Can South Africa pivot from decay to smart, green and inclusive development?

Picasso Headline,

A proud division of Arena Holdings (Pty) Ltd, Hill on Empire, 16 Empire Road (cnr Hillside Road), Parktown, Johannesburg, 2193 PO Box 12500, Mill Street, Cape Town, 8010 www.businessmediamags.co.za

Editor: Rodney Weidemann

Content Manager: Raina Julies rainaj@picasso.co.za

Contributors: James Chakwizira, Trevor Crighton, Gavin Kelly, Hope Hangwelani Magidimisha-Chipungu, Martin Meyer, Ipeleng Mkhari, Itumeleng Mogaki, Bukiwe Pantshi, Samantha Reyneke, Mfaniseni Fana Sihlongonyane, Georgina Smit, Vanessa Stander

Copy Editor: Anthony Sharpe

Content Co-ordinator: Natasha Maneveldt

Online Editor: Stacey Visser

Head of Design: Jayne Macé-Ferguson

Senior Designer: Mfundo Archie Ndzo

Project Designer: Zainab Aboo

Cover Images: [guphary]/123RF.com, [smyslovkir]/123RF.com, [petertt]/123RF.com, [peopleimages12]/123RF.com

Project Manager: Arnold Cruywagen arnoldc@picasso.co.za | +27(0) 21 469 2508

Sales: Tshepo Monyamane, Ilonka Moolman, Noel van Breda

Production Editor: Shamiela Brenner

Advertising Co-ordinator: Johan Labuschagne

Subscriptions and Distribution: Fatima Dramat, fatimad@picasso.co.za

Printer: CTP Printers, Cape Town

Management Accountant: Deidre Musha

Business Manager: Lodewyk van der Walt General Manager, Magazines: Jocelyne Bayer

There is no doubt that the country’s infrastructure has deteriorated signi cantly over the past decade, mostly due to consistent underinvestment, mismanagement and a lack of state capacity. Nonetheless, there are various infrastructure development scenarios for South Africa that, if applied correctly, could ensure a robust, sustainable and smart country by 2050. In this issue we consider what is required in to obtain nance for an infrastructure project and the role that green building principles play in this. In a similar vein, we look at how National Treasury’s recently revised regulations for public-private partnerships will help unlock private-sector expertise.

A key initiative underway is a partnership to spearhead our rail sector revival, offering hope for revitalising logistics and the overall economy. We also examine road maintenance, spatial planning, water and we take a look at where wind and hydropower lie in SA’s energy mix. While South Africa has its share of challenges, a lot of positive efforts are underway to x broken systems, drive green infrastructure innovation, nance better projects, and tweak the laws to enable greater private-sector expertise and funding for infrastructure.

Rodney Weidemann, Editor

The greener a project is, the easier it becomes to obtain nancing 4 RAIL

Transnet’s rail infrastructure must be reinvigorated to spur economic growth

6 PASSENGER AND FREIGHT TRANSPORT

A new partnership aims to revive South Africa’s rail sector

7

The perils of our deteriorating roads and how these can be rebuilt to deliver quality transport networks

11 LEGAL

How revised PPP regulations can unlock expertise and funding

12

Why it is vital to apply green principles to all new infrastructure projects

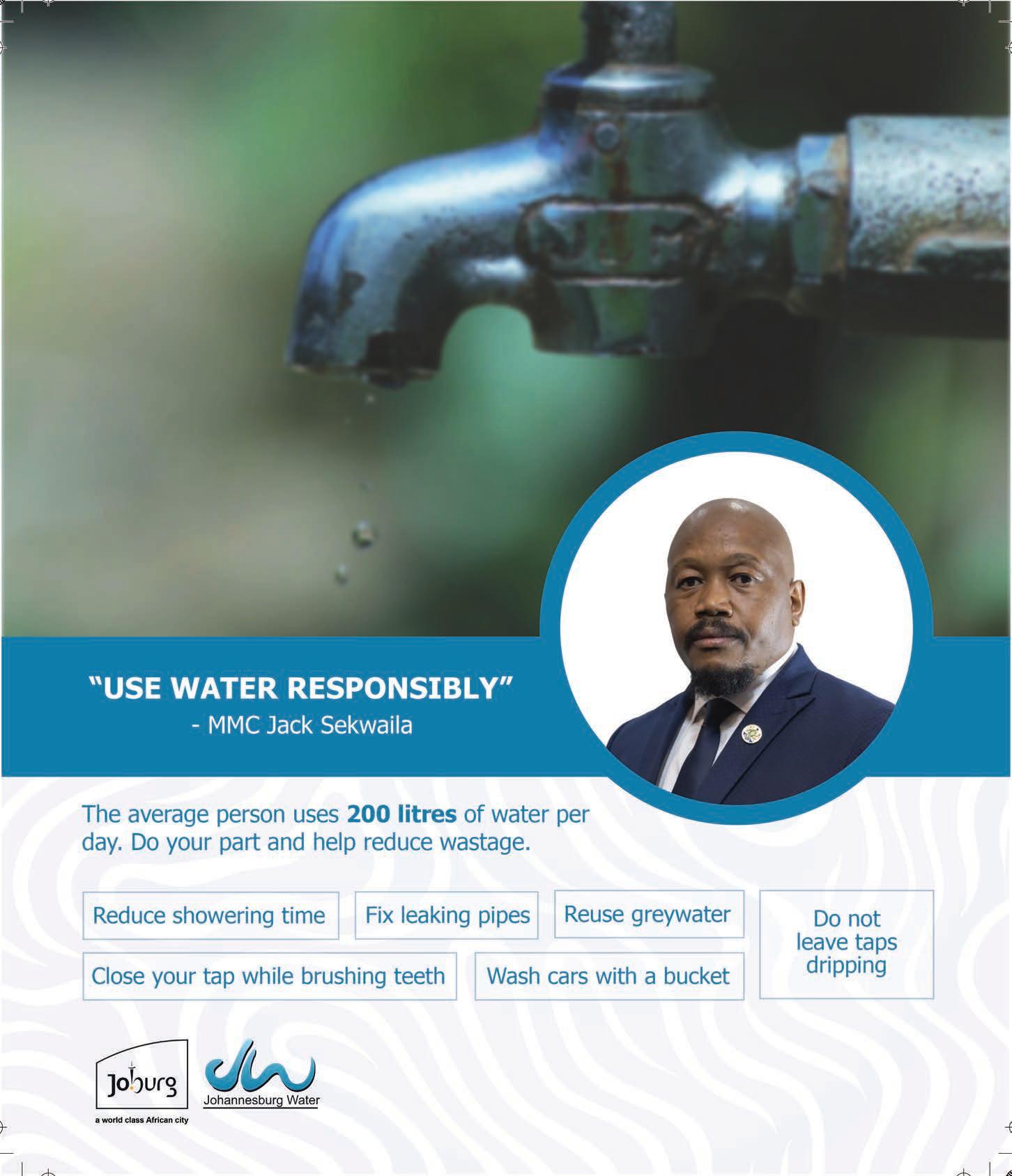

13 WATER

How do we arrest the slide of our failing water infrastructure – and rebuild?

16 ENERGY

Where do wind and hydropower lie in South Africa’s energy mix?

20 SPATIAL

Digital transformation is a key driver in the re-engineering of the spatial planning domain

How “green” does a green infrastructure project need to be before a bank will unlock essential financing, asks TREVOR CRIGHTON

Africa’s continuing demographic and economic growth is estimated to see the 2020 population of 1.1 billion double by 2050 – with most growth occurring in cities. In simply trying to meet this growing population’s basic needs, development and urbanisation have largely taken place without adequate planning, while investment has not kept pace with growing demand for services, placing stress on existing infrastructure and compounding its critical de cits.

A WWF paper, “The Case for Investment in Green Infrastructure in African Cities”, explains that there is an opportunity for African policymakers to invest differently in urban infrastructure, learning from the mistakes made by developed countries. Part of this approach must involve screening out risky or unsuitable projects.

The South African National Treasury released the rst edition of the South African Green Finance Taxonomy in April 2022. The document offers a classi cation system that outlines a minimum set of standards which must be

met for a project, asset, sector or activity to be classi ed as environmentally friendly, in line with international best practice and national priorities.

