South Africa remains one of the world’s most mature loyalty markets, with the increasing cost of living making these programmes more and more important for South Africans grappling with nancial strain. They’re equally important for brands seeking to differentiate themselves in a crowded and globalised market, with well-de ned, targeted loyalty initiatives providing a distinct competitive edge. They also represent a well of zero- and rst-party data – essential in a post-privacy world.

In this issue of Loyalty and Rewards, we look at how brands can use that data to build an understanding of their customers that can guide business strategy across the board. It’s also core to the evolution of loyalty programmes into integrated, customer relationship management-powered ecosystems. Then there are implications of privacy legislation, such as the Protection of Personal Information Act, with data minimisation and consent management now crucial to any loyalty offering. With loyalty increasingly linked to company strategy, we unpack how business objectives are considered when designing an effective programme, along with the key questions brands need to answer to ensure said programme advances these objectives.

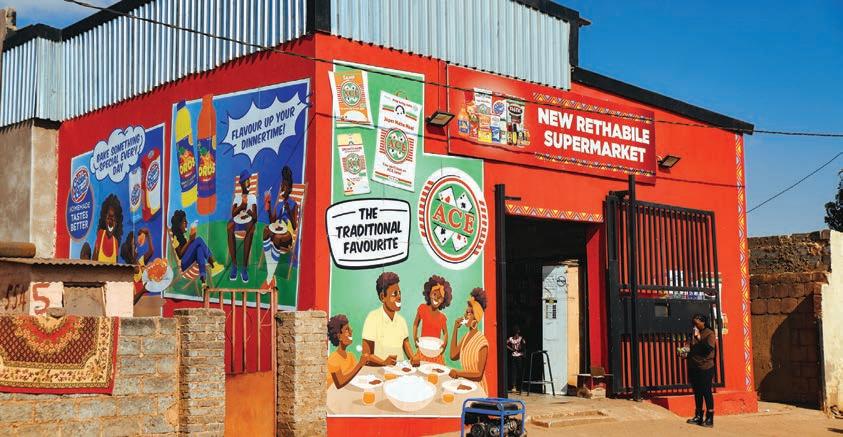

In South Africa’s evolving township economies, consumer objectives are shaped by survival, which, in turn, shapes the notion of loyalty and how brands must earn it through trust, adaptability and consistent value. In this and other environments, collaboration between brands is helping to deliver better value to consumers, leading to the creation of cross-vertical ecosystems that are more exible and have greater market reach.

All of this comes with tax considerations, unfortunately, which have been fundamentally reshaped in the past ve years, so we outline what brands and consumers need to be aware of across the board. It’s a complicated space, no doubt, but also a hotbed of innovation and growth in an economy that severely needs both.

Anthony Sharpe, Editor

Why

Celebrating

Bringing together customer relationship management systems and behavioural insights is supercharging loyalty programme effectiveness.

A look at the key principles behind developing a programme that delivers measurable returns.

Unpacking the challenges of leveraging nancial transaction data; How ntech is integrating with the loyalty space.

Businesses need to examine their loyalty programmes through the lens of privacy legislation.

Consumers are reshaping the rules of brand engagement in South Africa’s R900-billion township economy.

Operators and members of loyalty programmes ignore tax regulations at their peril.

Understanding the rise of multibrand and cross-vertical loyalty ecosystems.

What are brands doing to move consumers from plastic cards to app-based loyalty?

PUBLISHED BY

Picasso Headline,

A proud division of Arena Holdings (Pty) Ltd, Hill on Empire, 16 Empire Road (cnr Hillside Road), Parktown, Johannesburg, 2193 PO Box 12500, Mill Street, Cape Town, 8010 www.businessmediamags.co.za

EDITORIAL

Editor: Anthony Sharpe

Content Manager: Raina Julies rainaj@picasso.co.za

Contributors: Steven Burnstone, Joon Chong, Trevor Crighton, Amanda Cromhout, Gordon Dodge, James Gethings, Mongezi Mtati, Vanessa Rogers, Ahmore Burger-Smidt, Rodney Weidemann, Lisa Witepski

Copy Editor: Brenda Bryden

Content Co-ordinator: Natasha Maneveldt

DESIGN

Head of Design: Jayne Macé-Ferguson

Senior Design: Mfundo Archie Ndzo

Cover Images: Courtesy of Dis-Chem, faithie/123rf.com, milkos/123rf.com, pitinan/123rf.com, lebanmax/123rf.com, liudmilachernetska/123rf.com, dmitry16/123rf.com, supplied

SALES

Project Manager: Gavin Payne gavinp@picasso.co.za | +27 21 469 2477

Sales: Stephen Crawford

PRODUCTION

Production Editor: Shamiela Brenner

Advertising Co-ordinator: Johan Labuschagne

Subscriptions and Distribution: Fatima Dramat fatimad@picasso.co.za

Online Editor: Stacey Visser vissers@businessmediamags.co.za

Printer: CTP Printers, Cape Town

MANAGEMENT

Management Accountant: Deidre Musha

Business Manager: Lodewyk van der Walt

General Manager, Magazines: Jocelyne Bayer

COPYRIGHT: Picasso

Images: Supplied

For years, business leaders have repeated the phrase “data is the new oil”, but just like crude oil, raw data is limited in its use until it is refined, enriched and channelled into purposeful use. By GORDON DODGE , senior consultant and loyalty lead, and STEVEN BURNSTONE , CEO, at Eighty20

Across South Africa, loyalty programmes have become one of the richest yet underleveraged sources of consumer data. From grocery retailers and fuel forecourts to insurers and telcos, every swipe of a card or scan of an app captures something that few touchpoints can: a veri ed view of customer behaviour with the companies they engage with. Yet in many boardrooms, loyalty still lives in the marketing department, valued for its ability to drive spend or retention, but not recognised as the strategic growth engine it truly can be. We believe there has never been a better time to start utilising loyalty data as an enterprise-wide asset. The data generated through loyalty programmes isn’t just about points or promotions; it is about building a longitudinal understanding of customers that can

inform strategic decisions across product, risk and pricing, and enabling business innovation in previously unknown opportunities. Once re ned and analysed correctly, loyalty data becomes foundational for real business intelligence and even new revenue streams.

Loyalty data has a unique bene t in that it is not inferred; it is declared. Consumers identify with each transaction and interaction, producing copious amounts of clean, veri ed data that links behaviour to identity.

In South Africa, where growth is scarce and competition is erce, the ability to know who your customers are, what they buy, how often they return and how they engage

broadly with a brand is invaluable. Loyalty programmes have become the single richest source of consumer insights available to businesses. However, while this identi cation gives companies a powerful view of what consumers are doing, it does not explain why.

This is where data augmentation comes in – the process of enhancing existing data with contextual information drawn from other (internal or external) sources. Ultimately, data augmentation becomes about seeing the person, not just the purchase, and when demographic, lifestyle, geographic or nancial context is overlayed with loyalty data, new patterns and motivations emerge.

In addition, data augmentation also means collaboration. By sharing anonymised or permissioned data in compliant ways, companies that hold different parts of the consumer puzzle can work together to ll the gaps. Telcos, banks, insurers and retailers all capture a few touchpoints throughout a consumer’s spending life. When combined, those insights form a genuinely holistic view of the customer, one that bene ts both the business and the consumer when used responsibly.

Augmentation is a bridge between knowing what a customer does and understanding who they are and why they did it. Once that bridge is built, the possibilities for personalisation, modelling and forecasting, and the development of partnership ecosystems expand dramatically.

With augmentation providing the breadth, segmentation provides the depth. For more than two decades in loyalty, data science and research, Eighty20 has re ned this art through its Eighty20 National Segmentation (ENS) model – a detailed mapping of South African consumers into 1 500 microsegments that combine demographic, geographic, nancial and behavioural data points.

This microsegment approach allows companies to go beyond blunt demographic categories such as “middle-income families” or “young professionals.” Instead, the ENS can identify extremely speci c consumer pro les: from students and scholars who will be future heavy hitters to asset-rich ex-professional comfortable retirees. Each microsegment has distinct needs, propensities and product af nities.

When a business overlays its loyalty data on top of this microsegmentation framework (whether the ENS or some other market segmentation), they can identify the types of customers they already serve well, where there is headroom for growth, and which microsegments remain untapped. In a market as diverse and complex as South Africa’s, this kind of precision is transformative.

The ENS enables businesses to connect what happens inside their businesses and loyalty programmes to what is happening across the broader market. It shows, for instance, who your best customers are, how they differ from those you are not yet reaching and how large that opportunity gap really is.

Practically, the value of data augmentation and microsegmentation extends far beyond marketing or loyalty. It enables product teams to uncover unmet needs and design offerings that match real lifestyles. For credit and risk departments, it strengthens the ability of models to understand consumers not just transactionally, but also behaviourally. Retailers can go as far as re ning store locations, optimising merchandising and designing staff training and operations based on true customer values.

We have seen this approach help identify exactly which growth strategies can drive 100 per cent increase in revenue for a national retailer, while nancial institutions and retailers using this data-rich approach have improved their personalisation campaign results by ve to seven times.

THROUGH DEVELOPING DATA SCIENCE PLATFORMS THAT ENABLE AUGMENTATION AND DELIVER ACCESS ACROSS THE BUSINESS, COMPANIES CAN TURN ANALYTICS FROM A SPECIALIST FUNCTION

The real value, however, lies in activation. Insight only becomes powerful when it in uences decision-making, whether an arti cial intelligence-powered WhatsApp chatbot guiding customer engagement or a personalisation engine re ning campaign relevance in real-time. Measuring the impact of those activations completes the loop, ensuring loyalty data not only describes the customer, but also continuously drives smarter business decisions.

Globally, the impact of data-driven personalisation is already evident. McKinsey’s Next in Personalization 2021 Benchmarking Survey found that companies embedding rst-party data as a core element in their decision-making increased the share of revenue by personalisation from 5–10 per cent to as much 25 per cent.

Closer to home, Rainmaker Media, powered by the Shoprite Group of Companies, demonstrates how loyalty data can be monetised into a retail-media network. By measuring 1.1 billion grocery transactions annually, Rainmaker is converting these into 15 million unique monthly digital visitors and engagement with over 81 million shoppers every month.

With its high loyalty participation rates and well-developed nancial sector, South Africa is particularly well-placed to drive this evolution. Our market is sophisticated enough to collect world-class data but diverse enough that understanding who you are talking to truly matters. That combination gives South African companies a real competitive edge if they learn how to use it.

Realising the true value of loyalty data is no longer a technological issue, nor is it simply an IT or marketing discussion. It is a strategic decision that must be led from the top of organisations, facilitated by senior executives and driven by CEOs who recognise data as an enterprise-wide growth enabler.

Real progress comes when organisations democratise data, equipping teams across the business with the ability to access, explore and indulge their creativity. By developing data science platforms that enable augmentation and deliver access across the business, companies can turn analytics from a specialist function into a shared capability. Working with clients to build these new-generation data environments, Eighty20 has seen how businesses can operationalise their data across every layer of decision-making, enabling them to double or even triple their revenue opportunities.

