies' ability to compete at home and abroad."

The research highlights that business leadership still view supply chains as a cost centre rather than a strategic differentiator. This has broader implications for Australia's productivity, inflation management, crisis resilience, and national competitiveness. However, there is cause for optimism. With the cost of capital beginning to decrease, businesses have an opportunity to break free from the cost-cutting cycle.

Travis Erridge added: "Consumers today demand extensive choice, immediate delivery, and sustainable manufacturing - all at low cost. Yet businesses are responding with tactical cost-cutting rather than strategic transformation. The companies that take this moment to invest in long-term supply chain optimisation through digital transformation will win on cost, capability, and customer experience. Smarter supply chains are a competitive differentiator for companies and countries – that means investment."

The survey suggests that intelligent supply chains, enabled by data, AI and predictive analytics, can bridge the gap between cost efficiency and superior customer experience – allowing companies to anticipate customer needs while optimising inventory management.

TMX Transform's report, State of the Supply Chain Australia 2025, explores these findings in detail and outlines how Australian businesses can build supply chain resilience while managing cost pressures. ●

Marketplace Boom Reshapes Australian Retail as Shoppers

Prioritise Speed and Convenience

The rapid rise of online marketplaces is transforming Australian retail, with new research from Manhattan Associates (NASDAQ: MANH) revealing that nearly 40% of Australians now shop weekly on platforms such as Amazon, eBay, Temu and Shein. The convenience and speed of these platforms are driving a major shift in consumer behaviour, with 80% of shoppers saying their use of online marketplaces has reduced visits to traditional retail stores.

In response to this growing demand, marketplaces are investing heavily in local logistics infrastructure. Amazon’s recent $490 million investment in fulfilment centres across Sydney and Melbourne exemplifies the sector’s race to deliver faster, more reliable service. These logistics upgrades are not just operational improvements but are strategic initiatives that directly influence customer acquisition and retention.

These investments highlight how marketplaces are competing as much on logistics capability as on price. Convenience has become the defining factor for shoppers,

with one in three Australians saying ease of use and delivery speed are the main reasons they turn to marketplaces. Manhattan Associates’ research also found that 44% would choose Amazon over Temu even if the same product cost more, simply because Amazon could deliver it faster.

“Speed and reliability are now as influential in the purchase decision as price,” said Raghav Sibal, Vice President, APAC at Manhattan Associates. “Two-thirds of consumers told us they’re satisfied with marketplace delivery times, which shows that fulfilment performance has become a critical driver of loyalty. Traditional retailers that can match that level of consistency will be in a strong position to compete.”

However, trust remains a challenge for many marketplaces. Nearly half of Australians believe that product quality on these platforms is lower than that found in traditional retail stores, suggesting that perception still plays a powerful role in shaping loyalty. Returns are another pressure point. Two-thirds of shoppers say an easy returns process is critical to their experience, yet more than a third have encountered issues with refunds or product returns. Together, these findings highlight the importance of building confidence through clear product information, reliable fulfilment, and frictionless post-purchase service.

For traditional retailers, this is an opportunity to differentiate. While marketplaces dominate in convenience, stores continue to offer something marketplaces can’t replicate through trust and tangibility. Forty-two percent of Australians say the ability to see and touch products

draws them into stores, while 24% value immediate product availability. If retailers can combine those physical advantages with the same speed, precision and visibility that marketplaces achieve through advanced fulfilment, they can compete on every stage of the customer journey.

“Amazon’s new fulfilment centres in Sydney and Melbourne have raised the bar for logistics performance in Australia, and that’s a positive for the entire sector,” said Sibal. “It challenges every retailer to think differently and to view their supply chain not just as infrastructure, but as a strategic asset that shapes customer trust and drives long-term sales.”

To stay competitive, retailers need to connect their physical and digital retail experience through a unified supply chain. Achieving real-time visibility and orchestration across inventory, fulfilment and returns allows them to deliver with the same precision and pace as global marketplaces, while leveraging their store networks as a competitive advantage.

“Unified supply chain technology allows retailers to bring together the best of both worlds – the immediacy and connection of in-store retail, with the speed and efficiency of digital commerce. That’s where the future of retail competition lies, and it’s the space where Manhattan is enabling retailers to truly lead,” Sibal concluded. ●

Amazon Accelerates Logistics Expansion Across Australia in 2025

In 2025, Amazon is doubling down on its logistics footprint in Australia, launching a new fulfilment centres and delivery sites across Victoria and New South Wales, designed to speed up delivery times, support small businesses and generate thousands of jobs. The new facilities form part of Amazon’s largest logistics push yet in Australia.

In Victoria, Amazon has opened a 52,000-square-metre fulfilment centre in Cranbourne West and an 8,800-squaremetre delivery station in Ravenhall, creating 700 new jobs across Melbourne. The Cranbourne West facility – about the size of two and a half AFL fields – can store up to four million products available on Amazon. com.au, including electronics, beauty, furniture, books and everyday essentials.

In addition to the Cranbourne West site, Amazon has opened an 8,800-squaremetre delivery station in Ravenhall. Serving as a last-mile delivery hub, the facility will create more than 200 jobs and provide opportunities for local entrepreneurs to become Amazon Delivery Service Partners or earn flexibly through Amazon Flex.

“Amazon’s investment is a vote of

confidence in our workforce and small business – and it sends a clear message that Victoria’s economy is going from strength to strength,” said The Hon Danny Pearson MP, Minister for Finance of Victoria.

Amazon Australia now has three operating fulfilment centres and three delivery stations in Victoria, with a new Robotics Fulfilment Centre currently under construction in Craigieburn.

The company has also opened its newest logistics site in Chullora, Western Sydney, which will serve as a crucial distribution hub

for Amazon packages across the region. Opening in time for the upcoming peak shopping season, the site will enhance Amazon’s delivery capabilities, with capacity to process up to 50,000 packages daily.

The arrival of the logistics site provides new work opportunities for the local area in the lead-up to the festive period and beyond, with operational roles available as well as opportunities for local entrepreneurs to become an Amazon Delivery Service Partner or earn flexibly through Amazon Flex.

"We're thrilled to officially open our Chullora logistics site, demonstrating Amazon's continued commitment to Western Sydney,” said Paramjot Singh, Amazon Australia AMZL Country Leader. “This investment will not only create valuable employment opportunities but will also significantly enhance our delivery capabilities in one of Sydney's fastestgrowing regions."

The Chullora site is Amazon's 12th operational facility in Australia and joins existing Sydney operations to strengthen the company’s national delivery network. Packages are shipped to the site from Amazon fulfilment centres and are then picked up by Amazon Flex delivery partners and Amazon Delivery Service Partners to be delivered directly to customers. Together, this expansion reinforces Amazon’s ongoing commitment to investing in Australia’s logistics network, supporting faster delivery times, local job creation and opportunities for businesses across the country. ●

