Why SA’s payment revolution hinges on trust, technology and inclusion

Altron FinTech is a proudly South African company that has been innovating payment solutions for over 30 years. We’ve pioneered solutions that simplify payment challenges and make it easier for you to do business because it’s our business to support and grow yours.

Our purpose is simple: to help our customers get paid, grow their operations and serve their communities. We offer a wide range of services, from debit order processing and transaction switching to credit management tools, card personalisation and payment solutions like NuCard and iMali. Whether you run a school, are a microfinancier, a retail store or a medical practice, we’ve designed our technology to meet your needs and remove the technological, regulatory and processing complexities that get in your way.

Our people are dedicated to service and innovation, working behind the scenes to keep your business moving. We also partner with leading hardware providers, so you get top-tier, reliable payment devices.

We’ve seen how the right technology can change lives. That’s why we stand by our promise: our technology impacts lives, with our people behind it. We’re here to help you grow into tomorrow with smarter tools, trusted service and solutions that work because you matter.

For more information:

010 060 4444

www.altronfintech.com www.linkedin.com/company/altronfintech

Investec partners with private, institutional and corporate clients, offering international banking, investment and wealth management services in two principal markets, South Africa and the United Kingdom, as well as certain other countries. The group was established in 1974 and currently has approximately 7 800-plus employees. Investec has a dual-listed company structure with primary listings on the London and Johannesburg Stock Exchanges.

Visa is a world leader in digital payments, facilitating transactions between consumers, merchants, financial institutions and government entities across more than 200 countries and territories. Our mission is to connect the world through the most innovative, reliable and secure payment network, enabling individuals, businesses and economies to thrive.

Visa is pioneering this next chapter, and South Africa is uniquely positioned to lead in adoption. According to Visa’s Consumer Empowerment Study, 62 per cent of South African consumers trust that their data is being handled securely. Yet, 38 per cent seek greater control over how their data is used. Agentic commerce directly addresses this need by enabling consumers to set clear parameters around how, where and when their credentials are used – placing control firmly in their hands.

South Africa’s digital maturity further strengthens its readiness. Financial institutions are already deploying advanced technologies such as tokenisation and mobile-first authentication. Biometric verification is becoming commonplace, and digital wallets are gaining traction. These developments create a robust foundation for the seamless integration of agentic commerce.

For more information: https://www.visa.co.za/

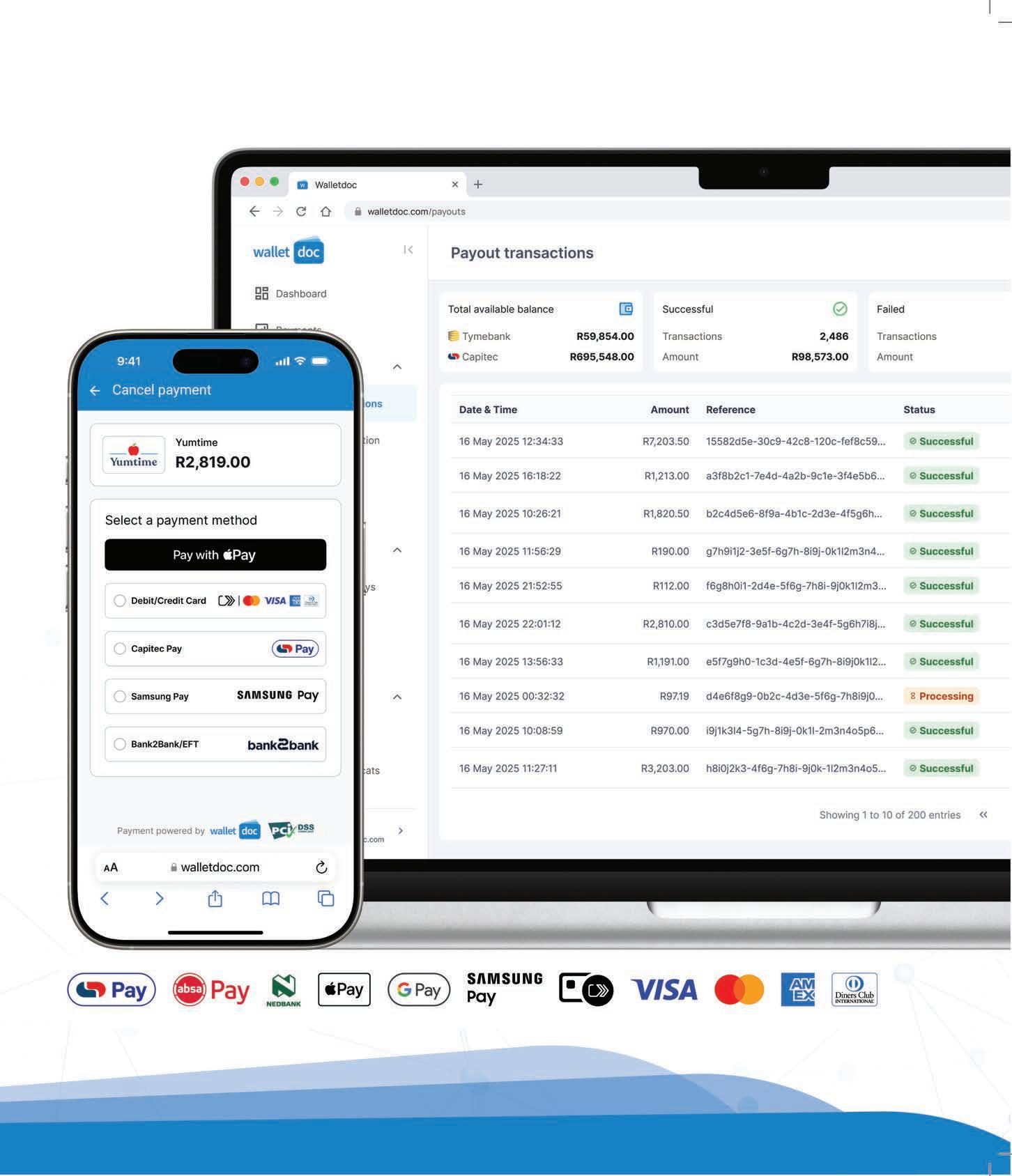

We make getting paid easy

Walletdoc is a proudly South African fintech transforming how businesses accept payments, online, in-app and in-store. Trusted nationwide, Walletdoc processes billions of rands annually. Our PCI Level 1 and PCI 3DS certification guarantees world-class transaction security.

We offer a complete suite of payment options, from card machines and e-commerce payments to mobile wallets such as Apple Pay, Google Pay, Samsung Pay and Click2Pay. Our solutions are designed for speed and simplicity, reducing payment friction and lowering cart abandonment.

Walletdoc leads with innovation, offering real-time transaction visibility, automated reconciliation and seamless integrations. Our mobile app and web portal give merchants instant access to data, making business management effortless.

With 24/7 local support, Walletdoc is more than a service provider; we are a partner in your success. Choose Walletdoc for secure, scalable, and user-friendly payment solutions that empower your business to thrive.

get started. sales@walletdoc.com | www.walletdoc.com

6 SUSTAINABILITY

Payment systems have a major impact on environmental, social and governance considerations across industries.

14 COMPLIANCE

As African fintech start-ups navigate the continent’s complex regulatory maze, compliance-as-a-service is becoming the backbone of their expansion.

20 DIGITAL PAYMENTS

Digital payment is no longer a peripheral convenience, this technology is now central to the transformation of payment ecosystems worldwide.

24 CONTACTLESS PAYMENTS

Initially driven by COVID-19 requirements, the implementation of contactless banking technology has now reached a stage of widespread acceptance.

29 FRICTION

Reducing friction in digital payments is key to enabling seamless commerce across Africa.

30 SUPER APPS

Integrating a growing array of services into one convenient, mobile-friendly package, super apps are winning over consumers.

34 CRYPTOCURRENCY

Shifts in how we interact with money, along with technology, are prompting a rethink of wealth from the ground up.

35 AFRICAN TRADE

The Pan-African Payment and Settlement System represents a game-changer for intra-African trade.

36 OFFLINE PAYMENTS

To ensure financial inclusion for all, South African businesses and consumers must fully embrace offline payment solutions.

42 INSTANT PAYMENTS

Demand for instant payments is driving a major rethink of South Africa’s digital payments landscape.

RMB is a leading African Corporate and Investment Bank (CIB). We partner with our clients to deliver advisory, lending, trading, securities, corporate banking, private equity and investment solutions. A presence in London, New York, Shanghai and Mumbai provides our global clients with a network to access African markets. We have a deal footprint in 35 African countries and facilitate cross-border trade and investment on the continent. RMB represents the CIB activities of FirstRand Limited – one of the largest financial services groups in Africa.

