PUBLISHED BY

Insurance is a vital pillar of individual security and economic resilience. In this issue of Insure, we explore how the sector in South Africa is evolving amid challenges and innovations.

Healthcare features prominently as we examine rising medical costs and the context behind increasing premiums. Insurers are moving beyond basic payouts to offer dynamic, personalised cover that adapts to customers’ needs. With public and private systems facing affordability and access challenges, we explain how medical insurance can bridge gaps, especially around dread disease coverage and prescribed minimum bene ts, which are often misunderstood.

Picasso Headline,

A proud division of Arena Holdings (Pty) Ltd, Hill on Empire, 16 Empire Road (cnr Hillside Road), Parktown, Johannesburg, 2193 PO Box 12500, Mill Street, Cape Town, 8010 www.businessmediamags.co.za

EDITORIAL

Editor: Elriza Theron

Content Manager: Raina Julies rainaj@picasso.co.za

Contributors: Isaac Chindotana, David Jewell, Vusi Khathi, David Kirk, Vukani Magubane, Busani Moyo, Vanessa Rogers, Anthony Sharpe, Paul Stevens, Jeanne van der Merwe, Lisa Witepski

Copy Editor: Brenda Bryden

Content Co-ordinator: Natasha Maneveldt

Online Editor: Stacey Visser vissers@businessmediamags.co.za

DESIGN

Head of Design: Jayne Macé-Ferguson

Senior Designer: Mfundo Archie Ndzo

Cover Image: altitudevisual/123rf.com

SALES

Project Manager: Tarin-Lee Watts wattst@arena.africa | +27 87 379 7119 +27 79 504 7729

PRODUCTION

Production Editor: Shamiela Brenner

Advertising Co-ordinator: Shamiela Brenner

Subscriptions and Distribution: Fatima Dramat fatimad@picasso.co.za

Printer: CTP Printers, Cape Town

MANAGEMENT

Management Accountant: Deidre Musha

Business Manager: Lodewyk van der Walt

General Manager, Magazines: Jocelyne Bayer

COPYRIGHT: Picasso Headline. No portion of this magazine may be reproduced in any form without written consent of the publisher. The publisher is not responsible for unsolicited material. INSURE is published by Picasso Headline. The opinions expressed are not necessarily those of Picasso Headline. All advertisements/advertorials have been paid for and therefore do not carry any endorsement by the publisher.

We also highlight critical insurance shortfalls, including life insurance gaps that leave many families exposed. On the short-term insurance front, we look at its role in personal security and economic stability, especially as climate change intensi es risks for agriculture and property.

Our features on environmental volatility and “acts of God” show how underinsured properties can

7 CREATING DYNAMIC COVER

Meeting the needs of grieving families requires more than a cash payout.

8 HEALTHCARE

How insurance helps South Africans access care, the difference between dread disease cover and PMBs, and how healthy habits are being rewarded.

13 FUNERAL COVER

The art of creating dynamic cover because meeting the needs of grieving families requires more than a cash payout.

16 LIFE INSURANCE SHORTFALL

Millions of South Africans are left exposed due to life insurance gaps.

18 WHEN NATURE STRIKES

Acts of God, a weak rand and underinsurance put homeowners at risk.

20 CLIMATE CHANGE AND AGRICULTURAL INSURANCE

Extreme weather is driving up agricultural insurance claims.

24 PROPERTY INSURANCE 101

Essential information every homeowner should know.

26 TRAVEL INSURANCE

From delayed ights, lost bags or medical emergencies – knowing your cover matters.

27 INNOVATION

AI helps insurers understand customers and speed up service –but not without risks.

30 TRADE CREDIT INSURANCE

How trade credit insurance protects businesses and supports nancial stability.

32 M&A INSURANCE

Three shifts driving merger and acquisition insurance deals and due diligence implications.

35 UMAS The vital role of underwriting management agencies in South Africa’s insurance sector.

worsen nancial hardship after disaster. For travellers and homeowners, we offer expert advice to navigate policy details. At the corporate level, trade credit insurance can protect businesses from the fallout of unpaid debts in tough economic times.

Finally, we explore how arti cial intelligence is transforming insurance – improving customer service while introducing new risks – and how mergers and specialist underwriting agencies are reshaping the industry.

Protection is not just peace of mind; it is power. We hope this issue empowers you to make informed decisions for your business, home and wellbeing.

Elriza Theron Editor

ELRIZA THERON speaks to experts to unpack the common misconception that medical aid alone is sufficient to cover all healthcare costs during serious illness, especially in retirement

When planning for one’s future, especially retirement, many people mistakenly believe they are adequately covered against illness-related expenses in their later years, simply because they have made provision for medical aid. Unfortunately, this belief often doesn’t materialise, partly due to a misunderstanding of what is actually covered by certain types of health, life and short-term insurance solutions.

Ursula Torr, a seasoned healthcare actuary and member of the Actuarial Society of South Africa, explains that many assume that having medical aid, along with prescribed minimum bene ts (PMBs) under the Medical Schemes Act, 1998, ensures full coverage during a major health event. In reality, while medical aids do offer PMBs and competitive pricing, there can still be signi cant gaps. Medical schemes typically cap payment amounts for healthcare provision and may exclude alternative therapies or very expensive care and medicine options, even if these could be bene cial.

Additionally, medical schemes rarely address the wide range of nonmedical expenses that often accompany serious illnesses. Joretha Bothma, head of product development, underwriting and claims at

Momentum Life Insurance, notes: “Many people assume that medical aid is a catch-all, but critical illness brings a range of unexpected costs. Critical illness cover is designed to give people the freedom to make the best decisions for their recovery and circumstances.”

In South Africa, the terms dread disease cover, severe illness cover and critical illness cover are used interchangeably. They all refer to insurance that pays out a lump sum if you meet the criteria for a listed serious illness, with the payout generally based on the illness’s severity. For example, following a qualifying cancer or stroke diagnosis, lifestyle adjustments, such as modifying a home, hiring a caregiver or purchasing assistive equipment, may need to be made. Severe illness bene ts can help fund such needs. They may also cover services not included in medical aid plans, such as private nursing, extended rehabilitation or transport and accommodation for treatment in distant centres.

There are also practical lifestyle impacts. Someone undergoing chemotherapy might be unable to handle daily tasks, such as childcare or cooking. A severe illness payout can help cover domestic assistance or childcare costs. Without this nancial support, the broader consequences of a critical illness can be devastating. Bothma says: “Families are often nancially derailed not by the illness itself, but by everything that comes with it: travel, home alterations or time off work.”

A key bene t of critical illness cover is the exibility in how the payout is used, whether for medical bills, lifestyle changes or to ease nancial stress during recovery. “While each person’s nancial needs are unique, most advisers agree: it’s good to have medical aid, better to add gap cover, and best to have all three: medical aid, gap cover and critical illness cover,” says Bothma. This comprehensive approach provides an essential extra layer of protection against the nancial strain of a major health event.

Torr also highlights the often-overlooked emotional bene t of a critical illness payout. “The mental impact of a critical illness, such as cancer, can be severe. Having a lump sum payout gives you breathing room and allows you to think clearly about your next steps, how to prioritise your life and wellbeing.”

She adds that these products offer more than nancial aid, they provide autonomy and control. “When your health is impacted, you are vulnerable and often at the mercy of the system. Having some nancial independence can bring relief, allowing you to choose how to manage your life moving forward.”

Bothma concludes: “Critical illness cover is not a luxury; it is an essential layer of nancial resilience. Medical schemes alone do not cover all the expenses related to a serious illness.” In the broader context, dread disease cover plays a vital role in safeguarding health and nancial security. Bothma advises speaking to a nancial adviser about how this type of protection ts into your broader nancial plan, so you and your loved ones can face the future with greater con dence and peace of mind.

Follow: Joretha Bothma @ www.linkedin.com/in/joretha-bothma Ursula Torr @ www.linkedin.com/in/ursula-torr-41a9a08b

The cost of medical care is rising, but so, too, are the costs of medical aid. Against this backdrop, medical insurance is helping South Africans bridge the gap between the necessity of medical care and its affordability. By

LISA WITEPSKI

If you’re a member of a medical scheme, you may have found that your medical aid contributions increased by 7–11 per cent during the past year. Across the world, medical inflation exceeded consumer price inflation (CPI) by an estimated 6.4 per cent in 2024.

Deon Kotze, chief commercial officer at Discovery Health, explains: “Medical inflation outpaces CPI due to ageing populations and a growing number of people being in poor health, which leads to a greater demand for healthcare services, over and above the increase in the cost of those services.”