Dematic Launches Intelligent Platform to Unify Warehouse Operations and Devices

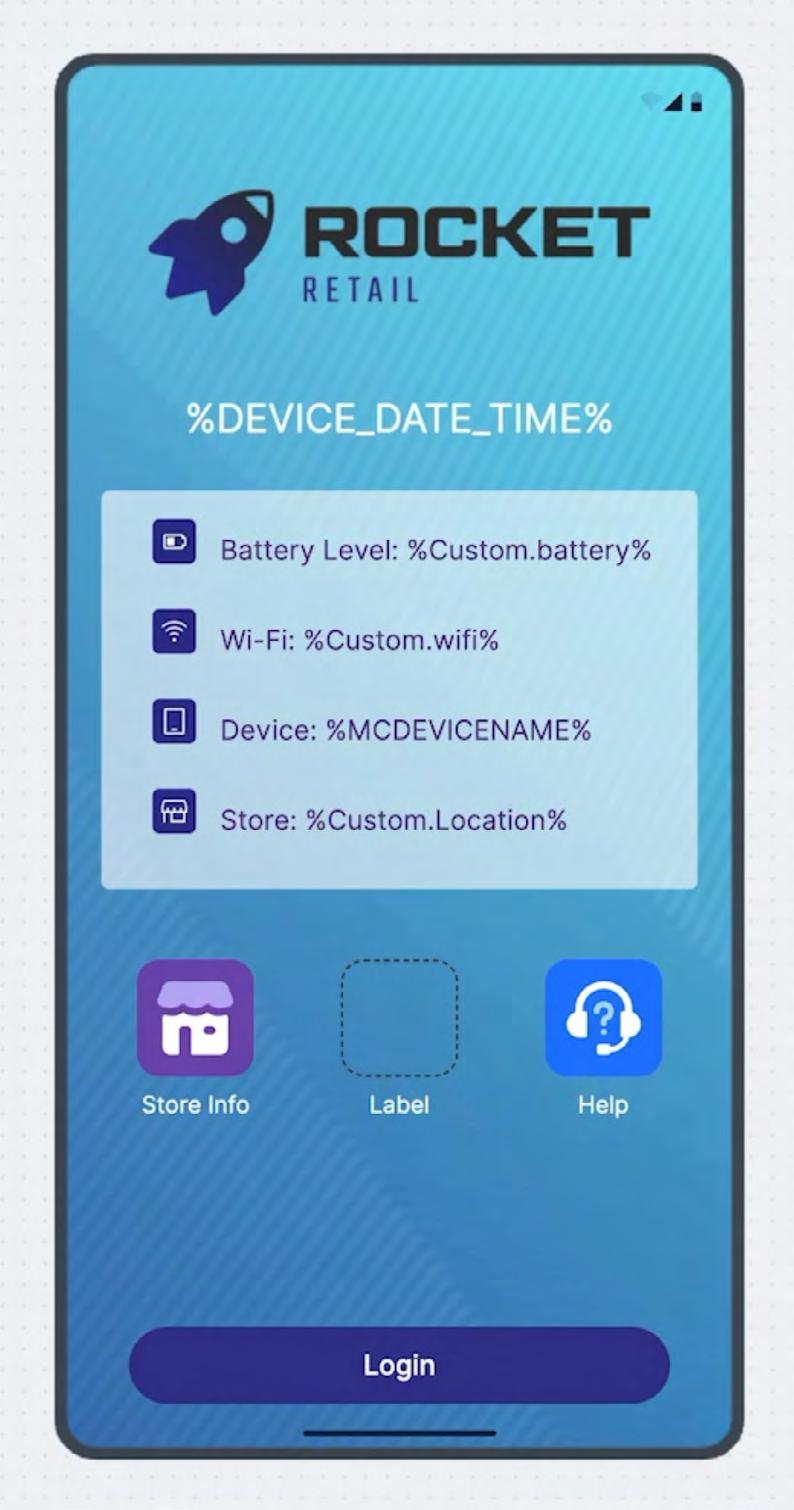

Dematic has today announced the launch of a new Connected Workforce Platform (CWP) for the supply chain market. CWP is an intelligent, flexible software layer that integrates seamlessly with existing warehouse systems and devices to improve operational visibility, streamline processes and support the evolving needs of frontline teams.

Designed to give businesses a clearer view of their operations, CWP consolidates data from any warehouse management system (WMS) and connects it to mobile, voice, vision and AMR-enabled workflows, providing one platform for all device-driven activities within the warehouse. The result is greater efficiency, faster decision-making and simplified management of warehouse technology.

“CWP is an extension of Dematic’s Connected Workforce Solution (CWS),”

explains Lee Koutsos, Director Connected Workforce Solutions (CWSTM), ANZ, Dematic. “It’s the result of our consultancyled approach, bringing together insights from working closely with customers to understanding their people, devices and processes and turning that into a flexible, intelligent platform that delivers real value. The platform is designed to build on and enhance CWS, giving businesses the visibility, control and adaptability they need as their operations grow more complex.”

Dematic’s new platform allows customers to visualise and manage key metrics, such as pick rates per hour, operator accuracy, congestion zones and order statuses in real-time dashboards. It also includes gamification features to drive team engagement and operator performance, while making it easier for supervisors to identify bottlenecks, configure workflows and respond to on-floor issues.

“Rather than adding more layers of technology, the new platform is all about making what you already have work better,” says Koutsos. “Most WMS platforms operate at a high level but lack the flexibility or speed to support day-to-day improvements. CWP bridges that gap by giving teams real-time insight and control without the need for costly customisation.”

CWP enables advanced picking logic, such as cluster and bulk picking and allows for smart consolidation based on worker location or warehouse zone. It’s compatible with a wide range of hardware including handhelds, vehicle-mount devices, vision glasses and voice headsets, with infrastructure support provided by Dematic’s wireless engineering team.

The new platform also helps address a common challenge in today’s warehousing sector: high staff turnover. By providing a more intuitive, data-rich environment, CWP helps reduce onboarding time and creates a smoother experience for new hires and experienced operators alike.

“Retention is one of the biggest cost pressures in the industry,” Koutsos adds.

“With CWP, businesses can onboard faster, manage better, and give their teams tools that genuinely make their work easier.”

The launch of CWP builds on Dematic’s expertise in connected workforce solutions, combining deep warehousing knowledge with local engineering support and a consultative approach to operational improvement. ●

For more information about Dematic’s Connected Workforce Platform, click here.

Growing demand and constraints of outdated facilities meant South West Healthcare needed a new approach to meet the region’s supply chain needs and future-proof operations, ensuring uninterrupted delivery of essential medical supplies, linen, and equipment to hospitals across Southwest Victoria, Australia.

Dematic provided an AutoStore solution that significantly increases storage capacity, improves order accuracy, and reduces the time to process orders. South West Healthcare can now deliver vital orders faster and has more space to dedicate to other important functions. Learn