Data is indeed the new oil, and when used smartly, it can be the fuel businesses need to drive sustained growth.

Eighty20 recently won Best Loyalty Data Agency in South Africa – an accolade it has received for the past three years. In addition to this, Eighty20 was awarded the Best Loyalty Enablement Technology Vendor at the 2025 South African Loyalty Awards.

Follow: Gordon Dodge www.linkedin.com/in/gordon-dodge Steven Burnstone www.linkedin.com/in/steven-burnstone-1a4a7b

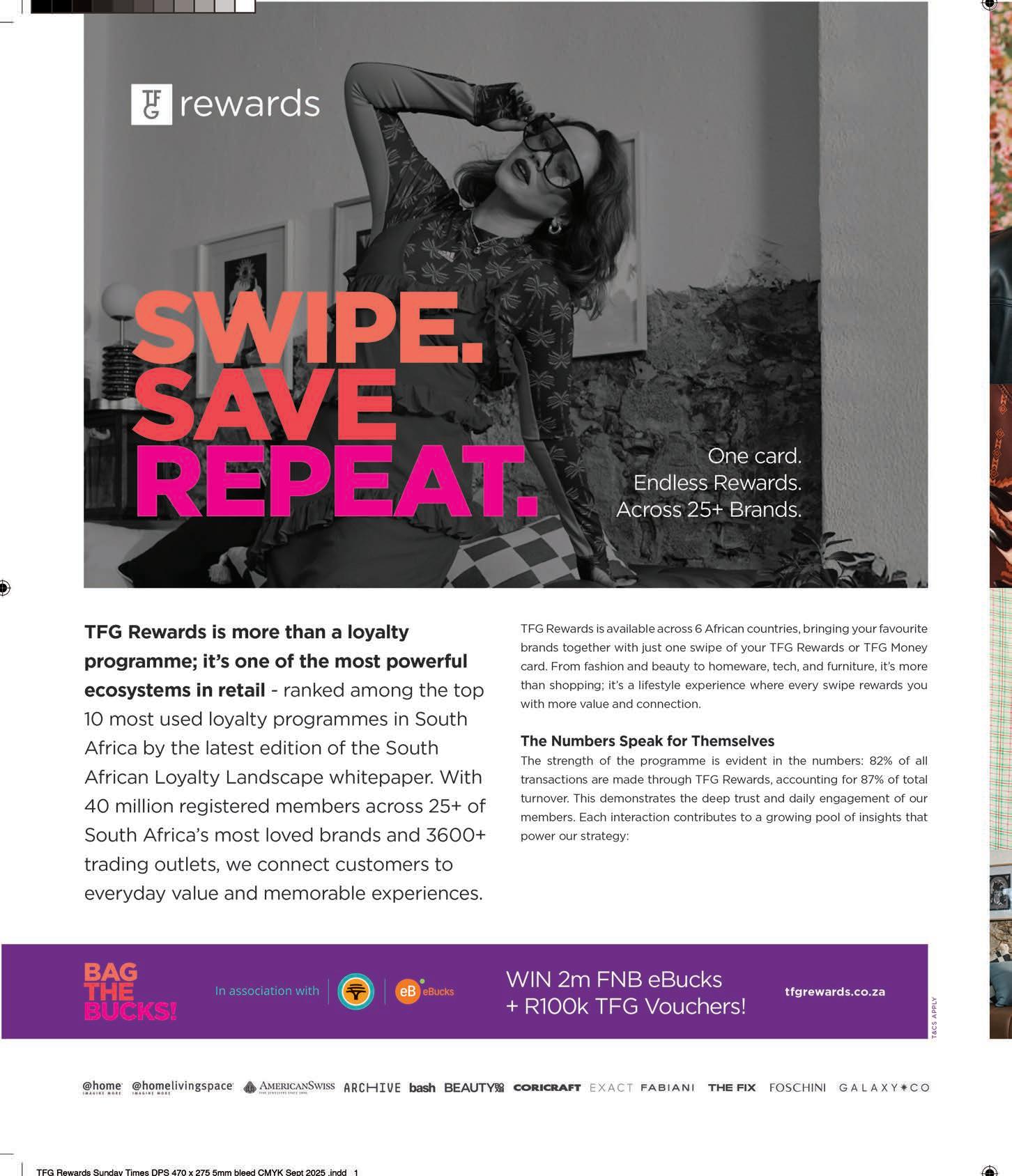

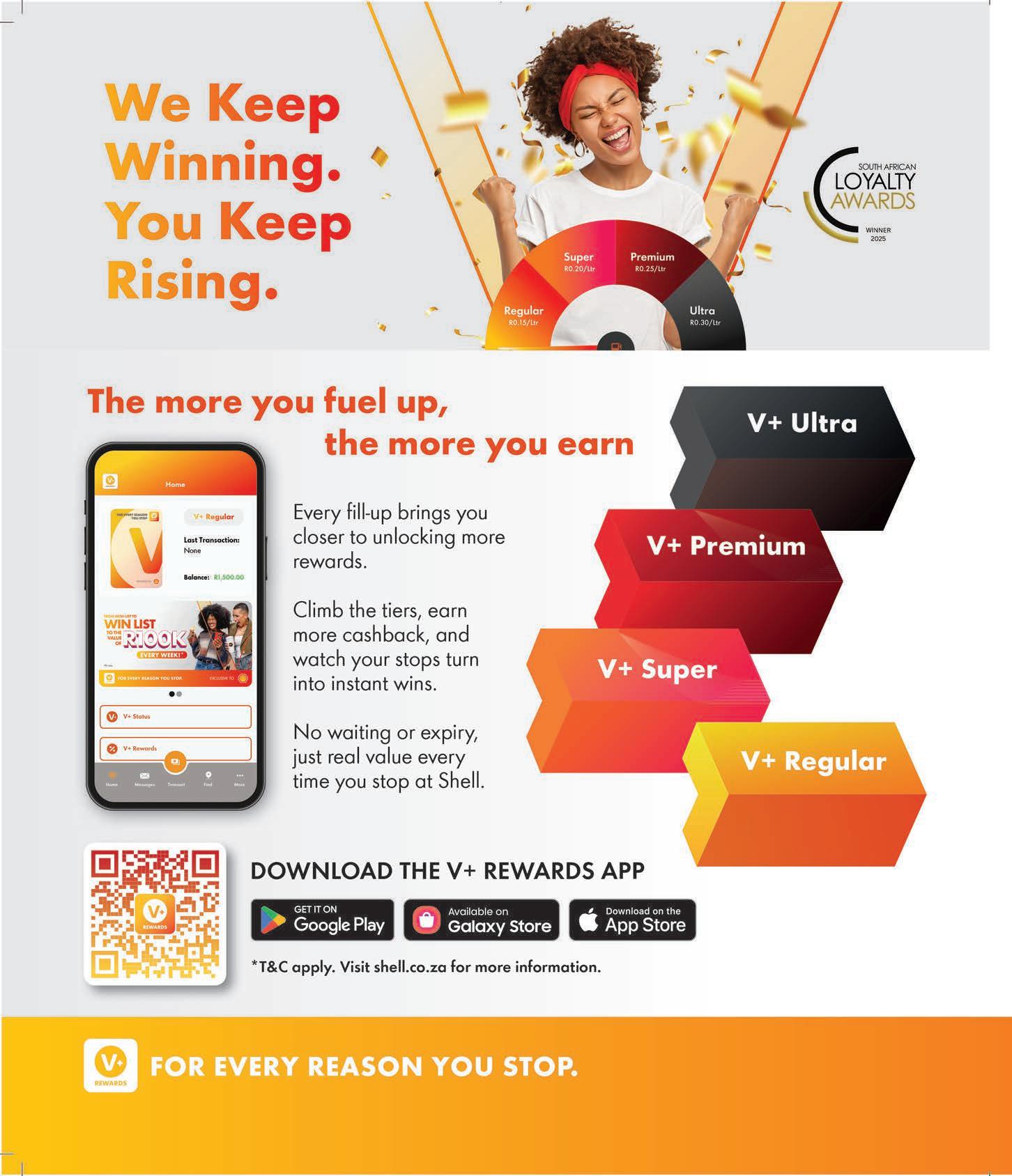

In September, winners of the South African Loyalty Awards were announced in Cape Town. Headline winners were brands such as FNB eBucks, Clicks ClubCard, Shoprite/Checkers Xtra Savings and TFG Rewards. By

AMANDA CROMHOUT , CEO

of Truth

More than 80 per cent of South Africans use loyalty programmes and, on average, utilise 10.2 cards. These statistics are according to the annual Truth and BrandMapp Loyalty Whitepaper 2024/5. South Africa also outstrips other global loyalty markets around the world in terms of engagement.

This explains why, beyond the excellence we reward here, South African loyalty brands also excel at the International Loyalty Awards. This year, the country with the most awards for its loyalty brands was South Africa, demonstrating how highly our industry is recognised on the global stage.

Several themes stood out among the winning brands and strategies for customer loyalty in South Africa at the 2025 awards. These are not new loyalty concepts, but are nevertheless worth noting.

Firstly, the strategic use of data is no longer optional; it is a prerequisite for a successful programme to ensure an improved brand experience for members and commercial return for the brand. The best retailing loyalty programme was Xtra Savings. To quote ShopriteX: “This is more than loyalty; it’s an intelligence platform. Xtra Savings powers REX, the group’s insights engine. From store oor to CEO, it’s the group’s strongest lever, ensuring customer relevance and long-term growth.”

Over and above brands such as Checkers and Shoprite, the awards celebrate the best use of data analytics and customer relationship management applications, with the award going to TFG Rewards. To quote TFG: “TFG has revolutionised loyalty in Africa through its AI-powered precision marketing engine, transforming how 39 million customers across 26 brands are engaged. By integrating 2 billion data points and 20+ machine learning models, TFG delivers hyper-personalised campaigns, resulting in x8 per cent return on investment.”

Secondly, the awards celebrate the theme of partnerships. Loyalty programmes worldwide are creating ecosystems that make it easier for users to earn, redeem and bene t from rewards. Over 70 per cent of consumers say they prefer consolidation, where they can collect and spend rewards across different partnering brands.

The best partnership programme for 2025 was awarded to FNB eBucks once again. eBucks allows customers to earn and spend eBucks at 30 online and in-store partners. The purpose is to create a win-win-win for eBucks, its partners and FNB clients who are members of the programme.

Interestingly, even on a campaign level, eBucks was recognised for its partnership with Pick n Pay Smart Shopper as the best short-term loyalty marketing campaign, delivering Burger Friday to South Africa. Only members of Pick n Pay Smart Shopper and FNB eBucks could get the best deal (R50) on a premium cheeseburger meal for four. The loyalty partnership spiked sales to 1 654 per cent in Friday burger sales and 539 per cent repeat customers.

