HOW TO

CREATE INNOVATIVE PERSONALISED OFFERS

IMPACT OF EMOTIONALLY ENGAGED CUSTOMERS

ENABLING CLIENTS TO GIVE BACK

PERFORMANCE TRACKING

Measuring the effectiveness of programmes

HOW TO

CREATE INNOVATIVE PERSONALISED OFFERS

IMPACT OF EMOTIONALLY ENGAGED CUSTOMERS

ENABLING CLIENTS TO GIVE BACK

Measuring the effectiveness of programmes

Experience a world of instant discounts and cashback rewards at Dis-Chem and Dis-Chem Baby City. As a Bene t Card holder, you will earn cashback rewards with each qualifying purchase either in-store, online or via the Dis-Chem DeliverD app, that is yours to redeem at any stage that suits you, whether for your next purchase or to save up for that something special. You can also enjoy increased earning potential through our accelerator partners.

Additional bene ts include instant discounts, free quarterly bene t magazines, personalised newsletters, double rewards and additional automatic entry into competitions and so much more.

Not only do you earn cashback rewards every time you swipe, you also give back through the Dis-Chem Foundation by helping organisations within our communities and improving the lives of individuals within organisations.

Sign up for your Bene t Card in-store, online at dischem.co.za or WhatsApp “Hi” to 0860 347 243 and follow the easy steps.

Earn even more with our accredited partners:

Save more, Get more, Give more

Your Dis-Chem and Dis-Chem Baby City Benefit Cards can be used at both retailers.

In today’s increasingly hyper-competitive business environment, customer loyalty matters more than ever. Just look at the bottom line. Research shows that the cost of acquiring new customers has increased by almost 50 per cent in the past half a decade while existing customers spend 31 per cent more than new ones.

Running a loyalty programme is an obvious way to grow customer engagement and loyalty, but how do you know it’s working? We kick off this issue of Loyalty & Rewards by looking at performance metrics for loyalty schemes, along with the value of the emotional connection people feel with brands and its role in increasing customer lifetime value. Building all-important customer engagement requires rewarding behaviours beyond the buying cycle – check out our story on omnichannel strategy in loyalty. With sustainability on everyone’s lips, we’ve got a rundown of what brands are doing to build loyalty programmes that contribute to a more sustainable world. On the technology front, we dive into the intriguing ways brands are leveraging NFTs and cryptocurrencies in loyalty. This year’s SA Loyalty Awards have also just taken place, so we take an in-depth look at the cream of the loyalty crop. We’ve also got insightful articles from brands and industry experts on how loyalty programmes can capitalise on the lifting of travel restrictions, the role of loyalty schemes in promoting good financial sense, and so much more.

Anthony Sharpe EditorPublished by:

Picasso Headline, a proud division of Arena Holdings (Pty) Ltd

Hill on Empire, 16 Empire Road (cnr Hillside Road), Parktown, Johannesburg, 2193

Postal Address: PO Box 12500, Mill Street, Cape Town, 8010

Tel: +27 21 469 2400 | Fax: +27 86 682 2926 www.businessmediamags.co.za

EDITORIAL

Editor: Anthony Sharpe

Content Manager: Raina Julies rainaj@picasso.co.za

Contributors: : Trevor Crighton, Amanda

Cromhout, Mart-Marié du Toit, Nceba Hene, Pinki Hoohlo, Michael Levinsohn, Anél Lewis, Rui Morais, Fionna Ronnie, Waldo Spies, Tiisetso Tlelima, Rodney Weidemann

Copy Editor: Brenda Bryden

Content Co-ordinator: Vanessa Payne

Digital Editor: Stacey Visser vissers@businessmediamags.co.za

DESIGN

Head of Design: Jayne Macé-Ferguson

Senior Designer: Mfundo Archie Ndzo

Advert Designer: Bulelwa Sotashe

Cover Images: istock.com/IC Production, istock.com/Aleksandr Koltyrin, istock.com/Kateryna Petruk, istock.com/MARHARYTA MARKO

SALES

Project Manager: Gavin Payne gavinp@picasso.co.za

+27 21 469 2477 I +27 74 031 9774

Sales: Brian McKelvie

PRODUCTION

Production Editor: Shamiela Brenner

Ad Co-ordinator: Shamiela Brenner

Subscriptions and Distribution: Fatima Dramat, fatimad@picasso.co.za

Printing: CTP Printers, Cape Town

MANAGEMENT

Management Accountant: Deidre Musha

Business Manager: Lodewyk van der Walt

General Manager Magazines: Jocelyne Bayer

50

The South African Loyalty Awards recognise the schemes, brands and industry figures leading the loyalty pack.

COPYRIGHT: Picasso Headline. No portion of this magazine may be reproduced in any form without written consent of the publisher. The publisher is not responsible for unsolicited material. Loyalty and Rewards SA is published by Picasso Headline. The opinions expressed are not necessarily those of Picasso Headline. All advertisements/advertorials have been paid for and therefore do not carry any endorsement by the publisher.

Consumers expect more from relationships with brands. So how do brands measure the return on investment of their loyalty programmes and respond with the right roll-outs to avoid losing customers to competitors?

By MART-MARIÉ DU TOITIn an already fast-changing loyalty landscape, the COVID-19 pandemic fundamentally changed consumer needs and preferences, and customer loyalty isn’t what it used to be. The Global Customer Loyalty Report by Antavo indicates that only a third of loyalty programmes measure performance, while more than 90 per cent of those who do say that their programme has a positive return on investment (ROI). So what metrics should programme managers use, and how do they shift their loyalty programme from a purely transactional model to one that emphasises emotional engagement and experiential rewards?

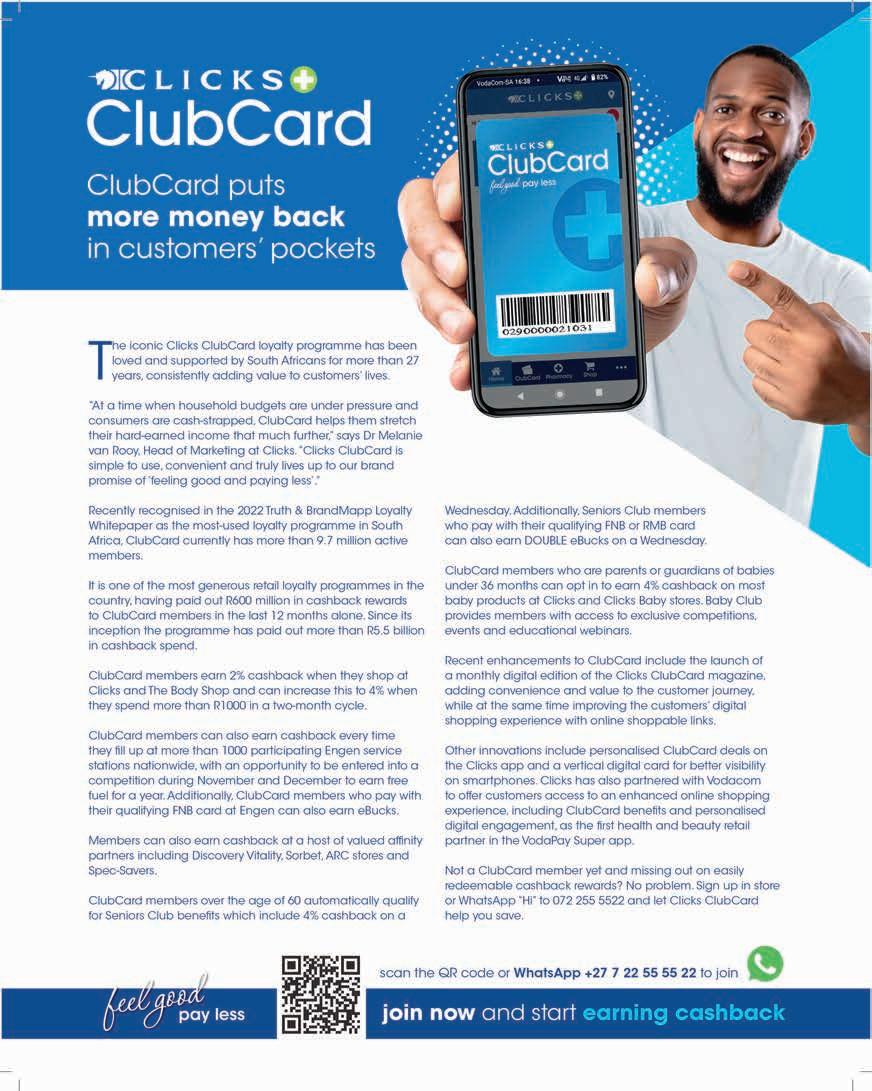

Dr Melanie van Rooy, head of marketing at Clicks, shares insights into the oldest loyalty programme in the country. “The iconic Clicks ClubCard loyalty programme launched in 1995 and is currently South Africa’s second-most-used loyalty programme. It has an active membership of over 9.5 million, which has grown by 600 000 in the last year. The spend by Clicks ClubCard

As much as brands need to create emotional loyalty with customers, 67 per cent of South African consumers still prefer cashback from a loyalty programme and 48 per cent enjoy discount vouchers as their second-favourite benefit.