at dematic.com/southwesthealthcare

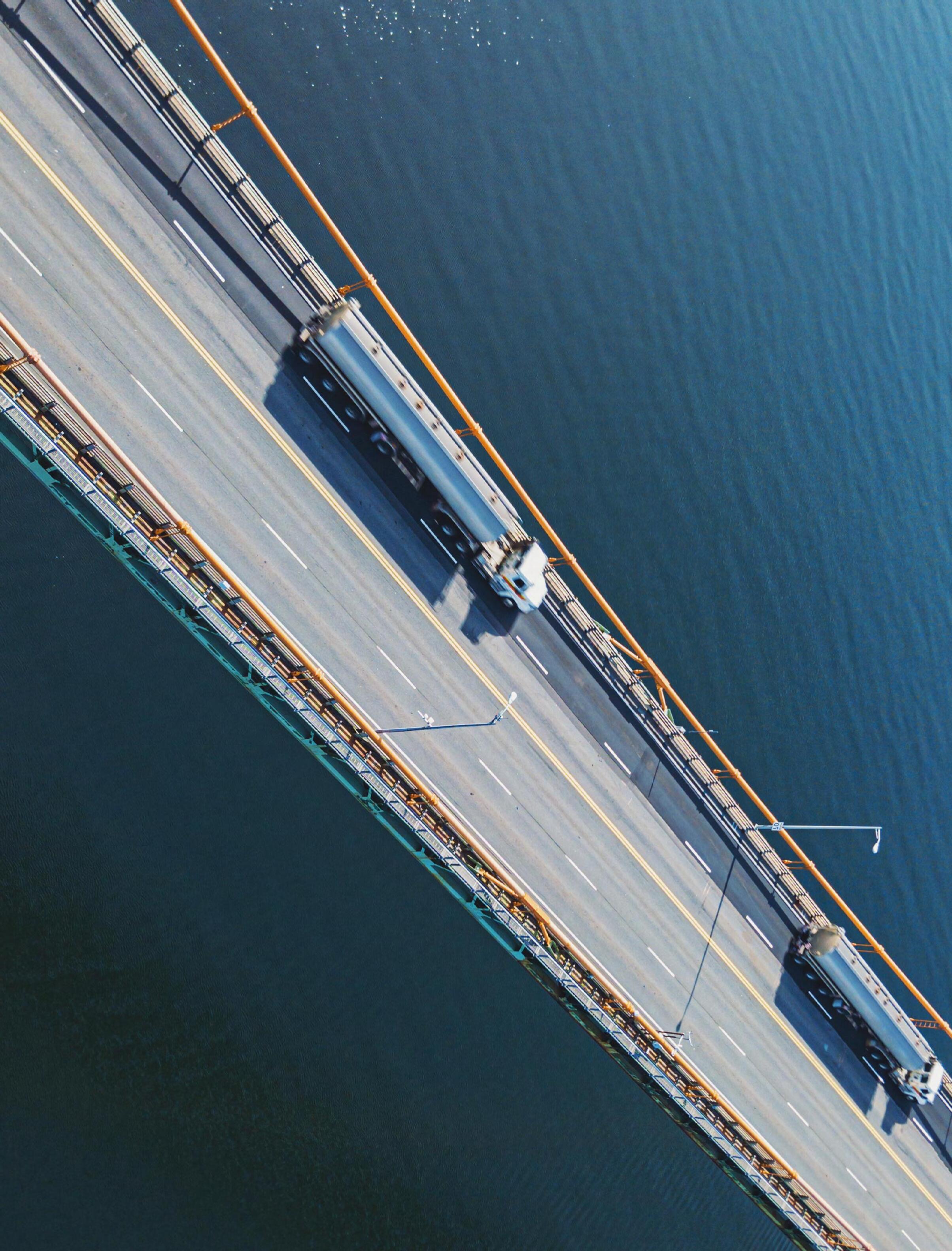

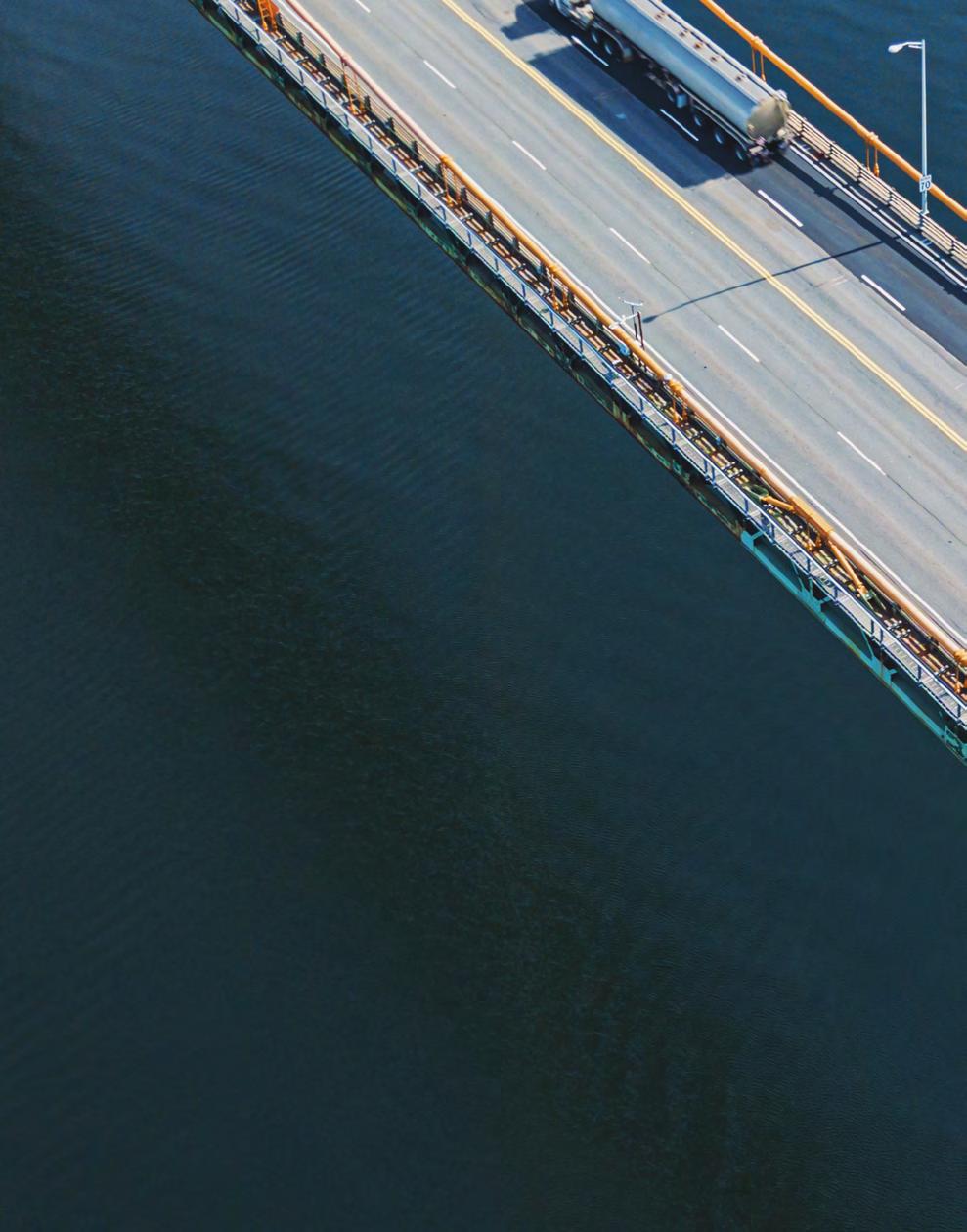

Electric Trucks Roll into Port Freight –and SMEs are Leading the Charge

WRITTEN BY BERNIE WILEY, HEAD OF SUSTAINABILITY AT WHO GIVES A CRAP

In an Australian first demonstration for a small-to-medium enterprise (SME), toilet paper brand Who Gives A Crap has proven that SMEs can electrify heavy freight.

Partnering with New Energy Transport and Volvo, the company successfully completed a port-to-warehouse run powered entirely by an electric heavy truck — a milestone in making zero-emission freight accessible beyond big corporates.

With mounting pressure for businesses to report on their emissions and layout reduction plans, the demonstration showed that small-to-medium businesses can be key players in the race to decarbonise the transport industry.

And with transport set to become Australia’s biggest source of emissions by 2030, and heavy trucks responsible for nearly half of road transport pollution, the sector is notoriously hard to decarbonise. But this successful demonstration proves that SMEs don’t need deep pockets or giant fleets to play their part in cutting emissions.

New Energy Transport, Australia’s first zero-emission heavy trucking company, combines low-cost renewable energy, highspeed charging and electric prime movers to offer zero- emission road freight at no extra cost compared to diesel-based freight.

With a clear alignment in goals and values, Who Gives A Crap sees this partnership as the perfect opportunity to drive solutions for overcoming common transport decarbonisation challenges and lead the way for other Aussie SMEs.

The trial saw Volvo’s FM Electric prime mover complete a full freight loop transporting a 40-foot container from Port Botany to Who Gives A Crap’s Sydney warehouse in Yennora and back.

The round trip totalled 88km, 118 minutes of driving time, utilised 34% of the truck’s charge and only 120kWh of energy. This showcased commercial and economic viability, with the trip easily being able to be

done a second time on the same charge and with the same productivity as diesel trucks but without the emissions.

“Decarbonising our supply chain has been a key focus for us for several years. By the end of this year, 30% of our outbound orders through ANC will be delivered by EV, supported by new warehouse charging solutions. This latest pilot takes our ambition to the next level,” says Bernie Wiley, Head of Sustainability at Who Gives A Crap.

Wiley continues, “Heavy freight is one of the hardest parts of any supply chain to decarbonise, so we wanted to partner with NET to prove it’s not just possible, but practical.

The results have been incredibly promising, and we’re excited to explore how we can expand electric trucking across our network. It’s great to show that when the right technology and partners come together, sustainability doesn’t have to come at the cost of efficiency.”

The demonstration tested real-world routing, performance, and operational complexities, generating critical insights into what it will take to scale electric freight solutions across Australia.

Furthermore, it highlighted that by decarbonising heavy road freight not only can there be a significant acceleration in the decarbonisation of the whole sector, but overall costs can be reduced.

“We’re incredibly proud to be partnering with Who Gives a Crap who are as passionate about electrifying heavy road freight as we are,” says Daniel Bleakley, Co-Founder of New Energy Transport.

“We’re really pleased with the results of the demonstration. We’ve proven that we’re able to operate heavy electric trucks for port cartage under the same conditions as diesel trucks, transporting the same payload in the same time across the same route - only we can do it with zero emissions, zero pollution and significantly reduced road noise,” continues Bleakley.

The collaboration reinforces Who Gives A Crap’s role as a trailblazer in EV fleet use for smaller enterprises, with the demonstration setting a precedent for democratising access to electric trucking.

Retailers in Southeast Asia Brace for Trade Shifts: Why Resilient Supply Chains Matter More Than Ever

Retailers across Southeast Asia are entering a period of heightened uncertainty as global trade tensions escalate. Tariff regimes are shifting faster than many businesses can adapt, with new duties being introduced or revised at short notice.

This volatility is disrupting supply chains, reshaping sourcing strategies, and making it harder for retailers to plan with confidence.

As a region exposed to these shocks, the implications for Southeast Asia are serious. Costs are climbing, freight routes are being redrawn, and markets once seen as safe alternatives are now caught in the crossfire. Retailers who invested heavily in shifting production out of China to markets like Vietnam, Bangladesh, and India are finding those moves have not insulated them from tariff pressure.

A Region Under Pressure

The fashion and apparel sector has been hit especially hard. Brands that once viewed Southeast Asia for manufacturing as a hedge against China’s rising costs are now facing levies that rival or even exceed the duties applied to Chinese goods.

Cambodia is contending with tariffs of around 19%, while India has been struck with a 50% rate, including a 25% ‘secondary tariff’ penalty tied to its diplomatic relations with Russia.

For retailers across Singapore, Malaysia, Thailand and Indonesia, these trade shifts translate into tighter margins and less predictable stock availability.

The problem isn’t only the cost, it’s the volatility.

When tariffs can change week to week, long-term planning becomes nearly impossible.

To manage this uncertainty, retailers need to concentrate on the areas of their supply chains that will give them the most flexibility and control.

Four priorities in particular are emerging as essential for navigating this turbulence:

Four Focus Areas for Resilient Retail Supply Chains

1. Regionalisation and Friendshoring

Retailers are diversifying sourcing across Southeast Asia to reduce dependence on China and manage trade risks. Vietnam and Indonesia have emerged as major beneficiaries, with Malaysia also increasingly in the mix. At the same time, trade and investment ties within the Association of Southeast Asian Nations (ASEAN) are strengthening, giving companies closer and lower-risk alternatives.

2. Automation and Real-Time Response

As tariffs shift unpredictably, so too must operations. Smarter warehouse systems, AI-powered demand forecasting, and robotics are helping retailers and logistics partners minimise waste and adapt quickly. eCommerce platforms like Lazada and Shopee are investing heavily in automation across their hubs in Singapore and Ho Chi Minh City, creating the flexibility needed to absorb volatility while meeting rising customer expectations.

3. Unifying Planning and Execution

Disconnected systems make disruption worse. The next step for Southeast Asia’s retailers is unification and connecting inventory management, fulfilment

and transport into a single digital thread. By removing silos, retailers gain real-time visibility and the ability to allocate resources more intelligently. In a tariff environment that can change overnight, fast, coordinated decision-making is crucial.

4. Scenario Planning and Risk Modelling

Resilient supply chains don’t simply react to disruption, rather they actively prepare for it. Retailers across Southeast Asia are increasingly adopting advanced scenario planning and risk modelling tools to forecast the potential impact of tariff changes, shipping delays, or supplier constraints. By stresstesting supply chains against multiple outcomes, businesses can identify vulnerabilities, build contingency routes and avoid costly surprises when the unexpected happens.