The taxonomy gives investors a base for measurement to provide adequate, comparative disclosure on green activities and track progress, while giving asset owners, asset managers, companies and government the opportunity to have constructive climate engagement using the same accepted criteria.

It’s important to remember that a shift towards a green economy also needs to be just – the implication being that as the economy moves to be more environmentally friendly, the social dynamic is not forgotten. Workforces need to be upskilled or reskilled, for example, to ensure that those

working in areas not classi ed as “green” are not left unemployable. The social aspect has been included in this taxonomy through the Minimum Social Safeguards criteria, but more work is needed to expand on this to take the South African social triple challenge of unemployment, poverty and inequality into account.

In its current form, the Green Finance Taxonomy enables the classi cation of relevant activities into two categories of environmental objectives: those economic activities that make substantial contributions to climate change mitigation, and climate change adaptation. In the future, additional coverage will be added to ll out the four further objectives: sustainable use of water and marine resources; pollution prevention; sustainable

“ESG RISKS ARE INTEGRATED INTO CREDIT ORIGINATION AT THE VERY EARLY STAGE OF THE ONBOARDING PROCESS OF CORPORATE AND RETAIL CUSTOMERS THROUGH KNOW YOUR CUSTOMER CHECKS.”

– MSIZI KHOZA

resource use and circularity; and ecosystem protection and restoration.

Broadly, to qualify as “green” under the taxonomy, the economic activity must meet four principles, namely that it contributes substantially towards at least one environmental objective, meets the applicable technical screening criteria, does no signi cant harm to any of the other taxonomy objectives and that it meets the Minimum Social Safeguards.

In February 2025, pan-African continental infrastructure investor Africa50 announced that it would be setting up the first region-wide investment vehicle dedicated to offgrid power companies, with plans to establish a R9.5-billion fund to invest in climate-friendly projects.

Source: Africa50

Msizi Khoza, Absa CIB managing executive for environmental, social and governance (ESG), says that in South Africa, the bank has driven measurable impact across several areas – including renewable energy and affordable housing. “As a direct result of our sustainable nancing efforts, we’ve mobilised over R120-billion for more than 50 projects, adding 5GW of clean energy infrastructure since 2021. As a key nancier in South Africa’s Renewable Energy Independent Power Producer Procurement Programme, we’ve backed over half of all closed deals. Absa sees broad opportunity across a range of sectors – including in renewable energy, especially in captive power.”

Khoza says that Absa has thus also developed its own robust environmental and social management system for nancing, based on international best practices. “ESG risks are integrated into credit origination

at the very early stage of the onboarding process of corporate and retail customers through Know Your Customer checks.

“Counterparty-level environmental and social risk checks are part of the loan origination and approval process through the environmental and social management system, and the environmental and social risk assessment tool, ensuring qualitative risk assessment and data collection. We have also developed a group-wide greenwashing policy outlining a series of principles to mitigate risks associated with greenwashing. These guide and promote our risk management strategy, business plans, decision-making, products and operational execution.”

Khoza says that green credentials on their own are necessary but not suf cient in securing funding; the underlying credit fundamentals must be in place. “Every project must have suf ciently robust cash ows to service the capital and interest obligations.

“Absa’s Sustainable Finance Issuance Framework speci cally covers the green and social use of proceeds as de ned by the International Capital Market Association (ICMA) and the Loan Market Association (LMA). We have recently adopted an internal transition nance framework to guide our classi cation for certain kinds of sustainable nance instruments – especially those advanced to clients in hard-to-abate sectors.”

In terms of the green attributes they look for, Khoza explains that Absa makes decisions guided by this framework. “There are eligible categories of green loans and/ or bonds ranging from renewable energy, energy ef ciency, and pollution prevention and control to clean transportation, climate change adaptation and green buildings.

These categories should meet regional, national or internationally recognised standards or certi cations.”

Michael Hillary, group executive for nancing Operations at the Development Bank of South Africa (DBSA), explains that the bank’s operations and product suite span the entire infrastructure development value chain, including active participation in the planning, preparation, structuring, funding and implementation of infrastructure solutions.

“DBSA supports the preparation and nancing of large-scale infrastructure projects within primarily the water, energy, transport, and information, communication and technology sectors.

“The bank’s approach to funding assets or projects that would contribute to achieving speci c objectives aligned to DBSA’s sustainable development mandate and business focus aims to realise the objectives of the United Nations Sustainable Development Goals. Green assets are de ned in line with international best practices and, importantly, South Africa’s Green Finance Taxonomy. Our taxonomical/ESG approach also endeavours to align with ICMA’s Green Bond Principles (June 2021) and Social Bond Principles (June 2023) for bonds, as well as the LMA’s Green Loan Principles (February 2023) and Social Loan Principles (February 2023) for loan-based nancing.”

Hillary says that, through alignment of these principles and standards, the bank’s ESG framework, processes and procedures enable it to facilitate, in part, its fundraising strategy.

“To this end, the bank is enabled to do more strategic and catalytic investments, ring-fenced to ESG-related imperatives within alternative innovative markets, as we move towards a lower carbon trajectory as a country.”

President Ramaphosa indicated in early 2024 that South Africa needs an additional R1.6-trillion in public-sector infrastructure investment and a further R3.2-trillion from the private sector by 2030 to achieve the country’s infrastructure goals.

Source: Sustainable Infrastructure Development Symposium

The planned reinvigoration of Transnet’s rail infrastructure indicates some promising reforms for economic growth, but challenges clearly still remain. By MARTIN MEYER, head of Energy and Infrastructure Finance, and BUKIWE PANTSHI, infrastructure consultant for Energy and Infrastructure Finance at Investec

South Africa’s crucial rail network has been a binding constraint on the country’s ability to support the economic activity needed to meet its development goals. Transnet –which owns and oversees operations and management of the rail infrastructure –grapples with nancial issues that hinder the maintenance of infrastructure and the rollout of new projects.

This situation is painfully evident in the marked decrease in freight movement from production centres to ports. As noted above, the implications of this decline go beyond logistics, ultimately also impacting the broader economy.

Government has recognised the need to address this, with plans for a substantial infrastructure rollout that can be conducted through state-owned enterprises and municipalities. Unfortunately, because of their nancial position, National Treasury support through infrastructure grants, budget facilities and guarantees will be required.

Bringing in the private sector as a partner to invest capital and improve on operational inef ciencies seems an obvious solution, and has proven to be a successful model in the past. Previously, we have seen successfully implemented build-operate-transfer contracts in water, roads and rail public-private partnerships, which come with government support structures.

The current nancial landscape requires a re-evaluation of this model, as the government can no longer afford to shoulder the increasing liabilities. To alleviate this, private investment and participation have been under discussion for several years.

For this to happen, the regulatory framework must be adjusted to ensure that private-sector participation is encouraged and regulated in an enabling way. Key reforms have already been established and are being implemented, signalling a promising shift in the rail sector.

The establishment of the National Rail Policy and the Economic Regulation of Transport Act, which aims to separate rail operations from infrastructure, is seen as a necessary step to attract private-sector investment, and enable third-party access and corridor concessions. If these are

structured and implemented correctly, freight and cargo owners will manage their rail logistics more ef ciently and cost effectively.

While the reforms are promising, some stumbling blocks remain. Foremost among these is the unpredictability of tariffs and the unilateral nature of penalties (assuming applicants already own or will lease rolling stock).

The nal Network Statement released in December, which outlines the operational framework for railway infrastructure and management of third-party access to the rail network, initially excited the market, with approved tariffs applicable until the end of March.

However, tariffs submitted to the Independent Rail Economic Regulator for the year beginning 1 April appear to be signi cantly higher and, if approved, could reverse this positive sentiment. Despite 98 applications for third-party access, the unpredictability of tariffs may deter operators and investors from participating.

In conclusion, there are promising moves on the reform front that will hopefully unlock private sector involvement in solving South Africa’s logistics challenges. Provided the private sector receives the assurances it needs to commit investments over the long term, there’s no reason why the rail sector shouldn’t be able to provide the economy with a signi cant boost.

