At Anglo American, our people are at the heart of everything we do. Our people are our business.

Together, we create and deliver sustainable value by working towards common goals while empowering individuals to realise their full potential.

We are committed to realising our Purpose of ‘Re-imagining mining to improve people’s lives.’ This is how we continue to nurture relationships with our host communities, government, suppliers, customers, and partners.

Thank you Sunday Times for recognising Anglo American, Kumba Iron Ore and Anglo American Platinum in the 2022 Top 100 companies.

Together, we are shaping a better future.

Scan to learn more

● Scope, size and investment period

● Companies listed on the JSE with a min imum market capitalisation of R5bn as at Au gust31 2022,witha trackrecordof fiveyears trading from September 1 2017 are included.

● Selected companies that meet the afore mentioned criteria but are no longer listed on the JSE or the share is suspended at August 31 2022 are excluded from the analysis.

● Theexecutive managementof Arena have also consideredcertain subjective qual ifyingcriteria, relatingtotheTop 100Com panies’ perceived compliance with good gov ernance and ethical conduct.

● Theshare performanceanalysis as sumesan initialinvestment ofR10,000 atthe closing price on August 31 2017 and held for a period offive yearsfrom September1 2017to August 31 2022.

● The companiesarerankedbased onthe compoundannualgrowth rateoverthefiveyearperiod.This analysisassumesthata fraction of a share can be purchased.

Corporate action

The shareprice performance isadjusted for corporate actions during the review period as follows:

● Ordinaryand specialdividends: The gross dividend per share is assumed to be re invested in the company on the dividend pay ment date at that date’s closing share price.

● Scrip dividends: Itis assumed that the cash option was elected and that the gross di vidend isreinvested inthe companyas de scribed above.

● Capitalisationissue: Sharesreceived are held until the end of the review period.

● Unbundling:The sharesin “NewCo” re ceived areassumed tobe receivedon thelast date totrade andare trackedseparately. The compoundannualgrowth rateiscalculated based onthe basket ofshares held atthe end of theperiod asa resultof theoriginal R10,000 investment.

● Share split/consolidation: Share price data is adjusted for these corporate events.

● Rights issue: It is assumed that rights are not takenup and lapse, thereforeno adjust ment is made.

* The Sunday Times Top 100 Companies results were compiled by Vestra Advisory. Vestra is a corporate advisory firm which provides regulatory, strategic and financial advice to its clients. Vestra assists its clients in providing bespoke solutions through the introduction of innovative ideas and compre hensive strategies founded on sound regulat ory understanding, relationships, structural expertise and knowledge of structured and specialised instruments.

3Sunday Times TOP 100 COMPANIES

METHODOLOGY Contents 5... 6... Montauk’s impressive growth trajectory Top balance sheet in tough year for Implats 8... 9... Royal Bafokeng speeds up the rankings Amplats standing strong 10... 12... Exxaro makes most of coal price Diversified portfolio stands ARM in good stead 16... 20... Northam’s growth strategy on track It’s not just about profit for Anglo American 21... 13... Transaction Capital’s resilient and agile portfolio Ensuring women’s seat at the table 15... 18... Providing hope and long-term vision Kumba’s cost control strategy is paying off Strong showing in a tough year P18 Lifetime Achiever P13 Business Leader of the Year P15 Cover

Nolo Moima

design:

TOP 100 COMPANIES OVER FIVE YEARS*

1

Share name

Montauk Renewables

Impala Platinum Royal B afokeng Platinum

Anglo American Platinum Exxaro Resources

African Rainbow Minerals Northam Platinum Kumba Iron Ore

Anglo American Transaction Capital Gold Fields

12 13 14 15 16 17 18 19 20 21 22 23 24 25 26 27 28 29 30 31 32 33 34

BHP Group Capitec Bank DRD Gold Clicks Group Sibanye Stillwater Industrials REIT

Afrimat

Sirius Real Estate South32 Astral Foods Compagnie Financière Richemont Anglogold Ashanti Glencore

Harmony Gold Mining Raubex Group Grindrod Stor-Age Property REIT PSG Group Datatec Absa Group Pan African Resources Metair Investments Tharisa Bidvest

Hosken Consolidated Investments PSG Konsult

Firstrand

Equites Property Fund Italtile

Investec plc Investec Ltd

Emira Property Fund Dis-Chem Pharmacies Rand Merchant Inv

Naspers -NNedbank Group Mr Price Group BID Corporation Shoprite

41.48 153.45 42.18 318.02 76.26 53.08 63.93 122.56 737.74 27.16 123.66 2,223.98 237.26 7.95 72.71 108.94 9.97 7.96 18.82 217.95 8.88 1,006.57 96.08 1,309.11 26.61 6.36 7.46 6.24 20.15 9.42 150.92 8.02 5.28 6.35 73.14 15.70 15.01 359.96 13.95 20.26 57.43 24.89 5.23 30.51 41.44 1,056.45 103.73 47.83 109.02 137.62

Total return (%)

830.5 435.7 427.2 374.4 256.5 252.5 227.7 226.1 222.7 176.8 165.9 165.7 144.1 136.4 119.6 115.3 114.4 104.4 93.3 86.2 85.8 85.3 83.2 75.3 74.1 71.8 70.5 67.2 62.1 61.5 60.1 57.5 56.1 52.8 44.9 44.7 43.7 43.7 40.6 39.8 38.6 35.5 29.5 26.3 24.9 24.3 20.5 20.5 20.0 18.0

*Final value (R) Compound annual growth rate (%)

93,049 53,570 52,719 47,440 35,646 35,254 32,771 32,607 32,270 27,682 26,586 26,571 24,413 23,643 21,962 21,529 21,443 20,438 19,333 18,619 18,580 18,529 18,320 17,525 17,409 17,184 17,046 16,724 16,205 16,148 16,014 15,746 15,613 15,279 14,487 14,475 14,374 14,371 14,064 13,984 13,862 13,547 12,950 12,629 12,488 12,435 12,050 12,046 12,002 11,801

56. 2 39.9 39.4 36.5 28.9 28.7 26.8 26.7 26.4 22.6 21.6 21.6 19.5 18.8 17.0 16.6 16.5 15.4 14.1 13.2 13.2 13.1 12.9 11.9 11.7 11.4 11.3 10.8 10.1 10.1 9.9 9.5 9.3 8.8 7.7 7.7 7.5 7.5 7.1 6.9 6.7 6.3 5.3 4.8 4.5 4.5 3.8 3.8 3.7 3. 4

51 52 53 54 55 56 57 58 59 60 61 62 63 64 65 66 67 68 69 70 71 72 73 74 75 76 77 78 79 80 81 82 83 84 85 86 87 88 89 90 91 92 93 94 95 96 97 98 99 100

Share name

Standard Bank Group Alexander Forbes Group MTN Group

Vukile Property Fund British American Tobacco Pick n Pay Stores The Spar Group Santam Woolworths Investec Property Fund JSE

MAS Real Estate Reinet Investments S.C.A. ArcelorMittal SA AECI AVI

Mondi ADvTECH Remgro TFG

Old Mutual Vodacom Group

Truworths International Sanlam Momentum Metropolitan Adcock Ingram Reunert Sasol Barloworld Tsogo Sun Gaming Discovery Life Healthcare Group Fortress REIT A Mediclinic International Telkom SA SOC

Growthpoint Properties RCL Foods Cashbuild Oceana Group Lesaka Technologies Netcare

Super Group SA Corporate Real Estate

Lighthouse Capital Coronation Fund Managers

Resilient REIT

Wilson Bayly Holmes-Ovcon NEPI Rockcastle KAP Industrial Anheuser-Busch InBev SA

PREVIOUS WINNERS

Market cap as at Aug 31 2022 (Rbn)

257.15 6.39 234.12 13.22 1,682.56 30.50 30.16 28.09 57.38 8.24 9.33 14.52 55.08 5.79 8.76 24.73 142.01 9.09 67.40 42.09 47.89 231.59 23.40 118.74 24.93 8.40 8.32 208.84 16.55 13.23 82.18 29.45 12.42 72.84 22.47 43.71 10.10 5.67 7.16 5.07 21.21 10.62 5.31 10.40 11.03 20.28 5.29 55.26 11.52 1,449.53

Total return (%)

17.9 17.7 16.8 16.4 16.2 14.5 13.9 12.7 11.3 8.8 8.6 7.7 7.3 2.2 1.8 1.4 0.6 -0.6 -2.5 -3.5 -3.8 -4.3 -4.7 -6.2 -6.3 -8.5 -9.7 -10.1 -11.7 -13.5 -13.9 -15.0 -16.1 -18.5 -18.9 -19.4 -20.7 -22.2 -25.3 -26.9 -27.4 -28.3 -28.8 -29.3 -30.4 -30.7 -30.8 -33.4 -38.5 -40.1

*Final value (R) Compound annual growth rate (%)

11,792 11,765 11,680 11,641 11,624 11,454 11,386 11,275 11,130 10,877 10,861 10,767 10,733 10,221 10,177 10,142 10,061 9,940 9,748 9,654 9,616 9,570 9,528 9,383 9,366 9,151 9,034 8,987 8,831 8,653 8,605 8,501 8,387 8,145 8,105 8,058 7,934 7,781 7,474 7,306 7,256 7,166 7,122 7,072 6,960 6,927 6,919 6,660 6,155 5,995

3.4 3.3 3.2 3.1 3.1 2.8 2.6 2.4 2.2 1.7 1.7 1.5 1.4 0.4 0.4 0.3 0.1 -0.1 -0.5 -0.7 -0.8 -0.9 -1.0 -1.3 -1.3 -1.8 -2.0 -2.1 -2.5 -2.9 -3.0 -3.2 -3.5 -4.0 -4.1 -4.2 -4.5 -4.9 -5.7 -6.1 -6.2 -6.4 -6.6 -6.7 -7.0 -7.1 -7.1 -7.8 -9.3 -9.7

