9 minute read

CORROSIVE IMPACT OF THE RF ON UKRAINIAN STRATEGIC ENTERPRISES IN THE PULP & PAPER INDUSTRY

from Analyzing Corrosive Investments into Ukraine’s Economy as an Element of Hybrid Warfare

by Center for Analytical Studies and Countering Hybrid Threats

Of all the industries where enterprises were identified as strategic for the economy and security of the state, paper production does not seem to be an industry that is directly responsible for the national security of Ukraine, when compared to mechanical engineering, energy, or telecommunications. Thus, only 10 enterprises of the paper production industry were defined as strategic by the Government of Ukraine at different times.

Technically, among those 10 enterprises in the paper industry, which were determined by the Government of Ukraine as strategic, three were apparently liquidated: Poninkivskyi Cardboard and Paper Mill JSC, Lutsk Cardboard and Paper Mill PrJSC and Dnipropetrovsk Paper Factory JSC.

Advertisement

Later, it was established that the first two joint-stock companies were liquidated only “legally” in fact. Rather, the companies’ corporate structures were changed from JSC to LLC, and the profile remained unchanged. Thus, Poninkivskyi Cardboard and Paper Factory LLC and Lutsk Cardboard and Paper Factory in Ukraine LLC, which currently are not strategic, produce and export products and pay taxes to the state budget of Ukraine.

At the same time, analysis of the influence of the Russian intelligence on destruction of Dnipropetrovsk Paper Factory JSC is a vivid example of an operation aiming to inflict damage along several operational lines of hybrid warfare (not only economic, but also political and informational), which will be discussed below.

Therefore, the paper industry is considered by reviewers as one of the economic clusters where hybrid operations along the economic line should contribute to achievement of political goals of the aggressor country. The destruction of the paper factory caused Ukraine's dependence on RF not only in terms of importing paper, but also finished printed products.

In 2015, Dnipropetrovsk Paper Factory JSC was finally liquidated, although production stopped approximately back in 2010.

An interesting feature of this factory is in the fact that it was in the orbit of an ex-member of the Party of Regions of Ukraine, collaborator Oleg Tsarev who acted in the interest of Russian authorities and special services, especially since 2014.

5.1. Company history, production volume and financial condition before bankruptcy

The factory was founded in 1914 and produced various volumes of paper products until the collapse of the USSR. During the economic crisis in 1990–1998, the factory was not operational. In 1998, the enterprise resumed its work as a JSC (joint-stock company).

In the 2000s, for the first time in Ukraine, the factory started producing offset paper weighing 60, 70, 80, 100 and 120 g per m.65

The uniqueness of the Dnipropetrovsk Paper Factory in producing such a variety of goods is confirmed by archival data of the Ministry of Economic Development and Trade of Ukraine for 2007. At that time, the share of Dnipropetrovsk Paper Factory JSC in the production of writing and printing grade paper in Ukraine was 85% (15,000 tons).66

Taking into account the company's virtual monopoly in offset paper production, as well as taking into account the Ukrainian demand for offset printing paper at about 75 thousand to 85 thousand tons per year, it is possible to note the persistent demand for the products of Dnipropetrovsk Paper Factory JSC in Ukrainian market and, as a result, the stable flow of revenue.

This is confirmed by the analysis of the company's financial status during 2003–2007 (according to the YouControl system) with a positive balance of assets and revenue against liabilities (Fig. 5.1).

Analysis has also been applied to results of legal disputes between OJSC Dnipropetrovsk Factory and counterparts, which were not controlled by the owners of the paper factory itself, regarding the debt settlements starting with 2006 and until the moment of bankruptcy.

During this period, Dnipropetrovsk Paper Factory JSC won court proceedings on debt collection in its favor in the amount of over 1.3 million UAH, and lost only about 47 thousand UAH.

Therefore, the company's financial condition before 2008 can be considered favorable in terms of profit and development opportunities.

5.2. Owners of Dnipropetrovsk Paper Factory JSC before bankruptcy

There is no information in the open registers about the owners back in the 90s. Given that the factory resumed operations in 1998 as a JSC, it is possible that until that year the company was gradually corporatized and probably privatized.

During 1998–2000, Oleg Tsarev was the Chairman of the board of Dnipropetrovsk Paper Factory JSC.