Founded in 1977 by three entrepreneurs, our business has always attracted a diverse group of talented people with an inherent curiosity and natural ability to harness different perspectives to tackle complex problems, creating solutions with lasting impact.

As an employer of choice, our unique and empowering culture is one that embraces human connection, inspiration and excellence to solve challenges and unlock opportunities for our clients and society.

RMB is made of Africa – our commitment to our clients, our continent and our people is evident in our successful track record. We create new opportunities where others see challenges.

For more information, visit: www.rmb.co.za

46 ECOSYSTEMS

In a move aimed at transforming the local payments landscape, eight nonbank fintech entities have formed the Association of South African Payment Providers.

52 FINTECH TRENDS

South Africa’s payments ecosystem has been evolving rapidly with significant growth over the past few years and open banking continuing to take centre stage.

54 GIG ECONOMY

As the gig economy booms, organisations need to cut red tape and speed up payment processes to match the speed at which their suppliers deliver.

56 EARNED WAGE ACCESS

What does allowing workers to access a portion of their earned income before payday mean for spending habits, financial inclusion and savings?

58 TRANSACTION SWITCHING

The power of transaction switching is revolutionising payment ecosystems.

South Africa is at a pivotal point in the evolution of its payments landscape.

We pioneered real-time clearing in 2006, have a strong, regulated banking system and a growing ntech ecosystem tackling local and global transaction challenges.

Yet, we’ve fallen behind. The South African Reserve Bank estimates that 55 per cent of transactions still use cash, likely excluding the informal economy. This is due to poverty, low-value transactions, mistrust in the system, lack of convenience and affordability issues.

Progress is underway. The launch of PayShap, enabling real-time, low-value interbank payments, aims to reduce cash reliance and improve convenience. In this issue of Payments, we explore how this

shift is reshaping the digital payments space for businesses and consumers.

We also examine ways to reduce friction in the ecosystem, the role of Bitcoin in nancial inclusion and the ESG impact of payments innovation.

Looking continentwide, the Pan-African Payment and Settlement System is tackling the long-standing issues of high costs and currency complexities in cross-border trade, vital for economic resilience.

Other developments include innovations in of ine payments to address limited internet access, improvements in contactless experiences, faster payments for gig workers and earned wage access systems supporting lower-income earners and promoting nancial literacy.

Customer experience is central, especially with the rise of super apps, hugely successful in Asia and gaining traction here. Much of this progress is driven by ntechs. We pro le three standout players in this issue, proof that while challenges remain, meaningful progress is being made.

Samsung South Africa is a subsidiary of the global electronics giant Samsung Electronics, which manufactures and redefines the world of electronic devices, including smartphones, wearables, tablets, TVs, monitors, home appliances, semiconductors and more. The company has been championing and embracing the transformative power of artificial intelligence, which is now quickly becoming integrated into everyone’s daily lives. Its purpose is simple: to give local consumers the freedom to take journeys, to discover new experiences and take charge of the world – providing them with a new way of life.

Since the dawn of democracy when Samsung entered the African continent with the establishment of the South African office, it has been committed to pushing its transformation agenda by investing in a number of empowerment programmes for the future, which have now led to positive social changes across the broader African continent. Samsung remains committed to contributing to a sustainable environment, both locally and globally.

For more information: www.samsung.co/za

Anthony Sharpe, Editor

SARB’S PAYMENTS STUDY REPORT 2023

Business Day

Picasso Headline, A proud division of Arena Holdings (Pty) Ltd, Hill on Empire, 16 Empire Road (cnr Hillside Road), Parktown, Johannesburg, 2193 PO Box 12500, Mill Street, Cape Town, 8010 www.businessmediamags.co.za

EDITORIAL

Editor: Anthony Sharpe

Content Manager: Raina Julies rainaj@picasso.co.za

Contributors: Keith Bain, Ben Caselin, Trevor Crighton, Megan Ellis, Rufaida Hamilton, David King, Dr Joseph Upile Matola, Lineshree Moodley, Busani Moyo, Brendon Petersen, Charl Janse van Rensburg, Rodney Weidemann, Lisa Witepski

Copy Editor: Brenda Bryden

Content Co-ordinator: Natasha Maneveldt

Online Editor: Stacey Visser vissers@businessmediamags.co.za

DESIGN

Head of Design: Jayne Macé-Ferguson

Senior Designer: Mfundo Archie Ndzo

Cover Image: [faithie]/123rf.com

SALES

Project Manager: Tarin-Lee Watts wattst@arena.africa | +27 87 379 7119 +27 79 504 7729

PRODUCTION

Production Editor: Shamiela Brenner

Advertising Co-ordinator: Johan Labuschagne

Subscriptions and Distribution: Fatima Dramat, fatimad@picasso.co.za

Printing: CTP Printers, Cape Town

MANAGEMENT

Management Accountant: Deidre Musha

Business Manager: Lodewyk van der Walt

General Manager, Magazines: Jocelyne Bayer

COPYRIGHT: No portion of this magazine may be reproduced in any form without written consent of the publisher. The publisher is not responsible for unsolicited material. Payments is published by Picasso Headline. The opinions expressed are not necessarily those of Picasso Headline. All advertisements/advertorials have been paid for

2025/06/20 10:47

in partnerships with our clients.

Industries worldwide are hastening to embrace environmental, social and governance principles as much to attract and retain clients as to fulfil their responsibilities in terms of society and the environment. How do payment providers measure up? By LISA

WITEPSKI

In South Africa, it is the inclusion – or social – element within the environmental, social and governance (ESG) framework that is garnering the most attention currently. This is an area where the payments industry stands to make a signi cant impact, says Tijsbert Creemers-Chaturvedi , managing director and senior partner at Boston Consulting Group (BCG) Johannesburg.

“The payment industry is pivotal in advancing nancial inclusion by facilitating individuals’ participation in the formal economy and promoting economic ow,” says Creemers-Chaturvedi. “Digital payments not only offer a safer alternative to cash, but also generate a data footprint that enables users to qualify for a broader range of nancial products and services, such as credit.”

Creemers-Chaturvedi adds that there are three distinct levels to nancial inclusion, starting with access to nancial products, then utilisation of the product and broader adoption, where multiple nancial products, such as credit and life insurance,

which means we have played a key role in driving nancial inclusion, especially for

There have been notable innovations

providers across the continent. M-PESA and MoMo are cases in point, and these payment solutions have served as

Mastercard is also cash to digital payments: “We work closely with banks, telcos and

ntechs to broaden access to digital nancial services,” explains Mark Elliott, president for Africa at Mastercard. The company’s collaboration with MTN Group Fintech has connected millions of previously unbanked individuals to the digital economy.

However, signi cant barriers to the adoption of digital payment solutions remain. Chief among these, according to Creemers-Chaturvedi, is the development of use cases that would promote further adoption and enhance nancial inclusion (still under development), while the paperwork associated with formal payment systems is frequently cumbersome.

In the UK, 11.2 billion unrecyclable paper receipts are printed annually.

Source: The Payments Association

and data packages are not accessible to all would-be users. Finally, many South Africans, especially the unbanked or underbanked, remain reliant on cash.

Kitso Lemo, associate director of BCG Johannesburg, notes that the costs associated with banking and payments in South Africa are often prohibitively high. This serves as a signi cant barrier to nancial inclusion, along with other factors such as trust issues. “There is often a lack of trust in digital nancial services, stemming from concerns related to fraud, cybercrime and data privacy.”

Credit scoring is an additional problem, while the digital divide means that smartphones

These problems are not insurmountable, Lemo insists. Access to affordable smartphones and data packages is a start because this would lay the foundation for engagement with digital payment services.

“One approach is to offer free or low-cost services to onboard users to digital payment platforms. For instance, telco providers’ mobile money services often have no fees for deposits, although they may impose charges for transactions and withdrawals. Additionally, payment processors such as Yoco are developing low-cost transaction models and subscription packages that are accessible for small, medium and micro enterprises (SMMEs) and local businesses, enabling them to accept payments from cashless customers.

“Another approach is to develop comprehensive ecosystems, not merely applications,” Lemo says. “Centred around a core service, providers, for example, Tymebank and Mukuru, offer a suite of services such as payments, remittances, savings and lending. This approach drives nancial inclusion by providing accessible and comprehensive nancial solutions to underserved communities.”

THE DIGITAL DIVIDE MEANS THAT SMARTPHONES AND DATA PACKAGES ARE NOT ACCESSIBLE TO ALL WOULD-BE USERS. FINALLY, MANY SOUTH AFRICANS,

IS WORKING WITH PARTNERS TO INTRODUCE SUSTAINABLE CARDS, REDUCING RELIANCE ON FIRST-USE PVC AND INSTEAD USING RECYCLED OR BIODEGRADABLE MATERIALS.