Source: 2021 SA Loyalty Landscape Whitepaper

members accounted for 80.1 per cent of Clicks sales in the past year alone, and the programme paid out R590-million in cashback. Over R5.5-billion has been paid to loyal members of the programme since inception.”

The programme’s sustained growth and longevity can be attributed to its easily redeemable rewards and relevance to today’s consumer with its continued focus on convenience, value, and differentiation.

Clicks has specific key performance indicators (KPIs) in place to assess the commercial benefits of ClubCard:

• Incremental spend and shopping frequency from the ClubCard member base versus customers who are not ClubCard members;

• Membership growth (including across key loyalty segments such as baby and seniors);

• Affinity partner performance (ClubCard member take-up);

• Customer sensing to evaluate customer attitudes and associations; and

• Promotional activity performance, including ClubCard-only promotions and personalised My ClubCard promotions.

Competitor Dis-Chem launched its rewards programme eight years after Clicks. Lynne Blignaut, head of loyalty and customer rewards at Dis-Chem, says their Dis-Chem Benefit programme is inextricably linked to a positive ROI. “It changes consumer’s behaviour and interactions with our brand in that loyal customers shop more frequently, and typically, we see bigger baskets and greater spend due to their frequency. We can attribute 73 per cent of all our transactions to our loyalty customers.”

They had two KPIs to start. “At the time, our target was to reward our existing shoppers and customer acquisition.” That has not changed,

and performance is now measured “via contribution to turnover, average basket and spend of a loyalty consumer versus nonloyalty,” Blignaut adds.

Darryl Adriaanzen, group executive: operations for African Bank, says the bank is taking a definitive step towards improving its customers’ financial wellbeing by introducing a new, updated loyalty programme, Audacious Rewards. The new scheme will incentivise positive financial behaviour, such as customers improving their credit scores. “Our motivation is to match benefits for the bank – retention, increased usage, and so forth – with benefits to our customers and hopefully, in so doing, strengthen the connection between our customers and the African Bank brand. We closely measure the uptake of rewards and the consequent changes in customer behaviour.”

Standard Bank’s UCount Rewards launched in 2013, and Fayelizabeth Foster, executive head: loyalty and rewards at Standard Bank, says the landscape has undoubtedly changed. “Rewards programmes are no longer a marketing cost; they have to make business sense and drive increased lifetime customer value.

This is measured on an ongoing basis to ensure the ROI is being achieved.” Although she keeps mum about its KPIs, she says Standard Bank’s focus is on building an emotional relationship with its customers. “Happy customers are more likely to recommend your product or service to others.”

The insurance ecosystem of health management programme 1Life Pulse, a partnership between 1Life Insurance, Samsung South Africa, and LifeQ, creates happy customers by incentivising a healthy lifestyle. The programme is backed by leading wearable and app technology and enables consumers to grow their life insurance cover

When asked about getting a personalised experience from a business, 87 per cent of survey respondents named at least one part of that experience that’s most important to them. In addition, 82 per cent are willing to share some personal data for a more personalised service. Consumers also prize fl exibility in personalisation, with one of the top preferences being “rewards my way” in a loyalty programme that offers businesses an opportunity to experiment more with experiential loyalty to improve customer retention.

Source: PwC Customer Loyalty Survey 2022

by making better lifestyle choices. Anton Keet, head of Risk Services at 1Life Insurance, says they measure performance by sales and utilisation. “Utilisation is the most important KPI – this is broken down to levels where we look at the number of downloads of the app as well as physical utilisation of the benefits.”

QR Payments company Zapper was founded in 2014 for merchants to offer quick, cashless payments. Shortly after that, the digital loyalty and voucher offering was launched to provide a way in which merchants of all sizes could easily and quickly offer rewards to their customers without the expense of a bespoke programme. CEO Mike Bryer says: “Once a loyalty programme is configured for a merchant, Zapper users will automatically receive their rewards by merely paying using Zapper.

In addition, the merchant can target its most loyal customers with additional vouchers that offer immediate discounts, rather than the frequency-based loyalty programmes.” Its KPIs are tailored to each merchant. “The KPIs provided to merchants vary based on the objectives of the campaigns. Apart from the common financial metrics and ROI measurements, the rewards programmes are intended to drive more customers (volume) to spend higher amounts (value) with the business,” he says. Innovative new fintech Dashpay also helps businesses with smart app-based solutions for attracting and maintaining customers. Pinki Hoohlo, executive: strategy payments at African Resonance and Dashpay says they use specific KPIs for “customer registrations, repeat purchases, redemptions

Most emotionally engaged consumers (86 per cent) expect a brand to show how it is loyal to them, regardless of participation in a “formal” loyalty programme. This expectation drops, but remains significant at 54 per cent, even in consumers with lower levels of emotional engagement. The clear message here is that consumers expect loyalty to be more than just a programme.

Source: Capgemini Loyalty Deciphered

and customer churn reduction or customer retention. Customers want to know and understand the loyalty benefit they are receiving. Once received, it should be tactile and have a tangible benefit.”

The world of loyalty programmes is changing. Businesses must tailor their KPIs to suit the loyalty programme and prioritise customer loyalty. Great experiences define great brands, so you need personalisation with rewards that are convenient to redeem and tiered programme structures that are more easily reached. This is how you earn and keep customer loyalty.

The

For many, the concept of nonfungible tokens (NFTs) remains arcane, dealing as it does with cryptocurrencies, blockchain and digital assets. Simply put, a digital asset – art, music or video – can be bought and sold on an NFT marketplace, the way an earlier generation used to collect and swap trading cards. However, unlike paper cards, NFTs are designed to be unique and thus offer the holder exclusive ownership, which is why it is a principle that has received so much hype.

What does all this have to do with loyalty and reward programmes? US coffee chain Starbucks, long renowned for being innovative in its loyalty and rewards setup, has announced that it will be among the first enterprises to offer NFTs at scale as part of its rewards programme.

Starbucks Odyssey, which launches later this year, is a new experience powered by Web3 technology, offering Starbucks Rewards members and Starbucks partners in the United States the opportunity to earn and purchase digital collectable assets that will unlock access to new benefits and immersive coffee experiences.

“Leveraging Web3 technology will allow our members to access experiences and ownership previously not possible, unlocking digital, physical, and experiential benefits unique to Starbucks.” – Brady Brewer

rise of cryptocurrencies, blockchain and NFTs presents unique opportunities for corporate loyalty programmes. But is South Africa ready for these?

By RODNEY WEIDEMANNStarbucks Rewards

“Starbucks has always served as the third place –between home and work – where you feel the warmth of connection over coffee, community and belonging,” says Brady Brewer, Starbucks executive vice president and chief marketing officer. “We are now extending the third place connection to the digital world. For the first time, we are connecting our Starbucks Rewards loyalty programme members not just to Starbucks, but also to each other.

“Leveraging Web3 technology will allow our members to access experiences and ownership previously not possible, unlocking digital, physical, and experiential benefits unique to Starbucks. Our vision is to create a place where our digital community can come together over coffee, engage in immersive experiences, and celebrate the heritage and future of Starbucks.”

Brewer explains further that, once logged in, members can engage in “journeys” – a series of activities such as playing interactive games or taking on fun challenges to deepen their knowledge of coffee and Starbucks. Members will be rewarded for completing journeys with a digital collectable “journey stamp”, or NFT. Each digital collectable stamp will include a point value based on its rarity, and the stamps can be bought or sold among members within the marketplace with ownership secured on a blockchain. As stamps are collected, members’ points will increase, unlocking access to unique benefits and experiences not offered previously.

“These experiences could range from a virtual espresso martini-making class and access to unique merchandise and artist collaborations to invitations to exclusive events at Starbucks Reserve Roasteries or even trips to Starbucks Hacienda Alsacia coffee farm in Costa Rica,” Brewer notes.

Clearly then, there is a lot of potential for NFTs within the scope of rewards programmes, but is this something that South Africa is ready for?

Yaron Assabi is the founder and CEO of Digital Solutions Group, among whose divisions is Digital Mall, one of the country’s first e-commerce platforms. He suggests that there is little doubt that NFTs offer the potential to

create unique experiences for the customer. However, he is unsure whether this will translate into local use of such tokens to provide a boost to loyalty programmes.

“NFTs are great for creating memories and artefacts, so businesses, enterprises, and civil society foundations may certainly consider creating NFTs for sale to raise additional funds. The same goes for someone collecting a physical item, such as wine. Since this is usually purchased as an investment, the use of blockchain provides the core identity rights, and the NFT serves as the ‘receipt’ that you own that specific bottle. The same applies to any situation where you have a complex split of intellectual property rights – such as in the music business. NFTs can be used to signify each owner’s share of the IP.