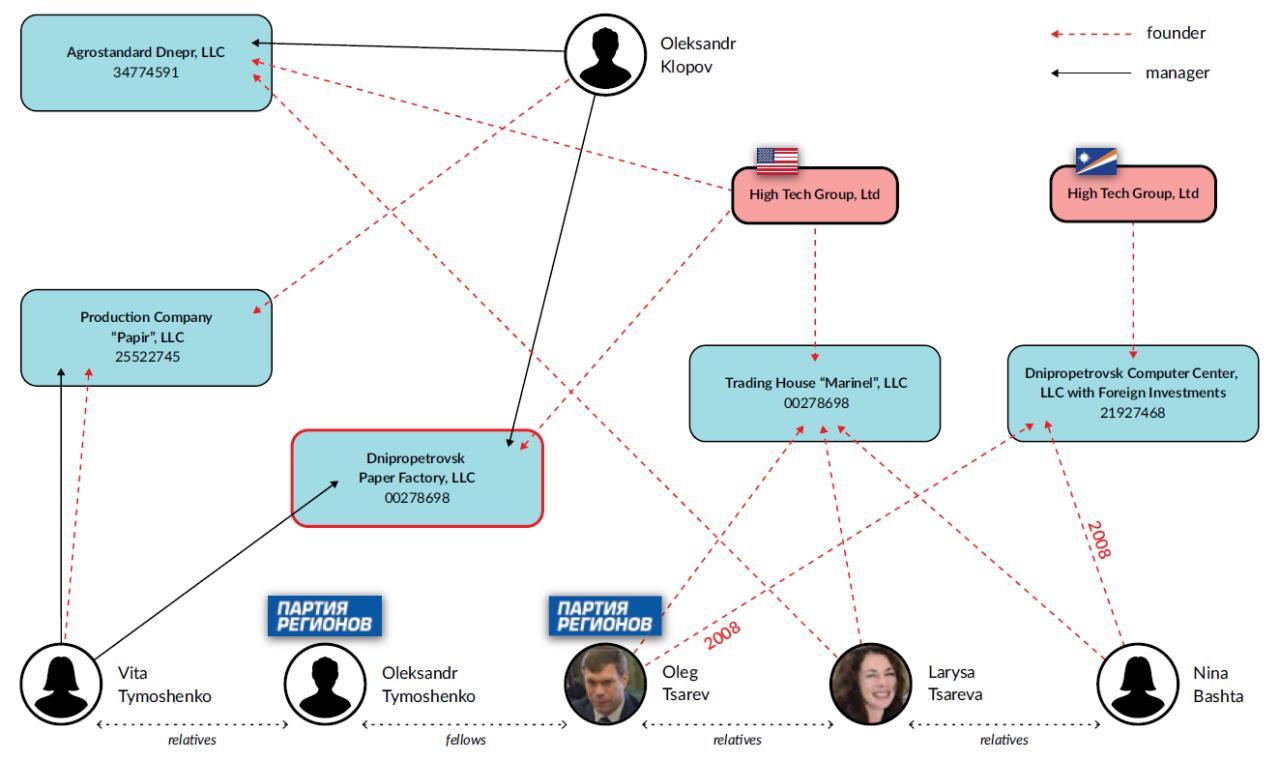

Among the available archival data, as of 2003, owners of the enterprise were the Ukrainian State Joint Stock Holding Company UkrPapirProm (30%) and the Dnipropetrovsk Computer Center LLC with Foreign Investments (60%). The latter company was founded by the offshore High Tech Group, Ltd from the Marshall Islands, which, according to investigation of Ukrainian anti-corruption structures, was related to Oleg Tsarev.67

66 http://www.ukrexport.gov.ua/ukr/p%0Arom/ukr/25.html

67 https://bankruptcy-ua.com/news/300

From 1995 to 1997, O. Tsarev himself was the Deputy Director, and later the Director of the Dnipropetrovsk Computer Center LLC with Foreign Investments (Fig. 5.2).

From 2008 to 2010, abovementioned 60% of the shares of Dnipropetrovsk Paper Factory JSC were already owned by 3 individuals related to O. Tsarev.68

Thus, as of the end of 2007, Dnipropetrovsk Paper Factory JSC was under control of the pro-Russian politician

5.3. “Toxic” foreign assets of O. Tsarev

One of the founders of Dnipropetrovsk Paper Factory was the American firm High Tech Group Ltd, of Little Rock, Arkansas.