Pumpkn.io is another company aiming to foster greater nancial inclusion. This digital lender targets the agri-food economy, historically overlooked by the traditional banking sector, which tends to focus more on small retailers and urban-based SMMEs.

“We understand that the largest barrier for agri-food entities is the fact that they lack the banking history that is usually required before a nancial institution will grant a loan,” says Jérôme van Innis, Pumpkin.io co-founder. The company turns this model on its head by making funding available within 24–72 hours; thereafter, the SMME can generate records that build its pro le and make it eligible for further funding.

Elliot says; however, they are also able to offset this footprint through a contribution to the Mastercard Priceless Planet Coalition, which funds reforestation.

Mastercard is working with partners to introduce sustainable cards, reducing reliance on rst-use PVC and instead using recycled or biodegradable materials. Since its inception in 2018, more than 750 nancial institutions in 100 countries have issued cards through the Sustainable Cards programme.

Funding doesn’t only facilitate inclusion, however. Van Innis observes that this is often merely the rst rung on a ladder; once a small business is thriving, it is able to explore avenues that would ultimately lead to greater climate resilience, such as funding new techniques for keeping produce fresh through climate-friendly refrigeration. “Sustainability is certainly a consideration for our clients as they are severely affected by weather events,” he points out. “Our solution aims to build their resilience.”

Companies are also turning their attention to reducing their environmental footprint. Mastercard has several initiatives underway in this regard, says Elliott. The company has introduced the Mastercard Carbon Calculator, allowing cardholders to measure their carbon footprint based on their spending. “This is intended to help them make better choices,”

As ESG gains greater prominence on the industry’s agenda, it is likely that more companies will nd ways to enhance their sustainability credentials and, by extension, those of their clients.

The Payments Association suggests the following steps as a foundation for environmental, social and governance (ESG) in any business:

• Transparency is key. Customers need to know why you are striving for greater sustainability. This includes revealing facts about your current environmental footprint.

• Make sustainable payment methods – such as digital currency, mobile wallets or electronic payments – part of your offering.

• Work with suppliers that support and amplify your ESG goals.

• Incorporate any customer feedback pertaining to your efforts. This will ensure that they add real value.

Follow: Mark Elliott @ www.linkedin.com/in/mark-elliott-bbb63826

Tijsbert Creemers-Chaturvedi @ www.linkedin.com/in/tijsbert-creemers-chaturvedi-701520

Kitso Lemo @ www.linkedin.com/in/kitso-lemo

Jérôme van Innis @ www.linkedin.com/in/jerome-van-innis

The amount of plastic used to produce banking cards every year weighs as much as 95 Boeing 747s.

Source: Thales Group

Nonetheless, the Payments Association (which operates in the United Kingdom, European Union and Asia), observes that several obstacles must be addressed before this becomes widespread practice. These range from consumers’ wariness around greenwashing to the reality that consumers are unlikely to adopt green measures if they lead to greater costs. Consumers also demand that, more than an image-building exercise for a company, these measures must provide real value. On the other side of the spectrum, there are many consumers who have not considered that a payments solution could – or even should – take environmental considerations into account. The task here is to generate awareness of why this is important.

“One of the key challenges is identifying the right partners to co-design, scale and deliver solutions that not only serve commercial needs, but also support sustainability goals. Integrating environmental and social responsibility into product design and usage requires alignment across the ecosystem, from issuers and acquirers to merchants and consumers,” concludes Elliott.

“INTEGRATING

ECOSYSTEM.”

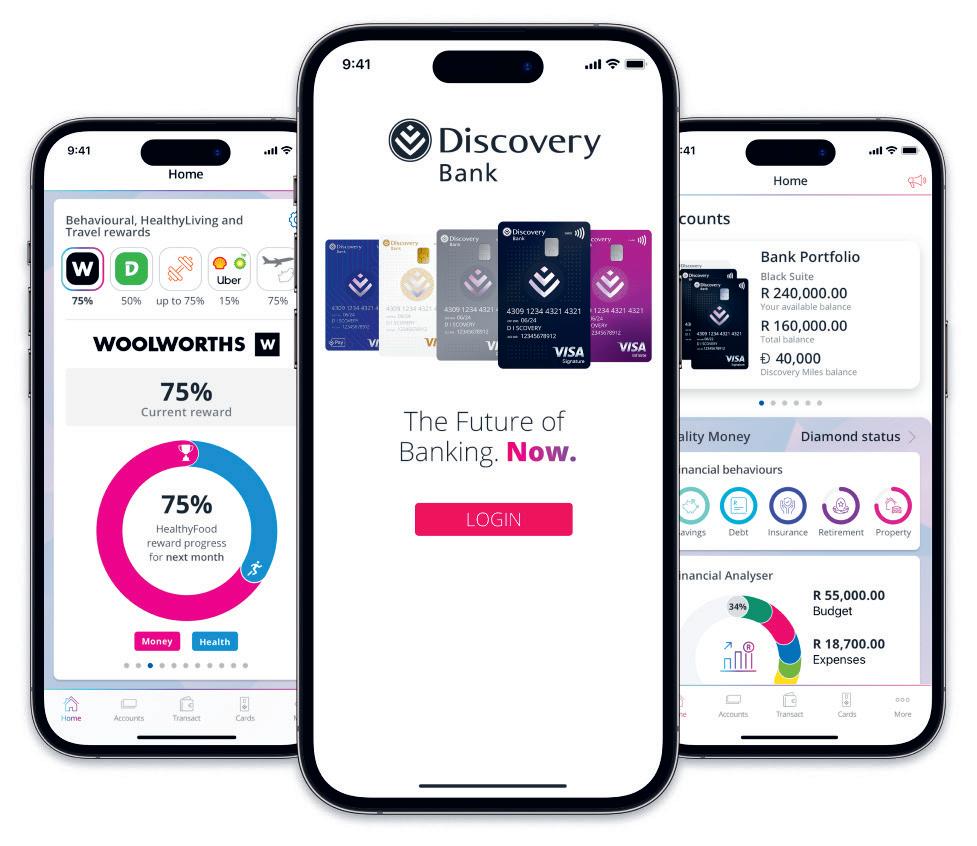

Powering South Africa’s real-time economy requires us to rethink the broader payments ecosystem, write KUBEN NAIDOO , head of corporate payments at Investec South Africa, and THIVIAN MOODLEY , head of product and pricing for Investec transactional products and solutions at Investec Bank

In the era of the real-time economy, payments must be instant, always available, secure and cost-effective. However, today’s expectations go far beyond reliable swipes and infrastructure. Consumers and businesses alike now demand personalised experiences, along with payment solutions that integrate effortlessly into everyday life and operations. This shift is driving a fundamental transformation in the payments landscape and how nancial services providers are using technology to innovate with purpose. No longer just a background utility, payments have become a catalyst for innovation, nancial inclusion and economic resilience. In South Africa, as around the world, real-time, digital- rst payment systems are not simply technological

upgrades; they represent a complete reimagining of how value moves through the economy.

Real-time payment systems are rapidly becoming the new standard globally. The rise of platforms like India’s UPI, Brazil’s Pix and Nigeria’s NIBSS Instant Payments has demonstrated the economic bene ts of enabling immediate, secure and costef cient transactions. In India alone, the digital economy contributed 11.74 per cent to gross domestic product in 2022–2023.

South Africa, once a global pioneer in payment innovation, having launched real-time clearing in 2006, now nds itself playing catch-up. It is estimated that over 55 per cent of South African transactions,

Investec’s strategy is built on two core pillars. Firstly, we are investing in advanced transactional platforms to serve mid-sized corporates across South Africa. Our focus is to enable these businesses to operate in a real-time environment, integrate with modern payment rails like PayShap and scale with confidence. Secondly, we are working closely with fintechs, retailers and mobile operators to deliver embedded solutions. Whether powering the back end of a national retailer’s consumer-facing applications or enabling seamless payouts for a growing fintech, our technologyforward approach ensures we adapt to our partners’ needs. Our payments team is not just modernising payment systems; they are co-creating new ones in collaboration with ecosystem players and deeply invested in bringing banking into businesses.

by volume, still happen in cash (and this is likely higher in the informal economy), despite widespread access to banking. However, this reliance on cash is not due to lack of access, but rather a result of gaps in convenience, trust and affordability, which digital platforms are only now beginning to solve.

The South African Reserve Bank’s (SARB) Payment Ecosystem Modernisation initiative, and particularly the launch of the Rapid Payment Programme and PayShap, have signalled a fundamental reset. PayShap is the rst mandatory, 24/7 payment scheme in South Africa. Unlike legacy EFT systems, it enables real-time, cost-effective transactions and is as easy to use for a merchant in Soweto as it is for an executive in Sandton.