Addressing Unpredictability and Meeting Market Demand

What makes this period uniquely challenging is unpredictability. Static contingency plans are no longer viable. The real task is building long-term adaptability through agile, digitally connected supply chains that can flex with the pressures of global politics and seasonal buying peaks.

With Black Friday, Lunar New Year and other peak shopping periods fast approaching, market volatility could undermine retailers’ ability to meet consumer demand.

Shoppers, already squeezed by inflation, are unlikely to tolerate higher prices or empty shelves. Retailers that fail to adapt risk not only eroded margins but also weakened customer trust at the very moment loyalty matters most. For Southeast Asian retailers, the time to rewire supply chains and capitalise on available demand isn’t tomorrow, it’s now. ●

Find out how Manhattan Associates strengthens supply chain resilience, click here.

TMX Transform recently surveyed 500 supply chain leaders, revealing that supply chains are often viewed as a significant cost centre, and therefore an obvious starting point for business leaders focused on cost reduction. More than a third (38%) of supply chain leaders say the focus on cost reduction is their biggest challenge and one in four (26%) say if they could improve only one area of their supply chain it would be to

This means that strategic, long-term planning of supply chains is being seriously neglected.

Supply chains are on ‘starvation diets’, and this lack of investment is hobbling innovation, business growth, and resilience. Not only will ever increasing customer demands eat this lack of supply chain strategy for breakfast, but the economy

The cost of capital is now decreasing. In a world where customer loyalty is fragile, and supply chains are fragmented and complex, businesses taking this moment to invest in long-term supply chain optimisation will win on cost, capability, and customer

experience. That is good for consumers and for Australia.

It’s all well and good to talk about AI as the answer to productivity, but it’s wishful thinking to assume it will fix everything overnight — you might have the brains, but without the muscle to execute, especially in supply chains, progress will stall.

Automation and material handling is key to a fully connected digital and physical supply chain network, but there are fewer humans who want to do the heavy lifting, and automation takes four to five years to implement. If the conversation is just starting now, then you are already late to the party.

So, if governments want all this to happen, they need to enable the speed aspect too. This progress must be supported by them running alongside, listening – writing the red tape can’t gum this progress up for years.

Supply chains are not glamorous, but they are part of the solution to what ails us.

Long term mindsets in Canberra, a focus on enabling investment whether through incentives or tax reform, and an ear for those industries who are involved in fulfilling the basics in our lives, are what is needed in the productivity debate. ●

For more information click here.

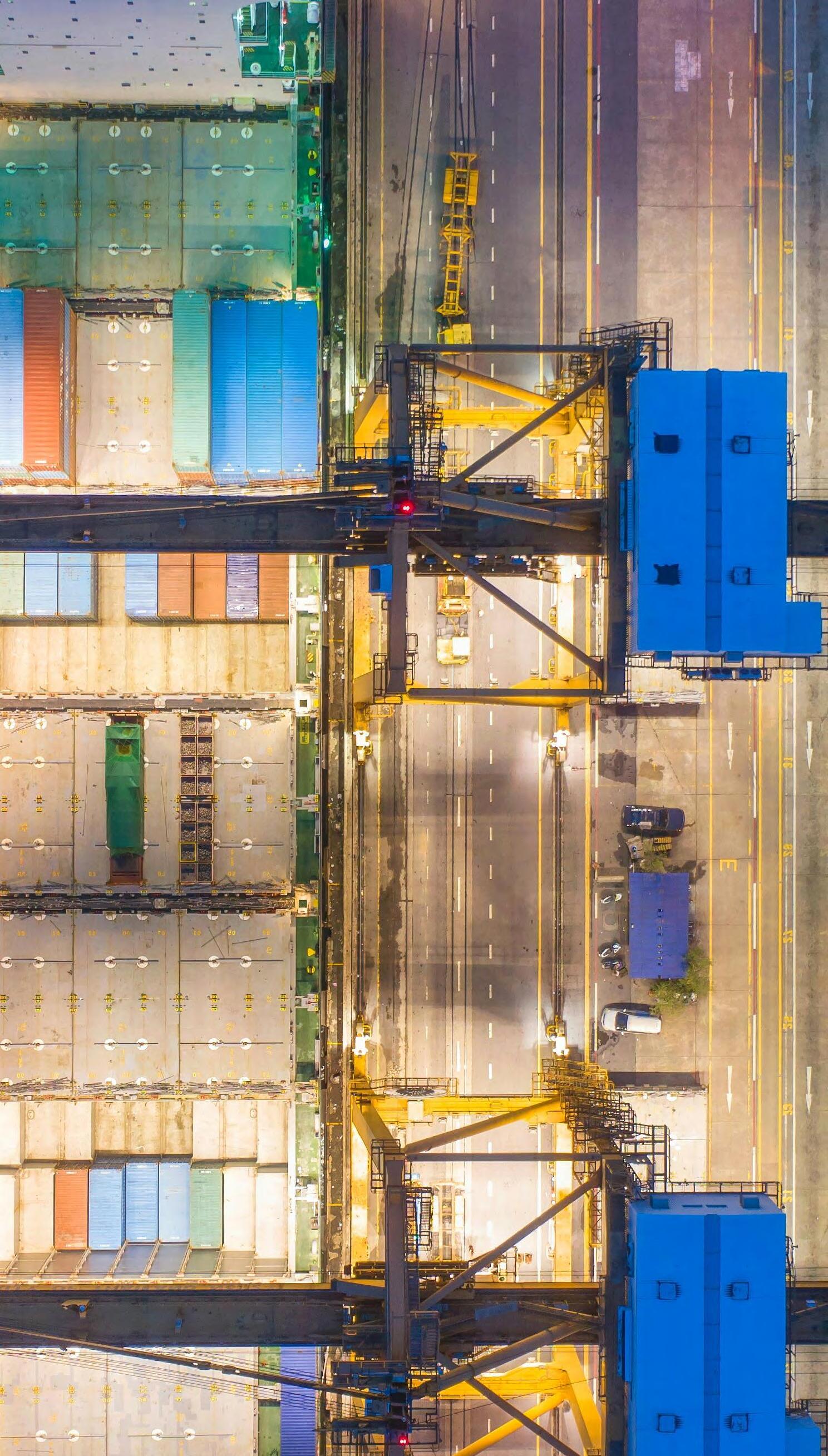

Lotte Chilsung and Dematic. Automating the Future of Beverage Logistics in Asia

As consumer expectations shift toward speed, variety and flexibility, logistics operations across the beverage industry are under increasing pressure to evolve.

In response, Lotte Chilsung, one of South Korea’s most iconic beverage producers, partnered with Dematic to develop the region’s first fully automated logistics facility dedicated to multi-product beverage distribution.

Located in Bupyeong, Incheon, the new logistics centre consolidates four previously separate facilities into a single, 8,264-square-metre hub. With a ceiling height of 42 metres and the capacity to process over 1.2 million beverage cases per month, the facility has become the cornerstone of Lotte Chilsung’s logistics network in the Gyeonggi region.

Built on a 20-year relationship between the two companies, the project represents a pioneering step forward for not only Korean logistics, but for the entire Asian beverage supply chain. It is the first example in the region of complete end-to-end automation in beverage logistics, encompassing automated storage, picking, palletising, and truckspecific dispatch sequencing.

“This project goes beyond simple system installation,” said Michael Bradshaw, Vice President of Solution Development, Dematic Asia Pacific. “It’s a landmark in automation for the beverage industry and a result of our deep, collaborative relationship with Lotte Chilsung.”

For Lotte Chilsung, the decision to invest in automation was driven by a range of business pressures. As demand increased across e-commerce, convenience retail, and food service channels, so too did the complexity of order profiles. More customers were placing small, mixed-product orders that required high-speed, high-accuracy fulfillment.

At the same time, the company faced space limitations at its legacy logistics centres, as well as escalating labour costs, particularly for night-shift operations. Warehouse workers were also exposed to repetitive, physically strenuous tasks such as lifting heavy cartons and manually assembling pallets, which presented long-term health and safety concerns.

“In today’s environment, traditional distribution models simply aren’t fast or flexible enough,” explained Shim Kyung-seop, Director of the Bupyeong Logistics Centre. “We needed a system that could respond in real-time to fluctuating demand while improving safety and efficiency.”

Adding further urgency was the need to futureproof operations through greater visibility and traceability. Lotte Chilsung wanted a logistics solution that could not only handle higher volumes but also deliver real-time performance insights, supporting long-term digital transformation goals.

The Challenge: Complexity, Space Constraints and Rising Customer Demands

The Solution: Integrated Automation from Receiving to Dispatch

To address these challenges, Dematic designed and implemented a fully automated solution tailored to Lotte Chilsung’s high-volume, high-mix beverage operation. The system integrates advanced robotics, software intelligence, and ergonomic design to deliver a seamless flow of goods from receiving to shipping.

At the heart of the facility is a high-density Automated Storage and Retrieval System (AS/ RS), capable of vertical storage up to 40 metres. This configuration maximises throughput and space utilisation within a limited urban footprint. When required, pallets are retrieved from the AS/ RS and transferred to a layer picking robot, which automatically breaks down the pallets into individual product cartons that enter a Dematic Multishuttle system for temporary storage.

When an order is received, product cartons are retrieved with precision and high-speed from the Multishuttle and transferred to a Dematic Rapid Pall palletising cell.