Management of this company included a Latvian citizen, Erik Vanagels.69 It was later established that he, as well as another Latvian, Stan Horin, were found to be involved by a media investigation by the Ukrainian anticorruption project “Our Money”, in 2011. That was a case regarding the purchase of the Black Sea oil rigs by the Ukrainian enterprise Chornomornaftogaz at an inflated price. Y. Boyko, the Minister of Energy of Ukraine at that time and a pro-Russian politician, according to media reports, used the intermediary offshore company Highway Investment Processing LLP, managed by E. Vanagels and S. Gorin, in that transaction, and actually earned USD 150 million

68 https://www.smida.gov.ua/db/owners/00278698/2009/4

69 https://opencorporates.com/companies/us_ar/800060593 via the margin between the purchase and sale prices.70 However, the investigation later noted that there was no evidence of Y. Boyko's involvement in the corruption scheme.71

In general, the name of E. Vanagels was found in many offshore companies created by the Latvian company IOS Group, which has offices in Dublin, Riga, Moscow, and Kyiv. Only 2% of company clients are residents of Latvia.72

In 2018–2019, IOS Group was subject to investigation conducted by the international anti-corruption organization OCCRP, as well as one conducted by US financial control authorities. Over the entire period of its existence (1992–2017), it created thousands of shell companies in Great Britain, the Virgin Islands, Panama, Cyprus, Hong Kong, and other countries with the purposes of hiding assets and real owners from regulators and money laundering (Fig. 5.3). The company was associated with the large Latvian offshore bank ABLV, which was liquidated in 2019 following the statements made by the US Ministry of Justice (“the basis of the bank's business is money laundering”).

It is worth noting that the offshore structures created by the IOS Group were involved in illegal schemes, the implementation of which was deemed impossible without Russian special services support, namely money laundering in the interests of the highest political leadership of the Russian Federation and Russia’s illegal supply of weapons to Sudan.73

Further taking into account the previous research by Yu. Felshtinskyi, who noted the establishment of overseas enterprises in the late 80s and early 90s by the Soviet special services, and later by the Russian special services, seeking to support external operations in Western countries (IOS Group was established in 1992 in Ireland), it is possible to make an assumption on the type of “assistance” that the Russian special services provided in creating foreign structures for O. Tsarev to control a strategic enterprise in Ukraine.

70 https://far.chesno.org/case/341/

71 https://www.pravda.com.ua/news/2018/02/2/7170377/

72 https://www.pravda.com.ua/news/2011/11/22/6776207/

73 https://www.occrp.org/ru/troikalaundromat/how-ios-group-supersized-the-shell-company-game

5.4. “Preparation” of Dnipropetrovsk Paper Factory JSC for bankruptcy

In 2007, the Dnipropetrovsk Economic Court enacted the decision recognizing the debt of Dnipropetrovsk Paper Factory JSC to Dnipropetrovsk Computer Center LLC with foreign investments in the amount of UAH 25.5 million,74 which the factory was expected to settle by confiscating property, since the paper company's accounts were out of funds.

In such a way, O. Tsarev transferred assets from one structure under his control to another, “artificially” preparing a strategic enterprise for further bankruptcy.

5.5. Start of bankruptcy

In 2008, the “Papir” Manufacturing Enterprise LLC filed a lawsuit with the Dnipropetrovsk Economic Court to declare Dnipropetrovsk Paper Factory JSC bankrupt due to a debt of about UAH 160,000. The court declared the factory bankrupt and ordered the liquidation procedure by its resolution dated 09 October 2008.75

Investigators of the “Nashi Groshi” Project published data confirming affiliation of the “Papir” Manufacturing Enterprise LLC in O. Tsarev's orbit.76

Thus, a pro-Russian politician handled an “artificial” bankruptcy of a strategic enterprise that was a monopolist in the offset paper production market.

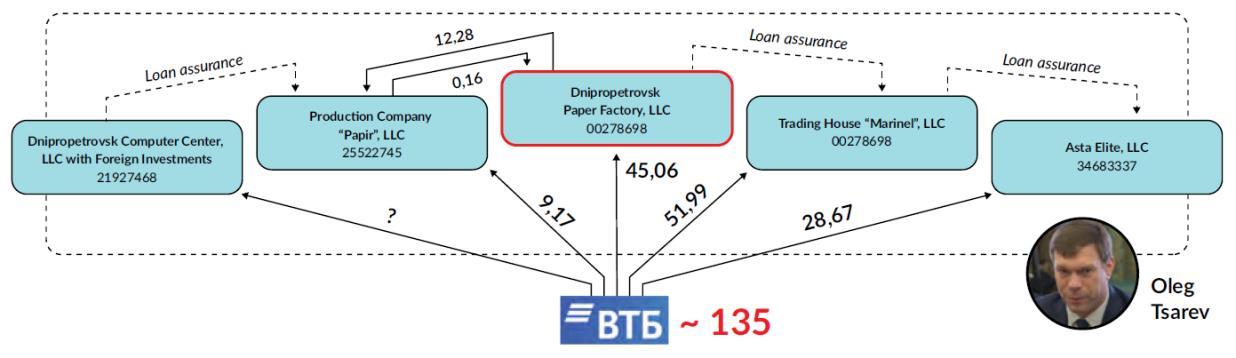

Due to the fact that 30% of the factory was owned by the state consortium Ukrpapiprom, the public structures subsequently initiated a court procedure to prevent bankruptcy. At the same time, the “insurance shot” in this story, in our opinion, was delivered by a subsidiary structure of the Russian bank VTB.