“That said, I don’t know if mass adoption of cryptocurrency and blockchain will be enough to convince large organisations to change their loyalty programmes to suit what will ultimately be a small segment of the market. I am still on the fence and simply observing the situation for now. It may well work and even be quite effective, but it could also simply be a brief trend or fad. Either way, it will certainly be interesting.”

Assabi indicates that businesses can get very creative, and he has witnessed a lot of amazing brand development, expression

and awareness using these technologies. “I think successfully using this in a loyalty programme requires the business to know its audience very well or have a relatively exclusive customer base, as would be the case for an expensive sports car manufacturer. If your audience is a broad and diverse group, and maybe only three per cent are likely to use cryptocurrency, then it is not really a good target market. It’s all about effort versus reward: why invest a lot of money in only a small segment of your customers?”

One thing that will need to be in place before South Africa sees the real benefits of these technologies is a proper regulatory framework, explained Wiehann Olivier, audit partner and digital asset lead for Mazars South Africa, at the recent Crypto Fest event in Cape Town. “There are three possible approaches to regulation. There is the outright ban on it, which is the approach China has used; there is the application of regulation as the market is forming, as New York tried; and there is the ‘wait-and-see’ approach applied by most regulators, including to an extent South Africa.

“Players in the cryptocurrency space also require answers around the issue of exchange controls and guidance from SARS, both from a corporate and personal perspective, to clearly understand the tax obligations around this.”

Better consumer protection, Olivier noted, will spur greater crypto investment and help eliminate the potential for scams in this arena. He suggested Africa is ultimately ripe for crypto to take off. “But all of this is only possible if regulations don’t stifle innovation – this is the critical factor lawmakers must consider when creating the laws that will govern this space moving forward.”

NFTs have a similar composition to cryptocurrency in that they are units of data recorded on a blockchain, a public ledger that uses cryptography technology to record these transactions and is secure due to the nature of cryptography. They are defi ned as “nonfungible”, in that each one is unique and exclusive.

NFTs are digital archives or tokens representing a worldly object. In simpler terms, an NFT will be the digital fi le of the owner. The owner of the NFT possesses the exclusive rights of ownership over the digital asset, and will have a unique digital certifi cate of ownership with the NFT effectively serving as a digital receipt. The price of NFTs is infl uenced and determined by their demand. They are not infl uenced by the economy or the fi nancial markets, only by the value a person is willing to pay for an individual NFT.

Source: www.lexology.com

“I don’t know if mass adoption of cryptocurrency and blockchain will be enough to convince large organisations to change their loyalty programmes to suit what will ultimately be a small segment of the market.” – Yaron AssabiWiehann Olivier

Quality loyalty and rewards programmes that make sense to customers offer huge benefi ts for retailers – particularly their bottom line. According to a Bain & Co study, businesses with loyalty programmes are 88 per cent more profi table than competitors without them. That’s no surprise when you consider that acquiring a new customer costs as much as seven times more than retaining an existing one.

Amid an economic crunch that has left retailers and consumers reeling – with interest rates increasing, foreign currency exchange rates rising and job numbers declining on the back of chastening COVID-19 lockdowns – loyalty and rewards programmes offer amazing value to both sides. Last year’s SA Loyalty Landscape Whitepaper showed that 74 per cent of South Africans who are economically active and have a household income of at least R10 000 per month are members of loyalty programmes, with the majority belonging to at least eight.

For consumers, benefi ts and cashback from retailers they regularly support draw them closer to the business – and help them survive. The whitepaper showed that cashback rewards were favoured by 67 per cent of loyalty and rewards programme

members, with many redeeming them for basics such as food, electricity, fuel, data, and airtime rather than luxury items over the last few years. Consumers have recognised the benefi ts of regularly shopping at a retailer that offers rewards they can use when times are tough. So why are more retailers not moving to partner with like-minded businesses to offer more effective rewards that make a tangible difference in consumers’ lives?

For retailers, 15 per cent of their most loyal customers can drive 55–70 per cent of their revenue, so building that relationship is essential, with compelling rewards infl uencing spend by up to 35 per cent. The benefi ts for the retailer go beyond the bottom line too, with the amount of data about customers’ likes, dislikes and purchasing patterns gleaned by tracking behaviour through a well-structured loyalty programme able to inform business decisions across the board.

Merchants can easily identify, target and upsell slipping customers and get them back in store with a unique reward that puts them back at top of mind. The system also allows for the development of personalised

interactions, from sign-up to referral rewards and location and interest-focused offers, while a mine of rich data helps them create campaigns that connect.

A loyalty programme can be as simple or complex as a retailer desires, whether offering a discount for repeat purchases or linking up with likeminded retailers to offer an umbrella benefi t redeemable across different stores.

If the registration, collection and redemption methods are cumbersome, there’s limited access to insights, for example, with a paper (card/stamp) system. If there’s no marketing and communication mechanism, a loyalty programme only delivers on a fraction of its potential to both retailer and customer.

The SA Loyalty Landscape Whitepaper found that many South Africans don’t fully understand how multipartner loyalty programmes work. However, those who do enjoy them because they can earn points faster – so it’s a question of positioning and whether the earning and redemption mechanisms are transparent and simple enough. There’s no benefit to retailers whose programmes are inflexible or unnecessarily complex and leave customers flummoxed. These retailers are leaving their own money on the table in unclaimed rewards and doing a monumental disservice to their brand and customer base.

In a low-touch world, a mobile application is the ideal way to manage a loyalty programme, offering opt-in, always-on lines of communication with customers for reminders and messaging via push notifications, tailored offers and in-your-pocket convenience.

Loyalty and rewards programmes are powerful tools that can make customers’ lives easier and genuinely impact the bottom line for retailers who use the connection they’ve built properly. Ultimately, they’re a no-brainer.

For retailers, 15 per cent of their most loyal customers can drive 55–70 per cent of their revenue, so building that relationship is essential.

In a low-touch world, a mobile application is the ideal way to manage a loyalty programme, offering opt-in, always-on lines of communication with customers.Pinki Hoohlo

We have measured and can confi rm that these personalised offers deliver improved customer response, cross-shopping behaviour and retention, resulting in increased growth.

In the age of heightened customer expectations, personalisation is key to consumer engagement. But how can retailers leverage the insights gained from customer data to create personalised offers that retain and grow loyalty? By