4 Sunday Times TOP 100 COMPANIES

2 3 4 5 6 7 8 9 10 11

35 36 37 38 39 40 41 42 43 44 45 46 47 48 49 50

Market cap as at Aug 31 2022 (Rbn)

Kumba Iron Ore DRDGOLD Capitec Bank Capitec Bank Finbond Group Calgro M3 Fortress Income Fund B Coronation Fund Managers Coronation Fund Managers Capitec Bank Assore Capitec Bank Basil Read Basil Read DAWN Mittal Steel SA Grindrod Grindrod Mvelaphanda Resources Mvelaphanda Resources 2021 2020 2019 2018 2017 2016 2015 2014 2013 2012 2011 2010 2009 2008 2007 2006 2005 2004 2003 2002 *Return over five years from September 1 2017 to August 31 2022, on a theoretical R10,000 investment. The results were compiled by Vestra Advisory and have been evaluated by Deloitte. The executive management of Arena Holdings have also considered certain subjective qualifying criteria, relating to the Top 100 Companies’ perceived compliance with good governance and ethical conduct. Graphic: Ruby-Gay Martin

Impressive growth trajectory

Montauk’ s all-handson-deck approach is a winning strategy

By AURELIA MBOKAZI-KASHE

● Thisyearbeganon ahighnoteforMon taukRenewables andit continueson anup ward trajectory. Thecompany is ranked number onein theSunday TimesTop 100 Companies, from second place in 2021.

The US-based renewable energy company, which specialisesin the management,recovery andconver sion ofbiogas intorenewable natur algas (RNG),completeda seriesof transactions that havethe potential to accelerate its growth further.

Amongthe developmentsisits announcementto beginconstruc tionof thesecond RNGprocessing facility at its Apex landfill gas project in Amsterdam, Ohio.This additional facilityis expectedtosignificantly expand the production capacity of the Nasdaq-listedcompany, witha

targetedaverage40% increaseinRNGpro cessingcapacity andan additional2,100 MMBtu a day production capacity.

It alsofiled aprovisional patentapplica tion with the US Patent and Trademark Office pertaining to combustion-basedoxygen re moval condensate neutralisation technology.

This development followedthe board of directors approving a capital improvement projectto upgradeitsRaegerfacility toin crease production.

CEO Sean McClain says Montauk Renew ables continues to implementits growth and development strategywith theexpansion of its multi-dairy RNG cluster project, one of the

projectsset todrivegrowthand takethe three-decades-old company to the next level.

“A critical componentto our development strategyistheability toaddcapacitytocom plementthegrowth endeavoursofourhost business partners,” says McClain.

Ata timewhenclimatechange isoneof the biggest threats tohumanity and requires urgent solutions,the growth ofMontauk Re newables, whichhas asecondary listingon theJSE,indicates shareholderinterestinre newable energy.

In a statement toinvestors, the company saidthedemandfor RNGproducedfrombio gas remainsstrong due toincreasing public policyinitiatives.These arefocusedon reducinggreenhouse gasemissions, including methane,and thedevelop ment of additional renewable energy sources to offsettraditional fossil fuels.

Totaloperating revenuein 2021in creased47.5% to$148.1mcompared with 2020.Operating profitin 2021 was down 6.9% to $3.3m.

Dividends inthe yearended December31 2021werenot paidand the company intendsto retain future

5Sunday Times TOP 100 COMPANIES

To Page 6 ➛

Share price, daily (cents) Montauk Renewables TOP 100 COMPANIES1 Graphic: Ruby-Gay Martin August2022: R93,049 1,000 8,000 15,000 22,000 29,000 201920202021 20182022 September 2017: R10,000 investment

Montauk Renewables' Humble Renewable Energy project in Texas, US. Picture: Montauk

Montauk Renewables CEO

earnings, ifany, tofinance theoperations, growth and development of its business.

With astaff complementof 132people across six statesin the US, thevalue of pro ducing clean energy and looking after the environment as well as colleagues is part of the organisational culture at Montauk.

“The ethos we’ve cultivated across the or ganisation, its management team,all of our 130employees isthe careandcustody ofthe environmentand anunwaveringcommit ment tothe healthand safetyof eachof the employees, ourproject stakeholders,[as well as] creativity and enthusiasm that helps us identify,develop andoptimise newpro jectopportunitiesas acomprehensivecol lective team,” says McClain.

CFOKevin vanAsdalansays theorgan isation’s biggest challenge over the past year was theindustry’s growth,which presented both challenges and opportunities.

“Therenewable naturalgas industryhas grownmeasurablyover thepastyear,in creasing and changing the competitive land scape for projectopportunities. Montauk has remaineddisciplined inits approachto selectingthe ...projectsitinvests in,provid ingeconomic stabilityand meaningfulre turnson capitaland avariety ofcommodity and attribute pricing scenarios.”

Headdsthatin lightoftheindustry’s growthandtostay aheadofitscompetitors, Montauk stuck to its tried-and-tested script to retain its entrepreneurial spirit and its col laborative approachto its growthand devel opment endeavours.

He says the company has an “all hands on deck” approachthat extendsacross the business, fromevaluating newproject op portunitiesto identifyingoptimisationop portunities within its existing project portfo lio,and generatingconfidencein discussionssurrounding thesegrowthen deavours with hostbusiness partners, fin ance syndications as well as its board of dir ectors.

Consistent, reputable and sustainable

Implats

By LYNETTE DICEY

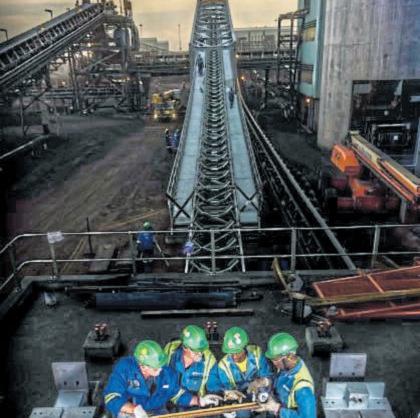

● Impala Platinum (Implats)has continued to reapthe benefitsof elevatedmetal pricing. Despite lower platinum group metal (PGM) pricingandsales volume,thebusinessde liveredheadline earningsof R32bn,gener atedR28.8bn infree cashflow, andearnings before interest, taxes,depreciation and amortisation of R53.4bn in the financial year.

Implatsis rankednumbertwo inthis year’s Sunday Times Top 100 Companies.

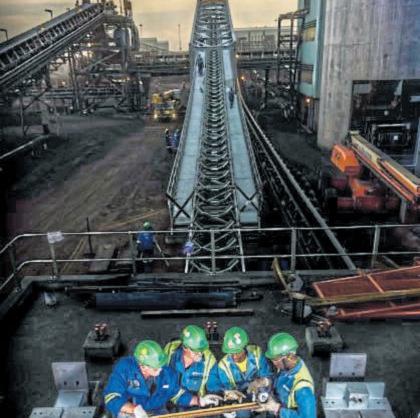

Theseresults wereachieved whilenavig atinga hostofoperational challenges,in cluding rising input costs, constrained supply chainsand labourmarkettightness. Thiswas compounded bysafety stoppages, intermit tent power supply and periods of community unrest, says Implats CEO Nico Muller.

“The business ended theyear with a strong and flexible balancesheet and is well positionedtofund ourplannedcapitalex penditure programme,sustain shareholder returns,aswellas pursuearangeofoppor tunities to enhance ourvalue delivery and long-term sustainability.”

The company hasachieved value-accret ive acquisitive growth andadvanced a suite of ambitious organic growth projects in the past year. It has also concluded a historic fiveyearwage agreement,which assuresthe business of a long period of stability.

A deterioratingglobal economicoutlook, dynamic PGM pricing and demand, and rising inflationaffecting inputcosts have

combined toensure achallenging environ ment for PGM miners.

Implatshas respondedbyfuture-proofing its business through advancing its competit ive position, improving its environmental, so cialand governance(ESG) performance,in vesting inits people, andsupporting product growth anddiversification, whilealigning its production to evolving demand, says Muller.

“A competitive asset portfolio is a strategic advantage thebusiness has soughtto bolster throughoperational exposuretoshallow, mechanisable ore bodiesand developing in tegratedprocessing facilities,” says Muller. “We are committed to a five-year, R50bn cap ital investment programme to increase bene ficiationcapacity andto extendlife-of-mine development.”

Totransform itsremaining exposureto high-cost,labour-intensive miningatImpala Rustenburg, Implats hasproposed acquiring Royal BafokengPlatinum. In addition,it has earmarked R9bnof thecapital investmentto expandits SouthAfrican andZimbabwean smelting and refining facilities. An initial $521m will be investedto expand its existing Zimbabwean smelting capacityand con struct asulphur dioxide (SO2) abatementplant to mitigate air-quality issues.

Zimplats hasaccess tohy dropowerand hassecureda power generationlicence for 185MW, with the first phase ofa 35MWsolarphotovoltaic project under way. This ex pansion, saysMuller, willac commodate an additional 600,000 PGM ouncesa year which, postsmelting, willbe

6 Sunday Times TOP 100 COMPANIES

➛ From Page 5 To Page 8 ➛

To transform its exposure to high-cost, labour-intensive mining at Rustenburg, Implats has proposed acquiring Royal Bafokeng Platinum. Picture: Philip Mostert

Share price, daily (cents) Impala Platinum TOP 100 COMPANIES2 201920202021 20182022 Graphic: Ruby-Gay Martin August2022: R53,570 1,000 7,500 14,000 20,500 27,000 September 2017: R10,000 investment

maintains top balance sheet in tough year for PGM miners

Montauk has remained disciplined in its approach to selecting the ... projects it invests in

Sean McClain

transportedtothe company’s South African processing facilities for further refining.