However, medical schemes are facing a host of other challenges that are contributing to rising healthcare costs, says Thoneshan Naidoo, chief executive officer of the Health Funders Association. While the demand for healthcare for older medical scheme members is typically cross-subsidised by younger members, the stagnation of South Africa’s economy has slowed the rate of young people joining the workforce and

becoming members. At the same time, advances in technology, while increasing quality of life and making for better health outcomes, are also increasing the cost of medical care; simultaneously, the cost of the set of prescribed minimum benefits (PMBs), a set of conditions that all schemes are obliged to cover, is increasing, too. Whereas in 2013, the average PMB package cost R508 per month per beneficiary, that figure now stands at over R1 100, making it unfeasible for a scheme to offer a package that costs any less. The proliferation of companies offering medical insurance also plays a role: members who, in the past, may have purchased a more comprehensive plan from a medical scheme are now content to invest in a basic hospital plan, topping it up with insurance.

Naidoo notes that the regulatory environment has often stifled competitiveness and innovation in this space. Despite sustained efforts by medical schemes to introduce low-cost benefit options to expand access and attract up to 10 million new lives, progress has been constrained by regulatory complexities and unresolved legislative issues.

– MARIA MAKHABANE

Nonetheless, many medical schemes are finding new ways to appeal to members.

For example, Medihelp Medical Scheme is collaborating with a partner to offer members gap cover to supplement their existing plan.

“This ensures better financial security when unexpected or high-cost claims arise,” explains Lien Potgieter, head of marketing. She adds that the scheme also offers insurance for primary healthcare through its partner. This cover targets consumers who cannot afford a full medical aid plan, covering essential day-to-day needs such as GP visits, chronic medication scripts and basic diagnostic and pharmacy needs. Medihelp also offers a medical aid plan specifically designed for students that is more than just a hospital plan.

Discovery Health Medical Scheme (DHMS), meanwhile, has responded to the challenges by introducing a new plan, the Active Smart, which specifically addresses professionals younger than 30, providing benefits tailored to their life stage at a more favourable rate. The scheme has also innovated through the launch of Discovery Health Personal Health Pathways, harnessing artificial intelligence to provide personalised health recommendations to members of DHMS.

Discovery Health has also entered the primary healthcare insurance sphere through Flexicare,

a product offered in partnership with Auto & General. Flexicare covers essential day-to-day needs such as GP visits, chronic and acute medication, dentistry, optometry and basic diagnostic needs.

Maria Makhabane, chief growth officer at Discovery Health, acknowledges that many South Africans may find the distinction between medical aid and medical insurance confusing. “Primary healthcare insurance is not a substitute for medical aid. It is a focused solution for day-to-day healthcare. It funds essential services like doctor visits, medication and basic diagnostics. In contrast, medical aid is more comprehensive, covering over three hundred PMBs and in-hospital care,” she explains.

While less comprehensive, medical insurance is a practical option, says Peter Hallendorff, director of healthcare solutions at the Pogir Group. “It’s not a watered-down version of medical aid. It’s leaner and simpler, a smart, budget-friendly lifeline for regular people.” Given that, according to Naidoo, as many as 20 million South Africans are paying out of pocket to access the private medical sector, it’s easy to understand the appeal, but Hallendorff says such an offering is especially attractive to young entrants and contract workers who want flexible, easy-to-understand options that provide sufficient cover, small businesses looking to offer healthcare perks to ensure their teams feel looked after, and families who wish to avoid the potentially devastating financial impact of an unexpected health event.

“MEDICAL INSURANCE IS LOOKING TO SOLVE A LARGE-SCALE PROBLEM: ACCESSIBLE QUALITY HEALTHCARE FOR THE MASSES BY PROVIDING AN IMMEDIATE SOLUTION TO HELP DELIVER UNIVERSAL HEALTHCARE TO MILLIONS OF SOUTH AFRICANS. – JESSICA BATES

Africans. Rather than joining forces with a third party, the company invested 25 per cent in Kaelo Holdings to provide products targeting the retail and corporate markets. Bates says the latter has shown increased interest of late, particularly now that it has become clear that it will be some time before NHI is implemented, and employers are seeking an affordable solution to fill the gap in the meantime. Individuals are equally seeing value in these products but, while they are attracted by the idea of affordability, many remain unsure of what, exactly, medical insurance is. “It’s important to educate people, not only about how medical insurance differs from medical aid, but also the benefits available to them and how to access them.”

Dr Reinder Nauta, founder of the National Healthcare Group whose MediClub offers access to private healthcare practitioners through a telemedicine platform, agrees that a lack of clarity around NHI has affected the take-up of insurance products that would otherwise have significant appeal.

“ONE

“Unfortunately, people tend to be wary of cheap products,” he says, once again bringing attention to the need for education.

Teshlin Akaloo, managing director of NetcarePlus, says the private sector is looking to innovation in

– TESHLIN AKALOO

Dis-Chem is another brand making health insurance available, with Dis-Chem Health launched in 2022. Jessica Bates, executive of integrated health at Dis-Chem, explains that the move made sense, given the company’s drive to reduce the cost of healthcare for South

product design, funding mechanisms and care delivery models to make healthcare more accessible. “One of the most promising trends is the rise of modular and prepaid healthcare solutions, which allow individuals to purchase specific healthcare services, such as doctor’s visits, medications or planned surgeries, through once-off payments. Then there are emergency-focused insurance products, which provide access to private hospital care during emergencies, often with unlimited cover for accidents. For individuals who already have medical aid but are struggling with high out-of-pocket expenses, gap cover products have become increasingly important, offering additional protection by covering co-payments, specialist shortfalls and even some out-of-hospital costs.”

Akaloo maintains that for healthcare to become more affordable, all stakeholders, including product providers, funders, healthcare systems and policymakers, need to work together to expand access to quality healthcare.

Hallendorff agrees, saying: “Insurers and health providers should team up and partner to deliver care like cancer screenings, prenatal care or care for chronic conditions. Partnerships of this nature could save lives and stretch resources.”

“Medical insurance is looking to solve a large-scale problem: accessible quality healthcare for the masses by providing an immediate solution to help deliver universal healthcare to millions of South Africans,” Bates concludes.

Follow: Teshlin Akaloo @ www.linkedin.com/in/teshlin-akaloo-3187613b

Jessica Bates @ www.linkedin.com/in/jessica-bates-55b7589a

Maria Makhabane @ www.linkedin.com/in/mariamakhabane

Thoneshan Naidoo @ www.linkedin.com/in/thoneshan-naidoo

Lien Potgieter @ www.linkedin.com/in/lienpotgieter

FNB LIFE INSURANCE offers smart, adaptable solutions that go beyond cover – supporting South Africans through life’s uncertainties with real-time claims, rewards, and financial resilience.

Most South Africans are looking for more than just insurance. They want assurance that their plans won’t unravel, their families won’t struggle, and their businesses won’t collapse if life takes an unexpected turn. Ranked among the Strongest Banking Brands in the World (Brand Finance Banking 500, 2023), FNB Life Insurance answers this call with intelligent,

adaptable insurance solutions designed to support clients in real time, across every stage of life and every phase of business.

“Life insurance shouldn’t just be about death,” says Deepesh Desai, CEO of FNB Life Insurance. “It’s about making sure life’s unpredictability doesn’t derail your nancial future.” Funeral insurance plays an equally vital role. With 1.5 million policies covering 4.3 million

lives, FNB Life Insurance understands the cultural and nancial weight of funerals. Between April 2024 and March 2025, FNB paid a fth of funeral claims – totalling over R1-billion – without human intervention, and more than a third of funeral claims are approved and paid within 30 minutes. FNB also scans Department of Home Affairs records to identify deceased policyholders and often initiates claims proactively.

FNB Life Insurance offers two agship products to meet clients’ evolving personal needs:

• Life Customised: Provides up to R100-million life cover and a R30 000 funeral bene t at no extra cost.

• Life and Legacy Plan: Combines life cover with estate planning, helping families build and preserve intergenerational wealth. The offering also includes income protection, critical illness cover, and disability bene ts — providing nancial stability during life’s major disruptions. Clients also earn eBucks, turning protection into real, daily value.

FNB Life Insurance’s commercial offering is built to protect the structural and nancial health of businesses. The Business Credit Protection

Plan simpli es risk management by allowing businesses to cover all credit exposures under one policy. Premiums are dynamically adjusted based on actual balances, offering exible and ef cient protection.