The best programme awards went to leading loyalty programmes across key sectors:

• Best overall long-term loyalty programme: FNB eBucks

• Best retail programme: Shoprite Group Xtra Savings

• Best financial services programme: FNB eBucks

• Best restaurant/QSR programme: Vida e Caffè

• Best travel and hospitality programme: Emirates Skywards

• Best B2B programme: FNB eBucks

• Best fuel programme: Shell V+

• Best telco programme: Vodacom Vodabucks

• Best entertainment/leisure programme: Virgin Active Rewards

• Best partnership programme: FNB eBucks

• Best programme: Newcomer: TakealotMORE

The awards also honour industry professionals, suppliers to the loyalty industry and the team of the year, which this year went to Clicks ClubCard. This team has created magic through the ClubCard programme for Clicks customers for over 30 years. It is one of South Africa’s oldest loyalty programmes, consistently giving back to its members through member-only deals and ClubCard cashback. It is the most used loyalty programme in the country, according to the Truth and BrandMapp Loyalty Whitepaper 2024/5, across all customer demographics in South Africa. At the awards, Clicks won three categories: Best use of AI to improve the loyalty experience, Best use of informative content in loyalty and Industry team of the year.

There is no question that the South African loyalty industry is growing from strength to strength – and the rest of the loyalty world is watching.

Follow: Amanda Cromhout https://www.linkedin.com/in/amanda-cromhoutcadipl%E2%84%A2%EF%B8%8F-34167b2

Bringing together client relationship management systems and behavioural insights is supercharging loyalty and rewards programme effectiveness, writes TREVOR CRIGHTON

Loyalty and rewards programmes used to be a great way for a retailer or a brand to track purchases and reward face-value behaviour. However, in a world of big data, they’ve adapted to become powerful client relationship management (CRM) tools, transforming the ways customers and the brands and retailers they use interact with each other.

Pick n Pay head of innovation and digital transformation Vincent Viviers has watched this shift in loyalty and rewards from siloed points systems to fully integrated, CRM-powered ecosystems. “Smart Shopper began as a classic ‘points as cashback’ programme and evolved into an integrated, CRM-powered ecosystem, giving more rewards and personalisation to our customers based on their behaviour,” he explains.

“Today, our programme blends cashback with real-time, personalised savings.”

Meredith Allan, general manager of strategy and rewards at ShopriteX, says the rewards programme’s strategic purpose is to create a truly customer- rst culture, enable precision retailing through rich customer insights and develop future- t channels that keep pace with evolving customer needs. “In just six years, Xtra Savings has scaled to become a fully integrated customer platform that powers effortless, transparent and instant savings –without points, tiers or ne print, offers hyper-personalisation and smarter promotions and has birthed new customer innovations like Xtra Savings Plus, South Africa’s rst grocery subscription service.

South Africa’s loyalty market is projected to grow 17.1 per cent annually, reaching R5.15-billion in 2025, with a compound annual growth rate of 14.7 per cent from 2025 to 2029.

Source: Globe Newswire

Rewards programmes aren’t only effective at delivering data for retailers. Gym chain Virgin Active has its own, evolving rewards programme. “In our rst year, the strategy was clear: improve engagement among previously disengaged members who were at risk of leaving,” explains Kia Abbott, Virgin Active Group chief customer of cer. “This involved static universal goals for all members. Over time, we evolved this towards dynamic goals that are more personal, matched with more personal rewards such as milestones and our ‘Top 100 Club’, which recognises the 100 members who have the highest number of visits each year. Members have really embraced the updates, showing they are motivated by clearer criteria and rewards that supported them in reaching their goals.”

Abbott says Virgin Active is deliberate in calling the programme a “rewards programme”, rather than a “loyalty programme”. “The focus isn’t on points or transactional incentives; it’s about driving positive behaviour change and making it easier for our members to achieve their wellness goals. We look to reward members for every visit and interaction.”

“WE NOW HAVE A SINGLE, UNIFIED VIEW OF OUR LOYAL CUSTOMER BASE, WHICH MAKES IT EASIER TO MEASURE THE IMPACT OF BEHAVIOUR CHANGES.” – VINCENT VIVIERS

Allan says customer centricity is at the heart of every decision the Xtra Savings team makes. “Data is analysed to understand how customers shop, what they value and how their needs are changing to create more relevant and rewarding experiences, such as tailored promotions and personalised offers, direct engagement with members via email, app, SMS and online pro les, and enhanced customer journeys on Sixty60, including personalised shopping lists and ‘Have you forgotten?’ reminders,” she explains. “Over 5 000 data points are processed per member. All data is anonymised and processed in line with the Protection of Personal Information Act.”

The Pick n Pay Smart Shopper team listens to what customers want in several ways. “We follow behaviour signals – what customers browse, buy and redeem, direct feedback –app reviews, surveys, panels and A/B testing of new offers and campaigns. We use these signals to strengthen and personalise our offering in-store and via asap! to ensure our Just-for-You offers are highly relevant, and to consider new or modify bene ts that are not working,” explains Viviers. “These insights not only offer relevance, but also user experience (UX) decisions, from navigation improvements to how we surface deals and communicate rewards, ensuring the programme is easy to use and genuinely rewarding.”

For Virgin Active Rewards, Abbott says the data tells a story, but following patterns and listening to the personal interactions between customers and staff deliver real value. “For example, we look at how many members are redeeming rewards, achieving their weekly goals or engaging with the app. However, when we overlay that with actual behavioural patterns, such as consistency of workouts, types of rewards chosen or how members interact with new features, it gives us a far richer picture of what really drives motivation,” she says.

“The real magic comes from personal interactions; our staff getting to know our members one-on-one in our clubs and hearing about their goals, fears and passions. Some of the best insights come from responses to little messages to members, who we’ve noticed haven’t been to train in a while, simply asking them what’s been happening in their lives. Their deeply personal and heartfelt responses go beyond what a typical loyalty programme can see in a pure data model.”

Vincent Viviers of Pick n Pay says maintaining customer trust is foundational to everything Smart Shopper does. “Data is treated with the highest privacy standards. We are always transparent, minimise collection of data, secure it and give control to customers with elements like clear opt-in and opt-out options via the app’s preference centre and easy channel preference selection. All personalisation is designed to be useful and unobtrusive,” he explains. Trust and transparency are non-negotiables for Virgin Active Rewards, too. “We make it clear what data we use and always in service of a better member experience aligned with our members’ personal goals,” explains Virgin Active’s Kia Abbott. “We communicate and build clear opt-in points and respect local data regulations across all our territories.”

Viviers says bringing CRM and loyalty together, from a technical and organisational perspective, has delivered interesting insights. “What’s been positive is that we now have a single, uni ed view of our loyal customer base, which makes it easier to measure the impact of behaviour changes. It also allows us to create richer segmentation and deliver more personalised experiences,” he says. “The main challenge

has been ensuring a seamless, omnichannel experience across physical and digital touchpoints. We’ve prioritised addressing this to maintain and improve customer satisfaction.”

Abbott says that bringing CRM and rewards together was crucial. “It’s given us a far richer understanding of our members by combining their behaviour in-club and on the app with how they respond to rewards and communication. That integration means we can target more effectively, deliver nudges that feel timely and personal, and create a seamless experience where members feel guided rather than marketed to.

“From an organisational perspective, it has helped align our teams around customer journeys rather than isolated campaigns,” she says. “Of course, the integration comes with technical complexity and requires constant re nement, but the bene ts far outweigh the challenges. We now have the ability to act on insight at pace, test and learn quickly and build long-term engagement strategies grounded in data. Ultimately, combining CRM with rewards has made the programme more impactful for our members and more valuable for the business.”

“XTRA SAVINGS HAS SCALED TO BECOME A FULLY INTEGRATED CUSTOMER PLATFORM THAT POWERS EFFORTLESS, TRANSPARENT AND INSTANT SAVINGS.” – MEREDITH ALLAN

Follow: Vincent Viviers www.linkedin.com/in/vincent-viviers-0719a79a

Meredith Allan www.linkedin.com/in/meredith-leigh-allan-40566371

Kia Abbott www.linkedin.com/in/kia-abbott-78115516

Too often, organisations design programmes that aim to appeal to everyone and ultimately resonate with no one.

This challenge is even more pronounced in large organisations with diverse customer bases, where multiple segments make up the overall audience. A good example of effective segmentation is FNB’s eBucks Rewards, an award-winning, comprehensive loyalty programme. It is available to all retail, private and business customers, with quali cation and earning rules carefully tailored to each segment. These are calibrated to align with the bank’s key revenue and cost drivers, ensuring the programme delivers both customer value and commercial impact.

FBy JAMES GETHINGS , director at Simon-Kucher & Partners

From strategic intent to customer engagement, these are the key principles behind developing a programme that delivers measurable returns.

rom retail and nancial services to telecommunications and travel, loyalty programmes have become a standard feature of doing business – and competition for consumer attention has never been more intense.

Successful loyalty strategies are often those rooted in a deep understanding of customer behaviour and closely aligned with a company’s broader strategic objectives. Effective programmes go beyond simple rewards; they create mutual value – driving engagement, in uencing behaviour and strengthening emotional connections between brands and their customers.

Designing a successful programme requires disciplined and strategic thinking. Success depends on asking the right questions. Whether developing a new programme or optimising an existing one, businesses must consider several fundamental design questions.

A clear understanding of the programme’s strategic objectives ensures every design decision supports broader commercial goals. When this is missing, programmes often consume valuable resources without delivering meaningful business impact.

Well-designed loyalty programmes can deliver upon a range of strategic outcomes.

They drive growth by supporting customer acquisition, incentivising upselling and cross-selling, and strengthening retention. They enhance market and brand positioning by fostering advocacy and creating meaningful differentiation from competitors. They also enable deeper customer engagement, generating valuable insights that inform future offers, pricing and communications.

The business must be aligned with its aims – this is the foundation upon which all subsequent design decisions are built.

A clear view of the target audience is a critical next step in any loyalty initiative. De ning who the programme is designed for and which customer segments offer the greatest potential value is essential to achieving measurable impact.

However, high levels of segmentation introduce complexity and can risk lower engagement if customers cannot clearly understand their individual pathway within the programme. Finding the right balance is essential – the goal is to design a structure that recognises meaningful differences between segments while remaining simple, transparent and easy for customers to navigate.

James Gethings

The next step is to de ne which customer behaviours the programme should incentivise. If the goal is to create economic value and deliver a positive return on investment, it is essential to identify the speci c actions driving that value. These may include increasing spend or product usage, promoting cross-category purchases or stimulating referrals and advocacy. Customer interviews and surveys can help reveal which behaviours matter most to customers and where incentives are most likely to in uence decisions. By linking rewards directly to behaviours supporting the organisation’s strategic priorities while delivering value to customers, loyalty programmes can generate measurable impact for the business and its customers.

COMPANY’S BROADER STRATEGIC OBJECTIVES.