The Dematic RapidPall palletising cell automatically assembles customer-specific, mixedSKU pallets. The system uses advanced algorithms to determine the optimal stacking configuration based on product size, weight and route delivery requirements, ensuring compact pallet build and integrity and minimising damage risk in transit.

The completed pallets are then conveyed to an automatic dispatch buffer. Using shuttle technology, the system queues and organises pallets by truck and delivery sequence, streamlining the loading process and reducing downtime at the dock.

Overseeing this entire operation is the Dematic Warehouse Control System (WCS), which integrates directly with Lotte Chilsung’s enterprise resource planning (ERP) platform. This connection enables real-time visibility of inventory and system performance, empowering staff with immediate insights and control over logistics workflows.

“The greatest strength of this system is its integration,” said Bradshaw. “From product receipt to dispatch, everything is connected. It’s a true endto-end solution that adapts to changing demand with speed and intelligence.”

The Benefits: Performance, Precision and Future-Readiness

Since the Bupyeong facility went live, Lotte Chilsung has seen significant improvements across all operational KPIs. By automating labour-intensive processes, the company has drastically reduced its dependency on manual work, allowing operations to continue reliably even during night shifts or periods of high demand.

Order accuracy has increased due to the elimination of manual pallet assembly, while system throughput remains consistent regardless of SKU complexity or order size. Even during seasonal peaks or last-minute volume spikes, the system maintains stable, high-speed performance.

Worker safety and well-being have also improved, as automation now handles the repetitive and physically demanding tasks that previously led to strain and injury. Employees have been redeployed to higher-value roles, including system monitoring, quality control and decision-making support which has contributed to greater job satisfaction and lower staff turnover.

Importantly, the facility’s vertical design has delivered significant space savings, reducing the company’s real estate footprint while increasing storage capacity. With over 21,000 cases handled within the Multishuttle alone and 8,208 pallet positions in the AS/RS, the centre demonstrates how automation can achieve more with less.

The system’s end-to-end visibility has also helped Lotte Chilsung improve inventory traceability, ensuring compliance with quality standards and customer service level agreements. The WCS provides real-time data on product movement, equipment status and performance metrics, enabling smarter and faster decisions.

“The Bupyeong Logistics Centre is now a benchmark in beverage logistics, not just in Korea but across Asia,” said Shim. “Dematic’s solution has empowered us to respond quickly to market changes, reduce costs and operate with greater resilience and agility.”

A Strategic Foundation for the Future

As Lotte Chilsung looks ahead, the success of the Bupyeong Logistics Centre is seen as a strategic foundation for broader digital transformation. The company continues to explore new ways to leverage automation in support of its ESG goals, operational resilience and to improve customer satisfaction.

“This project is a powerful example of how automation can transform an entire industry,” said Bradshaw. “By combining advanced technology with a deep understanding of Lotte Chilsung’s operational goals, we’ve delivered a solution that not only meets today’s demands but provides a scalable foundation for the future of beverage logistics in Asia.” ●

2026 Countdown: Is Australia's Transport Industry Future-Ready?

Transport Future-Ready?

The imperative to transform is clear for Australia's logistics sector, but the willingness to invest remains constrained.

As 2026 approaches, cost pressures are mounting, customer expectations are rising, and the old playbook no longer applies. So, what does practical transformation look like when capital is tight, and uncertainty persists?

Supply Chain Insights spoke with industry leaders to find out.

Australia's supply chains have absorbed repeated shocks throughout 2025. Trade tensions between major partners have complicated sourcing decisions and freight planning, with tariff changes forcing companies to reassess inventory positioning and distribution strategies. Flooding and extreme weather have exposed the fragility of networks built around single distribution hubs, driving a shift toward more distributed, resilient supply chain models.

The Corporate Emissions Reporting Standards have also added fresh compliance challenges, forcing businesses to track Scope 3 emissions across increasingly complex global supply chains. Labour shortages persist, particularly in transport, driving up wages and squeezing service reliability. Rising logistics, fuel, and operational costs against a backdrop of sluggish economic growth have left profit margins razor-thin. The Australian Government's National Freight and Supply Chain Strategy 2025 has outlined ambitious priorities for productivity, resilience, and decarbonisation, but what will this look like in 2026? Supply Chain Insights spoke with experts from TMX Transform, Manhattan Associates and Dematic to find out more.

"Investment activity has picked up this year and keeps building. I don't see it slowing down anytime soon."

PHILIP MAKOWSKI, MARKETING DIRECTOR, ASIA PACIFIC AT DEMATIC

The Cost-Customer Conundrum

The increased tension between cost management and customer experience will continue to dominate in 2026. "Our recent survey of over 500 supply chain leaders highlighted more than a third feel cost is the biggest challenge they face," shares Charlotte Jordan, Executive Director Supply Chain at TMX Transform. "Even more so we are seeing businesses stuck between cost and customer, with customer experience being key and ranked second for leaders in this same survey."

The TMX Transform State of the Supply Chain 2025 report reveals a disconnect. Despite end-toend visibility's critical role in reducing costs and delivering superior customer service, only one in ten businesses are prioritising it as a source of competitive advantage. "Businesses are challenging today’s supply chain leaders to find a way to 'transform, but not invest' due to the focus on cost," Charlotte says.

For Raghav Sibal, Vice President, APAC at Manhattan Associates, the challenges lie in persistent structural issues. "Rising labour costs and labour shortages are going to continue into next year," he says. "Geopolitical uncertainty is going to persist. There's also the challenge of finding the right balance of technology, namely using AI without it becoming disruptive, which there is a lot of hype around at the moment."

Dematic’s Marketing Director for Asia Pacific, Philip Makowski, agrees and adds that recent surveys in Southeast Asia and ANZ consistently identify labour as the toughest challenge, followed by rising costs, data visibility, and customer service levels. "Companies continue to find it challenging to find and retain workers in warehouses," he says. "With customers increasingly expecting next day if not same day deliveries with 100% order accuracy, and the labour constraints, companies will continue to invest in automation in 2026."

The infrastructure constraints are equally pressing. Land costs and availability, particularly in Sydney, are forcing difficult choices. "A number of our customers have made the call to invest in Melbourne," Philip reveals. However, building costs are rising, and electricity prices remain elevated.

"Some companies are experiencing waiting periods of up to 18 months to plug into the electricity network at new sites, because data centres – which are closer to city centres – are soaking up the available power capacity," he explains.

The Automation Imperative

The economic troubles of the past few years appear to be easing, with interest rates beginning to fall and retail sales showing year-on-year improvement. "We are seeing improvement, definitely in terms of people making the decision to invest across the board despite cost being a primary concern," says Philip. "Investment activity has picked up this year and keeps building. I don't see it slowing down anytime soon."

Part of this uptick in investment is due to the democratisation of automation. Its accessibility is no longer limited to large enterprises with deep pockets.

"With the latest technologies, we can enable smaller companies to gain the benefits of automation," Philip explains. The technology has evolved to the point where even start-ups are making automation part of their initial business strategy rather than a future aspiration. "Instead of seeing it as a future investment, new businesses are building automation into their foundations from day one," Philip says.

While automation is increasing, Philip emphasises the importance of granular operational data. "We are finding companies say, ‘We’ve implemented an ERP or a WMS, but it's not giving us what we need. We need a lot more granularity of information around what's happening at the operator level, device level, subsystem level, so you can get a good handle on where the bottlenecks are.’"

The automation discussion in 2026 extends beyond physical robotics into intelligent, autonomous systems. A good example of this is Manhattan

Associates' recent launch of AI agents that can make autonomous supply chain decisions.

"When you think about a warehouse supervisor who can get to the same outcome, they would need to spend at least 30 to 45 minutes and go through maybe a dozen or so screens," Raghav explains. "This can be done in seconds using AI agents."

The agents operate across multiple operational dimensions. "We’ve got agents that can identify what’s happening across an operation, whether it’s during a day shift, in an eCommerce fulfilment run, or in a specific area of the warehouse that’s falling behind," Raghav says. "It will look for where you need to move people from or where you may be ahead to move people to an area where you may be behind. It then picks the right people with the right qualifications and skills and moves them. All of this is happening autonomously, without any intervention."

Building Resilience for an Uncertain Future

Charlotte Jordan of TMX Transform emphasises that supply chain resilience hinges on strategic network design and operational flexibility.

She warns that network fragility persists, with single points of failure, such as reliance on one port, corridor, or mega-warehouse, leaving businesses vulnerable to floods, fires, cyberattacks, and industrial action.

To mitigate these risks, Charlotte advocates for a “multi-path to market” approach: at least two viable routes or modes for every major lane, supported by preapproved alternatives and rehearsed switch criteria.

She also recommends a modular node strategy, favouring smaller, near-demand cross-docks and selective storage over mega-sites. This accelerates recovery and spreads risk.

Inventory strategies have flipped as a result of supply chain disruptions, according to Dematic’s Philip Makowski. "Companies were shifting from just-in-case back to just-in-time as the business environment was regaining stability post-COVID," he says. "However, many companies are pivoting back to just-in-case as we see more disruptions with tariffs and all the follow-on impacts, and the competitive retail space forces retailers to continue to force inventory back down the chain to suppliers."