Business Life Insurance extends the safety net across three major risks:

• Key Person Insurance: Covering the loss of essential staff

• Contingent Liability Insurance: Protects business owners who’ve signed surety on debt

• Buy-and-Sell Insurance: Enables smooth equity transfers in case of death or disability

“We use real-time insights to tailor solutions to a business’s strategy, not just its risks,” says Desai. “That allows us to design integrated solutions that align with a business’s strategy, not just their risks.”

This intelligence-driven model drives growth and delivers value through eBucks rewards and optimised premiums, making FNB Life Insurance more than a reactive insurer. It enables continuity, supports growth, and builds resilience into the core of businesses.

FNB Life Insurance’s group risk solutions help employers protect their workforce with a wide range of cover, including life, disability, critical illness, family funeral cover, and income protection bene ts. These are offered as exible standalone options or integrated employee bene t plans.

The offering includes high-value features like:

• Education Protector, with both indemnity and non-indemnity options

• Spouse and family cover, burial repatriation, and accidental death bene ts

• Permanent and temporary disability cover, with medical aid and retirement contributions Group risk clients also gain access to LYRA Wellbeing services, which offer employees and their families free 24/7 counselling and support in all of cial South African languages. FNB’s Staf ng Solutions also provides nancial education workshops and personalised coaching to help employees improve nancial literacy, manage debt, and optimise spending.

Desai adds, “We’re a new and relatively small player in this space, but that gives us

the exibility to co-create solutions that are practical, fairly priced, and simple to implement.”

FNB Group Risk also boasts some of the highest bene t maximums in the market, delivering more value at competitive rates.

FNB Life Insurance’s real advantage lies in how it seamlessly connects with the wider FNB ecosystem. That integration unlocks powerful insights, enables smarter underwriting, and ensures every product is relevant to the client’s current and future needs. Customers can visit an FNB branch, speak directly to their Private Banker or Business Relationship Manager, or explore the FNB App > Menu > Insure.

“We’re not just selling cover,” concludes Desai. “We’re helping clients protect what matters most to you — today and into the future.”

Disclaimer: This is not financial advice. Terms and conditions apply.

First National Bank A division of FirstRand Bank Limited. An Authorised Financial Services and Credit Provider (NCRCP20). Insured by FirstRand Life Assurance Limited, a licensed insurer.

As South Africans live longer, thanks to advances in healthcare, growing wellness awareness and better access to information, one industry is quietly undergoing a transformation.

Life insurers are now facing a generation that will retire later, live longer and expect more from their coverage. Longer lifespans bring extended policy commitments, increased exposure to chronic illness and a growing need for retirement income security.

To meet these challenges, insurers are rethinking their approach. They’re designing products that promote wellness, incentivise prevention through personalised data, encourage healthy lifestyle choices and build long-term nancial resilience.

A key innovation is hyper-personalisation –the use of data to offer real-time, individualised health prompts and nancial incentives based on a client’s health pro le.

“It’s how well we live, not just how long,” says Gareth Friedlander, deputy chief executive of cer of Discovery Life.

Friedlander says life insurance is no longer solely about death cover. While medical advancements have extended life expectancy, the incidence of chronic illness is rising, bringing new nancial and societal pressures. “Longevity is positive,” he adds, “but when people live longer in poor health, it places signi cant strain not just on insurers, but also on families, society and the healthcare system.”

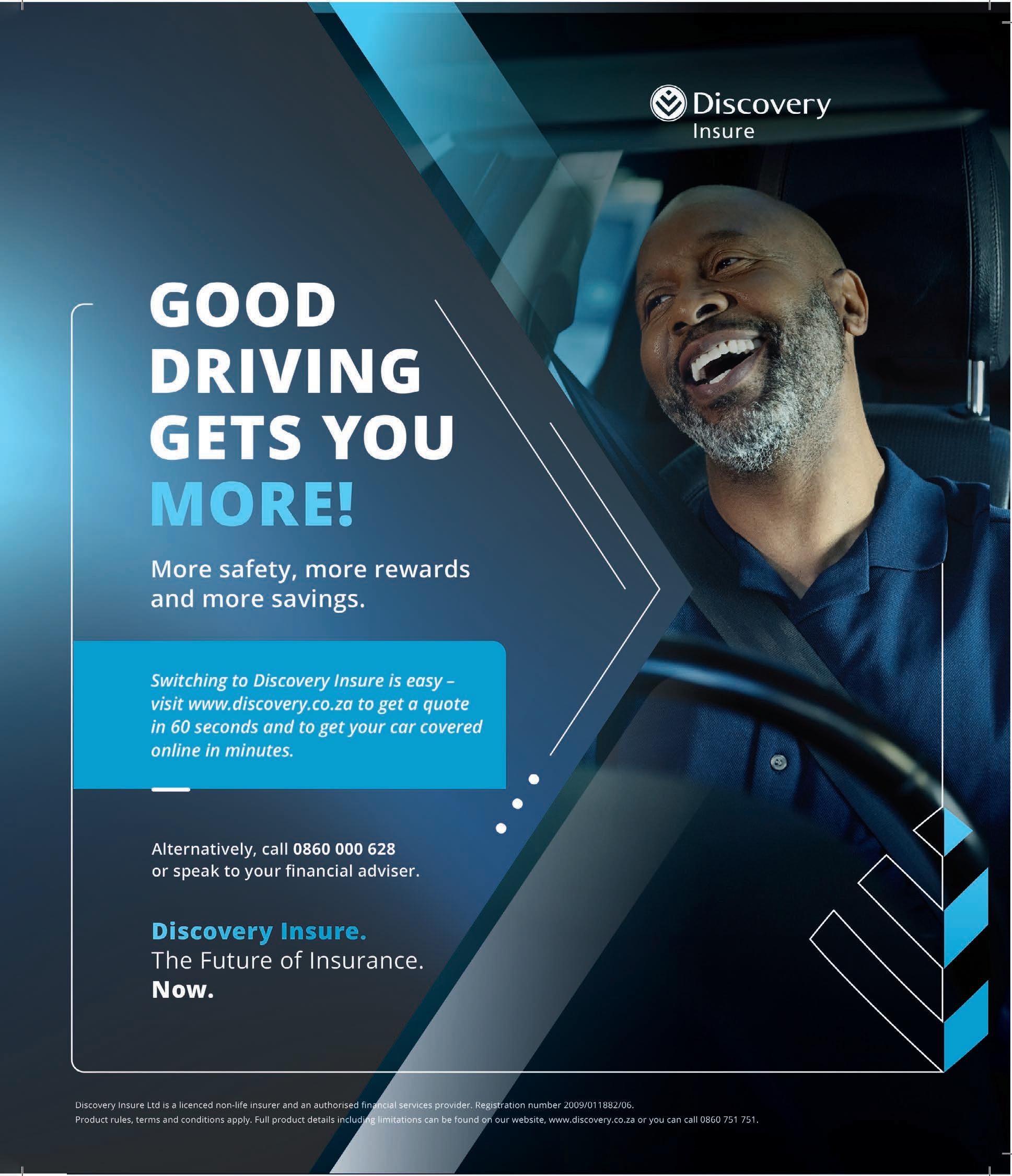

Discovery Life’s shared value insurance model aligns the interests of the insurer, client and society by rewarding healthier lifestyles. Through its partnership with Discovery Vitality, policyholders are encouraged to adopt health-promoting behaviours. A high Vitality status can lead to substantial bene ts, including premium discounts and payback rewards.

In 2024, shared value rewards for healthy behaviours outpaced payouts for death bene ts. Discovery Life paid R2.4-billion in shared value bene ts, including R1.4-billion in paybacks and R1-billion in cash conversions directly linked to how well clients managed their health.

Diamond Vitality members experience more than a 50 per cent reduction in mortality claims and live longer, healthier lives, Friedlander says.

“Hyper-personalisation is a payback booster for policyholders.”

1Life Insurance, the rst insurer in South Africa to offer fully underwritten policies online, is also responding to changing demographics. According to Anton Keet, head of risk at 1Life, the company has seen a 400 per cent increase in new policyholders over the past 10 months.

1Life encourages young people to take out cover earlier when premiums are lower and life

expectancy is higher. It also places a strong focus on nancial education, helping clients plan more effectively for longer retirement periods.

“Gen Z is coming of age,” says Keet. “They’re entering the business world and engaging with nancial services, but they prefer digital access. We’re seeing many rst-time buyers across all age groups. Younger people go online; older clients still prefer face-to-face or phone.”

The company’s loyalty programme rewards customers simply for paying their premiums, with plans to expand rewards linked to health and longevity. “We’re also exploring health self-management tools,” Keet says. “Clients are putting a premium on health.”