A good example is Discovery Vitality. The programme rewards and motivates members to adopt healthier habits that enhance their long-term wellbeing while reducing the likelihood of insurance claims. Discovery’s shared-value model is built on its behavioural change platform. By analysing the relationship between behaviour, cost and outcomes, the platform focuses on areas where positive change can deliver the greatest long-term impact – improving risk outcomes and creating sustainable value for all.

Once the desired behaviours have been de ned, the focus shifts to how best to motivate and reward them. The bene ts offered within a loyalty programme are central to driving engagement and shaping customer perception.

Rewards must feel relevant, attainable and aligned with the brand’s value proposition.

Traditional points-based models offer exibility and encourage long-term engagement, but can delay the moment of reward, reducing perceived value for consumers seeking instant grati cation. By contrast, cashback or instant discount programmes, such as Uber One and Checkers Xtra Savings, provide immediate, visible value at the point of purchase. Many South African consumers are gravitating toward these instant bene ts, viewing them as more meaningful and practical than deferred rewards.

Alongside these models, businesses are broadening their bene t mix to enhance appeal and engagement. Options such as gift cards, free products, lifestyle experiences, fee waivers and preferential pricing can add depth and differentiation to a programme. Increasingly, brands are also strengthening their reward portfolios through strategic partnerships that extend value across complementary industries. For example, TotalEnergies collaborates with Dis-Chem Bene ts, allowing customers to earn rewards when refuelling. These partnerships make loyalty more visible and relevant in customers’ everyday lives while enabling participating brands to share the costs – improving programme sustainability and amplifying overall impact.

Each approach has its advantages and drawbacks. Cashback and discounts are simple, transparent and deliver immediate grati cation, but can struggle to sustain loyalty once the discount ends. Points-based rewards encourage continued participation and behavioural change by linking value to

EFFECTIVE ENGAGEMENT MEANS DELIVERING THE RIGHT MESSAGE, AT THE RIGHT TIME, THROUGH THE RIGHT CHANNEL, TO THE RIGHT CUSTOMER.

ongoing engagement, although they can be more complex and costly to manage. Experiential rewards and premium service tiers help build emotional connection and reinforce brand positioning, but often appeal to narrower customer segments.

The most effective programmes combine these elements, offering immediate, tangible value to drive participation while using mechanisms such as points and aspirational rewards to foster long-term loyalty. The optimal balance of bene ts ultimately depends on the organisation’s strategic objectives and target audience.

Once the structural elements have been de ned, it becomes crucial to determine the overall level of reward. This decision can be broken into two key stages: quantifying value drivers and calibrating rewards.

Firstly, understand the economic value generated by the behaviours being incentivised. For example, a retailer wanting to reward customers for increasing their monthly spend or shifting to higher-margin product categories must calculate the incremental pro t associated with those behaviours. The same principle applies across industries – whether the behaviour in question is making healthier lifestyle choices, purchasing additional services or adopting more pro table channels. Developing a robust pro t model is a critical foundation for any effective loyalty design process.

Once the value of each behaviour is understood, the next step is to estimate how much of that behaviour can genuinely be attributed to the loyalty programme – in other words, how many of the additional actions are caused by the incentive versus how many would have happened anyway? This requires

careful calibration before and after launch. Pre-launch, specialist research can help predict behavioural shifts, while post-launch data analysis can measure real-world impact and help re ne assumptions.

Given the analytical and commercial expertise required, reward calibration is best managed by a dedicated pricing or value management function.

An effective engagement strategy is essential for personalisation and the programme’s overall success. Without strong engagement, programmes risk fading into the background and rewarding customers for behaviours they would have demonstrated anyway, undermining both purpose and return on investment.

Engagement must go beyond simple participation; it should actively in uence behaviour and encourage actions that extend beyond a customer’s typical activity. Effective engagement means delivering the right message, at the right time, through the right channel, to the right customer. Personalised communication, informed by real-time data and historical behaviour, signi cantly increases the likelihood of meaningful interaction and sustained participation.

Incorporating elements such as gami cation, progress tracking and behavioural nudges can make loyalty programmes more dynamic, interactive and personally relevant. For example, Starbucks Rewards combines gami cation through its “Star Dashes” with progress tracking and timely nudges to encourage ongoing engagement and repeat purchases. Success comes from creating mutual value: programmes that are economically sustainable for the business and genuinely rewarding for the customer.

Follow: James Gethings www.linkedin.com/in/jamesgethings

The data from financial transactions is known to bolster loyalty profiles and personalisation models, but it is not without its challenges. Here’s what companies operating in the space need to be wary of.

The ecosystems created by the convergence of loyalty and ntech are generating unprecedented volumes of transactional data. This data, when analysed responsibly, can strengthen loyalty pro les and enable highly personalised offers, improving relevance, customer experience and drive repeat spend, says Nicolene Schoeman-Louw, managing director of SchoemanLaw Inc in Cape Town. She adds that treating nancial transactions as signals of consumer behaviour allows brands to predict their preferences more accurately and tailor rewards in real-time. “However, the same data that strengthens loyalty models also raises signi cant regulatory and operational challenges.”

Arthur Goldstuck, CEO of World Wide Worx, agrees: “While the real currency of loyalty ecosystems is data, it only has value if responsibly handled.” Goldstuck believes compliance with South Africa’s Protection of Personal Information Act (POPIA) and other regulations is central to consumer trust. He warns that a single breach can undo years of goodwill – and hand competitors the advantage of being seen as much safer data custodians.

In South Africa, businesses must carefully manage four different aspects of risk regarding the data their rewards programmes generate. “The table alongside offers an outline of the importance of each of these aspects,” advises Schoeman-Louw.

Kitso Lemo, associate director of Boston Consulting Group, says these four aspects converge to render methods of implementation and execution critical to driving such programmes. “South Africa’s POPIA legislation requires opt-in for electronic marketing, and companies are required to ensure consent, legitimate interest tests and minimisation of any data collected. Programmes must treat data and customer value management as a core infrastructure with one ID to enable ef cient cross-selling and explicit user consent.”

By VANESSA ROGERS

Financial-transaction data can transform loyalty into a hyper-personalised, embedded ecosystem that drives customer lifetime value and opens new revenue streams, says Schoeman-Louw. However, these bene ts are only sustainable if businesses handle the data with integrity, transparency and regulatory compliance. “This means aligning loyalty and ntech strategies with all laws, together with robust risk management protocols. Loyalty is built on trust, which depends on your compliance,” she concludes.

Financial transaction data is considered personal information under the Protection of Personal Information Act 4 of 2013 (POPIA). This means:

•Informed consent is non-negotiable – consumers must be told what data is collected, why and how it will be shared.

• Purpose limitation requires that data collected cannot be repurposed for unrelated marketing or third-party monetisation, without fresh and explicit consent.

POPIA compliance

Banking and financial regulation

•Third-party sharing and cross-border transfers must be properly disclosed and governed by robust data-sharing agreements, especially where loyalty partners include banks, retailers and international platforms.

•According to data subject rights, consumers can withdraw consent, access their information and request deletion. Businesses must have clear processes for these requests.

•With sensitive financial data, strong safeguards, such as encryption, secure storage and breach notification procedures, are mandatory.

When loyalty programmes operate like financial services, for example, through digital wallets, pay-with-points mechanisms or branded financial products, regulatory overlap arises. Businesses may require or should look into:

• Banking licences or partnerships with licensed institutions if programmes function as deposit-taking or payment systems.

• Compliance with the National Credit Act if loyalty points or services resemble credit extensions.

• Risk management frameworks to address fraud, money laundering and operational risks, as far as these could be tied to the handling of financial data.

Transparency is central under both POPIA and the Consumer Protection Act, Act 68 of 2008. Consumers must clearly understand:

•The real value of loyalty points and whether they can expire.

Consumer protection considerations

Operational risk

•The risks of exchanging transaction data for rewards.

•How disputes (for example, unauthorised transactions or misapplied rewards) will ideally be fairly and efficiently resolved.

Using financial transaction data at scale raises concerns around:

•Accuracy – incorrect profiling could lead to discrimination or reputational harm.

•Cross-ecosystem risk – a breach at one partner could undermine trust across the network.

•Innovation versus compliance – moving too fast without embedding compliance frameworks risks regulatory sanctions and consumer backlash.

Follow: Nicolene Schoeman-Louw www.linkedin.com/in/nicolene-schoeman-%E2%80%93-louw-6965162b Arthur Goldstuck www.linkedin.com/in/arthurgoldstuck

Kitso Lemo www.linkedin.com/in/kitso-lemo

Companies in the loyalty and rewards space must offer more than just accumulating points or cashbacks. Here’s how loyalty programmes are cleverly permeating the fintech space. By

Loyalty and ntech are increasingly forming part of the same ecosystem, says Arthur Goldstuck, CEO of World Wide Worx. Payments, wallets and instant rewards, he advises, are being built into the same platforms – so what used to be separate industries are now becoming integrated layers of the same customer experience. “The line between banking and loyalty has effectively disappeared,” he advises.

Goldstuck says that when loyalty fuses with ntech, every transaction can be monetised. “Merchant fees, nancial product tie-ins and cross-platform partnerships all generate value – while the consumers who understand the mechanics of the platform can extract increasingly greater bene t. Engagement itself has becomes a revenue stream.”

Kitso Lemo, associate director at Boston Consulting Group (BCG), says experts in the space are observing ntech companies –globally and locally – pursuing four different forms of rewards models.

“First, spend-to-travel currencies are typically built on debit cards,” he says. “Revolut, the leading United Kingdom-based digital bank with over 50 million users, offers RevPoints that convert everyday spend into airline miles and partner redemptions, emulating entrenched credit card programmes.”

Second is the burgeoning instance of super-app currency, which is both spendable and aims to drive ecosystem engagement. “Grab, a South-East Asian mobility ntech

VANESSA ROGERS

with over 43 million monthly active customers, lets users earn-and-burn GrabRewards across rides, food and payments – prizing liquidity over price breakage.”

Third are behaviour-change currencies, most notably pioneered by the Discovery Group whose digital bank leverages dynamic pricing on interest rates, high earn for more secure digital payments versus a physical card and rewards tied to healthier and more secure nancial habits. “These are enabling shared value for the bank and its customers,” says Lemo.

Finally, some programmes offer merchant-funded cash rewards targeting low-cost engagement. “TymeBank, for example, through its partnership with Pick n Pay, allows consumers to earn when spending on groceries and petrol – in addition to bonus interest rates for those who provide advance notice of withdrawals and consistently use their debit cards for transactions,” explains Lemo. Such structures are integrated into the overall value proposition of each programme, aligning them with the speci c needs of that economic segment.

Tangible rewards that reduce daily expenses have never been more valuable, says Goldstuck. “Programmes that put real money into consumers’ pockets through fuel savings, grocery discounts or instant redemptions are seeing stronger stickiness. This is because loyalty is no longer only about perks, but also about nancial relief.”

