Q2 report_SoMe results.pptx

Q2 report_SoMe results.pptx

Thisreportdisplaysthe Q2 2025 datafromtheStraumannHQsocialmediaaccounts.

• Instagram: straumannglobal

• LinkedIn:Straumann –targetingallcountries

• Facebook:Straumann(default) –targetingallcountrieswithoutalocalFacebookpage.

Sources: Brandwatch andtherespectiveplatforms(Instagram, LinkedIn,Facebook)

Color coding:

Variationcomparedto Q1 2025

All channels, paid and organic

Impressions

Numberoftimesposts/ads appearedonscreen

Engagement rate

Totalengagement/reach (organic)

Reach Uniqueusersreached

Total engagement

Likes,comments,shares,saves

Clicksontheposts/ads’links

Trendcomparedtotheprevious quarter: increasing decreasing

Strongvisibilityboost: Impressionsandreachsurged, mainlydrivenbypaidcampaigns. Thisisalsoreflectedintheincrease inclicks.

Engagementreturnedtoits usuallevel:Totalengagement droppedvsQ1,reflectinga normalizationafterQ1’sexceptional peaks(e.g.,Busercollaborations). ComparedtoQ22024,engagement stillincreasedby+4%.

Videowatchtimedecreased: Suggestsaneedtoreviewand optimizereelscontent.

All channels, paid and organic

The%ofuserswhoclickedon theposts’links,outofthetotal reach

Theamountpaidforeachvisit

Sessions

Strongtrafficgrowth: Landingpagevisitsandengaged visitsgrewinlinewiththeclicks increase.

Engaged landing page visits

Sessionslastingmorethan10 seconds

Buttonsclicksonthelanding page(register,learnmore…)

Avg. visit time on landing page

Betteradefficiencywith refinedtargeting:Overallbudget spentwasslightlylower(-1.2kCHF vsQ1),yetvisitsincreased, showingmoreefficient campaigns.Theslightcostper visitincrease(+10%)canbe explainedbyaudience refinementsandahighershareof Europeancampaigns,whichare typicallymoreexpensive.

Interactionqualitydecrease explained:Buttonclicksandvisit timesdropped,partlybecause someQ2websitesrequiredfewer buttonclicks(e.g.,youTooth articles,CampusLive,SKILL).

BY CHANNEL

Engagementnormalized afterQ1peaks,butan increaseinprofiletaps, landingpagevisits,and buttonclicksconfirms continuedinterestin sharedtopics.

LinkedIn:Engagement slightlydecreased,butCTR improvedthanksto carousel/documentclicks. Conversionsgrew,showing qualitytrafficdespitefewer interactionsonposts.

Facebook:Forthefirst timeinmonths, engagementincreased significantly(+50%,~1k engagementsorganically), confirmingrenewed audienceactivity.

• Instagram:Biggestgrowthinmonths(+5.6%),confirmingrenewedaudienceinterest.

• LinkedIn:Steady,consistentgrowth(+3%),maintainingitsupwardtrajectory.

• Facebook:Followerbasefinallyreverseditsdownwardtrend,growingslightly(+0.3%)aftermonthsofdecline.

Instagram:Verticalvideosremainthetopperformingformatforengagement,followed byhorizontalvideos(Emdogain30years video,UN!Qteaser).Carouselsandbanners showloweraverageengagement,butsome specificpostsintheseformatsperformed exceptionallywell,confirmingthatcontent qualityandtopicrelevancestronglyinfluence performance.

LinkedIn:Verticalvideosandbannersare themostengagingformats.Carousels underperforminengagementbutremainkey fordrivingclicksandtraffic(asseeninCTR results).

BY CATEGORY, ORGANIC

Top-performing categories: 3rd party course (Istvan Urban), events behind-the-scenes/recaps, and product posts achieved the highest engagementoverall.

Platform-specifictrends:Product-postsperformparticularlywellonInstagram,whilewebinar/coursescontentperformsbestonLinkedIn.

BY TOPIC, ORGANIC

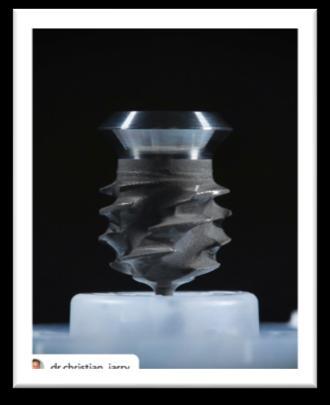

Eventsandstrategicproduct-relatedpostsperformedbest:IDS(wrap-upvideo)leadsonbothplatforms,whileiEXCEL,SmileCloud,UN!Q,Midas, andAXSalsorankedamongthetopperformers.