A further R3.9bn willbe invested over the nextfive yearsinimprovingits SouthAfrican processing facilities.

“Combined,these developmentswillbe nefitthe SouthernAfrican region’s produc tion,reducethe environmentalfootprintof the group’s beneficiationcapacity, and dir ectly increase local beneficiation, positioning the region more competitivelyas a global mine-to-market PGM producer,” says Muller.

In partnership withAfrican Rainbow Min erals, Implatshas committed R5.7bnto con struct anew Merenskymine andplant atthe Two Rivers operationto expand production. Though Implats hasonly a 46% stakein Two Rivers, 100%of the180,000 ouncesof PGM product production will be treated through its smelting and refining facilities.

Together, these projects will increase local beneficiation byabout 220,000PGM ounces a year from 2028 onwards. Muller says that added toa numberof life-of-mineextension projects, the company is confident it will sus

tainandgrowthe totalrefinedsupplyof PGMs fromits southern Africanassets over the next decade.

The businessis allocatingR4.3bn overthe next fiveyears toensure eachof its operations has renewable energy in itsmix, to meetImplats’ de carbonanisation targets and to strengthenenergy secur ity. “Ourrenewable energy projectswill contributesig nificantly to a progressive de cline in carbon emissions over time,” says Muller.

The companyis beingrecog nised forits ESGefforts withits MSCIESG ratingupgraded toAfrom BBB,re flectinganimproved approachtoemissions and water management and strong gov ernance structures.It wasone ofonly four JSE-listed metals andmining companies to beincludedin theS&PGlobalSustainability Yearbook 2022 and theonly company glob ally to be awarded the prestigious Metals and Mining Industry Mover Award.

The company maintains constructive rela tionshipswithits minehostcommunities

and,inthepast year,spentR170moncom munity development initiatives, R228m on housing, R14bn ondeveloping local enter prisesandR2bnon hostcommunities.Italso provides health-care services,food, agricul ture, education and skills development programmes to its local communities.

“Conversations withour core customer base continues to reflect increasedrequests formetalon long-term supply contracts and supports ourview ofrobust medi um-term demand for platinum, palla dium and rhodium.Customer requests reflect growing industrial and automot iveusesfor platinum,whilediscus sions on long-term availability for iridium and ruthenium continue to rise,” says Muller.

There areopportunities to berealised by advancing itsentry intoCanada, leveraging itscompetitiveadvantage inZimbabwe,and consolidating its competitive position in South Africa, he says.

“We’reconfident inthePGM market,des pite the global economicchallenges, and be lievewearewell positionedtobenefitfrom higher-for-longer price outlook.”

of tussle

Royal Bafokeng

By AURELIA MBOKAZI-KASHE

● RoyalBafokeng Platinum(RBPlat)has climbed17spotsto thirdplaceinthisyear’s Sunday Times Top 100Companies. No other company in the top 10 has come close to achieving this feat.

The mid-tierproducer ofplatinum groupmetals(PGMs) hasbeenthe subjectof ahigh stakescontest between ImpalaPlatinum Holdings (Implats) and Northam Holdings, as both seek a controlling stake.

Northam,in Novemberlastyear, announced ithad bought a34.5% in terestin RBPlatfromits parentcom pany, Royal Bafokeng Investment Holding Company(RBIH), withop tions and a right offirst refusal to ac quire a further 3.28%.

Meanwhile, Implats’ deal togain control ofRBPlat wasalready inpro gress.WhenRBPlat closeditsbooks

for the six months toJune 30 this year, Im plats’ sharewas just below 40%.Implats re quires 42% to gain control of RBPlat. Finalisa tionofitstakeover offerhasbeenstalledby

Northam’s application tobecome an inter veningparty inthe CompetitionTribunal merger hearing.

Weighing up the two bids, RBPlat CEO StevePhiri saidamergerwith Implatswould result in operational,community, labour and cost synergies becausethe two companies’ operationsare contiguousto eachother. While theNortham offerdid notpresent the same synergies owingto the distance between their operations,Phiri said both companieshad good-qualityassetswith long-life mines andgood management. He noted that Implats had a slight advantage.

The lengthy process tofinalise a deal has created some uncertainty.

Phiri characterised thetakeover bids as “thebiggest challenge... thathas been ragingfor the past 18months or so. When that happens in any corpor ate,itdistracts people,theworkers andeveryone else.The marketbe comes uncertain.The longerit takes, themore uncertaintyisperpetu ated.”

Phiri also lamentedthe decision by RBIH to sell itsshares, saying as a majorityshareholder andparent company,RBIH shouldhavebeen there to provide leadershipand be “a catalyst forconsolidation between

8 Sunday Times TOP 100 COMPANIES

Platinum has stayed on course amid the battle for its shares

➛ From Page 6

Crown jewel at centre

To Page 9 ➛ Royal Bafokeng Platinum is considering building a 98MW solar plant. Picture: Supplied Share price, daily (cents) Royal Bafokeng Platinum TOP 100 COMPANIES3 201920202021 20182022 Graphic: Ruby-Gay Martin August2022: R52,719 1,000 5,000 9,000 13,000 17,000 September 2017: R10,000 investment

Nico Muller

thetarget companyandthe acquirer.That did not happen”

Consequently, Phiri hasbeen leading a stakeholder managementcommunications strategy targeted at employees, organised la bour and communities to ensure they stay on course and that thecompany does not pro duce poor results.

Themessaging appearsto havesuc ceeded as the half-yearproduction to endJuneincreased by4.5%to 225,500PGM ounces, despiteoperational challengesre latedtogeological conditionsatStyldrift mine.

RBPlat attributed the challenges to Styldrift being a mechanised mine, requiring specificskills thatare inshortsupply, andas a result equipmentmaintenance and ma chine availabilitywere affected.Outside helphas sincebeenbrought in.

Due to higher costs aswell as lower basket prices, headline earnings per share plummeted 58% to R7.67.RBPlat cutits interim dividend by half to R711m.

In linewith its tagline, “More thanmining”,the ownerof Bafokeng Rasimone platinum mine (BRPM), Styldrift and the BRPM and Maseve concen tratorplants isconductinga feasibilitystudy to generate98MW ofclean, greensolar power to boost its energy security and re duce mining inflation. This marks part of RB Plat’s road map to net-zero carbon emissions by 2050.

The feather in thePGMs producer’s cap is the delivery of two state-of-the-art schools it builtin partnershipwiththeNorth Westde partment of education.

Theschoolsare located close to the company’s flagshipWaterkloof HillsEstate, which broke ground in 2013.

The Waterkloof Hills primary and sec ondary schools receivedtheir first pupils earlythis yearthough theywere onlyoffi cially opened in August. The two schools will be opened toall pupils in thearea and not only children of the5,000 employees living at Waterkloof Hills.Ultimately, the two schools willhave apupil population of 2,000.

“Thosetwo schoolsarebeautiful. Iim plorepeople tojustpassby andseethe schools in Rustenburg. Ithink it’s not just RBPlat that should take pride,it is the de partment of mineral resources & energy that has beenthe facilitator inthe Socialand La bourPlanforthe miningindustryasa whole,” says Phiri.

Amplats standing strong

The challenges of 2022 haven’t slowed down its commitment to society

By LYNETTE DICEY

● Despite local and global headwinds, Anglo AmericanPlatinum (Amplats)hascontinued to delivera strongfinancial performance withrevenue ofR86bn,earnings beforein terest, taxes,depreciation and amortisation (ebitda) of R43bn, andan ebitda mining mar gin of 59% achieved for the first six months of 2022, withR33bn paid individends, accord ing to its interim results.

Natascha Viljoen, CEOof Amplats, says 2022hasbeen largelyaboutmitigatingthe persistent operational headwinds of Covid, global supply chaindisruptions, se curityof electricitysupply, aswell as socialand geopoliticalcom plexities.

“Global supplychain issues continue to affectus. The deliv eryof substandardmaterialshas, for example, extended the Polok wane smelterrebuild bytwo months, leading us to lower our re fined productionand salesguid ance for the year,” she says.

Conceding thatthis hasbeen disappoint ing, she saysit’s a temporary delayin refined production anda timingissue ratherthan ac tual lost production.

Cost escalationsdue tosupply chaindis ruptionsand thewar inUkraine alsocontin ue to affect the business. Rising global infla tion,requiringcentral bankstorespond throughfiscal tightening,willresult inlower economic activity which hasa knock-on ef fect on demand for the company’s products.

ItsMogalakwena mineexperiencedun precedented rainfallat thestart ofthe year and supplychain disruptions,which ledto delaysin thedeliveryof drillingequipment. All its operations havealso been affected by load-shedding.

These challenges haven’t stopped the

business frommaking asignificant contribu tion to society.This year it haspaid out R6.8bn in salaries, increased local procure ment to R15.3bn which includes R1.1bn on doorstepcommunity procurement paid R350min communitydevelopmentspend and dividendpayouts tocommunity trusts, and R9.5bn in tax and royalties to the fiscus.

The company signed off a groundbreaking five-yearwage agreementwith unionsearli er in 2022.Viljoen says the agreementwas a positive, industry-leadingdevelopment ina challenging economiccontext andenables thebusiness toremain sustainablethrough PGM price cycles.

Viljoen is proud ofAmplats’ nuGen zero emissions haulage solution,a hydrogen fuel cellhaul truckwhich hasbeen designedto operate fullyladen witha payloadof 290 tonnes in mine conditions.

“The truck is the first of its kind in the world and putsSA on the globalstage in termsofinnovation andthedecar bonisation ofheavy-duty trans portation.This truckis theem bodiment of human ingenuity and what it means to think dif ferentlyabout mining,” she says.