While global trends show rapidly rising life expectancies, Keet notes that South African mortality tables have shifted more gradually. Life expectancy in South Africa currently sits at around 66 years.

To attract and support younger policyholders, 1Life has revamped its digital platforms. “We’ve made everything simple and accessible,” Keet explains. “Products are explained in plain language, and claims are fast and hassle-free.”

Insurers agree the future of life insurance will be driven by technology, arti cial intelligence, personalisation and behaviour change, all aimed at supporting healthier, longer and more nancially secure lives.

The days of a life policy quietly tucked away in a drawer, waiting for an untimely death, are over. This industry is not just about the end of life, it’s becoming a partner in how we live.

“While South Africa’s population does not have the same longevity (as other countries), what we have seen is Diamond Vitality clients having life expectancy of eighty- ve years – longevity largely based on behaviour,” Friedlander says. “They live twenty years longer.”

Meeting the needs of grieving families requires more than a cash payout, writes VUSI KHATHI , AVBOB Mutual Assurance Society general manager for tied sales

Adeath in the family is a time of grief and, often, confusion. At this point, the deceased’s insurance coverage is vital. Now is the time for the policy to act and deliver.

Policyholders expect more from their insurance. The whole industry has evolved. An in ux of new players in the market, particularly nontraditional providers such as banks and telcos, has raised the market’s expectations. Chief among these is that funeral and life policies must be exible and cater to customer needs.

Understanding those needs is the most important, along with enabling agents and brokers to determine and support them. For example, African funerals can be large events with many family members and friends in attendance. Does the policy cover things like catering or transport? Some funerals will include cultural events, such as the slaughtering of cattle. Can the policy facilitate that request? In some events, the needs are straightforward and yet crucial. What if the deceased died in Gauteng, but their family and home are in the Eastern Cape? How will the deceased reach their destination?

It’s easy to say that a policy must cover these things, but that is not enough. Dynamic cover is a process that incorporates several crucial elements.

Let’s start at the beginning. Was the policy coverage based on the customer’s needs and capacity? There is no point in selling a policy that someone cannot afford. Is the policy exible, can customers add more people if their nances improve? It’s also important to

be transparent when offering policies, particularly with new regulations for the funeral cover industry. For example, agents and brokers should be clear on what policies they can and cannot offer.

When the worst happens, can the policy deliver? Again, the issue is not just about money. It’s about enabling staff and brokers, the people at the frontline who communicate with the family and understand the community’s needs. AVBOB equips our personnel with tablets that contain all the necessary services to access what they need easily.

survivor’s bene t, funds that can help support them for several months.

The mutual society model is what enables us to support many of AVBOB’s value additions. Since our policyholders or members are shareholders, we reinvest pro ts into the business. This reinvestment is what enables us to offer services like free body repatriation or giving additional bene ts to policies older than two years.

Flexibility is crucial for our customers and from a business standpoint. Cost pressures have resulted in fewer people holding funeral policies than in recent years. When they have a policy, they want to see value, to treat it as an investment. This expectation lands on agents and underwriters, and it takes more than writing a cheque to meet those expectations.

Funeral cover is fundamentally a people business. Even though AVBOB provides digital and self-help channels, most of our customers want a person they can speak to. The trust in our brand depends on the trust in our people, and our exibility depends on how we enable them through technology, networks and community access.

Does the deceased’s body need to be transported? We are able to leverage our national network and our mutual assurance society model to provide transportation. Is a tent needed for the funeral? Our agents have channels to source it, whether from our national network or through a local business. What about afterwards? The family could access a

Flexible and dynamic cover is not just about one or two things. It grows from understanding what our customers need and putting the processes and networks in place that our employees can leverage. This is how funeral policies can deliver beyond the basics: not through a number, but through a business model that enables people, networks and communities.

INITIATIVES THAT EDUCATE PEOPLE NOT JUST ON INSURANCE, BUT ALSO ON BUDGETING, SAVING AND DEBT MANAGEMENT.

life insurance

South Africa faces a life insurance shortfall of R34.7-trillion, a silent crisis that threatens the financial stability of millions of households.

DAVID JEWELL, managing executive at Liberty, a wholly owned subsidiary of The Standard Bank Group, unpacks the human cost behind the numbers

In a country as resilient and aspirational as South Africa, one would expect a strong foundation of nancial protection underpinning families and communities. Yet, the reality tells a different story. According to The Association for Savings and Investment South Africa (ASISA), South Africa faces a staggering life insurance shortfall of R34.7-trillion, a number so vast, it’s almost incomprehensible, yet its implications are painfully tangible for millions of households.

As we confront an economy weighed down by poverty, inequality and systemic legacies, this insurance gap signals more than a statistical oversight. It’s a silent crisis; one that leaves families vulnerable to economic devastation when the unexpected strikes.

This shortfall, outlined in the 2022 ASISA The South African Insurance Gap Report, represents the difference between the nancial protection South African earners need versus what they actually have. It accounts not only for life insurance, but also disability and critical illness cover – key pillars of any resilient nancial plan.

What makes this gap so alarming is its human cost. When a breadwinner is lost or incapacitated, entire households can spiral into nancial despair. Dreams are derailed, children’s education is halted and generational progress is reversed.

Why does this gap persist? Affordability is a critical factor. In a country where many households struggle with basic expenses, insurance often feels like a luxury. Yet the problem runs deeper. There’s a persistent lack of nancial literacy, limited access to advice and structural complexity in acquiring the right cover.

Many consumers don’t fully understand the risks they’re exposed to or the true cost of being uninsured. While funeral policies offer cultural relevance and accessibility, they don’t provide

comprehensive cover for all needs. Funeral cover is a necessity but not suf cient and the importance of additional life insurance cannot be overstated. It isn’t theoretical. I’ve seen rst-hand how a well-structured Liberty policy helped a loved one maintain dignity, income and independence after a life-altering medical event. That moment underscored for me why insurance is not just a product; it’s a promise.

Addressing the life insurance gap begins with awareness. We must help South Africans understand the nancial risks they face and guide them toward practical solutions. Financial advisers play a crucial role here, not just in providing technical guidance on estate planning or tax, but in helping individuals clarify their needs, take action and stay the course. They are the architects of nancial futures.

For most people, insurance isn’t an exciting Saturday morning activity. It requires discipline to forgo present comfort for future certainty. That’s why starting small and building a portfolio over time is both achievable and impactful.

We are seeing promising innovation. At Liberty and as part of the Standard Bank Group, we’ve introduced life products that offer meaningful cover with minimal underwriting, three questions and ve minutes to secure half a million rand in life cover. With more detailed underwriting, even greater coverage becomes possible. We’re also leveraging digital channels to drive down costs and reach more people where they are through their phones, banking apps and workplaces.

High life insurance penetration has bene ts that stretch beyond individual households. It boosts nancial resilience, protects consumer spending and reduces the reliance on state welfare. Importantly, it creates a safety net that allows families to maintain progress across generations. When insured families receive a capital injection in times of crisis, they’re not just surviving; they can pivot, pay off debt, invest or start anew.

Moreover, the insurance sector fuels national savings, creates employment and supports capital markets. In a time when South Africa is reimagining its growth trajectory under a government of national unity, insurance must be seen as a strategic lever for economic stability. To truly move the dial, corporate South Africa must also lean in. Employers can strengthen employee value propositions with accessible group bene ts and allow providers into workplaces to provide tailored advice and products. Equally, we must continue investing in

nancial literacy initiatives that educate people not just on insurance, but also on budgeting, saving and debt management.

The journey ahead is long, but we must start taking action immediately. The cost of inaction is too high for families, communities and the nation.

Let’s move from conversations to commitments. Let’s make life insurance not an afterthought, but a cornerstone of South Africa’s nancial future and protect what matters most.

While life insurance plays a vital role in securing families and generational wealth, short-term insurance is just as critical to economic stability, particularly in a world of rising risks, writes JOHAN

VAN GREUNING, head of Standard Insurance Limited

From floods to fires, the frequency and severity of climate-related disasters have increased dramatically. These events not only devastate lives and property, but also strain public resources and disrupt entire economies.

Short-term insurance ensures individuals, businesses and communities can recover faster, reducing the long-term financial impact of such events.

to access coverage. This makes it difficult for insurers to spread risk across a broad base, leading to higher premiums and tougher underwriting, creating a cycle of exclusion.

Despite these challenges, opportunities exist. Digital innovation, microinsurance models, and public-private partnerships offer pathways to increase coverage. Technology enables insurers and reinsurers to use better risk modelling, improve pricing accuracy and reach underserved communities through mobile platforms.