Today, the shift to a real-time economy isn’t just about payments moving faster. It’s about creating an economy that works better for businesses, individuals and the country. By reducing reliance on cash, bringing the informal sector into the formal fold and enabling smarter, safer transactions, it unlocks economic growth, drives financial inclusion and fosters innovation.

The work is not done, however. As South Africa navigates its journey, the market must overcome the chicken-and-egg challenge of adoption. Merchants need to see consumer demand, while consumers need to see merchant availability. This tipping point is coming, and when it does, the explosion in digital payments will be swift and wide-reaching. Investec will be part of this future. Our goal is to ensure real-time payments deliver where it counts consistently. In the real-time economy, true resilience goes beyond speed; it’s built on out-of-the-ordinary solutions, trusted relationships and the strength of collaboration.

For business clients, the baseline has shifted. No longer is it enough to simply offer transaction capabilities; clients want personalised, datadriven nancial insights and proactive engagement. Whether it’s a small to medium enterprise managing cash ow or a ntech scaling rapidly, businesses need payment platforms that integrate seamlessly into daily operations, provide contextual intelligence and enhance decision-making.

This is where the broader ecosystem must evolve. Real-time rails are powerful, but their true potential is realised only when they are layered with intelligent

EFFORTLESSLY INTO EVERYDAY LIFE AND OPERATIONS. THIS SHIFT IS DRIVING A FUNDAMENTAL TRANSFORMATION IN THE PAYMENTS LANDSCAPE.

services that understand business rhythms. Marketplaces, platforms and service providers all need to be part of the equation, offering modular application programming interfaces (APIs), embedded nance options and data-led recommendations that go beyond the transaction.

However, in a digital economy, trust is not a byproduct; it is the currency itself. In South Africa, fear of fraud and unwanted debit orders has bred deep distrust in banking and digital payments. Many consumers withdraw their salaries in cash immediately after deposit to avoid unwanted deductions. This isn’t about access; it’s about con dence.

Rebuilding this trust requires transparency, consumer protection tools like PayShap Request that put the decision to authorise an account debit in the hands of the consumer and robust identity frameworks such as digital nancial IDs (DFIDs). The DFID initiative, driven by SARB and supported by Home Affairs, aims to make identity veri cation seamless and secure, using biometrics to protect wallets and accounts.

The success of PayShap, in particular, hinges on its ability to offer not just realtime payments, but also a safe, predictable experience. By being designed as a costeffective and ubiquitous platform, it builds

BUSINESSES NEED PAYMENT PLATFORMS THAT INTEGRATE SEAMLESSLY INTO DAILY OPERATIONS, PROVIDE CONTEXTUAL INTELLIGENCE AND ENHANCE DECISION-MAKING.

REAL-TIME RAILS ARE POWERFUL, BUT THEIR TRUE POTENTIAL IS REALISED ONLY WHEN THEY ARE LAYERED WITH INTELLIGENT SERVICES THAT UNDERSTAND BUSINESS RHYTHMS.

in the kind of structural safeguards that help users feel in control of their money, which is especially vital for users in the informal sector.

We are entering an era where banking is no longer a destination; it’s an enabler embedded within digital journeys. Through open APIs and embedded nance, payment

Kuben Naidoo is a former deputy governor at the South African Reserve Bank. He is a distinguished South African economist and public servant. Since June 2024, he has been the head of corporate payments at Investec Bank, bringing over two decades of experience in financial regulation and economic policy. In his previous position as the deputy governor of the South African Reserve Bank, he led the prudential authority as its first CEO and was a member of the Monetary Policy Committee. His earlier roles include heading the budget office at National Treasury and acting as head of the secretariat for the National Planning Commission. He is recognised for his commitment to financial stability and inclusive economic growth. Naidoo was recently appointed to the Presidential Economic Advisory Council.

Thivian Moodley is the head of product and pricing for Investec transactional products and solutions at Investec Bank. He leads the team responsible for building and launching the Investec transactional banking platform to business and corporate clients. Thivian has extensive experience in core banking, payments, VAS, digital channels, cash management, working capital and treasury management. With a Bachelor of Commerce degree in Economics from the University of Kwazulu-Natal, Thivian brings a strategic and innovative approach to his role. He is dedicated to driving innovation, delivering exceptional customer experiences and ensuring the success of Investec’s transactional banking solutions.

capabilities are being integrated directly into platforms used by retailers, mobile network operators and ntechs.

Consider the opportunities: Shoprite’s Extra Savings loyalty card, MTN’s wallet and loyalty programme, Vodacom’s Vodapay app and PEP’s virtual mobile network touch tens of millions of South African citizens in trusted ecosystems. When these distribution giants connect to real-time rails like PayShap and wrap those capabilities in trusted interfaces, the result can be transformational.

While APIs, bank connectivity and enabling new payment rails allow banks to become the invisible infrastructure, fuelling transactions, enabling settlements and managing compliance, it is this technology that allows the retailers, mobile network operators and ntechs to focus on the end-user experience, delivering value and driving adoption. This is the future of business banking: agile, intelligent and deeply embedded. This transformation is not a threat to traditional banking, but rather an opportunity to lead with relevance.

THIS IS THE FUTURE OF BUSINESS BANKING: AGILE, INTELLIGENT AND DEEPLY EMBEDDED. THIS TRANSFORMATION IS NOT A THREAT TO TRADITIONAL BANKING, BUT RATHER AN OPPORTUNITY TO LEAD WITH RELEVANCE.

For more information: www.investec.com

As African fintech start-ups navigate the continent’s complex regulatory maze, compliance-as-a-service is becoming the backbone of their expansion, writes BRENDON PETERSEN

Compliance-as-a-service is becoming a foundational element in the success of Africa’s ntech start-ups. In an environment where regulatory frameworks are dynamic and often fragmented across jurisdictions, these automated solutions are helping start-ups simplify operations, reduce costs and scale more ef ciently. Nowhere is this more evident than in South Africa, a country that has emerged as a digital nance leader on the continent.

Start-ups operating in the nancial space face a complex web of compliance requirements, including know-your-customer (KYC), anti-money laundering (AML) and data protection laws. Traditionally, meeting these obligations has meant signi cant manual work: document collection, ID veri cation and background checks that slow onboarding and drain resources. Compliance-as-a-service offers a more ef cient alternative, automating identity veri cation, monitoring transactions in real-time and generating audit-ready reports, thereby reducing the risk of noncompliance while improving customer experience.

Rahul Jain, CEO and co-founder of Peach Payments, explains the current compliance landscape. “People underestimate the burden of compliance on both the provider and the end user. Traditional KYC and AML processes can lead to high drop-off rates during onboarding, especially when the potential merchant is new to formal nancial services. That hinders nancial inclusion.”

Peach Payments operates in 11 African countries and has invested in building internal compliance infrastructure that can adapt across borders. Jain believes the

“TRANSACTIONS

As of 2022, 48 per cent of Africa’s population uses banking services, a significant increase attributed to the rise of mobile money and digital banking platforms. This growth underscores the importance of scalable compliance solutions for fintech expansion.

Source: African Digital Banking Transformation Report 2023

long-term goal is to make regulatory technology (regtech) solutions as seamless as electricity or plumbing – critical, yet invisible. “Transactions should be inherently compliant. Identity veri cation should be frictionless and secure by default, and regulatory reporting should happen automatically in the background.” However, Jain is realistic about current conditions. “We’re not there yet. It still requires founder-level attention, but the potential is clear: compliance should become embedded infrastructure.”

One of the most misunderstood aspects of KYC and AML, especially from a founder’s perspective, is the impact these processes have on conversion rates. Fintech start-ups targeting underserved populations often face the dual challenge of ensuring compliance while accommodating customers with limited documentation.

SHOULD HAPPEN AUTOMATICALLY IN THE BACKGROUND.” – RAHUL JAIN

High-friction onboarding processes lead to user abandonment, which hurts both business growth and nancial inclusion efforts.

Modern compliance-as-a-service solutions are addressing this. They use arti cial intelligence to verify documents, biometrics for user authentication and access digital ID registries to ll information gaps. These innovations make it possible to securely onboard users who may never have stepped inside a bank branch.

Between 2012 and 2022, the percentage of people in Africa with access to formal banking more than doubled – from 23 to 48 per cent – thanks largely to mobile banking and digital platforms. This surge in inclusion has only increased the need for compliance tools that can scale ef ciently and ethically.

South Africa is uniquely positioned as a ntech leader. In 2022, the country ranked rst in the average digital maturity score on the Oliver Wyman Digital Banking Index, outperforming countries like the United Kingdom and Spain. Its digital banking infrastructure is relatively advanced and regulators have shown a willingness to support innovation.