5.6. Consolidation of bankruptcy with the help of a Russian bank

In 2015, the Commercial Court of Dnipropetrovsk oblast enacted the final court decision declaring Dnipropetrovsk Paper Factory JSC bankrupt after a long litigation following the claims of VTB Bank against the structures of O. Tsarev in the amount of about UAH 135 million (Fig. 5.4).77

74 https://opendatabot.ua/court/963221-4e83f0f420a4ad85e321415e09ebab59

75 https://gorod.dp.ua/news/14730

76 https://nashigroshi.org/2014/02/17/ridni-firmy-tsarova-zaborhuvaly-rosijskomu-banku-bilshe-100-miljoniv/

77 https://www.epravda.com.ua/news/2014/02/17/420285/

5.7. Consequences of the bankruptcy of an enterprise that was strategic for economy of Ukraine

From 2008 to 2020, production of printing paper in Ukraine decreased by almost eight times. The “twofold” reduction took place in 2011 and 2014, when the court decisions declaring bankruptcy of Dnipropetrovsk Paper Factory JSC were finally enacted.

Such a state of affairs caused Ukraine to become completely dependent on offset paper imports. According to the Association of Ukrainian Paper Industry Enterprises UkrPapir, during 2019–2021 alone, the main factors directly affecting imports into Ukraine were the following:

1) EU paper export quotas because of: o reduction of imports from China; o repurposing a number of European factories from production of offset paper to packaging and cardboard. Such production is more profitable, less complicated, cheaper and meets the EU requirements in a transition to paper packaging materials in view of the polymer packaging ban;

2) doubled price of paper due to decreased production in EU countries;

3) increased maritime transportation prices, which made it unprofitable to import paper from Asia or America.78

Such factors established the dependence of Ukraine on the imports of offset paper from Russia, which amounted to about 40%. At the same time, this actually was a direct effect, since Russia's acquisition of leverage in the format of paper supply capacity directly created conditions for limiting Ukrainian publications by manipulating the volume, pricing, and timing of the paper supply. The consequences of this may be fewer Ukrainian books published and an increase in Russian printed products to manipulate the public opinion of Ukrainians.

At the same time, the hybrid nature of such actions also resulted in causing the split in Ukraine between authorities, publishing houses and manufacturers on account of dependence on Russian paper.

Thus, in November 2021, the Association of Ukrainian Paper Industry Enterprises UkrPapir appealed to the Cabinet of Ministers of Ukraine to ease the requirements banning the paper product imports from the Russian Federation. The association justified its position by the lack of Ukrainian industry’s capacity to produce the required quantity of paper, by the higher price of European paper, at premiums of 30% to 50%. This led to the bankruptcy of numerous publishing houses, the dismissal of employees and the failure to fulfill program requirements for printing Ukrainian textbooks.

Conclusions to Chapter 5

In this section, the project reviewers used the example of Dnipropetrovsk Paper Factory JSC to reveal a scheme that led to the Russian Federation’s corrosive influence on the Ukrainian economy via establishing control over a profitable and promising enterprise and driving it to bankruptcy, which increased Ukraine's dependence on Russian paper suppliers and created conditions for conducting disruptive hybrid operations along political and informational operational lines.

The scheme includes a sequence of the following actions:

• establishing control over the respective enterprise, the owner being either a Russian, a pro-Russian person or a person recruited to the role

• establishing contractual relations between that Ukrainian enterprise and another that is secretly controlled by the same people

• establishing financial relations with a Russian bank, including a loan or a third party liability assurance

• artificial failure of the Ukrainian enterprise to comply with the terms of relations with the one secretly controlled by the same beneficiaries

• a court judgement against the Ukrainian enterprise including the payment of debts using the enterprise’s assets

• in the event of a bankruptcy appeal by the public authorities of Ukraine, further consolidation of the bankruptcy by means of a Russian bank filing civil lawsuits against the Ukrainian enterprise to seek the settlement of debts