For Raghav Sibal from Manhattan Associates, the fundamentals matter most. "Companies need to look back and see that their foundation and fundamentals are strong," he says. "In the short term, it's more about efficiency, knowing where your inventory is and how you're maximising inventory returns. In the long term, it's how do you increase more flexibility through adding automation, how do you leverage AI and data strategies more strategically to create differentiation."

Digital twins are emerging as an essential tool for resilience planning. "Simulate port closures, weather and labour shocks," Charlotte advises.

"Pre-bake standard operating procedures and customer communication plays." TMX Transform uses simulation to quantify cost, service, and emissions trade-offs before committing capital."

Looking ahead to next year, U.S. tariff policies could continue to impact Australian supply chains, but perhaps not as much as some expect, and could even present opportunity. "Some economists are stating Australia may be one of the few countries seeing a net positive impact as our competitors get hit with high tariffs," says Philip. "For example, red meat may be beneficiaries, with Brazil facing 50% tariffs into the USA. Our meat industry should be able to take full advantage of that."

Australia's meat industry has positioned itself to capitalise through automation investment. "Dematic has implemented over 25 meat production automated storage and distribution systems around ANZ that enable red meat companies to ship products internationally up to one day faster," Philip notes. "The international competitors haven't really invested to the same extent. We are really a global leader in that regard."

Strategic Priorities for 2026

What should supply chain leaders do differently in 2026? The answer depends on their starting point and economic outlook.

For companies still wrestling with fragmented technology stacks, the priority is integration. "Fundamentally get into more unification across the end-to-end supply chain," Manhattan Associates’ Raghav advises. "Create a data foundation that you can layer on top with more AI and predictive analytics."

"Deploy industry playbooks... to capture quick wins around routing of products, slotting rules, and service policies,"

CHARLOTTE JORDAN, EXECUTIVE DIRECTOR

SUPPLY CHAIN AT TMX TRANSFORM

“There needs to be a good combination of driving efficiency using AI, but also not losing the human empathy,”

RAGHAV SIBAL, VICE PRESIDENT, APAC AT MANHATTAN ASSOCIATES

For those ready to invest in automation, TMX Transform’s Charlotte recommends starting with proven industry playbooks. "Deploy industry playbooks – beverage, grocery, healthcare, industrials – to capture quick wins around routing of products, slotting rules, and service policies," she suggests.

Philip adds that even brownfield sites offer significant opportunities, with voice and vision systems delivering 20-40% productivity gains with payback under 18 months.

On sustainability, the experts all recommend pragmatism. Philip highlights infrastructure limitations, noting that "Electricity supply has challenges at new sites in Australia". Charlotte echoes this view, stressing that progress must occur at a realistic and practical pace, aligned with infrastructure support.

The human factor remains critical as automation accelerates. "There needs to be a good combination of driving efficiency using AI, but also not losing the human empathy," Raghav warns.

As AI-driven chatbots and autonomous agents become more prevalent, companies must consider where efficiency improvements tip into customer experience degradation.

Charlotte offers scenario-based guidance. If economic conditions improve, she advises pulling forward fleet renewal and automation in highrepeat flows. If they stagnate, prioritise network consolidation and commercial resets. If they worsen, activate resilience plays – dual ports and carriers, pop-up capacity – without compromising Chain of Responsibility obligations.

As Charlotte puts it, the key is to link every investment to measurable outcomes – like delivery in full, on time, dwell time, empty kilometres, emissions per drop – not tech inputs. In 2026, CFOs will demand proof that transformation delivers tangible returns, not just technological upgrades. ●

Southeast Asia: The Hub Powering the Next Generation of Supply Chains

WRITTEN BY JONATHON

KOTTEGODA-BREDEN, PRESIDENT ASIA LOGISTICS, TOLL GROUP

Southeast Asia is fast becoming the new crossroads of global commerce. By 2040, it’s expected to rank as the world’s fourth-largest economy, driven by demographic strength, digital transformation and deepening regional integration.

For Australia, this moment presents a rare opportunity. Our proximity to the region gives us a front-row seat to one of the most dynamic growth stories of our time. To future-proof our transport and logistics industries, we must look to Asia and Southeast Asia, not as a distant market, but as a strategic partner.

Redrawing Trade Routes Through Southeast Asia

At the heart of Asia, Southeast Asia connects some of the world’s busiest shipping lanes. From Singapore to Port Klang, Ho Chi Minh City to Jakarta, the region’s ports and logistics ecosystems are rapidly expanding and modernising.

Regional initiatives such as the Regional Comprehensive Economic Partnership (RCEP) are

streamlining trade, reducing tariffs, and creating a more integrated market. These developments are reshaping global supply chains and positioning Southeast Asia as an essential hub linking East and West.

For Australian businesses, engaging deeply in this region means greater supply chain resilience, shorter lead times, and diversified trade routes that reduce risk from geopolitical or environmental disruptions.

Future-Proofing Through Diversification

The pandemic made one lesson clear: single-route dependencies leave supply chains vulnerable. Resilience now depends on diversity, agility, and data-driven visibility.

At Toll, Southeast Asia is a cornerstone of our global network.

Over the past two years, we’ve expanded more than 150,000 square metres across nine markets – a 17% increase in capacity – to better connect with the regional hubs and the wider world.

Our goal isn’t only to move goods faster, but to create networks that can flex and respond to change, giving businesses the confidence to operate in an unpredictable world.

Regional Partnerships Driving Innovation

The future of logistics will be shaped by collaboration between businesses, institutions, and governments that share a vision for smarter, greener, and more connected supply chains.

At our Innovation Centre in Singapore, we’re working with partners such as Republic Polytechnic and Singapore University of Technology and Design (SUTD) to pioneer smart warehousing, robotics, and AI-driven optimisation tools.

Unlocking Growth Markets

Southeast Asia’s booming consumer and manufacturing bases are not just destinations, they are engines of demand for sophisticated logistics solutions. With rising incomes, expanding e-commerce, and a growing middle class, the region is experiencing a surge in demand for fast, reliable, and tech-enabled supply chain services.

This creates fertile ground for Australian logistics providers to expand their footprint and offer differentiated services. Whether it’s warehousing, freight forwarding, or supply chain consulting, the opportunities are vast and growing.

Asia contributes 32% of Toll’s global revenue, highlighting this region’s strategic importance.

Key markets such as China, India, Malaysia, and Singapore are not only growth engines for Toll, but also vital gateways for Australian exporters and manufacturers seeking regional integration.

A Strategic Imperative for Australia

Strengthening Australia’s relationship with Southeast Asia is not just an economic opportunity, it’s a strategic imperative. As global supply chains become more regionalised and digitally integrated, proximity and partnership will define competitiveness. By stepping ahead with Southeast Asia, Australian businesses can:

• Enhance supply chain resilience through diversified routes and regional integration.

• Accelerate innovation via partnerships with forward-looking logistics ecosystems.

• Expand market access to one of the fastestgrowing consumer and industrial regions.

• Contribute to sustainable growth through inclusive trade practices and sustainable transport.

A strong relationship with Southeast Asia also allows businesses to make greater strides in reducing their emissions.

Toll has committed to achieving net-zero emissions by 2050, taking real action to achieve this goal. Recent investments include A$67M in electric heavy vehicles and A$200M in fuel-efficient fleet upgrades.

Conclusion: The Time to Act Is Now

Southeast Asia is not just rising, it’s reshaping the global trade landscape. For Australian export companies, the region offers a rare combination of scale, speed and strategic alignment. By engaging deeply, investing wisely, and collaborating boldly, we can build supply chains that are not only stronger but smarter.

At Toll, we’ve been proud to stand beside Asia’s businesses for 25 years, and with more than a century of experience behind us, we know that progress isn’t measured only in kilometres moved, but in the partnerships we build along the way.

The future of logistics will be regional, resilient, and deeply interconnected. And the time to step forward with Southeast Asia is now. ●

Australia Post Partners with Shopify to Deliver Seamless Shipping for Businesses

Thousands of businesses across Australia now have a quicker and easier way to manage shipping thanks to a powerful new integration between Australia Post and Shopify.

The built-in connection allows businesses to seamlessly book shipments, print labels and track parcels without the need to toggle between platforms.

With the integration now live, Shopify merchants will have tracking numbers for their outgoing Australia Post deliveries automatically assigned, eliminating the need for manual data entry.

With around 40% of Australia Post’s ‘My Post Business’ customers already using Shopify, this integration directly benefits a growing cohort of businesses who can now handle all their shipping needs through a single interface.

¹Australia Post

eCommerce Report: Click here.

Australia Post Executive General Manager Parcel, Post and eCommerce Services Gary Starr said the partnership came at a critical time as Australia Post sharpened its focus on customer experience amidst a boom in online shopping.

Australian households shopping online spent $19.2 billion online in the last quarter alone, up 15% YoY.¹

“As consumer expectations increase, we’re focused on innovating and improving the systems our business customers rely on.”

“We want to make the shipping process as seamless as possible for both merchants and consumers, from pick and pack to delivery,”

“This partnership delivers exactly what Australian businesses have been asking for — a smarter, more efficient way to manage their shipping which will save them valuable time.” Mr Starr said.

The integration will also have flow-on benefits for consumers as well as businesses through Shopify’s ‘Shop’ app - used by hundreds of millions of shoppers around the world to track deliveries and access the best possible post-purchase and delivery experience.