FIONNA RONNIE , head of customer capability at TFG

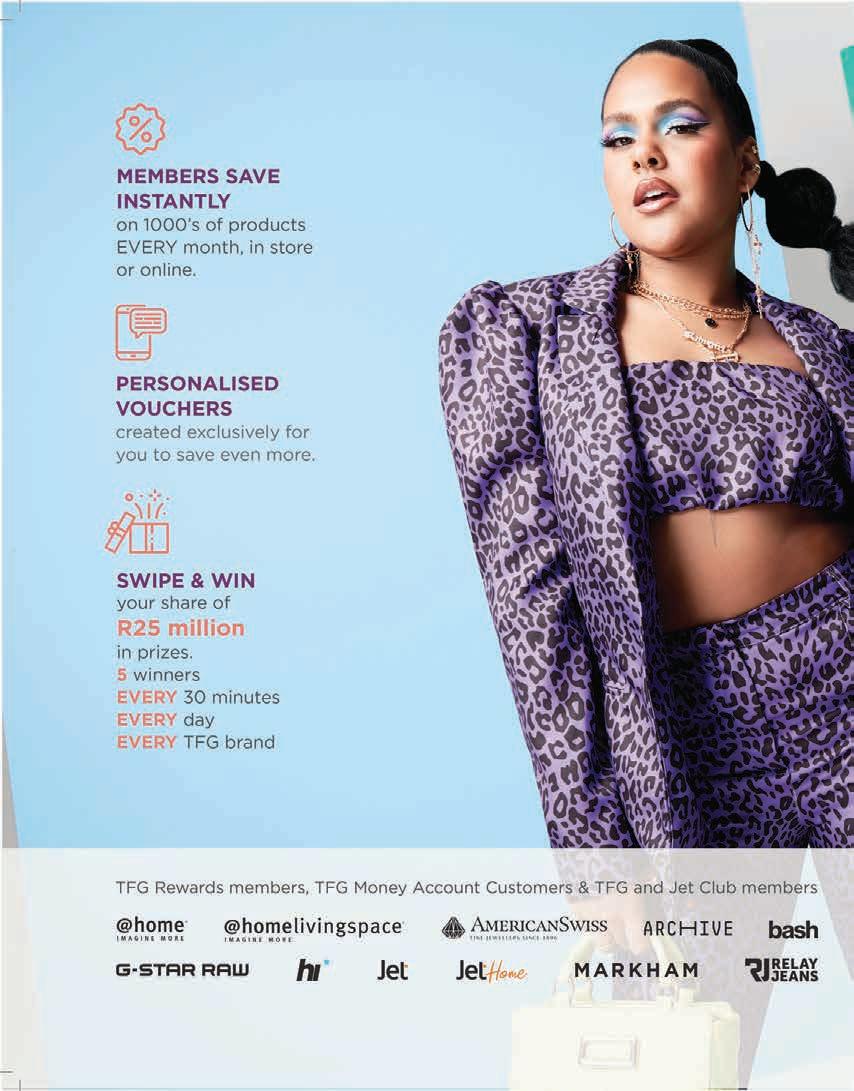

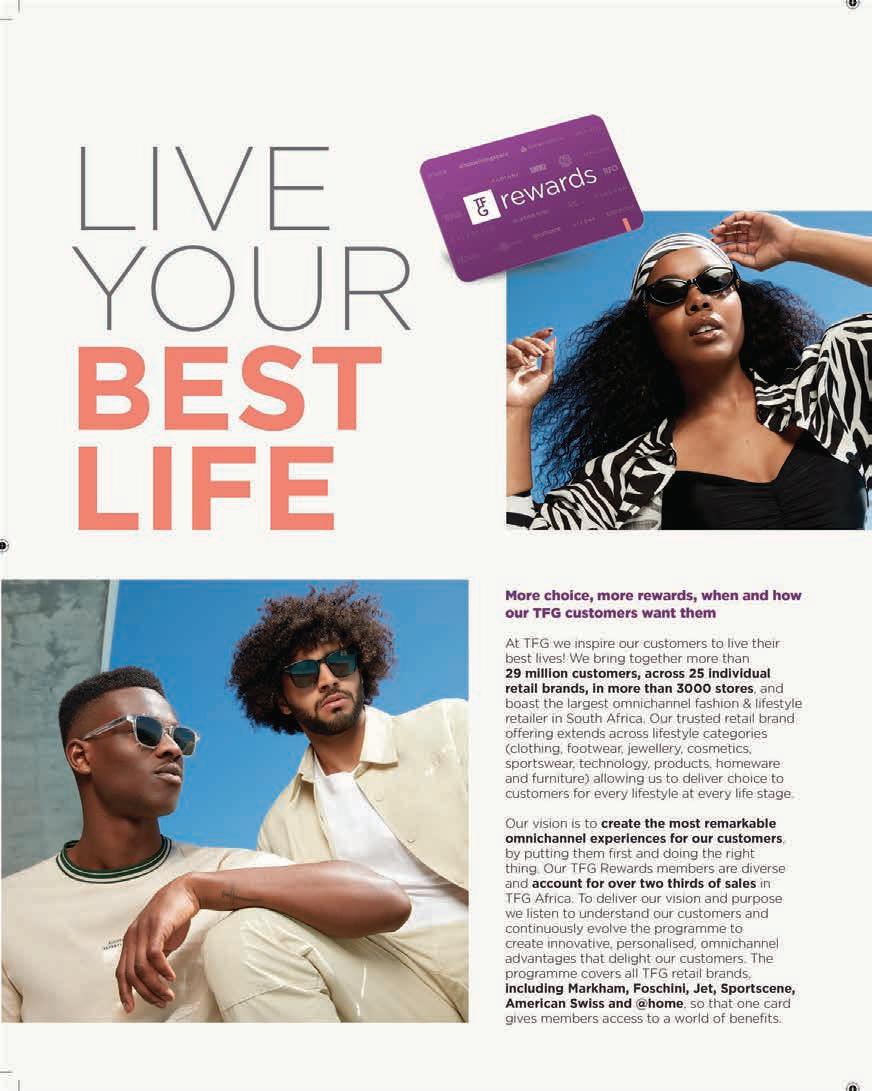

Retailers have the opportunity to get to know their customers better, and the more they know, the more personalised experiences can become. TFG is one of the leading retail groups in Africa, with a diverse portfolio of 25 retail brands, including fashion, jewellery, accessories, sporting apparel, cellular, homeware, and furniture. Our multibrand structure allows TFG’s loyalty programme, TFG Rewards, to collect customer data across various channels, brands and touchpoints to deliver value to more than 29 million customers.

Local and global legislation has changed the loyalty landscape, and today’s consumers are more aware of how their online and offl ine behaviours are tracked. Our loyalty programme establishes an explicit value exchange that encourages customers to share

TFG uses advanced analytics to match data from cross-functional sources and packages the most relevant content to each customer.

information with our brands. Through this, TFG successfully orchestrates the collection and unifi cation of customer data.

We harness the power of this enriched customer profi le to design multibrand campaigns that drive cross-shopping and deliver personalisation through advanced analytics. These initiatives enable TFG to leapfrog competitors by becoming truly customer-led and putting our customers at the heart of everything we do.

Personalisation is a customer-centric approach. TFG uses advanced analytics to match data from cross-functional sources and packages the most relevant content to each customer. This content is created for various customer cohorts, and we use analytics to match each customer to the correct communication. Thousands of key products are curated from 25 retail brands, and predefi ned rules match the top products to each customer in the communication. Basic behavioural nudges are used to personalise the customer experience further.

TFG’s rewards programme enables the delivery of actionable insights through customer research and analytics at scale, driving data-led decision-making and customer strategies for brands such as Markham, Sportscene, American Swiss, Jet and @home. The voice of the customer (VOC) programme was launched in TFG as early as 2014 and tracks sentiment, measuring NPS (Net Promoter Score) and drivers of CSAT (Customer Satisfaction) by customer segment, brand, product and store. By measuring sentiment and experience, we know that customers crave new ways of being engaged beyond just vouchers. TFG is currently running a daily surprise and delight reward in over 3 000 stores and online for all our loyalty members. Five shoppers win in real-time, every 30 minutes, in every brand and have R25-million in prizes to choose from – delivering choice and added value from things that members want most.

After the last two years, customer’s expectations and relationship with their favourite brands have changed. This is also refl ected in loyalty programmes, which must adapt to these new expectations and highlight a strong state of mind based on a return to simple things #ease, #engagement, #fun and #value. It’s up to us to listen to our customers and transform our loyalty programme, evolving and creating innovative, personalised, omnichannel advantages that always meet their expectations.

It’s up to us to listen to our customers and transform our loyalty programme, evolving and creating innovative, personalised, omnichannel advantages.

LYNNE BLIGNAUT, head of loyalty and customer rewards at Dis-Chem Pharmacies,

the interwoven facets of building loyalty, keeping customers, and the business of doing good

Dis-Chem’s Benefit Card loyalty programme, with 6.8 million members, has grown to become one of the country’s best-loved loyalty programmes. Now in its 19th year, it is built on a foundation of the relationship between the brand and the customer, underpinned by allegiance, affinity and trust. This is further supported by strategic partnerships that combine relevance, value and alignment to appeal to customers and ensure they earn superior rewards by shopping at Dis-Chem while giving back to the vulnerable members of our community. Customers can earn even more with our partners such as Bestmed, Standard Bank UCount, Capitec, Absa Rewards, Discovery

Vitality, Momentum Multiply, Sanlam Reality, Total Energies, Planet Fitness and Legacy Lifestyle.

The largest single Benefit Card member group – 32 per cent – is in the 19 to 35 age bracket. However, adapting to customer segments is key to the programme’s longevity and growth.

The Dis-Chem’s For YOUth Programme, for those aged between 18 and 25, offers savings and double Benefit Card points every Monday, tailor-made promotions and campaigns, automatic entry into competitions, exclusive offers and discounts, rewards and prizes just for shopping at Dis-Chem.

Our 60+ members enjoy double points every Wednesday including vouchers for the Skin and Hair Strategy Salons.

And those entering motherhood can join the Baby Programme, which gives the mom-to-be exclusive entry into competitions, vouchers to our Strategy Salons, information on milestones, and eligibility to the recently relaunched baby bag filled with complimentary goodies when spending the qualifying amount at Dis-Chem and Dis-Chem Baby City stores.

We are innovating by using state-of-the-art technology to bring personalised offers to our customers based on what we know they like to purchase, established on their unique shopping habits.

The Benefit Card Programme has been extended into Dis-Chem Baby City stores

The focus of the programme is to provide cashback rewards to our Benefit customers which will be instantly available on their next purchase, there is no waiting period, and can be redeemed at any time at either Dis-Chem or Dis-Chem Baby City stores.

The Dis-Chem Foundation is a beneficiary of the Dis-Chem Benefit Programme and so our customers are true partners of the Foundation by ensuring its ongoing ability to care for the less privileged in and around our communities.

bringing the benefits and partner offering to the Baby City customer. Benefit members enjoy all the wonderful rewards they are accustomed to from Dis-Chem within the Baby City space. Existing and upcoming strategic partnerships with established financial services brands will continue to increase our Benefit customers’ earning potential and add value.

For the benefi t of all members, no matter which category they fall into, we have removed any barriers to redemption – our customers can redeem at any time without vouchers, in-store and online. In addition, customers earn points when shopping on the DeliverD App.