Unlockingthe hydrogeneco nomyis amajor focusof Amplats. “We see hydrogen as a key enabler of a Just Transition, withsignificant potentialforSA tokick-start localisation andbeneficiation in SAand to produceand exportgreen hydrogen,” says Viljoen. “The great potential ... is that it allows for thestorage of excessrenewable energy thatcan thenbeusedin transport,heating and industrial processes.”

Platinum groupmetals, ofwhich South Africa is the world’s largest supplier, play a vital rolein polymerelectrolyte membrane (PEM), electrolysersand fuelcells. Byinvest inginthe hydrogeneconomy,saysViljoen, the companysecures future demandfor its metalswhile alsobeingableto materiallyin form a greener, cleaner future.

For several years now,the company has been investingin hydrogentechnologies and

9Sunday Times TOP 100 COMPANIES

➛ From Page 8 To Page 10 ➛

Amplats’ Mogalakwena mine ore sorter. Picture: Anglo American Platinum Natascha Viljoen

Steve Phiri

ventures. In 2018, itspun off a number ofthese investmentsin start-upcom paniesinto anindependentventure capitalfirm, APVentures, withinvest ments of $100meach from Amplats and the PublicInvestment Corpora tion.Over 500PGMopportunities havebeen discovered,withinvest ments in 24PGM-containing or en ablingtechnology companiesacross the hydrogen value chain.

TOP 100 COMPANIES

Anglo American Platinum

Share price, daily (cents)

August2022:

Thesafety, healthandwellbeing ofitsemployees arethereforeits foremost value.

“From a leadership perspective, ourvaluesand purposearenotjust words we say, butare embodied in everything wedo. This startsat the topand tricklesdown beyondthe mine gate,” says Viljoen.

201920202021 20182022

Graphic: Ruby-Gay Martin

“Thisis inaddition toin-house market development efforts, all target ingtheunique catalyticpropertiesofour metals to make theworld healthier and greener,” says Viljoen.

Oneofthe company’s four strategic prior ities isto bea leaderin environmental,social and governance (ESG). It is therefore focusing on implementingthe threepillars ofits sus tainable mining plan by developing trust as a corporate leaderand providingethical value chainsand improvedaccountability tothe communitiesitworks with,improvingthe health, qualityof educationand accessto

employmentandother opportunitiesinlocal communities, and maintaininga healthy en vironment bycreating waterless,carbonneutral minesand delivery-positivebiod iversity outcomes.

But it’s Amplats’ people who arethe real differentiator,saysViljoen. “As an organisa tion,weareclearthat wewouldnotbeable todoourwork ofreimaginingminingtoim prove people’s livesifit werenotfor themen andwomen whodo theintensive workof miningthemineral resourceswehavebeen blessed with as a country.”

The company expects global plat inumsupply anddemand totighten asautomotive platinumdemandim proveson theback ofautomakers replacing somepalladium inex haust catalysts with platinum.

Palladium supply and demand, says Vil joen, is likely to loosenfor the opposite reas on, though the extent will depend on how overallautomotive productionfares.Rhodi um supply and demand is expected to remain tight.

Amplats iswell positioned tomeet grow ingPGMdemand, particularlyasmorecoun tries announce hydrogen-specific strategies and moreinvestment iscommitted tobroad er hydrogen infrastructure and green hydro gen production.

Exxaro makes most of coal price

Top priorities solving logistics challenges and phasing out fossils

By LYNETTE DICEY

● Record coal prices helped Exxaro Re sources togrow headline earningsby more thana fifthin thefirst sixmonths of2022. This isdespite reduced exportvolumes and lower earnings from its iron ore investments.

Exxaro, whichis oneof thelargest blackempowereddiversified miningcompaniesin SouthAfrica withan assetportfolio thatin

cludes coal, iron ore,zinc and renewable en ergy, grew its half-year group revenue by 48% to R22.3bnat end-June2022 afterexport prices for coal more than tripled.

This year, Exxaro is ranked number five in the Sunday Times Top 100 Companies.

Thelandscapefor coalhaschangedsigni ficantly sincethe last Sunday TimesTop 100 Companies, says Exxaro CEO Nombasa Tsen gwa. “Webegan experiencinganincreasein coal pricestowards the end of2021, attribut ableto acombinationof supply-sidechal lenges and increasing demand.”

Graphic: Ruby-Gay Martin

August2022:

Coal prices have continuedrising in 2022, reachingrecordlevels duetofurthermarket tightnessand theenergycrisis resultingfrom theRussia-Ukrainewar. Butwhiletheprice environment has been favourable for Exxaro at a time whenit has been positioningto improveits quality coalmix, logistics challengeshave meantthere has been only limited oppor tunityto maximiseits thermal exportvolumes and take advantage of prices.

As aresult oflimited avail ability byTransnet Freight Rail, Exxaro has been forced toresortto truckingcoalto ports, including Maputo in Mozambique. This has, in someinstances, doubledthe

cost of coal transport.

InOctober, theMinerals CouncilSouth Africasaid theminingindustryhad lostan estimatedR50bn inrevenue in2022 dueto Transnet’s inefficient logistics infrastructure.

“Solvingtheselogistical challengesisa critical priority,” saysTsengwa. “We’ve been involvedwith findingand implementingsus tainablesolutionswith Transnetbothindi viduallyasa companyandcollectively throughtheMinerals CouncilSouthAfrica. However, thereis a lotfor thegovernment to

10 Sunday Times TOP 100 COMPANIES

➛

Page 9

From

4

R47,440 20,000 75,000 130,000 185,000 240,000 September 2017: R10,000 investment To Page 11 ➛ Share price, daily (cents) Exxaro Resources

TOP 100 COMPANIES5

201920202021 20182022

R35,646 September 2017: R10,000 investment 8000 11500 15000 18500 22000

Exxaro’s flagship mine, Grootegeluk, near Lephalale in Limpopo. Picture: Exxaro

Creating a better future

consider inincentivising theprivate sectorto help create sustainable rail capacity.”

She reports somesuccess, particularly in relation to bettersecurity of the coalline in certain areas.

Exxarohas anambitiousplan todiversify away from fossil fuelstowards alternative re source opportunities.While phasingout fossil fuelsis a priority,the businessis de termined to follow the Just Transition prin ciples and also decarbonise its operations.

Tsengwa says the company aims to be car bon neutral by 2050.

The companyalso plans todiversify its mining portfolioto ensureits growthis driv en by lower-carbon businesses.

Thefirst ofthese investmentswas into re newable wind energy through a whollyowned renewable energy business, Cennergi, currentlyoneof SouthAfrica’s largest locally-owned renewables developers. Cennergi’s wind farms,Amakhala Emoyeni andTsitsi kamma, togethergen erate229MW ofelec tricity into the grid.

Other renewable energy projectsin clude the develop mentof the70MWLephalale SolarProject. The latter development aimsto lower the emissions for Exxaro’s Limpopo-based Grootegeluk operations.

Ensuring Exxaro’ssustainability, shesays, is acombination of factorsincluding navigat ing andresponding tochange, balancing stakeholder expectationsand needs,as well asthe considerationof social,environmental and economic issues in all its strategies to en sure profitability and competitiveness.

Withcoal pricesexpectedto remainat current levels till the first half of 2023, Exxaro will continue to maximiseits volumes and highest quality mix to benefit from exports.

Exxaro’s safety achievements, community empowerment initiatives, employee engage ment efforts, environmental stewardship and high levels of governance resulted in a 3.8 out of 5 score in the FTSE Russell ESG Index.

Bythe middleof 2022,Exxaro hadbeen fatality free for more than five years.

Aspart ofExxaro Resources’ biodiversity and environmental strategies, the mining company isdonating 40white andblack rhinos fromits Manketti Game Reserveto the Zinave National Park in Mozambique.

“We promoteequal opportunities,fair ness,transparencyand consistencyinour practicesandpolicies, somethingwe’re par ticularly proudof. Weare pleasedwith the progress, whichalso includesthe continuous improvementsweare makinginourinteg rated reporting processes,” says Tsengwa.

11Sunday Times TOP 100 COMPANIES

through the way we do business

Providing meaningful employment

Creating value for all our stakeholders

Developing and caring for our host communities

Coolead 18932

Caring for and supporting our environment

Bringing long-term growth and opportunity for all our stakeholders

➛ From Page 10

Nombasa Tsengwa

ARM in good stead

Group improved its financial position despite low iron and PGM prices

By AURELIA MBOKAZI-KASHE

● Diversification hasproved advantageous for AfricanRainbow Minerals (ARM)in the face of lower ironore and platinum group metals prices.

The mining andminerals company held steady in sixthplace for a secondyear run ningintheSunday TimesTop100Compan ies, notwithstanding a13% drop in headline earnings to R11.3bn for the year ending June 30 2022.

Headlineearnings pershare alsoslumped toR57.87from R66.88 in2021, thoughtotal di vidends paid rose toR32 a share comparedwith R30theprevious year.

“ARM’s qualitydiversified portfolio enabledus to improveour financial position despite lower prices for iron ore and platinum group metals. Our net cash in creased fromR8.2bn toR11.2bn, enabling ARMtocontinue investinginourexisting business,paydividends andpursuevalueenhancing growth,” saidexecutive chairand founder Patrice Motsepe inthe annual re port.

In accordance with its commitment to the ParisAgreement, ARMaimsto achievenetzero greenhouse gasemissions from mining before 2050. Meanwhile, scope 1 and 2 emis sions werereduced by8% duringthe report ing period andwater withdrawn decreased by 13% to 17.3-million cubic metres.

The developmentof decarbonisation plans at the company is under way.

ARMPlatinumhas signedanagreement topurchase solarpower fromSola Group,in which Solawill build aphotovoltaic facility and wheel clean, low-costenergy to ARM’s PGM operations in Limpopo and Mpumalanga.