An international partnership aims to reinvigorate South Africa’s struggling rail sector, eliminating bottlenecks and inefficiencies, boosting logistics and improving the economy. By IPELENG MKHARI, co-founder and CEO of Motseng Investment Holdings

South Africa has long been recognised as having Africa’s most advanced railway system, consisting of around 30 000km of track. Despite this, however, the country’s rail and transportation sector remains assailed by challenges.

Among these are large-scale vandalism, and a lack of both suf cient infrastructure and capacity and skills within the workforce. This ongoing storm of issues has created a situation where the industry suffers signi cant disruptions, while the inef ciencies created here end up hindering the ow of goods and services, causing signi cant nancial losses.

In fact, some sources suggest that these rail challenges cost the country around R1-billion a day in economic output. That is equivalent to 4.9 per cent of annual gross domestic product, or R353-billion.

However, a new partnership has launched that is focused on spearheading South Africa’s rail sector revival and reshaping passenger and freight transport. African Infrastructure Investment Managers (AIIM), in conjunction with international players the RATP Group and Alstom, is working to develop a plan to modernise South Africa’s critical rail and logistics infrastructure. Success here will drive both economic recovery and long-term growth.

AIIM is looking higher than merely boosting rail transportation. The company recognises the enormous economic potential of local industries that can be unlocked simply by properly addressing the gaps that have held back South Africa’s rail and logistics sectors.

The company’s R25.8-billion IDEAS Fund will provide a signi cant injection of nance into the commuter rail sector, similar to the funding it has provided over the past two decades to the energy sector.

RATP Group and Alstom have already demonstrated their skills in the rail sector through their involvement in the success of the Gautrain project. These two organisations have a wealth of experience in rolling stock, signalling systems and operations. AIIM, RATP Group and Alstom will work closely with local partners, such as Motseng, AWCA Investment Holdings, and Gibb-Crede, to overcome the ongoing rail infrastructure challenges.

This new collaboration will see AIIM leverage pension capital in a manner that both safeguards future retirement security and contributes directly to South Africa’s sustainable economic development. Moreover, it will underline the enormous potential offered by public-private partnerships to overcome challenging infrastructure issues and turn rail into a core enabler of national growth.

The size of the challenge is highlighted by the fact that just a few decades ago, 70 per cent of the nation’s bulk goods were transported by rail, whereas today this gure sits at around 20 per cent. This has increased the cost of doing business for many industries, notably those that rely on the export of bulk goods like mining commodities and citrus, which now have to transport such products via road instead.

This is the reason the partnership has focused on eliminating this speci c pain point. In fact, AIIM, thanks to its acquisition of a strategic stake in The Logistics Group, has already been working towards improving the ef ciency of bulk freight transport through the optimisation of critical links between rail networks and ports.

This will in turn improve rail capacity and eliminate bottlenecks and inef ciencies, while helping to boost local competitiveness in global markets. This is more crucial than ever, given the current uncertainty in the global economy. This project is aligned with the South African government’s own priority of infrastructure investment and is expected to help to align the country’s transport systems with global standards.

Ultimately, with a project of this size, it is imperative that others, such as government stakeholders, the private sector and local communities, work with us to build a rail network that bene ts all. Together, we can create a transport ecosystem that supports economic growth, improves lives and positions South Africa as a leader in global logistics.

South Africa’s road network requires a range of interventions to arrest its degeneration. By

GAVIN KELLY,

CEO of the Road Freight Association

South Africa’s road network is of critical importance to the nation’s economy, facilitating the movement of people, goods and services over signi cant distances. However, the country’s secondary roads are in desperate need of repair, with the condition of these routes having a signi cant impact on the ef ciency of the road freight and logistics industry, and consequently on the country’s economy.

While the South African National Roads Agency Limited (SANRAL) has maintained national roads relatively well, the same cannot be said for secondary and local roads, which are often neglected. These are vital for the transportation of agricultural produce, mining outputs, and manufactured goods to processing centres and markets. The economy would grind to a halt without them.

The consequences of poorly maintained roads can be signi cant. For the road freight industry, they result in increased wear and tear on vehicles, higher maintenance costs and reduced ef ciency. This results in premature wear and tear of tyres, suspension systems and chassis components, as well as delayed delivery times.

Operators are forced to deploy additional vehicles to meet demand. These inef ciencies contribute to increased logistics costs, which are subsequently passed on to consumers, leading to in ation and undermining South Africa’s competitiveness in global markets.

The Road Freight Association (RFA) has pinpointed several underlying causes of the issue, including insuf cient funding, misallocation of resources and a decline in engineering expertise.

Funding for road maintenance is often reallocated to other areas of failing services, such as healthcare and water infrastructure, resulting in accelerated deterioration. Corruption and poor oversight further exacerbate the issue, while the country’s engineering and construction sectors are struggling with a loss of skilled professionals.

To address these challenges, the RFA is pushing for a multifaceted approach.

Firstly, the organisation advocates the ringfencing of the General Fuel Levy (GFL), which contributes tens of billions of rands annually to the national treasury. The GFL should be exclusively allocated to road maintenance and development. This would ensure a steady and reliable funding stream for SANRAL and other road authorities.

Secondly, authorities responsible for road maintenance must be held accountable for the funds they receive. The establishment of a public oversight body, analogous to the National Energy Regulator of South Africa, could oversee the allocation and utilisation of these funds, ensuring transparency and ef ciency.

Thirdly, the loss of skills in road design, construction and maintenance must be addressed urgently. This could involve partnerships with universities and technical colleges to train a new generation of engineers and technicians.

Finally, while national highways are vital, rural and secondary roads are equally important for connecting agricultural and mining regions to markets. It is essential that these roads receive the attention and investment they deserve.

Given SANRAL’s success with national roads, its role should be expanded to include oversight of provincial and municipal road networks. By providing engineering expertise, identifying reliable contractors, and holding local authorities accountable, SANRAL can help ensure that all roads are maintained to a high standard.

The establishment of a dedicated body to oversee road maintenance and development, holding the Minister of Transport and other stakeholders accountable, is further recommended. This would prevent the misallocation of funds and ensure that road infrastructure remains a national priority.

The RFA’s proposed solutions are not just about xing potholes; they are about safeguarding South Africa’s economic future. Ultimately, roads represent our nation’s vital infrastructure and their effective maintenance is crucial for fostering growth, development and poverty alleviation. By implementing these measures, South Africa can build a road network that supports its people and economy for generations to come.

By harnessing private investment and technical expertise, The JOHANNESBURG ROADS AGENCY is modernising its traffic management systems and paving the way for a more responsive and resilient road network for all road users

The Johannesburg Roads Agency (JRA) has launched an innovative traf c signals partnership with the private sector in a bold step toward smarter, safer and more ef cient urban mobility. This groundbreaking initiative started two years ago and brings together public infrastructure priorities and private sector agility to tackle one of the city’s most pressing challenges: traf c signal downtime. In a move to provide seamless movement on the city’s roads, JRA has partnered with over 51 companies to power more than 113 traf c light intersections during power outages,

using electricity from their own reserves. In addition to these efforts, 130 new traf c signals have been commissioned. The partnering companies supply power ranging from 550 watts per hour to as much as 1500 watts per hour at the most complex intersections.

Sipho Nhlapo, acting head of department for mobility and freight at the JRA says: “The goal is not just to power traf c lights, but also collect traf c data towards adaptive traf c signals through arti cial intelligence (AI). These efforts will contribute towards making the city smarter and improving the lives of its citizens.” Nhlapo adds that collaborating with the private sector will bring new technology and capital to bolster efforts to maintain functioning traf c lights.

The initiative has garnered support from corporate giants such as Investec, First National Bank, Total Energies, Vodacom, Primedia, Standard Bank, Nedbank, Growthpoint, Sasol, Rede ne Properties, Discovery Limited, Old Mutual, Liberty, Two Degrees and Pareto, Zenprop Property Holdings, Rand Merchant Bank, Morningside Shopping Complex, Momentum, Southern Sun, Blue Label Telecoms, The Cavaleros

JRA CEO Zweli Nyathi says: “The JRA is committed to building smarter cities and sustainable solutions for the future. It is our key mandate to improve traf c management. Partnering with the private sector to ensure mobility and safety within Johannesburg is a prime example of how collaboration can lead to positive outcomes.”