Rewards can be used on purchase or can be saved for that “something special”. Dis-Chem has been built on the premise of “pharmacists who care” and this philosophy extends beyond the physical boundaries of our stores. It is one of the pillars of the Dis-Chem Foundation, and the

connection between our philosophy, our brand, the Foundation and the Benefit Card is deliberate.

Directly linked to the Benefit Programme is the Dis-Chem Foundation, which was founded 16 years ago based on our long-held belief that as a corporate entity we have a role to play in making our society sustainable by For many years, the Dis-Chem Foundation has supported well-known initiatives such as clinics and mobile clinics, Smile Week and Reach for a Dream. A focus has also been on balanced nutrition in the early childhood development phase.

For more information:

Customer Careline 011 589 2200 0860 347 243

careline@dischem.co.za

www.dischem.co.za

Dischem @Dischem

Dis-Chem Pharmacies

We have removed any barriers to redemption – our customers can redeem at any time without vouchers.

improving the lives of individuals within organisations while relieving the burden on struggling communities.

A2017 study done by multinational IT services and consulting company Capgemini shows that 70 per cent of emotionally engaged customers spend twice as much on brands to which they are loyal. Brands that can foster loyalty through emotional engagement with consumers could increase their annual revenue by 5 per cent, and in addition, 81 per cent of emotionally connected consumers are likely to promote the brand among their family and friends.

Deon Olivier, founder of Woodstock Loyalty Marketing, says that in its most basic form, engagement implies that a customer feels that the product or service they are offered matches their needs to the extent that they do not wish to shop around anymore. “A higher level of engagement is delivered when the attributes of the product or service are way more than just functionally fi t for purpose, but also offer personalised attributes that align with the customers’ experiential needs and the need for self-actualisation.”

Actually, creating loyalty is about brands trying to differentiate themselves in a commoditised world, says Brandon de Kock, director of storytelling at WhyFive Insights. From banking to shopping for groceries, everything is the same so one way for brands to distinguish themselves is through loyalty programmes – fi nd out what’s important to people and show customers that they

As much as brands need to create emotional loyalty with customers, 67 per cent of South African consumers still prefer cashback from a loyalty programme and 48 per cent enjoy discount vouchers as their second-favourite benefit.

Source: 2021 SA Loyalty Landscape Whitepaper

care about them. “If I can show you or make you believe that I know you a little bit and I know what drives you, then you’re going to want to be my friend as a brand or retailer.”

Founder and CEO of loyalty consultancy Truth Amanda Cromhout takes it a step further and adds that creating emotional loyalty is not merely about customers spending more money on a brand here and there, but rather the 300 per cent higher lifetime value that comes with customers’ emotional connection to a brand. “It’s about how long customers spend with you. If it’s just a transactional loyalty programme such as a points-based programme, it’s very easy to be enticed away to a competitor who offers a higher earning rate or a deeper discount on a product. But when it’s an emotionally charged

True loyalty goes beyond a rewards card or points system. Consumers’ emotions play a critical role in determining to which brands they are loyal, writes TIISETSO TLELIMADeon Olivier Brandon de Kock

The Woolworths MySchool MyVillage MyPlanet loyalty programme, a multipartner programme with more than 8 000 educational, charitable and environmental beneficiaries, has spent almost R1-billion on good causes, triggering emotional and transactional loyalty. It won best loyalty team in the 2021 South African Loyalty Awards.

Source: thewisemarker.com

engagement, you remember it for so much longer, and it has a deeper impact on you.”

So how do brands build this emotional connection with customers? Cromhout thinks it’s about showing the more valued customers that they are special, for example, by offering a longer returns policy, inviting them to VIP events, or giving them early access to sales. Cromhout cites the Woolworths WRewards programme, which has a forum where customers are asked to give their input on which flavour or ingredient they want to add to their favourite product as one way to make customers feel special.

“Customers love being part of a customer forum and having their say,” she explains. “A good loyalty programme should be using data to identify which customers get access to VIP events, which get the dedicated service line, which get invited into the customer forum and offer what is relevant to them.”

De Kock concurs that it’s important to understand what each customer wants and needs. Some customers like to build up to a big reward and some want instant gratification. “So, if I’m the kind of person who enjoys immediate rewards and you offer that to me, you’re satisfying something emotional inside me. Whereas if you’re

the kind of person who doesn’t care about instant rewards, building points and buying something big with eBucks in the end makes you happy.”

Behavioural psychologists have demonstrated that an emotional bond is far more compelling and able to create much deeper “hooks” than a simple transactional bond. Olivier states that a brand’s positioning from the logo design, payoff line, outbound messaging, advertising, social media presence, and narrative must talk to what the brand can holistically do for its target market as opposed to the features that its products and services offer. Oliver cites FNB’s “How can we help you?”, Discovery Vitality’s “Live well. Get rewarded”, and Capitec Bank’s “Simplify banking. Live better” as some of the greatest examples of brands that are emotionally descriptive in their positioning and provide some of the largest loyalty programmes.

Brands can also create emotional loyalty by engaging with customers outside the buying cycle through nontransactional loyalty. Nontransactional loyalty is when brands encourage consumers to do other things that aren’t just about spending money on the brand and rewards them for it. “Old Mutual’s Moneyversity, which encourages people to learn more about their financial situation while rewarding them with points they can either use as vouchers to purchase products at partner brands or reinvest them into mutual savings, is a great example,”

says Cromhout. Another example is the Vans shoe brand, which encourages people to wear their Vans on a skateboard or while walking their dogs and upload pictures on social media to get points.

First-party data collected from loyalty programmes can help brands uncover customer insights, enhance personalisation and drive deeper engagement among a customer base. Olivier stipulates that, by definition, a good loyalty programme is a platform for the exchange of information and for creating shared values. “On the one hand, customers sign up expecting to be rewarded financially for their effort, and on the other because they will have the opportunity to have their voices heard by a listening brand and engage in meaning dialogue to fulfil their emotional needs,” he adds.

De Kock believes that consumers often don’t mind companies using their personal information as long as it results in better service, but they get annoyed if it doesn’t benefit them. Conversely, Cromhout argues that what brands really need to achieve is zero-party data, where customers willingly and proactively share information with brands instead of starting a one-sided first-party data such as sending a CRM newsletter, which often irritates customers.

There are different ways for brands to create brand advocacy, such as paid-for advocacy and surprise and delight. The former encourages customers to refer friends or family members to gain points, whereas the latter is when a brand surprises its most loyal customers with a birthday gift or a voucher.

“I think paid-for advocacy is less genuine, but surprise and delight create proper advocacy because it’s unexpected, and customers don’t have to do anything in return. In turn, this makes them more passionate about the brand, and they will more likely advocate for it,” explains Truth’s Amanda Cromhout.

“If I’m the kind of person who enjoys immediate rewards and you offer that to me, you’re satisfying something emotional inside me.”

– Brandon de Kock

“When it’s an emotionally charged engagement, you remember it for so much longer, and it has a deeper impact on you.”

– Amanda Cromhout

The value of the South African loyalty programme market was estimated to be more than R8-billion in 2021 – taking into account every aspect of loyalty-driven spend, savings and impact, according to the South Africa Loyalty Programs Market Intelligence Report 2022. That number is set to nearly double by 2026, as South Africans embrace loyalty and rewards programmes that give them tangible benefi ts for shopping, exercising, driving and behaving in ways that benefi t them and demonstrate their affi nity for certain brands, the report says.

In a country with so much need – 44.1 per cent of the population is unemployed and approximately 55.5 per cent (30.3 million people) of the population is living in poverty at the national upper poverty line, earning under R992 per month (Stats SA report on poverty) – a market that generates so much value in rewards can make a massive societal impact if offered the opportunity.

Discovery’s Vitality is a respected incentive-based wellness programme with over 20 million members in 37 global markets. “We take a shared-value approach where we pay out fi nancial incentives that encourage members to buy healthy food, go to gym to achieve exercise goals, drive safely and spend responsibly, which has a benefi t for our members as individuals as they improve their health and get rewarded for it,” says James Vos, head of product management at Discovery Vitality.

“That benefi ts Discovery as a group because we attract and retain members and help that member base stay healthier.”

Vos says that shared value pillar – the programme’s founding principle – also benefi ts society, with healthier people being more engaged and benefi tting the country’s economy by being a more productive workforce. “Our Vitality Active Rewards programme initially rewarded people with a free coffee or smoothie for meeting their exercise goals, but we added a third option, called MoveToGive, six years ago,” he says.

“Instead of choosing a drink as a reward, customers were able to donate the value of that drink to a deserving cause.” MoveToGive has evolved further as customers meet their goals and get rewarded with an opportunity to play the Vitality Gameboard and earn Vitality Miles, which can be converted into cash.

“Over the last six years, those customers have donated more than R15-million to an array of causes – with the amount much higher in

and rewards programmes can make a meaningful difference to deserving causes too, writes

“We partner with best-of-breed charitable organisations doing work that resonates with our clients.” – James Vos

instances where Vitality or other partners have matched customers’ donations in specifi c instances.