The solar energy supplied is expected to

caterfor athirdofthe division’s consump tion. Pending boardand regulatory approval, the project should be complete in three years. Plans to generate about 80MW of solar en ergy for the ferrous division are advanced.

ARMemploys 22,000people,including contractors.Salariespaid inthe2022finan cialyearstoodat R4.2bn,whileR198mwas spent on skillsdevelopment. Historically dis advantaged people make up 68% of manage ment.

ARM spent R151m on community projects with the emphasison supporting women, youth, thehistorically disadvantagedand people with disabilities. These projects focus on water provisionand sanitation, build ing andupgrading roads, health and education.

Communities which have an 8.5% share holding in Modikwa mine received R255m in dividends.

The miningand re source group recorded twofatalities inthe 2022 financialyear; thelost-time injuryfre quency rate improved by 24%.

With operationsin SouthAfrica and Malaysia, ARM minesand beneficiates iron ore, manganese ore, chrome ore, PGMs, nick eland coal.Italsoproduces manganeseal loys andhas astrategic investmentin gold through Harmony Gold.

ARMFerrous headlineearningsfell 16%to R6.7bn asa resultof lower iron oreprices; whileARM Platinum headlineearnings dropped 34% to R3.1bn on the backof lowerrhodiumand palladium prices.

Higherexport coalprices drove aR1.2 billionincrease inARM Coalheadlineearn ings to R928 million.

Inline withitsvalue-en hancing growth strategy, ARM acquired the Bokoni platinum mine in the eastern limbof theBushveldCom plex during the reporting

period, andfully settledthe R3.5bnpurchase consideration on September 1.

“Thestrategic acquisitionof thisquality asset enablesARM toscale itsPGM portfolio andimprove ourglobalcompetitiveness. Thismine isexpectedtomore thandouble our attributablePGM ounces overthe next five years,” Motsepe said in theannual re port.

Thedevelopmentof Bokoni,Motsepead ded, wouldalso create sustainablevalue for employees, local communities and black in dustrialists ascollectively theywould own 15% of the mine. The mine is also expected to create5,000 jobs,halfofwhich willbeper manent.

“Central to this mine plan is improv ing efficiencies, reducingunit costs and providing early revenue. We en visage development capital of about R5.3bn [inreal 2021 terms] over three years toramp the mine upto steady-stateproductionof about300,000ounces of6EPGM and 255,000 tonnes of chromite concentrateper annumfrom 2028,” CEOMike Schmidtsaid inthe annual report.

The R10.4bnmodernisation andexpan sionprojectofBlack RockMinewascom pletedand handedoverto operationsfor production.Unitproduction costsareexpec ted to decline as a result, while production of manganeseore shouldrampup to4.6-mil lion tonnes a year by the 2025 financial year.

12 Sunday Times TOP 100 COMPANIES

Share price, daily (cents) African Rainbow Minerals TOP 100 COMPANIES6 201920202021 20182022 Graphic: Ruby-Gay Martin August2022: R35,254 8,000 14,000 20,000 26,000 32,000 September 2017: R10,000 investment

African Rainbow Minerals' Modikwa platinum mine in Limpopo. Picture: Elijar Mushiana

Mike Schmidt

Patrice Motsepe

Lifetime achiever

EnsurEnsuringing w wo omen men’’s s sse eat atat at thethe tabletable

By AURELIA MBOKAZI-KASHE

● GloriaTomatoe Serobeisone ofSouth Africa’s iconic businessleaders, known for being an architect of women empowerment.

A co-founderof themultibillion-rand Women Investment Portfolio Holdings (Wiphold), her business acumen is steeped in socialtransformation valueswith theend goal being the empowerment of women.

Her sociallyinclusive economicmodels empower marginalised rural women through interventions underpinnedby agriculture and tourism, as well as corporate executives wholean onherforpersonal wisdomand business strategies, in equal measure.

Alongside herpartners, Serobecreated andbuilt Wipholdfromtheground up.The organisation lists WipholdInvestment Trust ashaving morethan 1,200direct and18,000 indirect women beneficiaries.

Humble, kind, compassionate, hardworking and determined are among the com

Astute businesswoman, champion of the poor and inspiring leader, Gloria Serobe’s integrity and passion informs all she does

monadjectives usedby familyand friendsto describe Serobe, this year’swinner of the Sunday Times Lifetime Achiever Award.

She sits on variousboards of directors, in cluding Hans MerenskyHoldings, Denel and AdcorpHoldings, andalsoserved onthe Presidential EconomicAdvisory Counciland the Presidential Working Group on Women.

During her illustriousbusiness career, she has received many accoladesfor her contri bution toSouth African society. Someof the tributes includebeing namedBusinesswo man of the Year in the corporate category and theAfrican WomenCharteredAccountants Woman of Substance in 2006.

Louisa Mojela,group

ofWiphold, saysSerobedeserves everyhon ourandrecognition bestowedonherowing to herpassion for ensuringwomen’s em powermentis alwaysontheradar ofpolitical leaders and at everygovernment policy dis cussion.

“One of the benefits of working with Glor ia isthat she’s greatat ensuringthat women from all walksof life have a seatat the table sothat theirviewsareheard andaddressed,” says Mojela.

“Sheis alwaysinvolved intransforming

13Sunday Times TOP 100 COMPANIES

CEOand co-founder

To Page 14 ➛

Gloria Serobe has been awarded the Lifetime Achiever award at the Sunday Times Top 100 Companies event. Pictured here, Serobe was theguestspeakeratthe InauguralArchbishopThaboMakgobaAnnualPublicLectureatNMU SouthCampusinMay2022.

Picture: Werner Hills

andempoweringwomen inurban,periurban and rural areas. She takes services to Centane to ensure women there are not left behind while also ensuring that Wiphold grows and benefits its shareholders.”

Serobe’s projects in Centane, a small rural coastal townin theEastern Cape,where she hasbeen drivingsizeable communitydevel opment partnerships, includean upmarket seasidehoteland alarge-scalecommunal farming project of maize and soya beans. This commercial-sized farming projecthas en abled rural women to take charge of their fin ances.

Mojelafurthercredits herlong-timebusi nesspartnerand colleagueforensuringthat all Wiphold employees uphold the highest level of integrity and governance.

In March 2020, Serobewas appointed by President Cyril Ramaphosa to chair the Solid arity Fund a collaboration between busi ness, the government and civic society estab lishedto offsetthe impactof Covidon citizens and the economy. Her role was to try tohelp thepoor andwomensurvive thehu manitarian crisis created by the pandemic.

Recognising her contribution to business inSouth Africa,fouruniversities have con ferredherwith honoraryPhDsoverthe years.

Serobe credited her conservative, reli giousupbringing (hergrandfather wasa Baptist priest) for hervalues underpinned by integrity, and for her success in business.

Her childhoodwas livedbetween Gugu lethu inCape Town,and Centanein theEast ern Cape. She has adapted the life lessons she learntgrowing uptomoderntimes toshare with the younger crop of professional women who look up to her for inspiration.

In aninterview with702, Serobeencour aged youngwomen businessleaders towork smarter andfocus on finding agood worklife balance and not abandon their families to pursue corporate careers.

She usedher entrepreneurialmother asa good example.

“My parents ran shops in townships. My mother would be gone from 7am until 9pm, but we knew where she was and that she was fending for us. After school, we would simply go to the shops to be with her.

“Beingan absentmother isnotnew andI don’twant youngprofessionalsto feelguilty. Youjusthaveto levelwithyourchildrenand letthemknowthat youwillnotalwaysbe present.However, don’tshock childrenby promising them you will be at their swim minglessons andnotbe there.Thisis oneof the lessons I learntfrom my mother,” she says.

“When you talk about legacy and mentor ingwomen, wehaveanobligation togive them tools to ensure theydo not only focus

on careers and abandon their homes and families. Theburden of balancingwork life and home is a huge struggle, but we have bet tertoolsthanour mothers.Wehavetechno logyandfacilitiesthat takepressureoffus, such as delivery apps, thatallow us to be [both] presentmothers thatcreate warm homes forour children andpowerful execut ives,” she says.

Her brother-in-law,City Serobe,speaks glowingly ofSerobe’s dedicationand lovefor her biggerfamily, which has elevatedher to the role of thegreater Serobe family matri arch, filling the shoes left by his mother.

“Gloria tells people that she is a wife and a motherfirst, andmanagesher differentroles withfinesse. Shehumbles herself,treats people with respect, andis persuasive while managing to make the family’s elders feel im portant,” he shares.

Mojela maintains that among her many business attributes, Serobe is resolute and fights towin in everyrespect andnever ac cepts failure.

“Whenever weexperience challengesas a company and there is an issue we need to ad dresswith thegovernment, Gloriais ourar senal.”

She says Serobe does not tolerate any form of mediocrityand gets morefrustrated when people whohave been entrustedwith im portant positions instate-owned entities and the privatesector “drop the ball” and forget their core mandate.

14 Sunday Times TOP 100 COMPANIES

➛ From Page 13

Whenever we experience challenges and there’s an issue we need to address with the government, Gloria is our arsenal

Louisa Mojela Group CEO and co-founder of Wiphold

She humbles herself, treats people with respect, and is persuasive while managing to make the family’s elders feel important City Serobe brother-in-law

Gloria Serobe sits on various boards of directors, including Hans Merensky Holdings, Denel and Adcorp Holdings,and also served on the Presidential Economic Advisory Council and the Presidential Working Group on Women. Picture: Robbie Tshabalala

Business Leader of the Year

Providing hope and long-term vision

CEO of Toyota South Africa Motors Andrew Kirby advises young leaders to focus on upskilling, rather than on how quickly they can get promoted. Picture: Darren Stewart/Gallo Images

By LYNETTE DICEY

● PresidentandCEO ofToyotaSouthAfrica

MotorsAndrew Kirbyisthe 2022Sunday Times Business Leader of the Year in recogni tion of his leadershipduring a particularly trying period for the vehicle manufacturer.