The executive mayor of the City of Johannesburg, Dada Morero, welcomes this initiative. “As the City of Johannesburg, we are committed to delivering resilient infrastructure, service excellence and putting our residents rst. Partnerships such as these bring us closer to the smart city we are building Johannesburg to become and are a testament to what we can achieve when the public and private sectors work together,” he says.

South Africa is desperately short of experienced engineers. The government and private sector must work together to deliver the conditions that will encourage expats to return home.

By CHRIS CAMPBELL, CEO of Consulting Engineers South Africa

At the recent Infrastructure Indaba, Minister of Public Works and Infrastructure Dean Macpherson made a direct call to South African engineers working abroad to return home. This heartfelt request highlighted the country’s dire challenges around experienced engineering professionals and begs the question: What must we do to create an engineering environment that retains talent?

It is imperative that the country invests in the next generation of engineers through mentorship and skills development. However, this approach must be accompanied by a concerted effort to improve working conditions, professional opportunities and industry stability at home.

Engineers are at the heart of infrastructure development, driving innovation, sustainability and economic growth. Despite this, many leave our shores due to limited career prospects, bureaucratic challenges or a devalued working environment.

If we go by statistics supplied by our member organisations, there is a pattern of both younger and more experienced engineers leaving companies in South Africa to take up positions around the globe.

This is not too surprising, as it comes during a time when many nations are looking to drive economic recovery through infrastructure development. They are happy to leverage experienced resources from

places like South Africa that have been slow out of the blocks in attempting to retain these skills.

South Africa’s real challenge is that, while we have around 18 000 registered engineers, fewer engineers are coming through the ranks, and the number of experienced professionals in-country continues to shrink.

Between the rising immigration numbers and the retirement of numerous senior engineers, it is clear that South Africa is falling behind the developed world. For example, where we have around 1 engineer per 3 000 people, China has 1 for every 200 citizens. Admittedly, this is a dated set of statistics –while it is true that our population has grown, the number of engineers has not kept pace to meet the demands.

More than merely encouraging South African engineers to return home, it is essential to convince them to join the local public sector and vital for government to make efforts towards improving the attractiveness of such roles.

If the aim is to encourage expatriates to return, it is crucial to understand the factors that drove them away in the rst place. Thus, government needs to not only address the issues that led them to seek out greener pastures, but also create an environment where infrastructure is being built to encourage them to return.

GOVERNMENT NEEDS TO NOT ONLY ADDRESS THE ISSUES THAT LED ENGINEERS TO SEEK OUT GREENER PASTURES, BUT ALSO CREATE AN ENVIRONMENT WHERE INFRASTRUCTURE IS BEING

It is also worth mentioning that many experienced engineers who have moved elsewhere have discovered that their new lives are poorer in many ways to the ones they were previously living in South Africa. Different laws, different cultures and a lack of unique home comforts are all factors that may negatively impact these players and lead them to consider returning home.

However, it is imperative that those who do choose to come back feel comfortable about returning – they will want to know they have a secure job, that they will move into a safe suburb and be assured that the education opportunities for their children will be improved by the move.

This is key: creating the right environment to bring expat engineers back home means not simply considering their personal individual needs, but also how things like employment, education and security may also impact their families.

Ultimately, government needs to come to the party by demonstrating that large infrastructure projects will be commissioned, the correct procurement processes will be followed and proper and effective management of corruption will take place. Demonstrating a willingness to achieve the above will go a long way towards convincing local engineering expats to return home, for the bene t of all.

National Treasury recently revised the regulations for public-private partnerships. What do these revisions mean and how can they help unlock private sector expertise and funds for infrastructure? By VANESSA

associate designate , and

OSTANDER,

SAMANTHA REYNEKE , director at NSDV

n 2 April, 2025, the National Assembly passed South Africa’s National Budget 2025 in its entirety, despite considerable debate surrounding a controversial one per cent VAT increase over two years. Minister of Finance Enoch Godongwana’s budget plans to use the additional funds, along with other public income sources, to support vital infrastructure projects and ful l essential government services across the country.

A key component of the Government of National Unity’s (GNU) economic strategy is a major push for infrastructure development, which is seen as a cornerstone of economic growth. The government has committed a substantial R1-trillion to develop public infrastructure, focusing on transport, energy, and water and sanitation sectors. However, the GNU acknowledges that the scale of investment required to address South Africa’s deteriorating public infrastructure far exceeds the current scal capacity of the state.

To address this challenge, the GNU is enhancing partnerships with the private sector through regulatory reforms. These reforms, which will amend Regulation 16 of the National Treasury Regulations under the Public Finance Management Act (PFMA), aim to unlock private sector investment and expertise for key infrastructure projects.

Public-private partnerships (PPPs) are a crucial mechanism in delivering large-scale infrastructure projects. These long-term agreements between the government and private companies involve signi cant nancial investments, often running into billions of rands. PPPs are governed by the PFMA and require approval from National Treasury at various stages: feasibility; procurement; valuefor-money assessments and nal agreements.

The amendments to Regulation 16, set to come into effect on 1 June 2025, are designed to simplify and expedite this process. The changes will particularly bene t smaller projects under R2-billion, exempting them from some of the more cumbersome approval processes. Key provisions of the amendments include:

•Streamlining approvals: the approval process for smaller PPP projects will be simpli ed, reducing red tape for initiatives under R2-billion.

•Establishing a PPP Advisory Unit: a dedicated advisory unit will help manage PPPs, clarifying roles and responsibilities and easing procedural challenges.

• Managing unsolicited proposals (USPs): clear guidelines will be put in place for managing USPs from the private sector, fostering better collaboration between the government and businesses.

• Strengthening scal risk management: new requirements for tracking and managing scal commitments and contingent liabilities will minimise nancial risks, making these projects more attractive to private investors.

These regulatory changes come at a time when South Africa faces a critical infrastructure gap that hampers economic development. By creating a more investor-friendly environment for PPPs, the GNU hopes to attract much-needed private-sector investment, bringing both capital and expertise to public projects.

The reforms are expected to open the door for greater private-sector involvement in infrastructure, addressing both the immediate needs of the country and long-term growth goals. With reduced nancial risks and clearer pathways for private-sector engagement, these changes are set to play a pivotal role in advancing South Africa’s economic agenda.

In conclusion, the amendments to Regulation 16 are a bold step towards leveraging private sector resources and expertise to meet the country’s infrastructure needs, foster growth and reduce the burden on government resources. The new framework signals a promising future for infrastructure development in South Africa, with the potential to transform critical sectors such as transport, energy and sanitation.

As South Africans, the word infrastructure (usually followed by failure, unfortunately) is part of our everyday conversation and awareness. What we are less aware of is what a different approach could look like if we applied our home-grown green expertise to tomorrow’s infrastructure approach.

A green-certi ed building or project is one that must not only meet the economic pressures endemic to the property development and real estate sectors, but also demonstrate that it achieves key sustainability actions and impacts. As an example, a building certi ed with Green Star New Buildings and Major Refurbishments commits itself to – at an absolute minimum:

• Being constructed responsibly to operate ef ciently and reduce operational waste

•Being healthy and supporting productivity for staff and operators

•Being low-carbon and using energy and water ef ciently

•Connecting with and supporting its neighbourhood and local ecosystems

•Being aware of major climate risks

This means that the building, starting from its rst blueprint, needs to do more than function cost effectively – it needs to embrace holistic sustainability in a way that supports both the planet and people to thrive.

While I’m sure many of us would settle for new infrastructure that just functions cost effectively, there are many reasons why we really should be demanding more.

With the climate crisis in full swing, it is more imperative than ever to ground all new construction projects in green principles. By

GEORGINA SMIT, executive director at the Green Building Council of South Africa

Firstly, in an unpredictable future of climate warming, weirding and whiplash, climate resilience is essential to maintain functionality. In order to cope with future climate change that is already “baked in”, it is imperative that our buildings and supporting infrastructure are built in a way that plans for the risks that threaten energy and water supply, as well as socioeconomic and health issues.