Yet across Africa, short-term insurance penetration remains alarmingly low. In South Africa, it sits below 20 per cent. In some African countries, it’s closer to 1–2 per cent. This leaves the majority of people financially vulnerable when disaster strikes, shifting the burden of recovery to governments, nongovernmental organisations and families themselves.

Several factors contribute to this low uptake, chief among them are cost, limited awareness and distrust of the insurance system. For many low-income households, insurance is seen as a luxury. Others simply don’t understand the benefits or how

Reinsurers also play a key role by absorbing a portion of the risk, making it possible for insurers to remain in high-risk markets without passing excessive costs on to consumers. Meanwhile, the South African government has committed billions to disaster relief and infrastructure rebuilding, signalling the urgent need for more proactive, insurance-based approaches to resilience. Ultimately, building financial resilience requires both life and short-term insurance to work in tandem. While one secures the future of families, the other shields everyday life from disruption. Expanding access to both is essential to ensure individuals, businesses and communities are equipped to withstand the shocks of a changing world.

SOUTH AFRICAN INSURANCE GAP REPORT

• South Africa: less than 20 per cent.

• Other African countries: as low as 1–2 per cent.

• Affordability: high premiums deter participation.

• Awareness gaps: limited financial literacy about insurance benefits.

• Trust deficit: perceived unreliability of insurers.

• Economic pressures: unemployment and inflation impact affordability.

OPPORTUNITIES FOR GROWTH

• Microinsurance: tailored, low-cost products for low-income groups.

• Digital access: mobile-first platforms improve reach.

• Public-private partnerships: collaboration expands coverage and trust.

• Global risk-sharing: protects insurers from catastrophic losses.

• Premium stability: helps manage claims and keeps policies affordable.

• Tech-driven risk modelling: AI and data refine pricing and predict risks.

SOUTH AFRICAN GOVERNMENT’S SUPPORT

• R1.7-billion: allocated for immediate disaster relief.

• R4-billion: for rebuilding infrastructure and long-term recovery.

• Working with municipalities on climate-resilient capital projects.

Source: Standard Insurance LImited

Follow: David Jewell @ www.linkedin.com/in/david-jewell-ba913a12 Johan van Greuning @ www.linkedin.com/in/johan-van-greuning

How could an “act of God”, the weakening rand and an underinsured property cause headaches to a homeowner in South Africa? Two seasoned insurance professionals weigh in and offer advice. By VANESSA

ROGERS

Don’t wait for a massive storm to hit before checking your insurance cover, this cautionary warning comes from Christelle Colman, chief executive of cer and founder of Ami Underwriting Managers. “Be proactive and ask your insurer precisely which categories of disaster are covered in your policy, and which are not, meaning no unpleasant surprises at claim time.”

Indeed, an “act of God” is used in both legal and insurance contexts, but there are nuances. Legally, it refers to a catastrophic peril that is impossible to prevent, serving as a defence against liability. In the insurance industry, however, the term refers to a natural disaster that may or may not be covered, depending on the terms and conditions of the policy.

Tarina Vlok, managing director at Elite Risk Acceptances, says top insurers have been

enhancing their offerings in anticipation of the unpredictable weather patterns climate change is expected to bring. “We don’t want to reach a point where insurers withdraw from particular areas, as has occurred in California following the devastating January 2025 wild res. To build industry resilience, we must keep pricing appropriate so clients pay in proportion to the risk they introduce to the pool.”

Can property owners adequately prepare for random events? Vlok points to the Financial Sector Conduct Authority’s newly sanctioned parametric policies, where a fund responds only in the event of a disaster. “While the concept gained regulatory approval in 2024, the market on the African continent is still evolving with the current focus strongly on crop insurance.

Parametric insurance pays a pre-agreed amount when a speci c threshold is met, rather than relying on an actual damage assessment. It shows great potential for the insurance industry in the face of climate change.”

Colman agrees about the importance of preparedness which, in South Africa, means

“FOR INSURANCE PURPOSES, RESIDENTIAL PROPERTY VALUE IS DETERMINED BY THE REINSTATEMENT COST IN THE EVENT OF A TOTAL LOSS.”

– TARINA VLOK

Tarina Vlok, managing director at Elite Risk Acceptances, says insurers are constantly seeking ways to reduce claim costs. With strong buying power, they can negotiate better prices with suppliers. “However, the weakening rand has driven up the cost of imported goods, contributing to higher premiums,” she explains. “We’re also closely monitoring tariff developments to continue delivering value to our policyholders, regardless of economic shifts.”

taking any warnings of extreme heat, drought or heavy rain seriously. “The coming summer’s projections underscore the need for meticulous homeowner preparation, balancing safety protocols with insurance considerations,” she advises. This includes clearing gutters and dry vegetation to reduce re risk and preparing an emergency kit and evacuation plan, as seen during the April 2025 Table Mountain wild res in Cape Town.

While South Africans tend to be optimistic, Colman reiterates that being organised is our most effective shield. “You’re advised to meet unpredictable natural events with a strong mix of robust insurance cover and precise planning,” she enthuses. “Keep your insured values aligned with economic realities, such as in ation and the weakening rand, and never let your coverage fall behind the rebuilding cost or the risk pro le of the property.”

Having an expert review your policy details is invaluable. “While direct insurance has its place for a subset of consumers, the responsibility then lies with the insurer to point out the relevant exclusions and conditions. Underinsurance is a signi cant issue in South African property insurance. Data shows eighty per cent of properties are underinsured by at least forty per cent,” says Colman.

“My team ensures properties are valued accurately at reinstatement or replacement cost. If assessed at market value, the payout could be reduced by the underinsurance percentage, effectively making the property owner a co-insurer.”

According to the Financial Intermediaries Association of South Africa, the insurance industry suffered substantial losses due to the KwaZulu-Natal floods in April 2022. As a result, premiums increased by between 15 and 20 per cent to accommodate rising claims and prepare for similar future events.

Homebuyers should also investigate the insurance standing of a property before purchasing. This due diligence could include reviewing the area’s claims history such as frequent pipe bursts or power surges and noting whether the property sits on a ood line, which could affect cover eligibility.

“A well-protected home with up-to-date insured values, solid safety features and no insurance red ags, is far more attractive to future buyers. If disaster strikes, it can be restored to full value, safeguarding the owner’s investment,” says Colman.

Upon purchasing a home, managing risk becomes your responsibility. Regularly updating your policy to re ect renovations or valuable new purchases and understanding exclusions, such as those related to municipal infrastructure shortcomings, are essential steps to preserve your asset’s value.

“In a recent travel insurance claim, I was shocked to nd ne print that limited my payout. If this could happen to a professional, it can happen to anyone. Your vigilance is vital,” she cautions. Her advice: review policies annually, ask pressing questions and adjust your cover as needed to keep it in line with the actual value of your property and possessions.

“For insurance purposes, residential property value is determined by the reinstatement

cost in the event of a total loss,” Vlok explains, adding that insurers are becoming “increasingly cautious about properties in high-risk areas”.

Following severe ooding in parts of the country, ood insurance has become dif cult to obtain, even in upmarket coastal towns like Knysna and exclusive estates like Val de Vie. “This trend means homeowners in disaster-hit regions may face higher premiums and special deductibles, or may be unable to obtain full cover,” Colman notes. What about failing infrastructure, such as widespread potholes? Vlok says insurers are concerned, as this not only affects supply chains, but also drives up claims costs. “Load shedding was another major expense for insurers in 2023, prompting exclusions or restrictions across many policies. Reinsurers have also expressed concerns about the national grid’s stability, which led to the implementation of grid-collapse exclusions,” she adds.

All these factors, risk level, insurability and coverage options directly in uence your property’s value. “If your home is underinsured or located in an increasingly uninsurable zone, its value, both to you and potential buyers, can decline,” Colman concludes. “Insurance should provide peace of mind, but it’s most effective when you actively engage with it and minimise your nancial risk through informed decisions.”

“YOU’RE ADVISED TO MEET UNPREDICTABLE NATURAL EVENTS WITH A STRONG MIX OF ROBUST INSURANCE COVER AND PRECISE PLANNING. KEEP YOUR INSURED VALUES ALIGNED WITH ECONOMIC REALITIES.”

– CHRISTELLE COLMAN

Follow: Tarina Vlok @ www.linkedin.com/in/tarina-vlok Christelle Colman @ www.linkedin.com/in/christelle-colman

“MANY INSURERS ARE CUTTING BACK COVERAGE OR DECLINING RENEWALS ALTOGETHER. THIS EFFECTIVELY RENDERS SOME RISKS UNINSURABLE.”