Toyota’sDurban productionfacilities suffered the most extensivedamage ever ex periencedby thecompany inits 60-yearhis toryinSouth AfricaonApril122022 asares ult of flooding.

“The magnitude of the disaster was enormous,” admits Kirby. “We hadbetween 0.6m and 1.8mof mud over ourentire 87ha site and extensivedamage to electrical, mechanical and IT equipment.We had to or der just over 100,000new equipment parts to replacedamaged partsand wereforced to crush about 4,300 vehicles.”

Parent company Toyota Motor Corp in Ja pandispatchedits seniordisastermanage mentexecutive toDurbanafter thefloods, whoconfirmed thiswasthe biggestdisaster causing themost extensive damage toany of the company’s productionfacilitiesin itshis tory.

This was not the first flood to affect Toyota’s Prospectonplant. Aftera much smaller floodin 2017, the companycreated a disaster protocol whichhas been regularly updated.Addedprecautions wereputin place, including strengtheningthe plant’s gutterand storm-waterdrainage systems,as

It’s important for leaders to spend time at the coalface of their businesses

CEO of Toyota SA Motors

“Iwas inJapanin2011 afterthetsunami

and ourdamage was evenworse than theirs,” says Kirby. “We wereshocked atthe enormityofthe destructionthefirsttime we wenton siteafter thefloods. Theentire plant was covered by thisthick mud. It took us months to recover.”

The company’s firstpriorityin theafter math of the floods wasto ensure the safety and wellbeing of its employees. “We were fortunate that none ofour staff lost their livesorwereinjured, butanumberofthem had their homes damaged.We have been assistingthosewho suffereddamageto their homes to rebuild.”

Its secondpriority wasits community, including suppliers andits dealer network, with Toyota’s technicalteams tasked with helping where necessary.

Recovering production wasonly a third priority,says Kirby,addingthat noemploy ees lost their jobs during this period.

“What was very reassuringwas the sup port wereceived fromour parentcompany. Theysenta numberoftechnicalexperts and engineersto helpus repairand rebuild. This,combined withthesupport fromlocal technical partners, gaveme enormous hope.”

He says he was also particularly proud of how manyof thecompany’s youngerem ployeestook responsibilityandownership duringtherecovery phase. “They were

15Sunday Times TOP 100 COMPANIES

Andrew Kirby’s exceptional leadership steered Toyota through its biggest production disaster To Page 16 ➛

well as installing a storm-water warning sys tem. Eventhese precautions,however, were not enough to withstand this year’s floods.

Andrew Kirby

Workers assemble vehicles as operations begin after flooding in April shut down the Toyota South Africa Motors plant in Durban. Picture: Rogan Ward/Reuters

presentingon thestatus ofthe recoveryas though theyhad fiveto 10years ofexperi ence,” he recalls.

By the end of July,the plant had started ramping up production and regained full pro duction inSeptember. “Ourrecovery has beennothingshort ofmiraculous,” says Kirby.

The companyhas now developeda com prehensiveset ofmeasuresdesigned forde fence againsta floodof thismagnitude. It’s working with the local authorities to address infrastructure issues, hasbetter secured its perimeter, and has put additional on-premise protections in place.

The company has had a difficult few years. Its operationswere haltedby theCovid pan demicin 2020,which wasfollowed bycivil unresta yearlater andthen thefloods. Kirbysays thecompany remainscommitted to South Africa.

Heconcedes, however,thecountry isnot without its challenges. To achieve shared prosperity, South Africa urgently needs to ad dress a numberof fundamentals, including lawand order,fraud andcorruption, andex pediting the judicial system. Getting these fundamentals right,believes Kirby,will go somewaytowards attractingbothlocaland foreign investment.

“At the same time, we need to be investing inutilitiesincluding energy,waterandsanit ation aswell asinfrastructure suchas rail, ports, roads and dams as these are all import ant for businesses and will create opportunit ies for growth.”

In the past year, thecompany has made a number of adjustments.

“We’renowpartof amuchlargerglobal disruption characterised bynew energy vehicles and carbon neutrality. Given that the majorityof ourexportsareto Europe,where petrol, dieseland hybrid vehicleswill ulti matelybe banned,weneedto ensurewe don’t become an old-technology supplier if we plan to maintain that export volume.”

Business leaders, he says, need to focus on whatthey cancontrolandnot expendtoo much energy on aspects out of their control.

“Our role as leaders is to provide hope and along-term visionforthefuture. It’s also im portant for leadersto spend time atthe coal face oftheir businesses. For me,that is spending time on the production line, in our offices, withour suppliers and withour deal er network. Not only doesthis allow us to keep grounded,but it ensuresbusinesses are galvanised in the right direction.”

Hisadvice toyoungleadersis tobepa tient.

“South Africais in desperateneed ofa tal ent pipeline of good leaders.Try to stay in one sector and focuson upskilling, rather than on how quickly you can get promoted.”

Northam’s growth strategy on track

Miner continues to benefit from acquisitive and organic growth strategy

By AURELIA MBOKAZI-KASHE

By AURELIA MBOKAZI-KASHE

● NorthamPlatinum hasmoved onenotch up the Sunday Times Top 100 Companies list, fromeighth in2021 tosevenththis year,des pite a7.6% decline in operatingprofit from last year’s record R16.1bn.

In contrast,in theyear toend-June 2022, revenuefor theintegratedmine-to-market platinumgroupmetals (PGMs)producerwas up from R32.6bn to R34.1bnand so was pro duction from 690,867ounces lastyear to 716,488 ounces in 2022.

Northam attributes thedip in operating profit to lower metalprices, increased social unrest inthe areassurrounding itsopera tions,andan 18.9%uptickinproduction costs.

CEO PaulDunne saidthe company’s growthstrategy isstill ontrack, withthe miner having set itselfa medium-term annu al production target of 1-million ounces.

Nodividend wasdeclaredinthe 2022fin ancial year as the company continued to pur sue its countercyclical investment in both ac quisitions and an organic growth strategy, the cornerstone of which isdevelopment of lowcost,long-lifeassets toderiskoperations against muted or volatile markets.

“In 2015, we embarkedon a focused pro gramme of acquisitions, targeting operations andmineral resourceswith synergisticand

optionality benefits,” said Dunne in the group’s integrated annual report.

Inaccordance withthe strategy,Northam acquired a34.5% shareholdingin RoyalBa fokeng Platinum (RBPlat)from its parent company, RoyalBafokeng InvestmentHold ings(RBIH), inNovember2021, withoptions andaright offirstrefusalto buyafurther 3.28%.

The transaction increasedNortham’s debt to R16bn, though CFOAlet Coetzee has sub sequently saidthe companyexpected tode leverage aggressively in the next 12 months.

Aspartofthedeal, RBIHtookupan8.67% stake in Northam so the Roy alBafokeng Nationcould continue tohold aninterest in RBPlat.

The transaction led to a skirmish withImpala Platin um(Implats), whosebidto acquire a controlling stake in RBPlat wasalready under way. Implats has since grown itssharein RBPlattojustbe low 40%.

Meanwhile, Northam’s application to becomean in

16 Sunday Times TOP 100 COMPANIES

➛ From Page 15

A smelter at Northam Platinum’s Zondereinde operation. Picture: Northam Platinum

To Page 17 ➛ Share price, daily (cents) Northam Platinum TOP 100 COMPANIES7 201920202021 20182022 Graphic: Ruby-Gay Martin August2022: R32,771 2,000 8,000 14,000 20,000 26,000 September 2017: R10,000 investment

tervening party in the Competition Tribunal’s hearingfor theproposedmerger ofImplats andRBPlat hasstalledthedeal, whichIm plats originallyintended to finaliseby April 2022. Ironically, Northam received a R536.2m dividend from RBPlat in April.

Northam’s new independent chair, Temba Mvusi,said intheannualreport theinvest mentinRBPlatis alignedtothegroup’s growth strategy.

“RBPlathasa large,proven,qualityre sourcebase, containingapremium mixof PGMs.Itsmines areshallow,well-capitalised and partiallymechanised. Theyare currently producing, have extensive lifeand are cash generative, withthe potential ofoperating in the lower half of the cost curve.”

Analysts havesaid that Implats’ bid to control RBPlat woulddeliver more valuegiven the proximity of the en tities’ assets, but Northam argues RB Plats’ two assetsare within 80kmof itsfullyowned Zondereinde and Eland operations. Nor tham’sthird mine,Booysendal,is situatedin the BushveldComplex. It fundsthe Button shope Conservancy Trust, which manages 8,500haof the14,690habiodiversity-rich land which the mine ownsand in which it’s located.

Northamalso countsaPGM recyclingfa cility in theUS among its assetsand holds significant interest in Dwaalkop Platinum Mine and SSG Holdings.

Mvusi leadsa boardwith adiverse skills set, whichcomprises four womenand five men,includingformer deputyfinanceminis ter McebisiJonas. Theboard haspaid tribute to late former chair David Brown.

Northam has created 2,864 new sustain able jobs in the2022 financial year, bringing total jobs created since 2015 to 11,096. The bulk of the workforce (82%) comprises his torically disadvantaged people, with 64.5% in management,and15.4% womeninmanage ment. The company maintains good relations withorganisedlabour andhassignedfiveyear wage agreementswith the National Union ofMineworkers atZondereinde and Eland.

Covid continuedto affectoperations dur ingtheyeardue tomedicalabsenteeismand employeeturnover ofolderstaff members,in particular. The company’s vaccine rollout yielded positive results. Sadly, two operation al fatalities were recorded at Zondereinde.