Today’s announcement for Australian businesses is just one part of Shopify’s expansion to its built-in fulfillment capabilities, as it launches partnerships with leading global carriers, and introduces bulk order processing to transform time-consuming tasks into streamlined workflows.

Shaun Broughton, Managing Director (APAC & Japan) at Shopify said the integration unlocks powerful new tools for one of the country’s largest and fastest-growing commerce communities.

“We’re thrilled to partner with Australia Post in this strategic collaboration which supports small and growing businesses—the backbone of the Australian economy,” Broughton said.

“Whether they’re mature, just starting out or rapidly growing, Australian merchants now have built-in capabilities that make fulfillment simple at every stage of their journey.”

Transportation at a Crossroads: Why 2030 Will Redefine Supply Chain Success

WRITTEN BY RAGHAV SIBAL, VICE PRESIDENT, APAC, MANHATTAN ASSOCIATES

Visibility gaps, AI ambition and sustainability pressures are pushing transportation management from the back office to the boardroom.

While transportation has long been the backbone of supply chains, its role today has become more pivotal than ever. Once considered a back-office function, it now sits at the centre of strategic discussions, influencing competitiveness, customer trust and long-term growth. New global research from Manhattan Associates, The Road Ahead: Unlocking the Future of Transportation Management, highlights this shift, showing just how important transportation has become to supply chains, and how quickly organisations need to adapt.

The research shows nearly 80% of global supply chain leaders already consider transportation as critical to success. By 2030, that figure is expected to climb even higher, with close to 90% naming it as a core driver of business performance. The concern is that existing Transportation Management Systems (TMS) may not be able to keep up. Eightyseven percent of respondents fear their current systems won’t meet the rising demands for speed, cost control and resilience. Transportation, in other words, has evolved beyond just moving goods from A to B. Instead, it has become the ultimate test of whether an organisation can keep its promises to customers in an unpredictable world.

The Visibility Challenge

A major fault line runs through visibility. Despite years of investment, far too many organisations still operate with fragmented systems. Around 40% of supply chain leaders admit their TMS is not integrated with the rest of the supply chain. That lack of connection has real-world consequences with around 50% of organisations admitting they struggle to reroute shipments when disruption hits and have difficulties optimising labour scheduling in their warehouses and docks. When customers expect accurate updates and on-time delivery, these gaps are a risk to reputation and revenue.

The financial impact is equally stark. Nearly half of the organisations surveyed spend more than 10% of their transportation budget dealing with the fallout from poor forecasting or unexpected disruptions –money that could otherwise be invested in growth. Yet there is a light at the end of the tunnel. The majority (82%) of leaders believe advances in forecasting and planning will drive down freight costs in the next five years. The tools exist to make this possible, but closing the visibility gap requires a sustained commitment to modernising systems and processes.

The AI Ambition Gap

Often positioned as the silver bullet, many businesses are turning to Artificial intelligence (AI) to address transportation management challenges. Manhattan’s research shows that 61% of organisations expect to be operating with fully or near-autonomous decision-

making within the next five years. Yet today, only 37% have deeply integrated AI into their TMS. The gap between ambition and reality is difficult to ignore.

Almost every organisation (99%) report facing, or expecting to face, hurdles when implementing AI. The most common barriers include shortages of skilled staff, inconsistent data quality and the difficulty of bolting new capabilities onto legacy systems. Against this backdrop, retrofitting AI into outdated platforms is unlikely to deliver the agility leaders are hoping for.

The more scalable option is to adopt modern TMS platforms that come with AI built in, reducing the need for specialist expertise and ensuring data flows consistently across the organisation. Done well, this can accelerate time to value and allow transportation to play its full role as a driver of resilience and growth.

Sustainability as a Non-Negotiable

Sustainability also adds an additional layer of complexity. For many organisations, it has become the most pressing constraint shaping transportation performance. In fact, 70% of businesses now describe sustainability as either a global mandate or a major source of pressure. Some organisations have implemented comprehensive reporting frameworks such as the Corporate Sustainability Reporting Directive, but embedding sustainability into daily decisions remains uneven. Only a minority are factoring it into procurement or operational planning, and even fewer have invested in carbon-friendly fuel strategies. Yet almost half of organisations expect the majority of their transportation to be sustainably optimised within five years.

This gap between intention and execution cannot continue. Regulatory pressure is only one side of the coin; the other is the growing expectation from customers who are increasingly aware of the carbon cost of what they purchase.

The Way Forward

Transportation leaders know where their capabilities need to be, but their systems are not yet fit for purpose. Visibility remains patchy, forecasting is draining budgets, AI ambition is running ahead of readiness, and sustainability remains too often an aspiration rather than an operational reality.

The way forward will be focused on building unified platforms that can connect across the supply chain, harness AI natively, and make sustainability part of everyday decision-making. With the right investments, transportation shifts from a cost and compliance burden to a driver of innovation and loyalty. Without them, legacy systems quickly become a liability.

Aster Pharmacy Achieves Scalable Growth with the Largest Automated Fulfilment Solution of its Kind in the UAE from Dematic

Aster Pharmacy, part of the larger Aster DM Healthcare network, has been a prominent player in the healthcare and pharmaceutical industry for over 37 years.

Headquartered in the United Arab Emirates (UAE), Aster Pharmacy is committed to delivering end-to-end healthcare, encompassing primary, secondary, and tertiary care.

As retailers benefit from the significant increase in As the business expanded, Aster Pharmacy faced the challenge of scaling its operations, driven by increasing demand in the UAE, Saudi Arabia, and other Gulf Cooperation Council (GCC) countries, as well as a significant push in its e-commerce operations.

“We are targeting to do around 20 000 orders e-commerce every single day in three years’ time from now,” explained Mr N.S. Balasubramanian, CEO at Aster Retail. “The most important aspect to support this, as a very key pillar, would be of course the supply chain.”

To support this growth, Aster Pharmacy turned to Dematic for a highly automated, scalable solution that would optimise the company’s fulfilment processes and support future plans.

Fulfilment Challenges Undermine Capacity Expansion

Aster Pharmacy’s existing fulfilment operations were primarily manual, which posed challenges in handling the growing volume of orders, particularly as the company set its sights on doubling its capacity within the next three to five years. With a 13,000-square-metre distribution centre catering to pharmacies, hospitals, and clinics across the region, Aster’s fulfilment centre handles 50 million units annually, including both inbound and outbound volumes. The operation covers more than 15,000 stock-keeping units (SKUs), shipping over 300,000 orders per week.

“We want to be able to scale our impact and be able to touch more lives,” explains Alisha Moopen, Managing Director & Group CEO for Aster DM Healthcare. “For us, the scalability of this vision requires technology to come and support us.”

Aster’s supply chain is critical to its operations, and the need for an advanced solution that would streamline processes, improve efficiency, and reduce costs became increasingly urgent.

“We needed a solution that would support the business in a scalable manner,” says Vamsikrishna, Head of Supply Chain Aster DM Healthcare. “Our goals were to improve overall DC efficiency, increase speed, and lower our costs, while maintaining high service levels for our customers.”

A Solution Designed for Business Growth

After conducting extensive due diligence and evaluating several solution providers, Aster Pharmacy chose Dematic to deploy the AutoStore™ solution. The system was designed to automate the manual picking process, dramatically improving efficiency while maintaining the accuracy and speed required to support Aster’s growing operations.

“We provided a solution based on the business problem to be solved and the return on investment,” explains Mithun Perinchery, Head of Sales, Middle East, Dematic. “The AutoStore™ system is built to pick up to 1,000 order lines per hour for outbound and 100 order lines inbound. The system allows storage of pharma products in multi-SKU bins with a pick pointer supporting ease of picking.”

The AutoStore™ system from Dematic consists of 17,250 bins, 33 robots, eight carousel ports for

picking, and four ports for inbound goods. This solution, the largest of its kind in the UAE, enables the handling of up to 3,000 order lines per hour.

“It was a process with a lot of due diligence and evaluation,” Vamsikrishna explains. “We needed to choose the right solution and the right partner capable of executing it. Finally, AutoStore™, implemented by Dematic, met our needs and exceeded expectations.”

The AutoStore™ system from Dematic allows Aster Pharmacy to store pharmaceutical products in multi-SKU bins, facilitating faster and more efficient picking. The system also allows for better use of space, reducing the need for additional square footage, even as order volumes increase. The solution supports Aster’s aim of scaling its operations while maintaining operational flexibility.

Smooth System Integration Drives Fulfilment Efficiency

The implementation of the AutoStore™ system from Dematic was smooth and on schedule, ensuring minimal disruption to Aster’s operations. This achievement was made possible due to the close collaboration between Dematic and Aster Pharmacy’s teams, who worked together to develop a strong governance model and rigorous testing protocols.

“Working with Dematic was seamless,” says Vamsikrishna. “They have proven why they are leaders in the intralogistics field, and their unwavering support has been a key factor in our success.”

The transition to the new system also included comprehensive training for Aster’s staff, ensuring that the system would be used to its full potential from day one. Dematic provided ongoing support, including a combination of 24/7 remote and local service plans to ensure maximum system availability and fast response times.

Aster Pharmacy Increases Fulfilment Speed and Accuracy with AutoStore™

Since implementing the AutoStore™ system from Dematic, Aster Pharmacy has seen significant improvements in fulfilment speed, accuracy, and overall efficiency. The system processes up to 1,000 order lines per hour for outbound goods and 100 order lines for inbound goods.