– ANDRIES WIESE

As climate change continues to fuel increasingly erratic and extreme weather, the agricultural insurance industry is facing a sharp rise in claims, writes ELRIZA THERON

Farmers are being hit by everything from prolonged droughts to unexpected frosts and severe ooding, prompting greater reliance on insurance for survival. In recent years, nature, and particularly the climate, has been blamed for a wide range of disruptions. While extreme weather is certainly increasing, it’s worth noting that weather patterns historically have been cyclical.

Traditional insurance models were built around this, using historical data to assess risk and set premiums. However, with weather events becoming both more severe and more frequent, those models are proving increasingly unreliable. The past was far kinder to insurers than current conditions suggest.

This shift is especially concerning in vulnerable regions where extreme weather is most costly and where insurance coverage or disaster recovery support is limited.

Andries Wiese, head of agricultural insurance at Hollard, highlights Africa’s unique vulnerability due to the “protection gap”, referring to the difference between what should be insured and what is. “Globally, insurance coverage typically ranges from forty to fty per cent, but in Africa, it drops drastically to just eight per cent, leaving ninety-two per cent of potential risks uncovered,” he explains.

Against this backdrop, proactive risk management is no longer optional. It’s becoming critical as insurers confront new risks, limited capacity and tighter regulations.

“One of the biggest challenges is the shrinking pool of insurance capacity,” says Wiese. “Many insurers are cutting back coverage or declining renewals altogether. This effectively renders some risks uninsurable. In response, insurers are raising deductibles, tightening terms and introducing exclusions for risks such as wild res in high-risk areas. As premiums rise, some businesses are opting out of coverage entirely or accepting more self-insured risk to manage costs.”

Farmers and other policyholders are urged to review their cover closely. “There may still be room for negotiation, especially where risk is being managed actively,” Wiese notes.

Insurers are also evolving, increasingly using satellite imagery and geo-mapping to identify high-risk zones, such as ood-prone areas.

One emerging solution is parametric insurance, also known as index insurance, which is gaining popularity for insuring large regions or groups of farmers.

Previously unavailable in South Africa due to regulatory de nitions, parametric insurance is now being explored as a viable tool. Unlike traditional policies, this model pays out based on pre-agreed indicators, such as rainfall or temperature thresholds, rather than actual losses.

“If, for example, rainfall is thirty per cent below normal and this correlates to an eighteen per cent crop loss, then all insured farmers in that area would receive a payout of eighteen per cent of their expected crop value,” Wiese explains. While this can result in over- or under-compensation for individuals, it enables fast, transparent payouts and broader risk coverage. The model works best over large areas where risk pooling lowers costs. However, this also means that if the area average doesn’t meet the loss threshold, even severely affected individual farmers may receive no payout.

Though not perfect, parametric insurance offers a valuable alternative. But, Wiese cautions: “It’s important to understand the mechanics. It’s not a one-size- ts-all solution.”

Importantly, climate risk extends beyond crops. Extreme weather also damages infrastructure essential to farming like packhouses, cold storage facilities and silos. Losing such assets can halt operations altogether, making their protection just as critical.

South African farmers are known for their resilience, growing world-class produce under some of the harshest conditions. However, that resilience must now be matched with strategic adaptation. The old assumption of a stable climate no longer applies. Farmers must align their practices with new realities and prepare for the ongoing challenges that nature increasingly brings.

Your home is more than just bricks and mortar; it’s your sanctuary, your most valuable investment. It’s also a cornerstone of your financial security and where you keep your most prized possessions. PAUL STEVENS, chief executive officer of Just Property Home insurance, shares essential information for homeowners

Homeownership involves more than just purchasing a property; it requires a clear understanding of the types of insurance needed to protect your investment. With various policies covering different aspects of your home and its contents, it’s crucial to know what coverage is required, what’s optional and what each policy entails. In this guide, we break down the key types of insurance every South African homeowner should be aware of.

Homeowners’ building insurance protects both the homeowner and the nancial institution and is mandated by the bank when you register a bond to nance the purchase of a new

home. It covers the structure of the home against loss or damage caused by unforeseen events.

Not all homeowners’ building insurance policies are equal, so it is vital to read your policy document carefully to understand what is and isn’t covered. It is also important to be aware that while these policies cover the structure of the property and all permanent ttings, they do not cover household contents and personal items.

Another important factor to bear in mind is that insurance companies may have valuation issues and reject claims made in respect of unapproved structures on your property. Therefore, it is best practice to ensure all house plans have been approved before signing the offer to purchase. Structures requiring approval include xed patio awnings, swimming pools, carports and even perimeter walls.

Cover varies from one insurance company to the next, in both claim value and items covered, making it crucial to read and understand all the details in your policy document.

Homeowners’ building insurance usually extends to (but is not limited to):

• Accidental or malicious damage to the property.

• Structural damage arising from the likes of re, explosions and natural disasters such as oods.

• Damages caused by leaking or burst geysers and pipes.

• Additional structures such as swimming pools, garages, carports, paving, perimeter walls and outbuildings.

Bond insurance – not to be confused with homeowners’ building insurance – is a separate life policy that covers the balance owed on your bond in the event of the bondholder’s death or disability. Usually not obligatory, taking out bond insurance is a good way to protect your loved ones from outstanding bond debt in the event of unforeseen circumstances. Bond protection is particularly important if the home was purchased jointly (for example, married couples or co-buyers) and one party passes away.

Designed to protect the items inside your home against loss, damage or theft, home contents insurance generally covers personal household objects. The speci cs vary from one insurance company to the next, so make sure you understand exactly what is and isn’t covered by your policy. Such policies generally exclude xed items, such as light ttings, taps and tted carpets, but include furniture and appliances, such as televisions and microwave ovens, although this may vary by provider. A useful analogy for determining whether something should be included in your home contents insurance is to imagine picking up your house, turning it upside down and giving it a good shake. Everything that falls out should be included in your policy.

The most common types of property ownership in South Africa are freehold and sectional title and they are distinctly different. Paul Stevens, CEO at Just Property Home insurance, shares what you need to know

In freehold property ownership, you own both the land and the dwelling(s) on it, and you are solely responsible for insuring the entire property. If you buy a freehold property within a security or gated estate, you have the same responsibilities as any other freehold property, but you may have to adhere to conditions stipulated by the complex’s homeowners association.

There are three elements to sectional title scheme ownership. Homeowners own a specific unit (or section) of a building or complex; they have a share of the common areas, such as driveways, gardens and lifts; and they may have exclusive use of a portion of the common property such as a garage, parking bay, balcony or storeroom.

Sectional schemes are managed by a body corporate, consisting of all owners of the building or complex. When you buy into a sectional scheme, you automatically become a member of the body corporate, which is responsible for maintaining and managing the common property.

Body corporate insurance, a legal entitlement for all developments in South Africa, covers the common property and buildings. The cost is usually shared by all owners and factored into the monthly levies.

While sectional title insurance covers the brick-and-mortar structures of a scheme and all common-use areas, each section owner is responsible for their own household contents insurance.

As is true of all insurance policies, owners in sectional title schemes should read and understand all policy documents to avoid potentially unpleasant surprises.

When determining the value of your home’s contents for insurance purposes include all contents. This will ensure an accurate value based on what you will need to pay today to replace the item, not what you paid for it when you bought it.

IT’S ADVISABLE TO REVIEW THE VALUE OF YOUR HOUSEHOLD CONTENTS ANNUALLY AND INFORM YOUR INSURANCE COMPANY OF ANY DEPRECIATION OR CHANGES.

If you under- or over-insure your household contents, your insurance company may either reject your claim or pay out only a percentage of it.

As the cost of living increases, the replacement value of your possessions will change over time. It’s advisable to review the value of your household contents annually and inform your insurance company of any depreciation or changes such as new appliances or items you no longer own.

Possible exclusions:

• General wear and tear.

• Damage caused by pets.

• Certain items not speci ed in your policy.

• Items covered by a manufacturer’s warranty.

• Negligence.

• Accidental damage or loss.

Whether a weekend away or an extended trip, any time your home or business is left unattended, it becomes vulnerable. Karen Rimmer, head of distribution at PSG Insure, says now is always the right time to review your short-term insurance and ensure your security measures are in place. “When properties are left empty, it’s crucial your insurance policy accurately reflects the value of your possessions and that your security systems are not only installed, but actively used,” she advises.