Monica Sasso, global nancial services digital transformation lead at Red Hat, believes the success of South Africa’s digital banking sector is closely tied to software strategy. “We’ve reached a point where software is the backbone of nancial institutions,” she says. “That includes how we approach compliance, security and customer trust.”

According to Sasso, compliance no longer begins and ends with transaction monitoring. It includes supply chain security, developer access and open-source dependencies. Over two-thirds of application code now comes from external sources, she notes, creating potential vulnerabilities that regulators and compliance of cers must address proactively.

While South Africa’s regulatory environment is considered progressive, ntech start-ups expanding into other African markets face a patchwork of legal frameworks. What counts as compliant in South Africa may fall short in Kenya or Ghana. This inconsistency has become a growth bottleneck for cross-border ntechs.

“WE’VE REACHED A POINT WHERE SOFTWARE IS THE BACKBONE OF FINANCIAL INSTITUTIONS. THAT INCLUDES HOW WE APPROACH COMPLIANCE, SECURITY AND CUSTOMER TRUST.”

– MONICA SASSO

Jain points out that many African regulators are aware of the challenges and are working to adapt. “Regulatory frameworks will always play catch-up to technology. However, we’re seeing strong intent from governments to support safe ntech uptake and broader nancial inclusion,” he says.

Compliance-as-a-service platforms help start-ups bridge the gap. By centralising compliance tools that can be con gured by market, these systems allow companies to enter new geographies without starting from scratch.

Regtech is increasingly being viewed not as an overhead cost, but also as the scaffolding that enables responsible innovation. This shift is especially critical as competition for funding increases.

“Investors are paying closer attention to how start-ups handle compliance,” says Jain. “A company that can show it has automated, auditable systems in place for onboarding, KYC and regulatory reporting is seen as a safer investment.”

As funding becomes more selective, a strong compliance posture is no longer just about avoiding nes. It’s about building trust with regulators, users and shareholders.

Follow: Rahul Jain @ www.linkedin.com/in/rahuljain19

Monica Sasso @ www.linkedin.com/in/monicasasso

A 2024 Synopsys report revealed that 96 per cent of commercial codebases contain open source software, with 77 per cent of the code within those bases being open source. This highlights the critical need for robust compliance and security measures in software development.

Source: Intel – The Careful Consumption of Open Source Software

The future of regtech in Africa lies in its invisibility. The more embedded these systems become in banking and payment infrastructure, the less friction end users will experience. In turn, this will accelerate nancial inclusion, reduce fraud and make compliance a strategic enabler rather than a burden.

However, getting there requires collaboration. Developers need to understand compliance protocols. Product teams must work alongside legal teams and regulators need to continue embracing open dialogue with ntech innovators.

As Jain puts it: “If we get this right, compliance won’t be something you think about. It will be something that just works.”

As Africa’s fintech scene matures, due diligence standards are tightening. “Investors are paying increasing attention to how start-ups manage compliance risk,” says Rahul Jain of Peach Payments. “If a company can demonstrate that it has automated and auditable systems in place for KYC, AML and reporting, it becomes a more attractive bet.” In post-2022 funding cycles, where caution has replaced the previous gold rush mindset, solid regulatory technology infrastructure has become a key differentiator. As compliance becomes more embedded in digital banking architecture, it is no longer just a regulatory hurdle; it is part of an investment-readiness checklist.

As artificial intelligence reshapes the way we live and shop, VISA is leading the charge into the future of commerce – where smart artificial intelligence agents not only assist, but also autonomously handle payments on your behalf, delivering unprecedented convenience, security and control for consumers and businesses

The landscape of commerce is evolving rapidly. What once involved face-to-face transactions and traditional payment methods has now shifted dramatically into the digital realm. Yet, the future is not just digital; it’s intelligent. At the heart of this transformation is agentic commerce, an innovative model where arti cial intelligence (AI) doesn’t just assist consumers, but actively participates in every step of the shopping and payment journey. Agentic commerce represents the next evolutionary step in the retail and payments ecosystem, empowering AI-driven digital agents to discover, evaluate and complete transactions autonomously on behalf of consumers. This revolution is set to rede ne the way consumers interact with merchants and nancial institutions, driving unprecedented convenience, personalisation and security.

For more than 70 years, Visa has been at the forefront of payment innovation. From pioneering the rst online purchase in 1994 to championing mobile payments and contactless technologies, Visa continues to play a pivotal role in shaping how people shop and pay worldwide. Today, Visa is once again leading the charge; this time into the era of intelligent commerce powered by AI.

Imagine a future where your digital assistant doesn’t just remind you about your shopping

list but actually makes purchases for you. You could say: “Find a hotel in Cape Town under R2 000 with sea views,” and within moments, an AI agent would browse multiple platforms, compare prices, check availability and complete the booking – all without any additional input.

This is the essence of agentic commerce: AI agents act autonomously, making decisions based on your preferences, budget and past behaviour. These intelligent systems go beyond simple recommendations; they complete the entire transaction process, creating a seamless, hands-free shopping experience.

This transformation isn’t limited to travel bookings. It extends to groceries, fashion, electronics, and even complex services such as insurance and nance. Consumers can enjoy highly personalised, convenient shopping journeys tailored to their speci c needs –saving time and effort while bene tting from competitive pricing and choices curated by AI.

To support the rise of agentic commerce, Visa has launched the Visa Intelligent Commerce initiative, a comprehensive global programme designed to provide AI developers and platforms with the tools to facilitate secure,

user-consented transactions. This initiative represents Visa’s commitment to ensuring the future of commerce is not only innovative, but also trustworthy and inclusive.

Key features of this initiative include:

• Agent APIs (application programming intefaces): provide essential services such as secure authentication, payment authorisation and personalised experiences tailored to users’ preferences. Agent APIs enable AI agents to seamlessly interact with Visa’s payment infrastructure, ensuring smooth transaction processing.

• Partner programme: Visa offers a commercial framework that allows AI platforms and developers to integrate Visa’s capabilities safely, scaling agentic commerce solutions globally while maintaining compliance with strict security standards. With over 4.8 billion credentials worldwide and access to more than 150 million merchant locations, Visa’s network is uniquely equipped to support the explosion of AI-driven payments while maintaining the highest standards of trust, transparency and security.

As AI agents become autonomous participants in commerce, trust and security are paramount. Consumers must feel con dent that their data is safe, their preferences respected and their money protected.

Visa’s multilayered approach to securing agentic commerce ensures every AI-initiated transaction meets rigorous standards. Here’s how Visa safeguards this ecosystem:

1. Tokenisation: instead of sharing actual card details, AI agents use tokenised credentials that minimise risks by limiting data exposure and enabling transparent transaction tracking.

2. Authentication: network-level veri cation con rms explicit user consent before any payment is processed, ensuring AI agents act only within authorised boundaries.

3. Personalisation with privacy: Visa Data Tokens allow AI agents to tailor shopping experiences based on real consumer behaviour, but always with user permission and strict privacy controls.

4. User-defined payment controls: consumers de ne the rules – setting spending limits, transaction types, merchant categories and timeframes – that AI agents must follow.

5. Transaction signals: Visa continuously analyses transaction signals to detect anomalies and fraud, intervening quickly to protect consumers and merchants alike. These measures, combined with Visa’s advanced fraud prevention tools, such as Visa Advanced Authorisation, provide banks and consumers with the con dence needed to embrace AI-driven commerce without compromising security or control.

South Africa is uniquely positioned to become a global leader in adopting agentic commerce. The country’s strong digital infrastructure, rapid adoption of mobile technologies and tech-savvy population create fertile ground for intelligent commerce innovation.

Key indicators include:

• Digital payment momentum: mobile wallets and tap-to-pay solutions have become mainstream, with more than 60 per cent of retail transactions conducted digitally.

• Advanced security practices: a large number of consumers use biometric authentication – ngerprint or facial recognition – to authorise payments, which enhances both convenience and security.

• Strong digital confi dence and a desire for control: Visa’s Consumer Empowerment Study shows that 62 per cent of South Africans trust that their data is being used securely. However, 38 per cent express a desire for greater control over how their personal information is accessed and applied. Agentic commerce directly addresses these evolving expectations, empowering consumers to set clear parameters on how, when and where their payment credentials are used, ushering in a new era of control, transparency and security.

WHERE COMMERCE IS NOT ONLY DIGITAL, BUT ALSO INTELLIGENT, DECENTRALISED AND AGENT-LED.

For consumers, agentic commerce means:

• More convenience: automated, hands-free shopping reduces time spent browsing and transacting.

• Greater personalisation: AI agents learn preferences, budgets and habits to deliver tailored recommendations and purchases.