“Our causes change every four to six months, and we partner with best-of-breed charitable organisations doing work that resonates with our clients,” says Vos. “We also address topical needs, such as the fl ooding in KwaZulu-Natal. We partnered with fi rst responders Gift of the Givers and allowed members to donate their Vitality Miles to help the organisation deliver more effective interventions where most needed.”

Vos says that clicking a button on the Discovery app to donate and make a difference in a deserving person’s life overcomes many of the barriers in the way of charitable giving, such as the pragmatic and psychological barriers. “We call it ‘crowdsourced philanthropy’, which sees hundreds of thousands of people donating small amounts that have a huge impact.”

Vitality clients also got heavily involved during the hard COVID-19 lockdown when Vitality partnered with FoodForward SA to provide meals to people in need. “With schools shut and facilities closed, many people lost access to their only square meal of the day. FoodForward SA was able to continue as an essential service and plug those gaps,” says Vos. “People were very socially minded at the time, so we received over twenty thousand unique donations

in six weeks, totalling over six hundred thousand Rand to help FoodForward SA meet those people’s needs.”

Another trend that Vos notes is that people are happy to give to causes they are used to, which is why Vitality partnered with the Dis-Chem Million Comforts campaign. The initiative, which has been running since 2015, aims to provide sanitary pads to teenage girls in need. It is committed to the empowerment of schoolgirls, raising awareness about women’s health and giving girls the opportunity to continue their education without the burden of hygiene risks, discomfort, embarrassment or loss of dignity.

The campaign is about to embark on its seventh consecutive year, with a partnership with Caring4Girls growing its distribution outreach nationwide to girls in less fortunate communities. “Vitality members are able to donate Discovery Miles over and above every pack of sanitary pads they donate at Dis-Chem till points, with Stafree matching those donations,” says Vos. “These partnerships generate scale by leveraging existing campaigns, and their topicality helps drive interest in very worthy causes.”

Fayelizabeth Foster, head of loyalty and rewards at Standard Bank, says that

the value derived from loyalty and rewards programmes in South Africa is increasing as interest rates continue to rise and the cost of living becomes a greater burden on households. “Our members are continuously looking at brands to engage with those that meet their needs, depending on their varied interests and life stages. We have focused on everyday spend partners – such as groceries, fuel and pharmacies – which make a real difference in our customers’ everyday lives. However, we have also included feel-good partners such as charities and education initiatives that are important for so many members who want to give back to society,” she says.

Foster says that, from a business perspective, the UCount Rewards programme was conceptualised and developed to meet the objectives of attracting, growing, and retaining customers. “From a customer perspective, the programme is a thank you for doing business with us, and they should benefi t easily, either fi nancially through increased convenience or with a better experience.”

Foster says that UCount Rewards can contribute to the broader South African society to help make a difference in people’s lives by providing charitable platforms where members can redeem or donate their Rewards Points to support these charities. “Members can choose to support the Tekkie Tax charities that help people and animals in need, contribute to the education of a South African student who is raising funds on crowdfunding platform Feenix, or support a learner, school or the Adopt-a-School Foundation through the School-Days platform,” she says.

By regularly engaging with customers to get feedback on the type of redemption partners they would like to see on the programme, UCount customers get to decide on the charitable partners onboarded for them to make a difference in their communities. “There is a multitude of benefi ciary sectors within South Africa, and it is important that UCount Rewards partners with platforms that support these sectors at a national level,” concludes Foster.

• Three hundred and thirty-five Vitality members donated over 95 per cent of all the Discovery Miles ever earned to Vitality MoveToGive. The top giver donated over R14 400, while another member donated to MoveToGive on 288 separate occasions.

• Members raised over R400 000 in just three weeks to support Gift of the Givers’ relief efforts after the KwaZulu-Natal floods – an amount the Discovery Fund matched.

Source: Discovery

“Our members are continuously looking at brands to engage with those that meet their needs, depending on their varied interests and life stages.”

– Fayelizabeth Foster

Voted the number one travel loyalty programme in South Africa last year (in an annual survey of economically active South Africans undertaken by independent research organisation WhyFive), Legacy Lifestyle has more than 1.2 million members and a host of national partners, including Dis-Chem, Pringle, Greenbacks, and Legacy Hotels and Resorts. One of the key partnerships of Legacy Lifestyle is with Airlink, which fl ies to 45 destinations in 13 African countries. A co-branded website enables Legacy Lifestyle members to log in, make bookings and earn cashback rewards. A feature of the programme is that members can earn cashback from the first rand spent, and on all classes of flights. This makes the programme very attractive to the mass market, as opposed to a select few. Members can pay with their rewards because the booking platform is integrated with Legacy Lifestyle’s rewards platform. The platform also provides access to cars, hotels and experiences at thousands of locations worldwide.

Being able to track and measure customer engagement is key for a loyalty programme, so marketing campaigns need to include an interactive element where programme members are incentivised to respond to promotional offers to receive the advertised benefit. Legacy Lifestyle and Lifestyle Travel have run a series of double-page adverts in Airlink’s Skyways magazine with a call to action, which provided the ability to track

are

engagement via QR and SMS short codes. The offers were designed to generate new member registrations and drive engagement with the brand through compelling offers.

Loyalty programmes generate significant amounts of data, and this must be used to refine marketing offers. Changes in member behaviour are also often leading indicators of evolving trends. One of the biggest changes we have seen is that people are booking closer to the time of departure than before the pandemic. For the hotel industry, this is important so that hotel operators maximise the room rate and don’t sell too early, too late, or at the wrong price. For those running loyalty programmes, this means that you have to manage your member communications effectively because you must create and personalise marketing offers in real-time to meet the changing demands of the marketplace. Loyalty programmes also provide a closed network where price-based offers can be communicated without being

seen as wholesale discounting, which is bad for the brand. In this context, the relationship between loyal customers and the hotel or airline operator is highly beneficial for both parties.

Another key factor for success is personalisation. Generic offers do not work well because consumers want products and services tailored to their individual preferences. This requires an investment in technology, as large amounts of data need to be stored, analysed, and then used to create personalised emailers or mobile marketing campaigns. The more personalised the offer, the higher the conversion rate.

A well-structured and run loyalty programme provides numerous, sustainable, competitive advantages. It enables cost-effective and direct communication with customers, provides measurable insights, and the data generated can be used to improve operational efficiencies.

For example, a loyalty programme member might have enough cashback in their account to qualify for an upgrade to business class, but they are not aware of the cost of the upgrade. Using in-app notifications, the airline can make the offer to the member as they check in and let them know that they also get lounge access as part of the upgrade. The intersection between airlines and loyalty programmes is exciting, and the best is yet to come.

South African consumers belong to 8.7 loyalty programmes on average and, besides cashback and discount vouchers, the most sought-after benefit is travel.

Source: The 2021 Truth SA Loyalty Landscape Whitepaper

Changes in member behaviour

also often leading indicators of evolving trends.

Given the high penetration of loyalty programmes among South African consumers, the loyalty sector is uniquely placed to play a role in promoting travel and identifying trends in the industry, writes MICHAEL LEVINSOHN, managing director of Legacy Lifestyle

The COVID-19 pandemic has resulted in heightened awareness of the importance of personal health and wellbeing, and the need to plan and invest in quality healthcare for our families, despite little improvement in the financial position of South Africans.

Where rewards programmes have typically looked to drive brand loyalty and incremental savings to customers, the need for these in healthcare runs far deeper, as customers desperately look to make space in their constrained budgets to accommodate this essential expenditure.

Dis- Chem is acutely aware of the scarcity of precious healthcare resources, both skills and infrastructure, and the need to prioritise preventative measures to alleviate the burden on these resources while managing them as efficiently as possible, to ensure that those in need of care have access to it.

This is exactly why Dis-Chem has launched extra by Dis-Chem, a rewards programme available to Dis-Chem Health policyholders. While accident cover, primary healthcare insurance and gap cover policyholders face differing needs and constraints, the extra rewards programme looks to encourage healthier behaviour while making

at Dis-Chemhealthcare choices possible through the savings it offers.

extra provides policyholders with an everyday and immediate 20 per cent discount on a basket of more than 2 500 healthy and essential products from Dis- Chem stores and online. T he basket includes leading brands in health, personal, home and baby care and is representative of our view that fully integrated healthcare extends beyond traditional medical services. Healthcare is about “healthy body, healthy home, healthy mind”, on the basis that health and wellbeing encompass an individual’s entire being. extra is being launched alongside the long-standing Dis- C hem Benefits rewards programme available to Dis- C hem customers.

extra rewards will be a significant benefit for medical insurance policyholders, many of whom would ordinarily have had to purchase private healthcare out of their pockets or rely on the public sector. We estimate that there are approximately 19 million S outh Africans with some form of household income for whom traditional medical aid is not a financially viable option, but who could afford and benefit from medical insurance to provide for preventative, day-to-day primary healthcare, and accidental emergency treatment in the

Dis-Chem and our participating partners have committed to providing material savings through the extra rewards programme.

private sector. For these individuals, medical insurance premiums are a new expense, and by adding value-added services, policyholders can look to make space in their budgets with savings earned through the rewards programme. A s policyholders commit to provisioning for their healthcare needs, Dis- C hem and our participating partners have committed to providing material savings through the extra rewards programme.