ProTalkteasers:Engagementhasbeendecliningpostafterpost,showingagradualdecreaseinaudienceinteractionovertime.

BY TOPIC, ORGANIC

In line with the current strategic priorities, iEXCEL remains the main focus (8 posts), followed by industry-related topics such as ProTalk and majorevents,includingiEDandEuroperio.

Productcontentcouldberebalanced:Emdogainwasslightlyoverrepresented(6postsvs~3forsimilarproducts).

Poststhatgeneratedthemostuserfollows(besidesregrams,cfnextslide): iEXCELsimplicitybanner(+11newfollowers)

ALL CHANNELS, PAID

Landing page view rate (engaged sessions): users who clicked our link and stayed on the page long enough to interact. It reflects meaningful traffic qualitybeyondsimpleclicks.

Strong overall efficiency: Most landing pages performed above the 2025 average view rate (54%), while costs remained below average (0.25 CHF), suggestinganoverallimprovementcomparedtoQ1.

Mixed cost vs engagement: Brito’s webinar on Immediacy reached excellent engagement (81%) but with slightly higher costs (0.21 CHF), likely due to refinedtargeting.

Lower time spent compared to Q1: Most landing pages performed below the 2025 average (39 sec), indicating lower user engagement than in Q1.

TopperformersinQ2:Productpages,iED,andmostyouToothpagesgeneratedthelongestsessions.

SKILL and CampusLive pages: shorter sessions as expected. These pages are designed for quick registration rather than long reading times; hence,alowersessiondurationisconsistentwiththeirpurpose.

*websitevisitsandbuttonclicksaren’ttrackedfor3rdpartywebsites

• Strongvisibilityandtrafficgrowth:Impressions,reach,andclickssurged,mainlydrivenbypaidcampaigns.Landingpagevisitsgrewsignificantly, withmostpagesperformingabovethe2025averageviewrate(54%).

• Positiveshiftsinaudiencegrowth:Instagramexperienceditsbiggestfollowergrowthinmonths,andFacebook’sfollowerbasestartedgrowing againaftermonthsofdecline.

• InstagramnormalizationafterQ1peaks:TotalengagementdroppedvsQ1butreturnedtoitsusuallevelafterQ1’sexceptionalpeaks(Buser collaborations).ComparedtoQ22024,engagementisactually+4%higher,showinglong-termgrowth.

• HighCTRonLinkedIn:CTRimproved(+2pp),stronglysupportedbycarouselanddocumentclicks,confirmingtheplatform’sstrengthfortraffic generation.

• FirstpositiveorganictrendonFacebook:Forthefirsttimeinmonths,Facebookorganicengagementshavesurgedsignificantly(+50%,~1k interactions),indicatingrenewedaudienceactivity.TheplatformisgraduallycatchingupwithLinkedInintermsofengagement(e.g.somewebinars andtheSciencecorporateforumcarouselgeneratedmoreinteractionsonFacebookthanonLinkedIn.Clinicalcasesalsoperformedwell,despite beingsharedassingle-bannerpostsratherthanfullcarouselsshowcasingtheentirecase).

• Productcontent(iEXCEL,Midas,UN!Q,Smilecloud,SIRIOS)performsparticularlywellonInstagram,whilewebinars/coursescontentleadson LinkedIn,reflectingplatform-specificbehaviors.TheEmdogain30-yearsvideogothigherviewsthaninaverageonInstagramandanicereachon Facebook.

• Clinicalcasescontent(youTooth)andeventscontinuetoattracthighengagementandlongersessions.

• Assetsfeaturing'heroes'ratherthanproductstendtounderperformorganicallybutgeneratestrongerengagementwhenpromotedthroughpaid ads.

• LowertimeonlandingpagesvsQ1:Averagetimespentdecreased(mostpagesbelow39sec),likelyduetofewerhigh-engagementcampaignsin Q2.

• ProTalkengagementdeclining:Engagementcontinuestodroppostafterpost.Opportunity:reworkformatsordiversifytopicstosustainaudience interest.

• Overrepresentedproducttopics:Emdogainappearedmorefrequentlythanotherproducts,whichcouldriskaudiencefatigue.

• Videoperformanceissue:VideoviewsdroppedsharplyonInstagram(-53%)andFacebook(-64%),indicatingtheneedtoreviewreels/video strategy.