To this end, partnerships within a neighbourhood, along with meaningful co-design, collaboration and implementation that add value to the spaces and places around it, are among the well-researched methods that turn intrusive infrastructure into community assets. Buildings that look beyond their own site boundaries to the impacts on spaces shared with their neighbours stand a better chance of weathering tough times as part of the community, rather than in opposition to it.

Design must rst aim to reduce to an absolute minimum the water and electricity that a building uses. This protects the functionality of building in the face of water disruptions and rising energy costs, and is in line with South Africa’s 2030 commitments to a lower carbon built environment.

Through the Green Star Sustainable Precincts tool, the Green Building Council of South Africa (GBCSA) offers the built environment an

internationally recognised framework to guide the design and construction of large or precinct-scale developments that further sustainable outcomes. It encourages urban planning approaches and infrastructure supply solutions that deliver resilient and resourceef cient spaces to live, work and play.

According to a long-running GBCSA study, Green Building in South Africa: A Guide to Costs and Trends, the average green construction premium for of ces (the extra money spent to make a project green) is only 3.14 per cent and falling over time. It can cost as much 10.83 per cent, but also drops as low as 0.47 per cent. The key message is that it isn’t prohibitively expensive, and is getting cheaper as we learn better and more effective green practices.

So, what’s the catch? If it is not too complicated, if we have the experts to guide us, if we can cover the costs, why isn’t every building a green building?

We need to think differently about, and invest some extra time and resources in the design, concept and construction stages. If we change our thinking and give more time to project teams to think about and develop designs, we get better, greener design. This in turn results in structures and sustainable infrastructure tuned to weather tomorrow’s storms – ef ciently, affordably and as a good neighbour, supporting both people and planet.

Thanks to a combination of political misalignment, mismanagement and technical deficiencies, South Africa’s water infrastructure has been facing increasing pressure, leading to significant failures that impact both urban and rural areas. By ITUMELENG MOGAKI

The fundamental cause of South Africa’s water infrastructure failure is the clash between political ideology and scienti c realities. This is the view of Professor Anthony Turton of the Centre for Environmental Management at the University of Free State.

“After 1994, the government pursued ambitious political goals, such as doubling irrigated agriculture, without considering that by 2002, 98 per cent of the country’s available water had already been allocated,” says Prof Turton. “Scientists who pointed out these limitations were disregarded, leading to an administrative structure dominated by politically loyal individuals, rather than skilled technical professionals. This lack of expertise initiated a downward spiral that contributed to the current state of infrastructure failure.”

Burt Rodrigues, CEO of Biodx, highlights another key issue: the loss of skilled labour. “Historically, apprenticeships in the water sector lasted up to 15 years, allowing for deep knowledge transfer. However, this process has been neglected, resulting in a workforce that lacks the necessary skills to maintain critical infrastructure.”

Water scarcity is primarily managed through infrastructure. When infrastructure

“IF INFRASTRUCTURE CONTINUES TO FAIL AT CURRENT RATES, SOUTH AFRICA FACES A TOTAL WATER SYSTEM COLLAPSE, WITH

is mismanaged, shortages become acute, particularly in urban areas where there are no natural alternatives.

Turton says this has given rise to criminal syndicates, known as “water ma as”, who sabotage municipal infrastructure to secure tenders for water supply via tankers. “This form of local-level state capture weakens government authority and increases service-delivery failures.”

In rural areas, while alternative water sources may exist, poor infrastructure still results in unreliable supply. Rodrigues points out that contamination of water bodies – as seen in cases like Bryanston, where ef uent over ow pollutes local ponds – threatens both human health and biodiversity. “Without immediate intervention, South Africa risks escalating public health crises and economic instability.”

Both experts agree that governance and corruption are major contributors to infrastructure failure. “The Department of Water and Sanitation, tasked with regulating the sector, also acts as an industry player, leading to con icts of interest,” says Turton.

“With that said, South Africa needs an independent water regulator to ensure accountability and prevent further deterioration.”

Rodrigues adds that municipalities consistently fail audits, as evidenced in the 2023 Blue Drop Report. “Poor budget management and lack of oversight allow mismanagement to persist, preventing necessary maintenance and upgrades. Without accountability, infrastructure continues to degrade, further reducing service reliability.”

If no urgent action is taken, the long-term consequences will be severe. Turton explains that businesses will collapse as they struggle with unreliable water supply, while investors will avoid a country unable to guarantee water security. This will lead to job losses, reduced tax revenues and an eventual scal crisis.

Rodrigues warns of the escalating health risks, as untreated sewage contamination could lead to widespread outbreaks of waterborne diseases. “If infrastructure continues to fail at current rates, South Africa faces a total water system collapse, with catastrophic effects on both households and the broader economy.”

Despite the grim outlook, Turton sees hope in the adoption of public-private partnerships. “These partnerships allow for nancial ring-fencing within municipalities, reducing opportunities for political interference and corruption,” he says, adding that criminal prosecution of municipal of cials, recently announced by the government, is a step in the right direction.

According to Rodrigues, neglecting investment in water infrastructure, technology and human resources will heighten disease risks and system failures. “Immediate action is needed to prevent total collapse. Implementing comprehensive water strategies this year could ensure clean water access for all South Africans by 2035,” he concludes.

Johannesburg Water pumps R92-million into new Erand Tower and Pump Station infrastructure project to boost water supply in Midrand.

By PFUNZO MUDZANANI , Johannesburg Water’s project manager

Johannesburg Water has invested R92-million into a new infrastructure project that will help boost water supply to the Midrand area. Construction of the new Erand Tower and Pump Station project is currently underway and will serve as additional capacity to the existing Erand Reservoir complex.

Part of the existing Midrand system consists of the Erand Reservoir site, which comprises a 25 megalitre (ML) capacity reservoir, a 9ML capacity reservoir and a pump station. The existing pump station sources water from the 9ML reservoir and delivers it to a 0.5ML capacity water tower elevated to 30 metres above ground level to produce the required hydrostatic pressure for the distribution of potable water to the local communities.

The Johannesburg Water Master Plan proposed the new and upgraded water pump station that will supply both the new 2ML water tower and the 0.5ML existing tower. To increase the water storage capacity of the existing system, speci cally for higher-lying areas, and to unlock the Midrand area for further development, Johannesburg Water is building a new 2ML water tower and pump station. This will increase the current storage capacity and provide a water network with adequate capacity to meet both present and future demands.

The construction of the new Erand Tower and Pump Station forms part of the Entity’s Reservoir Storage Upgrade Programme, which aims to ensure the provision of a 24-hour storage capacity in all the entity’s reservoirs. The project is currently about 60 per cent complete, and upon completion, will boost water supply in Carlswald, Blue Hills, Kyalami and Barbeque Downs.

The storage capacity is required to mitigate against service disruption should network bursts occur or should there be a supply disruption from the bulk supplier, as well as maintain adequate supply pressure in the reticulation system.

• Construction of a new 30-metre-high elevated reinforced concrete water tower with a capacity of 2ML. This includes the design and construction of piles, ground beams, shaft walls, columns, radial beams and a cylindrical water tank.

• Construction of a new pump station housing four pumps each, with a head of

INCREASE THE WATER

37 metres drawing water from the existing 25ML reservoir and delivering to both the new and existing water towers, including all the necessary appurtenance and control systems.

• Installation of all inlet and outlet pipework from the reservoir to the pump station and connecting to the existing distribution network.

• Cathodic protection and telemetry requirements.

• Installation of power supply to the new pump station and installation of a standby generator and lightning protection.

• Construction of new manholes and inlet and outlet chambers.

• Construction of paving around the pump station and tower.

OF THE EXISTING SYSTEM, SPECIFICALLY FOR HIGHER-LYING AREAS, AND TO UNLOCK THE MIDRAND AREA FOR FURTHER DEVELOPMENT, JOHANNESBURG WATER IS BUILDING A NEW 2ML WATER TOWER AND PUMP

South Africa’s response to climate change includes a shift towards renewable energies. RODNEY WEIDEMANN considers wind and hydropower’s place in this

South Africa is the 14th-largest emitter of greenhouse gases globally, with the country’s reliance on coal signi cantly contributing to these emissions.