• Enhanced control: consumers de ne payment rules, ensuring AI agents operate within safe boundaries.

For merchants and nancial institutions, this technology offers:

• New revenue streams: AI agents open opportunities for micro-merchants and niche services by facilitating seamless payments.

• Improved customer engagement: personalised, AI-driven commerce deepens customer relationships.

• Stronger security posture: Visa’s infrastructure protects against fraud while enabling innovation.

Visa envisions a future where commerce is not only digital, but also intelligent, decentralised and agent-led. This future supports emerging technologies such as:

• Stablecoins and digital currencies: facilitating fast, borderless payments.

• Micro-merchant solutions: empowering small sellers with scalable, secure payment options.

• AI-driven marketplaces: creating ecosystems where AI agents transact uidly across platforms.

Visa is actively building and scaling a platform that anticipates these needs, ensuring the future of payments is secure, seamless and inclusive for everyone, everywhere.

As Visa CEO Ryan McInerney succinctly puts it: “If there is no payment, there is no commerce.” Visa’s commitment is clear: to enable commerce that is not only possible, but also intelligent, trustworthy and accessible.

FIND OUT MORE

Visa Intelligent Commerce for AI agents

Agentic commerce is more than a technological trend; it’s a transformation in how people shop, pay and engage with the world around them. It offers consumers more control, convenience and confidence, shaping a future where intelligent agents act as trusted partners in everyday commerce.

South Africa stands ready to lead this transformation with Visa as a trusted partner, pioneering the technologies, security frameworks and ecosystems necessary for a safe and thriving AI-powered commerce landscape.

For consumers and businesses alike, this evolution promises a smarter, safer and more personalised commerce experience – one that empowers all South Africans to participate fully in the digital economy’s next great leap.

Discover more about Visa’s role in shaping the future of intelligent commerce at www.visa.co.za

The global commerce ecosystem is on the cusp of a transformative shift. At the centre of this evolution is agentic commerce – a new model powered by artifi cial intelligence where autonomous digital agents act on behalf of consumers to discover, evaluate and complete purchases. This innovation is set to redefi ne the relationships between consumers, merchants and fi nancial institutions.

South Africa’s digital maturity further strengthens its readiness. Financial institutions are already deploying advanced technologies such as tokenisation and mobile-first authentication. Biometric verification is becoming commonplace and digital wallets are gaining traction. These developments create a robust foundation for the seamless integration of agentic commerce.

Visa is pioneering this next chapter, and South Africa is uniquely positioned to lead in adoption. According to Visa’s Consumer Empowerment Study, 62 per cent of South African consumers trust that their data is being handled securely. Yet, 38 per cent seek greater control over how their data is used. Agentic commerce directly addresses this need by enabling consumers to set clear parameters around how, where and when their credentials are used – placing control firmly in their hands. For more information www.visa.co.za

As Visa CEO Ryan McInerney stated: “If there is no payment, there is no commerce.” Visa’s global network is built to support emerging payment flows, from AI-driven agents to stablecoin solutions for micro-merchants, while maintaining the highest standards of security, scalability, and trust.

The future of commerce is not only digital; it is intelligent, decentralised and increasingly autonomous. Visa is committed to ensuring this future is secure, inclusive and accessible to all.

As global commerce continues to evolve, contactless payments have emerged as a critical enabler of financial efficiency, security and inclusion.

By LINESHREE MOODLEY, country head for Visa, South Africa

Digital payment is no longer a peripheral convenience; this technology is now central to the transformation of payment ecosystems worldwide. At Visa, we are committed to advancing this evolution through innovation, strategic partnerships and a steadfast focus on consumer trust.

The adoption of contactless payments has accelerated signi cantly in recent years. Globally, these transactions are projected to account for over 50 per cent of all payments by the end of 2025. South Africa is experiencing a similar trajectory, with approximately 60 per cent of consumers now preferring contactless methods – a trend driven by increased smartphone penetration, ntech innovation and evolving consumer expectations.

Across the African continent, digital payment volumes grew by 16 per cent in 2024, with mobile wallets and contactless technologies playing a pivotal role in expanding access to nancial services. This growth re ects a broader shift toward digital- rst economies where convenience and security are paramount.

The appeal of contactless is simple: it’s fast, secure and seamless. Visa’s Value of Acceptance study found that 70 per cent of South African consumers believe tap-to-pay makes transactions faster and easier. With the average transaction taking less than a second, it’s easy to see why businesses are embracing it.

However, speed is only part of the equation. Security is paramount.

Visa’s advanced encryption and tokenisation technologies have helped drive a 25 per cent increase in consumer trust in

contactless payments over the past year. We invest over $500-million annually in cybersecurity and fraud prevention, deploying state-of-the-art technologies to protect consumers and businesses.

Contactless technology is also proving instrumental in advancing nancial inclusion. In South Africa, ntech companies are leveraging digital platforms to reach underserved populations. A prime example is Visa’s collaboration with Flash, Kazang and Shop2Shop, which provide tools that allow merchants to accept digital payments, manage inventory and build transaction histories – capabilities that support access to credit and formal nancial services. Such innovations are helping to digitalise informal economies and bridge the gap between traditional and modern commerce.

Visa’s partnership with Loop is another powerful example. Together, we are modernising South Africa’s public transport sector by introducing tap-to-phone payment technology in minibus taxis. This innovation allows commuters to pay fares using contactless cards or mobile devices, signi cantly reducing reliance on cash while enhancing safety, ef ciency and convenience for both passengers and operators. This is nancial inclusion in action.

In a similar stride toward digital transformation, Visa has enabled tap-to-pay functionality at the N3 Toll Plaza – one of South Africa’s busiest transport corridors. Motorists can now breeze through toll gates using contactless Visa cards or mobile wallets, reducing congestion, improving travel times and minimising the need for

cash handling. This advancement not only streamlines the travel experience, but also supports broader efforts to digitise payments across the country’s infrastructure.

The future of digital payments isn’t just about cards and phones – it’s about intelligent, arti cial intelligence-powered commerce that moves with you, anticipates your needs and simpli es your life.

Visa’s 2025 Global Product Drop marked a signi cant milestone with the introduction of Visa Intelligent Commerce. This innovation opens our trusted network to a new generation of arti cial intelligence-powered agents capable of autonomously browsing, selecting and purchasing on behalf of consumers. Whether it’s a smartwatch ordering your morning coffee or a virtual assistant managing your grocery list and checkout, Visa is building the infrastructure to make these experiences seamless and secure.

The future of digital payments will be built on three pillars:

• Collaboration between banks, ntechs, merchants and regulators to ensure interoperability and scale.

• Education builds trust and con dence in digital payment systems.

• Innovation that meets consumers where they are – whether in a bustling city centre, a rural village, a local spaza shop or a minibus taxi.

Each contactless transaction represents more than a payment; it’s a step toward a more connected, ef cient and inclusive economy. At Visa, we remain dedicated to enabling this future through leadership, innovation and a deep commitment to empowering individuals and businesses.

South Africa’s payments landscape is evolving. While digital transactions are growing rapidly, the use of cash for payments remains vital for millions. For businesses and consumers, success lies in integrating both cash and digital for broader reach and inclusion, writes Pay@

By December 2024, nearly 90 per cent of banked customers’ transactions were digital, according to a recently published article. However, in a country where over 11 million people remain unbanked or underbanked, cash continues to play a critical role.

Forward-looking businesses understand that digital payments will dominate in the future and recognise the importance of accessibility. In South Africa, where high data costs and limited smartphone access exclude many from app-based systems, being able to pay with

This is where Pay@, a leading payments solutions provider and orchestrator of payments across more than 35 ways to pay, bridges tech with human reality. Whether integrating digital platforms or enabling cash payments at over 9 500 retail locations and 150 000 POS points nationwide, Pay@ empowers businesses to offer payment convenience for all.

Pay@ orchestrates bill payments and e-commerce transactions through the country’s largest banks, national retailers, telcos and ntechs on behalf of leading bill issuers and merchants, such as insurers, municipalities and nancial service providers, helping them serve millions of customers,

Through innovation and accessibility, Pay@ helps businesses maintain reliable revenue streams, reduce costs and improve customer and brand experience, ensuring no customer is left behind.

To stay relevant in South Africa’s evolving payment landscape, your business needs a partner who connects it all.

For more information: payat.co.za

To align with the changes in regulations, designed to remove barriers to entry and promote participation in modern payment systems, greater collaboration is required, writes FIRSTRAND BANK

The rst half of 2025 has seen signi cant momentum in the global and domestic payments environment, with much activity and change underway in the payments space.

Mpho Mofokeng, Treasury and Trade Solutions – Transact Head for RMB, says: “The payments landscape is evolving rapidly, and RMB’s goal is to work alongside our clients and industry participants to de ne the future of modernised payment systems.”