Grocers and pharmacies have turned everyday spend into scale currencies, says Lemo. “Shoprite Group’s Xtra Savings Card now exceeds 33 million users, Clicks Clubcard has

A 2024 TransUnion survey reveals that 77 per cent of South Africans are hugely concerned about the rising prices of food, fuel and electricity. They are cutting back on spending, looking for extra jobs or even taking on debt to survive. In this landscape, loyalty programmes offer much-needed financial relief.

Source: TransUnion, Insurance.co.za

12 million users and FNB’s eBucks 6 million – with grocery, fuel, and travel partners ranking prevalently in the space. Woolworths WRewards programme has succeeded in providing useful discounts at the till rather than an accumulation of abstract points.”

These programmes are gaining traction because South Africa is a middle-income country with high cash usage and high price sensitivity. “Rewards must therefore be simple, immediate and relevant, for example, relating to transport, groceries, airtime and utilities,” advises Lemo.

This logic mirrors BCG’s ndings that suggest “points-plus-cashback” alone no longer differentiate a programme. Successful programmes feature high personalisation, rich partner ecosystems and a good loyalty margin.

“Execution matters in driving programmes. Beyond South Africa’s Protection of Personal Information legislation, programmes must demonstrate clear value and near-real time redemption, coupled with rigorous tracking of the loyalty margin,” Lemo concludes.

“THE LINE BETWEEN BANKING AND LOYALTY HAS EFFECTIVELY DISAPPEARED.”

ARTHUR GOLDSTUCK

Follow: Arthur Goldstuck www.linkedin.com/in/arthurgoldstuck

Kitso Lemo www.linkedin.com/in/kitso-lemo

Businesses must examine their loyalty programmes through the lens of privacy legislation, writes AHMORE BURGER-SMIDT , director and regulatory practice head at Werksmans

Loyalty programmes are at the heart of today’s retail strategies. They aim to drive repeat purchases, better understand customer requirements, enhance business enablement and deliver personalised experiences.

However, these programmes operate at the intersection of marketing innovation and data privacy. As they scale, they increasingly collide with a thorny web of privacy legislation that governs what data can be collected, how it can be used and what individuals can demand in return. Approaching loyalty through the lens of privacy law reveals both constraints that push for better governance and opportunities to build deeper trust with customers.

Privacy legislation determines the baseline for accountability in data collection. The Protection of Personal Information Act (POPIA) requires clear purpose limitation, data minimisation and explicit consent where necessary. For loyalty programmes, this translates into a careful understanding of data inventories: what data is collected (transactions, location, online behaviour, preferences), why it is collected (to personalise offers, reward redemption, programme analytics), and who has access (internal teams, partner networks).

Consent and transparency are the twin pillars of privacy. Programmes rely on consent for marketing communications and for certain data-intensive features, such as location-based offers. The challenge is balancing opt-in transparency – clearly informing customers about what data is being collected and how it is being used – with a frictionless customer experience, making the consent process as easy and seamless as possible.

APPROACHING LOYALTY THROUGH THE LENS OF PRIVACY LAW REVEALS BOTH CONSTRAINTS THAT PUSH FOR BETTER GOVERNANCE AND OPPORTUNITIES TO BUILD DEEPER TRUST WITH CUSTOMERS.

This means that privacy should be embedded from the outset: privacy notices tailored to loyalty activities, granular consent controls that let customers choose exactly which data they want to share and for what purposes and easy-to-use dashboards that allow customers to view, export or delete their data.

Core to POPIA is data minimisation. Data minimisation prompts intelligent design of loyalty ecosystems. Use cases that matter most for loyalty – purchase history, tier quali cation, reward preferences and opt-in engagement data – can often be supported with lean data strategies. Techniques, such as de-identi cation, tokenisation and aggregated analytics, reduce exposure while preserving value.

Consent management is no longer an optional add-on; it has become an operational necessity. Consent for loyalty programmes has to be managed with granularity (marketing versus personalisation versus partner data sharing). Privacy rights requests – data access, correction, deletion – must be actionable within tight regulatory timelines. Providing a frictionless, auditable process will not only bolster compliance, but also signal a commitment to customer autonomy.

The regulatory lens also shapes partner ecosystems. Loyalty programmes often rely on third-party data sharing for broader

personalisation or co-branded promotions. Data processing agreements, a jointly responsible party and operator understanding and precise data ow diagrams are essential. This means the responsible parties must ensure that third parties adhere to comparable privacy protections and that appropriate data transfer mechanisms safeguard transfers.

Privacy legislation intersects with reputational risk in meaningful ways. Consumers are increasingly aware of how their data is used and expect transparent, fair treatment. A privacy breach or perceived over-reach can undermine trust, jeopardise loyalty and invite regulatory scrutiny. Conversely, a privacy-forward loyalty programme can become a differentiator: customers willingly share data when they perceive clear value, control and respect for their privacy choices.

From a strategic perspective, the compliance lens should in uence loyalty programme design and governance. Key considerations should include:

• Purpose speci cation: de ne precise, limited purposes for data collection within the loyalty programme.

• Data minimisation: collect only what is necessary to achieve programme goals.

• Consent optimisation: implement granular, revocable consent with transparent opt-outs.

• Data governance: maintain data inventories, access controls and audit trails.

•Data retention: establish retention schedules aligned with business needs and legal requirements.

• Partner management: enforce equivalent privacy standards in third-party engagements.

• Incident response: have a tested privacy breach plan with customer noti cation and remediation steps.

Operationally, the most forward-looking loyalty programmes view privacy not as a constraint, but as a design parameter that enables deeper customer relationships. By building consent-driven, transparent and privacy-preserving systems, programmes can unlock richer, more personalised experiences without eroding trust or inviting regulatory risk. This reframing – privacy as a competitive differentiator – inspires investment in governance, technology and culture, and can lead to a signi cant competitive advantage.

Follow: Ahmore Burger-Smidt www.linkedin.com/in/ahmore-burger-smidt-67212a10

Consumers are reshaping the rules of brand engagement in South Africa’s R900-billion township economy.

By MONGEZI MTATI, senior brand strategist at Rogerwilco

For years, marketers have discussed brand loyalty as an emotional bond, the belief that customers will remain faithful to the brands they love, even as prices rise or alternatives emerge. However, in South Africa’s township economy, where consumers are grappling with food in ation that reached a 15-month high of 5.1 per cent in June 2025 and a basic grocery basket that now costs over R5 400, sentiment has taken a back seat in favour of survival.

The 2025 Township Customer Experience (CX) Report, produced by Rogerwilco in partnership with Field and Insights Africa and MoyaApp, shows that four in ten township shoppers switch brands when prices rise. This is not disloyalty; it is strategy. When the money runs out before the month does, every rand must work harder. Loyalty, in this context, is earned through trust, adaptability and consistent value.

Now in its fth year, the Township CX Report surveyed more than 1 600 township residents across South Africa’s nine provinces, complemented by a MoyaApp survey of nearly 3 820 participants. Together, the ndings paint a picture of shoppers who are deeply rational, resourceful and highly attuned to value. Price remains a powerful motivator, with 39 per cent of consumers switching brands when prices rise and one in ve changing stores altogether. However, beneath these shifts lies a more sophisticated value equation. A quarter of respondents weigh price against quality, location and promotions before switching, while 13 per cent reject poor-quality products entirely, even when they cost less.

Luigi Ferrini, chief customer of cer of Tiger Brands, observes: “Loyalty in the township economy is often anchored

more in relationships with retailers than with manufacturers.” Township shoppers do not abandon brands on a whim; they make deliberate trade-offs based on trust, convenience and perceived quality.

This is where many marketers misread the room. Traditional loyalty programmes are built around rewards, points and repeat purchases. In the R900-billion township market, loyalty is not transactional; it is relational, built on reliability, empathy and presence.

Donald Mokgale , managing director of MoyaApp, puts it succinctly: “Trust is fundamental in the township economy, but brands should also focus on what makes them meaningful and different from their competitors. Even in a highly price-sensitive market, consumers are willing to pay a premium for brands they trust, ones that truly understand their needs and differentiate themselves in meaningful ways.”

The data backs this up. While price increases have driven brand switching, many consumers

“LOYALTY IN

are not abandoning branded goods altogether. They’re recalibrating, choosing to buy trusted products in smaller pack sizes, delaying discretionary purchases or splitting their spend between supermarkets and spazas.

This multichannel strategy has become one of the de ning features of township retail. Supermarkets are gaining traction, with 54 per cent of respondents shopping there more often for bulk deals and promotions, while 29 per cent have increased their spaza purchases for daily convenience and top-up shopping.

The result is a more layered kind of loyalty that is both pragmatic and emotional. Township consumers are loyal not to a single store or category, but to brands and retailers that deliver consistent value, however small the purchase.

This emphasis on relationships is most visible in the spaza sector. Our research shows that 49 per cent of township residents prefer spaza shops run by familiar store owners, and almost as many say they feel more con dent buying from shops where they know the owner by name.

As Brian Makwaiba , MD of Vuleka, observes: “Trust has become the new currency. When consumers know who they’re buying from, and that the store is recognised and accountable, loyalty follows naturally.”

Spaza shops have evolved into microhubs of loyalty, where personal connections matter as much as price. For brands, this presents an opportunity to collaborate with spaza owners through merchandising, product education and community-focused initiatives that strengthen local trust and create shared value. Digital platforms are amplifying this dynamic even further. Among those who have increased their spaza shopping, 70 per cent discover new promotions or products through Facebook and discuss them on WhatsApp, as they compare deals and stores with friends and their networks. As Dr Semona Pillay from the University of Johannesburg notes: “Digital access may be costly, but it’s now a lifeline. Brands that adapt their strategies for low-data environments and mobile- rst communication will nd loyal audiences in unexpected places.”

For marketers, the message is clear: loyalty no longer lives only in cards or apps. It lives in the everyday digital spaces where people connect, from WhatsApp groups to local Facebook pages and groups, where

21% of shoppers change stores when prices increase, showing that loyalty is fragile across outlets.

41% of frequent spaza shoppers spend R1 000–R2 000 monthly on groceries.

91% of respondents have a bank account, but only 37% feel understood by their bank.

60% of township residents who spend more than R500 a month on data say job hunting is their primary online activity.

authenticity and relevance drive engagement far more effectively than points systems.

If spazas demonstrate the power of relational loyalty, then stokvels reveal its most enduring form.

The 2025 Township CX Report shows a remarkable rise in stokvel participation with 71 per cent of surveyed township residents now belonging to at least one

stokvel, a 39 per cent increase from just two years ago. Grocery and funeral stokvels dominate, revealing how households are pooling resources to meet immediate essentials rather than focusing on distant wealth building.

Tshepo Moloi, founder of StokFella, describes stokvels as “social contracts built on accountability and shared purpose”. They are, in many ways, the original loyalty programmes: groups bound by trust, transparency and a shared commitment to show up every month.

What makes stokvels successful holds valuable lessons for brands. Members trust each other because they know one another by name. They return month after month because the value is tangible and immediate. They remain loyal because the system is built on accountability, not just incentives.