A major oversight? Not updating your insurance after changes like home renovations, new security installations or acquiring high-value items. “Having the right cover and up-to-date information helps you avoid issues when it’s time to claim,” Rimmer explains. “Also be aware of policy conditions or exclusions that could affect your payout.” Alarm systems and other safety features must be properly used. For instance, if your insurer requires an active alarm when the property is vacant, not using it could invalidate a claim.

To reduce risk when leaving your property:

•Test your alarm system and replace batteries if needed.

•Ensure locks, gates and garage doors are secure.

• Consider CCTV, remote monitoring or hiring a guard service.

•Safely store or remove valuable items and documents.

Simple proactive steps:

•Have someone stay over: a house sitter can provide an effective deterrent. If not possible, install solar or timer lights to mimic occupancy.

• Handle visible signs of absence: ask a neighbour to collect post, bring in bins or keep an eye on things.

• Be cautious online: avoid posting travel plans or check-ins on social media while you’re away.

• Consult your insurer: a quick conversation with your adviser can ensure your policy still matches your needs.

Top things you need to know

From delayed flights and lost luggage to unexpected hospital visits abroad, travel insurance can be a genuine trip-saver, but only if you’re aware of the fine print and know exactly what your policy does and does not cover.

By BUSANI MOYO

Many travellers are caught off guard when making claims due to overlooked exclusions such as pre-existing conditions, restrictions around adventure activities and alcohol-related clauses. Simmy Micheli, sales and marketing manager at Travel Insurance Consultants (TIC), a division of Santam and South Africa’s largest travel insurance provider, shares her expert insights on how travellers can avoid such pitfalls.

“Historically, travel insurers sought to insure emergency medical expenses for travellers going to international destinations,” says Micheli. “More recently, we’ve introduced emergency hospitalisation for in-patient costs, which extends cover to certain pre-existing conditions. This bene t, however, is not standard across all products, tends to have a speci c bene t limit and is often subject to an age cap.”

She explains that most leisure sports are typically covered under a travel policy. Activities such as skiing, scuba diving or snorkelling generally fall within the standard scope. However, when it comes to higher-risk or so-called hazardous pursuits, caution is key. “Exclusions can apply to activities like high-altitude hiking, canyon treks or off-road biking. The extent of coverage varies between insurers so always verify with your provider before your trip,” she advises.

Pregnant travellers should take extra care. “Pregnant individuals usually enjoy emergency coverage up to the 25th week of pregnancy. Beyond that, complications related to the pregnancy are typically excluded,” she notes.

“TOPPING

Similarly, business travellers should be aware of manual work-related exclusions. “Injuries resulting from manual labour are not covered unless you’ve taken out a speci c policy that provides for such activities,” says Micheli. For those travelling within Africa, she also stresses the importance of comprehensive protection against tropical diseases like malaria. “It’s essential to ensure your policy offers unconditional cover, particularly as claims may require evidence of preventative measures such as vaccinations or prophylactics,” she says.

To maximise coverage, Micheli recommends purchasing travel insurance as soon as you book your trip. “Trip cancellation bene ts are much stronger when the policy is purchased within a few days of con rming your travel plans,” she explains. Doing so can mean the difference between recovering costs from unforeseen events or absorbing them yourself.

Many travellers assume their bank cards or medical schemes provide suf cient travel protection, but this is often limited to basic emergency medical bene ts. “Topping up with stand-alone insurance enhances your safety net, expanding protection to include missed ights, trip delays, baggage loss and even repatriation if needed,” she says.

Micheli also encourages travellers to prepare for the unexpected even after purchasing a policy. “Before departure, familiarise yourself with your insurer’s emergency procedure. Medical providers frequently require guarantees of payment from insurers before treatment. Some insurers may also require registration on a dedicated assistance portal prior to travel, which can facilitate quicker claims processing and support,” she explains.

– SIMMY MICHELI

Artificial intelligence is helping insurance providers understand their customers better and serve them faster – but it’s not without its risks,

writes ANTHONY SHARPE

Arti cial intelligence (AI) is inexorably nding its way into almost every facet of our lives, reshaping how we interact with information and services in ways both obvious and subtle. Everything from our shopping habits and musical taste to the driving routes we take and the information we nd is in uenced by algorithms that aggregate and analyse our behaviours, learning what we want – or what the patterns of these behaviours suggest we want.

With its ability to parse vast datasets much faster than a human could, AI is a natural t for industries that depend on behavioural analysis to function effectively, with insurance being a prime example.

“LARGE LANGUAGE MODELS ARE PERFECTLY SUITED TO HELP DISTIL LENGTHY POLICY DOCUMENTS INTO COMPREHENSIBLE INFORMATION.”

– PIETER VENTER

Pieter Venter is a co-founder of digital insurance advisor Ctrl. He says this technology underlies the apps the company produces, which let customers go through underwriting questions, get a range of quotes and accept them quickly and conveniently. “There’s an algorithm that

makes recommendations far quicker than a human advisor could because of the time it would take to read through all that information and adequately compare the quotes. The algorithm rates the quotes not only on price, but also on the excess and how it affects the overall cost.”

Venter believes the insurance claims process is fundamentally awed, but customers are motivated to work through it because they need redress for their loss. “What annoys people, however, is if they get to the end of the process only to nd out they’re not covered. That’s where the real problem lies: did you understand the cover you bought to begin with?”

He says large language models are perfectly suited to help distil lengthy policy documents into comprehensible information, with citations that show exactly which clause covers what. “If you help people understand what they’re covered for from the outset, you solve a lot of claims process issues there and then. People claiming for things they aren’t covered for introduces friction into the system.”

Of course, for insurance providers to leverage the power of AI, they need to feed it personal data about their customers. This introduces some ethical and regulatory questions about privacy.

According to McKinsey, artificial intelligence (AI) is coming to bear on several key factors:

• Underwriting and pricing: more personalised insurance products are being enabled through real-time risk assessment and dynamic pricing models.

• Claims management: with automation streamlining processes, turnaround times can be reduced significantly.

• Customer engagement: AI insights are powering more personalised customer interactions, improving retention and loyalty.

• Operational efficiency: AI-driven automation is reducing costs and freeing up human resources to focus on more strategic tasks.

Professor Emma Ruttkamp-Bloem, head of the Department of Philosophy at the University of Pretoria, says that in South Africa, various intersecting pieces of legislation govern how this data is managed, with the Protection of Personal Information Act (POPIA) being the most applicable.

“According to POPIA, people have the right to know that their data is being collected, why it is being collected and how decisions will be made based on that data,” she explains. “They also have the right to ask that their data be deleted.”

Then there is the matter of third-party sharing regulations, says Professor Ruttkamp-Bloem. “Will the insurance company share the data with af liated banks or other insurance companies? Moreover, if they say they will depersonalise your data, you have the right to ask what that means because if they are hacked, it’s still possible to nd traces of identity in depersonalised data.”

Professor Ruttkamp-Bloem says the best way forward for the industry, as it brings AI to bear on its operations, and the best way to engender trust in customers is to provide this information. “Companies need a data of cer who customers can contact. In the end, the only way to adopt AI sustainably is to adopt it ethically because even one lawsuit can cause huge reputational damage.”

Follow: Pieter Venter @ www.linkedin.com/in/pieter-venter-ctrl

Professor Emma Ruttkamp-Bloem @ www.linkedin.com/in/emma-ruttkamp-bloem-19400248

In the ever-evolving insurance landscape, cyclical shifts between aggregation and intermediation are common. While many companies are drawn to aggregation, Lombard Insurance’s decision to “grow big by staying small” sets a powerful industry precedent, writes ANTOINETTE SHAND, Managing Director

Lombard was founded on guarantee products, originating in the construction industry 35 years ago. Since then, we’ve diversi ed into multiple guarantee solutions, built long-lasting partnerships with ten underwriting management agencies (UMAs) and two divisions that develop specialist insurance solutions on our behalf.

Antoinette Shand

Globally, there’s been signi cant growth from managing general agents (MGAs) – UMAs in South Africa – who utilise their specialisation, product exibility, innovation and increasing focus on technology, data and analytics to drive growth. The United States MGA market shows a 20 per cent year-on-year growth with an estimated $102-billion in premiums in 2023 –re ecting a shift in insurer risk appetite and strategy.

We believe the South African market will follow this trend. While there has been some recovery, the physical risk space (motor, property and so forth) has faced signi cant challenges in recent years due to oods, riots, storms and res. There appears to be a strategic shift by major incumbents towards diversi cation and the pursuit of returns from the specialist insurance market. UMAs account for an estimated R22-billion in gross written

“OUR APPROACH PRIORITISES HUMAN CONNECTIONS, RECOGNISING THAT PEOPLE PREFER DOING BUSINESS WITH PEOPLE.”

premiums (15–17 per cent of the short-term market), with specialist lines comprising 40–50 per cent of that value.