Renewable energy, however, generates considerably lower levels of carbon emissions, helping to reduce the country’s overall carbon footprint and combat climate change.

The need to reduce CO2 emissions and provide reliable electricity for its people has driven the country to begin developing an effective renewable energy sector, encompassing biomass, wind, hydropower and solar energy.

Solar remains the nation’s single biggest renewable energy source, thanks to the country’s wonderful weather and vast open spaces that are ideal for solar plants. However, any successful renewable approach includes a mix of different sources, with both hydro and wind power making their own marks on South Africa’s renewable energy drive.

Much like solar energy, is an energy source that will never run out. However, according to the Department of Mineral Resources and

SOLAR

Energy, the amount of energy that can be extracted from the wind depends on its speed. The higher the wind speed, the more energy can be harnessed to generate electricity on a large scale. Additionally, this requires large tracts of land to install enough wind turbines or generators, which are also noisy.

Meanwhile, energy from water can come from waves, tides, waterfalls and rivers, and is equally renewable. In South Africa, we have a mix of small hydroelectricity stations and pumped water storage schemes. Currently, hydropower provides around two per cent of total South African energy production.

South Africa is not really suited to the kinds of hydropower traditionally generated in the northern hemisphere. However, conduit hydropower, whereby excess energy from pressurised pipelines is harnessed, represents an unconventional and unexplored opportunity.

According to Jay Bhagwan, executive manager at the South African Water Research Council, conduit hydropower involves using the

mechanical energy of water as part of the water delivery system through man-made conduits to generate electricity. “South Africa has made strides in developing, scaling and adopting conduit hydropower and leveraging its potential. This eco-friendly innovation has immense potential and promises long-term energy security as long as water continues to ow.

“Hydropower offers the prospect for economic expansion and for achieving the United Nations Sustainable Development Goals. In the past, hydropower has typically been harnessed at large dams, where the outlet ow is used to generate electricity through turbines.”

However, Bhagwan says that as most economically viable large dams have already been developed, attention has turned towards small-scale, mini and micro-hydropower as alternative means of generating electricity.

“By introducing an energy recovery device – in this case a conduit hydropower turbine – into the system, energy can be extracted to meet a speci c demand. It has negligible negative environmental impacts and zero carbon emissions. Conduit hydropower also comes with short payback periods due to the utilisation of the existing water supply and distribution infrastructure.”

Bhagwan notes that a number of water utilities have started taking the initiative in developing this type of hydropower and are con dent that there is signi cant potential in South Africa. “It is believed that conduit hydropower is the ‘low-hanging fruit’ in terms of viable renewable energy development. The City of Cape Town’s hydropower plants illustrate how existing municipal infrastructure can be utilised to contribute towards meeting South Africa’s sustainable energy goals while still providing essential services to consumers.”

Santosh Sookgrim, senior technical Advisor at the South African Wind Energy Association (SAWEA), says that a diverse energy mix is one of the key factors in ensuring grid stability and resilience. “When paired together, wind and solar provide a complementary supply of energy, with wind often picking up when solar output wanes, such as during the evening or in seasons with generally lower irradiance levels. When coupled with storage systems, wind can also be effective as a grid balancing and dispatchable energy option.

“South Africa’s wind resources are among the highest globally, considering the country’s size and location. These are particularly pronounced in the coastal regions of the Eastern Cape, Western Cape and parts of the Northern Cape. These regions experience consistent and proven wind patterns that are ideal for utility-scale wind farms.”

Furthermore, the wind resources are located in large swathes of rural undeveloped land that are ideal for onshore wind development. The country also has an expansive grid network

Currently, South Africa’s 3.5GW of installed wind capacity contributes to alleviating between one to two stages of load shedding during peak periods, powering around 3.6 million households annually.

Source: South African Wind Energy Association

connecting load centres with rural areas, where wind resources are highest.

Wind projects are also being developed in other provinces across the country, Sookgrim explains. The country’s wind energy footprint is expanding into new regions, including Mpumalanga, the Free State and KwaZulu-Natal. As illustrated by the 2024 South African Renewable Energy Grid Survey, the wind sector has a large project pipeline of over 33GW, highlighting South Africa’s ability to scale wind energy capacity further.

“Wind energy can also have a signi cant impact at both small and large scales,” says Sookgrim. “While there is currently a limited number of small-scale projects, such as those providing power to farms and commercial operations, these help reduce load on the grid during peak times and enhance energy security for those speci c sites.

“Additionally, there are over 1.8GW of private offtake wind projects and 1GW of publicly procured wind projects under construction, which will bolster the national grid, contributing to a cleaner energy mix.”

Sookgrim notes that grid capacity remains the primary challenge for accelerating the development of wind energy in the country. The existing transmission infrastructure must be strengthened and expanded, he says, to allow for additional grid connection capacity for wind projects. “Private-sector involvement in grid expansion, through initiatives such as Independent Transmission Projects, is a step in the right direction to address grid constraints.

However, the National Transmission Company South Africa must ensure that the Transmission Development Plan is accelerated and that priority is given to expanding transmission infrastructure in grid constrained regions.

“In addition, certain regulatory and permitting requirements can slow down project development. Streamlining these processes, investing in grid infrastructure and ensuring regulatory certainty remain critical steps for unlocking wind energy’s full potential.”

SAWEA believes that wind power has a transformative role to play in South Africa’s energy future. To date, the wind industry has contributed over 23 000 job years and brought more than R90-billion of investment into the national economy, while further contributing close to R900 million towards socioeconomic development and enterprise development initiatives.

Sookgrim indicates that the wind industry is positioned to accelerate this contribution, since there are over 33GW of wind projects in the pipeline, which could be connected to the grid in the next three years – provided that the constraints are resolved. “The emphasised role of wind energy in the energy mix is clear from the latest Draft Integrated Resource plan, which calls for a minimum of 69GW of wind energy to be installed between 2031 and 2050.

“Wind power directly supports energy security, reduces load shedding and helps South Africa meet its renewable energy targets. As the sector expands, it will continue to drive the country’s energy transition, contributing to a cleaner, more sustainable energy future.”

At City Power, collective excellence is at the heart of everything we do. Our commitment to energy security, innovation and sustainable infrastructure has driven our achievements in the 2023/2024 financial year, writes TSHIFULARO MASHAVA , CEO, City Power Johannesburg

Since my appointment as CEO in August 2022, City Power Johannesburg (City Power) has strengthened its role as a key player in the energy sector, expanding electri cation, securing infrastructure and pioneering alternative energy solutions.

City Power has exceeded its electri cation targets, connecting 2 675 households, surpassing its goal of 2 500. Communities such as Amarasta in Alexandra, Roodepoort, Slovo Park, Veggieland, Princess Plot, Matholesville and Kliptown have bene tted from these projects. Large-scale initiatives at George Goch Informal Settlement (1 390 households) and Jumpas (1 385 households) are also progressing well.

Beyond conventional grid connections, we have pioneered innovative energy solutions, including microgrids. The Amarasta microgrid in Alexandra set the foundation for similar projects in Denver, Vukani, The view and Vlakfontein, ensuring sustainable energy access for thousands.

City Power’s growing impact was acknowledged by Gauteng Premier Panyaza Lesu in the 2025 State of the Province Address. As the implementing agent for energy projects across Gauteng municipalities, City

Power has played a critical role in stabilising the province’s electricity supply.

A key achievement has been our partnership at Kelvin Power Station, which added 180MW to Johannesburg’s power grid, with expansion plans to reach 600MW. Additionally, the revitalisation of the John Ware Power Station has contributed 200MW to the grid. The premier also announced that City Power will manage the Eikenhof pumping station, a crucial intervention to stabilise Johannesburg’s water supply.

We made signi cant investments in upgrading our network infrastructure. The Cleveland and Eldorado substations have been successfully commissioned while the Lutz Dalkeith development, Lutz HV cable installation and Fleurhof-Robertville interconnector have been completed.

Lighting up Johannesburg remains a priority. We installed hundreds of new public lights, including 155 in Carlswald, 150 in Glen Austin and 100 in Buccleuch. Additionally, 126 solarpowered high-mast lights were installed, improving safety and reducing reliance on Eskom.