Financial service providers would do well to take note. Loyalty in this sector cannot be built through rewards or interest rates alone; it depends on replicating the same social trust, reliability and community connection that stokvels have perfected. The same principles apply to retailers: maintain a consistent presence, deliver tangible value and build trust through genuine understanding rather than short-term incentives.

The 2025 Township CX Report ultimately tells a story of resilience. Township consumers are not passive participants in the economy; they are active architects of it, making deliberate, informed decisions about where, how and why they spend.

For brands, success in the township market will come from meeting people where they are, building products and relationships rooted in affordability, access and authentic connection. Those that manage to do so will not only deepen loyalty, but also secure lasting relevance in an economy that rewards those who truly listen.

Follow: Mongezi Mtati www.linkedin.com/in/mongezimtati

Luigi Ferrini www.linkedin.com/in/luigi-ferrini-759b0122

Donald Mokgale www.linkedin.com/in/donald-mokgale-12668850

Brian Makwaiba www.linkedin.com/in/brian-makwaiba

Dr Semona Pillay www.linkedin.com/in/semonapillay

Tshepo Moloi www.linkedin.com/in/tshepo-moloi-54b41517

Operators and users of loyalty programmes ignore tax regulations at their peril, writes JOON CHONG, partner at Webber Wentzel

The tax treatment of loyalty programmes in South Africa has been fundamentally reshaped since 2021. The Constitutional Court’s landmark judgement in Clicks Retailers v CSARS provided a nal – and for many operators unfavourable – word on the income tax position of using section 24C to claim deductions for future expenditure from the loyalty programmes against income already earned from sales. This was swiftly followed by long-awaited guidance from the South African Revenue Service (SARS) on the value-added tax (VAT) consequences. These developments have created a new paradigm, forcing operators to rethink their strategy on how loyalty programmes are structured and accounted for.

INCOME TAX: SECTION 24C DEDUCTIONS REQUIRE “SAME CONTRACT”

The Clicks judgement delivered a decisive end to the industry’s long-held hope of using section 24C of the Income Tax Act 58 of 1962 on loyalty programmes that are points-based. Section 24C allows a taxpayer to claim an allowance for future expenditure against income already received, provided both the income and the obligation to incur the expenditure arise from the same contract For years, operators argued that the income from a sale and the future cost of redeeming the loyalty points earned from that sale were suf ciently linked to meet this test.

The Constitutional Court, however, established a far stricter interpretation. Building on its previous judgement in

OPERATORS MUST NOW RECOGNISE ALL INCOME IN THE YEAR OF SALE, BUT CAN ONLY DEDUCT THE COST OF THE REWARD IN THE FUTURE YEAR WHEN THE POINTS ARE REDEEMED.

EVEN IN AN AGE OF ADVANCED DATA ANALYTICS, THE COMPLEXITY AND COST OF IMPLEMENTING A FAIR

Big G Restaurants, the court ruled that for two separate contracts, such as a contract of sale and a loyalty programme contract, to be considered the “same”, they must be mutually dependent for their existence.

The Clicks programme, like most in South Africa, did not meet this “sameness” test. Clicks earns income from customers who are not loyalty members, meaning the sale contract can exist without the loyalty contract. Likewise, members could earn points at third-party “af nity partners”, creating an obligation for Clicks without it earning any income from a sale. The court concluded the contracts were “simply too independent of each other”.

The practical result is a direct impact on cash ow. Operators must now recognise all income in the year of sale, but can only deduct the cost of the reward in the future year when the points are redeemed. This nality has prompted a review of programme structures, with the only clear path to a section 24C allowance being to embed the loyalty obligation directly into the contract of sale – a logistically complex undertaking.

Six months after the Clicks judgement, SARS issued Interpretation Note 118 (IN 118) on 4 November 2021, providing much-needed clarity on the VAT treatment of points-based loyalty programmes where points are issued to be redeemed as payment or part-payment for future purchases of goods or services.

For loyalty programmes within its scope, IN 118 clari es that while VAT is levied on the full consideration of the initial sale, the awarding of points itself is a nil-value event. Upon redemption, the redemption vendor must declare output VAT on the full value of the reward, including the monetary value of the points used as payment or part-payment of the goods or services.

While the focus has been on the tax obligations of the operator, the question of whether rewards are taxable in the hands of the consumer remains a subject of debate. Currently, the prevailing view in South Africa is that loyalty rewards received from personal expenditure are not taxable. They are considered a fortuitous receipt of a capital nature – an incidental bene t akin to a discount, not a form of “gross income” earned through a pro t-making scheme. Similarly, the act of redemption is not seen as a disposal for capital gains tax purposes, but rather the natural culmination of the rights existence.

This position aligns with international norms. Tax authorities in jurisdictions such as Australia, Canada and the United Kingdom generally do not tax loyalty rewards that arise from purely private spending. The line is typically drawn where rewards are linked to business activities or form part of a contrived arrangement for remuneration.

Furthermore, any move by SARS to tax consumer rewards would face extreme practical dif culties. The sheer volume of microtransactions would create an administrative nightmare. Key challenges would include:

INTERNATIONAL PRECEDENT STRONGLY SUPPORTS THE NONTAXATION OF PERSONAL LOYALTY REWARDS.

WHILE THE FOCUS HAS BEEN ON THE TAX OBLIGATIONS OF THE OPERATOR, THE QUESTION OF WHETHER REWARDS ARE TAXABLE IN THE HANDS OF THE CONSUMER REMAINS A SUBJECT OF DEBATE.

•Valuation: how would the “income” be valued? Is it the cost to the company or the retail value of the reward? The value of a point often is not xed and can vary depending on how the points are redeemed.

•Tracking: it would require a system to track billions of points issued and redeemed by millions of South Africans across dozens of different programmes.

•Apportionment: a mechanism would be needed to distinguish between points

earned from personal expenditure versus those earned from reimbursed business expenses, which could be taxable.

• De minimis principle: the administrative cost of assessing and collecting tax on small, incidental rewards would likely far outweigh the revenue generated, making it an inef cient exercise.

Even in an age of advanced data analytics, the complexity and cost of implementing a fair and workable system to tax consumer loyalty rewards appear prohibitive.

The period since 2021 has brought significant clarity to the loyalty programme tax landscape. For operators, the rules of engagement for both income tax and VAT are now more clearly defined, albeit more restrictively. The untaxed value flowing to consumers should remain unchanged for compelling reasons.

First, loyalty rewards retain their character as fortuitous receipts of a capital nature, distinguishing them from systematic income-generating activities.

Second, the administrative burden of taxing consumer rewards would create the very administrative nightmare that tax policy seeks to avoid, with compliance costs far exceeding potential revenue.

Third, maintaining the current approach preserves horizontal equity between cash discounts and loyalty benefits, as both represent commercial incentives rather than taxable income. (Horizontal equity requires similar economic benefits to receive similar tax treatment: a R50 cash discount and R50 in loyalty points should both remain nontaxable as equivalent commercial incentives.)

Finally, international precedent strongly supports the nontaxation of personal loyalty rewards, and South Africa’s alignment with global norms enhances certainty for multinational operators and consumers alike. The tax-free nature of loyalty rewards should therefore remain a cornerstone of South African tax policy.

Increasingly, organisations are seeking to shift customer loyalty from a single-brand focus to a lifestyle-enhancing experience by collaborating to deliver a broader reward ecosystem, writes

South Africans are value-seeking and price-sensitive. This is pushing brands to collaborate rather than build in isolation. A multibrand ecosystem, suggests Yaron Assabi, CEO of Digital Solutions Group, allows customers to earn and redeem rewards in more places, making the programme feel useful every week, not just on big-ticket purchases.

“For business, this translates to lower acquisition costs, higher frequency and better data to fund personalisation. It also shares the cost of technology, fraud controls and marketing across all partners,” he says.

“The net effect is a tighter loop between spend, recognition and reward. When customers see value at the till and in their wallet, they stay active. That is why more coalitions are forming.”

RODNEY WEIDEMANN

For consumers, notes Frik van der Westhuizen, founder and owner of LoyaltyPlus, the appeal is clear: they can earn points more quickly across various brands, unlocking rewards more ef ciently and enjoying a more consistent, satisfying experience.

“This faster-earning ability boosts perceived value and encourages stronger engagement, ultimately fostering more loyal customers. On the other hand, for organisations within the ecosystem, the advantages are equally compelling. They include expanded market share, cost-effective marketing and valuable customer insights.”

Fayelizabeth Foster, head: loyalty, PPB at Standard Bank, adds that ecosystem partners act as mutual ampli ers. A customer who joins for one brand often discovers others that meet their needs, creating a ripple effect of loyalty across the network.

“Shared data, used responsibly and with consent, enables hyper-personalised offers that resonate with individual preferences. These tailored experiences foster emotional connection, making customers more likely to return, engage and advocate for the brands they trust, transforming loyalty from a transactional programme into a lifestyle,” Foster says.

The key is design, explains Assabi. “Categories must complement each other, offers must be straightforward, and each partner needs a clear role. If a member can see how to earn quickly and redeem without hoops, they will credit the brand that made it easy. Done well, the ecosystem lifts the whole, while each brand still owns its moments of truth.”

Foster adds that agreeing a shared commercial model, clear governance and fair allocation of revenue or reward costs prevents con ict and underpins longevity. “Payment integration is central to binding a multibrand rewards ecosystem because it makes earning and redemption seamless at the point of sale, turning loyalty into a natural part of

Follow: Yaron Assabi www.linkedin.com/in/yaronassabi

Fayelizabeth Foster www.linkedin.com/in/fayelizabeth-foster-mann-69684468

Frik van der Westhuizen www.linkedin.com/in/frik-van-der-westhuizen-725b72b

Too many partners will lead to a tipping point where categories overlap, brands blur and the catalogue merely becomes noise. A curated approach that anchors partners in daily spend, adds selective lifestyle partners, sets category caps and keeps redemption simple is preferable. The goal is breadth without confusion, and scale without losing each brand’s identity.

Source: Digital Solutions Group

everyday transactions, while removing friction for customers, increasing transaction frequency and enhancing programme engagement,” she says.

LoyaltyPlus believes that data collaboration is vital to the success of any such programme, noting that the process must be overseen by a single, trusted entity. Central governance ensures communications are ef cient, data remains secure and sensitive information doesn’t get leaked. It also strengthens accountability, so every partner functions within the same ethical and technical standards.

“In short, ethical data collaboration, based on trust, consent and compliance, is the foundation of a successful partnership. It turns fragmented insights into actionable intelligence, boosting loyalty, relevance and long-term value for both customers and partners,” concludes van der Westhuizen.

“SHARED DATA, USED RESPONSIBLY AND WITH CONSENT, ENABLES HYPER-PERSONALISED OFFERS THAT RESONATE WITH INDIVIDUAL PREFERENCES.”