Thisreportdisplaysthe Q2 2025 datafromtheStraumann localsocialmediaaccounts. Itexcludesdatafromthe StraumannHQchannels.

Sources: Brandwatch andtherespectiveplatforms(Instagram, LinkedIn,Facebook)

Color coding:

Variationcomparedto Q1 2025

DataexcludesHQchannels.

Instagram shows stronger upward trends at country level, with higher engagement momentum compared to HQ, where performance normalized after Q1peaks.

Aselectionofpagesshowinggrowthinfollowers,reach,totalengagementsandengagementrates.

Growthacrossallindicators—engagement,reach,andfollowers—iscrucialforthelong-termsuccessofasocialmediapage.Ahigherengagement ratemeansthecontentresonateswellwiththeaudience,fosteringmoremeaningfulinteractions.Atthesametime,anincreaseinreachindicates thatthecontentisbeingseenbyabroaderaudience,whichhelpsbringinnewfollowersandenhancesbrandvisibility.

OthercountrypagescouldbenefitfromanalyzingthesestandoutInstagramchannels'strategiesandbestpractices.Byidentifyingwhatcontent types,formats,orpostingfrequenciesaredrivingthesesuccessfulresults,theycanreplicatethesestrategiestoboosttheirgrowth.

Thisreportdisplaysthe Q2 2025 datafromselectedStraumann’s competitors’globalchannels andcomparesittothe StraumannHQchannels.

Sources: Brandwatch andtherespectiveplatforms(Instagram, LinkedIn,Facebook)

Color coding:

Variationcomparedto Q1 2025

• Followergrowthleader:Straumanngainedthemostfollowers(+2.6k),confirmingstrongbrandattractiveness.

• Reachleaderbutslowergrowth:StraumannholdsthehighestorganicreachaheadofNobelBiocare,whileOsstemshowsthestrongestreach growth,followedbyNobelBiocare.

• Engagementtrends:Straumannachievedthehighesttotalengagements(11k),butOsstemleadsinaverageengagementperpost(179vs Straumann’s159).

Instagram, organic

• NobelBiocare:Carousel-heavy;engagementslightlydecreased(-12%),sotheformataloneisn’tdrivinggrowth.Contenttypelikelyplaysabigger role.

• Osstem:Balanceduseofcarouselsandvideos;engagementtrendstronglypositive(+115%,cf.previousslide),suggestingitsmixand content strategyresonatebest.

• ZimmerBiomet&DentsplySirona:Video-focused,butengagementremainslowordeclining,confirmingthatvideosalonedon’tguarantee higherinteraction

—likelytopicorcreativequalityissues.

• Strongeducationalpositioning:Emphasisonhands-oncourses,webinars,andtheupcomingGlobal Symposium,highlightingeducationandinnovation.

• Scientificcredibility&productinnovation:Frequentreferencestoevidence-basedclaimsandpromotionof innovativeproducts(e.g.,NobelProcera®EstheticZirconiaImplantBridge).

• Focusonclinicalexcellence:Topicslikeperi-implanttissuemanagementanddigitalworkflows(All-on-4®, zygomaticimplants)aimtoenhanceclinicaloutcomes.

• Education&training:Strongfocusonuniversityvisits,trainingprograms,andspeakerdevelopment initiativestoadvanceendodonticandimplanteducation.

• Sustainability&CSR:Highlightseffortstoreduceplasticuseandeco-friendlypractices,alongside communityoutreach(e.g.,freedentalcareforunderservedchildren).

• Diversity&collaboration:Promotesinclusioninitiativesandstressestheimportanceofcollaborationin shapingdentalinnovation.

• Digitaldentistryleadership:Strongemphasisondigitalworkflowstoimproveefficiencyandpatient outcomes,withproductslikeRealGUIDEsoftware,BellaTek,andT3PROimplants.

• Education&skillenhancement:Regularwebinarsandhands-oncoursesonimplantdentistryandaesthetic restorations.

• Sustainability&community:Highlightssustainabilityinitiativesandeffortstoengagedentalprofessionals globally.

• Innovation&productlaunches:HighlightsnewsolutionsliketheEasyScrewRemovalKit,eDriverPlus,and advancementsindigitalguidedimplants.

• Strongeducationalpresence:Activeinuniversitypartnerships,majorcongresses(EuroPerio,OsstemWorld Meeting),andtraininginitiatives.

• Patient-focusedcontent:Sharesoralhealthtips,aftercareadvice,andpromotesoverallwellness,reinforcing acommitmenttoqualityandinnovation.