Infrastructure theft and vandalism remain a challenge, but City Power has taken decisive action. We secured 1 833 mini substations, reducing illegal connections and improving network stability.

City Power is also leading Johannesburg’s just energy transition. We successfully installed rooftop photovoltaic (PV) solar systems and battery storage at the Reuven, Roodepoort and Lenasia substations. These projects will ensure a cleaner, more resilient energy supply.

Our achievements in 2023/2024 re ect our unwavering commitment to collective excellence. The trust placed in City Power by the city and provincial government has allowed us to expand our impact beyond Johannesburg, ensuring more communities have access to safe, reliable and sustainable energy. We are not just keeping the lights on; we are lighting the way to a stronger, more sustainable future.

BEYOND CONVENTIONAL GRID CONNECTIONS, WE HAVE PIONEERED INNOVATIVE ENERGY SOLUTIONS, INCLUDING MICROGRIDS.

Digital transformation is a key driver in the re-engineering of the town planning, surveying, architecture, engineering and construction management disciplines and professions. By

PROF JAMES CHAKWIZIRA, PROF MFANISENI FANA SIHLONGONYANE and PROF HOPE HANGWELANI MAGIDIMISHA-CHIPUNGU

of the South African Council for Planners

Since time immemorial, technology waves have been part and parcel of shifts, changes and advancements in civilisation and spatial planning in the built environment. Since the 2000s, we have witnessed the emergence of arti cial intelligence, the Internet of Things, improved data analytics, autonomous systems, machine learning, geolocation, building information modelling (BIM), virtual reality (VR), augmented reality (AR), mixed reality (MR) and sophisticated imaging – to mention a few.

These digital technologies have signi cantly impacted disciplines in the built environment, including in the professions and disciplines of town planning, surveying, architecture, engineering and construction management.

In addition, technological innovations such as drones, 3D laser scanning and printing, LiDAR mapping, and geographic information systems (GIS)/BIM integration programmes propel the built environment’s progress. They are shaping and getting reshaped by the built environment and are growing the ef ciency, and cost-effectiveness of the processes and systems within it.

As urbanisation accelerates and the need for planning spatially sustainable cities, regions and rural areas grows, the lure of

resilient designs is intensifying. VR, AR and MR have become indispensable technologies shaping the future of spatial planning and the built environment – for example, by offering unique capabilities to visualise designs, simulate spatial planning and construction processes, and even engage stakeholders in a more meaningful manner.

It is quite easy to imagine the application of digital twins for the Lanseria smart city development, Musina-Makhado Special Economic Zone, Eastern Cape Seaboard smart city development and so forth. Such communicative and interactive technologies encourage both heightened active engagement and practical involvement of the public, in order to achieve buy-in and receive feedback.

This in turn has immense potential to improve communication in the perception of spatial plans, land use schemes, social housing programmes or proposed infrastructure projects. An example here might be the Pretoria-to-Polokwane high-speed train, where such communication would be key, especially during construction, when noise, restricted access issues, or the closure of business and amenities could negatively impact communities.

The infectious nature, power and impact of new technologies on the built environment, academia and practice industries cannot be ignored. Embracing, exploring and optimally exploiting the many opportunities and vulnerabilities imbued in changing the conventional spatial planning and built environment sectors methods – and in creating new opportunities – is challenging for all. However, as we embrace new technologies, there is a need for transitional arrangements to avoid implementation bottlenecks. To this end, clear legislation and regulations for certi cation of their use in an appropriate, safe and ethically responsible manner needs to be in place.

Challenges related to technology integration and design standards, as well as safety, cost and skills development, may arise, requiring industry, academia and practising professionals to adapt and upskill in order to harness the full potential of these new technologies.

Given the Protection of Personal Information Act in South Africa, technologically enhanced information systems and platforms that collect, process and manage the personal biometric data of individuals – essentially their behaviours, judgments and physical appearance – must be cybersecurity protected to prevent leakage of sensitive data.

One thing we can say for certain: the widespread adoption of VR/AR/MR in spatial planning and built environment project management will transform traditional planning and design processes, offering new opportunities for collaboration, innovation and ef ciency.

Respiratory protection is vital in many construction-related fields, but understanding what is required for what specific environment can be tricky, writes SURAKSHA MOHUN, PPE specialist at Dromex

Respiratory protection is vital in hazardous work environments for preserving workers’ lung health and overall wellbeing. Airborne contaminants like dust, fumes, gases, vapours and biological agents can lead to serious health issues, including acute or chronic respiratory illnesses, lung damage, asthma and even life-threatening conditions that may negatively impact a worker’s quality of life.

The effectiveness of a worker’s respiratory protection largely depends on two key factors: t and ltration. Proper t ensures a secure seal, while ltration determines how effectively particles/gases and contaminants are removed.

Since every person has a unique facial structure, each wearer must undergo a personalised t test to ensure their respirator provides the necessary protection for their speci c job. A t test veri es the seal between the respirator and the wearer’s face, identifying gaps or leaks that could put them at risk. Facial hair can signi cantly compromise this seal, reducing the respirator’s ability to protect the wearer.

It is important to remember that selecting the correct respiratory protection is crucial and can be the difference between life and death. To ensure that the correct respirator is chosen, one should always conduct certain essential checks.

A thorough risk assessment is the advisable starting point. This helps to identify the speci c hazards that are present in the environment and determine what type of respirator will be required to provide the necessary protection for the environment. For example, in environments where oxygen levels are below 19.5 per cent, the air is considered oxygen de cient and a reusable air purifying respirator cannot be used.

The effectiveness of a respirator is dependent on how well it ts the user, as only a properly tted respirator will be able to ensure that contaminants are effectively blocked.

Seal testing is an important part of the t test, and involves performing both a positive and negative pressure test to ensure that the respirator forms an airtight seal. This added step is to verify that the respirator will perform as expected in hazardous environments.

It is important to inspect your respirator regularly to ensure that it remains in good working condition. The seals, lters and valves must all be checked for wear and tear to con rm that the respirator continues to function correctly and protects the user effectively. If any parts are worn or damaged, the respirator must immediately be replaced. Different tasks and environments present unique hazards, so selecting the right equipment is critical. A clear understanding of these elements enables individuals to choose and use the most suitable device for their speci c exposure risks.

Here is a quick breakdown of some common types of respiratory protection: Disposable mask: effective for ltering airborne particles and mists, this functions by trapping contaminants within a ltering material, preventing them from passing through. However, these devices do not block gases or vapours.

A THOROUGH RISK ASSESSMENT HELPS TO IDENTIFY THE SPECIFIC HAZARDS THAT ARE PRESENT IN THE ENVIRONMENT AND DETERMINE WHAT TYPE OF RESPIRATOR WILL BE REQUIRED TO PROVIDE THE NECESSARY PROTECTION FOR THE ENVIRONMENT.

Half/full-face respirators: protect against particulates and some gases and vapours when used with speci c cartridges/ lters. A full-face respirator offers added eye and face protection.

Powered air-purifying respirators: use a battery-powered blower to deliver ltered air, making breathing easier.

Self-contained breathing apparatus and supplied airlines systems: provides an independent air supply, suitable for extremely hazardous and environments immediately dangerous to health and life.

Ultimately, regular inspections, t tests and compliance with safety regulations will ensure that workers remain protected. Awareness and education around respiratory protection are also essential.

By emphasising the importance of respiratory protection and selecting the appropriate equipment, individuals can protect their health in hazardous work environments, fostering a safer and healthier workforce for everyone.

Modern security providers are leveraging digital technologies to provide proactive security. By TONY BOTES, national administrator at the Security Association of South Africa, and ADRIAAN OTTO, director at Excellerate

Modern technologies have changed the security game, with consumers able to leverage the latest innovations in arti cial intelligence (AI) and the Internet of Things, among others.

Technology has a pivotal role to play in homes and businesses. Its rapid growth is visible in the security industry, where a growing number of service providers are using state-of-the-art motion-detecting CCTV cameras (monitored off-site and/or by security of cers on the premises), beams and so forth to supplement the human element in guarding.