Northam’s empowerment strategy has resultedin upto 23%equity heldby staffand host communities throughan extended em powerment transaction.

At Anglo American, our people are at the heart of everything we do. Our people are our business.

Together, we create and deliver sustainable value by working towards common goals while empowering individuals to realise their full potential.

We are committed to realising our Purpose of ‘Re-imagining mining to improve people’s lives.’ This is how we continue to nurture relationships with our host communities, government, suppliers, customers, and partners.

Thank you Sunday Times for recognising Anglo American, Kumba Iron Ore and Anglo American Platinum in the 2022 Top 100 companies.

Together, we are shaping a better future.

17Sunday Times TOP 100 COMPANIES Scan to learn more

➛ From Page 16

Paul Dunne

Strong showing in a tough year

Kumba’s disciplined cost control and value over volume strategy is paying off

By LYNETTE DICEY

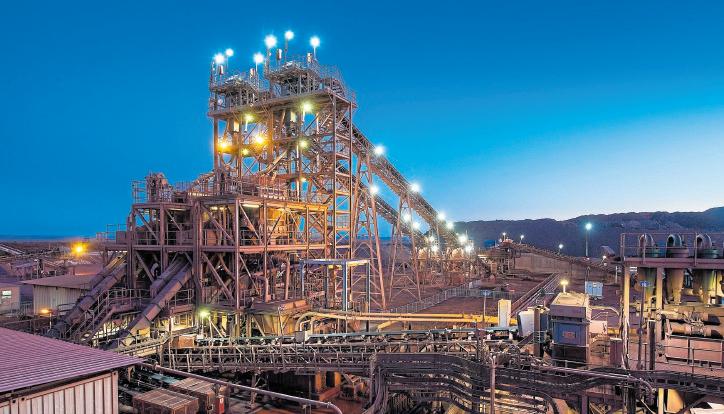

● Despitethe challengingmacroeconomic environment, South Africa’s largest iron ore producer,KumbaIron Ore,deliveredasolid financial performancefor the firsthalf of 2022, which translated into ebitda of more than R23bn and an ebitda margin of 54%.

Thecompany deliveredthis strongper formance in the first half of the year amid ad verse seasonalweather conditions,equip mentavailability issues,logisticchallenges, and a safety resetinitiative which affected operational activity.

Kumbais rankednumbereight inthis year’s Sunday Times Top 100 Companies.

Aside from weather-related impact on the railway line, suboptimallogistics perform ance hampered the business.

Though there was a slight improvement in

Kumba Iron Ore CEO

the secondquarter of 2022,rail constraints had a knock-on effect on performance: lower levels of stock at the port resulted in lost sales andrevenue, aswellashigher freightcosts due toship-loading delays,and ultimately meantthat salesincreased onlymarginally off a low 2021 base.

“Weare workingwithTransnet toimple ment improvement initiatives, including in

tegrated planningand trackingto reducethe number of speedrestrictions and unsched uled maintenance events. We should mitigate some of the losses through the use of the multipurpose terminalat SaldanhaPort, which will help to improve loading effi ciency,” says KumbaCEONompumelelo Zikalala.

Despite theimpact ofthe recentrail and portstrike,Kumba maintaineditsfull-year productionguidance,though atthelower end of38- to40-million tonnes,enabled by an increase in production at Sishen. However, thecompany recentlylowered itsfull-year export guidance by about 6% as a result of the Transnet strikeand theunplanned delayin the annual maintenance shutdown.

In aninflationary environment,it isdis ciplined cost control that’s paying off for Kumba.The costincreasesbrought aboutby operational headwindsincluding increased fuel, haulageand explosive costswere offset by higher work-in-progress stockpile replen ishments.

“Reducing our costs to ensure that we stay competitive is a priority,” says Zikalala.

Atthe sametime, avalue overvolume strategyhaspositioned thecompanyfora

18 Sunday Times TOP 100 COMPANIES

To Page 19 ➛

Kumba Iron Ore's Kolomela mine near Postmasburg in the Northern Cape. Picture: Philip Mostert

Reducing our costs to ensure that we stay competitive is a priority

Nompumelelo Zikalala

slowdown inthe priceof ironore. Thismeansinvesting innewtech nology toprocess the ironore at sourceso ithasahigher ironcon tent and thus higher value before transporting it toKumba’s cus tomers around the world.

Kumba Iron Ore

“Over the years, we’ve been fo cusingon ourTswelelopelemar ginenhancement strategyunder pinned by three drivers: improving the quality of products to maximise value,improving op erational efficiency, anddelivering a cumu lative cost saving of R4.5bn. This has seen our marginincreasefrom45% in2018to54%as we achievea marketpremium forthe quality of our ore,” she says.

Asthe marketembraces theneed forde carbonisation,Zikalala believessteel willre main pivotal for the future, because it is a cru cial ingredient that enables energy transition across all renewable power infrastructure and electric vehicles.

“Steel demand is expected to increase in the global shift towards renewable energy,” shesays. “Steelintensityin renewablepower infrastructure is between 10and 30 times that of fossil-based power infrastructure.”

In aneffort to decarbonisethe steelmak ing process, mills are investing more in direct reducediron, witha healthypipeline ofpro jects coming on board inthe next three dec ades. China and other traditional steelmak ingfurnaces areconsolidatingproduction into larger blast furnaces, reducing emissions by usinglump oreinstead offine ore,which significantly reduces overall emissions.

These trendsare expectedto benefit Kumba given that its share of lump ore is muchlarger than itscompetitors’ and itsproducts havea muchhigher ironore content.This, believesZikalala, willdrive demandfor high-qualityoreas itoffers higher productivity andhas lower energy

requirements.

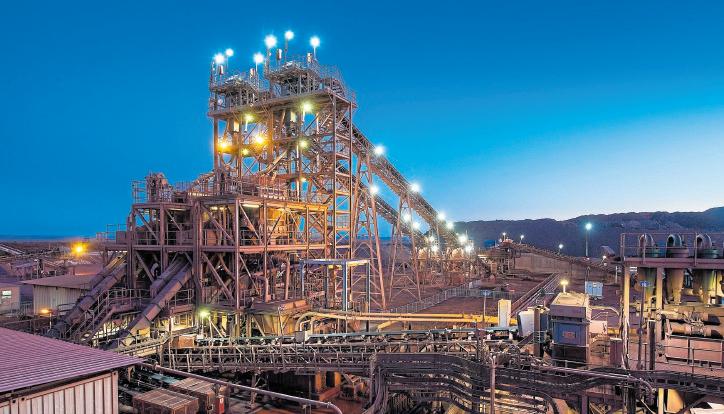

Kumba, partof theAnglo American Group, is an acknowledged leader in sustainability. Anglo’s FutureSmart MiningTM is focusedon developing the futureofsustainable miningwithan ambitiousplanto driveanincreasingly decarbonised “green steel” value chain.

“As part of our decarbonisation path way, we are targeting a 30% reduction in scope 1 and 2 greenhouse gas emissions by 2030, and achieving carbon neutrality by2040.Asa result,weareprioritising our participation inthe broader Anglo American Group’sregional renewable energy strategy.

“This includes the plan to develop a 65MW solar plant at Sishen by 2025, as well as wheeled wind and storageby 2030, which offers us a pathway tozero scope 2 emis sions,” says Zikalala.

Kumbaachieved aFTSE4GoodIndex score of 4.8 out of 5.

Thebusiness isalsostrivingto createa safe, inclusive and diverse workplace that en courages high performance and innovative thinking. Anew hybridemployee shareop tionscheme offersa tangibleand lastingbe nefit toemployees. Kumbais particularly proud ofhaving achievedsix consecutive years of fatality-free production.

Powering sustainable mining by integrating renewable energy into our existing minerals portfolio is how we will maximise coal’s full scope of possibilities, fulfilling a critical role in our industry.

Building our core businesses and diversifying our organisation to remain relevant and resilient in an ever-changing global environment means we will continue to make our coal business successful – a competitive cash generator and critical enabler to the broader South African economy.

19Sunday Times TOP 100 COMPANIES

price, daily (cents)

Share

TOP

8 201920202021 20182022

30,000 45,000 60,000

➛ From Page 18

100 COMPANIES

Graphic: Ruby-Gay Martin August2022: R32,607 15,000

75,000 September 2017: R10,000 investment

It It’’s nots not just just a aboutbout pr profi ofit ft for or A Anglonglo AmerAmericican an

Mining giant walks the talk in its commitment to employees, the environment and host communities

By AURELIA MBOKAZI-KASHE

By AURELIA MBOKAZI-KASHE

● Havingbeen inbusiness formore thana hundredyears, AngloAmericanis nowfo cusingonmorethan justmakingmoney.The global mining company celebrated its cen tenary in September 2017, and has since been on a quest to “reimagine mining to improve people’s lives”.

This yearis nodifferent, eventhough its financial performance for the six months to June 30was somewhatmuted compared with 2021’s commodity price-driven record earnings.

Underlyingearnings beforeinterest,tax, depreciation andamortisation (ebitda) slipped 28% to $8.7bn,but was still the

second highest on record for a half year.

Profit attributableto equityshareholders fell29% to$3.7bn,yieldinga dividendof $1.5bn,equivalent to$1.24 pershare, inline with Anglo’s 40% payout policy.

Anotableachievement wasthecommis sioning of Quellaveco ontime and on budget; the conglomerate’s mineinPeru isexpected toproduce 300,000copperequivalent tonnes in the next 10 years.

Atthe releaseoftheresults, themining giant wasmindful of how itsoperations were affectingemployees, hostcommunities,the environment and society at large.

CEO DuncanWanblad expressedsadness at theloss ofan employeein anequipment lifting incident in Australia.