This level of automation has reduced manual labour, while the increased storage efficiency has allowed Aster to handle more orders without needing additional warehouse space.

“Seventy percent of our volumes are now picked using AutoStore™, which has dramatically increased

our efficiency,” Vamsikrishna says. “The speed of fulfilment has improved, resulting in better service levels for our customers, while keeping costs low.”

The AutoStore™ system from Dematic has also enabled Aster to optimise its existing workforce. Instead of hiring additional staff to keep up with growing demand, the automated solution has allowed Aster to scale its operations without increasing labour costs.

“The increased storage efficiency meant that we needed less space to fulfil the same amount of business, and we were able to utilise our existing manpower while catering to our growing needs,” explains Vamsikrishna.

Aster’s long-term plans include further expansions within the UAE and into other GCC countries, as well as a significant e-commerce push.

With the AutoStore™ solution in place, Aster is well-positioned to handle an anticipated 20,000 e-commerce orders per day within the next three years.

Looking to Future Growth

Aster Pharmacy is optimistic about its future growth, particularly with the robust support of Dematic’s technology. The collaboration between the two companies has laid the foundation for continued success, as Aster looks to double its operational capacity and scale its impact across the region.

“For us, it’s all about creating a better environment for better health,” says Moopen. “We are excited about new solutions in healthcare that help us implement better care for our patients.”

“The AutoStore™ system from Dematic has been a critical part of that journey, helping us deliver lifechanging medications and services to our customers quickly and accurately.”

As Aster continues to expand, Dematic will remain a key partner, supporting the company’s growth with advanced intralogistics solutions and unparalleled customer service. This partnership highlights the value of working with a solution provider that not only understands a company’s current needs but also has the vision and expertise to support its future ambitions.

“We have built a strong working relationship based on mutual trust. Dematic has been a fantastic partner, and we look forward to continuing this journey together as we expand our impact in the healthcare industry,” Vamsikrishna concludes. ●

Delivery Isn't a Cost Centre Anymore, It's Your Competitive Edge

WRITTEN BY

ROB HANGO-ZADA CO-FOUNDER AND CO-CEO OF SHIPPIT

Amazon didn't just change how fast things arrive. They changed what customers expect delivery to mean. And now every Australian retailer is dealing with the fallout.

This isn't about matching Amazon's prices. It's about matching the experience they've normalised: sameday delivery, pinpoint accuracy, real-time tracking and sustainability credentials that actually matter.

According to Shippit's State of Shipping report, 71.4% of carriers say same-day delivery is now the biggest shift in customer expectations. The rest, precise windows, live tracking and green options, are close behind.

The stakes are higher than most carriers realise. Delivery used to be a back-end operation, a necessary cost of doing business. Now it's a front-line brand experience. When delivery fails, customers don't just blame the carrier, they blame the retailer. Research from Shippit and Jarden found 64% of shoppers won't return to a brand after one poor delivery experience. One strike and you're out.

That means carriers aren't just service providers anymore. They're reputation managers. Their network performance doesn't just affect their own business; it directly shapes retailer success and customer retention. The pressure is real, and it's only increasing.

What Retailers are Actually Investing in

If you want to know where carriers need to focus, look at where retailers are putting their money. In 2025, 20.7% of retailers made supply chain optimisation (covering fulfilment and delivery) their top investment priority. That's a massive jump from 2024, when it ranked fourth.

The message is clear: delivery isn't an afterthought anymore. It's central to customer experience, acquisition and retention.

Retailers are also betting big on AI and automation (16%) and real-time data analysis (16%). Together, these investments signal a fundamental shift away from gut-feel decision making towards insight-driven strategy. Other focus areas include inventory accuracy, omnichannel capabilities and unified commerce platforms.

For carriers, the implication is straightforward: your network needs to be flexible, data-rich and smart enough to support modern fulfilment models.

That's why 57.1% of carriers are now investing in AIpowered route optimisation software. They're not just reacting, they're rebuilding.

Beyond Routing: The Case for AIPowered Orchestration

Route optimisation is useful. Orchestration is transformative. Global logistics leaders have been using AI for years to stay ahead. Now Australian carriers have access to the same capabilities—tools that don't just find the fastest route but dynamically adapt to realworld chaos. Weather disruptions. Last-minute priority changes. AI-powered orchestration handles all of it in real time, accounting for vehicle type, capacity, delivery windows and customer priorities simultaneously. The result? Networks that don't just move faster, but smarter. They're more resilient, more reliable and more responsive to what customers actually need.

This is what next-generation logistics looks like in practice: AI-assisted dispatch, real-time customer tracking, and advanced algorithms working together to maximise fleet efficiency. Delivery stops being a cost centre and starts being a growth engine.

As delivery networks get denser and more localised, orchestration becomes the foundation of local commerce. Carriers who invest in scalable, AIpowered operations now will be the ones who can actually deliver on tomorrow's expectations.

What Future-Ready Looks Like

Being future-ready in transport comes down to three things: the flexibility to adapt, the intelligence to forecast and the resilience to deliver under pressure. As consumer expectations accelerate and global players keep raising the bar, orchestration, not just operation, will separate the survivors from the leaders.

AI will be at the centre of this shift. By forecasting challenges, orchestrating complexity, and enabling delivery that's consistently precise and transparent, AI gives both carriers and retailers the power to keep their promises to customers.

Carriers need to audit their current processes and infrastructure, then explore what emerging technologies can actually do for them. The options are out there. The question is whether you're evaluating them seriously and aligning them with what your business actually needs to stay competitive.

In a market where one bad delivery can cost you a customer for life, reliability isn't nice to have, it's everything. The carriers who embrace AI-powered orchestration now won't just survive the shift to 2026 and beyond. They'll define it. ●

To read Shippit’s 2025 State of Shipping Report, click here.

SOTI Launches New Mobile Tech That’s Changing the T&L Game

SOTI’s newest updates aim to streamline operations in the T&L industry by cutting downtime and reducing delivery delays.

SOTI, a proven innovator and industry leader for simplifying business mobility solutions, has introduced major updates to the SOTI ONE Platform. These enhancements help address one of the most costly and persistent challenges in the transportation and logistics (T&L) sector: mobile device downtime and its impact on operational efficiency.

Overtime, Delays and Downtime: The Hidden Costs Facing T&L Providers

T&L drivers are facing several challenges that directly impact their productivity, well-being and overall job satisfaction. Frequent operational delays and downtime force many organisations to rely on employee overtime just to stay on schedule. These issues are exacerbated by unreliable mobile technology, which leads to stress and frustration among frontline workers, especially when they miss delivery targets or lose access to preferred routes.

According to SOTI’s most recent T&L report, The Road Ahead: Driving Digital Transformation in T&L, Australian logistics workers lose an average of 16 hours per month due to mobile device or app downtime. This extended downtime results in increased stress for nearly half (41%) of workers and

overtime for 27%. Additionally, a quarter (25%) of drivers find it necessary to drive faster to complete deliveries, and 43% spend over half of a working day resolving delivery issues—further adding to operational pressure caused by device challenges.

“In Australia, where long distances and high delivery expectations leave little room for error, mobile disruptions can severely affect the speed and accuracy of shipments,” said Michael Dyson, VP of Sales, APAC at SOTI. “Our latest updates to the SOTI ONE Platform are designed to improve uptime, simplify device usage and give transport and logistics drivers real-time control to keep supply chains moving smoothly and on schedule.”

To address challenges faced by T&L organisations today, key updates to the SOTI ONE Platform were introduced at SOTI SYNC 25 in Montreal, Canada:

• Lockdown Reimagined: IT teams can leveage an intuitively guided and efficient drag and drop design system to quickly create custom tailored role-based device experiences that restrict frontline worker access to only the essential apps and tools that they need. The integrated authentication enhances frontline productivity and security with fast and convenient device access by using QR codes or NFC tags to speed up shift changes and device handovers. Real-time condition monitoring provides immediate security to lockdown device access even further, such as when a device is detected to be outside of its prescribed geofence. IT professionals also gain real-time visibility into device usage via powerful analytics which yield insights that can be used to identify inefficiencies and optimise workflows.

• Stella, the AI-Powered Assistant for Smarter IT Support: Stella enables IT administrators to troubleshoot and resolve common issues through simple conversation and voice commands, reducing time-to-resolution and freeing up limited and costly IT resources. AI-powered assistants can operate 24/7 and provide IT administrators with immediate support, ensuring end-users receive help whenever they need it—improving productivity and reducing downtime.

• SOTI XSight Integration with ServiceNow: : IT teams can now benefit from the advanced diagnostic tools of SOTI XSight directly within ServiceNow. This provides access to vital tools like Remote Control, screen recording, Live Chat, obtain device snapshots, retrieve debug log files and screen annotation. This accelerates IT response times and reduces device-related downtime in the field. IT teams now have everything integrated into one platform, allowing T&L drivers to focus on their job without the added stress of device failures.

• Indoor Location Camera Streaming with SOTI XSight: This improves device location visibility and device incident response times in warehouses and logistics hubs. The feature combines indoor mapping with live camera feeds, enabling IT teams to see exactly what's happening around a flagged device—empowering faster, more informed decision-making in fast-paced environments.