To meet evolving client needs, close collaboration on adoption, client participation and true partnership will become essential as the industry continues evolving.

Ravi Shunmugam, FNB EFT product house CEO, says: “No single stakeholder group can create an effective, inclusive and innovative payments ecosystem. The continued evolution in thinking, which favours the reliance on true partnerships between traditional players and emerging players, is key to shaping the future of payments in South Africa and realising the intended bene ts initially set out in the South African Reserve Bank’s (SARB) Vision 2025 for the National Payment System (NPS).”

Published in 2018, Vision 2025 outlines nine goals designed to foster nancial inclusivity, a transparent regulatory and governance framework, digitisation, interoperability and exibility. Creating an inclusive ecosystem was noted as a primary metric for successful payments modernisation in South Africa. It is therefore paramount that nonbanks are enabled to participate in the payments ecosystem. To facilitate the direct participation

of nonbanks, changes in regulations and policies are required in addition to changes in system capabilities.

To further drive the objectives set out in Vision 2025, the SARB has commenced work to redesign its licencing framework and participation rules to enable greater access and participation in the national payments system. The NPS Bill intends to expand direct participation of nonbanks in clearing and settlement without the need for bank sponsorship – removing barriers to entry and promoting participation in modern payment systems such as PayShap. As of March 2025, the NPS Bill is being prepared for public comment and both banks and nonbanks have been working closely with the regulator to ensure regulation that enhances competition while protecting clients by not introducing risk and instability to the payments network.

Over and above the bill, revision of current regulation and the establishment of governance frameworks that will best support future business models will also play a role in shaping the new payments landscape:

• The Banks Act Exemption Notice intends to exempt the issuance of electronic money from the Bank Act 94 of 1990 to enable nonbanks to offer payment accounts and services.

• The Authorisation Framework outlines the requirements for licensing and authorisation of payment activity (including clearing and settlement).

• The proposed establishment of PIB – the design of a new Payments Industry Body that is more inclusive and encompasses banks and nonbanks, fostering collaboration and competition between stakeholders.

“THE PAYMENTS LANDSCAPE IS EVOLVING RAPIDLY, AND RMB’S GOAL IS TO WORK ALONGSIDE OUR CLIENTS AND INDUSTRY PARTICIPANTS TO DEFINE THE FUTURE OF MODERNISED PAYMENT SYSTEMS.” – MPHO MOFOKENG

Updates to established payment systems will also ensure alignment with international technical standards and anti-money laundering control standards.

To drive these changes, First Rand Bank (FRB) has placed increasing strategic importance on payments, leading to a signi cant focus on payments strategy, executive structure, the operating model, resource capacity, execution, architecture and investment. FRB is approaching this together with clients to ensure they are well-positioned and aligned with the regulatory changes and objectives.

Tamara D’Onofrio, Treasury and Trade Solutions – Client Group Head, says: “RMB understands the importance of bringing clients along on this journey, informing them on how this impacts their businesses. We are invested in the co-creation of value with our clients and our partners and committed to taking meaningful steps to engage with them as projects mature suf ciently and opportunities present themselves.”

FRB welcomes the shift in the payments landscape toward greater inclusivity and global compliance and continues to work closely with clients and industry peers to navigate the future of payments in the country together.

Initially driven by COVID-19 requirements, the implementation of contactless banking technology has now reached a stage of widespread acceptance, writes RODNEY WEIDEMANN

Contactless payments have evolved in recent times. Accelerated by the unique demands of the COVID-19 pandemic, they have moved from novelty to necessity and are now being increasingly embraced by banks, ntechs, and retailers alike.

End users and merchants enjoy the speed of the transaction that assists in queue busting, while not compromising the security of the transaction. This is further recognised by the likes of nancial solutions providers and device manufacturers, as their new solutions and products are increasingly enabled for contactless payments.

Leonard Shenker, joint CEO at Walletdoc, says the pandemic and the many fears around transmission and hygiene certainly brought this technology to the fore and led to far quicker adoption than might otherwise have been the case. “Since then, merchants and customers have discovered the bene ts of this technology. It not only speeds up the transaction, but also offers convenience. Shop owners nd they get more customers through the till in the same amount of time, while the customers enjoy a speedier transaction, coupled with a better overall consumer experience.”

Steven Cohen, co-founder of Legend Tags, agrees that the surge in contactless payments globally is primarily driven by convenience, speed and security. “Consumers gravitate towards the quickest and easiest way to pay. Scanning a QR code and using existing payment gateways – such as Apple Pay and Google Pay –reduces checkout times and improves security, as only the gateways themselves have access to the clients’ personal details.

“We’ve tapped into these same drivers to enable everyday person-to-person transactions. People increasingly carry little or no cash, so providing a quick, secure way to pay a car guard or street vendor, via a simple tap or scan, ful ls a real need.”

By making the experience fast, safe and effortless for both parties, he continues, it is easy to extend the bene ts of the contactless revolution to every corner of daily life. This broad utility is why contactless payments have seen such rapid adoption: they make life easier for consumers and businesses, in ways both big and small.

Wearable solutions offer additional convenience, speed and ultimately security, which culminate in an even more seamless experience for consumers. Alternate technologies for merchants offer cost-effective mechanisms to adopt contactless payments, increasing the likelihood, for example, of uptake in less formal economies.

Source: KPMG

Jason Viljoen, head of card digitisation at FNB, notes that while contactless-enabled smart devices initially entered the market at a higher price point, the past few years have seen providers incorporating the technology into many lower-end devices. “Smart devices and wearables resonate with all members of society, with the bene t being the continued adoption of digital platforms for contactless payments and digital banking in general. Customers particularly enjoy the convenience and security contactless offers, from the activity itself to the shortened queue times,” he says.

Viljoen says customers are always in control of their card or device, simply having to tap the point-of-sale (POS) device to effect payment. “Customers enjoy the simplicity and security of not only using a digital wallet (such as Apple Pay or Google Pay) to pay in-store, but also when checking out online.”

Liesl Slabbert, partner and Southern Africa payments lead at KPMG, points out

“SHOP OWNERS FIND THEY GET MORE CUSTOMERS THROUGH THE TILL IN THE SAME AMOUNT OF TIME, WHILE THE CUSTOMERS ENJOY A SPEEDIER TRANSACTION, COUPLED WITH A BETTER OVERALL CONSUMER EXPERIENCE.”

– LEONARD SHENKER

that among the bene ts for users are a more seamless customer experience, increased convenience – there is less need to carry a wallet – better security and even loyalty bene ts that are offered by many banks.

“For merchants, the bene ts typically include the fact that a more seamless shopping experience means customers are happier and thus also more likely to return, while faster and easier processing of payments at checkout delivers additional downstream bene ts. These include reduced queues in peak periods and higher transaction volumes.”

Dan Wagner, joint CEO at Walletdoc, agrees that speed and convenience are bene cial to both, while the health and hygiene bene ts are equally obvious.

“Security is key, and since a smartphone utilises biometric security, it overcomes the challenge of using a PIN, which is outdated technology anyway. When coupled with tokenisation, it de nitely indicates the way forward from a security perspective.”

Wagner appreciates that now, contactless payments can be enabled across multiple wearable devices – including watches and rings – taking payment beyond the traditional card. “This only makes sense, since we all carry our phones all the time and most wear watches. So, from an applicability point of view, this enables even more payment methods.

“We cannot, however, forget South Africa’s rural areas. The importance of SoftPoS (software point-of-sale that turns smartphones into card readers) solutions here shouldn’t be underestimated, as this contactless technology can be leveraged – in conjunction with the right payment players – to enable of ine payments.”

Darryl Froom, co-founder of Legend Tags, adds that it is important to remember that contactless doesn’t always mean “high-tech”. “A person might use a simple QR code printed on a piece of paper. This is exactly our organisation’s approach: we empower people who may not have smartphones or bank accounts – like car guards, petrol attendants and informal vendors – to receive digital payments

Software point-of-sale that turns smartphones into card readers (SoftPOS) and offline solutions for rural and unbanked communities present an opportunity for financial inclusion. SoftPOS is a low-cost alternative to traditional terminals, ideal for small vendors, pop-up stores and informal traders. It however requires near-field communication-enabled smartphones, which is still a barrier for some.

Source: FNB

via a personal QR code tag. “No sophisticated device is required on the recipient’s part; a basic mobile phone is enough to register, as it uses SMS technology to verify the vendor, and the payer’s phone does the scanning.”

Netsai Ngidi, product head at FNB Merchant Services, suggests that the contactless solutions the bank supports are all enabled through levels of encryption, tokenisation and other key security elements. “Tokenisation plays a crucial role, ensuring sensitive credentials are substituted by unique nonsensitive tokens, bound to speci c use-cases – further securing customers against any possibility of compromise.