To use healthcare resources as efficiently as possible and keep primary healthcare insurance premiums affordable, Dis- Chem, along with our partner K aelo, leverages our primary healthcare infrastructure, preventative screenings, sophisticated chronic medication adherence programmes, and nurse- and pharmacy-led models alongside physical and virtual private doctor consultations to deliver appropriate, quality healthcare to policyholders.

E xtra rewards will also play an important role for Dis- C hem Health gap cover policyholders. T he need for gap cover has arisen due to the widening “gap” between the actual cost of in-hospital medical treatment and what medical aids are willing to pay for those treatments. G ap cover provides cover for these shortfalls for medical aid members, who are already under financial pressure with the high cost of medical aid premiums. We estimate that approximately eight million medical aid members in S outh Africa do not have gap cover – this need will only grow as medical aid tariffs struggle to keep up with rising healthcare costs. extra aims to provide some relief from the pressure of this additional expense through immediate savings on health and essential items.

At Dis- C hem, we understand that affordability is the key inhibitor to South Africans’ ability to effectively manage the health and wellness of their families and access quality healthcare when needed. By offering a rewards programme that encourages healthy behaviour and makes private healthcare more affordable, we are enabling our policyholders to meet these critical health needs.

extra provides policyholders with an everyday and immediate 20 per cent discount on a basket of over 2 500 healthy and essential products from Dis-Chem stores and online.

Rewards programmes have the potential to make primary private healthcare accessible to more people in trying financial times.

officerRui Morais

In a post-COVID-19 world, South Africans need to develop better financial sense, and loyalty programmes have a crucial role to play in this.

and

communications at Old Mutual Rewards

communications at Old Mutual Rewards

It’s a long-established fact that South Africa has one of the worst savings cultures in the world, exacerbated by our high rate of unemployment. This continues to be bad news, particularly in a post-COVID world, given that a good savings culture tends to translate into stronger economic growth. The Old Mutual Rewards programme endeavours to address this by providing incentives and rewards for loyalty programme members to become more financially savvy and to develop a more responsible approach to money, debt and savings.

Established four years ago, Old Mutual Rewards has, from the outset, focused on partnering with members on their journey to financial freedom and success. Open to both Old Mutual customers and noncustomers, the programme rewards its members for taking control of their finances.

There are three pillars to the programme. Firstly, members earn Old Mutual Rewards points while learning more about their finances, including how to budget, save and invest. Members can complete free online short courses through Old Mutual’s Moneyversity platform, do various other financial assessments, engage with financial savings

calculators and budgeting tools such as 22Seven or their free credit report, and speak to their Old Mutual financial adviser to gain a better understanding of how to manage their finances effectively.

The second pillar is focused on securing their finances through meeting their financial needs with Old Mutual financial solutions and earning points for sticking to their financial plan.

The final pillar allows members to enjoy a variety of rewards when they redeem their points from our over 30 partners, save toward their dreams or donate to charity.

According to the Old Mutual Saving and Investment Monitor 2022, one in three people earns less now than before the COVID-19 pandemic, with older consumers particularly hard hit. Consumers are under pressure and spending more cautiously amid the cost of living increases, and 66 per cent – up from 54 per cent in 2020 – say they are now using loyalty points and rewards to manage their finances better.

This might explain why Old Mutual Rewards is among the top 10 most-used loyalty programmes in the financial services sector, according to the 2021 SA Loyalty Landscape Whitepaper

We believe the keys to the success of a programme such as this are that it should be free to join, the programme should be easy to understand and engage with, and members should be able to redeem their points easily with a range of partners.

Old Mutual Rewards has never levied a fee for membership because we want the programme to be accessible to all South Africans. We believe programmes such as this play an important socioeconomic role in helping to drive financial literacy, encouraging responsible financial behaviour from a young age and improving South Africa’s savings culture.

There is clear evidence that the Old Mutual Rewards programme is achieving its objective of creating more financially empowered members. In the last four years, membership has grown to more 1.5 million members. The credit reports of programme members are seeing significant improvements each year, indicating that they are putting their learnings to good use.

There is also evidence that the programme is helping to build client loyalty. Our research reveals that customers are less likely to lapse their policies if they are members of Old Mutual Rewards. Noncustomers have a high propensity to become clients once they are members of the programme, while customers are more likely to increase the number of financial solutions they have with Old Mutual if they are members.

The Old Mutual Rewards programme is achieving its objective of creating more financially empowered members.

The keys to the success of a programme such as this are that it should be free to join, the programme should be easy to UNDERSTAND AND ENGAGE WITH, AND members should be able to redeem their points easily with a range of partners.Nceba Hene OLD MUTUAL SAVING AND INVESTMENT MONITOR

Everyday value has a name – Absa Rewards. Absa Rewards is a five-tiered loyalty programme. Members earn up to 30 per cent in real cash back, depending on their tier, through an array of everyday transaction categories.

The deeper the customer’s relationship with Absa, the higher their tier and the higher the monthly cash back they get on their card spend. We understand that, for customers, it is often the small things that make a big difference. With that in mind, Rewards members can earn across different categories, which include grocery, health and beauty, fuel, digital lifestyle (digital vouchers, food delivery and e-hailing), and travel (through Absa Rewards Travel.

Customers don’t need to be on the highest tier to enjoy signifi cant cash back. As an example, a customer on Tier 4 can earn up to R885 cash back per month on their credit card spend.

With Absa Rewards, what you see is what you get – our programme offers members

real cash instead of points or other loyalty currencies that are diffi cult to understand and are susceptible to breakage (customers not being able to redeem their rewards because of limited redemption partners and complicated rules). Absa was the fi rst South African bank to offer its Rewards members a cash back benefi t – this has been very popular with our customers who have received over R5-billion in cash since the programme’s inception.

Absa Rewards is more than just a loyalty programme; it is our way of rewarding customers for banking with Absa by putting actual cash back into their pockets. Recently, Absa Rewards boosted its fuel rewards offering members an additional bonus of 10 per cent cash back when they filled up at Rewards partner Sasol.

Helping customers cope with rising fuel costs is not a new concept. Absa introduced its fuel rewards boost, Double Cash Back Thursdays, in October 2021 in partnership with Sasol, an initiative that provided meaningful value to over a million Rewards members.

In addition to the standard Rewards cash back, at Absa, we offer several additional opportunities for customers to earn real cash:

• Absa Small Business Friday where customers receive double cash back for shopping at their local SMEs on Fridays, doing their bit to grow the economy and their communities.

• Our Absa Activate customers receive up to 40 per cent of their monthly premiums back in cash, further cushioning them from rising fuel prices.

• Other products where Absa customers can look forward to real cash benefi ts include Instant Life (the fi rst three months’ premiums back in cash), savings and investments (bonus savings rate for banking digitally), and home loans (up to R6 000 back when buying a new home).

At Absa, we care about giving our customers value for their money in every sense. Rewards members have access to the Absa Advantage challenge and can complete this at their convenience via the Absa Banking App on their smartphones. In the process, members earn instant rewards such as meal vouchers, which they can redeem at our leading retail partners. Absa Advantage is a programme designed to reward customers for banking smarter as well as driving positive banking behaviour. Now that’s everyday value you can bank on!

Absa rewards customers with more value and real cash back, writes RENDANI MAUDA , Head: Absa Rewards, Absa Everyday Banking

The saying “Money can’t buy you love” has never rung truer for brands trying to establish loyalty by only offering financial rewards. Post-pandemic consumers want more from their brands. They want engagement and emotional connection.

The average South African belongs to, on average, 8.7 loyalty programmes across brands, according to the 2021 SA Loyalty Landscape Whitepaper. Faced with such fierce competition for brand loyalty against a backdrop of rising living costs and increased social awareness, loyalty programmes need to go beyond traditional transactional rewards to build deeper, longer-lasting bonds with customers. A few free coffee vouchers

are not going to be enough of an incentive for a customer who wants to engage meaningfully with a brand.

Glenn Gillis, CEO of Sea Monster Entertainment, notes that consumers typically are not loyal and that it can be difficult to establish brand equity through “fractions-of-a-second engagement” on social media. “When you look at most of what is out there, you will mostly find reward schemes that give cashback for a purchase, but that’s not necessarily driving brand equity. I think the pandemic has really sharpened the importance of customers having an intrinsic connection with the brand.”

This kind of emotional loyalty leans towards nontransactional activities, personalised experiences, and relevant

rewards, says Lauren Venter, consultant for Truth Loyalty. “Brands need to understand more about their customers by looking beyond their transactional behaviour, such as shopping or swiping, to offer them the personalisation and relevance they want.” Old Mutual Rewards, Discovery Vitality, Standard Bank UCount and FNB eBucks are just some local brands offering rewards for nontransactional activities. Old Mutual rewards good financial behaviour, explains Venter, including using its financial tools and calculators, completing surveys and financial surveys, and signing up for Moneyversity courses.