– FAYELIZABETH FOSTER

While the value of shared loyalty programmes is clear, building one from scratch requires collaboration, while overcoming several complexities, writes RODNEY WEIDEMANN

While individual loyalty programmes offer bene ts to consumers, the growing trend of cross-vertical loyalty ecosystems offers increased value and exibility for customers, while also providing participating brands with richer customer data, shared costs and broader market reach.

The key to a collaborative ecosystem, suggests Yaron Assabi, CEO of Digital Solutions Group, is frequency and t. “Some categories are infrequent by nature, for example, buying furniture. These are paired with high-frequency, mobile-friendly value that keeps the customer active between major purchases. This mix – daily, monthly and occasional – makes the programme feel relevant all the time.

“The more natural the overlap, the faster members earn and redeem, and the easier it is to personalise in ways that matter. That’s how you keep attention without confusing the proposition.”

Such cross-industry collaborations can create complexities, explains Kgomotso Zaake, head of loyalty and rewards at Nedbank, especially when aiming to create a seamless client experience across the brands. It is therefore important to have a clearly de ned shared vision that resonates across all the participating brands.

of a proposition that delivers uni ed value. This must be supported by interoperable technology to drive the seamless customer experience and underpinned by the correct governance and legal frameworks,” she says.

Len Lubbe, CEO and founder of LoyaltyPlus, adds that selecting partners in complementary sectors with overlapping customer bases is essential for a loyalty ecosystem’s success.

“When you bring together like-minded organisations that serve similar customer pro les, but offer different products or services, you create a bene t cluster that feels cohesive and relevant to the end user. This allows customers to earn points faster across multiple touchpoints in their daily lives, making the programme more rewarding and engaging,” he explains.

To build a cross-vertical ecosystem, one must start with the customer, suggests Digital Solutions Group. Define the behaviours you want to influence, then design earn-and-burn around everyday spend, so value feels immediate. Build a small, curated core of partners and integrate at the point of payment so rewards trigger without extra steps.

Mobile matters because that is where customers live. Mobile gives you real-time engagement and the data to personalise responsibly. Technically, stand up a shared layer that can surface a single wallet, support in-app redemption and expose brand-specific experiences where needed. The aim is a win-win loop where customers see value quickly and brands gain frequency and insight.

related to the treatment and protection of customer data, which has to be shared across partners, to optimise the value proposition and the partnership.” Lubbe adds that in any loyalty ecosystem, partner turnover is inevitable, but managing that change with minimal disruption depends on clear, timely and simple communication. “Clear communication maintains trust and guarantees consistency in the customer value proposition. Ultimately, change becomes easier when customers feel valued. If the ecosystem keeps providing relevant rewards and smooth experiences, loyalty stays strong, even as partners grow,” he concludes.

“This starts with identifying the right strategic partners, which will allow for the delivery

Lubbe says that from a partner perspective, this strategy is much more cost-effective. “Each brand adds a part of the value, but together their impact is much greater. The shared customer base also makes marketing efforts more focused, and data collaboration becomes more valuable, leading to smarter engagement and stronger loyalty.”

As for data protection and customer privacy, Zaake notes that our regulatory landscape is relatively advanced, with many laws cutting across industries, such as the Protection of Personal Information Act, which ensures standards for the treatment of customer data and data privacy are applicable universally. “Such regulations, along with Nedbank’s robust internal policies and governance frameworks, guide how Nedbank Greenbacks contracts with partners on aspects

“WHEN YOU BRING TOGETHER LIKE-MINDED ORGANISATIONS THAT SERVE SIMILAR CUSTOMER PROFILES, BUT OFFER DIFFERENT PRODUCTS OR SERVICES, YOU CREATE A BENEFIT CLUSTER THAT FEELS COHESIVE AND RELEVANT TO THE END USER.” – LEN LUBBE

Follow: Yaron Assabi www.linkedin.com/in/yaronassabi

Kgomotso Zaake www.linkedin.com/in/kgomotso-zaake-mba-342b6584 Len Lubbe www.linkedin.com/in/len-lubbe

With some of South Africa’s largest loyalty programmes announcing changes in recent months, it’s clear that the way we approach loyalty is undergoing a key transformation, writes LISA WITEPSKI

There was a time when South Africans’ wallets bulged with loyalty cards, many of which went unused. That is because, says Alex de Bruyn, CEO of Let’sCreate, loyalty models based on earning points or receiving discounts failed to take into account a basic truth: today’s consumers expect to be in control. Moreover, they expect brands they choose to interact with to have a deep understanding of them and their habits.

This necessitates a switch: models that rely on extrinsic motivation will inevitably lose out to those that strive to keep consumers engaged by “speaking to the core drivers that keep people engaged: curiosity, autonomy, achievement and social status”, de Bruyn says. “This translates to a customer experience where the user’s effort is recognised and their rewards are not just earned, but also felt. They’re also highly personalised” – a far cry from slow, linear reward loops.

De Bruyn says this is why many loyalty programmes are turning to gami cation, providing an enhanced user experience that is fun and combines instant grati cation with unpredictability, with users unsure of what reward they will be given. He cites Discovery Vitality as a programme that has experienced signi cant success by implementing the gami ed approach.

Woolworths’ reimagined rewards programme, MyDifference, which was launched earlier this year, also employs gami cation. The programme differs from its forerunner because it combines the WReward card (which offered savings on certain items) and the MySchool card, which made it possible for consumers to donate a percentage of their spend to a cause of their choice. Now, in

addition to instant rewards, members can also participate in Play & Win campaigns, depending on their reward level. The programme has both an app-based presence and a physical card.