“In addition, FNB’s multilayered approach to security means that further controls, risk rules and various tools are constantly at work to ensure a secure payments experience.”

Slabbert agrees on security’s importance, noting that contactless payments are best secured through a combination of advanced technologies, regulatory oversight and industry best practices. “These include a dual security framework, transaction limits and PIN requirements, and fraud detection systems. Tokenisation plays a crucial role, especially when considering digital wallet adoption, as it replaces sensitive card information with unique identi ers, reducing the risk of fraud and data breaches.”

Shenker is of the opinion that banks and ntechs are already doing a great job of deploying infrastructure that is contactless-enabled.

“The future of contactless is super bright, adoption is taking off, and with continued innovation and adoption, it will become the de facto

payment standard, which should mean that, in the near future, we will witness a signi cant reduction in cash usage,” he states.

Ngidi agrees, suggesting that contactless payments are poised for continued exponential growth. “The future lies in ‘blended’ solutions, combining near- eld communication tokens, QR codes and of ine capabilities, to serve both urban and rural markets. If banks, ntechs and regulators collaborate, contactless could become the dominant payment method in the next ve years,” she concludes.

According to KPMG, a 2020 Mastercard study found that 75 per cent of South African consumers are using contactless payments. However, it must be acknowledged that key challenges exist for those with less access – such as:

• Ability to afford/obtain the required technology (for example, smartphones/near-field communication-enabled cards).

• Access to enabling infrastructure (for example, telecommunications network and electricity).

• Trust concerns (for example, around fees and “big brother” visibility).

• Financial/digital literacy (for example, understanding how to use such payment technologies).

While contactless payments technically offer security and convenience to all members of society, the need remains to focus on resolving these challenges – through alternate (more affordable) technology and infrastructure, and education.

Follow: Leonard Shenker @ www.linkedin.com/in/leonardshenker

Liesl Slabbert @ www.linkedin.com/in/liesl-slabbert-0a584743

Netsai Ngidi @ www.linkedin.com/in/netsai-ngidi-405368a3

Jason Viljoen @ www.linkedin.com/in/jason-viljoen-7539485

As South Africa’s payments landscape evolves, WALLETDOC is ready to ensure executing payments is simpler, smarter and safer

South Africa’s payments industry has always had a reputation for being innovative and complex. With a banking sector that is sophisticated by emerging market standards, the country has historically punched above its weight when it comes to digital payment systems. However, the past few years have brought seismic shifts to the way South Africans think about and execute payments.

From contactless cards and mobile wallets to real-time EFTs, the transformation of the payments landscape has been rapid. Consumers now demand simplicity, merchants expect affordability, and regulators prioritise safety and inclusion. In the eye of this storm of change is a new breed of ntechs reimagining how South Africans pay, get paid and manage their money.

One of these trailblazers is Walletdoc, a digital payments platform co-founded in 2015 by Dan Wagner and Leonard Shenker that addresses a very speci c need: simplifying how people pay their bills. Today, it’s become one of South Africa’s leading payments processors, enabling businesses to accept payments online, in-app and in-store.

However, to appreciate where Walletdoc ts into the picture, it’s worth understanding the broader shifts that have shaped – and are still shaping – the local payments industry.

The COVID-19 pandemic accelerated a transition already underway. Cash, once king in many parts of South Africa, suddenly became a health concern. Lockdowns made physical payments inconvenient and consumers, from Sandton to Soweto, were forced to experiment with digital channels. What might have taken a decade instead happened in less than two years.

Retailers responded by investing in contactless payment systems. Banks ramped up their mobile offerings. Fintech

start-ups found a growing and receptive audience. A 2023 Payments Association of South Africa report estimated that digital wallet usage had grown by over 40 percent in two years and EFT volumes had reached record highs.

In theory, the digital revolution should have removed friction from the payments process. In practice, though, many South Africans still struggle with inef ciencies. Too many steps, slow clearance times, payment failures and security concerns remain common grievances.

This is where platforms like Walletdoc have found resonance. By starting with a single use case, bill payments, the company was able to build trust around solving real-world pain points. “We saw a major opportunity in making utility payments smarter,” says Shenker. “People were still driving to municipalities or queuing in supermarkets to pay bills using their card. We thought, what if you could just do it instantly from your phone?” THE TRANSFORMATION OF THE PAYMENTS LANDSCAPE HAS

Walletdoc’s consumer bill payment app quickly gained traction. However, its real power lies in what happened behind the scenes: the automation of the payments work ow, the validation of payment data and integration with municipal nancial systems. This fusion of simplicity and sophistication is what has helped Walletdoc become a trusted player not just for consumers, but for businesses, too.

As digital payments become the norm in South Africa, the opportunity isn’t just in serving consumers or small businesses; it’s in helping large enterprise merchants transform how they transact, reconcile and operate at scale.

South Africa’s enterprise sector, including telecoms, insurance, gaming, education, retail, healthcare and beyond, faces increasing complexity in managing high-volume, recurring and multichannel payments. For these organisations, the payment process isn’t a simple transactional step; it’s tightly interwoven with customer experience, operational ef ciency and nancial reporting.

The challenges are substantial: fragmented systems, legacy integration hurdles, customer data inconsistencies and reconciliation delays all contribute to inef ciencies and cost. Add to that the pressure to meet evolving consumer expectations – instant payments, seamless digital interfaces and exible payment options – and it becomes clear that enterprise merchants need more than a traditional payments processor.

This is where platforms like Walletdoc are unlocking real value. Walletdoc has grown into a full-service payments platform designed to handle the scale and sophistication required by enterprise-grade clients. The company enables large merchants to accept and automate payments across card, bank account, QR and all the major mobile wallets (Apple Pay, Samsung Pay, Google Pay and Click2Pay) – all within a highly secure, compliant and deeply integrative framework.

“PEOPLE WANT TO KNOW THEY’RE DEALING WITH A COMPANY THAT’S LOCAL, ACCOUNTABLE AND REACHABLE. WE’VE BUILT OUR SUPPORT STRUCTURES AROUND THAT PRINCIPLE.”

– LEONARD SHENKER

Walletdoc’s cloud-based platform allows for settlement tracking, intelligent failed payment handling, automated billing integrations and full reconciliation, offering nance teams at major enterprises a level of visibility and control often missing in legacy systems.

“Enterprise clients are increasingly looking for infrastructure partners who can plug into their existing work ows with minimal friction and maximum reliability,” says Shenker. “It’s not just about collecting money; it’s about streamlining the entire receivables value chain.”

Major enterprises now rely on Walletdoc to improve how they collect payments, with end users enjoying a much smoother payment experience across devices. Walletdoc’s enterprise offering includes fully branded, white-label payment ows and APIs that allow companies to own the customer journey while bene tting from Walletdoc’s underlying infrastructure.

Importantly, the platform is built with South Africa’s regulatory and infrastructural realities in mind, supporting things such as reference validation, batched reporting and integration with enterprise resource planning systems.

In a landscape where consumer payment preferences are shifting faster than many enterprise systems can adapt, agility is critical. Enterprises that once viewed payments as a cost centre are now seeing it as a source of competitive advantage. By embracing modular, scalable platforms like Walletdoc, they are not only reducing operational drag, but also unlocking strategic value, from faster cash ow to richer data insights.

Indeed, with growing regulatory requirements, heightened consumer expectations and the emergence of open banking frameworks, businesses need more than just a payment gateway; they need partners who understand their operational realities.

Another area of innovation is real-time payments, which are gaining momentum globally and locally. South Africa’s Rapid Payments Programme (RPP), also known as PayShap, championed by BankServAfrica and the South African Reserve Bank, aims to bring real-time, low-cost payments to the masses.

While adoption is still in its early stages, the promise of real-time rails is huge: instant payments, reduced cash dependency and easier peer-to-peer transactions across banks. This will undoubtedly shape the next wave of ntech innovation.

Walletdoc is well-positioned to play a role in this transition, having already built a platform that processes billions of rands worth of PayShap payments with exceptional transaction approval rates. Its systems are designed for scalability and interoperability – a crucial requirement as the RPP matures and open application programming interfaces (APIs) become standard.

With growth comes risk, and the payments sector has seen its fair share of fraud attempts, phishing scams and data breaches. Trust is the currency of digital payments, and platforms that succeed are those that invest heavily in security and compliance.

Walletdoc’s approach has been to embed security into its architecture –evident from its Level 1 PCI-DSS and PCI 3DS certi cations. However, more than just the technical side, it’s also about transparency and support. “People want to know they’re dealing with a company that’s local, accountable and reachable,” says Shenker. “We’ve built our support structures around that principle.”