In an industry full of noise, rapid change and shifting customer needs, clarity of our unique market position is crucial. Last year, we made the dif cult decision to sell our commercial motor and property division. This business represented a departure from our stated strategy that focused on specialist risk and partnership-driven growth.

Although self-re ection is challenging, by staying true to our values and leveraging our strengths, we have committed to an evolutionary journey to strengthen what we do best – building meaningful partnerships and delivering specialist insurance solutions through UMA partners who t our criteria and align with our values.

Lombard gained a strategic shareholder last year – the Cert. Group, a global insurance licence platform holding four other international insurance licences. This relationship enables us to “grow big” without the burden of large corporate head of ce costs or a rigid global strategy. Aligning with this group provides a broad perspective and additional resources, even as our operations remain distinct.

In line with our commitment to “staying small”, Lombard’s highly successful Guarantee division will become an independent UMA and partner to Lombard. It will be part of the Credeq Group – a family of guarantee, credit insurance, ntech and nancial risk businesses across Europe, the United Kingdom and Australia. Credeq SA will operate under and leverage off a global brand, but maintain regional independence.

Logic suggests that consolidation of businesses, systems and processes leads to better ef ciencies. But are the economies of scale truly more effective?

One of the most compelling aspects of Lombard’s strategy is our emphasis on people who value in uence over control. In a highly regulated environment where oversight and control are inherent, there is both an art and a science to achieving this balance. This doesn’t mean we don’t value better ways to manage ef ciencies; our approach prioritises human connections over systems and processes, recognising that people prefer doing business with people.

“Partnership” is a buzzword tossed around like confetti. Many claim to embody this value, but true partnership is de ned by authentic collaboration and practice. We don’t always get it right, but we can honestly say that our partners – people and businesses – are our reason for being.

As the industry steadily evolves, our commitment to this purpose and our strategy of “growing big by staying small” will serve as a guiding light.

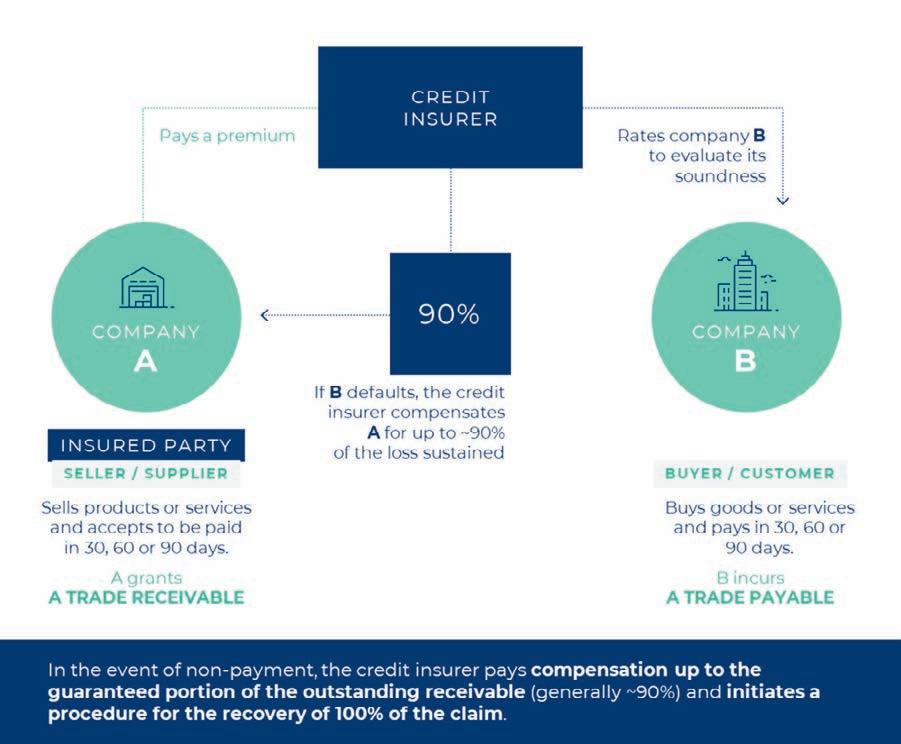

In the dynamic and often unpredictable South African commerce landscape, businesses face numerous challenges that can impact their financial stability. One of the most significant risks is the potential for unpaid invoices, which can severely disrupt cash flow and profitability, shares COFACE

In South Africa, the need for trade credit insurance has grown signi cantly due to economic volatility and the increasing risk of customer nonpayment. Statistics show that 80 per cent of small businesses face unpaid debts regularly, highlighting the critical need for effective risk management solutions.

Trade credit insurance is not just a safety net; it’s a strategic tool that enables companies to manage risk, protect their cash ow and drive growth.

Trade credit insurance is designed to protect businesses against the risk of nonpayment by their customers. When a company extends credit to its buyers, it inherently takes on the risk of those buyers defaulting on their payments.

This risk can be particularly acute in South Africa, where economic volatility and varying creditworthiness among businesses can pose signi cant challenges.

Coface’s trade credit insurance offers a robust solution to this problem. By insuring invoices against late payments or total defaults, businesses can trade con dently, knowing their receivables are protected. This protection not only stabilises cash ow, but also enhances the overall nancial resilience of the company.

Consider a South African manufacturing company that supplies products to various retailers countrywide. The company extends credit terms to its customers, allowing them to

pay for goods 30 days after delivery. However, one of the major retailers faces nancial dif culties and fails to pay a substantial invoice of R500 000.

With Coface’s trade credit insurance, the manufacturing company is protected against this nonpayment. The insurance policy covers the unpaid invoice, ensuring the company receives the R500 000 owed. Additionally, Coface’s value-added debt collection services come into play. Coface handles the recovery process on behalf of the client, using their expertise in debt collection to recover the funds ef ciently. This service saves the company time and resources, allowing it to focus on core business activities while ensuring the amount owed is recovered.

Enhanced cash flow and profitability

• Ensures businesses receive owed amounts even in cases of nonpayment.

• Stabilises cash ow for day-to-day operations and future growth.

• Mitigates bad debts, directly improving pro tability.

• Crucial for South African businesses operating on thin margins.

Reduced borrowing costs

• Insured receivables are viewed as lower risk by banks.

• Results in more favourable lending terms.

• Access to credit at lower interest rates.

• Reduces borrowing costs and improves nancial leverage.

• Signi cant bene t in South Africa where affordable credit is challenging.

Increased sales and market expansion

• Con dently extends credit to new and existing customers.

• Protection against defaults drives sales growth.

• Enables competitive payment terms and larger orders.

• Provides a stable foundation for expanding into new markets.

Improved risk management

• Comprehensive coverage against nonpayment.

• Essential for long-term business success.

• Coface’s expertise in credit risk assessment and debt collection enhances protection.

• Ensures effective credit risk management.

Any business is a link in a chain of suppliers and clients. Should any one of those suppliers or clients not meet their obligations, the chain breaks and the business runs the risk of going under. JEANNE VAN DER MERWE writes about the importance of trade credit insurance in an interview with Gideon Bochedi, chief executive officer of Credit Guarantee Insurance Company

Most businesses are vulnerable to bad debt, so trade credit insurance is indispensable to any enterprise supplying goods or services to other businesses. Although Credit Guarantee Insurance Company (CGIC) is hardly a household name in South Africa, it protects many household names in retail, manufacturing, telecommunications and construction from nancial risk by ensuring their cash ow is not compromised by bad debt arising from domestic or international debtors.

“We typically would not insure any company that sells to the man in the street,” says Gideon Bochedi, CEO of CGIC. He notes that their role in the economy is twofold: rstly, to give a business owner peace of mind. If their customers are not covered against bad debt, CGIC ensures they will get their money back. Secondly, if, in the broader economy, businesses are experiencing short-term spikes of demand and supply that lower prices and prevent them from covering their costs, CGIC can provide certain guarantees to nanciers that enable businesses to work through those challenges.

“We call ourselves a cash- ow buffer and a cash- ow enhancer; someone who can calm your creditors so you can work your magic to get your operating freedom back,” he explains. “For instance, when an exporter of fresh produce is threatened by the sudden implementation of a 30 per cent tariff in an important export market, this sector will get a shock in the form of depressed pricing due to an oversupply in an alternative market. These lower prices could put their cash ow under

pressure, which puts them at risk of being unable to meet their liabilities.”

In such instances, backing by CGIC could serve as security to the banking sector for a struggling business to obtain nance to meet the shortfall.