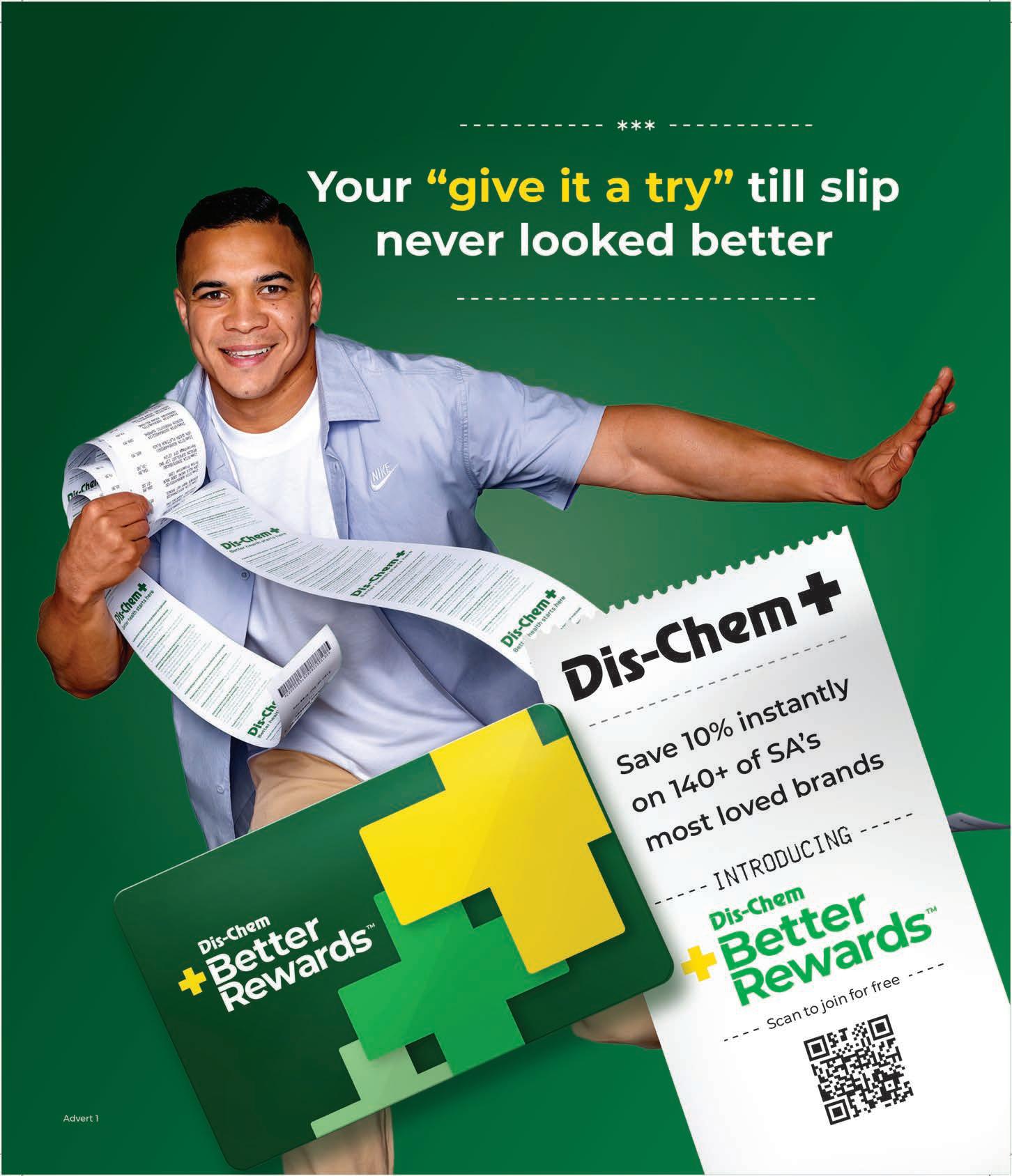

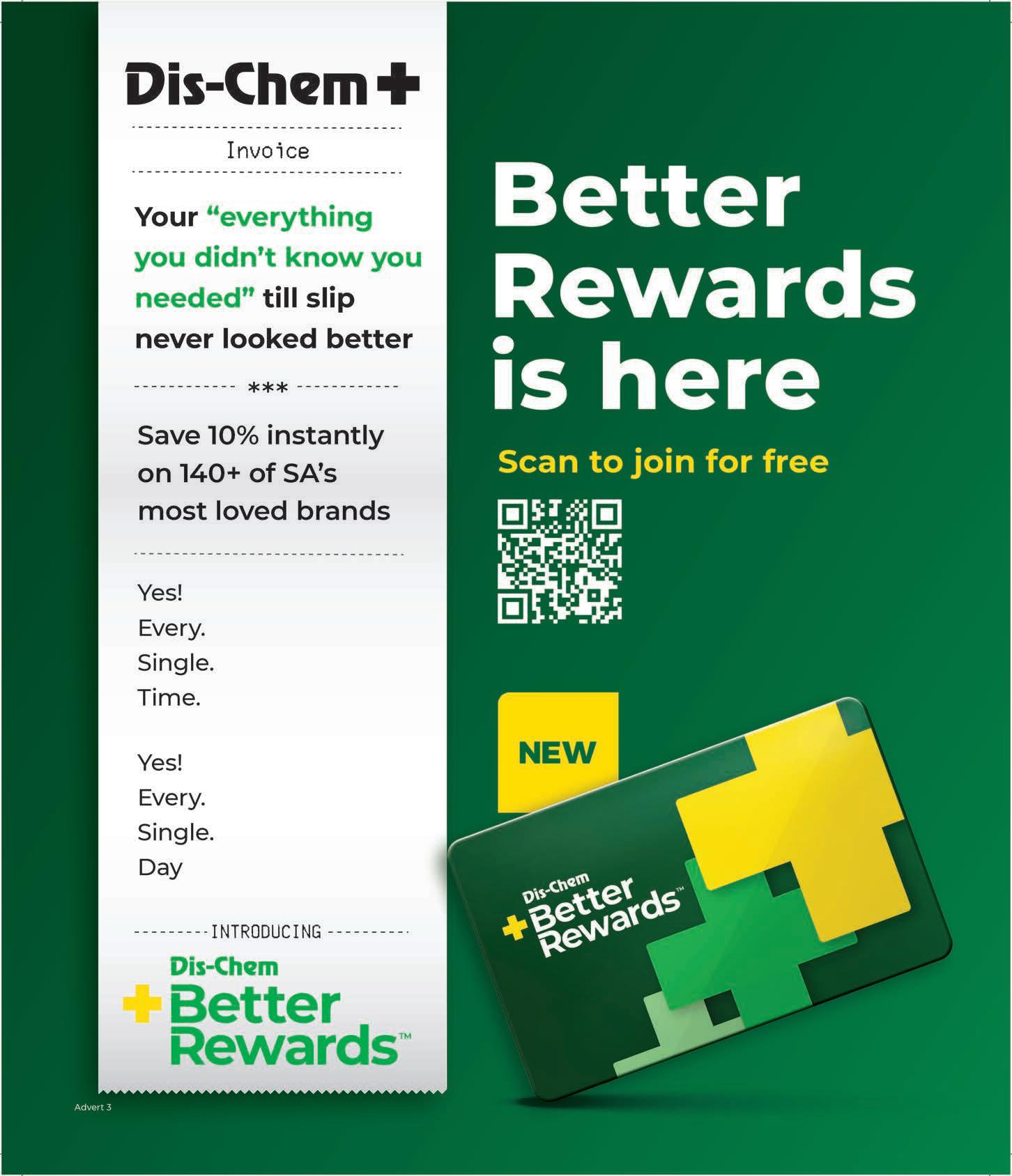

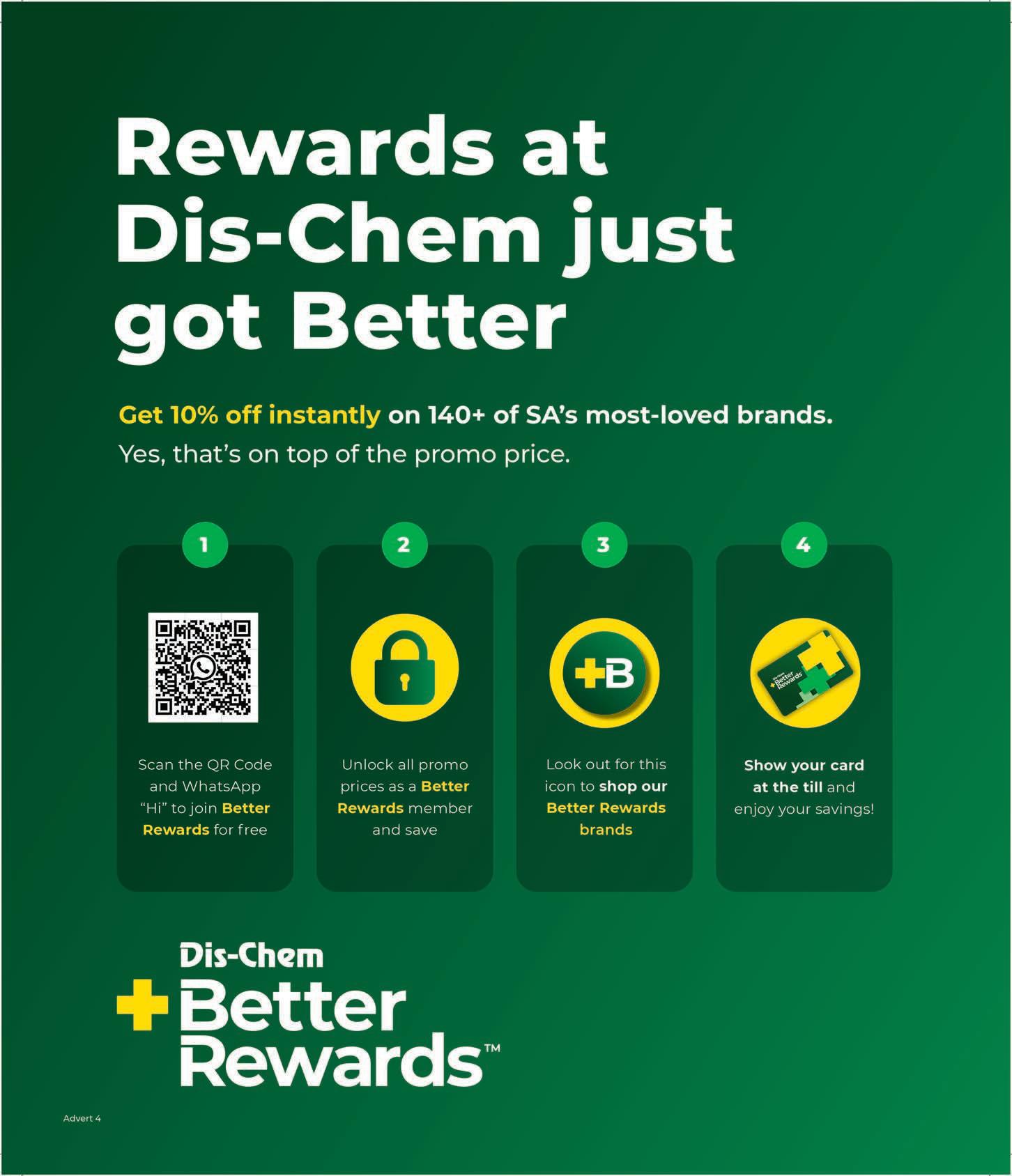

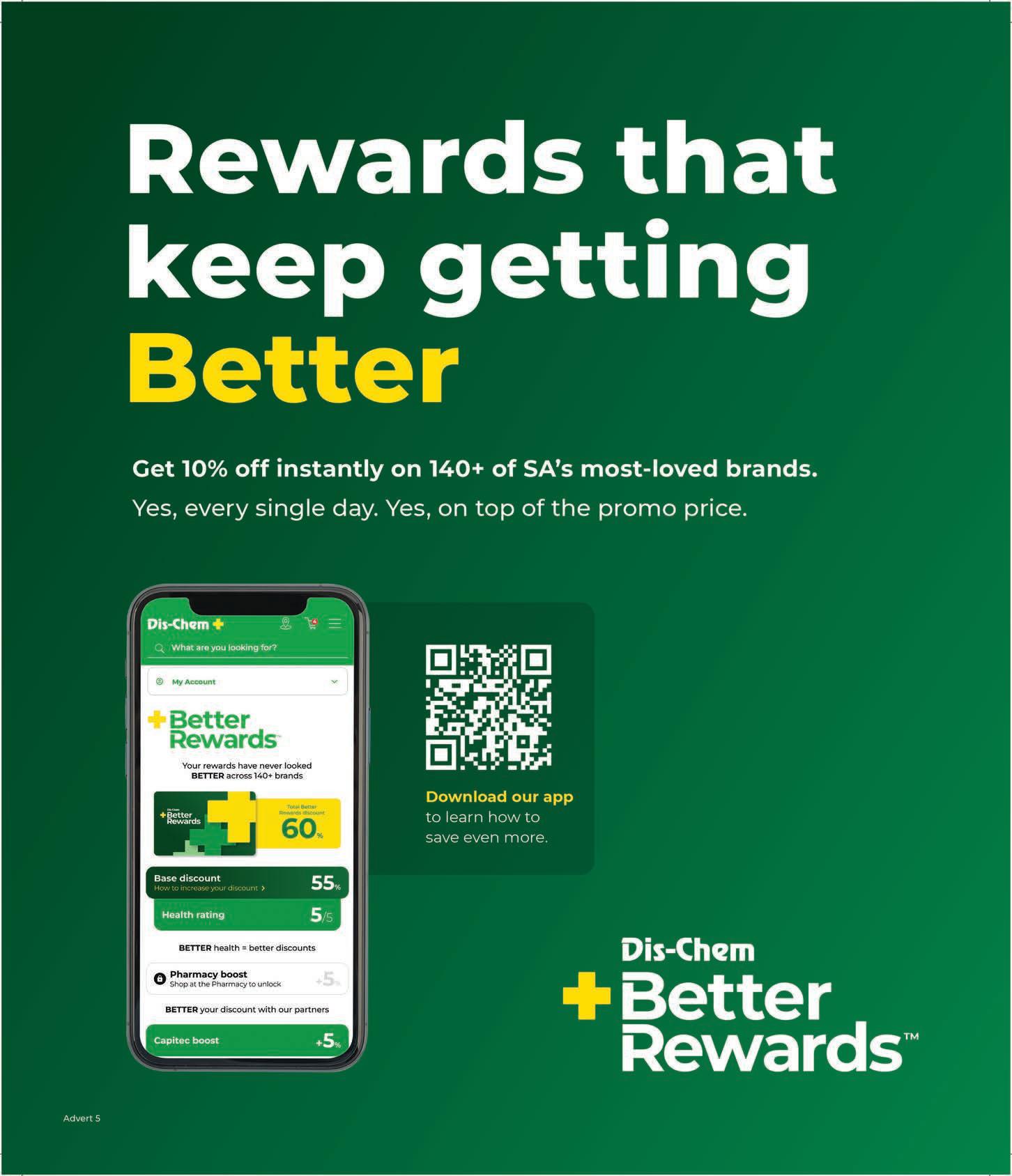

Dis-Chem has also introduced a signi cant overhaul to its loyalty programme. As of October, the 23-year-old Bene t Card programme was replaced by Better Rewards, which provides instant savings at the till rather than rewarding members retrospectively. Dis-Chem CEO Rui Morais explains that the new programme sees users receive a 10 per cent saving on 10 000 products, making it easier to plan their purchases and budget for essentials. He adds that the new approach re ects DisChem’s own evolution, from pharmacy retailer to integrated primary healthcare provider, as the programme is intended to provide nancial relief, with savings used to access primary healthcare products.

Fifteen per cent of mass market consumers who do not use loyalty programmes say it takes too long to earn decent rewards.

Source: Let’sCreate

Meanwhile, FNB’s eBucks – one of the country’s most successful loyalty programmes – has employed a different mechanism to nudge behaviour. “Tools such as ‘Track My Rewards’ and ‘Earn More eBucks’ have been a phenomenal success in helping our customers to shift behaviour and maximise their eBucks earn,” says Pieter Woodhatch, FNB eBucks CEO. These functional tools on the FNB app give customers safe and direct links to other bank products and features.