“It issimply unacceptableto losea lifeat work andwe aredetermined toeliminate workplace fatalities once and for all. This is my number one priority,” he said, adding that the Elimination of Fatalities Taskforce sup porteda93%reduction infatalincidentsin the past decade.

Covid continued to affect operations in the first half of theyear via related absenteeism, thoughhospitalisation anddeath rateswere lower due to less virulent variants and higher levels of vaccination.

The company made significant financial contributions to accelerate vaccination rates usingits ownhealthfacilities,while theLiv ing with Dignityprogramme helped tackle gender-based and domesticviolence to cre ate a healthier working environment.

Throughits SustainableMining Plan,the groupiscommitted toreducegreenhouse emissions by30% by 2030;improve energy efficiencyby 30%;achieve a50% netreduc tion in freshwaterabstraction in waterscarce areas; andreach net-positive impacts in biodiversity where it operates.

It is also committed to employing its assets to make products thatenable a low-carbon economy.

Aligned tothis strategy,it signeda memorandum ofunderstanding inMarch with EDF Renewables to work together to de velop a regional renewable energy ecosystem in South Africa.

Theecosystem issettomeet AngloAmer ican’s operational electricityrequirements in the country by supplying between 3GW and 5GW of solar and wind power, as well as stor age, by 2030.

Any excess electricity willbe supplied to

20 Sunday Times TOP 100 COMPANIES

To Page 21 ➛

AlexTumisangLekga isAfrica’sfirstlicensedhydrogen truckoperator.Hewas behindthewheelwhenAnglo American unveiled the world’s largest hydrogen-powered mine haul truck that operates at its Mogalakwena PGMs mine in Limpopo. Picture: Anglo American

At theend of June, themultinational star ted negotiations with FirstMode to combine Anglo American’s nuGenzeroemissions haulage solution(ZEHS) withFirst Mode’s

9

Anglo American

specialisttechnology toaccelerate thedevel opment anddeployment ofZEHS technology across Anglo American’s mine haul truck fleet. The ZEHS is powered by a hydrogen fuel cell and aims to decarbone heavy-duty trans port.

Earlierin JuneAnglo Americanannounced it had signed a$100m 10-year sustainabilitylinked loan agreement with the International Finance Corporation, to support community development in South Africa’s rural areas close toits operations.The loan will beused to promote jobcreation aswell asim prove thequality ofeducation for 73,000 students.

201920202021 20182022 Graphic: Ruby-Gay Martin August2022: R32,270 15,000 30,000 45,000 60,000 75,000 September 2017: R10,000 investment

Share price, daily (cents)

A resilient and agile portfolio

In 2021, Anglo American supported 147,000jobs across Australia,Brazil, Chile, China, India,South Africa,the UK andNorth Americaetc. It paid $3.5bn in taxes,a 6% rise from 2021.

We are determined to eliminate workplace fatalities once and for all

TOP 100

Share price, daily (cents) Transaction Capital

4,500 September 2017: R10,000 investment

3,500

2,500

Strong performances from Nutun and WeBuyCars has driven organic earnings

By LYNETTE DICEY

● TransactionCapital nowhasa decadeun der its belt as a listed company, during which timeithasremained aperennialmarketfa vourite.

The company invests in and operates a di versified portfolioof high-potentialbusi nesses in marketswhere historically low levelsofclient serviceandstakeholdertrust provide opportunities for disruption.

Thegroup isranked number10 inthis year’s Sunday Times Top 100 Companies.

This pastyear itextended itstrack record of organicearnings growth,driven primarily by strongperformances fromNutun (previ ouslyknown asTransaction CapitalRisk Services) and WeBuyCars.

Nutun has positioneditself to drive growth through twomain revenue streams: capital-enabled services and customer ex perience management services,the latter beingthe fastest-growingsegment ofthe

business.

1,500

Customerexperience managementser vices are capital light,and diversified across geographies, sectors andclients, which lowers concentration risk, enabling the busi nessto earnreturnsindifferent marketcon ditions.

This market positioning,says CEO David Hurwitz, is yielding positive results, with Nu tun’s earningsfor this financialyear growing at a higher rate than historic levels.

WeBuyCars, on theother hand, continues to gain market share, having exceeded its me dium-termtarget of10,000vehicle salesa month in the first half of the year.

Thisgrowthhas,in part,beendrivenby the expansionof itsphysical footprint.It has launched five new branches this year, includ ing alarge vehiclesupermarket atThe Dome in Johannesburg with a capacity of 1,400 bays.

The outlook for the used vehicle market in SouthAfricaremains positive,saysHurwitz. “There areabout 11-millionpassenger vehiclesin circulationinSA,with growthof between 2% and5% a year overthe past dec ade.The globalsupply ofnew vehicleshas recovered,which supportscontinuedgrowth in SA’s vehicle ‘car parc’ and, in turn, benefits used vehicle trading.”

“Parc” is a European term for all registered vehicleswithin adefined geographicregion, originating fromthe Frenchphrase parcde véhicules,meaning thecollective numberof vehicles or a vehicle collection.

He says cash-strappedconsumers trading down tomore affordable usedvehicles will drive future growth. “Vehicle ownership is an aspirationthatis deeplyrootedinSouth

To Page 22 ➛

21Sunday Times TOP 100 COMPANIES

Thebusiness plansto establishphysical dealerships across thecountry, which will COMPANIES10 201920202021 20182022

Graphic: Ruby-Gay Martin August2022: R27,682

500

the grid to bolsterits resilience. The partner shipis expectedtostimulatea hostofeco nomic benefits,including developmentof new sectors, and supportthe country’s Just Energy Transition.

The groupdropped five placesfromfourth toninthin this year’s Sunday Times Top 100 Companies.

TOP 100 COMPANIES

varyinsizeand structurebasedonmarket demand in the region.

Duncan Wanblad

➛ From Page 20

Anglo American CEO

African culture,” he says.

WeBuyCars’ proprietary data, tech and ar tificial intelligence capabilitiesenable it to make rapid adjustments to market pricing and this, combined with its high inventory turnover rate,reduces theimpact ofadverse vehicle price movements.

Over the medium-term, says Hurwitz, earnings from WeBuyCarsare expected to continue to grow at higher rates than before.

Over the past twodecades, SA Taxi’s busi nessmodelhasevolved fromaspecialityfin ancier withinthe minibus taxi sectorinto a vertically integratedmobility platformoffer ingaccess tominibustaxi ownership,fin ance, insurance and maintenance.

SA Taxi’s earnings this year have remained below 2021levels. Macroeconomichead winds including rising fuel and energy prices, inflationary pressures, rising interest rates, poweroutagesand persistentlyhighunem ploymenthave placedpressure onminibus taxi operator profitability, resulting in finance andinsurance instalmentaffordabilitycon straints. And, though commuter activity is in creasing, it is not expected to reach pre-pan demic levels in the short term.

SA Taxi’searnings were alsoaffected by Toyota’s productioncapability, whichcon strained the business’s abilitytogrowgross loans and advances.

Encouragingly, demand fornew minibus taxis and SA Taxi’s pre-owned quality re newedtaxis(QRTs) continuestoexceedprepandemic levelsand remainsfar higherthan supply, says Hurwitz.

David Hurwitz Transaction Capital CEO

“SATaxihas builtcapacitytorefurbish QRTs from 280 a month in 2020 to about 400 amonth,while increasingaccesstospare parts by enhancing its import processes.”

This increasedrefurbishment capacity will supporthigher QRTvehicle supplyand, in turn, grow QRT loan origination, he says. It’s astrategy which partiallybuffered the businessfromtheimpact oftheToyotaplant closure afterextensive flooddamage earlier this year.

Inthe yearahead,thebusiness plansto optimise its core minibus taxi lines.

In2022, thecompanylaunched GoMo,a used vehicle mobilityplatform, which lever ages offSA Taxi skillsand systemsto under write, fund,collect, repossessand designfin ance and insuranceproducts. It also leverages off WeBuyCars’ access to low-cost distributionatscaleand abilitytovalueand liquidate collateral efficiently.

GoMo aims to disruptand capture market share in an underpenetrated used vehicle fin ance and insurance sector.

Hurwitzsays GoMohasreceived avery positive response from themarket with the number of loan applications being signific antly higherthan expected. “We expect GoMo tobe beneficialto WeBuyCarsand to increase volumes traded aswell as drive higher penetrationof financeand insurance products, particularly onolder vehicles whichare nottraditionally financedby banks.”

Transaction Capital successfully com pleted an acceleratedbookbuild in Septem ber 2022,raising R1.28bn ofadditional capit al. Thebookbuild wasoversubscribed, highlighting just how strong shareholder support for the business remains.

Hurwitz believesthe group’s well-diversi fied portfolio of businesses is strategically and operationallyrelevant, resilientand agile.

“Based on our current assessment of oper ating conditionsand growthprospects, we expect organic earnings growthover the me diumterm tobeat leastinline withhistoric growth rates,” he says.

22 Sunday Times TOP 100 COMPANIES

➛ From Page 21

WeBuyCars showroom at The Dome in Johannesburg, with a 1,400 bay capacity. Picture: Supplied

Vehicle ownership is an aspiration deeply rooted in South African culture

Get more Benjamins. no matter where you bank. *Terms and conditions apply. Visit www.getshyft.co.za/terms-and-co nditions for more information. Foreign exchange rates and sha Shyft operates under the license of The Standard Bank of South Africa Limited, an authorised Financial Services Provider (FSP number 11287).

access to forex at the cheapest rate means more of your ZAR in dollars, pounds or euros.

–

your

Getting

Buy, own, send or trade forex

and make the most of

South African moolah.

By AURELIA MBOKAZI-KASHE

By AURELIA MBOKAZI-KASHE

By AURELIA MBOKAZI-KASHE

By AURELIA MBOKAZI-KASHE