User-centric loyalty programmes that offer more than swipe-and-earn rewards have the potential to engage consumers beyond the buying cycle, writes ANÉL LEWIS

“Brands need to understand more about their customers by looking beyond their transactional behaviour, such as shopping or swiping, to offer them the personalisation and relevance they want.” – LAUREN VENTER

Glenn GillisLauren Venter

Loyalty may be fl eeting if there is no meaningful engagement with a brand, as Tamas Oszi notes in Customer Loyalty Programs: A Defi nitive Guide With 13 Actionable Steps. Customers are willing to switch brands after a single transaction unless convinced otherwise, so rewarding them only for buying a certain product is not going to secure enduring loyalty. However, by incentivising them beyond the buying cycle, there is a greater likelihood of fostering loyalty.

“When you recognise the members of your loyalty programmes for a variety of interactions – not just transaction-related – they will feel good about your brand far more frequently,” notes Oszi. This means rewarding customers who engage with social media content, take part in competitions and events, or write product reviews.

This is not to say that there is no longer a place for traditional loyalty programmes. According to the 2021 SA Loyalty Landscape Whitepaper, cashback is still South African consumers’ preferred loyalty benefi t, closely followed by discounts. However, these discounts need to be personalised and customised to meet customers’ specifi c needs to establish enduring relationships that will extend beyond a transaction.

“When consumers choose your brand over competitors in the marketplace, you need to try and delight them while you have them, and then reward them for choosing your brand by incentivising them to come back,” says Samuel Nassimov, managing director of Premier Hotels. “The trick is to offer rewards

Emirates Skywards allows members to bid their points for Skywards Experiences, such as Formula 1 Grand Prix, football games with AC Milan, Arsenal and Real Madrid, or world-class sporting events. Members can redeem their points to secure “money-can’t-buy” experiences via the Skywards Exclusives online platform.

“We are defi nitely seeing more and more programmes offering experiences such as these as rewards,” says Lauren Venter of Truth. “Some consumers might not ordinarily be able to ‘access’ these experiences, but by using their points, they can. Some brands offer members an opportunity to attend an event or experience ‘by invitation only’, creating a feeling of importance. Having ‘bragging rights’ is a further incentive to engage with the brand.”

to customers for purchasing your product outside of their typical buying periods.”

Omnichannel marketing can build brand equity by keeping customers engaged and entertained at all touchpoints of their buying experience, says Gillis. “There is a need to design ways to connect what customers are doing in the real world and the digital world to reward them for their time and engagement.” This means offering incentives for customers to share their insights as they interact with the brand online and in real life. The modern defi nition of brand loyalty is that there is no loyalty, adds Gillis. “Rather, there is a recognition of how to maximise the lifetime value of a customer on the one hand, and how to build brand equity on the other.”

Gillis says brands must fi nd novel ways to build brand equity or consumer awareness. “In the past, brands just needed to say that they were doing something. Now, we want to see brands deliver on the promises that they make to us, whether these are promises of customer experiences or purpose-led promises.”

One way of improving customer engagement is by “segmenting the database to better understand customers’ needs, wants, behaviours and trends,” says Nassimov.

Seventy per cent of emotionally engaged consumers say they spend up to two times or more on brands they are loyal to.

Source: capegemini.com

Sea Monster uses games to drive brand equity. “Games are voluntary activities, and when you put users at the centre of an experience, you can effectively create a continual change of value between brand and customer,” explains Gillis. This could be in the form of providing entertainment, sharing knowledge, or rewarding them for their time and engagement. “There is growing acknowledgement that games can, and do, offer a new and serious marketing channel for brands, and we hope to see them gain even more traction in the world of marketing going forward.”

Brands must also keep their loyalty programmes current and relevant, says Venter. They can do this by personalising their communications, offering relevant rewards, and ensuring customers always know what’s in it for them. Pick n Pay’s Smart Shopper programme, named in the 2021 SA Loyalty Landscape Whitepaper as the country’s most-used rewards programme, offers personalised vouchers and strategic partnerships that make it possible for shoppers to earn even more points.

Gillis says that brands recognise that they need their customers’ data and insights to retain their loyalty and deliver a competitive service. “When it comes to anything that is data-driven, the consideration process (of the marketing funnel) should be where much more effort is invested because this is where the magic happens, and this is where omnichannel marketing in its truest form can offer a solution.”

“The trick is to offer rewards to customers for purchasing your product outside of their typical buying periods.” – Samuel Nassimov2021 SA LOYALTY LANDSCAPE WHITEPAPER Samuel Nassimov

they provide to consumers. Says Mtati: “They add insight to what sells in different seasons, at different times of the week and month, and even of the day. We shouldn’t overlook that they can enable highly targeted marketing.”

Spaza shops could also benefit from group buying, in much the same way as large chains do. Mtati says they should certainly be providing customers with incentives to shop locally for special occasions.

One of the most interesting research findings to come out of the 2022 Township Customer Experience (CX) Report was the overwhelming consensus that spaza loyalty programmes would be welcomed by consumers.

Ninety per cent of the survey respondents said they would be interested in earning points or cashback on their shopping.

If only it were that simple, says Mongezi Mtati, brand strategist at Rogerwilco, which commissioned the report.

“Spaza shops don’t fit neatly into an organised commerce business model, so we label them as part of the informal economy, but that’s not quite correct. It might not appear so to anyone used to the classic retail model, but spazas are structured to support an entire trading ecosystem, and it works.”

Brian Makwaiba, CEO of the Vuleka Platform, has plenty of experience in this area, having created the Vuleka spaza app, which connects manufacturers and wholesalers to spaza shop owners. He says a loyalty programme would have to serve the entire value chain,

from manufacturers and distributors/wholesalers to spaza owners and consumers. “Wholesalers already get discounts from manufacturers, but there’s no incentive for them to pass anything on to spaza owners and even less incentive to pass anything on to consumers. I’d like to see that change. Because the existing ecosystem already has structures in place, a loyalty programme would have to be a hybrid that plugs into what’s already there.”

Makwaiba cautions against expecting quick adoption of a loyalty programme. “There is much to consider. How would you track purchases from brand to shop to consumer so that you could monitor the programme? If you’re handing out a card, will it be swiped? What are the incentives for spaza owners, and what do consumer rewards look like? And the manufacturer needs to know how the programme translates to margin.”

Of course, loyalty programmes are not just about creating loyalty to drive sales. The access they provide to customer data and shopping patterns is as valuable to brands as the direct line

“If someone wants to buy a big slab of chocolate for their partner for Valentine’s Day, they have to take a taxi to a big supermarket where they can find the product and get a great price. Group buying by spazas could enable them to walk to the nearest spaza and do that. This is where a loyalty programme can work for owners and consumers alike.”

Spazas have a very clear role and there’s a wealth of knowledge in their place in the community. “No one understands the cultural nuances of the kasi consumer as spaza owners do, and incentivising their role in driving sales could be a useful marketing strategy,” says Makwaiba. “Product testing is a great example. Are customers buying a smaller pack size to sample a product before committing to a bulk size, or are they just topping up before their month-end shop? The spaza owner knows the answer to this question, and it could inform essential manufacturing decisions.”

As the big supermarket chains increasingly move into the kasis, spazas must be able to compete with them. Having a good loyalty programme would level the competitive playing field.

“No one understands the cultural nuances of the kasi consumer as spaza owners do, and incentivising their role in driving sales could be a useful marketing strategy.” – Brian MakwaibaTOWNSHIP CUSTOMER EXPERIENCE REPORT

Introducing loyalty programmes into the spaza shop sector has enormous potential for both merchants and consumers, but experts warn that such a system must benefit the entire value chainMongezi Mtati

“Spazas are structured to support an entire trading ecosystem, and it works.” – Mongezi MtatiBrian Makwaiba

FreshStop at Caltex has seen significant growth in the post-COVID-19 world. We’ve had our struggles and hardships over the last two-and-a-half years, but we have been able to adapt, overcome and weather the storm, and grow our market share in the convenience sector.

A report by digital analytics group Lightstone found that the average South African visits a petrol station nine times a month. This number is significant, as the average person does not refuel nine times a month. The reason for this is simple: forecourts offer the convenience and ease of shopping that bigger retailers and shopping centres do not.

A few years ago, we launched our loyalty app, FreshStop Rewards. What set our app apart from others was that customers were getting actual cashback just for shopping on the app – no loyalty points that could only be redeemed at FreshStop, but real currency deposited into their bank accounts. The uptake has been good for us so far, but we want to reach even more people.

We’ve also migrated to delivery apps such as Uber Eats and Mr. D. Customers should have all the choices available to them as to where and how they receive their goods. All this forms part of our plan to build meaningful trust with our shoppers.