The use of new-generation communication equipment, including the live positioning of security of cers and beams around the perimeters of entire premises, as well as sensitive areas, is also becoming increasingly common.

While innovation has resulted in the reduction of guard complements in some companies and unfortunately some lay-offs, there is hope that companies will upskill their surplus security of cers, use them to cover natural attrition or redeploy them in new contracts.

Anticipating threats

Excellerate Services, a Security Association of South Africa Gold Member and one of South Africa’s leading security providers, believes technology is playing a critical role in making security smarter, faster, and more reliable. Over the years, the company has steadily invested in systems that enhance both its responsiveness and the quality of its operations. Such commitment is now delivering real results, as – instead of merely reacting to incidents – it is able to anticipate them.

One key area is CCTV technology, which has evolved dramatically. Modern systems don’t just capture footage; they interpret it. Traditional setups often trigger false alarms, overwhelming operators with alerts. By integrating AI, the noise can be ltered out, allowing operators to concentrate on what truly matters.

Facial recognition has also come a long way and is now able to differentiate accurately between residents, approved visitors and unknown individuals, a capability that allows security organisations to detect a threat early and take action before an incident occurs.

In addition, predictive analytics technology adds another layer of intelligence by picking up on behaviours that may not raise red ags in isolation, like someone loitering repeatedly, or subtle patterns of unusual access attempts. On the back end, AI-driven language tools are streamlining how incident reports are captured and analysed, creating a richer database that can be used to spot trends and respond more rapidly.

Automatic number plate recognition has also become an essential layer of protection across of ce parks, residential estates and public spaces, with systems able to cross-reference vehicle details against

criminal databases, in real time. As a result, numerous incidents have been prevented by intercepting vehicles agged as suspicious, before they enter client spaces.

Multiplying effectiveness

Everything comes together in the control room, where AI’s speed and pattern recognition combines with the judgment and intuition of trained professionals. This creates a hybrid monitoring environment where the routine is handled by machines, allowing the people to focus on genuine risks. AI isn’t replacing people; it’s supporting them. These systems act as force multipliers, ensuring security teams can intervene early and intelligently.

The days of purely manned guarding are history. Professional security service providers are facing high-tech criminals on a daily basis, so they need to be proactive in order to stay one critical step ahead. The various law enforcement agencies just do not have the capacity, for whatever reason, to introduce sophisticated crime prevention systems.

The private security industry, however, has come to the party with the necessary tools, sharing these with the South African Police Services and other agencies. This has required massive capital injection by the private security industry – and the results speak for themselves.

INTELLIGENCE

PICKING

The rise of malls in residential areas is reshaping retail, but it is also driving significant economic and community impact, writes JONATHAN SINDEN, COO at Liberty Two Degrees

Malls and shopping centres have become more than just spaces to buy goods. Beyond being reimagined lifestyle destinations, they serve as economic engines of the country by fostering business growth, stimulating local employment and enhancing the neighbourhoods in which they are situated.

In fact, malls undoubtedly play a signi cant role in driving residential property values up. For instance, an international study analysing 87 shopping centres and approximately 4 000 residential properties found a positive correlation between the size of shopping centres and nearby residential property prices. Similarly, a local case study revealed that the announcement of a new shopping mall had signi cant positive effects on surrounding residential property prices. Consumer preferences are continuously evolving to prioritise convenience and lifestyle integration, which impacts the way they engage with retail spaces. This is driving the integration of retail and residential spaces.

The increasing trend of building malls and shopping centres in and around residential areas stems from the rise of the 15 Minute City concept pioneered by Carlos Moreno, where essential services such as grocery stores and tness centres are easily accessible within a short distance.

Additionally, the shift towards convenience means shoppers seek more than just products; they want vibrant spaces that offer an all-in-one experience (or mixed-use developments), including eateries, entertainment and social interaction.

With some organisations maintaining remote work models while others implement hybrid ones, this has allowed professionals exibility to move around even during the week, which increases foot traf c, making mixed used malls even more attractive. As a result, we are seeing more malls being developed as multifunctional lifestyle hubs, combining retail and leisure as spaces that meet residents’ needs.

The rise of malls in residential areas is not only reshaping retail, but also driving signi cant economic and community impact. Transforming malls into mixed-use spaces creates economic growth, allowing more small businesses an opportunity to operate, as residential malls often provide smaller spaces with exible leasing options and lower rental costs. This generates employment opportunities and appreciates the value of properties in surrounding areas, creating a cyclical effect.

As malls continue to evolve into multipurpose lifestyle destinations, technology and sustainability are also major contributors to the success of malls in residential areas, transforming them into smart, eco-friendly hubs that cater to modern consumer demands.

Smart infrastructure, such as advanced building management systems, digital directories and payment systems, as well as shopping mobile apps, provides a seamless experience for both shoppers and tenants.

At the same time, sustainability is at the forefront, with energy-ef cient buildings, solar power installations and water-saving initiatives becoming standard features for malls. Green spaces, eco-friendly construction materials and waste management solutions by malls further boost the value of surrounding residential properties, making them attractive to both conscious consumers and potential investors.

The future of precinct malls lies in their ability to adapt, integrating technology, sustainability and lifestyle aspects to meet the needs of modern consumers. Additionally, their popularity will continue to be in uenced by market trends, such as increasing urbanisation, the rise of hybrid work and changing consumer preferences.

Finally, millennial and Gen Z consumers who prioritise convenience, sustainability and experiential retail are further driving the need for mixed-use developments. These are potential long-term consumers and they demand a dynamic, all-in-one lifestyle experience that blends luxury, entertainment, dining and culture.

THE FUTURE OF PRECINCT MALLS LIES IN THEIR ABILITY TO ADAPT, INTEGRATING TECHNOLOGY, SUSTAINABILITY AND LIFESTYLE ASPECTS TO MEET THE NEEDS OF MODERN CONSUMERS.

Using the private sector to turbocharge South Africa’s Special Economic Zone programme could turn these entities into powerful instruments that drive new investment and create jobs, writes

ANNE BERNSTEIN, executive director of

the Centre for Development and Enterprise

South Africa is stuck in a low-growth, high-unemployment crisis. A meagre average annual growth rate of 0.8 per cent over the past decade means that there are a staggering 12.3 million South Africans who want to work but cannot get a job.

Special Economic Zones (SEZs) are geographic zones where regulations differ from the rest of the economy. Most successful SEZs focus on labour-intensive, export-driven manufacturing activities. Bringing in foreign capital, technology and skills – be these managerial, operational or entrepreneurial – contributes enormously to their success.

However, in South Africa, despite government spending some R25-billion on SEZs since their inception in 2014, only four of the 12 designated zones have attracted meaningful commercial activity: Coega; East London Industrial Development Zone; Dube TradePort; and Tshwane Automotive SEZ. Some R31-billion in investment has taken place, resulting in 27 000 jobs.

For an SEZ to be successful, it needs to truly be special. It needs to offer investors different rules from the rest of the economy. What if we permitted lower wages and more exible employment arrangements in a single experimental zone to see how investors responded to these changes?

The existing Coega SEZ is ideally situated for a pilot project to test whether and to what extent South Africa could create labour-intensive manufacturing that might absorb unskilled workers.

To inject new vigour into the national SEZ programme as a whole, the Centre for Development and Enterprise proposes that

South Africa follow global trends by giving the private sector a much more prominent role. This reform has produced positive results in many countries, including Colombia, Turkey and the Dominican Republic. Moreover, international research suggests that private zones are less expensive to develop and operate than public zones, and yield better economic result.

To unleash private sector energy, know-how and risk appetite, the following steps must be taken:

•Reconstitute the SEZ Advisory Board: the Board should be restructured to include mostly independent experts and private-sector entrepreneurs, with some government of cials, to ensure a fair and balanced decision-making process.

•Open up to a variety of privately run SEZs: private companies should be allowed to propose and run SEZs on both public and private land, assuming nancial risks while attracting new investments focused on export production and job creation.

•Adopt new, more exible criteria for approval: new zones should be approved based solely on their potential to increase investment and create jobs, rather than detailed and often unrealistic government-imposed criteria.